Calculation of the Registration Fee

Title of Each Class of Securities Offered | Maximum Aggregate Offering Price | Amount of Registration Fee(1)(2) | ||

| Notes | $9,368,000.00 | $368.16 | ||

| (1) | Calculated in accordance with Rule 457(r) of the Securities Act of 1933. |

| (2) | Pursuant to Rule 457(p) under the Securities Act of 1933, filing fees of $1,138,769.01 have already been paid with respect to unsold securities that were previously registered pursuant to a Registration Statement on Form S-3 (No. 333-134553) filed by Lehman Brothers Holdings Inc. and the other Registrants thereto on May 30, 2006, and have been carried forward, of which $368.16 is offset against the registration fee due for this offering and of which $1,138,400.84 remains available for future registration fees. No additional registration fee has been paid with respect to this offering. |

| Pricing supplement | Registration Statement no. 333-134553 | |

| To prospectus dated May 30, 2006, | Dated February 22, 2008 | |

| prospectus supplement dated May 30, 2006, | Rule 424(b)(2) | |

| product supplement no. 570-I dated February 26, 2008 and | ||

| underlying supplement no. 1160 dated February 5, 2008 |

LEHMAN BROTHERS HOLDINGS INC.

$9,368,000

Emerging Economies 100% Principal Protected Notes Linked to a Basket Consisting of a Foreign Equity Component and a Currency Component

Because these notes are part of a series of Lehman Brothers Holdings’ debt securities called Medium-Term Notes, Series I, this pricing supplement should also be read with the accompanying prospectus supplement, dated May 30, 2006 (the “Series I MTN prospectus supplement”) and the accompanying prospectus dated May 30, 2006 (the “base prospectus”). Terms used here have the meanings given to them in the Series I MTN prospectus supplement or the base prospectus, unless the context requires otherwise. As used in this pricing supplement, the “Company,” “we,” “us,” or “our” refers to Lehman Brothers Holdings Inc.

Lehman Brothers Inc., a wholly owned subsidiary of Lehman Brothers Holdings, makes a market in Lehman Brothers Holdings’ securities. It may act as principal or agent in, and this pricing supplement may be used in connection with, those transactions. Any such sales will be made at varying prices related to prevailing market prices at the time of sale.

Investing in the100% Principal Protected Notes Linked to a Basket Consisting of a Foreign Equity Component and a Currency Componentinvolves a number of risks. See “Risk Factors” beginning on page SS-1 of the accompanying product supplement no. 570-I, “Risk Factors” beginning on page US-1 of the accompanying underlying supplement no. 1160 and “Selected Risk Factors” beginning on page PS-2 of this pricing supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the notes or passed upon the accuracy or the adequacy of this pricing supplement, the base prospectus, Series I MTN prospectus supplement, product supplement no. 570-I, underlying supplement no. 1160 and any other related prospectus supplement, or any other relevant terms supplement. Any representation to the contrary is a criminal offense.

Summary Description

The notes are designed for investors who seek exposure to a foreign equity index (the “Equity Component”) as well as certain foreign currencies (the “Currency Component”) related to the Equity Component.

• | The Equity Component consists of the S&P BRIC 40® Index (SBR) (the “Basket Index”). |

| • | The Currency Component consists of the Brazilian real (BRL), the Russian ruble (RUB) and the Indian rupee (INR) (each, a “Basket Currency” and, collectively, the “Basket Currencies”). The Basket Currencies are substantially equally-weighted. |

The Equity Component represents 45% of the Basket and the Currency Component constitutes 55% of the Basket. The Notes give investors the opportunity to gain enhanced exposure to the return of a foreign index and the appreciation of foreign currencies against the USD, while providing principal protection if held to maturity.

If the Basket Return is greater than zero on the Valuation Date, the investor will receive a single payment at maturity equal to the principal amount of the notes plus an Additional Amount equal to the principal amount of the notes multiplied by the Basket Return multiplied by the Participation Rate. If the Basket Return on the Valuation Date is less than, or equal to, zero, then the investor will receive at maturity the principal amount of the notes. The notes do not bear interest and are 100% principal protected only if held to maturity.

| Issuer: | Lehman Brothers Holdings Inc. (A+, A1, AA-)† | |

| Issue Size: | USD9,368,000 | |

| Issue Price: | 100% | |

| Principal Protection: | 100% | |

| Pricing Date: | February 22, 2008 | |

| Settlement Date: | February 29, 2008 | |

| Valuation Date: | February 21, 2013†† | |

| Maturity Date: | February 28, 2013†† |

| Basket: | The notes are linked to a basket consisting of an Equity Component that consists of the S&P BRIC 40® Index (the “Basket Index”) and a Currency Component that consists of the Brazilian real, the Russian ruble and the Indian rupee (each, a “Basket Currency” and, collectively, the “Basket Currencies”). | |||||||

| Basket Weightings: | The Equity Component is weighted 45% and the Currency Component is weighted 55% of the Basket. | |||||||

| No Interest Payments: | There will be no interest payment during the term of the notes. | |||||||

| Payment at Maturity (per USD1,000): | A single USD payment on the Maturity Date equal to the principal amount of each note plus the Additional Amount, if any. | |||||||

| Additional Amount: | If the Basket Return is greater than 0% the Additional Amount will be calculated as follows:

USD1,000 per note × Basket Return × Participation Rate

If the Basket Return is not greater than 0% the Additional Amount will be $0. | |||||||

| Participation Rate: | 111.50% | |||||||

| Basket Return: | Ending Basket Level – Starting Basket Level Starting Basket Level | |||||||

| Starting Basket Level: | 1,000 | |||||||

| Ending Basket Level: | The Basket Closing Level on the Valuation Date. The “Basket Closing Level” will be calculated as follows: Ending Equity Component Level + Ending Currency Component Level. | |||||||

| Ending Equity Component Level: | The Closing Equity Component Level on the Valuation Date. The “Closing Equity Component Level” will be calculated as follows: Starting Equity Component Level × (1 + the Basket Index Return). | |||||||

| Starting Equity Component Level: | 450 | |||||||

| Basket Index Return: | Basket Index Ending Level – Basket Index Starting Level Basket Index Starting Level | |||||||

| Basket Index Ending Level: | The Index Level on the Valuation Date (subject to postponement as described below under “Disruption Event”). | |||||||

| Basket Index Starting Level: | 2,912.04, which was the Index Level on the Pricing Date. | |||||||

| Index Level: | On any Index Trading Day, the closing level of the Basket Index, as determined and published by the Index Sponsor (subject to postponement as described below under “Disruption Event”). | |||||||

| Index Sponsor: | Standard & Poor’s (“S&P”), a division of the McGraw Hill Companies, Inc. | |||||||

| Ending Currency Component Level: | The Closing Currency Component Level on the Valuation Date. The “Closing Currency Component Level” will be calculated as follows: Starting Currency Component Level × [1 + (sum of (Basket Currency Return × Basket Currency Weighting) for all Basket Currencies)]. | |||||||

| Reference Exchange Rate: | For each Basket Currency, the spot exchange rate for that Basket Currency quoted against the U.S. dollar expressed as the number of units of Basket Currency per one USD. | |||||||

| Starting Currency Component Level: | 550 | |||||||

Basket Currency Return: | Basket Currency Starting Level – Basket Currency Ending Level Basket Currency Ending Level | |||||||

Basket Currency Ending Level: | The Reference Exchange Rate on the Valuation Date, observed in accordance with the Settlement Rate Option (subject to the occurrence of a Disruption Event). For further information concerning the Settlement Rate Option, see “Description of the Notes—Currency-Indexed Notes” in the Series I MTN prospectus supplement and under Appendix A to the Series I MTN prospectus supplement. | |||||||

Basket Currency Starting Level: | Basket Currency | Bloomberg Ticker | Basket Currency | Basket Currency | ||||

| Brazilian real | BRL | 1.7075 | 33.33% | |||||

| Russian ruble | RUB | 24.4360 | 33.33% | |||||

| Indian rupee | INR | 40.0500 | 33.34% | |||||

* The Basket Currency Starting Level is the Reference Exchange Rate on the Pricing Date, determined in accordance with the applicable Settlement Rate Option. | ||||||||

Reference Exchange Rate: | ||||||||

Basket Currency | Screen Reference | Currency Valuation Business Day | ||||||

BRL | BRFR | Brazilia, Rio de Janiero or Sao Paulo | ||||||

RUB | EMTA | Moscow | ||||||

| INR | RBIB | Mumbai | ||||||

| For further information concerning the Settlement Rate Option and Currency Valuation Business Day, see “Description of Notes-Currency-Indexed Notes” in, and Appendix A to ,the Series I MTN prospectus supplement. | ||||||||

Business Day: | Any day that is not a Saturday, a Sunday or a day on which banking institutions generally are authorized or obligated by law or executive order to be closed in New York City and that is both (a) a Currency Business Day and (b) a trading day for a Basket Index, as defined under “Description of Notes—Payment at Maturity” in the accompanying product supplement no. 570-I (an “Index Trading Day”). | |||||||

Currency Business Day: | New York | |||||||

Disruption Event: | If a Disruption Event relating to the Basket Index and/or the Basket Currencies is in effect on the Valuation Date, the Calculation Agent will calculate the Basket Return using:

• for each Basket Index and/or Basket Currency thatdid not suffer a Disruption Event on the Valuation Date, the Basket Index Ending Level or the Basket Currency Ending Level, as applicable, on the Valuation Date for such Basket Index and/or the Basket Currency, and

• for each Basket Index and/or Basket Currency thatdid suffer a Disruption Event on the Valuation Date, the Basket Index Ending Level or the Basket Currency Ending Level, as applicable, on the immediately succeeding scheduled Index Trading Day or scheduled Currency Valuation Business Day, as applicable, on which no Disruption Event occurs or is continuing with respect to the Basket Index and/or the Basket Currency;

provided, however, that if a Disruption Event has occurred or is continuing with respect to the Basket Index and/or any or all of the Basket Currencies on each of the three scheduled Index Trading Days or scheduled Currency |

Valuation Business Days, as applicable, following the scheduled Valuation Date, then (a) such third scheduled Index Trading Day or scheduled Currency Valuation Business Day, as applicable, shall be deemed the Valuation Date for the affected Basket Index or Basket Currency, respectively, and (b) the Calculation Agent will determine, on such day, (i) in the case of the Basket Index, the Basket Index Ending Level, as set forth under “Description of Notes—Market Disruption Events” in the accompanying product supplement no. 570-I or (ii) in the case of a Basket Currency, the Basket Currency Ending Level for the affected Basket Currency in accordance with the “Fallback Rate Observation Methodology”, as defined under “Description of the Notes—Currency-Indexed Notes” in the Series I MTN prospectus supplement.

A “Disruption Event” means, for the Basket Index, a market disruption event (as defined under “Description of Notes—Market Disruption Events” in the accompanying product supplement no. 570-I) and, for a Basket Currency, a Currency Disruption Event.

A “Currency Disruption Event” means any of the following events, as determined in good faith by the Calculation Agent:

(A) the occurrence and/or existence of an event on any day that has the effect of preventing or making impossible the delivery of USD from accounts inside the country for which a Basket Currency is the lawful currency (such jurisdiction with respect to such Basket Currency, the “Basket Currency Jurisdiction”) to accounts outside that Basket Currency Jurisdiction;

(B) the occurrence of any event causing the Reference Exchange Rate for any Basket Currency to be split into dual or multiple currency exchange rates; or | ||

(C) a Reference Exchange Rate being unavailable, or the occurrence and/or existence of any event (other than those set forth in (A) or (B) above) that (i) materially disrupts the market for a Basket Currency or (ii) makes it generally impossible to obtain a Reference Exchange Rate for a Basket Currency on the scheduled Valuation Date.

For purposes of the above, “scheduled Index Trading Day” or “scheduled Currency Valuation Business Day” means a day that is or, in the judgment of the Calculation Agent, should have been, an Index Trading Day or a Currency Valuation Business Day. | ||

| Calculation Agent: | Lehman Brothers Inc. | |

| Underwriter: | Lehman Brothers Inc. | |

| Denominations: | USD1,000 per Note | |

| Minimum Investment: | USD20,000 and integral multiples of USD1,000 in excess thereof | |

| CUSIP: | 5252M0DD6 | |

| ISIN: | US5252M0DD61 |

| † | Lehman Brothers Holdings Inc. is rated A+ by Standard & Poor’s, A1 by Moody’s and AA- by Fitch. A credit rating reflects the creditworthiness of Lehman Brothers Holdings Inc. and is not a recommendation to buy, sell or hold securities, and it may be subject to revision or withdrawal at any time by the assigning rating organization. Each rating should be evaluated independently of any other rating. The creditworthiness of the issuer does not affect or enhance the likely performance of the investment other than the ability of the issuer to meet its obligations. |

| †† | Subject to postponement in the event that such date is not a Business Day or in the event of a Disruption Event as described under “Disruption Event” above and under “Description of Notes—Payment at Maturity” in the accompanying product supplement no. 570-I. |

| Price to Public (1) | Fees (2) | Proceeds to Us | ||||

| Per note | $1,000.00 | $37.50 | $962.50 | |||

| Total | $9,368,000.00 | $351,300.00 | $9,016,700.00 |

(1) | The price to the public includes the cost of hedging our obligations under the notes through one or more of our affiliates, which includes our affiliates’ expected cost of providing such hedge as well as the profit our affiliates expect to realize in consideration for assuming the risks inherent in providing such hedge. |

(2) | Lehman Brothers Inc. will receive commissions of $37.50 per $1,000 principal amount, or 3.75%, and may pay selling concessions or fees to other dealers not in excess of $30.00 per note. |

LEHMAN BROTHERS

February 22, 2008 | MTNI698 |

ADDITIONAL TERMS SPECIFIC TO THE NOTES

You may obtain the following documents and other documents Lehman Brothers Holdings Inc. has filed for free by searching the SEC online database (EDGAR®) at www.sec.gov (or if such address has changed, by reviewing our filings for the relevant date on the SEC website) with “Lehman Brothers Holdings Inc.” as a search term or through the links below.

| • | Product supplement no. 570-I dated February 26, 2008: |

http://www.sec.gov/Archives/edgar/data/806085/000119312508038716/d424b2.htm

| • | Underlying supplement no. 1160 dated February 5, 2008: |

http://www.sec.gov/Archives/edgar/data/806085/000119312508020496/d424b2.htm

| • | MTN prospectus supplement dated May 30, 2006: |

http://www.sec.gov/Archives/edgar/data/806085/000104746906007785/a2170815z424b2.htm

| • | Base prospectus dated May 30, 2006: |

http://www.sec.gov/Archives/edgar/data/806085/000104746906007771/a2165526zs-3asr.htm

As used in this pricing supplement, the “Company,” “we,” “us,” or “our” refers to Lehman Brothers Holdings Inc.

Selected Purchase Considerations

| • | Uncapped Appreciation Potential:The notes provide the opportunity to enhance equity/currency returns by multiplying a positive Basket Return by the Participation Rate of 111.50%. The notes are not subject to a predetermined maximum gain and, accordingly, any return at maturity will be determined by the appreciation of the Basket. Because the notes are our senior obligations, payment of any amount at maturity is subject to our ability to pay our obligations as they become due. |

• | Diversification Among the Basket Components:The return on an investment in the notes linked to the return of the S&P BRIC 40® Index and the appreciation of the Brazilian real, the Russian ruble and the Indian rupee against the U.S. dollar. The S&P BRIC 40® Index consists of 40 companies from the emerging markets of Brazil, Russia, India and China. For additional information about the Basket Index, see the information set forth under “The S&P BRIC 40® Index” in the accompanying underlying supplement no. 1160. For a discussion of risks relating to Currency-Indexed notes, see pages S-8 to S-10 in the accompanying Series I MTN prospectus supplement. |

| • | Certain U.S. Federal Income Tax Consequences:Lehman Brothers Holdings Inc. intends to treat, and by purchasing a note, for all tax purposes, you agree to treat, a note as debt subject to the |

PS-6

contingent payment debt instrument rules. Lehman Brothers Holdings Inc. is required to provide the comparable yield to you and, solely for tax purposes, is also required to provide a projected payment schedule that includes the fixed payments on the notes and estimates of the amount and timing of the contingent payments on the notes. Lehman Brothers Holdings Inc. has determined that the comparable yield will be an annual rate of 5.3665%, compounded semi-annually. Based on the comparable yield, the projected payment schedule per $1,000 principal amount note is $1,302.77 due at maturity. |

| • | Lehman Brothers Holdings Inc. agrees and, by purchasing a note, you agree, for United States federal income tax purposes, to be bound by Lehman Brothers Holdings Inc.’s determination of the comparable yield and projected payment schedule. As a consequence, for United States federal income tax purposes, you must use the comparable yield determined by Lehman Brothers Holdings Inc. and the projected payments set forth in the projected payment schedule prepared by Lehman Brothers Holdings Inc. in determining your interest accruals (even though you will not receive any periodic payments of interest on the notes), and the adjustments thereto, in respect of the notes. See “Certain U.S. Federal Income Tax Consequences” in the accompanying product supplement no. 570-I. |

An investment in the notes involves significant risks. Investing in the notes is not equivalent to investing directly in any of the stocks included in the Basket Index. These risks are explained in more detail in the “Risk Factors” section of the accompanying product supplement no. 570-I, in the “Risk Factors” section of the accompanying underlying supplement no. 1160 and in the “Risk Factors” section of the Series I MTN prospectus supplement. You should reach an investment decision only after you have carefully considered with your advisors the suitability of an investment in the notes in light of your particular circumstances.

| • | The Basket Index and Basket Currencies Are Not Equally Weighted: The Basket is composed of an Equity Component and a Currency Component, which are not equally weighted. Additionally, the Equity Component is comprised of only one Basket Index while the Currency Component is comprised of three Basket Currencies that are substantially equally-weighted to each other, but weighted differently from the Basket Index. One consequence of such unequal weighting is that the same percentage change in the Basket Index would have a greater effect on the Basket Closing Level than such percentage change in one of the Basket Currencies, which have a smaller weighting. |

| • | Changes in the Level of the Basket Components May Offset Each Other:The Basket is composed of one Basket Index and three Basket Currencies. At a time when the level or rate of the Basket Index or one or more of the Basket Currencies increases, the level or rate of the other Basket components may not increase or may even decline. Therefore, in calculating the Ending Basket Level, increases in the level or rate of the Basket Index or one or more of the Basket Currencies may be moderated, or more than offset, by lesser increases or declines in the level or rate of the other Basket components. |

| • | No Interest or Dividend Payments or Voting Rights:As a holder of the notes, you will not receive interest payments, and you will not have voting rights or rights to receive cash dividends or other distributions or other rights that holders of stocks included in the Basket Index would have. |

| • | Certain Built-in Costs are Likely to Adversely Affect the Value of the Notes Prior to Maturity:The original issue price of the notes includes the agent’s commission and the cost of hedging our obligations under the notes through one or more of our affiliates, which includes our affiliates’ expected cost of providing such hedge as well as the profit our affiliates expect to realize in consideration for assuming the risks inherent in providing such hedge. As a result, the price, if any, at which Lehman Brothers Inc. will be willing to purchase notes from you in secondary market transactions, if at all, will likely be lower than the original issue price and any sale prior to the maturity date could result in a substantial loss to you. The notes are not designed to be short-term trading instruments. YOU SHOULD BE WILLING TO HOLD YOUR NOTES TO MATURITY. |

| • | Dealer Incentives:We and our affiliates act in various capacities with respect to the notes. Lehman Brothers Inc. and other of our affiliates may act as a principal, agent or dealer in connection with the |

PS-7

notes. Such affiliates, including the sales representatives, will derive compensation from the distribution of the notes and such compensation may serve as an incentive to sell these notes instead of other investments. |

| • | Lack of Liquidity:The notes will not be listed on any securities exchange. Lehman Brothers Inc. intends to offer to purchase the notes in the secondary market but is not required to do so. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the notes easily. Because other dealers are not likely to make a secondary market for the notes, the price at which you may be able to trade your notes is likely to depend on the price, if any, at which Lehman Brothers Inc. is willing to buy the notes. |

| • | Potential Conflicts:We and our affiliates play a variety of roles in connection with the issuance of the notes, including acting as Calculation Agent and hedging our obligations under the notes. In performing these duties, the economic interests of the Calculation Agent and other affiliates of ours are potentially adverse to your interests as an investor in the notes. |

| • | You Must Rely on Your Own Evaluation of the Merits of an Investment in the Notes:In the ordinary course of their businesses Lehman Brothers Holdings Inc., or its respective affiliates, may from time to time express views on expected movements in the level of the Basket Index and/or rates of the Basket Currencies. These views are sometimes communicated to clients who are active participants in the equity and/or currency markets. However, these views, depending upon worldwide economic, political and other developments, may vary over differing time horizons, may be inconsistent with the investment view implied in the notes and are subject to change. In connection with your purchase of the notes, you should investigate the equity and currency markets and not rely on views which may be expressed by Lehman Brothers Holdings Inc. or its affiliates in the ordinary course of their businesses with respect to the future performance of the Equity Component and the Currency Component. |

| • | Many Economic and Market Factors Will Impact the Value of the Notes:In addition to the level of the Basket on any day, the value of the notes will be affected by a number of economic and market factors that may either offset or magnify each other and which are set out in more detail in the product supplement no. 570-I. |

| • | Creditworthiness of Issuer:An investment in the notes will be subject to the credit risk of Lehman Brothers Holdings, Inc., and the actual and perceived creditworthiness of Lehman Brothers Holdings Inc. may affect the market value of the notes. |

| • | Tax Treatment: You should consider the tax consequences of investing in the notes and you should consult your own tax advisor about your own tax situation before investing in the notes. |

PS-8

Hypothetical Payment at Maturity for Each USD1,000 Principal Amount Note

The following table illustrates the hypothetical payment amount at maturity, for a hypothetical range of performance of the Basket for a Basket Return of —100% to 50% and reflects the Starting Basket Level of 1,000 and the Participation Rate of 111.50%. The hypothetical payment at maturity examples set forth below are for illustrative purposes only, have been chosen arbitrarily for the purposes of these examples, are not associated with Lehman Brothers Research forecasts for the Equity Component or Currency Component and may not be indicative of the actual payment at maturity. The numbers appearing in the table below have been rounded for ease of analysis.

Hypothetical Basket Return | Hypothetical Ending Basket Level | Total Amount Payable at Maturity Per $1,000 Note | Hypothetical Total Rate of Return | Annualized Pre-Tax Rate of Return | ||||

| -100% | 0.00 | $1,000.00 | 0.00% | 0.00% | ||||

| -75% | 250.00 | $1,000.00 | 0.00% | 0.00% | ||||

| -50% | 500.00 | $1,000.00 | 0.00% | 0.00% | ||||

| -45% | 550.00 | $1,000.00 | 0.00% | 0.00% | ||||

| -40% | 600.00 | $1,000.00 | 0.00% | 0.00% | ||||

| -35% | 650.00 | $1,000.00 | 0.00% | 0.00% | ||||

| -30% | 700.00 | $1,000.00 | 0.00% | 0.00% | ||||

| -25% | 750.00 | $1,000.00 | 0.00% | 0.00% | ||||

| -20% | 800.00 | $1,000.00 | 0.00% | 0.00% | ||||

| -15% | 850.00 | $1,000.00 | 0.00% | 0.00% | ||||

| -10% | 900.00 | $1,000.00 | 0.00% | 0.00% | ||||

| -5% | 950.00 | $1,000.00 | 0.00% | 0.00% | ||||

| 0% | 1,000.00 | $1,000.00 | 0.00% | 0.00% | ||||

| 5% | 1,050.00 | $1,055.75 | 5.58% | 1.09% | ||||

| 10% | 1,100.00 | $1,111.50 | 11.15% | 2.14% | ||||

| 15% | 1,150.00 | $1,167.25 | 16.73% | 3.14% | ||||

| 20% | 1,200.00 | $1,223.00 | 22.30% | 4.11% | ||||

| 25% | 1,250.00 | $1,278.75 | 27.88% | 5.04% | ||||

| 30% | 1,300.00 | $1,334.50 | 33.45% | 5.94% | ||||

| 35% | 1,350.00 | $1,390.25 | 39.03% | 6.81% | ||||

| 40% | 1,400.00 | $1,446.00 | 44.60% | 7.65% | ||||

| 45% | 1,450.00 | $1,501.75 | 50.18% | 8.47% | ||||

| 50% | 1,500.00 | $1,557.50 | 55.75% | 9.27% |

Hypothetical Examples of Amounts Payable at Maturity

The examples below illustrate the hypothetical Payment at Maturity amount (including, where applicable, the payment of the Additional Amount) per $1,000 principal amount note, and reflect the Basket Index Starting Level, the Basket Currency Starting Levels, the Starting Equity Component Level, the Starting Currency Component Level and the Participation Rate. The examples also are based on hypothetical values for the Basket Index Ending Level (which will be determined on the Valuation Date), the Basket Currency Ending Levels (which will be determined on the Valuation Date), the Ending Equity Component Level (which will be determined on the Valuation Date) and the Ending Currency Component Level (which will be determined on the Valuation Date). The following results are based solely on the hypothetical examples cited; the hypothetical values above have been chosen arbitrarily for the purpose of these examples, are not associated with Lehman Brothers Research forecasts and should not be taken as indicative of the future performance of the Basket Index or the Basket Currencies. Numbers in the examples have been rounded for ease of analysis.

PS-9

Example 1: The Basket Index Ending Level is greater than the Basket Index Starting Level. As a result, the level of the Ending Equity Component Level increases from a Starting Equity Component Level of 450 to an Ending Equity Component Level of 549.000. The Basket Currency Ending Levels of the BRL, the RUB and the INR are lower than their respective Basket Currency Starting Levels (i.e., the BRL, the RUB and the INR have appreciated relative to the USD). As a result, the Ending Currency Component Level increases from a Starting Currency Component Level of 550 to an Ending Currency Component Level of 678.348.

Because the Ending Basket Level is the sum of the Ending Equity Component Level and the Ending Currency Component Level (549.000 + 678.348 = 1,227.348) and is above the Starting Basket Level of 1,000, the payment at maturity is equal to $1,253.50 per $1,000 principal amount note, and is calculated as follows:

$1,000 + [$1,000 × 0.2274 × 1.115] = $1,253.50

.2274 = Basket Level up 22.74%

1.115 = 111.50% Participation Rate

The table below illustrates how the Ending Basket Level in the above example was calculated:

Basket Index | Hypothetical Basket Index Starting Level (on Pricing Date) | Hypothetical Basket Index Ending Level (on Valuation Date) | Hypothetical Basket Index Return | Weighting | Hypothetical Weighted Return on Basket Index | |||||

| SBR | 2,912.04 | 3,552.69 | 22.0% | 100.00% | 22.000% | |||||

| Total Return on Equity Component = | 22.000% | |||||||||

| Ending Equity Component Level = 450 × (1 + Basket Index Return) = | 549.000 | |||||||||

Basket Currency | Hypothetical Basket Currency Starting Level (on Pricing Date) | Hypothetical Basket Currency Ending Level (on Valuation Date) | Hypothetical Basket Currency Return | Weighting | Hypothetical Weighted Return on Respective Basket Currency | |||||

| BRL | 1.7075 | 1.4229 | 20.0% | 33.33% | 6.667% | |||||

| RUB | 24.4360 | 22.2150 | 10.0% | 33.33% | 3.333% | |||||

| INR | 40.0500 | 28.6070 | 40.0% | 33.34% | 13.336% | |||||

| Total Return on Currency Component = | 23.336% | |||||||||

| Ending Currency Component Level = 550 × (1 + (sum of (Basket Currency Return × Basket Currency Weighting) for all Basket Currencies)) = | 678.348 | |||||||||

PS-10

Example 2: The Basket Index Ending Level is greater than the Basket Index Starting Level. As a result, the level of the Ending Equity Component Level increases from a Starting Equity Component Level of 450 to an Ending Equity Component Level of 675.000. The Basket Currency Ending Levels of the BRL and the INR are greater than their respective Basket Currency Starting Levels (i.e., the BRL and the INR have depreciated relative to the USD), but the Basket Currency Ending Level of the RUB is lower than its Basket Currency Starting Level (i.e., the RUB has appreciated relative to the USD). The decrease in the values of the BRL and the INR are not offset by the increase in the value of the RUB. As a result, the Ending Currency Component Level decreases from a Starting Currency Component Level of 550 to an Ending Currency Component Level of 509.662.

Because the Ending Basket Level is the sum of the Ending Equity Component Level and the Ending Currency Component Level (675.000 + 509.662 = 1,184.662) and is above the Starting Basket Level of 1,000, the payment at maturity is equal to $1,205.94 per $1,000 principal amount note, and is calculated as follows:

$1,000 + [$1,000 × 0.1847 × 1.115] = $1,205.94

.1847 = Basket Level up 18.47%

1.115 = 111.50% Participation Rate

The table below illustrates how the Ending Basket Level in the above example was calculated:

Basket Index | Hypothetical Basket Index Starting Level (on Pricing Date) | Hypothetical Basket Index Ending Level (on Valuation Date) | Hypothetical Basket Index Return | Weighting | Hypothetical Weighted Return on Basket Index | |||||

| SBR | 2,912.04 | 4,368.06 | 50.0% | 100.00% | 50.000% | |||||

| Total Return on Equity Component = | 50.000% | |||||||||

| Ending Equity Component Level = 450 × (1 + Basket Index Return) = | 675.000 | |||||||||

Basket Currency | Hypothetical Basket Level (on Pricing Date) | Hypothetical Basket Ending Level (on Valuation Date) | Hypothetical Basket Return | Weighting | Hypothetical Weighted | |||||

| BRL | 1.7075 | 2.1344 | -20.0% | 33.33% | -6.667% | |||||

| RUB | 24.4360 | 22.2150 | 10.0% | 33.33% | 3.333% | |||||

| INR | 40.0500 | 45.5110 | -12.0% | 33.34% | -4.001% | |||||

| Total Return on Currency Component = | -7.334% | |||||||||

| Ending Currency Component Level = 550 × (1 + (sum of (Basket Currency Return × Basket Currency Weighting) for all Basket Currencies)) = | 509.662 | |||||||||

PS-11

Example 3: The Basket Index Ending Level is lower than the Basket Index Starting Level. As a result, the level of the Ending Equity Component Level decreases from a Starting Equity Component Level of 450 to an Ending Equity Component Level of 360.000. The Basket Currency Ending Levels of the BRL and the INR are greater than their respective Basket Currency Starting Levels (i.e., the BRL and the INR have depreciated relative to the USD), but the Basket Currency Ending Level of the RUB is lower than its Basket Currency Starting Level (i.e., the RUB has appreciated relative to the USD). The decrease in the values of the BRL and the INR are more than offset by the increase in the value of the RUB. As a result, the Ending Currency Component Level increases from a Starting Currency Component Level of 550 to an Ending Currency Component Level of 559.159.

Because the Ending Basket Level is the sum of the Ending Equity Component Level and the Ending Currency Component Level (360.000 + 559.159 = 919.159) and is not greater than the Basket Starting Value of 1,000, the payment at maturity is equal to $1,000 per $1,000 principal amount note.

$1,000

The table below illustrates how the Ending Basket Level in the above example was calculated:

Basket Index | Hypothetical Basket Index Starting Level (on Pricing Date) | Hypothetical Basket Index Ending Level (on Valuation Date) | Hypothetical Basket Index Return | Weighting | Hypothetical Weighted Return on Basket Index | |||||

| SBR | 2,912.04 | 2,329.63 | -20.0% | 100.00% | -20.000% | |||||

| Total Return on Equity Component = | -20.000% | |||||||||

| Ending Equity Component Level = 450 × (1 + Basket Index Return) = | 360.000 | |||||||||

Basket Currency | Hypothetical Basket Currency Starting Level (on Pricing Date) | Hypothetical Basket Ending Level | Hypothetical | Weighting | Hypothetical Weighted | |||||

| BRL | 1.7075 | 2.1344 | -20.0% | 33.33% | -6.667% | |||||

| RUB | 24.4360 | 16.8520 | 45.0% | 33.33% | 15.000% | |||||

| INR | 40.0500 | 50.0630 | -20.0% | 33.34% | -6.668% | |||||

| Total Return on Currency Component = | 1.665% | |||||||||

| Ending Currency Component Level = 550 × (1 + (sum of (Basket Currency Return × Basket Currency Weighting) for all Basket Currencies)) = | 559.159 | |||||||||

PS-12

Example 4: The Basket Index Ending Level is lower than the Basket Index Starting Level. As a result, the level of the Ending Equity Component Level decreases from a Starting Component Basket Level of 450 to an Ending Equity Component Level of 270.000. The Basket Currency Ending Levels of the BRL, the RUB and the INR are greater than their respective Basket Currency Starting Levels (i.e., the BRL, the RUB and the INR have depreciated relative to the USD). As a result, the Ending Currency Component Level decreases from a Starting Currency Component Level of 550 to an Ending Currency Component Level of 449.158.

Because the Ending Basket Level is the sum of the Ending Equity Component Level and the Ending Currency Component Level (270.000 + 449.158 = 719.158) and is less than the Basket Starting Value of 1,000, the payment at maturity is equal to $1,000 per $1,000 principal amount note.

$1,000

The table below illustrates how the Ending Basket Level in the above example was calculated:

Basket Index | Hypothetical Basket Index Starting Level (on Pricing Date) | Hypothetical Basket Index Ending Level (on Valuation Date) | Hypothetical Basket Index Return | Weighting | Hypothetical Weighted Return on Basket Index | |||||

| SBR | 2,912.04 | 1,747.22 | -40.0% | 100.00% | -40.000% | |||||

| Total Return on Equity Component = | -40.000% | |||||||||

| Ending Equity Component Level = 450 × (1 + Basket Index Return) = | 270.000 | |||||||||

Basket Currency | Hypothetical Basket Level (on Pricing Date) | Hypothetical Basket Ending Level (on Valuation Date) | Hypothetical Return | Weighting | Hypothetical Weighted | |||||

| BRL | 1.7075 | 2.2767 | -25.0% | 33.33% | -8.330% | |||||

| RUB | 24.4360 | 25.7220 | -5.0% | 33.33% | -1.670% | |||||

| INR | 40.0500 | 53.4000 | -25.0% | 33.34% | -8.335% | |||||

| Total Return on Currency Component = | -18.335% | |||||||||

| Ending Currency Component Level = 550 × (1 + (sum of (Basket Currency Return × Basket Currency Weighting) for all Basket Currencies)) = | 449.158 | |||||||||

PS-13

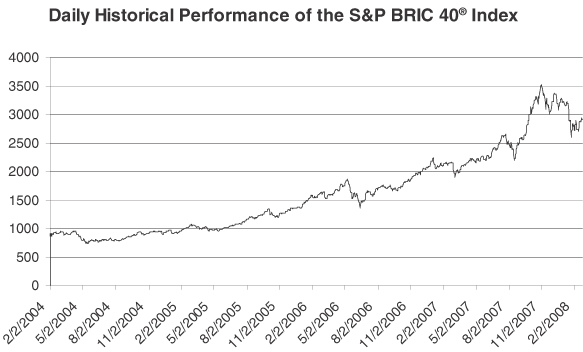

Historical Basket Index Information

The following graph sets forth the daily historical performance of the Basket Index from February 2, 2004 (the date on which the Index level was first calculated) through February 22, 2008. The closing level of the S&P BRIC 40® Index on February 22, 2008 was 2,912.04.

We obtained the various Index Levels below from Bloomberg Financial Markets, and accordingly, make no representation or warranty as to their accuracy or completeness. The historical level of the Basket Index should not be taken as an indication of future performance of the Basket Index, the Basket Index Return or what the value of the notes may be, and no assurance can be given as to the closing level of the Basket Index on the Valuation Date. Fluctuations in Index Levels make it difficult to predict whether the Additional Amount will be greater than zero at maturity. Historical Index Level fluctuations may be greater or lesser than those experienced by the holders of the notes.

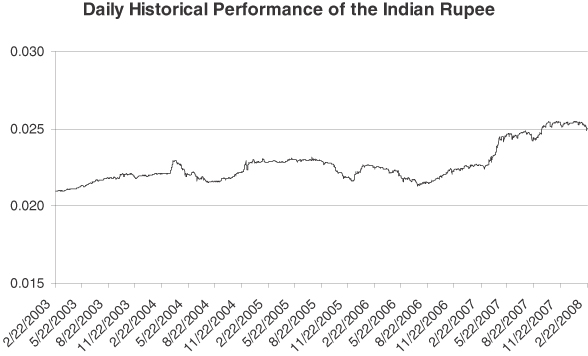

Historical Basket Currency Information

The following graphs set forth the daily historical performance of each Basket Currency from February 21, 2003 through February 22, 2008. The spot exchange rate for the BRL on February 22, 2008 was 1.7075. The spot exchange rate for the RUB on February 22, 2008 was 24.4360. The spot exchange rate for the INR on February 22, 2008 was 40.0500.

We obtained the various spot exchange rates below from Bloomberg Financial Markets, and accordingly, make no representation or warranty as to their accuracy or completeness. The spot exchange rates used in the graphs below are expressed as the amount of U.S. dollars per Basket Currency to show the appreciation or depreciation, as the case may be, of the Reference Currency against the U.S. dollar. The spot exchange rates used to calculate the Basket Return are expressed as the amount of Basket Currency per U.S. dollar, which are the inverse of the spot exchange rates presented in the examples above. The historical data on each Basket Currency should not be taken as an indication of future performance of the Basket Currencies, the Basket Currency Return or what the value of the notes may be, and no assurance can be given as to the Reference Exchange Rate of any Basket

PS-14

Currency on the Valuation Date. Fluctuations in exchange rates make it difficult to predict whether the Additional Amount will be greater than zero at maturity. Historical exchange rate fluctuations may be greater or lesser than those experienced by the holders of the notes.

PS-15

Supplemental Plan of Distribution

We have agreed to sell to Lehman Brothers Inc., and the Lehman Brothers Inc. has agreed to purchase, all of the notes at the price indicated on the cover of this pricing supplement.

We have agreed to indemnify Lehman Brothers Inc. against liabilities, including liabilities under the Securities Act of 1933, as amended, or to contribute to payments that Lehman Brothers Inc. may be required to make relating to these liabilities as described in the Series I MTN prospectus supplement and the base prospectus.

We expect to deliver the Notes against payment on or about February 29, 2008, which is the fifth business day following the Pricing Date. Under Rule 15c6-1 of the Exchange Act, trades in the secondary market generally are required to settle in three business days, unless the parties to any such trade expressly agree otherwise. Accordingly, if any purchaser wishes to trade the Notes on the Pricing Date, it will be required, by virtue of the fact that the Notes initially will settle on the fifth business day following the Pricing Date, to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement.

Lehman Brothers Inc. will offer the notes initially at a public offering price equal to the issue price set forth on the cover of this pricing supplement. After the initial public offering, the public offering price may from time to time be varied by Lehman Brothers Inc.

We have, or our affiliate has, entered into swap agreements or related hedge transactions with one of our other affiliates or unaffiliated counterparties in connection with the sale of the notes and Lehman Brothers Inc. and/or an affiliate may earn additional income as a result of payments pursuant to the swap, or related hedge transactions.

PS-16