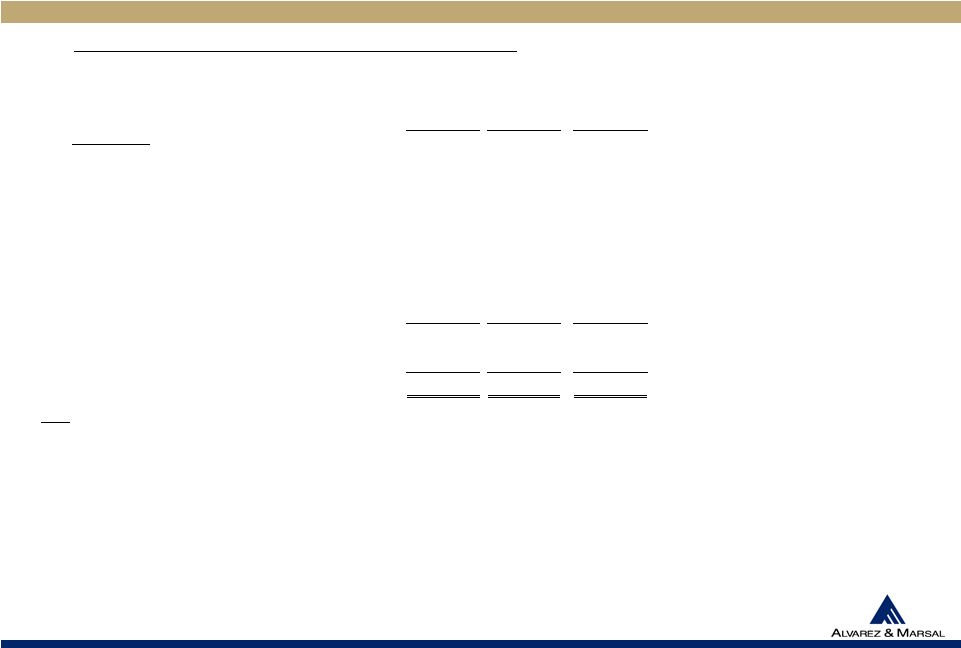

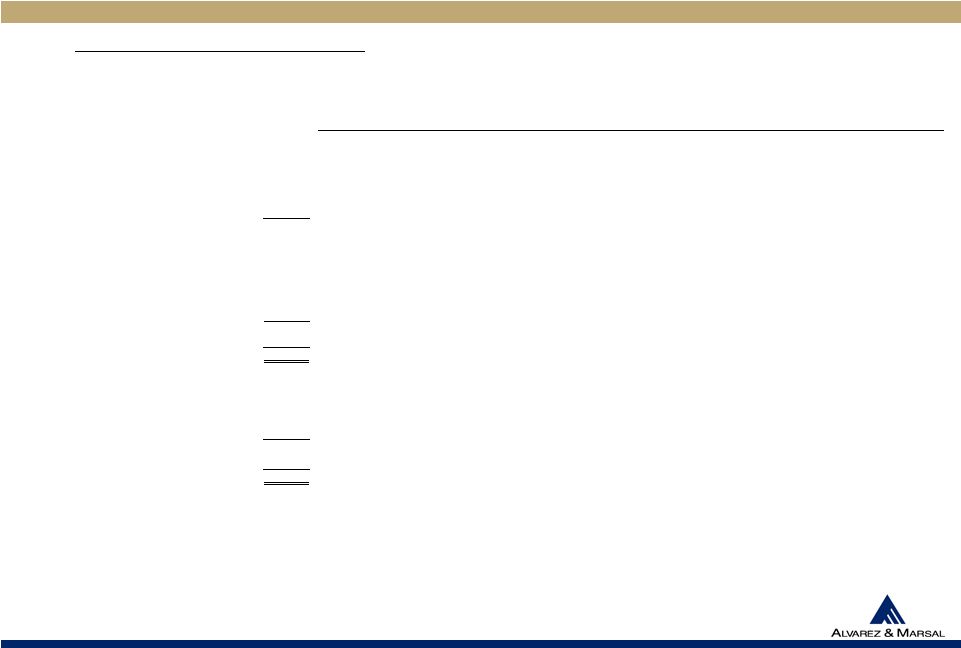

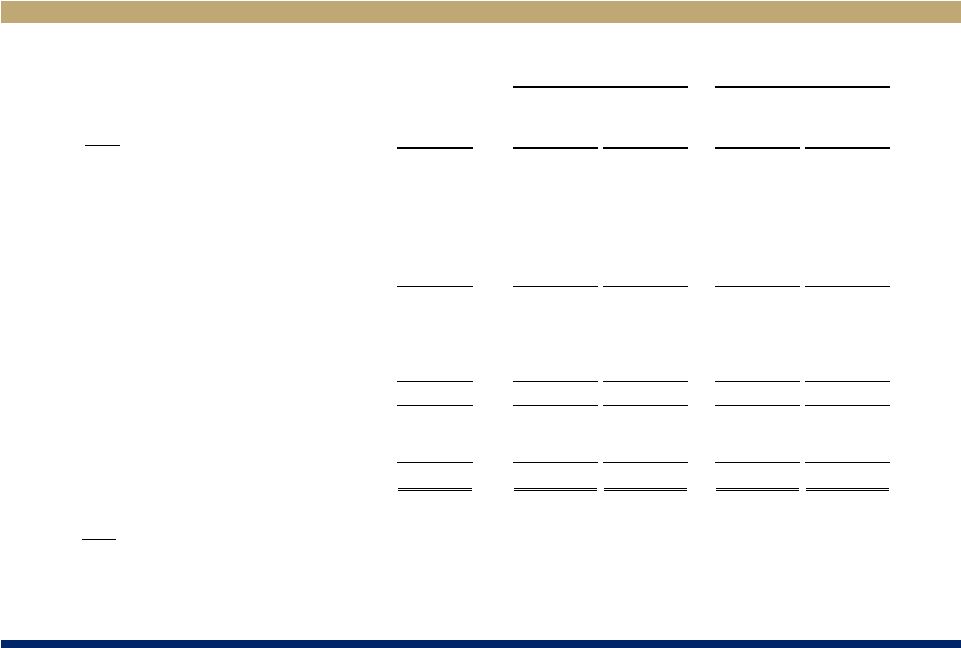

B. Cash Flow: Filing Date to 6/30/10 11 II. Asset Recovery Update (continued) ($ in Millions, foreign currencies reflected in USD equivalents) Sources of Cash Comments Derivatives 11,467 $ Primarily settlements from counterparties Loans 3,929 Primarily principal and interest from corporate borrowers Real Estate 2,165 Primarily principal and interest on real estate loans PE / PI 1,792 Primarily redemptions, distributions and/or proceeds from the sale of investments Other Regions 1,687 Transfers from Lehman entities in Asia and South America Major Assets 2,824 Includes sale of office buildings $1.3BN, Neuberger Berman $685MM, R3 Capital $254MM, Eagle Energy $230MM, and Aviation assets $166MM Minor Other Assets 2,121 Primarily dividend distributions, intercompany loan repayments, return of cash collateral, and other collections in legacy bank accts Total Sources of Cash 25,984 Uses of Cash Reinvestment in Legacy Assets (3,813) Primarily collateral posted for derivative hedging, purchase of open loan trades, preservation of real estate assets, and PEPI capital call funding Operating Expenses / Professional Fees (1,562) Compensation $550MM (including A&M), professional fees $527MM, Transaction Services Agreement $121MM, rent $91MM and other of $273MM Bankhaus Settlement (1,280) Purchase of loans per court-approved settlement Capital Contributions to Subsidiaries (380) Woodlands Bank $200MM and Aurora Bank $180MM Other Disbursements / FX Fluctuation (904) Total Uses of Cash (7,938) Net Cash Flow 18,045 $ Beginning Cash (9/15/08) 2,409 $ Beginning cash balance has been adjusted from the 11/18/09 State of Estate presentation to reflect cash collateral seized by BOA and JPM, adjustments for pre-petition overdraft balances, and inclusion of legacy Europe account balances Net Cash Flow 18,045 Financial Institution Set-Off and Other (1,532) Ending Cash (6/30/10) 18,922 Cash Collateral - Posted Pre-Petition 2,209 Includes $2.2BN still held as collateral by Citibank and HSBC that is subject to bank claims primarily for clearing and derivative exposure Ending Cash and Cash Collateral (6/30/10) 21,131 $ Excludes $9.3BN believed to be wrongfully taken by JPMorgan ("JPM"), Bank of America ("BOA"), and HSBC |