UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811 - 4906 | |||||

|

| |||||

| Dreyfus State Municipal Bond Funds |

| ||||

| (Exact name of Registrant as specified in charter) |

| ||||

|

|

| ||||

|

c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 |

| ||||

| (Address of principal executive offices) (Zip code) |

| ||||

|

|

| ||||

| John Pak, Esq. 200 Park Avenue New York, New York 10166 |

| ||||

| (Name and address of agent for service) |

| ||||

| ||||||

Registrant's telephone number, including area code: | (212) 922-6000 | |||||

|

| |||||

Date of fiscal year end:

| 4/30 |

| ||||

Date of reporting period: | 4/30/14 |

| ||||

| Dreyfus State |

| Municipal Bond Funds, |

| Dreyfus Connecticut Fund |

ANNUAL REPORT April 30, 2014

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

| Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents | |

THE FUND | |

| 2 | A Letter from the President |

| 3 | Discussion of Fund Performance |

| 6 | Fund Performance |

| 8 | Understanding Your Fund’s Expenses |

| 8 | Comparing Your Fund’s Expenses With Those of Other Funds |

| 9 | Statement of Investments |

| 19 | Statement of Assets and Liabilities |

| 20 | Statement of Operations |

| 21 | Statement of Changes in Net Assets |

| 23 | Financial Highlights |

| 28 | Notes to Financial Statements |

| 38 | Report of Independent Registered Public Accounting Firm |

| 39 | Important Tax Information |

| 40 | Board Members Information |

| 42 | Officers of the Fund |

FOR MORE INFORMATION | |

Back Cover |

Dreyfus State

Municipal Bond Funds,

Dreyfus Connecticut Fund

The Fund

A LETTER FROM THE PRESIDENT

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Connecticut Fund, a series of Dreyfus State Municipal Bond Funds, covering the 12-month period from May 1, 2013, through April 30, 2014. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

In the wake of heightened market volatility over much of 2013, municipal bonds generally stabilized over the opening months of 2014, enabling them to post modestly positive total returns, on average, for the reporting period overall.Although concerns regarding a shift to a more moderately accommodative monetary policy initially roiled fixed income markets, investors later took the Federal Reserve Board’s actions in stride. Moreover, investor demand rebounded while the supply of newly issued securities ebbed, and many states and municipalities saw improved credit conditions in the recovering U.S. economy.

We remain cautiously optimistic regarding the municipal bond market’s prospects over the months ahead.We expect the domestic economy to continue to strengthen, which could support higher tax revenues for most states and municipalities.We also anticipate rising demand for a limited supply of securities as more income-oriented investors seek the tax advantages of municipal bonds. As always, we encourage you to discuss our observations with your financial advisor to assess their potential impact on your investments.

Thank you for your continued confidence and support.

J. Charles Cardona

President

The Dreyfus Corporation

May 15, 2014

2

DISCUSSION OF FUND PERFORMANCE

For the period of May 1, 2013, through April 30, 2014, as provided by Daniel Barton and Jeffrey Burger, Portfolio Managers

Fund and Market Performance Overview

For the 12-month period ended April 30, 2014, Class A shares of Dreyfus Connecticut Fund, a series of Dreyfus State Municipal Bond Funds, produced a total return of –2.72%, Class C shares returned –3.39%, Class I shares returned –2.48%, ClassY shares from inception (9/3/13) returned 7.16%, and Class Z shares returned –2.50%.1 In comparison, the Barclays Municipal Bond Index, the fund’s benchmark index, which is composed of bonds issued nationally and not solely within Connecticut, achieved a total return of 0.50% for the full 12-month reporting period.2

Heightened market volatility over the reporting period’s first half was followed by rallies as investor demand rebounded, the supply of newly issued securities declined, and credit conditions improved. The fund lagged its benchmark, mainly due to a focus on longer maturities and lower rated securities, as well as weakness among Puerto Rico bonds.

The Fund’s Investment Approach

The fund seeks to maximize current income exempt from federal and Connecticut state income taxes, without undue risk.To pursue its goal, the fund normally invests substantially all of its assets in municipal bonds that provide income exempt from federal and Connecticut state income taxes.The fund invests at least 70% of its assets in investment-grade municipal bonds or the unrated equivalent as determined by Dreyfus. For additional yield, the fund may invest up to 30% of its assets in municipal bonds rated below investment grade or the unrated equivalent as determined by Dreyfus. The dollar-weighted average maturity of the fund’s portfolio normally exceeds 10 years, but the fund may invest without regard to maturity.

In managing the fund, we focus on identifying undervalued sectors and securities, and we minimize the use of interest rate forecasting.We select municipal bonds by using fundamental credit analysis to estimate the relative value of various sectors and securities and to exploit pricing inefficiencies in the municipal bond market. Additionally, we trade among the market’s various sectors, such as the pre-refunded,

The Fund 3

DISCUSSION OF FUND PERFORMANCE (continued)

general obligation and revenue sectors, based on their apparent relative values.The fund generally will invest simultaneously in several of these sectors.

Municipal Bonds Rebounded from Earlier Weakness

Like other financial assets, municipal bonds lost value in the wake of news in May 2013, that the Federal Reserve Board (the “Fed”) would back away from its quantitative easing program sooner than expected.The resulting market turbulence sent long-term bond prices lower, sparking a flight of capital from the municipal bond market. Selling pressure was particularly severe among lower rated and longer term securities.

However, municipal bonds stabilized in the fall, and the first four months of 2014 witnessed a market recovery amid weaker-than-expected economic data. Municipal bond prices also were supported by favorable supply-and-demand dynamics as investor demand recovered and less refinancing activity produced a reduced supply of newly issued securities.

The economic rebound resulted in better underlying credit conditions for most issuers. However, credit concerns lingered with regard to the fiscal problems of two major issuers:The City of Detroit filed for bankruptcy protection during the summer of 2013, and in September, municipal bonds issued by Puerto Rico lost value after media reports detailed the U.S. territory’s economic challenges. Connecticut continued to lag during the economic recovery due to above-average unemployment, capital gains tax shortfalls, and weak pension funding ratios.

Puerto Rico Bonds Undermined Relative Performance

The fund’s relative results were hindered during the reporting period by its holdings of Puerto Rico bonds, which are exempt from federal and Connecticut state taxes. In addition, an overweighted position in bonds with longer maturities and credit ratings of BBB and lower undermined results early in the reporting period. Bonds backed by the state’s settlement of litigation with U.S. tobacco companies also underperformed market averages.

The fund achieved better results through its emphasis on revenue bonds backed by hospitals, which saw robust demand from investors seeking higher levels of tax-exempt income. Overweighted exposure to bonds backed by education facilities, industrial corporations, and water-and-sewer facilities also fared relatively well.

4

Adapting to a Changing Market Environment

We currently expect U.S. economic growth to rebound as the weather warms, the labor market strengthens, and investor confidence improves. In addition, we believe that recently improved market trends have been driven, in part, by investors returning their focus to market and issuer fundamentals now that the Fed is tapering its quantitative easing program, and we expect this positive trend to continue.

We have taken advantage of bouts of volatility to reduce the fund’s Puerto Rico holdings at relatively attractive prices, and we have redeployed those assets primarily to longer term, higher quality securities backed by revenues from essential municipal services. We have maintained a relatively long average duration in anticipation of narrower yield differences along the market’s maturity spectrum.

May 15, 2014

Bond funds are subject generally to interest rate, credit, liquidity, and market risks, to varying degrees, all of which are more fully described in the fund’s prospectus. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes, and rate increases can cause price declines.

The amount of public information available about municipal bonds is generally less than that for corporate equities or bonds. Special factors, such as legislative changes, and state and local economic and business developments, may adversely affect the yield and/or value of the fund’s investments in municipal bonds. Other factors include the general conditions of the municipal bond market, the size of the particular offering, the maturity of the obligation, and the rating of the issue. Changes in economic, business, or political conditions relating to a particular municipal project, municipality, or state in which the fund invests may have an impact on the fund’s share price.

| 1 Total return includes reinvestment of dividends and any capital gains paid, and does not take into consideration the |

| maximum initial sales charge in the case of Class A shares or the applicable contingent deferred sales charge imposed |

| on redemptions in the case of Class C shares. Had these charges been reflected, returns would have been lower. Class |

| Z, ClassY, and Class I shares are not subject to any initial or deferred sales charge. Past performance is no guarantee |

| of future results. Share price, yield, and investment return fluctuate such that upon redemption, fund shares may be |

| worth more or less than their original cost. Income may be subject to state and local taxes for non-Connecticut |

| residents, and some income may be subject to the federal alternative minimum tax (AMT) for certain investors. |

| Capital gains, if any, are fully taxable. Returns for ClassY are from inception date of 9/3/2013. |

| 2 SOURCE: LIPPER INC. — Reflects reinvestment of dividends and, where applicable, capital gain distributions. |

| The Barclays Municipal Bond Index is a widely accepted, unmanaged total return performance benchmark for the |

| long-term, investment-grade, tax-exempt bond market. Index returns do not reflect fees and expenses associated with |

| operating a mutual fund. Investors cannot invest directly in any index. |

The Fund 5

FUND PERFORMANCE

| † | Source: Lipper Inc. |

| †† | The total return figures presented for Class I shares of the fund reflect the performance of the fund’s Class A shares |

| for the period prior to 12/15/08 (the inception date for Class I shares), adjusted to reflect the applicable sales load | |

| for Class A shares. | |

| The total return figures presented for ClassY shares of the fund reflect the performance of the fund’s Class A shares | |

| for the period prior to 9/3/13 (the inception date for ClassY shares), adjusted to reflect the applicable sales load for | |

| Class A shares. |

Past performance is not predictive of future performance.

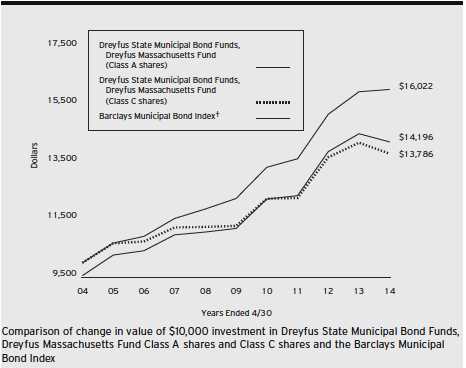

The above graph compares a $10,000 investment made in each of the Class A, Class C, Class I and ClassY shares of Dreyfus State Municipal Bond Funds, Dreyfus Connecticut Fund on 4/30/04 to a $10,000 investment made in the Barclays Municipal Bond Index (the “Index”) on that date. All dividends and capital gain distributions are reinvested. On May 7, 2013, the Board authorized the fund to offer ClassY shares, as a new class of shares, to certain investors, including certain institutional investors. On September 3, 2013, ClassY shares were offered at net asset value and are not subject to certain fees, including Distribution Plan and Shareholder Services Plan fees.

The fund invests primarily in Connecticut municipal securities and its performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on all classes. Performance for Class Z shares will vary from the performance of Class A, Class C, Class I and ClassY shares shown above due to differences in charges and expenses.The Index is not limited to investments principally in Connecticut municipal obligations.The Index, unlike the fund, is an unmanaged total return performance benchmark for the long-term, investment-grade, geographically unrestricted tax-exempt bond market, calculated by using municipal bonds selected to be representative of the municipal market overall.These factors can contribute to the Index potentially outperforming or underperforming the fund. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

| Average Annual Total Returns as of 4/30/14 | |||||||||

| Inception | From | ||||||||

| Date | 1 Year | 5 Years | 10 Years | Inception | |||||

| Class A shares | |||||||||

| with maximum sales charge (4.5%) | 5/28/87 | –7.07 | % | 3.66 | % | 3.34 | % | — | |

| without sales charge | 5/28/87 | –2.72 | % | 4.63 | % | 3.81 | % | — | |

| Class C shares | |||||||||

| with applicable redemption charge † | 8/15/95 | –4.33 | % | 3.86 | % | 3.04 | % | — | |

| without redemption | 8/15/95 | –3.39 | % | 3.86 | % | 3.04 | % | — | |

| Class I shares | 12/15/08 | –2.48 | % | 4.90 | % | 3.96 | %†† | — | |

| Class Y shares | 9/3/13 | –2.51 | %†† | 4.68 | %†† | 3.84 | %†† | — | |

| Class Z shares | 5/30/07 | –2.50 | % | 4.85 | % | — | 3.93 | % | |

| Barclays Municipal Bond Index | 5/31/07 | 0.50 | % | 5.54 | % | 4.83 | % | 4.92 | %††† |

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In addition to the performance of Class A shares shown with and without a maximum sales charge, the fund’s performance shown in the table takes into account all other applicable fees and expenses on all classes.

| † | The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the |

| date of purchase. | |

| †† | The total return performance figures presented for Class I shares of the fund reflect the performance of the fund’s |

| Class A shares for the period prior to 12/15/08 (the inception date for Class I shares). | |

| The total return performance figures presented for ClassY shares of the fund reflect the performance of the fund’s | |

| Class A shares for the period prior to 9/3/13 (the inception date for ClassY shares). | |

| ††† | The Index date is based on the life of Class Z shares. For comparative purposes, the value of the Index as of |

| 5/31/07 is used as the beginning value on 5/30/07 (the inception date for Class Z shares). |

The Fund 7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus State Municipal Bond Funds, Dreyfus Connecticut Fund from November 1, 2013 to April 30, 2014. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

Expenses and Value of a $1,000 Investment

assuming actual returns for the six months ended April 30, 2014

| Class A | Class C | Class I | Class Y | Class Z | ||||||

| Expenses paid per $1,000† | $ | 4.59 | $ | 8.51 | $ | 3.33 | $ | 3.03 | $ | 3.53 |

| Ending value (after expenses) | $ | 1,033.90 | $ | 1,030.90 | $ | 1,035.20 | $ | 1,035.80 | $ | 1,035.00 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment

assuming a hypothetical 5% annualized return for the six months ended April 30, 2014

| Class A | Class C | Class I | Class Y | Class Z | ||||||

| Expenses paid per $1,000† | $ | 4.56 | $ | 8.45 | $ | 3.31 | $ | 3.01 | $ | 3.51 |

| Ending value (after expenses) | $ | 1,020.28 | $ | 1,016.41 | $ | 1,021.52 | $ | 1,021.82 | $ | 1,021.32 |

| † Expenses are equal to the fund’s annualized expense ratio of .91% for Class A, 1.69% for Class C, .66% for |

| Class I, .60% for ClassY and .70% for Class Z, multiplied by the average account value over the period, multiplied |

| by 181/365 (to reflect the one-half year period). |

8

| STATEMENT OF INVESTMENTS | ||||

| April 30, 2014 | ||||

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments—98.1% | Rate (%) | Date | Amount ($) | Value ($) |

| Connecticut—91.1% | ||||

| Connecticut, | ||||

| GO | 5.00 | 12/15/22 | 1,855,000 | 2,059,569 |

| Connecticut, | ||||

| GO | 5.00 | 4/15/24 | 2,500,000 | 2,842,725 |

| Connecticut, | ||||

| GO | 5.00 | 3/1/26 | 5,000,000 | 5,921,150 |

| Connecticut, | ||||

| GO | 5.00 | 11/1/27 | 2,000,000 | 2,293,940 |

| Connecticut, | ||||

| GO | 5.00 | 11/1/27 | 5,000,000 | 5,722,700 |

| Connecticut, | ||||

| GO | 5.00 | 11/1/28 | 3,000,000 | 3,424,080 |

| Connecticut, | ||||

| GO | 5.00 | 11/1/28 | 5,000,000 | 5,698,600 |

| Connecticut, | ||||

| GO | 5.00 | 11/1/31 | 5,000,000 | 5,597,850 |

| Connecticut, | ||||

| Special Tax Obligation | ||||

| Revenue (Transportation | ||||

| Infrastructure Purposes) | 5.00 | 12/1/21 | 5,000,000 | 5,993,050 |

| Connecticut, | ||||

| Special Tax Obligation | ||||

| Revenue (Transportation | ||||

| Infrastructure Purposes) | 5.00 | 11/1/22 | 5,000,000 | 5,812,050 |

| Connecticut, | ||||

| Special Tax Obligation | ||||

| Revenue (Transportation | ||||

| Infrastructure Purposes) | 5.00 | 10/1/24 | 2,730,000 | 3,269,803 |

| Connecticut, | ||||

| Special Tax Obligation Revenue | ||||

| (Transportation Infrastructure | ||||

| Purposes) (Insured; AMBAC) | 5.25 | 7/1/19 | 3,395,000 | 4,039,880 |

| Connecticut, | ||||

| State Revolving Fund | ||||

| General Revenue | 5.00 | 1/1/19 | 5,275,000 | 6,186,467 |

| Connecticut, | ||||

| State Revolving Fund | ||||

| General Revenue | 5.00 | 1/1/23 | 1,250,000 | 1,474,037 |

The Fund 9

STATEMENT OF INVESTMENTS (continued)

| Long-Term Municipal | Coupon | Maturity | Principal | ||

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) | |

| Connecticut (continued) | |||||

| Connecticut, | |||||

| State Revolving Fund | |||||

| General Revenue | 5.00 | 3/1/24 | 1,195,000 | 1,450,240 | |

| Connecticut, | |||||

| State Revolving Fund | |||||

| General Revenue | 5.00 | 7/1/24 | 2,145,000 | 2,565,248 | |

| Connecticut Development Authority, | |||||

| Airport Facility Revenue | |||||

| (Learjet Inc. Project) | 7.95 | 4/1/26 | 2,300,000 | 2,376,958 | |

| Connecticut Development Authority, | |||||

| First Mortgage Gross Revenue | |||||

| (The Elim Park Baptist Home, | |||||

| Inc. Project) (Prerefunded) | 5.25 | 12/1/15 | 1,765,000 | a | 1,920,655 |

| Connecticut Development Authority, | |||||

| PCR (The Connecticut Light and | |||||

| Power Company Project) | 4.38 | 9/1/28 | 3,900,000 | 4,188,132 | |

| Connecticut Development Authority, | |||||

| Water Facilities Revenue | |||||

| (Aquarion Water Company of | |||||

| Connecticut Project) | 5.50 | 4/1/21 | 4,500,000 | 5,090,175 | |

| Connecticut Development Authority, | |||||

| Water Facilities Revenue (Aquarion | |||||

| Water Company of Connecticut | |||||

| Project) (Insured; XLCA) | 5.10 | 9/1/37 | 6,550,000 | 6,703,729 | |

| Connecticut Health and Educational | |||||

| Facilities Authority, Revenue | |||||

| (Ascension Health Senior | |||||

| Credit Group) | 5.00 | 11/15/40 | 10,000,000 | 10,663,900 | |

| Connecticut Health and Educational | |||||

| Facilities Authority, Revenue | |||||

| (Bridgeport Hospital Issue) | 5.00 | 7/1/25 | 3,625,000 | 3,986,666 | |

| Connecticut Health and Educational | |||||

| Facilities Authority, Revenue | |||||

| (Fairfield University Issue) | 5.00 | 7/1/25 | 1,340,000 | 1,500,840 | |

| Connecticut Health and Educational | |||||

| Facilities Authority, Revenue | |||||

| (Fairfield University Issue) | 5.00 | 7/1/27 | 1,420,000 | 1,576,456 | |

| Connecticut Health and Educational | |||||

| Facilities Authority, Revenue | |||||

| (Fairfield University Issue) | 5.00 | 7/1/34 | 4,000,000 | 4,322,600 |

10

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) |

| Connecticut (continued) | ||||

| Connecticut Health and Educational | ||||

| Facilities Authority, Revenue | ||||

| (Fairfield University Issue) | 5.00 | 7/1/35 | 2,000,000 | 2,118,940 |

| Connecticut Health and Educational | ||||

| Facilities Authority, Revenue | ||||

| (Fairfield University Issue) | 5.00 | 7/1/40 | 2,500,000 | 2,627,675 |

| Connecticut Health and Educational | ||||

| Facilities Authority, Revenue | ||||

| (Greenwich Academy Issue) | ||||

| (Insured; Assured Guaranty | ||||

| Municipal Corp.) | 5.25 | 3/1/32 | 10,880,000 | 13,918,675 |

| Connecticut Health and | ||||

| Educational Facilities | ||||

| Authority, Revenue | ||||

| (Hartford HealthCare Issue) | 5.00 | 7/1/27 | 3,265,000 | 3,614,551 |

| Connecticut Health and | ||||

| Educational Facilities | ||||

| Authority, Revenue | ||||

| (Hartford HealthCare Issue) | 5.00 | 7/1/32 | 1,000,000 | 1,056,000 |

| Connecticut Health and Educational | ||||

| Facilities Authority, Revenue | ||||

| (Hartford HealthCare Issue) | 5.00 | 7/1/41 | 2,000,000 | 2,077,960 |

| Connecticut Health and Educational | ||||

| Facilities Authority, Revenue | ||||

| (Hospital for Special Care | ||||

| Issue) (Insured; Radian) | 5.25 | 7/1/32 | 2,000,000 | 2,047,280 |

| Connecticut Health and Educational | ||||

| Facilities Authority, Revenue | ||||

| (Lawrence and Memorial | ||||

| Hospital Issue) | 5.00 | 7/1/31 | 1,000,000 | 1,068,810 |

| Connecticut Health and Educational | ||||

| Facilities Authority, Revenue | ||||

| (Loomis Chaffee School Issue) | ||||

| (Insured; AMBAC) | 5.25 | 7/1/28 | 1,760,000 | 2,211,968 |

| Connecticut Health and | ||||

| Educational Facilities | ||||

| Authority, Revenue | ||||

| (Quinnipiac University Issue) | ||||

| (Insured; National Public | ||||

| Finance Guarantee Corp.) | 5.00 | 7/1/19 | 2,000,000 | 2,198,540 |

The Fund 11

STATEMENT OF INVESTMENTS (continued)

| Long-Term Municipal | Coupon | Maturity | Principal | ||

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) | |

| Connecticut (continued) | |||||

| Connecticut Health and Educational | |||||

| Facilities Authority, Revenue | |||||

| (Quinnipiac University Issue) | |||||

| (Insured; National Public | |||||

| Finance Guarantee Corp.) | 5.75 | 7/1/33 | 5,000,000 | 5,675,650 | |

| Connecticut Health and Educational | |||||

| Facilities Authority, Revenue | |||||

| (Sacred Heart University Issue) | 5.38 | 7/1/31 | 1,000,000 | 1,072,670 | |

| Connecticut Health and Educational | |||||

| Facilities Authority, Revenue | |||||

| (Salisbury School Issue) (Insured; | |||||

| Assured Guaranty Corp.) | 5.00 | 7/1/33 | 5,000,000 | 5,445,050 | |

| Connecticut Health and Educational | |||||

| Facilities Authority, Revenue | |||||

| (Stamford Hospital Issue) | 5.00 | 7/1/30 | 6,750,000 | 7,160,872 | |

| Connecticut Health and Educational | |||||

| Facilities Authority, Revenue | |||||

| (The William W. Backus | |||||

| Hospital Issue) (Insured; | |||||

| Assured Guaranty Municipal | |||||

| Corp.) (Prerefunded) | 5.25 | 7/1/18 | 2,000,000 | a | 2,344,900 |

| Connecticut Health and Educational | |||||

| Facilities Authority, Revenue | |||||

| (Trinity College Issue) | |||||

| (Insured; National Public | |||||

| Finance Guarantee Corp.) | 5.00 | 7/1/22 | 1,000,000 | 1,007,430 | |

| Connecticut Health and Educational | |||||

| Facilities Authority, Revenue | |||||

| (University of Hartford Issue) | |||||

| (Insured; Radian) | 5.00 | 7/1/17 | 1,220,000 | 1,308,609 | |

| Connecticut Health and Educational | |||||

| Facilities Authority, Revenue | |||||

| (University of Hartford Issue) | |||||

| (Insured; Radian) | 5.25 | 7/1/36 | 2,500,000 | 2,541,275 | |

| Connecticut Health and Educational | |||||

| Facilities Authority, Revenue | |||||

| (Wesleyan University Issue) | 5.00 | 7/1/35 | 5,000,000 | 5,475,150 | |

| Connecticut Health and Educational | |||||

| Facilities Authority, Revenue | |||||

| (Wesleyan University Issue) | 5.00 | 7/1/39 | 6,500,000 | 7,068,425 |

12

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) |

| Connecticut (continued) | ||||

| Connecticut Health and Educational | ||||

| Facilities Authority, Revenue | ||||

| (Western Connecticut Health | ||||

| Network Issue) | 5.38 | 7/1/41 | 1,000,000 | 1,071,390 |

| Connecticut Health and Educational | ||||

| Facilities Authority, Revenue | ||||

| (Yale University Issue) | 5.00 | 7/1/40 | 5,000,000 | 5,518,150 |

| Connecticut Health and Educational | ||||

| Facilities Authority, Revenue | ||||

| (Yale-New Haven Hospital Issue) | 5.75 | 7/1/34 | 4,000,000 | 4,539,200 |

| Connecticut Health and Educational | ||||

| Facilities Authority, State | ||||

| Supported Child Care Revenue | 5.00 | 7/1/25 | 1,490,000 | 1,656,537 |

| Connecticut Higher Education | ||||

| Supplemental Loan Authority, | ||||

| Senior Revenue (Connecticut | ||||

| Family Education Loan Program) | ||||

| (Insured; National Public | ||||

| Finance Guarantee Corp.) | 4.50 | 11/15/20 | 1,510,000 | 1,512,054 |

| Connecticut Higher Education | ||||

| Supplemental Loan Authority, | ||||

| Senior Revenue (Connecticut | ||||

| Family Education Loan Program) | ||||

| (Insured; National Public | ||||

| Finance Guarantee Corp.) | 4.80 | 11/15/22 | 3,105,000 | 3,232,740 |

| Connecticut Municipal Electric | ||||

| Energy Cooperative, Power | ||||

| Supply System Revenue | 5.00 | 1/1/38 | 3,000,000 | 3,225,750 |

| Connecticut Municipal Electric | ||||

| Energy Cooperative, | ||||

| Transmission Services Revenue | 5.00 | 1/1/22 | 1,505,000 | 1,793,253 |

| Connecticut Resources Recovery | ||||

| Authority, RRR (American | ||||

| Ref-Fuel Company of Southeastern | ||||

| Connecticut Project) | 5.50 | 11/15/15 | 1,000,000 | 1,000,550 |

| Connecticut Resources Recovery | ||||

| Authority, RRR (American | ||||

| Ref-Fuel Company of Southeastern | ||||

| Connecticut Project) | 5.50 | 11/15/15 | 3,250,000 | 3,251,787 |

The Fund 13

STATEMENT OF INVESTMENTS (continued)

| Long-Term Municipal | Coupon | Maturity | Principal | ||

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) | |

| Connecticut (continued) | |||||

| Connecticut Transmission Municipal | |||||

| Electric Energy Cooperative, | |||||

| Transmission System Revenue | 5.00 | 1/1/42 | 3,000,000 | 3,219,870 | |

| Eastern Connecticut Resource | |||||

| Recovery Authority, Solid | |||||

| Waste Revenue (Wheelabrator | |||||

| Lisbon Project) | 5.50 | 1/1/20 | 7,000,000 | 7,010,500 | |

| Greater New Haven Water Pollution | |||||

| Control Authority, Regional | |||||

| Wastewater System Revenue | |||||

| (Insured; Assured Guaranty | |||||

| Municipal Corp.) | 5.00 | 11/15/37 | 1,800,000 | 1,937,268 | |

| Greater New Haven Water Pollution | |||||

| Control Authority, Regional | |||||

| Wastewater System Revenue | |||||

| (Insured; National Public | |||||

| Finance Guarantee Corp.) | 5.00 | 11/15/30 | 5,000,000 | 5,248,250 | |

| Greater New Haven Water Pollution | |||||

| Control Authority, Regional | |||||

| Wastewater System Revenue | |||||

| (Insured; National Public | |||||

| Finance Guarantee Corp.) | 5.00 | 8/15/35 | 2,000,000 | 2,106,520 | |

| Hamden, | |||||

| GO (Insured; National Public | |||||

| Finance Guarantee Corp.) | |||||

| (Escrowed to Maturity) | 5.25 | 8/15/14 | 5,000 | 5,075 | |

| Hartford, | |||||

| GO | 5.00 | 7/15/16 | 1,775,000 | 1,943,856 | |

| Hartford, | |||||

| GO | 5.00 | 4/1/24 | 1,000,000 | 1,153,160 | |

| Hartford, | |||||

| GO (Escrowed to Maturity) | 5.00 | 4/1/17 | 1,325,000 | 1,491,831 | |

| Hartford, | |||||

| GO (Insured; Assured Guaranty | |||||

| Municipal Corp.) | 5.00 | 4/1/32 | 595,000 | 641,517 | |

| Hartford, | |||||

| GO (Insured; Assured Guaranty | |||||

| Municipal Corp.) (Prerefunded) | 5.00 | 4/1/22 | 255,000 | a | 309,685 |

14

| Long-Term Municipal | Coupon | Maturity | Principal | |

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) |

| Connecticut (continued) | ||||

| Hartford County Metropolitan | ||||

| District, Clean Water | ||||

| Project Revenue | 5.00 | 4/1/31 | 3,510,000 | 3,895,679 |

| Meriden, | ||||

| GO (Insured; National Public | ||||

| Finance Guarantee Corp.) | 5.00 | 8/1/16 | 2,090,000 | 2,303,786 |

| New Britain, | ||||

| GO (Insured; Assured | ||||

| Guaranty Corp.) | 5.00 | 4/1/24 | 4,500,000 | 5,490,585 |

| New Haven, | ||||

| GO | 5.00 | 3/1/17 | 1,425,000 | 1,565,291 |

| New Haven, | ||||

| GO (Insured; Assured | ||||

| Guaranty Corp.) | 5.00 | 3/1/29 | 1,000,000 | 1,050,930 |

| Norwalk, | ||||

| GO | 5.00 | 7/15/24 | 1,000,000 | 1,187,000 |

| South Central Connecticut | ||||

| Regional Water Authority, | ||||

| Water System Revenue | 5.00 | 8/1/27 | 3,000,000 | 3,476,280 |

| South Central Connecticut | ||||

| Regional Water Authority, | ||||

| Water System Revenue | 5.00 | 8/1/31 | 3,940,000 | 4,353,976 |

| South Central Connecticut | ||||

| Regional Water Authority, | ||||

| Water System Revenue | 5.00 | 8/1/32 | 1,370,000 | 1,521,823 |

| South Central Connecticut | ||||

| Regional Water Authority, | ||||

| Water System Revenue | 5.00 | 8/1/33 | 4,000,000 | 4,422,120 |

| South Central Connecticut Regional | ||||

| Water Authority, Water System | ||||

| Revenue (Insured; National | ||||

| Public Finance Guarantee Corp.) | 5.25 | 8/1/24 | 2,000,000 | 2,458,540 |

| South Central Connecticut | ||||

| Regional Water Authority, | ||||

| Water System Revenue | ||||

| (Insured; National Public | ||||

| Finance Guarantee Corp.) | 5.25 | 8/1/31 | 2,000,000 | 2,214,580 |

The Fund 15

STATEMENT OF INVESTMENTS (continued)

| Long-Term Municipal | Coupon | Maturity | Principal | ||

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) | |

| Connecticut (continued) | |||||

| Stamford, | |||||

| GO | 5.00 | 7/1/21 | 4,410,000 | 5,337,114 | |

| University of Connecticut, | |||||

| GO | 5.00 | 2/15/25 | 1,000,000 | 1,151,450 | |

| University of Connecticut, | |||||

| GO | 5.00 | 2/15/27 | 1,000,000 | 1,147,750 | |

| University of Connecticut, | |||||

| GO | 5.00 | 2/15/28 | 1,000,000 | 1,132,480 | |

| University of Connecticut, | |||||

| GO (Insured; Assured Guaranty | |||||

| Municipal Corp.) (Prerefunded) | 5.00 | 2/15/15 | 1,225,000 | a | 1,271,881 |

| University of Connecticut, | |||||

| Special Obligation | |||||

| Student Fee Revenue | 5.00 | 11/15/24 | 5,000,000 | 5,913,350 | |

| U.S. Related—7.0% | |||||

| Children’s Trust Fund of Puerto | |||||

| Rico, Tobacco Settlement | |||||

| Asset-Backed Bonds | 5.50 | 5/15/39 | 3,000,000 | 2,709,630 | |

| Children’s Trust Fund of Puerto | |||||

| Rico, Tobacco Settlement | |||||

| Asset-Backed Bonds | 0.00 | 5/15/50 | 12,000,000 | b | 775,800 |

| Guam, | |||||

| LOR (Section 30) | 5.63 | 12/1/29 | 1,000,000 | 1,088,680 | |

| Guam Economic Development | |||||

| Authority, Tobacco Settlement | |||||

| Asset-Backed Bonds | |||||

| (Escrowed to Maturity) | 5.45 | 5/15/16 | 1,445,000 | 1,587,405 | |

| Guam Power Authority, | |||||

| Revenue | 5.50 | 10/1/30 | 1,750,000 | 1,866,655 | |

| Guam Power Authority, | |||||

| Revenue | 5.00 | 10/1/34 | 2,000,000 | 2,086,600 | |

| Guam Waterworks Authority, | |||||

| Water and Wastewater | |||||

| System Revenue | 5.50 | 7/1/16 | 750,000 | 777,068 | |

| Puerto Rico Aqueduct and Sewer | |||||

| Authority, Senior Lien Revenue | 5.13 | 7/1/37 | 620,000 | 416,355 |

16

| Long-Term Municipal | Coupon | Maturity | Principal | ||

| Investments (continued) | Rate (%) | Date | Amount ($) | Value ($) | |

| U.S. Related (continued) | |||||

| Puerto Rico Commonwealth, | |||||

| Public Improvement GO | |||||

| (Insured; FGIC) | 5.50 | 7/1/16 | 3,270,000 | 3,067,881 | |

| Puerto Rico Highways and | |||||

| Transportation Authority, | |||||

| Transportation Revenue | 5.50 | 7/1/22 | 3,025,000 | 1,661,663 | |

| Virgin Islands Public Finance | |||||

| Authority, Revenue (Virgin Islands | |||||

| Matching Fund Loan Note) | 5.00 | 10/1/25 | 5,000,000 | 5,382,300 | |

| Total Investments (cost $289,889,138) | 98.1 | % | 301,905,525 | ||

| Cash and Receivables (Net) | 1.9 | % | 5,790,538 | ||

| Net Assets | 100.0 | % | 307,696,063 | ||

| a These securities are prerefunded; the date shown represents the prerefunded date. Bonds which are prerefunded are |

| collateralized by U.S. Government securities which are held in escrow and are used to pay principal and interest on |

| the municipal issue and to retire the bonds in full at the earliest refunding date. |

| b Security issued with a zero coupon. Income is recognized through the accretion of discount. |

| Portfolio Summary (Unaudited)† | |||

| Value (%) | Value (%) | ||

| Education | 21.5 | City | 3.3 |

| Health Care | 16.3 | Prerefunded | 2.9 |

| Utility-Water and Sewer | 14.6 | Asset-Backed | 1.1 |

| State/Territory | 12.5 | Housing | .7 |

| Special Tax | 6.7 | Resource Recovery | .3 |

| Utility-Electric | 6.1 | Other | 4.5 |

| Industrial | 3.9 | ||

| Transportation Services | 3.7 | 98.1 | |

| † | Based on net assets. |

The Fund 17

STATEMENT OF INVESTMENTS (continued)

| Summary of Abbreviations | |||

| ABAG | Association of Bay Area | ACA | American Capital Access |

| Governments | |||

| AGC | ACE Guaranty Corporation | AGIC | Asset Guaranty Insurance Company |

| AMBAC | American Municipal Bond | ARRN | Adjustable Rate |

| Assurance Corporation | Receipt Notes | ||

| BAN | Bond Anticipation Notes | BPA | Bond Purchase Agreement |

| CIFG | CDC Ixis Financial Guaranty | COP | Certificate of Participation |

| CP | Commercial Paper | DRIVERS | Derivative Inverse |

| Tax-Exempt Receipts | |||

| EDR | Economic Development | EIR | Environmental Improvement |

| Revenue | Revenue | ||

| FGIC | Financial Guaranty | FHA | Federal Housing |

| Insurance Company | Administration | ||

| FHLB | Federal Home | FHLMC | Federal Home Loan Mortgage |

| Loan Bank | Corporation | ||

| FNMA | Federal National | GAN | Grant Anticipation Notes |

| Mortgage Association | |||

| GIC | Guaranteed Investment | GNMA | Government National Mortgage |

| Contract | Association | ||

| GO | General Obligation | HR | Hospital Revenue |

| IDB | Industrial Development Board | IDC | Industrial Development Corporation |

| IDR | Industrial Development | LIFERS | Long Inverse Floating |

| Revenue | Exempt Receipts | ||

| LOC | Letter of Credit | LOR | Limited Obligation Revenue |

| LR | Lease Revenue | MERLOTS | Municipal Exempt Receipts |

| Liquidity Option Tender | |||

| MFHR | Multi-Family Housing Revenue | MFMR | Multi-Family Mortgage Revenue |

| PCR | Pollution Control Revenue | PILOT | Payment in Lieu of Taxes |

| P-FLOATS | Puttable Floating Option | PUTTERS | Puttable Tax-Exempt Receipts |

| Tax-Exempt Receipts | |||

| RAC | Revenue Anticipation Certificates | RAN | Revenue Anticipation Notes |

| RAW | Revenue Anticipation Warrants | RIB | Residual Interest Bonds |

| ROCS | Reset Options Certificates | RRR | Resources Recovery Revenue |

| SAAN | State Aid Anticipation Notes | SBPA | Standby Bond Purchase Agreement |

| SFHR | Single Family Housing Revenue | SFMR | Single Family Mortgage Revenue |

| SONYMA | State of New York | SPEARS | Short Puttable Exempt |

| Mortgage Agency | Adjustable Receipts | ||

| SWDR | Solid Waste Disposal Revenue | TAN | Tax Anticipation Notes |

| TAW | Tax Anticipation Warrants | TRAN | Tax and Revenue Anticipation Notes |

| XLCA | XL Capital Assurance | ||

| See notes to financial statements. | |||

18

| STATEMENT OF ASSETS AND LIABILITIES |

| April 30, 2014 |

| Cost | Value | |||||

| Assets ($): | ||||||

| Investments in securities—See Statement of Investments | 289,889,138 | 301,905,525 | ||||

| Cash | 5,375,826 | |||||

| Interest receivable | 4,222,591 | |||||

| Receivable for shares of Beneficial Interest subscribed | 6,000 | |||||

| Prepaid expenses | 36,283 | |||||

| 311,546,225 | ||||||

| Liabilities ($): | ||||||

| Due to The Dreyfus Corporation and affiliates—Note 3(c) | 213,943 | |||||

| Payable for investment securities purchased | 3,423,420 | |||||

| Payable for shares of Beneficial Interest redeemed | 141,429 | |||||

| Accrued expenses | 71,370 | |||||

| 3,850,162 | ||||||

| Net Assets ($) | 307,696,063 | |||||

| Composition of Net Assets ($): | ||||||

| Paid-in capital | 303,536,958 | |||||

| Accumulated net realized gain (loss) on investments | (7,857,282 | ) | ||||

| Accumulated net unrealized appreciation | ||||||

| (depreciation) on investments | 12,016,387 | |||||

| Net Assets ($) | 307,696,063 | |||||

| Net Asset Value Per Share | ||||||

| Class A | Class C | Class I | Class Y | Class Z | ||

| Net Assets ($) | 188,116,885 | 10,919,676 | 8,003,998 | 1,047.21 | 100,654,457 | |

| Shares Outstanding | 16,114,876 | 936,889 | 685,637 | 89.69 | 8,623,997 | |

| Net Asset Value | ||||||

| Per Share ($) | 11.67 | 11.66 | 11.67 | 11.68 | 11.67 | |

| See notes to financial statements. | ||||||

The Fund 19

| STATEMENT OF OPERATIONS |

| Year Ended April 30, 2014 |

| Investment Income ($): | ||

| Interest Income | 13,579,308 | |

| Expenses: | ||

| Management fee—Note 3(a) | 1,817,263 | |

| Shareholder servicing costs—Note 3(c) | 693,701 | |

| Distribution fees—Note 3(b) | 91,908 | |

| Professional fees | 69,768 | |

| Registration fees | 45,082 | |

| Custodian fees—Note 3(c) | 30,734 | |

| Trustees’ fees and expenses—Note 3(d) | 18,139 | |

| Prospectus and shareholders’ reports | 15,492 | |

| Loan commitment fees—Note 2 | 2,860 | |

| Miscellaneous | 42,047 | |

| Total Expenses | 2,826,994 | |

| Less—reduction in fees due to earnings credits—Note 3(c) | (231 | ) |

| Net Expenses | 2,826,763 | |

| Investment Income—Net | 10,752,545 | |

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | ||

| Net realized gain (loss) on investments | (7,436,065 | ) |

| Net unrealized appreciation (depreciation) on investments | (15,677,500 | ) |

| Net Realized and Unrealized Gain (Loss) on Investments | (23,113,565 | ) |

| Net (Decrease) in Net Assets Resulting from Operations | (12,361,020 | ) |

| See notes to financial statements. | ||

20

STATEMENT OF CHANGES IN NET ASSETS

| Year Ended April 30, | ||||

| 2014 | a | 2013 | ||

| Operations ($): | ||||

| Investment income—net | 10,752,545 | 12,070,470 | ||

| Net realized gain (loss) on investments | (7,436,065 | ) | 420,757 | |

| Net unrealized appreciation | ||||

| (depreciation) on investments | (15,677,500 | ) | 5,400,756 | |

| Net Increase (Decrease) in Net Assets | ||||

| Resulting from Operations | (12,361,020 | ) | 17,891,983 | |

| Dividends to Shareholders from ($): | ||||

| Investment income—net: | ||||

| Class A | (6,573,801 | ) | (7,360,932 | ) |

| Class C | (297,369 | ) | (386,785 | ) |

| Class I | (304,394 | ) | (440,751 | ) |

| Class Y | (23 | ) | — | |

| Class Z | (3,565,069 | ) | (3,859,875 | ) |

| Net realized gain on investments: | ||||

| Class A | (50,303 | ) | (569,762 | ) |

| Class C | (2,854 | ) | (40,438 | ) |

| Class I | (2,057 | ) | (35,345 | ) |

| Class Z | (25,651 | ) | (275,082 | ) |

| Total Dividends | (10,821,521 | ) | (12,968,970 | ) |

| Beneficial Interest Transactions ($): | ||||

| Net proceeds from shares sold: | ||||

| Class A | 5,324,116 | 26,531,322 | ||

| Class C | 375,521 | 2,198,197 | ||

| Class I | 3,914,881 | 7,784,011 | ||

| Class Y | 1,000 | — | ||

| Class Z | 2,417,423 | 6,045,162 | ||

| Dividends reinvested: | ||||

| Class A | 5,161,909 | 5,838,337 | ||

| Class C | 239,380 | 315,905 | ||

| Class I | 156,025 | 261,740 | ||

| Class Z | 2,819,578 | 3,142,328 | ||

| Cost of shares redeemed: | ||||

| Class A | (47,553,467 | ) | (23,202,561 | ) |

| Class C | (5,216,090 | ) | (2,037,144 | ) |

| Class I | (7,324,431 | ) | (9,047,573 | ) |

| Class Z | (14,274,615 | ) | (9,026,854 | ) |

| Increase (Decrease) in Net Assets from | ||||

| Beneficial Interest Transactions | (53,958,770 | ) | 8,802,870 | |

| Total Increase (Decrease) in Net Assets | (77,141,311 | ) | 13,725,883 | |

| Net Assets ($): | ||||

| Beginning of Period | 384,837,374 | 371,111,491 | ||

| End of Period | 307,696,063 | 384,837,374 |

The Fund 21

STATEMENT OF CHANGES IN NET ASSETS (continued)

| Year Ended April 30, | ||||

| 2014 | a | 2013 | ||

| Capital Share Transactions: | ||||

| Class Ab | ||||

| Shares sold | 458,722 | 2,140,455 | ||

| Shares issued for dividends reinvested | 448,131 | 470,956 | ||

| Shares redeemed | (4,132,210 | ) | (1,872,114 | ) |

| Net Increase (Decrease) in Shares Outstanding | (3,225,357 | ) | 739,297 | |

| Class Cb | ||||

| Shares sold | 32,337 | 177,520 | ||

| Shares issued for dividends reinvested | 20,808 | 25,519 | ||

| Shares redeemed | (450,254 | ) | (165,401 | ) |

| Net Increase (Decrease) in Shares Outstanding | (397,109 | ) | 37,638 | �� |

| Class I | ||||

| Shares sold | 337,569 | 626,623 | ||

| Shares issued for dividends reinvested | 13,519 | 21,107 | ||

| Shares redeemed | (641,315 | ) | (735,171 | ) |

| Net Increase (Decrease) in Shares Outstanding | (290,227 | ) | (87,441 | ) |

| Class Y | ||||

| Shares sold | 89.69 | — | ||

| Class Z | ||||

| Shares sold | 210,048 | 488,690 | ||

| Shares issued for dividends reinvested | 244,829 | 253,555 | ||

| Shares redeemed | (1,244,898 | ) | (728,279 | ) |

| Net Increase (Decrease) in Shares Outstanding | (790,021 | ) | 13,966 |

| a Effective September 3, 2013, the fund commenced offering ClassY shares. |

| b During the period ended April 30, 2014, 16,378 Class C shares representing $201,623 were exchanged for |

| 16,365 Class A shares. |

See notes to financial statements.

22

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated.All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| Year Ended April 30, | ||||||||||

| Class A Shares | 2014 | 2013 | 2012 | 2011 | 2010 | |||||

| Per Share Data ($): | ||||||||||

| Net asset value, beginning of period | 12.39 | 12.23 | 11.32 | 11.68 | 11.16 | |||||

| Investment Operations: | ||||||||||

| Investment income—neta | .37 | .38 | .44 | .45 | .47 | |||||

| Net realized and unrealized | ||||||||||

| gain (loss) on investments | (.72 | ) | .19 | .91 | (.36 | ) | .52 | |||

| Total from Investment Operations | (.35 | ) | .57 | 1.35 | .09 | .99 | ||||

| Distributions: | ||||||||||

| Dividends from investment income—net | (.37 | ) | (.38 | ) | (.44 | ) | (.45 | ) | (.47 | ) |

| Dividends from net realized | ||||||||||

| gain on investments | (.00 | )b | (.03 | ) | — | — | — | |||

| Total Distributions | (.37 | ) | (.41 | ) | (.44 | ) | (.45 | ) | (.47 | ) |

| Net asset value, end of period | 11.67 | 12.39 | 12.23 | 11.32 | 11.68 | |||||

| Total Return (%)c | (2.72 | ) | 4.74 | 12.07 | .75 | 8.98 | ||||

| Ratios/Supplemental Data (%): | ||||||||||

| Ratio of total expenses | ||||||||||

| to average net assets | .90 | .90 | .91 | .91 | .90 | |||||

| Ratio of net expenses | ||||||||||

| to average net assets | .90 | .90 | .91 | .91 | .90 | |||||

| Ratio of net investment income | ||||||||||

| to average net assets | 3.21 | 3.10 | 3.69 | 3.90 | 4.07 | |||||

| Portfolio Turnover Rate | 9.50 | 19.13 | 13.77 | 17.05 | 11.42 | |||||

| Net Assets, end of period ($ x 1,000) | 188,117 | 239,626 | 227,398 | 215,132 | 246,190 | |||||

| a | Based on average shares outstanding at each month end. |

| b | Amount represents less than $.01 per share. |

| c | Exclusive of sales charge. |

See notes to financial statements.

The Fund 23

FINANCIAL HIGHLIGHTS (continued)

| Year Ended April 30, | ||||||||||

| Class C Shares | 2014 | 2013 | 2012 | 2011 | 2010 | |||||

| Per Share Data ($): | ||||||||||

| Net asset value, beginning of period | 12.37 | 12.21 | 11.30 | 11.66 | 11.14 | |||||

| Investment Operations: | ||||||||||

| Investment income—neta | .28 | .29 | .35 | .36 | .38 | |||||

| Net realized and unrealized | ||||||||||

| gain (loss) on investments | (.71 | ) | .19 | .91 | (.36 | ) | .52 | |||

| Total from Investment Operations | (.43 | ) | .48 | 1.26 | — | .90 | ||||

| Distributions: | ||||||||||

| Dividends from investment income—net | (.28 | ) | (.29 | ) | (.35 | ) | (.36 | ) | (.38 | ) |

| Dividends from net realized | ||||||||||

| gain on investments | (.00 | )b | (.03 | ) | — | — | — | |||

| Total Distributions | (.28 | ) | (.32 | ) | (.35 | ) | (.36 | ) | (.38 | ) |

| Net asset value, end of period | 11.66 | 12.37 | 12.21 | 11.30 | 11.66 | |||||

| Total Return (%)c | (3.39 | ) | 3.94 | 11.25 | (.01 | ) | 8.17 | |||

| Ratios/Supplemental Data (%): | ||||||||||

| Ratio of total expenses | ||||||||||

| to average net assets | 1.67 | 1.66 | 1.67 | 1.67 | 1.66 | |||||

| Ratio of net expenses | ||||||||||

| to average net assets | 1.67 | 1.66 | 1.67 | 1.66 | 1.66 | |||||

| Ratio of net investment income | ||||||||||

| to average net assets | 2.43 | 2.34 | 2.94 | 3.14 | 3.30 | |||||

| Portfolio Turnover Rate | 9.50 | 19.13 | 13.77 | 17.05 | 11.42 | |||||

| Net Assets, end of period ($ x 1,000) | 10,920 | 16,502 | 15,823 | 16,322 | 18,466 | |||||

| a | Based on average shares outstanding at each month end. |

| b | Amount represents less than $.01 per share. |

| c | Exclusive of sales charge. |

See notes to financial statements.

24

| Year Ended April 30, | ||||||||||

| Class I Shares | 2014 | 2013 | 2012 | 2011 | 2010 | |||||

| Per Share Data ($): | ||||||||||

| Net asset value, beginning of period | 12.39 | 12.22 | 11.31 | 11.68 | 11.16 | |||||

| Investment Operations: | ||||||||||

| Investment income—neta | .40 | .41 | .46 | .48 | .44 | |||||

| Net realized and unrealized | ||||||||||

| gain (loss) on investments | (.72 | ) | .21 | .92 | (.37 | ) | .58 | |||

| Total from Investment Operations | (.32 | ) | .62 | 1.38 | .11 | 1.02 | ||||

| Distributions: | ||||||||||

| Dividends from investment income—net | (.40 | ) | (.42 | ) | (.47 | ) | (.48 | ) | (.50 | ) |

| Dividends from net realized | ||||||||||

| gain on investments | (.00 | )b | (.03 | ) | — | — | — | |||

| Total Distributions | (.40 | ) | (.45 | ) | (.47 | ) | (.48 | ) | (.50 | ) |

| Net asset value, end of period | 11.67 | 12.39 | 12.22 | 11.31 | 11.68 | |||||

| Total Return (%) | (2.48 | ) | 5.09 | 12.38 | .92 | 9.27 | ||||

| Ratios/Supplemental Data (%): | ||||||||||

| Ratio of total expenses | ||||||||||

| to average net assets | .65 | .64 | .65 | .63 | .70 | |||||

| Ratio of net expenses | ||||||||||

| to average net assets | .65 | .63 | .65 | .63 | .65 | |||||

| Ratio of net investment income | ||||||||||

| to average net assets | 3.45 | 3.34 | 3.90 | 4.16 | 4.30 | |||||

| Portfolio Turnover Rate | 9.50 | 19.13 | 13.77 | 17.05 | 11.42 | |||||

| Net Assets, end of period ($ x 1,000) | 8,004 | 12,092 | 12,999 | 6,309 | 5,441 | |||||

| a | Based on average shares outstanding at each month end. |

| b | Amount represents less than $.01 per share. |

See notes to financial statements.

The Fund 25

FINANCIAL HIGHLIGHTS (continued)

| Period Ended | ||

| Class Y Shares | April 30, 2014a | |

| Per Share Data ($): | ||

| Net asset value, beginning of period | 11.15 | |

| Investment Operations: | ||

| Investment income—netb | .26 | |

| Net realized and unrealized | ||

| gain (loss) on investments | .53 | |

| Total from Investment Operations | .79 | |

| Distributions: | ||

| Dividends from investment income—net | (.26 | ) |

| Net asset value, end of period | 11.68 | |

| Total Return (%) | 7.16 | c |

| Ratios/Supplemental Data (%): | ||

| Ratio of total expenses to average net assets | .63 | d |

| Ratio of net expenses to average net assets | .63 | d |

| Ratio of net investment income | ||

| to average net assets | 3.45 | d |

| Portfolio Turnover Rate | 9.50 | |

| Net Assets, end of period ($ x 1,000) | 1 |

| a | From September 3, 2013 (commencement of initial offering) to April 30, 2014. |

| b | Based on average shares outstanding at each month end. |

| c | Not annualized. |

| d | Annualized. |

See notes to financial statements.

26

| Year Ended April 30, | ||||||||||

| Class Z Shares | 2014 | 2013 | 2012 | 2011 | 2010 | |||||

| Per Share Data ($): | ||||||||||

| Net asset value, beginning of period | 12.39 | 12.22 | 11.31 | 11.67 | 11.16 | |||||

| Investment Operations: | ||||||||||

| Investment income—neta | .40 | .41 | .46 | .48 | .49 | |||||

| Net realized and unrealized | ||||||||||

| gain (loss) on investments | (.72 | ) | .20 | .91 | (.37 | ) | .51 | |||

| Total from Investment Operations | (.32 | ) | .61 | 1.37 | .11 | 1.00 | ||||

| Distributions: | ||||||||||

| Dividends from investment income—net | (.40 | ) | (.41 | ) | (.46 | ) | (.47 | ) | (.49 | ) |

| Dividends from net realized | ||||||||||

| gain on investments | (.00 | )b | (.03 | ) | — | — | — | |||

| Total Distributions | (.40 | ) | (.44 | ) | (.46 | ) | (.47 | ) | (.49 | ) |

| Net asset value, end of period | 11.67 | 12.39 | 12.22 | 11.31 | 11.67 | |||||

| Total Return (%) | (2.50 | ) | 5.04 | 12.31 | .97 | 9.11 | ||||

| Ratios/Supplemental Data (%): | ||||||||||

| Ratio of total expenses | ||||||||||

| to average net assets | .69 | .69 | .71 | .70 | .70 | |||||

| Ratio of net expenses | ||||||||||

| to average net assets | .69 | .69 | .71 | .70 | .70 | |||||

| Ratio of net investment income | ||||||||||

| to average net assets | 3.43 | 3.32 | 3.89 | 4.11 | 4.27 | |||||

| Portfolio Turnover Rate | 9.50 | 19.13 | 13.77 | 17.05 | 11.42 | |||||

| Net Assets, end of period ($ x 1,000) | 100,654 | 116,617 | 114,892 | 106,076 | 112,728 | |||||

| a | Based on average shares outstanding at each month end. |

| b | Amount represents less than $.01 per share. |

See notes to financial statements.

The Fund 27

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus State Municipal Bond Funds (the “Company”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as a non-diversified open-end management investment company, and operates as a series company currently offering three series, including the Dreyfus Connecticut Fund (the “fund”).The fund’s investment objective is to maximize current income exempt from federal income tax and from Connecticut state income tax, without undue risk. The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser.

At a meeting held on May 7, 2013, the Company’s Board of Trustees (the “Board”) approved effective September 3, 2013, for the fund to offer Class Y shares.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Manager, is the distributor of the fund’s shares. The fund is authorized to issue an unlimited number of $.001 par value shares of Beneficial Interest in each of the following classes of shares: Class A, Class C, Class I, Class Y and Class Z. Class A shares generally are subject to a sales charge imposed at the time of purchase. Class C shares are subject to a contingent deferred sales charge (“CDSC”) imposed on Class C shares redeemed within one year of purchase. Class I and Class Y shares are offered at net asset value per share generally to institutional investors. Class Z shares are sold at net asset value per share generally only to shareholders of the fund who received Class Z shares in exchange for their shares of a Dreyfus-managed fund as a result of the reorganization of such Dreyfus-managed fund, and who continue to maintain accounts with the fund at the time of purchase. Class Z shares generally are not available for new accounts. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs, and certain voting rights. Income, expenses (other than expenses

28

attributable to a specific class) and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

As of April 30, 2014, MBC Investments Corp., an indirect subsidiary of BNY Mellon, held all of the outstanding ClassY shares of the fund.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions.Actual results could differ from those estimates.

The Company enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

The Fund 29

NOTES TO FINANCIAL STATEMENTS (continued)

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements.These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in securities are valued each business day by an independent pricing service (the “Service”) approved by the Board. Investments for which quoted bid prices are readily available and are representative of the bid side of the market in the judgment of the Service are valued at the mean between the quoted bid prices (as obtained by the Service from dealers in such securities) and asked prices (as calculated by the Service based upon its evaluation of the market for such securities). Other investments (which constitute a majority of the portfolio securities) are carried at fair value as determined by the Service, based on methods which include consideration of the following: yields or prices of municipal securities of comparable quality, coupon, maturity and

30

type; indications as to values from dealers; and general market conditions. All of the preceding securities are generally categorized within Level 2 of the fair value hierarchy.

The Service’s procedures are reviewed by Dreyfus under the general supervision of the Board.

When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board. Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers.These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For restricted securities where observable inputs are limited, assumptions about market activity and risk are used and are generally categorized within Level 3 of the fair value hierarchy.

The following is a summary of the inputs used as of April 30, 2014 in valuing the fund’s investments:

| Level 2—Other | Level 3— | |||

| Level 1— | Significant | Significant | ||

| Unadjusted | Observable | Unobservable | ||

| Quoted Prices | Inputs | Inputs | Total | |

| Assets ($) | ||||

| Investments in Securities: | ||||

| Municipal Bonds† | — | 301,905,525 | — | 301,905,525 |

| † | See Statement of Investments for additional detailed categorizations. |

The Fund 31

NOTES TO FINANCIAL STATEMENTS (continued)

At April 30, 2014, there were no transfers between Level 1 and Level 2 of the fair value hierarchy.

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gain and loss from securities transactions are recorded on the identified cost basis. Interest income, adjusted for accretion of discount and amortization of premium on investments, is earned from settlement date and recognized on the accrual basis. Securities purchased or sold on a when issued or delayed delivery basis may be settled a month or more after the trade date.

The fund follows an investment policy of investing primarily in municipal obligations of one state. Economic changes affecting the state and certain of its public bodies and municipalities may affect the ability of issuers within the state to pay interest on, or repay principal of, municipal obligations held by the fund.

(c) Dividends to shareholders: It is the policy of the fund to declare dividends daily from investment income-net. Such dividends are paid monthly. Dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(d) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, which can distribute tax-exempt dividends, by complying with the applicable provisions of the Code, and to make distributions of income and net realized capital gain sufficient to relieve it from substantially all federal income and excise taxes.

32

As of and during the period ended April 30, 2014, the fund did not have any liabilities for any uncertain tax positions.The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period ended April 30, 2014, the fund did not incur any interest or penalties.

Each tax year in the four-year period ended April 30, 2014 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At April 30, 2014, the components of accumulated earnings on a tax basis were as follows: undistributed tax-exempt income $350,684, accumulated capital losses $7,887,190 and unrealized appreciation $12,046,295.

Under the Regulated Investment Company Modernization Act of 2010 (the “2010 Act”), the fund is permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 (“post-enactment losses”) for an unlimited period. Furthermore, post-enactment capital loss carryovers retain their character as either short-term or long-term capital losses rather than short-term as they were under previous statute.

The accumulated capital loss carryover is available for federal income tax purposes to be applied against future net realized capital gains, if any, realized subsequent to April 30, 2014. The fund has $2,418,390 of post-enactment short-term capital losses and $5,468,800 of post-enactment long-term capital losses which can be carried forward for an unlimited period.

The tax character of distributions paid to shareholders during the fiscal periods ended April 30, 2014 and April 30, 2013 were as follows: tax-exempt income $10,743,671 and $12,049,889, ordinary income $77,850 and $205,699, and long-term capital gains $0 and $713,382, respectively.

The Fund 33

NOTES TO FINANCIAL STATEMENTS (continued)

During the period ended April 30, 2014, as a result of permanent book to tax differences, primarily due to the tax treatment for amortization adjustments and dividend reclassification, the fund decreased accumulated undistributed investment income-net by $11,889, decreased accumulated net realized gain (loss) on investments by $2,075 and increased paid-in capital by $13,964. Net assets and net asset value per share were not affected by this reclassification.

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed funds in a $265 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. Prior to October 9, 2013, the unsecured credit facility with Citibank, N.A. was $210 million. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for each Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing. During the period ended April 30, 2014, the fund did not borrow under the Facilities.

NOTE 3—Management Fee and Other Transactions with Affiliates:

(a) Pursuant to a management agreement with the Manager, the management fee is computed at the annual rate of .55% of the value of the fund’s average daily net assets and is payable monthly.

During the period ended April 30, 2014, the Distributor retained $3,684 from commissions earned on sales of the fund’s Class A shares and $2,617 from CDSCs on redemptions of the fund’s Class C shares.

(b) Under the Distribution Plan adopted pursuant to Rule 12b-1 under the Act, Class C shares pay the Distributor for distributing its shares at an annual rate of .75% of the value of its average daily net assets. During the period ended April 30, 2014, Class C shares were charged $91,908 pursuant to the Distribution Plan.

34

(c) Under the Shareholder Services Plan, Class A and Class C shares pay the Distributor at an annual rate of .25% of the value of their average daily net assets of their shares for the provision of certain services.The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the fund and providing reports and other information, and services related to the maintenance of shareholder accounts. The Distributor may make payments to Service Agents (securities dealers, financial institutions or other industry professionals) with respect to these services. The Distributor determines the amounts to be paid to Service Agents. During the period ended April 30, 2014, Class A and Class C shares were charged $512,804 and $30,636, respectively, pursuant to the Shareholder Services Plan.

Under the Shareholder Services Plan, Class Z shares reimburse the Distributor an amount not to exceed an annual rate of .25% of the value of Class Z shares’ average daily net assets for certain allocated expenses of providing personal services and/or maintaining shareholder accounts. The services provided may include personal services relating to shareholders accounts, such as answering shareholder inquiries regarding Class Z shares and providing reports and other information, and services related to the maintenance of shareholder accounts. During the period ended April 30, 2014, Class Z shares were charged $37,455 pursuant to the Shareholder Services Plan.

The fund has arrangements with the transfer agent and the custodian whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset transfer agency and custody fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of the Manager, under a transfer agency agreement for providing transfer agency and cash management services for the fund. The majority of transfer agency fees are comprised of amounts paid on a per account basis, while cash management fees are related to fund subscriptions and redemptions. During the period ended April 30, 2014,

The Fund 35

NOTES TO FINANCIAL STATEMENTS (continued)

the fund was charged $67,721 for transfer agency services and $2,884 for cash management services.These fees are included in Shareholder servicing costs in the Statement of Operations. Cash management fees were partially offset by earnings credits of $231.

The fund compensates The Bank of NewYork Mellon under a custody agreement for providing custodial services for the fund.These fees are determined based on net assets, geographic region and transaction activity. During the period ended April 30, 2014, the fund was charged $30,734 pursuant to the custody agreement.

The fund compensated The Bank of New York Mellon for performing certain cash management services related to fund subscriptions and redemptions, including shareholder redemption draft processing, under a cash management agreement that was in effect until September 30, 2013 and, beginning October 1, 2013, compensates The Bank of New York Mellon for processing shareholder redemption drafts under a shareholder draft processing agreement. During the period ended April 30, 2014, the fund was charged $1,622 pursuant to the agreements, which is included in Shareholder servicing costs in the Statement of Operations.

During the period ended April 30, 2014, the fund was charged $9,177 for services performed by the Chief Compliance Officer and his staff.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: management fees $138,654, Distribution Plan fees $6,670, Shareholder Services Plan fees $44,949, custodian fees $10,416, Chief Compliance Officer fees $736 and transfer agency fees $12,518.

(d) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

36

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended April 30, 2014, amounted to $30,827,657 and $80,581,444, respectively.

At April 30, 2014, the cost of investments for federal income tax purposes was $289,859,230; accordingly, accumulated net unrealized appreciation on investments was $12,046,295, consisting of $15,475,442 gross unrealized appreciation and $3,429,147 gross unrealized depreciation.

The Fund 37

| REPORT OF INDEPENDENT REGISTERED |

| PUBLIC ACCOUNTING FIRM |

Shareholders and Board of Trustees

Dreyfus State Municipal Bond Funds, Dreyfus Connecticut Fund

We have audited the accompanying statement of assets and liabilities, including the statement of investments, of Dreyfus State Municipal Bond Funds, Dreyfus Connecticut Fund (one of the series comprising Dreyfus State Municipal Bond Funds) as of April 30, 2014, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the periods indicated therein. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States).Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement.We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of April 30, 2014 by correspondence with the custodian and others.We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus State Municipal Bond Funds, Dreyfus Connecticut Fund at April 30, 2014, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the indicated periods, in conformity with U.S. generally accepted accounting principles.

New York, New York

June 26, 2014

38

IMPORTANT TAX INFORMATION (Unaudited)