UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04917 |

|

Morgan Stanley Mortgage Securities Trust |

(Exact name of registrant as specified in charter) |

|

522 Fifth Avenue, New York, New York | | 10036 |

(Address of principal executive offices) | | (Zip code) |

|

John H. Gernon 522 Fifth Avenue, New York, New York 10036 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 212-296-0289 | |

|

Date of fiscal year end: | October 31, | |

|

Date of reporting period: | October 31, 2016 | |

| | | | | | | | |

Item 1 - Report to Shareholders

Trustees

Frank L. Bowman

Kathleen A. Dennis

Nancy C. Everett

Jakki L. Haussler

Dr. Manuel H. Johnson

Joseph J. Kearns

Michael F. Klein

Michael E. Nugent, Chair of the Board

W. Allen Reed

Fergus Reid

Officers

John H. Gernon

President and Principal Executive Officer

Timothy J. Knierim

Chief Compliance Officer

Francis J. Smith

Treasurer and Principal Financial Officer

Mary E. Mullin

Secretary

Transfer Agent

Boston Financial Data Services, Inc.

2000 Crown Colony Drive

Quincy, Massachusetts 02169

Custodian

State Street Bank and Trust Company

One Lincoln Street

Boston, Massachusetts 02111

Independent Registered Public Accounting Firm

Ernst & Young LLP

200 Clarendon Street

Boston, Massachusetts 02116

Legal Counsel

Dechert LLP

1095 Avenue of the Americas

New York, New York 10036

Counsel to the Independent Trustees

Perkins Coie LLP

30 Rockefeller Plaza

New York, New York 10112

Adviser and Administrator

Morgan Stanley Investment Management Inc.

522 Fifth Avenue

New York, New York 10036

This report is submitted for the general information of the shareholders of the Fund. For more detailed information about the Fund, its fees and expenses and other pertinent information, please read its Prospectus. The Fund's Statement of Additional Information contains additional information about the Fund, including its trustees. It is available, without charge, by calling (800) 548-7786.

This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective Prospectus. Please read the Prospectus carefully before investing.

Morgan Stanley Distribution, Inc., member FINRA.

© 2016 Morgan Stanley

MTGANN

1651071 EXP. 12.31.17

INVESTMENT MANAGEMENT

Morgan Stanley

Mortgage

Securities Trust

Annual Report

October 31, 2016

Morgan Stanley Mortgage Securities Trust

Table of Contents

Welcome Shareholder | | | 3 | | |

Fund Report | | | 4 | | |

Performance Summary | | | 10 | | |

Expense Example | | | 12 | | |

Portfolio of Investments | | | 14 | | |

Statement of Assets and Liabilities | | | 26 | | |

Statement of Operations | | | 27 | | |

Statements of Changes in Net Assets | | | 28 | | |

Notes to Financial Statements | | | 29 | | |

Financial Highlights | | | 48 | | |

Report of Independent Registered Public Accounting Firm | | | 53 | | |

Investment Advisory Agreement Approval | | | 54 | | |

Privacy Notice | | | 57 | | |

Trustee and Officer Information | | | 62 | | |

2

Welcome Shareholder,

We are pleased to provide this Annual report, in which you will learn how your investment in Morgan Stanley Mortgage Securities Trust (the "Fund") performed during the latest twelve-month period. It includes an overview of the market conditions and discusses some of the factors that affected performance during the reporting period. In addition, the report contains financial statements and a list of portfolio holdings.

Morgan Stanley Investment Management is a client-centric, investor-led organization. Our global presence, intellectual capital, and breadth of products and services enable us to partner with investors to meet the evolving challenges of today's financial markets. We aim to deliver superior investment service and to empower our clients to make the informed decisions that help them reach their investment goals.

As always, we thank you for selecting Morgan Stanley Investment Management, and look forward to working with you in the months and years ahead.

This material must be preceded or accompanied by a prospectus for the fund being offered.

Market forecasts provided in this report may not necessarily come to pass. There is no assurance that the Fund will achieve its investment objective. The Fund is subject to market risk, which is the possibility that market values of securities owned by the Fund will decline and, therefore, the value of the Fund's shares may be less than what you paid for them. Accordingly, you can lose money investing in this Fund. Please see the prospectus for more complete information on investment risks.

3

Fund Report (unaudited)

For the year ended October 31, 2016

Total Return for the 12 Months Ended October 31, 2016 | |

| Class A | | Class B | | Class L | | Class I | | Class C | | Bloomberg

Barclays U.S.

Mortgage

Backed

Securities

(MBS) Index1 | |

Lipper U.S.

Mortgage

Funds Index2 | |

| | 6.70 | % | | | 6.01 | % | | | 6.45 | % | | | 7.04 | % | | | 5.91 | % | | | 3.27 | % | | | 3.40 | % | |

The performance of the Fund's five share classes varies because each has different expenses. The Fund's total returns assume the reinvestment of all distributions but do not reflect the deduction of any applicable sales charges. Such costs would lower performance. See Performance Summary for standardized performance and benchmark information.

Market Conditions

The 12-month reporting period began on a relatively stable note, as the Federal Reserve (Fed) enacted its much-anticipated interest rate increase at the end of 2015 and market reaction was muted. The first half of 2016 was volatile, but markets calmed and performance improved as the second half of the year progressed. In the first quarter of 2016, global economic weakness, falling energy prices and the stronger dollar combined to cause broad equities indexes to fall 10%, U.S. Treasury rates to fall 50 basis points, and credit spreads to widen substantially across many credit sectors.i In the second and early third quarters, Brexit concerns disrupted markets again, causing U.S. Treasury rates to hit historic lows and credit spreads to widen again. Once the dust settled on

the Brexit vote, credit sectors seemed to calm, interest rates drifted higher, and credit spreads began a steady tightening progression that persisted through the end of the reporting period.

Mortgage market conditions remained favorable over the period. While there was some interest rate volatility this year, mortgage rates have remained essentially range-bound, not breaking into a significantly lower rate range and causing prepayments to spike, and not drifting high enough for mortgage-backed securities (MBS) investors to fear duration extension risks. This lower mortgage rate volatility has enabled agency MBS to perform well this year, with nominal spreads and option-adjusted spreads tightening 2 to 3 basis points year-to-date.ii Agency MBS also continued to benefit from sponsorship from the Fed, which has maintained its $1.75 trillion agency MBS portfolio by purchasing $20-40 billion agency MBS on a monthly basis.iii We continue to believe that the agency MBS segment is marginally expensive both by historical comparison and relative to many credit-related MBS, but current levels are supported by the general stability of interest rates and mortgage prepayment speeds, and by the consistent support by the Fed. Agency MBS should continue to perform well as long as these conditions continue, but could underperform if the rates break out of their current range or if the Fed ends the reinvestment of its MBS portfolio.

i Source: Bloomberg L.P.

ii Source: YieldBook

iii Source: Federal Reserve Bank

4

U.S. housing market conditions also remained favorable. U.S. home prices were up 5.3% over the past 12 months, and have risen roughly 5% each of the past four years, as measured by the S&P CoreLogic Case-Shiller U.S. National Home Price Index.iv Home prices have now returned to their pre-crisis peak in July 2006. While this housing market recovery may sound concerning, homes remain affordable from a historical perspective when considering median incomes and the cost of owning a median-priced home. While home prices are back to prior peak levels, this does not account for the modest wage increases over the past 10-plus years, nor does it account for the significant decline in mortgage rates over this time frame. Household formation is also recovering from stunted levels during the crisis, and we consequently expect housing demand and home prices to continue to increase in coming years.

Non-agency MBS are among the most direct beneficiaries of increasing home prices. Rising home prices generally help reduce default and loss rates but also can increase prepayment speeds for non-agency MBS. Lower home prices and the resulting negative equity prevented many non-agency borrowers from being able to refinance into lower mortgage rates over the past six years. Unlike agency MBS borrowers who had government programs designed to allow them to refinance despite negative homeowner equity, non-agency borrowers have had a much more difficult time refinancing since the crisis. Now that home prices have returned to pre-crisis levels in many parts of the country, and many borrowers' negative equity has been reduced

or erased, we expect many of these borrowers to refinance in the near future. Unlike the agency MBS market where prepayments are negative since most agency MBS trade above par, the large majority of the non-agency MBS market currently trades at a discount to par and benefits from faster prepayments. Non-agency MBS spreads have tightened significantly over the past four months are now at the tightest levels since 2014, but we still like this sector given the improving fundamental conditions, increasing cash flow velocity, and still attractive yields.

U.S. commercial mortgage-backed securities (CMBS) have had a mixed performance in 2016 so far. AAA-rated CMBS spreads have tightened 25 to 30 basis points while BBB-rated CMBS spreads have widened 50 to 100 basis points year-to-date as of October 31, 2016.v Fundamentally, the commercial real estate market remains very stable, benefiting from the slowly improving economy, with rising real estate valuations and declining default rates. Office buildings have seen decreasing vacancy rates and increasing leasing rates. Hotels have experienced improving occupancy rates. Increasing retail sales have helped shopping malls. Multi-family residential buildings have benefited from rising home prices and corresponding higher rental rates. Commercial real estate prices are up roughly 5% over the past year and are now up more than 25% from the pre-crisis peak.vi While these current price levels do give us some cause for concern, we feel that current real estate economic conditions and improved loan underwriting quality help support these levels. We also

iv Source: S&P CoreLogic Case-Shiller

v Source: Bank America Merrill Lynch and Credit Suisse

vi Source: Green Street

5

maintain a bias toward seasoned CMBS, which have benefited from the recent price increases over newer production CMBS that are underwritten with current property valuations. CMBS supply also remains a concern, as new issuance volumes remain elevated. 2007 was one of the largest years of CMBS origination, and over $100 billion in loans are expected to reach their maturities and likely need to be refinanced in 2017.vii While net CMBS supply is actually shrinking, the large amount of gross CMBS issuance from this refinancing wave has still put some supply pressure on the CMBS market. Overall, we continue to like the CMBS market and believe it offers compelling relative value compared to other credit sectors.

Performance Analysis

All share classes of Morgan Stanley Mortgage Securities Trust outperformed both the Bloomberg Barclays U.S. Mortgage Backed Securities (MBS) Index (the "Index") and the Lipper U.S. Mortgage Funds Index for the 12 months ended October 31, 2016, assuming no deduction of applicable sales charges.

The Fund's outperformance relative to the Index over the reporting period can largely be attributed to the portfolio's exposure to non-agency MBS and collateralized mortgage obligations (CMOs). We believe the U.S. economy may continue to experience slow positive growth, which could benefit the credit-oriented, non-agency residential MBS and CMBS sectors. We also believe that interest rates are poised to move higher, which could be positive for the primarily interest-only

CMOs within the portfolio. The only meaningful detractors from performance over the period were the Fund's CMBS positions and the outright duration (interest-rate sensitivity) of the portfolio, which was shorter than that of the Index due to our expectation of higher rates in the near future. The Fund's duration positioning was managed, in part, using interest-rate swaps and futures.

We continue to believe that the normalization of the housing market will occur gradually. In our view, agency mortgage bonds may perform well in this environment, but will likely underperform non-agency MBS, CMBS and interest-only agency CMOs.

Additionally, during calendar year 2016, the Fund received monies related to certain nonrecurring litigation settlements. If these monies were not received, any period returns which include these settlement monies would have been lower. For example, the 2016 fiscal year total return would have been 5.78% for Class I Shares as of October 31, 2016. The returns on the other Share Classes would also have been similarly impacted. These were one-time settlements, and as a result, the impact on the net asset value and consequently the performance will not likely be repeated in the future. Please call 1-800-548-7786 for additional information.

There is no guarantee that any sectors mentioned will continue to perform as discussed herein or that securities in such sectors will be held by the Fund in the future.

vii Source: Bloomberg L.P., September 2016

6

PORTFOLIO COMPOSITION* as of 10/31/16 | |

Mortgages — Other | | | 32.7 | % | |

Agency Fixed Rate Mortgages | | | 20.7 | | |

Asset-Backed Securities | | | 20.0 | | |

Commercial Mortgage-Backed Securities | | | 11.3 | | |

Collateralized Mortgage Obligations —

Agency Collateral Series | | | 7.8 | | |

Short-Term Investments | | | 7.4 | | |

Agency Adjustable Rate Mortgages | | | 0.1 | | |

* Does not include open long/short futures contracts with an underlying face amount of $20,510,906 with net unrealized depreciation of $409,406. Does not include open foreign currency forward exchange contracts with net unrealized appreciation of $415,306 and does not include an open swap agreement with unrealized depreciation of $14,770.

LONG-TERM CREDIT ANALYSIS as of 10/31/16 | |

AAA | | | 36.3 | % | |

AA | | | 2.9 | | |

A | | | 6.3 | | |

BBB | | | 14.4 | | |

BB | | | 6.2 | | |

B or less | | | 22.3 | | |

Not Rated | | | 11.6 | | |

Subject to change daily. Provided for informational purposes only and should not be deemed as a recommendation to buy or sell the types of securities mentioned above. Portfolio composition data are as a percentage of total investments and long-term credit analysis data are as a percentage of total long-term investments.

Security ratings disclosed with the exception for those labeled "not rated" have been rated by at least one Nationally Recognized Statistical Rating Organization ("NRSRO"). These ratings are obtained from Standard & Poor's Ratings Group ("S&P"), Moody's Investors Services, Inc ("Moody's") or Fitch Ratings ("Fitch"). If two or more NRSROs have assigned a rating to a security, the highest rating is used and if securities are not rated, Morgan Stanley Investment Management Inc. (the "Adviser") has deemed them to be of comparable quality. Ratings from Moody's or Fitch, when used, are converted into their equivalent S&P rating.

Morgan Stanley is a full-service securities firm engaged in securities trading and brokerage activities, investment banking, research and analysis, financing and financial advisory services.

Investment Strategy

The Fund normally invests at least 80 percent of its assets in mortgage-related securities. These mortgage-related securities may include mortgage-backed securities such as mortgage pass-through securities, collateralized mortgage obligations ("CMOs"), stripped mortgage-backed securities ("SMBS"), commercial mortgage-backed securities ("CMBS") and inverse floating rate obligations ("inverse floaters"). The mortgage-backed securities in which the Fund invests may be issued or guaranteed by the U.S. Government, its agencies or instrumentalities or may be offered by non-governmental issuers, such as commercial banks, savings and loan institutions, private mortgage insurance companies, mortgage bankers and other secondary market issuers. The Fund is not limited as to the maturities or types of mortgage-backed securities in which it may invest.

For More Information About Portfolio Holdings

Each Morgan Stanley fund provides a complete schedule of portfolio holdings in its semiannual and annual reports within 60 days of the end of the fund's second and fourth fiscal quarters. The semiannual reports and the annual reports are filed electronically with the Securities and Exchange Commission (SEC) on Form N-CSRS and Form N-CSR, respectively. Morgan Stanley also delivers the semiannual and annual reports to fund shareholders and makes these reports available on its public web site, www.morganstanley.com/im. Each Morgan Stanley fund also files a complete schedule of portfolio holdings with the SEC for the fund's first and third fiscal quarters on Form N-Q. Morgan Stanley does not deliver the reports for the first and

7

third fiscal quarters to shareholders, nor are the reports posted to the Morgan Stanley public web site. You may, however, obtain the Form N-Q filings (as well as the Form N-CSR and N-CSRS filings) by accessing the SEC's web site, http://www.sec.gov. You may also review and copy them at the SEC's public reference room in Washington, DC. Information on the operation of the SEC's public reference room may be obtained by calling the SEC at (800) SEC-0330. You can also request copies of these materials, upon payment of a duplicating fee, by electronic request at the SEC's e-mail address (publicinfo@sec.gov) or by writing the public reference section of the SEC, Washington, DC 20549-1520.

Proxy Voting Policy and Procedures and Proxy Voting Record

You may obtain a copy of the Fund's Proxy Voting Policy and Procedures without charge, upon request, by calling toll free (800) 548-7786 or by visiting the Mutual Fund Center on our web site at www.morganstanley.com/im. It is also available on the SEC's web site at http://www.sec.gov.

You may obtain information regarding how the Fund voted proxies relating to portfolio securities during the most recent twelve-month period ended June 30 without charge by visiting the Mutual Fund Center on our web site at www.morganstanley.com/im. This information is also available on the SEC's web site at http://www.sec.gov.

Householding Notice

To reduce printing and mailing costs, the Fund attempts to eliminate duplicate mailings to the same address. The Fund delivers a single copy of certain shareholder documents, including shareholder reports, prospectuses and proxy materials, to investors with the same last name who reside at the same address. Your participation in this program will continue for an unlimited period of time unless you instruct us otherwise. You can request multiple copies of these documents by calling (800) 548-7786, 8:00 a.m. to 6:00 p.m., ET. Once our Customer Service Center has received your instructions, we will begin sending individual copies for each account within 30 days.

8

(This page has been left blank intentionally.)

Performance Summary (unaudited)

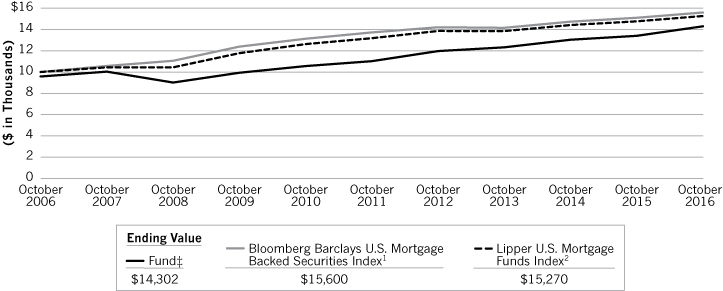

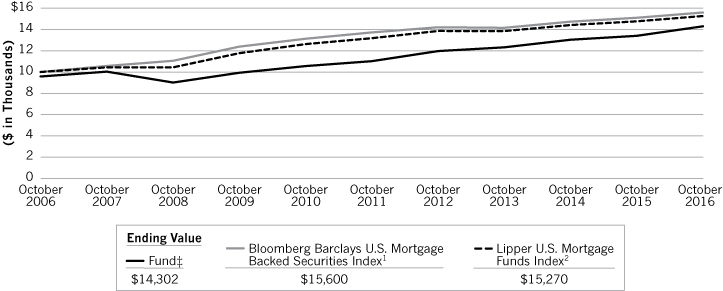

Performance of $10,000 Investment—Class A

Over 10 Years

10

Average Annual Total Returns—Period Ended October 31, 2016 (unaudited) | |

Symbol | | Class A Shares*

(since 07/28/97)

MTGAX | | Class B Shares **

(since 03/31/87)

MTGBX | | Class L Shares†

(since 07/28/97)

MTGCX | | Class I Shares††

(since 07/28/97)

MTGDX | | Class C Shares†††

(since 04/30/15)

MSMTX | |

| 1 Year | | | 6.70

2.114 | %3 | | | 6.01

1.014 | %3 | | | 6.45

— | %3 | | | 7.04

— | %3 | | | 5.91

4.914 | %3 | |

| 5 Years | | | 5.363

4.454 | | | | 4.743

4.404 | | | | 5.033

— | | | | 5.733

— | | | | —

— | | |

| 10 Years | | | 4.093

3.644 | | | | 3.603

3.604 | | | | 3.623

— | | | | 4.423

— | | | | —

— | | |

Since Inception | | | 4.703

4.474 | | | | 5.353

5.354 | | | | 4.083

— | | | | 4.873

— | | | | 3.733

3.734 | | |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. For most recent month-end performance figures, please visit www.morganstanley.com/im or speak with your Financial Advisor. Investment returns and principal value will fluctuate and fund shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance for Class A, Class B, Class L, Class I and Class C shares will vary due to differences in sales charges and expenses. See the Fund's current prospectus for complete details on fees and sales charges.

* The maximum front-end sales charge for Class A is 4.25%.

** The maximum contingent deferred sales charge (CDSC) for Class B is 5.0%. The CDSC declines to 0% after six years. Effective April 2005, Class B shares will generally convert to Class A shares approximately eight years after the end of the calendar month in which the shares were purchased. Performance for periods greater than eight years reflects this conversion (beginning April 2005). Class B shares are closed to new investments.

† Class L has no sales charge. Class L shares are closed to new investments.

†† Class I has no sales charge.

††† The maximum contingent deferred sales charge for Class C is 1.0% for shares redeemed within one year of purchase.

(1) The Bloomberg Barclays U.S. Mortgage Backed Securities (MBS) Index tracks agency mortgage backed pass-through securities (both fixed-rate and hybrid ARM) guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC). This Index is the Mortgage Backed Securities Fixed Rate component of the Bloomberg Barclays U.S. Aggregate Index. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

(2) The Lipper U.S. Mortgage Funds Index is an equally weighted performance index of the largest qualifying funds (based on net assets) in the Lipper U.S. Mortgage Funds classification. The Index, which is adjusted for capital gains distributions and income dividends, is unmanaged and should not be considered an investment. There are currently 30 funds represented in this Index. The Fund was in the Lipper U.S. Mortgage Funds classification as of the date of this report.

(3) Figure shown assumes reinvestment of all distributions and does not reflect the deduction of any sales charges.

(4) Figure shown assumes reinvestment of all distributions and the deduction of the maximum applicable sales charge. See the Fund's current prospectus for complete details on fees and sales charges.

‡ Ending value assuming a complete redemption on October 31, 2016.

11

Expense Example (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; and (2) ongoing costs, which may include advisory fees, administration fees, distribution and shareholder services (12b-1) fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period 05/01/16 – 10/31/16.

Actual Expenses

The first line of the table on the following page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table on the following page provides information about hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs, and will not help you determine the relative total cost of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

12

Expense Example (unaudited) continued

| | | Beginning

Account Value | | Ending

Account Value | | Expenses Paid

During Period@ | |

| | | 05/01/16 | | 10/31/16 | | 05/01/16 –

10/31/16 | |

Class A | |

Actual (4.70% return) | | $ | 1,000.00 | | | $ | 1,047.00 | | | $ | 5.09 | | |

Hypothetical (5% annual return before expenses) | | $ | 1,000.00 | | | $ | 1,020.16 | | | $ | 5.03 | | |

Class B | |

Actual (4.33% return) | | $ | 1,000.00 | | | $ | 1,043.30 | | | $ | 8.68 | | |

Hypothetical (5% annual return before expenses) | | $ | 1,000.00 | | | $ | 1,016.64 | | | $ | 8.57 | | |

Class L | |

Actual (4.59% return) | | $ | 1,000.00 | | | $ | 1,045.90 | | | $ | 6.63 | | |

Hypothetical (5% annual return before expenses) | | $ | 1,000.00 | | | $ | 1,018.65 | | | $ | 6.55 | | |

Class I | |

Actual (4.96% return) | | $ | 1,000.00 | | | $ | 1,049.60 | | | $ | 3.55 | | |

Hypothetical (5% annual return before expenses) | | $ | 1,000.00 | | | $ | 1,021.67 | | | $ | 3.51 | | |

Class C | |

Actual (4.33% return) | | $ | 1,000.00 | | | $ | 1,043.30 | | | $ | 9.19 | | |

Hypothetical (5% annual return before expenses) | | $ | 1,000.00 | | | $ | 1,016.14 | | | $ | 9.07 | | |

@ Expenses are equal to the Fund's annualized expense ratios of 0.99%, 1.69%, 1.29%, 0.69% and 1.79% for Class A, Class B, Class L, Class I and Class C shares, respectively, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). If the Fund had borne all of its expenses, the annualized expense ratios would have been 1.28%, 2.38%, 1.57%, 1.03% and 2.23% for Class A, Class B, Class L, Class I and Class C shares, respectively.

Refer to Note 7 in the Notes to Financial Statements for discussion of prior period custodian out-of-pocket expenses that were reimbursed in the current period.

13

Morgan Stanley Mortgage Securities Trust

Portfolio of Investments n October 31, 2016

PRINCIPAL

AMOUNT IN

(000) | |

| | COUPON

RATE | | MATURITY

DATE | | VALUE | |

| | | Agency Adjustable Rate Mortgage (0.1%) | | | |

$ | 99 | | | Federal National Mortgage Association,

Conventional Pool: (Cost $105,762) | | | 2.831 | % | | 05/01/33 | | $ | 104,316 | | |

| | | Agency Fixed Rate Mortgages (21.7%) | | | |

| | | Federal Home Loan Mortgage Corporation, | | | |

| | | Conventional Pools: | | | |

| | 5 | | | | | | | | 9.50 | | | 01/01/17 - 02/01/19 | | | 5,080 | | |

| | 58 | | | | | | | | 10.00 | | | 02/01/17 - 12/01/20 | | | 60,736 | | |

| | | Gold Pools: | | | |

| | 2,650 | | | | | | | | 3.50 | | | 01/01/44 - 06/01/45 | | | 2,810,246 | | |

| | 2,057 | | | | | | | | 4.00 | | | 12/01/41 - 10/01/45 | | | 2,202,120 | | |

| | 1,640 | | | | | | | | 4.50 | | | 03/01/41 - 09/01/41 | | | 1,798,920 | | |

| | 193 | | | | | | | | 5.00 | | | 12/01/40 - 05/01/41 | | | 217,535 | | |

| | 31 | | | | | | | | 5.50 | | | 07/01/37 | | | 34,910 | | |

| | 35 | | | | | | | | 6.00 | | | 12/01/37 - 03/01/38 | | | 39,756 | | |

| | 54 | | | | | | | | 6.50 | | | 06/01/29 - 09/01/33 | | | 61,376 | | |

| | 92 | | | | | | | | 7.50 | | | 04/01/20 - 05/01/35 | | | 113,754 | | |

| | 45 | | | | | | | | 8.00 | | | 08/01/32 | | | 55,248 | | |

| | 71 | | | | | | | | 8.50 | | | 08/01/31 | | | 90,018 | | |

| | 11 | | | | | | | | 10.00 | | | 10/01/21 | | | 11,970 | | |

| | | | | Federal National Mortgage Association, | | | | | | | | | | | | | |

| | | | | Conventional Pools: | | | | | | | | | | | |

| | 371 | | | | | | | | 3.00 | | | 04/01/45 | | | 385,619 | | |

| | 2,260 | | | | | | | | 3.50 | | | 08/01/45 - 02/01/46 | | | 2,383,407 | | |

| | 1,966 | | | | | | | | 4.00 | | | 04/01/45 - 09/01/45 | | | 2,129,697 | | |

| | 266 | | | | | | | | 4.50 | | | 08/01/40 - 09/01/41 | | | 291,769 | | |

| | 325 | | | | | | | | 5.00 | | | 11/01/40 - 07/01/41 | | | 362,261 | | |

| | 23 | | | | | | | | 5.50 | | | 08/01/37 | | | 26,218 | | |

| | 611 | | | | | | | | 6.50 | | | 02/01/28 - 12/01/33 | | | 700,659 | | |

| | 18 | | | | | | | | 7.00 | | | 07/01/23 - 06/01/32 | | | 18,550 | | |

| | 117 | | | | | | | | 7.50 | | | 08/01/37 | | | 141,012 | | |

| | 124 | | | | | | | | 8.00 | | | 04/01/33 | | | 153,119 | | |

| | 110 | | | | | | | | 8.50 | | | 10/01/32 | | | 139,764 | | |

| | 148 | | | | | | | | 9.50 | | | 04/01/30 | | | 174,679 | | |

| | 9 | | | | | | | | 10.00 | | | 10/01/18 | | | 9,083 | | |

| | | November TBA: | | | |

| | 870 | | | (a) | | | 2.50 | | | 11/01/31 | | | 895,284 | | |

| | 2,910 | | | (a) | | | 3.00 | | | 11/01/31 - 11/01/46 | | | 3,003,792 | | |

| | 1,050 | | | (a) | | | 3.50 | | | 11/01/46 | | | 1,102,418 | | |

See Notes to Financial Statements

14

Morgan Stanley Mortgage Securities Trust

Portfolio of Investments n October 31, 2016 continued

PRINCIPAL

AMOUNT IN

(000) | |

| | COUPON

RATE | | MATURITY

DATE | | VALUE | |

| | | Government National Mortgage Association, | | | |

| | | Various Pools: | | | |

$ | 839 | | | | | | | | 3.50 | % | | 10/20/44 - 05/20/45 | | $ | 896,213 | | |

| | 709 | | | | | | | | 4.00 | | | 07/15/44 | | | 767,952 | | |

| | 392 | | | | | | | | 5.00 | | | 05/20/41 | | | 432,791 | | |

| | 2 | | | | | | | | 11.00 | | | 04/15/21 | | | 1,766 | | |

| | | | | Total Agency Fixed Rate Mortgages (Cost $21,158,572) | | | | | | | 21,517,722 | | |

| | | Asset-Backed Securities (21.0%) | | | |

| | 471 | | | Apollo Aviation Securitization Equity

Trust (b) | | | 4.875 | | | 03/17/36 | | | 464,964 | | |

| | | | | Argent Securities, Inc. Asset-Backed

Pass-Through Certificates | | | | | | | | | | | |

| | 366 | | | | | | | | 2.409 | (c) | | 04/25/34 | | | 349,081 | | |

| | 600 | | | | | | | | 4.151 | (c) | | 09/25/33 | | | 575,181 | | |

| | 601 | | | Bear Stearns Asset-Backed Securities I

Trust | | | 0.854 | (c) | | 03/25/37 | | | 347,416 | | |

| | | Bear Stearns Asset-Backed Securities Trust | | | |

| | 157 | | | | | | | | 0.854 | (c) | | 01/25/47 | | | 153,115 | | |

| | 614 | | | | | | | | 2.242 | (c) | | 10/25/36 | | | 446,208 | | |

| | 600 | | | Carrington Mortgage Loan Trust | | | 0.774 | (c) | | 05/25/36 | | | 522,058 | | |

| | 363 | | | Castle Aircraft SecuritizationTrust (b) | | | 4.703 | | | 12/15/40 | | | 368,908 | | |

| | 262 | | | CDC Mortgage Capital Trust | | | 1.154 | (c) | | 01/25/33 | | | 245,361 | | |

| | 800 | | | Citicorp Residential Mortgage Trust | | | 5.755 | | | 03/25/37 | | | 831,548 | | |

| | | Countrywide Asset-Backed Certificates | | | |

| | 188 | | | (b) | | | 1.154 | (c) | | 06/25/33 | | | 182,891 | | |

| | 600 | | | | | | | | 1.959 | (c) | | 03/25/35 | | | 596,340 | | |

| | | | | Credit-Based Asset Servicing and

Securitization LLC | | | | | | | | | | | |

| | 309 | | | | | | | | 0.684 | (c) | | 05/25/36 | | | 231,990 | | |

| | 181 | | | | | | | | 3.609 | (c) | | 08/25/30 | | | 182,810 | | |

| | 449 | | | CWABS Asset-Backed Certificates Trust | | | 0.774 | (c) | | 10/25/46 | | | 356,126 | | |

| | 179 | | | EMC Mortgage Loan Trust (b) | | | 1.525 | (c) | | 11/25/30 | | | 164,927 | | |

| | 317 | | | GO Financial Auto Securitization Trust (b) | | | 3.27 | | | 11/15/18 | | | 317,266 | | |

| | | Green Tree Agency Advance Funding Trust I | | | |

| | 300 | | | (b) | | | 2.38 | | | 10/15/48 | | | 299,739 | | |

| | 250 | | | (b) | | | 4.058 | | | 10/15/48 | | | 249,505 | | |

| | | Invitation Homes Trust | | | |

| | 800 | | | (b) | | | 4.285 | (c) | | 06/17/31 | | | 796,826 | | |

| | 440 | | | (b) | | | 5.285 | (c) | | 08/17/32 | | | 445,469 | | |

See Notes to Financial Statements

15

Morgan Stanley Mortgage Securities Trust

Portfolio of Investments n October 31, 2016 continued

PRINCIPAL

AMOUNT IN

(000) | |

| | COUPON

RATE | | MATURITY

DATE | | VALUE | |

| | | | | Lehman ABS Manufactured Housing

Contract Trust | | | | | | | | | | | |

$ | 186 | | | | | | | | 3.70 | % | | 04/15/40 | | $ | 188,451 | | |

| | 500 | | | | | | | | 6.63 | (c) | | 04/15/40 | | | 534,689 | | |

| | 121 | | | Lehman Manufactured Housing

Asset-Backed | | | 6.635 | | | 07/15/28 | | | 124,099 | | |

| | 399 | | | Long Beach Mortgage Loan Trust | | | 0.974 | (c) | | 06/25/34 | | | 366,612 | | |

| | 250 | | | Mastr Asset-Backed Securities Trust | | | 3.009 | (c) | | 09/25/34 | | | 242,987 | | |

| | 400 | | | MERIT Securities Corp. | | | 7.524 | (c) | | 12/28/33 | | | 417,572 | | |

| | 393 | | | Mid-State Capital Corp. Trust | | | 7.758 | | | 01/15/40 | | | 434,541 | | |

| | | Nationstar HECM Loan Trust | | | |

| | 300 | | | (b) | | | 3.598 | | | 06/25/26 | | | 301,219 | | |

| | 709 | | | (b) | | | 4.115 | | | 11/25/25 | | | 707,717 | | |

| | 600 | | | (b) | | | 4.36 | | | 02/25/26 | | | 599,718 | | |

| | 406 | | | (b) | | | 6.657 | | | 11/25/25 | | | 403,320 | | |

| | 500 | | | (b) | | | 7.385 | | | 02/25/26 | | | 499,455 | | |

| | 211 | | | New Century Home Equity Loan Trust | | | 1.334 | (c) | | 11/25/33 | | | 169,173 | | |

| | 686 | | | NRZ Excess Spread-Collateralized

Notes (b) | | | 5.683 | | | 07/25/21 | | | 685,557 | | |

| | | Oakwood Mortgage Investors, Inc. | | | |

| | 877 | | | | | | | | 7.405 | (c) | | 06/15/31 | | | 414,705 | | |

| | 203 | | | | | | | | 7.72 | | | 04/15/30 | | | 214,896 | | |

| | 400 | | | | | | | | 7.84 | (c) | | 11/15/29 | | | 399,511 | | |

| | 500 | | | OnDeck Asset Securitization

Trust II LLC (b) | | | 4.21 | | | 05/17/20 | | | 502,162 | | |

| | 596 | | | People's Choice Home Loan Securities

Trust | | | 1.574 | (c) | | 06/25/34 | | | 560,025 | | |

| | 266 | | | RMAT LLC (b) | | | 4.826 | | | 06/25/35 | | | 265,597 | | |

| | 536 | | | Saxon Asset Securities Trust | | | 8.41 | (c) | | 05/25/29 | | | 532,866 | | |

| | 461 | | | Shenton Aircraft Investment I Ltd.

(Cayman Islands)(b) | | | 4.75 | | | 10/15/42 | | | 459,373 | | |

| | 350 | | | Silver Bay Realty Trust (b) | | | 4.075 | (c) | | 09/17/31 | | | 343,373 | | |

| | | Skopos Auto Receivables Trust | | | |

| | 144 | | | (b) | | | 3.10 | | | 12/15/23 | | | 143,371 | | |

| | 257 | | | (b) | | | 3.55 | | | 02/15/20 | | | 257,508 | | |

| | 325 | | | SPS Servicer Advance Receivables

Trust (b) | | | 2.92 | | | 07/15/47 | | | 325,573 | | |

| | 83 | | | Sunset Mortgage Loan Co., LLC (b) | | | 3.721 | | | 11/16/44 | | | 83,069 | | |

| | 500 | | | Tricon American Homes Trust (b) | | | 3.535 | (c) | | 05/17/32 | | | 491,339 | | |

| | 382 | | | Vericrest Opportunity Loan Trust (b) | | | 4.25 | | | 03/26/46 | | | 387,442 | | |

See Notes to Financial Statements

16

Morgan Stanley Mortgage Securities Trust

Portfolio of Investments n October 31, 2016 continued

PRINCIPAL

AMOUNT IN

(000) | |

| | COUPON

RATE | | MATURITY

DATE | | VALUE | |

$ | 100 | | | VOLT XIX LLC (b) | | | 5.00 | % | | 04/25/55 | | $ | 98,438 | | |

| | 199 | | | VOLT XXII LLC (b) | | | 4.25 | | | 02/25/55 | | | 193,884 | | |

| | 496 | | | VOLT XXXIII LLC (b) | | | 4.25 | | | 03/25/55 | | | 481,412 | | |

| | 434 | | | VOLT XXXIX LLC (b) | | | 4.125 | | | 10/25/45 | | | 438,386 | | |

| | 765 | | | Washington Mutural Asset-Backed

Certificates Trust | | | 0.594 | (c) | | 10/25/36 | | | 421,581 | | |

| | | | | Total Asset-Backed Securities (Cost $20,534,634) | | | | | | | 20,817,350 | | |

| | | Collateralized Mortgage Obligations - Agency Collateral Series (8.2%) | | | |

| | | Federal Home Loan Mortgage Corporation | | | |

| | 454 | | | (b) | | | 3.389 | (c) | | 07/25/22 | | | 447,415 | | |

| | | IO | | | |

| | 6,690 | | | | | | | | 0.704 | (c) | | 10/25/20 | | | 152,548 | | |

| | 3,069 | | | | | | | | 0.952 | (c) | | 01/25/31 | | | 286,247 | | |

| | 2,714 | | | | | | | | 1.36 | (c) | | 11/25/19 | | | 86,260 | | |

| | 3,641 | | | | | | | | 1.449 | (c) | | 04/25/17 | | | 15,042 | | |

| | | IO REMIC | | | |

| | 573 | | | | | | | | 1.904 | (c) | | 10/15/41 | | | 37,846 | | |

| | 1,125 | | | | | | | | 1.941 | (c) | | 10/15/39 | | | 71,065 | | |

| | 1,849 | | | | | | | | 1.942 | (c) | | 08/15/42 | | | 128,156 | | |

| | 1,274 | | | | | | | | 1.959 | (c) | | 04/15/39 | | | 90,163 | | |

| | 3,376 | | | | | | | | 2.033 | (c) | | 10/15/40 | | | 220,797 | | |

| | 3,960 | | | | | | | | 2.042 | (c) | | 09/15/41 | | | 221,406 | | |

| | 486 | | | | | | | | 4.00 | | | 04/15/39 | | | 52,362 | | |

| | 211 | | | | | | | | 5.00 | | | 08/15/41 | | | 28,487 | | |

| | 1,998 | | | | | | | | 5.465 | (c) | | 11/15/43 - 06/15/44 | | | 345,468 | | |

| | 465 | | | | | | | | 5.515 | (c) | | 04/15/39 | | | 42,196 | | |

| | | IO STRIPS | | | |

| | 7,644 | | | | | | | | 1.568 | (c) | | 10/15/37 | | | 386,474 | | |

| | 174 | | | | | | | | 7.00 | | | 06/01/30 | | | 39,475 | | |

| | 207 | | | | | | | | 7.50 | | | 12/01/29 | | | 56,852 | | |

| | | REMIC | | | |

| | 118 | | | | | | | | 6.94 | (d) | | 10/15/43 | | | 124,664 | | |

| | 328 | | | | | | | | 10.594 | (d) | | 12/15/43 | | | 359,516 | | |

| | | Federal National Mortgage Association, | | | |

| | | IO | | | |

| | 1,277 | | | | | | | | 5.856 | (c) | | 09/25/20 | | | 188,581 | | |

| | | IO REMIC | | | |

| | 6,901 | | | | | | | | 1.649 | | | 03/25/46 | | | 412,915 | | |

| | 3,090 | | | | | | | | 1.777 | (c) | | 05/15/38 | | | 194,197 | | |

See Notes to Financial Statements

17

Morgan Stanley Mortgage Securities Trust

Portfolio of Investments n October 31, 2016 continued

PRINCIPAL

AMOUNT IN

(000) | |

| | COUPON

RATE | | MATURITY

DATE | | VALUE | |

$ | 2,539 | | | | | | | | 1.85 | (c)% | | 03/25/44 | | $ | 214,455 | | |

| | 2,646 | | | | | | | | 2.028 | (c) | | 10/25/39 | | | 169,004 | | |

| | 1,471 | | | | | | | | 3.50 | | | 02/25/39 | | | 126,038 | | |

| | 1,289 | | | | | | | | 5.116 | (c) | | 11/25/41 | | | 156,662 | | |

| | 1,597 | | | | | | | | 5.516 | (c) | | 06/25/42 | | | 340,083 | | |

| | 868 | | | | | | | | 6.016 | (c) | | 08/25/41 | | | 137,484 | | |

| | | | | IO STRIPS | | | | | | | | | | | |

| | 63 | | | | | | | | 7.00 | | | 11/25/27 | | | 10,872 | | |

| | 151 | | | | | | | | 8.00 | | | 05/25/30 - 06/25/30 | | | 44,063 | | |

| | 92 | | | | | | | | 8.50 | | | 10/25/24 | | | 22,675 | | |

| | | | | REMIC | | | | | | | | | | | |

| | 125 | | | | | | | | 1.734 | (c) | | 12/25/23 | | | 127,975 | | |

| | 75 | | | | | | | | 6.838 | (c) | | 04/25/39 | | | 79,089 | | |

| | | | | Government National Mortgage Association, | | | | | | | | | | | | | |

| | | | | IO | | | | | | | | | | | | | |

| | 3,557 | | | | | | | | 0.818 | (c) | | 08/20/58 | | | 104,979 | | |

| | 5,667 | | | | | | | | 3.50 | | | 06/20/41 - 11/20/42 | | | 1,056,197 | | |

| | 946 | | | | | | | | 4.50 | | | 05/20/40 | | | 88,417 | | |

| | 186 | | | | | | | | 5.00 | | | 05/20/39 - 02/16/41 | | | 25,143 | | |

| | 1,063 | | | | | | | | 5.474 | (c) | | 08/20/42 | | | 235,539 | | |

| | 602 | | | | | | | | 5.515 | (c) | | 11/16/40 | | | 115,851 | | |

| | 1,360 | | | | | | | | 5.574 | (c) | | 04/20/41 - 08/20/42 | | | 254,106 | | |

| | 1,051 | | | | | | | | 5.614 | (c) | | 12/20/43 | | | 241,200 | | |

| | 870 | | | | | | | | 5.774 | (c) | | 09/20/43 | | | 175,533 | | |

| | 569 | | | | | | | | 6.015 | (c) | | 08/16/34 | | | 111,391 | | |

| | | | | IO PAC | | | | | | | | | | | |

| | 185 | | | | | | | | 5.00 | | | 10/20/40 | | | 25,605 | | |

| | 901 | | | | | | | | 5.524 | (c) | | 01/20/40 | | | 68,442 | | |

| | 1,814 | | | | | | | | 5.624 | (c) | | 10/20/41 | | | 197,407 | | |

| | | | | Total Collateralized Mortgage Obligations - Agency Collateral Series

(Cost $5,775,591) | | | | | | | 8,116,342 | | |

| | | Commercial Mortgage-Backed Securities (11.9%) | | | |

| | | | | BAMLL Commercial Mortgage Securities

Trust | | | | | | | | | | | |

| | 381 | | | (b) | | | 3.037 | (c) | | 12/15/29 | | | 346,408 | | |

| | 185 | | | (b) | | | 6.035 | (c) | | 12/15/31 | | | 159,121 | | |

| | 133 | | | Banc of America Commercial Mortgage

Trust | | | 3.167 | | | 09/15/48 | | | 104,041 | | |

| | 350 | | | BBCMS Trust (b) | | | 4.284 | (c) | | 09/10/28 | | | 331,673 | | |

See Notes to Financial Statements

18

Morgan Stanley Mortgage Securities Trust

Portfolio of Investments n October 31, 2016 continued

PRINCIPAL

AMOUNT IN

(000) | |

| | COUPON

RATE | | MATURITY

DATE | | VALUE | |

| | | Citigroup Commercial Mortgage Trust | | | |

$ | 220 | | | | | | | | 4.571 | (c)% | | 09/10/58 | | $ | 223,657 | | |

| | | | | IO | | | | | | | | | | | |

| | 4,518 | | | | | | | | 0.978 | (c) | | 09/10/58 | | | 293,118 | | |

| | | | | COMM Mortgage Trust | | | | | | | | | | | | | |

| | 388 | | | | | | | | 3.797 | (c) | | 08/10/48 | | | 295,385 | | |

| | 100 | | | (b) | | | 4.737 | (c) | | 07/15/47 | | | 81,071 | | |

| | 389 | | | (b) | | | 4.75 | (c) | | 12/10/23 | | | 363,514 | | |

| | 311 | | | (b) | | | 4.905 | (c) | | 04/10/47 | | | 272,120 | | |

| | | | | IO | | | | | | | | | | | |

| | 1,609 | | | | | | | | 0.99 | (c) | | 10/10/47 | | | 72,821 | | |

| | | | | Commercial Mortgage Pass-Through

Certificates | | | | | | | | | | | |

| | 187 | | | (b) | | | 4.75 | (c) | | 02/10/47 | | | 165,384 | | |

| | | | | IO | | | | | | | | | | | |

| | 3,232 | | | | | | | | 0.988 | (c) | | 02/10/47 | | | 112,686 | | |

| | 420 | | | Commercial Mortgage Trust | | | 5.475 | | | 03/10/39 | | | 421,470 | | |

| | 1,793 | | | COOF Securitization Trust II, IO (b) | | | 2.533 | (c) | | 08/25/41 | | | 181,211 | | |

| | 250 | | | CSMC Trust (b) | | | 3.735 | (c) | | 03/15/17 | | | 245,622 | | |

EUR | 193 | | | Deco Ltd. (Ireland)(b) | | | 4.50 | (c) | | 11/07/24 | | | 209,403 | | |

| | | | | GS Mortgage Securities Trust | | | | | | | | | | | | | |

$ | 450 | | | | | | | | 3.345 | | | 07/10/48 | | | 343,002 | | |

| | 100 | | | (b) | | | 4.529 | (c) | | 09/10/47 | | | 77,213 | | |

| | 370 | | | (b) | | | 4.768 | (c) | | 08/10/46 | | | 340,034 | | |

| | | IO | | | |

| | 2,031 | | | | | | | | 0.866 | (c) | | 09/10/47 | | | 96,847 | | |

| | 986 | | | | | | | | 1.158 | (c) | | 02/10/48 | | | 61,229 | | |

| | 2,311 | | | | | | | | 1.163 | (c) | | 04/10/47 | | | 135,500 | | |

| | 400 | | | HILT Mortgage Trust (b) | | | 4.274 | (c) | | 07/15/29 | | | 378,672 | | |

| | | | | JP Morgan Chase Commercial Mortgage

Securities Trust | | | | | | | | | | | |

| | 390 | | | (b) | | | 4.572 | (c) | | 07/15/47 | | | 308,354 | | |

| | 1,740 | | | | | | | | 5.464 | (c) | | 12/12/43 - 01/15/49 | | | 1,726,459 | | |

| | | | | JPMBB Commercial Mortgage Securities

Trust | | | | | | | | | | | |

| | 188 | | | (b) | | | 4.661 | (c) | | 08/15/47 | | | 158,071 | | |

| | 267 | | | (b) | | | 4.668 | (c) | | 04/15/47 | | | 230,299 | | |

| | | | | IO | | | | | | | | | | | |

| | 4,609 | | | | | | | | 1.02 | (c) | | 01/15/47 | | | 219,359 | | |

| | 3,397 | | | KGS-Alpha SBA COOF Trust, IO (b) | | | 3.053 | (c) | | 07/25/41 | | | 444,771 | | |

See Notes to Financial Statements

19

Morgan Stanley Mortgage Securities Trust

Portfolio of Investments n October 31, 2016 continued

PRINCIPAL

AMOUNT IN

(000) | |

| | COUPON

RATE | | MATURITY

DATE | | VALUE | |

| | | LB-UBS Commercial Mortgage Trust | | | |

$ | 587 | | | | | | | | 6.116 | (c)% | | 07/15/40 | | $ | 594,338 | | |

| | 200 | | | | | | | | 6.245 | (c) | | 09/15/45 | | | 202,606 | | |

| | 498 | | | TRU Trust (b)(e) | | | 2.79 | (c) | | 11/15/30 | | | 498,000 | | |

| | 77 | | | Wachovia Bank Commercial Mortgage

Trust | | | 5.603 | (c) | | 10/15/48 | | | 76,507 | | |

| | | Wells Fargo Commercial Mortgage Trust | | | |

| | 306 | | | (b) | | | 3.153 | | | 09/15/57 | | | 205,870 | | |

| | 335 | | | (b) | | | 3.938 | | | 08/15/50 | | | 271,884 | | |

| | | WF-RBS Commercial Mortgage Trust | | | |

| | 500 | | | (b) | | | 3.692 | | | 11/15/47 | | | 348,700 | | |

| | 500 | | | (b) | | | 3.907 | (c) | | 09/15/57 | | | 385,755 | | |

| | 201 | | | (b) | | | 3.986 | | | 05/15/47 | | | 152,626 | | |

| | 150 | | | (b) | | | 4.136 | (c) | | 05/15/45 | | | 137,600 | | |

| | 500 | | | (b) | | | 4.48 | (c) | | 08/15/46 | | | 456,303 | | |

| | | | | Total Commercial Mortgage-Backed Securities (Cost $12,034,167) | | | | | | | 11,728,704 | | |

| | | Mortgages - Other (34.3%) | | | |

| | | Adjustable Rate Mortgage Trust | | | |

| | 254 | | | | | | | | 1.174 | (c) | | 10/25/35 | | | 233,311 | | |

| | 372 | | | | | | | | 2.974 | (c) | | 04/25/35 | | | 358,883 | | |

| | 273 | | | | | | | | 3.101 | (c) | | 02/25/36 | | | 237,974 | | |

GBP | 368 | | | Alba PLC (United Kingdom) | | | 0.737 | (c) | | 11/25/42 | | | 391,327 | | |

| | | Alternative Loan Trust | | | |

$ | 505 | | | | | | | | 0.724 | (c) | | 11/25/46 | | | 415,238 | | |

| | 197 | | | | | | | | 5.50 | | | 02/25/25 - 01/25/36 | | | 178,877 | | |

| | (f) | | | | | | | | 6.00 | | | 08/25/17 | | | 97 | | |

| | 164 | | | | | | | | 36.816 | (d) | | 05/25/37 | | | 306,311 | | |

| | 562 | | | Alternative Loan Trust Resecuritization | | | 6.25 | | | 08/25/37 | | | 478,952 | | |

| | | American Home Mortgage Investment Trust | | | |

| | 287 | | | (b) | | | 6.60 | | | 01/25/37 | | | 162,332 | | |

| | | IO | | | |

| | 1,373 | | | | | | | | 2.078 | | | 05/25/47 | | | 246,279 | | |

| | | Banc of America Alternative Loan Trust | | | |

| | 467 | | | | | | | | 0.984 | (c) | | 11/25/36 | | | 283,744 | | |

| | 511 | | | | | | | | 5.50 | | | 10/25/35 | | | 500,518 | | |

| | 444 | | | | | | | | 6.50 | | | 05/25/46 | | | 387,591 | | |

| | 213 | | | Banc of America Funding Trust | | | 5.25 | | | 07/25/37 | | | 215,260 | | |

| | 5 | | | Banc of America Mortgage Trust | | | 5.25 | | | 11/25/19 | | | 5,495 | | |

See Notes to Financial Statements

20

Morgan Stanley Mortgage Securities Trust

Portfolio of Investments n October 31, 2016 continued

PRINCIPAL

AMOUNT IN

(000) | |

| | COUPON

RATE | | MATURITY

DATE | | VALUE | |

$ | 926 | | | Bear Stearns Asset-Backed Securities I

Trust | | | 23.493 | (d)% | | 03/25/36 | | $ | 821,376 | | |

| | 8,703 | | | Bear Stearns Mortgage Funding Trust, IO | | | 0.50 | | | 01/25/37 | | | 298,520 | | |

| | 159 | | | CHL Mortgage Pass-Through Trust

Resecuritization | | | 6.00 | | | 12/25/36 | | | 145,546 | | |

| | 217 | | | Citigroup Mortgage Loan Trust (b) | | | 6.50 | | | 10/25/36 | | | 164,826 | | |

GBP | 258 | | | Clavis Securities PLC (United Kingdom) | | | 0.832 | (c) | | 12/15/40 | | | 244,747 | | |

| | | | | Credit Suisse First Boston Mortgage

Securities Corp. | | | | | | | | | | | |

$ | 1,270 | | | | | | | | 1.254 | (c) | | 05/25/34 - 06/25/34 | | | 1,164,412 | | |

| | 497 | | | | | | | | 3.834 | (c) | | 02/25/32 | | | 446,311 | | |

| | 579 | | | | | | | | 6.50 | | | 11/25/35 | | | 242,622 | | |

| | 149 | | | CSMC Mortgage-Backed Trust | | | 7.00 | (c) | | 08/25/37 | | | 112,979 | | |

| | | CSMC Trust | | | |

| | 500 | | | (b) | | | 4.704 | (c) | | 11/25/57 | | | 493,717 | | |

| | 345 | | | (b) | | | 4.79 | (c) | | 08/25/62 | | | 337,592 | | |

| | | Eurosail BV, (Netherlands) | | | |

EUR | 471 | | | | | | | | 0.089 | (c) | | 04/17/40 | | | 474,357 | | |

| | 385 | | | | | | | | 1.189 | (c) | | 10/17/40 | | | 421,967 | | |

GBP | 300 | | | Eurosail PLC (United Kingdom) | | | 1.329 | (c) | | 06/13/45 | | | 338,622 | | |

| | | Fannie Mae Connecticut Avenue Securities | | | |

$ | 500 | | | | | | | | 4.934 | (c) | | 01/25/24 | | | 530,449 | | |

| | 324 | | | | | | | | 5.434 | (c) | | 11/25/24 | | | 347,443 | | |

| | 300 | | | | | | | | 5.534 | (c) | | 07/25/25 | | | 319,939 | | |

| | 400 | | | | | | | | 6.234 | (c) | | 04/25/28 | | | 428,738 | | |

GBP | 196 | | | Farringdon Mortgages No. 2 PLC

(United Kingdom) | | | 1.901 | (c) | | 07/15/47 | | | 226,163 | | |

$ | 305 | | | First Horizon Alternative Mortgage

Securities Trust | | | 5.50 | | | 04/25/35 | | | 291,652 | | |

| | 351 | | | First Horizon Mortgage Pass-Through

Trust | | | 6.25 | | | 11/25/36 | | | 333,515 | | |

EUR | 640 | | | Fondo de Titulizacion de Activos UCI 16

(Spain) | | | 0.00 | (c) | | 06/16/49 | | | 576,292 | | |

| | 561 | | | Fondo de Titulizacion de Activos UCI 17

(Spain) | | | 0.00 | (c) | | 12/17/49 | | | 484,740 | | |

| | | | | Freddie Mac Structured Agency Credit Risk

Debt Notes | | | | | | | | | | | |

$ | 500 | | | | | | | | 4.134 | (c) | | 04/25/24 | | | 515,949 | | |

| | 950 | | | | | | | | 4.534 | (c) | | 08/25/24 | | | 993,145 | | |

| | 300 | | | | | | | | 4.784 | (c) | | 11/25/23 | | | 316,181 | | |

See Notes to Financial Statements

21

Morgan Stanley Mortgage Securities Trust

Portfolio of Investments n October 31, 2016 continued

PRINCIPAL

AMOUNT IN

(000) | |

| | COUPON

RATE | | MATURITY

DATE | | VALUE | |

$ | 500 | | | | | | | | 5.084 | (c)% | | 10/25/24 | | $ | 529,307 | | |

| | | Freddie Mac Whole Loan Securities Trust | | | |

| | 360 | | | | | | | | 3.00 | | | 09/25/45 | | | 362,937 | | |

| | 223 | | | | | | | | 3.50 | | | 07/25/46 | | | 229,110 | | |

| | | GreenPoint Mortgage Funding Trust | | | |

| | 153 | | | | | | | | 0.694 | (c) | | 02/25/37 | | | 138,899 | | |

| | 406 | | | | | | | | 0.714 | (c) | | 01/25/37 | | | 330,376 | | |

EUR | 990 | | | Grifonas Finance PLC (Greece) | | | 0.088 | (c) | | 08/28/39 | | | 815,930 | | |

| | | GSR Mortgage Loan Trust | | | |

$ | 70 | | | | | | | | 0.784 | (c) | | 03/25/35 | | | 60,944 | | |

| | 961 | | | | | | | | 3.416 | (c) | | 12/25/34 | | | 926,669 | | |

| | 14 | | | | | | | | 5.50 | | | 11/25/35 | | | 13,660 | | |

| | 113 | | | HarborView Mortgage Loan Trust | | | 0.718 | (c) | | 01/19/38 | | | 97,584 | | |

EUR | 1,220 | | | IM Pastor 3 FTH (Spain) | | | 0.00 | (c) | | 03/22/43 | | | 1,075,964 | | |

| | 151 | | | IM Pastor 4 FTA (Spain) | | | 0.00 | (c) | | 03/22/44 | | | 136,090 | | |

$ | 366 | | | Impac CMB Trust | | | 1.329 | (c) | | 10/25/34 | | | 344,054 | | |

| | 406 | | | Impac Secured Assets Trust | | | 0.704 | (c) | | 08/25/36 | | | 302,403 | | |

| | 704 | | | JP Morgan Alternative Loan Trust | | | 0.694 | (c) | | 10/25/36 | | | 622,448 | | |

| | | JP Morgan Mortgage Trust | | | |

| | 301 | | | (b) | | | 2.545 | (c) | | 07/27/37 | | | 281,774 | | |

| | | PAC | | | |

| | 354 | | | | | | | | 6.00 | | | 04/25/36 | | | 370,723 | | |

| | | Lehman Mortgage Trust | | | |

| | 99 | | | | | | | | 5.50 | | | 11/25/35 | | | 90,789 | | |

| | 311 | | | | | | | | 6.00 | | | 06/25/37 | | | 190,897 | | |

| | 705 | | | | | | | | 6.50 | | | 09/25/37 | | | 532,952 | | |

EUR | 451 | | | Ludgate Funding PLC (United Kingdom) | | | 0.121 | (c) | | 12/01/60 | | | 385,665 | | |

| | 1,184 | | | Lusitano Mortgages No. 5 PLC (Portugal) | | | 0.00 | (c) | | 07/15/59 | | | 1,032,850 | | |

GBP | 285 | | | Mansard Mortgages Parent Ltd.

(United Kingdom) | | | 0.701 | (c) | | 04/15/49 | | | 301,969 | | |

| | 450 | | | Marble Arch Residential Securitisation

No. 4 Ltd. (United Kingdom) | | | 0.676 | (c) | | 03/20/40 | | | 516,379 | | |

$ | 173 | | | MASTR Adjustable Rate Mortgages Trust | | | 2.985 | (c) | | 02/25/36 | | | 159,882 | | |

| | | MASTR Alternative Loan Trust | | | |

| | 231 | | | | | | | | 6.00 | | | 05/25/33 | | | 240,317 | | |

| | 130 | | | | | | | | 6.25 | | | 07/25/36 | | | 111,293 | | |

| | 580 | | | MERIT Securities Corp. (b) | | | 2.785 | (c) | | 09/28/32 | | | 484,170 | | |

| | 66 | | | Merrill Lynch Mortgage Investors Trust | | | 1.748 | (c) | | 04/25/29 | | | 64,222 | | |

See Notes to Financial Statements

22

Morgan Stanley Mortgage Securities Trust

Portfolio of Investments n October 31, 2016 continued

PRINCIPAL

AMOUNT IN

(000) | |

| | COUPON

RATE | | MATURITY

DATE | | VALUE | |

| | | Money Partners Securities 3 PLC, | | | |

| | | (United Kingdom) | | | |

EUR | 459 | | | | | | | | 4.247 | (c)% | | 09/14/39 | | $ | 507,230 | | |

GBP | 420 | | | | | | | | 5.179 | (c) | | 09/14/39 | | | 520,520 | | |

| | 250 | | | Money Partners Securities 4 PLC (Ireland) | | | 5.182 | (c) | | 03/15/40 | | | 299,855 | | |

| | 304 | | | Moorgate Funding Ltd. (Ireland) | | | 1.165 | (c) | | 10/15/50 | | | 367,403 | | |

$ | 306 | | | Morgan Stanley Dean Witter Capital I, Inc.

Trust (See Note 9) | | | 2.222 | (c) | | 03/25/33 | | | 280,336 | | |

GBP | 331 | | | Newgate Funding (United Kingdom) | | | 3.382 | (c) | | 12/15/50 | | | 375,790 | | |

| | | Paragon Mortgages No. 13 PLC, | | | |

| | | (United Kingdom) | | | |

EUR | 500 | | | | | | | | 0.069 | (c) | | 01/15/39 | | | 463,059 | | |

GBP | 200 | | | | | | | | 0.801 | (c) | | 01/15/39 | | | 208,802 | | |

| | 500 | | | | | | | | 1.201 | (c) | | 01/15/39 | | | 488,803 | | |

| | 200 | | | Paragon Mortgages No. 22 PLC

(United Kingdom) | | | 2.032 | (c) | | 09/15/42 | | | 238,802 | | |

| | | RALI Trust | | | |

$ | 509 | | | | | | | | 1.234 | (c) | | 12/25/33 | | | 444,696 | | |

| | 320 | | | | | | | | 5.50 | | | 04/25/22 | | | 325,782 | | |

| | 1,066 | | | | | | | | 6.00 | | | 05/25/36 - 11/25/36 | | | 905,863 | | |

| | 347 | | | RBSSP Resecuritization Trust (b) | | | 15.789 | (c) | | 09/26/37 | | | 490,858 | | |

EUR | 739 | | | ResLoC UK PLC (United Kingdom) | | | 0.148 | (c) | | 12/15/43 | | | 615,253 | | |

$ | 170 | | | Structured Adjustable Rate Mortgage

Loan Trust | | | 3.048 | (c) | | 06/25/37 | | | 156,547 | | |

| | 200 | | | Structured Asset Mortgage Investments II

Trust | | | 0.764 | (c) | | 05/25/45 | | | 176,320 | | |

| | 335 | | | Structured Asset Securities Corp.

Trust | | | 0.784 | (c) | | 07/25/35 | | | 301,368 | | |

| | | | | Washington Mutual Mortgage Pass-Through

Certificates Trust | | | | | | | | | | | |

| | 288 | | | | | | | | 1.284 | (c) | | 04/25/47 | | | 212,740 | | |

| | 484 | | | | | | | | 1.484 | (c) | | 08/25/46 | | | 325,748 | | |

| | | | | Total Mortgages - Other (Cost $33,018,937) | | | | | | | 33,930,021 | | |

| | | Short-Term Investments (7.7%) | | | |

| | | U.S. Treasury Security (0.4%) | | | |

| | 427 | | | U.S. Treasury Bill (g)(h) (Cost $426,326) | | | 0.406 | | | 03/23/17 | | | 426,387 | | |

See Notes to Financial Statements

23

Morgan Stanley Mortgage Securities Trust

Portfolio of Investments n October 31, 2016

NUMBER OF

SHARES (000) | |

| | | |

| | VALUE | |

| | | Investment Company (7.3%) | |

| 7,260

| | | Morgan Stanley Institutional Liquidity Funds - Government Portfolio -

Institutional Class (See Note 9) (Cost $7,259,567) | | | | | | | | | | $ | 7,259,567 | | |

| | | Total Short-Term Investments (Cost $7,685,893) | | | | | | | 7,685,954 | | |

| | | Total Investments (Cost $100,313,556) (i)(j) | | | | | 104.9 | % | | | 103,900,409 | | |

| | | Liabilities in Excess of Other Assets | | | | | (4.9 | ) | | | (4,830,329 | ) | |

| | | Net Assets | | | | | 100.0 | % | | $ | 99,070,080 | | |

IO Interest Only.

PAC Planned Amortization Class.

REMIC Real Estate Mortgage Investment Conduit.

STRIPS Separate Trading of Registered Interest and Principal of Securities.

TBA To Be Announced.

(a) Security is subject to delayed delivery.

(b) 144A security - Certain conditions for public sale may exist. Unless otherwise noted, these securities are deemed to be liquid.

(c) Variable/Floating Rate Security - Interest rate changes on these instruments are based on changes in a designated base rate. The rates shown are those in effect on October 31, 2016.

(d) Inverse Floating Rate Security - Interest rate fluctuates with an inverse relationship to an associated interest rate. Indicated rate is the effective rate at October 31, 2016.

(e) When-issued security.

(f) Principal amount is less than $500.

(g) Rate shown is the yield to maturity at October 31, 2016.

(h) All or a portion of the security was pledged to cover margin requirements for futures contracts and swap agreements.

(i) Securities are available for collateral in connection with purchase of a when-issued security, securities purchased on a forward commitment basis, open foreign currency forward exchange contracts, futures contracts and a swap agreement.

(j) At October 31, 2016, the aggregate cost for federal income tax purposes is $100,314,046. The aggregate gross unrealized appreciation is $4,889,786 and the aggregate gross unrealized depreciation is $1,303,423 resulting in net unrealized appreciation of $3,586,363.

Foreign Currency Forward Exchange Contracts Open at October 31, 2016:

COUNTERPARTY | | CONTRACTS

TO DELIVER | | IN EXCHANGE

FOR | | DELIVERY

DATE | | UNREALIZED

APPRECIATION

(DEPRECIATION) | |

Australia and New Zealand

Banking Group | | $ | 8,107 | | | GBP | 6,652 | | | 11/04/16 | | $ | 35 | | |

Citibank NA | | EUR | 5,729,782 | | | $ | 6,447,781 | | | 11/04/16 | | | 157,420 | | |

HSBC Bank PLC | | EUR | 384,733 | | | $ | 418,262 | | | 11/04/16 | | | (4,112 | ) | |

HSBC Bank PLC | | GBP | 3,331,244 | | | $ | 4,338,352 | | | 11/04/16 | | | 260,755 | | |

HSBC Bank PLC | | GBP | 203,758 | | | $ | 250,497 | | | 11/04/16 | | | 1,088 | | |

HSBC Bank PLC | | $ | 36,291 | | | EUR | 33,079 | | | 11/04/16 | | | 24 | | |

JPMorgan Chase Bank NA | | $ | 20,485 | | | EUR | 18,752 | | | 11/04/16 | | | 102 | | |

| J PMorgan Chase Bank NA | | $ | 5,007 | | | GBP | 4,086 | | | 11/04/16 | | | (6 | ) | |

Net Unrealized Appreciation | | $ | 415,306 | | |

See Notes to Financial Statements

24

Morgan Stanley Mortgage Securities Trust

Portfolio of Investments n October 31, 2016

Futures Contracts Open at October 31, 2016:

| NUMBER OF CONTRACTS | | LONG/SHORT | | DESCRIPTION, DELIVERY

MONTH AND YEAR | | UNDERLYING FACE

AMOUNT AT VALUE | | UNREALIZED

APPRECIATION

(DEPRECIATION) | |

| | 40 | | | Long | | U.S. Treasury Long Bond,

Dec-16 | | |

$6,508,750 | | | |

$(322,813) | | |

| | 23 | | | Long | | U.S. Treasury 5 yr. Note,

Dec-16 | | |

2,778,328 | | | |

(9,344) | | |

| | 8 | | | Long | | U.S. Treasury Ultra Bond,

Dec-16 | | |

1,407,500 | | | |

(91,312) | | |

| | 45 | | | Short | | U.S. Treasury 2 yr. Note,

Dec-16 | | |

(9,816,328) | | | |

14,063 | | |

| | | | | | | Net Unrealized Depreciation | | | | $ | (409,406 | ) | |

Interest Rate Swap Agreement Open at October 31, 2016:

| SWAP COUNTERPARTY | | NOTIONAL

AMOUNT

(000) | | FLOATING RATE

INDEX | | PAY/RECEIVE

FLOATING RATE | | FIXED RATE | | TERMINATION

DATE | | UNREALIZED

DEPRECIATION | |

Morgan Stanley & Co., LLC* | | $ | 3,471 | | | | 3 Month LIBOR | | | Receive | | | 1.14 | % | | 07/23/17 | | $ | (14,770 | ) | |

* Cleared swap agreement, the broker is Morgan Stanley & Co., LLC.

LIBOR London Interbank Offered Rate.

Currency Abbreviations

EUR Euro.

GBP British Pound.

See Notes to Financial Statements

25

Morgan Stanley Mortgage Securities Trust

Financial Statements

Statement of Assets and Liabilities October 31, 2016

Assets: | |

Investments in securities, at value (cost $92,767,391) | | $ | 96,360,506 | | |

Investment in affiliate, at value (cost $7,546,165) | | | 7,539,903 | | |

Total investments in securities, at value (cost $100,313,556) | | | 103,900,409 | | |

Unrealized appreciation on open foreign currency forward exchange contracts | | | 419,424 | | |

Receivable for: | |

Interest and paydown | | | 411,516 | | |

Investments sold | | | 354,687 | | |

Shares of beneficial interest sold | | | 128,253 | | |

Variation margin on open futures contracts | | | 28,082 | | |

Interest and dividends from affiliates | | | 2,215 | | |

Prepaid expenses and other assets | | | 49,085 | | |

Total Assets | | | 105,293,671 | | |

Liabilities: | |

Unrealized depreciation on open foreign currency forward exchange contracts | | | 4,118 | | |

Payable for: | |

Investments purchased | | | 5,875,207 | | |

Advisory fee | | | 68,152 | | |

Dividends to shareholders | | | 53,537 | | |

Trustees' fee | | | 52,607 | | |

Shares of beneficial interest redeemed | | | 52,338 | | |

Transfer and sub transfer agent fees | | | 27,543 | | |

Distribution fee | | | 13,022 | | |

Administration fee | | | 7,025 | | |

Variation margin on open swap agreements | | | 316 | | |

| Accrued expenses and other payables | | | 69,726 | | |

Total Liabilities | | | 6,223,591 | | |

Net Assets | | $ | 99,070,080 | | |

Composition of Net Assets: | |

Paid-in-capital | | $ | 103,137,966 | | |

Net unrealized appreciation | | | 3,577,615 | | |

Dividends in excess of net investment income | | | (307,139 | ) | |

Accumulated net realized loss | | | (7,338,362 | ) | |

Net Assets | | $ | 99,070,080 | | |

Class A Shares: | |

Net Assets | | $ | 52,839,760 | | |

| Shares Outstanding (unlimited shares authorized, $0.01 par value) | | | 6,158,910 | | |

Net Asset Value Per Share | | $ | 8.58 | | |

Maximum Offering Price Per Share,

(net asset value plus 4.44% of net asset value) | | $ | 8.96 | | |

Class B Shares: | |

Net Assets | | $ | 348,220 | | |

| Shares Outstanding (unlimited shares authorized, $0.01 par value) | | | 41,492 | | |

Net Asset Value Per Share | | $ | 8.39 | | |

Class L Shares: | |

Net Assets | | $ | 2,193,813 | | |

| Shares Outstanding (unlimited shares authorized, $0.01 par value) | | | 257,937 | | |

Net Asset Value Per Share | | $ | 8.51 | | |

Class I Shares: | |

Net Assets | | $ | 42,881,342 | | |

| Shares Outstanding (unlimited shares authorized, $0.01 par value) | | | 5,086,684 | | |

Net Asset Value Per Share | | $ | 8.43 | | |

Class C Shares: | |

Net Assets | | $ | 806,945 | | |

| Shares Outstanding (unlimited shares authorized, $0.01 par value) | | | 94,840 | | |

Net Asset Value Per Share | | $ | 8.51 | | |

See Notes to Financial Statements

26

Morgan Stanley Mortgage Securities Trust

Financial Statements continued

Statement of Operations For the year ended October 31, 2016

Net Investment Income:

Income | |

Interest | | $ | 4,506,031 | | |

| Dividends from affiliate (Note 9) | | | 15,695 | | |

Interest from affiliate (Note 9) | | | 6,714 | | |

Total Income | | | 4,528,440 | | |

Expenses | |

Advisory fee (Note 4) | | | 462,698 | | |

Distribution fee (Class A shares) (Note 5) | | | 136,305 | | |

Distribution fee (Class B shares) (Note 5) | | | 3,251 | | |

Distribution fee (Class L shares) (Note 5) | | | 12,026 | | |

Distribution fee (Class C shares) (Note 5) | | | 6,907 | | |

Professional fees | | | 125,105 | | |

Sub transfer agent fees and expenses (Class A shares) | | | 50,484 | | |

Sub transfer agent fees and expenses (Class B shares) | | | 385 | | |

Sub transfer agent fees and expenses (Class L shares) | | | 1,931 | | |

Sub transfer agent fees and expenses (Class I shares) | | | 45,164 | | |

Administration fee (Note 4) | | | 78,757 | | |

Registration fees | | | 76,124 | | |

Shareholder reports and notices | | | 45,748 | | |

Transfer agent fees and expenses (Class A shares) (Note 6) | | | 30,411 | | |

Transfer agent fees and expenses (Class B shares) (Note 6) | | | 2,545 | | |

Transfer agent fees and expenses (Class L shares) (Note 6) | | | 2,410 | | |

Transfer agent fees and expenses (Class I shares) (Note 6) | | | 2,540 | | |

Transfer agent fees and expenses (Class C shares) (Note 6) | | | 2,333 | | |

Custodian fees | | | 29,443 | | |

Trustees' fees and expenses | | | 76 | | |

Other | | | 68,051 | | |

Total Expenses | | | 1,182,694 | | |

Less: waiver of advisory fees (Note 4) | | | (122,941 | ) | |

Less: reimbursement of class specific expenses (Class A shares) (Note 4) | | | (53,618 | ) | |

Less: reimbursement of class specific expenses (Class B shares) (Note 4) | | | (2,357 | ) | |

Less: reimbursement of class specific expenses (Class L shares) (Note 4) | | | (1,936 | ) | |

Less: reimbursement of class specific expenses (Class I shares) (Note 4) | | | (47,692 | ) | |

Less: reimbursement of class specific expenses (Class C shares) (Note 4) | | | (1,536 | ) | |

Less: reimbursement of custodian fees (Note 7) | | | (74,072 | ) | |

Less: rebate from Morgan Stanley affiliated cash sweep (Note 9) | | | (10,365 | ) | |

Net Expenses | | | 868,177 | | |

Net Investment Income | | | 3,660,263 | | |

Realized and Unrealized Gain (Loss):

Realized Gain (Loss) on: | |

Investments | | | 1,155,392 | | |

Investments in affiliate (Note 9) | | | 5,285 | | |

Futures contracts | | | 1,586,592 | | |

Swap agreements | | | (19,512 | ) | |

Foreign currency forward exchange contracts | | | 348,749 | | |

Foreign currency translations | | | 16,812 | | |

Net Realized Gain | | | 3,093,318 | | |

Change in Unrealized Appreciation (Depreciation) on: | |

Investments | | | (183,532 | ) | |

Investments in affiliates (Note 9) | | | (6,262 | ) | |

Futures contracts | | | (498,608 | ) | |

Swap agreements | | | 17,783 | | |

Foreign currency forward exchange contracts | | | 421,228 | | |

Foreign currency translations | | | 3,174 | | |

Net Change in Unrealized Appreciation (Depreciation) | | | (246,217 | ) | |

Net Gain | | | 2,847,101 | | |

Net Increase | | $ | 6,507,364 | | |

See Notes to Financial Statements

27

Morgan Stanley Mortgage Securities Trust

Financial Statements continued

Statements of Changes in Net Assets

| | | FOR THE YEAR

ENDED

OCTOBER 31, 2016 | | FOR THE YEAR

ENDED

OCTOBER 31, 2015 | |

Increase (Decrease) in Net Assets: | |

Operations: | |

Net investment income | | $ | 3,660,263 | | | $ | 1,720,452 | | |

Net realized gain | | | 3,093,318 | | | | 877,597 | | |

Net change in unrealized appreciation (depreciation) | | | (246,217 | ) | | | (699,983 | ) | |

Net Increase | | | 6,507,364 | | | | 1,898,066 | | |

Dividends to Shareholders from Net Investment Income: | |

Class A shares | | | (2,705,386 | ) | | | (3,131,721 | ) | |

Class B shares | | | (16,881 | ) | | | (31,321 | ) | |

Class L shares | | | (114,018 | ) | | | (169,137 | ) | |

Class I shares | | | (2,171,320 | ) | | | (625,404 | ) | |

Class C shares | | | (28,639 | ) | | | (428 | )* | |

Total Dividends | | | (5,036,244 | ) | | | (3,958,011 | ) | |

Net increase from transactions in shares of beneficial interest | | | 2,756,292 | | | | 30,011,187 | | |

Net Increase | | | 4,227,412 | | | | 27,951,242 | | |

Net Assets: | |

Beginning of period | | | 94,842,668 | | | | 66,891,426 | | |

End of Period

(Including dividends in excess of net investment income of $(307,139) and

accumulated undistributed net investment income of $657,589, respectively) | | $ | 99,070,080 | | | $ | 94,842,668 | | |

* For the period April 30, 2015 through October 31, 2015.

See Notes to Financial Statements

28

Morgan Stanley Mortgage Securities Trust

Notes to Financial Statements n October 31, 2016

1. Organization and Accounting Policies

Morgan Stanley Mortgage Securities Trust (the "Fund") is registered under the Investment Company Act of 1940, as amended (the "Act"), as a diversified, open-end management investment company. The Fund applies investment company accounting and reporting guidance. The Fund's investment objective is to seek a high level of current income. The Fund was organized as a Massachusetts business trust on November 20, 1986 and commenced operations on March 31, 1987. On July 28, 1997, the Fund converted to a multiple class share structure.

The Fund offers Class A shares, Class B shares, Class L shares, Class I shares and Class C shares. The five classes are substantially the same except that most Class A shares are subject to a sales charge imposed at the time of purchase and some Class A shares, most Class B shares, and most Class C shares are subject to a contingent deferred sales charge imposed on shares redeemed within eighteen months, six years and one year, respectively. Class L shares and Class I shares are not subject to a sales charge. Additionally, Class A shares, Class B shares, Class L shares and Class C shares incur distribution expenses.

The Fund suspended offering Class B and Class L shares to all investors (February 25, 2013 and April 30, 2015, respectively). Class B and Class L shareholders of the Fund do not have the option of purchasing additional Class B or Class L shares. However, the existing Class B and Class L shareholders may invest through reinvestment of dividends and distributions.

The following is a summary of significant accounting policies:

A. Valuation of Investments — (1) Certain portfolio securities may be valued by an outside pricing service/vendor approved by the Fund's Board of Trustees (the "Trustees"). The pricing service/vendor may employ a pricing model that takes into account, among other things, bids, yield spreads, and/or other market data and specific security characteristics. Alternatively, if a valuation is not available from an outside pricing service/vendor, and the security trades on an exchange, the security may be valued at its latest reported sale price (or at the exchange official closing price if such exchange reports an official closing price), prior to the time when assets are valued. If there are no sales on a given day and if there is no official exchange closing price for that day, the security is valued at the mean between the last reported bid and asked prices if such bid and asked prices are available in the relevant exchanges; (2) when market quotations are not readily available, including circumstances under which Morgan Stanley Investment Management Inc. (the "Adviser"), a wholly owned subsidiary of Morgan Stanley, determines that the closing price, last sale price or the mean between the last reported bid and asked prices are not reflective of a security's market value, portfolio securities are valued at their fair value as determined in good faith under procedures established by and under the general supervision of the Trustees; Occasionally, developments affecting the closing prices of securities and other assets may occur between the times at which valuations of such securities are determined (that is, close of the

29

Morgan Stanley Mortgage Securities Trust

Notes to Financial Statements n October 31, 2016 continued

foreign market on which the securities trade) and the close of business on the New York Stock Exchange ("NYSE"). If developments occur during such periods that are expected to materially affect the value of such securities, such valuations may be adjusted to reflect the estimated fair value of such securities as of the close of the NYSE, as determined in good faith by the Trustees or by the Adviser using a pricing service and/or procedures approved by the Trustees; (3) futures are valued at the settlement price on the exchange on which they trade or, if a settlement price is unavailable, at the last sale price on the exchange; (4) Unlisted swaps are valued by an outside pricing service approved by the Trustees or quotes from a broker or dealer. Unlisted swaps cleared on a clearinghouse or exchange may be valued using the closing price provided by the clearinghouse or exchange; (5) quotations of foreign portfolio securities, other assets and liabilities and forward contracts stated in foreign currency are translated into U.S. dollar equivalents at the prevailing market rates prior to the close of the NYSE; and (6) investments in mutual funds, including the Morgan Stanley Institutional Liquidity Funds, are valued at the net asset value ("NAV") as of the close of each business day.

The Trustees have responsibility for determining in good faith the fair value of the investments, and the Trustees may appoint others, such as the Fund's Adviser or a valuation committee, to assist the Trustees in determining fair value and to make the actual calculations pursuant to the fair valuation methodologies previously approved by the Trustees. Under procedures approved by the Trustees, the Fund's Adviser has formed a Valuation Committee whose members are approved by the Trustees. The Valuation Committee provides administration and oversight of the Fund's valuation policies and procedures, which are reviewed at least annually by the Trustees. These procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.