Exhibit 99.1

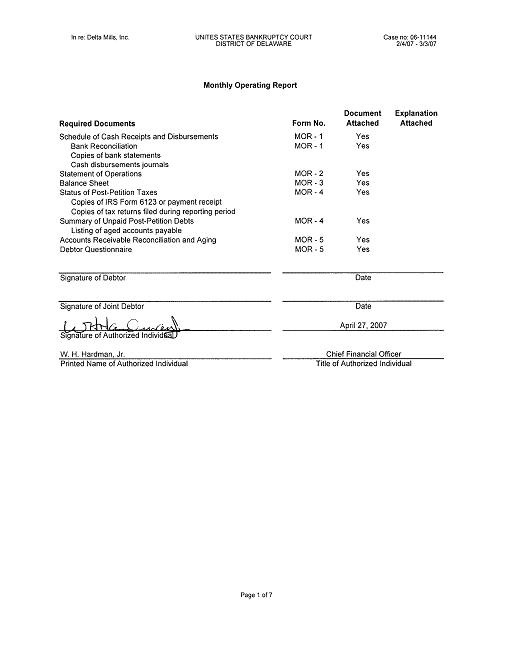

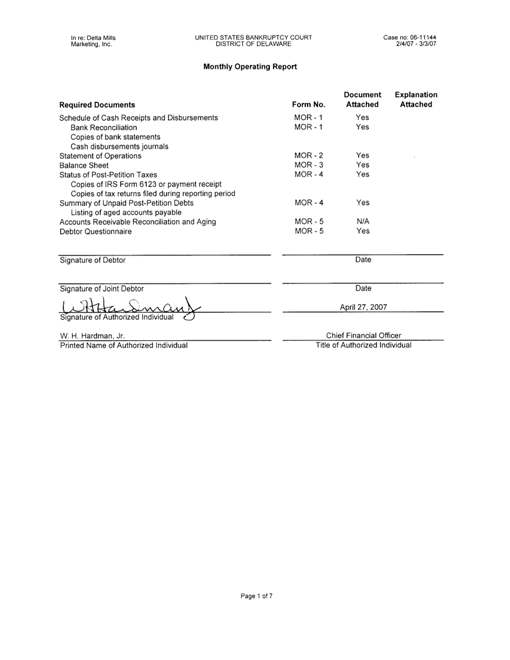

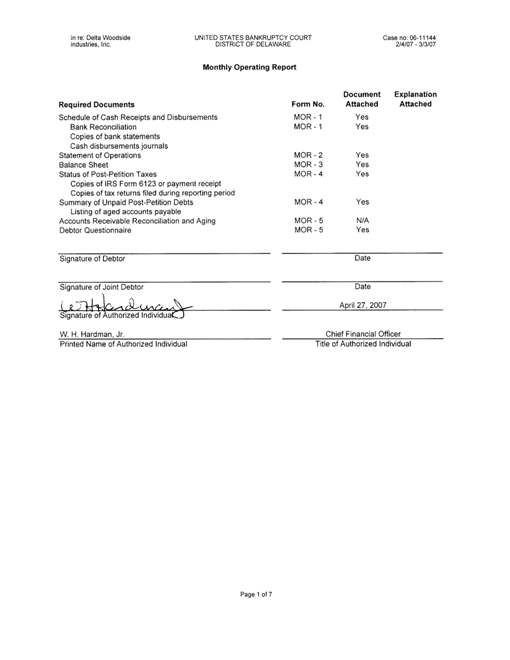

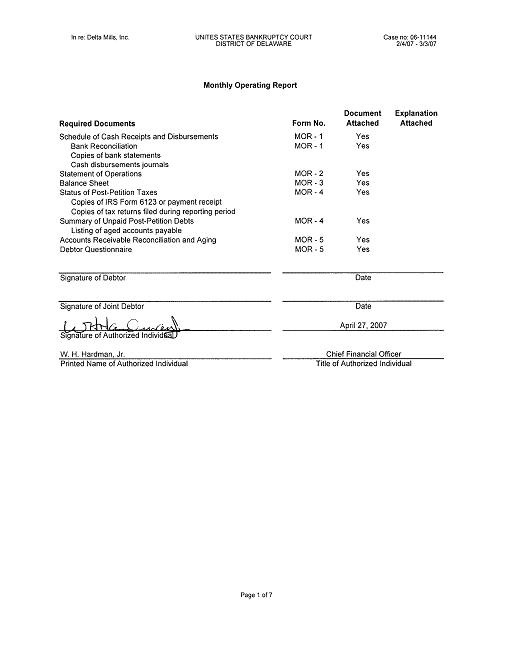

In re: Delta Mills, Inc. UNITES STATES BANKRUPTCY COURTCase no: 06-11144 DISTRICT OF DELAWARE2/4/07 - 3/3/07 Monthly Operating Report Required Documents Schedule of Cash Receipts and Disbursements Bank Reconciliation Copies of bank statements Cash disbursements journals Statement of Operations Balance Sheet Status of Post-Petition Taxes Copies of IRS Form 6123 or payment receipt Copies of tax returns filed during reporting period Summary of Unpaid Post-Petition Debts Listing of aged accounts payable Accounts Receivable Reconciliation and Aging Debtor QuestionnaireForm No. MOR-1 MOR - 1 MOR-2 MOR-3 MOR-4 MOR-4 MOR-5 MOR-5DocumentExplanation AttachedAttached Yes Yes Yes

Yes Yes Yes Yes Yes Date Signature of Debtor

Signature of Joint Debtor Date

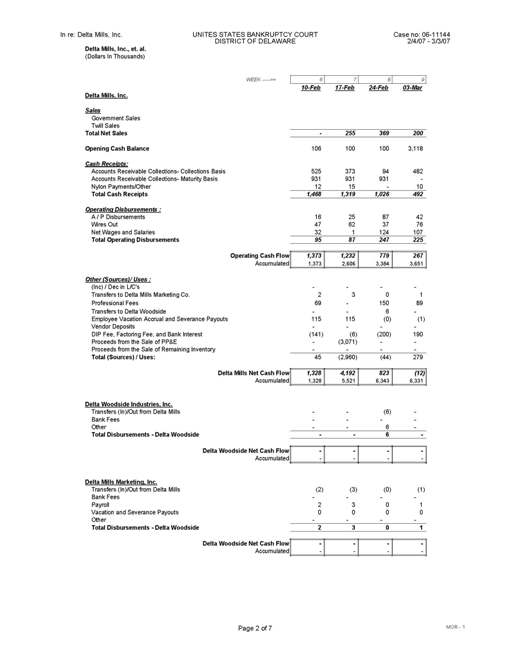

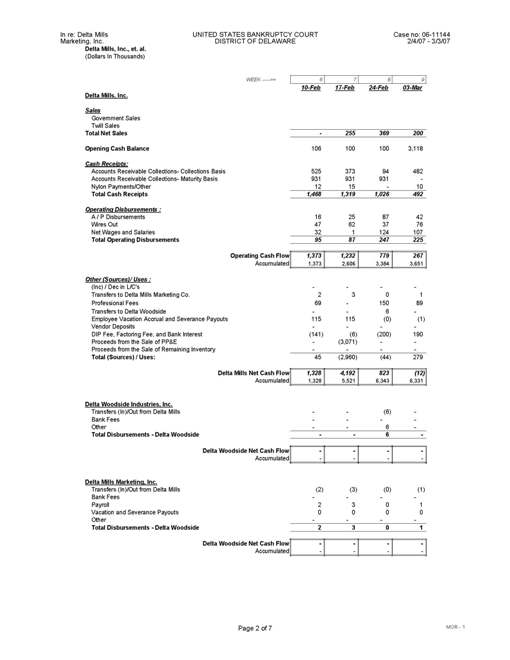

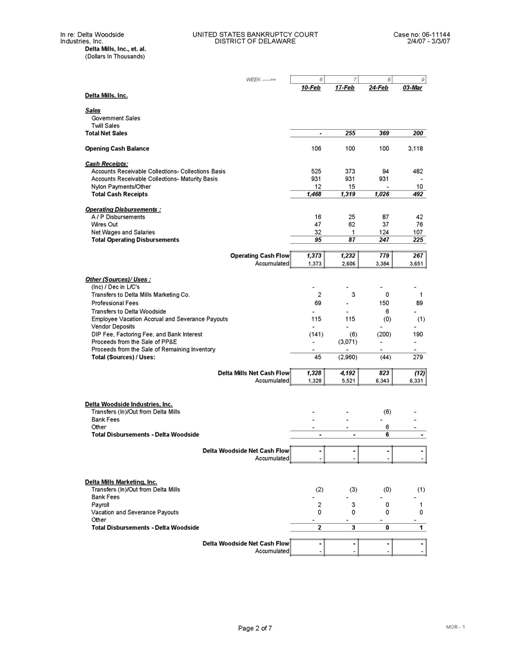

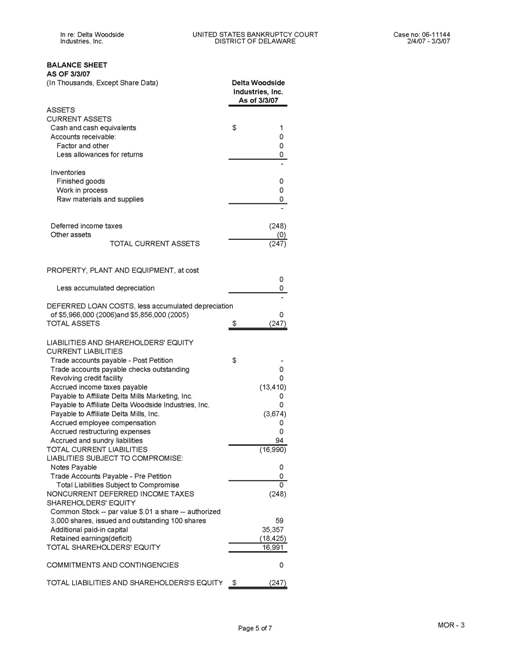

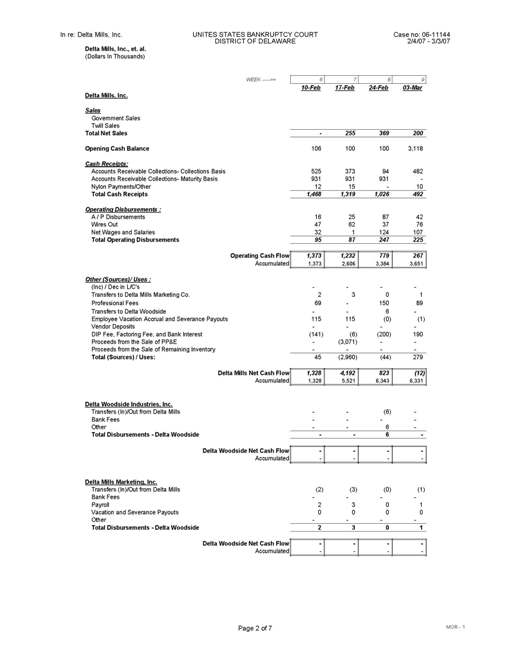

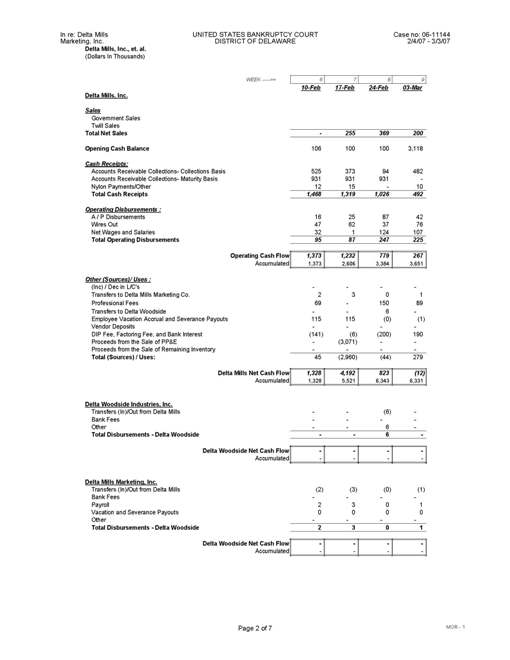

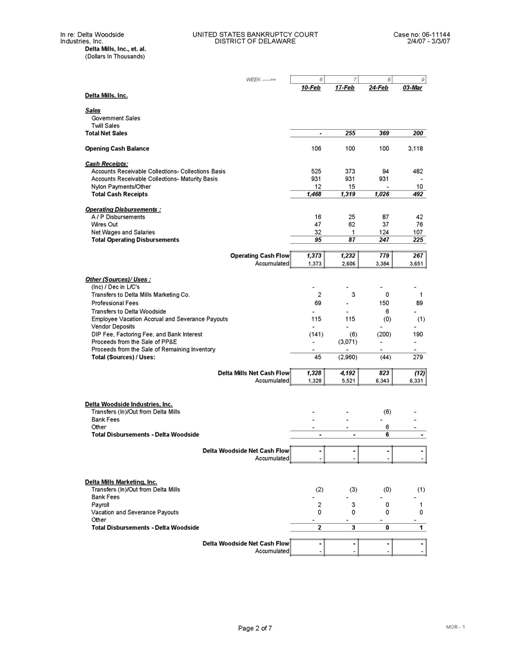

Delta Mills, Inc. Sales Government Sales Twill Sales Total Net Sales-255369200 Opening Cash Balance1061001003,118 Cash Receipts: Accounts Receivable Collections- Collections Basis52537394482 Accounts Receivable Collections- Maturity Basis931931931- Nylon Payments/Other1215-10 Total Cash Receipts1,4681,3191,026492 Operating Disbursements : A / P Disbursements16258742 Wires Out47623776 Net Wages and Salaries321124107 Total Operating Disbursements9587247225 Operating Cash Flow 1,3731,232779267 Accumulated1,3732,6063,3843,651 Other (Sources)/ Uses : (Inc) / Dec in L/C's---- Transfers to Delta Mills Marketing Co.2301 Professional Fees69-15089 Transfers to Delta Woodside--6- Employee Vacation Accrual and Severance Payouts115115(0)(1) Vendor Deposits---- DIP Fee, Factoring Fee, and Bank Interest(141)(6)(200)190 Proceeds from the Sale of PP&E-(3,071)-- Proceeds from the Sale of Remaining Inventory---- Total (Sources) / Uses:45(2,960)(44)279 Delta Mills Net Cash Flow1,3284,192823(12) Accumulated1,3285,5216,3436,331 Delta Woodside Industries, Inc. Transfers (In)/Out from Delta Mills--(6)- Bank Fees---- Other--6- Total Disbursements - Delta Woodside--6- Delta Woodside Net Cash Flow ---- Accumulated---- Delta Mills Marketing, Inc. Transfers (In)/Out from Delta Mills(2)(3)(0)(1) Bank Fees---- Payroll2301 Vacation and Severance Payouts0000 Other---- Total Disbursements - Delta Woodside2301 Delta Woodside Net Cash Flow ---- Accumulated----

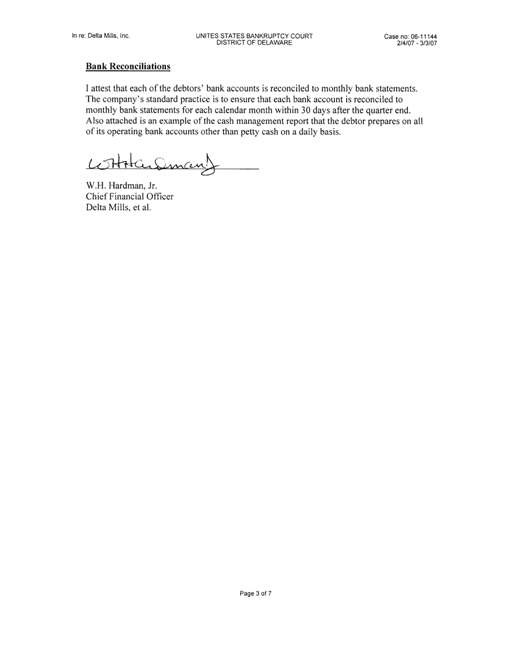

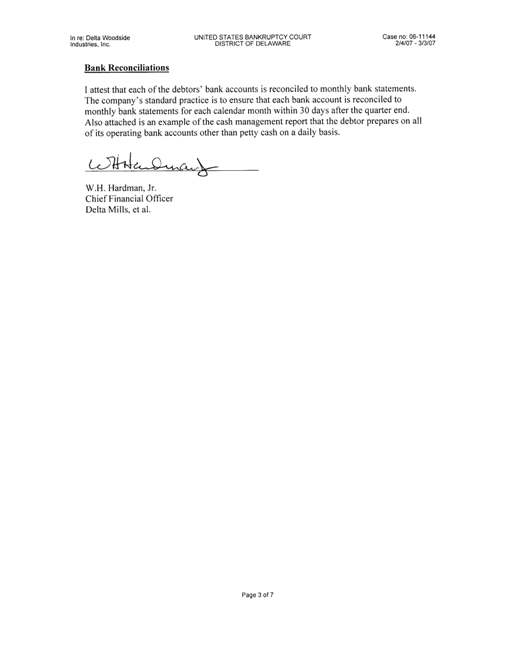

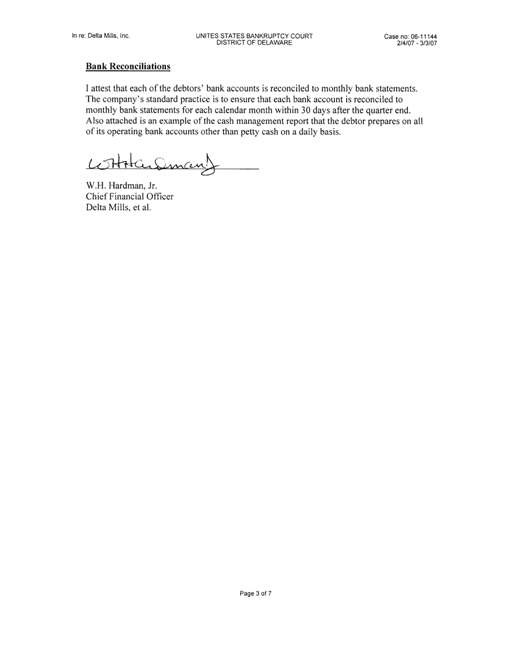

Bank Reconciliations I attest that each of the debtors' bank accounts is reconciled to monthly bank statements. The company's standard practice is to ensure that each bank account is reconciled to monthly bank statements for each calendar month within 30 days after the quarter end. Also attached is an example of the cash management report that the debtor prepares on all of its operating bank accounts other than petty cash

on a daily basis. W.H. Hardman, Jr. Chief Financial Officer Delta Mills, et al.

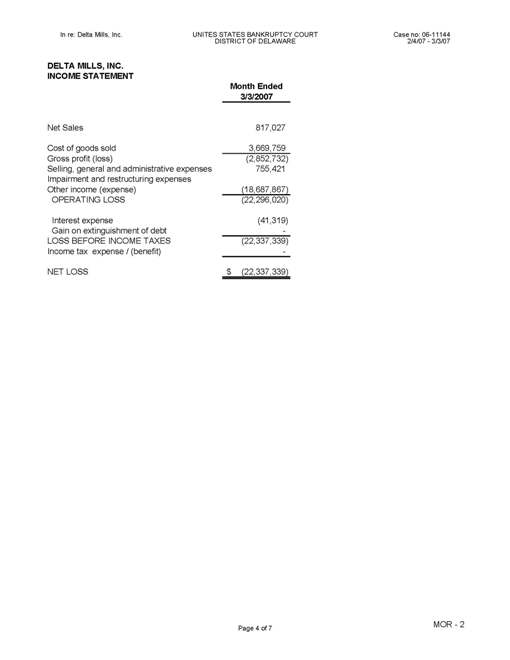

DELTA MILLS, INC. INCOME STATEMENT Month Ended 3/3/2007 Net Sales817,027 Cost of goods sold3,669,759 Gross profit (loss)(2,852,732) Selling, general and administrative expenses755,421 Impairment and restructuring expenses Other income (expense)(18,687,867) OPERATING LOSS(22,296,020) Interest expense(41,319) Gain on extinguishment of debt- LOSS BEFORE INCOME TAXES(22,337,339) Income tax expe

nse / (benefit)- NET LOSS$(22,337,339)

BALANCE SHEET AS OF 3/3/07 (In Thousands, Except Share Data)Delta Mills, Inc. As of 3/3/07 ASSETS CURRENT ASSETS Cash and cash equivalents$7,945 Accounts receivable: Factor and other6,125 Less allowances for returns99 6,026 Inventories Finished goods928 Work in process0 Raw materials and supplies1,400 2,328 Deferred income taxes493 Other assets911 TOTAL CURRENT ASSETS17,703 PROPERTY, PLANT AND EQUIPMENT, at cost24,006 Less accumulated depreciation14,629 9,376 DEFERRED LOAN COSTS, less accumulated depreciation of $5,966,000 (2006)and $5,856,000 (2005)52 TOTAL ASSETS$27,132 LIABILITIES AND SHAREHOLDERS' EQUITY CURRENT LIABILITIES Trade accounts payable - Post Petition$1 Trade accounts payable checks outstanding151 Revolving credit facility0 Accrued income taxes payable12,394 Payable to Affiliate Delta Mills Marketing, Inc.2,175 Payable to Affiliate Delta Woodside Industries, Inc.3,674 Payable to Affiliate Delta Mills, Inc.0 Accrued employee compensation97 Accrued restructuring expenses0 Accrued and sundry liabilities747 TOTAL CURRENT LIABILITIES19,239 LIABLITIES SUBJECT TO COMPROMISE: Notes Payable30,941 Trade Accounts Payable - Pre Petition3,550 Accrued Interest - Notes Payable1,836 Total Liabilities Subject to Compromise36,327 NONCURRENT DEFERRED INCOME TAXES2,061 SHAREHOLDERS' EQUITY Common Stock -- par value $.01 a share -- authorized 3,000 shares, issued and outstanding 100 shares1 Additional paid-in capital51,791 Retained earnings(deficit)(82,287) TOTAL SHAREHOLDERS' EQUITY(30,495) COMMITMENTS AND CONTINGENCIES0 TOTAL LIABILITIES AND SHAREHOLDERS'S EQUITY$27,132

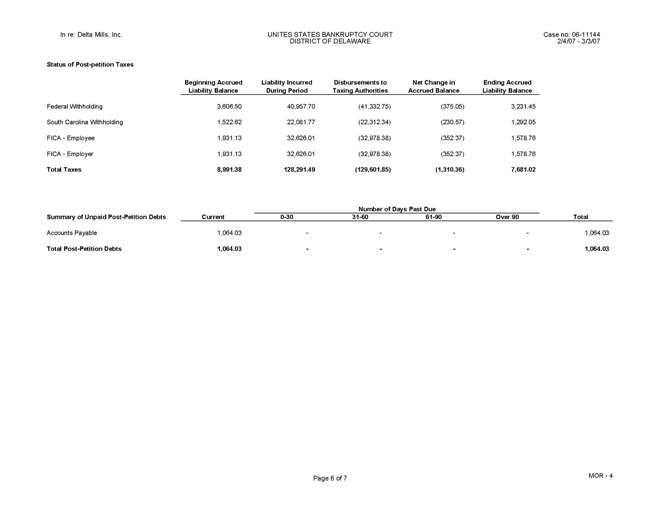

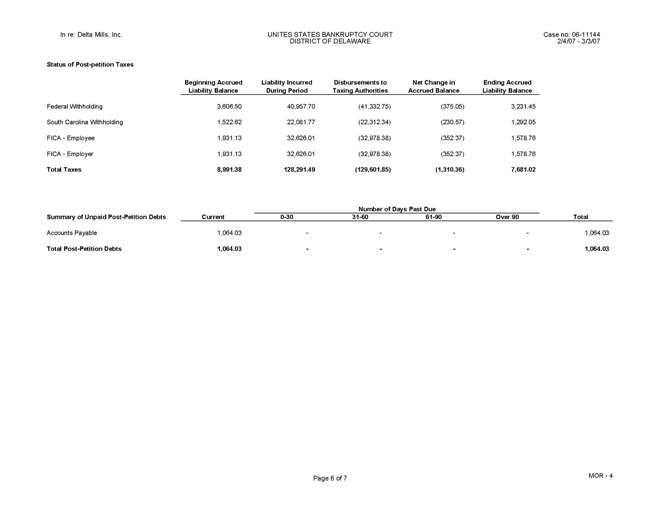

Status of Post-petition Taxes Beginning Accrued Liability BalanceLiability Incurred During PeriodDisbursements to Taxing AuthoritiesNet Change in Accrued BalanceEnding Accrued Liability Balance Federal Withholding3,606.5040,957.70(41,332.75)(375.05)3,231.45 South Carolina Withholding1,522.6222,081.77(22,312.34)(230.57)1,292.05 FICA - Employee1,931.1332,626.01(32,978.38)(352.37)1,578.76 FICA - Employer1,931.1332,626.01(32,978.38)(352.37)1,578.76 Total Taxes8,991.38128,291.49(129,601.85)(1,310.36)7,681.02 Number of Days Past Due Summary of Unpaid Post-Petition DebtsCurrent0-3031-6061-90Over 90Total Accounts Payable1,064.03----1,064.03 Total Post-Petition Debts1,064.03----1,064.03

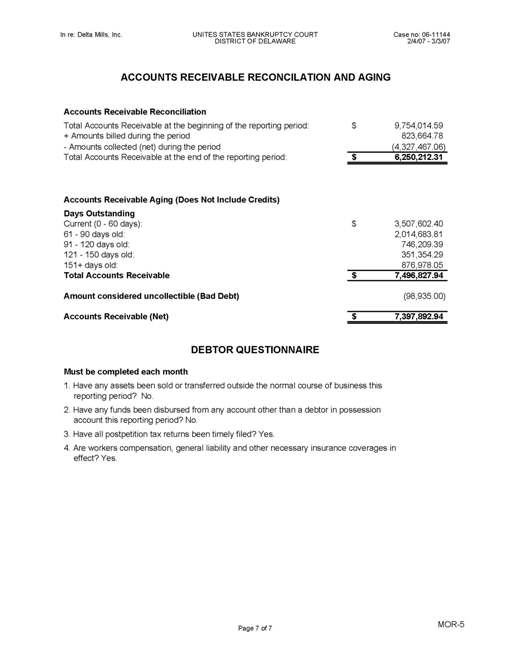

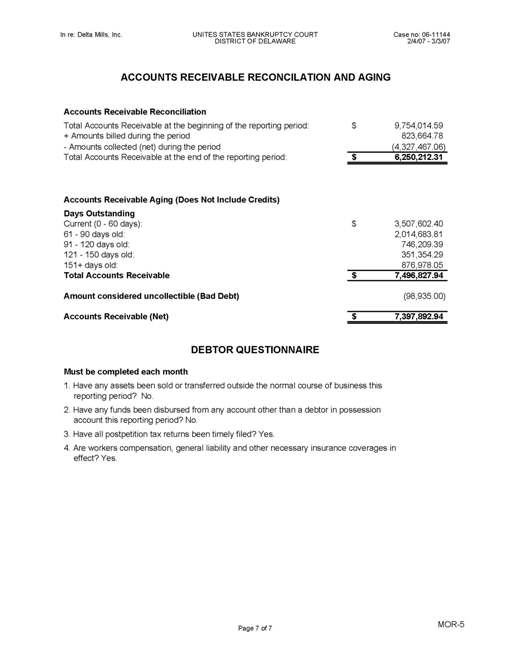

ACCOUNTS RECEIVABLE RECONCILATION AND AGING Accounts Receivable Reconciliation Total Accounts Receivable at the beginning of the reporting period:$9,754,014.59 + Amounts billed during the period823,664.78 - Amounts collected (net) during the period(4,327,467.06) Total Accounts Receivable at the end of the reporting period:$6,250,212.31 Accounts Receivable Aging (Does Not Include Credits) Days Outstanding Current (0 - 60 days):$3,507,602.40 61 - 90 days old:2,014,683.81 91 - 120 days old:746,209.39 121 - 150 days old:351,354.29 151+ days old:876,978.05 Total Accounts Receivable$7,496,827.94 Amount considered uncollectible (Bad Debt)(98,935.00) Accounts Receivable (Net)$7,397,892.94 DEBTOR QUESTIONNAIRE Must be completed each month 1.Have any assets been sold or transferred outside the normal course of business this reporting period? No. 2.Have any funds been disbursed from any account other than a debtor in possession account this reporting period? No. 3.Have all postpetition tax returns been timely filed? Yes. 4.A

re workers compensation, general liability and other necessary insurance coverages in effect? Yes.

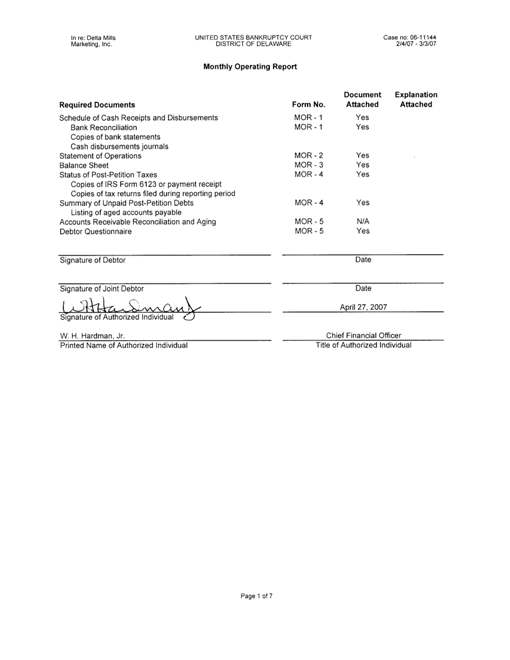

In re: Delta Mills UNITED STATES BANKRUPTCY COURT Case no: 06-11144 Marketing, Inc.DISTRICT OF DELAWARE2/4/07 - 3/3/07 Monthly Operating Report Required Documents Schedule of Cash Receipts and Disbursements Bank Reconciliation Copies of bank statements Cash disbursements journals Statement of Operations Balance Sheet Status of Post-Petition Taxes Copies of IRS Form 6123 or payment receipt Copies of tax returns filed during reporting period Summary of Unpaid Post-Petition Debts Listing of aged accounts payable Accounts Receivable Reconciliation and Aging Debtor QuestionnaireForm No. MOR - 1 MOR - 1 MOR-2 MOR-3 MOR-4 MOR-4 MOR-5 MOR-5DocumentExplanation AttachedAttached Yes Yes Yes Yes Yes Yes N/A Yes Date Signature of Debtor April 27, 2007 Signature of Joint Debtor Date Signature of Authorized Individual W. H. Hardman, Jr.Chief Financial Officer Printed Name of Authorized IndividualTitle of Authorized Individual

10-Feb 17-Feb 24-Feb 03-Mar Delta Mills, Inc. Sales Government Sales Twill Sales Total Net Sales-255369200 Opening Cash Balance1061001003,118 Cash Receipts: Accounts Receivable Collections- Collections Basis52537394482 Accounts Receivable Collections- Maturity Basis931931931- Nylon Payments/Other1215-10 Total Cash Receipts1,4681,3191,026492 Operating Disbursements : A / P Disbursements16258742 Wires Out47623776 Net Wages and Salaries321124107 Total Operating Disbursements9587247225 Operating Cash Flow 1,3731,232779267 Accumulated1,3732,6063,3843,651 Other (Sources)/ Uses : (Inc) / Dec in L/C's---- Transfers to Delta Mills Marketing Co.2301 Professional Fees69-15089 Transfers to Delta Woodside--6- Employee Vacation Accrual and Severance Payouts115115(0)(1) Vendor Deposits---- DIP Fee, Factoring Fee, and Bank Interest(141)(6)(200)190 Proceeds from the Sale of PP&E-(3,071)-- Proceeds from the Sale of Remaining Inventory---- Total (Sources) / Uses:45(2,960)(44)279 Delta Mills Net Cash Flow1,3284,192823(12) Accumulated1,3285,5216,3436,331 Delta Woodside Industries, Inc. Transfers (In)/Out from Delta Mills--(6)- Bank Fees---- Other--6- Total Disbursements - Delta Woodside--6- Delta Woodside Net Cash Flow ---- Accumulated---- Delta Mills Marketing, Inc. Transfers (In)/Out from Delta Mills(2)(3)(0)(1) Bank Fees---- Payroll2301 Vacation and Severance Payouts0000 Other---- Total Disbursements - Delta Woodside2301 Delta Woodside Net Cash Flow ---- Accumulated----

In re: Delta Mills UNITED STATES BANKRUPTCY COURTCase no: 06-11144 Marketing, Inc. DISTRICT OF DELAWARE 2/4/07 - 3/3/07 Bank Reconciliations I attest that each of the debtors' bank accounts is reconciled to monthly bank statements. The company's standard practice is to ensure that each bank account is reconciled to monthly bank statements for

each calendar month within 30 days after the quarter end. Also attached is an example of the cash management report that the debtor prepares on all of its operating bank accounts other than petty cash on a daily basis. W.H. Hardman, Jr. Chief Financial Officer Delta Mills, et at.

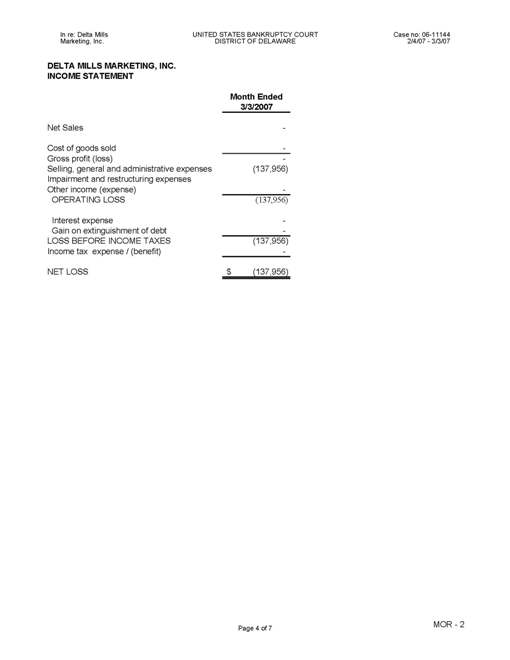

DELTA MILLS MARKETING, INC. INCOME STATEMENT Month Ended 3/3/2007 Net Sales - Cost of goods sold - Gross profit (loss) - Selling, general and administrative expenses (137,956) Impairment and restructuring expenses Other income (expense) - - OPERATING LOSS (137,956) Interest expense - Gain on extinguishment of debt - LOSS BEFORE INC

OME TAXES (137,956) Income tax expense / (benefit) - NET LOSS $ (137,956)

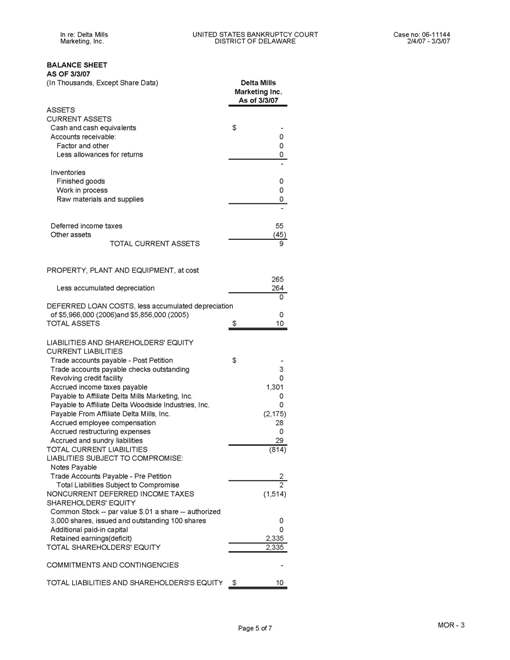

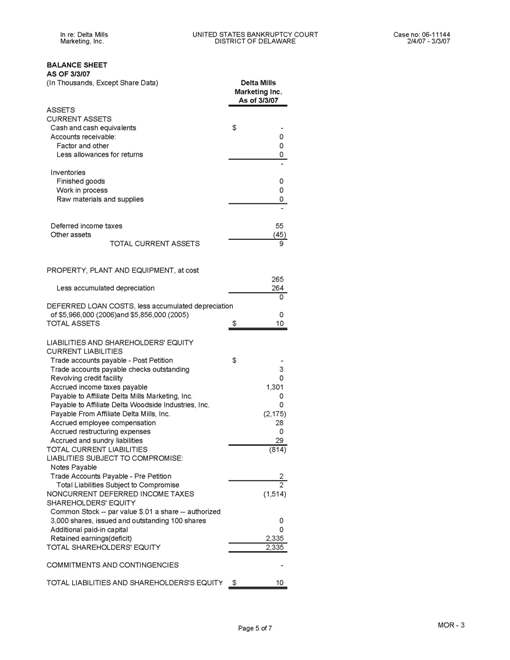

BALANCE SHEET AS OF 3/3/07 (In Thousands, Except Share Data) Delta Mills Marketing Inc. As of 3/3/07 ASSETS CURRENT ASSETS Cash and cash equivalents$ - - Accounts receivable: 0 Factor and other 0 Less allowances for returns 0 - Inventories Finished goods 0 Work in process 0 Raw materials and supplies 0 - Deferred income taxes 55 Other assets (45) TOTAL CURRENT ASSETS 9 PROPERTY, PLANT AND EQUIPMENT, at cost265 Less accumulated depreciation 264 0 DEFERRED LOAN COSTS, less accumulated depreciation of $5,966,000 (2006)and $5,856,000 (2005) 0 TOTAL ASSETS $ 10 LIABILITIES AND SHAREHOLDERS' EQUITY CURRENT LIABILITIES Trade accounts payable - Post Petition $ - - Trade accounts payable checks outstanding 3 Revolving credit facility 0 Accrued income taxes payable 1,301 Payable to Affiliate Delta Mills Marketing, Inc. 0 Payable to Affiliate Delta Woodside Industries, Inc. 0 Payable From Affiliate Delta Mills, Inc. (2,175) Accrued employee compensation 28 Accrued restructuring expenses 0 Accrued and sundry liabilities 29 TOTAL CURRENT LIABILITIES (814) LIABLITIES SUBJECT TO COMPROMISE: Notes Payable Trade Accounts Payable - Pre Petition 2 Total Liabilities Subject to Compromise 2 NONCURRENT DEFERRED INCOME TAXES (1,514) SHAREHOLDERS' EQUITY Common Stock -- par value $.01 a share -- authorized 3,000 shares, issued and outstanding 100 shares 0 Additional paid-in capital 0 Retained earnings(deficit) 2,335 TOTAL SHAREHOLDERS' EQUITY 2,335 COMMITMENTS AND CONTINGENCIES - TOTAL LIABILITIES AND SHAREHOLDERS'S EQUITY $ 10

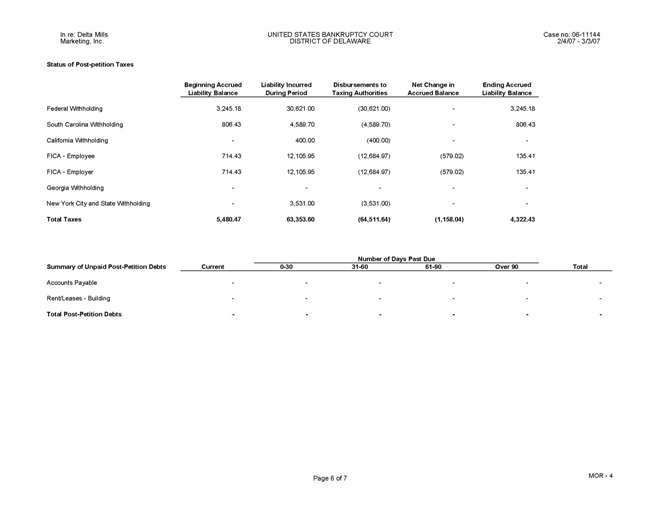

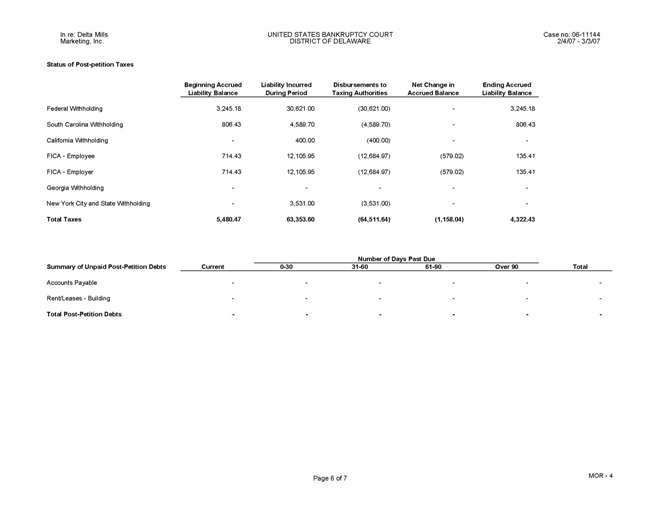

Status of Post-petition Taxes Beginning Accrued Liability Balance Liability Incurred During PeriodDisbursements to Taxing Authorities Net Change in Accrued Balance Ending Accrued Liability Balance Federal Withholding 3,245.18 30,621.00 (30,621.00) - - 3,245.18 South Carolina Withholding 806.434,589.70 (4,589.70) - - 806.43 California Withholding - - 400.00(400.00) - -

- FICA - Employee 714.4312,105.95 (12,684.97) (579.02) 135.41 FICA - Employer 714.43 12,105.95 (12,684.97) (579.02) 135.41 Georgia Withholding - - - - - - - - - New York City and State Withholding - - 3,531.00 (3,531.00) - - - Total Taxes 5,480.47 63,353.60 (64,511.64) (1,158.04) 4,322.43 Number of Days Past Due Summary of Unpaid Post-Petition Debts Accounts Payable Rent/Leases - Building Total Post-Petition Debts Current0-30 - - -31-60 61-90 - - - - - -

DEBTOR QUESTIONNAIRE Must be completed each month Have any assets been sold or transferred outside the normal course of business this reporting period? No. Have any funds been disbursed from any account other than a debtor in possession account this reporting period? No. Have all postpetition tax ret

urns been timely filed? Yes. Are workers compensation, general liability and other necessary insurance coverages in effect? Yes.

In re: Delta Woodside UNITED STATES BANKRUPTCY COURTCase no: 06-11144 Industries, Inc. DISTRICT OF <?xml:namespace prefix = st1 />DELAWARE 2/4/07 - 3/3/07 Monthly Operating Report Required Documents Schedule of Cash Receipts and Disbursements Bank Reconciliation Copies of bank statements Cash disbursements journals Statement of Operations Balance Sheet Status of Post-Petition Taxes Copies of IRS Form 6123 or payment receipt Copies of tax returns filed during reporting period Summary of Unpaid Post-Petition Debts Listing of aged accounts payable Accounts Receivable ReconciliaYes Yes Yes Yes N/A Yes Signature of Debtor Date April 27, 2007 W.H. Hardma, Jr. Chief Financial Officer Printed Name of Authorized Individual Title of Authorized Individual

10-Feb17-Feb24-Feb03-Mar Delta Mills, Inc. Sales Government Sales Twill Sales Total Net Sales - - 255 369 200 Opening Cash Balance 106 100 100 3,118 Cash Receipts: Accounts Receivable Collections- Collections Basis 525 373 94 482 Accounts Receivable Collections- Maturity Basis 931 931 931 - Nylon Payments/Other 12 15 - - 10 Total Cash Receipts1,468 1,319 1,026 492 Operating Disbursements :A / P Disbursements 16 25 87 42 Wires Out 47 62 37 76 Net Wages and Salaries 32 1 124 107 Total Operating Disbursements 95 87 247 225 Operating Cash Flow 1,373 1,232 779 267 Accumulated 1,373 2,606 3,384 3,651 Other (Sources)/ Uses : (Inc) / Dec in L/C's - - - - - - - Transfers to Delta Mills Marketing Co. 2 3 0 1 Professional Fees 69 - - 150 89 Transfers to Delta Woodside - - - - 6 - Employee Vacation Accrual and Severance Payouts 115 115 (0) (1) Vendor Deposits - - - - - - - DIP Fee, Factoring Fee, and Bank Interest(141) (6) (200) 190 Proceeds from the Sale of PP&E - - (3,071)- - Proceeds from the Sale of Remaining Inventory - - - - - - - Total (Sources) / Uses: 45 (2,960)(44) 279 Delta Mills Net Cash Flow 1,328 4,192 823 (12) Accumulated 1,328 5,521 6,343 6,331 Delta Woodside Industries, Inc. Transfers (In)/Out from Delta Mills- - - (6) - Bank Fees - - - - - - - Other- - - 6 - Total Disbursements - Delta Woodside - - - - 6 - Delta Woodside Net Cash Flow - - - - - - - Accumulated - - - - - - Delta Mills Marketing, Inc. Transfers (In)/Out from Delta Mills (2) (3) (0) (1) Bank Fees - - - - - - - Payroll 2 3 0 1 Vacation and Severance Payouts 0 0 0 0 Other - - - - - - - Total Disbursements - Delta Woodside 2 3 0 1 Delta Woodside Net Cash Flow - - - - - - - Accumulated - - - - - -

Bank Reconciliations I attest that each of the debtors' bank accounts is reconciled to monthly bank statements. The company's standard practice is to ensure that each bank account is reconciled to monthly bank statements for each calendar month within 30 days after the quarter end. Also attached is an example of the cash management report that the debtor prepares on all of its operating bank accounts other than petty cash on a daily basis. W.H. Hardman, Jr. Chief Financial Officer Delta Mills, et al.

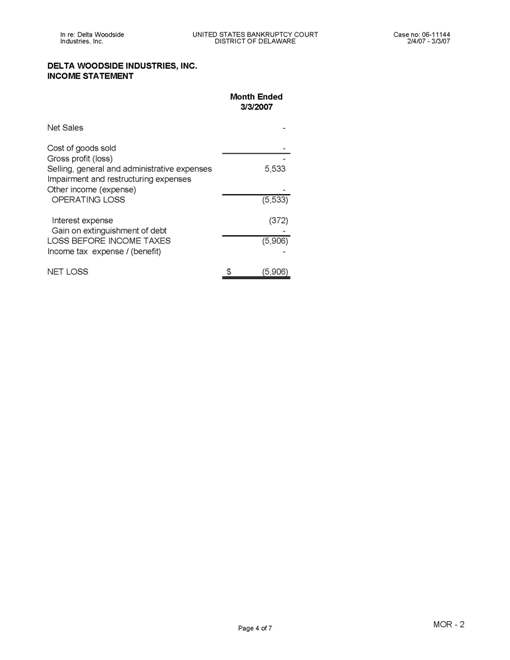

DELTA WOODSIDE INDUSTRIES, INC. INCOME STATEMENT Month Ended 3/3/2007 Net Sales - Cost of goods sold - Gross profit (loss) - Selling, general and administrative expenses 5,533 Impairment and restructuring expenses Other income (expense) - OPERATING LOSS(5,533) Interest expense (372) Gain on extinguishment of debt - LOSS BEFORE INCOME TAXES (5,906) Income tax expense / (benefit) - NET LOSS $ (5,906)

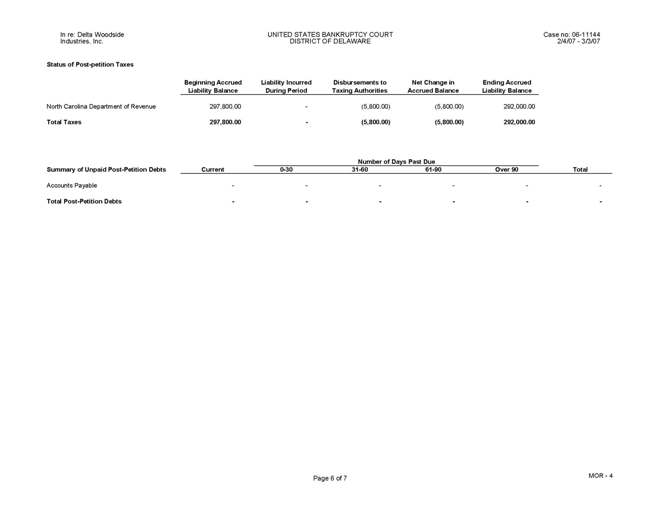

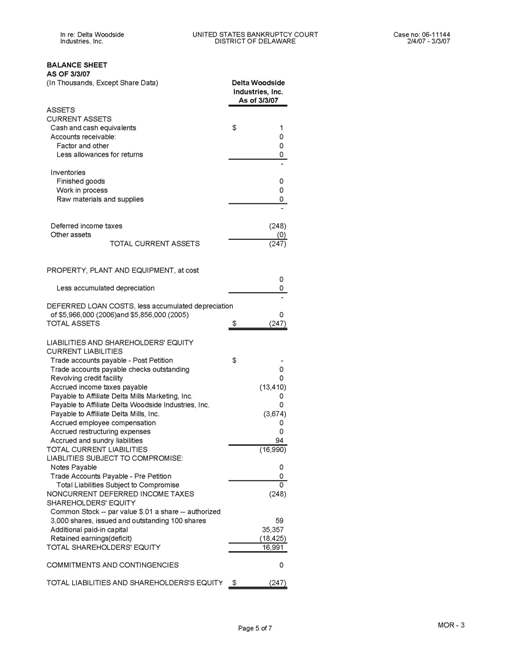

BALANCE SHEET AS OF 3/3/07 (In Thousands, Except Share Data) Delta Woodside Industries, Inc. As of 3/3/07 ASSETS CURRENT ASSETS Cash and cash equivalents $ 1 Accounts receivable: 0 Factor and other 0 Less allowances for returns 0 - Inventories Finished goods 0 Work in process 0 Raw materials and supplies 0 - Deferred income taxes (248) Other assets (0) TOTAL CURRENT ASSETS (247) PROPERTY, PLANT AND EQUIPMENT, at cost 0 Less accumulated depreciation 0 - DEFERRED LOAN COSTS, less accumulated depreciation of $5,966,000 (2006)and $5,856,000 (2005) 0 TOTAL ASSETS $ (247) LIABILITIES AND SHAREHOLDERS' EQUITY CURRENT LIABILITIES Trade accounts payable - Post Petition $ - Trade accounts payable checks outstanding 0 Revolving credit facility 0 Accrued income taxes payable (13,410) Payable to Affiliate Delta Mills Marketing, Inc. 0 Payable to Affiliate Delta Woodside Industries, Inc. 0 Payable to Affiliate Delta Mills, Inc. (3,674) Accrued employee compensation 0 Accrued restructuring expenses 0 Accrued and sundry liabilities94 TOTAL CURRENT LIABILITIES (16,990) LIABLITIES SUBJECT TO COMPROMISE: Notes Payable 0 Trade Accounts Payable - Pre Petition 0 Total Liabilities Subject to Compromise 0 NONCURRENT DEFERRED INCOME TAXES (248) SHAREHOLDERS' EQUITY Common Stock -- par value $.01 a share -- authorized 3,000 shares, issued and outstanding 100 shares 59 Additional paid-in capital 35,357 Retained earnings(deficit) (18,425) TOTAL SHAREHOLDERS' EQUI

TY 16,991 COMMITMENTS AND CONTINGENCIES 0 TOTAL LIABILITIES AND SHAREHOLDERS'S EQUITY $ (247)

Status of Post-petition Taxes Beginning Accrued Liability Incurred Disbursements to Net Change in Ending Accrued Liability Balance During Period Taxing Authorities Accrued Balance Liability Balance North Carolina Department of Revenue 297,800.00 - - (5,800.00) (5,800.00) 292,000.00 Total Taxes 297,800.00 - - (5,800.00) (5,800.00) 292,000.00 Number of Days Past Due <?xml:namespace prefix = v ns = "urn:schemas-microsoft-com:vml" /><?xml:namespace prefix = w ns = "urn:schemas-microsoft-com:office:word" />Summary of Unpaid Post-Petition Debts Current0-30 31-60 61-90 Over 90 Total Accounts Payable - - - - - - - - - - - Total Post-Petition Debts - - - - - - - - - - -