1.2 CONFIRMATION OF PLAN.

1.2.1 REQUIREMENTS. The requirements for Confirmation of the Plan are set forth in detail in section 1129 of the Bankruptcy Code. The following summarizes some of the pertinent requirements:

(a) Acceptance by Impaired Classes. Except to the extent that the “cramdown” provisions of section 1129(b) of the Bankruptcy Code may be invoked, each Class of Claims and each Class of Interests must either vote to accept the Plan or, where the Claims or Interests of such Class are not Impaired, be deemed to accept the Plan.

(b) Feasibility. The Bankruptcy Court is required to find that the Plan is likely to be implemented and that parties required to perform or pay monies under the Plan will be able to do so.

(c) “Best Interest” Test. The Bankruptcy Court must find that the Plan is in the “best interest” of all Creditors and Interest holders. To satisfy this requirement, the Bankruptcy Court must determine that each holder of a Claim against, or Interest in, the Debtor: (i) has accepted the Plan; or (ii) will receive or retain under the Plan money or other property which, as of the Effective Date, has a value not less than the amount such holder would receive if the Debtors’ property were liquidated under Chapter 7 of the Bankruptcy Code on such date.

(d) “Cramdown” Provisions. Under the circumstances which are set forth in detail in section 1129(b) of the Bankruptcy Code, the Bankruptcy Court may confirm the Plan even though a Class of Claims or Interests has not accepted the Plan, so long as one Impaired Class of Claims has accepted the Plan, excluding the votes of insiders, if the Plan is fair and equitable and does not discriminate unfairly against such non-accepting Classes. Except as otherwise set forth in the Plan, the Debtors will invoke the “cramdown” provisions of section 1129(b) of the Bankruptcy Code (to the extent available) should any voting Class fail to accept the Plan.

1.2.2 PROCEDURE. To confirm the Plan, the Bankruptcy Court must hold a hearing to determine whether the Plan meets the requirements of section 1129 of the Bankruptcy Code (the “Confirmation Hearing”). The Bankruptcy Court has set September 5, 2007, at 10:00 a.m. (ET), for the Confirmation Hearing.

1.2.3 OBJECTION TO CONFIRMATION. Any party in interest may object to the Confirmation of the Plan and appear at the Confirmation Hearing to pursue such objection. The Court has set August 27, 2007, at 4:00 p.m. (ET), as the deadline for filing and serving objections to Confirmation of the Plan. Objections to Confirmation must be filed with the Bankruptcy Court,

with a copy served upon:

(a) Counsel for the Debtors:

Robert J. Dehney, Esq.

Morris, Nichols, Arsht & Tunnell, LLP

1201 North Market Street

P.O. Box 1347

Wilmington, Delaware 19899-1347

and

C. Richard Rayburn, Jr., Esq. Rayburn Cooper & Durham, P.A. Suite 1200, The Carillon

227 West Trade Street

Charlotte, NC 28202

(b) Counsel for the Creditors’ Committee:

Christopher R. Donoho III, Esq. Lovells, LLP

590 Madison Avenue

New York, NY 10022

and

Mark E. Felger, Esq.

Cozen O’Connor

1201 N. Market Street, Suite 1400 Wilmington, Delaware 19801

(c) The United States Trustee:

Office of the United States Trustee Attn: Mark S. Kenney, Esq.

844 N. King Street, Room 2207 Lockbox #35

Wilmington, DE 19899-0035

1.2.4 EFFECT OF CONFIRMATION. Except as otherwise provided in the Plan or in the Confirmation Order, Confirmation vests title to property of the Debtors’ Estates in the Merged Debtors free and clear of all Claims and Liens of Creditors and Interest holders, subject to the provisions of the Plan. Confirmation serves to make the Plan binding upon the Debtors and all Creditors, Interest holders and other parties in interest, regardless of whether they cast a ballot (“Ballot”) to accept or reject the Plan.

1.3 VOTING ON THE PLAN.

1.3.1 IMPAIRED CLAIMS OR INTERESTS. Pursuant to section 1126 of the Bankruptcy Code, only the holders of Claims or Interests in Classes “Impaired” by the Plan may vote on the Plan. Pursuant to section 1124 of the Bankruptcy Code, a Class of Claims or Interests may be “Impaired” if the Plan alters the legal, equitable or contractual rights of the holders of such Claims or Interests treated in such Class. The holders of Claims or Interests not Impaired by the Plan are deemed to accept the Plan and do not have the right to vote on the Plan. The holders of Claims or Interests in any Class which will not receive any payment or distribution or retain any property pursuant to the Plan are deemed to reject the Plan and do not have the right to vote. This Disclosure Statement is being distributed for informational purposes to all Creditors entitled to vote under the Plan.

1.3.2 ELIGIBILITY. In order to vote on the Plan, a Creditor must have timely filed or been assigned a timely filed proof of Claim which has been Allowed, unless its Claim is scheduled by the Debtors and is not identified as disputed, unliquidated or contingent on the Debtors’ respective Schedules of Assets and Liabilities (as may be amended, the “Schedules”). Creditors having a Claim in more than one Class that is entitled to vote may vote in each Class in which they hold a separate Claim by casting a Ballot in each Class.

1.3.3 BINDING EFFECT. Whether a Creditor or Interest holder votes on the Plan or not, such Person will be bound by the terms of the Plan if the Plan is confirmed by the Bankruptcy Court. Absent some affirmative act constituting a vote, a Creditor will not be included in the vote: (a) for purposes of accepting or rejecting the Plan or (b) for purposes of determining the number of Persons voting on the Plan.

1.3.4 PROCEDURE. Allowed Class 1 – GMAC Claims, Allowed Class 2 – General Secured Claims, Allowed Class 3 – Priority Non-Tax Claims, and Allowed Class 4 – Indemnification Claims are not Impaired by the Plan and are deemed, therefore, to accept the Plan. Members of Allowed Class 5 – Convenience Claims, Allowed Class 6 – General Unsecured Claims and Allowed Class 7 – Reclamation Settlement Claims are Impaired and may vote to accept or reject the Plan. Class 8 – Interests shall neither receive nor retain any property on account of their Interests and are deemed to reject the Plan. Accordingly, holders of GMAC Claims, General Secured Claims, Priority Non-Tax Claims, Indemnification Claims, and Interests in Classes 1, 2, 3, 4, and 8 are not entitled to vote on the Plan. In order for a vote in Class 5, 6 or 7 to count, you must complete, date, sign and properly mail the enclosed Ballot (please note that envelopes have been included with the Ballot) to:

If via U.S. mail: Delta Mills, Inc. – Balloting Center Grand Central Station, P.O. Box 5295 New York, New York 10150-5295 | If via delivery by hand, courier, or overnight service: Delta Mills, Inc. – Balloting Center 757 Third Avenue, 3rd Floor New York, New York 10017 |

BALLOTS SENT BY TELECOPIER, FACSIMILE OR OTHER ELECTRONIC MEANS ARE NOT ALLOWED AND WILL NOT BE COUNTED.

Pursuant to Bankruptcy Rule 3017, the Bankruptcy Court has ordered that Ballots with original signatures for the acceptance or rejection of the Plan must be received by mail or overnight delivery by Bankruptcy Services, LLC, at one of the addresses set forth above on or before 5:00 p.m. (ET) on August 27, 2007. Once you have delivered your Ballot, you may not change your vote, except for cause shown to the Bankruptcy Court after notice and hearing.

| Ballots will be tabulated according to the following procedures: |

| |

| (a) | any Ballot that is properly completed, executed and timely returned to the Balloting Agent but either: (a) does not indicate an acceptance or a rejection of the Plan or (b) indicates both an acceptance and a rejection of the Plan, shall not be counted for the purposes of rejecting or accepting the Plan; |

| | |

| (b) | if no votes to accept or reject the Plan are received with respect to a particular Class, such Class will not be counted for the purposes of rejecting or accepting the Plan; |

| | |

| (c) | if a Holder of a Claim casts more than one Ballot voting the same Claim before the Ballot Deadline, the last properly completed, executed and timely returned Ballot received with respect to such Claim before the Ballot Deadline will be deemed to reflect the voter’s intent and thus will supersede any prior Ballots with respect to such Claim; |

| | |

| (d) | holders of multiple Claims will be required to vote all of their Claims within a particular Class under the Plan by one Ballot either to accept or reject the Plan and may not split their votes; thus, a Ballot within a Class received from a single Holder of a Claim that partially rejects and partially accepts the Plan will not be counted; |

| | |

| (e) | for purposes of determining whether the numerosity and Claim amount requirements of sections 1126(c) and 1126(d) of the Bankruptcy Code have been satisfied, the Debtors will tabulate only those Ballots cast by the Ballot Deadline; and |

| | |

| (f) | except where otherwise ordered by the Court, any Ballot received by the Balloting Agent which casts a vote on behalf of a Claim which (i) cannot be identified in the Balloting Agent’s voter database as a Claim entitled to vote on the Plan or (ii) cannot be identified as a Claim entitled to vote on the Plan in the Class and for the amount specified on such Ballot, shall not be counted; provided,however, that such Ballot is not submitted with respect to a Claim for which a Rule 3018 Motion has been filed. |

1.4 ACCEPTANCE OF THE PLAN.

1.4.1 CREDITOR ACCEPTANCE. As a Creditor, your acceptance of the Plan is important. In order for the Plan to be accepted by an Impaired Class of Claims, a majority in number and two-thirds in dollar amount of the Claims voting (of each Impaired Class of Claims) must vote to accept the Plan, or the Plan must qualify for cramdown of any non-accepting Class of Claims pursuant to section 1129(b) of the Bankruptcy Code. In any case, at least one impaired Class of Creditors, excluding the votes of insiders, must actually vote to accept the Plan. You are urged to complete, date, sign and promptly mail the enclosed Ballot. Please be sure to complete the Ballot properly and legibly identify the exact amount of your Claim and the name of the Creditor.

1.4.2 CRAMDOWN ELECTION. Except as otherwise provided in the Plan, if all Classes do not accept the Plan, but at least one Impaired Class votes to accept the Plan, excluding the votes of insiders, the Debtors may attempt to invoke the “cramdown” provisions. Cramdown may be an available remedy, because the Debtors believe that, with respect to each Impaired Class, the Plan is fair and equitable within the meaning of section 1 129(b)(2) of the Bankruptcy Code and does not discriminate unfairly.

1.5 SOURCES OF INFORMATION.

The information contained in this Disclosure Statement has been obtained from the Debtors’ books and records and from pleadings filed by the Debtors and other parties-ininterest. Every reasonable effort has been made to present accurate information and such information is believed to be correct as of the date hereof. Any value given as to the Assets of the Debtors is based upon an estimation of such value. You are strongly urged to consult with your financial, legal and tax advisors to understand fully the Plan and Disclosure Statement.

The financial information contained in this Disclosure Statement is given as of the date hereof, unless otherwise specified. The delivery of this Disclosure Statement does not, under any circumstance, imply that there has been no change in the facts set forth herein since such date. This Disclosure Statement is intended, among other things, to summarize the Plan and must be read in conjunction with the Plan and its exhibits, if any. If any conflicts exist between the Plan and Disclosure Statement, the terms of the Plan shall control.

1.6 ADDITIONAL INFORMATION.

Should you have any questions regarding the Plan or this Disclosure Statement, or require clarification of any information presented herein, please contact the following counsel for the Debtor:

MORRIS, NICHOLS, ARSHT & TUNNELL, LLP

Robert J. Dehney (No. 3578)

Gregory T. Donilon (No. 4244)

1201 North Market Street

P.O. Box 1347

Wilmington, Delaware 19899-1347

(302) 658-9200

and

RAYBURN COOPER & DURHAM, P.A. C.

Richard Rayburn, Jr.

John R. Miller, Jr.

Shelley K. Abel

Suite 1200, The Carillon

227 West Trade Street

Charlotte, NC 28202

(704) 334-0891

2. THE DEBTORS.

2.1 DESCRIPTION OF THE DEBTORS AND NAUTILUS AND THEDEBTORS’ BUSINESSES.

2.1.1 CORPORATE STRUCTURE.

(a) Delta Mills.

Delta Mills is a Delaware corporation with a principal executive office located at 700 North Woods Drive, Fountain Inn, South Carolina. Delta Mills is a wholly owned subsidiary of DLWI. As of the Petition Date, Delta Mills operated a woven textile business consisting of: (a) the manufacture and sale of cotton and cotton/synthetic blend fabrics to apparel manufacturers and resellers, which in turn sold primarily to department stores and other retailers and (b) the manufacture and sale of camouflage print fabrics primarily to apparel manufacturers that contracted with the United States Government to fulfill its requirements for military uniforms.

Delta Mills conducted its business from its corporate office and its Beattie Plant, both located in Fountain Inn, South Carolina (the “Beattie Plant”), and its Delta 3 Plant in Wallace, South Carolina (the “Delta 3 Plant”). As of the Petition Date, Delta Mills had closed its Pamplico and Cypress Plants in Pamplico, South Carolina (the “Pamplico Plant”), and its Delta 2 Plant, located in Wallace, South Carolina (collectively with the Delta 3 Plant, the “Delta Plant”), as part of its exit from the woven synthetic fabrics business prior to the Petition Date. The Bankruptcy Court approved the sale of equipment located at both the Beattie Plant and the Delta Plant, as well as the real estate upon which the Delta Plant is situated in Wallace, SC, in the Pre-Confirmation Sale Orders.

(b) DLWI.

DLWI is a publicly held South Carolina corporation with its principal office at 700 North Woods Drive, Fountain Inn, South Carolina. At the Petition Date, the Common Stock of DLWI was listed on the NASDAQ Over-the-Counter (“OTC”) Bulletin Board under the symbol “DLWI.OB.” DLWI is a holding company, which conducted no pre-petition business operations.

(c) Marketing

Marketing is a Delaware corporation and wholly-owned subsidiary of Delta Mills, which, as of the Petition Date, maintained offices located at 104 West 40th Street, New York, New York. Marketing provided marketing services for the products manufactured by Delta Mills.

(d) Nautilus.

Nautilus International, Inc. (“Nautilus”) was a former wholly owned subsidiary of DLWI, and was a Virginia corporation, and is not a debtor in these cases. Nautilus was the non-operating entity remaining after Nautilus’ sale of the Nautilus fitness equipment business in January, 1999. Nautilus’ corporate existence was terminated on or about October 31, 2000 and it was purged from the Virginia corporate records effective on or about December 31, 2005.

2.1.2 CORPORATE HISTORY.

The Debtors’ operations date back to 1972, when the company that is now DLWI was originally incorporated. Since that time DLWI underwent a number of mergers, spin-offs and reorganizations. In particular, from 1998 through the Petition Date, DLWI underwent substantial structural change. In 1998, DLWI and its subsidiaries operated a textile business with two divisions (the Stevcoknit Fabric Company knit textiles business and the Delta Mills woven textiles business), two apparel businesses (the Delta Apparel and Duck Head Apparel businesses) and a fitness equipment business (Nautilus International). During its 1998 and 1999 fiscal years, DLWI closed the Stevcoknit Fabric Company business and sold Nautilus International (the sale of which closed in January 1999).

During its 2000 fiscal year, DLWI undertook an internal reorganization whereby DLWI (a) put its two apparel companies into two directly-owned subsidiaries, Delta Apparel, Inc. and Duck Head Apparel Company, Inc. and, subsequently (b) spun off these two subsidiaries by means of a pro rata stock distribution to its shareholders at the end of fiscal year 2000. Delta Apparel, Inc. remains a publicly-held company whose stock is traded on the American Stock Exchange (“AMEX”) under the symbol “DLA.” Duck Head Apparel Company, Inc., was also a publicly-held company traded on AMEX but was acquired by tender offer and merger by a third party in 2001.

2.2 THE DEBTORS’ FINANCIAL HISTORY AND PRE-PETITION DEBTSTRUCTURE.

2.2.1 SECURED INDEBTEDNESS – THE GMAC CREDIT FACILITY.

As of the Petition Date, Delta Mills and Marketing were indebted to GMAC Commercial Finance, LLC (“GMAC”) in the approximate principal amount of $18,955,000 under the terms of that certain Amended and Restated Revolving Credit, Term Loan and Security Agreement, dated as of May 30, 2006 (as amended, the “GMAC Credit Agreement”). GMAC holds a first priority lien on all of Delta Mills’ accounts receivable and inventory to secure the obligations of Delta Mills and Marketing under the GMAC Credit Agreement. As of the Petition Date, under the GMAC Factoring Agreement and GMAC Credit Agreement, Delta Mills sold to GMAC most of Delta Mills’ accounts receivable, and GMAC provided factoring services and extended a revolving line of credit.

2.2.2 UNSECURED AND OTHER INDEBTEDNESS.

(a) The Senior Notes. The Bank of New York serves as Indenture Trustee for the Delta Mills 9.625% Senior Notes due September 1, 2007 (the “Senior Notes”). The Senior Notes are unsecured obligations. As of the Petition Date, the outstanding balance of the Senior Notes was approximately $30,941,000, exclusive of accrued but unpaid interest. Pursuant to the terms of the Senior Notes, Delta Mills is required to make periodic interest payments. Delta Mills failed to make a required interest payment to holders of Senior Notes on September 1, 2006, and failed to pay the interest payment within the thirty-day grace period provided under the Series A and Series B 9.625% Senior Notes Indenture (the “Indenture”).

(b) Ordinary Course Trade Payables and Other Unsecured Claims. The Debtors estimate that their total allowable unsecured claims, exclusive of amounts due under the Senior Notes are between approximately $3,200,000 and $6,300,000, including ordinary course trade payables to various vendors that provided raw materials to Delta Mills, such as yarn, dyes, and chemicals used in the operation of its weaving, dying and finishing operations. The range reflected in this estimate is primarily due to the possibility of contingent contract rejection damages claims, late-filed claims, and various workers’ compensation claims as described in greater detail in Section 6.2.5. In addition, a number of claims have been filed against the Debtors with respect to which the Debtors dispute some or all liability. The Debtors intend to file or have filed objections to these claims. The outcome of those objections will have a significant impact on the amount and number of allowed general unsecured claims.

2.3 EVENTS LEADING TO THE BANKRUPTCY FILING.

2.3.1 CONTRACTION OF OPERATIONS.

Delta Mills operated in an extremely competitive environment with respect to its manufacture of woven textiles. Continued pressure from foreign imports, primarily from China, after the phase out of textile and apparel quotas by the World Trade Organization at the end of 2004, and overcapacity in the domestic textile business, combined with increasing energy, raw materials and production costs resulted in continued operating losses over the past several years. In fiscal years 2003 and 2004, DLWI sustained consolidated net losses of $4,616,000 and $7,664,000, respectively.

Following fiscal year 2001, Delta Mills’ operations underwent significant contraction in response to these competitive pressures. Of seven Delta Mills manufacturing facilities operating in fiscal year 2001, five closed, leaving two facilities operating as of the Petition Date. Specifically, during fiscal year 2002, Delta Mills announced the closing of the Furman weaving facility in Fountain Inn, South Carolina, and liquidated the assets related to that operation. Delta Mills announced the closure of the Catawba yarn manufacturing facility in Maiden, North Carolina, in fiscal year 2003 and the closing of the Estes weaving facility in Piedmont, South Carolina, in fiscal year 2005 and completed the liquidation of the related assets of both of these facilities in fiscal year 2005. Delta Mills also eliminated the yarn manufacturing operations at the Beattie Plant in fiscal year 2005.

In fiscal year 2005, Delta Mills announced and completed its 2005 Realignment Plan, which was designed to and did produce significant cost savings in operations. The execution of the plan generated total asset sales proceeds of approximately $9,100,000. The impairment and restructuring expenses of $12,077,000 in fiscal year 2005 together with a decline in sales from $174,358,000 in fiscal 2004 to $157,863,000 in fiscal year 2005 and other factors resulted in a consolidated net loss of $27,417,000 in fiscal year 2005. Delta Mills continued to implement cost-saving measures in fiscal year 2006, including, without limitation, the exit described below from the synthetics business in response to continued losses and negative cash flow associated with that portion of the business. Despite these efforts, adverse market conditions continued to negatively affect Delta Mills, including continuing stagnation in the khaki market and continuing competitive pressures from overseas. In the first quarter of fiscal year 2006, Delta Mills sustained a net loss of $6,643,000; in the second quarter of fiscal year 2006, it sustained a net loss of $3,326,000; and, in the third quarter ended April 3, 2006, it had a net loss of $100,000.3

In fiscal year 2006, Delta Mills announced its exit from the synthetics business, which had been suffering for some time from increased competition from foreign imports, rising costs and declining sales prices. The synthetics portion of the business had sustained recurring losses, with Delta Mills running at less than sixty percent (60%) capacity utilization in its synthetic manufacturing facilities, and required increasing working capital outlays. As a part of its exit from the synthetics business, Delta Mills closed the Pamplico Plant spinning and weaving facility, as well as the Delta 2 Plant finishing facility. Delta Mills has been actively marketing the Pamplico Plant since January of 2006.

2.3.2 THE DEBTORS’ INCREASED RELIANCE ON THE GMACCREDIT FACILITY.

As a result of its operating losses, Delta Mills increased its reliance on revolver borrowings under the GMAC Credit Facility and was unable to reduce significantly the principal amount of its outstanding Senior Notes.

The GMAC Credit Agreement, both as originally entered into in March 2000 and as amended and restated in May 2006, includes and included certain financial covenants. Continuing losses forced Delta Mills to seek a series of amendments and waivers to avoid defaulting under the GMAC Credit Agreement. On August 18, 2004, October 18, 2004, May 12, 2005, and May 17, 2005, Delta Mills obtained waivers or amendments from GMAC with respect to the GMAC Credit Agreement.

On August 9, 2005, Delta Mills obtained a waiver and amendment from GMAC that included a waiver of noncompliance with the minimum earnings before interest, taxes, depreciation and amortization (“EBITDA”) covenant for the quarter ended July 2, 2005, and permission for the payment of deferred compensation participant account balances.

Under this August 9, 2005, amendment, Delta Mills received additional liquidity in the form of a $3,000,000 reduction in an asset-based availability block through February 2006.

On September 30, 2005, Delta Mills obtained a further waiver and amendment (the “September 30 Waiver”) to the GMAC Credit Agreement, which included a waiver of the requirement to provide financial statements for the fiscal year ended July 2, 2005, reported without qualification by Delta Mills’ independent accounting firm. The September 30 Waiver also set new reduced required minimum EBITDA levels for each quarter of fiscal year 2006 and required an appraisal of Delta Mills’ inventory.

___________________

3 During this quarter, Delta Mills reduced its income tax reserves by approximately $2,000,000 to reflect resolution of a North Carolina state tax matter.

In April 2006, Delta Mills initiated a tender offer and consent solicitation with respect to the Senior Notes (the “April 2006 Tender Offer”) and, in May 2006, Delta Mills entered into an amended and restated credit facility with GMAC with the intention of using term loan amounts under the facility to purchase Senior Notes under the April 2006 Tender Offer (if successful). However, Delta Mills did not receive tenders from holders of a majority of the Senior Notes and accordingly did not purchase any notes pursuant thereto. The amended and restated credit facility set EBITDA covenants for Delta Mills’ 2007 fiscal year.

2.3.3 THE DEBTORS’ EVALUATION OF STRATEGIC ALTERNATIVES AND TURNAROUND EFFORTS.

Over several years prior to the Petition Date, the Debtors’ management and boards of directors examined and explored a number of potential alternatives to address the Debtors’ debt structure, business operations and financial situation, and made efforts to restructure their debts outside of bankruptcy. In April 2004, the Debtors engaged Soles Brower Smith & Co. (“SBS”) as financial advisors to advise the Debtors on strategic alternatives available to them given the state of their business and the textile industry in general.

In the summer of 2004, SBS and/or the Debtors approached three potential strategic acquirers in the Debtors’ industry. These potential strategic acquirers all had strategic interest in the sectors of the textile industry in which the Debtors competed, either engaging in the manufacture of fabric for military uniforms or the production of cotton twill. The Debtors executed confidentiality agreements with two of those potential acquirers, provided substantial due diligence to both and entered into negotiations respecting a potential merger or acquisition transaction with either or both potential acquirers.

One potential acquirer issued the Debtors a preliminary indication of interest in September 2004 (the “2004 Expression of Interest”) that would have required the Debtors to file for bankruptcy protection and a significant compromise in the value of the Debtors’ unsecured creditors’ claims and, in particular, the claims of the holders of the Senior Notes. The Debtors’ boards of directors considered the 2004 Expression of Interest. After close examination of the 2004 Expression of Interest and after being presented with an analysis prepared by SBS comparing the 2004 Expression of Interest with an orderly run-out scenario, the Debtors’ boards determined that the 2004 Expression of Interest (a) did not constitute an offer to purchase all or part of the Debtors’ assets due to the numerous contingencies in the 2004 Expression of Interest, and (b) provided an insufficient return in comparison to the Debtors’ other strategic options to warrant further negotiations with the potential acquirer at that time. Specifically, the Debtors’ boards had recently approved implementation of the 2005 Realignment Plan, which the Debtors’ boards believed had the potential to create greater long-term value for the Debtors’ stakeholders.

While the other potential acquirer with whom the Debtors executed a confidentiality agreement and to whom the Debtors provided due diligence never issued a written indication of interest in purchasing some or all of the Debtors’ assets as a going concern, in the early spring of 2005, that potential acquirer did propose terms and conditions for a potential combination of the twill operations of the Debtors and the potential acquirer (the “2005 Combination Proposal”). The Debtors’ boards of directors considered the 2005 Combination Proposal and determined that the 2005 Combination Proposal (a) did not constitute an offer to purchase some or all of the Debtors’ assets and (b) provided an insufficient potential return in comparison to the Debtors’ other strategic options to warrant further negotiations with that potential acquirer at that time. The Debtors’ boards also believed at that time that, as a result of the 2005 Realignment Plan, continuation of the Debtors’ business as a going concern provided the opportunity for greater long-term value for the Debtors’ stakeholders.

As described above, the Debtors elected to pursue a realignment plan in the fall of 2004 (the “2005 Realignment Plan”) that incorporated closing the Estes weaving and spinning operation and the elimination of spinning operations at the Beattie Plant. In addition, the Debtors implemented a series of cost reduction measures that, in combination with the closing of the Estes plant and elimination of spinning operations in the Beattie Plant, were expected to produce savings of $12 million on an annual basis. The forecasted savings were expected to move the Debtors toward profitability in the future.

In the summer of 2005, the Debtors, in consultation with their professionals, decided that, because of continued losses and negative cashflows in the synthetics business, the Debtors should exit the synthetics business. The Debtors initiated the orderly run-out of the synthetics business in September 2005 with the expectation that the run-out would be complete by December 2005. As previously noted, the Debtors have actively marketed the Pamplico Plant, which was used in the Debtors’ synthetic business, since January 2006.

During the summer of 2005, the Debtors also initiated a conversation with another potential strategic acquirer who was a competitor of the Debtors in the cotton twill business. Before serious negotiations commenced, however, the potential acquirer suffered a catastrophic accident at one of its manufacturing complexes, which forced the closure of a significant component of its manufacturing capacity. The accident forced the potential acquirer to cease discussions with the Debtors and the potential acquirer eventually initiated an orderly run-out of its manufacturing operations.

As the successful run-out of the Debtors’ synthetics business was completed, the Debtors began the analysis of the feasibility of the April 2006 Tender Offer, as described above in greater detail. Prior to the initiation of the April 2006 Tender Offer, the Debtors approached the two potential acquirers with whom it had previously had serious negotiations to inquire whether those parties had any interest in restarting discussions regarding a merger or purchase of some or all of the operating assets of the Debtors. One of the potential acquirers entered into a new confidentiality agreement with the Debtors and continued to conduct certain due diligence. The other potential acquirer, however, declined to execute a new confidentiality agreement.

Because the Debtors had made little meaningful progress with either of these potential acquirers at that time, however, the Debtors initiated the April 2006 Tender Offer. Near the expiration of the April 2006 Tender Offer, the potential acquirer that had entered into the new confidentiality agreement provided the Debtors with a brief indication of interest that implied a return to the Senior Notes in excess of the value of the April 2006 Tender Offer, which was disclosed to the public. Shortly thereafter, the April 2006 Tender Offer expired without consummation.

Prior to the expiration of the April 2006 Tender Offer, the Debtors were contacted by an informal committee of noteholders (the “Ad Hoc Committee”) representing approximately forty percent (40%) of the Senior Notes. The members of the Ad Hoc Committee executed confidentiality agreements with the Debtors. The Debtors disclosed to the Ad Hoc Committee that they were in discussions with a potential acquirer, and the Ad Hoc Committee requested that the Debtors engage in negotiations with the Ad Hoc Committee regarding their course of action while continuing to have discussions with the potential acquirer.

The Debtors received a letter of intent from the potential acquirer in June 2006 that was subsequently amended after further negotiations (the “June 2006 LOI”) and disclosed to the Ad Hoc Committee. The Debtors and the Ad Hoc Committee subsequently negotiated the terms of a proposed exchange offer (the “Exchange Offer”) that would have consisted of: (a) cash, (b) new Delta Mills senior notes with a second lien on Delta Mills’ assets, and (c) preferred stock of Delta Mills in exchange for the Senior Notes. The Debtors obtained preliminary agreement from GMAC to fund the cash portion of the Exchange Offer and anticipated commencing the Exchange Offer in early September 2006.

In late August, 2006, while Delta Mills was preparing to distribute the Exchange Offer, along with solicitations of a back-up pre-packaged chapter 11 plan of reorganization, as more fully described in the Form 8-K filed by DLWI on September 1, 2006, the Debtors were informed by their military supply customers that the Department of Defense’s (the “DOD’s”) demand for products of the Debtors’ customers would be substantially lower than anticipated, and, in fact, would be below the minimum levels contained in the current in-force contracts awarded by the DOD to the Debtors’ customers (the “DOD Announcement”). This significant decrease in the Debtors’ military portion of the business was sudden and unforeseen, and the proposed Exchange Offer had been based upon the assumption that the Debtors’ military business would remain substantially at current levels.

In light of this new information regarding decreased demand for military product, the Debtors’ managements and boards of directors determined that they would not return to profitability as expected, and might in fact be unable to service the secured debt required to repurchase the Senior Notes under the proposed Exchange Offer.

Accordingly, given their current situation and the revised sales forecast, the Debtors determined that their primary options were to pursue (a) a sale of some or all of the operating assets of the Debtors in a manner intended to maximize the value of the enterprise for all constituencies, or, (b) in the event such a sale were unsuccessful, to perform an orderly run-out of customer orders and orderly liquidation of the Debtors in a manner designed to maximize recoveries for the Debtors’ estates and creditors. As a result of this new information about future sales on the military side of the business, the Debtors determined not to make a scheduled interest payment to holders of Senior Notes on September 1, 2006.

After the Debtors disclosed to the Ad Hoc Committee the effect of the DOD Announcement, the Ad Hoc Committee informed the Debtors that it wanted the Debtors to continue discussions with the potential acquirer with whom the Debtors were negotiating at that time, and also consider the liquidation of the business. At that time, the Debtors again contacted the other potential acquirer with whom the Debtors had previously executed a confidentiality agreement, as well as another competitor, concerning a possible combination transaction. As of the Petition Date, neither of the latter two parties expressed any interest in engaging in discussions with the Debtors regarding such a transaction.

Subsequent to the decision to cancel commencement of the Exchange Offer, the Debtors continued conversations with the potential acquirer with whom they had negotiated the June 2006 LOI, and received a new letter of intent from that party in early September 2006. The Debtors and the potential acquirer further negotiated the letter of intent and the Debtors received a “final” letter of intent from that potential acquirer in early October 2006 (the “October 2006 LOI”). At board meetings held October 5 and 9, 2006, the Debtors’ boards of directors considered and analyzed the October 2006 LOI, as well as a preliminary analysis prepared by the Debtors’ financial advisors comparing the likely returns under the October 2006 LOI to those likely under an orderly run-out scenario. At those board meetings, the Debtors’ board of directors determined that the October 2006 LOI did not constitute a sufficient offer to purchase assets of the Debtors due to a multitude of contingencies contained in and risks associated with the proposal, and instructed the Debtors to move forward with an orderly run-out of the Debtors’ businesses.

The Debtors’ boards of directors authorized the Debtors’ management and financial advisors, however, to continue to pursue a definitive offer to purchase some or all of the Debtors’ assets, including without limitation further negotiations with the potential acquirer seeking to improve upon the October 2006 LOI, while moving forward with an orderly run-out of the Debtors’ businesses through the Debtors’ bankruptcy cases.

On October 9, 2006, the potential acquirer submitted another letter of intent to the Debtors (the “Second October 2006 LOI”). Following a telephone conference involving the Debtors, the potential acquirer and the Ad Hoc Committee, the Debtors and the Ad Hoc Committee determined that the Second October 2006 LOI did not constitute a sufficient offer to purchase assets of the Debtors.

As a result of the above-described events, the boards of directors of DLWI, Delta Mills and Marketing authorized the filing of these cases.

2.4 DEBTORS’ BANKRUPTCY PROCEEDINGS.

2.4.1 PETITION DATE. On October 13, 2006, the Debtors filed voluntary petitions under chapter 11 of the Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware.

2.4.2 FIRST DAY ORDERS. On the Petition Date, the Debtors filed several motions seeking certain relief by virtue of so-called first day orders. The first day orders assisted the Debtors in transitioning into operating as debtors in possession by approving certain regular business practices that may not be specifically authorized under the Bankruptcy Code or as to which the Bankruptcy Code requires prior court approval. The first day orders in the Debtors’ cases authorized, among other things:

| · | continued maintenance of the Debtors’ bank accounts, continued use of existing business forms and continued use of the Debtors’ existing cash management system; |

| · | appointment of Bankruptcy Services, LLC, as the claims, noticing and balloting agent in the Chapter 11 Cases; |

| · | continued utility service during the pendency of the Chapter 11 Cases; |

| · | certain payments to employees on account of accrued prepetition wages, salaries and benefits; |

| · | continuation of certain prepetition practices with critical vendors, common carriers and insurance providers and payment to certain critical vendors on account of prepetition obligations; |

| · | establishment of bidding procedures for the sale of all or substantially all of the Debtors’ Assets; and |

| · | the debtors-in-possession financing facility on an interim basis. |

2.4.3 THE CREDITORS’ COMMITTEE. On or about October 20, 2006, the United States Trustee appointed the Creditors’ Committee consisting of: (i) Parkdale Mills, Inc.; (ii) Dexter Chemical, LLC; (iii) The Bank of New York Trust Company, N.A.; (iv) Amino Acid Capital LLC, and (v) Flagg Street Capital, LLC. The Creditors’ Committee retained the law firms Stroock & Stroock & Lavan, LLP and Cozen O’Connor as its counsel and Mesirow Financial Consulting, LLC, as its financial advisor. The Debtors have been informed that Parkdale Mills, Inc., has withdrawn from the Creditors’ Committee.

2.4.4 THE DIP FINANCING FACILITY.

On October 13, 2006, the Debtors filed the Debtors’ Motion For Emergency Interim Order And Final Order Pursuant to 11 U.S.C. §§ 105, 361, 362, and 364 and Bankruptcy Rules 2002, 4001, and 9014 (i) Authorizing the Debtors to Enter into a Post-Petition Credit Facility with GMAC Commercial Finance and Incur Post-Petition Secured Indebtedness, (ii) Granting Security Interests and Priority Claims; (iii) Modifying the Automatic Stay; (iv) Setting a Final Hearing; and (v) Granting Related Relief (D.I. 11).

Following a final hearing on the Debtors’ request to obtain post-petition financing under the terms and conditions set forth in the Final DIP Agreement, the Bankruptcy Court, on October 31, 2006, entered the Final Order (a) Authorizing Debtors to Obtain Post-Petition Financing and Granting Security Interests and Superpriority Administrative Expense Status Pursuant to 11 U.S.C. §§ 105 and 3 64(c); (b) Modifying the Automatic Stay Pursuant to 11 U.S.C. § 362; and (c) Authorizing Debtors to Enter into Agreements with GMAC Commercial Finance LLC (D.I. 88) (the “DIP Financing Order”).

2.4.5 SALE OF CERTAIN OF THE DEBTORS’ ASSETS.

As set forth above, prior to the Petition Date, the Debtors were seeking a purchaser for all or substantially all of their Assets. On October 13, 2006, the Debtors filed their Motion for Order Under 11 U.S.C. § 105(a), 363, 365 and 1146(c) and Federal Rules of Bankruptcy Procedure 2002, 6004, and 9014 (a) Approving (i) Initial Bidding Procedures, (ii) Overbidding Procedures, (iii) Auction Procedures, (b) Approving Notice Procedures for (i) the Solicitation of Bids, (ii) an Auction and (iii) the Assumption and Assignment of Contracts and Leases; (c) Scheduling Hearings on Approval of (i) Bid Protection for a Stalking Horse Bidder, (ii) a Sale or Sales of Substantially All of Debtors’ Assets and (iii) Miscellaneous Asset Sales, and (d) Granting Related Relief (D.I. 15).

On October 16, 2006, the Court entered the Order under 11 U.S.C. §§ 105(a), 363, 365 and 1146 and Federal Rules of Bankruptcy Procedure 2002, 6004, 6006 and 9014 (a) Approving (i) Initial Bidding Procedures, (ii) Overbidding Procedures, (iii) Auction Procedures, (b) Approving Notice Procedures for (i) the Solicitation of Bids, (ii) an Auction and (iii) the Assumption and Assignment of Contracts and Leases; (c) Scheduling Hearings on Approval of (i) Bid Protections for a Stalking Horse Bidder, (ii) a Sale or Sales of Substantially All of Debtors’ Assets and (iii) Miscellaneous Asset Sales, and (c) Granting Related Relief (D.I. 28) (the “Initial Bidding Procedures Order”), dated October 13, 2006, which authorized the Debtors to solicit bids for the Debtors’ Assets as a going concern, including (a) the Beattie Plant and all of the operating assets at that location, (b) the Delta 3 Plant and all of the operating assets at that location and (c) any customer lists, inventory backlogs, and other intangibles reflecting the Debtors’ value as a going concern.

Following the entry of the Bidding Procedures Order and building upon the Debtors’ extensive pre-petition marketing efforts, Soles Brower Smith & Co. (“SBS”) immediately contacted nine (9) strategic competitors and investors to provide those parties information about the Assets. In addition, SBS contacted eight (8) other parties who SBS believed may be interested in purchasing significant portions of the Debtors’ Assets, regardless of whether that interest might be for operating Assets as a going concern or fixed Assets to be purchased consistent with the run out of the Debtors’ business operations, including, without limitation, real property, plants, machinery, equipment and certain inventory and raw materials to be sold out of the ordinary course of business. Six (6) other potential purchasers contacted the Debtors and/or SBS requesting additional information.

In all, eleven (11) potential purchasers interested in the Debtors’ Assets as a going concern signed confidentiality agreements and obtained access to an electronic data room established by SBS to provide due diligence on the Debtors’ Assets, operations and historical financial data to potential purchasers.

The Debtors had hoped that, through the process established under the Initial Bidding Procedures Order, the potential acquirer who submitted the Second October 2006 LOI would improve upon the Second October 2006 LOI by: (a) improving the economic return to the Debtors’ estates such that the transaction would likely provide a greater return to the Debtors’ estates than an orderly run-out of the Debtors’ business, and (b) providing a definitive asset purchase agreement as a basis upon which the Debtors and its various stakeholders could evaluate the strategic purchaser’s offer, during the early stage of these cases. In addition, the Debtors anticipated that other potential purchasers of some or all of the Debtors’ Assets would submit definitive offers to purchase some or all of the Debtors’ Assets as a going concern during the early part of these cases. The Initial Bidding Procedures Order was designed to accommodate such an offer from one or more potential acquirers. However, in the absence of any such bids and in consultation with the Creditors’ Committee, the Debtors determined in their reasoned business judgment that they could not continue to operate as a going concern in the absence of a stalking horse bid that contemplated a purchase of the Debtors’ Assets as a going concern.

Because the Debtors (a) did not receive any bids for the Assets that would result in a sale of the Debtors’ Assets as a going concern and (b) continued to experience deepening operating losses that would accompany any continuation of the Debtors’ businesses as a going concern, the Debtors and the Debtors’ Boards of Directors (the “Boards”) determined, after consultation with the Creditors’ Committee, that, subject to Court approval, it was in the best interests of the Debtors, their estates and creditors and other parties in interest that the Debtors’ businesses continue to be run out (to finish and sell inventory) and the Assets liquidated in an orderly fashion, and that the Debtors continue to seek bids for the purchase of the Debtors’ Assets pursuant to one or more sale transactions, including bulk sales of the Assets and sales pursuant to the Miscellaneous Sale Procedures (the “ORO”). Accordingly, the Debtors did not propose any stalking horse bidder for the Debtors’ operating assets. On October 31, 2006, the Bankruptcy Court entered the Order Under 11 U.S.C. §§ 105(a), 363, and 365 and Federal Rules of Bankruptcy Procedures 2002, 6004, 6006 and 9014 (i) Approving and Authorizing the Debtors to Proceed with an Orderly Run out of the Debtors’ Business; (ii) Approving Procedures for the Sale or Sales of All or Substantially All of the Debtors’ Fixed Assets; (iii) Establishing Procedures for the Sale of Miscellaneous Assets and (iv) Granting Related Relief (D.I. 89) (the “Second Bidding Procedures Order”).

The Debtors then employed Bidding Procedures similar to those previously approved by the Initial Bidding Procedures Order to solicit bids for the Debtors’ fixed, non-operating assets. The Debtors or their professionals were in contact with twenty-six (26) potential bidders, eight (8) of which were interested in nearly all of the Debtors’ fixed assets and eighteen (18) of which were interested in one or more specific groups of the Debtors’ fixed assets. The Debtors received two written bids prior to the bidding deadline of November 21, 2006, and the Debtors’ Boards determined in their business judgment that these bids, as described below, represented the highest and best bid for the assets covered by each such bid.

On December 6, 2006, Delta Mills entered into three asset purchase agreements for the sale of its real property and most of its tangible personal property at its Delta Plant and the sale of most of its tangible personal property at its Beattie Plant. Pursuant to the Order (a) Approving Debtors’ Stalking Horse Selection; (b) Approving Breakup Fee; (c) Approving Form and Manner of Notice; (d) Scheduling a Hearing to Consider the Sale of Certain of the Debtors’ Assets and (e) Granting Related Relief (D.I. 189) (the “Stalking Horse Order”), the Bankruptcy Court approved the Debtors’ selection of the three asset purchase agreements as a “stalking horse bid” and approved procedures for an auction of the assets subject to the agreements.

One of the asset purchase agreements was for the sale of the real property at the Delta Plant facility to Schwarz Properties, LLC (“Schwarz”) for $1,000,000, subject to certain adjustments. Another of the asset purchase agreements was for the sale of all of the machinery, equipment, spare parts and other tangible personal property (other than certain fixtures and electronic office equipment) located at the Delta Plant for $125,000 to Greystone Private Equity LLC (“Greystone”). The third asset purchase agreement was for the sale of the machinery, equipment, spare parts and other tangible personal property (other than certain fixtures and electronic office equipment) located at the Beattie Plant for $2,375,000 also to Greystone. For purposes of the auction procedures contemplated in the Stalking Horse Order, the real and tangible personal property at the Delta Plant subject to the first two agreements were referred to collectively as the “First Lot” and the tangible personal property at the Beattie facility subject to the third agreement was referred to as the “Second Lot.”

The Stalking Horse Order provided that the three asset purchase agreements constituted the “Stalking Horse Bid” in an auction for the assets subject to those agreements. Any interested qualified bidders were required to make “Overbids” for those assets by December 12, 2006, and the auction took place on December 13, 2006. Bidders were required to bid on either the First Lot or the Second Lot or both, but could not bid on portions of either Lot. Initial Overbids for either Lot were required to exceed the purchase price set forth in the Stalking Horse Bid for the assets in the Lot by 6% (inclusive of a breakup fee of 3%) so that the initial Overbid amounts were $67,500 for the First Lot, $142,500 for the Second Lot and $210,000 for both Lots. Thereafter, successive Overbids would increase by minimum increments of $25,000 per Lot or $50,000 for both Lots.

On December 13, 2006, the Debtors accepted the overbid of Michael Fox International, Inc. (“Fox”), and entered into an asset purchase agreement with Fox for the sale of most of Delta Mills’ tangible personal property at its Beattie Plant. Accordingly, on December

13, 2006, Delta Mills terminated the agreement with Greystone relating to the equipment located at the Beattie Plant and entered into the Asset Purchase Agreement Between Delta Mills and Fox. The Asset Purchase Agreement Between Delta Mills and Fox provided for a $2,517,500 purchase price for the machinery, equipment, spare parts and other tangible personal property (other than certain fixtures and electronic office equipment) and was otherwise identical in all material respects to the previous agreement with Greystone. On December 15, 2006, the Bankruptcy Court approved the sale of the assets to Fox, Schwarz, and Greystone and entered the Pre-Confirmation Sale Orders (as defined in the Plan) approving the various asset purchase agreements. The Asset Purchase Agreement Between Delta Mills and Fox was amended slightly before closing, in accordance with the applicable Pre-Confirmation Sale Order, to reflect a change in the asset list and a reduction in the purchase price by $20,500. Pursuant to the terms of the agreement with Greystone, Delta Mills paid $71,250 to Greystone as a break-up fee at the time the Asset Purchase Agreement Between Delta Mills and Fox was closed.

The various asset purchase agreements approved by the Pre-Confirmation Sale Orders were closed on February 13, 2007. Pursuant to the Asset Purchase Agreement Between Delta Mills and Schwarz, Schwarz and an affiliated entity, Schwarz Wallace, LLC, which purchased the real property at the Delta Plant facility, assumed all liabilities related to the Delta Plant.

2.4.6 SCHEDULES. On December 13, 2006, the Debtors filed their respective Schedules and Statements of Financial Affairs with the Bankruptcy Court (D.I. 2 16-222).

2.4.7 BAR DATE ORDERS.

(a) The First Bar Date Order and Special Bar Dates. As fixed by the First Bar Date Order, the Bar Date was February 1, 2007, at 4:00 p.m. (ET) for Claims arising prior to the Petition Date and Administrative Claims that arose prior to December 15, 2007, provided,however, the Bar Date for governmental units, as set forth in section 101(27) of the Bankruptcy Code, was April 11, 2007, at 4:00 p.m. (ET). Pursuant to the First Bar Date Order, all Creditors (except governmental units as defined under section 101(24) of the Bankruptcy Code) who hold and assert a prepetition Claim or a post-petition Administrative Claim arising on or before December 15, 2006, against the Debtors were required to file a proof of claim, so that it was received pursuant to the procedures set forth in the First Bar Date Order, on or before February 1, 2007, at 4:00 p.m. (ET). In addition, the First Bar Date Order allows for the fixing of a special Bar Date for certain creditors in the event such creditors are given notice of the Bar Date at a later date. Special Bar Dates of April 9, 2007, and April 11, 2007, were established for certain workers’ compensation claimants. On March 9, 2007, the Debtors filed their first Notice of Special Bar Date for Workers’ Compensation Claimants, establishing April 9, 2007, as the last date and time by which certain workers’ compensation claimants set forth therein may file proofs of claim (D.I. 362). Further, on March 11, 2007, the Debtors filed their second Notice of Special Bar Date for Workers’ Compensation Claimants, establishing April 11, 2007, as the last date and time by which certain workers’ compensation claimants set forth therein may file proofs of claim (D.I. 365).

(b) The Second Bar Date Order. Pursuant to the Second Bar Date Order, the Bar Date for those Administrative Claims that arose after December 15, 2006, through the Confirmation Date shall be twenty-five (25) days after the Effective Date.

(c) Bar Dates for Executory Contracts and Unexpired Leases. Pursuant to the First Bar Date Order, Claims related to the rejection of any executory contract or lease shall have thirty (30) days after the entry of an order authorizing the Debtors’ rejection of such contract or lease or, with respect to any executory contract or unexpired lease rejected pursuant to the Rejection Procedures Order, the later of (i) the Bar Date established by the First Bar Date Order and (ii) thirty (30) days after the effective date of the rejection pursuant to the Rejection Procedures Order in which to file a proof of Claim for damages related to such rejection. As set forth in Section 8.2 of the Plan, a Claim arising from any rejection of an executory contract or unexpired lease that is effectuated through the Plan must be filed on or before thirty (30) days after the effective date of such rejection or shall be forever barred.

2.4.8 INCENTIVE PAYMENTS TO EXECUTIVE EMPLOYEES. On October 25, 2006, the Bankruptcy Court entered its Order Authorizing the Debtors (i) To Pay (a) Employees for Accrued Vacation Upon Termination; (b) Salary and Compensation Exceeding the Cap Under Section 507(a) (4) of the Bankruptcy Code to Employees; (c) Non-Executive Employees Under the Modified Severance Plan; and (d) Incentive Payments to Executive Employees and (ii) To Honor the 2004 Stock Plan (D.I. 63) (the “Executive Incentive Order”). The Executive Incentive Order provided, among other things, that each of the Debtors’ officers, William F. Garrett, William H. Hardman, Jr., and Donald C. Walker, (collectively the “Officers”), shall each earn an incentive payment upon the achievement of certain operational and financial goals, as set forth in detail in the Executive Incentive Order (the “Incentive Payment”). Fifty percent (50%) of the Incentive Payment (the “First Payment”) is earned upon the repayment in full of GMAC (other than amounts payable with respect to outstanding letters of credit), provided that, as of any date within the period beginning on the date of such full repayment and ending on April 30, 2007, the aggregate recovery from the working capital assets (excluding cash) exceeds the aggregate amount paid to GMAC after the Petition Date. The First Payment was earned, pursuant to the terms of the Executive Incentive Order, on or before February 3, 2007. The Debtors notified the Committee on February 9, 2007, that the First Payment had been earned, and each of the Debtors’ Officers began receiving payments on account of the First Payment on or about February 16, 2007, in twenty (20) equal weekly installment payments scheduled to end during the week of June 30, 2007.

The second fifty percent (50%) of the Incentive Payment (the “Second Payment”) is earned by each Officer upon the satisfaction of each of the following tests: (a) at least ninety percent (90%) of the dollar amount of the accounts receivable shown in the budget approved by GMAC on the Petition Date (net of reserves contemplated by the budget) have been collected and (b) the aggregate net recovery from the sale of inventory and collection of accounts receivable by the Debtors equals or exceeds 90% of the aggregate amount thereof contemplated by the budget. The Second Payment was earned, pursuant to the terms of the Executive Incentive Order, on or before March 1, 2007. The Debtors notified the Committee on March 2, 2007, that the Second Payment had been earned, and each of the Officers began receiving payments on account of the Second Payment on or about February 28, 2007, in eighteen (18) weekly installments scheduled to end during the week of June 30, 2007.

2.4.9 SETTLEMENT AMONG EXECUTIVES, THE DEBTORS AND THE COMMITTEE. After the Petition Date, the Committee sought, and the Debtors provided, information regarding payments the Officers received from the Debtors prior to the Petition Date on account of, among other things, deferred compensation and, in the case of William F. Garrett, bonuses. The Committee alleged that certain payments made to the Officers prior to the Petition Date may be avoidable and recoverable by the Debtors’ estates pursuant to one or more of sections 547, 548 and 550 of the Bankruptcy Code.

After arms-length negotiations between the Officers and the Committee, each of the Officers, the Committee and the Debtors entered into that certain Settlement Agreement and Release dated April 23, 2007 (the “Settlement Agreement”), which was approved by the Bankruptcy Court by Order entered June 18, 2007 (D.I. 561). The Settlement Agreement provides, among other matters, that each of the Officers shall waive receipt of a portion of the First Payment and Second Payment earned under the Executive Incentive Order in exchange for the Debtors’ and Committee’s release of any and all claims or causes of action against each of the Officers related to any of the following: (i) payments received by any of the Officers for deferred compensation, (ii) payments received by Mr. Garrett for any bonuses, (iii) payments to which any of the Officers are entitled under the Executive Incentive Order (except as specifically set forth in the Settlement Agreement), (iv) prepetition and/or postpetition payments to or claims made by any of the Officers for accrued vacation pay, expense reimbursements, salary and/or severance, and (v) payments or benefits to which any of the Officers are entitled under the Debtors’ 2004 Stock Plan. Further, the Settlement Agreement provides that, at each Officers’ option, he may (a) add the waived portion of the First Payment and Second Payment to his allowed, unsecured claim in these cases, or (b) earn some or all of the waived portion of the First Payment and Second Payment back upon the achievement by the Debtors of certain goals for distribution percentages on Class 6 Claims (the “Earnback Option”). In addition, if an Officer chooses the Earnback Option, he must provide uncompensated services to the post-confirmation Merged Debtors after the Effective Date for an aggregate of sixty (60) hours. The Debtors have been informed that each of the Executives have exercised the Earnback Option.

2.4.10 SALE OF THE BEATTIE PLANT. After the entry of the Second Bidding Procedures Order, the Debtors continued to market their Assets, including that certain property consisting of approximately 98 acres including an industrial building of approximately 423,000 square feet, located at 700 North Woods Drive, Fountain Inn, South Carolina 29644 (collectively, the “Beattie Plant”), to various interested parties. While certain parties expressed an interest in purchasing the Beattie Plant, no acceptable bids for the Beattie Plant were received prior to the bid deadline under the Second Bidding Procedures Order. The Debtors had been advertising the sale of two vacant parcels of land that comprise a portion of the Beattie Plant on the open market since on or before June 30, 2006, and, after the Petition Date, sought a sale of the entire Beattie Plant pursuant to the Second Bidding Procedures Order. Subsequent to the bid deadline under the Second Bidding Procedures Order, which passed in December 2006, the Debtors received an expression of interest from Stanley Atkins (“Atkins”) regarding his potential purchase of the Beattie Plant. After receipt of this expression of interest, the Debtors negotiated the terms of the offer with Atkins. On or about April 30, 2007 (the “April Board Meeting”), Delta Mills presented the general terms of Atkins’s proposed contract for the purchase of the Beattie Plant (as executed, the “Atkins Contract”) to the Boards of Directors of DLWI, Marketing and Delta Mills. At the April Board Meeting, the Board of Directors of Delta Mills, with the approval of the Boards of DLWI and Marketing, authorized Delta Mills to designate Atkins as the Stalking Horse Bidder for the purchase of the Beattie Plant.

The proposed purchase price for the Beattie Plant under the Atkins Contract was $3,750,000.00. Pursuant to the Atkins Contract, Atkins deposited $375,000 with the Debtors’ counsel upon Delta Mills’ and Atkins’ execution of the Atkins Contract (the “Earnest Money”). In accordance with the Atkins Contract, Atkins provided Delta Mills with a statement from Atkins’ banker indicating that Atkins has the required financial ability to close on the purchase of the Beattie Plant. The Atkins Contract did not provide for any break-up fee in the event that Delta Mills failed to close on a sale to Atkins. The Atkins Contract did provide that, if the Debtors determined that Atkins submits the highest and best offer at the Auction and the Court approves Atkins’s bid at the hearing to approve the sale of the Beattie Plant, should Delta Mills fail to close within the time specified in the Atkins Contract (where Atkins is not in breach of the Atkins Contract), the Earnest Money would be returned to Atkins. In the event Atkins was not approved as the purchaser of the Beattie Plant at the hearing to approve the sale of the Beattie Plant, Atkins’s sole remedy was return of any Earnest Money deposited.

After entry of the Stalking Horse Order, between May 23 and May 25, 2007, the Debtors sent, via electronic or first class mail, the Stalking Horse Notice, Stalking Horse Order, Bidding Procedures, and the Atkins Contract (the “Solicitation Package”) to approximately 164 parties that they believed, based on their experience and knowledge of the industry, might have some interest in purchasing the Beattie Plant. In addition, on May 28, 2007, the Debtors published a notice of the selection of Atkins as the Stalking Horse Bidder for the Beattie Plant and the Bidding Procedures to be employed with respect to the sale of the Beattie Plant (the “Published Notice”) in the major Greenville, South Carolina (Greenville News) and Columbia, South Carolina (The State) newspapers. Each party who either received the Solicitation Package or saw the Published Notice shall be known herein as the “Potential Bidders.” Approximately ten (10) Potential Bidders contacted the Debtors after their receipt of the Solicitation Package seeking additional information, which the Debtors provided to each Potential Bidder. The deadline to submit overbids with respect to the Atkins Contract was June 22, 2007. The Debtors received one potential Overbid from Gibbs International, Inc. (“Gibbs”) prior to the Overbid Deadline. The Debtors and Committee reviewed the potential Overbid and agreed to extend the Overbid Deadline until June 26, 2007, with respect to that potential overbidder only, in order to allow the potential Overbid to be amended to become a Qualified Bid. Upon submission of an amended Overbid, the Debtors and Committee agreed that the amended Overbid (“Overbid of Gibbs”) was a Qualified Bid. The Overbid of Gibbs was the only Overbid received by the Debtors.

The Debtors conducted an auction (the “Auction”) for the Beattie Plant on June 27, 2007, commencing at 11:00 a.m., in the offices of Wyche, Burgess, Freeman & Parham, P.A., in Greenville, South Carolina. Both Atkins and Gibbs were present at in the Auction. In addition, Leon Szlezinger of Mesirow Financial Consulting, LLC, the financial advisor to the Committee, was present at the Auction and participated fully in the consideration of and negotiation of each bid presented at the Auction. As a result of competitive bidding at the Auction, Gibbs, as the successful bidder, will pay $4,500,000 for the Beattie Plant pursuant to the Purchase and Sale Agreement between Delta Mills and Gibbs dated June 27, 2007 (the “Gibbs APA”). In addition, Gibbs has agreed to provide the Debtors free storage and office space at the Beattie Plant until the earlier of (i) one year following the closing of the Sale or (ii) entry of a final decree in these cases. The Order approving the sale of the Beattie Plant to Gibbs was entered on June 29, 2007 (D.I. 589) (the “Gibbs Sale Order”). Pursuant to the Stalking Horse Order, if Gibbs fails to consummate its purchase pursuant to the Gibbs APA because of a breach or failure to perform on the part of Gibbs, Delta Mills will be authorized (but not required) to consummate the sale of the Beattie Plant to Mr. Atkins at his last bid (which was $4,400,000).

2.5 SUMMARY OF THE DEBTORS’ REMAINING ASSETS ANDEXPECTED DISTRIBUTIONS UNDER THE PLAN.

Assuming the Effective Date occurs on or about September 4, 2007, the Debtors project that they will have in excess of $3,000,000.00 (net of applicable Reserved Funds) cash on hand available for distribution on the Effective Date, based on the Chapter 11 Orderly Liquidation Analysis (the “Liquidation Analysis”), attached hereto as Exhibit B. From those funds, the Debtors intend to make distributions to Allowed Administrative, Secured, Priority Tax, Priority Non-Tax, Reclamation Settlement and Convenience Claims. After these distributions, the Debtors or Merged Debtors will distribute remaining cash on hand, net of applicable Reserved Funds, as an initial distribution to holders of Allowed General Unsecured Claims. In addition, the Designated Officers will attempt to liquidate the Debtors’ or Merged Debtors’ remaining assets, as more fully described below. The Debtors anticipate making additional distributions to holders of Allowed General Unsecured Claims following the liquidation of the Residual Assets.

2.5.1 LIQUIDATION OF RESIDUAL ASSETS. The Debtors or Merged Debtors, through the Designated Officers, shall continue to market and liquidate the Residual Assets, for the highest and best consideration achievable in light of the circumstances. From and after the Effective Date, the Debtors or Merged Debtors shall not be required to seek or obtain authority of the Bankruptcy Court to sell any of the Residual Assets except (i) the Pamplico Plant and, (ii) in the event the Debtors are unable to consummate any sale of the Beattie Plant pursuant to the Beattie Stalking Horse Order, Gibbs APA and Gibbs Sale Order, the Beattie Plant. The Bidding Procedures attached to the Plan as Exhibit A shall govern any proposed sale of (i) the Pamplico Plant and, (ii) in the event the Debtors are unable to consummate any sale of the Beattie Plant pursuant to the Beattie Stalking Horse Order, Gibbs APA and Gibbs Sale Order, the Beattie Plant. Upon the liquidation of all Residual Assets, the Cash received on account of such sale or sales, net of any amounts necessary to pay costs of the sale of such Residual Assets and to satisfy any Liens against such Residual Assets and other costs of the Estate or Merged Debtors, shall be distributed to holders of Claims according to the terms of the Plan.

The primary Residual Assets are likely to be the real property upon which the Pamplico Plant is located and, in the event the Debtors are unable to consummate any sale of the Beattie Plant pursuant to the Beattie Stalking Horse Order, Gibbs APA and Gibbs Sale Order, the Beattie Plant. The Debtors anticipate the use of one or more agents to market the Pamplico Plant and, if necessary, the Beattie Plant, in order to achieve the best consideration possible.

2.5.2 COLLECTION OF ACCOUNTS RECEIVABLE. After the Petition Date, and in accordance with the Final Order (a) Authorizing Debtors to Obtain Interim Post-Petition Financing and Grant Security Interest and Superpriority Administrative Expense Status Pursuant to 11 U.S.C. §§ 105 and 3 64(c); (b) Modifying the Automatic Stay Pursuant to 11 U.S.C. § 362; and (c) Authorizing the Debtors to Enter into Agreements with GMAC Commercial Finance LLC (D.I. 88), GMAC has has served as factor for the Debtors and remitted the proceeds of the Debtors’ accounts receivable to the Debtors. On or about May 17, 2007, the Debtors received a notice of default from GMAC whereby GMAC notified the Debtors that it believed the Debtors were in default under the GMAC Credit Agreement and purported to terminate the GMAC Credit Agreement and GMAC Factoring Agreement. The Debtors have notified GMAC that they dispute this allegation of default. GMAC has also filed an objection to the Disclosure Statement whereby GMAC objects to any request or requirement under the Plan that GMAC continue to factor any receivables of the Debtors after the Confirmation Date. The Debtors believe that GMAC has agreed to preserve this objection for the Confirmation Hearing and will not pursue the objection at the hearing to approve the Disclosure Statement. The Debtors hope to reach a consensual agreement with GMAC regarding the post-confirmation collection of receivables. In the event GMAC does not continue to factor the Debtors’ receivables after the Confirmation Date, the Merged Debtors will use their best efforts to pursue such collections, if any. The Cash received from GMAC on account of such collections, net of any amounts necessary to compensate GMAC pursuant to the GMAC Factoring Agreement, if applicable, and to pay the costs of the Estates or the Merged Debtors, shall be distributed to holders of Claims according to the terms of the Plan. To the extent accounts receivable are collected directly by the Merged Debtors, such Cash, net of applicable Reserved Funds, shall also be distributed to holders of Claims according to the terms of the Plan. The Debtors are currently engaged in discussions with GMAC regarding a possible dispute over GMAC’s obligations with respect to one of the receivables subject to the GMAC Factoring Agreement, and have reserved certain rights and Causes of Action against GMAC under the Plan.

2.5.3 ANALYSIS OF AVOIDANCE ACTIONS AND OTHER CAUSES OF ACTION. As reflected in the Schedules, the Debtors made transfers in excess of $5,000.00 to approximately 272 creditors other than insiders, totaling approximately $29,754,669.00, within the ninety (90) days prior to the Petition Date. Having performed their preliminary analysis of these transfers, the Debtors, in consultation with the Creditors’ Committee, have identified and determined to release certain potential avoidance actions of little or no potential value to the Estates, including preferences assertable under section 547 of the Bankruptcy Code, given the defenses available to the various transferees being released. Furthermore, the Debtors and the Creditors’ Committee have performed an investigation of potential Causes of Action and, based upon this review, have determined that, except with respect to the Causes of Action set forth on Exhibit C to the Plan, no Causes of Action of significant value to the Debtors’ Estates exist subject, however, to the following paragraph. Therefore, as set forth in Sections 14.2 and 14.5 of the Plan, the Debtors intend to release all Avoidance Actions and other Causes of Action against third parties except for those specifically set forth on Exhibit C to the Plan.

The Creditors’ Committee is continuing its investigation into certain potential contingent Causes of Action (the “Potential Causes of Action”) that the Creditors’ Committee has disclosed to the Debtors. By reason of the Potential Causes of Action, the Creditors’ Committee would ordinarily object to the list of preserved causes of action that is set forth in Exhibit C to the Plan. As the Potential Causes of Action may be obviated prior to confirmation, however, the Creditors’ Committee has agreed not to object to the list of preserved causes of that is set forth in Exhibit C to the Plan in conjunction with approval of the Disclosure Statement. In return for this agreement, the Debtors have agreed that any future objection by the Creditors’ Committee to Exhibit C to the Plan shall not be contested on the ground that such objection should have been brought prior to approval of this Disclosure Statement to the extent that such objection is based on the Potential Causes of Action and that Exhibit C may be later expanded to include such Potential Causes of Action. Any dispute over the inclusion of the Potential Causes of Action on Exhibit C shall be resolved by the Bankruptcy Court absent consensual resolution.

2.5.4 ANALYSIS OF OTHER NOMINAL REMAINING ASSETS. The Debtors believe that other assets remaining to be liquidated include: the collection of nominal deposits and the return of sums currently held as a retainer by counsel for the Debtors to the extent such retainers are not subsequently drawn upon.

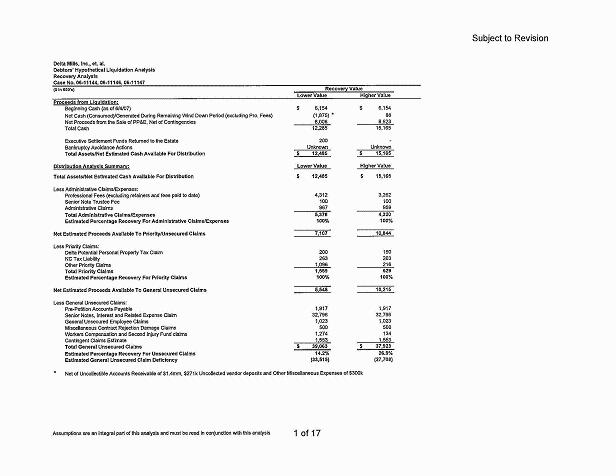

2.5.5 EXPECTED DISTRIBUTIONS UNDER THE PLAN. As set forth on the Liquidation Analysis, the Debtors estimate that holders of Allowed General Unsecured Claims will receive a total distribution of approximately $0.142 to $0.269 per $1.00 of Allowed Claim. The Debtors anticipate that a substantial distribution will be made to holders of Allowed General Unsecured Claims on the Initial Distribution Date. See Section 6, Risk Factors, below for a description of some of the factors that may cause actual distribution amounts and timing to differ from expected distributions.

2.6 SECURED CLAIMS ENCUMBERING THE DEBTORS’ PROPERTY.

As detailed in Sections 2.2.1 and 2.3.2 above, Delta Mills was party to financing agreements which encumbered many of its Assets and the Assets of Marketing. Marketing served as a guarantor of these obligations of Delta Mills. In addition, various local governmental tax agencies may have asserted secured claims against the Debtors regarding personal property taxes and real property taxes. The Debtors believe that most, if not all, such claims have been satisfied in full as of the date hereof.

As of the date of this Disclosure Statement, although GMAC has not released all of its security interests in the Debtors’ Assets, the Debtors believe that they have satisfied all secured claims, exclusive of any contingent claims for attorneys’ fees and expenses, held by GMAC encumbering the Debtors’ property and that those fees and claims will be satisfied by the application of cash reserves held by GMAC. Notwithstanding the above, the Debtors have preserved in Exhibit C to the Plan, all rights, Causes of Action and potential Causes of Action against GMAC, including without limitation all claims, counterclaims, and rights of setoff, recoupment and turnover held by the Debtors or Merged Debtors against GMAC, whether arising under the GMAC Credit Agreement, the GMAC Factoring Agreement, the Bankruptcy Code or applicable state or federal law.

2.7 ADMINISTRATIVE CLAIMS.

2.7.1 Administrative Claims. Administrative Claims are generally Claims that are incurred in the ordinary course of business on or after the Petition Date and on or before the Effective Date. The Debtors believe they have paid claims arising in the ordinary course of business as they came due during the pendency of these cases. Certain pre-petition claimants have also asserted administrative priorities for their claims pursuant to, among other provisions, section 503(b)(9) of the Bankruptcy Code and the Debtors have, to the extent review of their books and records demonstrated that such claim was not entitled to priority under section 503(b)(9) of the Bankruptcy Code, objected to such claims. The Debtors estimate that the total Allowed amount of administrative expense claims that have not been paid in the ordinary course of the Debtors’ businesses during these cases, and exclusive of professional fees, will be approximately $1,000,000.

2.7.2 Professional Fee Claims. Professional Fee Claims are Administrative Claims for the compensation of the Debtors’ or the Creditors’ Committee’s Professionals or other Professionals who provided services or incurred expenses in the Debtors’ cases on or before the Effective Date. All payments to Professionals for Professional Fee Claims will be made in accordance with the procedures established in the Bankruptcy Code, the Bankruptcy Rules, the United States Trustee Guidelines and the Bankruptcy Court relating to the payment of interim and final compensation for services rendered and reimbursement of expenses. The Bankruptcy Court will review and determine all applications for compensation for services rendered and reimbursement of costs.

2.8 UNSECURED CLAIMS AGAINST THE DEBTORS.