UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4915

DNP Select Income Fund Inc.

(Exact name of registrant as specified in charter)

200 S. Wacker Drive, Suite 500, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| Alan M. Meder | Lawrence R. Hamilton, Esq. |

| DNP Select Income Fund Inc. | Mayer Brown LLP |

| 200 S. Wacker Drive, Suite 500 | 71 South Wacker Drive |

| Chicago, Illinois 60606 | Chicago, Illinois 60606 |

(Name and address of agents for service)

Registrant’s telephone number, including area code:(312) 263-2610

Date of fiscal year end:October 31

Date of reporting period:April 30, 2019

ITEM 1. REPORTS TO STOCKHOLDERS.

The Semi-Annual Report to Stockholders follows.

Fund Distributions and Managed Distribution Plan: DNP Select Income Fund Inc. (the “Fund”) has been paying a regular 6.5 cent per share monthly distribution on its common stock since July 1997. In February 2007, the Board of Directors adopted a Managed Distribution Plan, which provides for the Fund to continue to make a monthly distribution on its common stock of 6.5 cents per share. Under the Managed Distribution Plan, the Fund will distribute all available investment income to shareholders, consistent with the Fund’s primary investment objective. If and when sufficient investment income is not available on a monthly basis, the Fund will distribute long-term capital gains and/or return capital to its shareholders in order to maintain the steady distribution level that has been approved by the Board. If the Fund estimates that it has distributed more than its income and capital gains in a particular period, a portion of your distribution may be a return of capital. A return of capital may occur, for example, when some or all of the money that you invested in the Fund is paid back to you. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income.”

To the extent that the Fund uses capital gains and/or return of capital to supplement its investment income, you should not draw any conclusions about the Fund’s investment performance from the amount of the Fund’s distributions or from the terms of the Fund’s Managed Distribution Plan.

Whenever a monthly distribution includes a capital gain or return of capital component, the Fund provides you with a written statement indicating the sources of the distribution and the amount derived from each source. As the most recent monthly statement from the Fund indicated, the cumulative distributions paid this fiscal year to date through November 10 were estimated to be composed of net investment income, capital gains and return of capital.

The amounts and sources of distributions reported monthly in statements from the Fund are only estimates and are not provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. The Fund will send you a Form 1099-DIV for the calendar year that will tell you how to report these distributions for federal income tax purposes.

The Board reviews the operation of the Managed Distribution Plan on a quarterly basis, with the most recent review having been conducted in June 2019, and the Adviser uses data provided by an independent consultant to review for the Board the Managed Distribution Plan annually. The Board may amend, suspend or terminate the Managed Distribution Plan without prior notice to shareholders if it deems such action to be in the best interests of the Fund and its shareholders. For example, the Board might take such action if the Managed Distribution Plan had the effect of shrinking the Fund’s assets to a level that was determined to be detrimental to Fund shareholders. The suspension or termination of the Managed Distribution Plan could have the effect of creating a trading discount (if the Fund’s stock is trading at or above net asset value), widening an existing trading discount, or decreasing an existing premium.

The Managed Distribution Plan is described in a Question and Answer format on your Fund’s website, www.dpimc.com/dnp, and discussed in the section of management’s letter captioned “About Your Fund.” The tax characterization of the Fund’s distributions for the last 5 years can also be found on the website under the “Tax Information” tab.

June 13, 2019

Dear Fellow Shareholders:

Performance Review: Consistent with its primary objective of current income and long-term growth of income, and its Managed Distribution Plan, the Fund declared six monthly distributions of 6.5 cents per share of common stock during the first half of the 2019 fiscal year. The 6.5 cent per share monthly rate, without compounding, would be 78 cents annualized, which is equal to 6.7% of the April 30, 2019, closing price of $11.64 per share. Please refer to the inside front cover of this report and the portion of this letter captioned “About Your Fund” for important information about the Fund and its Managed Distribution Plan.

Your Fund had a total return (income plus change in market price) of 10.5% for the six months ended April 30, 2019, which is in line with the 10.6% total return of the composite of the S&P 500® Utilities Index and the Bloomberg Barclays U.S. Utility Bond Index, weighted to reflect the stock and bond ratio of the Fund. In comparison, the S&P 500® Utilities Index—a stock-only index—had a total return of 11.2% over that same period.

On a longer-term basis, as of April 30, 2019, your Fund had a five-year annualized total return of 11.5% on a market value basis, which is higher than the 9.4% return of the composite of the S&P 500® Utilities Index and the Bloomberg Barclays U.S. Utility Bond Index, weighted to reflect the stock and bond ratio of the Fund. In comparison, the S&P 500® Utilities Index had an annualized total return during that period of 10.2%.

The table below compares the performance of your Fund to various market benchmarks. It is important to note that the composite and index returns referred to in this letter do not include fees or expenses, whereas the Fund’s returns are net of expenses.

Total Return1

For the period indicated through April 30, 2019 |

| | | Six Months | | One Year | | Three Years

(annualized) | | Five Years

(annualized) |

DNP Select Income Fund Inc. | | | | | | | | | | | | | | | | | | |

Market Value2 | | | | 10.5 | % | | | 15.2 | % | | | 13.3 | % | | | 11.5 | % |

Net Asset Value3 | | | | 14.6 | % | | | 19.9 | % | | | 11.0 | % | | | 9.1 | % |

Composite Index4 | | | | 10.6 | % | | | 16.2 | % | | | 9.5 | % | | | 9.4 | % |

S&P 500® Utilities Index4 | | | | 11.2 | % | | | 18.0 | % | | | 10.4 | % | | | 10.2 | % |

Bloomberg Barclays U.S. Utility Bond Index4 | | | | 6.8 | % | | | 5.0 | % | | | 2.8 | % | | | 3.7 | % |

| 1 | | Past performance is not indicative of future results. Current performance may be lower or higher than performance in historical periods. |

| 2 | | Total return on market value assumes a purchase of common stock at the opening market price on the first business day and a sale at the closing market price on the last business day of the period shown in the table and assumes reinvestment of dividends at the actual reinvestment prices obtained under the terms of the Fund’s dividend reinvestment plan. In addition, when buying or selling stock, you would ordinarily pay brokerage expenses. Because brokerage expenses are not reflected in the above calculations, your total return net of brokerage expenses would be lower than the total return on market value shown in the table. Source: Administrator of the Fund. |

| 3 | | Total return on NAV uses the same methodology as is described in note 2, but with use of NAV for beginning, ending and reinvestment values. Because the Fund’s expenses (ratios detailed on page 14 of this report) reduce the Fund’s NAV, they are already reflected in the Fund’s total return on NAV shown in the table. NAV represents the underlying value of the Fund’s net assets, but the market price per share may be higher or lower than NAV. Source: Administrator of the Fund. |

| 4 | | The Composite Index is a composite of the returns of the S&P 500® Utilities Index and the Bloomberg Barclays U.S. Utility Bond Index (formerly known as the Barclays U.S. Utility Bond Index), weighted to reflect the stock and bond ratio of the Fund. The indices are calculated on a total return basis with dividends reinvested. Indices are unmanaged; their returns do not reflect any fees, expenses or sales charges; and they are not available for direct investment. Performance returns for the S&P 500® Utilities Index and Bloomberg Barclays U.S. Utility Bond Index were obtained from Bloomberg LP. |

PG&E Bankruptcy and the Impact on the California Utility Industry: In previous shareholder letters we have discussed the concerns around potential liabilities facing the California utilities as a result of the devastating wildfires in that state. Unfortunately, the liabilities for PG&E Corporation were significant enough to lead the company to file for Chapter 11 bankruptcy protection on January 29, 2019. The company estimated that its liabilities

1

associated with the 2017 and 2018 wildfires could exceed $30 billion, which would wipe out its equity. With the 2019 California wildfire season starting soon, liabilities could increase even further. PG&E’s CEO resigned after the bankruptcy filing, and a new CEO was appointed along with several new board members. The last time PG&E filed for bankruptcy in 2001, only the utility subsidiary, Pacific Gas and Electric Company, was involved, and it took three years to exit. Now, it is both the parent and the utility that have filed, so the process could take as long, if not longer. We suspect the new PG&E that emerges at the end of bankruptcy could look much different than the current company, as asset sales or a breakup of the company into smaller utilities are certainly a possibility. For the foreseeable future, PG&E is clearly not a viable investment for DNP.

But what are the implications for Edison International and Sempra Energy, the other California utilities thatare still held by the Fund? We’ve already seen S&P downgrade the debt for the utility subsidiaries of both companies to incorporate the California wildfire risk, while Moody’s and Fitch have put them on negative watch for possible downgrades. The rating agencies have indicated that more downgrades are possible if the liabilities the utilities face due to the wildfires are not addressed by the California legislature and regulators.

Thankfully, it appears there is a newfound energy among all parties in California to come up with a solution to the wildfire liability issue as it relates to the utilities. Governor Newsom appointed a “strike force” earlier in the year that was tasked with making recommendations on how to deal with the financial liabilities imposed by the wildfires on the state’s electric utilities. The strike force issued its report on April 12, which focused on several themes, such as wildfire prevention and response, mitigating climate change, allocation of wildfire costs, providing the California Public Utilities Commission with additional tools to effectively manage a changing utility market and holding PG&E accountable by building a utility that prioritizes safety.

Strictly from a shareholder’s perspective, the allocation of wildfire costs is probably of greatest importance. There are a number of proposals under discussion relating to paying for wildfire claims, one of which is the creation of a catastrophic wildfire fund to pay uninsured or underinsured claims, assuming the utilities were not at fault. It is likely that utility shareholders will be on the hook to provide support for this fund, which could run into the billions of dollars.

The California Senate formed a committee to review the strike force’s recommendations, gather public feedback, and draft legislation. Concurrently, the Commission on Catastrophic Wildfire and Cost Recovery (“Blue Ribbon Commission”) has been holding public meetings, focused on many of the same issues as the strike force. The Blue Ribbon Commission was created as part of the wildfire legislation that was passed last year to come up with solutions to pay for the wildfire liabilities faced by the utilities. A final report was issued by the Commission early in June, containing recommendations for the legislative committee to consider.

The Governor has set a deadline of July 12 for the legislators to have a bill drafted so that it can be voted on before September 13, which is the final legislative day in 2019 before it goes into recess for the remainder of the year. While progress has been made, there is much left to be done. We will be closely monitoring the various regulatory and legislative proceedings in California over the next few months to see if a long-term solution can be found that would benefit not only PG&E but Edison International and Sempra Energy as well.

U.S. Monetary Policy: Late in 2015, the Federal Open Market Committee (“FOMC”), the committee within the Federal Reserve that sets domestic monetary policy, began to reverse the highly accommodative policy of the previous seven years, when it raised the target range for the federal funds rate for the first time in almost a decade. Over this tightening cycle, the target range for the federal funds rate was raised nine times, with the most recent increase coming on December 19, 2018, when it was raised to a range of 2.25% to 2.50%. Once again, investors seemed to be faced with the reality that the era of unprecedented U.S. monetary stimulus had come to an end. However, early in 2019, amidst equity market volatility and choppy U.S. growth, the FOMC signaled a potential pause in its efforts to normalize policy. As a result, the timing and extent of further adjustments to monetary policy has become a lively topic of debate.

2

Ten years after the last recession ended, the U.S. economy remains on track to experience steady, moderate growth over the next few quarters. A strong job market, improving housing sector, and low energy prices continue to provide support for consumers. However, slowing global growth and rising trade tensions have introduced near-term downside risks, which could change the outlook for the economy.

Given volatile equity markets, rising trade tensions, ongoing geopolitical concerns and the developing implications of the flattening yield curve (i.e., a small difference between short-term yields and long-term yields), the fixed income market is likely to remain highly volatile and reactive to the tone of economic data. In the near term, we expect the U.S. economic recovery to remain measured and relatively low global interest rates to limit upward pressure on U.S. Treasury yields. Over the longer term, a scenario which includes a self-sustaining economic recovery, rising inflation expectations and growing budget deficits could set the stage for a persistent and meaningful rise in interest rates. If that happens, the total return of income-oriented funds, including the Fund, could possibly be reduced.

Board of Directors Meeting: At the regular March and June 2019 Board of Directors’ meetings, the Board declared the following monthly dividends:

| | Cents Per

Share | | | | Record

Date | | Payable

Date | | | | Cents Per

Share | | Record

Date | | Payable

Date | |

| | 6.5 | | | | April 30 | | May 10 | | | | 6.5 | | July 31 | | August 12 | |

| | 6.5 | | | | May 31 | | June 10 | | | | 6.5 | | August 30 | | September 10 | |

| | 6.5 | | | | June 28 | | July 10 | | | | 6.5 | | September 30 | | October 10 | |

About Your Fund: The Fund seeks to achieve its investment objectives by investing primarily in the public utility industry. Under normal market conditions, more than 65% of the Fund’s total assets are invested in a diversified portfolio of equity and fixed income securities of public utility companies engaged in the production, transmission or distribution of electric energy, gas or telecommunications services. The Fund does not currently use derivatives and has no investments in complex or structured investment vehicles.

The Fund seeks to provide investors with a stable monthly dividend that is primarily derived from current fiscal year earnings and profits. The Investment Company Act of 1940 and related SEC rules generally prohibit investment companies from distributing long-term capital gains more often than once in a twelve–month period. However, in 2008, the SEC granted the Fund’s request for exemptive relief from that prohibition, and the Fund is now permitted, subject to certain conditions, to make periodic distributions of long-term capital gains as frequently as twelve times a year. In connection with the exemptive relief, in February 2008 the Board of Directors reaffirmed the current 6.5 cent per share monthly distribution rate and formalized the monthly distribution process by adopting a Managed Distribution Plan (MDP). The Board reviews the operation of the MDP on a quarterly basis, with the most recent review having been conducted in June 2019, and the Adviser uses data provided by an independent consultant to review for the Board the MDP annually. The MDP is described on the inside front cover of this report and in a Question and Answer format on the Fund’s website, www.dpimc.com/dnp.

The use of leverage enables the Fund to borrow at short-term rates and invest in higher yielding securities. As of April 30, 2019, the Fund had $1 billion of total leverage outstanding which consisted of: 1) $168 million of floating rate preferred stock, 2) $132 million of fixed rate preferred stock, 3) $300 million of fixed rate secured notes and 4) $400 million of floating rate secured debt outstanding under a committed loan facility. On that date the total amount of leverage represented approximately 26% of the Fund’s total assets. The amount and type of leverage used is reviewed by the Board of Directors based on the Fund’s expected earnings relative to the anticipated costs (including fees and expenses) associated with the leverage. In addition, the long-term expected benefits of leverage are weighed against the potential effect of increasing the volatility of both the Fund’s net asset value and the market value of its common stock. Historically, the tendency of the U.S. yield curve to exhibit a positive slope (i.e., long-term rates higher than short-term rates) has fostered an environment in which leverage used to purchase

3

fixed income securities can make a positive contribution to the earnings of the Fund. There is no assurance that this will continue to be the case in the future. A decline in the difference between short-term and long-term rates could have an adverse effect on the income provided from leverage. Also, the amount of leverage used to purchase equity securities will have a direct effect on the Fund’s net asset value and may increase the volatility of the Fund’s net asset value and market price. The use of leverage increases the benefits to the Fund when equity valuations are rising and conversely, exacerbates the negative impact to the Fund when equity valuations are falling. If the Fund were to conclude that the use of leverage was likely to cease being beneficial, it could modify the amount and type of leverage it uses or eliminate the use of leverage entirely.

Along with the influence on the income provided from leverage, the level of interest rates can be a primary driver of bond returns, including the return on your Fund’s fixed income investments. For example, an extended environment of historically low interest rates adds an element of reinvestment risk, since the proceeds of maturing bonds may need to be reinvested in lower yielding securities. Alternatively, a sudden or unexpected rise in interest rates would likely reduce the total return of fixed income investments, since higher interest rates could be expected to depress the valuations of fixed rate bonds held in a portfolio.

Maturity and duration are measures of the sensitivity of a fund’s fixed income investments to changes in interest rates. More specifically, duration refers to the percentage change in a bond’s price for a given change in rates (typically +/- 100 basis points). In general, the greater the average maturity and duration of a portfolio, the greater is the potential percentage price volatility for a given change in interest rates. As of April 30, 2019, your Fund’s fixed income investments had an average maturity of 7.1 years and duration of 5.5 years, while the Bloomberg Barclays U.S. Utility Bond Index had an average maturity of 15.5 years and duration of 10.0 years.

In addition to your Fund’s fixed income investments, the income-oriented equity investments held in your Fund can be adversely affected by a rise in interest rates. However, while rising interest rates generally have a negative impact on income-oriented investments, if improved growth accompanies the rising rates, the impact may be mitigated.

As a practical matter, it is not possible for your Fund’s portfolio of investments to be completely insulated from unexpected moves in interest rates. Management believes that over the long term, the conservative distribution of fixed income investments along the yield curve and the growth potential of income-oriented equity holdings positions your Fund to take advantage of future opportunities while limiting volatility to some degree. However, a sustained and meaningful rise in interest rates from current levels would have the potential to significantly reduce the total return of leveraged funds holding income-oriented equities and fixed income investments, including the DNP Fund. A significant rise in interest rates would likely put downward pressure on both the net asset value and market price of such funds.

Visit us on the Web: You can obtain the most recent shareholder financial reports and distribution information at our website, www.dpimc.com/dnp.

We appreciate your interest in DNP Select Income Fund Inc., and we will continue to do our best to be of service to you.

Connie M. Luecke, CFA

| | | | Nathan I. Partain, CFA

|

Vice President, Chief Investment Officer

| | | | Director, President, and Chief Executive Officer |

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein, are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

4

DNP SELECT INCOME FUND INC.

SCHEDULE OF INVESTMENTS

April 30, 2019

(Unaudited)

| Shares | | | | Description | | Value |

| COMMON STOCKS & MLP INTERESTS—115.5% |

| | | | | n ELECTRIC, GAS AND WATER—81.4%

|

| 2,239,240 | | | | Alliant Energy Corp.(a) | | | $105,759,305 | |

| 1,403,000 | | | | Ameren Corp.(a) | | | 102,096,310 | |

| 1,106,000 | | | | American Electric Power Co., Inc.(a) | | | 94,618,300 | |

| 949,000 | | | | American Water Works Co.(a) | | | 102,672,310 | |

| 714,210 | | | | Aqua America, Inc. | | | 27,897,042 | |

| 732,000 | | | | Atmos Energy Corp.(a)(b) | | | 74,912,880 | |

| 3,071,300 | | | | CenterPoint Energy, Inc.(a) | | | 95,210,300 | |

| 1,924,200 | | | | CMS Energy Corp.(a) | | | 106,889,310 | |

| 1,147,000 | | | | Dominion Energy, Inc.(a) | | | 89,316,890 | |

| 833,700 | | | | DTE Energy Co.(a) | | | 104,804,427 | |

| 1,000,000 | | | | Edison International(a) | | | 63,770,000 | |

| 1,296,855 | | | | Emera Inc. (Canada) | | | 48,501,914 | |

| 1,592,441 | | | | Evergy, Inc.(a)(b) | | | 92,074,939 | |

| 1,453,900 | | | | Eversource Energy(a)(b) | | | 104,186,474 | |

| 821,500 | | | | Fortis Inc. (Canada) | | | 30,241,362 | |

| 541,200 | | | | NextEra Energy, Inc.(a)(b) | | | 105,230,928 | |

| 1,010,250 | | | | Nextera Energy

Partners, LP | | | 46,501,808 | |

| 2,655,000 | | | | NiSource Inc.(a) | | | 73,755,900 | |

| 800,000 | | | | Northwest Natural

Holding Co. | | | 53,512,000 | |

| 2,300,000 | | | | OGE Energy Corp.(a) | | | 97,382,000 | |

| 576,000 | | | | ONE Gas, Inc. | | | 50,987,520 | |

| 1,000,000 | | | | Pinnacle West Capital Corp.(a) | | | 95,270,000 | |

| 1,800,000 | | | | Public Service Enterprise Group Inc.(a)(b) | | | 107,370,000 | |

| 798,400 | | | | Sempra Energy(a)(b) | | | 102,155,280 | |

| 1,500,000 | | | | South Jersey Industries, Inc. | | | 48,180,000 | |

| 2,000,000 | | | | Southern Co.(a)(b) | | | 106,440,000 | |

| 903,000 | | | | Spire Inc. | | | 76,023,570 | |

| 1,327,800 | | | | WEC Energy Group, Inc.(a) | | | 104,139,354 | |

| 1,825,000 | | | | Xcel Energy Inc.(a)(b) | | | 103,112,500 | |

| | | | | | | | 2,413,012,623 | |

| | | | | | | | | | | |

| | | | | n OIL & GAS STORAGE, TRANSPORTATION AND PRODUCTION—19.8%

| | |

| 184,729 | | | | Andeavor Logistics LP | | | $6,193,963 | |

| 1,311,419 | | | | Antero Midstream Corp . | | | 16,012,426 | |

| 280,941 | | | | Cheniere Energy

Partners, LP | | | 12,310,834 | |

| 431,000 | | | | DCP Midstream LP | | | 13,404,100 | |

| 1,286,845 | | | | Enbridge Inc. (Canada) | | | 47,536,054 | |

| 2,679,062 | | | | Energy Transfer Equity LP | | | 40,507,417 | |

| 434,500 | | | | EnLink Midstream, LLC | | | 5,079,305 | |

| 1,416,000 | | | | Enterprise Products Partners LP | | | 40,540,080 | |

| 505,000 | | | | GasLog Partners LP (Marshall Islands) | | | 10,635,300 | |

| 310,000 | | | | Golar LNG Limited (Bermuda) | | | 6,057,400 | |

| 1,835,026 | | | | Kinder Morgan, Inc.(a) | | | 36,461,967 | |

| 382,090 | | | | Magellan Midstream Partners LP | | | 23,693,401 | |

| 145,000 | | | | Marathon Petroleum Corp. | | | 8,826,150 | |

| 852,185 | | | | MPLX LP | | | 27,491,488 | |

| 125,444 | | | | Noble Midstream

Partners LP | | | 4,319,037 | |

| 312,150 | | | | ONEOK, Inc. | | | 21,204,350 | |

| 986,600 | | | | Pembina Pipeline Corp. (Canada) | | | 35,130,940 | |

| 308,419 | | | | Phillips 66 Partners LP | | | 15,275,993 | |

| 1,248,900 | | | | Plains All American Pipeline, LP | | | 28,912,035 | |

| 280,625 | | | | Shell Midstream

Partners LP | | | 5,643,369 | |

| 703,305 | | | | Tallgrass Energy, LP | | | 16,977,783 | |

| 615,120 | | | | Targa Resources Corp. | | | 24,697,068 | |

| 1,375,500 | | | | TransCanada Corp. (Canada)(a) | | | 65,693,880 | |

| 622,020 | | | | Westlake Chemical Partners LP | | | 13,933,248 | |

| 536,300 | | | | Western Midstream Partners, LP | | | 16,936,354 | |

| 1,538,500 | | | | The Williams

Companies, Inc. | | | 43,585,705 | |

| | | | | | | | 587,059,647 | |

The accompanying notes are an integral part of these financial statements.

5

DNP SELECT INCOME FUND INC.

SCHEDULE OF INVESTMENTS—(Continued)

April 30, 2019

(Unaudited)

| Shares | | | | Description | | Value |

| | | | | n TELECOMMUNICATIONS—14.3%

|

| 289,000 | | | | American Tower Corp. | | | $56,441,700 | |

| 2,129,000 | | | | AT&T Inc.(a)(b) | | | 65,913,840 | |

| 951,515 | | | | BCE Inc. (Canada)(a) | | | 42,570,781 | |

| 800,000 | | | | CenturyLink Inc. | | | 9,136,000 | |

| 690,400 | | | | Crown Castle International Corp.(a)(b) | | | 86,838,512 | |

| 1,000,000 | | | | Orange SA (France) | | | 15,650,583 | |

| 1,280,300 | | | | Telus Corp. (Canada) | | | 46,950,044 | |

| 1,502,089 | | | | Verizon Communications Inc.(a)(b) | | | 85,904,470 | |

| 782,200 | | | | Vodafone Group Plc ADR (United Kingdom) | | | 14,486,344 | |

| | | | | | | | 423,892,274 | |

| | | | | Total Common Stocks & MLP Interests (Cost $2,467,321,895) | | | 3,423,964,544 | |

Par Value

| | | | | | | | | | |

BONDS—16.3%

|

| | | | | n ELECTRIC, GAS AND WATER—7.8%

|

| $9,000,000 | | | | American Water

Capital Corp.

3.40%, 3/01/25(a) | | | 9,130,190 | |

| 22,000,000 | | | | Arizona Public Service Co.

67/8%, 8/01/36(a)(b) | | | 28,198,580 | |

| 9,000,000 | | | | CMS Energy Corp.

5.05%, 3/15/22(a) | | | 9,508,265 | |

| 6,000,000 | | | | CMS Energy Corp.

3.45%, 8/15/27 | | | 6,014,396 | |

| 5,000,000 | | | | Connecticut Light & Power Co.

3.20%, 3/15/27 | | | 5,014,697 | |

| 10,000,000 | | | | DPL Capital Trust II

81/8%, 9/01/31 | | | 10,208,900 | |

| 6,400,000 | | | | DTE Electric Co.

3.65%, 3/15/24 | | | 6,618,129 | |

| 4,875,000 | | | | DTE Electric Co.

3.45%, 10/01/20 | | | 4,921,092 | |

| 10,000,000 | | | | Duke Energy Corp.

3.15%, 8/15/2027 | | | 9,832,629 | |

| 5,600,000 | | | | Edison International

41/8%, 3/15/28 | | | 5,430,761 | |

| 9,500,000 | | | | Entergy Louisiana, LLC 5.40%, 11/01/24 | | | 10,718,221 | |

| 5,000,000 | | | | Entergy Louisiana, LLC 4.44%, 1/15/26 | | | 5,300,702 | |

| 4,000,000 | | | | Entergy Texas, Inc.

4.00%, 3/30/29 | | | 4,165,511 | |

| 7,000,000 | | | | Eversource Energy

41/4%, 4/01/29 | | | 7,494,572 | |

| 10,000,000 | | | | Florida Power & Light Co. 31/4%, 6/01/24 | | | 10,261,751 | |

| 4,000,000 | | | | Indiana Michigan

Power Co.

3.20%, 3/15/23 | | | 4,047,191 | |

| 10,000,000 | | | | Interstate Power & Light

31/4%, 12/01/24 | | | 10,062,214 | |

| 14,000,000 | | | | NiSource Finance Corp.

3.49%, 5/15/27 | | | 14,030,492 | |

| 5,000,000 | | | | Ohio Power Co.

6.60%, 2/15/33 | | | 6,384,637 | |

| 10,345,000 | | | | Oncor Electric Delivery Co. LLC

7.00%, 9/01/22(a)(b) | | | 11,686,258 | |

| 5,000,000 | | | | Public Service Electric 3.00%, 5/15/25 | | | 4,994,735 | |

| 10,000,000 | | | | Public Service Electric 3.00%, 5/15/27 | | | 9,894,913 | |

| 5,000,000 | | | | Public Service New Mexico 3.85%, 8/01/25 | | | 5,050,156 | |

| 9,000,000 | | | | Sempra Energy

3.55%, 6/15/24 | | | 9,112,696 | |

| 9,000,000 | | | | Southern Power Co. 4.15%, 12/01/25 | | | 9,374,837 | |

| 10,000,000 | | | | Virginia Electric &

Power Co.

3.15%, 1/15/26 | | | 9,993,155 | |

| 4,000,000 | | | | Wisconsin Energy Corp.

3.55%, 6/15/25 | | | 4,090,478 | |

| | | | | | | | 231,540,158 | |

The accompanying notes are an integral part of these financial statements.

6

DNP SELECT INCOME FUND INC.

SCHEDULE OF INVESTMENTS—(Continued)

April 30, 2019

(Unaudited)

| Par Value | | | | Description | | Value |

| | | | | n OIL & GAS STORAGE, TRANSPORTATION AND PRODUCTION—4.4%

| |

| $11,000,000 | | | | Enbridge Inc. (Canada)

41/4%, 12/01/26 | | | $11,469,921 | |

| 6,488,000 | | | | Energy Transfer Partners

7.60%, 2/01/24 | | | 7,435,809 | |

| 8,850,000 | | | | Energy Transfer Partners

81/4%, 11/15/29 | | | 11,078,891 | |

| 6,000,000 | | | | Enterprise Products Operating LP

5.20%, 9/01/20 | | | 6,188,875 | |

| 6,000,000 | | | | Enterprise Products Operating LP

3.35%, 3/15/23 | | | 6,082,850 | |

| 12,826,000 | | | | EQT Corp.

81/8%, 6/01/19 | | | 12,875,519 | |

| 8,030,000 | | | | Kinder Morgan, Inc. 6.85%, 2/15/20 | | | 8,271,373 | |

| 9,000,000 | | | | Magellan Midstream Partners, LP

5.00%, 3/1/26 | | | 9,791,822 | |

| 11,000,000 | | | | ONEOK, Inc.

6.00%, 6/15/35 | | | 12,127,258 | |

| 10,000,000 | | | | Phillips 66

3.90%, 3/15/28 | | | 10,321,365 | |

| 5,000,000 | | | | Plains All American Pipeline, LP

4.65%, 10/15/25 | | | 5,228,147 | |

| 12,210,000 | | | | TransCanada PipeLines Ltd. (Canada)

33/4%, 10/16/23 | | | 12,542,032 | |

| 10,000,000 | | | | Williams Partners LP 3.60%, 3/15/22 | | | 10,156,011 | |

| 5,000,000 | | | | Williams Partners LP

4.55%, 6/24/24 | | | 5,272,254 | |

| | | | | | | | 128,842,127 | |

| | | | | n TELECOMMUNICATIONS—3.8%

|

| 4,500,000 | | | | American Tower Corp. 5.00%, 2/15/24 | | | 4,860,094 | |

| 5,500,000 | | | | American Tower Corp. 3.00%, 6/15/23 | | | 5,490,111 | |

| 5,000,000 | | | | AT&T Inc.

4.45%, 4/01/24 | | | 5,289,135 | |

| 10,000,000 | | | | BellSouth Capital

Funding Corp.

77/8%, 2/15/30(a) | | | 12,111,082 | |

| 15,000,000 | | | | CenturyLink Inc.

67/8%, 1/15/28 | | | 14,760,750 | |

| 5,900,000 | | | | Comcast Corp.

7.05%, 3/15/33 | | | 7,854,538 | |

| 9,385,000 | | | | Crown Castle

International Corp. 4.45%, 2/15/26 | | | 9,844,714 | |

| 15,000,000 | | | | Koninklijke KPN NV (Netherlands)

83/8%, 10/01/30(a)(b) | | | 19,204,188 | |

| 5,000,000 | | | | TCI Communications Inc. 71/8%, 2/15/28 | | | 6,300,561 | |

| 15,500,000 | | | | Verizon Global

Funding Corp.

73/4%, 12/01/30 | | | 20,997,440 | |

| 5,000,000 | | | | Vodafone Group Plc (United Kingdom)

77/8%, 2/15/30 | | | 6,435,826 | |

| | | | | | | | 113,148,439 | |

| | | | | n NON-UTILITY—0.3%

|

| 8,000,000 | | | | Dayton Hudson Corp.

97/8%, 7/01/20(a) | | | 8,607,322 | |

| | | | | | | | 8,607,322 | |

| | | | | Total Bonds (Cost $454,695,137) | | | 482,138,046 | |

SHORT-TERM INVESTMENTS—1.3%

|

| | | | | n U.S. TREASURY BILLS—1.3%

|

| 19,000,000 | | | | 2.42%, 5/09/19(c) | | | 18,989,993 | |

| 19,000,000 | | | | 2.38%, 6/06/19(c) | | | 18,954,733 | |

| | | | | Total Short-Term Investments (Cost $37,945,480) | | | 37,944,726 | |

The accompanying notes are an integral part of these financial statements.

7

DNP SELECT INCOME FUND INC.

SCHEDULE OF INVESTMENTS—(Continued)

April 30, 2019

(Unaudited)

| | | | TOTAL INVESTMENTS—133.1% (Cost $2,959,962,512) | | | 3,944,047,316 | |

| | | | Secured borrowings—(13.5)% | | | (400,000,000 | ) |

| | | | Secured notes—(10.1)% | | | (300,000,000 | ) |

| | | | Mandatory Redeemable Preferred Shares at liquidation value—(10.1)% | | | (300,000,000 | ) |

| | | | Other assets less other liabilities—0.6% | | | 18,619,715 | |

| | | | NET ASSETS APPLICABLE TO COMMON STOCK—100.0% | | | $2,962,667,031 | |

| (a) | | All or a portion of this security has been pledged as collateral for borrowings and made available for loan. |

| (b) | | All or a portion of this security has been loaned. |

| (c) | | Rate shown represents yield-to-maturity. |

The percentage shown for each investment category is the total value of that category as a percentage of the net assets applicable to common stock of the Fund.

The Fund’s investments are carried at fair value which is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. The three-tier hierarchy of inputs established to classify fair value measurements for disclosure purposes is summarized in the three broad levels listed below.

Level 1—quoted prices in active markets for identical securities

Level 2—other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.)

Level 3—significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments)

The accompanying notes are an integral part of these financial statements.

8

DNP SELECT INCOME FUND INC.

SCHEDULE OF INVESTMENTS—(Continued)

April 30, 2019

(Unaudited)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in these securities. The following is a summary of the inputs used to value each of the Fund’s investments at April 30, 2019:

| | | | Level 1 | | Level 2 |

Common stocks & MLP interests | | | | $ | 3,423,964,544 | | | | — | |

Bonds | | | | | — | | | $ | 482,138,046 | |

Short-Term Investments | | | | | — | | | | 37,944,726 | |

Total | | | | $ | 3,423,964,544 | | | $ | 520,082,772 | |

There were no Level 3 priced securities held and there were no transfers into or out of Level 3.

Other information regarding the Fund is available on the Fund’s website at www.dpimc.com/dnp or the Securities and Exchange Commission’s website at www.sec.gov.

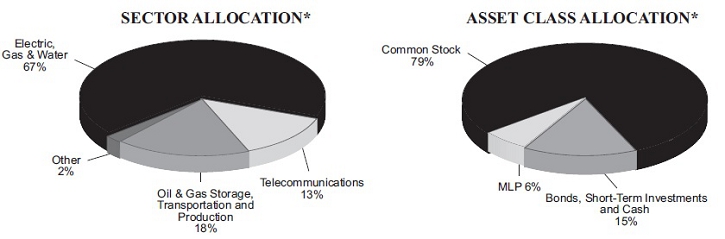

* | | Percentages are based on total investments rather than total net assets applicable to common stock and include securities pledged as collateral for the Fund’s credit facility. |

The accompanying notes are an integral part of these financial statements.

9

DNP SELECT INCOME FUND INC.

STATEMENT OF ASSETS AND LIABILITIES

April 30, 2019

(Unaudited)

ASSETS:

| | | | | | |

Investments at value (cost $2,960,047,547) including $375,267,374 of securities loaned | | | | $ | 3,944,047,316 | |

Cash | | | | | 23,834,409 | |

Receivables:

| | | | | | |

Securities sold | | | | | 224,504 | |

Interest | | | | | 6,161,811 | |

Dividends | | | | | 9,107,600 | |

Shares sold (Note 9) | | | | | 676,232 | |

Securities lending income | | | | | 824 | |

Prepaid expenses | | | | | 733,422 | |

Total assets | | | | | 3,984,786,118 | |

| |

LIABILITIES:

| | | | | | |

Secured borrowings (Note 6) | | | | | 400,000,000 | |

Secured notes (net of deferred offering costs of $2,476,908)(Note 6) | | | | | 297,523,092 | |

Dividends payable on common stock | | | | | 19,305,038 | |

Interest payable on secured notes (Note 6) | | | | | 2,395,691 | |

Investment advisory fee (Note 3) | | | | | 1,752,549 | |

Administrative fee (Note 3) | | | | | 408,044 | |

Interest payable on secured borrowings (Note 6) | | | | | 1,162,967 | |

Interest payable on mandatory redeemable preferred shares (Note 7) | | | | | 1,157,048 | |

Accrued expenses | | | | | 131,635 | |

Mandatory redeemable preferred shares (liquidation preference $300,000,000, net of deferred offering costs of $1,716,977)(Note 7) | | | | | 298,283,023 | |

Total liabilities | | | | | 1,022,119,087 | |

NET ASSETS APPLICABLE TO COMMON STOCK | | | | $ | 2,962,667,031 | |

| |

CAPITAL:

| | | | | | |

Common stock ($0.001 par value per share; 350,000,000 shares authorized and 297,059,885 shares issued and outstanding) | | | | | $297,060 | |

Additional paid-in capital | | | | | 1,999,189,945 | |

Total distributable earnings | | | | | 963,180,026 | |

Net assets applicable to common stock | | | | $ | 2,962,667,031 | |

NET ASSET VALUE PER SHARE OF COMMON STOCK | | | | | $9.97 | |

The accompanying notes are an integral part of these financial statements.

10

DNP SELECT INCOME FUND INC.

STATEMENT OF OPERATIONS

For the six months ended

April 30, 2019

(Unaudited)

INVESTMENT INCOME:

| | | | | | |

Interest | | | | | $11,804,025 | |

Dividends (less foreign withholding tax of $1,083,305) | | | | | 70,671,970 | |

Less return of capital distributions (Note 2) | | | | | (18,686,718 | ) |

Securities lending income, net | | | | | 152,891 | |

Total investment income | | | | | 63,942,168 | |

| |

EXPENSES:

| | | | | | |

Investment advisory fees (Note 3) | | | | | 10,107,758 | |

Interest expense and amortization of deferred offering costs

on preferred shares (Note 7) | | | | | 7,881,357 | |

Interest expense and fees on secured borrowings (Note 6) | | | | | 7,202,972 | |

Interest expense and amortization of deferred offering costs

on secured notes (Note 6) | | | | | 4,552,891 | |

Administrative fees (Note 3) | | | | | 2,368,675 | |

Reports to shareholders | | | | | 714,000 | |

Professional fees | | | | | 230,700 | |

Custodian fees | | | | | 200,100 | |

Transfer agent fees | | | | | 144,300 | |

Directors’ fees (Note 3) | | | | | 133,484 | |

Other expenses | | | | | 306,172 | |

Total expenses | | | | | 33,842,409 | |

Net investment income | | | | | 30,099,759 | |

| |

REALIZED AND UNREALIZED GAIN:

| | | | | | |

Net realized gain on investments | | | | | 109,495,604 | |

Net change in unrealized appreciation (depreciation) on investments and foreign currency translation | | | | | 239,707,776 | |

Net realized and unrealized gain | | | | | 349,203,380 | |

| |

NET INCREASE IN NET ASSETS APPLICABLE TO COMMON STOCK RESULTING FROM OPERATIONS | | | | $ | 379,303,139 | |

The accompanying notes are an integral part of these financial statements.

11

DNP SELECT INCOME FUND INC.

STATEMENTS OF CHANGES IN NET ASSETS

| | | | For the six

months ended

April 30, 2019

(Unaudited) | | For the year

ended

October 31, 2018 |

OPERATIONS:

| | | | | | | | | | |

Net investment income | | | | | $30,099,759 | | | | $57,791,463 | |

Net realized gain | | | | | 109,495,604 | | | | 135,884,929 | |

Net change in unrealized appreciation (depreciation) | | | | | 239,707,776 | | | | (240,852,245 | ) |

Net increase (decrease) in net assets applicable to

common stock resulting from operations | | | | | 379,303,139 | | | | (47,175,853 | ) |

| |

DISTRIBUTIONS TO COMMON STOCKHOLDERS:

| | | | | | | | | | |

Net investment income and capital gains | | | | | (28,631,961 | )* | | | (188,582,095 | ) |

In excess of net investment income | | | | | (86,529,999 | )* | | | — | |

Return of capital | | | | | —* | | | | (37,627,599 | ) |

Decrease in net assets from distributions to common

stockholders (Note 5) | | | | | (115,161,960 | ) | | | (226,209,694 | ) |

| |

CAPITAL STOCK TRANSACTIONS:

| | | | | | | | | | |

Shares issued to common stockholders from dividend reinvestment

of 2,040,868 and 3,838,880 shares, respectively | | | | | 21,740,781 | | | | 41,114,504 | |

Net proceeds from shares issued through at-the-market offering of 1,821,379 and 1,695,121 shares, respectively (Note 8) | | | | | 20,204,317 | | | | 18,311,035 | |

Net increase in net assets derived from capital share transactions | | | | | 41,945,098 | | | | 59,425,539 | |

Total increase (decrease) in net assets | | | | | 306,086,277 | | | | (213,960,008 | ) |

| |

TOTAL NET ASSETS APPLICABLE TO COMMON STOCK:

| | | | | | | | | | |

Beginning of period | | | | | 2,656,580,754 | | | | 2,870,540,762 | |

End of period | | | | | | | | | | |

| | | | $ | 2,962,667,031 | | | $ | 2,656,580,754 | |

* | | Allocations to net investment income, net realized gain and/or return of capital will be determined at fiscal year end. |

The accompanying notes are an integral part of these financial statements.

12

DNP SELECT INCOME FUND INC.

STATEMENT OF CASH FLOWS

For the six months ended

April 30, 2019

(Unaudited)

INCREASE (DECREASE) IN CASH

| | | | | | | | | | |

Cash flows provided by (used in) operating activities:

| | | | | | | | | | |

Interest received | | | | | $13,424,402 | | | | | |

Income dividends received | | | | | 50,677,275 | | | | | |

Return of capital distributions on investments | | | | | 19,830,413 | | | | | |

Securities lending income, net | | | | | 152,912 | | | | | |

Interest paid on secured borrowings | | | | | (6,116,666 | ) | | | | |

Interest paid on secured notes | | | | | (4,380,000 | ) | | | | |

Interest paid on mandatory redeemable preferred shares | | | | | (7,539,011 | ) | | | | |

Expenses paid | | | | | (14,358,348 | ) | | | | |

Purchase of investment securities | | | | | (321,326,243 | ) | | | | |

Proceeds from sales and maturities of investment securities | | | | | 388,274,046 | | | | | |

Net change in short-term investments | | | | | (37,860,446 | ) | | | | |

Net cash provided by operating activities | | $80,778,334 | |

Cash flows provided by (used in) financing activities:

| | | | | | | | | | |

Distributions paid | | | | | (114,911,267 | ) | | | | |

Proceeds from issuance of common stock under dividend reinvestment plan | | | | | 21,740,781 | | | | | |

Proceeds from issuance of mandatory redeemable preferred shares | | | | | 131,168,457 | | | | | |

Payout for redemption of mandatory redeemable preferred shares | | | | | (132,000,000 | ) | | | | |

Net proceeds from issuance of common stock though at-the-market offering | | | | | 20,150,325 | | | | | |

Offering costs in connection with issuance of common shares | | | | | (42,759 | ) | | | | |

Net cash used in financing activities | | (73,894,463 | ) |

Net increase in cash and cash equivalents | | 6,883,871 | |

Cash and cash equivalents—beginning of period | | 16,950,538 | |

Cash and cash equivalents—end of period | | $23,834,409 | |

Reconciliation of net increase in net assets resulting from operations to net cash provided by operating activities:

| | | | | | | | | | |

Net increase in net assets resulting from operations | $ | 379,303,139 | |

Purchase of investment securities | | | | | (321,326,243 | ) | | | | |

Proceeds from sales and maturities of investment securities | | | | | 388,274,046 | | | | | |

Net change in short-term investments | | | | | (37,860,446 | ) | | | | |

Net realized gain on investments | | | | | (109,495,604 | ) | | | | |

Net change in unrealized (appreciation) depreciation on investments | | | | | (239,707,776 | ) | | | | |

Net amortization and accretion of premiums and discounts on debt securities | | | | | 945,441 | | | | | |

Return of capital distributions on investments | | | | | 19,830,413 | | | | | |

Amortization of deferred offering costs | | | | | 537,419 | | | | | |

Decrease in interest receivable | | | | | 674,935 | | | | | |

Increase in dividends receivable | | | | | (1,307,976 | ) | | | | |

Increase in interest payable on mandatory redeemable preferred shares | | | | | 10,565 | | | | | |

Decrease in interest payable on secured notes | | | | | (32,747 | ) | | | | |

Increase in interest payable on secured borrowings | | | | | 1,086,306 | | | | | |

Decrease in accrued expenses | | | | | (153,159 | ) | | | | |

Decrease in other receivable | | | | | 21 | | | | | |

Total adjustments | | (298,524,805 | ) |

Net cash provided by operating activities | | $80,778,334 | |

The accompanying notes are an integral part of these financial statements.

13

DNP SELECT INCOME FUND INC.

FINANCIAL HIGHLIGHTS—SELECTED PER SHARE DATA AND RATIOS

The table below provides information about income and capital changes for a share of common stock outstanding throughout the periods indicated (excluding supplemental data provided below):

| | | For the six

months

ended April 30,

2019 | | For the year ended October 31, | |

PER SHARE DATA: | | (Unaudited) | | 2018 | | 2017 | | 2016 | | 2015 | | 2014 | |

Net asset value: | | | | | | | | | | | | | |

Beginning of period | | $9.06 | | $9.98 | | $9.40 | | $8.72 | | $10.21 | | $8.98 | |

Net investment income | | 0.10 | | 0.20 | | 0.22 | | 0.27 | | 0.29 | | 0.35 | |

Net realized and unrealized gain (loss) | | 1.20 | | (0.34 | ) | 1.14 | | 1.19 | | (1.00 | ) | 1.66 | |

Net increase (decrease) from investment operations applicable to common stock | | 1.30 | | (0.14 | ) | 1.36 | | 1.46 | | (0.71 | ) | 2.01 | |

Distributions on common stock:

| | | | | | | | | | | | | |

Net investment income | | (0.10 | ) | (0.26 | ) | (0.26 | ) | (0.31 | ) | (0.36 | ) | (0.39 | ) |

In excess of net investment income | | (0.29 | ) | — | | — | | — | | — | | — | |

Net realized gain | | — | | (0.39 | ) | (0.41 | ) | (0.34 | ) | (0.34 | ) | (0.30 | ) |

Return of capital | | — | | (0.13 | ) | (0.11 | ) | (0.13 | ) | (0.08 | ) | (0.09 | ) |

Total distributions | | (0.39 | ) | (0.78 | ) | (0.78 | ) | (0.78 | ) | (0.78 | ) | (0.78 | ) |

Net asset value:

| | | | | | | | | | | | | |

End of period | | $9.97 | | $9.06 | | $9.98 | | $9.40 | | $8.72 | | $10.21 | |

Per share market value:

| | | | | | | | | | | | | |

End of period | | $11.64 | | $10.93 | | $11.25 | | $10.09 | | $9.77 | | $10.47 | |

RATIOS TO AVERAGE NET ASSETS APPLICABLE TO COMMON STOCK: | | | | | | | | | | | | | |

Operating expenses | | 2.44 | %* | 2.31 | % | 2.04 | % | 1.86 | % | 1.64 | % | 1.60 | % |

Operating expenses, without leverage | | 1.02 | %* | 1.01 | % | 1.02 | % | 1.04 | % | 1.03 | % | 1.05 | % |

Net investment income | | 2.17 | %* | 2.19 | % | 2.23 | % | 2.98 | % | 3.05 | % | 3.67 | % |

SUPPLEMENTAL DATA:

| | | | | | | | | | | | | |

Total return on market value(1) | | 10.45 | % | 4.80 | % | 20.17 | % | 12.08 | % | 1.08 | % | 17.05 | % |

Total return on net asset value(1) | | 14.64 | % | (1.26 | %) | 15.04 | % | 17.34 | % | (7.09 | %) | 23.37 | % |

Portfolio turnover rate | | 8 | % | 13 | % | 11 | % | 16 | % | 15 | % | 16 | % |

Net assets applicable to common stock, end of period (000’s omitted). | | $2,962,667 | | $2,656,581 | | $2,870,541 | | $2,664,973 | | $2,440,250 | | $2,820,578 | |

Borrowings outstanding, end of period (000’s omitted) | | | | | | | | | | | | | |

Secured borrowings(2) | | $400,000 | | $400,000 | | $400,000 | | $400,000 | | $700,000 | | $700,000 | |

Secured notes(2) | | 300,000 | | 300,000 | | 300,000 | | 300,000 | | — | | — | |

Total borrowings | | $700,000 | | $700,000 | | $700,000 | | $700,000 | | $700,000 | | $700,000 | |

Asset coverage on borrowings(3) | | $5,661 | | $5,224 | | $5,529 | | $5,236 | | $4,915 | | $5,458 | |

Preferred stock outstanding, end of period (000’s omitted)(2) | | $300,000 | | $300,000 | | $300,000 | | $300,000 | | $300,000 | | $300,000 | |

Asset coverage on preferred stock(4) | | $396,267 | | $365,658 | | $387,054 | | $366,497 | | $344,025 | | $382,058 | |

Asset coverage ratio on total leverage (borrowings and preferred stock)(5) | | 396 | % | 366 | % | 387 | % | 367 | % | 344 | % | 382 | % |

| (1) | | Total return on market value assumes a purchase of common stock at the opening market price on the first day and a sale at the closing market price on the last day of each year shown in the table and assumes reinvestment of dividends at the actual reinvestment prices obtained under the terms of the Fund’s dividend reinvestment plan. Total return on net asset value uses the same methodology, but with use of net asset value for beginning, ending and reinvestment values. |

| (2) | | The Fund’s secured borrowings, secured notes and preferred stock are not publicly traded. |

| (3) | | Represents value of net assets applicable to common stock plus the borrowings and preferred stock outstanding at period end divided by the borrowings outstanding at period end, calculated per $1,000 principal amount of borrowing.The secured borrowings and secured notes have equal claims to the assets of the Fund. The rights of debt holders are senior to the rights of the holders of the Fund’s common and preferred stock. The asset coverage disclosed represents the asset coverage for the total debt of the Fund including both the secured borrowings and secured notes. |

| (4) | | Represents value of net assets applicable to common stock plus the borrowings and preferred stock outstanding at period end divided by the borrowings and preferred stock outstanding at period end, calculated per $100,000 liquidation preference per share of preferred stock. |

| (5) | | Represents value of net assets applicable to common stock plus the borrowings and preferred stock outstanding at year end divided by the borrowings and preferred stock outstanding at year end. |

The accompanying notes are an integral part of these financial statements.

14

DNP SELECT INCOME FUND INC.

NOTES TO FINANCIAL STATEMENTS

April 30, 2019

(Unaudited)

Note 1. Organization:

DNP Select Income Fund Inc. (the “Fund”) was incorporated under the laws of the State of Maryland on November 26, 1986. The Fund commenced operations on January 21, 1987, as a closed-end diversified management investment company registered under the Investment Company Act of 1940 (the “1940 Act”). The primary investment objectives of the Fund are current income and long-term growth of income. Capital appreciation is a secondary objective.

Note 2. Significant Accounting Policies:

The following are the significant accounting policies of the Fund:

A. Investment Valuation: Equity securities traded on a national or foreign securities exchange or traded over-the counter and quoted on the NASDAQ Stock Market are valued at the last reported sale price or, if there was no sale on the valuation date, then the security is valued at the mean of the bid and ask prices, in each case using valuation data provided by an independent pricing service, and are generally classified as Level 1. Equity securities traded on more than one securities exchange shall be valued at the last sale price on the business day as of which such value is being determined at the close of the exchange representing the principal market for such securities and are classified as Level 1. If there was no sale on the valuation date, then the security is valued at the mean of the closing bid and ask prices of the exchange representing the principal market for such securities. Debt securities are valued at the mean of the bid and ask prices provided by an independent pricing service when such prices are believed to reflect the fair value of such securities and are generally classified as Level 2. Any securities for which it is determined that market prices are unavailable or inappropriate are valued at a fair value using a procedure determined in good faith by the Board of Directors and are classified as Level 2 or 3 based on the valuation inputs.

B. Investment Transactions and Investment Income: Security transactions are recorded on the trade date. Realized gains or losses from sales of securities are determined on the identified cost basis. Dividend income is recognized on the ex-dividend date. Interest income and expense are recognized on the accrual basis. Discounts and premiums on securities are amortized or accreted over the lives of the respective securities for financial reporting purposes. Discounts and premiums are not amortized or accreted for tax purposes.

The Fund invests in master limited partnerships (“MLPs”) which make distributions that are primarily attributable to return of capital. Dividend income is recorded using management’s estimate of the percentage of income included in the distributions received from the MLP investments based on their historical dividend results. Distributions received in excess of this estimated amount are recorded as a reduction of cost of investments (i.e., a return of capital). The actual amounts of income and return of capital are only determined by each MLP after its fiscal year-end and may differ from the estimated amounts. For the year ended October 31, 2018, 100% of the MLP distributions were treated as a return of capital.

C. Federal Income Taxes: It is the Fund’s intention to comply with requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its taxable income and capital gains to its shareholders. Therefore, no provision for Federal income or excise taxes is required. Management of the Fund has concluded that there are no significant uncertain tax positions that would require

15

DNP SELECT INCOME FUND INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

April 30, 2019

(Unaudited)

recognition in the financial statements. Since tax authorities can examine previously filed tax returns, the Fund’s tax returns filed for the tax years 2015 to 2018 are subject to review.

D. Foreign Currency Translation: Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation at the mean of the quoted bid and asked prices of such currencies. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts at the rate of exchange prevailing on the respective dates of such transactions. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

E. Accounting Standards: In 2017, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2017-08, which shortens the premium amortization period for callable debt. For public companies, the amendments are effective for financial statements issued for fiscal years beginning after December 15, 2018. At this time, management is evaluating the provisions of ASU No. 2017-08 and its impact on the financial statements and accompanying notes.

F. Use of Estimates: The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates.

Note 3. Agreements and Management Arrangements:

A. Adviser and Administrator: The Fund has an Advisory Agreement with Duff & Phelps Investment Management Co. (the “Adviser”) an indirect, wholly owned subsidiary of Virtus Investment Partners, Inc. (“Virtus”), to provide professional investment management services for the Fund and has an Administration Agreement with J. J. B. Hilliard, W. L. Lyons, LLC (the “Administrator”) to provide administrative and management services for the Fund. The Adviser receives a quarterly fee at an annual rate of 0.60% of the Average Weekly Managed Assets of the Fund up to $1.5 billion and 0.50% of Average Weekly Managed Assets in excess thereof. The Administrator receives a quarterly fee at annual rates of 0.20% of Average Weekly Managed Assets up to $1 billion, and 0.10% of Average Weekly Managed Assets over $1 billion. For purposes of the foregoing calculations, “Average Weekly Managed Assets” is defined as the average weekly value of the total assets of the Fund minus the sum of all accrued liabilities of the Fund (other than the aggregate amount of any outstanding borrowings or other indebtedness constituting financial leverage).

B. Directors: The Fund pays each director not affiliated with the Adviser an annual fee. Total fees paid to directors for the six months ended ended April 30, 2019 were $133,484.

C. Affiliated Shareholder: At April 30, 2019, Virtus Partners, Inc. (a wholly owned subsidiary of Virtus) held 229,206 shares of the Fund, which represent 0.08% of the shares of common stock outstanding. These shares may be sold at any time.

16

DNP SELECT INCOME FUND INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

April 30, 2019

(Unaudited)

Note 4. Investment Transactions:

Purchases and sales of investment securities (excluding short-term investments) for the six months ended April 30, 2019 were $316,605,543 and $388,498,550, respectively.

Note 5. Distributions and Tax Information:

At October 31, 2018, the federal tax cost and aggregate gross unrealized appreciation (depreciation) were as follows:

| Federal Tax Cost | | Unrealized

Appreciation | | Unrealized

Depreciation | | Net Unrealized

Appreciation |

$2,929,551,889 | | $894,325,445 | | $(175,065,990) | | $719,259,455 |

The difference between the book basis and tax basis of unrealized appreciation (depreciation) and cost of investments is primarily attributable to MLP earnings and basis adjustments, the tax deferral of wash sales losses, the accretion of market discount and amortization of premiums.

The Fund declares and pays monthly dividends on its common shares of a stated amount per share. Subject to approval and oversight by the Fund’s Board of Directors, the Fund seeks to maintain a stable distribution level (a Managed Distribution Plan) consistent with the Fund’s primary investment objective of current income. If and when sufficient investment income is not available on a monthly basis, the Fund will distribute long-term capital gains and/or return capital in order to maintain the $0.065 per common share distribution level. The amount and timing of distributions are determined in accordance with federal tax regulations, which may differ from U.S. generally accepted accounting principles.

The tax character of distributions paid to common shareholders during the year ended October 31, 2018 was as follows:

| | | | 10/31/18 |

Distributions paid from:

| | | | | | |

Ordinary income | | | | $ | 80,941,350 | |

Long-term capital gains | | | | | 107,273,507 | |

Return of capital | | | | | 37,627,599 | |

Total distributions | | | | $ | 225,842,456 | |

The tax character of distributions paid in 2019 will be determined at the Fund’s fiscal year end, October 31, 2019.

Note 6. Debt Financing:

The Fund has a Committed Facility Agreement (the “Facility”) with a commercial bank (the “Bank”) that allows the Fund to borrow cash up to a limit of $400,000,000. The Fund has also issued Secured Notes (the “Notes”). The Facility and Notes rank pari passu and are senior, with priority in all respects to the outstanding common and preferred stock as to the payment of dividends and with respect to the distribution of assets upon dissolution,

17

DNP SELECT INCOME FUND INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

April 30, 2019

(Unaudited)

liquidation or winding up of the affairs of the Fund. Key information regarding the Facility and Notes is detailed below.

A. Borrowings Under the Facility: Borrowings under the Facility are collateralized by certain assets of the Fund (the “Hypothecated Securities”). The Fund expressly grants the Bank the right to re-register the Hypothecated Securities in its own name or in another name other than the Fund’s and to pledge, repledge, hypothecate, rehypothecate, sell, lend or otherwise transfer or use the Hypothecated Securities. Interest is charged at 3 month LIBOR (London Inter-bank Offered Rate) plus an additional percentage rate of 0.90% on the amount borrowed. The Bank has the ability to require repayment of the Facility upon 179 days’ notice or following an event of default. For the six months ended April 30, 2019, the average daily borrowings under the Facility and the weighted daily average interest rate were $400,000,000 and 3.58%, respectively. As of April 30, 2019, the amount of such outstanding borrowings was $400,000,000 and the applicable interest rate was 3.48%.

The Bank has the ability to borrow the Hypothecated Securities (“Rehypothecated Securities”). The Fund is entitled to receive a fee from the Bank in connection with any borrowing of Rehypothecated Securities. The fee is computed daily based on a percentage of the difference between the fair market rate as determined by the Bank and the Fed Funds Open and is paid monthly. The Fund can designate any Hypothecated Security as ineligible for rehypothecation and can recall any Rehypothecated Security at any time and if the Bank fails to return it (or an equivalent security) in a timely fashion, the Bank will be liable to the Fund for the ultimate delivery of such security and certain costs associated with delayed delivery. In the event the Bank does not return the security or an equivalent security, the Fund will have the right to, among other things, apply and set off an amount equal to 100% of the then-current fair market value of such Rehypothecated Securities against any amounts owed to the Bank under the Facility. The Fund is entitled to receive an amount equal to any and all interest, dividends or distributions paid or distributed with respect to any Hypothecated Security on the payment date. At April 30, 2019, Hypothecated Securities under the Facility had a market value of $2,040,317,635 and Rehypothecated Securities had a market value of $375,267,374. If at the close of any business day, the value of all outstanding Rehypothecated Securities exceeds the value of the Fund’s borrowings, the Bank shall promptly, at its option, either reduce the amount of the outstanding Rehypothecated Securities or deliver an amount of cash at least equal to the excess amount.

B. Notes: In 2016, the Fund completed a private placement of $300,000,000 of Notes in two fixed-rate series. Net proceeds from the issuances were used to reduce the amount of the Fund’s borrowing under its Facility. The Notes are secured by a lien on all assets of the Fund of every kind, including all securities and all other investment property, equal and ratable with the liens securing the Facility. The Notes are not listed on any exchange or automated quotation system.

Key terms of each series of secured notes are as follows:

| Series | | | | Amount | | Rate | | Maturity | | Estimated Fair Value |

| A | | | | $ | 100,000,000 | | | | 2.76 | % | | | 7/22/23 | | | $ | 97,710,000 | |

| B | | | | | 200,000,000 | | | | 3.00 | % | | | 7/22/26 | | | | 193,020,000 | |

| | | | | $ | 300,000,000 | | | | | | | | | | | $ | 290,730,000 | |

The Fund incurred costs in connection with the issuance of the Notes. These costs were recorded as a deferred charge and are being amortized over the respective life of each series of Notes. Amortization of these offering costs

18

DNP SELECT INCOME FUND INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

April 30, 2019

(Unaudited)

of $205,638 is included under the caption “Interest expense and amortization of deferred offering costs on secured notes” on the Statement of Operations and the unamortized balance is deducted from the carrying amount of the Notes under the caption “Secured notes” on the Statement of Assets and Liabilities.

Holders of the Notes are entitled to receive semi-annual interest payments until maturity. The Notes accrue interest at the annual fixed rate indicated above. The Notes are subject to optional and mandatory redemption in certain circumstances and subject to certain prepayment penalties and premiums.

The estimated fair value of the Notes was calculated, for disclosure purposes, based on estimated market yields and credit spreads for comparable instruments or representative indices with similar maturity, terms and structure. The Notes are categorized as Level 2 within the fair value hierarchy.

Note 7. Mandatory Redeemable Preferred Shares:

The Fund has issued and outstanding Mandatory Redeemable Preferred Shares (MRP Shares) with a liquidation preference of $100,000 per share.

In 2014, the Fund issued 3,000 Floating Rate Mandatory Redeemable Preferred Shares and on January 29, 2019 issued 1,320 Fixed Rate Mandatory Redeemable Preferred Shares. On March 1, 2019 the proceeds of the issuance of 1,320 MRP Shares Series E were used to redeem all 1,320 issued and outstanding MRP Shares Series A in advance of their stated maturity date of April 1, 2019.

Key terms of each series of MRP Shares at April 30, 2019 are as follows:

| Series | | | | Shares

Outstanding | | Liquidation

Preference | | Quarterly Rate Reset | | Rate | | Weighted Daily

Average Rate | | Mandatory

Redemption

Date | | Estimated

Fair Value |

B | | | | | 600 | | | $ | 60,000,000 | | | 3M LIBOR + 2.05% | | | 4.64 | % | | | 4.68 | % | | | 4/1/2021 | | | $ | 60,000,000 | |

C | | | | | 750 | | | | 75,000,000 | | | 3M LIBOR + 2.15% | | | 4.74 | % | | | 4.78 | % | | | 4/1/2024 | | | | 75,000,000 | |

D | | | | | 330 | | | | 33,000,000 | | | 3M LIBOR + 1.95% | | | 4.54 | % | | | 4.58 | % | | | 4/1/2021 | | | | 33,000,000 | |

E | | | | | 1,320 | | | | 132,000,000 | | | Fixed Rate

| | | 4.63 | % | | | 4.63 | % | | | 4/1/2027 | | | | 135,656,400 | |

| | | | | 3,000 | | | $ | 300,000,000 | | | | | | | | | | | | | | | | | $ | 303,656,400 | |

The Fund incurred costs in connection with the issuance of the MRP Shares. These cost were recorded as a deferred charge and are being amortized over the respective life of each series of MRP Shares. Amortization of these deferred offering costs of $331,781 is included under the caption “Interest expense and amortization of deferred offering costs on preferred shares” on the Statement of Operations and the unamortized balance is deducted from the carrying amount of the MRP Shares under the caption “Mandatory redeemable preferred shares” on the Statement of Assets and Liabilities. The unamortized costs incurred in connection with the issuance of MRP Shares Series A were fully expensed when the shares were redeemed.

Holders of the MRP Shares are entitled to receive quarterly cumulative cash dividend payments on the first business day following each quarterly dividend date which is the last day of each of March, June, September and December.

19

DNP SELECT INCOME FUND INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

April 30, 2019

(Unaudited)

MRP Shares are subject to optional and mandatory redemption in certain circumstances. The redemption price per share is equal to the sum of the liquidation preference per share plus any accumulated but unpaid dividends plus, in some cases, an early redemption premium (which varies based on the date of redemption). The MRP Shares are not listed on any exchange or automated quotation system. The MRP Shares are categorized as Level 2 within the fair value hierarchy. The Fund is subject to certain restrictions relating to the MRP Shares such as maintaining certain asset coverage, effective leverage ratio and overcollateralization ratio requirements. Failure to comply with these restrictions could preclude the Fund from declaring any distributions to common shareholders and could trigger the mandatory redemption of the MRP Shares at liquidation value.

In general, the holders of the MRP Shares and of the Common Stock have equal voting rights of one vote per share. The holders of the MRP Shares are entitled to elect two members of the Board of Directors, and separate class votes are required on certain matters that affect the respective interests of the MRP Shares and the Common Stock.

Note 8. Offering of Shares of Common Stock:

In 2018, the Fund’s shelf registration statement allowing for an offering of up to $250,000,000 of shares of common stock became effective. These shares may be offered and sold directly to purchasers, through at-the-market offerings or through a combination of these methods. The Fund entered into an agreement with Wells Fargo Securities, LLC to act as equity distribution agent. The Fund incurred costs in connection with this offering of shares of common stock. These costs were recorded as a deferred charge and are being amortized as shares of common stock are sold. Amortization of these offering costs of $42,759 is recorded as a reduction in paid-in surplus on common stock.

Note 9. Indemnifications:

Under the Fund’s organizational documents, its Officers and Directors are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts that provide general indemnifications to other parties. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not occurred. However, the Fund has not had prior claims or losses pursuant to these arrangements and expects the risk of loss to be remote.

Note 10. Subsequent Events:

Management has evaluated the impact of all subsequent events on the Fund through the date the financial statements were issued, and has determined that there were no subsequent events requiring recognition or disclosure in these financial statements.

20

RENEWAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited)

Under Section 15(c) of the Investment Company Act of 1940 (the “1940 Act”), the terms of the Fund’s investment advisory agreement must be reviewed and approved at least annually by the Board of Directors of the Fund (the “Board”), including a majority of the directors who are not “interested persons” of the Fund, as defined in section 2(a)(19) of the 1940 Act (the “Independent Directors”). Section 15(c) of the 1940 Act also requires the Fund’s directors to request and evaluate, and the Fund’s investment adviser to furnish, such information as may reasonably be necessary to evaluate the terms of the investment advisory agreement. To assist the Board with this responsibility, the Board has appointed a Contracts Committee, which is composed of the Independent Directors of the Fund and acts under a written charter that was most recently amended on December 17, 2015. A copy of the charter is available on the Fund’s website at www.dpimc.com/dnp and in print to any shareholder, upon request.

The Contracts Committee, assisted by the advice of independent legal counsel, conducted an annual review of the terms of the Fund’s contractual arrangements, including the investment advisory agreement with Duff & Phelps Investment Management Co. (the “Adviser”). Set forth below is a description of the Contracts Committee’s annual review of the Fund’s investment advisory agreement, which provided the material basis for the Board’s decision to continue the investment advisory agreement.

In the course of the Contracts Committee’s review, the members of the Contracts Committee considered all of the information they deemed appropriate, including informational materials furnished by the Adviser in response to a request made by independent counsel on behalf of the Contracts Committee. In arriving at its recommendation that continuation of the investment advisory agreement was in the best interests of the Fund and its shareholders, the Contracts Committee took into account all factors that it deemed relevant, without identifying any single factor or group of factors as all-important or controlling. Among the factors considered by the Contracts Committee, and the conclusion reached with respect to each, were the following:

Nature, extent, and quality of services. The Contracts Committee considered the nature, extent and quality of the services provided to the Fund by the Adviser. Among other materials, the Adviser furnished the Contracts Committee with a copy of its most recent investment adviser registration form (Form ADV). In evaluating the quality of the Adviser’s services, the Contracts Committee noted the various complexities involved in the operations of the Fund, such as the use of multiple forms of leverage (senior notes, preferred stock and borrowings under a credit facility), the rehypothecation of portfolio securities pledged under the credit facility and the Fund’s ongoing “at-the-market” offering program for its common stock, and concluded that the Adviser is consistently providing high-quality services to the Fund in an increasingly complex environment. The Contracts Committee also considered the length of service of the individual professional employees of the Adviser who provide services to the Fund. In the Contracts Committee’s view, the long-term service of capable and conscientious professionals provides a significant benefit to the Fund and its shareholders. The Contracts Committee also considered the Fund’s investment performance as discussed below. The Contracts Committee also took into account its evaluation of the quality of the Adviser’s code of ethics and compliance program. In light of the foregoing, the Contracts Committee concluded that it was generally satisfied with the nature, extent and quality of the services provided to the Fund by the Adviser.

Investment performance of the Fund and the Adviser. The Contracts Committee reviewed the Fund’s investment performance over time and compared that performance to other funds in its peer group. In making its comparisons, the Contracts Committee utilized data provided by the Adviser and a report from Broadridge (“Broadridge”), an independent provider of investment company data. As reported by Broadridge, the Fund’s net asset value (“NAV”) total return ranked in the first quintile among all leveraged closed-end equity funds categorized by Broadridge as utility funds for the 3- and 10-year periods ended June 30, 2018, and ranked in the second quintile for the 1- and 5-year periods, each ended June 30, 2018. The Adviser provided the Contracts Committee with

21