and Rule 19b-1 in order to distribute long-term capital gains more than once in a 12-month period. Having a Board-approved Managed Distribution Plan in place is generally a prerequisite for the SEC to consider exemptive relief from Section 19(b) of the 1940 Act.

Second, from a compliance standpoint, the Board is required to consider the policies and procedures that the Fund’s Administrator and Adviser propose to adopt relating to the Plan. Specifically, the compliance procedures relating to the Plan must: (1) be designed to provide reasonable assurance that all notices required to be sent to Fund shareholders pursuant to Section 19 of the 1940 Act include all the required disclosures; (2) require that the Fund keep records that demonstrate its compliance with all of the conditions of Section 19 of the 1940 Act; (3) provide for the Fund’s Chief Compliance Officer to review the adequacy of the policies and procedures proposed by the Fund’s Administrator and Adviser, determine whether the Fund and the Fund’s Adviser have complied with the conditions set out by the SEC in the exemptive order, and report the results of the review to the Board of Directors at least once every three months or at the next regularly scheduled quarterly board meeting; (4) address the course of action for widespread public disclosure of information regarding the Fund’s periodic distributions via press releases, SEC filings, website postings, and inclusion in Fund information, communications, and reports to shareholders, beneficial owners, and potential shareholders; (5) address monitoring the trading in the Fund’s common stock so that the Board of Directors may readdress the appropriateness of the Plan and its benefits to Fund shareholders if the Fund’s common stock has traded at greater than a 10% premium to NAV and/or the Fund’s annualized distribution rate, expressed as a percentage of NAV, is greater than the Fund’s average annual total return in relation to the change in NAV over a prescribed period of time.

Question 6: What are the primary advantages of a Managed Distribution Plan?

Answer: A managed distribution plan allows a fund to provide to its common shareholders a regular, periodic distribution that is not dependent on the timing or amount of income earned or capital gains realized by the fund. This type of distribution plan recognizes that many investors are willing to accept the higher price volatility of equity investments but also like to receive a consistent level of cash distributions each month for reinvestment or other purposes. It also reduces share price volatility associated with a potentially large one-time distribution. Further, Lipper Analytical Services (“Lipper”) data indicate that managed distribution policies tend to have a positive effect on supporting a closed-end fund’s market price in relation to its NAV. Even though your Fund historically has traded at a premium, there can be no assurance that the premium will persist over the long term.

To the extent that the Fund distributes long-term capital gains, either annually or, if the Fund is granted exemptive relief from Section 19(b) of the 1940 Act, the tax effects will be favorable under current tax law, as the applicable tax rate will be the lower capital gains tax rate instead of the rate applied to ordinary income.

Question 7: What are the primary disadvantages of a Managed Distribution Plan?

Answer: One disadvantage of the Managed Distribution Plan is a negative tax impact on shareholders when the Fund’s distribution includes capital loss carryforwards offset by realized capital gains. (See Question 11 below.) Distributions of offset capital gains are characterized under the Internal Revenue Code as ordinary income to shareholders, and are taxed as such, rather than at the more favorable rate on long-term capital gains. In addition, the Managed Distribution Plan may affect the Fund’s portfolio management strategy, which is discussed in Question 8 below. If the Fund’s total return is less than the annual distribution, the Managed Distribution Plan could shrink the assets of the Fund over time and thus increase the Fund’s expense ratio (i.e., the Fund’s fixed expenses will be spread over a smaller pool of assets). Another potential disadvantage of the Managed Distribution Plan is that it is subject to modification, suspension or termination at any time, without notice, by the Board. This is discussed in more detail in Question 9 below. Finally, a managed distribution that contains a return of capital will require shareholders to adjust their cost basis by the amount of each return of capital so that when they sell their shares, their cost basis will be lower. This will add to the recordkeeping requirements of shareholders.

Advantages and disadvantages notwithstanding, the Fund has no control over the capital gains it may be forced to realize because of unexpected tender offers or mergers of the issuers of its underlying stockholdings. In addition, the components of dividends received from real estate investment trusts (REITs) – ordinary income, capital gains, and return of capital – cannot be determined by the Fund at the time of distribution. Indeed, the REITs themselves do not know the exact percentage breakdown of those components until after the end of the calendar year, at which time REIT security holders (including the Fund) are notified. The tax characteristics of the REIT dividend portion of the Fund’s total distribution for a year are then made available to Fund shareholders, but are not within the control of the Fund.

Question 8: Will the Managed Distribution Plan impact the way in which the Fund is managed?

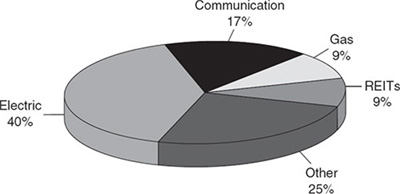

Answer: Adoption of the Plan is not expected to materially change the portfolio management strategy of the Fund. The Fund’s primary investment objectives continue to be current income and growth in income; capital appreciation remains a secondary objective. The Fund seeks to achieve these objectives by investing in a diversified portfolio of equity and fixed income securities of companies in the public utilities industry. Under normal conditions, the Fund’s investment policies require the Fund to invest at least 65% of its assets in companies engaged in the production, transmission, or distribution of electric energy, gas, or telephone services. The Adviser does

33

not expect to change the makeup of the portfolio because of the adoption of a managed distribution policy; rather, the Fund will maintain its traditional focus on the securities of high-quality, income-generating utility companies. The Adviser may manage the portfolio slightly differently than in the absence of the Managed Distribution Plan, but not in such a way that is likely to negatively impact shareholders. For instance, the Adviser may realize a loss in a security by selling it in order to offset realized capital gains; absent the Managed Distribution Plan, the Advisers might not have caused the Fund to realize the loss. This would result in slightly higher portfolio turnover with a small cost of trading. However, the Adviser will not retain positions that it believes should be sold based on fundamental analysis of the underlying company.

Question 9: Under what circumstances can the Managed Distribution Plan be terminated or suspended?

Answer: The Managed Distribution Plan can be modified, suspended, or terminated at any time by the Board, without any notice to or approval by shareholders. Because the Managed Distribution Plan has been implemented prior to receiving exemptive relief from Section 19(b) and Rule 19b-1 of the 1940 Act, its continuation without violating Section 19(b) and Rule 19b-1 will be dependent on a number of factors over which the Fund has no control. For this reason, the Fund has the flexibility to modify, suspend, or terminate the Managed Distribution Plan immediately if the Board deems such action to be in the best interests of the Fund and its shareholders. For instance, the Board may modify, suspend, or terminate the Managed Distribution Plan if the Plan has the effect of shrinking the Fund’s assets to a level that is determined to be detrimental to Fund shareholders. The suspension or termination of the Managed Distribution Plan could have the effect of creating a trading discount (if the Fund is trading at or above NAV) or widening an existing trading discount.

Question 10: Are the managed distribution payments considered “yield”?

Answer: Not necessarily. You should not draw any conclusions about the Fund’s investment performance based on the magnitude of the distribution. Yield is a measure of net investment income, relative to the share price, that is distributed to the Fund’s shareholders. A distribution of capital gains, for example, is not considered net investment income. Neither is a return of capital. Therefore, managed distributions consisting of capital gains and/or return of capital do not result in a higher yield or a high yield fund.

Question 11: Will the Managed Distribution Plan result in any additional administrative consequences or have tax effects for shareholders?

Answer: There would be an added recordkeeping obligation for shareholders if at some point the distributions contain a return of capital component. Return of capital is not taxable to shareholders in the year it is paid. Rather, shareholders are required to reduce the cost basis of their shares by the amount of the return of capital so that, when the shares are ultimately sold, they will have properly accounted for the return of capital. Such an adjustment may cause a shareholder’s gain to be greater, or loss to be smaller, depending on the sales proceeds received. For example, assume a shareholder bought shares in the Fund for $10.00 per share and then received dividends from the Fund that included $1.00 per share of return of capital. At that point, the cost basis should be adjusted down to $9.00 per share. If the shareholder subsequently sells the shares for $10.50 each, the gain is $1.50 per share, taxed at the long-term capital gains tax rate. Essentially, a return of capital defers shareholders’ tax liability until the shares are sold. Shareholders who hold their shares in non-taxable accounts such as IRAs will not need to make any adjustments in the cost basis.

34

Other tax effects of the Plan are minimal. As described in the answers to Questions 2, 3, and 7 above, if the Fund has net realized long-term capital gains and a tax loss carryforward position, as has been the case over the past few years, distributions of those gains are treated as ordinary income to shareholders and taxed at the ordinary income tax rate under the Internal Revenue Code. However, a long-term capital gains distribution, regardless of whether it is disbursed monthly or once annually, will be taxed at the long-term capital gain tax rate under the Internal Revenue Code.

The foregoing is not intended to be a complete discussion of the tax consequences of the Managed Distribution Plan and shareholders are urged to seek their own professional tax advice regarding this matter. The Fund will send you a Form 1099-DIV following the end of each calendar year that will tell you how to report Fund distributions for federal income tax purposes.

Question 12: Why do shareholders receive a 19(a) Notice?

Section 19(a) of the 1940 Act provides that if a registered investment company’s distributions are composed of a source other than net income earned on the underlying holdings, the distribution must be accompanied by a written statement (a “19(a) Notice”) that adequately discloses the sources of the distribution. Net realized short-and long-term capital gains and return of capital are examples of other sources from which the Fund’s distribution may be paid. Therefore, in accordance with the 1940 Act, the Fund provides a 19(a) Notice to shareholders, detailing the proportion of the distribution represented by net investment income, net realized short-and/or long-term capital gains, and return of capital, as pertinent to the period covered by the distribution.

Because the 19(a) Notice would alert shareholders if at some point distributions contain a return of capital, it would also alert shareholders that they might have a record keeping obligation (as discussed in Question 11). It is important for shareholders to understand that the calculations in the 19(a) Notice are based on Generally Accepted Accounting Principles (GAAP); on the other hand, the tax characteristics of distributions detailed on the 1099-DIV form that shareholders receive after the end of a calendar year are based on the Internal Revenue Code, which may or may not be equivalent to the GAAP treatment. Shareholders are urged to seek their own professional tax advice regarding this distinction.

The 19(a) Notice also assists you in understanding the Fund’s yield and return characteristics. You should not draw any conclusions about the Fund’s investment performance simply based on the magnitude of the distribution. Yield is a measure of net investment income, relative to the share price, that is distributed to the Fund’s shareholders. A distribution of capital gains, for example, is not considered net investment income. Neither is a return of capital. Therefore, managed distributions consisting of capital gains and/or return of capital do not result in a higher yield or a high yield fund.

Question 13: Will additional information be available to shareholders?

Yes. Current information about the Managed Distribution Plan will be included in the Fund’s quarterly reports to shareholders and will be posted on the Fund’s website, http://www.dnpselectincome.com. Through these channels, shareholders will be kept informed of any decision by the SEC regarding the Fund’s request for an exemptive order and any actions taken by the Board of Directors to modify, suspend or terminate the Plan.

35

(This page intentionally left blank)

| |

Board of Directors | DNP Select |

| Income Fund Inc. |

FRANCIS E. JEFFRIES | |

Chairman | Common stock listed on the New York |

| Stock Exchange under the symbol DNP |

NANCY LAMPTON | |

Vice Chairman | 55 East Monroe Street, Suite 3600 |

| Chicago, Illinois 60603 |

STEWART E. CONNER | (312) 368-5510 |

| |

CONNIE K. DUCKWORTH | Shareholder inquiries please contact: |

| |

ROBERT J. GENETSKI | Transfer Agent, |

| Dividend Disbursing |

CHRISTIAN H. POINDEXTER | Agent and Custodian |

| |

CARL F. POLLARD | The Bank of New York |

| Shareholder Relations |

DAVID J. VITALE | Church Street Station |

| P.O. Box 1258 |

| New York, New York 10286-1258 |

| (877) 381-2537 |

| |

| Investment Adviser |

| |

| Duff & Phelps Investment |

| Management Co. |

Officers | 55 East Monroe Street |

| Chicago, Illinois 60603 |

NATHAN I. PARTAIN, CFA | |

President, Chief Executive Officer and | Administrator |

Chief Investment Officer | |

| J.J.B. Hilliard W.L. Lyons, Inc. |

T. BROOKS BEITTEL, CFA | 500 West Jefferson Street |

Senior Vice President and Secretary | Louisville, Kentucky 40202 |

| (888) 878-7845 |

JOSEPH C. CURRY, JR. | |

Senior Vice President and Treasurer | Legal Counsel |

|

Mayer Brown, Rowe & Maw LLP

|

JOYCE B. RIEGEL | 71 South Wacker Drive |

Chief Compliance Officer | Chicago, Illinois 60606 |

| |

MICHAEL SCHATT | Independent Registered Public Accounting Firm |

Senior Vice President | |

| Ernst & Young LLP |

DIANNA P. WENGLER | 233 South Wacker Drive |

Vice President and Assistant Secretary | Chicago, Illinois 60606 |

| ITEM 2. | | CODE OF ETHICS. |

| | | As of the end of the period covered by this report, the registrant has adopted a Code of Business Conduct and Ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant’s principal financial officer also performs the functions of principal accounting officer. |

| | | |

| | | The text of the registrant’s Code of Business Conduct and Ethics is posted on the registrant’s web site at http://www.dnpselectincome.com. In the event that the registrant makes any amendment to or grants any waiver from the provisions of its Code of Business Conduct and Ethics, the registrant intends to disclose such amendment or waiver on its web site within five business days. |

| | | |

| ITEM 3. | | AUDIT COMMITTEE FINANCIAL EXPERT. |

| | | |

| | | The registrant’s board of directors has determined that two members of its audit committee, Christian H. Poindexter and Carl F. Pollard, are audit committee financial experts and that each of them is “independent” for purposes of this Item. |

| | | |

| ITEM 4. | | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

| | | |

| | | The information required by this Item is incorporated by reference from the section captioned “Audit and Non-Audit Fees” in the registrant’s definitive proxy statement filed within 120 days after the end of the fiscal year covered by this report. |

| | | |

| ITEM 5. | | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

| | | |

| | | The registrant has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934 (the “Exchange Act”). The members of the committee are Connie K. Duckworth, Robert J. Genetski, Christian H. Poindexter and Carl F. Pollard. |

| | | |

| ITEM 6. | | SCHEDULE OF INVESTMENTS |

| | | Included as part of the report to shareholders filed under Item 1 of this Form. |

| | | |

| ITEM 7. | | DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES |

| | | FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

| |

| | | PROXY VOTING POLICIES AND PROCEDURES |

| | | Adopted May 13, 2003 |

| I. | Definitions. As used in these Policies and Procedures, the following terms shall have the meanings ascribed below: |

| |

| | A. | “Adviser” refers to Duff & Phelps Investment Management Co. (“DPIM”). |

| |

| | B. | “corporate governance matters” refers to changes involving the corporate ownership or structure of an issuer whose securities are within a portfolio holding, including changes in the state of incorporation, changes in capital structure, including increases and decreases of capital and preferred stock issuance, mergers and other corporate restructurings, and |

| |

| | | anti-takeover provisions such as staggered boards, poison pills, and supermajority voting provisions. |

| |

| | C. | “Delegate” refers to the Adviser, any proxy committee to which the Adviser delegates its responsibilities hereunder and any qualified, independent organization engaged by the Adviser to vote proxies on behalf of the Fund. |

| |

| | D. | “executive compensation matters” refers to stock option plans and other executive compensation issues. |

| |

| | E. | “Fund” refers to DNP Select Income Fund Inc. |

| |

| | F. | “portfolio holding” refers to any company or entity whose securities are held within the investment portfolio of the Fund as of the date a proxy is solicited. |

| |

| | G. | “proxy contests” refer to any meeting of shareholders of an issuer for which there are at least two sets of proxy statements and proxy cards, one solicited by management and the others by a dissident or group of dissidents. |

| |

| | H. | “social issues” refers to social, political and environmental issues. |

| |

| | I. | “takeover” refers to “hostile” or “friendly” efforts to effect radical change in the voting control of the board of directors of a company. |

| |

| II. | General policy. It is the intention of the Fund to exercise stock ownership rights in portfolio holdings in a manner that is reasonably anticipated to further the best economic interests of shareholders of the Fund. Accordingly, the Fund or its Delegate(s) shall endeavor to analyze and vote all proxies that are considered likely to have financial implications, and, where appropriate, to participate in corporate governance, shareholder proposals, management communications and legal proceedings. The Fund and its Delegate(s) must also identify potential or actual conflicts of interests in voting proxies and address any such conflict of interest in accordance with these Policies and Procedures. |

| |

| III. | Factors to consider when voting. |

| |

| | A. | The Delegate may abstain from voting when it concludes that the effect on shareholders’ economic interests or the value of the portfolio holding is indeterminable or insignificant. |

| |

| | B. | In analyzing anti-takeover measures, the Delegate shall vote on a case-by-case basis taking into consideration such factors as overall long-term financial performance of the target company relative to its industry competition. Key measures which shall be considered include, without limitation, five-year annual compound growth rates for sales, operating income, net income, and total shareholder returns (share price appreciation plus dividends). Other financial indicators that will be considered include margin analysis, cash flow, and debt levels. |

| |

| | C. | In analyzing proxy contests for control, the Delegate shall vote on a case-by-case basis taking into consideration such factors as long-term financial performance of the target company relative to its industry; management’s track record; background to the proxy contest; qualifications of director nominees (both slates); evaluation of what each side is offering shareholders as well as the likelihood that the proposed objectives and goals can be met; and stock ownership positions. |

| |

| | D. | In analyzing contested elections for director, the Delegate shall vote on a case-by-case basis taking into consideration such factors as the qualifications of all director nominees. The Delegate shall also consider the independence and attendance record of board and |

| |

| | | |

| |

| | | key committee members. A review of the corporate governance profile shall be completed highlighting entrenchment devices that may reduce accountability. |

| |

| | E. | In analyzing corporate governance matters, the Delegate shall vote on a case-by-case basis taking into consideration such factors as tax and economic benefits associated with amending an issuer’s state of incorporation, dilution or improved accountability associated with changes in capital structure, management proposals to require a supermajority shareholder vote to amend charters and bylaws and bundled or “conditioned” proxy proposals. |

| |

| | F. | In analyzing executive compensation matters, the Delegate shall vote on a case-by-case basis taking into consideration such factors as executive pay and spending on perquisites, particularly in conjunction with sub-par performance and employee layoffs. |

| |

| | G. | The Delegate shall generally vote against shareholder proposals on social issues, except where the Delegate determines that a different position would be in the clear economic interests of the Fund and its shareholders. |

| |

| IV. | Responsibilities of Delegates. |

| |

| | A. | In voting proxies on behalf of the Fund, each Delegate shall have a duty of care to safeguard the best interests of the Fund and its shareholders and to act in accordance with these Policies and Procedures. |

| |

| | B. | The Adviser may delegate its responsibilities hereunder to a proxy committee established from time to time by the Adviser and may engage one or more qualified, independent organizations to vote proxies on behalf of the Fund. The Adviser shall be responsible for the ensuring that any such Delegate is informed of and complies with these Policies and Procedures. |

| |

| | C. | No Delegate shall accept direction or inappropriate influence from any other client or third party, or from any director, officer or employee of any affiliated company, and shall not cast any vote inconsistent with these Policies and Procedures without obtaining the prior approval of the Board of Directors of the Fund or its duly authorized representative. |

| |

| V. | Conflicts of interest |

| |

| | A. | The Fund and its Delegate(s) seek to avoid actual or perceived conflicts of interest in the voting of proxies for portfolio holdings between the interests of Fund shareholders, on the one hand, and those of the Adviser or any affiliated person of the Fund or the Adviser, on the other hand. The Board of Directors may take into account a wide array of factors in determining whether such a conflict exists, whether such conflict is material in nature, and how to properly address or resolve the same. |

| |

| | B. | While each conflict situation varies based on the particular facts presented and the requirements of governing law, the Board of Directors or its duly authorized representative may take the following actions, among others, or otherwise give weight to the following factors, in addressing material conflicts of interest in voting (or directing Delegates to vote) proxies pertaining to portfolio holdings: (i) vote pursuant to the recommendation of the proposing Delegate; (ii) abstain from voting; or (iii) rely on the recommendations of an established, independent third party with qualifications to vote proxies, such as Institutional Shareholder Services. |

| |

| | C. | The Adviser shall promptly notify the Board of Directors of the Fund promptly after becoming aware that any actual or potential conflict of interest exists and shall seek the Board of Directors’ recommendations for protecting the best interests of Fund’s |

| |

| | | shareholders. The Adviser shall not waive any conflict of interest or vote any conflicted proxies without the prior written approval of the Board of Directors or its duly authorized representative. |

| |

| VI. | Miscellaneous. |

| |

| | A. | A copy of the current Proxy Voting Policies and Procedures and the voting records for the Fund, reconciling proxies with portfolio holdings and recording proxy voting guideline compliance and justification, shall be kept in an easily accessible place and available for inspection either physically or through electronic posting on an approved website. |

| |

| | B. | In the event that a determination, authorization or waiver under these Policies and Procedures is requested at a time other than a regularly scheduled meeting of the Board of Directors, the Chairman of the Audit Committee shall be the duly authorized representative of the Board of Directors with the authority and responsibility to interpret and apply these Policies and Procedures and shall provide a report of his or her determinations at the next following meeting of the Board of Directors. |

| |

| | C. | The Adviser shall present a report of any material deviations from this Statement of Policy at every regularly scheduled meeting of the Board of Directors and shall provide such other reports as the Board of Directors may request from time to time. The Adviser shall provide to the Fund or any shareholder a record of its effectuation of proxy voting pursuant to this Statement of Policy at such times and in such format or medium as the Fund shall reasonably request. The Adviser shall be solely responsible for complying with the disclosure and reporting requirements under applicable laws and regulations, including, without limitation, Rule 206(4)-6 under the Investment Advisers Act of 1940. The Adviser shall gather, collate and present information relating to the its proxy voting activities of those of each Delegate in such format and medium as the Fund shall determine from time to time in order for the Fund to discharge its disclosure and reporting obligations pursuant to Rule 30b1-4 under the Investment Company Act of 1940, as amended. |

| |

| | D. | The Adviser shall pay all costs associated with proxy voting for portfolio holdings pursuant to these Policies and Procedures and assisting the Fund in providing public notice of the manner in which such proxies were voted. |

| |

| | E. | In performing its duties hereunder, any Delegate may engage the services of a research and/or voting adviser, the cost of which shall be borne by such Delegate. |

| |

| | F. | These Policies and Procedures shall be presented to the Board of Directors annually for their amendment and/or approval. |

| |

| |

| ITEM 8. | PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

The Fund’s Portfolio Managers

A team of investment professionals employed by Duff & Phelps Investment Management Co., the Fund’s investment adviser (the “Adviser”), is responsible for the day-to-day management of the Fund’s portfolio. The members of that investment team and their respective areas of responsibility and expertise, as of March 2, 2007, are as follows:

Nathan I. Partain, CFA, has led the Fund’s portfolio management team since 1998 and has served on the Fund’s portfolio management team since 1996. He has been President, Chief Executive Officer and Chief Investment Officer of the Fund since February 2001 (Executive Vice President and Chief Investment Officer from 1998 to 2001). Mr. Partain has been President and Chief Investment Officer of the Adviser since April 2005 (Executive Vice President from 1997 to 2005), President and Chief Executive Officer of DTF Tax-Free Income Inc. (“DTF”) and Duff & Phelps Utility and Corporate Bond Trust Inc. (“DUC”), two other closed-end utilities oriented funds, since February 2004, and lead portfolio manager of Phoenix Global Utilities Fund (“PGU”), an open-end utilities oriented fund, since October 2004. Mr. Partain has final investment authority with respect to the Fund’s entire investment portfolio. He joined the Duff & Phelps organization in 1987 and has served since then in positions of increasing responsibility. He is also a director of Otter Tail Corporation (since 1993).

T. Brooks Beittel, CFA, has served on the Fund’s portfolio management team and has been Secretary and a Senior Vice President of the Fund since January 1995 (Treasurer from January 1995 to September 2002). He has been Senior Vice President of the Adviser since 1993 (Vice President 1987-1993) and Secretary of DTF and DUC since May 2005. He is also a member of the portfolio management teams of DUC and PGU. Mr. Beittel concentrates his research on fixed-income securities and has investment authority with respect to the Fund’s fixed-income portfolio. He joined the Duff & Phelps organization in 1987 and has served since then in positions of increasing responsibility.

Michael Schatt has served on the Fund’s portfolio management team since 1996 and has been a Senior Vice President of the Fund since April 1998 (Vice President from January 1997 to April 1998). Mr. Schatt has been a Senior Vice President of the Adviser since January 1997 and was a Managing Director of Phoenix Investment Partners from 1994 to 1996. Mr. Schatt concentrates his research on REIT securities and has investment authority with respect to the Fund’s REIT portfolio. He is also the senior portfolio manager for all REIT products managed by the Adviser. These products include the Phoenix Real Estate Securities Fund, the Phoenix Real Estate Securities Series sub-account of the Phoenix Edge Series annuity products, Duff & Phelps Real Estate Securities Trust and various separate accounts. Before joining the Duff & Phelps organization in 1994, Mr. Schatt spent four years as a director of the Real Estate Advisory Practice for Coopers & Lybrand, LLC, advising foreign pension funds on the acquisition and disposition of U.S. real estate assets and assisting clients in evaluating public real estate investments as an alternative to private real estate investments. Prior to joining Coopers & Lybrand, he had 10 years’ experience in real estate finance.

Deborah A. Jansen, CFA, has served on the Fund’s portfolio management team and has been a Senior Vice President of the Adviser since January 2001. She is also a member of the portfolio management team of PGU. Ms. Jansen concentrates her research on the global electric and natural gas industries and makes recommendations to Mr. Partain with regard to equity investments in those industries. Prior to joining the Adviser in 2001, Ms. Jansen was a Senior Vice President, Principal and Equity Portfolio Manager at Stein Roe and Farnham, Inc. from 1996 to 2000.

Connie M. Luecke, CFA, has served on the Fund’s portfolio management team since 1996 and has been a Senior Vice President of the Adviser since January 1998 (Managing Director from 1996 to 1998). She is also a member of the portfolio management team of PGU. Ms. Luecke concentrates her research on the global telecommunications industries and makes recommendations to Mr. Partain with regard to equity investments in those industries. She joined the Duff & Phelps organization in 1992 and has served since then in positions of increasing responsibility.

Daniel J. Petrisko, CFA, has served on the Fund’s portfolio management team since 2004 and has been a Senior Vice President of the Adviser since 1997 (Vice President from 1995 to 1997). He has been Chief Investment Officer of DUC, another closed-end utilities oriented fund, since February 2004 (Portfolio Manager from 2002 to 2004, Vice President since 2000). Mr. Petrisko assists Mr. Beittel with respect to the management of the Fund’s fixed-income portfolio. He joined the Duff & Phelps organization in 1995 and has served since then in positions of increasing responsibility.

Randle L. Smith, CFA, has served on the Fund’s portfolio management team since 1996 and has been a Senior Vice President of the Adviser since January 1998 (Managing Director from 1996 to 1998). He is also a member of the portfolio management team of PGU. Mr. Smith concentrates his research on the global electric and natural gas industries and makes recommendations to Mr. Partain with regard to equity investments in those industries. He joined the Duff & Phelps organization in 1990 and has served since then in positions of increasing responsibility.

Other Accounts Managed by the Fund’s Portfolio Managers

The following table provides information as of December 31, 2006 regarding the other accounts besides the Fund that are managed by the portfolio managers of the Fund. As noted in the table, portfolio managers of the Fund may also manage or be members of management teams for other mutual funds within the same fund complex or other similar accounts. For purposes of this disclosure, the term “fund complex” includes the Fund and all other investment companies advised by affiliates of Phoenix Investment Partners,

Ltd. (“PXP”), the Adviser’s parent company. As of December 31, 2006, the Fund’s portfolio managers did not manage any accounts with respect to which the advisory fee is based on the performance of the account, nor do they manage any hedge funds.

| | | Registered Investment | | Other Pooled Investment | | | | | |

| | | Companies (1) | | Vehicles (2) | | Other Accounts (3) |

| |

|

|

|

|

|

|

|

| |

| Name of | | Number of | | Total Assets | | Number of | | Total Assets | | Number of | | Total Assets |

| Portfolio Manager | | Accounts | | (in millions) | | Accounts | | (in millions) | | Accounts | | (in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Nathan I. Partain | | 1 | | | $ | 32.3 | | | 0 | | — | | | 0 | | — | |

| T. Brooks Beittel | | 2 | | | $ | 546.3 | | | 0 | | — | | | 0 | | — | |

| Michael Schatt | | 2 | | | $ | 1,651.1 | | | 1 | | $54.8 | | | 10 | | $365.3 | |

| Deborah A. Jansen | | 1 | | | $ | 32.3 | | | 0 | | — | | | 0 | | — | |

| Connie M. Luecke | | 1 | | | $ | 32.3 | | | 0 | | — | | | 0 | | — | |

| Daniel J. Petrisko | | 1 | | | $ | 514.1 | | | 0 | | — | | | 9 | | $1,532.6 | |

| Randle L. Smith | | 1 | | | $ | 32.3 | | | 0 | | — | | | 0 | | — | |

_________________________

| (1) | Registered Investment Companies include all open and closed-end mutual funds. For Registered Investment Companies, assets represent net assets of all open-end investment companies and gross assets of all closed- end investment companies. | |

| | | |

| (2) | Other Pooled Investment Vehicles include, but are not limited to, securities of issuers exempt from registration under Section 3(c) of the Investment Company Act of 1940, such as private placements and hedge funds. | |

| | | |

| (3) | Other Accounts include, but are not limited to, individual managed accounts, separate accounts, institutional accounts, pension funds and collateralized bond obligations. | |

| | | |

There may be certain inherent conflicts of interest that arise in connection with the portfolio managers’ management of the Fund’s investments and the investments of any other accounts they manage. Such conflicts could include aggregation of orders for all accounts managed by a particular portfolio manager, the allocation of purchases across all such accounts, the allocation of IPOs and any soft dollar arrangements that the Adviser may have in place that could benefit the Fund and/or such other accounts. The Adviser has adopted policies and procedures designed to address any such conflicts of interest to ensure that all management time, resources and investment opportunities are allocated equitably. There have been no material compliance issues with respect to any of these policies and procedures during the Fund’s most recent fiscal year.

Compensation of the Fund’s Portfolio Managers

The following is a description of the compensation structure, as of December 31, 2006, of the Fund’s portfolio managers. The Fund’s portfolio managers receive a competitive base salary, an incentive bonus opportunity and a benefits package.

Each portfolio manager is paid a fixed base salary, which is determined by PXP and is designed to be competitive in light of the individual’s experience and responsibilities. The management of PXP uses compensation survey results of investment industry compensation conducted by an independent third party in evaluating competitive market compensation for its investment management professionals.

The incentive bonus package for portfolio managers is based upon how well the individual manager meets or exceeds assigned goals and a subjective assessment of contribution to the team effort. Their incentive bonus also reflects an investment performance component. The performance component is based in part on achieving and/or exceeding income targets underlying the Fund’s ability to pay common stock dividends, and in part on performance relative to a composite of the Standard & Poor’s Utilities Index and the Lehman Brothers Utility Bond Index reflecting the stock and bond ratio of the Fund. The performance component is further adjusted to reward investment personnel for managing within the stated framework and for not taking unnecessary risks. This ensures that investment personnel will remain focused on managing and acquiring securities that correspond to the Fund’s mandate and risk profile. It also avoids the temptation for portfolio managers to take on more risk and unnecessary exposure to chase performance for personal gain.

Incentive bonus compensation of the Fund’s portfolio managers is currently comprised of two main components: 70% of the incentive bonus is based on formulaic calculation of investment performance measures, including the Fund’s earnings per share and total return over a one-year period. The total return is compared to a composite of the Lehman Utility Bond Index and the S&P Utility Market Price Index. Portfolio managers who manage more than one product may have other components in their formulaic calculation that are appropriate to the other products, weighted according to the proportion of the manager’s time that is allocated to each specific product. The remaining 30% of the incentive bonus is based on the profitability of The Phoenix Companies, Inc. (“PNX”), the ultimate parent of PXP and the Adviser.

Prior to 2006, the incentive bonus compensation has been paid 100% in cash. However, PNX has determined that 15% of the incentive bonus compensation for 2006 (payable in 2007) will be paid in PNX restricted stock units which will vest over a three-year period.

The portfolio managers’ incentive bonus compensation is not based on the value of assets held in the Fund’s portfolio, except to the extent that the level of assets in the Fund’s portfolio affects the advisory fee received by the Adviser, and thus indirectly the profitability of PNX.

Finally, the Fund’s portfolio managers are eligible to participate in a deferred compensation plan to defer their compensation and realize tax benefits. Portfolio managers are also eligible to participate in broad-based plans offered generally to the firm’s employees, including broad-based retirement, 401(k), health and other employee benefit plans. Portfolio managers may also receive PNX stock options and/or be granted PNX restricted stock at the discretion of the PNX board of directors. To date no portfolio manager of the Fund has received awards under the PNX restricted stock units long-term incentive plan.

Equity Ownership of Portfolio Managers

The following table sets forth the dollar range of equity securities in the Fund beneficially owned, as of December 31, 2006, by each of the portfolio managers identified above.

| | | Dollar Range of |

| Name of Portfolio Manager | | Equity Securities in the Fund |

| T. Brooks Beittel | | $1-$10,000 |

| Deborah A. Jansen | | None |

| Connie M. Luecke | | $1-$10,000 |

| Nathan I. Partain | | $100,001-$500,000 |

| Daniel J. Petrisko | | None |

| Michael Schatt | | $10,001-$50,000 |

| Randle L. Smith | | $50,001-$100,000 |

| |

| ITEM 9. | | PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT |

| | | INVESTMENT COMPANY AND AFFILIATED PURCHASERS. |

| | | |

| | | During the period covered by this report, no purchases were made by or on behalf of the registrant or any “affiliated purchaser” (as defined in Rule 10b-18(a)(3) under the Exchange Act) of shares or other units of any class of the registrant’s equity securities that is registered by the registrant pursuant to Section 12 of the Exchange Act. |

| | | |

ITEM 10. | | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

| | | |

| | | No changes to the procedures by which shareholders may recommend nominees to the registrant’s board of directors have been implemented after the registrant last provided disclosure in response to the requirements of Item 7(d)(2)(ii)(G) of Schedule 14A (i.e., in the registrant’s Proxy Statement dated March 1, 2005) or this Item. |

| | | |

| ITEM 11. | | CONTROLS AND PROCEDURES. |

| | | |

| | | (a) The registrant’s principal executive officer and principal financial officer have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “1940 Act”)) are effective, based on an evaluation of those controls and procedures made as of a date within 90 days of the filing date of this report as required by Rule 30a-3(b) under the 1940 Act and Rule 13a-15(b) under the Exchange Act. |

| | | |

| | | (b) There has been no change in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act) that occurred during the second fiscal quarter of the fiscal half-year covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting. |

| | | |

| | | |

| ITEM 12. | | EXHIBITS. | |

| | | | |

| (a) | | Exhibit 99.CERT | Certifications pursuant to Section 302 of the Sarbanes-Oxley |

| | | | Act of 2002 |

| | | | |

| (b) | | Exhibit 99.906CERT | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| | | | |

| | | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (Registrant) | DNP SELECT INCOME FUND INC. |

| | |

| By (Signature and Title)* | /s/ NATHAN I. PARTAIN |

| |

| |

| | Nathan I. Partain |

| | President and Chief Executive Officer |

| | |

Date | March 2, 2007 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title)* | /s/ NATHAN I. PARTAIN |

| |

| |

| | Nathan I. Partain |

| | President and Chief Executive Officer |

| | |

Date | March 2, 2007 |

| | |

| | |

| By (Signature and Title)* | /s/ JOSEPH C. CURRY, JR. |

| |

| |

| | Joseph C. Curry, Jr. |

| | Senior Vice President and Treasurer (principal financial officer) |

| | |

| Date | March 2, 2007 |

* Print the name and title of each signing officer under his or her signature.