UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Section 240.14a-12 |

DNP Select Income Fund Inc.

Duff & Phelps Utility and Infrastructure Fund Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

DNP SELECT INCOME FUND INC.

DUFF & PHELPS UTILITY AND INFRASTRUCTURE FUND INC.

200 S. Wacker Drive, Suite 500

Chicago, Illinois 60606

(800) 338-8214

NOTICE OF JOINT ANNUAL MEETING OF SHAREHOLDERS

March 8, 2021

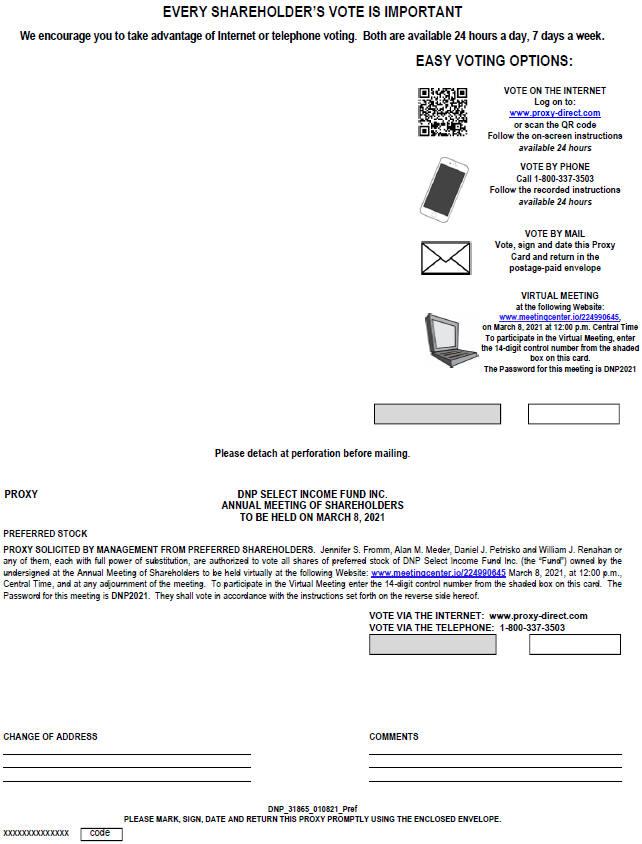

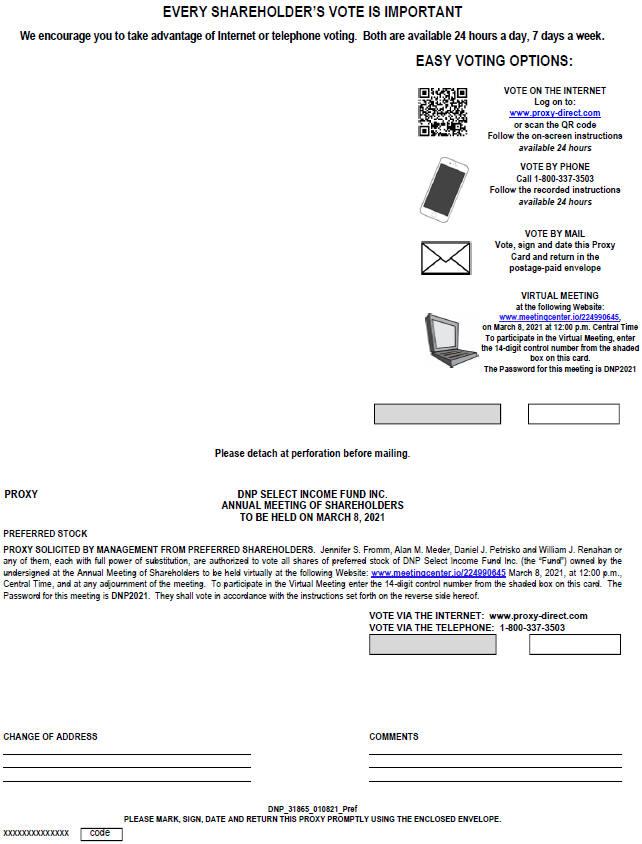

The annual meeting of shareholders of each of DNP Select Income Fund Inc. (“DNP”) and Duff & Phelps Utility and Infrastructure Fund Inc. (“DPG” and, together with DNP, the “Funds”) will be held on March 8, 2021 at 12:00 p.m., Central Time, conducted solely online via webcast. You will be able to virtually attend and participate in the annual meeting online, vote your shares electronically and submit your questions prior to and during the meeting by visiting: www.meetingcenter.io/224990645 at the meeting date and time described in the accompanying proxy statement. To participate in the annual meeting, you will need to log on using the control number from your proxy card or meeting notice. The control number can be found in the shaded box. The password for the meeting is DNP2021. There is no physical location for the annual meeting.

The annual meeting will be held to:

| | 1. | Elect directors of each Fund in the following manner: |

| | a. | Elect Eileen A. Moran as a director of DNP by the holders of DNP’s common stock, voting as a separate class; |

| | b. | Elect Donald C. Burke as a director of DNP by the holders of DNP’s preferred stock, voting as a separate class; |

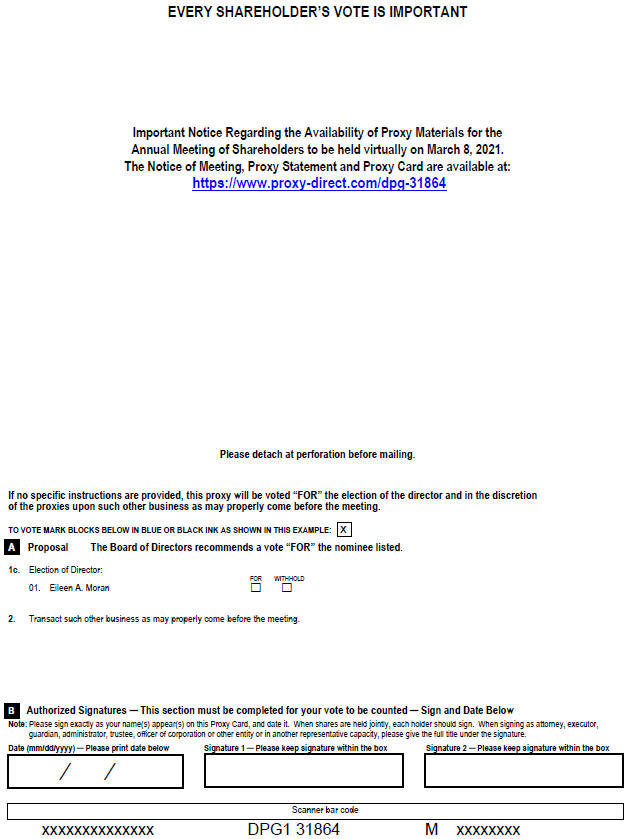

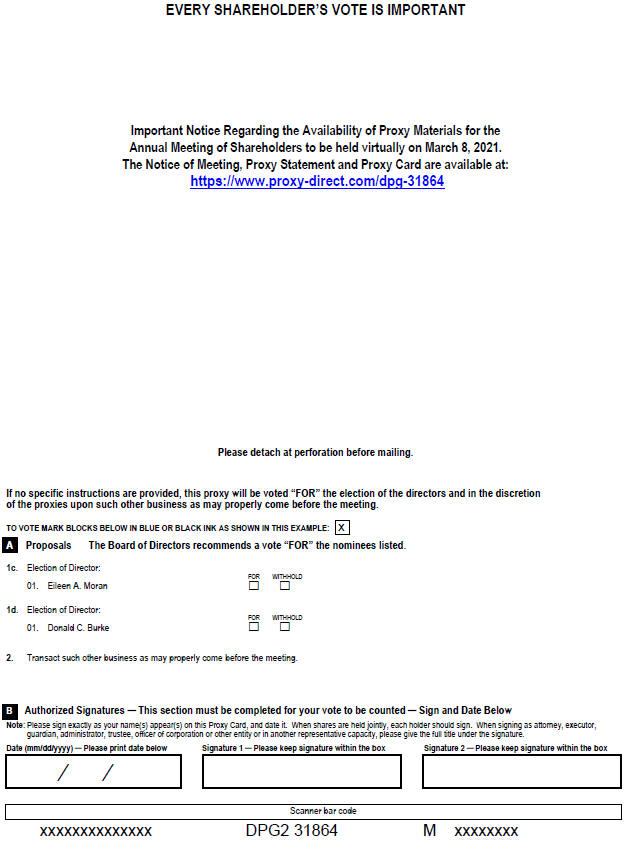

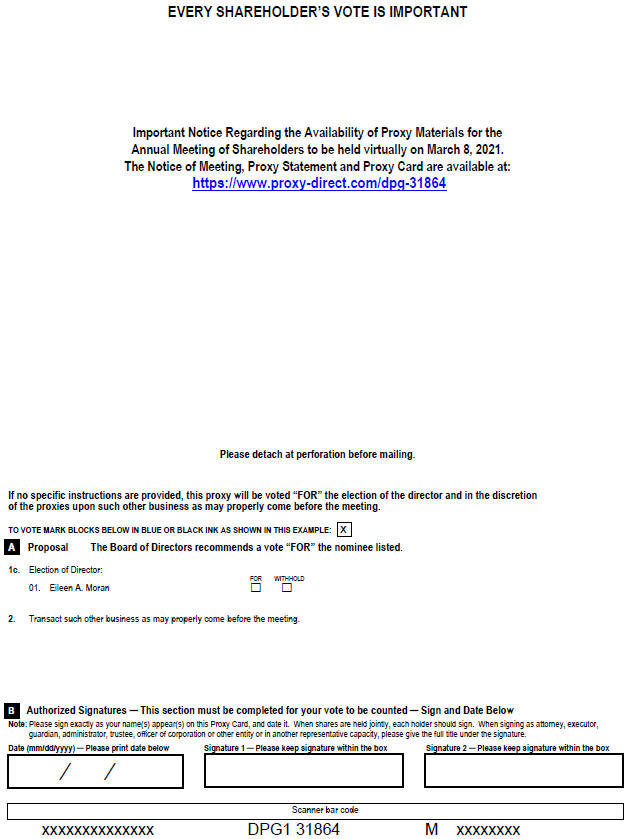

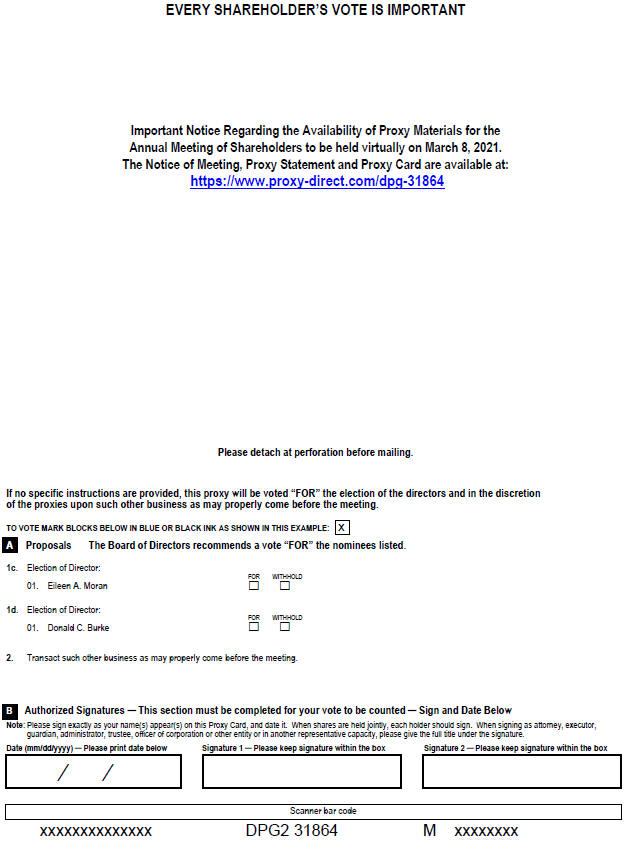

| | c. | Elect Eileen A. Moran as a director of DPG by the holders of DPG’s common and preferred stock, voting together as a single class; and |

| | d. | Elect Donald C. Burke as a director of DPG by the holders of DPG’s preferred stock, voting as a separate class. |

| | 2. | Transact such other business as may properly come before the meeting, or any adjournment or postponement thereof. |

Shareholders of record at the close of business on January 19, 2021 are entitled to vote at the meeting.

For the Board of Directors of each of the Funds,

JENNIFER S. FROMM, Secretary

January 22, 2021

SHAREHOLDERS, WE NEED YOUR PROXY VOTE IMMEDIATELY.

YOUR VOTE IS VITAL. THE JOINT MEETING OF SHAREHOLDERS WILL HAVE TO BE ADJOURNED WITHOUT CONDUCTING ANY BUSINESS IF FEWER THAN A MAJORITY OF THE SHARES ELIGIBLE TO VOTE ARE REPRESENTED. IN THAT EVENT, ONE OR MORE OF THE FUNDS WOULD ADJOURN THE MEETING AND CONTINUE TO SOLICIT VOTES IN AN ATTEMPT TO OBTAIN A QUORUM. TO AVOID THE EXPENSE OF AND THE POSSIBLE DELAY CREATED BY SUCH A SOLICITATION, PLEASE VOTE YOUR PROXY IMMEDIATELY. YOU AND ALL OTHER SHAREHOLDERS WILL BENEFIT FROM YOUR COOPERATION.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on March 8, 2021: The proxy statement for the 2021 annual meeting, the form of proxy card and the annual report for the most recently ended fiscal year are available to DNP shareholders at www.dpimc.com/dnp and to DPG shareholders at www.dpimc.com/dpg. There is no physical location for the annual meeting so you cannot attend in person. If you have questions regarding how to access the virtual meeting, please contact the administrator for DNP at (833) 604-3163 (toll-free) or fa@rwbaird.com or the administrator for DPG at (866) 270-7598 (toll-free) or duff@virtus.com.

JOINT PROXY STATEMENT

The board of directors (the “Board”) of each of DNP Select Income Fund Inc. (“DNP”) and Duff & Phelps Utility and Infrastructure Fund Inc. (“DPG” and, together with DNP, the “Funds”) is soliciting proxies from the shareholders of each Fund for use at the joint annual meeting of shareholders to be held on Monday, March 8, 2021 and at any adjournment or postponement of that meeting. A proxy may be revoked at any time before it is voted, either by voting at the meeting or by written notice to the applicable Fund or delivery of a later-dated proxy.

The meeting is scheduled as a joint meeting of the respective shareholders of the Funds because the shareholders of each Fund are expected to consider and vote on similar matters. The Board has determined that the use of a joint proxy statement for the meeting is in the best interest of the shareholders of each Fund. In the event that any shareholder of a Fund virtually present at the meeting objects to the holding of a joint meeting, raises a reasonable basis for the objection, and moves for an adjournment of such Fund’s meeting to a time immediately after the meeting, so that such Fund’s meeting may be held separately, the persons named as proxies will vote in favor of such adjournment. Shareholders of each Fund will vote separately on each of the proposals relating to their respective Fund, and an unfavorable vote on a proposal by the shareholders of one Fund will not affect the implementation by the other Fund of such proposal if the shareholders of such other Fund approve the proposal.

Summary of Proposals to Be Voted Upon

| | | | |

| Proposal | | Fund and Classes of Shareholders Entitled to Vote |

| 1a. | | Election of Eileen A. Moran as a director of DNP | | DNP common stock |

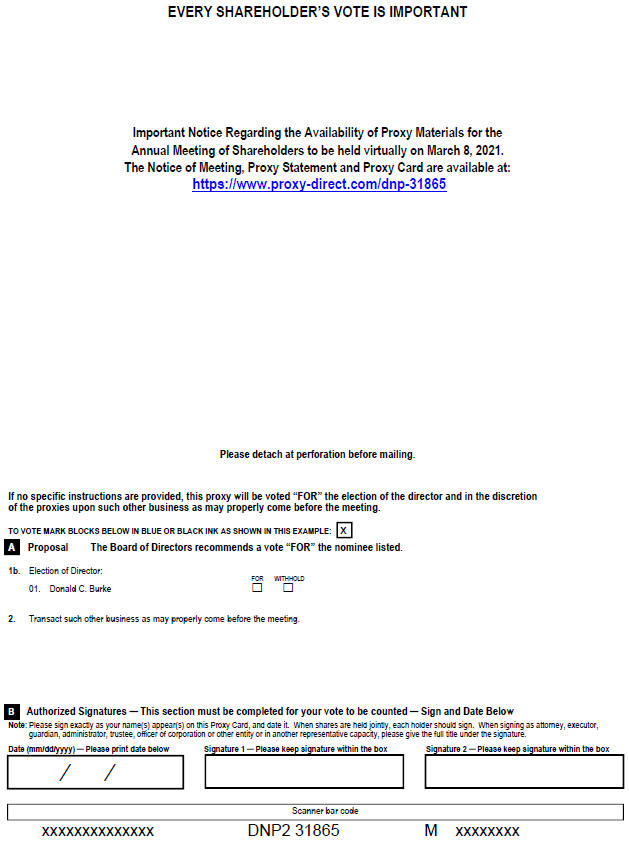

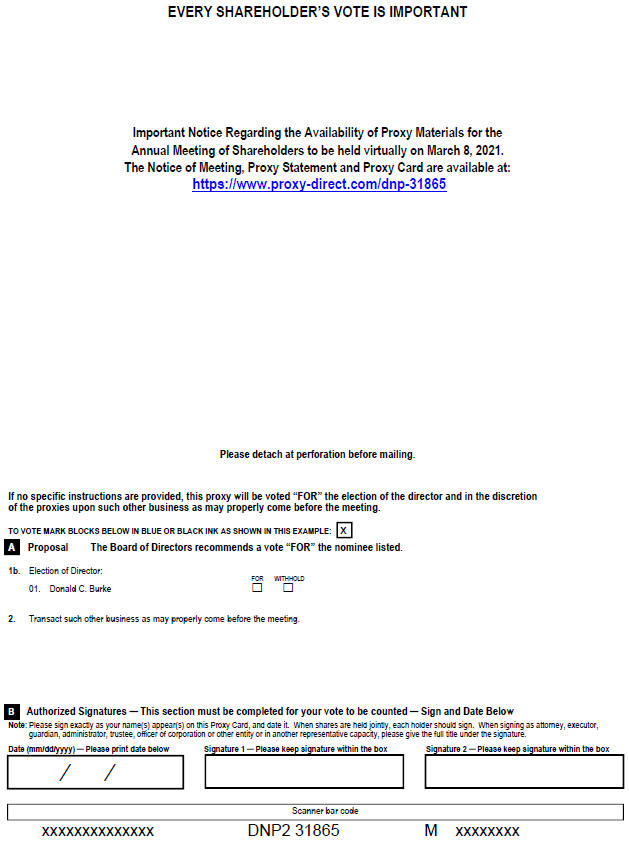

| 1b. | | Election of Donald C. Burke as a director of DNP | | DNP preferred stock |

| 1c. | | Election of Eileen A. Moran as a director of DPG | | DPG common and preferred stock |

| 1d. | | Election of Donald C. Burke as a director of DPG | | DPG preferred stock |

Shareholders of record of each Fund at the close of business on January 19, 2021 are entitled to notice of and to participate in the meeting. On the record date: DNP had 309,302,549 shares of common stock outstanding and 3,000 shares of preferred stock outstanding and DPG had 37,929,806 shares of common stock outstanding and 3,200,000 shares of preferred stock outstanding. Each share of common stock outstanding on the record date entitles the holder thereof to one vote for each director being elected by the common stock (with no cumulative voting permitted) and to one vote on each other matter. Each share of preferred stock outstanding on the record date entitles the holder thereof to one vote for each director being elected by the preferred stock (with no cumulative voting permitted) and to one vote on each other matter.

This proxy statement is first being mailed on or about January 22, 2021. The Funds will bear the cost of the annual meeting and this proxy solicitation.

1. ELECTION OF DIRECTORS

The Board of each Fund is responsible for the overall management and operations of that Fund. As of the date of this joint proxy statement, the Board of each Fund is comprised of seven directors. Directors of each Fund are divided into three classes and are elected to serve staggered three-year terms.

1

The persons named in the enclosed proxy intend to vote in favor of the election of the persons named below (unless otherwise instructed). Each of the nominees has consented to serve as a director of the Funds, if elected. In case any of the nominees should become unavailable for election for any unforeseen reason, the persons designated in the proxy will have the right to vote for a substitute.

Upcoming Director Retirement

Pursuant to the Funds’ director retirement policy, Robert J. Genetski will be retiring from the Board at the end of the annual meeting of shareholders on March 8, 2021. Dr. Genetski has been a director of DNP since 2001 and of DPG since 2011. The Funds express deep appreciation to Dr. Genetski for his many years of dedicated service and wish him well in his retirement.

When Dr. Genetski retires from the Board at the annual meeting of shareholders, the size of the Board will be reduced from seven to six. In the future, the Board may decide to increase the size of the Board if doing so would improve the overall diversity of backgrounds, experiences and/or skills of the Board members.

Dr. Genetski has served as one of two directors elected by the holders of the Funds’ preferred stock. Because the holders of the Funds’ preferred stock are entitled to elect two directors at all times, the Board has nominated Donald C. Burke, an incumbent director whose current term is expiring this year, for election at this year’s annual meeting by the holders of preferred stock of each Fund, voting as a separate class.

Election of DNP Directors (Proposal 1a. and 1b.)

At the meeting, holders of DNP common stock are entitled to elect one director for a term ending in 2024 and the holders of DNP preferred stock are entitled to elect one director for a term ending in 2024, in each case to serve until the annual meeting of shareholders in that year and until their respective successors are elected and qualified. A plurality of votes cast at the meeting by the holders of DNP common stock as to the director representing the common stock is necessary to elect that director. A plurality of votes cast at the meeting by the holders of DNP preferred stock as to the director representing the preferred stock is necessary to elect that director. Abstentions and broker-non-votes will be counted for purposes of determining whether a quorum is present at the meeting, but will not affect the determination of whether a director candidate has received a plurality of votes cast.

Election of DPG Directors (Proposal 1c. and 1d.)

At the meeting, holders of DPG common and preferred stock, voting as a single class, are entitled to elect one director for a term ending in 2024 and the holders of DPG preferred stock, voting as a separate class, are entitled to elect one director for a term ending in 2024, in each case to serve until the annual meeting of shareholders in that year and until their respective successors are elected and qualified. A plurality of votes cast at the meeting by the holders of DPG common and preferred stock, voting as a single class, as to the director representing the common and preferred stock is necessary to elect that director. A plurality of votes cast at the meeting by the holders of DPG preferred stock as to the director representing the preferred stock is necessary to elect that director. Abstentions and broker-non-votes will be counted for purposes of determining whether a quorum is present at the meeting, but will not affect the determination of whether a director candidate has received a plurality of votes cast.

2

Biographical Information about Nominees and Continuing Directors

Set forth in the table below are the names and certain biographical information about the nominees for the position of director and the continuing directors of the Funds. Except as noted:

| | • | | all of the directors are elected to the DNP Board by the holders of DNP common stock voting as a separate class; and |

| | • | | all of the directors are elected to the DPG Board by the holders of DPG common and preferred stock voting as a single class. |

In addition to the Funds, all of the Funds’ directors also serve on the board of directors of Duff & Phelps Utility and Corporate Bond Trust Inc. (“DUC”) and DTF Tax-Free Income Inc. (“DTF”). All of the directors of the Funds, with the exception of Mr. Partain, are classified as independent directors because none of them are “interested persons” of the Funds, as defined in the Investment Company Act of 1940 (the “1940 Act”). Mr. Partain is an “interested person” of the Fund by reason of his position as President and Chief Executive Officer of the Fund, and because prior to January 1, 2021, he served as President, Chief Investment Officer and employee of the Funds’ investment adviser, Duff & Phelps Investment Management Co. (the “Adviser”). The term “Fund Complex” refers to the Funds and all other investment companies advised by affiliates of Virtus Investment Partners, Inc. (“Virtus”), the Adviser’s parent company. The address for all directors is c/o Duff & Phelps Investment Management Co., 200 South Wacker Drive, Suite 500, Chicago, Illinois 60606.

| | | | | | | | | | | | |

Name, Address and Age | | Positions

Held

with Funds | | Term of

Office and

Length of

Time Served | | Principal

Occupation(s)

During Past

5 Years &

Qualifications | | Number of

Portfolios in

Fund Complex

Overseen by

Director | | | Other

Directorships

Held

by the Director

During Past 5 Years |

Nominees—Independent Directors |

| | | | | |

Donald C. Burke(1)(2) Age: 60 | | Director | | Nominee for term expiring in 2024; Director of DNP and DPG since 2014. | | Private investor since 2009; President and Chief Executive Officer, BlackRock U.S. Funds 2007-2009; Managing Director, BlackRock Inc. 2006-2009; Managing Director, Merrill Lynch Investment Managers 1990-2006 | | | 72 | | | Director, Avista Corp. (energy company); Trustee, Goldman Sachs Fund Complex 2010-2014; Director, BlackRock Luxembourg and Cayman Funds 2006-2010 |

| |

| | Mr. Burke was selected to serve on the Board because of his extensive experience with mutual funds, including as president and chief executive officer of a major fund complex, and subsequently as an independent trustee of another major fund complex, and because of his knowledge of the utility industry derived from his service on the board of a public company involved in the production, transmission and distribution of energy. |

3

| | | | | | | | | | | | |

Name, Address and Age | | Positions

Held

with Funds | | Term of

Office and

Length of

Time Served | | Principal

Occupation(s)

During Past

5 Years &

Qualifications | | Number of

Portfolios in

Fund Complex

Overseen by

Director | | | Other

Directorships

Held

by the Director

During Past 5 Years |

| | | | | |

Eileen A. Moran Age: 66 | | Director and Vice Chairperson of the Board | | Nominee for term expiring in 2024; Director of DNP since 1996 and of DPG since 2011 | | Private investor since 2011; President and Chief Executive Officer, PSEG Resources L.L.C. (investment company) 1990-2011 | | | 4 | | | |

| |

| | Ms. Moran was selected to serve on the Board because of her experience in managing a large portfolio of assets, a significant portion of which were invested in the electric and natural gas utility industry. |

Continuing Directors—Independent Directors |

| | | | | |

Philip R. McLoughlin Age: 74 | | Director | | Term expires 2022; Director of DNP since 2009 and of DPG since 2011 | | Private investor since 2010; Partner, CrossPond Partners, LLC (investment management consultant) 2006-2010; Managing Director, SeaCap Partners LLC (strategic advisory firm) 2009-2010 | | | 72 | | | Chairman of the Board, Lazard World Trust Fund (closed-end fund; f/k/a The World Trust Fund) 2010-2019 (Director 1991-2019) |

| |

| | Mr. McLoughlin was selected to serve on the Board because of his understanding of asset management and mutual fund operations and strategy gained from his experience as chief executive officer of an asset management company and chief investment officer of an insurance company. |

| | | | | |

Geraldine M. McNamara(1)(2) Age: 69 | | Director | | Term expires 2023; Director of DNP since 2009 and of DPG since 2011 | | Private investor since 2006; Managing Director, U.S. Trust Company of New York 1982-2006 | | | 72 | | | |

| |

| | Ms. McNamara was selected to serve on the Board because her experience of advising individuals on their personal financial management has given her an enhanced understanding of the goals and expectations that individual investors bring to the Funds. |

4

| | | | | | | | | | |

Name, Address and Age | | Positions

Held

with Funds | | Term of

Office and

Length of

Time Served | | Principal

Occupation(s)

During Past

5 Years &

Qualifications | | Number of

Portfolios in

Fund Complex

Overseen by

Director | | Other

Directorships

Held

by the Director

During Past 5 Years |

| | | | | |

David J. Vitale Age: 74 | | Director and Chairman of the Board | | Term expires 2023; Director of DNP since 2000 and of DPG since 2011 | | Advisor, Ariel Investments, LLC since 2019; Chairman, Urban Partnership Bank 2010-2019; President, Chicago Board of Education 2011-2015; Senior Advisor to the CEO, Chicago Public Schools 2007-2008 (Chief Administrative Officer 2003-2007); President and Chief Executive Officer, Board of Trade of the City of Chicago, Inc. 2001-2002; Vice Chairman and Director, Bank One Corporation 1998-1999; Vice Chairman and Director, First Chicago NBD Corporation, and President, The First National Bank of Chicago 1995-1998; Vice Chairman, First Chicago Corporation and The First National Bank of Chicago 1993-1998 (Director 1992-1998; Executive Vice President 1986-1993) | | 4 | | Director, United Continental Holdings, Inc. (airline holding company); Ariel Investments, LLC; Wheels, Inc. (automobile fleet management) and Chairman, Urban Partnership Bank 2010-2019 |

| |

| | Mr. Vitale was selected to serve on the Board because of his extensive experience as an executive in both the private and public sector, his experience serving as a director of other public companies and his knowledge of financial matters, capital markets, investment management and the utilities industry. |

5

| | | | | | | | | | |

Name, Address and Age | | Positions

Held

with Funds | | Term of

Office and

Length of

Time Served | | Principal

Occupation(s)

During Past

5 Years &

Qualifications | | Number of

Portfolios in

Fund Complex

Overseen by

Director | | Other

Directorships

Held

by the Director

During Past 5 Years |

Continuing Director—Interested Director |

| | | | | |

Nathan I. Partain, CFA Age: 64 | | President, Chief Executive Officer and Director | | Term expires 2022; Director of DNP since 2007 and of DPG since

2011 | | Consultant to the Adviser since January 2021 (President and Chief Investment Officer of the Adviser 2005-December 2020; Executive Vice President 1997-2005); Director of Utility Research, Duff & Phelps Investment Research Co. 1989-1996 (Director of Equity Research 1993-1996 and Director of Fixed Income Research 1993); President and Chief Executive Officer of DNP since 2001 (Chief Investment Officer 1998-2017; Executive Vice President 1998-2001; Senior Vice President 1997-1998); President and Chief Executive Officer of DUC and DTF since 2004 and of DPG since 2011 | | 4 | | Chairman of the Board and Director, Otter Tail Corporation (manages diversified operations in the electric, plastics, manufacturing and other business operations sectors) |

| |

| | Mr. Partain was selected to serve on the Board because of his significant knowledge of the Funds’ operations as Chief Executive Officer of the Funds and President of the Adviser, and because of his experience serving as a director of another public utility company and chairman of its board and audit committee. |

| (1) | Elected (or nominated to be elected) to the DNP Board by the holders of DNP preferred stock, voting as a separate class. |

| (2) | Elected (or nominated to be elected) to the DPG Board by the holders of DPG preferred stock, voting as a separate class. |

6

Board Leadership Structure

The Board believes that the most appropriate leadership structure for the Funds is for the Chairman of the Board to be an independent director, in order to provide strong, independent oversight of each Fund’s management and affairs, including each Fund’s risk management function. Accordingly, while the Chief Executive Officer of the Funds will generally be a member of the Board, he or she will not normally be eligible to serve as Chairman of the Board. The independent Chairman of the Board presides at meetings of the shareholders, meetings of the Board and meetings of independent directors. In addition, the independent Chairman of the Board takes part in the meetings and deliberations of all committees of the Board, facilitates communication among directors and communication between the Board and the Funds’ management and is available for consultation with the Funds’ management between Board meetings. The Board has four standing committees, which are described below: the executive committee, the audit committee, the contracts committee, and the nominating and governance committee.

The executive committee of the Board is currently comprised of Mr. Vitale (Chairman), Mr. Burke, Ms. McNamara and Ms. Moran, and has authority, with certain exceptions, to exercise the powers of the Board between Board meetings.

The audit committee of the Board is currently comprised of all independent directors of the Funds (Mr. Burke, Chairman) and makes recommendations regarding the selection of each Fund’s independent registered public accounting firm and meets with representatives of that accounting firm to determine the scope of and review the results of each audit and assists the Board in overseeing each Fund’s accounting, auditing, financial reporting and internal control functions.

The contracts committee of the Board is currently comprised of all independent directors of the Funds (Ms. Moran, Chairperson) and makes recommendations regarding each Fund’s contractual arrangements for investment management and administrative services, including the terms and conditions of such contracts.

The nominating and governance committee of the Board is currently comprised of all independent directors of the Funds (Ms. McNamara, Chairperson) and selects nominees for election as directors, recommends individuals to be appointed by the Board as officers of the Funds and members of Board committees and makes recommendations regarding other Fund governance and Board administration matters. The committee also oversees the Board’s continuing education program, which includes quarterly presentations for directors covering a variety of topics, including, among other topics, (i) the industries and types of investments in which the Funds invests, (ii) investment techniques utilized by the Funds, (iii) current developments in securities law and the mutual fund industry, (iv) best practices in corporate and mutual fund governance and (v) enterprise risk management, cybersecurity, and other emerging issues.

In addition to the four standing committees, the DNP Board also has a special committee called the ATM committee, which is comprised of the members of the executive committee of the DNP Board (Mr. Vitale (Chairman), Mr. Burke, Ms. McNamara and Ms. Moran) and is responsible for certain oversight functions in connection with DNP’s ongoing “at-the-market” (“ATM”) offering program.

During DNP’s fiscal year ended October 31, 2020, the DNP Board met eleven times; the DNP audit committee met two times; the DNP nominating and governance committee met three times; the DNP contracts committee met two times; the DNP executive committee did not meet or act by written consent; and the DNP ATM committee did not meet or act by written consent. During DPG’s fiscal year ended October 31, 2020, the

7

DPG Board met ten times; the DPG audit committee met two times; the DPG nominating and governance committee met three times; the DPG contracts committee met two times; and the DPG executive committee did not meet but acted once by written consent. Each director attended at least 75% in the aggregate of the meetings of the Board and of the committees on which he or she served.

Risk Oversight. The audit committee charter provides that the audit committee is responsible for discussing with management the guidelines and policies that govern the process by which management assesses and manages each Fund’s major financial risk exposures. The contracts committee charter provides that in assessing whether each Fund’s investment advisory agreement and administration agreement should be continued, the contracts committee is to give careful consideration to the risk oversight policies of the Adviser and each Fund’s administrator, respectively. In addition, the audit committee and the full Board receive periodic reports on enterprise risk management from the chief risk officer of the Adviser.

Nomination of Directors. The nominating and governance committee acts under a written charter that was most recently amended on December 17, 2020. A copy of the charter is available on each Fund’s website at www.dpimc.com/dnp, and www.dpimc.com/dpg and in print to any shareholder who requests it. None of the members of the nominating and governance committee are “interested persons” of the Funds as defined in Section 2(a)(19) of the 1940 Act. In identifying potential director nominees, the nominating and governance committee considers candidates recommended by one or more of the following sources: the Funds’ current directors, the Funds’ officers, the Funds’ shareholders and any other source the committee deems appropriate. The committee may, but is not required to, retain a third-party search firm at the Funds’ expense to identify potential candidates. Shareholders wishing to recommend candidates to the nominating and governance committee should submit such recommendations to the Secretary of the Funds, who will forward the recommendations to the committee for consideration. See also “Shareholder Proposals and Nominations” under “Other Information” below.

Criteria for Director Nominations. The goal of the Funds is to have a board of directors comprising individuals with a diversity of business, educational and life experiences (including, without limitation, with respect to accounting and finance, business and strategic judgment, investment management and financial markets, and knowledge of the industries in which the Funds invest) that will enable them to constructively review, advise and guide management of the Funds. The annual Board self-evaluation process includes consideration of whether the Board’s composition represents an appropriate balance of skills and diversity for the Funds’ needs. In evaluating potential director nominees, including nominees recommended by shareholders, the nominating and governance committee considers such qualifications and skills as it deems relevant but does not have any specific minimum qualifications that must be met by a nominee. The committee considers, among other things:

| | • | | the extent to which the candidate’s business, educational and life experiences will add to the diversity of the Board; |

| | • | | whether the candidate will qualify as a director who is not an “interested person” of the Funds; |

| | • | | the absence of any real or apparent conflict of interest that would interfere with the candidate’s ability to act in the best interests of the Funds and their shareholders; |

| | • | | the contribution that the candidate can make to the Board by virtue of his or her education, business experience and financial expertise; |

| | • | | the interplay of the candidate’s skills and experience with the skills and experience of other Board members; |

8

| | • | | whether the candidate is willing to commit the time necessary to attend meetings and fulfill the responsibilities of a director; and |

| | • | | the candidate’s personality traits, including integrity, independence, leadership, sound business judgment and the ability to work effectively with the other members of the Board. |

With respect to the renomination of incumbent directors, past service to the Board is also considered.

Diversity, Equity and Inclusion. In selecting nominees for the position of director, and in appointing officers of the Funds, the nominating and governance committee is required by its charter to consider and seek out candidates who are women or members of racial or ethnic minority groups in order to help promote diversity, equity and inclusion among the members of the Board and the officers of the Funds.

Retirement Policy. The bylaws of the Funds establish a mandatory retirement age of 78 for directors of the Funds. Specifically, no person who has attained the age of 78 years is eligible for election or reelection as a director, and no incumbent director who attains the age of 78 years is qualified to continue serving as a director following the adjournment of the next succeeding annual meeting of shareholders, and therefore his or her service on the Board will automatically terminate at such time. None of the director nominees or directors whose terms will continue after the annual meeting are 78 years or older as of the date of this proxy statement or will be 78 years or older as of the scheduled date of the annual meeting.

Officers of the Funds

The officers of the Funds are elected at the annual meeting of the Board held in connection with the annual meeting of shareholders. The officers receive no compensation from the Funds, but are also officers of the Adviser or a Fund administrator, or are employees of an affiliate of the Adviser, and receive compensation in such capacities. Information about Nathan I. Partain, the President and Chief Executive Officer of the Funds, is provided above under the caption “Continuing Director—Interested Director.” The address for all officers listed below is c/o Duff & Phelps Investment Management Co., 200 South Wacker Drive, Suite 500, Chicago, Illinois 60606, except as noted.

9

| | | | |

Name, Address

and Age | | Position(s) Held with Funds and

Length of Time Served | | Principal Occupation(s)

During Past 5 Years |

W. Patrick Bradley, CPA Virtus Investment Partners, Inc. One Financial Plaza Hartford, CT 06103 Age: 48 | | Vice President and Assistant Treasurer of DPG since 2011 | | Executive Vice President, Fund Services, Virtus Investment Partners, Inc. since 2016 (Senior Vice President 2010-2016 and various officer positions with Virtus affiliates 2006-2009); Executive Vice President, Virtus mutual funds’ complex (68 portfolios) since 2016 (Senior Vice President 2013-2016) and Chief Financial Officer and Treasurer since 2004 (Vice President 2011-2013); Director, Virtus Global Funds, plc since 2013; Director, Virtus Global Funds, ICAV since 2019 |

| | |

Eric J. Elvekrog, CFA, CPA Age: 55 | | Vice President and Chief Investment Officer of DPG since 2016 (Portfolio Manager 2011-2016) | | Senior Managing Director of the Adviser since 2015 (Vice President 2001-2014; Assistant Vice President 1996-2001; Analyst 1993-1996) |

| | |

Jennifer S. Fromm Virtus Investment Partners, Inc. One Financial Plaza Hartford, CT 06103 Age: 47 | | Vice President and Secretary of DNP and of DPG since March 2020 | | Vice President of Virtus Investment Partners, Inc. since 2016 and Senior Counsel, Legal of Virtus Investment Partners Inc. and/or certain of its subsidiaries since 2007; Vice President, Chief Legal Officer, Counsel and Secretary of Duff & Phelps Select MLP and Midstream Energy Fund Inc., Virtus Global Multi-Sector Income Fund Inc. and Virtus Total Return Fund Inc. since 2020; Vice President of various Virtus-affiliated open-end funds since 2017 and Assistant Secretary since 2008; Vice President, Chief Legal Officer, Counsel and Secretary of Virtus Variable Insurance Trust and Virtus Alternative Solutions Trust since 2013; various officer positions of Virtus affiliates since 2008 |

| | |

Connie M. Luecke, CFA Age: 62 | | Vice President and Chief Investment Officer of DNP since 2018 | | Senior Managing Director of the Adviser since 2015 (Senior Vice President 1998-2014; Managing Director 1996-1998; various positions with an Adviser affiliate 1992-1995); Portfolio Manager, Virtus Total Return Fund Inc. since 2011; Portfolio Manager, Virtus Duff & Phelps Global Infrastructure Fund since 2004 |

10

| | | | |

Name, Address

and Age | | Position(s) Held with Funds and

Length of Time Served | | Principal Occupation(s)

During Past 5 Years |

| | |

Alan M. Meder, CFA, CPA Age: 61 | | Treasurer, Principal Financial and Accounting Officer and Assistant Secretary of DNP since 2011 (Assistant Treasurer 2010-2011); Treasurer, Principal Financial and Accounting Officer and Assistant Secretary of DPG since 2011 | | Chief Risk Officer of the Adviser since 2001 and Senior Managing Director since 2014 (Senior Vice President 1994-2014); Member, Board of Governors of CFA Institute 2008-2014 (Chair 2012-2013; Vice Chair 2011-2012); Member, Financial Accounting Standards Advisory Council 2011-2014 |

| | |

Daniel J. Petrisko, CFA Age: 60 | | Senior Vice President of DNP since 2017 and Assistant Secretary since 2015 (Vice President 2015-2016); Senior Vice President of DPG since 2017 and Assistant Secretary since 2015 | | Executive Managing Director of the Adviser since 2017 (Senior Managing Director 2014-2017; Senior Vice President 1997-2014; Vice President 1995-1997) |

| | |

William J. Renahan Age: 51 | | Chief Compliance Officer of DPG since March 2020 and Vice President of DPG since 2012 (Secretary 2015-March 2020); Chief Compliance Officer of DNP since March 2020 and Vice President of DNP since 2015 (Secretary 2015-March 2020) | | Secretary of the Adviser since 2014 and Chief Compliance Officer since 2019 (Senior Counsel 2015-2019); Senior Legal Counsel and Vice President, Virtus Investment Partners, Inc. since 2012; Managing Director, Legg Mason, Inc. (and predecessor firms) 1999-2012 |

| | |

Nikita K. Thaker Virtus Investment Partners, Inc. One Financial Plaza Hartford, CT 06103 Age: 42 | | Vice President and Assistant Treasurer of DPG since 2018 | | Assistant Vice President—Mutual Fund Accounting & Reporting, CEF Treasurer, Fund Services, Virtus Investment Partners, Inc. since 2017 and Assistant Vice President since 2015 (Director 2011-2015; Manager 2007-2011); Assistant Treasurer, Virtus closed-end funds (3 portfolios) since 2017 |

| | |

Dianna P. Wengler Robert W. Baird & Co. Incorporated 500 West Jefferson Street Louisville, KY 40202 Age: 60 | | Vice President of DNP since 2006 and Assistant Secretary since 1988 (Assistant Vice President 2004-2006) | | Senior Vice President and Director—Fund Administration, Robert W. Baird & Co. Incorporated since 2019; Senior Vice President, J.J.B. Hilliard, W.L. Lyons, LLC 2016-2019 (Vice President 1990-2015); Senior Vice President, Hilliard-Lyons Government Fund, Inc. 2006-2010 (Vice President 1998-2006; Treasurer 1988-2010) |

11

The following table provides certain information relating to the equity securities beneficially owned by each director or director nominee as of October 31, 2020, (i) in DNP, (ii) in DPG and (iii) on an aggregate basis, in any registered investment companies overseen or to be overseen by the director or nominee within the same family of investment companies as the Funds, in each case based on information provided to the Funds, including information furnished by the Funds’ service providers.

| | | | | | |

| | | Dollar Range of

Equity Securities

Owned in DNP | | Dollar Range of

Equity Securities

Owned in DPG | | Aggregate Dollar

Range of Equity

Securities in

All Funds

Overseen or to

be Overseen

by Director or

Nominee in

Family of

Investment

Companies |

Independent Directors | | | | | | |

Donald C. Burke | | $50,001–$100,000 | | $10,001–$50,000 | | Over $100,000 |

Philip R. McLoughlin | | Over $100,000 | | $10,001–$50,000 | | Over $100,000 |

Geraldine M. McNamara | | Over $100,000 | | $50,001–$100,000 | | Over $100,000 |

Eileen A. Moran | | $10,001–$50,000 | | $50,001–$100,000 | | Over $100,000 |

David J. Vitale | | $10,001–$50,000 | | $50,001–$100,000 | | $50,001–$100,000 |

| | | |

Interested Director | | | | | | |

Nathan I. Partain | | Over $100,000 | | $10,001–$50,000 | | Over $100,000 |

Based on information provided to the Funds, including information furnished by the Funds’ service providers, as of October 31, 2020, none of the independent directors, or their immediate family members, owned any securities of the Adviser or any person (other than a registered investment company) directly or indirectly controlling, controlled by or under common control with the Adviser.

The following table sets forth the aggregate compensation paid to each director by each Fund with respect to its most recently completed fiscal year and by the Fund Complex with respect to the fiscal year ended October 31, 2020.

COMPENSATION TABLE(1)

| | | | | | | | | | | | | | | | | | | | |

Name of Director | | Aggregate

Compensation

from DNP | | | Aggregate

Compensation

from DPG | | | Aggregate

Compensation

from DUC

and DTF | | | Aggregate

Compensation

from Other Funds

in Fund Complex(2) | | | Total Compensation

from Fund Complex

Paid to Directors(2) | |

Independent Directors | | | | | | | | | | | | | | | | | | | | |

Donald C. Burke | | $ | 68,522 | | | $ | 13,023 | | | $ | 10,455 | | | $ | 280,000 | | | $ | 372,000 | |

Philip R. McLoughlin | | | 62,563 | | | | 11,891 | | | | 9,546 | | | | 521,250 | | | | 605,250 | |

Geraldine M. McNamara | | | 68,522 | | | | 13,023 | | | | 10,455 | | | | 280,000 | | | | 372,000 | |

Eileen A. Moran | | | 68,522 | | | | 13,023 | | | | 10,455 | | | | — | | | | 92,000 | |

David J. Vitale | | | 99,803 | | | | 18,969 | | | | 15,228 | | | | — | | | | 134,000 | |

| | | | | |

Interested Director | | | | | | | | | | | | | | | | | | | | |

Nathan I. Partain | |

| —

|

| | | — | | |

| —

|

| |

| —

|

| |

| —

|

|

| (1) | Because each director serves as a director of each of DNP, DPG, DUC and DTF, directors receive a single set of fees as remuneration for their service to all four funds: (i) each director not affiliated with the Adviser |

12

| | receives a retainer fee of $84,000 per year; (ii) the chairpersons of the audit committee, contracts committee and nominating and governance committee each receive an additional retainer fee of $8,000 per year; and (iii) the Chairman of the Board receives an additional retainer fee of $50,000 per year. Directors and officers affiliated with the Adviser receive no compensation from the Funds for their services as such. In addition to the amounts shown in the table above, all directors and officers who are not interested persons of the Funds or the Adviser or affiliated with a Fund administrator are reimbursed for the expenses incurred by them in connection with their attendance at a meeting of the Board or a committee of the Board. The Funds do not have a pension or retirement plan applicable to their directors or officers. |

| (2) | Please refer to the table on the preceding pages for the number of investment companies in the Fund Complex overseen by each director. As noted in the table, in addition to DNP, DPG, DUC and DTF, Mr. Burke, Mr. McLoughlin and Ms. McNamara each oversee 68 additional funds that are advised by affiliates of Virtus. |

The Board of each of the Funds, including all of the independent directors, unanimously recommends a vote “FOR” the election of the two nominees for director named above.

OTHER BUSINESS

Management is not aware of any other matters that will come before the meeting. If any other business should come before the meeting, however, your proxy, if signed and returned, will give discretionary authority to the persons designated in it to vote according to their best judgment.

OTHER INFORMATION

The Adviser. Duff & Phelps Investment Management Co. acts as investment adviser for each Fund. The address of the Adviser is 200 S. Wacker Drive, Suite 500, Chicago, Illinois 60606. The Adviser (together with its predecessor) has been in the investment management business for more than 75 years and, as of December 31, 2020, had approximately $10.6 billion in client accounts under discretionary management. The Adviser is an indirect, wholly-owned subsidiary of Virtus, a public company whose common stock is traded on the NASDAQ Global Market under the trading symbol “VRTS.”

The Administrators. Robert W. Baird & Co. Incorporated (“Baird”) serves as administrator of DNP. The address of Baird is 500 West Jefferson Street, Louisville, KY 40202. Founded in 1919, Baird is an employee-owned, international financial services firm. Baird provides private wealth management, asset management, investment banking, capital markets and private equity services to clients through its offices in the United States, Europe and Asia.

Virtus Fund Services, LLC (“Virtus Fund Services”) serves as DPG’s administrator. The address of Virtus Fund Services is One Financial Plaza, Hartford, CT 06103. Virtus Fund Services is an indirect, wholly-owned subsidiary of Virtus and acts as administrator and/or transfer agent to registered investment companies, including DPG.

Shareholders. The following table shows shares of common stock of the Funds as to which each director and director nominee, and all directors and executive officers of the Funds as a group, had or shared power over voting or disposition at October 31, 2020. The directors, director nominees and executive officers of the Funds owned no shares of preferred stock of any of the Funds. Shares are held with sole power over voting and

13

disposition except as noted. The shares of common stock held by each of the persons listed below and by all directors and executive officers as a group represented less than 1% of the outstanding common stock of each Fund.

| | | | |

| | | Shares of

DNP common stock | | Shares of

DPG common stock |

Donald C. Burke(1) | | 5,200 | | 2,600 |

Robert J. Genetski | | 70,100 | | 6,900 |

Philip R. McLoughlin | | 11,353 | | 4,256 |

Geraldine M. McNamara(1) | | 10,111 | | 5,352 |

Eileen A. Moran | | 1,331 | | 5,525 |

Nathan I. Partain(1)(2) | | 101,748 | | 3,845 |

David J. Vitale(2) | | 24,406 | | 11,000 |

Directors and executive officers as a group(1)(2)(3) | | 167,350 | | 47,995 |

| (1) | Mr. Burke had shared power to vote and/or dispose of 5,200 of the DNP shares and 2,600 of the DPG shares listed as owned by him. Ms. McNamara had shared power to vote and/or dispose of 10,111 of the DNP shares and 5,352 of the DPG shares listed as owned by her. Mr. Partain had shared power to vote and/or dispose of 24,538 of the DNP shares and 3,845 of the DPG shares listed as owned by him. Mr. Vitale had shared power to vote and/or dispose of 23,281 of the DNP shares and 6,000 of the DPG shares listed as owned by him. The directors and executive officers, in the aggregate, had shared power to vote and/or dispose of 58,557 of the DNP shares and 16,169 of the DPG shares listed as owned by the directors and executive officers as a group. |

| (2) | Mr. Partain disclaims beneficial ownership of 24,538 of the DNP shares listed as owned by him. Mr. Vitale disclaims beneficial ownership of 23,281 of the DNP shares and 6,000 of the DPG shares listed as owned by him. The directors and executive officers, in the aggregate, disclaim beneficial ownership of 47,819 of the DNP shares and 6,000 of the DPG shares listed as owned by the directors and executive officers as a group. |

| (3) | The group of directors and executive officers consists of 12 and 13 individuals for DNP and DPG, respectively. |

14

To the Funds’ knowledge, as of the date of this proxy statement, the only persons (including any “group” as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934 (the “1934 Act”)) who beneficially own more than 5% of any class of any Fund’s voting securities (as determined in accordance with Rule 13d-3 under the 1934 Act) are the persons identified in the following table. Except as otherwise indicated, the information in this table is based on information provided in Schedule 13D and 13G filings made with the Securities and Exchange Commission by each of the persons listed.

| | | | | | | | | | | | |

Fund | | Name of Beneficial Owner | | Class of Shares | | Number of

Shares | | | Percentage

of Class | |

DNP | | Metropolitan Life Insurance Company (“MLIC”) and certain affiliated entities advised by MLIC or MetLife Investment Management, LLC(1) | | Preferred stock | | | 1,738 | | | | 57.93% | |

| | 10 Park Avenue, Morristown, New Jersey 07962 | | | | | | | | | | |

| | | | |

| | MetLife Insurance K.K. (“MLJ”) 1-3, Kioichi, Chiyoda-ku, Tokyo, 102-8525 Japan | | | | | | | | | | |

| | | | |

| | MetLife Reinsurance Company of Charleston (“MRCC”) 1095 Avenue of the Americas, New York, New York 10036 | | | | | | | | | | |

| | | | |

| | Metropolitan Tower Life Insurance Company 200 Park Avenue, New York, New York 10166 (“MTLIC”) | | | | | | | | | | |

| | | | |

DNP | | American International Group Inc. (“AIG”) and certain entities advised by AIG Asset Management (U.S.), LLC (“AAM”)(2) | | Preferred stock | | | 660 | | | | 22.00% | |

| | 2929 Allen Parkway, Houston, Texas 77019 | | | | | | | | | | |

| | | | |

| | American General Life Insurance Company (“AGLIC”) 2727-A Allen Parkway, Houston, Texas 77019 | | | | | | | | | | |

15

| | | | | | | | | | | | |

Fund | | Name of Beneficial Owner | | Class of Shares | | Number of

Shares | | | Percentage

of Class | |

| | The United States Life Insurance Company in the City of New York (“USLIC”) 2727-A Allen Parkway, Houston, Texas 77019 | | | | | | | | | | |

| | | | |

| | The Variable Annuity Life Insurance Company (“VALIC”) 2929 Allen Parkway, Houston, Texas 77019 | | | | | | | | | | |

| | | | |

DNP | | Voya Financial, Inc. (“Voya Financial”) and certain entities advised by Voya Investment Management, LLC(3) | | Preferred stock | | | 480 | | | | 16.00 | % |

| | 5780 Powers Ferry Road, NW, Atlanta, Georgia 30327 | | | | | | | | | | |

| | | | |

| | Voya Retirement Insurance and Annuity Company (“VRIAC”) One Orange Way, Windsor, Connecticut 06095 | | | | | | | | | | |

| | | | |

| | Voya Insurance and Annuity Company (“VIAC”) 909 Locust Street, Des Moines, Iowa 50309 | | | | | | | | | | |

| | | | |

DPG | | Metropolitan Life Insurance Company and certain affiliated entities advised by MLIC or MetLife Investment Advisors, LLC(4) | | Preferred stock | | | 2,720,000 | | | | 85.00 | % |

| | 10 Park Avenue, Morristown, New Jersey 07962 | | | | | | | | | | |

| | | | |

| | MetLife Insurance K.K. (“MLIKK”) 4-1-3, Tahei, Sumida-ku, Tokyo, 130-0012 Japan | | | | | | | | | | |

| | | | |

| | Metropolitan Life Insurance Company 1095 Avenue of the Americas, New York, New York 10036 | | | | | | | | | | |

| | | | |

| | Metropolitan Tower Life Insurance Company (“MTLIC”) 1095 Avenue of the Americas, New York, New York 10036 | | | | | | | | | | |

| | | | |

DPG | | Brighthouse Financial, Inc.(5) 11225 North Community House Road, Charlotte, North Carolina 28277 | | Preferred stock | | | 480,000 | | | | 15.00 | % |

| (1) | Based on information provided by or on behalf of such entities, (i) MLIC, MLJ, MRCC and MTLIC, respectively, have sole voting and dispositive power over 1008, 400, 265 and 65 of the shares listed (representing, respectively, 33.60%, 13.33%, 8.83% and 2.17% of the class) and (ii) each such entity disclaims beneficial ownership of all shares other than those set forth with respect to it in clause (i) of this note. |

| (2) | Based information provided by or on behalf of the following entities as well as information derived from a Form 4 filed on March 1, 2019 and a Schedule 13G/A filed by AIG on December 31, 2019, (i) AAM has |

16

| | shared voting and dispositive power over 660 of the shares listed (representing 22.00% of the class), (ii) AGLIC, USLIC and VALIC, respectively, have shared voting and dispositive power over 640, 10 and 10 of the shares listed (representing, respectively, 21.33%, 0.33% and 0.33% of the class) and (iii) each of AGLIC, USLIC and VALIC disclaims beneficial ownership of all shares other than those set forth with respect to it in clause (ii) of this note. |

| (3) | Based on a Schedule 13G filed by Voya Financial on October 14, 2016 and information provided by or on behalf of the following entities, (i) VRIAC and VIAC, respectively, have sole voting and dispositive power over 380 and 100 of the shares listed (representing, respectively, 12.67% and 3.33% of the class) and (ii) each such entity disclaims beneficial ownership of all shares other than those set forth with respect to it in clause (i) of this note. |

| (4) | Based on information provided by or on behalf of such entities, (i) MLIKK, MLIC and MTLIC, respectively, have sole voting and dispositive power over 1,184,000, 1,256,000 and 280,000 of the shares listed (representing, respectively, 37.00%, 39.25% and 8.75% of the class) and (ii) each such entity disclaims beneficial ownership of all shares other than those set forth with respect to it in clause (i) of this note. |

| (5) | Based on publicly available information and information provided by or on behalf of Brighthouse Financial, Inc. and its subsidiary, Brighthouse Life Insurance Company (formerly known as MetLife Insurance Company USA). |

Section 16(a) Beneficial Ownership Reporting Compliance. Section 30(h) of the 1940 Act imposes the filing requirements of Section 16 of the 1934 Act upon (i) the Funds’ directors and officers, (ii) the Funds’ investment adviser and certain of their affiliated persons and (iii) every person who is directly or indirectly the beneficial owner of more than 10% of any class of a Fund’s outstanding securities (other than short-term paper). Based solely on a review of the copies of Section 16(a) forms furnished to the Funds, or written representations that no Forms 5 were required, the Funds believe that during each Fund’s most recently completed fiscal year all such filing requirements were complied with, except that Kyle West was late in filing a Form 3 for DNP.

Report of the Audit Committee. The Funds’ independent directors comprise the audit committee of each Fund and act under a written charter which sets forth the audit committee’s responsibilities. A copy of the audit committee charter is available on each Fund’s website at www.dpimc.com/dnp and www.dpimc.com/dpg and in print to any shareholder who requests it. Each of the members of the audit committee is independent as defined in the listing standards of the New York Stock Exchange. In connection with the audit of each Fund’s 2020 audited financial statements, the audit committee: (1) reviewed and discussed each Fund’s 2020 audited financial statements with management, (2) discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T, (3) received and reviewed the written disclosures and the letter from the independent accountant required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee concerning independence, and (4) discussed with the independent accountant its independence from each Fund and its management. Based on the foregoing reviews and discussions, the audit committee recommended to the board of directors that each Fund’s audited financial statements be included in the Annual Report to Shareholders for filing with the Securities and Exchange Commission.

The Audit Committee

Donald C. Burke (Chairman)

Robert J. Genetski

Philip R. McLoughlin

17

Geraldine M. McNamara

Eileen A. Moran

David J. Vitale

Independent Registered Public Accounting Firm. The 1940 Act requires that each Fund’s independent registered public accounting firm be selected by the vote, cast in person, of a majority of the members of the Board who are not interested persons of the Fund. In addition, the listing standards of the New York Stock Exchange vest the audit committee, in its capacity as a committee of the Board, with responsibility for the appointment, compensation, retention and oversight of the work of each Fund’s independent registered public accounting firm. In accordance with the foregoing provisions, the firm of Ernst & Young LLP (“Ernst & Young”) has been selected as independent registered public accounting firm of each Fund to perform the audit of the financial books and records of the Funds for the fiscal year ending October 31, 2021. A representative of Ernst & Young is expected to be present at the joint annual meeting of shareholders and will be available to respond to appropriate questions and will have an opportunity to make a statement if the representative so desires.

Pre-Approval of Audit and Non-Audit Services. Each Fund is responsible for the appointment, compensation and oversight of the work of the independent registered public accounting firm. As part of this responsibility, each Fund’s audit committee is required to pre-approve the audit and non-audit services performed by the independent accountant in order to assure that they do not impair the independent accountant’s independence from the Fund. Accordingly, each Fund’s audit committee has adopted a joint audit and non-audit services pre-approval policy (the “Joint Audit Committee Pre-Approval Policy”), which sets forth the procedures and the conditions pursuant to which services proposed to be performed by the independent accountant may be pre-approved. Each engagement of an independent accountant to render audit or non-audit services to a Fund must be either (i) a specific service pre-approved by the Fund’s audit committee or the chairman of the audit committee, to whom the committee has delegated the authority to grant such pre-approvals between scheduled meetings of the committee, or (ii) come within the scope of a general pre-approval granted under the Joint Audit Committee Pre-Approval Policy. As provided in the Joint Audit Committee Pre-Approval Policy, unless a type of service has received general pre-approval (i.e., the proposed services are pre-approved without consideration of specific case-by-case services by the audit committee), then the service will require specific pre-approval by the audit committee if the proposed service is to be provided by the independent accountant. As provided in the Joint Audit Committee Pre-Approval Policy, any proposed services exceeding pre-approved cost levels or budgeted amounts require specific pre-approval by the audit committee. In deciding whether to grant pre-approval for such services, the audit committee, or the chairman of the audit committee acting under delegated authority, as the case may be, will consider whether such services are consistent with the SEC’s rules on auditor independence. Additionally, the audit committee, or the chairman of the audit committee acting under delegated authority, as the case may be, will also consider whether the independent accountant is best positioned to provide the most effective and efficient service, after considering a number of factors as a whole, with no one factor being necessarily determinative.

Each Fund’s audit committee is also required to pre-approve its accountant’s engagements for non-audit services rendered to the Adviser and any entity controlling, controlled by or under common control with the Adviser that provides ongoing services to the Fund, if the engagement relates directly to the operations and financial reporting of the Fund. In deciding whether to grant pre-approval for such non-audit services, the audit committee or the chairman of the audit committee, as the case may be, considers whether the provision of such non-audit services is compatible with maintaining the independence of the Fund’s accountants.

18

Audit and Non-Audit Fees. The following table sets forth the aggregate audit and non-audit fees billed to each Fund for each of the last two fiscal years for professional services rendered by Ernst & Young. For purposes of this table, to the extent the amount of a fee for a pre-approved service is known as of the date of this report, such fee amount has been allocated to the fiscal year to which the applicable service relates, even in cases where the applicable Fund has not yet been billed for such service.

| | | | | | | | |

| | | DNP | |

| | | Fiscal year

ended

October 31,

2020 | | | Fiscal year

ended

October 31,

2019 | |

Audit Fees(1) | | $ | 104,500 | | | $ | 124,500 | |

Audit-Related Fees(2)(6) | | | 0 | | | | 0 | |

Tax Fees(3)(6) | | | 19,800 | | | | 19,800 | |

All Other Fees(4)(6) | | | 0 | | | | 0 | |

Aggregate Non-Audit Fees(5)(6) | | | 19,800 | | | | 19,800 | |

| |

| | | DPG | |

| | | Fiscal year

ended

October 31,

2020 | | | Fiscal year

ended

October 31,

2019 | |

Audit Fees(1) | | $ | 54,000 | | | $ | 54,000 | |

Audit-Related Fees(2)(6) | | | 0 | | | | 0 | |

Tax Fees(3)(6) | | | 6,500 | | | | 7,895 | |

All Other Fees(4)(6) | | | 0 | | | | 0 | |

Aggregate Non-Audit Fees(5)(6) | | | 6,500 | | | | 7,895 | |

| (1) | Audit Fees are fees billed for professional services rendered by each Fund’s principal accountant for the audit of the Fund’s annual financial statements and for services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements. For DNP, for the fiscal years ended October 31, 2020 and 2019, such fees included $40,000 and $60,000, respectively, for services rendered in connection with the registration statement for DNP’s public offering. |

| (2) | Audit-Related Fees are fees billed for assurance and related services by each Fund’s principal accountant that are reasonably related to the performance of the audit of the Fund’s financial statements and are not reported under the caption “Audit Fees.” |

| (3) | Tax Fees are fees billed for professional services rendered by each Fund’s principal accountant for tax compliance, tax advice and tax planning. In both years shown in the table, such services consisted of preparation of the annual federal and state income tax returns and excise tax returns for DNP. In the case of DPG, such services consisted of review of the Fund’s annual federal and excise tax returns and preparation and analysis of state income tax returns. |

| (4) | All Other Fees are fees billed for products and services provided by each Fund’s principal accountant, other than the services reported under the captions “Audit Fees,” “Audit-Related Fees” and “Tax Fees.” |

| (5) | Aggregate Non-Audit Fees are non-audit fees billed by each Fund’s accountant for services rendered to the Fund, the Adviser and any entity controlling, controlled by or under common control with the Adviser that provides ongoing services to the Fund. During both years shown in the table, no portion of such fees related to services rendered by each Fund’s accountant to the Adviser or to any entity controlling, controlled by or under common control with the Adviser that provides ongoing services to the Fund. |

19

| (6) | No portion of these fees was approved by the audit committee after the beginning of the engagement pursuant to the waiver of the pre-approval requirement for certain de minimis non-audit services described in Section 10A of the 1934 Act and applicable regulations. |

Communications with the Board by Shareholders and Other Interested Persons. The Board has adopted the following procedures for shareholders and other interested persons to send communications to the Board. Shareholders and other interested persons may mail written communications to the full Board, to committees of the Board or to specified individual directors in care of the Secretary of the Funds, 200 S. Wacker Drive, Suite 500, Chicago, Illinois 60606. All such communications received by the Secretary will be forwarded promptly to the full Board, the relevant Board committee or the specified individual directors, as applicable, except that the Secretary may, in good faith, determine that a communication should not be so forwarded if it does not reasonably relate to the Funds or their operations, management, activities, policies, service providers, Board, officers, shareholders, or other matters relating to an investment in the Funds or is purely ministerial in nature. Each of the Funds’ directors is encouraged to attend the annual meeting of shareholders. All of the individuals who were directors of the Fund at the time of the March 9, 2020 joint annual meeting of the Funds’ shareholders were in attendance at that meeting.

Shareholder Proposals and Nominations. In order for any shareholder proposal or director nomination to be considered for inclusion in any Fund’s proxy statement and form of proxy for the 2022 annual meeting of shareholders, such proposal or nomination must be received by the Secretary of the Fund no later than September 24, 2021. Under the circumstances described in, and upon compliance with, Rule 14a-4(c) under the 1934 Act, a Fund may solicit proxies in connection with the 2022 annual meeting which confer discretionary authority to vote on any shareholder proposals of which the Secretary of the Fund does not receive notice by December 8, 2021. Any notice of a shareholder proposal or director nomination must conform to the requirements in the Fund’s bylaws. Copies of the bylaws of any of the Funds may be requested from the Secretary of the Funds, 200 S. Wacker Drive, Suite 500, Chicago, Illinois 60606.

Solicitation of Proxies. Proxies will be solicited by mail. Proxies may be solicited by Fund personnel personally or by telephone, postal mail or electronic mail, but such persons will not be specially compensated for such services. The Funds will inquire of any record holder known to be a broker, dealer, bank or other nominee as to whether other persons are the beneficial owners of shares held of record by such persons. If so, the Funds will supply additional copies of solicitation materials for forwarding to beneficial owners, and will make reimbursement for reasonable out-of-pocket costs.

Further Information About Voting and the Annual Meeting. A majority of the outstanding shares of each Fund entitled to vote at the annual shareholder meeting shall constitute a quorum for purposes of conducting business of the Fund.

The Board has fixed the close of business on January 19, 2021 as the record date for the determination of shareholders of each Fund entitled to notice of, and to vote at, the annual meeting. Shareholders of a Fund on that date will be entitled to one vote on each matter to be voted on for each share held.

Instructions regarding how to vote via telephone or the Internet are included on the enclosed proxy card. The required control number for Internet and telephone voting is printed on the enclosed proxy card. The control number is used to match proxy cards with shareholders’ respective accounts and to ensure that, if multiple proxy cards are executed, shares are voted in accordance with the proxy card bearing the latest date.

The annual meeting will be a completely virtual meeting of shareholders, which will be conducted exclusively by webcast. You are entitled to participate in the annual meeting only if you were a shareholder of DNP or DPG as of the close of business on the January 19, 2021, the record date, or if you hold a valid proxy for

20

the annual meeting. No physical meeting will be held. You will be able to virtually attend the annual meeting online and submit your questions during the meeting by visiting www.meetingcenter.io/224990645. You also will be able to vote your shares online by attending the annual meeting by webcast.

To participate in the annual meeting, you will need to log on using the control number from your proxy card or meeting notice. The control number can be found in the shaded box. The password for the meeting is DNP2021.

If you are a registered shareholder, you do not need to register to attend the annual meeting virtually on the Internet. If you hold your shares through an intermediary, such as a bank or broker, you must register in advance in order to attend the meeting. To register to attend the annual meeting online by webcast you must submit proof of your proxy power (legal proxy) reflecting your holdings along with your name and email address to Computershare. You must contact the bank or broker who holds your shares to obtain your legal proxy. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, 3 business days prior to the meeting date. You will receive a confirmation of your registration by email after we receive your legal proxy. Requests for registration should be directed to us by emailing an image of your legal proxy, to shareholdermeetings@computershare.com.

The online meeting will begin promptly at 12 p.m., Central Time. We encourage you to access the meeting prior to the start time leaving ample time for the check in.

All shares represented by properly executed proxies received prior to the annual meeting will be voted at the annual meeting in accordance with the instructions marked thereon or otherwise as provided therein. If any other business is brought before the annual meeting, your shares will be voted at the proxies’ discretion. If you sign the proxy card, but do not fill in a vote, your shares will be voted “FOR ALL” of the nominees for director, in accordance with the recommendation of the Board.

Shareholders who execute proxy cards or record their voting instructions via telephone or the Internet may revoke their proxies at any time prior to the time they are voted by giving written notice to the Secretary of the Funds, by delivering a subsequently dated proxy (including via telephone or the Internet) prior to the date of the annual meeting or by virtually attending and voting at the annual meeting. Merely virtually attending the annual meeting, however, will not revoke a previously submitted proxy.

Annual Report. Each Fund will provide without charge to any shareholder who so requests, a copy of the Fund’s annual report for the Fund’s most recently completed fiscal year. The annual reports for DNP are available by calling Baird toll-free at (833) 604-3163 and are also available on each such Fund’s web site at www.dpimc.com/dnp. The annual report for DPG is available by calling Virtus Fund Services toll-free at (866) 270-7598 and is also available on DPG’s web site at www.dpimc.com/dpg.

General. A list of shareholders of each Fund entitled to be present and vote at the annual meeting will be available at the offices of the Funds, 200 S. Wacker Drive, Suite 500, Chicago, Illinois 60606, for inspection by any shareholder during regular business hours for ten days prior to the date of the meeting.

Failure of a quorum of shareholders of any of the Funds to be present at the annual meeting will necessitate adjournment of the meeting with respect to those Funds and will give rise to additional expense.

EVERY SHAREHOLDER VOTE IS IMPORTANT. WE ENCOURAGE YOU TO TAKE ADVANTAGE OF INTERNET OR TELEPHONE VOTING. BOTH ARE AVAILABLE 24 HOURS A DAY, 7 DAYS A WEEK.

January 22, 2021

21

DNP SELECT INCOME FUND INC. IMPORTANT PROXY INFORMATION Your Vote Counts! PLEASE USE THE 14 DIGIT CONTROL NUMBER & 8 DIGIT SECURITY CODE LISTED IN THE BOXES BELOW WHEN REQUESTING MATERIAL VIA THE TELEPHONE & INTERNET. When you are ready to vote, you can use the same Control Number & Security Code to record your vote. Shareholder Meeting Notice – THIS IS NOT A PROXY – Please read carefully for voting instructions. Important Notice Regarding the Availability of Proxy Materials for the DNP Select Income Fund Inc. Shareholders Meeting to be held virtually on March 8, 2021. As a shareholder, it is important for you to vote! On the back of this notice, you will find a summary of the proposals that require a shareholder vote at the Meeting. This communication is NOT a form for voting and presents only an overview of the more complete proxy materials that are available to you on the Internet or by mail. We encourage you to access and review all of the important information contained in the proxy materials before voting. The Proxy Statement for the Meeting and Form of Proxy are available at: https://www.proxy-direct.com/dnp-31865 If you want to receive a paper copy of the documents or an email with a link to the documents, you must request them. There is no charge to you for requesting a copy. Paper materials will be mailed to the address on file within 3-business days of receipt of the request. Please make your request as soon as possible, but no later than February 25, 2021, to facilitate timely delivery. The Meeting of Shareholders of DNP Select Income Fund Inc. will be held virtually at the following website: www.meetingcenter.io/224990645 on March 8, 2021, at 12:00 p.m., Central Time. To participate in the Virtual Meeting enter the 14-digit control number from the shaded box on this notice. The Password for this meeting is DNP2021. ONLINE MATERIAL ACCESS AND PAPER COPY REQUESTS CAN BE MADE UTILIZING ONE OF THE THREE METHODS BELOW. YOU CAN ALSO USE ONE OF THESE THREE METHODS TO ELECT A PERMANENT DELIVERY PREFERENCE FOR FUTURE MEETINGS. ACCESS MATERIALS AND VOTE OR REQUEST PAPER DELIVERY OF MATERIALS EASY ONLINE ACCESS – REQUEST BY INTERNET Log on to the Internet and go to: https://www.proxy-direct.com/dnp-31865 On this site you can view the Proxy Statement and Form of Proxy online, request paper copies, request an email with a link to the materials and/or set future delivery preferences. Just follow the steps outlined on this secure website. TELEPHONE REQUESTS - CALL 1-877-816-5331 Obtain paper copies of the Proxy Statement and/or Form of Proxy with an option to set future delivery preference by touch tone phone. Call toll free from the U.S. or Canada at NO CHARGE to you. Follow the instructions provided in the recorded messages. E-MAIL REQUEST AT: proxymaterials@computershare.com: Email us to request Proxy Materials for the shareholder meeting and/or to set future delivery preferences. - Provide only your 14-Digit Control Number and 8-Digit Security Code as listed on this notice in your email request for materials. - If you want to elect to receive all future proxy materials in paper form or via email, please note your request and for email, provide the address. PAPER COPY REQUESTS SHOULD BE MADE NO LATER THAN FEBRUARY 25, 2021, TO FACILITATE TIMELY DELIVERY. DNP_31865_NA_011121

Your Fund Holdings: FUND DNP SELECT INCOME FUND INC. The following matters will be considered at the Meeting: 1a. Election of Director. The Board of Directors unanimously recommends that shareholders vote “FOR” the nominee to the Board of Directors identified in the Proxy Statement. 2. Transact such other business as may properly come before the meeting. Please refer to the Proxy Materials for further details on the proposals. YOUR VOTE IS IMPORTANT NO MATTER HOW MANY SHARES YOU OWN Common Questions about Notice and Access Why am I receiving a Notice of Internet Availability instead of a Proxy card and Proxy statement? Your fund has elected to utilize a distribution model authorized by the Securities and Exchange Commission in 2007. This model, known as Notice and Access, allows mutual funds and public companies to send you a Notice instead of a full set of printed proxy materials. As a shareholder, you can select the means by which you access those proxy materials. You can view the materials electronically via the Internet, or request a full set of printed materials for this Shareholder Meeting and all future meetings, or you can make that choice on a case by case basis. How do I access the materials, set my preference for future shareholder meeting materials and record my vote? On the front side of this Notice are easy to follow instructions on how to access Proxy materials electronically or request a full set of printed materials. Once you are on the website or ordering on the phone, you can also make your selection for future meetings. When you are ready to vote, electronic voting is available by Internet or Touch Tone Phone by using the Control Number and Security Code on the front of this Notice. The Touch Tone voting phone number is different from the ordering phone number and is displayed on the website. If you want to vote via Mail, you will need to request a paper copy of the materials to receive a Proxy Card and Return Envelope. If I request printed proxy materials, how long will it take for me to receive them? The SEC rule requires that the materials be sent via first class mail within three business days of receipt of your request. DNP_31865_NA_011121

DNP SELECT INCOME FUND INC. IMPORTANT PROXY INFORMATION Your Vote Counts! PLEASE USE THE 14 DIGIT CONTROL NUMBER & 8 DIGIT SECURITY CODE LISTED IN THE BOXES BELOW WHEN REQUESTING MATERIAL VIA THE TELEPHONE & INTERNET. When you are ready to vote, you can use the same Control Number & Security Code to record your vote. Shareholder Meeting Notice – THIS IS NOT A PROXY – Please read carefully for voting instructions. Important Notice Regarding the Availability of Proxy Materials for the DNP Select Income Fund Inc. Shareholders Meeting to be held virtually on March 8, 2021. As a shareholder, it is important for you to vote! On the back of this notice, you will find a summary of the proposals that require a shareholder vote at the Meeting. This communication is NOT a form for voting and presents only an overview of the more complete proxy materials that are available to you on the Internet or by mail. We encourage you to access and review all of the important information contained in the proxy materials before voting. The Proxy Statement for the Meeting and Form of Proxy are available at: https://www.proxy-direct.com/dnp-31865 If you want to receive a paper copy of the documents or an email with a link to the documents, you must request them. There is no charge to you for requesting a copy. Paper materials will be mailed to the address on file within 3-business days of receipt of the request. Please make your request as soon as possible, but no later than February 25, 2021, to facilitate timely delivery. The Meeting of Shareholders of DNP Select Income Fund Inc. will be held virtually at the following website: www.meetingcenter.io/224990645 on March 8, 2021, at 12:00 p.m., Central Time. To participate in the Virtual Meeting enter the 14-digit control number from the shaded box on this notice. The Password for this meeting is DNP2021. ONLINE MATERIAL ACCESS AND PAPER COPY REQUESTS CAN BE MADE UTILIZING ONE OF THE THREE METHODS BELOW. YOU CAN ALSO USE ONE OF THESE THREE METHODS TO ELECT A PERMANENT DELIVERY PREFERENCE FOR FUTURE MEETINGS. ACCESS MATERIALS AND VOTE OR REQUEST PAPER DELIVERY OF MATERIALS EASY ONLINE ACCESS – REQUEST BY INTERNET Log on to the Internet and go to: https://www.proxy-direct.com/dnp-31865 On this site you can view the Proxy Statement and Form of Proxy online, request paper copies, request an email with a link to the materials and/or set future delivery preferences. Just follow the steps outlined on this secure website. TELEPHONE REQUESTS - CALL 1-877-816-5331 Obtain paper copies of the Proxy Statement and/or Form of Proxy with an option to set future delivery preference by touch tone phone. Call toll free from the U.S. or Canada at NO CHARGE to you. Follow the instructions provided in the recorded messages. E-MAIL REQUEST AT: proxymaterials@computershare.com: Email us to request Proxy Materials for the shareholder meeting and/or to set future delivery preferences. - Provide only your 14-Digit Control Number and 8-Digit Security Code as listed on this notice in your email request for materials. - If you want to elect to receive all future proxy materials in paper form or via email, please note your request and for email, provide the address. PAPER COPY REQUESTS SHOULD BE MADE NO LATER THAN FEBRUARY 25, 2021, TO FACILITATE TIMELY DELIVERY. DNP_31865_NA_011121_Pref