Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-4920

WASATCH FUNDS, INC.

(Exact name of registrant as specified in charter)

150 Social Hall Avenue

4th Floor

Salt Lake City, Utah 84111

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) | Copy to: | |

Samuel S. Stewart, Jr. Wasatch Funds, Inc. 150 Social Hall Avenue, 4th Floor Salt Lake City, Utah 84111 | Eric F. Fess, Esq. Chapman & Cutler LLP 111 West Monroe Street Chicago, IL 60603 | |

Registrant’s telephone number, including area code: (801) 533-0777

Date of fiscal year end: September 30

Date of reporting period: September 30, 2009

Table of Contents

| Item 1: | Report to Shareholders. |

Table of Contents

| ANNUAL REPORT |

| SEPTEMBER 30, 2009 | EQUITY FUNDS | |

| WASATCH CORE GROWTH FUND | ||

| WASATCH EMERGING MARKETS SMALL CAP FUND | ||

| WASATCH GLOBAL OPPORTUNITIES FUND | ||

| WASATCH GLOBAL SCIENCE & TECHNOLOGY FUND | ||

| WASATCH HERITAGE GROWTH FUND | ||

| WASATCH HERITAGE VALUE FUND | ||

| WASATCH INTERNATIONAL GROWTH FUND | ||

| WASATCH INTERNATIONAL OPPORTUNITIES FUND | ||

| WASATCH MICRO CAP FUND | ||

| WASATCH MICRO CAP VALUE FUND | ||

| WASATCH SMALL CAP GROWTH FUND | ||

| WASATCH SMALL CAP VALUE FUND | ||

| WASATCH STRATEGIC INCOME FUND | ||

| WASATCH ULTRA GROWTH FUND | ||

| WASATCH-1ST SOURCE INCOME EQUITY FUND | ||

| WASATCH-1ST SOURCE LONG/SHORT FUND | ||

| BOND FUNDS (Sub-Advised) | ||

| WASATCH-HOISINGTON U.S. TREASURY FUND | ||

| WASATCH-1ST SOURCE INCOME FUND | ||

Table of Contents

WASATCH FUNDS, INC.

Salt Lake City, Utah

www.wasatchfunds.com

800.551.1700

Table of Contents

| TABLEOF CONTENTS | ||

| 2 | ||

| 4 | ||

| 5 | ||

Wasatch Emerging Markets Small Cap Fund™ Management Discussion | 6 | |

| 7 | ||

| 8 | ||

| 9 | ||

Wasatch Global Science & Technology Fund® Management Discussion | 10 | |

| 11 | ||

| 12 | ||

| 13 | ||

| 14 | ||

| 15 | ||

| 16 | ||

| 17 | ||

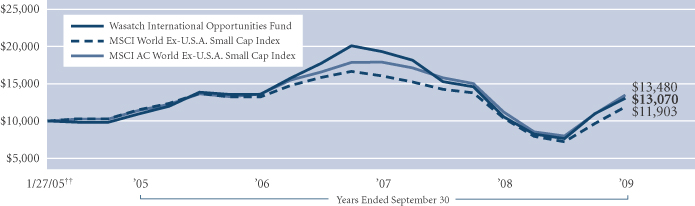

Wasatch International Opportunities Fund® Management Discussion | 18 | |

| 19 | ||

| 20 | ||

| 21 | ||

| 22 | ||

| 23 | ||

| 24 | ||

| 25 | ||

| 26 | ||

| 27 | ||

| 28 | ||

| 29 | ||

| 30 | ||

| 31 | ||

Wasatch-1st Source Income Equity Fund™ Management Discussion | 32 | |

| 33 | ||

| 34 | ||

| 35 | ||

Wasatch-Hoisington U.S. Treasury Fund® Management Discussion | 36 | |

| 37 | ||

| 38 | ||

| 39 | ||

| 40 | ||

| 42 | ||

| 88 | ||

| 92 | ||

| 96 | ||

| 104 | ||

| 113 | ||

| 131 | ||

| 132 | ||

| 132 | ||

| 134 | ||

| 134 | ||

| 134 | ||

| 137 | ||

| 138 | ||

| 139 |

This material must be accompanied or preceded by a prospectus.

Please read the prospectus carefully before you invest.

Wasatch Funds are distributed by ALPS Distributors, Inc.

1

Table of Contents

| LETTERTO SHAREHOLDERS | ||

Samuel S. Stewart, Jr. PhD, CFA President of | DEAR FELLOW SHAREHOLDERS:

A WILD YEAR

A year ago we were talking about the Lehman collapse and its likely impact on the economy. The outlook was bleak as we prepared for a prolonged recession. What I didn’t foresee was the level of fear that would envelop the market when talking heads got stirred up and began speculating about the next great depression and a global economic collapse. In March the S&P 500* finally turned north, after bottoming more than 55% off its peak, as the first signals began to emerge that the world might not be coming to an end. Positive economic signs have continued to trickle in since then and the market has moved steadily up — with somewhat surprising conviction given how rapidly it had declined. As of September 30th the S&P 500 was actually within 7% of where it started a year earlier.

|

Clearly it’s been a very turbulent year, but it is now beginning to feel like we’ve made it across to the other side. However, it’s important not to get ahead of ourselves. We may have crossed what seemed like a white-water river, but we still have a steep bank to climb before the economy reaches safety. In many respects we are now back to where we were pre-Lehman, still facing a tough period of prolonged economic challenge.

THE ECONOMY & MARKET TODAY

There clearly appears to be an economic recovery underway. We hear more and more about “green shoots” (early signs of recovery) turning into “green stalks” (more substantial manifestations of recovery). Here are a number of positive signs that I see:

| • | The credit market bellwether that I have been referring to in recent quarters is finally showing traction, as credit is becoming more available to reasonable borrowers at reasonable terms |

| • | The global stimulus efforts are having an impact |

| • | Housing appears that it may have bottomed |

| • | The rate of job loss seems to be slowing |

| • | Pockets of retail sales are beginning to pick up |

| • | Gross national product (GNP)** is growing again |

| • | The stock market is functioning better, including the re-emergence of initial public offerings (IPOs)† |

But as mentioned, we still have significant work to do, and I believe we will see a slow-growth economy for some time due to continuing fundamental challenges:

| • | The financial system is far from fixed |

| • | The economy continues to deleverage,†† with less demand for credit and tighter restrictions on those seeking it |

| • | Unemployment is at high absolute levels, reaching a 26 year high of 9.8% as of September 30, 2009 |

| • | Budget gaps have increased at local, state, and national levels |

| • | Commercial real estate is still weak |

Investors have focused on the positives, taking note of the green stalks and the market has risen quickly over the last quarter. In March the economy was uncertain, but stock valuations were too compelling to overlook. Now an economic recovery feels like its underway, but stocks may be ahead of the recovery as it is much harder to find compelling valuations.

WASATCH PERFORMANCE

In the extreme market volatility of last fall we made a conscious decision to remain very disciplined in our investment approach. We even tightened our process a bit as we:

| • | Moved our Portfolio Managers into the same room to increase multiple eyes collaboration among our most experienced investors |

| • | Reviewed our assumptions on every investment, with a keen focus on the long-term prospects of each company given the changing economic environment |

| • | Increased our conversations with management teams to keep a close pulse on the economic impact being felt by our companies |

| • | Narrowed our investment focus to our best ideas |

As a result, our overall name count continued to decrease, our positions moved toward higher quality companies, and our confidence in our portfolio holdings increased. I believe our solid performance over the last 12 months was a direct result of this discipline. For the year ended September 30, 2009, our equity funds were up +6.33% on average, with 12 of 16 funds outperforming their benchmark indexes, while the S&P 500 was down -6.91% and the Russell 2000 Index‡ was down -9.55%. In such an uncertain year we have been pleased to see our steady approach rewarded.

The past year really played out in what I saw as three distinct periods in the market.

| • | First period: indiscriminant selling that took place last fall after the financial collapse. During this period our holdings sold off along with everything else. |

2

Table of Contents

| SEPTEMBER 30, 2009 | ||

| • | Second period: a move toward quality in the first quarter of 2009 as the selling continued, but on a more selective basis. It was during this period that many of our funds outperformed and built a nice lead on their respective benchmarks. |

| • | Third period: the strong rebound, with perhaps a little bit of a “junk” rally over the last few months. Our funds rebounded nicely as well, with the lead many of our funds held over the benchmark indexes narrowing slightly. |

Our performance over these three distinct periods is consistent with our investment approach. We hope that because of our focus on quality companies that we will generally outperform in a discriminating down market and lead in a gently rising market, but likely lag in a strong bull market. The past 12 months have shown us a variety of market conditions that would typically play out over much longer market cycles. We found it rewarding to see many of our funds move nicely ahead of the market and their peers over this mini-cycle, particularly after a frustrating 2008 when we weren’t able to limit shareholder losses as we would have liked.

FINAL THOUGHT

One afternoon, while on my recent trip to Africa, I watched a lion poised for attack. Time and again she passed up what appeared to be perfectly good opportunities. Clearly the lion knew what she was looking for, and was carefully selecting the appropriate time to spring. Similarly, I think we at Wasatch have learned this year to be even more selective in our investment choices — to be cautious committers of capital with a closer eye on valuation as we make each investment decision. I believe our distance from the Wall Street herd also continues to help in this regard by allowing us to avoid getting caught up in the fads of the market and to stay focused on evaluating each individual company.

Thirty four years after founding Wasatch Advisors I continue to be a firm believer in our investment approach for long-term investors. We appreciate your confidence in us as well.

Sincerely,

Samuel S. Stewart, Jr.

President of Wasatch Funds

Information in this report regarding market or economic trends or the factors influencing historical or future performance reflects the opinions of management as of the date of this report. These statements should not be relied upon for any other purpose. Past performance is no guarantee of future results, and there is no guarantee that the market forecasts discussed will be realized.

*The S&P 500 Index represents 500 of the United States’ largest stocks from a broad variety of industries. The Index is unmanaged, and a common measure of common stock total return performance. You cannot invest directly in this or any index.

**Gross national product (GNP) is a measure of a country’s economic performance, or what its citizens produced (i.e. goods and services) and whether they produced these items within its borders.

†Initial public offering (IPO) is the first sale of stock by a private company to the public. IPOs are often issued by smaller, younger companies seeking the capital to expand, but can also be done by large privately owned companies looking to become publicly traded.

††Deleverage refers to the reduction of the amount of credit (or leverage) being used in the economy.

‡The Russell 2000 Index represents the smallest 2,000 companies in the Russell 3000 Index, as ranked by total market capitalization. The Index is unmanaged and widely considered to accurately capture the universe of small company stocks. You cannot invest directly in this or any index.

CFA® is a registered trademark owned by CFA Institute.

3

Table of Contents

| WASATCH CORE GROWTH FUND (WGROX) — Management Discussion | SEPTEMBER 30, 2009 | |

The Wasatch Core Growth Fund is managed by a team of Wasatch portfolio managers led by JB Taylor and Paul Lambert.

JB Taylor |

Paul Lambert | OVERVIEW

The Wasatch Core Growth Fund returned -0.45% during the 12-month period ended September 30, 2009, strongly outperforming the -9.55% return of the Russell 2000 Index. We are pleased |

that the Fund outperformed by such a substantial margin during a difficult period for the broader market. A key factor in the Fund’s outperformance was our decision to maintain positions in what we felt were undervalued securities when the market was going against us in the first half of the annual period. Once stocks rebounded from the irrationally low valuations they hit in late 2008, we saw a broad-based recovery among companies held by the Fund that boasted strong free cash flow but whose shares had nonetheless sold off during the market downturn. We believe this illustrates how our deep due diligence of the companies in the Fund helps us distinguish between their true worth and the often irrational values afforded them in the market.

DETAILSOFTHE YEAR

The largest contribution to performance versus the Index came from stock selection in the financials sector. The financial stocks in the benchmark lost over 23%, while those held in the Fund actually gained over 15%. Much of this outperformance resulted from the fact that we held only a small position in banks, which lagged by a wide margin, in favor of what we believed were healthier companies with more stable business models. Among these were Annaly Capital Management, Inc., the insurance company Tower Group, Inc., and the financial analytics and benchmarks provider MSCI, Inc.

We also generated significant outperformance in the consumer discretionary sector, another potentially challenging area of the market. Our holdings in this group gained over 22%, well above the -1.6% return for the broader sector. The Fund’s top contributor, adding over four percentage points to absolute performance, was auto parts retailer O’Reilly Automotive, Inc. O’Reilly bucked the broader trend of slowing consumer spending and its stock registered a gain of over 34%.

The information technology sector was another important source of performance, led by a U.S.-based outsourcing company with operations in India, Cognizant Technology Solutions Corp. We purchased Cognizant last autumn, when fears were rampant that the company’s exposure to the financials sector would translate into slower growth. Our purchase was predicated upon the idea that the company’s technology services are essential for companies that

outsource such services as a way to cut costs and stay competitive. Cognizant’s shares rebounded over 120% from the time we bought it through September 30, which helps illustrate how having a deep knowledge of what you own is essential to navigating volatile markets.

As would be expected in a year when stock prices declined sharply in the first half and recovered strongly in the second, the majority of our detractors were stocks that we sold prior to the recovery in the broader market. Among these were GMX Resources, Inc. KKR Financial Holdings, LLC and Chicago Bridge & Iron Co. N.V. (Netherlands). We also lost some ground to the Index from the underperformance of our holdings in the energy sector. Current and future holdings are subject to risk.

In terms of portfolio activity, we have opted for a steady, consistent approach. Turnover was low, reflecting our enthusiasm for the companies we continue to hold in the Fund. At the same time, however, we have not been afraid to trim positions in stocks that have run ahead of fundamentals in the short term. We also maintained a focus on quality, recognizing that reasonably valued, market-leading companies with strong earnings prospects tend to outperform the broader market over the long term. We believe this is the appropriate way to position the Fund for an environment characterized by slower economic growth.

OUTLOOK

Those who follow the markets will know that the current debate is focused on the likely “shape” of the economic recovery. While there have been some positive signs in recent months, we are not among those who are analyzing every data point in order to determine the direction of macroeconomic trends. Instead, our focus is on the “micro” level — the earnings outlook for each of the individual stocks we hold in the Fund. And on this front, our outlook remains optimistic. For the first time in over a year, Wall Street analysts’ earnings estimates for the companies we hold are beginning to rise. In this light, the market’s recent optimism seems warranted. What differentiates the Wasatch Core Growth Fund is that by our estimate a high percentage of our companies are on track to post higher earnings in 2010 than they did in 2007 — a remarkable statistic given the sharp decline in earnings for the broader market during the same interval.

Looking ahead, we will be focusing our efforts on ensuring that the Fund is populated with companies that have the potential to generate steady earnings growth. By “steady” we mean growth not just in 2009 and 2010, when year-over-year comparisons will be relatively easy and cyclical factors will likely provide a tailwind, but growth that we believe can continue through 2011, 2012 and beyond, an indicator that the earnings expansion is secular, and not cyclical, in nature.

Thank you for the opportunity to manage your assets.

4

Table of Contents

| WASATCH CORE GROWTH FUND (WGROX) — Portfolio Summary | SEPTEMBER 30, 2009 | |

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | 10 YEARS | ||||

Core Growth | -0.45% | 0.77% | 8.77% | |||

Russell 2000 Index | -9.55% | 2.41% | 4.88% |

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.wasatchfunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2009 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Core Growth Fund are 1.21%. The expense ratio shown elsewhere in this report may be higher. Total Annual Fund Operating Expenses include direct expenses paid to the Advisor as well as indirect expenses incurred by the Fund as a result of its investments in other investment companies (each an “Acquired Fund”), before any expense reimbursements by the Advisor. The Net Expense includes any reimbursement by the Advisor. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees or taxes, which if reflected, would reduce the performance quoted. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds.

TOP 10 EQUITY HOLDINGS*

| Company | % of Fund | |

| Emeritus Corp. | 4.68% | |

| Copart, Inc. | 4.49% | |

| MEDNAX, Inc. | 4.00% | |

| Life Time Fitness, Inc. | 3.43% | |

| Aaron’s, Inc. | 3.21% | |

| PSS World Medical, Inc. | 3.05% |

| Company | % of Fund | |

| Fidelity National Information Services, Inc. | 2.63% | |

| Alliance Data Systems Corp. | 2.54% | |

| Pharmaceutical Product Development, Inc. | 2.42% | |

| Ports Design Ltd. (China) | 2.33% | |

| 32.78% | ||

| *As | of September 30, 2009, there were 56 holdings in the Fund. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

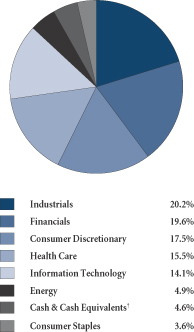

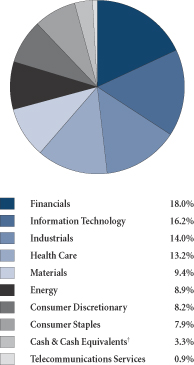

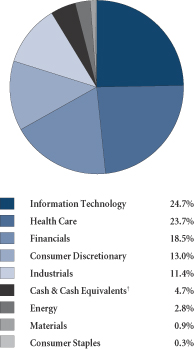

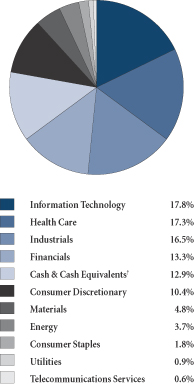

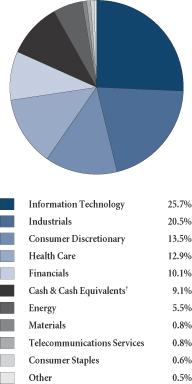

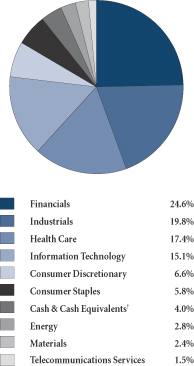

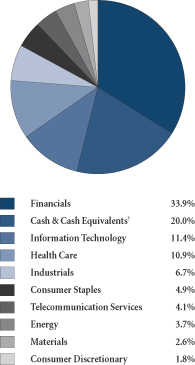

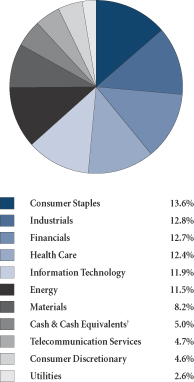

SECTOR BREAKDOWN**

| **Excludes | securities sold short and written options, if any. |

| †Also | includes Other Assets and Liabilities. |

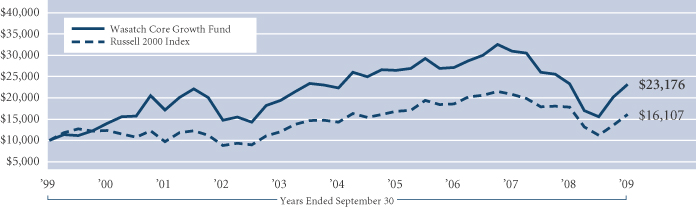

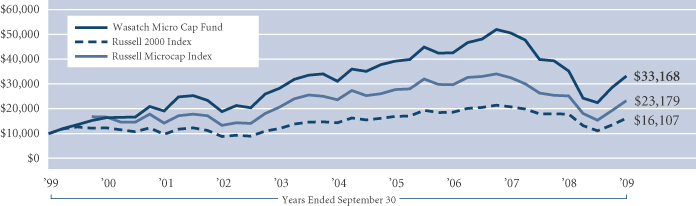

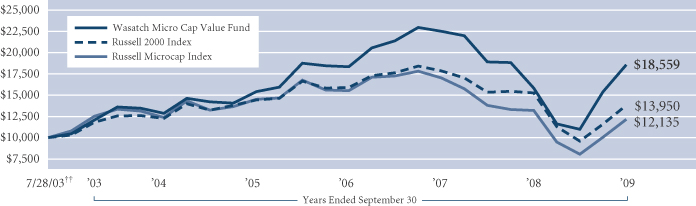

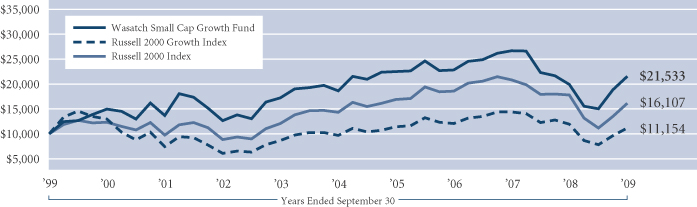

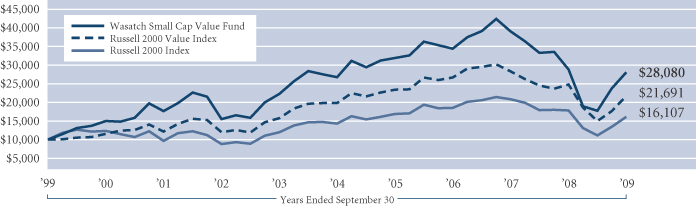

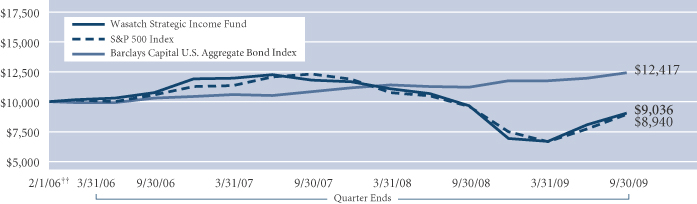

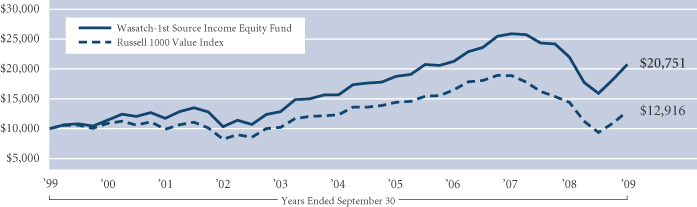

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance and the graph above does not reflect the deduction of taxes that you would pay on fund distributions or the redemption of fund shares. Performance shown in the chart above does not include any applicable sales charges and fees. Wasatch does not charge any sales fees. The Russell 2000 Index is an unmanaged total return index of the smallest 2,000 companies in the Russell 3000 Index, as ranked by total market capitalization. The Russell 2000 Index is widely regarded in the industry as accurately capturing the universe of small company stocks. You cannot invest directly in this or any index.

5

Table of Contents

| WASATCH EMERGING MARKETS SMALL CAP FUND (WAEMX) — Management Discussion | SEPTEMBER 30, 2009 | |

The Wasatch Emerging Markets Small Cap Fund is managed by a team of Wasatch portfolio managers led by Roger Edgley and Laura Geritz.

Roger D. Edgley, CFA Portfolio Manager |

Laura Geritz, CFA Portfolio Manager | OVERVIEW

The Wasatch Emerging Markets Small Cap Fund gained 26.80% in the 12 months ended September 30, 2009, and trailed the MSCI Emerging Markets Small Cap Index, which gained |

41.18%. Most of this underperformance occurred in the fourth quarter of 2008, when world markets were melting down and commodities prices were dropping from historic highs to historic lows. Both the Fund and the Index suffered significant losses during this period. The Fund’s overweight in commodities-focused areas like Brazil and the Middle East hurt performance. Performance in 2009 has been much improved as investors have realized that emerging markets in general were oversold.

Although the Index proved a tough mark to beat, we were pleased that the Fund ended such a turbulent year with such a substantial gain. Investments in the BRIC nations — Brazil, Russia, India and China — helped to power the Fund’s return. China was by far the top contributor, followed by Brazil and India. Indonesia was also a notable contributor aided by our investments in coal producers. Looking at sectors, the Fund benefited from the strong performance of our financials, consumer discretionary and information technology holdings.

Emerging market stocks have had quite a run. Nevertheless, our stocks for the most part still seem reasonably valued given the growth we expect from our companies. The Fund’s holdings are characterized by solid fundamentals including higher return on assets, operating margins, net margins, and lower debt than the emerging market stocks in the Index. As a result, we believe the Fund is well positioned for the future.

DETAILSOFTHE YEAR

China continued to be the largest weight in the Fund due to our positive take on the growth prospects of companies focused on selling products within China. Five of the Fund’s top 10 contributors came from China including: sportswear manufacturers Anta Sports Products Ltd. and China Dongxiang Group Co. Ltd.; Wasion Group Holdings Ltd., a maker of electronic power meters and data collection terminals; Shandong Weigao Group Medical Polymer Co. Ltd., a manufacturer of single-use medical devices; and Shanda Interactive Entertainment Ltd., a provider of online games.

Members of the Wasatch team recently visited Brazil and came away feeling upbeat about Brazil’s emergence as a consumer-driven culture. Within Brazil, the Fund holds investments in a variety of industries including banks, retailers,

metals and mining, and chemicals. One of our best performing Brazilian holdings was Banco do Estado do Rio Grande do Sul S.A., a bank that we like for its strong fundamentals.

China and India are the world’s two most populous countries and they are expected to wrest the lead for global gross domestic product (GDP)* from the U.S. and Europe over the next five years. Having a strong presence in these dynamic markets has been and will be important for the Fund. As in China, the Fund is overweight relative to the benchmark in India with holdings in a multitude of industries. In India, we’re particularly attracted to lending institutions. This past year, LIC Housing Finance Ltd., one of the largest mortgage lenders in India, made a substantial contribution to the Fund’s return.

Indonesia is another important area of investment for the Fund. We like Indonesia for its young population, emerging democracy, and place as a coal producer. Indonesia is Asia’s largest supplier of thermal coal used to drive power plants. The Fund has two coal-related holdings in Indonesia that were strong contributors to performance —Tambang Batubara Bukit Asam and Indo Tambangraya Megah.

The Fund was overweight and outperformed the Index in the BRIC nations and Indonesia. In contrast, the Fund’s substantially underweight position in Taiwan and Korea hindered relative performance, especially in Taiwan, a country that benefited from strong-performing chip manufacturers and other technology-related companies. We have focused less in these countries because, although they are theoretically emerging markets, their major industries such as autos and electronics are largely dependent upon developed world growth.

On a related note, our underweight position in information technology, particularly our lack of exposure to semiconductors, computers and peripherals firms, hurt the Fund’s relative results. Information technology was the best performing sector within the Index fueled by short-term inventory replenishment in the microchip industry. Within the IT sector, we have elected to focus on online gaming, which is seeing huge growth in Asia, and on companies that produce electronic equipment and instruments used in infrastructure development. In lieu of a larger position in IT, we expect to continue overweighting sectors like consumer, financials, and health care where growth can be driven by domestic demand. Current and future holdings are subject to risk.

OUTLOOK

Generally, we have made no dramatic changes to the Fund’s country or sector weights and we still see the potential for our holdings to deliver at least 15% earnings growth. We feel we can get faster growth from small companies within emerging markets for about the same price tag as similar companies in the developed world. With this in mind, we will continue seeking to provide shareholders with the most exposure possible to true emerging markets.

Thank you for the opportunity to manage your assets.

CFA® is a registered trademark of CFA Institute. |

| *Gross | domestic product (GDP) is a basic measure of a country’s economic performance and is the market value of all final goods and services made within the borders of a country in a year. |

6

Table of Contents

| WASATCH EMERGING MARKETS SMALL CAP FUND (WAEMX) — Portfolio Summary | SEPTEMBER 30, 2009 | |

AVERAGE ANNUAL TOTAL RETURNS

1 YEAR | 5 YEARS | SINCE INCEPTION 10/1/07 | ||||

Emerging Markets Small Cap | 26.80% | N/A | -11.25% | |||

MSCI Emerging Markets Small Cap Index | 41.18% | N/A | -11.42% | |||

MSCI Emerging Markets Index | 19.07% | N/A | -10.82% |

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.wasatchfunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2009 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging Markets Small Cap Fund are 2.69%. The expense ratio shown elsewhere in this report may be higher. Total Annual Fund Operating Expenses include direct expenses paid to the Advisor as well as indirect expenses incurred by the Fund as a result of its investments in other investment companies (each an “Acquired Fund”), before any expense reimbursements by the Advisor. The Net Expense includes any reimbursement by the Advisor. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees or taxes, which if reflected, would reduce the performance quoted. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds.

TOP 10 EQUITY HOLDINGS*

| Company | % of Fund | |

| Bharat Electronics Ltd. (India) | 2.00% | |

| Coca-Cola Icecek AS (Turkey) | 1.81% | |

| Ports Design Ltd. (China) | 1.79% | |

| CP ALL PCL (Thailand) | 1.73% | |

| Aramex PJSC (United Arab Emirates) | 1.71% | |

| Sesa Goa Ltd. (India) | 1.67% | |

| Bolsa Mexicana de Valores S.A.B. de C.V., Series A (Mexico) | 1.60% |

| Company | % of Fund | |

| LIC Housing Finance Ltd. (India) | 1.54% | |

| JSE Ltd. (South Africa) | 1.53% | |

| Shandong Weigao Group Medical Polymer Co. Ltd., Class H (China) | 1.52% | |

| 16.90% | ||

| *As | of September 30, 2009, there were 116 holdings in the Fund. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

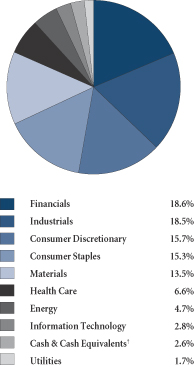

SECTOR BREAKDOWN**

| **Excludes | securities sold short and written options, if any. |

| †Also | includes Other Assets and Liabilities. |

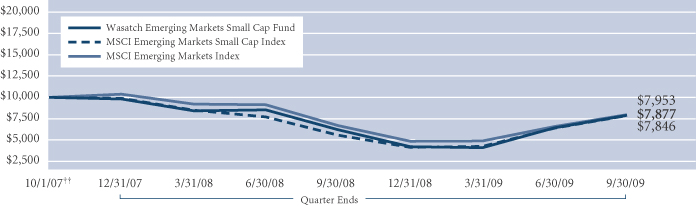

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance and the graph above does not reflect the deduction of taxes that you would pay on fund distributions or the redemption of fund shares. Performance shown in the chart above does not include any applicable sales charges and fees. Wasatch does not charge any sales fees. ††Inception: October 1, 2007. The MSCI Emerging Markets and Small-Mid Cap Indexes are free float-adjusted market capitalization indexes that are designed to measure equity market performance in the global emerging markets. As of June 2006, the MSCI Emerging Markets Index consisted of the following 25 emerging market country indexes: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Jordan, Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey. You cannot invest directly in these or any indexes.

7

Table of Contents

| WASATCH GLOBAL OPPORTUNITIES FUND (WAGOX) — Management Discussion | SEPTEMBER 30, 2009 | |

The Wasatch Global Opportunities Fund is managed by a team of Wasatch portfolio managers led by Robert Gardiner and Blake Walker.

Robert Gardiner, CFA Portfolio Manager |

Blake H. Walker Portfolio Manager | OVERVIEW

The Wasatch Global Opportunities Fund returned 69.00% since its inception on November 17, 2008 through September 30.* The Fund benefited from our intentional move |

to begin operations when global stock prices were depressed due to uncertainty regarding the financial crisis and the strength of the global economy. As investors became optimistic that government efforts to stabilize the financial sector were gaining traction, stock prices rebounded sharply. The Fund outperformed its benchmarks during the period. The MSCI AC World Small Cap Index returned 56.05%. The S&P Global SmallCap Index returned 51.73%. The MSCI AC World Index returned 35.26%.

Often a good year for a fund is driven by performance in just a few areas, but we are pleased to report that the Fund’s holdings provided broad-based performance over the period. Specifically, our stock picks outperformed across domestic and international markets, as well as across developed and emerging markets, and virtually every industry group and sector. Performance was constrained to a degree by the Fund’s cash position, which averaged approximately 13% over the period.

DETAILSOFTHE PERIOD

As true bottom-up investment managers, we build the portfolio company by company. Most of our holdings will be smaller companies that we believe have great management teams, sustainable competitive advantages, sound business models and the potential for strong earnings growth — we call these WBGC’s, or the World’s Best Growth Companies. We will also hold “fallen angels” — growth companies that have hit a temporary setback and have been overly punished by the market. A third category might be deemed “stalwarts” — somewhat more established companies in the mid-cap range that may not have the growth potential of smaller companies but which have dominant market positions and which we have been able to purchase at what we view as attractive valuations. Our ability to find these companies in any market in the world gives us the opportunity to seek out the best companies.

The Fund performed well across geographies, outperforming in the U.S. and developed and emerging markets. We outperformed in Western Europe led by Germany, the United Kingdom, Italy and Sweden. We also did well in Asia led by our overweight in China but also by strong performance in the important Japanese market and

in India, Singapore, Korea and Indonesia. We lagged in Australia, Brazil and Canada, markets focused on materials and energy, and areas we are underweight. We continue to broaden the number of countries we are invested in.

Through our due diligence, we ended up overweight in information technology (IT), the best performing segment of the overall market, and our technology picks outperformed within the sector. Our biggest overweight was in semiconductors, which was one of the best performing industry groups since the Fund’s inception. We were also overweight and outperformed in the IT services segment. Our largest holding, Wirecard (Germany), a developer of electronic payment systems, more than doubled.

While health care stocks lagged the market, our selections within the sector outperformed, rising over 80%. Our medical device stocks did especially well. The stock price of our largest holding at the beginning of the period — VNUS Medical Technologies, Inc. — nearly doubled. The company was acquired during the second quarter of 2009.

We had substantial exposure to consumer discretionary, another outperforming area. Our holdings there outperformed the market, notably sporting goods retailer Big 5 Sporting Goods Corp. and Ports Design Ltd. (China), a fashion and luxury goods manufacturer.

Our underweighting and stock picking drove the Fund’s strong relative performance in financials. Notably, we underweighted U.S. banks and overweighted banks in countries with less exposure to the financial crisis such as India, Brazil and Canada.

We struggled somewhat in consumer staples. While many of our holdings performed well, we had some notable detractors, including Beauty China Holdings Ltd. Overall, consumer staples is an exciting place to us, especially in emerging markets, and we feel we can do well in this area. Current and future holdings are subject to risk.

Finally, we had significant cash which held back performance as the market rallied. The cash allocation did not reflect any negative market outlook on our part, but was instead driven by our desire to put assets to work in an organic way as we find great companies globally in which to invest.

OUTLOOK

Stock prices have gone up a long way in a short time and we expect more modest returns going forward.

We will continue to look for great companies. This involves extensive research, conducting company-by-company financial analysis, and traveling around the world to meet with management teams. As global investors, we have the ability to seek out what we believe are the best stocks in every region and in every industry.

As the world continues to get smaller, we believe this benefits investors like ourselves who take a global approach. The Fund is off to an excellent start, with our picks in almost every area having outperformed since inception. We are passionate about applying Wasatch’s time-tested equity strategies on a global level, and are excited about the prospects for the Fund over the coming years and decades.

Thank you for the opportunity to manage your assets.

CFA® is a registered trademark of CFA Institute. |

| * | The Fund’s return since inception is not annualized. |

8

Table of Contents

| WASATCH GLOBAL OPPORTUNITIES FUND (WAGOX) — Portfolio Summary | SEPTEMBER 30, 2009 | |

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | SINCE INCEPTION 11/17/08 | |||

Global Opportunities | N/A | 69.00%* | ||

MSCI AC World Small Cap Index | N/A | 56.05%* | ||

S&P Global SmallCap Index | N/A | 51.73%* | ||

MSCI AC World Index | N/A | 35.26%* |

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.wasatchfunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2009 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Global Opportunities Fund are 2.61%. The expense ratio shown elsewhere in this report may be higher. Total Annual Fund Operating Expenses include direct expenses paid to the Advisor as well as indirect expenses incurred by the Fund as a result of its investments in other investment companies (each an “Acquired Fund”), before any expense reimbursements by the Advisor. The Net Expense includes any reimbursement by the Advisor. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees or taxes, which if reflected, would reduce the performance quoted. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in small and micro cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

| *Not | annualized. |

TOP 10 EQUITY HOLDINGS**

| Company | % of Fund | |

| Wirecard AG (Germany) | 1.88% | |

| O2Micro International Ltd. ADR (China) | 1.48% | |

| Create SD Holdings Co. Ltd. (Japan) | 1.14% | |

| Melexis N.V. (Belgium) | 1.02% | |

| Ports Design Ltd. (China) | 0.99% | |

| Resources Connection, Inc. | 0.93% |

| Company | % of Fund | |

| Audika S.A. (France) | 0.92% | |

| Ted Baker plc (United Kingdom) | 0.91% | |

| Apollo Group, Inc., Class A | 0.90% | |

| Abcam plc (United Kingdom) | 0.90% | |

| 11.07% | ||

| **As | of September 30, 2009, there were 308 holdings in the Fund. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

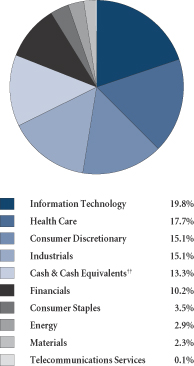

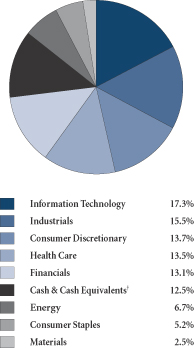

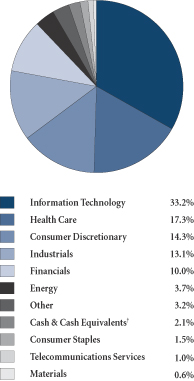

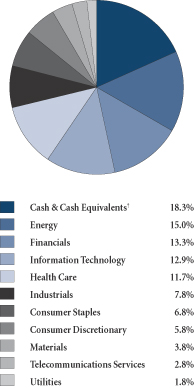

SECTOR BREAKDOWN†

| †Excludes | securities sold short and written options, if any. |

| ††Also | includes Other Assets and Liabilities. |

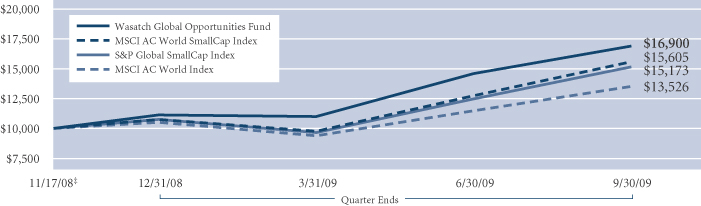

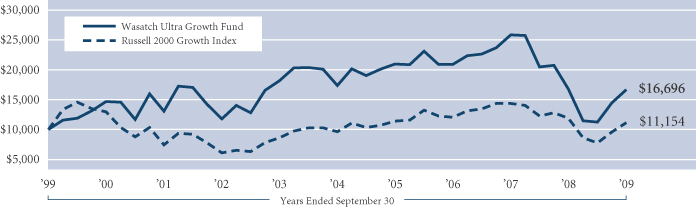

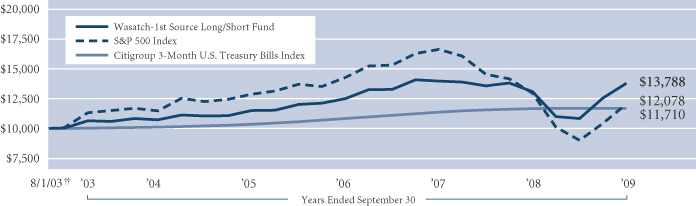

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance and the graph above does not reflect the deduction of taxes that you would pay on fund distributions or the redemption of fund shares. Performance shown in the chart above does not include any applicable sales charges and fees. Wasatch does not charge any sales fees. ‡Inception: November 17, 2008. The MSCI AC World Small Cap Index is an unmanaged index and includes reinvestment of all dividends of issuers located in countries throughout the world representing developed and emerging markets, including securities of U.S. issuers, with market capitalizations between US $200 million and $1.5 billion. The S&P Global SmallCap Index is an unmanaged index and includes reinvestment of all dividends of issuers located across developed and emerging markets, including the United States, who fall in the bottom 15% of their country’s market cap range. The MSCI AC World Index is an unmanaged index and includes reinvestment of all dividends of issuers located in countries throughout the world representing developed and emerging markets, including securities of U.S. issuers, of all capitalizations. You cannot invest directly in these or any indexes.

9

Table of Contents

| WASATCH GLOBAL SCIENCE & TECHNOLOGY FUND (WAGTX) — Management Discussion | SEPTEMBER 30, 2009 | |

The Wasatch Global Science & Technology Fund is managed by a team of Wasatch portfolio managers led by Sam Stewart.

Samuel S. Stewart, Jr. PhD, CFA Portfolio Manager | OVERVIEW

The Wasatch Global Science & Technology Fund returned 7.86% during the 12 months ended September 30, 2009, and underperformed the 10.89% return of its primary benchmark, the Russell 2000 Technology Index. Two aspects of the broader market environment contributed to the Fund’s positive absolute return. First, small- and mid-cap stocks outperformed large-caps — a positive for the Fund given that our primary focus is on smaller, |

faster-growing companies. Second, information technology stocks outpaced the return of the market as a whole. Another plus was that our stock picks outperformed by a wide margin in the portion of the Fund invested in information technology — while the tech stocks in the benchmark returned approximately 12%, those held in the Fund returned over 28%.

On the other hand, health care stocks underperformed at a time of rising investor risk appetites and uncertainty about the U.S. government’s reform efforts. The Fund’s holdings in health care produced a slightly negative return, a drag on relative performance in a positive market. Nevertheless, we continue to see a wealth of outstanding longer-term opportunities in this area. The sector as a whole may not always keep pace with the broader indexes in rapidly rising markets, but we feel confident in the long-term prospects for the health care stocks we hold in the Fund.

DETAILSOFTHE YEAR

The Fund’s largest source of outperformance was its substantial weighting in the international markets. Nearly half of the Fund’s assets are invested abroad, reflecting our view that technology investors need a global perspective to benefit from the full range of opportunities that the tech and health care sectors have to offer. Of the Fund’s top 10 contributors to performance, seven were companies domiciled abroad. Among our top contributors from outside the United States were Wasion Group Holdings Ltd., a Chinese maker of power meters and data collection terminals that is benefiting from the rapid build-out of the country’s power grid; China Automation Group Ltd., which is capitalizing on the continued investments in safety and control systems in Chinese industries; and Wirecard AG, a leading international provider of electronic payment solutions that is based in Germany.

We also added value through our longstanding holding in Cognizant Technology Solutions Corp., a provider of information technology services to businesses with significant operations in India. We held on to our position in Cognizant even when the stock was being pressured by the global economic crisis of late 2008, as we believed it would maintain steady earnings through the downturn. The stock

subsequently recovered as investors recognized Cognizant’s value, and its stock closed the annual period with a gain of nearly 70%. We believe that the company’s strong long-term business prospects and not just the momentum of the broader equity market support this rebound and we are maintaining our position in Cognizant.

Turning to detractors, a key factor in the underperformance of the Fund’s health care sector was the poor returns of the senior assisted-living companies — The Providence Service Corp., Emeritus Corp., Capital Senior Living Corp., and Sunrise Senior Living, Inc. We elected to eliminate all of the Fund’s holdings in this group during the winter, which meant that we were unable to participate in their subsequent recovery. We also lost ground through a position in Cardica, Inc., a maker of systems used in coronary bypass surgery. The company’s management team mishandled its cash position amid a tough environment for hospitals, contributing to a decline of over 80% in Cardica’s stock price. Our cash position, which averaged over 7% during the year, also proved to be a drag on relative performance in a rising market. However, with stock prices having risen so much in recent months, we prefer to keep some powder dry in the event that a market pullback creates potential buying opportunities.

OUTLOOK

We continue to believe that the information technology and health care sectors remain fertile ground for individual stock selection. The information technology sector is one of the few sectors expected to generate positive earnings growth in the year ahead, as it has the potential to benefit from increased spending among either consumers or businesses. Health care, meanwhile, remains home to an abundance of companies with compelling product cycles and attractive bottom-up growth stories. We continue to take advantage of the extensive Wasatch research base to select what we see as being the best-in-class companies within the health care sector.

Despite our optimism regarding the prospects for the companies we hold in the Fund, we are maintaining a cautious approach overall. High unemployment, continued deleveraging, and the increased role of government in the United States’ economy are all factors that point to slower growth in the months and years ahead. As a result, we are being careful to take profits in our winners and take advantage of opportunities to invest in what we consider to be high quality companies at attractive prices. For example, we are finding compelling ideas among businesses where customers can receive a favorable return on their investment, such as security, storage, and network performance management. We are also maintaining our emphasis on fundamentals in order to mitigate the potential for negative surprises from the Fund’s holdings. We believe this is the prudent approach at a time when opportunities remain abundant, but where risks remain very much in place.

Thank you for the opportunity to manage your assets.

CFA® is a registered trademark of CFA Institute. |

10

Table of Contents

| WASATCH GLOBAL SCIENCE & TECHNOLOGY FUND (WAGTX) — Portfolio Summary | SEPTEMBER 30, 2009 | |

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | SINCE INCEPTION 12/19/00 | ||||

Global Science & Technology | 7.86% | 4.97% | 3.21% | |||

Russell 2000 Technology Index | 10.89% | 4.16% | -3.89% | |||

Nasdaq Composite Index | 2.54% | 3.12% | -1.75% |

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.wasatchfunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2009 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Global Science & Technology Fund are 1.92%. The expense ratio shown elsewhere in this report may be higher. Total Annual Fund Operating Expenses include direct expenses paid to the Advisor as well as indirect expenses incurred by the Fund as a result of its investments in other investment companies (each an “Acquired Fund”), before any expense reimbursements by the Advisor. The Net Expense includes any reimbursement by the Advisor. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees or taxes, which if reflected, would reduce the performance quoted. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in concentrated funds will be more volatile and loss of principal could be greater than investing in more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

TOP 10 EQUITY HOLDINGS*

| Company | % of Fund | |

| Cognizant Technology Solutions Corp., Class A | 2.71% | |

| Abcam plc (United Kingdom) | 2.01% | |

| Wirecard AG (Germany) | 1.89% | |

| MEDNAX, Inc. | 1.74% | |

| Akamai Technologies, Inc. | 1.57% | |

| Taiwan Semiconductor Manufacturing Co. Ltd. ADR (Taiwan) | 1.54% |

| Company | % of Fund | |

| Interactive Intelligence, Inc. | 1.48% | |

| Opnet Technologies, Inc. | 1.46% | |

| Power Integrations, Inc. | 1.45% | |

| O2Micro International Ltd. ADR (China) | 1.43% | |

| 17.28% | ||

| *As | of September 30, 2009, there were 89 holdings in the Fund. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

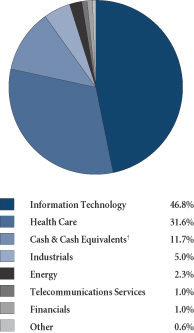

SECTOR BREAKDOWN**

| **Excludes | securities sold short and written options, if any. |

| †Also | includes Other Assets and Liabilities. |

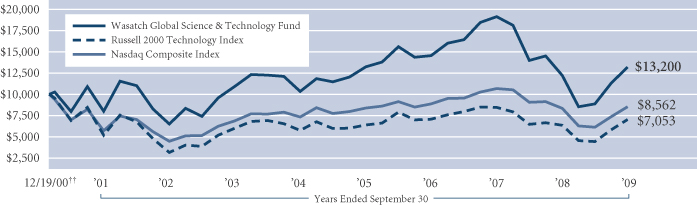

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance and the graph above does not reflect the deduction of taxes that you would pay on fund distributions or the redemption of fund shares. Performance shown in the chart above does not include any applicable sales charges and fees. Wasatch does not charge any sales fees. ††Inception: December 19, 2000. The Russell 2000 Technology Index is a capitalization-weighted index of companies that serve the electronics and computer industries or that manufacture products based on the latest applied science. The Nasdaq Composite Index is unmanaged and measures all Nasdaq domestic and non-U.S. based common stocks listed on The Nasdaq Stock Market. The Index is market-value weighted. This means each company’s security affects the Index in proportion to its market value. The market value, the last sale price multiplied by total shares outstanding, is calculated throughout the trading day, and is related to the total value of the Index. Due to their number and size, technology stocks tend to dominate the direction of the Index. You cannot invest directly in these or any indexes.

11

Table of Contents

| WASATCH HERITAGE GROWTH FUND (WAHGX) — Management Discussion | SEPTEMBER 30, 2009 | |

The Wasatch Heritage Growth Fund is managed by a team of Wasatch portfolio managers led by Chris Bowen and Ryan Snow.

Chris Bowen Portfolio Manager |

Ryan Snow Portfolio Manager | OVERVIEW

The past year brought with it a range of investor emotions that drove the market from one extreme to another. This reaction was initially driven by the fear of a depression, which sent |

the market into a freefall. Then, in early March, optimism gradually began to replace the doomsday mentality that had gripped the market, setting the stage for a powerful rebound, which lasted through September 30th.

Through the turmoil, our approach remained the same as always: Stay the course. It is beneficial in times like these to keep the perspective that the process of managing the Fund is a marathon and not a sprint. This prevents us from getting bogged down in the day-to-day market noise and allows us to remain disciplined to our approach of striving to invest in great companies.

Certainly, the Fund’s stock holdings were at the mercy of the market gyrations but, overall, the outstanding business results delivered by many of our companies helped the Fund significantly outpace its benchmark. While we’re not celebrating the 3.74% gain posted by the Fund over the past year, it compared favorably to the 0.40% decline of the Russell Midcap Growth Index over the same period.

While much of the economic pessimism that prevailed early in the year has dissipated, significant challenges remain. For example, it is difficult to imagine that consumer spending, which accounts for approximately two-thirds of gross domestic product (GDP)* in the U.S., can stage a meaningful and lasting rebound with unemployment levels at a 25-year high, hovering around 10%. This is one element that continues to weigh down the economy as Americans try to put the recession in the rear-view mirror.

DETAILSOFTHE YEAR

We believe that one of the reasons our companies held up so well was their relatively light use of debt. While the credit crunch was detrimental — and sometimes fatal — to many companies relying on external financing to run their businesses, this was a mild concern within the Fund. In many cases, our holdings have been able to not only survive, but thrive, as they’ve grown their businesses by reinvesting their own cash flows and capturing market share. Self-financed companies, combined with management teams that can efficiently utilize that money, have resulted in average returns on equity (ROE) and returns on assets (ROA) in the Fund that handily surpass the corresponding figures in the benchmark.** We believe that, consistently delivered, these metrics are indicators of long-term success.

Our large allocation to information technology (IT) was a meaningful contributor to the annual results. The portfolio holds a diverse group of companies, from credit card processors to semiconductor chip producers. In particular, Infosys Technologies and Cognizant Technology Solutions Corp., both information technology outsourcers, received strong votes of confidence from investors, with overall returns topping 59% apiece. As global cutbacks blurred these companies’ revenue projections in late 2008, their stocks declined in price. As companies continue to tighten their belts, we believe that IT outsourcing will become an increasingly cost-effective option. The outlook for Cognizant and Infosys has become less muddled and their stock prices rebounded.

With the uncertainty surrounding proposed health care reform legislation, many stocks in the health care sector struggled over the past 12 months. In particular Covance, Inc., a provider of research services including drug testing and trials for the pharmaceutical industry, was one of our largest detractors from performance. Late in 2008, the company revised its near-term revenue outlook primarily due to project delays as pharmaceutical companies scaled back. We are encouraged about Covance’s prospects, including its diversified client base and service offerings and growing multi-year service contracts. We were able to add to our position at attractive prices as the stock rebounded strongly from its lows. Current and future holdings are subject to risk.

OUTLOOK

Forecasting near term company performance with any degree of accuracy was nearly impossible six months ago. However, at the time, we also felt like many of our most highly esteemed companies were trading at what would prove to be attractive levels once things began to normalize. Investor fear seemed to be concealing the true value of many companies. Since then, we feel that this opinion has been validated, resulting in more normal valuations, significantly benefiting the Fund’s performance in the process.

It is a moderate concern that the stock market may have gone up too far, too fast as bullish behavior began to return in earnest. This strong upward push was driven by forecasted economic improvement, but if expectations fail to be met, the market could experience a short-term setback. We are confident that as we continue to apply our consistent, disciplined investment process, the Fund will have the potential for long-term success.

Thank you for the opportunity to invest your assets.

| *Gross | domestic product (GDP) is a basic measure of a country’s economic performance and is the market value of all final goods and services made within the borders of a country in a year. |

| **Return | on assets (ROA) measures a company’s profitability by showing how many dollars of earnings a company derives from each dollar of assets it controls. Return on equity (ROE) measures a company’s efficiency at generating profits from shareholders’ equity. |

12

Table of Contents

| WASATCH HERITAGE GROWTH FUND (WAHGX) — Portfolio Summary | SEPTEMBER 30, 2009 | |

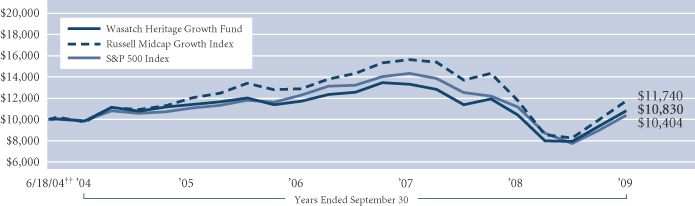

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | SINCE INCEPTION 6/18/04 | ||||

Heritage Growth | 3.74% | 1.89% | 1.52% | |||

Russell Midcap Growth Index | -0.40% | 3.75% | 3.08% | |||

S&P 500 Index | -6.91% | 1.02% | 0.75% |

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.wasatchfunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2009 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Heritage Growth Fund are 1.01%. The expense ratio shown elsewhere in this report may be higher. Total Annual Fund Operating Expenses include direct expenses paid to the Advisor as well as indirect expenses incurred by the Fund as a result of its investments in other investment companies (each an “Acquired Fund”), before any expense reimbursements by the Advisor. The Net Expense includes any reimbursement by the Advisor. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees or taxes, which if reflected, would reduce the performance quoted. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in mid cap funds will be more volatile and loss of principal could be greater than investing in large cap funds. Equity investing involves risks including potential loss of the principal amount invested.

TOP 10 EQUITY HOLDINGS*

| Company | % of Fund | |

| Apollo Group, Inc., Class A | 3.76% | |

| Altera Corp. | 3.54% | |

| St. Jude Medical, Inc. | 3.37% | |

| Express Scripts, Inc. | 3.25% | |

| Redecard S.A. (Brazil) | 2.98% | |

| CVS Caremark Corp. | 2.98% |

| Company | % of Fund | |

| Copart, Inc. | 2.79% | |

| NII Holdings, Inc. | 2.71% | |

| BMC Software, Inc. | 2.69% | |

| Amphenol Corp., Class A | 2.61% | |

| 30.68% | ||

| *As | of September 30, 2009, there were 54 holdings in the Fund. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

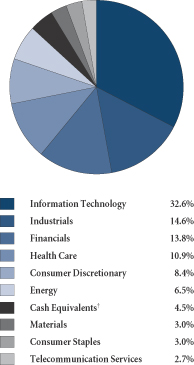

SECTOR BREAKDOWN**

| **Excludes | securities sold short and written options, if any. |

| †Also | includes Other Assets and Liabilities. |

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance and the graph above does not reflect the deduction of taxes that you would pay on fund distributions or the redemption of fund shares. Performance shown in the chart above does not include any applicable sales charges and fees. Wasatch does not charge any sales fees. ††Inception: June 18, 2004. The Russell Midcap Growth Index measures the performance of those Russell Midcap Index companies with higher price-to-book ratios and higher forecasted growth values. The stocks in the Russell Midcap Growth Index are also members of the Russell 1000 Growth Index. The S&P 500 Index represents 500 of the United States’ largest stocks from a broad variety of industries. The index is unmanaged, and a common measure of common stock total return performance. You cannot invest directly in these or any indexes.

13

Table of Contents

| WASATCH HERITAGE VALUE FUND (WAHVX) — Management Discussion | SEPTEMBER 30, 2009 | |

The Wasatch Heritage Value Fund is managed by a team of Wasatch portfolio managers led by Brian Bythrow.

Brian Bythrow, CFA Portfolio Manager | OVERVIEW

Over the past year, we saw investors appear to lose all hope, then regain it surprisingly quickly. Over the first six months, market turmoil was severe. Risk-wary investors shed stocks in favor of less-volatile assets, as the market offered few safe havens from the market meltdown. The U.S. Federal Reserve, along with many of its global counterparts, put all its tools to work to help ease the crisis. |

Economic stimulus plans, particularly those from the U.S. and China, were also put into action. It appeared that these concerted efforts had at least some impact, and stocks began to move upward in March. Many were skeptical, though, of whether this constituted the beginning of a true recovery, or simply a bear-market* rally.

From spring through the summer, stock markets staged a significant and broad-based rally, even as evidence supporting the hope of economic recovery remained scarce. Money came off the sidelines as investors put it to work in the equity markets, boosting stock prices. Stocks benefited around the globe, among all major sectors, and across the market-cap spectrum.

Over the course of this newsworthy year, the Wasatch Heritage Value Fund posted a return of -1.13% for the 12 months ended September 30, 2009. This placed the Fund’s performance well ahead of its benchmark, the Russell 1000 Value Index, which returned -10.62% for the year.

Our underweighting in the financials sector, particularly large banks, played a definitive role in the Fund’s outperformance of the Index for the year.

DETAILSOFTHE YEAR

Although established markets staged a comeback in the second half of the year, along with developing ones, we continue to have concerns about the outlook for consumer spending in the U.S. and other mature economies. Emerging markets, however, appear to offer the potential for robust growth on the consumer side of the economy.

Among our holdings that have the potential to gain from the continued expansion of the consumer class in emerging nations is our top contributor for the period, Brazil’s Weg S.A., a manufacturer of motors used in washers, dryers, and other home appliances. Demand has been growing for Weg’s products, which are primarily destined for domestic consumption, rather than for export to developed markets. In light of the resilience of emerging consumers, and the many constraints facing those in the U.S., we are likely to continue to emphasize the former in our consumer stocks.

Health care generally is seen as an area that can sail above economic woes. It’s not certain if that is always true, but what is clear is that these stocks can be affected by concerns about the impact of cost-cutting measures by insurers and

government programs. That’s why we like companies that can benefit from an emphasis on cost-consciousness, including our second-strongest contributor, Mylan, Inc., a maker of generic prescription drugs. As consumers seek — and insurers demand — the use of less costly treatments, Mylan is positioned to benefit. The stock’s solid performance also reflects Mylan’s success in paying down some of the debt resulting from its acquisition of Merck’s** generic drug portfolio in 2008, and its continued progress in integrating the two companies’ operations.

While we de-emphasized financials over the year, the sector was home to our third-strongest contributor for the period, property/casualty insurer CNA Financial Corp. We found that CNA and other insurers offered better balance sheets and stronger earnings power than most banks, and were available to us below tangible book value. There are some early hints that we may be at the beginning of a “hardening” insurance cycle, a point at which insurers enjoy greater pricing power. This trend is driven not just by a potentially improving business climate, but also by the exit of former major competitors — notably AIG — from the field. Current and future holdings are subject to risk.

OUTLOOK

While the stock market’s recent performance indicates that most investors are confident that a full-blown economic recovery is on the horizon, we are not so sure. In fact, we had anticipated that there might be some pullback during the period’s final months, given stocks’ strong run from April through June. Instead, stocks continued on a firm path upward. Although we are happy for this positive development, we retain some concern that the markets have gotten ahead of themselves.

For that reason, we look for companies that we believe will not require a powerful economic recovery in order to do well. We believe our cautious stance makes sense. While it’s evident that world economies have come a long way from the deeply troubled environment they faced late last year, there are still many issues to be addressed. U.S. consumers still face pressure from high debt loads, tight credit, and home values that are stagnant at best. This clouds the outlook for a breakout in spending anytime soon.

We intend to continue to deploy more of our cash as we identify worthy opportunities. Given the still-uncertain state of both the U.S. and many global economies, though, we will not seek to hop rapidly into stocks, but rather will retain our commitment to deep due diligence, and seek outstanding companies at prices that make sense. This may mean that we will not be able to pare down our cash position as quickly as we would like, but we believe the negative consequences of hasty purchases can far outweigh those of some excess cash.

Thank you for the opportunity to manage your assets.

CFA® is a registered trademark of CFA Institute. |

| *A | bear market is generally defined as a drop of 20% or more in stock prices over at least a two-month period. |

| **As | of September 30, 2009, the Wasatch Heritage Value Fund was not invested in Merck & Co., Inc. |

14

Table of Contents

| WASATCH HERITAGE VALUE FUND (WAHVX) — Portfolio Summary | SEPTEMBER 30, 2009 | |

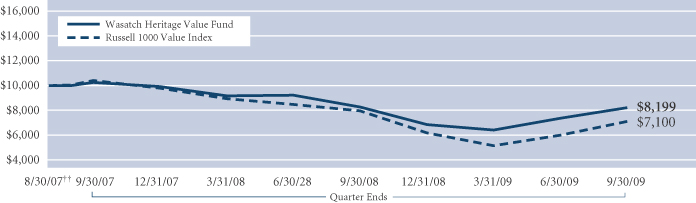

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | SINCE INCEPTION 8/30/07 | ||||

Heritage Value | -1.13% | N/A | -9.07% | |||

Russell 1000 Value Index | -10.62% | N/A | -15.11% |

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.wasatchfunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2009 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Heritage Value Fund are 3.89%. The expense ratio shown elsewhere in this report may be higher. Total Annual Fund Operating Expenses include direct expenses paid to the Advisor as well as indirect expenses incurred by the Fund as a result of its investments in other investment companies (each an “Acquired Fund”), before any expense reimbursements by the Advisor. The Net Expense includes any reimbursement by the Advisor. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees or taxes, which if reflected, would reduce the performance quoted. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investments in value stocks can perform differently from the market as a whole and other types of stocks and can continue to be undervalued by the market for long periods of time. Loss of principal is a risk of investing. Being non-diversified, the Fund can invest a larger portion of its assets in the securities of a limited number of companies than a diversified fund. Non-diversification increases the risk of loss to the Fund if the values of these securities decline. Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

TOP 10 EQUITY HOLDINGS*

| Company | % of Fund | |

| Covidien plc | 3.41% | |

| Old Republic International Corp. | 3.36% | |

| Visa Inc., Class A | 3.11% | |

| Perrigo Co. | 3.06% | |

| Sonoco Products Co. | 3.02% | |

| Pfizer Inc. | 2.98% |

| Company | % of Fund | |

| American Water Works Co., Inc. | 2.97% | |

| Spectra Energy Corp. | 2.93% | |

| Fifth Third Capital Trust VI, 7.25%, 11/15/67 Pfd. | 2.88% | |

| Sherwin-Williams Co. | 2.88% | |

| 30.60% | ||

| *As | of September 30, 2009, there were 35 holdings in the Fund. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

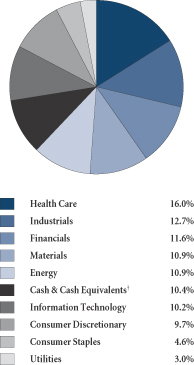

SECTOR BREAKDOWN**

| **Excludes | securities sold short and written options, if any. |

| †Also | includes Other Assets and Liabilities. |

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance and the graph above does not reflect the deduction of taxes that you would pay on fund distributions or the redemption of fund shares. Performance shown in the chart above does not include any applicable sales charges and fees. Wasatch does not charge any sales fees. ††Inception: August 30, 2007. The Russell 1000 Value Index measures the performance of those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values. You cannot invest directly in these or any indexes.

15

Table of Contents

| WASATCH INTERNATIONAL GROWTH FUND (WAIGX) — Management Discussion | SEPTEMBER 30, 2009 | |

The Wasatch International Growth Fund is managed by a team of Wasatch portfolio managers led by Roger Edgley.

Roger D. Edgley, CFA Portfolio Manager | OVERVIEW

The Wasatch International Growth Fund gained 18.03% in a tumultuous 12-month period, compared to a gain of 20.13% for the MSCI AC World Ex-U.S.A. Small Cap Index. Stock prices declined dramatically in the first six months of the period as world markets were shaken by the far-reaching financial crisis. Stocks surged over the last six months as investors gained confidence that governments had succeeded in |

averting disaster and that economic stimulus efforts were beginning to take hold.

Developed markets have been hit harder by the financial crisis than emerging markets and they are taking longer to recover. Investors realized this and jumped back into emerging markets, helping fuel a strong recovery in stock prices. The Fund’s presence in emerging markets, especially in China, Brazil and India, aided performance in the last 12 months. There were also several notable performers from among our investments in developed markets, where we focus on companies that have the potential to grow despite economic headwinds.

DETAILSOFTHE YEAR

Two themes that we have discussed before continued to bolster the Fund’s results. The first is securities exchanges that we like because they virtually monopolize their markets, and because they have scaleable business models, strong balance sheets and healthy free cash flow. Two of our top contributors for the year were securities exchanges — Brazil’s BM&F Bovespa S.A. and Japan’s Osaka Securities Exchange Co. Ltd.

Finding ways to capitalize on China’s growing middle class is another prominent theme for us. Several Chinese apparel and footwear companies that sell products within China contributed to the Fund’s solid results including Anta Sports Products Ltd., China Dongxiang Group Co. Ltd. and Li Ning Co. Ltd. Over the course of the year, however, the number of new competitors entering this space has tempered our view of these companies’ prospects. As a result, we decided to trim our exposure to this area in favor of other consumer-focused investments in China.

How we approach investing in China is quite different from our approach in Japan, by far the biggest country weighting in the Index. Our overweight position in China is supported by favorable demographics including China’s more than 1.3 billion people, growing middle class, and the government’s massive infrastructure programs aimed at stimulating the economy. In contrast, Japan’s population is declining, its real estate values are stagnant, and the government has been struggling to stave off deflation. The Fund is underweight relative to the benchmark in Japan, where our careful, bottom-up research has uncovered individual companies with the potential to grow independent from macro influences. In the 12-month period, the Fund benefited from the performance of

our investments in China and Japan, and our allocations to these countries aided performance versus the Index.

In most developed markets, we tend to favor companies whose growth prospects are tied to global demand for specialized products rather than to economic growth within their home countries. Companies from four developed markets helped the Fund’s results over the past 12 months and are good examples of our investment focus. These were: DiaSorin S.p.A. (Italy), a developer of in vitro diagnostic products; Abcam plc (United Kingdom), a biotechnology company that supplies antibodies used in life science research; Wirecard AG (Germany) a leading global provider of electronic payment systems; and Tandberg ASA (Norway) a provider of videoconferencing solutions. Current and future holdings are subject to risk.

The financials sector contributed to the Fund’s absolute return for the 12-month period. This was primarily due to the solid gain produced by our diversified financial services holdings. Among the leaders in this group were several of our securities exchanges and India’s Infrastructure Development Finance Co. Ltd. (IDFC). IDFC provides financing for projects such as power, roads, ports and telecommunications and appears well positioned to benefit from ongoing efforts to build out and improve India’s infrastructure.

In contrast, banks with exposure to the Western world’s financial troubles detracted from the Fund’s results and caused the financials sector to be a drag on performance versus the Index. Another area of relative weakness was the industrials sector. A notable detractor was Campbell Bros. Ltd., an Australian analytical testing services provider that does lab work for mining companies. While our industrial holdings struggled during the depths of the downturn, they have been strong performers in the budding economic recovery. For example, Campbell Brothers was the Fund’s second leading contributor in the most recent quarter. Fluctuations in oil and gas prices caused significant volatility in the energy sector. This negatively impacted several of our Canadian energy holdings and resulted in the Fund underperforming the Index in Canada.

OUTLOOK

Stocks around the world have come back from the brink following the massive amounts of liquidity that were withdrawn from global markets beginning in late 2007 and extending throughout much of 2008. Now, stocks are more reasonably valued, but the easy gains are behind us. Going forward, companies will have to live up to earnings growth expectations in order for stock prices to climb higher.

In such an environment, we expect our disciplined, bottom-up research will help us find companies capable of producing the earnings growth we seek, whether they are located in developed markets still struggling with negative economic growth or in faster growing emerging markets. We expect to maintain our broad sector and geographic exposure and do not anticipate making any significant changes to the way we manage the Fund in the coming months.

Thank you for the opportunity to manage your assets.

CFA® is a registered trademark of CFA Institute. |

16

Table of Contents

| WASATCH INTERNATIONAL GROWTH FUND (WAIGX) — Portfolio Summary | SEPTEMBER 30, 2009 | |

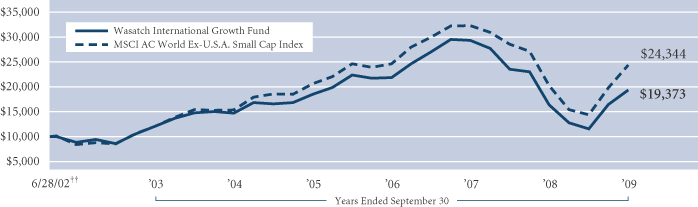

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | SINCE INCEPTION 6/28/02 | ||||

International Growth | 18.03% | 5.66% | 9.54% | |||

MSCI AC World Ex-U.S.A. Small Cap Index | 20.13% | 9.64% | 13.03% |

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.wasatchfunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.