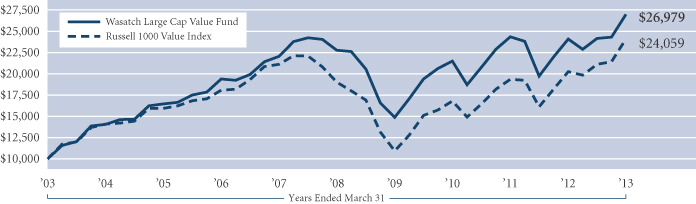

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04920

WASATCH FUNDS TRUST

(Exact name of registrant as specified in charter)

150 Social Hall Avenue

4th Floor

Salt Lake City, Utah 84111

(Address of principal executive offices)(Zip code)

| | |

| (Name and Address of Agent for Service) | | Copy to: |

| |

Samuel S. Stewart, Jr. Wasatch Funds Trust 150 Social Hall Avenue, 4th Floor Salt Lake City, Utah 84111 | | Eric F. Fess, Esq. Chapman & Cutler LLP 111 West Monroe Street Chicago, IL 60603 |

Registrant’s telephone number, including area code: (801) 533-0777

Date of fiscal year end: September 30

Date of reporting period: March 31, 2013

| Item 1: | Report to Shareholders. |

Wasatch Funds

Salt Lake City, Utah

www.wasatchfunds.com

800.551.1700

This material must be accompanied or preceded by a prospectus.

Please read the prospectus carefully before you invest.

Wasatch Funds are distributed by ALPS Distributors, Inc.

1

| | |

| LETTER TO SHAREHOLDERS — BERNANKE’S BACKYARD BARBECUE |

|

|

|

| | |

Samuel S. Stewart, Jr. PhD, CFA President of

Wasatch Funds | | DEAR FELLOW SHAREHOLDERS: If you watch financial news programs on a regular basis, you’ll often see some short-term charts alongside a Wall Street talking head who’s frantically answering questions about how to invest based on the latest economic and market events. Can you imagine Warren Buffett appearing in this way, with periodic interruptions as he barks orders through a headset to buy and sell individual companies? Not likely. The difference here is that the Wall Street talking head is a trader, while Warren Buffett is an investor. Buffett focuses on long-term company fundamentals, which is what we try to do at Wasatch Advisors. So when I’ve recently been asked about my views regarding the all-time highs in the stock market, I have a mixed reaction. Clearly, the surge in stock prices is very impressive. But an equally valid point is that the U.S. market is only now reaching the heights it achieved more than five years ago. From my perspective, rather than focusing on the headlines about record levels in the market, I prefer to spend my time trying to find the World’s Best Growth Companies® — and buy them at what I believe to be reasonable valuations. While I don’t place much emphasis on new highs in stocks, I do believe it’s important to have views on both the fundamental and sentiment factors that drive the economy and the markets. These factors have |

direct and indirect influences on the companies in which we invest, and on the prices at which we can buy or sell them.

Some of the most-important factors I see today are the actions of the Federal Reserve (Fed). Under Chairman Ben Bernanke, the Fed has engaged in unprecedented levels of “quantitative easing” by buying government securities to support bond prices and reduce interest rates. In fact, the Fed has committed to these low rates at least through 2015. For those of us who’ve spent any time around a backyard barbecue, Chairman Bernanke’s approach is analogous to pouring massive amounts of lighter fluid on the grill and hoping the charcoal briquettes eventually catch fire.

ECONOMY

To continue the barbecue analogy, the use of lighter fluid certainly produces an impressive blaze in the short term. But the real key is to create a sustainable fire in the economic briquettes. The question remains: Is the lighter fluid simply burning off, or is the economy starting to fire on its own? We probably won’t know the answer to this question until Chairman Bernanke runs out of fluid or has a change of heart regarding the efficiency of his actions.

My views concerning economic conditions are shaped by the data. And based on the data, conditions remain mixed with a bias toward a muddling economy with slow growth. On the negative side, the Congressional Budget Office recently forecast that real gross domestic product (GDP) in the U.S. will grow at only 1.4% for 2013, down from the 1.9% estimate for 2012. On the positive side, retail sales have been decent, jobless claims have declined and the unemployment rate has edged down.

Among the problems we face in our economy today are too much debt (including future Medicare and Social Security obligations), a sizable and seemingly unending budget deficit, and artificially low interest rates. The Fed’s extreme measures to support asset prices and investor sentiment have allowed the balance-sheet recession to linger on. This means that bad debts remain on the books of our government, our banks and our corporations. Until these bad debts are resolved, we will not have a healthy lending environment. In addition, somewhat higher interest rates are needed so that savers, the would-be providers of capital, are incentivized with reasonable returns on their investments. Currently these savers, both individual and corporate, are largely encouraged to be hoarders of capital because the potential returns seem low relative to the risks.

My advice to Chairman Bernanke would be to put a cap on his bottle of lighter fluid because loose monetary policy can be inflationary over the longer term and is not a good tool for promoting capital investment, growing the economy and creating jobs. Instead, I believe Bernanke should more forcefully encourage the president and Congress to pursue sensible fiscal policies that address infrastructure, education and the bad debts currently being ignored in our financial system.

MARKETS

While I believe economic conditions lean toward slow growth, the stock market certainly caught fire during the first quarter of 2013. The S&P 500 Index was up 10.61% in the first quarter after being down 0.38% in the fourth quarter of 2012.

Despite my concerns about the economy and the Fed’s policies, I remain somewhat bullish on stocks for a few main reasons. First, academic research suggests that slower GDP growth does not necessarily translate into poor stock returns. Second, I’m finding companies that are beating their competition in a tough economic environment by providing better, faster and often less expensive products and services. Many of these companies are selling at reasonable price/earnings multiples with strong growth rates and sometimes-attractive dividend yields. Third, stocks are potentially good hedges against the eventual rise in inflation because an inflationary environment allows companies to increase prices, which can lead to higher earnings and stock valuations.

Another important point is that a slow-growth economic environment is a good backdrop for strong stock-pickers who can sort out the best companies. At Wasatch Advisors, we’ve historically found many of what we believe to be the best companies in the small- and micro-cap areas because these areas are often less well-researched and the companies are usually faster growers. More recently, I’ve also found good opportunities among mid- and large-cap stocks. In particular, I think many big-cap technology companies are amazingly inexpensive.

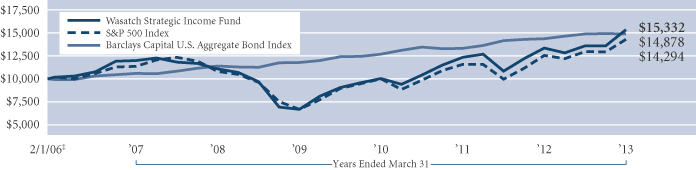

The two Wasatch mutual funds I currently manage — the World Innovators Fund (co-managed with Josh Stewart) and the Strategic Income Fund — have significant allocations to mid- and large-cap stocks for the reasons described above. Some of the

2

holdings in these funds have been selling at price/earnings multiples in the high single digits or low double digits. What I find so attractive are the combinations of these types of valuations with growth rates that exceed the price/earnings multiples and substantial dividend yields. In addition, the fact that the companies are larger gives investors the potential for less risk. In my career, I’ve generally had good success with stocks bought at such reasonable valuations.

A final point I’d like to make regarding the markets is that I believe diversification is now more important than ever. This is why I’ve diversified my small-cap U.S. stock investments with some larger-cap and international names. Similarly, I think holding a portion of a portfolio in cash is a wise form of diversification because it gives investors the ability to put money to work at attractive valuations when stocks suffer periodic corrections.

WASATCH

I’m pleased to announce that four of our Wasatch mutual funds received a total of six 2013 Lipper Awards on March 14, 2013. These awards recognize mutual funds that, relative to peers, have delivered consistently strong risk-adjusted performance whereby smaller downside losses are given even more importance than larger upside gains.

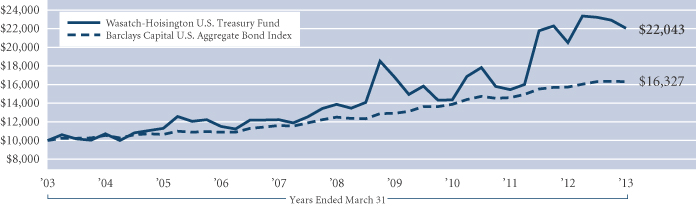

The Wasatch Emerging Markets Small Cap Fund (WAEMX) was recognized as #1 over the three-year and five-year periods ended December 31, 2012 among 308 and 219 emerging markets funds, respectively. This recognition was earned for the second year in a row — the Emerging Markets Small Cap Fund was recognized in 2012 for its three-year performance ended December 31, 2011 among 296 emerging markets funds. The Wasatch World Innovators Fund (WAGTX) was honored as #1 for the three-year and five-year periods ended December 31, 2012 among 144 and 72 global multi-cap growth funds, respectively. The Wasatch International Growth Fund (WAIGX) received the Lipper Award for #1 performance for the three-year period ended December 31, 2012 among 111 international small/mid-cap growth funds. Finally, the Wasatch-Hoisington U.S. Treasury Fund (WHOSX) earned the Lipper Award for the #1 ranking over the five-year period ended December 31, 2012 among 20 general U.S. Treasury funds.

All of us at Wasatch Advisors are very proud of these awards, in part because they cover a wide range of our fund strategies.

With sincere thanks for your continued investment and for your trust,

Sam Stewart

President of Wasatch Funds

P.S. As always, please be sure to read the prospectus before investing in any fund.

Information in this report regarding market or economic trends or the factors influencing historical or future performance reflects the opinions of management as of the date of this report. These statements should not be relied upon for any other purpose. Past performance is no guarantee of future results, and there is no guarantee that the market forecasts discussed will be realized.

CFA® is a trademark owned by CFA Institute.

Wasatch Advisors is the investment advisor to Wasatch Funds.

The Lipper Fund Awards program honors funds that have excelled in delivering consistently strong risk-adjusted performance relative to peers. Lipper designates award-winning funds in most individual classifications for the three-, five- and 10-year periods. Please visit the Awards for Excellence website (http://excellence.thomsonreuters.com/award/lipper) for more details about the Lipper Fund Awards. Lipper Award designations are not intended to constitute investment advice or predict future results, and Lipper does not guarantee the accuracy of this information. In addition to periods of positive returns, the Wasatch Funds that received Lipper Awards have experienced some periods of negative returns during the award time frames. Past performance is not indicative of future results.

The investment objective of the Wasatch Emerging Markets Small Cap Fund, the Wasatch World Innovators Fund and the Wasatch International Growth Fund is long-term growth of capital. The investment objective of the Wasatch-Hoisington U.S. Treasury Fund is to provide a rate of return that exceeds the rate of inflation over a business cycle by investing in U.S. Treasury securities with an emphasis on both income and capital appreciation. The primary investment objective of the Wasatch Strategic Income Fund is to capture current income; a secondary objective is long-term growth of capital.

World’s Best Growth Companies (WBGCs) are defined by Wasatch as companies that we believe possess an identifiable, sustainable competitive advantage, are well managed, undervalued and are producing above average earnings growth relative to their industry and country of origin.

Valuation is the process of determining the current worth of an asset or company.

Quantitative easing is a government monetary policy used to increase the money supply by buying government securities or other securities from the market. Quantitative easing increases the money supply by flooding financial institutions with capital in an effort to promote increased lending and liquidity.

Gross domestic product (GDP) is a basic measure of a country’s economic performance and is the market value of all final goods and services made within the borders of a country in a year.

A balance-sheet recession is a recession caused by some form of financial crisis or balance-sheet shock that can leave businesses in the position of having liabilities that exceed their assets.

The S&P 500 Index includes 500 of the United States’ largest stocks from a broad variety of industries. The Index is unmanaged but is a commonly used measure of common stock total return performance. You cannot invest directly in this or any index.

A price/earnings multiple, also known as the price-to-earnings or P/E ratio, is the price of a stock divided by its earnings per share.

Dividend yield is a company’s annual dividend payments divided by its market capitalization, or the dividend per share divided by the price per share. For example, a company whose stock sells for $30 per share that pays an annual dividend of $3 per share has a dividend yield of 10%.

3

| | |

| WASATCH CORE GROWTH FUND (WGROX / WIGRX) — Management Discussion | | MARCH 31, 2013 |

|

|

|

The Wasatch Core Growth Fund is managed by a team of Wasatch portfolio managers led by JB Taylor and Paul Lambert.

| | | | |

JB Taylor Portfolio Manager | |

Paul Lambert Portfolio Manager | | OVERVIEW The Wasatch Core Growth Fund — Investor Class posted a gain of 7.59% in the first quarter of 2013 and lagged the Russell 2000 Index, which rose 12.39%. It appears that the relatively |

strong returns generated by small cap equities in 2012 have caused an increase in the amount of capital flowing to the space. This is understandable in an environment of low interest rates, when fixed income investments appear to offer unattractive absolute returns.

Our moderate underperformance in a market as strong as we saw in the first quarter is not surprising to us, especially in light of our relative outperformance last year. In addition, we would not characterize the first quarter as a stock picker’s environment because the move up in prices was unusually broad —advancers outnumbered decliners by a wide margin and security selection was less important. Accordingly, the Fund lagged the Index not because a large percentage of our stocks declined. Rather, most of them performed well but were hard pressed to keep pace with the broad market advance.

DETAILSOFTHE QUARTER

Two of our best performing stocks for the quarter were Copart, Inc. and SEI Investments Co. We believe Copart continues to execute extremely well. The company provides online auctions and vehicle remarketing services in the U.S., Canada and the United Kingdom. It is our opinion that Copart has a strong business model that would be difficult to replicate at any price. In the wake of Hurricane Sandy, the company’s services proved invaluable to auto insurers faced with the task of disposing of large numbers of damaged vehicles in a short period of time.

SEI is an investment manager that also provides back-end technology for banks and other financial services firms. SEI’s services allow financial advisors and institutions to get closer to their customers, to react to customer needs quicker, with better transaction processing and better service. We have owned the stock for years and have always admired SEI not only for what we consider to be a top-notch management team, but also for having one of the highest return on investment (ROI) business models we have encountered.

Herbalife Ltd., which has been in the news recently, was up strongly for the quarter and was a significant contributor to the Fund’s performance. The company delivered good fourth quarter results, with sales and earnings up over 20%. Herbalife’s stock has been volatile over the last several months as a few well known institutional investors have taken large long and short positions in the stock. In

addition, these investors have engaged in highly publicized debates regarding their views on the company. We are pleased that Herbalife has continued to execute well, despite the distractions resulting from the investor debates.

Polypore International, Inc. was one of our biggest detractors for the first quarter after posting strong gains in the previous quarter. Polypore makes filtration membranes used in batteries, including the lead-acid batteries used in conventional automobiles and the lithium-ion batteries used in consumer electronics and electric cars. In addition, the company has a growing and profitable business selling high technology filters to the health care industry for use in such products as kidney dialysis machines. We believe the conventional automobile and rapidly growing consumer electronics battery segments of Polypore’s business, together with its health care segment, largely support the stock’s current valuation. While the stock declined in the first quarter amid uncertainty about the timing for meaningful adoption of electric cars, we believe the inevitability of automobile electrification and Polypore’s leadership position in the membrane filtration industry justify a positive long term outlook for the company and the stock.

The share price of health club operator Life Time Fitness, Inc. fell during the quarter, and its substantial position size meant it was a big detractor in the Fund. After a good run from 2010 to 2012, Life Time’s fourth quarter earnings preannouncement revealed that membership had not grown as rapidly as expected. Earnings also weakened on increased marketing expenses and other costs to reinvest in the business. We believe the stock was punished somewhat unfairly and that Wall Street estimates had become too optimistic.

OUTLOOK

Valuations of our portfolio companies currently average 23 times trailing earnings, which is slightly above the longer term average of 21 times trailing earnings. So, while valuations are not strained, we would not describe the market or the Fund’s holdings as particularly inexpensive.

Regarding the U.S. economy, we are still facing the burdens of large government debt balances and higher tax rates. Restrained by these factors, subdued economic growth can create the type of market environment in which the stocks we favor can potentially outperform. Conversely, if the liquidity driven environment we see today continues and the small cap market broadly marches higher without respect to company fundamentals, we would expect the Fund to have some difficulty keeping pace. Nevertheless, we will stick with our time-tested approach of focusing on what we see as the highest quality companies and seeking to hold them at reasonable valuations.

Thank you for the opportunity to manage your assets and for your trust.

| Current | and future holdings are subject to risk. |

4

| | |

| WASATCH CORE GROWTH FUND (WGROX / WIGRX) — Portfolio Summary | | MARCH 31, 2013 |

|

|

|

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | | |

| | | SIX MONTHS* | | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

Core Growth (WGROX) — Investor | | | 11.98% | | | | 15.52% | | | | 9.78% | | | | 11.26% | |

Core Growth (WIGRX) — Institutional | | | 12.02% | | | | 15.62% | | | | 9.81% | | | | 11.27% | |

Russell 2000® Index | | | 14.48% | | | | 16.30% | | | | 8.24% | | | | 11.52% | |

Russell 2000® Growth Index | | | 13.71% | | | | 14.52% | | | | 9.04% | | | | 11.61% | |

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.wasatchfunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2013 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Core Growth Fund — Investor Class: 1.23% / Institutional Class: 1.55%, Net: 1.12%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees or taxes, which if reflected, would reduce the performance quoted. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 1/31/2012 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 1/31/2012 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds.

TOP 10 EQUITY HOLDINGS**

| | | | |

| Company | | % of Net

Assets | |

| Copart, Inc. | | | 5.4% | |

| IDEX Corp. | | | 3.3% | |

| Life Time Fitness, Inc. | | | 3.3% | |

| Waste Connections, Inc. | | | 3.2% | |

| MEDNAX, Inc. | | | 3.0% | |

| | | | |

| Company | | % of Net

Assets | |

| Polypore International, Inc. | | | 2.9% | |

| MSC Industrial Direct Co., Inc., Class A | | | 2.8% | |

| Alliance Data Systems Corp. | | | 2.6% | |

| SEI Investments Co. | | | 2.4% | |

| Allegiant Travel Co. | | | 2.3% | |

| ** | As of March 31, 2013, there were 60 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

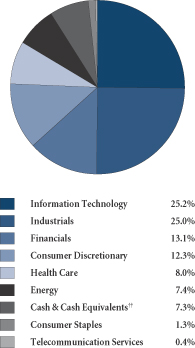

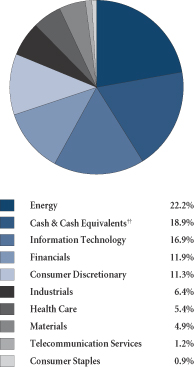

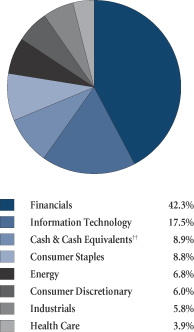

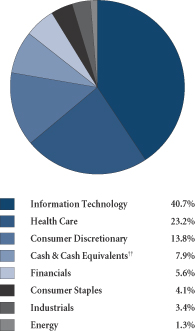

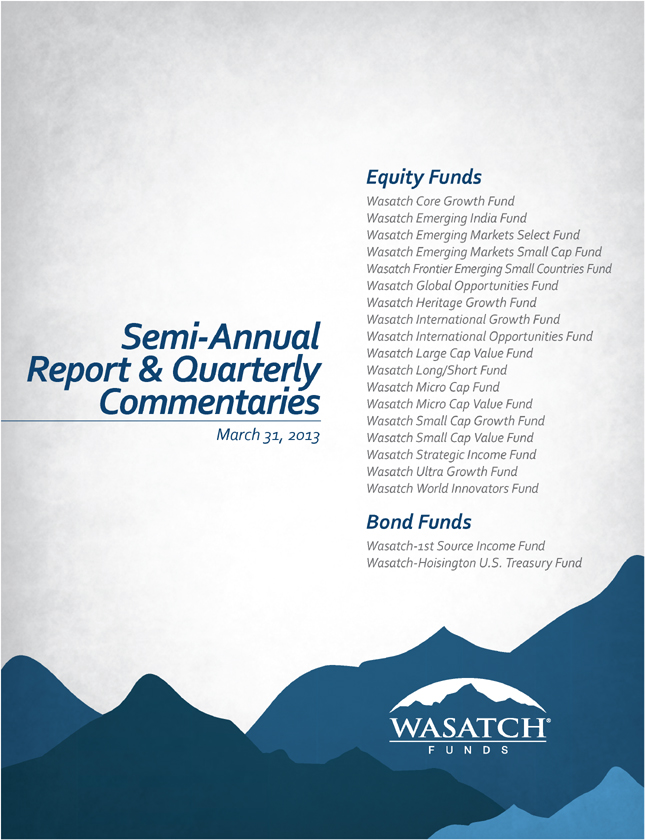

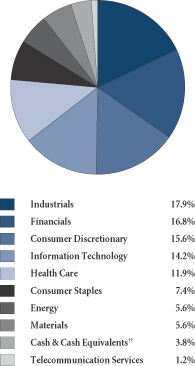

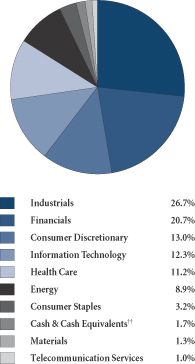

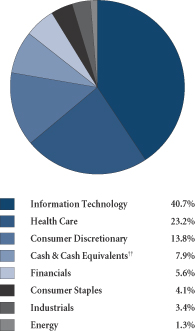

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

| †† | Also includes Other Assets & Liabilities. |

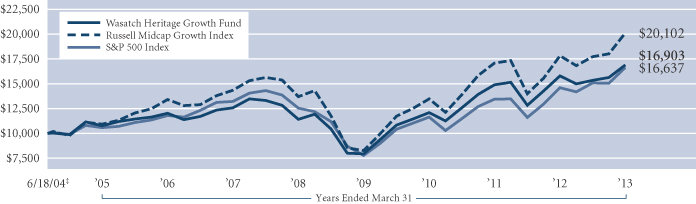

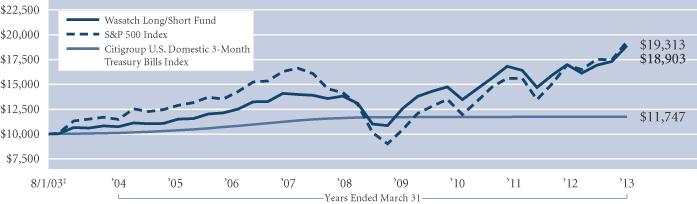

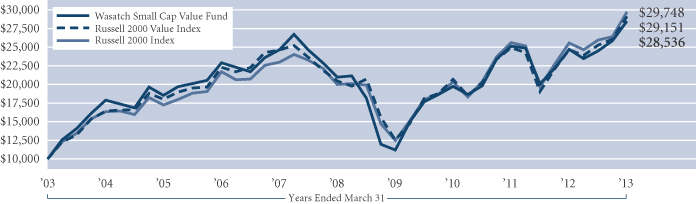

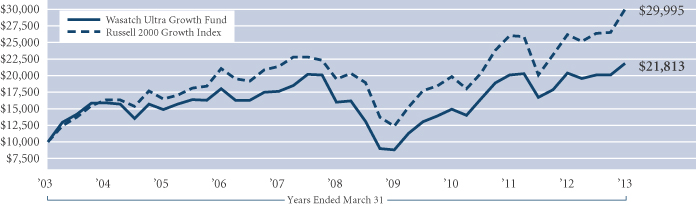

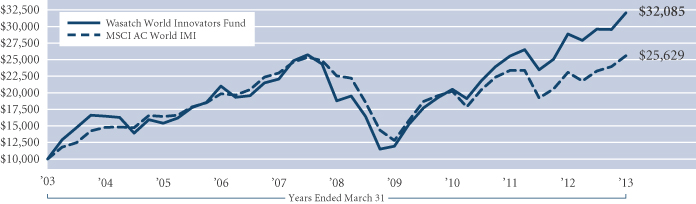

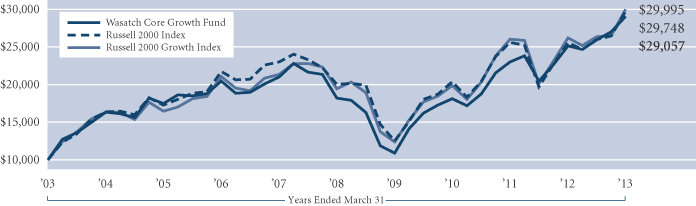

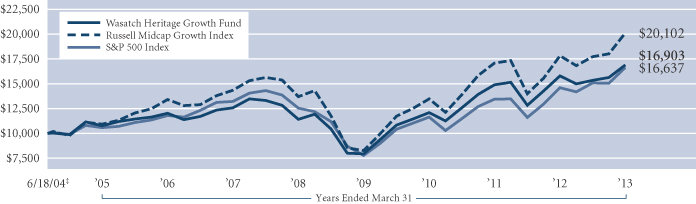

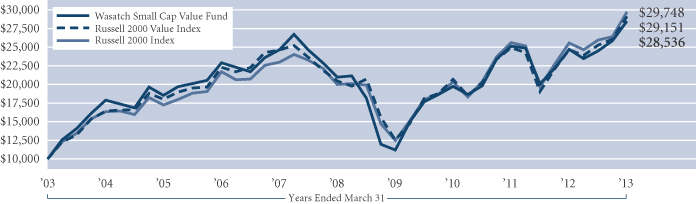

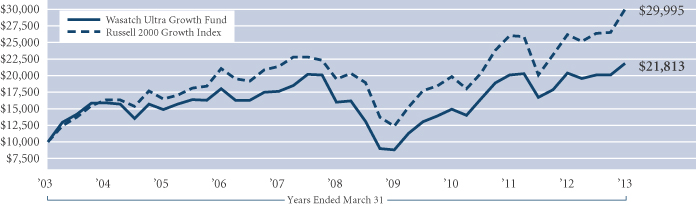

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance and the graph above does not reflect the deduction of taxes you would pay on fund distributions or the redemption of fund shares. Performance shown in the chart above does not include any applicable sales charges and fees. Wasatch does not charge any sales fees. The Russell 2000 Index is an unmanaged total return index of the smallest 2,000 companies in the Russell 3000 Index, as ranked by total market capitalization. The Russell 2000 Index is widely regarded in the industry as accurately capturing the universe of small company stocks. The Russell 2000 Growth Index is an unmanaged total return index that measures the performance of those Russell 2000 Index companies with higher price-to-book ratios and higher forecasted growth values. You cannot invest directly in these or any indices.

5

| | |

| WASATCH EMERGING INDIA FUND (WAINX) — Management Discussion | | MARCH 31, 2013 |

|

|

|

The Wasatch Emerging India Fund is managed by a team of Wasatch portfolio managers led by Ajay Krishnan.

| | |

Ajay Krishnan, CFA Portfolio Manager | | OVERVIEW The first quarter of 2013 was a disappointing period for the Fund. India’s markets started strong and then faded on concerns of a slowing economy and political instability. The Fund leans more toward investing in companies with growth driven by India’s rising middle class (domestic demand). We tend to under-invest in companies that are tied to the global economy. That is one of the reasons the Fund slightly |

underperformed its benchmark, the MSCI India Investable Market Index, in the first quarter. The strongest performing sector for the benchmark was information technology (IT), which gained over 22%, driven by global IT service companies like Infosys, Wipro, TCS, etc. We lost nearly three percentage points of relative performance in the IT sector because we were not invested in these types of companies and we were underweighted in the sector overall. While we think our focus on companies tied to domestic demand will bear fruit over the long term, that wasn’t the case this quarter.

DETAILSOFTHE QUARTER

Typically in a down market is where we expect to add alpha, but this quarter we were hurt by the underperformance of some of our holdings in the financials sector. There seems to be broad-based weakening in India’s economy (services and manufacturing) and financial services stocks were hit relatively hard. Part of this is attributable to concerns surrounding non-performing assets including loans to real estate developers, construction and power companies. The financials sector was also roiled by a recent investigation and subsequent allegations of money laundering (with the collusion of mid-level managers) at several large private banks. We remain convinced of the long-term investment opportunity in financials. India is still relatively unbanked — about 50% of the people do not have bank accounts and a large percentage of the population has no access to banking services. Public sector banks still have over 75% market share. We believe the better-run private banks have the opportunity to take share from them. The bottom line is that we think the headroom for growth in the financials sector is still significant. Banks have demonstrated adequate prudence in their past behavior (not 100% though) and regulators have kept a tight leash on the banking system in general.

Another development that weighed on the market in March was that the coalition government lost the support of a key ally. This has put additional pressure on the government and it is likely that planned reforms have been put on hold. There has been ongoing concern regarding the lack of movement on infrastructure and related projects, including power, mining and land reform. India’s current account deficit is also of concern. None of these challenges are new.

We think the types of companies we hold in the Fund have the potential to grow even in challenging circumstances. Although many of our stocks certainly seem to have taken a pause this quarter, the good news is that valuations among the Fund’s holdings look attractive. The market has been trading at a 13.6 times forward price-to-earnings (P/E) ratio and the Fund has been trading at 22 times with a P/E to growth rate of 1.

A recent CRISIL report (the Standard & Poor’s affiliate in India) shows that the textile, power, engineering, construction and capital goods areas of the market are showing the most stress. The Fund tends to be underinvested in companies that are capital intensive and have poor cash flow characteristics.

As noted earlier, the Fund underperformed the Index in the financials sector. LIC Housing Finance Ltd. (a non-bank finance company) was the biggest detractor in the quarter amid concerns regarding loans to real estate developers. This is relatively a small piece of LIC’s loan book (about 4%) and we believe it is an attractive segment. Although LIC’s margins have also compressed over the last three quarters, we believe the worst is behind them. We see LIC Housing Finance as a conservative lender and believe the big picture still looks attractive. We have trimmed the position a little but continue to stay invested.

OUTLOOK

The Indian economy has certainly slowed down over the past three months. However, stocks seem attractively valued at this point, and we believe the Fund is well positioned due to our conscious strategy to invest in companies tied to domestic demand. We are using this opportunity to selectively add to what we believe are our highest quality names.

Thank you for the opportunity to invest your assets.

| Current | and future holdings are subject to risk. |

6

| | |

| WASATCH EMERGING INDIA FUND (WAINX) — Portfolio Summary | | MARCH 31, 2013 |

|

|

|

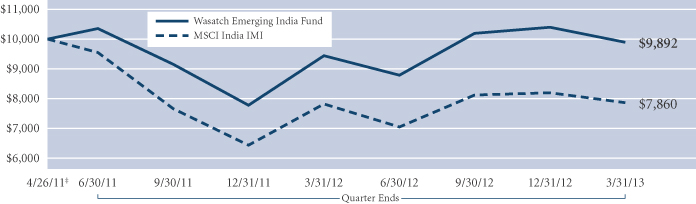

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | |

| | | SIX MONTHS* | | 1 YEAR | | 5 YEARS | | SINCE INCEPTION 4/26/11 | |

Emerging India | | -2.97% | | 4.81% | | N/A | | | -0.56% | |

MSCI India IMI | | -3.23% | | 0.54% | | N/A | | | -11.71% | |

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.wasatchfunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2013 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging India Fund are 3.41%. The Net Expenses are 1.95%. The expense ratio shown elsewhere in this report may be different. Net Expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees or taxes, which if reflected, would reduce the performance quoted. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in small or micro cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as unstable currencies, highly volatile securities markets and political and social instability, which are described in more detail in the prospectus. The Fund is non-diversified, meaning that it can invest a larger portion of its assets in the stocks of a limited number of companies than a diversified fund. Non-diversification increases the risk of loss to the Fund if the values of these securities decline.

TOP 10 EQUITY HOLDINGS**

| | | | |

| Company | | % of Net

Assets | |

| Gruh Finance Ltd. (India) | | | 3.6% | |

| Mahindra & Mahindra Financial Services Ltd. (India) | | | 3.3% | |

| Amara Raja Batteries Ltd. (India) | | | 3.2% | |

| Jubilant Foodworks Ltd. (India) | | | 3.0% | |

| Cognizant Technology Solutions Corp., Class A | | | 3.0% | |

| | | | |

| Company | | % of Net

Assets | |

| Axis Bank Ltd. (India) | | | 3.0% | |

| Housing Development Finance Corp. Ltd. (India) | | | 2.7% | |

| IndusInd Bank Ltd. (India) | | | 2.7% | |

| CMC Ltd. (India) | | | 2.6% | |

| Berger Paints India Ltd. (India) | | | 2.5% | |

| ** | As of March 31, 2013, there were 56 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

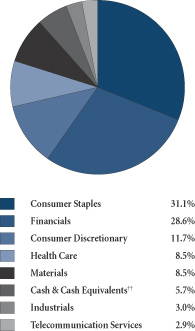

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

| †† | Also includes Other Assets & Liabilities. |

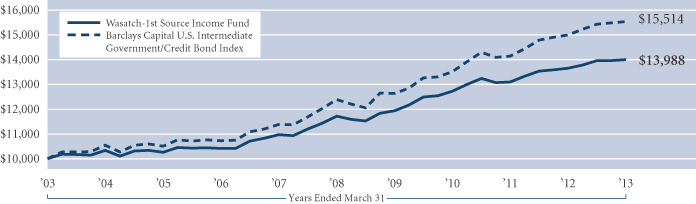

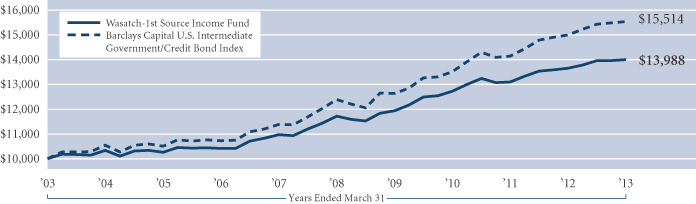

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance and the graph above does not reflect the deduction of taxes you would pay on fund distributions or the redemption of fund shares. Performance shown in the chart above does not include any applicable sales charges and fees. Wasatch does not charge any sales fees. ‡Inception: April 26, 2011. The MSCI India IMI Investable Market Index (IMI) covers all investable large, mid and small cap securities across India, targeting approximately 99% of the Indian market’s free-float adjusted market capitalization. You cannot invest directly in this or any index.

7

| | |

| WASATCH EMERGING MARKETS SELECT FUND (WAESX/WIESX) — Management Discussion | | MARCH 31, 2013 |

|

|

|

The Wasatch Emerging Markets Select Fund is managed by a team of Wasatch portfolio managers led by Ajay Krishnan and Roger Edgley.

| | | | |

Ajay Krishnan, CFA Portfolio Manager | |

Roger D. Edgley, CFA Portfolio Manager | | OVERVIEW The Emerging Markets Select Fund is off to a strong start. The Fund’s Investor Class gained 2.06% in the first quarter and outperformed its benchmark, the MSCI Emerging Markets Index, |

which returned -1.62%. Emerging markets trailed developed markets during the first quarter of 2013, and we saw slowing growth in large emerging economies like China and Brazil.

We have positioned the Fund to exploit opportunities arising from the explosion in domestic demand driven by consumers in emerging markets. As these markets grow and their middle class desires the same things as their contemporaries in the developed world, we think per-capita consumption expenditures can substantially increase. Roughly 70% of the Fund is invested in companies that we believe can benefit from this domestic consumption theme. This focus and our bottom-up process of analyzing the investment potential of individual companies have resulted in above benchmark weights in the consumer discretionary and consumer staples sectors.

Our goal is to find high quality companies, as defined by strong cash flow, high returns on capital and relatively small capital needs, that we believe have a sustainable competitive advantage demonstrated by stable or expanding margins, and are led by a strong management team. These companies also have significant headroom — the ability to continue growing for long periods of time.

We seek to mitigate risk through broad country exposure, low correlations between countries and companies, and reasonable valuations. The Fund has a lower beta than the Index. We believe this is due to our focus on the domestic consumption theme and because we have underemphasized global cyclicals.

DETAILSOFTHE QUARTER

During the quarter, many of the Fund’s holdings in the financials and consumer staples sectors outperformed their benchmark counterparts. Hong Kong-based investment manager First Pacific Co. Ltd., Philippines-based Metropolitan Bank & Trust Co., provider of a range of banking and financial products and services, and SM Prime Holdings, Inc., which develops and owns shopping malls in the Philippines, were among the significant number of financial companies that contributed to the Fund’s performance for the period.

Consumer staples companies that performed well during the quarter included Coca-Cola Icecek A.S., a bottler and distributor of soft drinks in Turkey, and Magnit, Russia’s largest food retailer by market value.

While the Fund was significantly underweighted in industrials and materials relative to the Index, the few names we held in these sectors dramatically outperformed in aggregate. These included International Container Terminal Services, Inc., a port management company in the Philippines, Asian Paints (India) Ltd., a paint manufacturer, and Semen Indonesia (Persero), a cement manufacturer.

The consumer discretionary sector underperformed. Golden Eagle Retail Group Ltd., an operator of department stores in China, weighed on results in the sector and was the Fund’s biggest detractor. The stock has been eliminated from the Fund.

OdontoPrev S.A., a dental plan provider in Brazil, also detracted. Aggressive efforts to gain market share by one of the company’s competitors, in the run-up to that company being acquired, resulted in higher loss ratios for OdontoPrev. While we believe OdontoPrev is a great way to invest in the emerging middle class in Brazil, we have chosen to move to the sidelines as we assess the competitive pressures the company faces.

South Africa was a weak-performing market in the quarter due to slowing growth for commodity exports. Our South African stocks struggled along with the market, especially food retailer Shoprite Holdings Ltd.

The Fund was not invested in Poland, Egypt or the Czech Republic, which were some of the weakest performing markets in the Index.

OUTLOOK

The Fund’s portfolio metrics remain favorable. We expect earnings growth in the high teens over the next three years. The weighted average price-to-earnings (P/E) ratio stood at 19.6 as of March 31, 2013, and the P/E to growth rate was 1.3, which tells us the Fund’s portfolio is reasonably valued. In addition, 75% of the Fund’s holdings outperformed the benchmark, supporting our confidence in the strategy.

Judging by the metrics and the outperformance of the majority of our holdings, we believe the Fund is well positioned. As noted, we view the growing middle class in emerging markets as an enduring theme that provides the potential for the Fund to produce outstanding results over the long run.

However, if there were a strong risk-on move and high beta sectors like energy and materials (i.e., global cyclicals) lead the performance, we would expect the Fund to experience short-term underperformance.

Thank you for the opportunity to manage your assets.

| Current | and future holdings are subject to risk. |

8

| | |

| WASATCH EMERGING MARKETS SELECT FUND (WAESX/WIESX) — Portfolio Summary | | MARCH 31, 2013 |

|

|

|

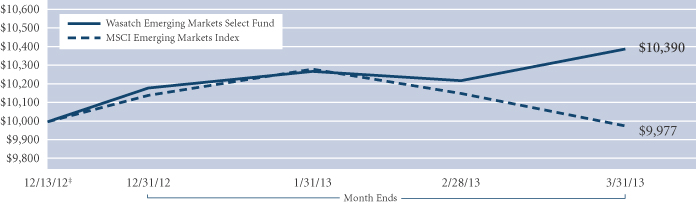

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | | |

| | | SIX MONTHS | | | 1 YEAR | | | 5 YEARS | | | SINCE INCEPTION* 12/13/12 | |

Emerging Markets Select (WAESX) — Investor | | | N/A | | | | N/A | | | | N/A | | | | 3.90% | |

Emerging Markets Select (WIESX) — Institutional | | | N/A | | | | N/A | | | | N/A | | | | 4.00% | |

MSCI Emerging Markets Index | | | N/A | | | | N/A | | | | N/A | | | | -0.23% | |

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.wasatchfunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2013 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging Markets Select Fund are Investor Class — Gross: 2.27%, Net: 1.69% / Institutional Class —Gross: 2.29%, Net: 1.50%. The expense ratio shown elsewhere in this report may be different. Net Expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees or taxes, which if reflected, would reduce the performance quoted. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Being non-diversified, the Fund can invest a larger portion of its assets in the securities of a limited number of companies than a diversified fund. Non-diversification increases the risk of loss to the Fund if the values of these securities decline.

TOP 10 EQUITY HOLDINGS**

| | | | |

| Company | | % of Net

Assets | |

| Coca-Cola Icecek A.S. (Turkey) | | | 3.2% | |

| International Container Terminal Services, Inc. (Philippines) | | | 3.0% | |

| Imperial Holdings Ltd. (South Africa) | | | 3.0% | |

| PT Tower Bersama Infrastructure Tbk (Indonesia) | | | 3.0% | |

| | | | |

| Company | | % of Net

Assets | |

| Asian Paints Ltd. (India) | | | 3.0% | |

| Turkiye Halk Bankasi A.S. (Turkey) | | | 3.0% | |

| SM Prime Holdings, Inc. (Philippines) | | | 3.0% | |

| SJM Holdings Ltd. (Hong Kong) | | | 2.9% | |

| Credicorp Ltd. (Peru) | | | 2.9% | |

| Godrej Consumer Products Ltd. (India) | | | 2.9% | |

| ** | As of March 31, 2013, there were 33 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

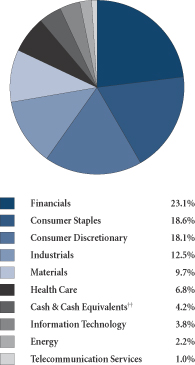

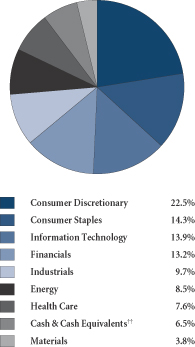

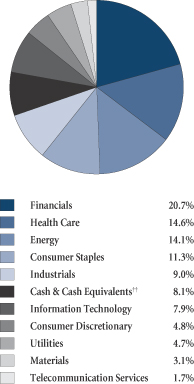

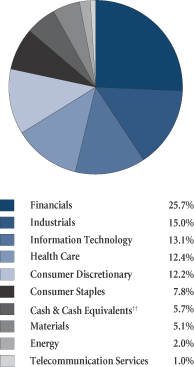

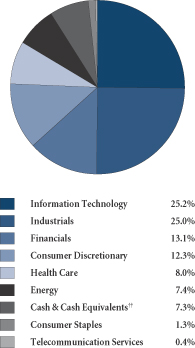

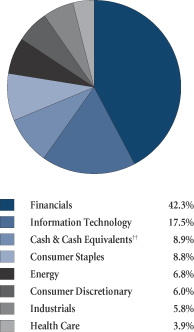

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

| †† | Also includes Other Assets & Liabilities. |

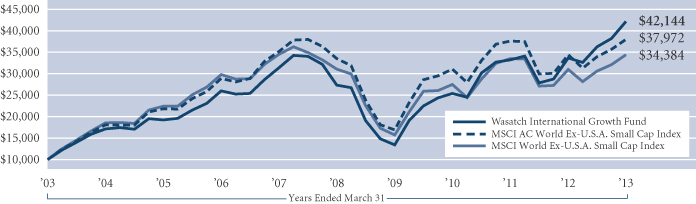

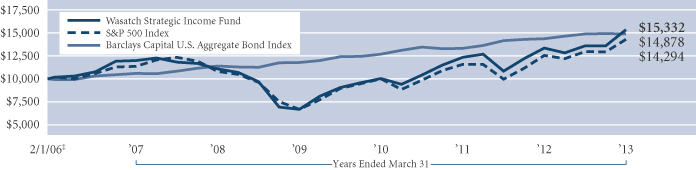

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance and the graph above does not reflect the deduction of taxes you would pay on fund distributions or the redemption of fund shares. Performance shown in the chart above does not include any applicable sales charges and fees. Wasatch does not charge any sales fees. ‡Inception: December 13, 2012. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index designed to measure the equity market performance of emerging markets. You cannot invest directly in this or any index.

9

| | |

| WASATCH EMERGING MARKETS SMALL CAP FUND (WAEMX) — Management Discussion | | MARCH 31, 2013 |

|

|

|

The Wasatch Emerging Markets Small Cap Fund is managed by a team of Wasatch portfolio managers led by Roger Edgley and Laura Geritz.

| | | | |

Roger D. Edgley, CFA Portfolio Manager | |

Laura Geritz, CFA Portfolio Manager | | OVERVIEW For the first quarter of 2013, emerging markets lagged developed markets. After a strong 2012, we believed that this year could be more difficult for returns in emerging markets, especially considering the |

visible slowdowns in countries like China and Brazil. We are seeing more disparate performance across emerging markets, with smaller countries, those in Southeast Asia for example, outperforming the BRIC (Brazil, Russia, India and China) countries. We have been overweight in Thailand, the Philippines and Mexico to a significant degree and it helped performance in the quarter. The Wasatch Emerging Markets Small Cap Fund was up 4.63% for the quarter, and outperformed the MSCI Emerging Markets Small Cap Index, which returned 4.20%.

In March, the Fund was recognized with a Lipper Fund Award for #1 performance over the three-year and five-year periods ended December 31, 2012 among 308 and 219 emerging markets funds, respectively. This recognition was earned for the second year in a row. The Emerging Markets Small Cap Fund was previously recognized in 2012 for its three-year performance ended December 31, 2011 among 296 emerging markets funds.*

DETAILSOFTHE QUARTER

As mentioned, smaller countries outside of the BRICs showed stronger performance in general. In Thailand, strong performance from names that were larger positions for us came from Minor International Public Co. Ltd. (hotel management and restaurants), Home Product Center Public Co. Ltd. (a home improvement retailer), Bangkok Life Assurance Public Co. Ltd. (life insurance) and Siam Makro Public Co. Ltd. (membership-based cash and carry trade centers). In the Philippines, our names did well with strong performance from Universal Robina Corp. (snack foods), International Container Terminal Services, Inc. (container terminal management) and Security Bank Corp. (universal bank).

It is interesting how the fundamentals of markets like Thailand and the Philippines have forced a decoupling from the rest of the emerging markets. The equity markets of these countries at present are backed by solid gross domestic product (GDP) growth (in the 5% to 7% range), strong banking systems, and strengthening investment and consumer spending. Banks and corporations are wary of over-growing and over-investing, a result of the Asian financial crisis, which caused a decade-long aftermath of rebuilding balance sheets and increased capital discipline.

Recovery from crises like the Asian financial crisis, or like Ireland recently, take at least a decade. Of course, newspaper headlines will be full of those countries in crises of some sort, not those in steady recovery or rebuilding mode like Thailand.

Today, the main risk we see in these countries is less one of overinvestment causing massive misallocation of capital and more of too much enthusiasm by investors bidding up multiples. What is remarkable about Thailand today for us, aside from the economic recovery, is its central place in a region showing positive political development and growth — namely Laos, Vietnam, Cambodia and Myanmar. Thai corporations are already benefiting from growth and investment in these countries, as well as from visitors coming to Thailand.

Markets where we underperformed were Indonesia and China. China especially has proven to be a difficult market after a strong real estate led third quarter. Consumer names like Dah Chong Hong Holdings Ltd. and Golden Eagle Retail Group Ltd. saw softer consumer spending with disappointing growth numbers. We continue to be significantly underweight relative to the Index in China. However, companies we own in Taiwan that are growing in China include Standard Foods Corp., Chailease Holding Co. Ltd. and Taiwan Hon Chuan Enterprise Co. Ltd. South Africa also had a more difficult quarter, with weak consumer numbers and concerns over the country’s currency. Consumer names in Indonesia have been softer, as evidenced in the earnings being reported.

OUTLOOK

In terms of outlook, we see a more difficult year for equity markets in emerging countries (although we are wary of our own predictive abilities here). This is evident today especially in the BRIC markets. In the last two years, the BRIC markets have been underperforming emerging markets. Some of this is being driven by structural and political factors. Although the Fund has no holdings in South Korea, it is a significant part of the benchmark and there are clearly major political worries with North Korea — the KOSPI** was down about 4% year-to-date through March 31 as a result. For non-BRIC countries we are optimistic about the prospects of a number of the smaller markets like Thailand, Mexico, Turkey and the Philippines, where the economic drivers of growth are visibly better. We expect to see continued long-term divergence in performance — a reflection of the diversity of countries within emerging markets.

Thank you for the opportunity to manage your assets.

| * | The Lipper Fund Awards program honors funds that have excelled in delivering consistently strong risk-adjusted performance relative to peers. Lipper designates award-winning funds in most individual classifications for the three-, five- and 10-year periods. Please visit the Awards for Excellence website (http://excellence.thomsonreuters.com/award/lipper) for more details about the Lipper Fund Awards. Lipper Award designations are not intended to constitute investment advice or predict future results, and Lipper does not guarantee the accuracy of this information. In addition to periods of positive returns, the Wasatch Emerging Markets Small Cap Fund experienced some periods of negative returns during the award time frame. Past performance is not indicative of future results. |

| ** | KOSPI refers to the variety of indicators that are used to measure the performance of stocks on the Korea Stock Exchange. The KOSPI itself is best known and refers to a capitalization-weighted index of about 700 Korean equities. |

| | Current and future holdings are subject to risk. |

10

| | |

| WASATCH EMERGING MARKETS SMALL CAP FUND (WAEMX) — Portfolio Summary | | MARCH 31, 2013 |

|

|

|

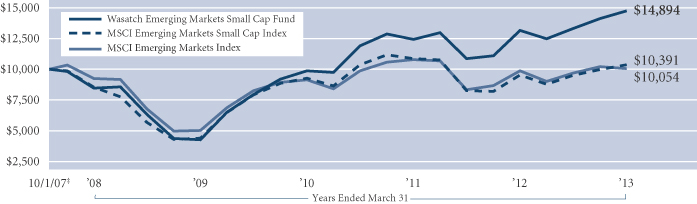

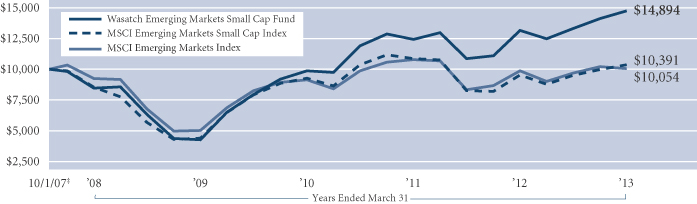

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | | |

| | | SIX MONTHS* | | | 1 YEAR | | | 5 YEARS | | | SINCE INCEPTION 10/1/07 | |

Emerging Markets Small Cap | | | 11.05% | | | | 12.31% | | | | 12.09% | | | | 7.51% | |

MSCI Emerging Markets Small Cap Index | | | 9.52% | | | | 9.20% | | | | 4.13% | | | | 0.70% | |

MSCI Emerging Markets Index | | | 3.87% | | | | 1.96% | | | | 1.09% | | | | -0.48% | |

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.wasatchfunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2013 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging Markets Small Cap Fund are 2.13%. The Net Expenses are 1.95%. The expense ratio shown elsewhere in this report may be different. Net Expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees or taxes, which if reflected, would reduce the performance quoted. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds.

TOP 10 EQUITY HOLDINGS**

| | | | |

| Company | | % of Net

Assets | |

| Minor International Public Co. Ltd. (Thailand) | | | 2.3% | |

| Home Product Center Public Co. Ltd. (Thailand) | | | 2.1% | |

| Universal Robina Corp. (Philippines) | | | 2.1% | |

| Siam Makro Public Co. Ltd. (Thailand) | | | 1.8% | |

| Security Bank Corp. (Philippines) | | | 1.8% | |

| PT Holcim Indonesia Tbk (Indonesia) | | | 1.7% | |

| | | | |

| Company | | % of Net

Assets | |

| Parque Arauco S.A. (Chile) | | | 1.6% | |

| Sonda S.A. (Chile) | | | 1.6% | |

| Chailease Holding Co. Ltd. (Taiwan) | | | 1.6% | |

| Mahindra & Mahindra Financial Services Ltd. (India) | | | 1.6% | |

| ** | As of March 31, 2013, there were 90 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

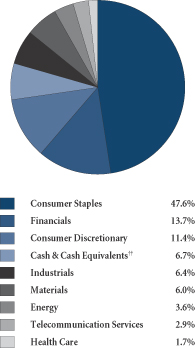

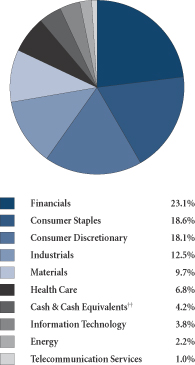

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

| †† | Also includes Other Assets & Liabilities. |

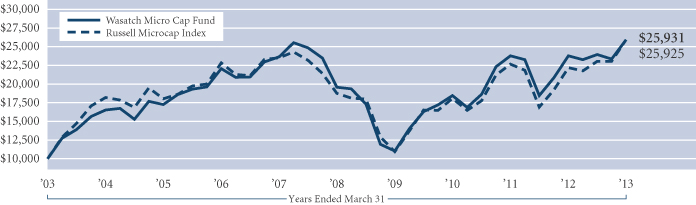

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance and the graph above does not reflect the deduction of taxes you would pay on fund distributions or the redemption of fund shares. Performance shown in the chart above does not include any applicable sales charges and fees. Wasatch does not charge any sales fees. ‡Inception: October 1, 2007. The MSCI Emerging Markets and Emerging Markets Small Cap indices are free float-adjusted market capitalization indices designed to measure the equity market performance of emerging markets. You cannot invest directly in these or any indices.

11

| | |

| WASATCH FRONTIER EMERGING SMALL COUNTRIES FUND (WAFMX) — Management Discussion | | MARCH 31, 2013 |

|

|

|

The Wasatch Frontier Emerging Small Countries Fund is managed by a team of Wasatch portfolio managers led by Laura Geritz.

| | |

Laura Geritz, CFA Portfolio Manager | | OVERVIEW The Wasatch Frontier Emerging Small Countries Fund marked its first-year anniversary in the quarter with an absolute rank of #1, according to Morningstar, out of 560 Diversified Emerging Markets funds based on total return for the 12 months ended March 31, 2013.* The Fund continued to put up solid performance in the quarter, producing an 8.33% return versus the MSCI Frontier Emerging Markets |

Index, which was up 4.39%.

Year-to-date, media pundits have postulated a return to the risk-on trade. Yet the traditional high beta sectors, namely energy and materials, were weak in the quarter, and investors are showing a strong preference for markets with relatively strong growth prospects.

DETAILSOFTHE QUARTER

NagaCorp Ltd. was our top-contributing stock this quarter. We met NagaCorp’s management in our office recently, and the company’s long-term growth plans appear intact. We feel fortunate to have had very few torpedoes in this Fund and we have done well with our country tilts. A notable miss in the quarter was the United Arab Emirates due to our low weighting and the underperformance of our holdings relative to the Index. We are active in this market, but have struggled to find companies that meet our quality criteria.

Instead of recounting play-by-play details on Fund performance, I want to elaborate on one of our central tenets for launching the Fund. A core premise is that investors need to rethink index constructs, which emphasize the BRIC (Brazil, Russia, India and China) nations, Taiwan, and Korea. Instead, we believe investors need to consider using active management to craft a well-diversified portfolio, which seeks the next great growth countries and strives to mitigate risk through analyzing correlation statistics — how countries move in the same or vastly different directions.

One of the other tenets of the Fund I want to discuss comes as a direct response to a question I often receive from investors and that is “What do I think constitutes a frontier or an emerging small country?” Frontier and emerging small countries primarily have either low GDP per capita, and hence great growth potential like Nigeria and Kenya, or are wealthy countries whose markets are simply illiquid like the United Arab Emirates. Others are like Costa Rica, a country that is actually relatively wealthy. Little of its GDP is recognized in market capitalization yet. It is absent from the indices, and many Costa Rican companies are not public. That is a future opportunity for investors.

I like to call our frontier and emerging small countries portfolio a Frankenstein portfolio, constructed of different nations with vastly different economic and political parts.

Yet unlike Mary Shelley’s fictional beast, the sum of the parts — the portfolio — works. Remove the sutures and you have interesting uncorrelated growth and value markets where we believe quality abounds. This means a portfolio manager can potentially mitigate volatility by putting together countries that don’t move in concert.

To elaborate on our portfolio creation, let me talk about one of the trips we took in the quarter. We visited a number of countries in Africa including Zimbabwe and South Africa. I think Zimbabwe is a perfect example of how a seemingly dysfunctional country can still be a great investment — our brewer in Zimbabwe does not move in concert with our brewer in Morocco, yet both have gone up over time. Zimbabwe went from being the breadbasket of Africa to Africa’s basket case. Zimbabwe has had it all — a kleptocratic government, sweeping nationalizations, hyperinflation, price controls, capital controls, and a currency collapse. Yet, I’m optimistic. At some point, President Mugabe will have to go — he is the country’s past not its future. Zimbabwe is known for its high level of education. It is a pleasant country with agricultural resources and little crime. The informal economy is sizable, driving demand for our consumer goods holdings — Delta, Innscor and Dairibord. I can’t help but marvel at what I consider to be the biggest positive — the quality of the companies.

In the quarter, a number of our South African companies were weak, as the region is witnessing a slowdown in consumption following mining strikes last year and a credit boom. Mr Price Group, Shoprite, Woolworths and Tiger Brands were impacted in the quarter by softness in South African consumption. However, I believe these companies can use their scale and proximity — at the doorstep of sub-Sahara — to canvas the continent. Long-term, I expect these will be great Pan-African companies, and I have been rounding up into weakness.

OUTLOOK

Frontier and emerging small countries offer low correlations, valuations still appear reasonable, growth has been good, and quality looks high on an absolute and relative basis. We believe we can craft the Fund’s portfolio by using our process of screening and deep due diligence to find companies within these markets that have outstanding potential. Our upcoming quarter once again entails rigorous travel. We will be traveling to Vietnam, Sri Lanka, Turkey, Thailand, Kenya, Uganda, Rwanda and Tanzania to name just a few markets. We remain convinced that the Fund’s long-term opportunity looks good — even for a Frankenstein portfolio.

Thank you for your investment.

| * | The Morningstar absolute rank is the rank of a fund among its category peers, which rank is based on a comparison of a fund’s total return performance against its peers over the stated time period. Past performance is no guarantee of future results. © 2013 Morningstar, Inc. All rights reserved. The information contained herein (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. |

| | Current and future holdings are subject to risk. |

12

| | |

| WASATCH FRONTIER EMERGING SMALL COUNTRIES FUND (WAFMX) — Portfolio Summary | | MARCH 31, 2013 |

|

|

|

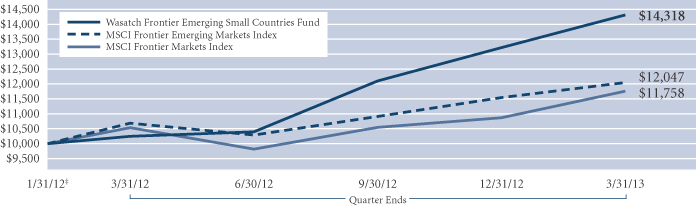

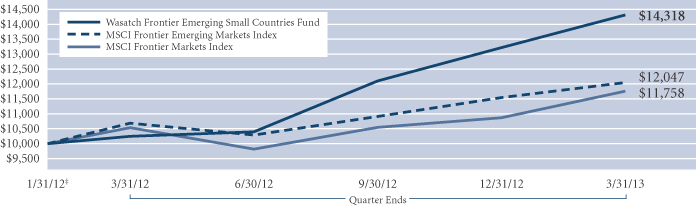

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | |

| | | SIX MONTHS* | | | 1 YEAR | | | 5 YEARS | | SINCE INCEPTION 1/31/12 | |

Frontier Emerging Small Countries | | | 18.33% | | | | 39.69% | | | N/A | | | 36.10% | |

MSCI Frontier Emerging Markets Index | | | 10.42% | | | | 12.71% | | | N/A | | | 17.31% | |

MSCI Frontier Markets Index | | | 11.48% | | | | 11.62% | | | N/A | | | 14.90% | |

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.wasatchfunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2013 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Frontier Emerging Small Countries Fund are 3.64%. The Net Expenses are 2.25%. The expense ratio shown elsewhere in this report may be different. Net Expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees or taxes, which if reflected, would reduce the performance quoted. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in frontier and emerging markets, entails special risks, such as unstable currencies, highly volatile securities markets and political and social instability, which are described in more detail in the prospectus. Being non-diversified, the Fund can invest a larger portion of its assets in the stocks of a limited number of companies than a diversified fund. Non-diversification increases the risk of loss to the Fund if the values of these securities decline.

TOP 10 EQUITY HOLDINGS**

| | | | |

| Company | | % of Net

Assets | |

| Nestlé Nigeria plc (Nigeria) | | | 4.3% | |

| East African Breweries Ltd. (Kenya) | | | 3.7% | |

| NagaCorp Ltd. (Cambodia) | | | 3.3% | |

| Nigerian Breweries plc (Nigeria) | | | 2.7% | |

| Ulker Biskuvi Sanayi A.S. (Turkey) | | | 2.0% | |

| | | | |

| Company | | % of Net

Assets | |

| Shoprite Holdings Ltd. (South Africa) | | | 2.0% | |

| Commercial Bank of Ceylon plc (Sri Lanka) | | | 2.0% | |

| Zenith Bank plc (Nigeria) | | | 1.9% | |

| Kuwait Foods Americana (Kuwait) | | | 1.9% | |

| Universal Robina Corp. (Philippines) | | | 1.9% | |

| ** | As of March 31, 2013, there were 109 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

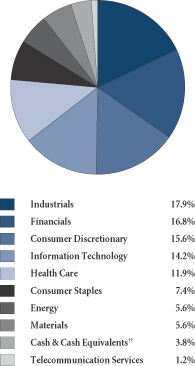

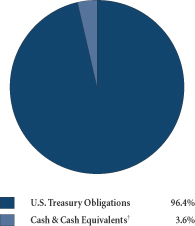

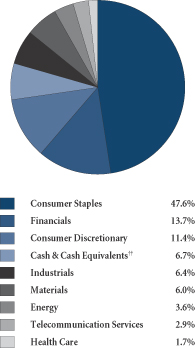

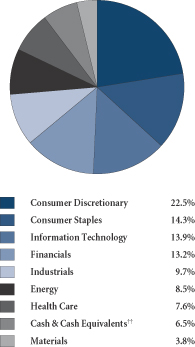

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

| †† | Also includes Other Assets & Liabilities. |

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance and the graph above does not reflect the deduction of taxes you would pay on fund distributions or the redemption of fund shares. Performance shown in the chart above does not include any applicable sales charges and fees. Wasatch does not charge any sales fees. ‡Inception: January 31, 2012. The MSCI Frontier Emerging Markets and MSCI Frontier Markets indices are free float-adjusted market capitalization indices designed to measure the equity market performance of the global frontier and emerging markets. You cannot invest directly in these or any indices.

13

| | |

| WASATCH GLOBAL OPPORTUNITIES FUND (WAGOX) — Management Discussion | | MARCH 31, 2013 |

|

|

|

The Wasatch Global Opportunities Fund is managed by a team of Wasatch portfolio managers led by JB Taylor and Ajay Krishnan.

| | | | |

JB Taylor Portfolio Manager | |

Ajay Krishnan, CFA Portfolio Manager | | OVERVIEW The Wasatch Global Opportunities Fund gained 8.25% in the first quarter, and the MSCI AC World Small Cap Index rose 9.65%. The quarter was a combination of strong results in |

absolute terms and modest underperformance versus the benchmark. Our investments in the vast majority of sectors and countries posted gains, with particular strength in industrials, information technology, Australia and Japan. The biggest factor in the Fund’s performance versus the MSCI AC World Small Cap Index was our lower relative weight in U.S. stocks. Our holdings in the United States performed well, generating double-digit gains that were slightly behind the average for U.S. small caps. Our international stocks did slightly better than the international component of the Index, mitigating some of the effect of a low U.S. weight.

DETAILSOFTHE QUARTER

Our international holdings, which accounted for about 58% of the Fund, gained approximately 7.5% for the quarter, and exceeded the 6.54% increase in the MSCI AC World Ex-U.S.A. Small Cap Index.* Keeping pace with our benchmark, the MSCI AC World Small Cap Index, was made more difficult by our overweight positions in two markets that declined — India and South Africa. The political environment has been tenuous in India. One of the key members of the ruling coalition government recently pulled its support from the government, triggering a broad sell-off in equities. In South Africa, concerns about the country’s growth outlook and ongoing labor tensions put downward pressure on its currency, eroding equity returns for U.S.-based investors.

As a market, Japan caught many investors by surprise, posting a gain of nearly 16% for the period. Coming into the quarter, the Fund’s weight in Japan was less than half of the Index’s, but we still outperformed in the country. This was in part due to MonotaRO Co. Ltd., an Internet-based distributor of maintenance, repair and operations (MRO) supplies headquartered in Japan. It was the Fund’s largest position coming into the quarter and the stock gained nearly 51%. The company offers about two million products and has been posting record monthly sales. On the negative side, LIC Housing Finance Ltd., one of India’s largest mortgage lenders, was a major detractor. LIC reported slower loan growth and an increase in non-performing assets. We sold the stock in response to the disappointing results, as well as our concerns about LIC’s relatively new management team.

Our domestic holdings, which accounted for approximately 37% of the Fund, were up about 12.2%. This was a strong result. However, it was not quite as strong as the performance of the MSCI U.S. Small Cap Index,** which rose 12.79%. In the aggressive market environment that prevailed during the quarter, economically sensitive and more speculative stocks were generally the market’s best performers. Stocks related to construction and housing were especially strong. Biotechnology stocks were also top performers. With risk appetites elevated, many of our stable companies with consistent earnings and solid business models looked less appealing by comparison. While this was a challenge for our style of investing, the margin of underperformance in the domestic portion of the Fund was small.

One of our steady growth companies that did outperform was Copart, Inc., a provider of online auctions and vehicle remarketing services in the United States, the United Kingdom and Canada. Strong, profitable relationships with auto insurers are key drivers of its business, and Copart continues to win exclusive contracts with insurance companies. SEI Investments Co., a stock we added this quarter, was another notable contributor. SEI is an investment manager that also provides back-office technology to banks and other financial services firms. The company has been investing heavily in its “Global Wealth Services” to attract large bank customers, and this initiative is starting to pay off. Sales trends are positive, and earnings growth is reaccelerating.

One of the biggest U.S. detractors this quarter was Polypore International, Inc. Polypore makes filtration membranes used in batteries, including the lithium-ion batteries used in electric cars. The stock declined amid uncertainty about the timing for the meaningful adoption of electric vehicles. Despite the recent weakness, our long-term thesis on Polypore remains intact. We believe that vehicle electrification is inevitable and that the company is well positioned for this opportunity since it is one of the world’s leading suppliers of lithium battery membranes.

OUTLOOK

As always, we remain focused on identifying companies whose individual characteristics provide the potential for them to excel and grow regardless of broad trends in the global economy. According to our models, our portfolio companies are on track to generate 18% annual earnings growth over the next three years, while delivering a 24% return on equity. In addition, the Fund’s weighted-average price-to-earnings ratio is 19 times forward 12-month earnings, which is attractive relative to our earnings estimates. These metrics give us confidence that our portfolio of Wasatch’s best global ideas is well positioned for the months ahead.

Thank you for the opportunity to manage your assets.

| * | The MSCI All Country (AC) World Ex-U.S.A. Small Cap Index is an unmanaged index and includes reinvestment of all dividends of issuers located in countries throughout the world representing developed and emerging markets, excluding securities of U.S. issuers. This index is a free float-adjusted market capitalization index designed to measure the performance of small capitalization securities. |

| **The | MSCI U.S. Small Cap Index represents the universe of small capitalization companies in the U.S. equity market. |

| | Current and future holdings are subject to risk. |

14

| | |

| WASATCH GLOBAL OPPORTUNITIES FUND (WAGOX) — Portfolio Summary | | MARCH 31, 2013 |

|

|

|

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | |

| | | SIX MONTHS* | | | 1 YEAR | | | 5 YEARS | | SINCE INCEPTION 11/17/08 | |

Global Opportunities | | | 13.92% | | | | 19.69% | | | N/A | | | 26.71% | |

MSCI AC World Small Cap Index | | | 13.74% | | | | 13.71% | | | N/A | | | 21.62% | |

S&P Global SmallCap Index | | | 14.33% | | | | 14.03% | | | N/A | | | 20.68% | |

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.wasatchfunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2013 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Global Opportunities Fund are 1.84%. The expense ratio shown elsewhere in this report may be different. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees or taxes, which if reflected, would reduce the performance quoted. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in small and micro cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

TOP 10 EQUITY HOLDINGS**

| | | | |

| Company | | % of Net

Assets | |

Wirecard AG (Germany) | | | 2.0% | |

REA Group Ltd. (Australia) | | | 2.0% | |

Coca-Cola Icecek A.S. (Turkey) | | | 2.0% | |

MonotaRO Co. Ltd. (Japan) | | | 1.9% | |

Sa Sa International Holdings Ltd. (China) | | | 1.7% | |

Aberdeen Asset Management plc

(United Kingdom) | | | 1.7% | |

| | | | |

| Company | | % of Net

Assets | |

Elekta AB, Class B (Sweden) | | | 1.7% | |

Abcam plc (United Kingdom) | | | 1.7% | |

Rotork plc (United Kingdom) | | | 1.6% | |

Domino’s Pizza Group plc

(United Kingdom) | | | 1.6% | |

| ** | As of March 31, 2013, there were 93 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

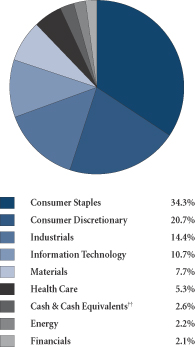

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

| †† | Also includes Other Assets & Liabilities. |

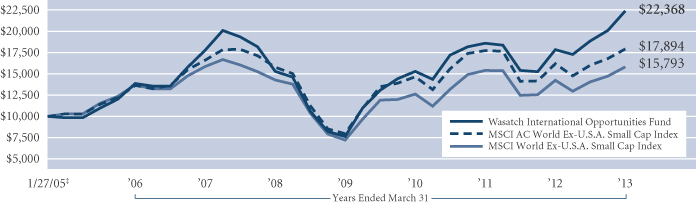

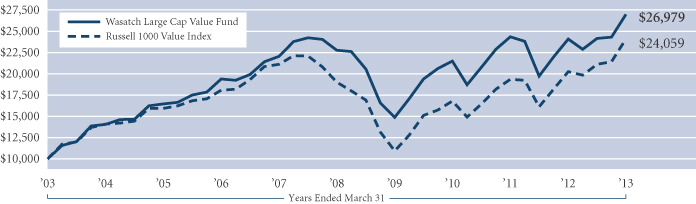

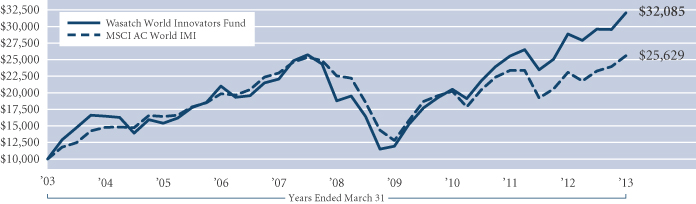

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance and the graph above does not reflect the deduction of taxes you would pay on fund distributions or the redemption of fund shares. Performance shown in the chart above does not include any applicable sales charges and fees. Wasatch does not charge any sales fees. ‡Inception: November 17, 2008. The MSCI All Country (AC) World Small Cap Index is an unmanaged index and includes reinvestment of all dividends of issuers located in countries throughout the world representing developed and emerging markets. This index is a free float-adjusted market capitalization index designed to measure the performance of small capitalization securities. The S&P Global SmallCap Index is an unmanaged index and includes reinvestment of all dividends of issuers located across developed and emerging markets, including the United States, that fall in the bottom 15% of their country’s market cap range. You cannot invest directly in these or any indices.

15

| | |

| WASATCH HERITAGE GROWTH FUND (WAHGX) — Management Discussion | | MARCH 31, 2013 |

|

|

|

The Wasatch Heritage Growth Fund is managed by a team of Wasatch portfolio managers led by Chris Bowen and Ryan Snow.

| | | | |

Chris Bowen Portfolio Manager | |

Ryan Snow Portfolio Manager | | OVERVIEW Spurred on, in part, by the rebound in the housing market, the stock market continued its upward advance to open the year. Virtually every sector finished the first quarter in |

positive territory during a broad market rally.

The Wasatch Heritage Growth Fund also posted strong performance with an 8.18% gain for the quarter. The Fund’s benchmark, the Russell Midcap Growth Index, performed even better by returning 11.51%.

We are pleased that the Fund delivered a significant gain. We are also disappointed — though not completely surprised — that it underperformed the benchmark. As we’ve said in the past, the steadily growing, top quality companies that we believe we hold in the Fund tend to generate less market excitement when stock prices are soaring. We would have liked the market to recognize the untapped potential of the Fund’s holdings. But — more importantly — we believe the consistent execution of the companies we hold gives them the potential to outperform when market participants aren’t so optimistic. Although our top 20 holdings by position size each delivered a positive return, we simply weren’t invested where the market was the strongest this quarter.

We believe we should be good stewards and vigorous protectors of the Fund’s capital. This means that part of our job is to drown out the short-term noise of market movements — whether up or down — so we can remain focused on the task of finding great companies valued at reasonable prices. We don’t invest with the intent of capturing all of the available upside because, in addition to securing gains, we also believe we are charged with minimizing downward movements. Though this isn’t always an immediately rewarding process, we are confident that our disciplined approach is the best way to achieve outstanding results over time.

DETAILSOFTHE QUARTER

The Fund’s underperformance was primarily attributable to being less exposed to consumer discretionary and consumer staples companies than the benchmark. Both sectors were meaningful contributors to the benchmark’s return.

Even though we are witnessing signs of modest economic improvement, the overhang of debt — both on the government and individual level — continues to make us cautious in our outlook. As irrepressible as consumer spending has been, with savings rates dipping and tax rates increasing, we currently see few enticing investment opportunities among companies dependent upon consumers, especially among retailers.

IntercontinentalExchange, Inc. was a strong performer during the quarter. While headlines focused on the company’s pending acquisition of NYSE Euronext,* operator of the New York Stock Exchange, we believe the more attractive component of the transaction is the NYSE Liffe, which deals in derivatives, a rapidly expanding segment of trading activity.

Covance, Inc. was also a significant contributor. The company, which partners primarily with pharmaceutical firms to assist in drug development, has been in a difficult environment. Its early-stage business virtually dried up in 2008 as biotechnology companies encountered severe challenges. We’re optimistic about the current Food and Drug Administration environment, which seems to now have a more efficient approval process. We believe that Covance has a good opportunity to return its margins back to where they once were, which should support a higher stock price.

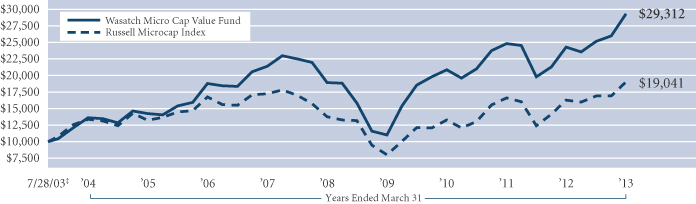

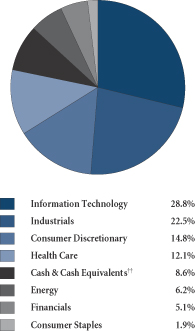

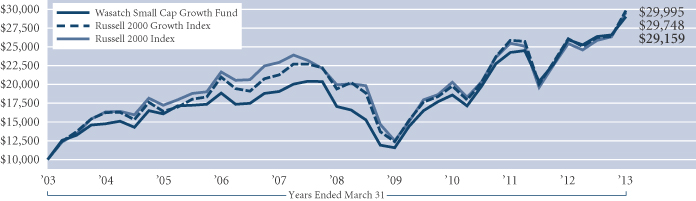

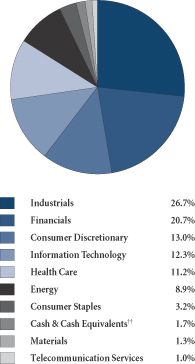

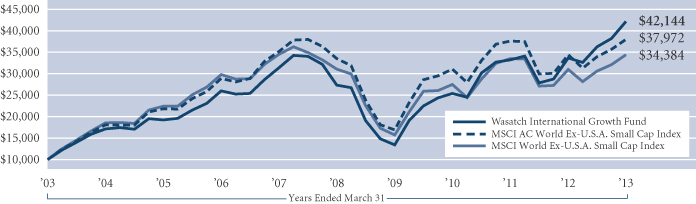

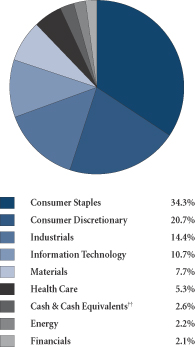

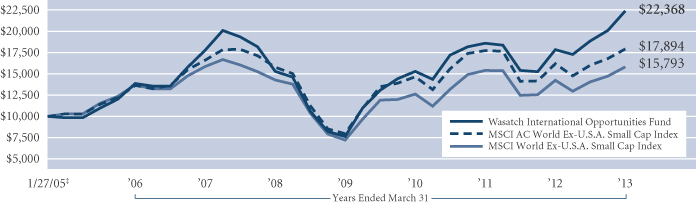

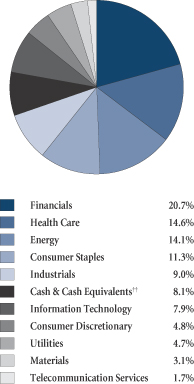

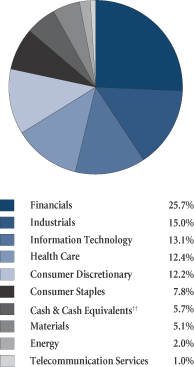

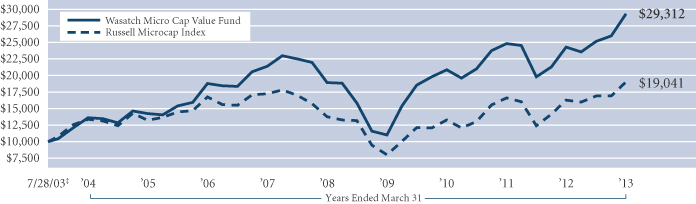

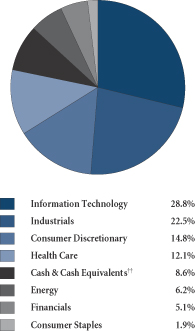

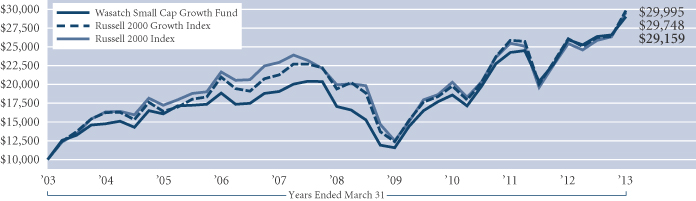

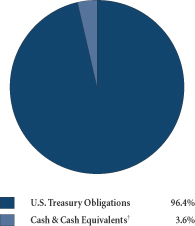

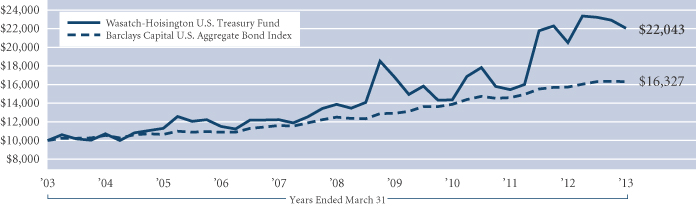

SEI Investments Co. performed well and is an example of a quintessential portfolio holding. This diversified investment manager and processor has continued to make strides coming off of the deep decline of the equity markets since the financial crisis began in late 2007. We increased our position size during the quarter as we felt the company’s valuation looked appealing and we expect meaningful earnings growth driven by SEI’s expansion into new markets.