Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04920

WASATCH FUNDS TRUST

(Exact name of registrant as specified in charter)

505 Wakara Way, 3rd Floor

Salt Lake City, UT 84108

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) | Copy to: | |

Samuel S. Stewart, Jr. Wasatch Advisors, Inc. 505 Wakara Way, 3rd Floor Salt Lake City, UT 84108 | Eric F. Fess, Esq. Chapman & Cutler LLP 111 West Monroe Street Chicago, IL 60603 | |

Registrant’s telephone number, including area code: (801) 533-0777

Date of fiscal year end: September 30

Date of reporting period: September 30, 2014

Table of Contents

| Item 1: | Report to Shareholders. |

Table of Contents

2014 Annual Report

September 30, 2014

EQUITY FUNDS/ Wasatch Core Growth Fund. Wasatch Emerging India Fund. Wasatch Emerging Markets Select Fund. Wasatch Emerging Markets Small Cap Fund. Wasatch Frontier Emerging Small Countries Fund. Wasatch Global Opportunities Fund. Wasatch Heritage Growth Fund. Wasatch International Growth Fund. Wasatch International Opportunities Fund. Wasatch Large Cap Value Fund. Wasatch Long/Short Fund. Wasatch Micro Cap Fund. Wasatch Micro Cap Value Fund . Wasatch Small Cap Growth Fund. Wasatch Small Cap Value Fund. Wasatch Strategic Income Fund. Wasatch Ultra Growth Fund. Wasatch World Innovators Fund BOND FUNDS/ Wasatch-1st Source Income Fund. Wasatch-Hoisington U.S. Treasury Fund

Table of Contents

Wasatch Funds

Salt Lake City, Utah

www.WasatchFunds.com

800.551.1700

Table of Contents

| TABLEOF CONTENTS | ||

| ||

| ||

| 2 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

Wasatch Emerging Markets Small Cap Fund® Management Discussion | 10 | |||

| 11 | ||||

Wasatch Frontier Emerging Small Countries Fund™ Management Discussion | 12 | |||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

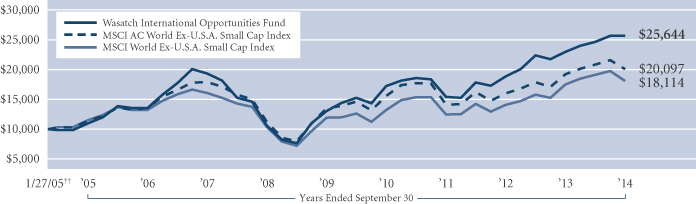

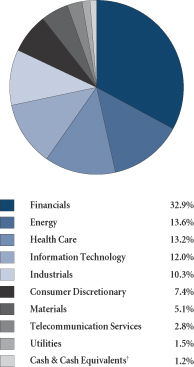

Wasatch International Opportunities Fund® Management Discussion | 20 | |||

| 21 | ||||

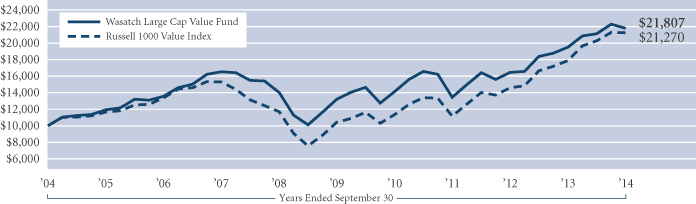

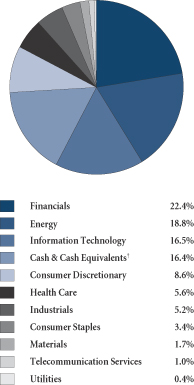

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

Wasatch-Hoisington U.S. Treasury Fund® Management Discussion | 42 | |||

| 43 | ||||

| 44 | ||||

| 45 | ||||

| 48 | ||||

| 92 | ||||

| 98 | ||||

| 104 | ||||

| 112 | ||||

| 118 | ||||

| 119 | ||||

| 140 | ||||

| 141 | ||||

| 141 | ||||

| 142 | ||||

| 143 | ||||

| 143 | ||||

| 143 | ||||

| 144 |

This material must be accompanied or preceded by a prospectus.

Please read the prospectus carefully before you invest.

Wasatch Funds are distributed by ALPS Distributors, Inc.

1

Table of Contents

| LETTERTO SHAREHOLDERS — READING BETWEENTHE (HEAD)LINES | ||||

|

| |||

|

| |||

Samuel S. Stewart, Jr. PhD, CFA President of | DEAR FELLOW SHAREHOLDERS:

I like a good headline as much as anyone. And as I considered possible headlines for this letter, I recalled a quote that’s been attributed to Bill Gates: “Headlines, in a way, are what mislead you because bad news is a headline, and gradual improvement is not.” Not only are headlines often negative, they frequently tell us what we already know — and, from an investment perspective, what’s already been factored into market prices. Just consider the pessimistic nature of recent headlines: The likelihood of an imminent correction in stocks. The potential for Fed-induced runaway inflation. The Russia/Ukraine conflict. The Ebola threat. Tensions in the Middle East. Given all this bad news, it’s little wonder that many Americans think we’re headed in the wrong direction. Yet, by many measures, the U.S. economy has returned to where it was before the global financial crisis of 2008 and early 2009. Today, bank loans to businesses exceed those of 2007. Total private employment has topped 2008 levels. And after a multi-year trend of declining incomes, there has been some recent improvement. Despite the headlines, our economy has been making incremental progress. |

ECONOMY

Annualized growth in nominal gross domestic product (GDP) was 6.8% (4.6% after inflation) for the second calendar quarter of 2014, up sharply from the negative rate recorded for the first calendar quarter. Taking a longer view, the three-year average of nominal GDP growth was just under 4%, and this growth rate has not improved over the last decade. Further, forecasters expect GDP growth for the rest of 2014 to remain near the three-year average at about 4%. The good news is that the economy continues to move ahead; the bad news is that the pace of recovery remains measured.

Other positive signs include the recent 8.4% quarterly rebound in corporate profits, continued improvement in unemployment figures, only small increases in interest rates and a decline in the rate of inflation. Unemployment dropped to 5.9% in September and the rate of new-job creation in the first half of 2014 hit a 15-year high.

At the same time, price declines in August brought the annualized inflation rate for 2014 down to 1.7%, near the Federal Reserve’s target of 2.0%. With quantitative easing set to end soon, it seems to me that the Fed has handled its responsibilities well. The economy is recovering, but not so quickly that the Fed will be forced to stomp on the brakes by rapidly raising interest rates.

If there are potential trouble spots, I think they’re mainly overseas — in Europe, China, India, Japan, Russia and the Middle East. To gain some perspective on the nature of these problems, it’s useful to consider the comparative well-being of the U.S. The U.S. is the third most populous nation on the planet, and the American economy is more self-sufficient than most. We have a common currency and a common language. As citizens, we expect our tax dollars to be used primarily for the general well-being of all Americans. Therefore, we share many of the same economic goals.

Although the eurozone in aggregate has a population similar in size to that of the U.S., the eurozone lacks a common language, a common culture and a commitment to the general welfare of all citizens. Europe does benefit from being relatively self-sufficient when taken as a whole. But the lack of commitment to the general welfare has the effect of pitting nation against nation — northern countries enjoy relative prosperity while southern countries stagnate. The net result is a sluggish economy faced with slipping back into recession, and maybe into deflation.

Europe’s challenges have implications for emerging-market countries. The two largest trading partners for the export-driven emerging markets are the U.S. and Europe, each accounting for about 30% of global consumption. When consumer and industrial spending in the U.S. and Europe are less robust, the GDPs of these emerging economies suffer.

Japan has been experiencing a long period of deflation. And after many years of a strong currency, which makes the country’s exports more expensive to the rest of the world, the Japanese government recently undertook policies to weaken the yen. While this may be good for Japan’s global-trade competitiveness, it could cause large exporting countries — including emerging markets — to devalue their currencies in an effort to support their export industries. Such a currency war would likely be inflationary on a wide scale.

The conflict between Russia and Ukraine has significant implications outside of these countries because Russia is a major energy supplier to Europe and other parts of the world. In addition, Russia is a large importer of European finished goods.

MARKETS

During the second calendar quarter of 2014, markets were almost universally riding a wave of optimism despite uneven economic news. The situation reversed somewhat during the third calendar quarter. In the U.S., economic news improved and the dollar strengthened, but stock-market conditions were mixed. Generally speaking, large-cap stocks advanced modestly, mid-caps held relatively steady and small-caps pulled back.

International stock markets were also mixed for the most recent quarter. Although the economic and geopolitical problems abroad are disturbing, I continue to believe there are attractive investment opportunities around the world. In general, while European economic growth is slower than in the U.S., valuations are somewhat less expensive in Europe and we’re able to find companies that operate globally. Within emerging markets, valuations are typically more expensive, but long-term growth rates are often higher — despite recent economic challenges. And we seek to mitigate some of the risks in emerging markets by focusing

2

Table of Contents

| SEPTEMBER 30, 2014 (UNAUDITED) | ||

| ||

| ||

on companies that are meeting home-country demands, rather than the demands of the developed world. Finally, in Japan, exporters of manufactured goods may benefit from weakness in the Japanese yen, even if this has negative implications for exporters from other countries.

Performance in the fixed-income markets was generally positive for the most recent quarter. Despite this positive overall performance, interest rates rose late in the period, leading to some declines in bond prices. Nevertheless, I continue to believe that bonds are expensive. And many investors may not even be aware that significant increases in interest rates would cause substantial principal losses — particularly for longer-term bonds.

Regarding U.S. stocks in general, while overall valuations are on the high side, we’re finding a good number of reasonably priced stocks, including some that pay attractive dividend yields. In addition, U.S. economic conditions continue to improve. And of the measures of market psychology I’ve found useful over the years, most are showing significant resilience. As a result, I remain a cautious bull.

WASATCH

Did you know the typical mutual-fund shareholder, over time, receives a return at least 2% less per year than the return of the fund itself? To explain why this is the case, and more importantly to help you avoid experiencing such poor results yourself, I want to tell you a bit about the way we invest at Wasatch.

Our funds have experienced substantial gains in the years since the global financial crisis. It’s worth noting, however, that just as all segments of the economy have not recovered at the same rate or time, our funds have not always been in sync with their benchmark indices. As active managers, our goal is to outperform the indices, not mimic them. The only way to achieve this goal over the long term is to construct fund portfolios that are substantially different from their benchmarks. As a result, performance relative to the index in the short term is very unpredictable.

Our fund portfolios may differ from the indices because we seek to invest in high-quality companies — businesses with strong balance sheets, innovative products and services, and talented management teams. It’s not unusual for the stocks of these companies to lag during certain segments of an economic recovery, which may favor companies that were severely beaten up in the preceding downturn or companies that are new and exciting but unproven. Over the long term, however, we believe that our investments in higher-quality companies will have the potential to generate outsized returns with reasonable risks.

Unlike broad-based indices, some Wasatch Funds may concentrate investments in a relatively small number of companies. Or in the case of our international funds, including those focusing on emerging markets, we may vary our investments by country, sector and company size. Many of the emerging-market indices, by contrast, are heavily weighted in companies that are large exporters to developed countries. At Wasatch, we sense better opportunities in emerging-market companies that are satisfying local demands.

We recognize that shareholders may sometimes feel frustrated that a particular fund appears to be underperforming. In our experience, this frustration often creates the urge to sell the underperforming fund in order to buy one that’s been doing better lately. While it’s human nature to want to chase performance, this behavior is rarely effective when it comes to achieving long-term goals.

That’s why we urge shareholders to do their research and choose their portfolio managers and funds with care. Periodic, short-term underperformance is normal for an actively managed fund. A quick trigger finger may cost a shareholder much more over the long term.

With sincere thanks for your continued investment and for your trust,

Sam Stewart

President of Wasatch Funds

Information in this report regarding market or economic trends or the factors influencing historical or future performance reflects the opinions of management as of the date of this report. These statements should not be relied upon for any other purpose. Past performance is no guarantee of future results, and there is no guarantee that the market forecasts discussed will be realized.

CFA® is a trademark owned by CFA Institute.

Wasatch Advisors is the investment advisor to Wasatch Funds.

3

Table of Contents

| WASATCH CORE GROWTH FUND (WGROX / WIGRX) — Management Discussion | SEPTEMBER 30, 2014 (UNAUDITED) | |

| ||

| ||

The Wasatch Core Growth Fund is managed by a team of Wasatch portfolio managers led by JB Taylor and Paul Lambert.

JB Taylor Lead Portfolio Manager |

Paul Lambert Portfolio Manager | OVERVIEW

The Wasatch Core Growth Fund — Investor Class gained 3.26% for the 12 months ended September 30, 2014. The Russell 2000 Index, the Fund’s primary benchmark, |

gained 3.93% for the same period.

Since early 2013, we have seen a disconnect between company fundamentals and stock prices. Over this time, companies with weaker fundamentals have outperformed those with higher-quality balance sheets and stronger earnings growth. One illustration of this trend is the recent performance of money-losing companies. For the five quarters between December 31, 2012 and March 31, 2014, Russell 2000 Growth Index companies posting quarterly losses in earnings-per-share (EPS) outperformed companies with quarterly profits. This trend began to reverse in the second calendar quarter and continued during the third calendar quarter of 2014.

We suspect the Fed’s quantitative-easing program encouraged risk taking and contributed to a momentum-driven market. The scheduled end of the program may encourage investors to once again focus on company fundamentals.

DETAILSOFTHE YEAR

A future more focused on fundamentals should bode well for the Wasatch Core Growth Fund. In the most recent quarter, our companies reported sales and EPS growth of 15.6% and 16.2%, respectively. By comparison, the median sales and EPS growth of the average company in the Russell 2000 Index were 8.9% and 7.3%, respectively. Our companies have higher operating margins and better returns-on-capital than the average company in the Index. Most importantly, our companies are led by management teams that we have vetted through numerous on-site visits and conference calls. A low-turnover strategy makes this endeavor possible. On average, our current top 20 holdings have been held in the Fund for over six years.

While the Fund underperformed the Index for the 12-month period, our health-care stocks outpaced their benchmark counterparts helped by strong performance from Ensign Group, Inc. and ICON plc, both of which produced double-digit gains for the year.

The industrials sector was another area of outperformance led by Spirit Airlines, Inc., the Fund’s top overall contributor. This airline has continued to grow by entering new markets as a low-cost alternative to bigger carriers. With larger hub-and-spoke airlines focused on moving “up market” and expanding return on capital, Spirit’s low cost structure is enabling it to grow revenue through careful expansion

of its route map. At just 1% market share, we believe Spirit has plenty of room to grow.

Two other strong performers from the industrials sector were trucking companies Old Dominion Freight Line, Inc. and Knight Transportation, Inc. Both companies have been benefiting from the improving economy, especially strength in manufacturing, and tight capacity in the trucking industry. In addition, higher operating costs due to new government regulations have hurt smaller competitors.

Our largest detractor was in the consumer-staples sector. Nu Skin Enterprises, Inc. sells premium skin-care products and nutritional supplements worldwide. The stock’s weak performance began in January 2014, when the Chinese government opened an investigation into the company’s direct-selling practices. With the investigation now settled and measures taken to address the Chinese government’s concerns, Nu Skin is beginning to regain momentum. This process will take time and, for investors, a large amount of patience. We still like the stock. The company remains highly profitable, has ample financial resources, and faces significant opportunities to grow its brand in emerging Asian markets.

The energy sector was one of the worst-performing sectors for the period. Our energy companies reflected this weakness. The price of oil declined 12% over the past 12 months in spite of alarming global headlines in major oil-producing regions of the world. This kind of volatility in a commodity-related industry is not uncommon. Our investments in the energy sector are focused on the long-run need for efficient energy production to fuel economic growth and, for domestic energy producers and service providers, to help the United States gain energy independence. CARBO Ceramics, Inc. was a notably weak stock. Less expensive alternatives to CARBO’s high-quality ceramic proppants are challenging the company’s business model. We sold our position in CARBO since this shift in market share could be a long-lasting trend as weaker oil prices will result in more emphasis on saving money versus the increased output offered by ceramic proppants.

OUTLOOK

Notwithstanding recent small-cap stock performance, most indicators for the economy appear as healthy as they have been in a long time. The median company revenue growth in the Russell 2000 Growth Index topped 10% for the first time in two years and the number of Index companies missing estimates was down versus the last few quarters. Wall Street analyst expectations call for accelerating growth rates going forward. On the flipside, valuations are still a concern.

We don’t see cause for alarm. We do see signs of a transition from a period when momentum and liquidity were the market’s primary drivers, to one in which growth rates and rational valuations should determine returns. We welcome this type of “stock picker’s market” in which our insights on a company’s management, business-model quality and long-term growth prospects should be properly rewarded.

Thank you for the opportunity to manage your assets and for your trust.

| Current | and future holdings are subject to risk. |

4

Table of Contents

| WASATCH CORE GROWTH FUND (WGROX / WIGRX) — Portfolio Summary | SEPTEMBER 30, 2014 (UNAUDITED) | |

| ||

| ||

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | 10 YEARS | ||||||||||

Core Growth (WGROX) — Investor | 3.26% | 15.94% | 8.09% | |||||||||

Core Growth (WIGRX) — Institutional | 3.31% | 15.99% | 8.11% | |||||||||

Russell 2000® Index | 3.93% | 14.29% | 8.19% | |||||||||

Russell 2000® Growth Index | 3.79% | 15.51% | 9.03% | |||||||||

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.WasatchFunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2014 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Core Growth Fund — Investor Class: 1.21% / Institutional Class: 1.32%, Net: 1.12%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 1/31/2012 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 1/31/2012 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

TOP 10 EQUITY HOLDINGS*

| Company | % of Net Assets | |||

| Copart, Inc. | 4.8% | |||

| Allegiant Travel Co. | 3.4% | |||

| Dealertrack Technologies, Inc. | 3.2% | |||

| Spirit Airlines, Inc. | 3.2% | |||

| Life Time Fitness, Inc. | 2.7% | |||

| Company | % of Net Assets | |||

| Vistaprint N.V. | 2.7% | |||

| MEDNAX, Inc. | 2.5% | |||

| Waste Connections, Inc. | 2.5% | |||

| IDEX Corp. | 2.5% | |||

| SEI Investments Co. | 2.4% | |||

| * | As of September 30, 2014, there were 61 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

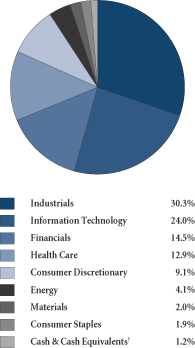

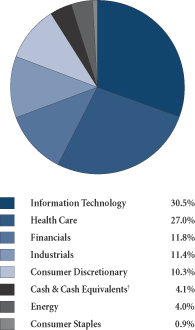

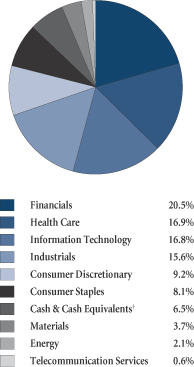

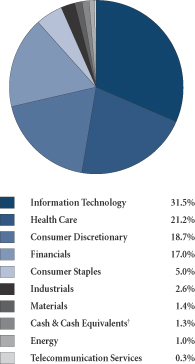

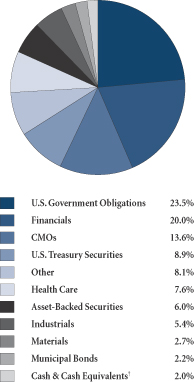

SECTOR BREAKDOWN**

| ** | Excludes securities sold short and options written, if any. |

| † | Also includes Other Assets & Liabilities. |

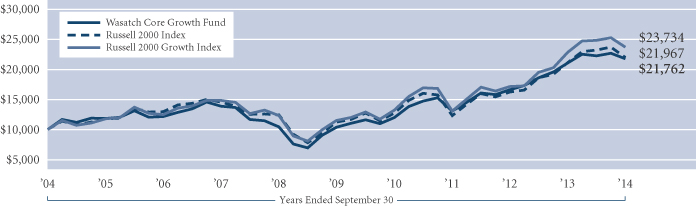

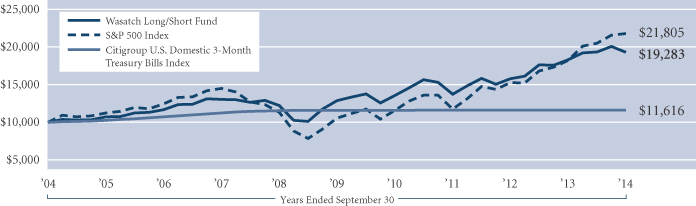

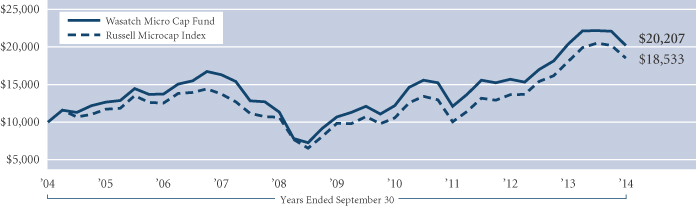

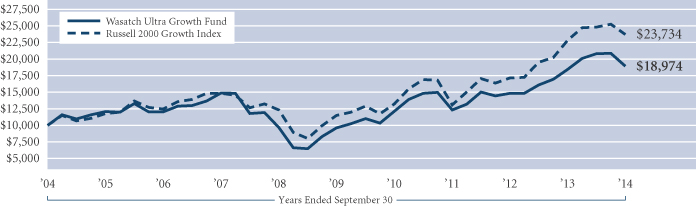

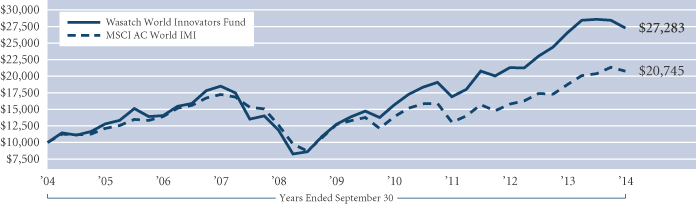

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees. The Russell 2000 Index is an unmanaged total return index of the smallest 2,000 companies in the Russell 3000 Index, as ranked by total market capitalization. The Russell 2000 Index is widely regarded in the industry as accurately capturing the universe of small company stocks. The Russell 2000 Growth Index is an unmanaged total return index that measures the performance of those Russell 2000 Index companies with higher price-to-book ratios and higher forecasted growth values. You cannot invest directly in these or any indices.

5

Table of Contents

| WASATCH EMERGING INDIA FUND (WAINX) — Management Discussion | SEPTEMBER 30, 2014 (UNAUDITED) | |

| ||

| ||

The Wasatch Emerging India Fund is managed by a team of Wasatch portfolio managers led by Ajay Krishnan.

Ajay Krishnan, CFA Lead Portfolio Manager | OVERVIEW

The Wasatch Emerging India Fund gained 53.37% in the 12 months ended September 30, 2014. The Fund outperformed its benchmark, the MSCI India Investable Market Index (IMI), which rose 41.83%. Optimism surrounding India’s national elections last May fueled a strong rally in its stock market that pushed its major stock averages to all-time highs throughout the year. |

Widespread dissatisfaction with India’s Congress party had stirred desire for a change in leadership that investors believed would usher in a new era of economic reforms.

India suffers from years of underinvestment in the capital and infrastructure needed for its economy to operate at its full potential. Inefficiencies in production and transportation have held back economic growth, while contributing to structural inflation in the prices of basic items. Investors hope that the policies of newly elected Prime Minister Narendra Modi, leader of the Bharatiya Janata Party (BJP), will engender a self-sustaining investment cycle that will revitalize India’s economy.

In response to growing sentiment for political change, we had gradually increased the Fund’s holdings of industrial companies from about 9% of assets at the beginning of the fiscal year to about 15% going into its final quarter. We viewed industrials as among the sectors likely to benefit most from a victory by the BJP — a scenario that so far has played out essentially as we had expected. Led by our machinery and building-products stocks, our industrials outgained the industrials in the Index by a wide margin. In addition, our overweight position in industrials — which proved to be the top-performing sector of the Index — provided a strong tailwind for the Fund.

As a result, the industrials sector was the Fund’s largest source of outperformance relative to its benchmark. Advantageous stock selection helped the Fund outperform its benchmark in every other sector as well.

DETAILSOFTHE YEAR

Our strongest contributor to performance for the year was motor-vehicle manufacturer Eicher Motors Ltd. The company is experiencing healthy demand for its Royal Enfield motorcycles. In its most-recently reported quarter, Eicher’s consolidated net profit grew 70.5% year-over-year on increased revenues and strong operational performance.

Kajaria Ceramics Ltd. was our second-best contributor. The company manufactures and sells ceramic and vitrified tiles in India. It also exports its products to approximately 20 countries. Strong demand for Kajaria’s tiles, as well as improved sentiment toward the building-products industry, drove its shares to record highs during the year. In the company’s most-recently reported quarter, consolidated net

profit rose 48.0% on 18.6% growth in total income from operations versus the same period a year ago. Kajaria’s announcement that it planned to increase production capacity also helped lift its shares.

Our greatest detractor from performance for the year was gaming and hospitality company Delta Corp. Ltd. In addition to its offshore casinos, Delta owns one of India’s first land-based casinos. Expenses in the company’s most-recently reported quarter included all start-up costs, interest and depreciation attributable to its newly opened Deltin Hotel in Daman. Consequently, Delta posted a consolidated net loss, and its stock declined modestly. In our view, however, nothing fundamental has changed, and we continue to hold the stock in the Fund.

ICRA Ltd. is a new position in the Fund. The company, a division of international rating agency Moody’s, operates as an independent investment-information and credit-rating agency in India. In the final quarter of our fiscal year, ICRA’s stock rose sharply when management reported solid operating results. After we purchased shares for the Fund, however, the stock gave back some of its previous gains. In a year in which most of the Fund’s holdings rose in value, the moderate decline in this small position was enough to make it our second-largest detractor.

OUTLOOK

With the dramatic rise in India’s stock market — both in the run-up to this year’s elections and in their aftermath — valuations have moved somewhat faster than the fundamentals. While we believe much of the current optimism will prove justified over the long-term, a country the size of India does not change radically in just a few months. For that reason, a near-term pause in which Indian equities digest their recent gains should not be ruled out.

Nevertheless, India is the only economy among the BRIC (Brazil, Russia, India and China) nations in which growth is seen as accelerating. In the most-recent estimate from the International Monetary Fund (IMF), GDP growth in the 2014 - 2015 fiscal year (which begins on April 1) was revised upward to 5.6% from 5.4% previously. The Reserve Bank of India expects the Indian economy to grow 5.5% in the current fiscal year and accelerate to 6.3% in 2015 - 2016. These estimates compare to growth of less than 5% in India’s past two fiscal years. If the newly elected government can enact the reforms necessary to enable India’s economy to operate closer to its full potential, we believe the long-term prospects for well-situated Indian equities are among the most attractive in the world.

In the short term, we don’t expect the scheduled end of quantitative easing in the U.S. to impact India’s currency as it did in 2013. Since then, India’s foreign-currency reserves have increased, and its fiscal and current-account situations have improved significantly.

Thank you for the opportunity to manage your assets.

| Current | and future holdings are subject to risk. |

6

Table of Contents

| WASATCH EMERGING INDIA FUND (WAINX) — Portfolio Summary | SEPTEMBER 30, 2014 (UNAUDITED) | |

| ||

| ||

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | SINCE INCEPTION 4/26/11 | |||||||||||||

Emerging India | 53.37% | N/A | 9.79% | ||||||||||||

MSCI India IMI | 41.83% | N/A | -0.40% | ||||||||||||

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.WasatchFunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2014 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging India Fund are 2.99%. The Net Expenses are 1.95%. The expense ratio shown elsewhere in this report may be different. Net Expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

TOP 10 EQUITY HOLDINGS*

| Company | % of Net Assets | |||

| Marksans Pharma Ltd. (India) | 2.5% | |||

| Lupin Ltd. (India) | 2.5% | |||

| Natco Pharma Ltd. (India) | 2.4% | |||

| Persistent Systems Ltd. (India) | 2.4% | |||

| Eicher Motors Ltd. (India) | 2.0% | |||

| Company | % of Net Assets | |||

| Glenmark Pharmaceuticals Ltd. (India) | 2.0% | |||

| Amara Raja Batteries Ltd. (India) | 1.9% | |||

| HCL Technologies Ltd. (India) | 1.9% | |||

| Godrej Consumer Products Ltd. (India) | 1.8% | |||

| WABCO India Ltd. (India) | 1.8% | |||

| * | As of September 30, 2014, there were 77 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

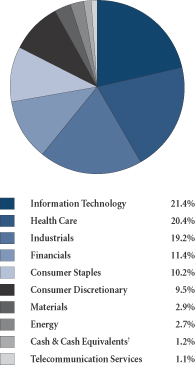

SECTOR BREAKDOWN**

| ** | Excludes securities sold short and options written, if any. |

| † | Also includes Other Assets & Liabilities. |

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees. ††Inception: April 26, 2011. The MSCI India IMI (Investable Market Index) covers all investable large, mid and small cap securities across India, targeting approximately 99% of the Indian market’s free-float adjusted market capitalization. You cannot invest directly in this or any index.

7

Table of Contents

| WASATCH EMERGING MARKETS SELECT FUND (WAESX / WIESX) — Management Discussion | SEPTEMBER 30, 2014 (UNAUDITED) | |

| ||

| ||

The Wasatch Emerging Markets Select Fund is managed by a team of Wasatch portfolio managers led by Ajay Krishnan and Roger Edgley.

Ajay Krishnan, CFA Lead Portfolio Manager |

Roger Edgley, CFA Portfolio Manager | OVERVIEW

The Wasatch Emerging Markets Select Fund — Investor Class gained 7.92% for the 12 months ended September 30, 2014. The Fund outperformed its benchmark, |

the MSCI Emerging Markets Index, which rose 4.30%.

Russia’s annexation of Crimea was one of the main factors affecting emerging markets during the year. Although Russian stocks currently account for less than 5% of the Index, the deepening conflict between Ukraine and Russia is disrupting trade in the region. The impact has been felt especially in the developed economies of Europe, which is where Russia’s primary trading partners are located.

The Fund’s focus on companies selling products and services primarily in their home countries kept it somewhat insulated from international tensions and was one of the reasons it outperformed its benchmark. Our exit from Russia during March and April also helped the Fund’s return by removing exposure to what proved to be one of the year’s worst-performing countries.

India, which is the Fund’s most-heavily weighted country, was also one of its best performers. Although India struggled in 2013 amid currency weakness and poor sentiment toward the so-called “Fragile Five” (Brazil, Indonesia, India, Turkey and South Africa), we remained convinced that our Indian companies were well-positioned for long-term growth. That patience paid off this year, as our Indian stocks outgained the Indian stocks in the Index and were the Fund’s largest source of outperformance.

Other countries in which the Fund’s investments performed especially well included Thailand and the United Arab Emirates (U.A.E.). In Thailand, the May 22nd military coup seems to have boosted investor sentiment by ending anti-government protests and restoring order. Meanwhile, strong gains in our bank stocks made the U.A.E. the Fund’s top-performing country for the year. We used that strength to reduce the Fund’s holdings in the U.A.E., as escalating violence in the Middle East dimmed our outlook for growth in the region. We also trimmed the Fund’s positions in Thailand in response to the increased valuations of our companies.

Weakness in the Fund’s Hong Kong-based hotel-casino stocks was its largest source of underperformance. The Fund’s holdings also declined in Turkey, where the poor political situation continues to forestall significant improvements in the fundamentals.

DETAILSOFTHE YEAR

Our two strongest contributors to Fund performance for

the year were Lupin Ltd. of India, and China’s Sino Biopharmaceutical Ltd. Lupin markets its branded and generic pharmaceuticals primarily in India, the U.S. and Japan. Among the factors supporting the company’s stock price were its excellent record of compliance with U.S. Food and Drug Administration (FDA) regulations, and its significant number of new drugs completing registration and ready to enter production.

Sino Biopharmaceutical manufactures and sells Chinese medicines and Western chemical medicines primarily in Mainland China. Sales and earnings at the company have risen amid strong demand for its products, especially in China’s growing market for generic pharmaceuticals.

Our greatest detractor from Fund performance for the year was Yandex N.V. The Netherlands-based company operates Russia’s main Internet search engine and generates approximately 62% of all search traffic in Russia. The company also has a strong search presence in Belarus, Kazakhstan, Turkey and Ukraine. The stock declined as the crisis in Ukraine unfolded, and we sold it when we determined the situation would not be resolved quickly.

Melco International Development Ltd., based in China, operates hotel-casinos in Macau. Melco was our second-largest detractor. A number of factors combined to suppress tourism in Macau from wealthy mainland Chinese gamblers during the year. The most important was the Chinese government’s campaign against what it considered excessively lavish banquets and entertainment at VIP clubs, such as those in Macau’s casino resorts. Although we may adjust the position size in anticipation of a further deterioration in sentiment, we continue to hold the stock.

OUTLOOK

With Russian output and industrial production in decline even before the Ukraine crisis began, sanctions and uncertainty have worsened the already-weak structural situation. As a result, Russia now appears headed for recession. Nevertheless, a fading of international tensions could touch off a relief rally in Russian stocks. While we believe any such rally is likely to be temporary, the Fund’s lack of investments in Russia would work to its disadvantage in such a scenario and hurt performance relative to its benchmark.

As weakness in Russia continues to impact its trading partners in Europe, a sustained rise in exports from emerging markets to developed countries is becoming less likely in our view. For that reason and others, we continue to favor countries — such as India, Mexico and the Philippines — in which we expect domestic-demand growth to accelerate going forward.

We do not expect the scheduled end of quantitative easing (QE) to materially impact emerging markets as it did in 2013. First, in the absence of inflationary pressures, we think any increases in U.S. interest rates are likely to be subdued. Second, we believe the end of QE has been adequately discounted by the markets. Third, with the exception of South Africa, the countries that proved most vulnerable to tighter liquidity in 2013 have significantly improved their balance sheets and current-account situations.

Thank you for the opportunity to manage your assets.

| Current | and future holdings are subject to risk. |

8

Table of Contents

| WASATCH EMERGING MARKETS SELECT FUND (WAESX / WIESX) — Portfolio Summary | SEPTEMBER 30, 2014 (UNAUDITED) | |

| ||

| ||

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | SINCE INCEPTION 12/13/12 | ||||||||

Emerging Markets Select (WAESX) — Investor | 7.92% | N/A | 1.80% | |||||||

Emerging Markets Select (WIESX) — Institutional | 8.13% | N/A | 2.27% | |||||||

MSCI Emerging Markets Index | 4.30% | N/A | 0.65% | |||||||

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.WasatchFunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2014 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging Markets Select Fund are Investor Class — Gross: 2.40%, Net: 1.69% / Institutional Class — Gross: 2.21%, Net: 1.50%. The expense ratio shown elsewhere in this report may be different. Net Expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Being non-diversified, the Fund can invest a larger portion of its assets in the securities of a limited number of companies than a diversified fund. Non-diversification increases the risk of loss to the Fund if the values of these securities decline.

TOP 10 EQUITY HOLDINGS*

| Company | % of Net Assets | |||

| Sino Biopharmaceutical Ltd. (China) | 3.8% | |||

| Cemex Latam Holdings S.A. (Colombia) | 3.7% | |||

| International Container Terminal Services, Inc. (Philippines) | 3.7% | |||

| Metropolitan Bank & Trust (Philippines) | 3.3% | |||

| Kasikornbank Public Co. Ltd. (Thailand) | 3.3% | |||

| Company | % of Net Assets | |||

| M Dias Branco S.A. (Brazil) | 3.2% | |||

| BBVA Banco Continental S.A. (Peru) | 3.2% | |||

| PT Tower Bersama Infrastructure Tbk (Indonesia) | 3.2% | |||

| Raia Drogasil S.A. (Brazil) | 3.2% | |||

| Godrej Consumer Products Ltd. (India) | 3.1% | |||

| * | As of September 30, 2014, there were 40 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

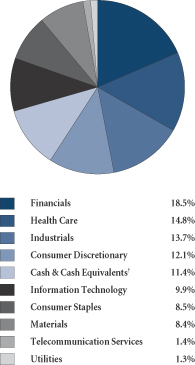

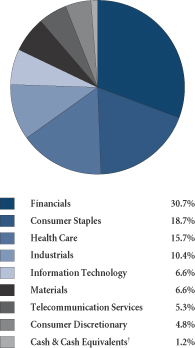

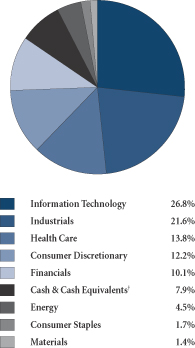

SECTOR BREAKDOWN**

| ** | Excludes securities sold short and options written, if any. |

| † | Also includes Other Assets & Liabilities. |

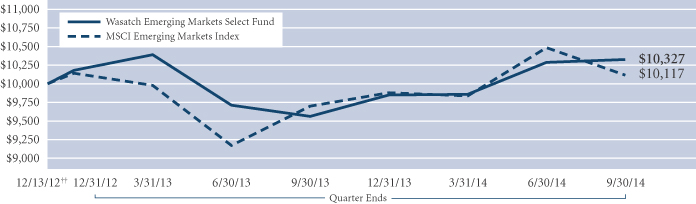

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees. ††Inception: December 13, 2012. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index designed to measure equity market performance of emerging markets. You cannot invest directly in this or any index.

9

Table of Contents

| WASATCH EMERGING MARKETS SMALL CAP FUND (WAEMX) — Management Discussion | SEPTEMBER 30, 2014 (UNAUDITED) | |

| ||

| ||

The Wasatch Emerging Markets Small Cap Fund is managed by a team of Wasatch portfolio managers led by Roger Edgley, Laura Geritz and Andrey Kutuzov.

Roger Edgley, CFA Lead Portfolio Manager |

Laura Geritz, CFA Portfolio Manager |

Andrey Kutuzov, CFA Associate Portfolio Manager |

OVERVIEW

The Wasatch Emerging Markets Small Cap Fund gained 4.90% for the fiscal year ended September 30, 2014 and underperformed its benchmark, the MSCI Emerging Markets Small Cap Index, which returned 8.84%.

During the year, the performance of the world’s small-cap markets varied considerably. Several emerging Asian markets delivered strong gains, including Thailand where greater political stability contributed to an improved economic outlook. In India, equities advanced on expectations that actions by the new government would lead to significant economic improvement.

DETAILSOFTHE YEAR

The Fund is overweight relative to the Index in Thailand and our holdings significantly outperformed. India also contributed to the Fund’s performance versus the Index over the past 12 months driven by our structurally overweight position. While our Indian holdings on average had strong gains, they were not up as much as those in the Index.

The Fund’s investments in Russia detracted from performance. The Russia/Ukraine conflict has had severe negative impacts on the Russian stock market and on Russia’s currency, the ruble. The long-term consequences are likely to be continuing deceleration in economic growth and sustained currency weakness. The performance of the Fund’s Russian holdings reflected the challenging macro environment. TCS Group Holding plc, a provider of online retail financial services; MD Medical Group Investments plc, a provider of pre-natal health care; and M Video OJSC, a consumer-electronics and home-appliances retail chain, were all down significantly and detracted from performance for the year. We have since exited almost all of our positions in Russia.

Due to economic concerns and the difficulty of finding high-quality growth companies in China, we’ve been structurally underweight — and positioned defensively — in Chinese companies. Nevertheless, the Fund’s Chinese holdings weighed on performance for the year. Large decliners included Biostime International Holdings Ltd., a pediatric-nutrition and baby-care-products provider; Melco International Development Ltd., a hotel-casino operator in Macau; and Sa Sa International Holdings Ltd., a cosmetics retailer in Hong Kong with a strong regional presence. A sizable driver of Sa Sa’s sales

is Chinese tourism to Hong Kong. Such activity decelerated due to a new tourism law in China, resulting in slower top-line growth and margin pressure for Sa Sa.

It is worth discussing our strategy with regard to investing in China. Over the next 10 years, investing in China will be much like investing in Japan 20 years ago when it came to dominate investment in the Asia-Pacific region. At present, there are in effect three Chinese equity markets: H-shares listed on the Hong Kong Stock Exchange, the domestic Chinese equity market (centered in Shanghai), and offshore listings (centered in the U.S.). These three equity markets have large-scale market capitalizations.

Chinese equities are an important segment of the global equities market today, but will become even more significant as the sizable domestic market becomes truly accessible to foreign investors. We expect China to become a bigger part of the MSCI Emerging Markets Index. We could even see China becoming its own asset class the way Japan did. We also expect more convergence in the classification of Chinese equities — indices will group U.S.-listed stocks with Hong Kong-listed stocks and domestically listed Chinese stocks.

The challenges investors have faced in China include issues with corporate governance, the role of state-owned enterprises, the policy framework, and over-investment and hyper-competition in many industries. The assumption of many investors in China has been that high gross domestic product (GDP) growth would lead to high earnings per share growth and thus value creation. Investors often don’t realize that they are in for a turbulent ride.

What are some of the investment themes we currently like? E-commerce will continue to be an important theme for China, as non-legacy companies have a real opportunity to re-make the economic landscape by providing more open access to goods in third and fourth tier cities. Other themes are automation, renewable energy, health care and financial leasing. Some areas like mortgage finance — attractive to us in other emerging market countries — are the province of some of China’s large state-controlled banks and thus off limits.

The outlook for China is for slower growth. However, we believe the quality of that growth will be higher because it will be less investment-driven. New economy sectors (like health care, renewable energy and information technology) have recently delivered stronger growth, and Hong Kong H-shares have been slowing down, leaving valuations more attractive. As a result, there are opportunities to invest in new-economy stocks that have the potential to do well in a less supportive macro environment.

OUTLOOK

We see near-term challenges for investors in emerging markets as the U.S. dollar strengthens and the Federal Reserve ends its bond-buying program. For Eastern Europe, Russia will remain a difficult place in which to invest. Where are the opportunities? We are seeing a pickup in manufacturing across Asia, a marked change in India and solid growth in countries like Thailand and the Philippines.

Thank you for your ongoing support.

| Current | and future holdings are subject to risk. |

10

Table of Contents

| WASATCH EMERGING MARKETS SMALL CAP FUND (WAEMX) — Portfolio Summary | SEPTEMBER 30, 2014 (UNAUDITED) | |

| ||

| ||

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | SINCE INCEPTION 10/1/07 | ||||||||||

Emerging Markets Small Cap | 4.90% | 12.49% | 5.13% | |||||||||

MSCI Emerging Markets Small Cap Index | 8.84% | 6.66% | 1.15% | |||||||||

MSCI Emerging Markets Index | 4.30% | 4.42% | -0.18% | |||||||||

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.WasatchFunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2014 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging Markets Small Cap Fund are 2.06%. The Net Expenses are 1.95%. The expense ratio shown elsewhere in this report may be different. Net Expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds.

TOP 10 EQUITY HOLDINGS*

| Company | % of Net Assets | |||

| Hotel Shilla Co. Ltd. (Korea) | 2.3% | |||

| Pidilite Industries Ltd. (India) | 1.9% | |||

| Berger Paints India Ltd. (India) | 1.8% | |||

| Merida Industry Co. Ltd. (Taiwan) | 1.8% | |||

| Minor International Public Co. Ltd. (Thailand) | 1.7% | |||

| Bangkok Life Assurance Public Co. Ltd. NVDR (Thailand) | 1.7% | |||

| Company | % of Net Assets | |||

| International Container Terminal Services, Inc. (Philippines) | 1.6% | |||

| Security Bank Corp. (Philippines) | 1.6% | |||

| Shriram City Union Finance Ltd. (India) | 1.5% | |||

| Interpark Corp. (Korea) | 1.5% | |||

| * | As of September 30, 2014, there were 114 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

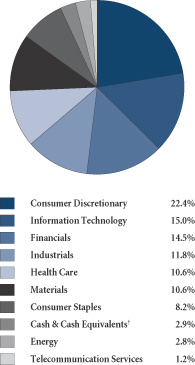

SECTOR BREAKDOWN**

| ** | Excludes securities sold short and options written, if any. |

| † | Also includes Other Assets & Liabilities. |

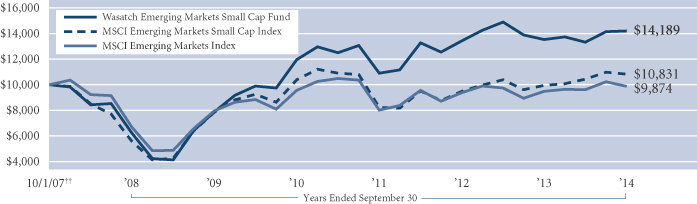

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees. ††Inception: October 1, 2007. The MSCI Emerging Markets and Emerging Markets Small Cap indices are free float-adjusted market capitalization indices designed to measure the equity market performance of emerging markets. You cannot invest directly in these or any indices.

11

Table of Contents

| WASATCH FRONTIER EMERGING SMALL COUNTRIES FUND (WAFMX) — Management Discussion | SEPTEMBER 30, 2014 (UNAUDITED) | |

| ||

| ||

The Wasatch Frontier Emerging Small Countries Fund is managed by a team of Wasatch portfolio managers led by Laura Geritz.

Laura Geritz, CFA Lead Portfolio Manager | OVERVIEW

The Wasatch Frontier Emerging Small Countries Fund returned 11.97% for the year ended September 30, 2014, while its benchmark the MSCI Frontier Emerging Markets Index returned 21.51%. I’ve mentioned in the past that I’m worried about our benchmark. This is still true. It has too few countries to be called diversified. In an environment of global capital mismanagement by central banks, I believe we’re pursuing |

a responsible course for investing the Fund’s assets by focusing on broad country diversification and taking the time to thoroughly assess the quality of each company in which we invest. I believe this approach is of paramount importance in our efforts to protect shareholders from unknown risks.

I’m often asked about the future growth prospects of China and the broad implications for the rest of the world in which we invest. The truth is I just don’t know about China. What I can say is that there is now expensive labor at the low end of the manufacturing sector, but cheap labor had been the most important contributor to China’s miraculous rise. Today, China is no longer a story of farm to factory, but Bangladesh, Vietnam, and many countries in Africa are just starting on this transformative path. This is the world where the Wasatch Frontier Emerging Small Countries Fund hunts for investment ideas.

DETAILSOFTHE YEAR

The Fund was substantially underweight in the Middle East during the fiscal year. The region has seen a cyclical rebound over the last year, and an even stronger rebound in its cyclical stocks — banks and property developers. We were not invested in these areas, and that detracted from performance relative to the benchmark. In a macro landscape that gets a boost from high energy prices, I think markets in the Middle East might finally lose some steam with oil prices declining.

The Fund was also hit hard by its overweight position in Africa. The headlines have not helped (although almost none of the Ebola outbreaks are happening in the countries in which we invest). I remain resolutely confident in the region. Foreign direct investment supports my view. There has been a big advance in foreign direct investment into Africa, and even better, it is moving beyond the commodities realm. China is providing a lot of cheap capital. Labor is abundant, young, and inexpensive across the continent. I see the same long-term opportunities in Africa as in Bangladesh and Sri Lanka, although I think Bangladesh and Sri Lanka are sitting prettier on the geopolitical front. As if to lend credence to this view, Bangladesh was the Fund’s top-contributing country for the 12-month period aided by strong performance from Square Pharmaceuticals Ltd., GrameenPhone Ltd. and British

American Tobacco Bangladesh Co. Ltd. Sri Lanka also made a strong contribution led by Commercial Bank of Ceylon Ltd.

In Africa, I think we will see a turn in our hard-hit consumer-staples names. Input prices have been falling, comparisons have been getting better, and I see improving fundamentals ahead, all of which support the case for future margin expansion. Nevertheless, several of the Fund’s largest detractors — East African Breweries Ltd., Guinness Nigeria plc, Unilever Ghana Ltd., Unilever Nigeria plc, and Shoprite Holdings Ltd. — were African consumer-staples companies.

The markets have been on a wild ride recently, which tends to be good for us. I believe the evolution of the global economy, one with soggy demand in countries with expensive labor — the world’s indebted markets and I would now put China in that pack when I look at debt levels and labor costs — is starting to work to our relative advantage again. With oil prices falling, hence making the top-down investment case in the oil-driven Middle East less compelling, our set of frontier and emerging small countries appear poised to benefit, as they start to gain market share with low-cost labor.

OUTLOOK

When China came on the scene, the U.S., Europe and Japan had mature, expensive labor forces. China, through its amazing success, is now struggling with similar problems. China is going to lose low-end jobs to frontier countries, and we as frontier investors are well-situated to capture this growth — the shift in market share. As you know, I’m not that excited about the cyclical markets on offer in the frontier index — primarily in the Middle East. However, I like the true frontier and emerging small countries with great secular opportunities from young, ambitious labor forces — like Bangladesh, Vietnam, Pakistan, Cambodia, Laos, Myanmar, Indonesia, the Philippines, Peru, Ecuador, and many countries in sub-Saharan Africa. The Fund has overweight positions in many of these nations. Valuations look reasonable for the non-cyclical, high-quality growth companies in which we seek to invest. When asked about investing in frontier markets, I say that one of the most important reasons to do so is their lack of correlation with the rest of the world. Since the Fund has fewer investments in the markets of the Middle East, I’d argue that the Fund should be less correlated than the Index to the developed world. However, I think the most important takeaway is that as China suffers from rising labor costs and as the developed world continues to struggle with growth and possibly deflation, there are still some regions of the world — frontier and emerging small countries — that offer good, secular growth prospects.

Thanks for your investment!

| Current | and future holdings are subject to risk. |

12

Table of Contents

| WASATCH FRONTIER EMERGING SMALL COUNTRIES FUND (WAFMX) — Portfolio Summary | SEPTEMBER 30, 2014 (UNAUDITED) | |

| ||

| ||

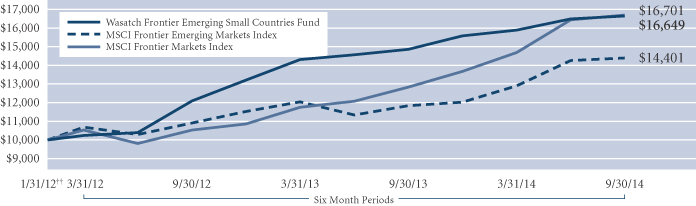

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | SINCE INCEPTION 1/31/12 | |||||||||||||

Frontier Emerging Small Countries | 11.97% | N/A | 21.07% | ||||||||||||

MSCI Frontier Emerging Markets Index | 21.51% | N/A | 14.66% | ||||||||||||

MSCI Frontier Markets Index | 30.05% | N/A | 21.21% | ||||||||||||

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.WasatchFunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2014 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Frontier Emerging Small Countries Fund are 2.43%. The Net Expenses are 2.25%. The expense ratio shown elsewhere in this report may be different. Net Expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in frontier and emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Being non-diversified, the Fund can invest a larger portion of its assets in the stocks of a limited number of companies than a diversified fund. Non-diversification increases the risk of loss to the Fund if the values of these securities decline.

TOP 10 EQUITY HOLDINGS*

| Company | % of Net Assets | |||

| Universal Robina Corp. (Philippines) | 3.1% | |||

| GrameenPhone Ltd. (Bangladesh) | 3.1% | |||

| MTN Group Ltd. (South Africa) | 3.0% | |||

| Nigerian Breweries plc (Nigeria) | 3.0% | |||

| East African Breweries Ltd. (Kenya) | 2.9% | |||

| Company | % of Net Assets | |||

| Nestlé Nigeria plc (Nigeria) | 2.9% | |||

| Square Pharmaceuticals Ltd. (Bangladesh) | 2.2% | |||

| Vietnam Dairy Products JSC (Vietnam) | 2.2% | |||

| Safaricom Ltd. (Kenya) | 2.1% | |||

| Kuwait Foods Americana (Kuwait) | 2.0% | |||

| * | As of September 30, 2014, there were 130 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

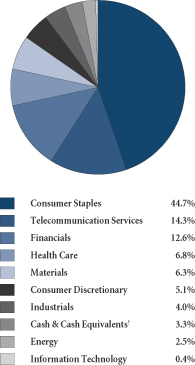

SECTOR BREAKDOWN**

| ** | Excludes securities sold short and options written, if any. |

| † | Also includes Other Assets & Liabilities. |

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees. ††Inception: January 31, 2012. The MSCI Frontier Emerging Markets and MSCI Frontier Markets indices are free float-adjusted market capitalization indices designed to measure the equity market performance of the global frontier and emerging markets. You cannot invest directly in these or any indices.

13

Table of Contents

| WASATCH GLOBAL OPPORTUNITIES FUND (WAGOX) — Management Discussion | SEPTEMBER 30, 2014 (UNAUDITED) | |

| ||

| ||

The Wasatch Global Opportunities Fund is managed by a team of Wasatch portfolio managers led by JB Taylor and Ajay Krishnan.

JB Taylor Lead Portfolio Manager |

Ajay Krishnan, CFA Lead Portfolio Manager | OVERVIEW

The Wasatch Global Opportunities Fund gained 3.94% in the 12 months ended September 30, 2014, and the MSCI AC World Small Cap Index rose 6.82%. Following extraordinary returns |

in the prior 12 months, the global small-cap market continued to climb higher. Overall, emerging markets outpaced the broad market, boosted by gains in India, where voters elected a new prime minister with an ambitious reform agenda. U.S. small caps also outperformed, lifted by an improving U.S. economy and continuation of the Federal Reserve’s (Fed) near-zero interest-rate policy. While stocks in most countries posted gains, a handful of markets registered sharp declines. These included Russia, which was impacted by the Ukrainian conflict, and Brazil, whose economy fell into recession.

In this environment, the Fund’s investments in numerous countries and sectors generated positive returns. Performance trailed the benchmark, however, largely because of stock selection in the United States and developed international markets. These negative effects were partly offset by stock selection and an overweight in emerging markets that resulted from our bottom-up research.

DETAILSOFTHE YEAR

The Fund’s international holdings, which accounted for about 60% of the portfolio, rose more than 8%. This result outpaced the 4.56% return of the MSCI AC World Ex-U.S.A. Small Cap Index, driven by a nearly 20% gain in our emerging market stocks. The list of top contributors was dominated by Indian names, including Lupin Ltd., a generic pharmaceutical maker, and MakeMyTrip Ltd., India’s largest online travel agency. Lupin’s product pipeline is exploding, and the company has not received any adverse comments from the U.S. Food and Drug Administration, which stepped up vigilance on Indian drug companies due to rising U.S. imports. MakeMyTrip benefited from positive trends in the company’s airline ticketing business. We see even greater potential in its hotel reservations business, where we think margins could rise to 15% over time.

Calbee, Inc. and Wirecard AG were other top contributors in the international portion of the Fund. Calbee is a Japanese snack food company that is posting strong domestic sales and expanding its footprint into the rest of Southeast Asia. Germany-based Wirecard is a processor of online payment transactions that is capitalizing on the rapid growth of e-commerce in Europe. On the negative side, Melco International Development Ltd., a Macau-based gaming company,

was one of our weaker international stocks. Melco was caught up in an industry-wide selloff precipitated by the Chinese government’s efforts to crack down on “junket operators” —people who recruit wealthy patrons for Macau casinos.

Our U.S. holdings, which accounted for about 37% of the portfolio, rose more than 3% but trailed the 8.89% increase in the MSCI U.S. Small Cap Index. Two of the biggest U.S. detractors were Nu Skin Enterprises, Inc. and Cornerstone OnDemand, Inc. Shares of Nu Skin, a marketing company that sells personal care products, declined in response to faltering revenues in China. Last winter, the Chinese government conducted an investigation into the company’s sales practices, prompting Nu Skin to put all promotional activities on hold in China. The investigation has been concluded, and Nu Skin was exonerated. The company is now rebuilding its business in China, and we expect it to show good growth from here.

Cornerstone provides human resources and talent management solutions to employers, delivered over the Internet as software-as-a-service. Second-quarter revenues came in slightly below expectations, putting pressure on the stock. However, bookings (i.e., customer commitments) were strong, with the company recording the largest number of million-dollar deals in its history. We took advantage of the selloff to add to our position.

A key area of strength in the U.S. portion of the Fund was the industrials sector — our industrial stocks posted a double-digit gain. Within the sector, the top performers were trucking companies Knight Transportation, Inc. and Old Dominion Freight Line, Inc. While improvement in the U.S. economy has been slow, the economy’s steady progress has reduced capacity in the trucking industry over the last six months, giving Knight and Old Dominion more pricing power.

OUTLOOK

The U.S. economy appears to be on solid ground, and inflation is low enough that any interest-rate increases from the Fed over the next year should be gradual. One concern we have is that valuations of certain segments of the U.S. small-cap market appear stretched. Valuations are generally more favorable overseas; however, the growth outlook is mixed. A national sales tax increase that went into effect April 1st has taken a toll on the Japanese economy, and events in Russia could stall Europe’s recovery, at least in the near term. While most emerging economies are expanding faster than their developed peers, any slowdown in Europe could have a ripple effect on export-driven growth.

Regardless of how big-picture events unfold, we believe the Fund remains well positioned for the months ahead. The weighted-average price-to-earnings (P/E) multiple of the portfolio was 21.6 times 12-month forward earnings at period-end, and its estimated long-term earnings growth rate was 19%. The level of growth we are expecting from our companies bodes well for the Fund, since history has shown that stock prices ultimately follow earnings.

Thank you for the opportunity to manage your assets.

| Current | and future holdings are subject to risk. |

14

Table of Contents

| WASATCH GLOBAL OPPORTUNITIES FUND (WAGOX) — Portfolio Summary | SEPTEMBER 30, 2014 (UNAUDITED) | |

| ||

| ||

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | SINCE INCEPTION 11/17/08 | |||||||||||||

Global Opportunities | 3.94% | 13.54% | 21.84% | ||||||||||||

MSCI AC World Small Cap Index | 6.82% | 12.08% | 18.88% | ||||||||||||

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.WasatchFunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2014 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Global Opportunities Fund are 1.80%. The expense ratio shown elsewhere in this report may be different. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in small and micro cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

TOP 10 EQUITY HOLDINGS*

| Company | % of Net Assets | |||

| MakeMyTrip Ltd. (India) | 2.4% | |||

| Wirecard AG (Germany) | 2.2% | |||

| Lupin Ltd. (India) | 2.1% | |||

| Knight Transportation, Inc. | 2.0% | |||

| MercadoLibre, Inc. (Brazil) | 1.9% | |||

| Company | % of Net Assets | |||

| International Container Terminal Services, Inc. (Philippines) | 1.9% | |||

| Sino Biopharmaceutical Ltd. (China) | 1.9% | |||

| Shriram City Union Finance Ltd. (India) | 1.8% | |||

| Marksans Pharma Ltd. (India) | 1.8% | |||

| Calbee, Inc. (Japan) | 1.7% | |||

| * | As of September 30, 2014, there were 81 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

SECTOR BREAKDOWN**

| ** | Excludes securities sold short and options written, if any. |

| † | Also includes Other Assets & Liabilities. |

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees. ††Inception: November 17, 2008. The MSCI AC (All Country) World Small Cap Index is an unmanaged index and includes reinvestment of all dividends of issuers located in countries throughout the world representing developed and emerging markets. This index is a free float-adjusted market capitalization index designed to measure the performance of small capitalization securities. You cannot invest directly in this or any index.

15

Table of Contents

| WASATCH HERITAGE GROWTH FUND (WAHGX) — Management Discussion | SEPTEMBER 30, 2014 (UNAUDITED) | |

| ||

| ||

The Wasatch Heritage Growth Fund is managed by a team of Wasatch portfolio managers led by Chris Bowen.

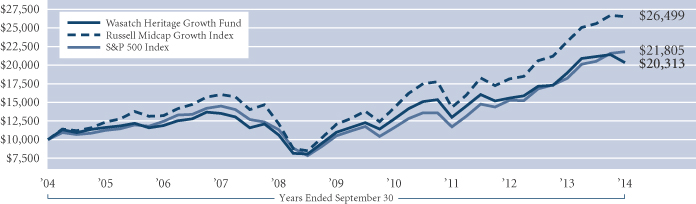

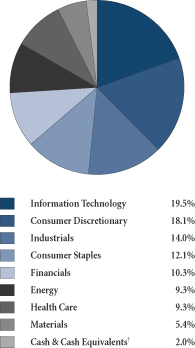

Chris Bowen Lead Portfolio Manager | OVERVIEW

Despite mixed stock-market returns during the most recent quarter, equities delivered gains for the year ended September 30, 2014. The Wasatch Heritage Growth Fund advanced 7.21%, which trailed the performance of the Fund’s benchmark, the Russell Midcap Growth Index, which returned 14.43%. In recent months, large-cap stocks in general had the strongest returns, small- and micro-cap stocks had the weakest |

and mid-cap stocks fell somewhere in the middle. Investors appeared to move up the market-cap spectrum, turning to the perceived safety of large-cap stocks as a way of mitigating risk in response to the Federal Reserve’s scheduled end of quantitative easing and heightened geopolitical concerns.

This past year was a good reminder not to get too caught up in the results of any one short-term period. We take a marathon approach to investing. We believe that we can add value as an investment manager by choosing our holdings carefully and then exercising patience while waiting for the stock market to recognize the value and quality of the companies held in the Fund.

We consistently assess the Fund’s positions and overall structure. Compared with the stocks in the benchmark, the Fund’s holdings have better valuations, outstanding returns-on-capital and stronger balance sheets, while generating a compelling level of earnings growth. We believe that holding companies with these characteristics is important, especially during periods of heightened market volatility.

The Fund’s largest contributors for the 12-month period were Spirit Airlines, Inc., Amphenol Corp. and Tim Hortons, Inc. The largest detractors were Nu Skin Enterprises, Inc., RetailMeNot, Inc. and LKQ Corp.

DETAILSOFTHE YEAR

Spirit Airlines has many of the attributes we seek and has been an outstanding investment since we purchased the stock a little over a year ago. The ultra-discount, no-frills airline continues to grow by methodically entering new markets as a low-cost alternative to the big carriers. It would be easy for an airline like Spirit to try to grow faster by spending more, but the management team appears to be sticking to its plan. We are keeping a close eye on Spirit’s valuation with the stock up over 170% since our initial purchase.

Electronics manufacturer Amphenol is one of our largest holdings, and its stock was up almost 30% over the last 12 months as the company continued its strong execution. Amphenol should supplement future growth through a recently acquired company that manufactures electronics for the auto industry, an area forecasting strong worldwide growth over the next several years.

While the stock price of Tim Hortons, a Canada-based chain of quick-service restaurants, had been increasing after

management reported solid earnings results, the stock price appreciated even more when Burger King* announced that it would acquire the company. We believe the buyout price is fair and, barring any unforeseen complications, we expect the Fund to recognize an attractive return from this position that we initiated over five years ago.

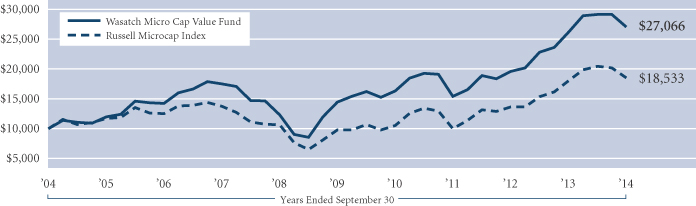

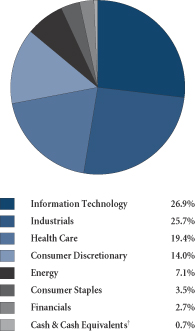

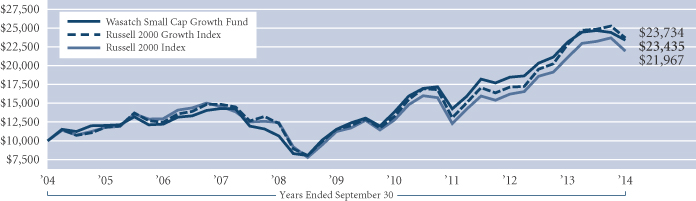

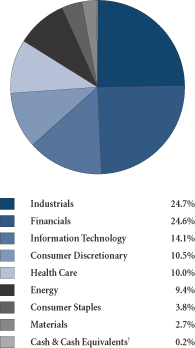

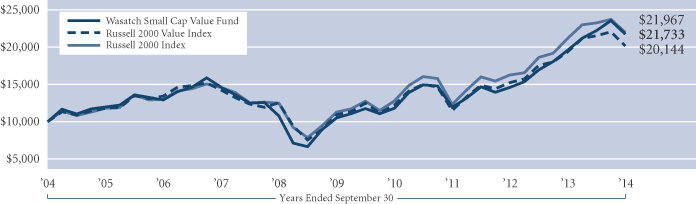

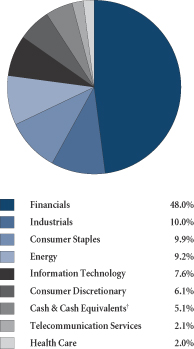

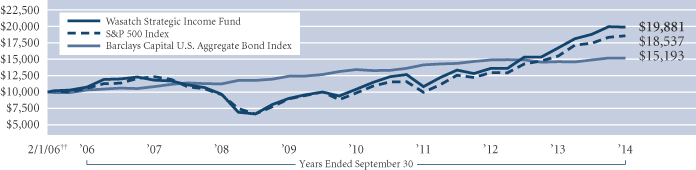

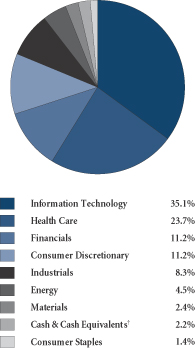

Nu Skin undoubtedly took a step back this year. The company markets personal-care products through a worldwide network of independent dealers that build their own businesses. Our investment thesis revolved around Nu Skin’s growing business in China. However, Chinese regulators determined that a very small portion of the company’s sales were out of compliance with Chinese regulations and Nu Skin was assessed a modest fine. The stock dropped over 60% from our initial entry point. Nu Skin’s management proactively decided to halt growth in China while it addressed the regulator’s concerns, and now the company is starting to reignite its growth. We feel that Nu Skin’s valuation is attractive and that the Chinese market will continue to grow.