UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04920

WASATCH FUNDS TRUST

(Exact name of registrant as specified in charter)

505 Wakara Way, 3rd Floor

Salt Lake City, UT 84108

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) | Copy to: | |

Eric S. Bergeson Wasatch Advisors, Inc. 505 Wakara Way, 3rd Floor Salt Lake City, UT 84108 | Eric F. Fess, Esq. Chapman & Cutler LLP 111 West Monroe Street Chicago, IL 60603 | |

Registrant’s telephone number, including area code: (801) 533-0777

Date of fiscal year end: September 30

Date of reporting period: September 30, 2021

Item 1. Report to Shareholders.

| (a) | A copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”) is filed herewith. |

WASATCHGLOBAL.COM SEPTEMBER 30, 2021 2021 Annual Report Fund Investor Institutional Fund Investor Institutional Name Class Class Name Class Class Wasatch Core Growth Fund WGROX WIGRX Wasatch International Opportunities Fund WAIOX WIIOX Wasatch Emerging India Fund WAINX WIINX Wasatch International Select Fund WAISX WGISX Wasatch Emerging Markets Select Fund WAESX WIESX Wasatch Micro Cap Fund WMICX WGICX Wasatch Emerging Markets Small Cap Fund WAEMX WIEMX Wasatch Micro Cap Value Fund WAMVX WGMVX Wasatch Frontier Emerging Small Wasatch Small Cap Growth Fund WAAEX WIAEX WAFMX WIFMX Countries Fund Wasatch Small Cap Value Fund WMCVX WICVX Wasatch Global Opportunities Fund WAGOX WIGOX Wasatch Ultra Growth Fund WAMCX WGMCX Wasatch Global Select Fund WAGSX WGGSX Wasatch-Hoisington U.S. Treasury Fund WHOSX —Wasatch Global Value Fund FMIEX WILCX Wasatch Greater China Fund WAGCX WGGCX Wasatch International Growth Fund WAIGX WIIGX

Wasatch Funds

Salt Lake City, Utah

wasatchglobal.com

800.551.1700

| Table of Contents |

| 2 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

Wasatch Emerging Markets Small Cap Fund® Management Discussion | 10 | |||

| 11 | ||||

Wasatch Frontier Emerging Small Countries Fund® Management Discussion | 12 | |||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

Wasatch International Opportunities Fund® Management Discussion | 24 | |||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 37 | ||||

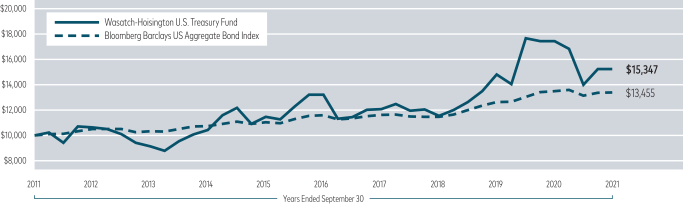

Wasatch-Hoisington U.S. Treasury Fund® Management Discussion | 38 | |||

| 39 | ||||

Management Discussions — Definitions of Financial Terms and Index Descriptions | 40 | |||

| 42 | ||||

| 45 | ||||

| 82 | ||||

| 88 | ||||

| 94 | ||||

| 102 | ||||

| 110 | ||||

| 111 | ||||

| 138 | ||||

| 139 | ||||

| 139 | ||||

| 141 | ||||

| 141 | ||||

| 141 | ||||

| 142 | ||||

| 142 | ||||

This material must be accompanied or preceded by a prospectus.

Please read the prospectus carefully before you invest.

Wasatch Funds are distributed by ALPS Distributors, Inc.

1

| Letter to Shareholders — Our Take on China and India |

Ajay Krishnan, CFA Head of Emerging Markets Investing and Portfolio Manager |

Dan Chace, CFA Portfolio Manager | DEAR FELLOW SHAREHOLDERS:

Recent clampdowns by Chinese regulators in areas such as technology and private education have caused some investors to rethink their China allocations. Investors began to ponder the implications in November 2020 when regulators suspended the initial public offering (IPO) of Ant Group, a financial-technology (fintech) firm whose chairman and majority shareholder is renowned tech titan Jack Ma. This year, restrictions announced during the summer rattled financial markets. Pundits have even begun to question the Chinese government’s commitment to capitalism.

CHINESE CAPITALISM VERSUS WESTERN CAPITALISM

Chinese capitalism isn’t the same as Western capitalism. In its modern form, |

Western capitalism rests largely on the free-market principles laid out by eighteenth-century philosopher and economist Adam Smith. In The Theory of Moral Sentiments, Smith introduced the concept of the “Invisible Hand” to describe the unintended social good brought about by individuals acting in their own self-interest.

In contrast, the Chinese believe capital allocation driven by self-interest and greed inevitably leads to inequality, exploitation and the dangerous accumulation of power by large corporations. Because these things undermine the Chinese Communist Party’s (CCP’s) objectives of common prosperity and social cohesion, capitalism must be kept on a tight leash. Therefore, Adam Smith’s Invisible Hand is replaced by the not-so-invisible and sometimes-heavy hand of the Chinese government.

IMPLICATIONS FOR RETURNS ON CAPITAL: A COMPARISON TO INDIA

Primarily due to heightened competition, returns on capital have generally been less sustainable in China than in some Western-style economies. In India, for example, competitive advantages such as proprietary technologies, barriers to entry and economies of scale have tended to be more enduring. Additionally, business-friendly reforms enacted by a coalition led by India’s Prime Minister Narendra Modi have allowed long-running investment themes to play out more fully and with less regulatory interference than might otherwise have been the case. For these reasons, Wasatch’s emerging markets funds have typically been structurally overweight in India and underweight in China compared to their respective benchmarks.

To the extent recent events in China foreshadow a more activist role for the government in determining how businesses are run, returns on capital may become compressed somewhat further. However, we believe companies will still be permitted reasonable levels of profitability. Capitalism has enabled China to bring hundreds of millions of its citizens out of abject poverty. So the government clearly understands the profit motive’s essential role in spurring the innovation necessary for China’s continued growth and development.

THE NEED FOR A COMMON-SENSE APPROACH TO INVESTING IN CHINA

We think the government’s willingness to flex its regulatory muscle in pursuit of its policy goals makes it more important than ever to take a pragmatic approach to investing in China. Certain consumer-facing businesses may be especially at risk of finding themselves at odds with the government. Among these are companies such as payment and social-media platforms that collect large amounts of proprietary data on Chinese citizens and companies that may be perceived as failing to promote socially responsible behavior. Also at risk are firms the government deems important to China’s competitiveness and may therefore be less able to operate freely.

Because China’s economy has matured to the point of becoming self-sustaining, exports and capital from overseas are no longer vital to its survival. As a result, companies are encouraged to emulate the CCP’s vision of what their business models should look like. Today, the government has additional scope to regulate industries without fear of alienating international investors.

CHINESE VARIABLE INTEREST ENTITIES (VIEs)

VIEs are companies controlled through contracts designed to mimic the rights and economic interests of direct ownership. Because VIEs are used to circumvent restrictions on foreign investment in China, we think VIEs that are traded in the form of depositary receipts are the most likely to draw the ire of Chinese regulators. Rather than providing clear commentary on the legality of the VIE structure, recent legislation simply doesn’t mention VIEs. In view of what appears to be a deliberately gray area of Chinese law, no Wasatch fund has more than a modest exposure to VIEs — and we don’t own VIEs listed on stock exchanges outside Hong Kong and mainland China.

LONG-TERM OPPORTUNITIES IN CHINA REMAIN INTACT

Despite sensationalistic headlines declaring that China has abandoned capitalism, we believe the long-term opportunities there remain intact. China’s self-sustaining economy and relatively stable currency provide advantages found in few other emerging markets. Measured in terms of the number of IPOs, the rate of capital formation in Greater China (China, Hong Kong and Taiwan) is the highest in the world.

That said, investing in China has become more complex. Besides evaluating a company’s underlying fundamentals, investors must now weigh the extent to which business practices align with the Chinese government’s policy objectives. We think this

2

| SEPTEMBER 30, 2021 |

creates opportunities for actively managed funds to outperform. We also believe our legacy in small-cap investing provides Wasatch with an additional advantage, as smaller companies may be better-positioned to grow for longer periods without attracting unwanted attention from the government.

Once the regulatory dust has settled, we believe China’s health-care sector will present additional investment opportunities. We’re much less optimistic about Chinese financial companies. In addition to being subject to government control, Chinese financials lack transparency and tend to be highly leveraged. Because this combination of traits makes risks difficult to assess, we expect our exposure to Chinese financial stocks to remain somewhat limited. For more about our views on China, please see the Greater China Fund management discussion on page 20.

TIME AND AGAIN, INDIA FINDS WAYS TO IMPRESS US

Our unenthusiastic position toward Chinese financials stands in stark contrast to our optimism about financial firms in India. In our view, Indian financials offer more attractive long-term growth prospects with significantly less uncertainty than their Chinese counterparts. The financialization of India has been one of our long-running investment themes.

During the fiscal year, investors — encouraged by record-low interest rates, hopes for a pickup in consumer demand and an improved outlook for manufacturing — drove India’s major stock averages to new all-time highs. Inflationary pressures from food and housing have eased in recent months, providing India’s central bankers with additional scope to keep interest rates low in support of economic growth.

INDIAN IPOs SIGNAL A HEALTHY ENVIRONMENT

Robust demand from retail, institutional and foreign investors is encouraging Indian firms to go public at a record pace, with new listings expected to add about $400 billion of capital to India’s equity market over the next several years. Besides the large number and size of India’s recent IPOs, their nature is also quite remarkable. Compared to the past when IPOs consisted almost exclusively of traditional businesses, recent IPOs show better representation of new-economy industries such as e-commerce, software and fintech.

Although IPO participation isn’t a major part of our investment process, we believe our fundamental approach naturally lends itself to the analysis of companies seeking to go public. For more about our views on India, please see the Emerging India Fund management discussion on page 6.

With sincere thanks for your continuing investment and for your trust,

Ajay Krishnan and Dan Chace

Information in this report regarding market or economic trends, or the factors influencing historical or future performance, reflects the opinions of management as of the date of this report. These statements should not be relied upon for any other purpose. Past performance is no guarantee of future results, and there is no guarantee that the market forecasts discussed will be realized.

CFA® is a trademark owned by the CFA Institute.

Wasatch Advisors, Inc., doing business as Wasatch Global Investors, is the investment advisor to Wasatch Funds.

Wasatch Funds are distributed by ALPS Distributors, Inc. (ADI). ADI is not affiliated with Wasatch Global Investors.

Definitions of financial terms and index descriptions and disclosures begin on page 40.

3

| Wasatch Core Growth Fund (WGROX / WIGRX) | SEPTEMBER 30, 2021 |

Management Discussion

The Wasatch Core Growth Fund is managed by a team of Wasatch portfolio managers led by JB Taylor, Paul Lambert and Mike Valentine.

JB Taylor Lead Portfolio Manager |

Paul Lambert Portfolio Manager |

Mike Valentine Portfolio Manager |

OVERVIEW

During the 12-month period ended September 30, 2021, stocks rose amid optimism that the economy is on track to recover from the pandemic. For the full period, the Wasatch Core Growth Fund — Investor Class gained 44.83% while the benchmark Russell 2000 Index increased 47.68% and the Russell 2000 Growth Index rose 33.27%.

We think the best way to summarize events of the period is that we stuck to our knitting and the Fund performed exactly as we would have expected. While we were certainly aware of macro events, they didn’t drive our investment decisions because we don’t believe they change the long-term prospects for our companies. Instead, we focused on staying diversified across many high-quality businesses with significant returns on capital, low debt, great management teams, and innovative products and services in expanding markets.

DETAILS OF THE YEAR

From a sector perspective relative to the benchmark, the Fund’s stock selections were favorable in health care, consumer staples, communication services, real estate, financials, industrials and information technology. Stock selections in consumer discretionary and materials, and lack of exposure to energy were drags on relative performance.

The Fund’s top contributor was Medpace Holdings, Inc. — which provides services to life-sciences companies and organizations. Services include management and monitoring of clinical trials, regulatory submissions, quality assurance and other services designed to increase the efficiency of organizations’ research processes. The company reported significant year-on-year increases in revenues on the back of outstanding net new business wins. We believe Medpace is well-positioned to continue its dynamic growth.

Another significant contributor was Bank OZK — a full-service bank offering financial services such as savings accounts, personal and business loans, debit and credit cards, letters of credit, certificates of deposit, mortgages, equipment financing, cash management and online banking. Bank OZK specializes in commercial real estate. While loan growth hasn’t accelerated yet, loss provisions should decline and credit conditions should get stronger as the

economy continues to reopen. The stock bounced higher in anticipation of these improvements.

The largest detractor from Fund performance was Ollie’s Bargain Outlet Holdings, Inc. The company’s retail stores offer a continually changing selection of close-out items and brand-name merchandise at deeply discounted prices. Over the next few quarters, Ollie’s faces difficult comparisons to 2020 — when stimulus payments and enhanced unemployment benefits boosted the disposable income of consumers. Longer term, we think the company’s unique treasure-hunt shopping experience and still-limited national footprint offer attractive prospects for expansion. We added to the Fund’s holdings of Ollie’s in the belief the stock price already reflects future negative developments that may occur.

Another significant detractor was Grand Canyon Education, Inc. — which offers graduate and undergraduate degree programs and certifications in fields related to teaching, business and health care. Grand Canyon provides instruction via online classes, and it operates a full-service campus in Arizona complete with dormitories and Division I sports. While the use of online education was especially strong during the height of the pandemic, recent on-campus enrollments have been somewhat weaker partially because admissions counselors were unable to visit many high schools due to the pandemic. As a result, the stock was down during the period. But we believe the issue is transitory and Grand Canyon’s growth trajectory will resume in 2022.

OUTLOOK

Late in the 12-month period, concerns arose regarding higher interest rates, inflation, political stalemates, Fed policies, ongoing supply-chain disruptions, the Delta variant of Covid-19 and problems in the Chinese property market. While these concerns clearly affected the performance of stocks in the final three months of the period, we don’t have much to say about them going forward because macro forecasting isn’t one of our strengths.

What we can say, however, is we haven’t detected any significant trends that we believe warrant major changes to our holdings. For instance, consider the possibility of continually rising interest rates and inflation. If that happens, it will likely mean the economy is growing reasonably well. In such an environment, we’ll be comfortable owning our industry-leading companies that have pricing power and the ability to deal effectively with supply-chain challenges. On the other hand, if economic growth falters, we’ll be pleased to have the diversification of our less economically sensitive information-technology and health-care names.

In closing, we’re pleased to report that we’ve already begun to resume our face-to-face research meetings with company management teams.

Thank you for the opportunity to manage your assets.

Current and future holdings are subject to risk.

4

| Wasatch Core Growth Fund (WGROX / WIGRX) | SEPTEMBER 30, 2021 |

AVERAGE ANNUAL TOTAL RETURNS

| 1 Year | 5 Years | 10 Years | |||||||||||||

Core Growth (WGROX) — Investor | 44.82% | 20.75% | 18.00% | ||||||||||||

Core Growth (WIGRX) — Institutional | 44.98% | 20.92% | 18.12% | ||||||||||||

Russell 2000® Index | 47.68% | 13.45% | 14.63% | ||||||||||||

Russell 2000® Growth Index | 33.27% | 15.34% | 15.74% | ||||||||||||

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2021 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Core Growth Fund are Investor Class: 1.19% / Institutional Class — Gross: 1.08%, Net: 1.05%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 1/31/2012 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 1/31/2012 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

TOP 10 EQUITY HOLDINGS*

| Company | % of Net Assets | |||

CyberArk Software Ltd. | 3.1% | |||

ICON PLC | 2.9% | |||

Medpace Holdings, Inc. | 2.9% | |||

Bank OZK | 2.9% | |||

Morningstar, Inc. | 2.8% | |||

| Company | % of Net Assets | |||

Balchem Corp. | 2.7% | |||

Novanta, Inc. | 2.7% | |||

Trex Co., Inc. | 2.6% | |||

Kadant, Inc. | 2.5% | |||

Hamilton Lane, Inc., Class A | 2.5% | |||

| * | As of September 30, 2021, there were 58 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

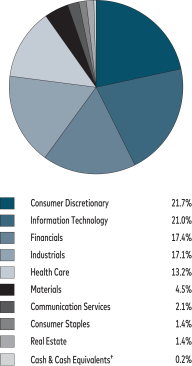

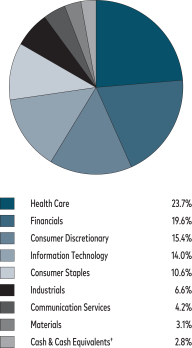

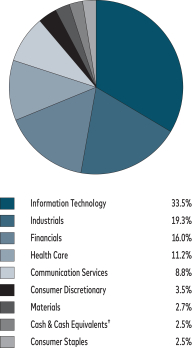

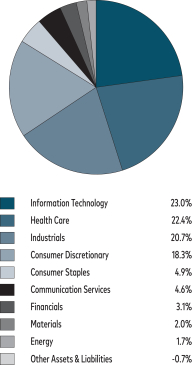

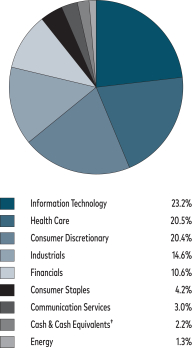

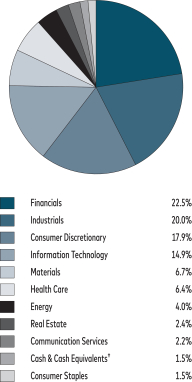

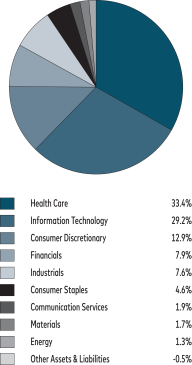

SECTOR BREAKDOWN**

| ** | Excludes securities sold short and options written, if any. |

| † | Also includes Other Assets & Liabilities. |

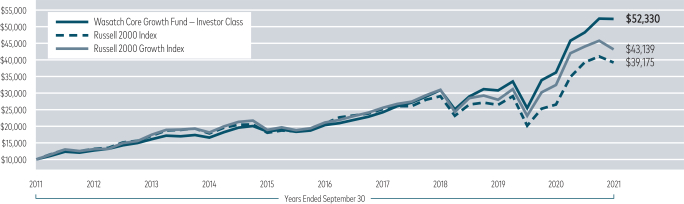

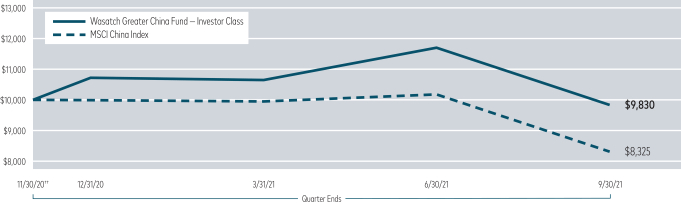

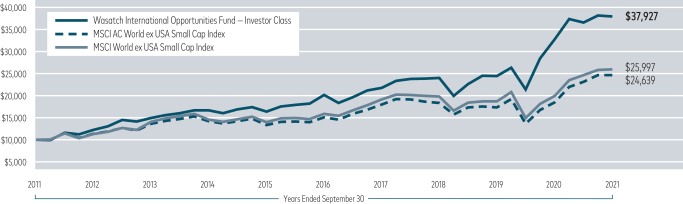

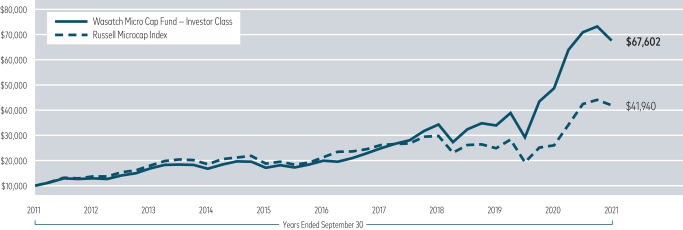

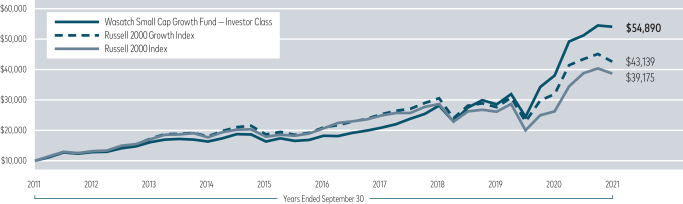

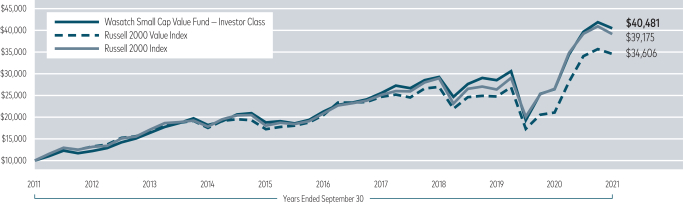

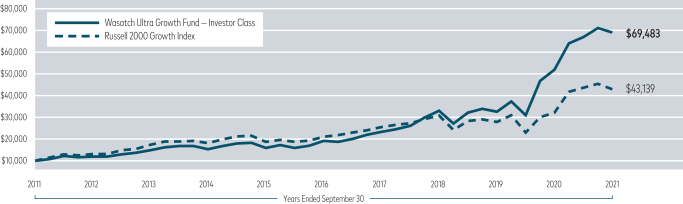

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.

5

| Wasatch Emerging India Fund (WAINX / WIINX) | SEPTEMBER 30, 2021 |

Management Discussion

The Wasatch Emerging India Fund is managed by a team of Wasatch portfolio managers led by Ajay Krishnan and Matthew Dreith.

Ajay Krishnan, CFA Lead Portfolio Manager |

Matthew Dreith, CFA Portfolio Manager | OVERVIEW

Despite India’s battle with a larger, more deadly second wave of Covid-19, Indian stocks finished with outsized gains for the 12 months ended |

September 30, 2021. The benchmark MSCI India Investable Market Index (IMI) rose 57.32% during the period. Outperforming its benchmark, the Wasatch Emerging India Fund — Investor Class generated a total return of 64.69%.

Fallout from India’s second outbreak of the coronavirus was less significant than had been feared. By early May, signs that fresh lockdown measures in the country’s hardest-hit regions were gaining traction touched off a powerful rally in Indian stocks. As the number of daily new cases receded, India’s major equity averages soared to record levels. High-frequency indicators of business and consumer activity recovery of lost ground more rapidly than they did during the first wave of the virus. Gross domestic product rose 20.1% in the three months to June 30 versus the year-ago period — boosted by rising factory orders, robust demand from overseas and a rebound in the services sector.

DETAILS OF THE YEAR

Improving business conditions and solid company fundamentals helped the Fund surpass its benchmark, with the information-technology (IT) sector providing the largest source of relative outperformance. The IT stocks owned in the Fund logged gains well ahead of the IT stocks in the Index, significantly enhancing the Fund’s return. Other areas in which the Fund outperformed included health care, consumer staples, industrials and communication services. The Fund also benefited from its lack of investments in energy, which allowed it to sidestep the lowest-returning sector of the Index during the period.

The materials sector was the largest source of weakness against the benchmark. Our materials stocks rose less than those in the Index, and the Fund’s underweight position in this high-flying sector was a headwind to performance. Our financials also lagged the lofty returns posted by the financials in the Index, but the Fund’s structural overexposure to financial firms more than offset the negative impact on relative performance.

Bajaj Finance Ltd. and Mindtree Ltd. were the Fund’s strongest contributors during the period. A non-bank financial company offering a broad spectrum of lending services, Bajaj saw its stock price move higher amid an explosion of

interest in digital banking and financial technology (fintech). The company is increasingly viewed as a disruptor in the Indian financial space, and its expanding digital presence has encouraged investors. Mindtree is an IT-services firm that has benefited as the Covid-19 pandemic accelerated large-scale migration of corporate clients to digital platforms and the cloud. We believe the IT-services industry may be undergoing structural gains in profitability as the shift to working from home allows more offshoring of business to India.

The greatest detractor from performance was Britannia Industries Ltd. A producer of fast-moving consumer goods, Britannia experienced exceptionally strong demand early in the coronavirus pandemic as citizens under lockdown stocked their pantries and ate more of the company’s products. As panic buying of food staples eased and sales growth slowed, however, we sold the stock to seek better opportunities elsewhere. Coforge Ltd. was the only other detractor in what was an exceptionally strong period for Indian equities. The Fund owned this provider of IT consulting and software services only briefly and exited the position at a small loss.

OUTLOOK

Robust demand from retail, institutional and foreign investors is encouraging Indian firms to go public at a record pace in what’s shaping up to be the best year ever for local initial public offerings (IPOs). The surge of new listings is expected to add about $400 billion of new capital to India’s equity market over the coming two to three years. And based on recent announcements, the IPO pipeline is likely to remain strong for at least the next year or so.

Compared to past periods when the IPO calendar consisted almost exclusively of traditional businesses, this time around there’s better representation from new-economy industries such as e-commerce, software and fintech. Examples include Zomato Ltd., an online restaurant guide and food-delivery company that went public in July, and digital-payments startup Paytm, which has filed to raise as much as $2.2 billion.

Although IPO participation isn’t a major part of our investment process, we believe our fundamental approach naturally lends itself to the analysis of companies seeking to go public. Moreover, we believe a healthy IPO calendar filled with new-economy businesses helps to sustain investor enthusiasm and increase the flow of international capital into India’s financial markets.

Thank you for the opportunity to manage your assets.

Current and future holdings are subject to risk.

6

| Wasatch Emerging India Fund (WAINX / WIINX) | SEPTEMBER 30, 2021 |

AVERAGE ANNUAL TOTAL RETURNS

| 1 Year | 5 Years | 10 Years | |||||||||||||

Emerging India (WAINX) — Investor | 64.69% | 18.01% | 15.82% | ||||||||||||

Emerging India (WIINX) — Institutional | 65.02% | 18.19% | 15.94% | ||||||||||||

MSCI India IMI | 57.32% | 13.32% | 9.49% | ||||||||||||

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2021 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging India Fund are Investor Class: 1.64% / Institutional Class: 1.45%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 2/1/2016 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 2/1/2016 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in foreign securities, especially in emerging markets, entails special risks, such as unstable currencies, highly volatile securities markets and political and social instability, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Being non-diversified, the Fund can invest a larger portion of its assets in the stocks of a limited number of companies than a diversified fund. Non-diversification increases the risk of loss to the Fund if the values of these securities decline.

TOP 10 EQUITY HOLDINGS*

| Company | % of Net Assets | |||

Bajaj Finance Ltd. | 10.7% | |||

Mindtree Ltd. | 9.6% | |||

Larsen & Toubro Infotech Ltd. | 7.7% | |||

L&T Technology Services Ltd. | 6.9% | |||

Info Edge India Ltd. | 6.3% | |||

| Company | % of Net Assets | |||

HDFC Bank Ltd. | 6.2% | |||

Divi’s Laboratories Ltd. | 6.2% | |||

Dr. Lal PathLabs Ltd. | 5.8% | |||

Trent Ltd. | 5.1% | |||

Avenue Supermarts Ltd. | 4.8% | |||

| * | As of September 30, 2021, there were 24 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

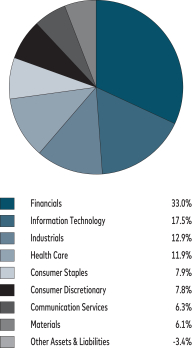

SECTOR BREAKDOWN**

| ** | Excludes securities sold short and options written, if any. |

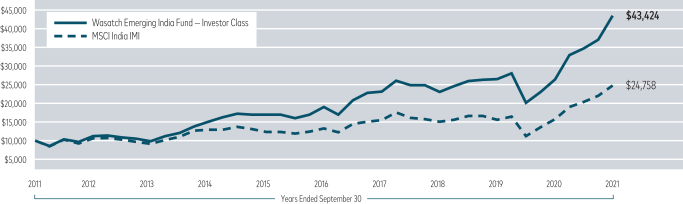

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.

7

| Wasatch Emerging Markets Select Fund (WAESX / WIESX) | SEPTEMBER 30, 2021 |

Management Discussion

The Wasatch Emerging Markets Select Fund is managed by a team of Wasatch portfolio managers led by Ajay Krishnan, Scott Thomas and Matthew Dreith.

Ajay Krishnan, CFA Lead Portfolio Manager |

Scott Thomas, CFA Associate Portfolio |

Matthew Dreith, CFA Associate Portfolio |

OVERVIEW

For the 12-month period ended September 30, 2021, the Wasatch Emerging Markets Select Fund — Investor Class gained 56.43%. The Fund significantly outperformed the benchmark MSCI Emerging Markets Index, which rose 18.20%.

Despite strong overall performance for emerging markets during the period, the Delta variant of Covid-19 has raised doubts about whether China’s attempts to tightly contain the virus can be sustained. Sudden lockdowns of entire cities and the mass testing of millions of people in response to a few dozen cases have imposed enormous economic and quality-of-life costs.

Even so, it seems unlikely that the government will abandon its zero-Covid approach until after the Winter Olympics in Beijing — and perhaps not until the National Party Congress meets in October of next year. In the meantime, virus containment and regulatory crackdowns will continue to pose short-term headwinds for China.

DETAILS OF THE YEAR

India, the Fund’s most heavily weighted country, was the largest source of outperformance relative to the benchmark. Our Indian holdings outgained the Indian stocks in the Index, and our overweight position in India was a tailwind for the Fund. Encouraged by record-low interest rates, hopes for a pickup in consumer demand and an improved outlook for the manufacturing sector, investors pushed India’s major stock averages to new all-time highs.

Chinese stocks produced uninspiring returns amid ongoing concerns about earnings, valuations, stimulus withdrawal and a government crackdown on the country’s tech giants. Our Chinese stocks substantially outgained the China component of the Index, boosting the Fund’s relative performance. Manufacturing activity in China has grown at a slower pace in recent months as supply bottlenecks and higher input costs crimped output.

Taiwan was another source of Fund outperformance relative to the benchmark. Surging overseas demand for computer chips and other electronic goods are helping the island’s economy. According to a government report released in June, gross domestic product expanded at the fastest pace in over 10 years.

On the negative side of the ledger, the Fund’s Korean and Brazilian stocks lagged their counterparts in the Index.

Bajaj Finance Ltd. was the Fund’s top contributor for the period. An Indian non-bank financial company, Bajaj offers a broad spectrum of lending services. The company’s stock price moved higher amid an explosion of interest in digital banking and financial technology (fintech). Bajaj is increasingly viewed as a disruptor in the Indian financial space, and the company’s expanding digital presence has encouraged investors.

Another strong contributor was Taiwan-listed Silergy Corp. Silergy manufactures high-performance mixed-signal and analog integrated circuits used in a wide array of electronic devices. Because Silergy’s business model — which is based on analog design engineering — is difficult to replicate, we believe the company has ample headroom for future growth.

The largest detractor from Fund performance for the period was Magazine Luiza SA — which operates a multi-channel retail platform of mobile, website and physical stores in Brazil. Investor enthusiasm for the company appeared to wane amid difficult year-over-year comparisons to 2020, when homebound shoppers flocking to the internet drove strong growth in the company’s e-commerce business.

One of the highest profile examples of volatility induced by regulatory developments in China was Alibaba Group Holding Ltd., which also detracted from Fund performance. In December 2020, one month after the suspension of the initial public offering of Ant Group (also owned by Alibaba founder Jack Ma), Alibaba saw its recent stock gains largely wiped away following the announcement by Chinese regulators of an antitrust investigation into alleged monopolistic business practices. The matter appears to have been resolved by payment of a $2.8 billion fine in April.

OUTLOOK

Once the regulatory dust has settled, we believe China’s health-care sector will present additional investment opportunities that are potentially attractive for the Fund. We’re much less optimistic about Chinese financial companies, however. In addition to being subject to government control, Chinese financials lack transparency and tend to be highly leveraged. Because this combination of traits makes risks difficult to assess, we expect the Fund’s exposure to Chinese financial stocks to remain somewhat limited.

Our unenthusiastic position toward Chinese financials stands in stark contrast to our optimism about financial firms in India. In our view, Indian financials offer more attractive long-term growth prospects with significantly less uncertainty than their Chinese counterparts. The financialization of India has been one of the Fund’s long-running investment themes, which we expect will continue as an upswell of initial public offerings boosts awareness and adds new names to the space.

Thank you for the opportunity to manage your assets.

Current and future holdings are subject to risk.

8

| Wasatch Emerging Markets Select Fund (WAESX / WIESX) | SEPTEMBER 30, 2021 |

AVERAGE ANNUAL TOTAL RETURNS

| 1 Year | 5 Years | Since Inception 12/13/2012 | |||||||||||||

Emerging Markets Select (WAESX) — Investor | 56.18% | 19.52% | 9.71% | ||||||||||||

Emerging Markets Select (WIESX) — Institutional | 56.42% | 19.82% | 10.02% | ||||||||||||

MSCI Emerging Markets Index | 18.20% | 9.23% | 4.58% | ||||||||||||

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2021 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging Markets Select Fund are Investor Class — Gross: 1.80%, Net: 1.51% / Institutional Class — Gross: 1.41%, Net: 1.21%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Being non-diversified, the Fund can invest a larger portion of its assets in the stocks of a limited number of companies than a diversified fund. Non-diversification increases the risk of loss to the Fund if the values of these securities decline.

TOP 10 EQUITY HOLDINGS*

| Company | % of Net Assets | |||

Bajaj Finance Ltd. | 7.0% | |||

Larsen & Toubro Infotech Ltd. | 5.9% | |||

Sea Ltd. ADR | 5.6% | |||

Silergy Corp. | 5.3% | |||

Globant SA | 5.1% | |||

| Company | % of Net Assets | |||

HDFC Bank Ltd. | 4.8% | |||

Voltronic Power Technology Corp. | 4.6% | |||

MercadoLibre, Inc. | 4.4% | |||

TCS Group Holding PLC GDR | 4.3% | |||

Lasertec Corp. | 4.2% | |||

| * | As of September 30, 2021, there were 32 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

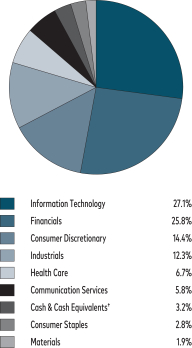

SECTOR BREAKDOWN**

| ** | Excludes securities sold short and options written, if any. |

| † | Also includes Other Assets & Liabilities. |

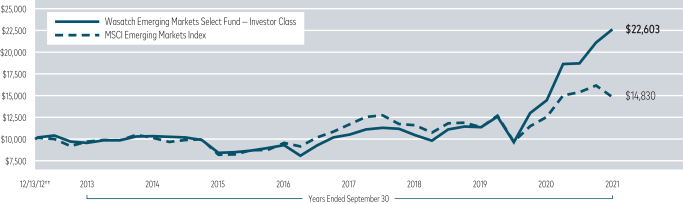

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

††Inception: December 13, 2012. Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.

9

| Wasatch Emerging Markets Small Cap Fund (WAEMX / WIEMX) | SEPTEMBER 30, 2021 |

Management Discussion

The Wasatch Emerging Markets Small Cap Fund is managed by a team of Wasatch portfolio managers led by Ajay Krishnan, Dan Chace, Scott Thomas and Kevin Unger.

Ajay Krishnan, CFA Lead Portfolio Manager

Scott Thomas, CFA Associate Portfolio Manager |

Dan Chace, CFA Portfolio Manager

Kevin Unger, CFA Associate Portfolio Manager | OVERVIEW

For the 12-month period ended September 30, 2021, the Wasatch Emerging Markets Small Cap Fund — Investor Class gained 50.23%. The Fund meaningfully outperformed the benchmark MSCI Emerging Markets Small Cap Index, which rose 43.24%. Despite the extraordinary performance during the period, concerns have grown that an | ||

end to the U.S. Federal Reserve’s extremely accommodative monetary policy might trigger an exodus of foreign capital from certain emerging markets, driving their currencies lower. Inflationary pressures already building in these countries might then be exacerbated as imports become more expensive. One of the ways we address such a scenario is to apply a higher hurdle rate to investments in countries where the structural backdrop is weaker. Our goal in these situations is to find businesses that we believe will generate earnings growth sufficient to offset potential declines in the currency, while still providing attractive rates of return.

DETAILS OF THE YEAR

Taiwan was the Fund’s largest source of outperformance relative to the benchmark. Surging overseas demand for computer chips and other electronic goods are helping the island’s economy. According to a government report released in June, gross domestic product expanded at the fastest pace in over 10 years.

India, the Fund’s most heavily weighted country, was also a large source of outperformance relative to the benchmark. Our Indian holdings outgained the Indian stocks in the Index, and our overweight position in India was a strong tailwind for the Fund. Encouraged by record-low interest rates, hopes for a pickup in consumer demand and an improved outlook for the manufacturing sector, investors pushed India’s major stock averages to new all-time highs.

China was a significant source of weakness against the benchmark. Although our group of Chinese holdings underperformed the Chinese component of the Index, the Fund’s below-benchmark weighting in China mitigated part of the effect on performance. Our Korean and Brazilian stocks also lagged their counterparts in the Index.

The top contributor to Fund performance for the period was Taiwan-listed Silergy Corp. Silergy manufactures high-performance mixed-signal and analog integrated circuits used in a wide array of electronic devices. Because Silergy’s business model — which is based on analog-design engineering — is difficult to replicate, we believe the company has ample headroom for future growth.

Mindtree Ltd., an Indian IT-services firm, was also a strong contributor. The company focuses mainly on the hospitality and retail industries. We believe the IT-services industry may be undergoing structural improvements in profitability as the shift to working from home allows more offshoring of business to India.

AK Medical Holdings Ltd. was the largest detractor from Fund performance for the period. The company sells orthopedic implants, spinal interbody cages and artificial vertebral bodies in China. The stock price fell in July after the company issued a profit warning disclosing that customers had temporarily reduced their purchases in anticipation of potentially lower prices arising from China’s national volume-based procurement policy for joint implants. We sold our position in AK Medical to seek better opportunities elsewhere.

Tokai Carbon Korea Co. Ltd. was also a significant detractor. The company produces silicon wafers and semiconductor materials for industrial applications. Unfavorable court decisions in patent litigation initiated by Tokai against competitors have resulted in the loss of some of the company’s intellectual property. Even so, key patents and trade secrets surrounding the manufacturing processes remain in place. We added to the Fund’s position in the belief that the loss of intellectual property won’t significantly increase competition for Tokai in the markets it serves.

OUTLOOK

We believe our focus on high-quality companies tends to be helpful in inflationary environments. We think talented, innovative management teams are more likely to find ways to adapt to rising costs for materials and shortages of labor. In addition, our companies typically have strong market positions that afford them a certain degree of pricing power — which allows them to pass on higher costs to their customers.

During past periods of inflation, we saw high-quality companies gain market share and widen their competitive advantages compared to lower-quality companies that were less able to cope with inflationary challenges. To the extent that a well-managed company can weather bouts of inflation better than its competitors, we think such periods offer the potential to enhance the long-term growth trajectory of the business.

Thank you for the opportunity to manage your assets.

Current and future holdings are subject to risk.

10

| Wasatch Emerging Markets Small Cap Fund (WAEMX / WIEMX) | SEPTEMBER 30, 2021 |

AVERAGE ANNUAL TOTAL RETURNS

| 1 Year | 5 Years | 10 Years | |||||||||||||

Emerging Markets Small Cap (WAEMX) — Investor | 50.23% | 15.24% | 9.96% | ||||||||||||

Emerging Markets Small Cap (WIEMX) — Institutional | 50.53% | 15.42% | 10.04% | ||||||||||||

MSCI Emerging Markets Small Cap Index | 43.24% | 9.75% | 7.21% | ||||||||||||

MSCI Emerging Markets Index | 18.20% | 9.23% | 6.09% | ||||||||||||

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2021 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging Markets Small Cap Fund are Investor Class: 1.95% / Institutional Class: 1.81%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 2/1/2016 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 2/1/2016 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Being non-diversified, the Fund can invest a larger portion of its assets in the stocks of a limited number of companies than a diversified fund. Non-diversification increases the risk of loss to the Fund if the values of these securities decline.

TOP 10 EQUITY HOLDINGS*

| Company | % of Net Assets | |||

Silergy Corp. | 7.2% | |||

Voltronic Power Technology Corp. | 6.3% | |||

Mindtree Ltd. | 5.5% | |||

Globant SA | 4.2% | |||

Larsen & Toubro Infotech Ltd. | 4.0% | |||

| Company | % of Net Assets | |||

L&T Technology Services Ltd. | 3.9% | |||

momo.com, Inc. | 3.8% | |||

TCS Group Holding PLC GDR | 3.7% | |||

Bajaj Finance Ltd. | 3.5% | |||

HeadHunter Group PLC ADR | 3.4% | |||

| * | As of September 30, 2021, there were 47 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

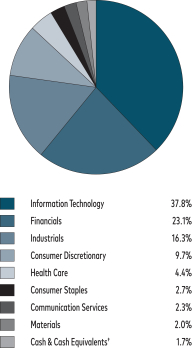

SECTOR BREAKDOWN**

| ** | Excludes securities sold short and options written, if any. |

| † | Also includes Other Assets & Liabilities. |

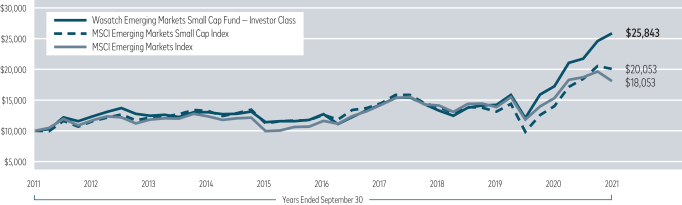

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.

11

| Wasatch Frontier Emerging Small Countries Fund (WAFMX / WIFMX) | SEPTEMBER 30, 2021 |

Management Discussion

The Wasatch Frontier Emerging Small Countries Fund is managed by a team of Wasatch portfolio managers led by Scott Thomas.

Scott Thomas, CFA Lead Portfolio Manager | OVERVIEW

The Wasatch Frontier Emerging Small Countries Fund — Investor Class finished the 12-month period ended September 30, 2021 with a gain of 46.18%, significantly outperforming its primary benchmark, the MSCI Frontier Emerging Markets Index, which gained 20.13% over the same period. |

Stock selection in countries and sectors overwhelmingly accounted for the Fund’s outperformance of its benchmark during the period. On a country basis, Russia, India and Singapore contributed the most to Fund performance. On a sector basis, stock selection was particularly impactful in financials, communication services, industrials and information-technology (IT). The Fund significantly outperformed the benchmark in each of these sectors. Health care was the only sector of the Fund that meaningfully lagged its benchmark counterpart.

The Fund is overweight versus the benchmark in financials, which is our most heavily weighted sector. Fintech companies — businesses operating at the crossroads of financials and information technology — such as those enabling digital banking, payments and shopping have seen demand spike during the pandemic and their stocks generally performed well during the 12-month period.

DETAILS OF THE YEAR

Three companies that operate in the fintech space — TCS Group Holding PLC, Sea Ltd. and MercadoLibre, Inc — finished among the Fund’s top contributors for the period. In our view, all three companies are well-positioned to facilitate and benefit from trends in digital finance.

The largest contributor to Fund performance was TCS, the holding company for Tinkoff Bank, Russia’s largest digital bank. Serving over 13 million customers with its branchless business model, the bank has thrived during the pandemic. Also helping shares of TCS has been growing optimism about the company’s investment-brokerage business.

We added Singapore-based Sea Ltd. in the second calendar quarter of 2020, and it has been one of the best contributors to Fund performance since then. Beyond its digital-payments platform, SeaMoney, the company’s other business segments include mobile-game developer Garena and online-shopping platform Shopee. We believe Sea has an opportunity to become a dominant force, if not the dominant force, in Southeast Asia in each of the spaces in which it operates. The company’s prospects for long-term growth are also supported by its expansion into Latin America.

E-commerce powerhouse MercadoLibre operates the largest digital payments system across 18 countries in Latin

America. Although the company is already a market leader, we believe it has headroom for years of growth as the region boasts a population of approximately 635 million people that are increasingly embracing the internet for everything from banking to operating online businesses and shopping.

One of the Fund’s largest detractors during the period was Thailand-based TQM Corp. Public Co. Ltd. An insurance provider, TQM has faced challenges stemming from the pandemic, including impacts on the company’s own staff and on its revenue. We maintained the position as we believe the company is well-run and we like its strong balance sheet.

Another significant detractor was Magazine Luiza SA. The company operates a multi-channel retail platform of mobile, online and physical stores in Brazil. Investor enthusiasm waned as Magazine Luiza has faced difficult year-over-year comparisons to 2020 — when homebound shoppers flocking to the internet drove strong growth in the company’s e-commerce business. Recent economic conditions have weighed on Brazilian stocks in general.

Cleopatra Hospital Co. was also a detractor. The company operates Egypt’s largest private hospital network by number of hospital beds and number of operating hospitals. Although the company has faced challenges during the year, including an acquisition deal that fell through, we believe Cleopatra’s fundamentals remain strong. We expect growth to continue and be supported by its acquisitions pipeline.

OUTLOOK

We are pleased with the Fund’s strong performance during the 12-month period. From an investing standpoint, the pandemic appears to have accelerated multiple secular trends. In addition to highlighting the need for many businesses to modernize their operations, which has led to a massive shift toward cloud-based platforms, the pandemic also appears to have dramatically increased consumers’ appetites for all manner of goods and services. In many instances, we believe these trends may help drive companies’ growth for years to come.

While the pandemic and ongoing efforts to vaccinate the global population, along with macro concerns including inflation, interest rates and the eventual withdrawal of economic stimulus measures, are certain to influence investor sentiment in the months ahead, we believe that earnings growth is ultimately the primary factor that drives stock prices over the long-term. So rather than worry about macro events over which we have no control, we think it’s more productive to use our bottom-up research process to find exciting companies in frontier and emerging small countries that we believe are well-positioned to grow over coming years. One reason for our optimism regarding these countries is their young populations compared to more highly developed nations.

Thank you for the opportunity to manage your assets.

Current and future holdings are subject to risk.

12

| Wasatch Frontier Emerging Small Countries Fund (WAFMX / WIFMX) | SEPTEMBER 30, 2021 |

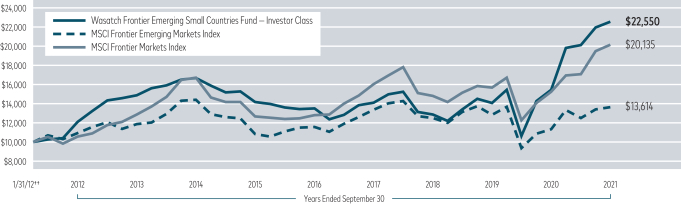

AVERAGE ANNUAL TOTAL RETURNS

| 1 Year | 5 Years | Since Inception 1/31/2012 | |||||||||||||

Frontier Emerging Small Countries (WAFMX) — Investor | 45.70% | 10.84% | 8.77% | ||||||||||||

Frontier Emerging Small Countries (WIFMX) — Institutional | 46.23% | 11.06% | 8.93% | ||||||||||||

MSCI Frontier Emerging Markets Index | 20.13% | 3.32% | 3.24% | ||||||||||||

MSCI Frontier Markets Index | 32.20% | 9.52% | 7.51% | ||||||||||||

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2021 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Frontier Emerging Small Countries Fund are Investor Class — Gross: 2.38%, Net: 2.15% / Institutional Class — Gross: 2.18%, Net: 1.96%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 2/1/2016 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 2/1/2016 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in foreign securities, especially in frontier and emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Being non-diversified, the Fund can invest a larger portion of its assets in the stocks of a limited number of companies than a diversified fund. Non-diversification increases the risk of loss to the Fund if the values of these securities decline.

TOP 10 EQUITY HOLDINGS*

| Company | % of Net Assets | |||

Sea Ltd. ADR | 8.9% | |||

TCS Group Holding PLC GDR | 8.7% | |||

Bajaj Finance Ltd. | 8.3% | |||

MercadoLibre, Inc. | 6.5% | |||

VEF AB | 6.0% | |||

| Company | % of Net Assets | |||

FPT Corp. | 5.2% | |||

Globant SA | 4.9% | |||

HeadHunter Group PLC ADR | 3.5% | |||

Wilcon Depot, Inc. | 3.0% | |||

DCVFMVN Diamond ETF | 2.8% | |||

| * | As of September 30, 2021, there were 32 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

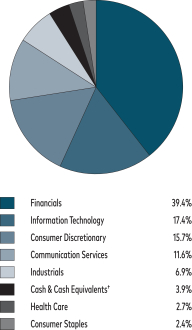

SECTOR BREAKDOWN**

| ** | Excludes securities sold short and options written, if any. |

| † | Also includes Other Assets & Liabilities. |

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

††Inception: January 31, 2012. Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.

13

| Wasatch Global Opportunities Fund (WAGOX / WIGOX) | SEPTEMBER 30, 2021 |

Management Discussion

The Wasatch Global Opportunities Fund is managed by a team of Wasatch portfolio managers led by JB Taylor, Ajay Krishnan, Ken Applegate and Paul Lambert.

JB Taylor Lead Portfolio Manager

Ken Applegate, CFA Portfolio Manager |

Ajay Krishnan, CFA Lead Portfolio Manager

Paul Lambert Portfolio Manager | OVERVIEW

The Wasatch Global Opportunities Fund — Investor Class finished the 12-month period ended September 30, 2021 with a gain of 51.70% and significantly outperformed its benchmark, the MSCI AC (All Country) World Small Cap Index, which gained 40.61%. Over the past 12 months, the Fund’s performance gained | ||

a substantial benefit from our holdings in emerging markets. Led by India and Taiwan, our emerging-market investments outperformed the benchmark’s emerging-market position by a wide margin. Approximately one-quarter of the Fund’s net assets are invested in emerging markets, and we are overweight compared to the benchmark. Our holdings in developed markets added the most to the Fund’s return and outperformed their benchmark counterparts. Japan was our top-contributing developed market, followed by Israel.

Despite a short-lived shift to value-oriented names that began late in 2020 amid widespread optimism for a post-Covid economic rebound, over the entire 12-month period, investors generally preferred high-quality growth companies such as those in which the Fund seeks to invest. The Fund’s performance relative to the benchmark was helped to a large extent by our holdings in the information-technology and industrials sectors. These two sectors are often where we find companies that meet our strict criteria for quality and that have strong long-term growth potential.

DETAILS OF THE YEAR

For a second-consecutive annual period, Taiwan-listed semiconductor manufacturer Silergy Corp. was the Fund’s top contributor. In addition to benefiting from the global semiconductor shortage, we think Silergy’s business model — which is based on analog design engineering — is difficult to replicate and is likely to provide the company with significant headroom for growth over the coming decade.

India contributed the most to the Fund’s outperformance of the benchmark for the 12-month period led by Mindtree Ltd. A global software-development firm, Mindtree offers business software solutions and product-development services, focusing mainly on the hospitality and retail industries. The company also designs reusable “building blocks” that can

be easily deployed by other high-tech firms. Mindtree has benefited as the Covid-19 pandemic accelerated the large-scale migration of corporate clients to digital platforms and the cloud.

Our top developed-market contributor was Israel-based Kornit Digital Ltd. The company makes machines that enable on-demand printing of designs and images on clothing and fabrics. The Covid-19 pandemic has highlighted the advantages of Kornit’s on-demand technology, which greatly reduces the need for inventory on hand and in supply chains. Kornit’s equipment is also environmentally friendly. It uses no water — whereas traditional printing methods consume vast amounts of water — and the inks it uses are biodegradable. The stock also benefited from growing optimism about the KornitX operating system.

While the U.S. added the most to the Fund’s return, our U.S. holdings underperformed their benchmark counterparts. The largest detractor for the 12-month period was Ollie’s Bargain Outlet Holdings, Inc., a discount retailer that offers a continually changing selection of close-out items and brand-name merchandise at deeply discounted prices. Over the next few quarters, Ollie’s faces difficult comparisons to 2020 — when stimulus payments and enhanced unemployment benefits boosted the disposable income of consumers. Longer term, we think the company’s unique treasure-hunt shopping experience and still-limited national footprint offer attractive prospects for expansion.

Vitasoy International Holdings Ltd., a position we ultimately exited, was also a significant detractor. The company is headquartered in Hong Kong and produces numerous food and beverage items. On the heels of rapid growth, a combination of competitive and regulatory pressures caused us to believe our original investment thesis might be impaired.

OUTLOOK

Some small-company growth stocks remain richly priced by historical standards. In addition to currently high valuations, inflation and higher interest rates rank among possible challenges the Fund may encounter in the quarters ahead. Beyond these risks, the Covid-19 pandemic and continuing efforts to vaccinate the global population are certain to influence investor sentiment.

While we attempt to mitigate the potential impacts of these risks, we make no forecasts as to when or if they might come into play. Instead, our core focus remains on finding new companies that fit our model for long-term investments and on conducting thorough and ongoing due diligence for the companies we already hold. We feel confident in the makeup of the Fund and believe its outperformance of the benchmark during a volatile year provides some vindication of our long-term, quality-oriented investment approach.

Thank you for the opportunity to manage your assets.

Current and future holdings are subject to risk.

14

| Wasatch Global Opportunities Fund (WAGOX / WIGOX) | SEPTEMBER 30, 2021 |

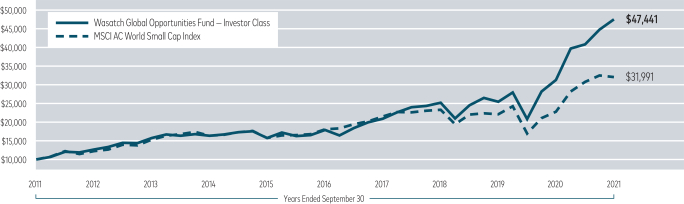

AVERAGE ANNUAL TOTAL RETURNS

| 1 Year | 5 Years | 10 Years | |||||||||||||

Global Opportunities (WAGOX) — Investor | 51.70% | 21.55% | 16.85% | ||||||||||||

Global Opportunities (WIGOX) — Institutional | 52.21% | 21.80% | 16.97% | ||||||||||||

MSCI AC World Small Cap Index | 40.61% | 12.20% | 12.33% | ||||||||||||

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2021 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Global Opportunities Fund are Investor Class: 1.53% / Institutional Class — Gross: 1.48%, Net: 1.35%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 2/1/2016 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 2/1/2016 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in small and micro cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

TOP 10 EQUITY HOLDINGS*

| Company | % of Net Assets | |||

Mindtree Ltd. | 4.2% | |||

Silergy Corp. | 3.8% | |||

Kornit Digital Ltd. | 3.7% | |||

L&T Technology Services Ltd. | 3.5% | |||

BayCurrent Consulting, Inc. | 3.4% | |||

| Company | % of Net Assets | |||

Voltronic Power Technology Corp. | 2.7% | |||

Open Lending Corp., Class A | 2.6% | |||

Globant SA | 2.6% | |||

JMDC, Inc. | 2.4% | |||

Ollie’s Bargain Outlet Holdings, Inc. | 2.3% | |||

| * | As of September 30, 2021, there were 68 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

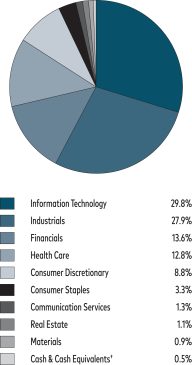

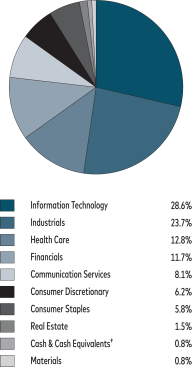

SECTOR BREAKDOWN**

| ** | Excludes securities sold short and options written, if any. |

| † | Also includes Other Assets & Liabilities. |

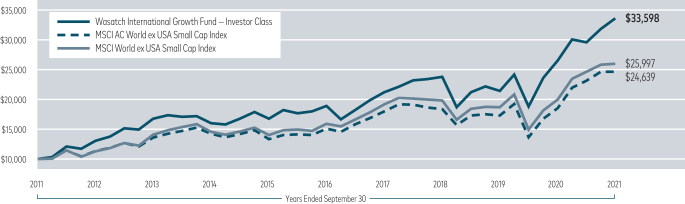

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.

15

| Wasatch Global Select Fund (WAGSX / WGGSX) | SEPTEMBER 30, 2021 |

Management Discussion

The Wasatch Global Select Fund is managed by a team of Wasatch portfolio managers led by Ken Applegate, Paul Lambert, Linda Lasater and Mike Valentine.

Ken Applegate, CFA Portfolio Manager

Linda Lasater, CFA Portfolio Manager |

Paul Lambert Portfolio Manager

Mike Valentine Portfolio Manager | OVERVIEW

The Wasatch Global Select Fund — Investor Class gained 25.84% for the 12 months ended September 30, 2021 and underperformed its benchmark, the MSCI AC (All Country) World Index, which gained 27.44%. Although our developed-market investments |

produced a double-digit gain and added the most to the Fund’s return for the 12-month period, they underperformed the benchmark’s developed-market holdings. On the other hand, the Fund’s investments in emerging markets gained substantially more than the benchmark’s emerging-markets position. India was the top-contributing emerging market. Among developed markets, Japan contributed the most to performance relative to the Index.

Despite a short-lived shift to value-oriented names that began late in 2020 amid widespread optimism for a post-Covid economic rebound, over the entire 12-month period, investors generally preferred high-quality growth companies such as those in which the Fund seeks to invest. The Fund’s performance was aided significantly by our holdings in the information-technology (IT) and industrials sectors. These two sectors are often where we find companies that meet our strict criteria for quality and that have strong long-term growth potential.

DETAILS OF THE YEAR

The Fund’s strong showing in India was overwhelmingly driven by the stock-price gain of Bajaj Finance Ltd., the top contributor for the 12-month period. A non-bank financial company, Bajaj offers a broad spectrum of lending services. The company’s stock price moved higher amid an explosion of interest in digital banking and financial technology (fintech). Bajaj is increasingly viewed as a disruptor in the Indian financial space, and the company’s expanding digital presence has encouraged investors.

Outperformance in Japan was led by the Fund’s position in BayCurrent Consulting, Inc. BayCurrent operates in the digital transformation space, offering comprehensive consulting services including a specialization in IT consulting

and integration. We believe Japan is a particularly attractive market for the company’s offerings thanks to a large pool of cash-rich corporations that lag their peers in other markets in terms of digital modernization. We also believe BayCurrent may continue to benefit from an “early mover” advantage.

Our U.S. investments added the most to the Fund’s return but underperformed the benchmark’s U.S. position. The Fund’s top U.S. contributor was Old Dominion Freight Line, Inc., a trucking company that transports goods across the U.S. A long-time Wasatch holding, we believe the company has been firing on all cylinders.

Recent economic conditions have weighed on Brazilian stocks in general, as currency weakness and surging inflation force the country’s central bank to extend the world’s most aggressive series of interest-rate hikes this year. Unsurprisingly, Brazil subtracted the most from the Fund’s return. The largest detractor was Magazine Luiza SA, which operates a multi-channel retail platform of mobile, web-based and physical stores in Brazil. Investor enthusiasm waned as Magazine Luiza faced difficult year-over-year comparisons to 2020 — when homebound shoppers flocking to the internet drove strong growth in the company’s e-commerce business.

Another significant detractor was Chr. Hansen Holding AS, a Denmark-based bioscience company that makes specialized medical components. We sold the stock in favor of new opportunities we believe are more promising.

Vitasoy International Holdings Ltd., another position we ultimately exited, also detracted. The company is headquartered in Hong Kong and produces numerous food and beverage items. On the heels of rapid growth, a combination of competitive and regulatory pressures caused us to believe our original investment thesis might be impaired.

OUTLOOK

Various macro themes, including the ongoing pandemic and efforts to vaccinate the global population, inflation, higher interest rates and the eventual withdrawal of monetary stimulus by central banks around the world, will continue to play out and will likely produce short-term waves of volatility in global equity markets. We believe we’ve assembled a portfolio of strong companies that are well-positioned to weather uncertain environments and grow over the long term, in part thanks to the strong underlying balance sheets we look for as a fundamental feature of any investment.

We remain focused on finding new companies that meet our strict criteria for quality and have outstanding potential for long-term growth. We also continue to conduct thorough due diligence on the companies we already hold.

Thank you for the opportunity to manage your assets.

Current and future holdings are subject to risk.

16

| Wasatch Global Select Fund (WAGSX / WGGSX) | SEPTEMBER 30, 2021 |

AVERAGE ANNUAL TOTAL RETURNS

| 1 Year | Since Inception 10/1/2019 | |||||||||

Global Select (WAGSX) — Investor | 25.84% | 25.92% | ||||||||

Global Select (WGGSX) — Institutional | 26.31% | 26.35% | ||||||||

MSCI AC World Index | 27.44% | 18.62% | ||||||||

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2021 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Global Select Fund are Investor Class — Gross: 4.70%, Net: 1.36% / Institutional Class — Gross: 2.79%, Net: 0.96%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in foreign securities, especially in emerging and frontier markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Being non-diversified, the Fund can invest a larger portion of its assets in the stocks of a limited number of companies than a diversified fund. Non-diversification increases the risk of loss to the Fund if the values of these securities decline.

TOP 10 EQUITY HOLDINGS*

| Company | % of Net Assets | |||

Bajaj Finance Ltd. | 4.8% | |||

ICON PLC | 4.4% | |||

Amphenol Corp., Class A | 4.1% | |||

Copart, Inc. | 3.9% | |||

Morningstar, Inc. | 3.8% | |||

| Company | % of Net Assets | |||

Amadeus IT Group SA | 3.7% | |||

BayCurrent Consulting, Inc. | 3.6% | |||

Bank OZK | 3.6% | |||

Assa Abloy AB, Class B | 3.5% | |||

MISUMI Group, Inc. | 3.3% | |||

| * | As of September 30, 2021, there were 36 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

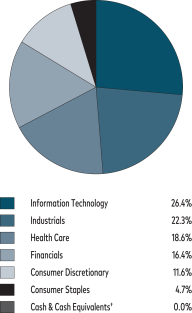

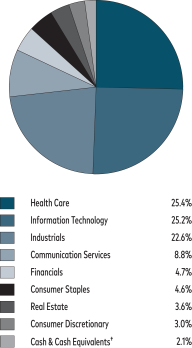

SECTOR BREAKDOWN**

| ** | Excludes securities sold short and options written, if any. |

| † | Also includes Other Assets & Liabilities. |

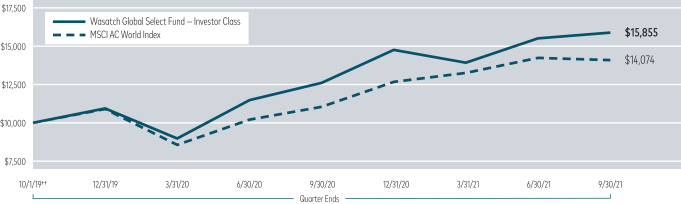

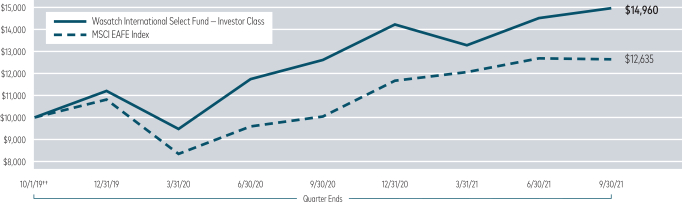

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT