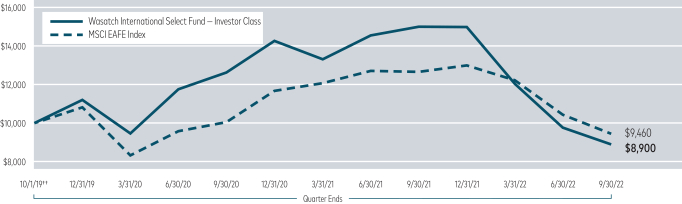

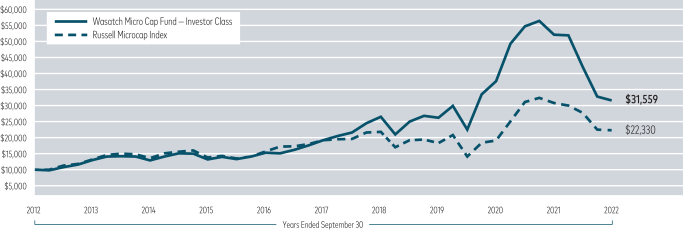

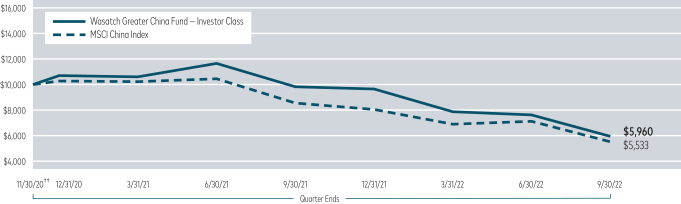

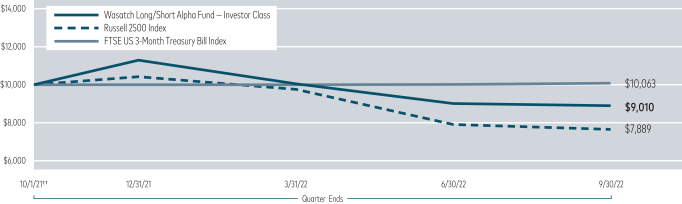

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04920

WASATCH FUNDS TRUST

(Exact name of registrant as specified in charter)

505 Wakara Way, 3rd Floor

Salt Lake City, UT 84108

(Address of principal executive offices)(Zip code)

| | |

| (Name and Address of Agent for Service) | | Copy to: |

| |

Eric S. Bergeson Wasatch Advisors, Inc. 505 Wakara Way, 3rd Floor Salt Lake City, UT 84108 | | Eric F. Fess, Esq. Chapman & Cutler LLP 320 S. Canal Street Chicago, IL 60606 |

Registrant’s telephone number, including area code: (801) 533-0777

Date of fiscal year end: September 30

Date of reporting period: September 30, 2022

Item 1. Report to Shareholders.

| (a) | A copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”) is filed herewith. |

SEPTEMBER 30, 2022 2022 Annual Report Fund Investor Institutional Name Class Class Wasatch Core Growth Fund WGROX WIGRX Wasatch Emerging India Fund WAINX WIINX Wasatch Emerging Markets Select Fund WAESX WIESX Wasatch Emerging Markets Small Cap Fund WAEMX WIEMX Wasatch Frontier Emerging Small Countries Fund WAFMX WIFMX Wasatch Global Opportunities Fund WAGOX WIGOX Wasatch Global Select Fund WAGSX WGGSX Wasatch Global Value Fund FMIEX WILCX Wasatch Greater China Fund WAGCX WGGCX Wasatch International Growth Fund WAIGX WIIGX Fund Investor Institutional Name Class Class Wasatch International Opportunities Fund WAIOX WIIOX Wasatch International Select Fund WAISX WGISX Wasatch Long/Short Alpha Fund WALSX WGLSX Wasatch Micro Cap Fund WMICX WGICX Wasatch Micro Cap Value Fund WAMVX WGMVX Wasatch Small Cap Growth Fund WAAEX WIAEX Wasatch Small Cap Value Fund WMCVX WICVX Wasatch Ultra Growth Fund WAMCX WGMCX Wasatch U.S. Select Fund WAUSX WGUSX Wasatch-Hoisington U.S. Treasury Fund WHOSX —

Wasatch Funds

Salt Lake City, Utah

wasatchglobal.com

800.551.1700

This material must be accompanied or preceded by a prospectus.

Please read the prospectus carefully before you invest.

Wasatch Funds are distributed by ALPS Distributors, Inc.

1

| | |

| Letter to Shareholders — Stock Returns Diverged from Revenue-Growth Trends | | |

| | |

Eric Bergeson President Wasatch Global Investors | | DEAR FELLOW SHAREHOLDERS: Market sentiment for growth-oriented small-caps turned down after an interim peak in November 2021. This negative sentiment continued during the first quarter of 2022 and accelerated during the second quarter. After a summer rally, the Russell 2000® Index of U.S. small caps finished the third quarter of 2022 near the low point for the year. We think the main reason for conditions worsening in the market was that investors started to see macro forces bite more significantly into company fundamentals. These forces included war disruptions, supply-chain challenges, higher interest rates, and rising costs for labor and other inputs. Additionally, recession fears became more pronounced as the U.S. Federal Reserve (Fed) increased interest rates and signaled more increases in the future. To top things off, energy and food prices crimped the budgets of average consumers who also saw government stimulus receipts dry up. |

One of the most disconcerting aspects of investing is that you never know whether actual conditions will get as bad as forecasts. This is a reason it’s impossible to predict a bottom in the market. Having said that, after the recent decline, we feel much better about stock prices being very attractive and about the prospects of our companies to maintain or improve their revenues and earnings over a reasonably long investment horizon. Of course, continued short-term dislocations are always possible.

QUALITY AMID MARKET DOWNTURNS

During market downturns like the one that started in November 2021, we typically see that stocks punished the most are of companies that may be a step lower in quality. Because these stocks can rebound very quickly, it sometimes makes sense to take a nuanced approach with respect to quality in order to participate more heavily in a post-downturn rally.

What we also saw recently, which was rather unusual, was that some — but certainly not all — of the highest-quality stocks were down on the same order of magnitude as some of the lower-quality stocks. As a result, we think certain high-quality growth stocks — especially those of companies with little debt and significant cash on hand — may also be excellent performers in a post-downturn rally.

Based on the typical and the unusual aspects of the recent downturn, our tactics over the past several months have required slightly more portfolio adjustments as described below. Still, our primary investment criteria are:

| | • | | Innovative products, recurring revenues and sustainable business models in markets with headroom for long-duration growth |

| | • | | Ability to increase prices if necessary and still gain market share — which is a powerful combination in maintaining profit margins, especially amid rising inflation |

| | • | | Operations that are comparatively insensitive to economic cycles such as recessions |

| | • | | Significant returns on capital, relatively low debt and cash-rich balance sheets |

MAKING SLIGHTLY MORE PORTFOLIO ADJUSTMENTS

During the extreme volatility in stock prices since November 2021, we’ve responded the way we always do amid market dislocations. More specifically, on the margin, we’ve sold some positions that we considered relatively expensive — and we’ve rotated into companies that we believe are at bargain prices.

From a tactical perspective, we’ve made slightly more portfolio adjustments compared to what we’d do amid a more typical downturn. As mentioned above, we think certain top-quality stocks will be excellent performers in a post-downturn rally. But we also think that, despite the largely negative market environment since November 2021, the stocks of some companies that we believe have “operationally stellar” businesses may not be poised to outperform because they haven’t traded down as much as the overall small-cap market. And the stocks of some “merely good” companies have been pummeled unfairly in our view. So we’ve exited several “operationally stellar” positions due to extreme priciness, and we’ve bought several “merely good” companies based on compelling valuations.

Although these sales and corresponding purchases could be viewed as making minor trades down in quality, our approach is to always maintain high standards — but not overpay. For example, in the current environment, a “merely good” company that’s already fallen -60% might be a better investment than an “operationally stellar” company that’s dropped only -25%. Again, any trades we’ve made in this regard are important but don’t represent major changes to our funds.

STEADY ASCENTS DON’T EXIST IN SMALLER-CAP STOCKS

When we discuss historical Wasatch holdings, many of our shareholders are surprised to learn that some of our most successful long-term investments periodically fell by more than -60% — often multiple times. Beyond overall negative psychology, reasons for such declines could be nervousness among investors that a company is too small, too illiquid and/or too difficult for

2

establishing a desired position size. In these and certain other cases, high-quality micro-caps and small-caps could be ripe for acquisitions at premiums above their market prices. Currently, the significant amount of money in the hands of private-equity firms may be a tailwind for such acquisitions.

The most obvious benefit of buying a stock that’s declined in the vicinity of -60% is that the price could be poised to rebound very quickly. Another benefit can be that a smaller company often flies under the radar of geopolitical events and isn’t especially vulnerable after a decline has already occurred. This is more likely if the stock wasn’t down due to geopolitics in the first place. Making such a determination is part of our research process.

STICKING TO OUR GAME PLAN

In the rising interest-rate environment since late-2021, several Wasatch funds have underperformed their benchmarks largely because the discounted cash flows of growth companies are generally weighted further into the future. While it’s never pleasant to underperform or to see negative returns, we’ve experienced such conditions before — and we’ve always emerged gratified that we stuck to our time-tested game plan. For example, similar to the recent environment, we experienced dramatic underperformance in 2016. But the subsequent years through the end of 2021 were some of our best, on a relative basis, in our nearly five decades of managing money.

What gave us the confidence to stick to our game plan? The answer in 2016 was the same as it is today: We believe the corporate operating performance that’s being “captured” by our funds isn’t being properly reflected in the stock returns. In other words, the revenue growth rates — which may eventually translate into earnings growth — that our high-quality companies have generated while we’ve held the stocks over the past five years have exceeded the stock returns by wide margins. Based on our experience, this gap between “captured” revenues and stock returns should eventually close — with performance accruing in our favor.

WASATCH’S COMPLETE LINEUP OF FUNDS ARE NOW FULLY AVAILABLE

On September 7, we announced the reopening of six Wasatch funds. With this announcement, Wasatch’s complete lineup of offerings are fully available, and all fund share classes are now open to new investors.

Consistent with our longstanding commitment to shareholders, we have periodically closed certain funds to new investors so we could maintain our disciplined and focused investment approach. Wasatch remains financially strong and hasn’t seen significant outflows. The full reopening simply reflects our view that the current market environment may present attractive prospects for long-term investors. We remain committed to thoughtfully managing capacity and will continue to close funds when we think it’s in the best interest of existing shareholders to do so.

With sincere thanks for your continuing investment and for your trust,

Eric Bergeson

Information in this report regarding market or economic trends, or the factors influencing historical or future performance, reflects the opinions of management as of the date of this report. These statements should not be relied upon for any other purpose. Past performance is no guarantee of future results, and there is no guarantee that the market forecasts discussed will be realized.

Wasatch Advisors, Inc., doing business as Wasatch Global Investors, is the investment advisor to Wasatch Funds.

Wasatch Funds are distributed by ALPS Distributors, Inc. (ADI). ADI is not affiliated with Wasatch Global Investors.

Eric Bergeson is a registered representative of ADI.

Definitions of financial terms and index descriptions and disclosures begin on page 45.

3

| | |

| Wasatch Core Growth Fund (WGROX / WIGRX) | | SEPTEMBER 30, 2022 |

Management Discussion

The Wasatch Core Growth Fund is managed by a team of Wasatch portfolio managers led by JB Taylor, Paul Lambert and Mike Valentine.

| | | | |

JB Taylor Lead Portfolio Manager | |

Paul Lambert Portfolio Manager | |

Mike Valentine Portfolio Manager |

OVERVIEW

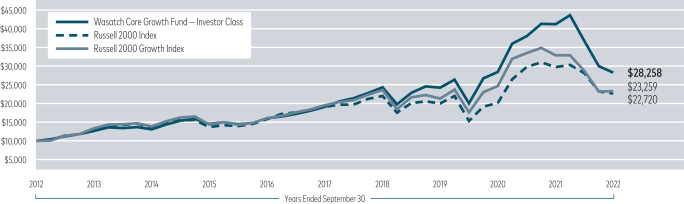

For the 12 months ended September 30, 2022, the Wasatch Core Growth Fund — Investor Class declined -31.47% while the benchmark Russell 2000® Index fell -23.50% and the Russell 2000 Growth Index lost -29.27%.

Our bottom-up, quality-focused investment approach didn’t fare well against the macroeconomic headwinds present during the 12-month period. Early in 2022, as the U.S. Federal Reserve began hiking interest rates to combat inflation, investors perceived rising rates to be especially negative for our high-growth companies because the cash flows of these companies are typically more heavily weighted further in the future. Prior to 2022, the Fund had outperformed for several years, but no investment strategy can succeed in all market environments.

DETAILS OF THE YEAR

From a sector perspective, the Fund’s performance relative to the benchmark suffered most in financials and industrials, and our lack of exposure to energy, the best-performing segment in the Index, caused us to lose additional ground. For our part, however, we don’t usually find many high-quality, differentiated long-duration growth companies in the energy sector. Our health-care holdings aided performance relative to the benchmark.

The Fund’s largest detractor for the 12-month period was Neogen Corp. The company provides products to food and animal producers that help keep the world’s food supply safe from pathogens and other risks. Although rising costs for freight and supply-chain management have affected the company’s gross margins, we don’t think Neogen is any more vulnerable than its competitors. Additionally, we believe Neogen’s margin erosion is temporary because the company’s products are still in strong demand. Another factor that may have impacted the stock was Neogen’s acquisition of 3M’s food-safety business, which has increased the debt on the balance sheet. In our view, the acquisition was strategically sound, and we see the debt level as reasonable.

Trex Co., Inc. was another significant detractor. A manufacturer of high-performance composite (non-wood) decking and accessories, Trex’s stock declined after management cut guidance for the second half of 2022 as normalizing demand

post-Covid caused customers to de-stock inventory. However, we continue to believe in the company’s long-term growth potential and view the inventory de-stocking as a short-term issue. Trex continues to take market share from competitors, and composite decking continues to take market share from harder-to-maintain wood products. Lastly, Trex’s balance sheet appears solid.

The Fund’s top contributor was HealthEquity, Inc., the largest U.S. non-bank custodian for health-savings accounts (HSAs). Account holders have online access to their tax- advantaged HSAs and can compare treatment options, pay medical bills, earn wellness incentives, and receive personalized benefit and clinical information. We like HealthEquity for its economically resilient business model. The company also appears well-positioned for an environment of higher interest rates, which likely helped buoy the stock. Going forward, we think HealthEquity has a long runway for growth.

Another significant contributor was Intra-Cellular Therapies, Inc. The stock was up due to increasing revenue growth driven by strong sales of Caplyta,® a treatment for bipolar depression and schizophrenia. We believe Intra-Cellular will continue to maximize Caplyta’s potential, expanding its approval to other areas including major depressive disorder, certain neurologically based sleep disorders and Parkinson’s disease.

OUTLOOK

There’s no doubt that significant fears still exist among investors. Broadly speaking, these fears relate to persistently high inflation, rising interest rates, the possibility of recessions around the world, the war in Ukraine and ongoing supply-chain challenges — exacerbated by China’s zero-Covid policy.

The main offset to these fears is that many of our small-cap companies have stocks trading at the best valuations we’ve seen in more than a decade. While macro forces could keep valuations down for a while, we’re focusing on things we can control. For instance, we’re taking care to ensure that the investment thesis for each of our companies is still sound. And we’re on the road visiting management teams at their places of business.

We believe holding growth-oriented companies amid continually elevated interest rates and inflation could be beneficial. While growth stocks did suffer outsized losses as interest rates rose, we think there are other factors to consider. First, our growth companies generally don’t have significant debt loads that higher interest rates would impact. Second, quality growth companies should be better able to attract talent and raise prices during an environment of escalating wage and input-cost inflation. Third, we believe the top growth companies are best positioned to navigate difficult challenges — ranging from logistical problems amid a booming economy, to the need for increased market share amid a recession.

Thank you for the opportunity to manage your assets.

Current and future holdings are subject to risk.

4

| | |

| Wasatch Core Growth Fund (WGROX / WIGRX) | | SEPTEMBER 30, 2022 |

Portfolio Summary

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | |

| | | |

| | | 1 Year | | 5 Years | | 10 Years |

| | | |

Core Growth (WGROX) — Investor | | | | -31.47% | | | | | 8.19% | | | | | 10.95% | |

| | | |

Core Growth (WIGRX) — Institutional | | | | -31.37% | | | | | 8.34% | | | | | 11.07% | |

| | | |

Russell 2000® Index | | | | -23.50% | | | | | 3.55% | | | | | 8.55% | |

| | | |

Russell 2000® Growth Index | | | | -29.27% | | | | | 3.60% | | | | | 8.81% | |

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2022 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Core Growth Fund are Investor Class: 1.17% / Institutional Class: 1.05%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

TOP 10 EQUITY HOLDINGS*

| | | | |

| |

| Company | | % of Net Assets | |

| |

Bank OZK | | | 3.5% | |

| |

Ensign Group, Inc. | | | 3.4% | |

| |

Five Below, Inc. | | | 3.4% | |

| |

RBC Bearings, Inc. | | | 3.2% | |

| |

HealthEquity, Inc. | | | 3.2% | |

| | | | |

| |

| Company | | % of Net Assets | |

| |

Kadant, Inc. | | | 3.2% | |

| |

Morningstar, Inc. | | | 3.0% | |

| |

ICON PLC | | | 2.8% | |

| |

Paylocity Holding Corp. | | | 2.7% | |

| |

Trex Co., Inc. | | | 2.7% | |

| * | As of September 30, 2022, there were 56 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

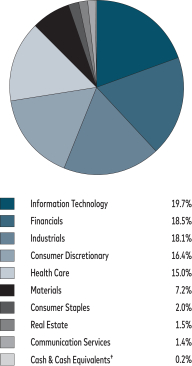

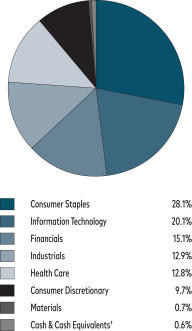

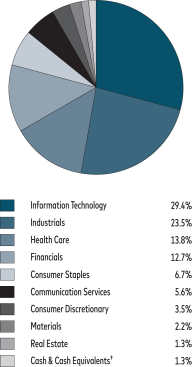

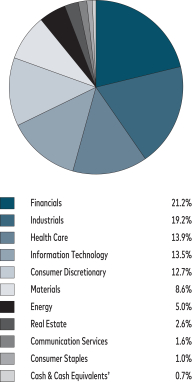

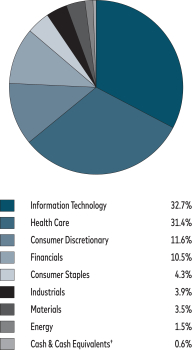

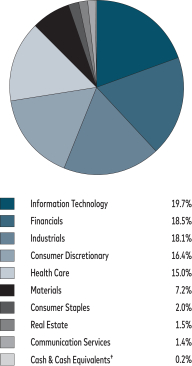

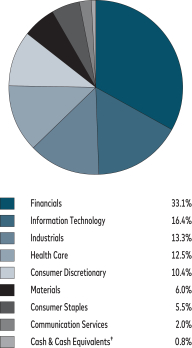

SECTOR BREAKDOWN**

| ** | Excludes securities sold short, if any. |

| † | Also includes Other Assets & Liabilities. |

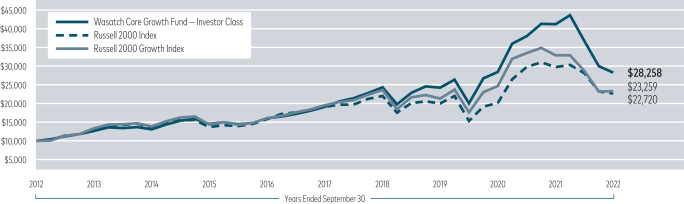

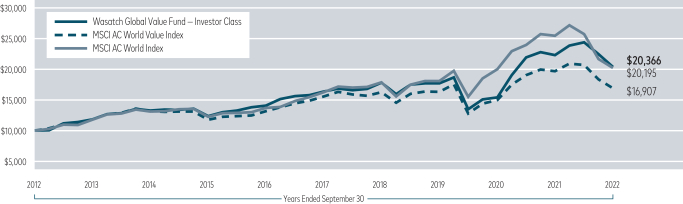

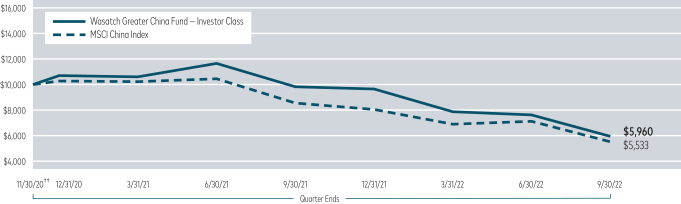

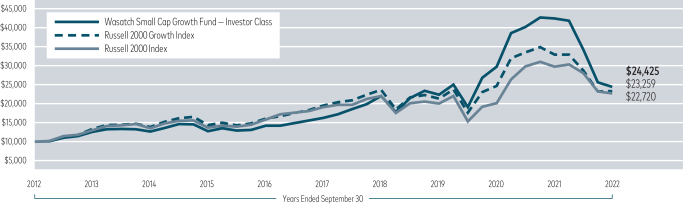

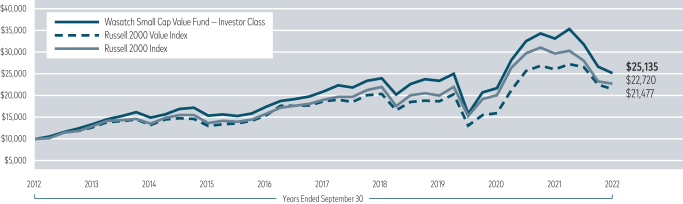

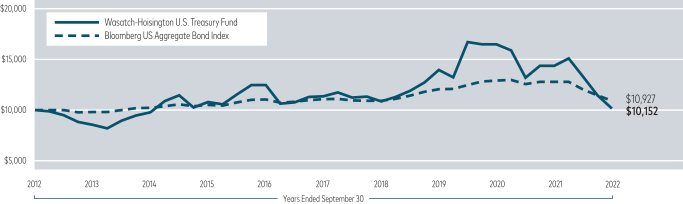

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.

5

| | |

| Wasatch Emerging India Fund (WAINX / WIINX) | | SEPTEMBER 30, 2022 |

Management Discussion

The Wasatch Emerging India Fund is managed by a team of Wasatch portfolio managers led by Ajay Krishnan and Matthew Dreith.

| | | | |

Ajay Krishnan, CFA Lead Portfolio Manager | |

Matthew Dreith, CFA Portfolio Manager | | OVERVIEW Indian equities treaded water for most of the 12-month period ended September 30, 2022. After hovering near all-time record highs for most of the period, stocks pulled |

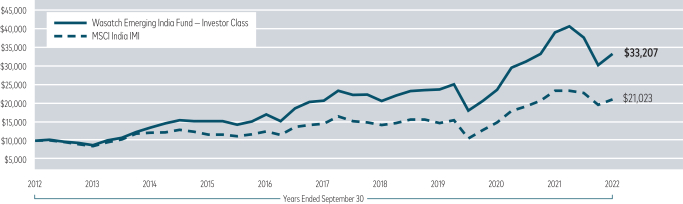

back during the final weeks, tracking a global selloff triggered by a surging dollar and rising probabilities of recession in the U.S. and Europe. The benchmark MSCI India Investable Market Index (IMI) slipped -9.96% for the period. Underperforming its benchmark, the Wasatch Emerging India Fund — Investor Class declined -14.79%.

Our investment approach, which is based on bottom-up, fundamental analysis of individual companies, struggled to gain traction in an environment driven largely by macro factors. Escalating costs for energy and agricultural commodities forced the Reserve Bank of India (RBI) to join the central banks of other nations in raising interest rates. Because growth companies of the type we favor have cash flows weighted further into the future, higher rates have an outsized impact on the valuations of these businesses.

DETAILS OF THE YEAR

Health care was the Fund’s biggest source of underperformance relative to the benchmark. As cases of Covid-19 declined in India, stocks tied to diagnostic testing, anti-viral treatments and other areas that had benefited from the pandemic fell out of favor. The Fund’s lack of investments in utilities also hurt relative performance by precluding exposure to what was the highest-returning sector of the Index.

Industrials and consumer discretionary were the Fund’s main sources of strength against the benchmark. These sectors also accounted for the two strongest contributors to performance for the period — Elgi Equipments Ltd. and Trent Ltd., respectively. Elgi manufactures and sells air compressors and automotive components in India and internationally. The company has experienced growing demand for its products, in India as well as overseas. Elgi’s efforts to expand its international segment appear to be paying off — particularly in the U.S. and Europe, where the company has been investing heavily for the past several years.

Trent operates a leading chain of retail stores that specialize in fashion apparel, cosmetics, perfumes and toiletries. Slowing economies in the U.S., Europe and China have burnished the appeal of India’s domestic consumer markets. Trent has been posting impressive top- and bottom-line

growth driven by improved efficiency in its supply chains and the accelerated opening of new stores.

The greatest detractor from Fund performance was Info Edge India Ltd. Starting with online businesses dedicated to jobs, education, matrimony and real estate, Info Edge has broadened its portfolio to include internet companies specializing in other areas. Info Edge has continued to hold significant stakes in investee companies Zomato Ltd. and PB Fintech Ltd. after their initial public offerings (IPOs) of stock.* With Zomato and PB Fintech down substantially from their peaks and India’s IPO market cooling, Info Edge’s business model has temporarily become less attractive to investors.

Mindtree Ltd. was also a significant detractor. An information-technology (IT) services company, Mindtree’s revenues surged during the Covid-19 pandemic as increased at-home activity for work, study and shopping forced Mindtree’s clients to digitalize customer-facing functions. With cases of the virus down sharply and year-over-year comparisons becoming more difficult, the stock pulled back on concerns that the company’s growth may slow.

OUTLOOK

India’s financial sector is an area that we believe offers pockets of opportunity in a world where slowing growth and elevated inflation pose serious challenges for investors seeking attractive real (inflation-adjusted) returns. Financial companies in India have benefited as credit demand rebounded from the most recent wave of Covid-19. Lifted in part by financials, India’s stock market — as measured by the S&P BSE Sensex Index — has held up better than most others over the past 12 months.

We’re somewhat less enthusiastic about the IT-services industry because of its vulnerability to economic weakness in developed countries. Having spent much of the past two years inking contracts to help their clients generate revenue, IT-services firms now face the very real risk that those clients will retreat into cost-cutting mode.

Currency risk is always a consideration when investing internationally, especially in emerging markets such as India. We allow for a certain amount of depreciation in the rupee and seek companies that we believe can outgrow the currency’s potential devaluation against the dollar. Over the past year, the RBI has shored up the rupee by intervening in currency markets, drawing down its foreign-exchange reserves somewhat in the process. However, RBI governor Shaktikanta Das has sought to reassure investors that the central bank’s foreign-exchange reserves are adequate to maintain a reasonable level of stability and handle external shocks.

Thank you for the opportunity to manage your assets

| * | As of September 30, 2022, the Wasatch Emerging India Fund was not invested in Zomato Ltd. or PB Fintech Ltd. |

Current and future holdings are subject to risk.

6

| | |

| Wasatch Emerging India Fund (WAINX / WIINX) | | SEPTEMBER 30, 2022 |

Portfolio Summary

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | |

| | | |

| | | 1 Year | | 5 Years | | 10 Years |

| | | |

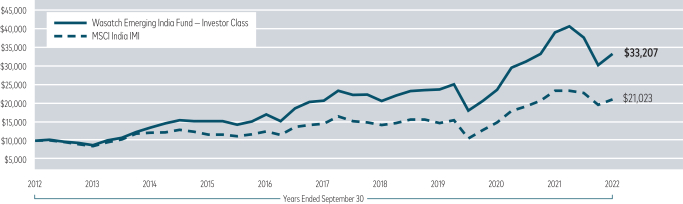

Emerging India (WAINX) — Investor | | | | -14.79% | | | | | 9.90% | | | | | 12.75% | |

| | | |

Emerging India (WIINX) — Institutional | | | | -14.77% | | | | | 10.03% | | | | | 12.88% | |

| | | |

MSCI India IMI Index | | | | -9.96% | | | | | 7.61% | | | | | 7.71% | |

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2022 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging India Fund are Investor Class: 1.52% / Institutional Class: 1.37%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 2/1/2016 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 2/1/2016 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as unstable currencies, highly volatile securities markets and political and social instability, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Being non-diversified, the Fund can invest a larger portion of its assets in the stocks of a limited number of companies than a diversified fund. Non-diversification increases the risk of loss to the Fund if the values of these securities decline.

TOP 10 EQUITY HOLDINGS*

| | | | |

| |

| Company | | % of Net Assets | |

| |

Bajaj Finance Ltd. | | | 9.9% | |

| |

Elgi Equipments Ltd. | | | 7.7% | |

| |

AU Small Finance Bank Ltd. | | | 6.5% | |

| |

Trent Ltd. | | | 6.3% | |

| |

HDFC Bank Ltd. | | | 6.0% | |

| | | | |

| |

| Company | | % of Net Assets | |

| |

Mindtree Ltd. | | | 5.9% | |

| |

Larsen & Toubro Infotech Ltd. | | | 5.6% | |

| |

Avenue Supermarts Ltd. | | | 5.5% | |

| |

Dr. Lal PathLabs Ltd. | | | 5.3% | |

| |

L&T Technology Services Ltd. | | | 4.9% | |

| * | As of September 30, 2022, there were 22 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

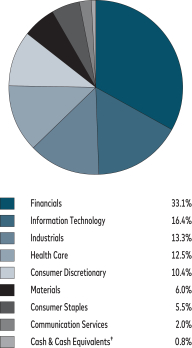

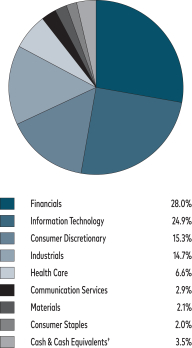

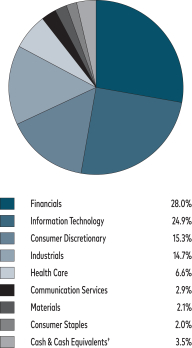

SECTOR BREAKDOWN**

| ** | Excludes securities sold short, if any. |

| † | Also includes Other Assets & Liabilities. |

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.

7

| | |

| Wasatch Emerging Markets Select Fund (WAESX / WIESX) | | SEPTEMBER 30, 2022 |

Management Discussion

The Wasatch Emerging Markets Select Fund is managed by a team of Wasatch portfolio managers led by Ajay Krishnan, Neal Dihora, Scott Thomas and Matthew Dreith.

| | | | |

Ajay Krishnan, CFA Lead Portfolio Manager

Scott Thomas, CFA Associate Portfolio

Manager | |

Neal Dihora, CFA Portfolio Manager

Matthew Dreith, CFA Associate Portfolio

Manager | | OVERVIEW For the 12-month period ended September 30, 2022, the Wasatch Emerging Markets Select Fund — Investor Class fell

-40.42%. The Fund underperformed the benchmark MSCI Emerging Markets Index, which lost -28.11%. Late in the period, emerging-market equities resumed their descent following |

hawkish comments from officials of the U.S. Federal Reserve (Fed). Investors feared overly aggressive monetary tightening by central banks would increase recessionary risks, potentially impacting the earnings of companies selling goods and services into developed markets.

At the Fed’s annual economic symposium in Jackson Hole, Chairman Jerome Powell echoed statements from colleagues the previous week. Affirming the central bank’s commitment to hiking interest rates until inflation is under control, Chairman Powell dashed hopes for an early pivot toward a more accommodative monetary stance. His remarks sent the dollar soaring, eroding dollar-equivalent prices of assets denominated in other currencies. In addition to its direct effects on performance, a stronger U.S. dollar makes riskier investments in emerging markets less attractive to international investors.

DETAILS OF THE YEAR

Taiwan was a source of weakness for the Fund — both in absolute terms and relative to the benchmark. Geopolitical tensions with China may also have contributed to the poor investment backdrop in Taiwan.

Concerns about an excess supply of semiconductors weighed on Silergy Corp., the largest detractor from Fund performance for the 12-month period. This Taiwanese company manufactures high-performance mixed-signal and analog integrated-circuit chips used in a wide array of electronic devices. Over the long term, we think Silergy’s business model — which is based on analog design engineering — is difficult to replicate and is likely to provide the company with significant headroom for growth.

Singapore-based Sea Ltd., ADR also detracted — as earnings and forward guidance disappointed investors. The company provides e-commerce, digital-entertainment and financial services in Southeast Asia. Post-Covid moderation of

online activities and India’s decision to block the company’s most popular mobile game have been headwinds for Sea. But we believe the company remains well-situated amid an ongoing global shift toward digital consumption and entertainment.

India was a source of relative strength for the Fund. The country’s gross domestic product (GDP) rose 13.5% in the April-to-June quarter versus the same period a year ago. Looser mobility restrictions boosted India’s services sector — which accounts for over 50% of the nation’s economy — as robust domestic demand fueled the fastest pace of economic expansion in a year.

The Fund’s top contributor was Page Industries Ltd., the licensee of Jockey International and Speedo in India. An upswell of discretionary consumer spending has helped the company as it expands into the athleisure and children’s categories.

Tata Elxsi Ltd. was another contributor. Headquartered in India, the company provides design-led technology services that include software development and integration. Tata Elxsi has been experiencing strong growth in the automotive market, winning strategic deals with both original equipment manufacturers (OEMs) and suppliers for design, technology and digital services across geographies.

OUTLOOK

Our structural overweighting of India reflects our belief that high-quality Indian companies offer attractive prospects to investors seeking long-term growth. According to data from the World Bank, private domestic consumption accounts for over 70% of GDP in India, the world’s sixth-largest consumer market. With exports representing only about 12% of GDP, the country is well-positioned in our view to withstand the effects of a potential global slowdown.

Foreign investors returned to India in droves during the third quarter of 2022 after withdrawing a record $33 billion from Indian stocks during the nine months through June. Their purchases have helped offset declining domestic inflows into equity mutual funds, which slowed in August to about $765 million — the lowest monthly amount since October 2021. Moreover, the recent uptick in cash flows from overseas have helped support India’s currency, the rupee, as foreigners converted their local currencies into rupees and used the proceeds to buy Indian stocks.

China stands in sharp contrast to India. While the Chinese central bank has signaled its intent to cut interest rates to stimulate the economy, currency weakness in the yuan has largely constrained its ability to do so. Troubles in the property sector and a zero-Covid policy are additional challenges confronting the economy. Nevertheless, the current situation won’t last forever. And we’re maintaining our investments in what we consider high-quality Chinese companies, although our weighting is well below that of the benchmark.

Thank you for the opportunity to manage your assets.

Current and future holdings are subject to risk.

8

| | |

| Wasatch Emerging Markets Select Fund (WAESX / WIESX) | | SEPTEMBER 30, 2022 |

Portfolio Summary

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | |

| | | |

| | | 1 Year | | 5 Years | | Since Inception

12/13/2012 |

| | | |

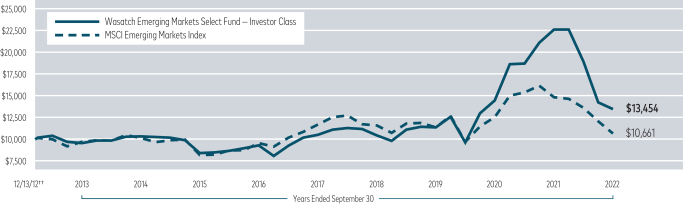

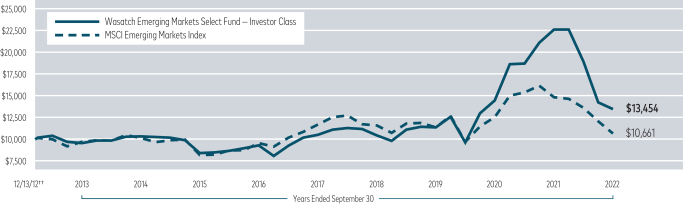

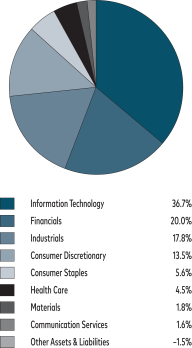

Emerging Markets Select (WAESX) — Investor | | | | -40.42% | | | | | 5.08% | | | | | 3.07% | |

| | | |

Emerging Markets Select (WIESX) — Institutional | | | | -40.40% | | | | | 5.29% | | | | | 3.35% | |

| | | |

MSCI Emerging Markets Index | | | | -28.11% | | | | | -1.81% | | | | | 0.66% | |

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2022 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging Markets Select Fund are Investor Class: 1.37% / Institutional Class: 1.18%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Being non-diversified, the Fund can invest a larger portion of its assets in the stocks of a limited number of companies than a diversified fund. Non-diversification increases the risk of loss to the Fund if the values of these securities decline.

TOP 10 EQUITY HOLDINGS*

| | | | |

| |

| Company | | % of Net Assets | |

| |

Bajaj Finance Ltd. | | | 7.8% | |

| |

HDFC Bank Ltd. | | | 6.2% | |

| |

MercadoLibre, Inc. | | | 5.9% | |

| |

Globant SA | | | 5.7% | |

| |

Voltronic Power Technology Corp. | | | 5.0% | |

| | | | |

| |

| Company | | % of Net Assets | |

| |

Chailease Holding Co. Ltd. | | | 4.0% | |

| |

Silergy Corp. | | | 3.9% | |

| |

NU Holdings Ltd., Class A | | | 3.7% | |

| |

WEG SA | | | 3.6% | |

| |

Grupo Aeroportuario del Pacifico SAB de CV, Class B | | | 3.6% | |

| * | As of September 30, 2022, there were 33 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

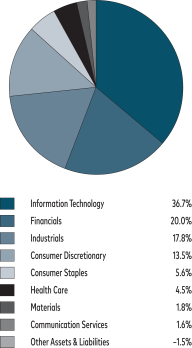

SECTOR BREAKDOWN**

| ** | Excludes securities sold short, if any. |

| † | Also includes Other Assets & Liabilities. |

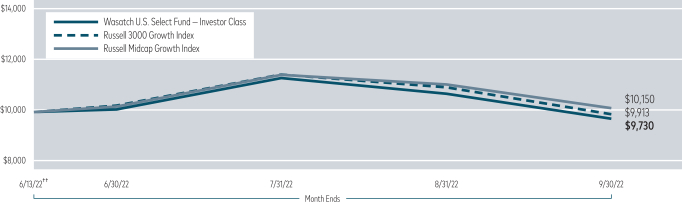

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

††Inception: December 13, 2012. Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.

9

| | |

| Wasatch Emerging Markets Small Cap Fund (WAEMX / WIEMX) | | SEPTEMBER 30, 2022 |

Management Discussion

The Wasatch Emerging Markets Small Cap Fund is managed by a team of Wasatch portfolio managers led by Ajay Krishnan, Dan Chace, Scott Thomas, Kevin Unger and Anh Hoang.

| | | | |

Ajay Krishnan, CFA Lead Portfolio Manager

Kevin Unger, CFA Associate Portfolio Manager | |

Dan Chace, CFA Portfolio Manager

Anh Hoang, CFA Associate Portfolio Manager | |

Scott Thomas, CFA Portfolio Manager OVERVIEW Inflation, rising interest rates and the war between Russia and Ukraine posed headwinds for emerging-market equities during the 12-month period |

|

ended September 30, 2022. The Wasatch Emerging Markets Small Cap Fund — Investor Class declined -37.93%. The Fund underperformed the benchmark MSCI Emerging Markets Small Cap Index, which fell -23.23%.

Monetary tightening by the U.S. Federal Reserve (Fed) and other central banks had an outsized impact on long-duration growth stocks of the type we favor. After raising its policy interest rate again in September, the Fed continued to pound the rate-hike drum — signaling further increases until inflation has been brought visibly under control. In emerging markets, higher U.S. interest rates made their presence felt largely in the form of a stronger dollar. Currency depreciation against the dollar subtracted -6.39 percentage points from the Fund’s return during the period. For the benchmark, the currency impact was -8.97 percentage points.

DETAILS OF THE YEAR

The tech-heavy stock markets and export-linked currencies of Korea and Taiwan were hit particularly hard during the period, with the Korean won and the New Taiwan dollar dropping -17.6% and -12.4%, respectively, against the greenback. Low exposure to Korea helped the Fund by allowing it to sidestep much of the decline in what was one of the period’s worst-performing emerging markets. Taiwan was the Fund’s greatest source of weakness — both in absolute terms and relative to the benchmark. Cross-strait tensions with China appeared to contribute to worsening investor sentiment toward Taiwan.

Other sources of underperformance included India and Russia. China was a source of strength against the benchmark, as our group of Chinese stocks declined less than the Chinese component of the Index. With China’s Covid-battered economy continuing to sputter, our below-benchmark exposure also improved the Fund’s relative return.

Concerns about softening demand from developed markets and mounting worries about an excess supply of semiconductor chips weighed on Silergy Corp., the biggest detractor from Fund performance for the period. The company manufactures high-performance mixed-signal and analog integrated-circuit chips. Over the long term, we think Silergy’s business model — which is based on analog design engineering — is difficult to replicate and is likely to provide the company with significant headroom for growth.

HeadHunter Group PLC, ADR also detracted. The company operates an online recruitment platform in Russia, Kazakhstan, Belarus and other countries. We exited the position with a near-complete loss following Russia’s perpetration of war in Ukraine.

The strongest contributor to performance during the period was Trent Ltd. The company operates a leading chain of retail stores in India that specialize in fashion apparel, cosmetics, perfumes and toiletries. Slowing economies in the U.S., Europe and China have burnished the appeal of India’s domestic consumer markets. Trent has been posting impressive top- and bottom-line growth driven by improved efficiency in its supply chains and the accelerated opening of new stores.

Proya Cosmetics Co. Ltd. was also a top contributor. The company markets skin-care applications, makeup and related products in China. Mask wearing, working from home and movement restrictions sharply reduced demand for cosmetics during the pandemic. Shares of Proya recovered over the past 12 months amid optimism that future lockdowns in China would be limited in scope and duration.

OUTLOOK

As developed countries grapple with rising inflation, declining equity prices and mounting risks of recession, India stands out among the major emerging markets. Unlike export-driven economies such as Korea, India doesn’t depend heavily on Western markets for growth.

Toward the other end of the spectrum is China — where sentiment has remained poor amid a deepening property crisis, a nationwide mortgage boycott and an austere zero-Covid regime that’s crushed demand and strangled the economy. By most estimates, the Chinese government can muster the resources necessary to bail out the ailing property sector. Relief from zero-Covid is likely to prove more elusive.

With that having been said, the current situation in China won’t last forever. Zero-Covid isn’t sustainable in our view, and we believe any progress on that front could touch off a powerful rally in Chinese stocks. In the meantime, periods of extreme pessimism and depressed valuations have often provided advantageous opportunities to purchase well-situated, high-quality businesses for long-term investment.

Thank you for the opportunity to manage your assets.

Current and future holdings are subject to risk.

10

| | |

| Wasatch Emerging Markets Small Cap Fund (WAEMX / WIEMX) | | SEPTEMBER 30, 2022 |

Portfolio Summary

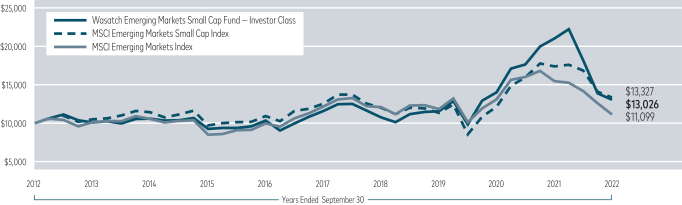

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | |

| | | |

| | | 1 Year | | 5 Years | | 10 Years |

| | | |

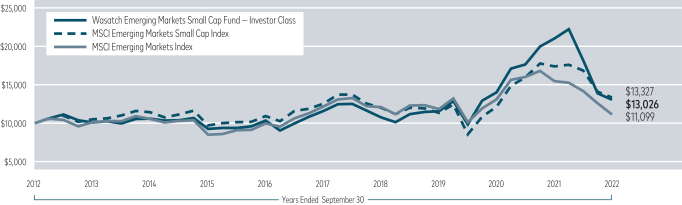

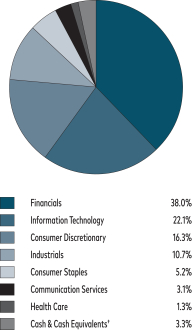

Emerging Markets Small Cap (WAEMX) — Investor | | | | -37.93% | | | | | 2.41% | | | | | 2.68% | |

| | | |

Emerging Markets Small Cap (WIEMX) — Institutional | | | | -37.75% | | | | | 2.56% | | | | | 2.79% | |

| | | |

MSCI Emerging Markets Small Cap Index | | | | -23.23% | | | | | 1.25% | | | | | 2.91% | |

| | | |

MSCI Emerging Markets Index | | | | -28.11% | | | | | -1.81% | | | | | 1.05% | |

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2022 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging Markets Small Cap Fund are Investor Class: 1.88% / Institutional Class: 1.76%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 2/1/2016 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 2/1/2016 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Being non-diversified, the Fund can invest a larger portion of its assets in the stocks of a limited number of companies than a diversified fund. Non-diversification increases the risk of loss to the Fund if the values of these securities decline.

TOP 10 EQUITY HOLDINGS*

| | | | |

| |

| Company | | % of Net Assets | |

| |

Voltronic Power Technology Corp. | | | 6.2% | |

| |

AU Small Finance Bank Ltd. | | | 6.0% | |

| |

Trent Ltd. | | | 5.0% | |

| |

Globant SA | | | 4.8% | |

| |

Aavas Financiers Ltd. | | | 4.5% | |

| | | | |

| |

| Company | | % of Net Assets | |

| |

Silergy Corp. | | | 4.3% | |

| |

Dr. Lal PathLabs Ltd. | | | 4.1% | |

| |

ASPEED Technology, Inc. | | | 4.0% | |

| |

L&T Technology Services Ltd. | | | 3.6% | |

| |

Mindtree Ltd. | | | 3.5% | |

| * | As of September 30, 2022, there were 48 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

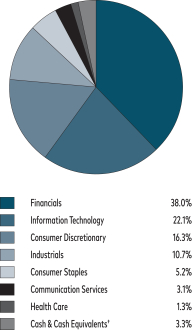

SECTOR BREAKDOWN**

| ** | Excludes securities sold short, if any. |

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.

11

| | |

| Wasatch Frontier Emerging Small Countries Fund (WAFMX / WIFMX) | | SEPTEMBER 30, 2022 |

Management Discussion

The Wasatch Frontier Emerging Small Countries Fund is managed by a team of Wasatch portfolio managers led by Scott Thomas.

| | |

Scott Thomas, CFA Lead Portfolio Manager | | OVERVIEW Stocks declined broadly over the past 12 months — not only in frontier markets but around the globe. At the forefront of investors’ concerns were macroeconomic factors including inflation, rising interest rates, Covid-19 restrictions in China and Russia’s invasion of Ukraine. As central banks took their cue from the U.S. |

Federal Reserve and began raising interest rates, the selloff became most pronounced among the stocks of faster-growing companies. This was a headwind for the Wasatch Frontier Emerging Small Countries Fund as we tend to be heavily weighted in high-growth businesses. Because the cash flows of growth companies typically occur further into the future, higher interest rates make the income streams of these businesses less valuable in the present, lowering their valuations.

In this challenging environment, the Fund’s Investor Class shares finished the annual period with a loss of -43.89%. The Fund underperformed its primary benchmark, the MSCI Frontier Emerging Markets Index, which declined -23.58%.

DETAILS OF THE YEAR

As we looked across our holdings, we noted that the vast majority of losses stemmed from price/earnings multiple contraction, as growth stocks fell out of favor with investors in a rising interest-rate environment. Conversely, only a small portion of the Fund’s absolute loss was attributable to deteriorating fundamentals among our holdings. Though rising interest rates have affected their stocks, our ongoing research indicates that the underlying fundamentals of our companies remain strong. These businesses continue to demonstrate strong revenue growth, which we think will eventually drive stock prices in future periods.

Among our holdings, Sea Ltd., ADR, was the largest detractor from Fund performance for the 12-month period. The company’s business segments include Shopee, the leading e-commerce platform in Southeast Asia and Taiwan, and Garena, a platform for mobile and PC online games. Sea was caught up in a broader selloff of information-technology (IT) stocks, as the prospect of rising interest rates caused some investors to discount the valuations of growth-oriented stocks. However, the company has continued to put up phenomenal operating results, and we believe it’s well-positioned for the ongoing shift to digital consumption and entertainment around the world.

TCS Group Holding PLC, GDR was another large detractor. TCS is the holding company for Tinkoff Bank, Russia’s largest digital bank. Unfortunately, the repercussions of Russia’s attack on Ukraine overwhelmed what we had

believed to be strong business fundamentals for the company, and we exited our position in the stock.

Grupo Aeroportuario del Centro Norte SAB de CV, was the top contributor to Fund performance for the period. The company, often referred to as “OMA,” operates international airports in the northern and central regions of Mexico under contracts with the government. OMA’s stock price rose as declining Covid-19 caseloads boosted airport traffic and tariff revenue. By the second quarter of 2022, OMA was hosting nearly as many passengers as it did prior to the pandemic.

PT Mitra Keluarga Karyasehat Tbk was another contributor. A relatively new addition to the Fund, the company, known informally as “MIKA,” operates hospitals in Indonesia. We believe MIKA has a long runway for growth, in part because statistics such as hospital beds per capita indicate that Indonesia needs more hospitals to meet demand for health care. Further, we think MIKA’s position as the largest private hospital operator in Indonesia gives it a competitive advantage it can build upon. As MIKA increases the number of hospitals under its umbrella, we think strong name brand recognition will result in more people choosing to be treated at the company’s hospitals. This in turn would drive higher revenues, which would allow MIKA to recruit and retain the best doctors in the country, further reinforcing the quality of care at it hospitals.

OUTLOOK

Despite a slowing global economy, fundamentals for our companies remain firm. Revenue growth for the majority of companies held in the Fund met or exceeded consensus expectations in the most recently reported quarter and there were few negative revisions for the year.

We believe earnings will remain resilient through a downturn, in large part because our companies play a vital role in modernizing frontier economies. For example, within the Fund we own: IT companies enabling a digital transformation for businesses and consumers; financial-service firms that facilitate safer and frictionless digital transactions for a growing middle class; hospital chains that are improving the quality of health care within local markets; and retail companies and communication-services firms aligned to new purchasing and consumption trends.

These secular trends should push forward regardless of the economic background. This leaves us feeling confident about the Fund’s long-term return potential, despite the near-term economic outlook.

Thank you for the opportunity to manage your assets.

Current and future holdings are subject to risk.

12

| | |

| Wasatch Frontier Emerging Small Countries Fund (WAFMX / WIFMX) | | SEPTEMBER 30, 2022 |

Portfolio Summary

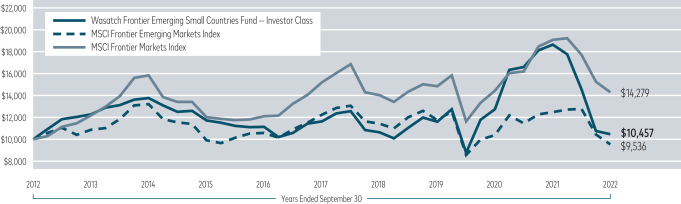

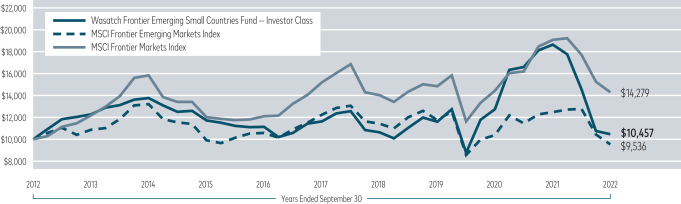

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | |

| | | |

| | | 1 Year | | 5 Years | | 10 Years |

| | | |

Frontier Emerging Small Countries (WAFMX) — Investor | | | | -43.89% | | | | | -2.13% | | | | | 0.45% | |

| | | |

Frontier Emerging Small Countries (WIFMX) — Institutional | | | | -43.89% | | | | | -1.94% | | | | | 0.58% | |

| | | |

MSCI Frontier Emerging Markets Index | | | | -23.58% | | | | | -4.88% | | | | | -0.47% | |

| | | |

MSCI Frontier Markets Index | | | | -25.20% | | | | | -1.24% | | | | | 3.63% | |

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2022 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Frontier Emerging Small Countries Fund are Investor Class: 2.13% / Institutional Class — Gross: 2.09%, Net: 1.96%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 2/1/2016 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 2/1/2016 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in foreign securities, especially in frontier and emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Being non-diversified, the Fund can invest a larger portion of its assets in the stocks of a limited number of companies than a diversified fund. Non-diversification increases the risk of loss to the Fund if the values of these securities decline.

TOP 10 EQUITY HOLDINGS*

| | | | |

| |

| Company | | % of Net Assets | |

| |

Bajaj Finance Ltd. | | | 9.9% | |

| |

FPT Corp. | | | 8.8% | |

| |

MercadoLibre, Inc. | | | 6.9% | |

| |

DCVFMVN Diamond ETF | | | 5.2% | |

| |

Globant SA | | | 5.0% | |

| | | | |

| |

| Company | | % of Net Assets | |

| |

Wilcon Depot, Inc. | | | 4.3% | |

| |

Qualitas Controladora SAB de CV | | | 4.2% | |

| |

Bank for Foreign Trade of Vietnam JSC | | | 4.1% | |

| |

WEG SA | | | 3.6% | |

| |

NU Holdings Ltd., Class A | | | 3.5% | |

| * | As of September 30, 2022, there were 35 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

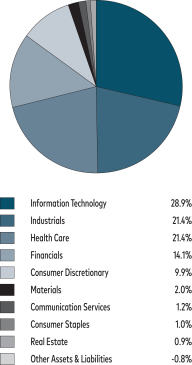

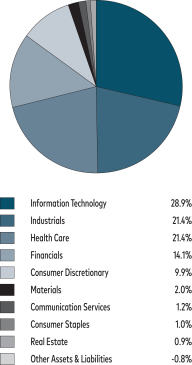

SECTOR BREAKDOWN**

| ** | Excludes securities sold short, if any. |

| † | Also includes Other Assets & Liabilities. |

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.

13

| | |

| Wasatch Global Opportunities Fund (WAGOX / WIGOX) | | SEPTEMBER 30, 2022 |

Management Discussion

The Wasatch Global Opportunities Fund is managed by a team of Wasatch portfolio managers led by JB Taylor, Ajay Krishnan, Ken Applegate and Paul Lambert.

| | | | |

JB Taylor Lead Portfolio Manager

Ken Applegate, CFA Portfolio Manager | |

Ajay Krishnan, CFA Lead Portfolio Manager

Paul Lambert Portfolio Manager | | OVERVIEW In the 12-month period ended September 30, 2022, global equity markets suffered considerable losses as macro factors including inflation, rising interest rates, Covid-19 restrictions in China, and Russia’s invasion of Ukraine drove markets lower. Data pointing to a slowdown for the global economy also impacted stocks. |

|

In this challenging environment, the Wasatch Global Opportunities Fund — Investor Class declined -36.97% and underperformed its benchmark, the MSCI AC (All Country) World Small Cap Index, which was down -24.80%.

DETAILS OF THE YEAR

In addition to geopolitical and macroeconomic worries negatively affecting stocks broadly, rising interest rates have posed strong headwinds for growth stocks in 2022. Because the cash flows of growth companies typically occur further into the future, higher rates make the income streams of these businesses less valuable in the present, lowering their valuations. As a result, our preference for growth-oriented companies was the main reason the Fund underperformed its benchmark for the 12-month period. Although rising interest rates have been a headwind, we believe that when investors refocus on company-specific fundamentals they’ll appreciate the quality and growth potential of the Fund’s holdings.

Kornit Digital Ltd. was the largest detractor from Fund performance. Since late 2021, the stock has struggled as investors have become concerned over macro issues and the valuations of some growth-oriented companies. In the second quarter of 2022, the company fell short of earnings expectations and lowered guidance for future earnings, which also weighed on the stock. Kornit makes machines for environmentally sustainable printing on clothing and fabrics. We believe the company will continue to gain market share because its on-demand technology greatly reduces the need for inventory on hand and in supply chains.

Silergy Corp. was another detractor. The stock price declined amid a broader selloff in technology shares. Later in the period, concerns about an excess supply of semiconductor chips negatively affected the stock. However, we want to own Silergy

through the semiconductor demand cycle. The company manufactures high-performance mixed-signal and analog integrated circuits used in a wide array of electronic devices. We believe Silergy’s business model — which is based on complex, analog-design engineering — is difficult to replicate, and provides the company with ample headroom for growth.

Intra-Cellular Therapies, Inc. was the top contributor to Fund performance for the 12-month period. Intra-Cellular develops therapeutics for disorders of the central nervous system. News that the U.S. Food and Drug Administration had approved the company’s anti-psychotic drug, Caplyta,® sent Intra-Cellular’s stock price higher in December. Robust prescription growth for Caplyta helped support the stock for most of the remainder of the period.

Another significant contributor was HealthEquity, Inc., the largest U.S. non-bank custodian for health-savings accounts (HSAs). Account holders have online access to their tax- advantaged HSAs and can compare treatment options, pay medical bills, earn wellness incentives, and receive personalized benefit and clinical information. During the first quarter of 2022, management’s upwardly revised forecasts for revenues and earnings in HealthEquity’s current fiscal year cheered investors. In our view, the company also appears well-positioned for an environment of higher interest rates, which likely helped buoy the stock.

OUTLOOK

Wasatch has invested through a variety of market environments over our 47-year history.

Our investment philosophy is based upon identifying high-quality, long-duration growth companies. Economic downturns and times of uncertainty like we’ve encountered recently are when the quality of a company matters most. We believe firms with strong balance sheets, low debt levels and cash generative business models can weather an economic storm. They can also continue with self-funded growth initiatives at a time when the rising cost of capital prevents their competitors from doing so.

These high-quality factors should help our companies not only survive an economic downturn but also thrive in the future. We’ve seen our companies use the challenging environment to their advantage, by consolidating an industry or taking market share from weaker competitors, for example. In turn, we believe these actions should set our companies up for even better growth prospects over the medium to long term.

Looking ahead, we won’t try to predict when the economy, or stock markets, will rebound. But the valuations of many global small-cap companies are already at or near decade lows. With a portfolio stacked full of what we believe are exceptional investment opportunities, we’re extremely excited about the Fund’s prospects over the next three to five years.

Thank you for the opportunity to manage your assets.

Current and future holdings are subject to risk.

14

| | |

| Wasatch Global Opportunities Fund (WAGOX / WIGOX) | | SEPTEMBER 30, 2022 |

Portfolio Summary

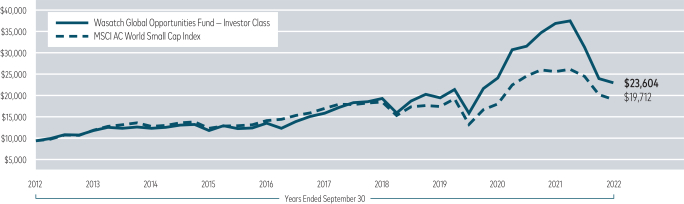

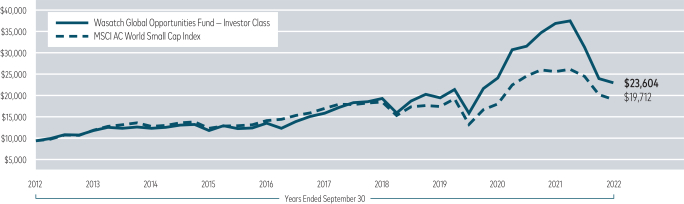

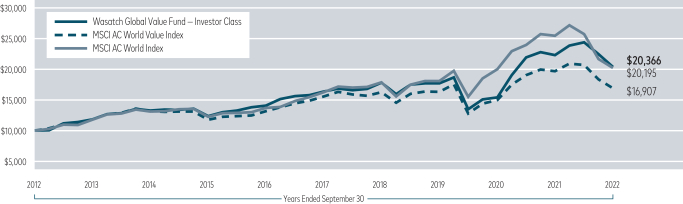

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | |

| | | |

| | | 1 Year | | 5 Years | | 10 Years |

| | | |

Global Opportunities (WAGOX) — Investor | | | | -36.97% | | | | | 7.48% | | | | | 8.97% | |

| | | |

Global Opportunities (WIGOX) — Institutional | | | | -36.94% | | | | | 7.65% | | | | | 9.08% | |

| | | |

MSCI AC World Small Cap Index | | | | -24.80% | | | | | 2.32% | | | | | 7.02% | |

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2022 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Global Opportunities Fund are Investor Class: 1.46% / Institutional Class — Gross: 1.40%, Net: 1.35%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 2/1/2016 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 2/1/2016 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in small and micro cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

TOP 10 EQUITY HOLDINGS*

| | | | |

| |

| Company | | % of Net Assets | |

| |

AU Small Finance Bank Ltd. | | | 5.1% | |

| |

BayCurrent Consulting, Inc. | | | 4.6% | |

| |

Abcam PLC | | | 3.7% | |

| |

Five Below, Inc. | | | 3.7% | |

| |

Ensign Group, Inc. | | | 3.6% | |

| | | | |

| |

| Company | | % of Net Assets | |

| |

Globant SA | | | 3.4% | |

| |

HealthEquity, Inc. | | | 3.1% | |

| |

Voltronic Power Technology Corp. | | | 2.8% | |

| |

Bank OZK | | | 2.7% | |

| |

Mindtree Ltd. | | | 2.4% | |

| * | As of September 30, 2022, there were 63 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

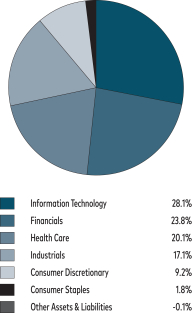

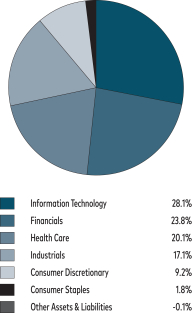

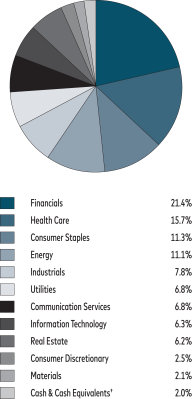

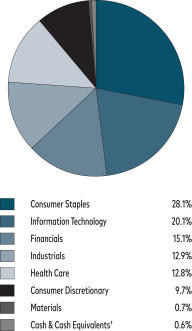

SECTOR BREAKDOWN**

| ** | Excludes securities sold short, if any. |

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.

15

| | |

| Wasatch Global Select Fund (WAGSX / WGGSX) | | SEPTEMBER 30, 2022 |

Management Discussion

The Wasatch Global Select Fund is managed by a team of Wasatch portfolio managers led by Ken Applegate, Paul Lambert, Linda Lasater and Mike Valentine.

| | | | |

Ken Applegate, CFA Portfolio Manager

Linda Lasater, CFA Portfolio Manager | |

Paul Lambert Portfolio Manager

Mike Valentine Portfolio Manager | | OVERVIEW During the 12 months ended September 30, 2022, global equity markets suffered considerable losses. Inflation, rising interest rates, Covid-19 restrictions in China, and Russia’s invasion of Ukraine each played a role in driving markets lower. Data pointing to a slowdown for the global economy also weighed on stocks. |

In this environment, the Wasatch Global Select Fund — Investor Class declined -37.76% and underperformed its benchmark, the MSCI AC (All Country) World Index, which was down -20.66%.

DETAILS OF THE YEAR

Broadly speaking, stocks struggled due to geopolitical and macroeconomic concerns. Moreover, rising interest rates posed strong headwinds for growth stocks in 2022. Because the cash flows of growth companies typically occur further into the future, higher rates make the income streams of these businesses less valuable in the present, lowering their valuations. As a result, the most significant factor driving the Fund’s underperformance relative to its benchmark was our preference for growth-oriented companies. While rising interest rates have been a headwind, we have high conviction in the Fund’s return potential once investors refocus on company-specific fundamentals.

The greatest detractor from Fund performance for the 12-month period was TCS Group Holding PLC, GDR, which was our sole Russian holding. TCS is the holding company for Tinkoff Bank, Russia’s largest digital bank. The repercussions of Russia’s attack on Ukraine overwhelmed what we had believed were strong business fundamentals, and the stock sold off with the rest of the Russian equity market. We exited the position.

BayCurrent Consulting, Inc. was another detractor. This Japanese company operates in the digital-transformation space, offering consulting services including a specialization in information-technology (IT) consulting and integration. BayCurrent’s stock was caught in a broader selloff of growth equities as interest rates rose in 2022. Moreover, Japanese equities have been negatively affected by Japan’s slow emergence from Covid-19 restrictions. However, we continue

to like BayCurrent’s growth potential. Japan is behind many countries when it comes to digitalization. The pandemic and work-from-home environment underscored the need to catch up. As Japanese enterprises undertake large-scale digitalization projects, we believe they’re likely to prefer working with domestic IT consultants such as BayCurrent, instead of global consultants outside the region.

The top contributor to Fund performance was HealthEquity, Inc., the largest U.S. non-bank custodian for health-savings accounts (HSAs). Account holders have online access to their tax-advantaged HSAs and can pay medical bills, earn wellness incentives, and receive personalized benefit and clinical information. During the first quarter of 2022, management’s upwardly revised forecasts for revenues and earnings in HealthEquity’s current fiscal year cheered investors. The company also appears well-positioned for an environment of higher interest rates, which likely supported the stock. Going forward, we continue to think HealthEquity has a long runway for growth.

Trent Ltd. also contributed to Fund performance. The company operates a chain of retail stores in India that specialize in fashion apparel, cosmetics, perfumes and toiletries. Trent has been posting impressive top- and bottom-line growth, helped by improved efficiency in its supply chains and the accelerated opening of new stores. That growth helped lift the stock during the period.

OUTLOOK

Wasatch has invested through a variety of market environments over our 47-year history.

Our investment philosophy is based upon identifying high-quality, long-duration growth companies. Economic downturns and times of uncertainty like we’ve encountered recently are when the quality of a company matters most. We believe firms with strong balance sheets, low debt levels and cash generative business models can weather an economic storm. They can also continue with self-funded growth initiatives at a time when the rising cost of capital prevents their competitors from doing so.

These high-quality factors should help our companies not only survive an economic downturn but also thrive in the future. We’ve seen our companies use the challenging environment to their advantage, by consolidating an industry or taking market share from weaker competitors, for example. In turn, we believe these actions should set our companies up for even better growth prospects over the medium to long term.

Looking ahead, we won’t try to predict when the economy, or stock markets, will rebound. But the valuations of many global companies are already at or near decade lows. With a portfolio stacked full of what we believe are exceptional investment opportunities, we’re extremely excited about the Fund’s prospects over the next three to five years.

Thank you for the opportunity to manage your assets.

Current and future holdings are subject to risk.

16

| | |

| Wasatch Global Select Fund (WAGSX / WGGSX) | | SEPTEMBER 30, 2022 |

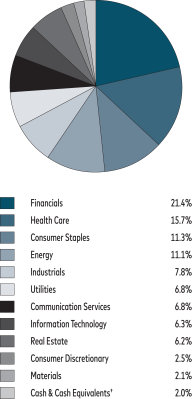

Portfolio Summary

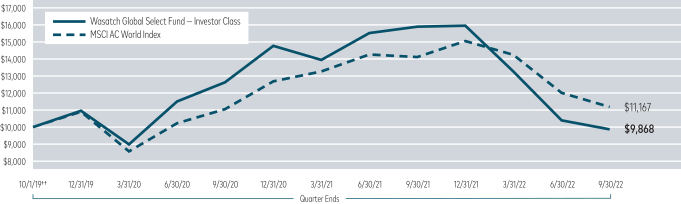

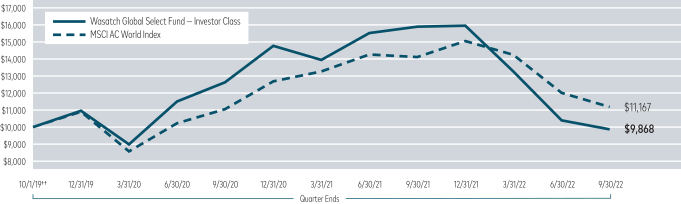

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | |

| | |

| | | 1 Year | | Since Inception 10/1/2019 |

| | |

Global Select (WAGSX) — Investor | | | | -37.76% | | | | | -0.44% | |

| | |

Global Select (WGGSX) — Institutional | | | | -37.47% | | | | | -0.06% | |

| | |

MSCI AC World Index | | | | -20.66% | | | | | 3.75% | |

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2022 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Global Select Fund are Investor Class — Gross: 2.17%, Net: 1.35% / Institutional Class — Gross: 1.56%, Net: 0.95%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in foreign securities, especially in emerging and frontier markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Being non-diversified, the Fund can invest a larger portion of its assets in the stocks of a limited number of companies than a diversified fund. Non-diversification increases the risk of loss to the Fund if the values of these securities decline.

TOP 10 EQUITY HOLDINGS*

| | | | |

| |

| Company | | % of Net Assets | |

| |

Bajaj Finance Ltd. | | | 5.3% | |

| |

Bank OZK | | | 4.8% | |

| |

Abcam PLC | | | 4.7% | |

| |

HDFC Bank Ltd. | | | 4.6% | |

| |

Amphenol Corp., Class A | | | 4.3% | |

| | | | |

| |

| Company | | % of Net Assets | |

| |

Morningstar, Inc. | | | 4.2% | |

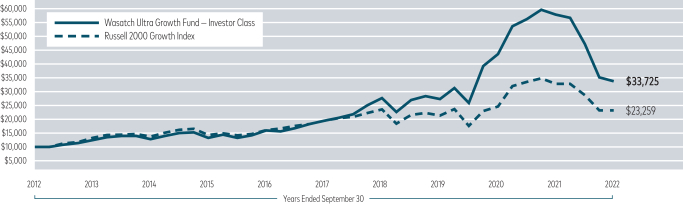

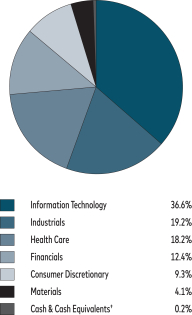

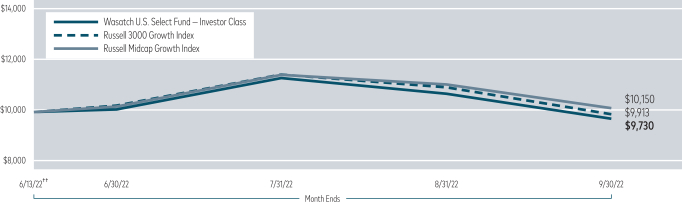

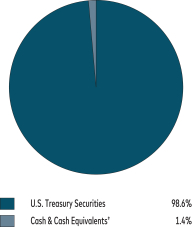

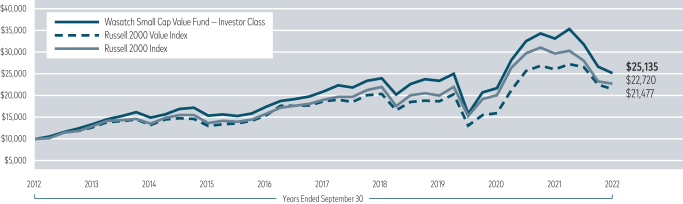

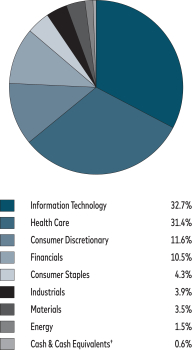

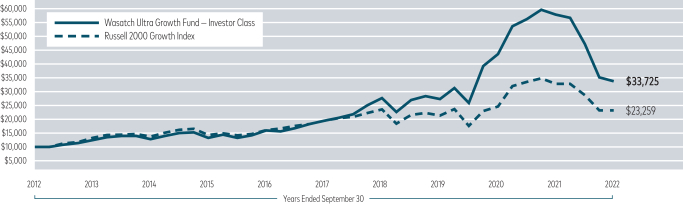

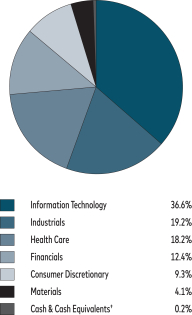

| |