UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| x | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

Response Biomedical Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

1781 - 75th Avenue W.

Vancouver, BC

V6P 6P2 CANADA

May [__], 2012

INVITATION TO SHAREHOLDERS

Dear Shareholder,

We are pleased to invite you to attend our 2012 annual meeting of shareholders to be held on Tuesday, June 19, 2012 at 10:00 a.m. Pacific time, at our headquarters located at 1781-75th Avenue W. Vancouver, BC, Canada. The formal meeting notice and information circular are attached.

At this year’s annual meeting, our shareholders will be asked to:

| | · | set the size of the board at six directors and elect six directors for a one-year term to expire at the 2013 Annual Meeting of Shareholders; |

| | · | approve a special resolution approving the consolidation of our outstanding common shares at a ratio of twenty (20) to one (1), as more particularly described in the information circular; |

| | · | approve an ordinary resolution approving the prior grant of certain options and approving certain amendments to our existing 2008 stock option plan, as more particularly described in the information circular; and |

| | · | approve the appointment of PricewaterhouseCoopers LLP, as our auditors to hold office until our next annual general meeting. |

It is important that you use this opportunity to take part in the affairs of Response Biomedical Corporation by voting on the business to come before this meeting. After reading the enclosed Information Circular, please promptly mark, sign, date and return the enclosed Proxy or voting instruction form and the reply card as instructed to ensure that your shares will be represented. Regardless of the number of shares you own, your careful consideration of, and vote on, the matters before our shareholders is important.

Thank you for your ongoing support of Response Biomedical Corporation. We look forward to seeing you at our annual meeting.

Sincerely yours,

Peter A. Thompson, M.D.

Chief Executive Officer and Chairman of the Board

1781-75th Avenue W.

Vancouver, BC

Canada V6P 6P2

RESPONSE BIOMEDICAL CORPORATION

1781 - 75th Avenue W.

Vancouver, BC

V6P 6P2 CANADA

NOTICE OF ANNUAL MEETING OF

SHAREHOLDERS AND INFORMATION CIRCULAR

To the Shareholders of Response Biomedical Corporation:

Notice is hereby given that the Annual Meeting of the Shareholders of Response Biomedical Corporation, will be held on June 19, 2012 at 10:00 a.m. Pacific Time at 1781 – 75th Avenue W., Vancouver, BC for the following purposes:

1. To set the size of our board at six directors and elect six directors for a one-year term to expire at the 2013 Annual Meeting of Shareholders. Our present board of directors has nominated and recommends for election as directors the following persons:

Anthony F. Holler, M.D.

Joseph D. Keegan, Ph.D.

Clinton H. Severson

Lewis J. Shuster

Peter A. Thompson, M.D.

David G. Wang, M.D.

2. To approve a special resolution approving the consolidation of our outstanding common shares at a ratio of twenty (20) to one (1), as more particularly described in the information circular accompanying this Notice of Annual Meeting.

3. To approve an ordinary resolution approving the prior grant of certain options and approving certain amendments to our existing 2008 stock option plan, as more particularly described in the information circular accompanying this Notice of Annual Meeting.

4. To approve the appointment of PricewaterhouseCoopers LLP as auditors to hold office until our next annual general meeting.

5. To transact such other business as may be properly brought before our annual meeting or any adjournment thereof.

Our board of directors has fixed the close of business on April 23, 2012 as the record date for the determination of shareholders entitled to notice of and to vote at our annual meeting and at any adjournment or postponement thereof.

Accompanying this Notice is a Proxy. Whether or not you expect to be at our Annual Meeting, please complete, sign and date the Proxy you received in the mail and return it promptly. If you plan to attend our Annual Meeting and wish to vote your shares personally, you may do so at any time before the Proxy is voted.

All shareholders are cordially invited to attend the meeting.

| | By Order of the Board of Directors, /s/ Peter A. Thompson Peter A. Thompson, M.D. Chairman of the Board |

May [__], 2012

TABLE OF CONTENTS

Page

| INFORMATION CIRCULAR | 1 |

| Shareholder Proposals | 2 |

| Annual Report | 3 |

| Householding of Proxy Materials | 3 |

| CORPORATE GOVERNANCE AND BOARD OF DIRECTORS | 4 |

| Board Leadership Structure | 4 |

| Board Role in Risk Oversight | 4 |

| Board Meetings | 4 |

| Committees of the Board | 5 |

| Director Nomination Process | 7 |

| Identification and Evaluation of Nominees for Directors | 8 |

| Communications with the Board of Directors | 8 |

| Code of Business Conduct and Ethics | 9 |

| Corporate Governance Documents | 9 |

| Pricing Committee | 9 |

| 2011 Compensation of Directors | 9 |

| Director Attendance at Annual Meetings | 10 |

| PROPOSAL 1 - ELECTION OF DIRECTORS | 11 |

| Board Structure | 11 |

| Nominees to Be Elected (Term Expiring in 2013) | 11 |

| Information Regarding Directors | 11 |

| Required Vote | 13 |

| Recommendation | 14 |

| Director Independence | 14 |

| Cease Trade Orders, Bankruptcies, Penalties or Sanctions | 14 |

| PROPOSAL 2 — SPECIAL RESOLUTION RELATED TO PROPOSED CONSOLIDATION OF OUTSTANDING COMMON SHARES | 16 |

| Recommendation | 17 |

| PROPOSAL 3 — APPROVE PRIOR STOCK OPTION GRANTS AND AMENDMENTS TO STOCK OPTION PLAN | 18 |

| Prior Grant of Options | 18 |

| Increase to Maximum Number of Common Shares Issuable Under Plan | 18 |

| Recommendation | 19 |

| Summary of Terms of 2008 Stock Option Plan | 19 |

| PROPOSAL 4 — APPOINTMENT OFAUDITORS | 21 |

| Principal Accounting Fees and Services | 21 |

| Audit Committee Policy Regarding Pre-Approval of Audit and Permissible Non-Audit Services of Our Independent Auditors | 22 |

| Recommendation | 22 |

| Report of the Audit Committee | 23 |

| MANAGEMENT'S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING | 24 |

| EXECUTIVE COMPENSATION | 27 |

| Our Executive Officers | 27 |

| Executive Compensation | 28 |

| Outstanding Equity Awards at Fiscal Year-End | 29 |

| Employment Arrangements and Change of Control Arrangements | 30 |

| Perquisites | 31 |

| Option Exercises and Stock Vested at Fiscal Year End | 31 |

| Pension Benefits | 31 |

| Nonqualified Deferred Compensation | 31 |

| Non-Employee Director Compensation | 31 |

| Compensation Committee Interlocks and Insider Participation | 31 |

| Performance Graph | 32 |

| Compensation Committee Interlocks and Insider Participation | 32 |

| RELATED PERSON TRANSACTIONS AND SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 33 |

| Related Person Transactions | 33 |

| Directors’ and Officers’ Liability Insurance | 34 |

| Policy Concerning Audit Committee Approval of Related Person Transactions | 34 |

| Section 16(a) Beneficial Ownership Reporting Compliance | 34 |

| SECURITY OWNERSHIP | 35 |

| OTHER BUSINESS | 37 |

RESPONSE BIOMEDICAL CORPORATION

1781 - 75th Avenue W.

Vancouver, BC

V6P 6P2 CANADA

INFORMATION CIRCULAR

The Board of Directors of Response Biomedical Corporation, a Vancouver, British Columbia, Canada corporation, or the Company, is soliciting the Proxy for use at our Annual Meeting of Shareholders to be held on June 19, 2012 at 10:00 a.m. Pacific Time at 1781 - 75th Avenue W. Vancouver, BC V6P 6P2 Canada and at any adjournments or postponements thereof.

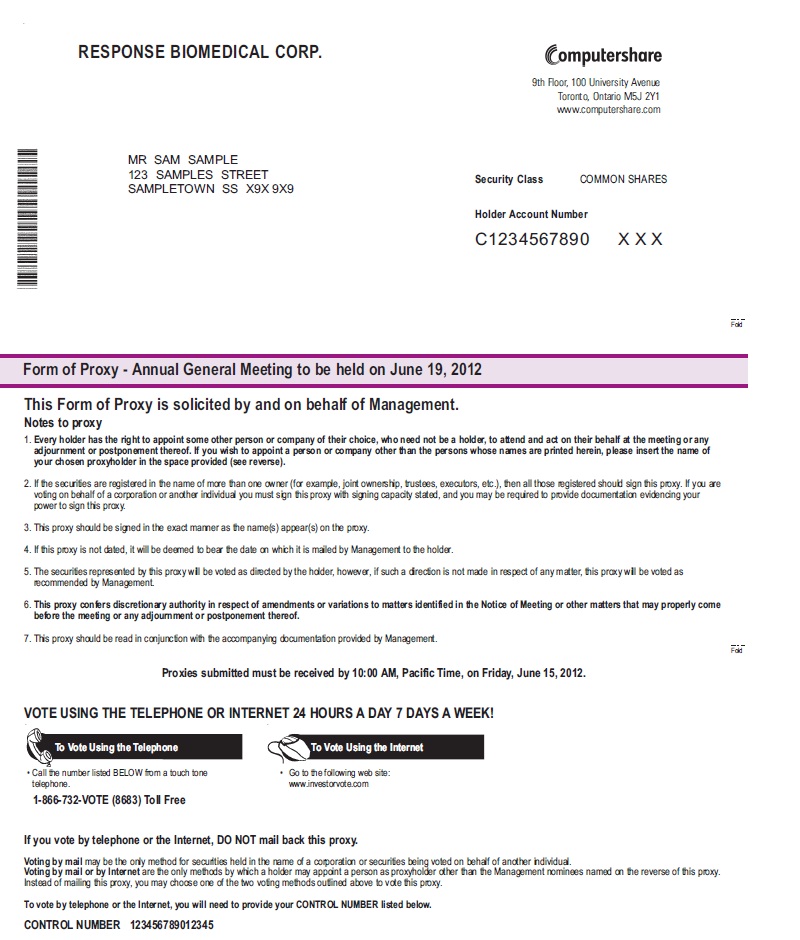

A proxy is your legal designation of another person to vote the stock you own. The person you designate is your “proxy,” and you give the proxy authority to vote your shares by submitting the enclosed proxy card or, if available, voting by telephone or over the Internet. We have designated our chief executive officer, Dr. Peter A. Thompson, our chief financial officer, Richard A. Canote, and our Vice President, Administration and Corporate Communications, Patricia Massitti, to serve as proxies for the annual meeting.

We are providing these proxy materials in connection with the solicitation by our board of directors of proxies to be voted at our 2012 annual meeting of shareholders, which will take place on June 19, 2012 at 10:00 a.m. Pacific Time at our headquarters located at 1781 - 75th Avenue W. Vancouver, BC V6P 6P2 Canada. As a shareholder, you are invited to attend the annual meeting and are requested to vote on the items of business described in this information circular.

The information in this information circular relates to the proposals to be voted on at the annual meeting, the voting process, the compensation of our directors and most highly paid executive officers, our corporate governance policies, information on our board of directors, and certain other required information.

This information circular and the accompanying proxy card, notice of annual meeting, and voting instructions are being mailed starting May [__], 2012, to all shareholders of record entitled to vote at the annual meeting

A proxy may be revoked by written notice to the Secretary of the Company at any time prior to the voting of the proxy, or by executing a subsequent proxy prior to voting or by attending the meeting and voting in person. Unrevoked proxies will be voted in accordance with the instructions indicated in the proxies, or if there are no such instructions, such proxies will be voted:

| | · | “FOR” the setting of the size of our board at six members; |

| | · | “FOR” the election of the six nominees as directors named in the information circular; |

| | · | “FOR” the consolidation of our outstanding common shares on a twenty (20) for one (1) basis; |

| | · | “FOR” the approval of certain prior stock option grants and certain amendments to our existing stock option plan; |

| | · | “FOR” the appointment of PricewaterhouseCoopers LLP as our auditors to hold office until our next annual general meeting. |

Shares represented by proxies that reflect abstentions or include “broker non-votes” will be treated as present and entitled to vote for purposes of determining the presence of a quorum. Abstentions have the same effect as votes “against” the matters, except in the election of directors. “Broker non-votes” do not constitute a vote “for” or “against” any matter and thus will be disregarded in the calculation of “votes cast.”

Shareholders of record at the close of business on April 23, 2012 (the “Record Date”), will be entitled to vote at the annual meeting or vote by proxy using the Proxy Card that was mailed to you with the Notice of Annual Meeting. As of the Record Date, 129,078,166 of our common shares without par value were outstanding. Each share of our common stock is entitled to one vote. Two people present at the meeting, in person or by proxy, and holding in the aggregate not less than 5% of the issued common shares entitled to vote at our annual meeting constitutes a quorum. A majority of the shares present in person or represented by proxy at our annual meeting and entitled to vote thereon is required to set the board size at 6 members and for the election of directors, to approve the ratification of the appointment of our independent registered public accounting firm and to approve previous option grants and proposed amendments to our existing stock option plan. A special majority of two-thirds of the shares present in person or represented by proxy at our annual meeting and entitled to vote thereon is required to approve the consolidation of our shares on a 20 to 1 basis.

The cost of preparing, assembling and mailing the Notice of Annual Meeting, Information Circular, and Proxy card will be borne by the Company. In addition to soliciting proxies by mail, our officers, directors and other regular employees, without additional compensation, may solicit proxies personally or by other appropriate means. It is anticipated that banks, brokers, fiduciaries, other custodians, and nominees will forward proxy soliciting materials to their principals. Upon request, we will reimburse such reasonable and direct out-of-pocket mailing expense.

Shareholder Proposals

Proposals of shareholders intended to be presented at our Annual Meeting of Shareholders to be held in 2013 must be received by us no later than January 10, 2013, which is 120 days prior to the first anniversary of the mailing date of the proxy, in order to be included in our information circular and form of proxy relating to that meeting. These proposals must comply with the requirements as to form and substance established by the SEC for such proposals in order to be included in our information circular.

Shareholders may present proper proposals for inclusion in our information circular and for consideration at the next annual meeting of shareholders by submitting their proposals in writing to our corporate secretary in a timely manner. For a shareholder proposal to be considered for inclusion in our information circular for our 2013 annual meeting of shareholders, our corporate secretary must receive the written proposal at our principal executive offices no later than January 10, 2013; provided, however, that in the event that we hold our 2013 annual meeting of shareholders more than 30 days before or after the one-year anniversary date of the 2012 annual meeting, we will disclose the new deadline by which shareholders proposals must be received under Item 5 of our earliest possible Quarterly Report on Form 10-Q or, if impracticable, by any means reasonably calculated to inform shareholders. In addition, shareholder proposals must otherwise comply with the requirements of Rule 14a-8 of the Securities Exchange Act of 1934, as amended. Such proposals also must comply with SEC regulations under Rule 14a-8 regarding the inclusion of shareholder proposals in company-sponsored proxy materials. Proposals should be addressed to Response Biomedical Corp., 1781 - 75th Avenue W. Vancouver, BC V6P 6P2 Canada, Attention: Corporate Secretary.

In the event that we hold our 2013 annual meeting of shareholders more than 30 days before or after the one-year anniversary date of the 2012 annual meeting, then notice of a shareholder proposal that is not intended to be included in our information circular must be received not later than the close of business on the later of the following two dates:

| | · | the 90th day before such annual meeting: or |

| | · | the 10th day following the day on which public announcement of the date of such meeting is first made. |

If a shareholder who has notified us of his or her intention to present a proposal at an annual meeting does not appear to present his or her proposal at such meeting, we are not required to present the proposal for a vote at such meeting.

Annual Report

Our Annual Report for the fiscal year ended December 31, 2011 will be mailed to shareholders of record as of April 23, 2012. Our Annual Report does not constitute, and should not be considered, a part of this information circular.

A copy of our Annual Report on Form 10-K will be furnished without charge upon receipt of a written request identifying the person so requesting a report as a shareholder of the Company at such date to any person who was a beneficial owner of our common stock on the Record Date. Requests should be directed to Response Biomedical Corp., 1781 - 75th Avenue W. Vancouver, BC V6P 6P2 Canada, Attention: Corporate Secretary.

Householding of Proxy Materials

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, shareholders of record who have the same address and last name and do not participate in electronic delivery of proxy materials will receive only one copy of our notice of annual meeting, information circular and 2011 annual report, unless one or more of these shareholders notifies us that they wish to continue receiving individual copies. This procedure will reduce our printing costs and postage fees.

Shareholders who wish to participate in householding will continue to receive separate proxy cards.

If you are eligible for householding, but you and other shareholders of record with whom you share an address currently receive multiple copies of the notice of annual meeting, information circular, 2011 annual report and accompanying documents, or if you hold stock in more than one account, and, in either case, you wish to receive only a single copy of each of these documents for your household, please notify your broker, direct your written request to Response Biomedical Corp., Investor Relations; 1781 – 75th Avenue W., Vancouver, BC V6P 6P2 or contact Response Biomedical Corp. at 604-456-6010. Shareholders who currently receive multiple copies of the proxy materials at their address and would like to request “householding” of their communications should contact their brokers.

If you participate in householding and wish to receive a separate copy of this notice of annual meeting, information circular, 2011 annual report and the accompanying documents, or if you do not wish to continue to participate in householding and prefer to receive separate copies of these documents in the future, please contact Computershare Trust Company, N.A. as indicated above.

CORPORATE GOVERNANCE AND BOARD OF DIRECTORS

Board Leadership Structure

Our board of directors does not have a policy on whether or not the roles of chief executive officer and chairman of the board should be separate and, if they are to be separate, whether the chairman of the board should be selected from the non-employee directors or be an employee. The offices of chief executive officer and chairman of the board have been at times combined and at times separated, and our board of directors considers such combination or separation in conjunction with, among other things, its succession planning processes. Our board of directors believes that it should be free to make a choice regarding the leadership structure from time to time in any manner that is in the Company’s and its shareholders’ best interests.

We currently have combined the roles chairman of the board and chief executive officer. Our board of directors does not have a lead independent director. We believe this is appropriate because our board includes a number of seasoned independent directors. In concluding that having Dr. Peter A. Thompson serve as chief executive officer and chairman of the board represents the appropriate structure for the Company at this time, our board of directors considered the benefits of having the chief executive officer serve as a bridge between management and our board of directors, ensuring that both groups act with a common purpose. Our board of directors also considered Dr. Thompson’s knowledge regarding our operations and the industry in which we compete and his ability to promote communication, to synchronize activities between our board of directors and our senior management and to provide consistent leadership to both our board of directors and the Company in coordinating our strategic objectives. Our board of directors further concluded that the combined role of chairman of the board and chief executive officer ensures there is clear accountability.

Board Role in Risk Oversight

While each of the committees of our board of directors evaluate risk in their respective areas of responsibility, our corporate governance and nominating committee is primarily responsible for overseeing the Company’s risk management processes on behalf of the full board. We believe that employing a committee specifically focused on the Company’s risk profile is beneficial, given the increased importance of monitoring risks in the current economic and business climate. Our corporate governance and nominating committee discusses the Company’s risk profile, and the corporate governance and nominating committee reports to the full board on the most significant risk issues. Our compensation committee is responsible for overseeing the management of risks relating to our executive compensation plans and arrangements.

While our board of directors and our corporate governance and nominating committee oversee the Company’s risk management, Company management is ultimately responsible for day-to-day risk management activities. We believe this division of responsibilities is the most effective approach for addressing the risks facing the Company and that our board leadership structure supports this approach.

Board Meetings

Our board of directors held fifteen meetings during 2011. No director who served as a director during the past year attended fewer than 75% of the aggregate of the total number of meetings of our board of directors and the total number of meetings of committees of our board on which he or she served.

Committees of the Board

Our board of directors currently has, and appoints members to, four standing committees: our compensation committee, our corporate governance and nominating Committee, our audit committee and our pricing committee. The current members of our committees are identified below:

| | | | Corporate Governance and Nominating | | | | |

Anthony F. Holler, M.D. | | Member (2) | | Member | | Member | | Member |

Joseph D. Keegan, Ph.D. | | Member | | | | | | |

Clinton H. Severson | | | | | | Member | | |

Lewis J. Shuster | | | | | | Member (1) | | Member (4) |

Peter A. Thompson, M.D. | | | | Member (3) | | | | |

David G. Wang, M.D. | | Member | | | | | | |

| (1) | Audit Committee Chair. |

| (2) | Compensation Committee Chair. |

| (3) | Corporate Governance and Nominating Committee Chair. |

| (4) | Pricing Committee Chair. |

Below is a description of each committee of our board of directors. Our board of directors has determined that each member of each committee meets the applicable SEC rules and regulations and all applicable Canadian securities rules and regulations regarding independence and that each member is free of any relationship that would impair his individual exercise of independent judgment with regard to the Company.

Audit Committee

Our audit committee consists of three members, with Mr. Shuster serving as chairman. Our audit committee held thirteen meetings during 2011. All members of our audit committee are independent directors (as independence is currently defined under the rules and regulations of the U.S. Securities and Exchange Commission, or SEC, and applicable Canadian securities rules). Mr. Shuster qualifies as an “audit committee financial expert” as that term is defined in the rules and regulations established by the SEC. The Audit Committee is governed by a written charter approved by our board of directors. The functions of this committee include, among other things:

| | · | monitoring our financial reporting process and internal control system; |

| | · | appointing and replacing our independent outside auditors from time to time, to determine their compensation and other terms of engagement and to oversee their work; |

| | · | overseeing the performance of our internal audit function; and |

| | · | overseeing our compliance with legal, ethical and regulatory matters. |

Both our independent auditors and internal financial personnel regularly meet privately with our audit committee and have unrestricted access to this committee. Our audit committee has the power to investigate any matter brought to its attention within the scope of its duties. It also has the authority to retain counsel and advisors to fulfill its responsibilities and duties.

Compensation Committee

Our compensation committee currently consists of three members, with Anthony F. Holler, M.D. serving as chairman. Our compensation committee held two meetings during 2011. All members of our compensation committee are independent (as independence is currently defined under the rules and regulations of the SEC, applicable Canadian securities rules and Internal Revenue Service qualification requirements). Our compensation committee is governed by a written charter approved by our board of directors. The functions of this committee include, among other things:

| | · | providing oversight of the development and implementation of the compensation policies, strategies, plans and programs for the Company’s key employees and directors, including policies, strategies, plans and programs relating to long-term compensation for the Company’s senior management, and the disclosure relating to these matters; |

| | · | making recommendations regarding the operation of and/or implementation of employee bonus plans and incentive compensation plans; |

| | · | reviewing and approving the compensation of the chief executive officer and the other executive officers of the Company and the remuneration of the Company’s directors; and |

| | · | providing oversight of the selection of officers, management, succession planning, the performance of individual executives and related matters. |

Role and Authority of Compensation Committee

Our compensation committee is responsible for discharging the responsibilities of our board of directors with respect to the compensation of our executive officers. Our compensation committee approves all compensation of our executive officers without further board action. Our compensation committee reviews and approves each of the elements of our executive compensation program and continually assesses the effectiveness and competitiveness of our program. Our compensation committee also periodically reviews director compensation.

The Role of our Executives in Setting Compensation

Our compensation committee meets with our chief executive officer, Dr. Thompson, and/or other executives at least once per year to obtain recommendations with respect to Company compensation programs, practices, and packages for executives, directors and other employees. Management makes recommendations to our compensation committee on the base salary, bonus targets, and equity compensation for the executive team and other employees. Our compensation committee considers, but is not bound by and does not always accept, management’s recommendations with respect to executive compensation. Our compensation committee has the ultimate authority to make decisions with respect to the compensation of our named executive officers, but may, if it chooses, delegate any of its responsibilities to subcommittees.

Dr. Thompson attends some of our compensation committee’s meetings, but our compensation committee also regularly holds executive sessions not attended by any members of management or non-independent directors. Our compensation committee discusses Dr. Thompson’s compensation package with him, but makes decisions with respect to his compensation outside of his presence.

Corporate Governance and Nominating Committee

Our corporate governance and nominating committee, or our corporate governance committee, members are two, with Peter A. Thompson, M.D. serving as chairman. Our corporate governance committee held no formal meetings during 2011, however communicated via email with regards to the nominees for election to our board of directors at the annual meeting. All members of our corporate governance committee, other than Dr. Thompson, are independent directors (as independence is currently defined under the rules and regulations of the SEC and applicable Canadian securities rules). Our corporate governance committee is governed by a written charter approved by our board of directors. The functions of this committee include, among other things:

| | · | establishing criteria for our board of directors and committee membership and to recommend to our board of directors proposed nominees for election to our board of directors and for membership on committees of our board of directors; |

| | · | ensuring that appropriate processes are established by our board of directors to fulfill its responsibility for (i) the oversight of strategic direction and development and the review of our ongoing results of operations by the appropriate committee of our board of directors and (ii) the oversight of our investor relations and public relations activities and ensuring that procedures are in place for the effective monitoring of the shareholder base, receipt of shareholder feedback and responses to shareholder concerns; |

| | · | monitoring the quality of the relationship between management and our board of directors and to recommend improvements for ensuring an effective and appropriate relationship; and |

| | · | making recommendations to our board of directors regarding corporate governance matters and practices. |

Director Nomination Process

Director Qualifications

In evaluating director nominees, our corporate governance committee considers, among others, the following factors:

| | · | experience, skills and other qualifications in view of the specific needs of our board of directors and the Company; |

| | · | diversity of background; and |

| | · | demonstration of high ethical standards, integrity and sound business judgment. |

Our corporate governance committee’s goal is to assemble a board that brings to us a variety of perspectives and skills derived from high quality business and professional experience which are well suited to further the our objectives. In doing so, our corporate governance committee also considers candidates with appropriate non-business backgrounds.

Other than the foregoing, there are no stated minimum criteria for director nominees, although our corporate governance committee may also consider such other facts as it may deem are in the best interests of the Company and its shareholders. Our corporate governance committee does, however, believe it appropriate for at least one, and, preferably, several, members of our board of directors to meet the criteria for an “audit committee financial expert” as defined by SEC rules, and that a majority of the members of our board of directors meet the definition of an “independent director” under the TSX qualification standards. At this time, our corporate governance committee also believes it appropriate for our chief executive officer to serve as the chairman of the board.

Identification and Evaluation of Nominees for Directors

Our corporate governance committee identifies nominees for board membership by first evaluating the current members of our board of directors willing to continue in service. Current members with qualifications and skills that are consistent our corporate governance committee’s criteria for board service and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of our board of directors with that of obtaining a new perspective. If any member of our board of directors does not wish to continue in service or if our board of directors decides not to re-nominate a member for re-election, our corporate governance committee identifies the desired skills and experience of a new nominee in light of the criteria above. Our corporate governance committee generally polls our board of directors and members of management for their recommendations. Our corporate governance committee may also review the composition and qualification of our boards of directors of our competitors, and may seek input from industry experts or analysts. Our corporate governance committee reviews the qualifications, experience and background of the candidates. Final candidates are interviewed by our independent directors and chief executive officer. In making its determinations, the our corporate governance committee evaluates each individual in the context of the board as a whole, with the objective of assembling a group that can best attain success for the Company and represent shareholder interests through the exercise of sound judgment. After review and deliberation of all feedback and data, our corporate governance committee makes its recommendation to our board of directors. Historically, our corporate governance committee has not relied on third-party search firms to identify Board candidates. The Corporate Governance Committee may in the future choose to do so in those situations where particular qualifications are required or where existing contacts are not sufficient to identify and acquire an appropriate candidate.

Our corporate governance committee has not received director candidate recommendations from our shareholders and does not have a formal policy regarding consideration of such recommendations since it believes that the process currently in place for the identification and evaluation of prospective members of our board of directors is adequate. Any recommendations received from shareholders will be evaluated in the same manner as potential nominees suggested by members of our board of directors or management. Shareholders wishing to suggest a candidate for director should write to the Company’s chief financial officer.

Communications with the Board of Directors

Our shareholders and other interested parties may send written correspondence to non-management members of our board of directors to the corporate secretary or chief executive officer at 1781 - 75 Avenue W. Vancouver, BC V6P 6P2 or IR@responsebio.com. Our corporate secretary or chief executive officer will review the communication, and if the communication is determined to be relevant to our operations, policies, or procedures (and not vulgar, threatening, or of an inappropriate nature not relating to our business), the communication will be forwarded to the Chairman of the Board. If the communication requires a response, our Corporate Secretary will assist the Chairman of the Board (or other directors) in preparing the response.

Code of Business Conduct and Ethics

We have established a Code of Business Conduct and Ethics that applies to our officers, directors and employees. The Code of Business Conduct and Ethics contains general guidelines for conducting our business consistent with the highest standards of business ethics, and is intended to qualify as a “code of ethics” within the meaning of Section 406 of the Sarbanes-Oxley Act of 2002 and Item 406 of Regulation S-K. The Code of Business Conduct and Ethics is available on our website at www.responsebio.com. If we make any substantive amendments to the Code of Business Conduct and Ethics or grant any waiver from a provision of the Code to any executive officer or director, we will promptly disclose the nature of the amendment or waiver on our website.

Corporate Governance Documents

Our corporate governance documents, including the Audit Committee Charter, Compensation Committee Charter, Corporate Governance and Nominating Committee Charter and Code of Business Conduct and Ethics are available free of charge on our website at www.responsebio.com. Please note, however, that the information contained on the website is not incorporated by reference in, or considered part of, this information circular. We will also provide copies of these documents free of charge to any shareholder upon written request to Investor Relations, Response Biomedical Corporation, 1781 - 75 Avenue W. Vancouver, BC V6P 6P2 or IR@responsebio.com.

Pricing Committee

Our pricing committee consists of two members, with Lewis J. Shuster serving as its chairman. Our pricing committee held three meetings during 2011. All members of our pricing committee are independent directors (as independence is currently defined under the rules and regulations of the SEC and applicable Canadian securities rules). Our pricing committee was authorized to oversee and direct counsel and other advisers to us with regards to potential acquisitions, the rights offering, bridge loan agreement, and any ongoing negotiations with Orbimed Advisors LLC or its advisers over the terms of the proposed rights offering or other shareholder matters. Our pricing committee was active in 2011 but is presently inactive.

2011 Compensation of Directors

Prior to July 1, 2011, non-management board members received an annual retainer of $12,000 and board of director meeting fees of $750 for local residents for local board of director meetings and $1,500 for non-local residents and meetings with no additional fees to be paid for committee meetings. Effective July 1, 2011, non-management board members received an annual retainer of $15,000 and board of director meeting fees of $1,500 for attendance in person and $500 for attendance by teleconference. In addition, the Chairman and Committee chairs received an annual stipend of $5,000 except for the Chair of the Audit Committee, who received an annual stipend of $25,000. Our pricing committee was formed on July 1, 2011 and the Chair of the committee received $5,000 on a monthly basis. This compensation was completed December 31, 2011 with the close of the Company’s rights offering. Finally, the Chair of our audit committee received a $30,000 completion fee for work performed with respect to the restatement of the audited financial statements for the year ended December 31, 2010 and the restatement of the unaudited financial statements for the periods ended March 31, 2011 and June 30, 2011.

Director Attendance at Annual Meetings

Although we do not have a formal policy regarding attendance by members of our board of directors at our annual meeting, we encourage all of our directors to attend. All of the members of our board of directors attended our 2011 Annual Meeting of Shareholders in person.

PROPOSAL 1

ELECTION OF DIRECTORS

Board Structure

Under our articles of incorporation, the size of our board of directors is to be set from time to time by ordinary resolution of our shareholders. Our board of directors currently consists of six members. Each of our directors is elected for a term of one year to serve until his successor is duly elected and qualified or until his earlier death, resignation or removal.

Nominees to Be Elected (Term Expiring in 2013)

At our annual meeting, shareholders will be asked to pass an ordinary resolution fixing the size of the board at six. Our corporate governance committee recommended and our board of directors nominated the following six nominees for election to our board of directors at our upcoming annual meeting: Anthony F. Holler, Joseph D. Keegan, Clinton H. Severson, Lewis J. Shuster, Peter A. Thompson and David G. Wang, each of whom is presently a member of our board of directors.

Each nominee has agreed to serve if elected, and management has no reason to believe that they will be unavailable to serve. In the event any nominee is unable or declines to serve as a director at the time of the annual meeting, proxies will be voted for any nominee who may be proposed by our corporate governance committee and designated by the present board of directors to fill the vacancy.

Information Regarding Directors

The information set forth below as to the nominees for election to serve on our board of directors has been furnished to us by the nominees:

Nominees for Election to the Board of Directors

| | | | |

Anthony F. Holler, M.D. | | 61 | | Director |

Joseph D. Keegan, Ph.D. | | 59 | | Director |

Clinton H. Severson | | 64 | | Director |

Lewis J. Shuster | | 57 | | Director |

Peter A. Thompson, M.D. | | 53 | | Chairman of the Board and Chief Executive Officer |

David G. Wang, M.D. | | 51 | | Director |

Anthony F. Holler, M.D., British Columbia, Canada

Dr. Holler joined Response Biomedical Corporation’s Board as a Director in March 2006. He was one of the original founders of ID Biomedical, and has served as its Director since 1991. Dr. Holler has been the Chairman of CRH Medical Corporation (Formerly Medsurge Medical Products Corp.) since December 2005 and also the Chairman of Trevali Resources Corporation since October 2010. He serves as Non-Executive Chairman of Q2 Gold Resources Inc. and has been its Director since June 2007. He has been a Director of Neptune Technologies & BioResources, Inc. since July 2011 and as a Director of CRH Medical Corporation since December 2005. Dr. Holler served as Non-Executive Chairman of Corriente Resources Inc. from 2003 to June 2010 and its Director from September 2003. Dr. Holler served as an Emergency physician at University Hospital at University of British Columbia. He is a Member of the British Columbia College of Physicians and Surgeons and received a Bachelor of Science in 1975 and a Medical Degree in 1979 from the University of British Columbia. Dr. Holler’s medical and business background gives him a perspective that is helpful to the Board for understanding the Company’s product markets.

Joseph D. Keegan, Ph.D., California, United States

Dr. Keegan joined Response Biomedical Corporation’s Board as a Director and Member of the Compensation in June 2011. Dr. Keegan has more than 30 years of experience in life science businesses. Most recently as CEO at ForteBio, Inc. he led the Series C financing which raised $25M, established product development and sales strategies that resulted in 2007-11 compounded annual revenue growth of 45%, and exited the company through its sale to Pall Corporation at 6x ttm revenue. During his 9 year tenure at Molecular Devices Corporation, Dr. Keegan grew the company’s revenues from $30M to $200M through internal growth and acquisitions. In early 2007, he oversaw its acquisition by MDS for $615M. Dr. Keegan joined MDC from Becton Dickinson and Company where he served as President of Worldwide Tissue Culture and Vice President, General Manager of Worldwide Flow Cytometry. Prior to Becton Dickinson, Dr. Keegan was Vice President of the Microscopy and Scientific Instruments Division of Leica, Inc. He currently serves on the Board of Directors of ALSSA as Chairman, Labcyte Corporation as Chairman, Seahorse Bioscience Inc., Stereotaxis, Inc. (Nasdaq: STXS) and the San Francisco Opera. Dr. Keegan holds a B.A. in Chemistry from Boston University and a Ph.D. in Physical Chemistry from Stanford University. Dr. Keegan brings to the Board a long history of experience in the field of biotechnology and business strategy.

Clinton H. Severson, California, United States

Mr. Clinton H. Severson joined Response Biomedical Corporation’s Board as a Director and Member of the Audit Committee in June 2011. Mr. Severson has been President and Chief Executive Officer of Abaxis Inc. since June 1996. From February 1989 to May 1996, Mr. Severson served as President and CEO of MAST Immunosystems, Inc. Mr. Severson began his career at Syva from 1978 to 1984, and then moved to 3M Diagnostic Systems from 1984 to 1989. He has been Chairman of the Board of Abaxis Inc. since May 1998 and a Director since June 1996. Mr. Severson has been Non-Executive Director of Trinity Biotech plc since November 2008, a Director of CytoCore, Inc. from November 2006 to February 2012, a Director of IntelliDx, Inc. and as a Director of LXN Corporation since October 2000. Mr. Severson received his Bachelors of Business Administration from Minot State University in 1973. Mr. Severson’s years of experience in the life sciences industry are very valuable to the Company as it works to execute its business strategy.

Lewis J. Shuster, California, United States

Mr. Lewis Shuster joined Response Biomedical Corporation’s Board as a Director and Audit Committee Chairman in June 2011. Currently, he is the Chief Executive Officer of Shuster Capital. From 2003 to 2007, he served as CEO of Kemia Inc., a drug discovery and development company and had previously held executive positions with Invitrogen, including Chief Operating Officer. From 1994 through to 1999, while at Pharmacopeia, Inc. Mr. Shuster served as the firm’s Chief Financial Officer and later as COO of Pharmacopeia Labs. Mr. Shuster also served as EVP, Finance and Operations at Human Genome Sciences from 1992 to 1994. Prior to this he served as EVP and then CEO of Microbiological Associates, where he led a successful turnaround of a failing LBO and built a profitable GLP biological testing service business today known as BioReliance from 1986 until 1992. Before joining Microbiological Associates, he held positions with MDL Ltd. and the Boston Consulting Group. He presently serves as Board Member and Audit Committee Chairman for Complete Genomics, Inc. (NASDAQ: GNOM), Molecular Insight Pharmaceuticals, and MSN Healthcare. Mr. Shuster also serves as Board Member of ADVENTRX Inc. (NASDAQ: ANX) and Retrotope, Inc. Mr. Shuster earned an M.B.A. from Stanford University and a B.A. from Swarthmore College. Mr. Shuster’s experience as a chief executive officer and chief financial officer brings to the Board perspective regarding financial and accounting issues.

Peter A. Thompson, M.D., Washington, United States

Dr. Peter Thompson joined Response Biomedical Corporation’s Board as a Director and Member of the Compensation Committee in June 2010. He was appointed to the offices Executive Chairman and Chief Executive Officer on August 9, 2011. Dr. Thompson is a proven biotechnology executive and entrepreneur with over 20 years of experience in the industry. He co-founded Trubion Pharmaceuticals, and served as Chief Executive Officer and Chairman from its inception through its successful IPO on NASDAQ and as a public company until his retirement in 2009. Dr. Thompson is the former Vice President & General Manager of Chiron Informatics at Chiron Corporation and held various executive positions in Becton Dickinson, including Vice President, Research and Technology Department of BD Bioscience, prior to joining Chiron. Dr. Thompson is a co-founder of iMetrikus, a clinical decision support company, where he served as CEO and Chairman. He is a Venture Partner at Orbimed Advisors and the founder and Managing Director of Strategicon Partners, an investment and management services company. He serves as a Director on the Boards of Anthera Pharmaceuticals (NASDAQ: ANTH), Methylgene (TSX: MYG), Cleave Biosciences (Co-Founder), Principia Biosciences, & CoDa Therapeutics. Dr. Thompson is an Ernst & Young Entrepreneur of the Year awardee, an inventor on numerous patents, a board-certified internist and oncologist, and was on staff at the National Cancer Institute following his internal medicine training at Yale University. As an experienced biotechnology entrepreneur, Dr. Thompson is specially qualified to serve on the Board because of his detailed knowledge of our operations and markets.

David G. Wang, M.D., Shanghai, China

Dr. David Wang joined Response Biomedical Corporation’s Board as a Director and Member of the Compensation Committee and Audit Committee in October 2011. Dr. Wang currently works at OrbiMed as Senior Managing Director for Asia. Previously, he worked as Managing Director at WI Harper Group, responsible for healthcare investment in China. He also served as Head of Business Development at Siemens Medical Solutions, where he directed corporate strategy and new businesses in molecular diagnostics and diagnostic imaging. Dr. Wang was co-founder and Executive Vice President at First Genetic Trust, a personalized medicine company. During his tenure at Bristol-Myers Squibb he was Chairman of The SNP Consortium Management Committee, responsible for strategy and leadership. The SNP Consortium is the first group of its kind, formed by the pharmaceutical and technology industries as well as academia and charities to support the development of personalized medicine. He currently serves on the Board of Directors of Edan Instruments, a provider of medical electronic devices, where he also serves on both the audit committee and strategic committee. Dr. Wang received his M.D. from Peking University Medical School and his doctorate in Developmental Biology from California Institute of Technology. Dr. Wang’s extensive medical and international experience makes him a valuable addition to the Board.

Required Vote

A plurality of the votes of the shares present in person or represented by proxy at the annual meeting and entitled to vote on the election of directors is required to set the size of our board of directors and elect directors. If no contrary indication is made, Proxies in the accompanying form are to be voted: (i) the resolution setting the size of our board of directors at six; and (ii) the election of our board’s nominees to serve on our board of directors. Each person nominated for election has agreed to serve if elected and our board of directors has no reason to believe that any nominee will be unable to serve.

Recommendation

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION AS DIRECTOR OF EACH NOMINEE LISTED ABOVE.

Director Independence

Our board of directors has determined that each of the director nominees, other than Drs. Thompson and Wang, standing for election is an independent director under the SEC and applicable Canadian securities rules. In determining the independence of our directors, our board of directors considered all transactions in which the Company and any director had any interest, including those discussed under “Certain Relationships and Related Transactions” below.

Cease Trade Orders, Bankruptcies, Penalties or Sanctions

Except as described below, to the knowledge of the Company, no nominee for election as a director:

| | (i) | is, at the date hereof or has been, within the 10 years before, a director, chief executive officer or chief financial officer of any company, that while that person was acting in that capacity: |

| | (a) | was the subject of a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, for more than 30 consecutive days, or |

| | (b) | was subject to an event that resulted, after the director or executive officer ceased to be a director, chief executive officer or chief financial officer, in the company being the subject of a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, for more than 30 consecutive days, or |

| | (ii) | is, as at the date hereof or has been, within the 10 years before, a director or executive officer of any company, that while that person was acting in that capacity or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or |

| | (iii) | has, within the 10 years before the date hereof, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the director or executive officer. |

| | (iv) | Anthony Holler is a former director of Inviro Medical Inc. (“Inviro”). Inviro is a company incorporated under the laws of Canada which owns certain intangible assets including goodwill and customer relationships, and all of the issued and outstanding shares of Inviro Medical Devices, Inc. (the “US Subsidiary”). The US Subsidiary owns inventory manufactured in accordance with licenses issued by the Department of Health of the Government of Canada and the Food and Drugs Administration of the United States of America. On October 29, 2010, Inviro declared that it was no longer a going concern, and on or about that date, Inviro ceased to carry on business and all of its directors and officers, including Mr. Holler, resigned. On February 7, 2011, Mr. Holler, on behalf of a committee of debenture holders of Inviro, filed a Notice of Civil Claim seeking, among other things, an order for the appointment of a receiver of all of the assets and undertakings of Inviro. On February 10, 2011, the Supreme Court of British Columbia issued an order appointing Alvarez & Marsal Canada Inc. (the “Receiver’) as receiver and receiver and manager of all of the assets, undertakings and properties of Inviro. The Receiver is in the process of supervising the sale of all remaining assets of Inviro’s US subsidiary. |

PROPOSAL 2

SPECIAL RESOLUTION RELATED TO PROPOSED CONSOLIDATION OF

OUTSTANDING COMMON SHARES

Our board of directors seeks shareholder approval to implement a consolidation of our outstanding common shares such that each twenty (20) outstanding common shares will be consolidated into one (1) common share, the Consolidation. The Consolidation is subject to the approval of the Toronto Stock Exchange.

The primary purpose of completing the Consolidation is to increase the market price of our common shares. Our board of directors believes that the higher share price that might initially result from the Consolidation could help generate interest in our business among investors and thereby assist us in raising future capital to fund our operations or make acquisitions. Shareholders should be aware that the Consolidation will not affect the number of our authorized common shares. In particular, if the Consolidation is completed, although the number of issued common shares will be significantly decreased, the number of authorized common shares will remain unlimited.

Shareholders should note that the ultimate effect of the Consolidation upon the market price for our common shares cannot be accurately predicted. In particular, if the Consolidation is implemented, there is no assurance that the market price for our common shares will be 20 times greater than the price for those common shares immediately prior to the Consolidation. Furthermore, even if the market price of the common shares is initially significantly higher after the Consolidation, there can be no assurance that the market price of the common shares will maintain such level for any period of time.

In addition, shareholders should be aware that even if they approve the special resolution regarding the Consolidation, or the Consolidation Resolution, at our annual meeting, the proposed form of the Consolidation Resolution provides our board of directors with the discretion not to proceed with the Consolidation if they determine that to be in our best interests.

Fractional common shares which would otherwise be issued to shareholders in connection with the Consolidation will be not be issued but will, instead, be rounded down to the next nearest whole number of common shares. If the Consolidation Resolution is approved at our annual meeting and our board directors decides to proceed with the Consolidation, we will send letters of transmittal to each registered shareholder providing instructions on those shareholders may obtain new certificates representing the number of common shares to which they are entitled as a result of the Consolidation.

At our annual meeting, or any adjournment thereof, shareholders will be asked to consider and if deemed appropriate, pass, with or without variation, the Consolidation Resolution as follows:

“BE IT RESOLVED, AS A SPECIAL RESOLUTION, THAT:

| | 1. | Subject to the receipt of all required regulatory approvals (including the approval of the Toronto Stock Exchange, or TSX), the consolidation of the outstanding common shares, or the “Common Shares, of Response Biomedical Corporation, or the Company, on the basis of twenty (20) old Common Shares for one (1) new Common Share, the Consolidation, is hereby approved; |

| | 2. | No fractional Common Shares will be issued in connection with the Consolidation. Where any shareholder would otherwise be entitled to receive a fractional share as a result of the Consolidation, such fraction shall be rounded down to the next lower whole number; |

| | 3. | Notwithstanding that this special resolution has been duly passed by the holders of the Common Shares of the Company, the directors of the Company may in their discretion revoke this special resolution in whole or in part at any time prior to its being given effect without further notice to, or approval of, the holders of the Common Shares of the Company; and |

| | 4. | Subject to the directors determining to proceed with the Consolidation, any one director or officer of the Company is hereby directed and authorized to take all necessary actions, steps and proceedings and to execute, deliver and file any and all declarations, agreements, documents and other instruments and do all such other acts and things that may be necessary or desirable to give effect to this special resolution, including the filing of all necessary documents with regulatory authorities including the TSX.” |

Recommendation

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF THE SPECIAL RESOLUTION RELATED TO THE PROPOSED CONSOLIDATION OF OUR OUTSTANDING COMMON SHARES ON THE BASIS OF TWENTY (20) OLD COMMON SHARES FOR ONE (1) NEW COMMON SHARE.

The affirmative vote of not less than two-thirds of the votes properly cast at our annual meeting will be required to approve the Consolidation Resolution.

PROPOSAL 3

APPROVE PRIOR STOCK OPTION GRANTS AND AMENDMENTS TO STOCK OPTION PLAN

At our annual meeting, the shareholders will be asked to approve an ordinary resolution:

| | (a) | approving an amendment to the terms of our 2008 Stock Option Plan, or the Plan, to increase the maximum number of common shares which may be issued upon exercise of options granted under that Plan from 1,700,000 to 24,200,000; and |

| | (b) | approving the prior grant of a total of 10,645,034 options to acquire common shares under the Plan, which was approved by our board of directors on April 2, 2012 but made specifically subject to receipt of shareholder approval at our annual meeting. |

Prior Grant of Options

In early 2012, the Board of Directors assessed overall compensation levels for our officers, directors and employees and determined that it was appropriate to grant a total of 10,645,034 options to acquire common shares under the Plan. These options were all granted on April 2, 2012 with an exercise price of $0.11 per share and a term of 10 years. All such options were granted on condition that they could not be exercised until they were approved by shareholders at the Annual Meeting.

The options granted fall generally into 3 categories:

| | · | 3,333,333 options were issued to our chief executive officer, Peter Thompson, as additional compensation for his service after the resignation of our former Chief Executive Officer in August, 2011. These options all vest immediately upon issue. |

| | · | 400,000 options were issued to each member of our board of directors other than Peter Thompson (for a total of 2,000,000 options). These options all vest fully and will be exercisable on April 2, 2013. |

| | · | 5,311,701 options were issued to various of our officers and employees. These options vest as follows: |

| | (a) | 25% of such options will vest and be exercisable on April 2, 2013; and |

| | (b) | an additional 1/48th of such options will vest and be exercisable on the first day of each calendar month beginning in May, 2013 and continuing for 35 additional consecutive calendar months until all such options are fully vested. |

Increase to Maximum Number of Common Shares Issuable Under Plan

Under our existing Plan, the maximum number of common shares that may be issued upon exercise of options granted under that Plan is 1,700,000. Prior to the option grant described above, there were a total of 1,131,115 options to acquire common shares issued under the Plan. Accordingly, in order to permit the exercise of the additional options granted above and to give the Board of Directors flexibility to grant additional options in future years when the Board considers it to be in our best interests to do so, the Board is seeking approval to increase the maximum number of common shares issuable under the Plan from 1,700,000 to 24,200,000. If approved, the new maximum number of shares issuable under the Plan would represent approximately 15.6% of the number of common shares currently outstanding and approximately 9.8% of the number of common shares outstanding on a fully diluted basis.

At our annual meeting, or any adjournment thereof, shareholders will be asked to consider and if deemed appropriate, pass, with or without variation, the following resolution:

“BE IT RESOLVED THAT:

| | 5. | The prior grant of a total of 10,645,034 options to acquire common shares under the Response Biomedical Corporation, or the Company, 2008 Stock Option Plan, or the Plan, as described in the information circular for this annual meeting, is hereby ratified, confirmed and approved; |

| | 6. | An increase in the maximum number of common shares issuable upon exercise of options granted under the Plan from 1,700,000 to 24,200,000 is hereby approved; |

| | 7. | The directors are authorized to prepare and file with the Toronto Stock Exchange, or the TSX, an amended form of the Plan to reflect the new maximum number of common shares issuable thereunder; and |

| | 8. | Any one director or officer of the Company is hereby directed and authorized to take all necessary actions, steps and proceedings and to execute, deliver and file any and all declarations, agreements, documents and other instruments and do all such other acts and things that may be necessary or desirable to give effect to this resolution, including the filing of all necessary documents with regulatory authorities including the TSX.” |

Recommendation

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF THE FOREGOING RESOLUTIONS.

Summary of Terms of 2008 Stock Option Plan

Our 2008 Stock Option Plan, or the Plan, governs our issuance of stock options. The Plan was originally approved by shareholders at our 2008 Annual General Meeting.

Our board of directors has the sole discretion to grant options to any executives, employees and consultants, or the Eligible Individuals, on the terms set out in the Plan, provided no option may be granted to a consultant that is in the United States unless the consultant is a natural person providing bona fide services to us. As of the date of this information circular (and, therefore, including the options granted on April 2, 2012 described above), there are currently 160,939 options issued under the Plan (with a weighted average exercise price of $3.02) and 1,131,115 common shares reserved for issuance pursuant to the valid exercise of options issued under the Plan (not including any increase approved by shareholders at our annual meeting), being approximately 0.1% and 0.9% of the total number of outstanding common shares, respectively.

In any one-year period, our insiders may not receive, in aggregate, a number of options equal to more than 10% of the outstanding issue. In any one-year period, no Eligible Individual is entitled to receive a number of options equal to more than 5% of the outstanding issue.

Our board of directors sets the exercise price of an option in its sole discretion, subject to the requirement that the exercise price be no lower than market value. Market value is determined by the closing price of our common shares on our primary organized trading facility currently the Toronto Stock Exchange), or as determined to be fair value by our board of directors. Options granted under the Plan vest according to the vesting schedule of the respective option agreement, as determined by our board of directors, unless vesting is accelerated at the discretion of our board of directors. The expiry date of options may not be later than the tenth anniversary of the date the options were granted.

The option holder’s entitlement to options which are granted under the Plan but which remain unexercised ceases (either immediately or after a specified period of up to 6 months, depending on the reason for such individual’s departure) upon the Eligible Individual no longer holding office, or when the employment of the Eligible Individual is terminated for any reason, including resignation. Options are non-assignable, except in certain conditions related to death or disability.

The Plan may be amended as set out in the plan. We do not provide financial assistance to participants under the Plan.

PROPOSAL 4

APPOINTMENT OF AUDITORS

Since 1995, Ernst & Young has served as our auditors. This year, our board of directors, in conjunction with our audit committee, decided it was appropriate to institute a competitive bidding process to select a firm to be nominated as our auditor for 2012. The process involved reviewing the past performance of Ernst & Young LLP, or Ernst & Young, assessing our current needs and evaluating a total of five potential firms (including Ernst & Young). Following this review and evaluation, a process that included interviews and discussions with representatives from each candidate firm, our audit committee recommended, and our board of directors appointed, PricewaterhouseCoopers LLP, or PWC, as our independent registered public accounting firm for ratification by shareholders at our annual meeting.

Representatives of PWC will be present at our annual meeting and will be available to respond to appropriate questions from shareholders and to make a statement if they desire to do so. Representatives from Ernst & Young will not be present.

There have been no reportable events as defined in National Instrument 51-102 of the Canadian Securities Administrators between us and Ernst & Young. There have been no reservations contained in the reports of Ernst & Young on our annual financial statements for the last two fiscal years.

On May 2, 2012, the audit committee of our board of directors, or the Audit Committee, approved the dismissal of Ernst & Young as its certifying independent registered public accountant, subject to the completion of its quarterly review then in progress and the approval of the Company’s shareholders, which approval is required for a change of auditors under the laws of British Columbia, Canada. None of the reports of Ernst & Young on the financial statements of the Company for either of the past two fiscal years contained any adverse opinion or disclaimer of opinion, or was qualified or modified as to uncertainty, audit scope or accounting principles, except for a going concern paragraph in Ernst & Young’s report on our financial statements as of and for the years ended December 31, 2011 and 2010.

During the Company’s two most recent fiscal years and any subsequent interim periods preceding the date of the audit committee approved the dismissal of Ernst & Young, there were no disagreements with Ernst & Young on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreement(s), if not resolved to Ernst & Young’s satisfaction, would have caused them to refer to the subject matter of the disagreement(s) in connection with its report; and there were no “reportable events” as defined in Item 304(a)(1) of the Securities and Exchange Commission’s Regulation S-K.

On May 2, 2012, the Audit Committee approved the engagement of PwC as its independent registered public accounting firm for the fiscal year ended December 31, 2012, subject to the approval of the Company’s shareholders, which approval is required for a change of auditors under the laws of British Columbia, Canada.

During the two most recent years and any subsequent interim periods through the date of the approval of its engagement, neither the Company nor anyone engaged on its behalf has consulted with PwC regarding: (i) either the application of accounting principles to a specified transaction, either completed or proposed; or the type of audit opinion that might be rendered on the Company’s financial statements; or (ii) any matter that was either the subject of a disagreement (as defined in Item 304(a)(1)(iv) or (v) of Regulation S-K).

The Company has furnished Ernst & Young and PWC with a copy of the disclosures required by Item 304 of Regulation S-K and included in our Current Report on Forms 8-K filed May 3, 2012 and requested that Ernst & Young provide a letter addressed to the SEC stating whether or not they agree with the statements made herein and therein or stating the reasons in which they do not agree. The letter from Ernst & Young is included in Appendix B hereto and was filed with the Current Report on Form 8-K filed by the Company on May 3, 2012.

Set forth as Appendix B to this information circular are:

| | (a) | the text of our notice regarding the proposed change of independent registered public accounting firm, pursuant to National Instrument 51-102, to the applicable securities regulatory authorities in Canada, Ernst & Young and PWC; |

| | (b) | the text of letters from each of Ernst & Young and PWC addressed to the relevant securities regulatory authorities in Canada; and |

| | (c) | the text of the letter from Ernst & Young addressed to the SEC. |

At our annual meeting, the term of office of Ernst & Young LLP will come to an end and shareholders will be asked to consider and, if thought appropriate, approve the appointment of PricewaterhouseCoopers LLP as our auditors to hold office until our next annual general meeting at remuneration to be fixed by our board of directors. The affirmative vote of the holders of a majority of the shares of our common stock represented and voting at our annual meeting will be required to approve the appointment of PricewaterhouseCoopers LLP as auditors.

Principal Accounting Fees and Services

In connection with the audit of our 2011 financial statements, we entered into an engagement agreement with Ernst & Young LLP, which set forth the terms by which Ernst & Young has performed audit services for us.

The following table sets forth the aggregate fees agreed to by us for the annual and statutory audits for the years ended December 31, 2011 and 2010, and all other fees paid by us to Ernst & Young during 2011 and 2010:

| | | For the years ended December 31, | |

| | | | | | | |

Audit fees | | $ | 393,016 | (1) | | $ | 71,646 | |

Audit-related fees | | | — | | | | — | |

Tax fees | | | — | | | | — | |

All other fees | | | 60,210 | | | | — | |

Totals | | $ | 453,226 | | | $ | 71,646 | |

| (1) | Includes $132,944, which amount relates to the investigation and restatement of our 2010 audited financial statements. |

Audit Fee. Audit fees for the years ended December 31, 2011 and 2010 were for professional services provided in connection with the audit of our annual consolidated financial statements, review of our quarterly consolidated financial statements for the quarters ended June 30, 2011 and September 30, 2011, restatement of our financial statements for the year ended December 31, 2011, accounting matters directly related to the annual audits, and audit services provided in connection with other statutory or regulatory filings.

Audit Related Fees. There were no audit related fees for the year ended December 31, 2010.

Tax Fees. There were no tax fees incurred in the last two fiscal years.

All Other Fees. All other fees for the financial year ended December 31, 2011 were for professional services provided in the French translations of our audited financial statements for the year ended December 31, 2010 and our unaudited financial statements for the quarters ended June 30, 2011 and September 30, 2011 together with the notes and related management’s discussion and analysis in connection with our rights offering.

All audit fees relating to the audit for the financial year ended December 31, 2011, were approved in advance, or were ratified, by our audit committee. All audit and non-audit services to be provided by Ernst & Young LLP were, and will continue to be, pre-approved by our audit committee.

Audit Committee Policy Regarding Pre-Approval of Audit and Permissible Non-Audit Services of Our Independent Auditors

Our Audit Committee has established a policy that requires that all audit and permissible non-audit services provided by our independent auditors will be pre-approved by the Audit Committee. These services may include audit services, audit-related services, tax services and other services. The Audit Committee considers whether the provision of each non-audit service is compatible with maintaining the independence of our auditors. Pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. Our independent auditors and management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent auditors in accordance with this pre-approval, and the fees for the services performed to date.

Recommendation

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPOINTMENT OF PWC AS OUR AUDITORS TO HOLD OFFICE UNTIL OUR NEXT ANNUAL GENERAL MEETING.

Report of the Audit Committee

The following is the report of the audit committee with respect to the Company’s audited financial statements for the year ended December 31, 2011.

The purpose of the audit committee is to assist the Company’s board of directors in its general oversight of the financial reporting, internal controls and audit functions. The Audit Committee Charter describes in greater detail the full responsibilities of our audit committee and is available on our website at www.responsebio.com. All of the members of the audit committee are independent directors under the TSX and SEC audit committee structure and membership requirements.

The audit committee has reviewed and discussed the consolidated financial statements with management and Ernst & Young LLP, or Ernst & Young, the Company’s independent registered public accounting firm for the year ended December 31, 2011. Management is responsible for the preparation, presentation and integrity of our financial statements, accounting and financial reporting principles; establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rule 13a-15(e)); establishing and maintaining internal control over financial reporting (as defined in Exchange Act Rule 13A-15(f)); evaluating the effectiveness of disclosure controls and procedures; evaluating the effectiveness of internal control over financial reporting; and evaluating any change in internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, internal control over financial reporting. Ernst & Young is responsible for performing an independent audit of the consolidated financial statements and expressing an opinion on the conformity of those financial statements with generally accepted accounting principles in the United States of America.

Beginning in fiscal 2004 and continuing through fiscal 2011, management has implemented a process of documenting, testing and evaluating the Company’s internal control over financial reporting in accordance with the requirements of the Sarbanes-Oxley Act of 2002. The audit committee is kept apprised of the progress of the evaluation and provides oversight and advice to management regarding such compliance. In connection with this oversight, the audit committee receives periodic updates provided by management at each regularly scheduled audit committee meeting. At a minimum, these updates occur quarterly. At the conclusion of the process, management provides the audit committee with a report on the effectiveness of the Company’s internal control over financial reporting which is reviewed and commented upon by the audit committee. The audit committee also holds regular private sessions with Ernst & Young to discuss their audit plan for the year, and the results of their quarterly reviews and the annual audit. The audit committee also reviewed Ernst & Young’s Report of Independent Registered Public Accounting Firm included in the Company’s Annual Report on Form 10-K related to our consolidated financial statements and financial statement schedules. The audit committee continues to oversee the Company’s efforts and reviewed management’s report on the effectiveness of its internal control over financial reporting and management’s preparations for the evaluation.