May 18, 2012

Via EDGAR & Overnight Delivery

U.S. Securities and Exchange Commission

Division of Corporate Finance

100 F Street, NE

Washington, DC 20549

| | Re: | Response Biomedical Corporation |

Schedule 14A

Filed May 3, 2012

File No. 000-50571

Ladies and Gentleman:

Response Biomedical Corporation, or the Company, provides this response to the comments of the staff (“Staff”) of the United States Securities and Exchange Commission (the “Commission”) to the filing of the above-referenced Schedule 14A (the “Preliminary Proxy Statement”), which were furnished by your letter dated May 16, 2012 (the “Staff Letter”). In response to the Staff’s comments, we have reproduced below the comments set forth in the Staff Letter and followed each comment with our response. The numbered paragraphs of this letter set forth below correspond to the numbered paragraphs of the Staff Letter. References to “we”, “our” or “us” mean the Company or its advisors as the context may require.

Schedule 14A

Proposal 3 Approve Prior Stock Option Grants and Amendments to Stock Option Plan, page 18

| | 1. | Your resolution asks shareholders to ratify and approve the prior grant of 10.6 million options and approve an increase in the number of shares issuable under your 2008 Stock Option Plan. These appear to be related but separate matters. Please advise us how you considered Rules 14A-4(a)(3) and (b)(1) with respect to your proposal or revise. |

The Company respectfully acknowledges the Staff’s comment and has revised the Preliminary Proxy Statement accordingly.

| | 2. | Please provide a complete description of all material features of your Plan, as amended. See Item 10(a)(1) of Schedule 14A. For guidance on the staff’s view, please consider Manual of Publicly Available Telephone Interpretations No. 25 available at http://222.sec.gov/interps/telephone/cftelinterps_proxrules-sch14a.pdf. |

1781 – 75th Avenue W., Vancouver, BC V6P 6P2

www.responsebio.com

U.S. Securities and Exchange Commission

May 18, 2012

Page 2

The Company respectfully acknowledges the Staff’s comment and has revised the Preliminary Proxy Statement accordingly.

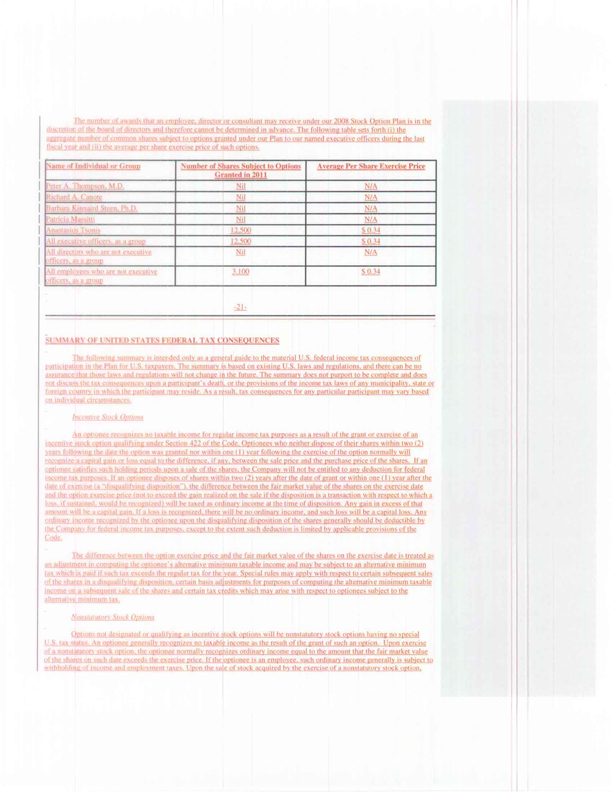

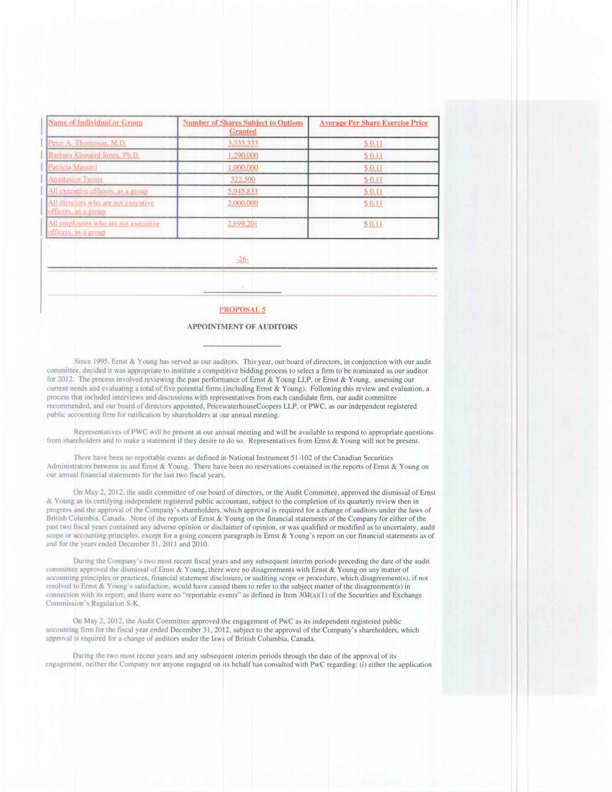

| | 3. | Please provide the table required by Item 10(a)(2)(i) of Schedule 14A. For guidance on the staff’s view, please consider Manual of Publicly Available Telephone Interpretations No. 28. |

The Company respectfully acknowledges the Staff’s comment and has revised the Preliminary Proxy Statement accordingly.

| | 4. | Please provide the disclosure requested by Item 10(b)(2)(i) and (ii) of Schedule 14A. For guidance on the staff’s view, please consider Manual of Publicly Available Telephone Interpretations Nos. 36 and 40. |

The Company respectfully acknowledges the Staff’s comment and has revised the Preliminary Proxy Statement accordingly.

| | 5. | Please include a copy of your revised plan as an appendix to your proxy. See Instruction 3 to Item 10 of Schedule 14A. |

The Company respectfully acknowledges the Staff’s comment and has revised the Preliminary Proxy Statement accordingly.

* * *

The Company acknowledges that it is responsible for the adequacy and accuracy of the disclosure in the filing and that staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing. The Company further acknowledges that it may not assert staff comments as a defense in any proceedings initiated by the Commission or any person under the federal securities laws of the United States.

Please contact me at (604) 456-6027 if you have any questions regarding this letter.

| | Sincerely,

/s/ Richard A. Canote Richard A. Canote Chief Financial Officer |

| | |

| | |

Enclosures

1781 – 75th Avenue W., Vancouver, BC V6P 6P2

www.responsebio.com

U.S. Securities and Exchange Commission

May 18, 2012

Page 3

| cc: | Jay Williamson, Securities Exchange Commission (w/ enclosures) |

| | Jim Lopez, Securities Exchange Commission (w/ enclosures) |

| | Peter Thompson (w/o enclosures)Rich Canote (w/o enclosures) Scott Watkinson, Wilson Sonsini Goodrich & Rosati P.C. (w/o enclosures) Anthony Mauriello, Wilson Sonsini Goodrich & Rosati P.C. (w/o enclosures) Warren Learmonth, Borden Ladner Gervais LLP (w/o enclosures) |

1781 – 75th Avenue W., Vancouver, BC V6P 6P2

www.responsebio.com

Securities and Exchange Commission

May 18, 2012

Supplemental Page 1

Oral Comment

In response to an oral comment received from the Staff the Company has revised page 24 of the Preliminary Proxy Statement to disclose the market value of the securities underlying the options as of a recent practicable date, specifically the closing price of the Company’s common stock on the Toronto Stock Exchange on May 17, 2012 of $0.10 per share, or $1,064,503.40 in the aggregate for all options subject to approval pursuant to the applicable resolution.