SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549

|

| FORM 10-K |

| (Mark One) |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended December 31, 2012 |

| | Or |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from _________________ to _______________________ |

Commission file number: 000-50571 |

| RESPONSE BIOMEDICAL CORP. |

| (Exact name of registrant as specified in its charter) |

| Vancouver, British Columbia, Canada | 98 -1042523 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

1781 - 75th Avenue W. Vancouver, British Columbia, Canada | V6P 6P2 |

| (Address of principal executive offices) | (Zip Code)) |

Registrant's telephone number, including area code: (604) 456-6010 |

Securities registered pursuant to Section 12(b) of the Act: NONE Securities registered pursuant to Section 12(g) of the Act: COMMON STOCK WITHOUT PAR VALUE |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x |

| Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. |

Large accelerated filer o | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company x |

Indicate by check mark if the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x |

| The aggregate market value of the voting common stock held by non-affiliates of the Registrant (assuming officers, directors and 10% stockholders are affiliates), based on the last sale price for such stock on June 30, 2012: $2,777,110. The Registrant has no non-voting common stock. |

| As of February 28, 2013, there were 6,497,149 shares of the Registrant's common stock outstanding. |

| DOCUMENTS INCORPORATED BY REFERENCE |

Portions of the Registrant's Proxy Statement for the 2013 Annual and Special Meeting of Stockholders of the Registrant to be held on June 18, 2013 are incorporated by reference into Part III of this Form 10-K. The Registrant makes available free of charge on or through its website (http://www.responsebio.com) its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934. The material is made available through the Registrant's website as soon as reasonably practicable after the material is electronically filed with or furnished to the U.S. Securities and Exchange Commission, or SEC. All of the Registrant's filings may be read or copied at the SEC's Public Reference Room at 100 F Street, N.E., Room 1580, Washington D.C. 20549. Information on the hours of operation of the SEC's Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. The SEC maintains a website (http://www.sec.gov) that contains reports and proxy and information statements of issuers that file electronically. |

| |

RESPONSE BIOMEDICAL CORP.

Form 10-K – ANNUAL REPORT

For the Fiscal Year Ended December 31, 2012

Table of Contents

| | Page |

| | |

| PART I |

| Item 1. | Business | 2 |

| Item 1A. | Risk Factors | 19 |

| Item 2. | Properties | 33 |

| Item 3. | Legal Proceedings | 33 |

| Item 4. | Mine Safety Disclosures | 33 |

| |

| PART II |

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 34 |

| Item 6. | Selected Financial Data | 35 |

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 36 |

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | 46 |

| Item 8. | Financial Statements and Supplementary Data | 48 |

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 76 |

| Item 9A. | Controls and Procedures | 76 |

| Item 9B. | Other Information | 77 |

| |

| PART III |

| Item 10. | Directors, Executive Officers and Corporate Governance | 77 |

| Item 11. | Executive Compensation | 86 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 90 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 92 |

| Item 14. | Principal Accountant Fees and Services | 93 |

| |

| PART IV |

| Item 15. | Exhibits and Financial Statement Schedules | 95 |

PART I

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements relating to future events and our future performance within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In some cases, you can identify forward-looking statements by terms such as "may", "will", "should", "could", "would", "hope", "expects", "plans", "intends", "anticipates", "believes", "estimates", "projects", "predicts", "potential" and similar expressions intended to identify forward-looking statements. These forward-looking statements include, without limitation, statements relating to future events, future results, and future economic conditions in general and statements about:

| | · | Our future strategy, structure, and business prospect; |

| | · | The development of new products, regulatory approvals of new and existing products and the expansion of the market for our current products; |

| | · | Implementing aspects of our business plan and strategies; |

| | · | Our ability to attain and maintain profitability; |

| | · | Our financing goals and plans; |

| | · | Our existing working capital and cash flows and whether and how long these funds will be sufficient to fund our operations; and |

| | · | Our raising of additional capital through future equity and debt financings. |

These statements involve known and unknown risks, uncertainties and other factors, including the risks described in Part I, Item 1A. of this Annual Report on Form 10-K, which may cause our actual results, performance or achievements to be materially different from any future results, performances, time frames or achievements expressed or implied by the forward-looking statements. Given these risks, uncertainties and other factors, you should not place undue reliance on these forward-looking statements. Information regarding market and industry statistics contained in this Annual Report on Form 10-K is included based on information available to us that we believe is accurate. It is generally based on academic and other publications that are not produced for purposes of securities offerings or economic analysis. We have not reviewed or included data from all sources and cannot assure you of the accuracy of the market and industry data we have included.

Corporate Information

ITEM 1. Business

General

Response Biomedical Corp. (“Response,” “Company,” “us,” “we” or “our”) develops, manufactures and markets rapid on-site diagnostic tests for use with our RAMP® platform for clinical and environmental applications. RAMP® represents a paradigm in diagnostics that provides high sensitivity and reliable information in minutes. It is ideally suited to both point of care testing and laboratory use. Response was incorporated in British Columbia in August 1980. Our principal offices are located at 1781 – 75th Avenue West, Vancouver, British Columbia, Canada. Our common stock is traded on the Toronto Stock Exchange (TSX) under the trading symbol “RBM” and quoted on the OTC markets under the symbol “RPBIF”. Our results by segment are included in our financial statements, which are included under Item 8 to this Annual Report on Form 10-K.

Our Technology – The RAMP® System

Our RAMP® system is a proprietary platform technology that combines a sensitive fluorescence detection system with simple lateral flow immunoassays. Although lateral flow immunoassay technology has been available for over 25 years, the market for early generation rapid immunoassays has been limited by their inability to provide the accurate, quantitative results required by the majority of test situations.

RAMP® maintains the key positive attributes of lateral flow immunoassays - simplicity, specificity, reliability and rapid results, while adding a unique, patented feature that can improve test performance versus other companies’ traditional lateral flow systems. Specifically, in addition to analyzing a traditional “detection zone” in its tests, the RAMP® system also has a second “control zone”. By introducing a second population of known antibodies into the “control zone” that are impacted by the same conditions as the test antibodies in the typical lateral flow technology’s “detection zone”, the ratio of a measurement of the signal from the two sets of antibodies effectively factors out uncontrolled variability, thereby providing an accurate result. This ratio is unique to our test system. Furthermore, the use of a fluorescent label in the cartridge combined with a custom optical scanner in the RAMP® Reader or RAMP® 200 Reader (“Reader”), results in a reliable and sensitive detection system. Our RAMP® System has demonstrated its capability to detect and quantify a wide variety of analytes with sensitivity and accuracy comparable to centralized lab systems, including testing multiple analytes simultaneously.

A large menu of tests can be run on our proprietary RAMP® system, namely:

Cardiovascular Tests

Environmental Test

Biodefense Tests

Infectious Disease Tests

| | - | Respiratory syncytial virus (RSV) |

Minimal training is required to use our RAMP® System. A test is performed by adding a sample (e.g., blood, nasal or sinus mucus, saliva, water or unknown powders) containing the analyte of interest (e.g., Myoglobin, anthrax spores, etc.) mixed with a proprietary buffer and labeled antibodies to the sample well of a test cartridge. The cartridge is then inserted into the Reader, which scans the test strip and provides the result in 20 minutes or less, depending on the assay. In the absence of rapid on-site and point-of-care (POC) test results like our RAMP® test, health care providers and first responders may be forced to wait up two (2) or more hours for a confirmatory result from a government- or hospital-run lab.

Our RAMP® system consists of a reader and single-use disposable test cartridges, and has the potential to be adapted to more than 250 other medical and non-medical tests currently performed in laboratories.

Our Products

Medical Laboratory and Point-of-Care (POC) Clinical Diagnostics

Cardiovascular Testing

A major focus of our development programs in cardiovascular testing has been clinical tests for the quantification of cardiovascular markers. Cardiovascular markers are biochemical substances that are released by the body after it has been damaged or stressed. We have tests for elevated levels of the markers associated with three important health conditions: acute myocardial infarction (heart attack), congestive heart failure or thrombotic disease.

| | 1. | Acute myocardial infarction (i.e. heart attack) markers |

Response sells tests that detect three of the primary markers for the detection of an acute myocardial infarction: Myoglobin, CK-MB and Troponin I.

| | 2. | Congestive Heart Failure (CHF) markers |

Response sells tests to detect the two primary markers for congestive heart failure, B-type natriuretic peptide (BNP) and NT-proBNP. Response’s NT-proBNP test is marketed in various countries by our international distributor network with the exception of Japan, where BNP is sold solely.

| | 3. | Thrombotic disease markers |

Response sells tests to detect D-dimer, one of the most prescribed markers for deep venous thrombosis (DVT), pulmonary embolism (PE) or disseminated intravascular coagulation (DIC).

Acute Myocardial Infarction (Heart Attack) Testing

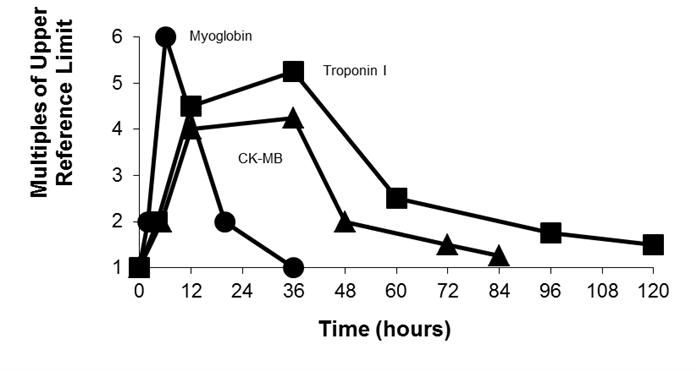

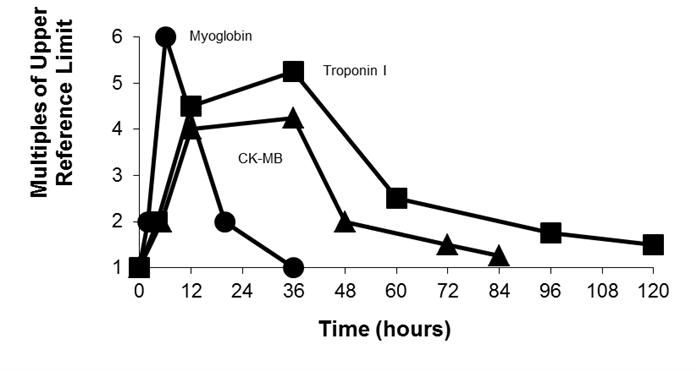

Serial measurement of biochemical markers is now universally accepted as an important determinant in the diagnosis of an acute myocardial infarction (AMI). The ideal AMI marker is one that has high clinical sensitivity and specificity, appears soon after the onset of a heart attack, remains elevated for several days following a heart attack and can be assayed with a rapid turnaround time.1 Today, there is no single marker that meets all of these criteria, thus necessitating the need to test for multiple cardiac markers. The biochemical markers that are commonly used by physicians to aid in the diagnosis of a heart attack are Myoglobin, CK-MB, Troponin I and Troponin T. We sell tests to detect these markers. As seen in the figure below, cardiac markers follow a specific, predictable pattern of release kinetics following an acute coronary event. The differences in the time for each marker to reach its peak concentration has made it common practice for clinicians to make use of at least two different markers in tandem, an early marker such as Myoglobin and a later one such as Troponin I. International guidelines recommend the use of serial Troponin assays for definitive diagnosis of heart attacks.

1 Adams JE, III, Clin Chem Acta, 1999.

Release of Cardiac Markers into the Bloodstream Following a Heart Attack2

The turn-around times (TAT) for results from a hospital lab can vary from as little as thirty minutes to more than two hours due to the necessity of test ordering and specimen collection, specimen transport, sample preparation, test completion and reporting. In rural settings and physicians’ offices, the TAT can be many hours or even days. Evidence-based clinical practice guidelines recommend that the results from cardiac marker testing be available within 60 minutes of patient presentation and ideally within thirty minutes. POC testing with products such as our RAMP® system could provide doctors with the information they need to diagnose and treat heart attack patients in a much shorter timeframe (e.g. less than 20 minutes from blood draw to result). In most cases, this is more likely to be within the critical window of time to minimize irreversible heart damage or death. Our RAMP® System is expected to aid in the diagnosis of heart attack by enabling physicians to easily and frequently monitor changes in the levels of a patient’s AMI cardiac markers. Early access to this information enables physicians to use accelerated care protocols, which are intended to drive earlier and better treatment decisions. According to statistics published by the U.S. Centers for Disease Control and Prevention (CDC) approximately 7 million people visit U.S. hospital emergency departments each year with complaints of chest pain, a primary symptom of heart attack.3

Congestive Heart Failure (CHF) testing

Congestive heart failure (CHF) is a chronic, progressive disease in which the heart muscle weakens overall and the left ventricle becomes distended, thus impeding the heart's ability to pump enough blood to support the body's metabolic demands. CHF is the only cardiovascular disorder to show a marked increase in incidence in the past 40 years and it is expected to continue rising due in part to the aging population and better survival prospects of patients with other cardiovascular diseases.4 Many patients hospitalized with CHF will need to be repeatedly hospitalized due to their hearts’ continued functional degradation over time.

Previous methods for the diagnosis and assessment of CHF, which include physical examinations and chest x-rays, are not usually conclusive, making accurate diagnoses difficult. We sell tests to detect the two primary markers for congestive heart failure, B-type natriuretic peptide (BNP) and NT-proBNP. The introduction of testing for the BNP and NT-proBNP markers of the disease dramatically changed the ability of physicians to make qualified diagnoses and to more effectively monitor the success of their treatment plans because the levels of the BNP and NT-proBNP markers are elevated in the blood whenever the heart is forced to work harder. BNP and NT-proBNP tests have proven to be more accurate than any other single physical or laboratory gauge of heart failure.5 Both BNP and NT-proBNP are fragments of proBNP, a neurohormone that is released by the heart in response to increased blood pressure and volume overload causing stretching of the ventricular muscle of the heart during heart failure. Both of these markers are elevated in the blood during heart failure and are sensitive and specific indicators of congestive heart failure.

2 Wu AHB, Introduction to Coronary Artery Disease (CAD) and Biochemical Markers, 1998.

3 National Hospital Ambulatory Medical Care Survey: 2009 Emergency Department Summary Tables

4 McCullough, PA, Nowak, RM, McCord J, et al. B-type natriuretic peptide and clinical judgment in emergency diagnosis of heart failure. Clin Inv Rep. 2002;106:416-422.

5 http://www.stjohnsmercy.org/healthinfo/newsletters/heart/Aug02.asp

Thrombotic Disease testing

D-dimer is considered to be a marker of blood clotting and therefore D-dimer is present in the circulation as part of the normal wound healing process, but it is also valuable as a diagnostic marker for a spectrum of diseases where a clot has formed in blood vessels in other areas of the body such as Disseminated Intravascular Coagulation (DIC), Venous Thromboembolism (VTE), Deep Vein Thrombosis (DVT) and Pulmonary Embolism (PE). We sell a test to detect this marker.

Blood D-dimer levels are elevated in a number of additional disease states including malignant neoplasm, myocardial infarction, trauma, recent surgery, and hepatic insufficiency.6 This limits the test’s specificity for any one given disease, preventing it from becoming a screening test for the presence of PE and DVT. A negative test, however, has been found to have a high negative predictive value and is clinically useful as a predictor of the absence of both DVT and PE. Also, in situations when the patient presents at a time when the full range of diagnostic tests is not available, a negative D-dimer test may allow the patient to be discharged until further tests can be completed, avoiding hospital admission.

Greater than 2 million people in the US develop DVT each year. D-dimer testing can reduce length of stay and the rate of admission and discharge to the Emergency Room. D-dimer may improve medical outcome.7

Infectious Disease Testing

Flu A + B

Influenza (Flu) viruses cause seasonal epidemics associated with high morbidity and mortality, especially affecting those with underlying medical conditions and the elderly.8 Influenza is characterized by a rapid start of high fever, chills, myalgia, headache, sore throat and cough. However, even during periods of a large outbreak, clinical diagnosis can be difficult due to the possibility of other respiratory viruses.9 The rapid and accurate diagnosis of Influenza is important for determining appropriate treatment strategies and to minimize the unnecessary use of antibiotics.10 The laboratory diagnosis of Influenza infections is based on detection of the Influenza virus directly, isolation of the virus in a cell culture or the detection of nucleic acid by a polymerase chain reaction, each of which can take several hours to days before results become available.

6Arch Pathol Lab Med. 1993. 117(10): 977-80

7Point of Care Diagnositic Testing World Market, Trimark Publications April 2013.

8 Nicholson KG, Wood JM, Zambon M (2003) Influenza. Lancet 362:1733– 1745.

9http://www.cdc.gov/flu/about/qa/disease.htm.

10 http://www.cdc.gov/flu/professionals/treatment/0506antiviralguide.htm.

Seasonal influenza (Flu) is a highly variable, contagious and potentially life-threatening viral respiratory infection. Flu can lead to severe complications and results in approximately 3,000 - 49,000 seasonal influenza-related deaths in the United States each year11. With the recent development of different treatments for Influenza A and B and the need to begin therapy within the first 48 hours of infection12, the demand for rapid and accurate Influenza tests has grown. Being able to rapidly identify patients with Influenza in the clinic or hospital allows sites to reduce infections occurring in hospitals and reduces the amount of unnecessary or incorrect treatment and administration. We sell a test to detect Influenza A and B.

Respiratory Syncytial Virus (RSV)

Respiratory syncytial virus (RSV) is a respiratory virus that infects the lungs and breathing passages. Most otherwise healthy people recover from an RSV infection in 1- 2 weeks. RSV is a virus that infects virtually all children by the age of two. RSV in the United States is responsible for thousands of hospitalizations annually among children younger than one year. It is believed to be the most common viral cause of death in children younger than five years and, in particular, children younger than one year. In the first two years of life, virtually all children are infected with the virus at some point.13 In fact, RSV is the most common cause of bronchiolitis (inflammation of the small airways in the lung) and pneumonia in children under one year of age in the United States. In addition, RSV is more often being recognized as an important cause of respiratory illness in older adults.14 We sell a test to detect RSV.

On- Site Environmental Testing

Environmental tests are generally considered to be products and services used to detect and quantify substances and microbes in the environment that may have potentially harmful effects in humans. We participate in two distinct areas of the environmental market. The first is biodefense, where our RAMP® products are used for the detection and identification of threatening biological agents. The second is the vector environmental testing market, where a RAMP® product is used to test samples from mosquito pools for West Nile Virus to monitor the threat to humans.

Biodefense Testing

We have developed and are selling RAMP® tests for the rapid detection and identification of anthrax, ricin, botulinum toxin and orthopox viruses (including smallpox). The target market for our RAMP® Biodefense tests is primarily public safety institutions, or first responders, such as fire and police departments, military installations, emergency response teams and hazardous materials (HAZMAT) units. Government agencies and corporations that handle mail are also candidates for on-site anthrax tests. The rapid detection and identification of biological agents is an important capability affecting the management of a bioterrorism event, forming the basis of emergency response, medical treatment and consequence management. In addition, the rapid identification of biological agents facilitates the quick dismissal of hoaxes and panic-based reports, thereby reducing the logistical burden on first responders who have to maintain a higher level of ongoing preparedness when facing a likely real biodefense threat. In the aftermath of the terrorist attacks on September 11, 2001, there was an increased desire to be prepared for potential terrorist attacks, particularly on the part of the U.S. government, as evidenced by numerous initiatives, including the creation of the U.S. Department of Homeland Security (DHS). The first priority of the DHS is to protect the United States against further terrorist attacks. Component agencies analyze threats and intelligence, guard borders and airports, protect critical infrastructure and coordinate the response of the U.S. to future emergencies.

Following the use of anthrax as a weapon for terrorist attacks in the United States in October 2001, we saw an opportunity to adapt our RAMP® technology for the rapid detection and identification of agents used in acts of bioterrorism and initiated development of a test for the rapid, on-site detection of Bacillus anthracis, the causative agent for anthrax, referred to as the Anthrax Test. Development of the Anthrax Test was substantially completed in April 2002 following successful initial validation by the Maryland State Department of Health where testing confirmed that our RAMP® Anthrax Test could reliably detect anthrax spores at levels lower than an infectious dose of 10,000 spores. These results were supported by further independent testing conducted by Defense Research and Development Canada in Suffield. Response’s Anthrax Test was launched commercially in May 2002. In September 2006, our RAMP® Anthrax Test was the first biodetection technology approved for field use by first responders in the United States for the detection of anthrax in an independent testing program conducted by the Association of Analytical Communities (AOAC) and sponsored by the U.S. Department of Homeland Security. Since the commercial launch of Response’s Anthrax Test in May 2002, we have commercialized tests for ricin, botulinum toxin and orthopox (including smallpox), three other priority, bio-threat agents. Commercial sales of the ricin test and the botulinum toxin test commenced in November 2002 and the orthopox test was launched in May 2003.

11 CDC. http:www.cdc.gov/flu/about/disease/us_flu-related_deaths.htm (MMWR 2010; 52(33): 1057-1062)

12 http://www.cdc.gov/flu/keyfacts.htm.

13 CDC. http:www.cdc.gov/RSV

14 Centers for Disease Control & Prevention – http://www.cdc.gov/RSV/

Vector Environmental Testing

West Nile Virus (WNV) is an arbovirus that can cause a fatal neurological disease in humans and is commonly found in North America, Europe, Africa, the Middle East, and West Asia. Since first being detected in the United States in 1999, the virus has spread and is now widely established in North and Central America, from Canada to Venezuela. In the United States alone, the CDC has reported 5,387 total human WNV disease cases and a total of 243 deaths. The virus is mainly transmitted to people through the bites of infected mosquitoes, thus mosquito surveillance programs for WNV have been successfully implemented in the USA to monitor and mitigate the spread of the virus.

In North America, WNV prevalence is dependent on climate and has a specific season, beginning in May and ending in September, when the temperature and the mosquito population drop. We sell a test to detect WNV in the environment.

Our Markets

We develop, manufacture and sell our RAMP® system for the global medical point of care market including cardiovascular testing, infectious disease testing market and the on-site environmental testing market including biodefense and vector environmental testing.

Cardiovascular Testing Markets

Our RAMP® cardiovascular tests are intended for use primarily in hospital emergency rooms, laboratories and walk-in clinics around the world. We have obtained clearance to market these tests in the U.S., Canada, the European Union, China and other regulated jurisdictions around the world. RAMP® Cardiovascular testing products represent over 90% of our sales around the world.

In China, we sell our RAMP® and RAMP®200 readers, as well as our Myoglobin, CK-MB, Troponin I and NT-proBNP tests to O&D Biotech Co., Ltd. (O&D), which then co-brands our tests with the O&D brand name(s), logo(s) and registered trademark(s). O&D has an exclusive agreement with us to distribute our products under co-branded name(s) throughout China, except in the Hong Kong Special Administrative Region and the Macau Special Administrative Region.

Also in China, we sell our RAMP® and RAMP® 200 readers, as well as our Myoglobin, CK-MB, Troponin I and NT-proBNP tests to Wondfo Biotech Co. Ltd (Wondfo), who then re-brands our readers and tests under its Wondfo brand name(s), logo(s) and registered trademark(s). Wondfo has an exclusive agreement with us to distribute our products under Wondfo’s brand name(s) throughout China.

In Japan, our distributor, Shionogi & Co., Ltd. (Shionogi), sells a rapid quantitative test for BNP under its own brand name.

In the United States, we sell our RAMP® reader, as well as our Myoglobin, CK-MB, Troponin I and NT-proBNP tests to Laboratory Supply Company, Inc. (LABSCO), which then distributes our RAMP-branded readers and tests directly to end-users, nationwide. In addition to the above, we have agreements with regional distributors that sell our RAMP® cardiovascular products in various countries in Asia, Latin America, Europe, the Middle East and Africa.

Infectious Disease Testing Markets

Flu A + B and RSV

In the United States, we sell our RAMP® 200 reader, as well as our Flu A + B and RSV tests to Fisher HealthCare, which then distributes these RAMP-branded readers and tests directly to end-users, nationwide. These tests provide hospitals with reliable and objective electronic results in approximately 15 minutes.

For our Flu tests, we were granted a Special 510(k) clearance by the U.S. Food and Drug Administration, or FDA, for an update to our RAMP® Flu A + B Assay Package Insert to include analytical reactivity information for a strain of the 2009 H1N1 virus cultured from positive respiratory specimens. Although our RAMP® Flu A + B Assay has been shown to detect the 2009 influenza A (H1N1) virus in cultured isolates, the performance characteristics of this device with clinical specimens that are positive for the 2009 influenza A (H1N1) virus have not been established. Our RAMP® Flu A + B Assay can distinguish between influenza A and B viruses, but it cannot differentiate influenza subtypes.

On-Site Environmental Testing Markets

Environmental tests are generally considered to be products and services used to detect and quantify substances and microbes in the environment that have potentially harmful effects to humans. We participate in two distinct areas of the environmental market. The first is biodefense, where our RAMP® tests are used for the detection and identification of threatening biological agents. The second is the vector environmental testing market, where our RAMP® tests are used to test samples from mosquito pools for West Nile Virus to monitor the threat of the disease to humans.

Biodefense Testing Markets

We market and sell our biodefense products through a network of regional distributors in the United States, and country-specific national distributors in certain other countries. These efforts are supplemented by direct sales in some geographical territories. Since October 2002, our RAMP® biodefense systems have been sold in Canada, the United States, Saipan, Guam, Japan, Italy, Australia, Ireland, Israel, Korea, China, Singapore and the United Arab Emirates. Our customers include UNMOVIC, the United States Air Force, the United States Army, Canadian Department of Defense, Health Canada, and the Royal Canadian Mounted Police. Our RAMP® Systems are being used in many major U.S. markets including Chicago, Orlando, Philadelphia, Los Angeles, West Palm Beach, Atlanta, and Houston.

Vector Environmental Testing Markets

The market for our West Nile Virus (WNV) Test is comprised of the following end users: state public health/veterinary labs, mosquito control districts and universities. It is estimated that approximately 279,000 tests are performed throughout North America each year to screen for West Nile Virus. On December 1, 2003, we entered into a sole distribution agreement with ADAPCO Inc., the largest distributor of mosquito control products in the United States.

Key Sales and Distribution Agreements

O&D Biotech, LTD. China (O&D)

In February 2011, we signed an agreement with O&D, amended May 2012, that replaces an earlier agreement signed in April 2007, as the exclusive distributor of RAMP® co-branded cardiovascular products in the People’s Republic of China, exclusive of Hong Kong and the Macau Special Administrative Region. Under the agreement, O&D is subject to certain minimum purchase levels. In the event O&D does not meet those levels, we have the option to terminate the agreement.

Wondfo Biotech Co., Ltd (Wondfo)

In December 2009, we signed a private label original equipment manufacturer (OEM) agreement with Wondfo which names Wondfo as the exclusive distributor for the marketing and sale of their private label OEM cardiac testing products in the People’s Republic of China, excluding Hong Kong and Macau Special Administrative Region. This agreement is subject to certain minimum purchase requirements by Wondfo. Should they fail to meet the minimum purchase requirements under the agreement, we may at our discretion either convert this to a non-exclusive OEM agreement or immediately terminate the agreement.

Shionogi & Co., Ltd. (Shionogi)

In May 2006, we signed an agreement with Shionogi, amended August 2012, to market and sell our BNP tests in Japan. Under the terms of the agreement, we agreed to become the exclusive manufacturer of BNP tests on an OEM basis. The agreement is subject to minimum purchase levels by Shionogi. In the event Shionogi fails to meet these minimum purchase levels, it is required to pay us a percentage of the unit price for each unit that represents the shortfall. The agreement may be terminated by either party with twelve months notice, should either party be in breach under the terms of the agreement, or under certain other conditions.

3M Company and 3M Innovative Properties Company (3M)

In September 2012, we regained the worldwide rights to our Flu A + B and RSV testing products as a result of the termination of our collaboration with 3M including agreements for the joint development, supply, and distribution of our RAMP®-based products.

Thermo Fisher Scientific L.L.C. (Fisher)

In January 2013, we announced that we entered into a nonexclusive distribution agreement with Fisher HealthCare, a subsidiary of Fisher, to distribute our Infectious Disease portfolio of our RAMP® products in the United States.

Fisher will market our Infectious Disease Point of Care (POC) test panel, which currently includes the RAMP® Flu A + B test and the RAMP® RSV test, on the RAMP® 200.

Laboratory Supply Company, Inc. (LABSCO)

In January 2013, we entered into a distribution agreement with LABSCO, with principal offices in Louisville, KY, USA, a leading distributor of innovative diagnostic technologies and laboratory products to hospitals, physician office laboratories and alternate healthcare settings, to distribute our cardiovascular portfolio of RAMP® products in the United States exclusively to hospitals with less than 150 beds.

The distribution agreement was entered into between our newly formed, wholly owned United States subsidiary, Response Point of Care Inc., and LABSCO for an initial term of three years and is renewable annually thereafter upon mutual agreement. LABSCO will initially market our cardiovascular POC test panels on our RAMP® Reader in all settings and on our RAMP® 200 reader in laboratory settings.

ADAPCO, Inc. (ADAPCO)

In April 2008, we entered into a distribution agreement with ADAPCO, which replaced an earlier agreement signed in March 2006. The initial term of the agreement was for one year, and is automatically renewed on an annual basis. This agreement appoints ADAPCO as the exclusive distributor of our tests and readers for detection of West Nile Virus in the United States; however the agreement also gives us the right to sell these products directly.

Roche Diagnostics GmbH and Roche Diagnostics Ltd.

In July 2005, we secured a license from Roche Diagnostics GmbH to develop, manufacture and sell NT pro-BNP tests in markets where we do not also sell our BNP tests.

In June 2008, we entered into a sales and distribution agreement with Roche Diagnostics. That agreement granted Roche Diagnostics the rights to market our line of cardiovascular POC tests worldwide with the exception of in Japan. This agreement was revised in February 2010 to limit the licensed territory to the United States. On September 2, 2011, we received notification from Roche Diagnostics that they had terminated the sales and distribution agreement between Roche and Response effective September 30, 2011. Roche Diagnostics terminated the agreement because we had not obtained the necessary approvals from the FDA to permit Roche Diagnostics to market our cardiovascular POC tests in the United States using the RAMP® 200 Reader.

Competition

Medical Point-of- Care (POC) Market

The medical POC test market is comprised of five basic segments: clinical chemistry, hematology, immunoassay, blood glucose and urinalysis, plus miscellaneous other tests. Dozens of companies sell qualitative POC tests in these segments. Few companies, however, participate in the quantitative POC immunoassay market. The following table summarizes our key known competitors in the POC testing market.

| | Test Market Segment |

| Company | Cardiac Markers | CHF Marker | Drugs of Abuse | Flu and Infectious Disease | Pregnancy / Ovulation | Blood Gases/ Electrolytes | Coagulation |

| Response Biomedical Corp. | Ö | Ö | | Ö | | | |

| Abbott Point of Care Inc. | Ö(1) | Ö | | | | Ö | Ö |

| Becton Dickinson Corporation | | | | Ö | | | |

| Dade Behring | Ö | Ö | | | | | |

| Alere Inc. | Ö | Ö | Ö | Ö | Ö | Ö | Ö |

Mitsubishi Chemical Medience Corporation (3) | Ö | Ö | | | | | |

Roche Diagnostics (2) | Ö | Ö | Ö | | | Ö | Ö |

Quidel Corporation (4) | | | | Ö | Ö | | |

| (1) | Only Troponin I, CK-MB and BNP cardiac tests at this time. |

| (2) | The Cardiac Reader measures Troponin T rather than TnI and does not measure CK-MB. This platform uses semi-quantitative technology. This limits the upper end of their NT-proBNP assay to only 20% of the entire clinical range. |

| (3) | Mitsubishi Pathfast weighs 33kg, which for some would not be considered a POC system but rather a small laboratory analyzer. |

| (4) | The Quidel Corporation’s rapid Influenza test is visually read, requires precise timing and does not require an instrument. |

Certain of the competitors listed in the table above have stated their intention to broaden their category offerings. In addition to the key competitors listed above, we believe that each of the major diagnostics companies has an active interest in POC testing and, as well as being potential competitors, are also potential business partners.

Alere Inc. (formerly Inverness Medical Innovations Inc.), or Alere, has sold a three-in-one quantitative immunoassay and reader system for cardiac markers (CK-MB, Troponin I and Myoglobin) on the market since 1999 and is currently one of the leading participants in quantitative POC cardiovascular testing on the basis of market share, revenues and technology. They also sell a “shortness of breath” panel cartridge, which includes Myoglobin, CK-MB, Troponin I, BNP and D-dimer. While BNP is available as a stand-alone cartridge, Alere’s system can only perform Troponin I tests as part of a panel. In 2007, Biosite Incorporated (Biosite) was acquired by Inverness Medical Innovations in a transaction valued at $1.68 billion. Based on published list prices for the Biosite products and data from the completed multi-site clinical study entitled “Evaluation of a point-of-care assay for cardiac markers for patients suspected of acute myocardial infarction,”15 we believe that RAMP® has several advantages over the competing Biosite products including product performance and menu flexibility.

Since 2003, Abbott Point of Care Inc., formerly iStat Corporation, has sold a 10-minute Troponin I test for use on the i-STAT Portable Clinical Analyzer, a biosensor-based technology. In 2005, Abbott Point of Care launched a CK-MB test and, in 2006, launched a POC BNP test. In addition, Abbott Point of Care offers several tests for other markers in whole blood, predominantly electrolytes and blood gases. We believe that the requirement for different sample types for the i-STAT markers for heart attack (TnI and CK-MB) and congestive heart failure (BNP) is a significant disadvantage as compared to our RAMP® system.

Quidel Corporation has sold rapid, qualitative tests for the detection of RSV and Influenza A and B since 2001 as the QuickVue® Influenza A+B test and the QuickVue® RSV test. Based on data published in March 2011, we believe that our RAMP® RSV test offers superior performance versus the QuickVue® RSV test. Binax, Inc., a division of Alere, has been selling Influenza A, Influenza B and RSV tests under the BinaxNOW® brand since 2002 and a combined Influenza A+B test since 2004. Both of these tests have received Clinical Laboratory Improvement Amendments of 1988, or CLIA-waived status, which has allowed for their use in physician office laboratories.

Other infectious disease tests manufacturers available include Becton-Dickinson and Thermo Electron Corp. which produce rapid Influenza A+B tests that are not currently CLIA-waived.

Other technologies that may compete against RAMP® in the future by delivering highly sensitive, quantitative results, for some POC tests include immunosensors or biosensors and nanotechnology-based approaches. Biosensor methods use specific binding molecules such as antibodies to generate a measurable signal as a direct result of binding to their target molecule (or analyte). These technologies are extremely complex and have been under development for many years with limited commercial success to date. Immunobiosensors, to date, have limited sensitivity and are not competitive with RAMP®. Although methods of testing using biosensors and nanotechnology can be fast, they generally suffer from a significant lack of accuracy, repeatability and reliability, and can be expensive to manufacture. Biosensors are now in limited use for selected diagnostic applications, most notably for blood glucose monitoring using non-immunoassay methods. Nanotechnology is a relatively new and growing field that deals with the use of inert micro-etched wafers, or chips, to provide templates for chemical, biochemical and biological processes.

Much of the research effort for recent diagnostic testing has been directed toward the development of DNA hybridization probe tests. These tests identify specific gene sequences that can be associated with certain genetically-based disorders, infectious diseases and the prediction of predisposition to certain medical conditions, such as cancer. Several companies, such as Becton-Dickinson and Gen-Probe Inc., are now marketing specific probe tests for infectious diseases such as tuberculosis, hepatitis, Legionnaires disease and vaginitis. DNA probe technology is useful for gene markers that have been shown to be associated with specific disease states or clinical conditions. Although more useful gene sequences are being discovered all the time, we believe they will not displace the need for high-sensitivity immunoassays; there is, for instance, no genetic change when a person has a heart attack. In addition, our RAMP® format may be applicable to hybridization probe methods if a need is found for these tests to be quantitative and for use at the point-of-care.

15 Munjal I, Gialanella P, Goss C, McKitrick JC, Avner JR, Quiulu Pan, Litman C, Levi ML, J Clin Micro 2011Mar 49(3):1151-3.

Biodefense Market

The following table summarizes our known competitors in the rapid on-site environmental biodefense testing market (note that this table may not include all biological agents for which these companies may have tests):

| Company | Biological Agent |

| Anthrax | Ricin | Botulinum Toxin | Orthopox | Brucella | Plague | Tularemia | SEB |

| Response Biomedical Corp. | Ö | Ö | Ö | Ö | | | | |

Alexeter Technologies LLC (1) | Ö | Ö | Ö | Ö | Ö | Ö | Ö | Ö |

| New Horizons Diagnostics | Ö | Ö | Ö | | | Ö | Ö | Ö |

| ADVNT Inc. | Ö | Ö | Ö | | | Ö | | Ö |

Idaho Technology Inc. (2) | Ö | Ö | Ö | Ö | Ö | Ö | Ö | |

| Tetracore, Inc. | Ö | Ö | Ö | Ö | Ö | Ö | Ö | Ö |

Smiths Detection BioSeeq Plus (3) | Ö | | | Ö | | Ö | Ö | |

| QTL/MSA | Ö | Ö | | | | | | Ö |

(1) | Product includes a portable reader based on reflectance technology. |

| (2) | Product includes a portable reader based on polymerase chain reaction technology. |

| (3) | Product includes a portable reader based on polymerase chain reaction technology. |

A number of independent studies have been conducted on biodefense tests. Our RAMP® Anthrax Test has been evaluated at four sites in the United States and Canada: DRDC Suffield,16 a division of the Canadian Department of National Defense; the Maryland State Department of Health;17 Intertox Inc.,18 a Seattle-based public and occupational health firm, and, Edgewood Chemical Biological Center, part of the U.S. Army's Aberdeen proving ground, and more recently AOAC testing.19 Data from these four evaluations show that our RAMP® Anthrax Test meets or exceeds its product claims of reliably detecting less than 4,000 live spores, with 99 percent confidence in specificity. The CDC defines a lethal dose of anthrax as 10,000 spores.

In November 2004, our RAMP® System was the only commercially available rapid on-site anthrax detection system of those tested that met the new performance standards introduced by AOAC for rapid immunoassay-based anthrax detection systems and to receive the AOAC Official Methods Certificate 070403 stating that our RAMP® Anthrax Test performed as we claimed and that we are authorized to display the AOAC Performance Tested certification mark. All other commercially available rapid on-site anthrax detection systems tested failed to meet the AOAC’s performance standard. A further intensive, independent field testing program conducted by AOAC and sponsored by the DHS, culminated in the announcement in September 2006 that our RAMP® Anthrax Test was the first biodetection technology approved for field use by first responders in the United States for the detection of anthrax in an independent testing program conducted by AOAC.

16 Defence Research and Development Canada, July, 2002.

17 Maryland State Department of Health, March 2002.

18 Intertox Inc., July 2002.

19 The U.S. Army Aberdeen Proving Ground, November 2004.

Since our initial RAMP® product launch, many competitors have launched competitive products into the market place, including Alexeter Biotechnologies and ADVNT Inc., both of which also market rapid detection tests in the United States for Anthrax, Ricin and Botulinum, in addition to SEB, Y. pestis (plague) and others. Internationally, Smith Detection maintains a strong market share. We also believe that a number of diagnostics companies have an active interest in rapid on-site biodefense testing and have the potential to become either competitors or business affiliates.

We currently have approximately 350 RAMP® biodefense systems in field use by our customers.

Vector Environmental Market

Our main competitor in the rapid on-site vector environmental testing market is VecTest, currently distributed by Thermo Scientific. VecTest is a qualitative test strip, available in multiplex format, used to detect WNV, SLE, EEE and WEE. While a study by the CDC in 2006 confirmed that our RAMP® West Nile Virus Test outperforms VecTest20, VecTest continues to occupy a market share due to its qualitative nature as no instrument is required to perform the testing.

Emerging competition in the detection of West Nile Virus in the United States market is from RT-PCR systems, as more labs are investing in PCR technology in lieu of rapid detection.

Operations and Manufacturing

Our RAMP® System consists of a Reader and test kits (Kits) of applicable RAMP® tests. Manufacturing of the Readers is currently outsourced to an electronics manufacturer that we have qualified, located in British Columbia, Canada. We manufacture all Kits in-house in order to maximize return on investment, protect proprietary technology, and ensure compliance with government and internal quality standards. Kit manufacturing includes reagent and component production, cartridge assembly and final packaging (with the exception of our Chinese customers where some bulk components are shipped to our distributors in China for final packaging).

In advance of the expected growth of our products, we invested significantly, starting in 2007, to increase the automation, quality and capacity of our manufacturing operations. In March 2008, we moved into our current corporate headquarters, a leased, multi-use, 46,000 square foot facility in Vancouver, British Columbia, Canada where we coordinate all support operations including customer support, technical and instrument service, production planning, shipping and receiving. The facility houses all of our administrative and test manufacturing operations and will allow us to achieve our projected manufacturing capacity targets for the next five or more years. Our manufacturing scale-up is ongoing, and our test production capacity has increased from approximately 500,000 tests per shift per year to over 2 million tests per shift per year. The initial term of the lease agreement is 15 years with two 5-year renewal options.

Where possible, we require distribution and marketing partners to provide a twelve-month rolling forecast in order to ensure timely and adequate product supply and to allow efficient production, materials, shipping and inventory planning, see “Risk Factors". We plan to meet cost and quality targets through strict scale-up validation procedures and by negotiating supplier agreements for key materials that emphasize both reasonable costs and the highest possible quality. Final packaging, inventory storage and product distribution to marketing partners are managed in accordance with individual partner agreements.

The primary raw materials required to manufacture a test cartridge consist of: antibody reagents, nitrocellulose membrane and injection molded plastic parts to act as housing for the cartridge assembly. There are several different components required to perform the test that are included with the Kit. These are a sample transfer device, a solution for diluting the test sample and reagent-containing tips (for placing the sample being tested into the cartridge). We purchase these primary raw materials from unaffiliated domestic and international suppliers, some of which are sole suppliers. Interruptions in the delivery of these materials or services could adversely impact the Company.

20 Burkhalter et al. 2006

Patents and Proprietary Rights

We rely on a combination of patents, trademarks, confidential procedures, contractual provisions and similar measures to protect our proprietary information. To develop and maintain our competitive position, we also rely upon continuing invention, trade secrets and technical know-how.

It has been our practice to periodically file for patent and trademark protection in the United States and other countries with significant markets, such as Canada, Western European countries, Japan and China. No assurance can be given that patents or trademarks will be issued to us pursuant to our applications or that our patent portfolio will provide us with a meaningful level of commercial protection. We file patent applications on our own behalf as assignee and, when appropriate, have filed and expect to continue to file, applications jointly with our collaborators. Our ability to obtain and enforce patents is uncertain and we cannot guarantee that any patents will issue from any pending or future patent applications owned by or licensed to us, see “Risk Factors”.

In the United States, we own a total of seven utility patents (including three patents having expiration dates ranging from 2020 to 2028), two design patents having expiration date in 2024, and two pending US patent applications. We have many foreign counterparts (patents/applications) in other jurisdictions. In addition, patent applications related to our key technologies are pending in China and Hong Kong. We also have three registered trademarks in the United States and counterparts in other jurisdictions.

We seek to protect our trade secrets and technology by entering into confidentiality agreements with employees and third parties (such as potential licensees, customers, strategic partners and consultants). In addition, we have implemented certain security measures in our laboratories and offices. Despite such efforts, no assurance can be given that the confidentiality of our proprietary information can be maintained. Also, to the extent that consultants or contracting parties apply technical or scientific information independently developed by them to our projects, disputes may arise as to the proprietary rights to such data.

Government Regulation

Regulatory Approval

Clinical Diagnostics

The Food and Drug Administration (FDA), Health Canada and comparable agencies in foreign countries impose substantial requirements upon the development, manufacturing and marketing of drugs and medical devices through the regulation of laboratory and clinical testing procedures, manufacturing, marketing and distribution by requiring labeling, registration, notification, clearance or approval, record keeping and reporting. See “Risk Factors”.

In China, clearance to market drugs and medical devices must be granted by the State Food & Drug Administration (SFDA). In May 2004 and November 2004, O&D received regulatory clearance from the SFDA to market the RAMP® Reader and three RAMP® cardiac marker tests in China. In November 2007, they received clearance to market the RAMP® NT-proBNP Assay, in December 2010, the clearance to market the RAMP®200 Reader and in March of 2011, the clearance to market the RAMP® BNP Assay.

As of December 7, 2003, all medical devices sold in the countries of the European Union (EU) are required to be compliant with the EU In-Vitro Diagnostic Directive. All new in-vitro diagnostic devices must bear a mark, called the CE Mark, to be registered and legally marketed in the EU after that date. The regulatory requirements for marketing are based on the classification of the individual products and EU member countries are not allowed to impose any additional requirements on medical device manufacturers other than the language used in product labeling. In April 2003, we fulfilled the requirements of the EU In-Vitro Diagnostic Directive Essential Requirements for our three RAMP® cardiac tests and RAMP® Reader; in December 2006, we registered our NT-proBNP test as well as our RAMP® liquid cardiac marker controls used by laboratories to verify Kit performance and user technique; in May 2009, we registered our RAMP® 200 Reader, in December 2009, we registered our Influenza A+B Test and in September, 2010 our RSV Test. In November, 2012, we received the CE mark for an important new test, D-dimer, capable of the quantification of D-dimer in the blood important for detecting a variety of thrombotic disorders. Through the EC Declaration of Conformity, we are entitled to apply the CE Mark to these products. As with the FDA, future RAMP® tests may have different classifications which would require ISO 13485 registration as well as a technical file review by a registration organization, known as a Notified Body, prior to authorization to apply the CE Mark.

Prior to sale in the United States, RAMP® clinical products will typically require pre-marketing clearance through a filing with the FDA called a 510(k) submission. A 510(k) submission claims substantial equivalence to an accepted reference method or a similar, previously cleared product known as a “predicate device” and minimally takes about ninety (90) days for approval once a submission is made. Some RAMP® tests may detect analytes or have applications, intended uses for which there are no equivalent products on the market. In such cases, the test will require pre-market approval, a process that requires clinical trials to demonstrate clinical utility, as well as the safety and efficacy of the product. Including clinical trials, the pre-market approval process can take approximately two years.

Marketing clearance for our RAMP® Myoglobin Assay and RAMP® Reader was received in 2001. Marketing clearances for the RAMP® CK-MB Assay and the RAMP® Troponin I Assay on our RAMP® Reader were received in May 2004. The marketing clearance for our RAMP® Flu A+B Assay and our RAMP® 200 Reader was received in April 2008. The marketing clearance for our RAMP® NT-proBNP Assay on our RAMP® Reader was received in July 2008. The marketing clearance for our RAMP® RSV Assay on our RAMP® 200 was received in July 2009.

As of March 23, 2012, we have received FDA premarket clearance for Myoglobin, CK-MB, Troponin I and NT-proBNP on our RAMP® Reader and Flu A+B and RSV on our RAMP® 200 reader. In January 2013, documentation of extensive internal validation testing was completed as required by the U.S. Food and Drug Administration (FDA) guidance “Replacement Reagent and Instrument Family Policy”, to allow for the addition of the 510(k) cleared RAMP® 200 as a laboratory analyzer for use with the 510(k) cleared RAMP® Troponin I, NT-proBNP, CK-MB and Myoglobin cardiovascular tests. This testing demonstrated that the RAMP® Reader and the RAMP® 200 give equivalent results when the cardiac products are used in a laboratory setting.

We are currently developing additional tests that we will have to clear with the FDA through the 510(k) notification procedures. These new test products are crucial for our continued success in the human medical market. If we do not receive 510(k) clearance for a particular product, we will not be able to market that product in the United States until we provide additional information to the FDA and gain premarket clearance. The inability to market a new product during this time could harm our future sales in the United States.

For our products to be sold in the physician’s office lab market in the United States, we will need to obtain waiver status under the CLIA. A CLIA-waived test is a test that employs methodologies that are so simple and accurate as to render the likelihood of erroneous results negligible and/or pose no reasonable risk of harm to the patient if the test is performed incorrectly. CLIA-waived tests are designed to be performed by less experienced and untrained personnel. The current CLIA regulations divide laboratory tests into three categories: “waived,” “moderately complex” and “highly complex.” Many of the tests performed using our RAMP® platform are in the “moderately complex” category. Moderately complex tests can only be performed in laboratories fulfilling certain criteria, which are fulfilled by a minority of physician office laboratories in the United States.

In Canada, in vitro diagnostics are regulated by the Therapeutic Products Directorate of Health Canada (“TPD”) and are licensed for sale through submission to the TPD. The timeline for approval is similar to that of the FDA’s 510(k) process. As of January 2003, all new and existing class II, III and IV Medical Device Licenses (“MDL”) in Canada also require a valid International Organization for Standardization (ISO), 13485 or ISO 13488 Quality System Certificate from a registrar recognized by the Canadian Medical Devices Conformity Assessment System (“CMDCAS”). We achieved registration to the ISO 13485:2003 standard in April 2004. An MDL was issued for our Myoglobin Assay and Reader in 2002. MDLs were received for our RAMP® CK-MB Assay and RAMP® Troponin I Assay in August 2004; for our RAMP® NT-proBNP Assay in June 2007, and for our RAMP® liquid cardiac marker controls used by laboratories to verify Kit performance and user technique. These controls are manufactured for us by a U.S. company who holds the 510(k) clearance with the FDA. An MDL was received for our RAMP® Flu A+B Assay and RAMP® 200 reader in May 2009. An MDL was received for our RAMP® RSV Assay in May 2010.

In other parts of the world, the regulatory process varies greatly and is subject to rapid change. Many developing countries only require an import permit from their own government agency or proof of approval from the regulatory agency in the manufacturer’s country of origin. We require our marketing and distribution partners to ensure that all regulatory requirements are met in order to sell our RAMP® tests in their respective territories.

Clinical consultants are used to support in-house resources where necessary to develop protocols and prepare regulatory submissions for government agencies such as the FDA and the TPD. We completed multi-center clinical trials for our RAMP® Myoglobin Assay and our RAMP® Reader in 2001, for our RAMP® CK-MB Assay and our RAMP® Troponin I Assay in November 2003, for our RAMP® NT-proBNP Assay in November 2006 and for our Flu A+B Assay and our RAMP® 200 reader in May 2007, and for our RAMP® RSV Assay in November 2008.

ON-SITE ENVIRONMENTAL TESTING

Biodefense Testing

There are currently no regulatory approvals or clearances required to market on-site environmental biodefense tests in North America. There appears to be some support from the market for regulatory oversight of such testing, and regulatory agencies such as the Department of Homeland Security may in the future impose substantial requirements upon the development, manufacturing and marketing of devices through the regulation of laboratory and clinical testing procedures, manufacturing, marketing and distribution by requiring labeling, registration, pre-market notification, clearance or approval, record keeping and reporting. While additional regulatory requirements will make it more difficult for poorly performing products to participate in the market, they could also significantly increase the time and cost for companies to bring new tests to market, creating a barrier to entry.

The lack of regulatory oversight in the biodefense industry means there is virtually no independent data available for a customer to verify a manufacturer’s product claims. Since launching our Anthrax Test, we have received third party validation of the product’s performance. See “On-Site Environmental Testing Market, Competition.” Currently, however, companies are not required to have any form of regulatory clearance to market handheld assays for the detection of biodefense threats such as anthrax. See “Risk Factors.”

The performance and field-testing programs conducted by the AOAC in 2004 through 2006 were developed in collaboration with and funded by the DHS. One of the goals of the testing programs was to develop industry performance standards. The final form and substance of these possible standards and the impact on our industry is currently unclear.

Vector Environmental Testing

There is no regulatory clearance required for our RAMP® West Nile Virus Test because it is only used for testing mosquitoes.

Manufacturing Regulations and Various Federal, State, Local and International Regulations

The 1976 Medical Device Amendment also requires us to manufacture our RAMP® products in accordance with Good Manufacturing Practice guidelines. Current Good Manufacturing Practices (CGMPs) requirements are set forth in the 21CFR 820 Quality System Regulation. These requirements regulate the methods used in, and the facilities and controls used for the design, manufacture, packaging, storage, installation and servicing of our medical devices intended for human use. Our manufacturing facility is subject to periodic inspections. In addition, various state regulatory agencies may regulate the manufacture of our products.

Federal, state, local and international regulations regarding the manufacture and sale of health care products and diagnostic devices may change. In addition, as we continue to sell in foreign markets, we may have to obtain additional governmental clearances in those markets.

To date, we have complied with the following federal, state, local and international regulatory requirements:

| | · | In December 2012, the United States FDA conducted its second routine Quality Systems Inspection at Response since August of 2007. The four-day FDA visit covered FDA’s Quality System/CGMPs Regulations for Medical Devices. The inspection was successful and there were no Form 483 observations issued to Response. This successful inspection is indicative of a robust and effective Quality Management System at Response and a company-wide commitment to quality. |

| | · | Health Canada Therapeutic Products Directorate: In 2004, the TPD granted our manufacturing facility Medical Device Licenses, based on the Medical Device Regulations (SOR/98-282), Section 36, for the manufacture of our medical devices. |

| | · | International Organization for Standardization: In July 2004, we received our ISO 9001 certification, expanding our compliance with international quality standards. In April 2004, we received ISO 13485 Quality System certification as required by the 2003 European In Vitro Device Directive. This certified our quality system specifically to medical devices. In April 2004, we received the Canadian Medical Device Conformity Assessment System stamp on our ISO 13485 certificate to signify compliance with Health Canada regulations. In June 2010, we received our recertification to the ISO 13485:2003 Quality System Standard for medical devices. |

Research and Development Expenditures

Research and development activities relate to development of new tests and test methods, clinical trials, product improvements and optimization and enhancement of existing products. Our research and development expenses, which consist of personnel costs, facilities, materials and supplies, regulatory activities and other related expenses were $3.0 million, $2.9 million, and $4.1 million for the years ended December 31, 2012, 2011, and 2010, respectively.

Seasonal Variations in Business

Our operating results may fluctuate from quarter to quarter due to many seasonal factors. Many of our end-users are government related organizations at a federal, state/provincial or municipal level. Consequently, our sales may be tied to government budget and purchasing cycles. Sales may also be slower in the traditional vacation months, could be accelerated in the first or fourth calendar quarters by customers whose annual budgets are about to expire (especially affecting purchases of our fluorescent Readers), may be distorted by unusually large Reader shipments from time to time, or may be affected by the timing of customer cartridge ordering patterns. Sales of our Flu A+B Tests are typically slower in the non-traditional influenza months of April through September.

Backlog

Because we ship our products shortly after we receive the orders from our customers, we generally operate with a limited order backlog. As a result, our product sales in any quarter are generally dependent on orders that we receive and ship in that quarter. As a result, any such revenue shortfall would immediately materially and adversely impact our operating results and financial condition. The sales cycle for our products can fluctuate, which may cause revenue and operating results to vary significantly from period to period. We believe this fluctuation is primarily due (i) to seasonal patterns in the decision-making processes by our independent distributors and direct customers, (ii) to inventory or timing considerations by our distributors and (iii) to the purchasing requirements by various international governments to acquire our products.

Risks Attendant to Foreign Operations and Dependence

We sell in China through an exclusive distributor for RAMP® co-branded products, O&D, and an exclusive distributor for private labeled OEM products, Wondfo. Sales to O&D accounted for 48% of our total product sales in the year ended December 31, 2012. If O&D underperforms, we may not be able to generate alternative distribution channels rapidly enough to prevent a significant disruption in sales generated in China, which would have an adverse impact on our business performance.

Financial Information about Industry Segments

The Company operates primarily in one business segment, the research, development, commercialization and distribution of diagnostic technologies, with primarily all of its assets and operations located in Canada. The Company’s revenues are generated from product sales primarily in China, the United States, Europe, Asia and Canada. Expenses are primarily incurred from purchases made from suppliers in Canada and the United States.

The geographical distribution of our product sales is as follows:

| Years ended December 31, | | 2012 $ | | | 2011 $ | | | 2010 $ | |

| China | | | 7,748,243 | | | | 5,281,063 | | | | 3,576,935 | |

| United States | | | 1,124,290 | | | | 1,551,444 | | | | 1,003,297 | |

| Asia (excluding China) | | | 823,989 | | | | 794,667 | | | | 844,633 | |

| Europe | | | 1,080,805 | | | | 654,649 | | | | 812,328 | |

| Canada | | | 29,955 | | | | 59,148 | | | | 52,872 | |

| Other | | | 942,915 | | | | 683,112 | | | | 502,065 | |

| Total | | | 11,750,197 | | | | 9,024,083 | | | | 6,792,130 | |

Product sales by type of product were as follows:

| Years ended December 31, | | 2012 $ | | | 2011 $ | | | 2010 $ | |

| Cardiovascular | | | 10,797,968 | | | | 7,295,501 | | | | 5,969,672 | |

| Infectious Diseases | | | 173,422 | | | | 587,040 | | | | 67,472 | |

| Biodefense products | | | 316,857 | | | | 659,462 | | | | 444,896 | |

| West Nile Virus (Environmental) | | | 461,950 | | | | 482,080 | | | | 310,090 | |

| Total | | | 11,750,197 | | | | 9,024,083 | | | | 6,792,130 | |

For further information, please see Item 6 (“Selected Financial Data”).

Working Capital

Please see Item 6 (“Selected Financial Data”) and Item 7 (“Management's Discussion and Analysis of Financial Condition and Results of Operations").

Employees

On December 31, 2012, we had 72 full-time employees.

Available Information

Our corporate Internet address is http://responsebio.com. At the "Investors" section of this website, we make available free of charge our Annual Report on Form 10-K, our Annual Proxy statement, our quarterly reports on Form 10-Q, any Current Reports on Form 8-K, and any amendments to these reports, as soon as reasonably practicable after we electronically file them with, or furnish them to, the Securities and Exchange Commission, or the SEC. The information found on our website is not part of this Annual Report on Form 10-K. In addition to our website, the Securities and Exchange Commission, or the SEC, maintains an Internet site at www.sec.gov that contains reports, proxy and information statements, and other information regarding us and other issuers that file electronically with the SEC.

ITEM 1A. Risk Factors

Our future performance is subject to a number of risks. If any of the following risks actually occur, our business could be harmed and the trading price of our common stock could decline. In evaluating our business, you should carefully consider the following risks in addition to the other information in this Annual Report on Form 10-K. We note these factors for investors as permitted by the Private Securities Litigation Reform Act of 1995. It is not possible to predict or identify all such factors and, therefore, you should not consider the following risks to be a complete statement of all the potential risks or uncertainties that we face.

Risks Related to Our Company

We may need to raise additional capital to fund operations. If we are unsuccessful in attracting capital to our Company, we will not be able to continue operations or will be forced to sell assets to do so. Alternatively, capital may not be available to our Company on favorable terms, or at all. If available, financing terms may lead to significant dilution to the shareholders' equity in our Company.

We are not profitable and have negative cash flow from operations. Based on our current cash resources, expected cash burn, and anticipated revenues, we expect that we can maintain operations through fiscal 2013. We may need to raise additional capital to fund our operations. We have relied primarily on debt and equity financings to fund our operations and commercialize our products. Additional capital may not be available, at such times or in amounts as needed by us. Even if capital is available, it might be on adverse terms. Any additional equity financing will be dilutive to our shareholders. If access to sufficient capital is not available as and when needed, our business will be materially impaired and we may be required to cease operations, curtail one or more product development programs, attempt to obtain funds through collaborative partners or others that may require us to relinquish rights to certain technologies or product candidates, or we may be required to significantly reduce expenses, sell assets, seek a merger or joint venture partner, file for protection from creditors or liquidate all our assets.

Our inability to generate sufficient cash flows may result in our Company not being able to continue as a going concern.

We have incurred significant losses to date. As at December 31, 2012, we had an accumulated deficit of $112,171,008 and have not generated positive cash flow from operations. Accordingly, there is substantial doubt about our ability to continue as a going concern. We may need to seek additional financing to support our continued operation; however, there are no assurances that any such financing can be obtained on favorable terms, if at all. In view of these conditions, our ability to continue as a going concern is dependent upon our ability to obtain such financing and, ultimately, on achieving profitable operations. The outcome of these matters cannot be predicted at this time. The consolidated financial statements for the year ended December 31, 2012 do not include any adjustments to the amounts and classification of assets and liabilities that might be necessary should we be unable to continue in business. Such adjustments could be material.

We have incurred substantial operating losses to date. We expect these losses to continue for the near future. If we are unable to generate sufficient revenue, positive cash flow or earnings, or raise sufficient capital to maintain operations, we may not be able to continue operating our business and be forced to sell our Company or liquidate our assets.

We have evolved from a pure development company to a commercial enterprise but to date have realized minimal operating revenues from product sales. As of December 31, 2012, we have incurred cumulative losses since inception of $112,171,008. For the fiscal years ending December 31, 2012, 2011, and 2010, we incurred losses of $5,280,917, $5,371,312, and $10,081,911, respectively. We currently are not profitable and expect operating losses to continue. Generating revenues and profits will depend significantly on our ability to successfully develop, commercialize, manufacture and market our products. The time necessary to achieve market success for any individual product is uncertain. No assurance can be given that product development efforts will be successful, that required regulatory approvals can be obtained on a timely basis, if at all, or that approved products can be successfully manufactured or marketed. Consequently, we cannot assure that we will ever generate significant revenue or achieve or sustain profitability. As well, there can be no assurance that the costs and time required to complete commercialization will not exceed current estimates. We may also encounter difficulties or problems relating to research, development, manufacturing, distribution and marketing of our products. In the event that we are unable to generate adequate revenues, cash flow or earnings, to support our operations, or we are unable to raise sufficient capital to do so, we may be forced to cease operations and either sell our business or liquidate our assets.

Current and future conditions in the global economy may have a material adverse effect on our business prospects, financial condition and results of operations.

During the second half of fiscal year 2008, the global financial crisis, particularly affecting the credit and equity markets, accelerated and the global recession deepened, with an exceptionally weak global economy in 2009 and 2010 followed by a mixed economic performance during 2011 and 2012. Though we cannot predict the extent, timing or ramifications of the global financial crisis and the economic outlook in different economies, we believe that the current downturn in the world's major economies and the constraints in the credit markets have heightened or could heighten a number of material risks to our business, results of operations, cash flows and financial condition, as well as our future prospects, including the following: