UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

Filed by the Registrant☒

Filed by a Party other than the Registrant☐

Check the appropriate box:

☒ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

Response Biomedical Corp. |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

1781 - 75th Avenue W.

Vancouver, BC

V6P 6P2 CANADA

September 26, 2013

INVITATION TO SHAREHOLDERS

Dear Shareholder,

We are pleased to invite you to attend a Special Meeting of Shareholders (the “Meeting”) to be held on November 7, 2013 at 10:00 a.m. Pacific time, at our headquarters located at 1781-75th Avenue W. Vancouver, BC, Canada. The formal meeting notice and information circular are attached.

At the Meeting, shareholders will be asked to pass an ordinary resolution approving, in accordance with the rules of the Toronto Stock Exchange (“TSX”), the issuance of units (“Units”) of Response Biomedical Corp. (“Response,” the “Company,” “we,” “us,” or “our”) upon conversion of previously issued subscription receipts (the “Subscription Receipts”) at a price of CDN$2.45 per Subscription Receipt (the “Private Placement”). The Subscription Receipts were issued in concurrent brokered and non-brokered private placements. Insiders of the Company that have purchased Subscription Receipts (and their affiliates and associates) will not be entitled to vote on the resolution.

Each Subscription Receipt is automatically exercised into one Unit upon satisfaction of the Escrow Release Conditions (as defined below), and each Unit consists of one common share of the Company (the “Private Placement Shares”) and one-half of one warrant to purchase one common share of the Company (the “Warrants”). In addition, pursuant to an agency agreement entered into with Bloom Burton & Co. Inc. (the “Agent”), the Company will pay the Agent a 5% cash commission on the gross proceeds of the Private Placement (other than proceeds received from certain existing shareholders of the Company) and issue to the Agent warrants to purchase common shares with a value equal to 7% of the gross proceeds of the Private Placement (other than proceeds received from certain existing shareholders of the Company (the “Agent Warrants” and together with the Private Placement Shares and the Warrants, the “Private Placement Securities”). The gross proceeds of the Private Placement will be held in escrow by a third party pending satisfaction of the Escrow Release Conditions, being the approval of the Private Placement, including the issuance of the Private Placement Securities, by disinterested Company shareholders in accordance with the rules of the TSX (the “Escrow Release Conditions”).

It is important that you use this opportunity to take part in the affairs of the Company by voting on the business to come before the Meeting. After reading the enclosed information circular, please promptly mark, sign, date and return the enclosed proxy or voting instruction form and the reply card as instructed to ensure that your shares will be represented. Regardless of the number of common shares you own, your careful consideration of, and vote on, the matters before our shareholders is important.

Thank you for your ongoing support of Response Biomedical Corp. We look forward to seeing you at the Meeting.

Sincerely yours,

/s/ Jeffrey L. Purvin

Chief Executive Officer

1781-75th Avenue W.

Vancouver, BC

Canada V6P 6P2

RESPONSE BIOMEDICAL CORP.

1781 - 75th Avenue W.

Vancouver, BC

V6P 6P2 CANADA

NOTICE OF SPECIAL MEETING OF

SHAREHOLDERS AND INFORMATION CIRCULAR

To the Shareholders of Response Biomedical Corp.:

Notice is hereby given that a Special Meeting of the Shareholders of Response Biomedical Corp., will be held on November 7, 2013 at 10:00 a.m. Pacific Time at 1781 – 75th Avenue W., Vancouver, BC for the following purposes:

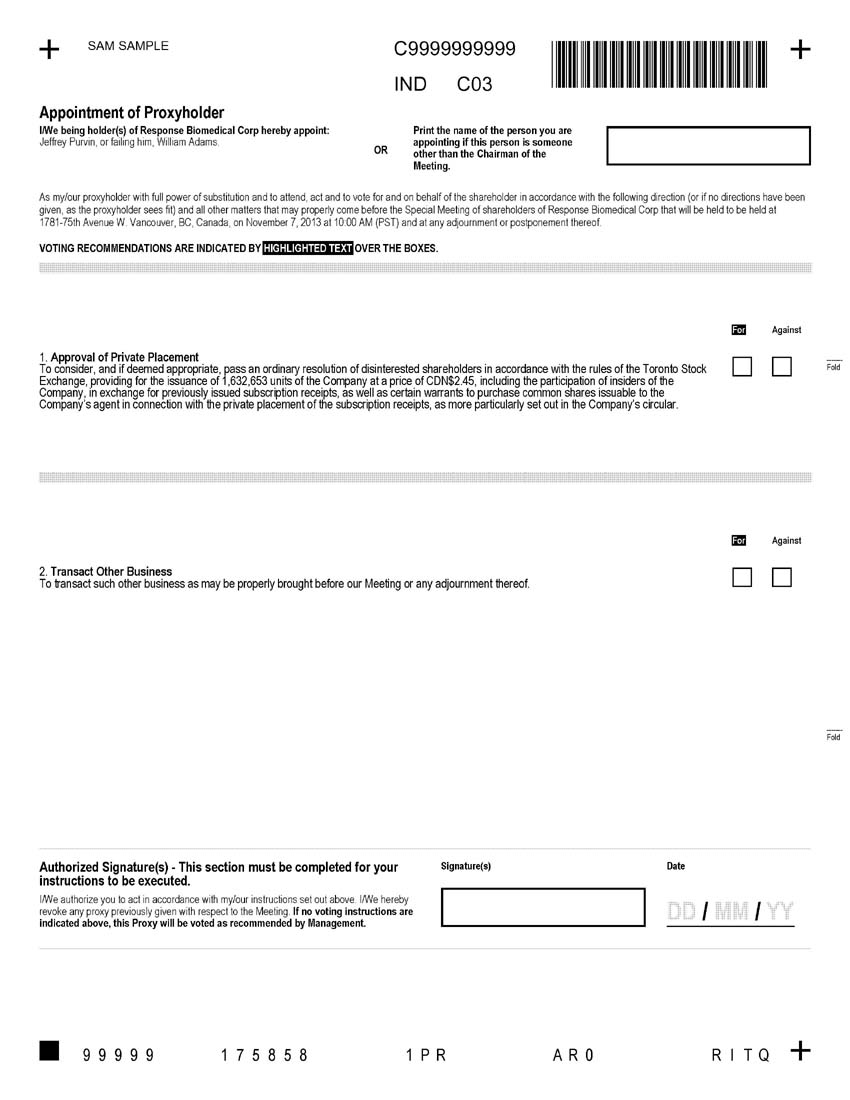

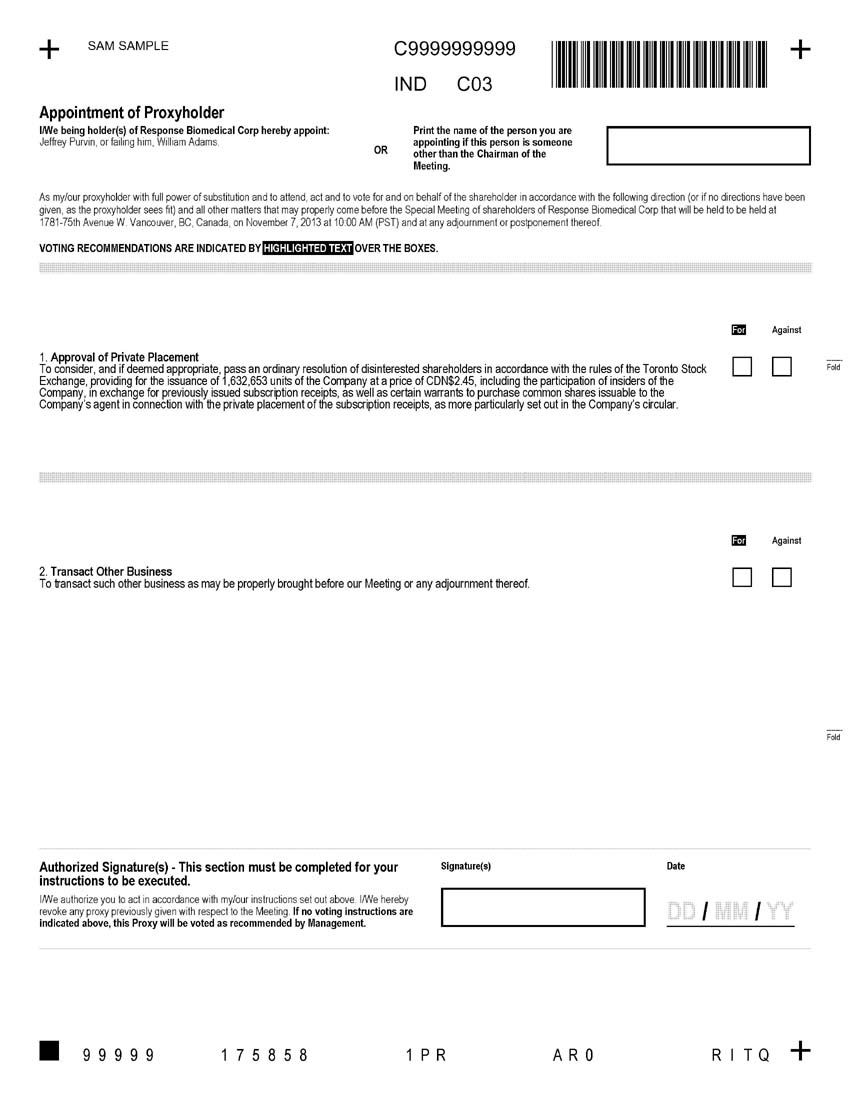

1. To consider, and if deemed appropriate, pass an ordinary resolution of disinterested shareholders in accordance with the rules of the Toronto Stock Exchange, providing for the issuance of up to 1,632,653 units of the Company at a price of CDN$2.45, including the participation of insiders of the Company, in exchange for previously issued subscription receipts, as well as certain warrants to purchase common shares issuable to the Company’s agent in connection with the private placement of the subscription receipts, as more particularly set out therein; and

2. To transact such other business as may be properly brought before our Meeting or any adjournment thereof.

Our board of directors has fixed the close of business on October 2, 2013 as the record date for the determination of shareholders entitled to notice of and to vote at our Meeting and at any adjournment or postponement thereof.

Accompanying this Notice is a Proxy.Whether or not you expect to be at our Meeting, please complete, sign and date the Proxy you received in the mail and return it promptly. If you plan to attend our Meeting and wish to vote your shares personally, you may do so at any time before the Proxy is voted.

All shareholders are cordially invited to attend the Meeting.

By Order of the Board of Directors,

/s/ Lewis Shuster

Lewis Shuster

Director

September 26, 2013

TABLE OF CONTENTS |

| | Page |

INFORMATION CIRCULAR | 2 |

Shareholder Proposal | 3 |

Householding of Proxy Materials | 4 |

PROPOSAL 1 -APPROVAL OF THE PRIVATE PLACEMENT | 5 |

Private Placement | 5 |

Summary of the Terms of the Subscription Agreement | 6 |

Description of Common Stock to be Issued | 6 |

Description of Warrants to be Issued | 7 |

Summary of the Terms of the Subscription Receipt Agreement | 8 |

Summary of the Terms of the Agency Agreement | 9 |

Use of Proceeds | 10 |

Interests of Certain Persons in the Private Placement | 10 |

Potential Effects of This Proposal | 10 |

Proposed Resolution | 11 |

Required Vote | 11 |

Recommendation | 12 |

SECURITY OWNERSHIP | 13 |

OTHER BUSINESS | 15 |

ADDITIONAL INFORMATION | 16 |

Interest of Certain Persons in Matters to Be Acted Upon | 16 |

Indebtedness of Directors and Executive Officers | 16 |

Interest of Management and Others in Material Transactions | 16 |

INCORPORATION BY REFERENCE | 17 |

RESPONSE BIOMEDICAL CORPORATION

1781 - 75th Avenue W.

Vancouver, BC

V6P 6P2 CANADA

INFORMATION CIRCULAR

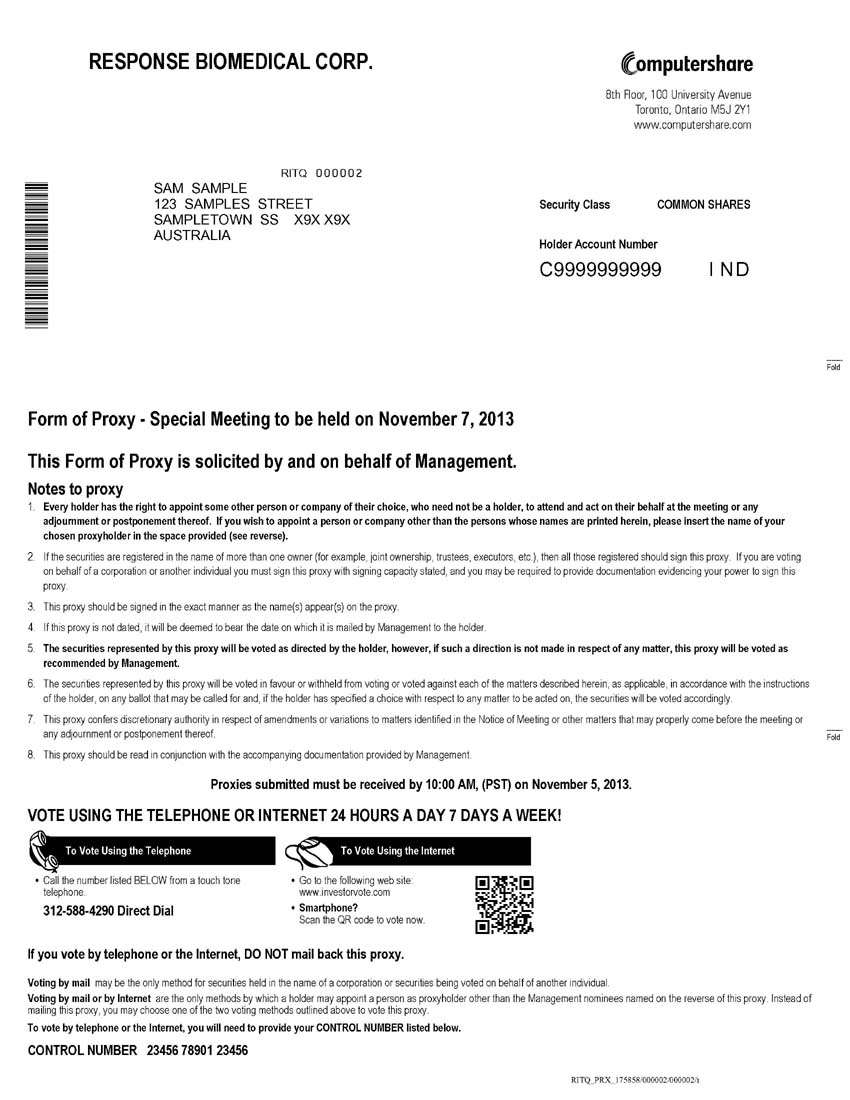

The board of directors of Response Biomedical Corp., a British Columbia, Canada corporation, is soliciting the Proxy for use at a Special Meeting of Shareholders to be held on November 7, 2013 at 10:00 a.m. Pacific Time at 1781 - 75th Avenue W. Vancouver, BC V6P 6P2 Canada and at any adjournments or postponements thereof.

A proxy is your legal designation of another person to vote the shares you own. The person you designate is your “proxy,” and you give the proxy authority to vote your shares by submitting the enclosed proxy card or, if available, voting by telephone or over the Internet. We have designated our chief executive officer, Jeffrey L. Purvin and our chief financial officer and secretary, William J. Adams, to serve as proxies for the Meeting.

We are providing these proxy materials in connection with the solicitation by our board of directors of proxies to be voted at the Meeting. As a shareholder, you are invited to attend the Meeting and are requested to vote on the items of business described in this information circular.

The information in this information circular relates to the proposals to be voted on at the Meeting, the voting process, and certain other required information.

This information circular and the accompanying proxy card, the Notice, and voting instructions are being mailed starting October[●], 2013 to all shareholders of record entitled to vote at the Meeting. All information provided in this information circular is given as of September 26, 2013 unless otherwise noted.

A proxy may be revoked by written notice to the Secretary of the Company at any time prior to the voting of the proxy, or by executing a subsequent proxy prior to voting or by attending the meeting and voting in person. Unrevoked proxies will be voted in accordance with the instructions indicated in the proxies, or if there are no such instructions, such proxies will be voted“FOR” the issuance of 1,632,653units of the Company, each unit consisting of one common share of the Company (“Private Placement Shares”) and one-half of one warrant to purchase one common share (each whole warrant, a “Warrant”), pursuant to the conversion of previously issued subscription receipts (the “Subscription Receipts”) and 816,326 warrants to purchase common shares issued to the Company’s agent in connection with the issuance and sale of Subscription Receipts.

The persons named in the enclosed form of proxy are officers and directors of the Company. Each shareholder has the right to appoint a person or a company (who need not be a shareholder) to attend and act for him/her and on his/her behalf at the Meeting other than the persons designated in the enclosed form of proxy.Such right may be exercised by striking out the names of the persons designated on the enclosed form of proxy and by inserting such appointed person’s name in the blank space provided for that purpose or by completing another form of proxy acceptable to the board of directors.

On any ballot that may be called for, the common shares represented by a properly executed proxy given in favor of the person(s) designated by management of the Company in the enclosed form of proxy will be voted or withheld from voting in accordance with the instructions given on the form of proxy and, if the shareholder specifies a choice with respect to any matter to be acted upon, the common shares will be voted accordingly.

Shares represented by proxies that reflect abstentions or include “broker non-votes” will be treated as present and entitled to vote for purposes of determining the presence of a quorum. Abstentions have the same effect as votes “against” the matter. “Broker non-votes” do not constitute a vote “for” or “against” the matter and thus will be disregarded in the calculation of “votes cast.”

The Company’s authorized capital consists of an unlimited number of common shares and no other class of voting securities, and the Company does not have any classes of restricted securities. Shareholders of record at the close of business on October 2, 2013 (the “Record Date”), will be entitled to vote at the Meeting or vote by proxy using the Proxy card that was mailed to you with the Notice. As of the Record Date, 6,577,664 of our common shares without par value were outstanding. Each of our common shares is entitled to one vote. Two people present at the meeting, in person or by proxy, and holding in the aggregate not less than 5% of the issued common shares entitled to vote at our Meeting constitutes a quorum. A majority of the shares present in person or represented by proxy at our Meeting and entitled to vote thereon is required to approve the proposal set forth in this information circular, excluding certain insiders of the Company.

The cost of preparing, assembling and mailing the Notice, information circular, and Proxy card will be borne by the Company. In addition to soliciting proxies by mail, our officers, directors and other regular employees, without additional compensation, may solicit proxies personally or by other appropriate means. It is anticipated that banks, brokers, fiduciaries, other custodians, and nominees will forward proxy soliciting materials to their principals.

The Company will not pay for intermediaries to deliver the Notice, information circular, and Proxy card to objecting beneficial holders (as defined in National Instrument 54-101), and objecting beneficial holders will not receive the Notice, information circular, and Proxy card unless their intermediary assumes the cost of delivery.

Shareholder Proposals

Proposals of shareholders intended to be presented at our annual meeting of shareholders to be held in 2014 must be received by us no later than January 22, 2014, which is 120 days prior to the first anniversary of the mailing date of the previous year's proxy, in order to be included in our information circular and form of proxy relating to that meeting. These proposals must comply with the requirements as to form and substance established by the U.S. Securities and Exchange Commission (the “SEC”) for such proposals in order to be included in our information circular.

Shareholders may present proper proposals for inclusion in our information circular and for consideration at the next annual meeting of shareholders by submitting their proposals in writing to our corporate secretary in a timely manner. For a shareholder proposal to be considered for inclusion in our information circular for our 2014 annual meeting of shareholders, our corporate secretary must receive the written proposal at our principal executive offices no later than January 22, 2014; provided, however, that in the event that we hold our 2014 annual meeting of shareholders more than 30 days before or after the one-year anniversary date of the 2013 annual meeting, we will disclose the new deadline by which shareholders proposals must be received under Item 5 of our earliest possible Quarterly Report on Form 10-Q or, if impracticable, by any means reasonably calculated to inform shareholders. In addition, shareholder proposals must otherwise comply with the requirements of Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Securities Act”). Such proposals also must comply with SEC regulations under Rule 14a-8 regarding the inclusion of shareholder proposals in company-sponsored proxy materials. Proposals should be addressed to Response Biomedical Corp., 1781 - 75th Avenue W. Vancouver, BC V6P 6P2 Canada, Attention: Corporate Secretary.

In the event that we hold our 2014 annual meeting of shareholders more than 30 days before or after the one-year anniversary date of the 2013 annual meeting, then notice of a shareholder proposal that is not intended to be included in our information circular must be received not later than the close of business on the later of the following two dates:

| ● | the 90th day before such annual meeting: or |

| ● | the 10th day following the day on which public announcement of the date of such meeting is first made. |

If a shareholder who has notified us of his or her intention to present a proposal at an annual meeting does not appear to present his or her proposal at such meeting, we are not required to present the proposal for a vote at such meeting.

Householding of Proxy Materials

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, shareholders of record who have the same address and last name and do not participate in electronic delivery of proxy materials will receive only one copy of our notice of meeting and information circular unless one or more of these shareholders notifies us that they wish to continue receiving individual copies. This procedure will reduce our printing costs and postage fees. Shareholders who wish to participate in householding will continue to receive separate proxy cards.

If you are eligible for householding, but you and other shareholders of record with whom you share an address currently receive multiple copies of the notice of meeting and information circular and accompanying documents, or if you hold stock in more than one account, and, in either case, you wish to receive only a single copy of each of these documents for your household, please notify your broker, direct your written request to Response Biomedical Corp., Investor Relations; 1781 – 75th Avenue W., Vancouver, BC V6P 6P2 or contact us at 604-456-6010.

If you participate in householding and wish to receive a separate copy of the Notice, information circular, and the accompanying documents, or if you do not wish to continue to participate in householding and prefer to receive separate copies of these documents in the future, please contact Computershare Trust Company, N.A. at P.O. Box 43078, Providence, Rhode Island 02940 or by telephone at (800) 662-7232 or (781) 575-4238.

Additional information relating to the Company is available on SEDAR at www.sedar.com and EDGAR at www.sec.gov. To request hard copies of the Company’s financial statements and management’s discussion and analysis, free of charge, shareholders should contact, Corporate Secretary, at Response Biomedical Corp., 1781 – 75th Avenue W., Vancouver, BC, telephone (604) 456-6010 or fax (604) 456-6066. Financial information is provided in the Company’s comparative financial statements and management’s discussion and analysis for its most recently completed financial year.

PROPOSAL 1 - APPROVAL OF PRIVATE PLACEMENT

Private Placement

We are asking our shareholders to approve the Private Placement of up to 1,632,653 Subscription Receipts at a price of CDN$2.45 per Subscription Receipt (the “Subscription Price”). The Subscription Price represents approximately a 15% discount to the market price of our common shares (determined in accordance with the TSX Company Manual as the volume weighted average price of our common shares on the TSX for the five trading days immediately preceding September 20, 2013, the date on which the Subscription Receipts were priced). This discount is within the allowable discount to market price prescribed in the TSX Company Manual. The Private Placement may be effected in one or more closings.

Each Subscription Receipt will be automatically exercised into a unit of the Company (a “Unit”) upon satisfaction of the Escrow Release Conditions on or before November 24, 2013(the “Escrow Release Deadline”), each Unit consisting of (i) one common share and (ii) one-half of one Warrant to purchase one common share with an exercise price of CDN$3.58. The total number of common shares to be issued in the Private Placement (including shares issuable upon exercise of the Warrants (the “Warrant Shares”) and including shares issuable upon exercise of the Agent Warrants (the “Agent Warrant Shares”)) is up to 2,506,121, which represents approximately 38.1% of the current issued and outstanding common shares, or 20.7% on a fully-diluted basis. In addition, pursuant to the Agency Agreement described below, we intend to issue Agent Warrants exercisable to purchase up to 57,142 common shares, with an exercise price of CDN$2.45. The gross proceeds of the Private Placement are held in escrow by a third party Subscription Receipt Agent (as discussed below) pending satisfaction of the Escrow Release Conditions, being the approval of the Private Placement, including the issuance of the Private Placement Securities, by disinterested Company shareholders in accordance with the rules of the TSX. If the Escrow Release Conditions are not satisfied by the Escrow Release Deadline, the proceeds from the sale of Subscription Receipts will be returned to the subscribers. If the total amount of 1,632,653 Subscription Receipts are sold, the total consideration received by the Company will be approximately $4,000,000.

The Private Placement, including the participation of insiders of the Company (“Insiders”), is subject to disinterested shareholder approval because greater than 10% of the Private Placement Shares are issuable to Insiders and the Private Placement is in an amount greater than 25% of the Company’s issued and outstanding common shares. In order for the Private Placement to be completed, the resolution approving the Private Placement, as set forth below, must be approved by an ordinary resolution of disinterested shareholders (excluding the 4,079,276common shares held by Insiders participating in the Private Placement, including their associates and affiliates), present in person or by proxy at the Meeting.

The Private Placement is also subject to disinterested shareholder approval because the Agent Warrants will have an exercise price less than the “market price” as defined by the TSX Company Manual.

The Subscription Receipts have been offered and sold to “accredited investors” pursuant to exemptions from the registration requirements under the Securities Act, afforded by Section 4(2) thereof orRegulation D promulgated thereunder, in Canada to “accredited investors” and purchasers of more than CDN$150,000 of Subscription Receipts in reliance on National Instrument 45-106 – Prospectus and Registration Exemptions and in Canada and other jurisdictions outside of the United States in reliance on Regulation S promulgated under the Securities Act. Set forth below are the material terms of the Private Placement.

THIS SUMMARY OF THE TERMS OF THE Private Placement IS INTENDED TO PROVIDE YOU WITH BASIC INFORMATION CONCERNING THE PRIVATE PLACEMENT; HOWEVER, IT IS NOT INTENDED AS A SUBSTITUTE FOR REVIEWING THE FORM OF SUBSCRIPTION AGREEMENT, SUBSCRIPTION RECEIPT AGREEMENT AND AGENCY AGREEMENT IN THEIR ENTIRETY, WHICH WE HAVE INCLUDED ASANNEXES A,BANDC, RESPECTIVELY, TO THIS PROXY STATEMENT. YOU SHOULD READ THIS SUMMARY TOGETHER WITH THESE DOCUMENTS.

Summary of the Terms of the Subscription Agreement

The Company and subscribers for Subscription Receipts (the “Subscribers”) have entered into Subscription Agreements and any additional Subscribers who participate will be required to enter into a subscription agreement on substantially similar terms. The Subscription Agreements provide the terms and conditions on which each purchaser has subscribed for, and the Company has issued, the Subscription Receipts.

The Subscription Agreements contain representations and warranties by us and by the Subscribers to each other and is not intended to provide any other factual information about us. The representations and warranties given by the Subscribers relate to, among other things, the Subscriber’s authority to enter into the Subscription Agreement, the basis on which the Subscriber is eligible to participate in the Private Placement in accordance with Canadian and United States securities laws, as well as certain acknowledgements regarding the terms of the Subscription Receipts and underlying common shares and Warrant Shares. The representations of the Company are incorporated from the Agency Agreement (described below). The representations and warranties given by the Company will survive the closing of the Private Placement for a period of three years.

The Subscription Agreements do not contain any pre-emptive rights or ongoing covenants of the Company regarding information rights or any restrictions on transfer of the common shares or Warrant Shares (other than those imposed by applicable securities laws).

Description of Private Placement Shares to be Issued

Subscribers participating in the Private Placement have subscribed for Subscription Receipts. Each Subscription Receipt will, upon satisfaction of the Escrow Release Conditions, be automatically exercisable and entitles the holder to receive, without payment of additional consideration, one Unit. The Subscription Receipts have been issued for the Subscription Price.

Each Unit will consist of one common share in the capital of the Company and one-half of one Warrant (the terms of which are described more particularly below). Unless and until the Escrow Release Conditions have been satisfied and the Company has issued the Subscribers the Private Placement Shares, a holder of Subscription Receipts will not be entitled to the rights of a shareholder of the Company. The Company’s authorized capital consists of an unlimited number of common shares and no other classes of shares. Each common share carries the right to notice of and one vote at, any meeting of the Company’s shareholders.

The total number of Private Placement Shares to be issued (including shares issuable upon exercise of the Warrants and the Agent Warrants) is 2,506,121, which represents approximately 38.1% of the current issued and outstanding common shares, or 20.7% on a fully-diluted basis.

Description of Warrants to be Issued

Subscriber Warrants

As noted above, each Unit also consists of one-halfof one Warrant to purchase one common share. Each whole Warrant is exercisable to purchase one common share. The Warrants will have a term of 36 months from closing of the Private Placement and an exercise price of CDN$3.58. Upon due exercise, each whole Warrant will entitle the holder thereof to subscribe for one common share in the capital of the Company. At the option of the holder, the Warrants will be exercisable on a “net” cashless basis in the event that the market price of the Company’s common shares on the TSX is greater than the exercise price of the Warrant on the date of exercise. , pursuant to the following formula:

Where X = the number of Common Shares to be issued to the Warrant holder

Y = the number of Common Shares purchasable under the Warrant or, if only a portion of the Warrant is being exercised, the number of Common Shares purchasable under the portion of the Warrant so exercised (at the date of such calculation)

A = the Current Market Price of one Common Share (at the date of such calculation)

B = Exercise Price (as adjusted to the date of such calculation).

The number of Common Shares issuable pursuant to each Warrant will be subject to standard adjustment provisions in the event that the Company undertakes a capital or corporate reorganization, share consolidation, stock dividend, or other capital restructuring transaction.

The Warrants are transferrable by the holder thereof, subject to compliance with applicable securities laws, and will not be listed for trading on any stock exchange.

Prior to their exercise, the Warrants will not confer any shareholder rights upon their holder and a holder of Warrants will not be entitled to notice, or voting rights, at any general or special meeting of the Company’s shareholders. Upon exercise of a Warrant, no fractional common shares will be issued. Holders will be entitled to a cash payout of any fractional interest at the then current market price of common shares.

Agent Warrants

The Agent Warrants have generally the same terms as the Warrants, with the following exceptions:

| | 1) | The Agent Warrants will have an exercise price of CDN$2.45. Because the exercise price is less than the “market price” as defined by the TSX Company Manual, the Company’s disinterested shareholders must approve their issuance, as described in Proposal 1. |

| | 2) | The Agent Warrants will not be transferrable. |

| | 3) | The Agent Warrants will expire 24 months from the closing date of the Private Placement. |

| | 4) | The Agent Warrants will not be exercisable on a “net” cashless basis. |

The total number of common shares issuable upon exercise of the Warrants and Agent Warrants is 873,468, which represents approximately 13.3% of the current issued and outstanding common shares, or 7.2% on a fully-diluted basis.

Summary of the Terms of the Subscription Receipt Agreement

The Subscription Receipt Agreement governs the relationship between the Company, the Agent (as defined below) and Computershare Trust Company of Canada who will act as Subscription Receipt Agent on behalf of the Company in respect of the Subscription Receipts. In particular, the Subscription Receipt Agreement provides for the terms upon which the Subscription Receipt Agent will hold the proceeds in escrow pending satisfaction of the Escrow Release Conditions and mechanics and procedures for releasing the subscription proceeds and issuing the Private Placement Shares and Warrants upon satisfaction of the Escrow Release Conditions.

Pursuant to the Subscription Receipt Agreement, the Subscription Receipt Agent is currently holding the gross proceeds of the Private Placement for the benefit of the subscribers and the Company. The Subscription Receipt Agreement sets out the manner in which the proceeds may be invested.

The Subscription Receipt Agent will keep a register of Subscription Receipt holders for the duration of the escrow period. Upon satisfaction of the Escrow Release Conditions and delivery of a certificate signed by the Company and the Agent so indicating, the Subscription Receipts will be deemed to be converted and surrendered to the Subscription Receipt Agent without any further action required by their holder, and the Subscription Receipt Agent will, within three business days following receipt of such certificate, issue an applicable number of Units to the Agent in the names of the Subscribers for delivery to the Subscribers.

Prior to the satisfaction of the Escrow Release Conditions, the Subscription Receipt Agreement provides for customary anti-dilution adjustment provisions to the number of Subscription Receipts in the event that the Company undertakes a capital or corporate reorganization, share consolidation, rights offering, special distribution, or other capital restructuring transaction.

If the Escrow Release Conditions are not satisfied on or before 5:00 p.m. (Toronto time) on November 24, 2013, the Subscription Receipt Agent will return, without interest, the escrowed subscription proceeds to the Agent on behalf of the Subscribers.

Pursuant to the Subscription Receipt Agreement, the Company has also agreed to indemnify the Subscription Receipt Agent, and to pay the Subscription Receipt Agent’s reasonable expenses and disbursements in connection with its retention as Subscription Receipt Agent. Finally, in limited circumstances, the Subscription Receipt Agreement also provides for the procedure by which a meeting of Subscription Receipt holders may be called, and for the notice, quorum, voting and other related requirements of such a meeting.

Summary of the Terms of the Agency Agreement

In connection with the Private Placement, the Company has entered into an Agency Agreement with Bloom Burton & Co. Inc., as Agent, governing the Company’s relationship with the Agent and the terms of their engagement as exclusive agent of the Company to offer the Subscription Receipts for sale on a “best efforts” basis in accordance with the terms of the Agency Agreement. The Agent is not required to purchase any securities of the Company as principal under the Agency Agreement.

As compensation for their engagement, the Company has agreed to pay the Agent a cash commission equal to 5% of the gross proceeds of the Private Placement (other than proceeds received from certain existing shareholders of the Company). The Company has also agreed to issue to the Agent the Agent Warrants to purchase common shares having a value of 7% of the gross proceeds of the Private Placement (other than proceeds received from certain existing shareholders of the Company). The Agent Warrants will have a term of 24 months and an exercise price of CDN$2.45. Upon due exercise, each Agent Warrant will entitle the holder thereof to subscribe for one common share in the capital of the Company and otherwise have the terms described above. In addition, the Company has agreed to reimburse the Agent for all fees incurred in respect of the Private Placement, subject to certain maximum amounts, individually and in the aggregate.

The Agency Agreement contains representations and warranties given by both the Company and the Agent, including representations and warranties of the company regarding, among other things, the Company’s authority to enter into the Agency Agreement, valid issuance of the Subscription Receipts and authorization to issue the Private Placement Shares, Warrants and Agent Warrants, compliance with laws (including securities laws and rules of the TSX), capitalization, accuracy of financial statements, the absence of litigation involving the Company, tax matters, environmental matters and employee matters. The Agency Agreement also contains customary covenants of the Agent and the Company in respect of Canadian and U.S. Securities Laws in respect of the offer and sale of the Subscription Receipts.

The Agency Agreement also dictates the closing conditions and closing deliverables of the Company in respect of the closing of the Private Placement such as legal opinions and corporate certificates in respect of certain factual matters. Finally, the Agency Agreement also provides standard termination rights to the Agent in the event of (a) a regulatory proceeding being commenced against the Company which in the reasonable opinion of the Agent, operates to prevent or restrict the trading of the common shares or any other securities of the Company or materially and adversely affects or will materially and adversely affect the market price or value of the common shares or any other securities of the Company, (b) any event, action, state, condition or major financial occurrence of national or international consequence (including terrorism) or any new law or regulation or a change thereof which in the reasonable opinion of the Agent, materially adversely affects, or involves, or will, materially adversely affect, or involve, the financial markets or the business, operations or affairs of the Company and its subsidiary taken as a whole, and (c) any material change in the affairs of the Company, or there should be discovered any previously undisclosed material fact required to be disclosed under applicable securities laws, in each case which, in the reasonable opinion of Agent, has or would be expected to have a material adverse effect on the market price or value of the common shares or any other securities of the Company; or (d) any breach of any material term, condition or covenant of the Agency Agreement by the Company or any material representation or warranty given by the Company in the Agency Agreement is or becomes false in any material respect.

Use of Proceeds

The Company intends to use the net proceeds of the Private Placement to fund research and development of the Company’s products, as well as to fund operational expenses and for other general working capital and corporate purposes. The Company may in the ordinary course of business raise additional capital for the same purposes through additional issuances of equity or the incurrence of indebtedness.

Interests of Certain Persons in the Private Placement

It is intended that Insiders of the Company will participate in the Private Placement as follows:

Insider | Pre-Private Placement Common Shares

(%) | Private Placement Shares

(%) | Warrants

(%) | Total Number of Common Shares (non-diluted / fully diluted)

(%)(1) |

OrbiMed Advisors LLC, and its affiliates | 4,079,276 (62.02%) | 816,325 (12.4%) | 408,162 (6.2%) | 4,895,601 (66.2%) 8,654,968 (59.2%) |

| | Notes: | | |

| | | (1) | On a partially diluted basis, assuming exercise by OrbiMed of all convertible securities held by it, OrbiMed would own 8,654,968common shares (72.3% of the total issued and outstanding common shares) |

To the best of the knowledge of our directors and executive officers, Insiders, as a group, have subscribed for 816,325 Subscription Receipts, representing approximately 64.1% of the Private Placement sold as of September 26, 2013 (or 12.4% of the current issued and outstanding common shares, or 6.7% on a fully diluted basis, and 50% of the maximum size of the Private Placement). No new control persons will be created as a result of the Private Placement.

In connection with the Private Placement, the Company entered into a side letter agreement (the “Letter Agreement”) with affiliates of OrbiMed Advisors, LLC (“OrbiMed”) pursuant to which, among other things, the Company agreed to waive certain representations and warranties of OrbiMed in the Subscription Agreement that are inapplicable due to OrbiMed’s status as an Insider, and to reimburse OrbiMed for certain expenses incurred in connection with the Private Placement not to exceed CDN$50,000 without the Company’s prior written consent. In addition, pursuant to the Letter Agreement, the Agent has agreed that, without OrbiMed’s consent, the Agent will not take certain actions under the Subscription Receipt Agreement and Agency Agreement that would be adverse to OrbiMed, including waiving the Release Condition or extending the deadline by which the Release Condition must be satisfied, or waiving the Company’s obligation to deliver a customary opinion of counsel in respect of the Private Placement. We have included the full text of the Letter Agreement asAnnex D.

Potential Effects of this Proposal

The Private Placement will have a dilutive effect on current shareholders who are not participating in the Private Placement in that the percentage ownership of the Company held by such current shareholders will decline as a result of the issuance of the Private Placement Securities. This means also that our current shareholders who are not participating in the Private Placement will own a smaller interest in us as a result of the Private Placement and therefore have less ability to influence significant corporate decisions requiring shareholder approval. Issuance of the Private Placement Securities could also have a dilutive effect on book value per share and any future earnings per share. Dilution of equity interests could also cause prevailing market prices for our common shares to decline.

The TSX has conditionally approved the Private Placement and the listing of the Private Placement Shares, Warrant Shares and common shares issuable upon exercise of the Agent Warrants.

Proposed Resolution

At the Meeting, or any adjournment thereof, shareholders will be asked to consider and if deemed appropriate, pass, with or without variation, the following resolutions:

“BE IT RESOLVED THAT:

(a) The issuance of (i) up to 1,632,653 common shares (“Common Shares”) in the capital of Response Biomedical Corp. (“Response”), (ii) up to 816,326 warrants to purchase one Common Share, in each case, upon the conversion of previously issued subscription receipts at a price of CDN$2.45per subscription receipt, and (iii) up to 57,142 warrants to purchase one Common Share issued to the Agent (the “Private Placement”), as more particularly set forth in the Management Information Circular, is hereby authorized and approved;

(b) Insiders of the Company be permitted to participate in the Private Placement, as more particularly set forth in the Management Information Circular,

(c) The exercise price of the Agent Warrants, as more particularly set forth in the Management Information Circular, is hereby authorized and approved;

(d) Any director or officer of Response is hereby authorized and directed for and on behalf of Response to execute, whether under corporate seal of Response or otherwise, and to deliver such documents as are necessary or desirable to complete the Private Placement.

(e) Notwithstanding the foregoing approval, Response be and is authorized to abandon all or any part of these resolutions at any time prior to giving effect thereto.

Required Vote

A majority of the votes of the shares present in person or represented by proxy at the Meeting and entitled to vote is required to approve the Private Placement, excluding all shares held by persons who are Insiders of the Company who are participating in the Private Placement. A total of 4,079,276 held by Insiders of the Company who are participating in the Private Placement wil not be eligible to vote on the foregoing resolutions. Unless such authority is withheld, the management representatives designated in the enclosed form of proxy intend to vote “FOR” the approval of the foregoing resolution.

Recommendation

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE PRIVATE PLACEMENT AND THE ISSUANCE OF THE PRIVATE PLACEMENT SHARES, WARRANTS AND WARRANT SHARES.

In reaching its determination to approve Proposal 1, the Board, with advice from our management and legal advisors, considered a number of factors, including:

| | ● | the fact that the proceeds from the Private Placement will enable us to advance our strategic direction; |

| | ● | the fact that the terms of the Private Placement are the result of arm’s length negotiations among the Company, the Agent and certain significant participants in the Private Placement; |

| | ● | our financial condition, results of operations, cash flow and liquidity, which required us to raise additional capital for ongoing cash needs; |

| | ● | our view that the proceeds from the Private Placement will enhance our balance sheet; and |

| | ● | the fact that our management and certain of our directors have explored financing options with other potential investors and are not aware of an ability for us to obtain the financing needed for our ongoing cash needs on comparable or better terms to the Private Placement, or at all. If the Private Placement is approved by shareholders, it may allow the Company access to other forms of financing, including debt financing. |

SECURITY OWNERSHIP

The following table sets forth information as of September 13, 2013 regarding the beneficial ownership of our common stock by (i) each person we know to be the beneficial owner of 5% or more of our common shares, (ii) each of our current executive officers, (iii) each of our directors and (iv) all of our current executive officers and directors as a group. Information with respect to beneficial ownership has been furnished by each director, executive officer or 5% or more shareholder, as the case may be. Percentage of beneficial ownership is calculated based on 6,577,664 common shares outstanding as of September 13, 2013. Beneficial ownership is determined in accordance with the rules of the SEC which generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power with respect to those securities and includes shares of our common shares issuable pursuant to the exercise of stock options, warrants or other securities that are immediately exercisable or convertible or exercisable or convertible within 60 days of September 13, 2013. Unless otherwise indicated, the persons or entities identified in this table have sole voting and investment power with respect to all shares shown as beneficially owned by them. Unless otherwise noted, the address for each person set forth on the table below is c/o Response Biomedical Corp., 1781 – 75th Avenue W, Vancouver, BC, V6P 6P2, Canada.

Name of Beneficial Owner | | Shares Beneficially Owned | | | Percentage of Shares Beneficially Owned (%) | |

5% Shareholder: | | | | | | | | |

OrbiMed Advisors LLC (1)(2)(3) | | | 7,430,481 | | | | 74.8 | |

Executive Officers and Directors: | | | | | | | | |

William J. Adams (4) | | | 31,256 | | | | * | |

Anthony F. Holler, M.D. (5) | | | 54,769 | | | | * | |

Joseph D. Keegan, Ph.D. (6) | | | 26,791 | | | | * | |

Barbara Kinnaird-Steen, Ph.D. (7) | | | 42,426 | | | | * | |

Jeffrey L. Purvin (8) | | | 110,550 | | | | 1.7 | |

Clinton H. Severson (9) | | | 26,791 | | | | * | |

Timothy Patrick Shannon (10) | | | 25,999 | | | | * | |

Lewis J. Shuster (11) | | | 30,433 | | | | * | |

Peter A. Thompson, M.D. (12) | | | 174,933 | | | | 2.6 | |

David Wang, M.D. (13)(14) | | | 7,455,500 | | | | 74.9 | |

Jonathan Jian Wang (15)(16) | | | 7,456,694 | | | | 74.9 | |

All directors and executive officers as a group (11) people) (17) | | | 8,005,661 | | | | 76.6 | |

(*) | Represents beneficial ownership of less than 1%. |

(1) | OrbiMed Advisors LLC’s address is 601 Lexington Avenue, 54th Floor, New York, NY, 10022. |

(2) | Includes 3,351,205 shares subject to 67,024,128 warrants exercisable within 60 days of September 13, 2013. |

(3) | OrbiMed Advisors LLC’s shares are beneficially owned through three entities: OrbiMed Private Investments III, LP, OrbiMed Asia Partners, LP, and OrbiMed Associates. |

| | • | OrbiMed Private Investments III, LP beneficially owns 4,625,066 shares which includes 2,085,383 shares subject to 41,707,675 warrants exercisable within 60 days of September 13, 2013. |

| | • | OrbiMed Asia Partners, LP beneficially owns 2,761,376 shares which includes 1,245,964 shares subject to 24,919,282 warrants exercisable within 60 days of September 13, 2013. |

| | • | OrbiMed Associates beneficially owns 44,039 shares which includes 19,858 shares subject to 397,171warrants exercisable within 60 days of September 13, 2013. |

(4) | Includes 20,156 shares subject to options exercisable within 60 days of September 13, 2013. |

(5) | Includes 24,650 shares subject to 493,000 warrants exercisable within 60 days of September 13, 2013, 20,375 shares subject to options exercisable within 60 days of September 13, 2013, and 9,744 shares subject to restricted share units exercisable within 60 days of September 13, 2013. |

(6) | Includes 20,000 shares subject to options exercisable within 60 days of September 13, 2013 and 6,791 shares subject to restricted share units exercisable within 60 days of September 13, 2013. |

(7) | Includes 8,259 shares subject to 165,192 warrants exercisable within 60 days of September 13, 2013 and 25,908 shares subject to options exercisable within 60 days of September 13, 2013. |

(8) | Includes 93,750 shares subject to options exercisable within 60 days of September 13, 2013. |

(9) | Includes 20,000 shares subject to options exercisable within 60 days of September 13, 2013 and 6,791 shares subject to restricted share units exercisable within 60 days of September 13, 2013. |

(10) | Includes 12,499 shares subject to options exercisable within 60 days of September 13, 2013. |

(11) | Includes 20,000 shares subject to options exercisable within 60 days of September 13, 2013 and 10,433 shares subject to restricted share units exercisable within 60 days of September 13, 2013. |

(12) | Includes 166,666 shares subject to options exercisable within 60 days of September 13, 2013 and 8,267 shares subject to restricted stock units exercisable within 60 days of September 13, 2013. |

(13) | Includes 20,000 shares subject to options exercisable within 60 days of September 13, 2013 and 5,019 shares subject to restricted share units exercisable within 60 days of September 13, 2013. |

(14) | Refer to footnotes 1 through 3. The individual listed herein may be deemed to have shared voting and dispositive power over the shares which are or may be deemed to be beneficially owned by OrbiMed Advisors LLC. However, David Wang disclaims beneficial ownership of the shares except to the extent of his pecuniary interest therein. |

(15) | Includes 20,000 shares subject to options exercisable within 60 days of September 13, 2013 and 6,213 shares subject to restricted share units exercisable within 60 days of September 13, 2013. |

(16) | Refer to footnotes 1 through 3. The individual listed herein may be deemed to have shared voting and dispositive power over the shares which are or may be deemed to be beneficially owned by OrbiMed Advisors LLC. However, Jonathan Jian Wang disclaims beneficial ownership of the shares except to the extent of his pecuniary interest therein. |

(17) | See footnotes 4 through 16 inclusive. |

OTHER BUSINESS

Our board of directors does not know of any matter to be presented at our Meeting which is not listed on the Notice of Special Meeting and discussed above. If any other matters properly come before the Meeting, it is the intention of the persons named in the proxy to vote the shares they represent as our board of directors may recommend. Discretionary authority with respect to such other matters is granted by a properly submitted proxy.

ADDITIONAL INFORMATION

Interest of Certain Persons in Matters to Be Acted Upon

Except as described elsewhere in this information circular, no Person has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in matters to be acted upon at the Meeting. For the purpose of this paragraph, “Person” shall include each person or company: (a) who has been a director or executive officer of the Company at any time since the commencement of the Company’s last financial year; (b) who is a proposed nominee for election as a director of the Company; or (c) who is an associate or affiliate of a person or company included in subparagraphs (a) or (b).

Indebtedness of Directors and Executive Officers

As at the date of this information circular, no executive officer, director, employee or former executive officer, director or employee of the Company or any of its subsidiaries is indebted to the Company, or any of its subsidiaries, nor are any of these individuals indebted to another entity which indebtedness is the subject of a guarantee, support agreement, letter of credit or another similar arrangement or understanding provided by the Company, or any of its subsidiaries.

Interest of Management and Others in Material Transactions

Other than as disclosed elsewhere in this information circular, no director, executive officer or shareholder that beneficially owns, or controls or directs, directly or indirectly, more than 10% of the issued Common shares, or any of their respective associates or affiliates, has any material interest, direct or indirect, in any transaction since the commencement of Response’s most recently completed financial year or in any proposed transaction which has materially affected or would materially affect Response or any of its subsidiaries.

INCORPORATION BY REFERENCE

Statements contained in this information circular, or in any document incorporated by reference in this information circular regarding the contents of any contract or other document, are not necessarily complete and each such statement is qualified in its entirety by reference to that contract or other document filed as an exhibit with the SEC. The SEC allows us to “incorporate by reference” into this information circular documents we file with the SEC. This means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be a part of this information circular, and later information that we file with the SEC will update and supersede that information. We incorporate by reference the documents listed below and any documents filed by us pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this information circular and before the date of the Special Meeting (in each case, other than information and exhibits “furnished” to and not “filed” with the SEC in accordance with SEC rules and regulations):

| | ● | our Annual Report on Form 10-K for the year ended December 31, 2012, filed with the SEC on March 15, 2013; |

| | ● | our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2013 and June 30, 2013, filed with the SEC on May 14, 2013 and August 13, 2013, respectively; and |

| | ● | our Current Reports on Form 8-K filed with the SEC on January 4, January 25, March 1, March 13, May 14, June 20, July 30, August 13, 2013, and September 26, 2013. |

Financial information is provided in the Company’s comparative annual financial statements and MD&A for its most recently completed financial year.

This information circular incorporates important business and financial information about the Company from other documents that are not included in or delivered with this document. This information is available to you without charge upon your written request. You can obtain the documents incorporated by reference in this information circular through our website, www.responsebio.com, under the Company’s profile on SEDAR at www.sedar.com and from the SEC at its website, www.sec.gov, or by written request directed to us in care of the Corporate Secretary, Response Biomedical Corp., 1781 – 75th Avenue W., Vancouver, BC, telephonic request to (604) 456-6010 or fax (604) 456-6066. Shareholders may also read and copy materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. Shareholders may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

It is important that your common shares be represented at the Meeting, regardless of the number of common shares that you hold. You are, therefore, urged to vote as promptly as possible to ensure your vote is recorded.

By Order of the Board of Directors,

/s/ Lewis Shuster

Director

ANNEX A

SUBSCRIPTION AGREEMENT

RESPONSE BIOMEDICAL CORP. (THE “ISSUER”)

PRIVATE PLACEMENT SUBSCRIPTION AGREEMENT

FOR SUBSCRIPTION RECEIPTS

INSTRUCTIONS TO PURCHASER

1. | All purchasers must complete all the information in the boxes on page 2 and sign where indicated with an “X”. |

2. | If you are purchasing less than $150,000 and are an “accredited investor”, then complete and sign the “Accredited Investor Form” that starts on page 5. The purpose of the form is to determine whether you meet the standards for participation in a private placement under National Instrument 45-106. |

3. | If you are a “U.S. Purchaser”, complete and sign the certification that starts on page 13. A “U.S. Purchaser” is (a) any person in the United States, (b) any person purchasing Purchased Securities on behalf of any person in the United States, (c) any person that receives or received an offer to purchase the Purchased Securities while in the United States (except persons excluded from the definition of “U.S. person” pursuant to Rule 902(k)(2)(i) or (vi) of Regulation S), or (d) any person that is in the United States at the time the purchaser’s buy order was made or this subscription agreement was executed or delivered (except persons excluded from the definition of “U.S. person” pursuant to Rule 902(k)(2)(i) or (vi) of Regulation S). If you are a U.S. Purchaser, the Purchased Securities are being offered and sold only to “accredited investors”, as that term is defined in Rule 501(a) of Regulation D promulgated under the United States Securities Act of 1933, as amended (the “1933 Act”). |

4. | If you are resident in a country other than Canada or the United States, then complete and sign the “Foreign Purchasers Certificate” that starts on page 19. |

Important Notes to Purchasers:

The gross proceeds will be held in trust until the Release Condition (as defined herein) is satisfied. Upon satisfaction of the Release Condition, each Subscription Receipt (as defined herein) will automatically convert into one unit of the Issuer (a “Unit”). Each Unit will consist of one common share of the Issuer (“Common Share”) and one-half of one warrant to purchase one whole Common Share. In the event that the Release Condition is not satisfied on or before 5:00 p.m. (Toronto Time) on November 24, 2013, then the subscription shall terminate and all subscription funds shall be returned to investors without interest.

This is page 2 of 36 pages of a subscription agreement and related appendices, acknowledgements, provisions and forms. Collectively, these pages together are referred to as the “Subscription Agreement”.

PRIVATE PLACEMENT SUBSCRIPTION AGREEMENT

TO: | Response Biomedical Corp.(the “Issuer”), of 1781 – 75th Avenue W., Vancouver, B.C. V6P 6P2 |

| | |

| AND TO: | Bloom Burton & Co. Inc. (the “Agent”) of 65 Front St. East, Suite 300, Toronto, Ontario, M5E 1B5 |

Subject and pursuant to the terms set out in the Terms on pages 9 to 12, the General Provisions on pages 21 to 36 and the other appendices, acknowledgements, provisions and forms attached which are hereby incorporated by reference, the undersigned purchaser (the “Purchaser”) hereby irrevocably subscribes for, and on Closing will purchase from the Issuer, the following securities at the following price:

___________________________ Subscription Receipts $2.45 per Subscription Receipt for a total purchase price of $________________________________

|

The Purchaser directs the Issuer to issue, register and deliver the certificates representing the Purchased Securities as follows, unless instructed otherwise by the Agent

REGISTRATION INSTRUCTIONS | | DELIVERY INSTRUCTIONS |

Name to appear on certificate | | Name and account reference, if applicable |

Account reference if applicable | | Contact name |

Address | | Address |

| | | Telephone Number |

Additional Purchaser Information

Present Ownership of Securities The Purchaser either [check appropriate box]: ☐ owns directly or indirectly, or exercises control or direction over, no common shares in the capital stock of the Issuer or securities convertible into common shares in the capital stock of the Issuer; or ☐ owns directly or indirectly, or exercises control or direction over, ________________ common shares in the capital stock of the Issuer and convertible securities entitling the Purchaser to acquire an additional ______________ common shares in the capital stock of the Issuer. |

Registrant Status The Purchaser either [check appropriate box]: ☐ is a “registrant” as defined in theSecurities Act (British Columbia), namely: “registrant” means a person that is registered or is required to be registered under theSecurities Act (British Columbia) because that person: (a)trades in a security or exchange contract; (b)acts as an adviser; (c)acts as an investment fund manager; or (d)acts as an underwriter; or ☐ is not a “registrant”. |

Insider Status The Purchaser either [check appropriate box]: ☐ is an “Insider” of the Issuer as defined in the Policies of the Toronto Stock Exchange, namely: “Insider” means (and includes associates and affiliates of the Insider): (a) a director or officer of the Issuer; (b) a director or officer of a person that is itself an Insider or subsidiary of the Issuer; (c) a person or company that has, (i) beneficial ownership of, or control or direction over, directly or indirectly, securities of the Issuer carrying more than 10 per cent of the voting rights attached to all the Issuer’s outstanding voting securities, excluding, for the purpose of the calculation of the percentage held, any securities held by the person or company as underwriter in the course of a distribution, or (ii) a combination of beneficial ownership of, and control or direction over, directly or indirectly, securities of the Issuer carrying more than 10 per cent of the voting rights attached to all the Issuer’s outstanding voting securities, excluding, for the purpose of the calculation of the percentage held, any securities held by the person or company as underwriter in the course of a distribution, (d) the Issuer if it has purchased, redeemed or otherwise acquired a security of its own issue, for so long as it continues to hold that security, (e) a person or company designated as an Insider in an order made under subsection (11) of theSecurities Act(Ontario), and (f) a person or company that is in a class of persons or companies designated under subparagraph 40v of subsection 143 (1) of theSecurities Act (Ontario). ☐ is not an “Insider” of the Issuer. |

EXECUTED by the Purchaser this day of , 20. By executing this Subscription Agreement, the Purchaser certifies that the Purchaser and any beneficial purchaser for whom the Purchaser is acting is resident in the jurisdiction shown as the “Address of Purchaser”.

EXECUTION BY PURCHASER: X Signature of individual (if Purchaseris an individual) X Authorized signatory (if Purchaser is not an individual) Name of Purchaser and/or authorized signatory (please print) Name of beneficial purchaser for whom Purchaser is contracting (if applicable) (please print) Address of Purchaser (residence) Address of beneficial purchaser (if applicable) Telephone number and e-mail address |

RESPONSE BIOMEDICAL CORP.(i)accepts the subscription set forth above this _____ day of _____________________________, 2013; and (ii) represents and warrants to the Purchaser that the representations and warranties made by the Issuer in this Subscription Agreement (including those representations and warranties incorporated herein by reference) are true and correct as of the date hereof and will be true and correct as of the Closing Date, and agrees to be bound by the obligations of the Issuer set forth in this Subscription Agreement.

______________________________________

Authorized Signatory

Subscription Agreement (with related appendices, acknowledgements, provisions and forms) Page 5of 61 pages

ACCREDITED INVESTOR FORM

(Capitalized terms not specifically defined in this Form have the meaning ascribed to them in the Subscription Agreement to which this Form is attached.)

In connection with the execution of the Subscription Agreement to which this Form is attached, the undersigned (the “Purchaser”) represents and warrants to the Issuer that the Purchaser satisfies one or more of the categories indicated below (please place an “X” on the appropriate lines):

_____Category 1 | a Canadian financial institution, or a Schedule III bank |

_____Category 2 | the Business Development Bank of Canada incorporated under the Business Development Bank of Canada Act (Canada) |

_____Category 3 | a subsidiary of any person referred to in Category 1 or 2, if the person owns all of the voting securities of the subsidiary, except the voting securities required by law to be owned by directors of that subsidiary |

_____Category 4 | a person registered under the securities legislation of a jurisdiction of Canada as an adviser or dealer, other than a person registered solely as a limited market dealer under one or both of the Securities Act (Ontario) or the Securities Act (Newfoundland and Labrador) |

_____Category 5 | an individual registered or formerly registered under the securities legislation of a jurisdiction of Canada as a representative of a person referred to in Category 4 |

_____Category 6 | the Government of Canada or a jurisdiction of Canada, or any crown corporation, agency or wholly owned entity of the Government of Canada or a jurisdiction of Canada |

_____Category 7 | a municipality, public board or commission in Canada and a metropolitan community, school board, the Comité de gestion de la taxe scolaire de l’ile de Montreal or an intermunicipal management board in Québec |

_____Category 8 | any national, federal, state, provincial, territorial or municipal government of or in any foreign jurisdiction, or any agency of that government |

_____Category 9 | a pension fund that is regulated by the Office of the Superintendent of Financial Institutions (Canada), a pension commission or similar regulatory authority of a jurisdiction of Canada |

_____Category 10 | an individual who, either alone or with a spouse, beneficially owns financial assets having an aggregate realizable value that before taxes, but net of any related liabilities, exceeds $1,000,000 |

_____Category 11 | an individual whose net income before taxes exceeded $200,000 in each of the two (2) most recent calendar years or whose net income before taxes combined with that of a spouse exceeded $300,000 in each of the two (2) most recent calendar years and who, in either case, reasonably expects to exceed that net income level in the current calendar year |

_____Category 12 | an individual who, either alone or with a spouse, has net assets of at least $5,000,000 |

_____Category 13 | a person, other than an individual or investment fund, that has net assets of at least $5,000,000 as shown on its most recently prepared financial statements |

_____Category 14 | an investment fund that distributes or has distributed its securities only to (a) a person that is or was an accredited investor at the time of the distribution; (b) a person that acquires or acquired securities in the circumstances referred to in sections 2.10 of National Instrument 45-106 [Minimum amount investment], or 2.19 of National Instrument 45-106 [Additional investment in investment funds]; or (c) a person described in paragraph (a) or (b) that acquires or acquired securities under section 2.18 of National Instrument 45-106 [Investment fund reinvestment] |

_____Category 15 | an investment fund that distributes or has distributed securities under a prospectus in a jurisdiction of Canada for which the regulator or, in Quebec, the securities regulatory authority, has issued a receipt |

_____Category 16 | a trust company or trust corporation registered or authorized to carry on business under the Trust and Loan Companies Act (Canada) or under comparable legislation in a jurisdiction of Canada or a foreign jurisdiction, acting on behalf of a fully managed account managed by the trust company or trust corporation, as the case may be |

Subscription Agreement (with related appendices, acknowledgements, provisions and forms) Page 6of 36 pages

_____Category 17 | a person acting on behalf of a fully managed account managed by that person, if that person (a) is registered or authorized to carry on business as an adviser or the equivalent under the securities legislation of a jurisdiction of Canada or a foreign jurisdiction; and (b) in Ontario, is purchasing a security that is not a security of an investment fund |

_____Category 18 | a registered charity under the Income Tax Act (Canada) that, in regard to the trade, has obtained advice from an eligibility adviser or an adviser registered under the securities legislation of the jurisdiction of the registered charity to give advice on the securities being traded |

_____Category 19 | an entity organized in a foreign jurisdiction that is analogous to any of the entities referred to in Categories 1 to 4 or Category 9 in form and function |

_____Category 20 | a person in respect of which all of the owners of interests, direct, indirect or beneficial, except the voting securities required by law to be owned by directors, are persons that are accredited investors |

_____Category 21 | an investment fund that is advised by a person registered as an adviser or a person that is exempt from registration as an adviser |

_____Category 22 | a person that is recognized or designated by the securities regulatory authority or, except in Ontario and Québec, the regulator as an accredited investor |

The statements made in this Form are true and accurate as of the date of signing and will be true and accurate as of the Closing Date. If any such representations and warranties shall cease to be true and accurate at any time prior to Closing, the Purchaser will promptly notify the Agent and the Issuer.

Dated _____________________________________ 20___.

| |

| | X |

| | Signature of individual (if Purchaseris an individual) |

| | |

| | X |

| Authorized signatory (if Purchaser isnotan individual) |

| |

| | _____________________________________________ |

| | Name of Purchaser (please print) |

| | |

| | _____________________________________________ |

| | Name of authorized signatory (please print) |

| | |

| | _____________________________________________ |

| | Official capacity of authorized signatory (please print) |

For the purposes hereof:

| | (a) | “accredited investor” means a person who meets the criteria in any of the above categories; |

| | (b) | “Canadian financial institution” means: |

| | (i) | an association governed by theCooperative Credit Associations Act(Canada) or a central cooperative credit society for which an order has been made under section 473(1) of that Act; or |

| | (ii) | a bank, loan corporation, trust company, trust corporation, insurance company, treasury branch, credit union, caisse populaire, financial services cooperative, or league that, in each case, is authorized by an enactment of Canada or a jurisdiction of Canada to carry on business in Canada or a jurisdiction of Canada; |

Subscription Agreement (with related appendices, acknowledgements, provisions and forms) Page 7of 36 pages

| | (c) | “eligibility adviser” means |

| | (i) | a person that is registered as an investment dealer and authorized to give advice with respect to the type of security being distributed; and |

| | (ii) | in Saskatchewan or Manitoba, also means a lawyer who is a practicing member in good standing with a law society of a jurisdiction of Canada or a public accountant who is a member in good standing of an institute or association of chartered accountants, certified general accountants or certified management accountants in a jurisdiction of Canada provided that the lawyer or public accountant must not: |

| | (A) | have a professional, business or personal relationship with the issuer, or any of its directors, executive officers, founders or control persons, and |

| | (B) | have acted for or been retained personally or otherwise as an employee, executive officer, director, associate or partner of a person that has acted for or been retained by the issuer or any of its directors, executive officers, founders or control persons within the previous 12 months; |

| | (d) | “financial assets” means |

| | (iii) | a contract of insurance, a deposit or an evidence of a deposit that is not a security for the purposes of securities legislation; |

| | (e) | “fully managed account” means an account of a client for which a person makes the investment decisions if that person has full discretion to trade in securities for the account without requiring the client’s express consent to a transaction; |

| | (f) | “investment fund” means a mutual fund or a non-redeemable investment fund, and, for great certainty in British Columbia, includes an employee venture capital corporation and a venture capital corporation as such terms are defined in National Instrument 81-106Investment Fund Continuous Disclosure; |

| | (g) | “non-redeemable investment fund” means an issuer: |

| | (i) | whose primary purpose is to invest money provided by its securityholders; |

| | (A) | for the purpose of exercising or seeking to exercise control of an issuer, other than an issuer that is a mutual fund or a non-redeemable investment fund, or |

| | (B) | for the purpose of being actively involved in the management of any issuer in which it invests, other than an issuer that is a mutual fund or a non-redeemable investment fund, and |

| | (iii) | that is not a mutual fund; |

Subscription Agreement (with related appendices, acknowledgements, provisions and forms) Page 8of 36 pages

| | (iii) | a partnership, trust, fund and an association, syndicate, organization or other organized group of persons, whether incorporated or not; and |

| | (iv) | an individual or other person in that person’s capacity as a trustee, executor, administrator or personal or other legal representative; |

| | (i) | “related liabilities” means |

| | (i) | liabilities incurred or assumed for the purpose of financing the acquisition or ownership of financial assets, or |

| | (ii) | liabilities that are secured by financial assets; |

| | (j) | “Schedule III bank” means an authorized foreign bank named in Schedule III of theBank Act(Canada); |

| | (k) | “spouse” means, an individual who, |

| | (i) | is married to another individual and is not living separate and apart within the meaning of theDivorce Act(Canada), from the other individual, |

| | (ii) | is living with another individual in a marriage-like relationship, including a marriage-like relationship between individuals of the same gender, or |

| | (iii) | in Alberta,is an individual referred to in paragraph (i) or (ii),or is an adult interdependent partner within the meaning of theAdult Interdependent Relationships Act(Alberta); and |

| | (l) | “subsidiary” means an issuer that is controlled directly or indirectly by another issuer and includes a subsidiary of that subsidiary. |

Subscription Agreement (with related appendices, acknowledgements, provisions and forms) Page 9of 36 pages

TERMS

Reference date of this Subscription Agreement | September 24, 2013 (the “Agreement Date”). |

| |

The Offering |

| |

The Issuer | Response Biomedical Corp. (the “Issuer”). |

| | |

The Agent | The offering is made on a commercially reasonable efforts basis by Bloom Burton & Co. Inc. (which, together with any sub-agents, including a registered United States broker-dealer (a “U.S. Affiliate”), is referred to as the “Agent”) under an agency agreement dated for reference the Agreement Date (the “Agency Agreement”). |

| | |

Offering | The offering (the “Offering”) consists of an aggregate of up to 1,632,653 subscription receipts of the Issuer (the “Subscription Receipts”). |

| | |

Purchased Securities | The “Purchased Securities” are non-transferable Subscription Receipts purchased pursuant to the terms of this Subscription Agreement. Each Subscription Receipt will automatically convert, for no additional consideration, on the Effective Date (as defined below) into one previously unissued unit (a “Unit”) of the Issuer. Each Unit will consist of one common share of the Issuer (a “Share”) and one-half of one warrant to purchase one share (each whole warrant, a “Warrant”, each underlying Share, a “Warrant Share”). Each Warrant will have an exercise price of $3.58 and will expire on the three-year anniversary of the Closing Date. The Warrants will be eligible for cashless exercise and will be subject to standard adjustment provisions. |

| | |

Funds from Subscription Receipts | The conversion of the Subscription Receipts and the release of the subscription proceeds are conditional upon (A) the Issuer obtaining disinterested shareholder approval for the Offering at a meeting of the shareholders of the Issuer to be held on or about November 1, 2013, or at any adjournment thereof (the “Release Condition”). |

| | |

| | From the Closing Date until the date on which the Release Condition is satisfied (the “Effective Date”), the gross proceeds of this Offering will be held in trust by an escrow agent acceptable to the Agent and the Issuer. After the Release Condition is satisfied, the gross proceeds less the Commission (as defined below) and any remaining expenses of the Agent will be released to the Issuer. |

| | |

| | On the Effective Date, the Subscription Receipts will automatically convert, for no additional consideration, into Units. There can be no assurance that the Release Condition will be satisfied. |

| | |

| | If the Release Condition are not satisfied on or before 5:00 p.m. (Toronto Time) on November 24, 2013 (the “Expiry Time”), all Subscription Receipts will be automatically cancelled and be null and void, and the proceeds held by the escrow agent will be returned to the Agent, on behalf of the Purchasers, in the full amounts of their subscriptions. |

Subscription Agreement (with related appendices, acknowledgements, provisions and forms) Page 10of 36 pages

Compensation to Agent | The Agent will receive a cash commission equal to 5% and broker warrants equal to 7.0% of the gross proceeds received by the Issuer from the sale of the Subscription Receipts, excluding certain specified investors (together, these amounts and Securities are the “Commission”). The Commission will be paid out of the gross proceeds only upon the Release Condition being satisfied. |

| | |

| | If the Release Condition is not satisfied on or before the Expiry Time the Commission will be not be paid to the Agent. |

| | |

Total amount | Up to $4,000,000. |

| | |

Price | $2.45 per Subscription Receipt. |

| | |

Selling Jurisdictions | The Subscription Receipts may be sold in all of the Provinces of Canada and in certain “off shore” jurisdictions outside Canada and outside the United States and in the United States in accordance with available exemptions(the “Selling Jurisdictions”). |

| | |

Exemptions | The Offering will be made in accordance with the following exemptions from the prospectus requirements in Canada: (a) the “accredited investor” exemption found in section 2.3 of National Instrument 45-106Prospectus and Registration Exemptions; and (b) the “minimum amount investment ($150,000)” exemption found in section 2.10 of National Instrument 45-106 Prospectus and Registration Exemptions. The Offering will also be made in the United States, pursuant to Rule 506 of Regulation D, Regulation S and/or section 4(2) of the United States Securities Act of 1933, as amended. |

Subscription Agreement (with related appendices, acknowledgements, provisions and forms) Page 11of 36 pages