UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: (811- 05215 )

Exact name of registrant as specified in charter: Putnam Tax Exempt Money Market Fund

Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109

| Name and address of agent for service: | Beth S. Mazor, Vice President |

| | One Post Office Square |

| | Boston, Massachusetts 02109 |

| |

| Copy to: | John W. Gerstmayr, Esq. |

| | Ropes & Gray LLP |

| | One International Place |

| | Boston, Massachusetts 02110 |

Registrant’s telephone number, including area code: (617) 292-1000

Date of fiscal year end: September 30, 2007

Date of reporting period: October 1, 2006— March 31, 2007

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

What makes Putnam different?

In 1830, Massachusetts Supreme Judicial Court Justice Samuel Putnam established The Prudent Man Rule, a legal foundation for responsible money management.

THE PRUDENT MAN RULE

All that can be required of a trustee to invest is that he shall conduct himself faithfully and exercise a sound discretion. He is to observe how men of prudence, discretion, and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital to be invested.

A time-honored tradition in money management

Since 1937, our values have been rooted in a profound sense of responsibility for the money entrusted to us.

A prudent approach to investing

We use a research-driven team approach to seek consistent, dependable, superior investment results over time, although there is no guarantee a fund will meet its objectives.

Funds for every investment goal

We offer a broad range of mutual funds and other financial products so investors and their financial representatives can build diversified portfolios.

A commitment to doing what’s right for investors

We have below-average expenses and stringent investor protections, and provide a wealth of information about the Putnam funds.

Industry-leading service

We help investors, along with their financial representatives, make informed investment decisions with confidence.

Putnam

Tax Exempt

Money Market Fund

3| 31| 07

Semiannual Report

| Message from the Trustees | 2 |

| About the fund | 4 |

| Report from the fund managers | 7 |

| Performance | 13 |

| Expenses | 15 |

| Your fund’s management | 17 |

| Terms and definitions | 18 |

| Trustee approval of management contract | 19 |

| Other information for shareholders | 25 |

| Financial statements | 26 |

Cover photograph: © Richard H. Johnson

Message from the Trustees

Dear Fellow Shareholder

Although the global economy continues to demonstrate healthy growth, it has become evident that certain sectors of the U.S. economy have slowed somewhat. Volatility in the financial markets has been on the rise, reflecting increased uncertainty about the potential impact of problems in the housing market. However, we have also seen indications that inflation is stabilizing and the unemployment rate is declining. We consequently believe the resilience of the U.S. economy will enable it to weather this period of uncertainty.

As you may have heard, on February 1, 2007, Marsh & McLennan Companies, Inc. announced that it had signed a definitive agreement to sell its ownership interest in Putnam Investments Trust, the parent company of Putnam Management and its affiliates, to Great-West Lifeco Inc. Great-West Lifeco is a financial services holding company with operations in Canada, the United States, and Europe and is a member of the Power Financial Corporation group of companies. This transaction is subject to regulatory approvals and other conditions, including the approval of new management contracts by shareholders of a substantial number of Putnam funds at shareholder meetings scheduled for May 15, 2007. We currently expect the transaction to be completed by the middle of 2007.

Putnam’s team of investment and business professionals will continue to be led by Putnam President and Chief Executive Officer Ed Haldeman. Your Trustees have been actively involved through every step of the discussions, and we will continue in our role of overseeing the Putnam funds on your behalf.

2

In the following pages, members of your fund’s management team discuss the fund’s performance and strategies for the fiscal period ended March 31, 2007, and provide their outlook for the months ahead. As always, we thank you for your support of the Putnam funds.

Putnam Tax Exempt Money Market Fund: seeking to

offer accessibility and tax-advantaged income at low risk

For most people, keeping part their savings in a low-risk, easily accessible place is an essential part of pursuing their overall investment strategy. And if earnings from that vehicle are tax-favored, all the better. That is why Putnam Tax Exempt Money Market Fund can play a valuable role in many investors’ portfolios. The fund seeks to earn as high a rate of current income that is exempt from federal income taxes as Putnam believes is consistent with liquidity, as well as with preservation and stability of principal. In short, the fund aims to provide investors with tax-favored income at short-term rates.

Because the fund invests in securities issued by borrowers with excellent credit ratings, the fund’s risk of losing principal is low.

Furthermore, because the fund holds instruments that pay interest that is exempt from federal income tax (but may be subject to the federal alternative minimum tax, or AMT), investors in the fund are able to keep more income after taxes.

Putnam Tax Exempt Money Market Fund’s management team is backed by the resources of Putnam’s fixed-income organization, one of the largest in the investment industry. Putnam’s municipal security analysts are grouped into sector teams and conduct ongoing, rigorous research.

Whether you want to earmark money for planned near-term expenses or future investment opportunities, or to stow away cash for an unforeseen “rainy day” while earning tax-favored income, Putnam Tax Exempt Money Market Fund can be an attractive choice.

Capital gains, if any, are taxable for federal and, in most cases, state purposes. For some investors, investment income may be subject to the federal alternative minimum tax. Income from federally exempt funds may be subject to state and local taxes. Tax-free funds may not be suitable for IRAs and other non-taxable accounts. Please consult your tax advisor for more information.

An investment in this fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund seeks to maintain a constant share price of $1.00 per share, it is possible to lose money by investing in the fund.

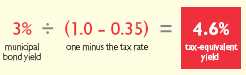

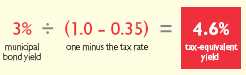

Understanding tax-equivalent yield

To understand the value of tax-free income, it is helpful to compare a municipal bond’s yield with the “tax-equivalent yield” — the before-tax yield that must be offered by a taxable bond in order to equal the municipal bond’s yield after taxes.

How to calculate tax-equivalent yield:

The tax-equivalent yield equals the municipal bond’s yield divided by “one minus the tax rate.” For example, if a municipal bond’s yield is 3%, then its tax-equivalent yield is 4.6%, assuming the maximum 35% federal tax rate for 2007.

Results for investors subject to lower tax rates would not be as advantageous.

Municipal securities may finance a range of projects in your

community and thus play a key role in its development.

Putnam Tax Exempt Money Market Fund is designed for investors seeking as high a level of current income exempt from federal income tax as we believe is consistent with capital preservation, stability of principal, and maintenance of liquidity.

Highlights

• For the six months ended March 31, 2007, Putnam Tax Exempt Money Market Fund’s class A shares returned 1.54% .

• The average return for the fund’s Lipper category, Tax-Exempt Money Market Funds, was 1.45% .

• Additional fund performance, comparative performance, and Lipper data can be found in the performance section beginning on page 13.

Performance

Total return for class A shares for periods ended 3/31/07

Since the fund’s inception (10/26/87), average annual return is 2.90% at NAV.

Current 7-day yield (at 3/31/07) is 3.05%, with expense limitation. Taxable equivalent: 4.69%.

Current 7-day yield (at 3/31/07) is 2.94%, without expense limitation. Taxable equivalent: 4.52%.

| | Average annual return | Cumulative return |

| | NAV | NAV |

|

| 10 years | 2.15% | 23.71% |

|

| 5 years | 1.47 | 7.59 |

|

| 3 years | 2.02 | 6.17 |

|

| 1 year | 3.07 | 3.07 |

|

| 6 months | — | 1.54 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Investment return will fluctuate. Performance assumes reinvestment of distributions. For a portion of the period, this fund limited expenses, without which returns and yields would have been lower. Class A shares do not bear an initial sales charge. To obtain the most recent month-end performance, visit www.putnam.com.

The 7-day yield is one of the most common gauges for measuring money market mutual fund performance. Yield reflects current performance more closely than total return. Taxable equivalent assumes the maximum 35% federal income tax rate for 2007. Results for investors subject to lower tax rates would not be as advantageous. Investment income from federally exempt funds may be subject to state and local taxes.

6

Report from the fund managers

The period in review

With the Federal Reserve (Fed) holding its benchmark short-term interest rate, the federal funds rate, steady during the first half of your fund’s 2007 fiscal year, tax-exempt money market yields hovered within a narrow range. In this environment, our efforts to take advantage of seasonal factors, such as tax-related selling, proved advantageous for the fund. Another effective strategy we used was investing the proceeds from maturing holdings into floating-rate securities, particularly variable-rate demand notes whose rates reset at one- and seven-day intervals. We also believe we were able to capture temporary increases in yield by keeping the portfolio’s weighted average days to maturity relatively short during the period. Reflecting these efforts, the fund’s total return at net asset value (NAV) edged ahead of the average for its Lipper peer group for the six months ended March 31, 2007.

Market overview

Shortly before the beginning of the fund’s 2007 fiscal year, which started October 1, 2006, there was a major change in the Fed’s interest-rate policy. After 17 increases in the federal funds rate, the Fed suspended its credit-tightening program in August 2006, holding this benchmark rate for overnight loans between banks steady at 5.25% . Rates remained at this level throughout the six-month period. Since then, statements from the Federal Open Market Committee, the central bank’s policy-setting panel, have indicated that future rate decisions will depend on whether the Fed concludes that inflation or slower growth represents the greater risk to the economy. Reflecting the uncertainty in the marketplace regarding the Fed’s policy direction, yields on shorter-maturity bonds increased, and short- and intermediate-term tax-exempt bonds underperformed co mparable Treasuries.

One particular area in the economy that received much media attention during the period was sub-prime lending in the housing sector. While multiple lenders have experienced problems, we would like to reassure

7

shareholders that the money market sector has largely been unaffected by the difficulties in the sub-prime mortgage market. If the issues in the sub-prime market spill over into the broader economy, there could be some widening of credit spreads throughout the entire fixed-income market. In any event, we believe the fund’s high-quality focus should help insulate it from any potential ripples should the sub-prime mortgage lending sector experience further deterioration.

According to iMoneyNet, assets of all money market funds have continued to grow, increasing 10% over the six-month period covered by this report. By the end of the period, assets of all money-market mutual funds — taxable, institutional, and tax-free — had climbed to a record $2.396 trillion.* Part of this tremendous growth is due to the increasing popularity of taxable and tax-free money market funds among cash managers at major corporations, who invest in money market funds and directly in short-term investments such as time deposits and commercial paper.

Strategy overview

With the money market yield curve remaining flat throughout the six-month period, we saw little advantage in buying fixed-rated or longer-term money market securities. Instead, we kept the fund’s weighted average days to maturity (WAM), which indicates its sensitivity to changes in interest rates,

*Source: iMoneyNet, March 30, 2007.

Market sector performance

These indexes provide an overview of performance in different market sectors for the six months ended 3/31/07.

| Bonds | |

|

| Lipper Tax-Exempt Money Market Funds category average | 1.45% |

|

| Merrill Lynch 91-day Treasury Bill Index (short-maturity U.S. Treasury bills) | 2.52% |

|

| Lehman Municipal Bond Index (tax-exempt bonds) | 1.93% |

|

| Lehman Aggregate Bond Index (broad bond market) | 2.76% |

| |

| Equities | |

|

| S&P 500 Index (broad stock market) | 7.38% |

|

| Russell 1000 Index (large-company stocks) | 8.25% |

|

| Russell 2000 Index (small-company stocks) | 11.02% |

|

8

short relative to many competitors in its peer group. The fund’s WAM decreased from 21 days at the beginning of the fiscal year on October 1, 2006, to 16 days on March 31, 2007.

We reduced the portfolio’s WAM with strategies that favored certain types of securities with short-term maturities, while closely monitoring developments in the market for variable rate demand notes (VRDNs). We believed this would position the fund to benefit from seasonal opportunities that typically occur during the weeks leading up to the federal and state tax filing deadline. Historically, VRDN yields tend to rise during this time, because investors are liquidating assets to make tax payments. This selling pressure forces dealers to raise yields on VRDNs to attract buyers. Not surprisingly, municipal commercial paper and tax-free fixed-rate money market securities became relatively less attractive. By actively managing the fund through this fluctuation in supply/demand dynamics, we believe we positioned the fund for the best income opportunities that the market offered at that time.

Your fund’s holdings

The fund continues to hold a majority of its assets in interest-rate-sensitive VRDNs. VRDNs are structured with a long-term maturity and a daily or weekly put feature that allows the security to be money market eligible. The coupon resets daily or weekly, depending on the type of the municipal debt.

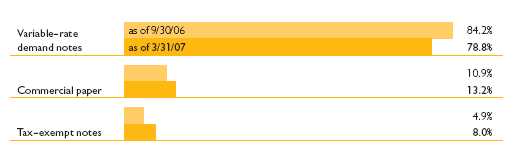

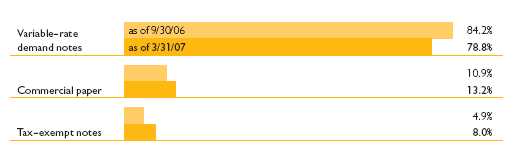

Portfolio composition comparison

This chart shows how the fund’s weightings have changed over the last six months. Weightings are shown as a percentage of portfolio value. Holdings will vary over time.

9

The VRDNs that we purchase are often backed by some form of liquidity or third-party credit support. This can take the form of a letter of credit (LOC) from a major commercial bank. The VRDN may also be insured and have a standby bond purchase agreement (SBPA) from a commercial bank or insurer. Ambac and FGIC are two of the four main bond insurers that retain an abundance of hard capital and generally have very strong claims-paying abilities. Ambac continues to pursue its long-term strategy of expanding its presence in Europe, as well as increasing its exposure to less competitive public finance sectors. This insurer is known for its conservative underwriting standards and the strength of its claims-paying resources, which reached $13 billion in 2006. Since FGIC’s 2003 sale to a group of investors, the company’s management team has implemented a new strategy focused on the expansion of its structured finance business and international presence. FGIC has been successful in increasing its market share at the expense of its larger competitors.

Based in Belgium, the Dexia Group is the largest public finance provider in Europe. While it is not a holding of the fund, a number of securities in the portfolio use this Belgium bank as their liquidity provider. A Dexia subsidiary, Financial Security Assurance Inc., writes credit insurance, which in essence is a financial guarantee for a security. This

Performance comparisons

As of 3/31/07

| | Current yield* | After-tax yield |

|

| Regular savings account | 0.20% | 0.13% |

|

| Average taxable money market fund compound 7-day yield | 4.87 | 3.17 |

|

| 3-month certificate of deposit | 5.30 | 3.45 |

|

| Putnam Tax Exempt Money Market Fund 7-day yield | | |

| (with expense limitation) | 3.05 | 3.05 |

|

| Putnam Tax Exempt Money Market Fund 7-day yield | | |

| (without expense limitation) | 2.94 | 2.94 |

|

The net asset value of money market mutual funds is uninsured and designed to be fixed, while distributions vary daily. Investment returns will fluctuate. The principal value on regular savings accounts and on bank certificates of deposits (CDs) is generally insured up to certain limits by state and federal agencies. Unlike stocks, which incur more risk, CDs offer a fixed rate of return. Unlike money market funds, bank CDs may be subject to substantial penalties for early withdrawals. After-tax return assumes a 35% maximum federal income tax rate.

During the period, the fund limited expenses, without which yields would have been lower.

* Sources: Bank of America (regular savings account), iMoneyNet Money Fund Report (average taxable money market fund compound 7-day yield), and Federal Reserve Board of Governors (3-month CDs).

10

insurance is perceived by the market as a credit enhancement, and thus augments the investment’s creditworthiness.

At the end of the reporting period, one of the fund’s largest letter of credit (LOC) providers was U.K.-based Barclays Bank. Barclays provides a broad range of investment banking and asset management services worldwide and has banking operations across continental Europe and South Africa.

We also purchased tax-revenue-anticipation notes (TRANs) issued by the state of New Jersey. These Series Fiscal 2007A Notes are secured solely by the moneys on deposit in the General Fund and Property Tax Relief Fund for fiscal 2007. According to fiscal 2007 estimates, debt service coverage on the notes should be a solid 2.2 times the amount of principal and interest. As additional security, the state has committed to set aside such amounts so that the balances on June 8, 2007, and June 21, 2007, w ill equal 75% and 100%, respectively, of the principal and interest due on the Series A Notes.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future.

Of special interest

Among the funds in its Tax-Exempt Money Market Funds category, Lipper ranked Putnam Tax Exempt Money Market Fund’s class A shares 28th out of 113, 31st out of 92, and 32nd out of 75 funds for the 1-, 5-, and 10-year periods ended March 31, 2007, respectively. These rankings put the fund in the 25th, 34th, and 43rd percentile for the same respective periods. The lower the percentile ranking according to Lipper, the better the fund’s performance relative to its Lipper peers. Lipper rankings do not reflect sales charges and are based on total return of funds with similar investment styles or objectives as determined by Lipper. Past performance does not guarantee future results.

11

The outlook for your fund

The following commentary reflects anticipated developments that could affect your fund over the next six months, as well as your management team’s plans for responding to them.

We believe the Fed will likely continue to hold interest rates steady until more data becomes available to clarify whether inflation or slower growth is the greater risk to our currently stable economy. While the Fed still seems more worried about inflation than growth, it has backed away from an explicit bias towards tightening. Therefore, while we anticipate that economic growth is likely to slow as 2007 unfolds, we plan to maintain a relatively short duration strategy until longer-range Fed policy becomes clearer.

Against this backdrop, we will be looking for opportunities to extend the weighted average days to maturity to lock in higher yields. This will likely involve lowering the portfolio’s exposure to VRDNs and purchasing fixed-rate tax-exempt notes and municipal paper. In the process, we’ll begin to position the portfolio for an eventual decline in interest rates. However, should growth remain strong or become stronger while inflation picks up or maintains its current pace, we expect to maintain our current strategy. In this case, we will continue to place high-quality issuers and securities into the fund to ensure that the credit quality remains strong and well diversified.

The views expressed in this report are exclusively those of Putnam Management. They are not meant as investment advice.

Capital gains, if any, are taxable for federal and, in most cases, state purposes. For some investors, investment income may be subject to the federal alternative minimum tax. Income from federally exempt funds may be subject to state and local taxes. Money market funds are not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other governmental agency. Although the fund seeks to maintain a constant share price of $1.00, it is possible to lose money by investing in this fund. Tax-free funds may not be suitable for IRAs and other non-taxable accounts.

12

Your fund’s performance

This section shows your fund’s performance for periods ended March 31, 2007, the end of the first half of its current fiscal year. Performance should always be considered in light of a fund’s investment strategy. Data represents past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return will fluctuate, and you may have a gain or a loss when you sell your shares. For the most recent month-end performance, please visit www.putnam.com or call Putnam at 1-800-225-1581.

Fund performance and comparative index results

For periods ended 3/31/07

| | | Putnam Tax | | Lipper Tax-Exempt | |

| | | Exempt Money | | Money Market Funds | |

| | | Market Fund | | category average* | |

|

| Annual average | | |

| (life of fund, since 10/26/87) | 2.90% | | 2.94% | |

|

| 10 years | 23.71 | | 23.29 | |

| Annual average | 2.15 | | 2.11 | |

|

| 5 years | 7.59 | | 7.08 | |

| Annual average | 1.47 | | 1.38 | |

|

| 3 years | 6.17 | | 5.79 | |

| Annual average | 2.02 | | 1.89 | |

|

| 1 year | 3.07 | | 2.89 | |

|

| 6 months | 1.54 | | 1.45 | |

|

| Current yield (end of period) | | |

| Current 7-day yield1 | | |

| (with expense limitation) | 3.05 | | |

|

| Taxable equivalent2 | 4.69 | | |

|

| Current 7-day yield1 | | |

| (without expense limitation) | 2.94 | | |

|

| Current 30-day yield1 | | |

| (with expense limitation) | 3.01 | | |

|

| Taxable equivalent2 | 4.63 | | |

|

| Current 30-day yield1 | | |

| (without expense limitation) | 2.90 | | |

|

Performance assumes reinvestment of distributions and does not account for taxes. There is no initial sales charge. For a portion of the period, this fund limited expenses, without which returns and yields would have been lower.

* Over the 6-month and 1-, 3-, 5-, 10-year, and life-of-fund periods ended 3/31/07, there were 116, 113, 102, 92, 75, and 36 funds, respectively, in this Lipper category.

1 The 7-day and 30-day yields are the two most common gauges for measuring money market mutual fund performance. Yield reflects current performance more closely than total return.

2 Assumes the 35% 2007 maximum federal income tax rate. Results for investors subject to lower tax rates would not be as advantageous. Capital gains, if any, are taxable for federal and, in most cases, state purposes. Investment income may be subject to state and local taxes. For some investors, investment income may also be subject to the federal alternative minimum tax.

13

Fund distribution information

For the six-month period ended 3/31/07

| Distributions* | |

|

| Number | 6 |

|

| Income | $0.015243 |

|

| Total | $0.015243 |

|

* Dividend sources are estimated and may vary based on final tax calculations after the fund’s fiscal year-end.

14

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. In the most recent six-month period, your fund limited these expenses; had it not done so, expenses would have been higher. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial advisor.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Putnam Tax Exempt Money Market Fund from October 1, 2006, to March 31, 2007. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | Class A | | | |

| | | |

| Expenses paid per $1,000* | $ 2.96 | | | |

| | | |

| Ending value (after expenses) | $1,015.40 | | | |

| | | |

* Expenses are calculated using the fund’s annualized expense ratio, which represents the ongoing expenses as a percentage of average net assets for the six months ended 3/31/07. Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended March 31, 2007, use the calculation method below. To find the value of your investment on October 1, 2006, go to www.putnam.com and log on to your account. Click on the “Transaction History” tab in your Daily Statement and enter 10/01/2006 in both the “from” and “to” fields. Alternatively, call Putnam at 1-800-225-1581.

15

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | Class A | | | |

| | | |

| Expenses paid per $1,000* | $ 2.97 | | | |

| | | |

| Ending value (after expenses) | $1,021.99 | | | |

| | | |

* Expenses are calculated using the fund’s annualized expense ratio, which represents the ongoing expenses as a percentage of average net assets for the six months ended 3/31/07. Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

Compare expenses using industry averages

You can also compare your fund’s expenses with the average of its peer group, as defined by Lipper, an independent fund-rating agency that ranks funds relative to others that Lipper considers to have similar investment styles or objectives. The expense ratio for each share class shown below indicates how much of your fund’s average net assets have been used to pay ongoing expenses during the period.

| | Class A | | | |

| | | |

| Your fund’s annualized expense ratio | 0.59% | | | |

| | | |

| Average annualized expense ratio for Lipper peer group* | 0.59% | | | |

| | | |

* Simple average of the expenses of all funds in the fund’s Lipper peer group, calculated in accordance with Lipper’s standard method for comparing fund expenses (excluding 12b-1 fees and without giving effect to any expense offset and brokerage service arrangements that may reduce fund expenses). This average reflects each fund’s expenses for its most recent fiscal year available to Lipper as of 3/31/07. The peer group may include funds that are significantly smaller or larger than the fund, which may limit the comparability of the fund’s expenses to the simple average, which typically is higher than the asset-weighted average.

16

Your fund’s management

Your fund is managed by the members of the Putnam Fixed-Income Money Market Team. Joanne Driscoll is the Portfolio Leader and Jonathan Topper is a Portfolio Member of the fund. The Portfolio Leader and Portfolio Member coordinate the team’s management of the fund.

For a complete listing of the members of the Putnam Fixed-Income Money Market Team, including those who are not Portfolio Leaders or Portfolio Members of your fund, visit Putnam’s Individual Investor Web site at www.putnam.com.

Fund manager compensation

The total 2006 fund manager compensation that is attributable to your fund is approximately $10,000. This amount includes a portion of 2006 compensation paid by Putnam Management to the fund managers listed in this section for their portfolio management responsibilities, calculated based on the fund assets they manage taken as a percentage of the total assets they manage. The compensation amount also includes a portion of the 2006 compensation paid to the Chief Investment Officer of the team and the Group Chief Investment Officer of the fund’s broader investment category for their oversight responsibilities, calculated based on the fund assets they oversee taken as a percentage of the total assets they oversee. This amount does not include compensation of other personnel involved in research, trading, administration, systems, compliance, or fund operations; nor does it include non-compensation costs. These percentages are determined as of the fund’s fiscal period-end. For personnel who joined Putnam Management during or after 2006, the calculation reflects annualized 2006 compensation or an estimate of 2007 compensation, as applicable.

Other Putnam funds managed by the Portfolio Leader and Portfolio Member

Joanne Driscoll is also a Portfolio Leader of Putnam Money Market Fund and Putnam Prime Money Market Fund.

Jonathan Topper is also a Portfolio Member of Putnam Money Market Fund and Putnam Prime Money Market Fund.

Joanne Driscoll and Jonathan Topper may also manage other accounts and variable trust funds advised by Putnam Management or an affiliate.

Changes in your fund’s Portfolio Leader and Portfolio Member

Your fund’s Portfolio Leader and Portfolio Member did not change during the year ended March 31, 2007.

17

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the price, or value, of one share of a mutual fund, without a sales charge. NAVs fluctuate with market conditions. NAV is calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

Class A shares of your fund do not carry an initial sales charge or a 12b-1 fee. Exchange of your fund’s class A shares into another fund may involve a sales charge.

Comparative indexes

Lehman Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

Lehman Municipal Bond Index is an unmanaged index of long-term fixed-rate investment-grade tax-exempt bonds.

Lipper Tax-Exempt Money Market Funds category average is an arithmetic average of the total return of all tax-exempt money market mutual funds in the Lipper universe.

Merrill Lynch 91-Day Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

Russell 1000 Index is an unmanaged index of the 1,000 largest companies in the Russell 3000 Index.

Russell 2000 Index is an unmanaged index of the 2,000 smallest companies in the Russell 3000 Index.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

18

Trustee approval of

management contract

General conclusions

The Board of Trustees of the Putnam funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Management. In this regard, the Board of Trustees, with the assistance of its Contract Committee consisting solely of Trustees who are not “interested persons” (as such term is defined in the Investment Company Act of 1940, as amended) of the Putnam funds (the “Independent Trustees”), requests and evaluates all information it deems reasonably necessary under the circumstances. Over the course of several months ending in June 2006, the Contract Committee met four times to consider the information provided by Putnam Management and other information developed with the assistance of the Board’s independent counsel and independent staff. The Contract Committee reviewed and discussed key aspects of this informat ion with all of the Independent Trustees. Upon completion of this review, the Contract Committee recommended, and the Independent Trustees approved, the continuance of your fund’s management contract, effective July 1, 2006.

This approval was based on the following conclusions:

• That the fee schedule in effect for your fund represented reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds and the costs incurred by Putnam Management in providing such services, and

• That such fee schedule represented an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the fee arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that certain aspects of such arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of these same arrangements in prior years.

19

Management fee schedules and categories; total expenses

The Trustees reviewed the management fee schedules in effect for all Putnam funds, including fee levels and breakpoints, and the assignment of funds to particular fee categories. In reviewing fees and expenses, the Trustees generally focused their attention on material changes in circumstances — for example, changes in a fund’s size or investment style, changes in Putnam Management’s operating costs, or changes in competitive practices in the mutual fund industry — that suggest that consideration of fee changes might be warranted. The Trustees concluded that the circumstances did not warrant changes to the management fee structure of your fund, which had been carefully developed over the years, re-examined on many occasions and adjusted where appropriate. The Trustees focused on two areas of particular interest, as discussed further below:

• Competitiveness. The Trustees reviewed comparative fee and expense information for competitive funds, which indicated that, in a custom peer group of competitive funds selected by Lipper Inc., your fund ranked in the 24th percentile in management fees and in the 34th percentile in total expenses (less any applicable 12b-1 fees) as of December 31, 2005 (the first percentile being the least expensive funds and the 100th percentile being the most expensive funds). (Because the fund’s custom peer group is smaller than the fund’s broad Lipper Inc. peer group, this expense information may differ from the Lipper peer expense information found elsewhere in this report.) The Trustees noted that expense ratios for a number of Putnam funds, which show the percentage of fund assets used to pay for managem ent and administrative services, distribution (12b-1) fees and other expenses, had been increasing recently as a result of declining net assets and the natural operation of fee breakpoints.

The Trustees noted that the expense ratio increases described above were currently being controlled by expense limitations implemented in January 2004 and which Putnam Management, in consultation with the Contract Committee, has committed to maintain at least through 2007. These expense limitations give effect to a commitment by Putnam Management that the expense ratio of each open-end fund would be no higher than the average expense ratio of the competitive funds included in the fund’s relevant Lipper universe (exclusive of any applicable 12b-1 charges in each case). The Trustees observed that this commitment to limit fund expenses has served shareholders well since its inception. In order to ensure that the expenses of the Putnam funds continue to meet evolving competitive standards, the Trustees requested, and Putnam Management agreed, to implement an additional expense limitation for certain funds for the twelve months beginning January 1, 2007 equal to the average expense ratio (exclusive of 12b-1 charges) of a custom peer group of competitive funds selected by Lipper based on the size of the fund. This additional expense limitation will be applied to those open-end funds that had above-average expense ratios (exclusive of 12b-1 charges) based on the Lipper custom peer group data for the period ended December 31, 2005. This additional expense limitation will not be applied to your fund.

20

• Economies of scale. Your fund currently has the benefit of breakpoints in its management fee that provide shareholders with significant economies of scale, which means that the effective management fee rate of a fund (as a percentage of fund assets) declines as a fund grows in size and crosses specified asset thresholds. Conversely, as a fund shrinks in size — as has been the case for many Putnam funds in recent years — these breakpoints result in increasing fee levels. In recent years, the Trustees have examined the operation of the existing breakpoint structure during periods of both growth and decline in asset levels. The Trustees concluded that the fee schedules in effect for the funds represented an appropriate sharing of economies of scale at current asset levels. In reaching this conclusion, the Trustees considered the Contract Committee’s stated intent to continue to work with Putnam Management to plan for an eventual resumption in the growth of assets, including a study of potential economies that might be produced under various growth assumptions.

In connection with their review of the management fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of the services to be provided and profits to be realized by Putnam Management and its affiliates from the relationship with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability with respect to the funds’ management contracts, allocated on a fund-by-fund basis. Because many of the costs incurred by Putnam Management in managing the funds are not readily identifiable to particular funds, the Trustees observed that the methodology for allocating costs is an important factor in evaluating Putnam Management’s costs and profitability, both as to the Putnam funds in the aggregate and as to individual funds. The Trustees reviewed Putnam Management’s cost allocation methodology with the assistance of independent consultants and concluded that this methodology was reasonable and well-considered.

Investment performance

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the Putnam funds’ investment process and performance by the work of the Investment Process Committee of the Trustees and the Investment Oversight Committees of the Trustees, which meet on a regular monthly basis with the funds’ portfolio teams throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process — as measured by the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to such personnel, and in general the ability of Putnam Management to attract and retain high-quality personnel — but also recognize that this does not guarantee favorable investment results for every fund in every time period.

21

The Trustees considered the investment performance of each fund over multiple time periods and considered information comparing each fund’s performance with various benchmarks and with the performance of competitive funds.

The Trustees noted the satisfactory investment performance of many Putnam funds. They also noted the disappointing investment performance of certain funds in recent years and discussed with senior management of Putnam Management the factors contributing to such underperformance and actions being taken to improve performance. The Trustees recognized that, in recent years, Putnam Management has made significant changes in its investment personnel and processes and in the fund product line to address areas of underperformance. In particular, they noted the important contributions of Putnam Management’s leadership in attracting, retaining and supporting high-quality investment professionals and in systematically implementing an investment process that seeks to merge the best features of fundamental and quantitative analysis. The Trustees indicated their intention to continue to monitor performance trends to assess the effectiveness of t hese changes and to evaluate whether additional changes to address areas of underperformance are warranted.

In the case of your fund, the Trustees considered that your fund’s class A share cumulative total return performance at net asset value was in the following percentiles of its Lipper Inc. peer group (Lipper Tax-Exempt Money Market Funds) (compared using tax-adjusted performance to recognize the different federal income tax treatment for capital gains distributions and exempt-interest distributions) for the one-, three- and five-year periods ended March 31, 2006 (the first percentile being the best performing funds and the 100th percentile being the worst performing funds):

| One-year period | Three-year period | Five-year period |

|

| 31st | 35th | 36th |

(Because of the passage of time, these performance results may differ from the performance results for more recent periods shown elsewhere in this report. Over the one-, three- and five-year periods ended March 31, 2006, there were 114, 104, and 93 funds, respectively, in your fund’s Lipper peer group.* Past performance is no guarantee of future performance.)

As a general matter, the Trustees concluded that cooperative efforts between the Trustees and Putnam Management represent the most effective way to address investment performance problems. The Trustees noted that investors in the Putnam funds have, in effect, placed their trust in the Putnam organization, under the oversight of the funds’ Trustees, to make appropriate decisions regarding the management of the funds. Based on the responsiveness of Putnam Management in the recent past to Trustee concerns about investment performance, the Trustees

* The percentile rankings for your fund’s class A share annualized total return performance in the Lipper Tax-Exempt Money Market Funds category for the one-, five- and ten-year periods ended March 31, 2007, were 25%, 34%, and 43%, respectively. Over the one-, five- and ten-year periods ended March 31, 2007, the fund ranked 28 out of 113, 31 out of 92, and 32 out of 75 funds, respectively. Unlike the information above, these rankings reflect performance before taxes. Note that this more recent information was not available when the Trustees approved the continuance of your fund’s management contract.

22

concluded that it is preferable to seek change within Putnam Management to address performance shortcomings. In the Trustees’ view, the alternative of terminating a management contract and engaging a new investment adviser for an underperforming fund would entail significant disruptions and would not provide any greater assurance of improved investment performance.

Brokerage and soft-dollar allocations; other benefits

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include benefits related to brokerage and soft-dollar allocations, whereby a portion of the commissions paid by a fund for brokerage may be used to acquire research services that may be useful to Putnam Management in managing the assets of the fund and of other clients. The Trustees indicated their continued intent to monitor the potential benefits associated with the allocation of fund brokerage to ensure that the principle of seeking “best price and execution” remains paramount in the portfolio trading process.

The Trustees’ annual review of your fund’s management contract also included the review of its distributor’s contract and distribution plan with Putnam Retail Management Limited Partnership and the custodian agreement and investor servicing agreement with Putnam Fiduciary Trust Company, all of which provide benefits to affiliates of Putnam Management.

Comparison of retail and institutional fee schedules

The information examined by the Trustees as part of their annual contract review has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, etc. This information included comparison of such fees with fees charged to the funds, as well as a detailed assessment of the differences in the services provided to these two types of clients. The Trustees observed, in this regard, that the differences in fee rates between institutional clients and the funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients reflect to a substantial degree historical competitive forces operating in separate market places. The Trustees considered the fact that fee rates across all asset sectors are higher on average for funds than for institutional clients, as well as the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to institutional clients of the firm, but did not rely on such comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

23

Approval of new management contracts in connection with pending change in control

As discussed in the “Message from the Trustees” at the beginning of this shareholder report, on February 1, 2007, Marsh & McLennan Companies, Inc. announced that it had signed a definitive agreement to sell its ownership interest in Putnam Investments Trust, the parent company of Putnam Management and its affiliates, to Great-West Lifeco Inc., a member of the Power Financial Corporation group of companies. This transaction is subject to regulatory approvals and other conditions, including the approval of new management contracts by shareholders of a substantial number of Putnam funds at shareholder meetings scheduled for May 15, 2007. The transaction is currently expected to be completed by the middle of 2007.

At an in-person meeting on February 8-9, 2007, the Trustees considered the approval of new management contracts for each Putnam fund proposed to become effective upon the closing of the transaction, and the filing of a preliminary proxy statement. At an in-person meeting on March 8-9, 2007, the Trustees considered the approval of the final forms of the proposed new management contracts for each Putnam fund and the proxy statement. They reviewed the terms of the proposed new management contracts and the differences between the proposed new management contracts and the current management contracts. They noted that the terms of the proposed new management contracts were substantially identical to the current management contracts, except for certain changes developed at the initiative of the Trustees and designed largely to address inconsistencies among various of the existing contracts, which had been developed and implemented at different times in the past. In considering the approval of the proposed new management contracts, the Trustees also considered, as discussed further in the proxy statement, various matters relating to the transaction. Finally, in considering the proposed new management contracts, the Trustees also took into account their deliberations and conclusions (discussed above in the preceding paragraphs of the “Trustee Approval of Management Contract” section) in connection with the most recent annual approval of the continuance of the Putnam funds’ management contracts effective July 1, 2006, and the extensive materials that they had reviewed in connection with that approval process. Based upon the foregoing considerations, on March 9, 2007, the Trustees, including all of the Independent Trustees, unanimously approved the proposed new management contracts and determined to recommend their approval to the shareholders of the Putnam funds.

24

Other information

for shareholders

Important notice regarding delivery of shareholder documents

In accordance with SEC regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2006, are available on the Putnam Individual Investor Web site, www.putnam.com/individual, and on the SEC’s Web site, www.sec.gov. If you have questions about finding forms on the SEC’s Web site, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s Web site at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s Web site or the operation of the Public Reference Room.

25

Financial statements

A guide to financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and noninvestment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlight table also includes the current reporting period.

26

The fund’s portfolio 3/31/07 (Unaudited)

|

| Key to abbreviations | |

| | |

| AMBAC AMBAC Indemnity Corporation | MBIA MBIA Insurance Company |

| CIFG CIFG Assurance North America, Inc. | TRAN Tax Revenue Anticipation Notes |

| FGIC Financial Guaranty Insurance Company | VRDN Variable Rate Demand Notes |

| FSA Financial Security Assurance | XLCA XL Capital Assurance |

| LOC Letter of Credit | |

| MUNICIPAL BONDS AND NOTES (96.1%)* | | | | | |

|

| | Rating** | | Principal amount | | Value |

|

| Alabama (0.9%) | | | | | |

| Jefferson Cnty., Swr. VRDN, Ser. B-7, | | | | | |

| XLCA, 3.67s, 2/1/42 | VMIG1 | $ | 700,000 | $ | 700,000 |

|

| |

| Colorado (1.6%) | | | | | |

| U. of CO. Hosp. Auth. VRDN, Ser. B, 3.66s, | | | | | |

| 11/15/35 (Citibank, N.A. (LOC)) | VMIG1 | | 1,250,000 | | 1,250,000 |

|

| |

| Connecticut (1.3%) | | | | | |

| CT State Special Tax Oblig. VRDN (Trans. | | | | | |

| Infrastructure), Ser. 1, FGIC, 3.66s, 9/1/20 | VMIG1 | | 1,000,000 | | 1,000,000 |

|

| |

| Florida (3.0%) | | | | | |

| Highlands Cnty., Hlth. Fac. Auth. VRDN | | | | | |

| (Adventist Hlth.), Ser. A, 3.7s, 11/15/32 | | | | | |

| (SunTrust Bank (LOC)) | VMIG1 | | 400,000 | | 400,000 |

| Seminole Cnty., Indl. Dev. Auth. Hlth. | | | | | |

| Care Fac. VRDN (Hospice of the | | | | | |

| Comforter), 3.69s, 12/1/25 (Fifth Third | | | | | |

| Bank (LOC)) | A-1+ | | 2,000,000 | | 2,000,000 |

| | | | | | 2,400,000 |

|

| |

| Georgia (3.8%) | | | | | |

| Metro. of Atlanta, Rapid Transit Auth. | | | | | |

| Commercial Paper Ser. 04-B, 3 1/2s, | | | | | |

| 4/5/07 (Dexia Credit Local (LOC)) | P-1 | | 3,000,000 | | 3,000,000 |

|

| |

| Idaho (0.5%) | | | | | |

| ID Hlth. Fac. Auth. VRDN (St. Lukes Med. | | | | | |

| Ctr.), FSA, 3.79s, 7/1/30 | VMIG1 | | 375,000 | | 375,000 |

|

| |

| Illinois (7.0%) | | | | | |

| IL Dev. Fin. Auth. VRDN (North Shore | | | | | |

| Country Day), 3.66s, 7/1/33 (Northern | | | | | |

| Trust Company (LOC)) | VMIG1 | | 1,000,000 | | 1,000,000 |

| IL Fin. Auth. VRDN | | | | | |

| (Lawrence Hall Youth Svcs.), 3.69s, | | | | | |

| 11/1/41 (Fifth Third Bank (LOC)) | VMIG1 | | 1,500,000 | | 1,500,000 |

27

| MUNICIPAL BONDS AND NOTES (96.1%)* continued | | | | |

|

| | Rating** | | Principal amount | | Value |

|

| Illinois continued | | | | | |

| IL Fin. Auth. VRDN | | | | | |

| (Saint Xavier U.), 3.68s, 10/1/40 (LaSalle | | | | | |

| Bank, N.A. (LOC)) | A-1 | $ | 2,000,000 | $ | 2,000,000 |

| IL State VRDN, Ser. B, 3.66s, 10/1/33 | VMIG1 | | 1,000,000 | | 1,000,000 |

| | | | | | 5,500,000 |

|

| |

| Indiana (5.1%) | | | | | |

| IN Dev. Fin. Auth. VRDN (IN Museum of Art), | | | | | |

| 3.7s, 2/1/39 (Bank One, N.A. (LOC)) | VMIG1 | | 1,000,000 | | 1,000,000 |

| IN Hlth. Fac. Fin. Auth. VRDN (Fayette | | | | | |

| Memorial Hosp. Assn.), Ser. A, 3.84s, | | | | | |

| 10/1/32 (U.S. Bank, N.A. (LOC)) | A-1+ | | 2,000,000 | | 2,000,000 |

| IN Muni. Pwr. Agcy. Supply Syst. VRDN, Ser. A, | | | | | |

| 3.67s, 1/1/18 (Dexia Credit Local (LOC)) | VMIG1 | | 1,000,000 | | 1,000,000 |

| | | | | | 4,000,000 |

|

| |

| Iowa (2.5%) | | | | | |

| IA State TRAN, 4 1/4s, 6/29/07 | MIG1 | | 2,000,000 | | 2,003,475 |

|

| |

| Kansas (1.9%) | | | | | |

| KS State Dev. Fin. Auth. Hlth. Fac. VRDN | | | | | |

| (Deaconess Long Term Care), Ser. C, | | | | | |

| 3.71s, 5/15/30 (JPMorgan Chase Bank (LOC)) | VMIG1 | | 1,500,000 | | 1,500,000 |

|

| |

| Kentucky (1.8%) | | | | | |

| Boyle Cnty., Hosp. VRDN (Ephraim McDowell | | | | | |

| Hlth.), 3.67s, 4/1/36 (Fifth Third Bank (LOC)) | VMIG1 | | 1,400,000 | | 1,400,000 |

|

| |

| Maine (3.5%) | | | | | |

| ME State Hsg. Auth. VRDN, Ser. E-1, AMBAC, | | | | | |

| 3.68s, 11/15/30 | VMIG1 | | 2,770,000 | | 2,770,000 |

|

| |

| Massachusetts (6.3%) | | | | | |

| MA Hlth. & Edl. Fac. Auth. Commercial | | | | | |

| Paper (Harvard U.), Ser. EE, 3.57s, 4/4/07 | P-1 | | 1,500,000 | | 1,500,000 |

| MA Wtr. Res. Auth. Commercial Paper Ser. 99 | | | | | |

| 3 1/2s, 5/10/07 (State Street Bank & | | | | | |

| Trust Co. (LOC)) | P-1 | | 1,500,000 | | 1,500,000 |

| 3 1/2s, 4/5/07 (State Street Bank & | | | | | |

| Trust Co. (LOC)) | P-1 | | 2,000,000 | | 2,000,000 |

| | | | | | 5,000,000 |

|

| |

| Michigan (3.1%) | | | | | |

| MI Muni. Board Auth. Rev. Bonds, Ser. B-2, | | | | | |

| 4 1/2s, 8/20/07 (Bank of Nova Scotia (LOC)) | SP-1+ | | 1,000,000 | | 1,003,130 |

| MI State Hosp. Fin. Auth. VRDN (Hlth. Care | | | | | |

| Equip. Loan), Ser. C, 3.7s, 12/1/32 | | | | | |

| (Fifth Third Bank (LOC)) | A-1+ | | 1,400,000 | | 1,400,000 |

| | | | | | 2,403,130 |

28

| MUNICIPAL BONDS AND NOTES (96.1%)* continued | | | | |

|

| | Rating** | | Principal amount | | Value |

|

| Minnesota (3.8%) | | | | | |

| Cohasset, VRDN (MN Pwr. & Light Co.), Ser. A, | | | | | |

| 3.66s, 6/1/20 (LaSalle Bank, N.A. (LOC)) | A-1+ | $ | 1,000,000 | $ | 1,000,000 |

| Minnanoka & Ramsey Cntys., North Suburban | | | | | |

| Hosp. Dist. VRDN (Hlth. Ctr.), 3.7s, | | | | | |

| 8/1/14 (Wells Fargo Bank, N.A. (LOC)) | A-1+ | | 2,000,000 | | 2,000,000 |

| | | | | | 3,000,000 |

|

| |

| Mississippi (0.3%) | | | | | |

| Jackson Cnty., Poll. Control VRDN (Chevron | | | | | |

| USA, Inc.), 3.78s, 6/1/23 | P-1 | | 200,000 | | 200,000 |

|

| |

| Missouri (2.4%) | | | | | |

| MO State Hlth. & Edl. Fac. Auth. VRDN | | | | | |

| (Deaconess Long-term Care), Ser. B, 3.71s, | | | | | |

| 5/15/30 (JPMorgan Chase Bank (LOC)) | VMIG1 | | 1,500,000 | | 1,500,000 |

| (Cox Hlth. Syst.), AMBAC, 3.8s, 6/1/22 | VMIG1 | | 400,000 | | 400,000 |

| | | | | | 1,900,000 |

|

| |

| Montana (2.5%) | | | | | |

| MT Hlth. Fac. Auth. VRDN (Hlth. Care | | | | | |

| Pooled Loan), Ser. A, FGIC, 3.68s, 12/1/15 | VMIG1 | | 1,970,000 | | 1,970,000 |

|

| |

| New Jersey (3.8%) | | | | | |

| NJ State TRAN, 4 1/2s, 6/22/07 | MIG1 | | 3,000,000 | | 3,006,835 |

|

| |

| New Mexico (0.5%) | | | | | |

| Farmington, Poll. Control VRDN (AZ Pub. | | | | | |

| Service Co.), Ser. B, 3.78s, 9/1/24 | | | | | |

| (Barclays Bank PLC (LOC)) | P-1 | | 400,000 | | 400,000 |

|

| |

| North Carolina (2.5%) | | | | | |

| NC Cap. Fac. Commercial Paper (Duke U.), | | | | | |

| Ser. A1/A2, 3.63s, 6/14/07 | P-1 | | 2,000,000 | | 2,000,000 |

|

| |

| Ohio (5.9%) | | | | | |

| Cuyahoga Cnty., Hosp. VRDN (Metro Hlth. | | | | | |

| Syst.), 3.68s, 2/1/35 (National City Bank (LOC)) | VMIG1 | | 2,000,000 | | 2,000,000 |

| OH State Air Quality Dev. Auth. VRDN | | | | | |

| (Poll. Control- First Energy), Ser. B, | | | | | |

| 3.7s, 1/1/34 (Barclays Bank PLC (LOC)) | VMIG1 | | 650,000 | | 650,000 |

| OH State Higher Edl. Fac. VRDN (Cleveland | | | | | |

| Inst. Music), 3.68s, 5/1/30 (National | | | | | |

| City Bank (LOC)) | VMIG1 | | 2,000,000 | | 2,000,000 |

| | | | | | 4,650,000 |

|

| |

| Oklahoma (0.8%) | | | | | |

| OK State Cap. Impt. Auth. State Facs. VRDN | | | | | |

| (Higher Ed.) | | | | | |

| Ser. D-1, CIFG, 3.8s, 7/1/31 | VMIG1 | | 200,000 | | 200,000 |

| Ser. D-2, CIFG, 3.8s, 7/1/32 | VMIG1 | | 400,000 | | 400,000 |

| | | | | | 600,000 |

29

| MUNICIPAL BONDS AND NOTES (96.1%)* continued | | | | |

|

| | Rating** | | Principal amount | | Value |

|

| Pennsylvania (12.5%) | | | | | |

| Allegheny Cnty., Hosp. Dev. Auth. VRDN | | | | | |

| (Hlth. Ctr. Presbyterian), Ser. D, MBIA, | | | | | |

| 3.7s, 3/1/20 | VMIG1 | $ | 2,300,000 | $ | 2,300,000 |

| Beaver Cnty., Indl. Dev. Auth. Poll. | | | | | |

| Control VRDN (First Energy), Ser. A, | | | | | |

| 3.7s, 1/1/35 (Barclays Bank PLC (LOC)) | VMIG1 | | 1,000,000 | | 1,000,000 |

| Dauphin Cnty., Gen. Auth. VRDN (School | | | | | |

| Dist. Pooled Fin. Project II), AMBAC, | | | | | |

| 3.68s, 9/1/32 | VMIG1 | | 3,520,000 | | 3,520,000 |

| Philadelphia, Hosp. & Higher Ed. Fac. | | | | | |

| Auth. VRDN (Temple U. Hlth.), Ser. A, | | | | | |

| 3.67s, 7/1/27 (Wachovia Bank, N.A. (LOC)) | VMIG1 | | 3,000,000 | | 3,000,000 |

| | | | | | 9,820,000 |

|

| |

| Tennessee (1.3%) | | | | | |

| Metro. Govt. Nashville & Davidson Cnty., | | | | | |

| Hlth. & Edl. Fac. Board VRDN | | | | | |

| (Ensworth School), 3.66s, 12/1/27 | | | | | |

| (SunTrust Bank (LOC)) | VMIG1 | | 1,000,000 | | 1,000,000 |

|

| |

| Texas (3.2%) | | | | | |

| Denton, VRDN, Ser. 05-A, 3.68s, 8/1/35 | A-1+ | | 2,000,000 | | 2,000,000 |

| North TX Thruway Syst. VRDN | | | | | |

| (North Dallas), Ser. C, FGIC, 3.67s, 1/1/25 | VMIG1 | | 520,000 | | 520,000 |

| | | | | | 2,520,000 |

|

| |

| Utah (2.5%) | | | | | |

| Intermountain Power Agency VRDN (UT State | | | | | |

| Pwr. Supply), Ser. B, FGIC, 3.67s, 7/1/23 | VMIG1 | | 2,000,000 | | 2,000,000 |

|

| |

| Virginia (1.3%) | | | | | |

| Clarke Cnty., Indl. Dev. Auth. Hosp. Facs. | | | | | |

| VRDN (Winchester Med. Ctr., Inc.), FSA, | | | | | |

| 3.66s, 1/1/30 | VMIG1 | | 1,000,000 | | 1,000,000 |

|

| |

| Washington (4.7%) | | | | | |

| WA State Hlth. Care Fac. Auth. Lease VRDN | | | | | |

| (National Hlth. Care Research & Ed.), | | | | | |

| 3.7s, 1/1/32 (BNP Paribas (LOC)) | VMIG1 | | 2,700,000 | | 2,700,000 |

| WA State Hsg. Fin. Comm. VRDN | | | | | |

| (Northwest School), 3.67s, 6/1/32 (Bank | | | | | |

| of America, N.A. (LOC)) | VMIG1 | | 1,000,000 | | 1,000,000 |

| | | | | | 3,700,000 |

|

| |

| Wisconsin (1.5%) | | | | | |

| WI State Hlth. & Edl. Fac. Auth. VRDN | | | | | |

| (Wheaton Franciscan Svcs.), Ser. B, | | | | | |

| 3.66s, 8/15/33 (U.S. Bank, N.A. (LOC)) | VMIG1 | | 1,200,000 | | 1,200,000 |

30

| MUNICIPAL BONDS AND NOTES (96.1%)* continued | | | | |

|

| | Rating** | | Principal amount | | Value |

|

| Wyoming (4.3%) | | | | | |

| Gillette, Poll. Control VRDN, 3.69s, | | | | | |

| 1/1/18 (Barclays Bank PLC (LOC)) | P-1 | $ | 3,400,000 | $ | 3,400,000 |

|

| |

| TOTAL INVESTMENTS | | | | | |

|

| Total investments (cost $75,668,440) | | | | $ | 75,668,440 |

* Percentages indicated are based on net assets of $78,741,283.

** The Moody’s or Standard & Poor’s ratings indicated are believed to be the most recent ratings available at March 31, 2007 for the securities listed. Ratings are generally ascribed to securities at the time of issuance. While the agencies may from time to time revise such ratings, they undertake no obligation to do so, and the ratings do not necessarily represent what the agencies would ascribe to these securities at March 31, 2007. Securities rated by Putnam are indicated by “/P.” Securities rated by Fitch are indicated by “/F.” Security ratings are defined in the Statement of Additional Information.

The rates shown on VRDN are the current interest rates at March 31, 2007.

The dates shown on debt obligations are the original maturity dates.

The fund had the following sector concentrations greater than 10% at March 31, 2007 (as a percentage of net assets):

| Financial | 51.8% |

| Health care | 11.9 |

The accompanying notes are an integral part of these financial statements.

31

Statement of assets and liabilities 3/31/07 (Unaudited)

| ASSETS | |

|

| Investment in securities, at value (Note 1): | |

| Unaffiliated issuers (at amortized cost) | $75,668,440 |

|

| Cash | 83,063 |

|

| Interest and other receivables | 450,429 |

|

| Receivable for shares of the fund sold | 211,938 |

|

| Receivable for securities sold | 3,000,600 |

|

| Total assets | 79,414,470 |

| |

| |

| LIABILITIES | |

|

| Distributions payable to shareholders | 9,020 |

|

| Payable for shares of the fund repurchased | 491,347 |

|

| Payable for compensation of Manager (Note 2) | 94,095 |

|

| Payable for investor servicing and custodian fees (Note 2) | 17 |

|

| Payable for Trustee compensation and expenses (Note 2) | 44,511 |

|

| Payable for administrative services (Note 2) | 2,821 |

|

| Other accrued expenses | 31,376 |

|

| Total liabilities | 673,187 |

|

| Net assets | $78,741,283 |

| |

| |

| REPRESENTED BY | |

|

| Paid-in capital (Unlimited shares authorized) (Notes 1 and 4) | $78,673,405 |

|

| Undistributed net investment income (Note 1) | 69,280 |

|

| Accumulated net realized loss on investments (Note 1) | (1,402) |

|

| Total — Representing net assets applicable to capital shares outstanding | $78,741,283 |

| |

| |

| COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE | |

|

| Net asset value, offering price and redemption price per class A share | |

| ($78,741,283 divided by 78,673,405 shares) | $1.00 |

The accompanying notes are an integral part of these financial statements.

32

Statement of operations Six months ended 3/31/07 (Unaudited)

| INTEREST INCOME | $2,054,583 |

|

| |

| EXPENSES | |

|

| Compensation of Manager (Note 2) | 253,294 |

|

| Investor servicing fees (Note 2) | 40,655 |

|

| Custodian fees (Note 2) | 3,501 |

|

| Trustee compensation and expenses (Note 2) | 12,479 |

|

| Administrative services (Note 2) | 11,802 |

|

| Auditing | 26,378 |

|

| Other | 25,910 |

|

| Fees waived and reimbursed by Manager (Note 2) | (39,360) |

|

| Total expenses | 334,659 |

|

| Expense reduction (Note 2) | (63,574) |

|

| Net expenses | 271,085 |

|

| Net investment income | 1,783,498 |

|

| Net increase in net assets resulting from operations | $1,783,498 |

The accompanying notes are an integral part of these financial statements.

33

Statement of changes in net assets

| INCREASE (DECREASE) IN NET ASSETS | | | | |

| | | Six months ended | | Year ended |

| | | 3/31/07* | | 9/30/06 |

|

| Operations: | | | | |

| Net investment income | $ | 1,783,498 | $ | 3,248,013 |

|

| Net increase in net assets resulting from operations | | 1,783,498 | | 3,248,013 |

|

| Distributions to shareholders: (Note 1) | | | | |

|

| From tax exempt net investment income | | (1,722,712) | | (3,259,670) |

|

| Increase (decrease) from capital share transactions (Note 4) | | (46,375,985) | | 10,639,550 |

|

| Total increase (decrease) in net assets | | (46,315,199) | | 10,627,893 |

| |

| |

| NET ASSETS | | | | |

|

| Beginning of period | | 125,056,482 | | 114,428,589 |

|

| End of period (including undistributed net investment | | | | |

| income of $69,280 and $8,494, respectively) | $ | 78,741,283 | $ | 125,056,482 |

* Unaudited

The accompanying notes are an integral part of these financial statements.

34

Financial highlights (For a common share outstanding throughout the period)

| CLASS A | | | | | | |

| |

| PER-SHARE OPERATING PERFORMANCE | | | | | |

|

| Six months ended** | | | Year ended | | |

| | 3/31/07 | 9/30/06 | 9/30/05 | 9/30/04 | 9/30/03 | 9/30/02 |

|

| Net asset value, | | | | | | |

| beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

|

| Investment operations: | | | | | | |

| Net investment income | .0161(c) | .0270(c,d,e) | .0153(c,d) | .0044(c) | .0065(c) | .0114 |

|

| Net realized gain | | | | | | |

| on investments | — | — | — | — | —(f ) | — |

|

| Total from | | | | | | |

| investment operations | .0161 | .0270 | .0153 | .0044 | .0065 | .0114 |

|

| Less distributions: | | | | | | |

| From net investment income | (.0152) | (.0270) | (.0153) | (.0044) | (.0065) | (.0114) |

|

| Total distributions | (.0152) | (.0270) | (.0153) | (.0044) | (.0065) | (.0114) |

|

| Net asset value, | | | | | | |

| end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

|

| Total return at | | | | | | |

| net asset value (%)(a) | 1.54* | 2.74 | 1.54 | .44 | .65 | 1.15 |

| |

| |

| RATIOS AND SUPPLEMENTAL DATA | | | | | |

|

| Net assets, end of period | | | | | | |

| (in thousands) | $78,741 | $125,056 | $114,429 | $124,293 | $148,603 | $113,068 |

|

| Ratio of expenses to | | | | | | |

| average net assets (%)(b) | .30(c)* | .54(c,d,e) | .55(c,d) | .60(c) | .64(c) | .76 |

|

| Ratio of net investment income | | | | | |

| to average net assets (%) | 1.58(c)* | 2.71(c,d,e) | 1.51(c,d) | .47(c) | .62(c) | 1.08 |

* Not annualized.

** Unaudited.

(a) Total return assumes dividend reinvestment.

(b) Includes amounts paid through expense offset arrangements (Note 2).

(c) Reflects an involuntary contractual expense limitation in effect during the period. As a result of such limitation, the expenses of the fund reflect a reduction of the following amounts (Note 2):

| | Percentage |

| | of average |

| | net assets |

|

| March 31, 2007 | 0.03% |

|

| September 30, 2006 | 0.11 |

|

| September 30, 2005 | 0.12 |

|

| September 30, 2004 | 0.20 |

|

| September 30, 2003 | 0.15 |

|

35

Financial highlights (Continued)

(d) Reflects a voluntary waiver of fund expenses in effect from July 1, 2005 through December 31, 2005. As a result of this waiver, the expenses of the fund reflect a reduction of the following amounts (Note 2):

| | Percentage |

| | of average |

| | net assets |

|

| September 30, 2006 | 0.02% |

|

| September 30, 2005 | 0.02 |

|

(e) Reflects a non-recurring accrual related to a reimbursement paid to the fund by Putnam Investments relating to the calculation of certain amounts paid by the fund to Putnam in previous years for transfer agent services which amounted to less than $0.01 per share and 0.02% of average net assets (Note 5).

(f) Amount represents less than $0.0001 per share.

The accompanying notes are an integral part of these financial statements.

36

Notes to financial statements 3/31/07 (Unaudited)

Note 1: Significant accounting policies

Putnam Tax Exempt Money Market Fund (the “fund”), a Massachusetts business trust, is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end management investment company. The fund seeks as high a level of current income exempt from federal income tax as Putnam Investment Management, LLC (“Putnam Management”), the fund’s manager, an indirect wholly-owned subsidiary of Putnam, LLC, believes is consistent with preservation of capital, maintenance of liquidity and stability of principal by investing primarily in a diversified portfolio of high-quality short-term tax-exempt securities.

The fund offers class A shares, which are sold without a front-end sales charge and are not subject to a contingent deferred sales charge.

In the normal course of business, the fund enters into contracts that may include agreements to indemnify another party under given circumstances. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be, but have not yet been, made against the fund. However, the fund expects the risk of material loss to be remote.

The following is a summary of significant accounting policies consistently followed by the fund in the preparation of its financial statements. The preparation of financial statements is in conformity with accounting principles generally accepted in the United States of America and requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.