Exhibit 4.24

WPP

Ogilvy & Mather

2002-2004 Long Term Incentive Plan:

Participant Guide

Objectives

The Long Term incentive Plan (LTIP) is an important part of your total compensation, so you need to fully understand how it works and its value to you. This booklet describes the details of the Plan.

The LTIP has the following objectives:

| • | | Incentivise our executives to achieve outstanding long-term financial performance. |

| • | | Allow our executives to participate directly in the profitable growth of Ogilvy. |

| • | | Reinforce the importance of the goals which are established as part of Ogilvy’s three-year strategic business plan. |

| • | | Increase our executives’ ownership of WPP Group stock. |

| • | | Ensure that our executives have the opportunity to earn competitive total compensation. |

Please note:

This booklet is for eligible executives working in those companies that are members of the Ogilvy group of companies.

Overview

The Long Term Incentive Plan (LTIP) rewards executives for exceptional financial performance against Ogilvy’s three-year business plan. The plan pays rewards in the form of cash and WPP Group restricted stock. Plan terms beginning with capitals are defined in the glossary.

Key facts

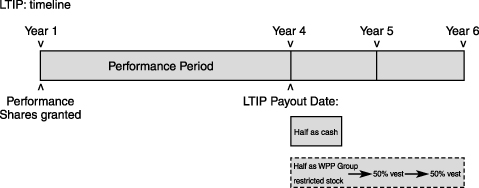

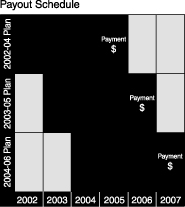

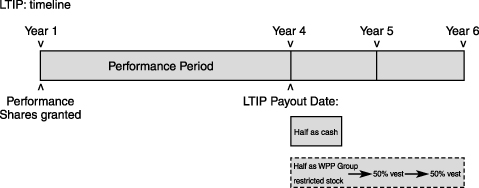

| • | | Three-year plan. The LTIP to a three-year rolling plan—this means each year a new three-year plan begins. Under the LTIP, members are awarded Performance Shares. The value of the shares is determined by the financial performance of Ogilvy over a three-year period. |

| • | | Performance Shares. Each year, you receive a fixed number of Performance Shares based Iargely on your role and past contribution. Each share has a target value of $100. The size of your grant defines your LTIP earnings opportunity. |

| • | | Payouts based on financial performance. For each three-year plan, LTIP financial performance targets are set that define how the Performance Shares will be valued. |

| • | | Payouts In cash and restricted stock.Your LTIP payout is made half in cash and half in WPP Group restricted stock which vests over the two years following the end of the performance period (50% each year). |

| • | | If you leave Ogilvy.Generally, if you retire from Ogilvy, become disabled, die or take another position within the WPP Group, you keep a pro-rated portion of your LTIP Performance Shares. Otherwise, you forfeit all Performance Shares and non-vested restricted stock if you leave Ogilvy. |

Plan details

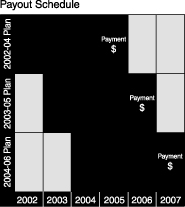

Rolling three-year plan

The LTIP is a rolling three-year plan. This means that Ogilvy announces a new plan every year that pays out after the third year, providing performance targets are met. So, starting with your fourth year at Ogilvy, you can receive an annual payout based on performance over the prior three-year Performance Period, as shown below.

Targets based on Ogilvy profitability

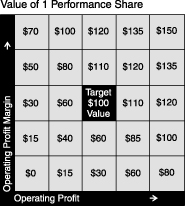

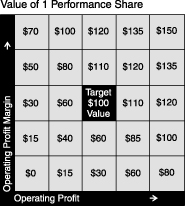

For each three-year plan, Ogilvy sets targets that determine how performance will be measured. These targets are based on two measures:

| • | | Ogilvy’s average Operating Profit, which means revenue minus operating costs (see the glossary for a full definition). |

| • | | Ogilvy’s average Operating Profit Margin is calculated as operating profit divided by gross revenue and based on a three-year plan cycle (see the glossary for a full definition). |

Grant based on your role and contribution

At the start of each three-year plan, you will receive a grant of Performance Shares that defines your individual stake in the plan. Grants are made in January each year.* The size of your grant is based on our ability to influence the profitable growth of Ogilvy, your current performance and your potential to contribute to the firm’s long-term success. LTIP grants are discretionary and there is no guarantee that you will receive a grant every year. You should also be aware that Performance Shares do not constitute equity ownership in Ogilvy or WPP Group.

Performance Shares

The terms of each award of Performance Shares are described to you in an award letter from the Chief Executive of Ogilvy, which sets out the financial performance targets which will determine the value of Performance Shares.

Each Performance Share has a target value of $100 at the time of grant. This establishes what each Performance Share will be worth if Ogilvy meets its three-year financial performance targets. The ultimate value of each share can range from $0 to $150 depending on actual performance against targets, as shown below.

| * | | Grants are made in January but participants are generally notified of their award in Q2. |

For example, if you were granted 500 Performance Shares, your LTIP target for that three-year plan would be $50,000($100 x 500). Your actual payout could range from $0 to $75,000 ($50,000 x 150%), depending on Ogilvy’s three-year performance against targets. Ogilvy completes a valuation at the end of each three-year plan to determine the Performance Share value.

Payouts in cash and restricted stock

LTIP payouts are usually made in March of each year, following the Valuation Date as of 31 December for the prior three-year performance period. Your payout is made as follows:

| • | | 50% as WPP Group restricted stock, half of which vests (i.e. you earn the right to keep) one year from the Payout Date, and half vests two years from the Payout Date. |

During this restricted period, dividends on your shares will be automatically reinvested in WPP Group stock.

As explained above, LTIP payouts are made in cash and WPP Group restricted stock. Starting with the 2000-02 plan, you will receive a grant of restricted stock at the beginning of the three-year plan cycle, equalling half the value of your Performance Shares at target. For example, let’s say your LTIP grant is 500 performance Shares with a target value of $50,000 (500 x $100). You would receive $25,000 in restricted WPP stock at the time of grant, representing half of the target value of your Performance Shares.

Although this restricted WPP stock still vests over a two-year period after the Payout Date, receiving the restricted stock portion of your grant at the beginning of the plan cycle gives you the opportunity to gain from increases in the value of WPP Group stock. In the example above, if WPP Group stock increases in value over three years by 20%, your $25,000 grant would have a value of $30,000 at the end of the three-year plan cycle, or $5,000 more than the initial grant. And, the value of your shares may increase further over the two-year vesting period.

Of course, your actual payout is based on Ogilvy performance, which means you may receive more or less than the LTIP target. And, there is the possibility that the value of WPP Group stock will decrease over the three-year plan cycle.

Taxation

In terms of paying taxes on your LTIP payouts, current UK and US tax laws hold that:

| • | | There are no taxes payable at the time you receive your LTIP grant (i.e. at the beginning of the three-year Performance Period). |

| • | | The cash portion of your LTIP payout is taxable in the year you receive it. |

| • | | Your restricted stock becomes taxable as it vests. This means that for a given grant, 50% of your restricted stock would be taxable one year from the Payout Date, and the remaining 50% would be taxable two years from the Payout Date. |

This situation is subject to change and you should consult your own accountant or qualified financial advisor. You are responsible for paying all taxes that arise from your LTIP payouts.

If you change jobs or leave Ogilvy

If you move to a new job within Ogilvy & Mather or another WPP Group company, you keep your Performance Shares and receive an LTIP payout at the end of the three-year plan. As with any LTIP grant, any new Performance Shares you receive under later plans will depend on your performance, contribution and role.

If you retire from Ogilvy, your LTIP payout will be pro-rated to reflect your service through the date you left Ogilvy. You will receive this pro-rated payout at the end of the three-year LTIP cycle, at the same time as other plan members. (You generally don’t receive a payout at the time you leave Ogilvy.)

If you become disabled or die, you or your estate will receive a pro-rated LTIP payout reflecting your service through the date of your death or disability. This pro-rated payout is made at the end of the three-year LTIP.

If you leave Ogilvy for any other reason—for example, you leave to take another position outside of the WPP Group or you are dismissed from Ogilvy, you forfeit all outstanding LTIP Performance Shares and any other non-vested WPP Group restricted stock.

Your questions answered

Do Ogilvy’s performance targets remain unchanged for the three-year plan cycle, or can they change midway through?

Once the targets are set at the start of the LTIP cycle, they do not change. Keep in mind that the plan measures results over a three-year period, which is designed to balance ups and downs in performance from year to year.

Does the LTIP include any performance measures linked to overall WPP Group results?

The performance measures are based solely on Ogilvy’s performance. However, since your LTIP payout includes WPP Group restricted stock, the ultimate value of your payout is also influenced by the value of WPP Group stock.

What If I take on a broader leadership role—will my number of Performance Shares increase?

The number of Performance Shares you receive under a particular Long Term Incentive Plan remains fixed. However, keep in mind that new LTIP grants are made each year. So, if Ogilvy leadership determines that you have assumed a role with a broader scope and greater impact on profitable growth, you may receive a greater number of Performance Shares under the next plan.

Is the valuation or Performance Shares at the end of the LTIP cycle strictly formula-driven, or is there room for adjustment based on special business or market conditions?

The valuation is driven solely by financial performance against the targets established at the start of the three-year LTIP cycle. There’s little room for subjectivity or interpretation.

What are my choices after my restricted stock vests?

When your restricted stock vests, the WPP Group plan administrator will send you a form to complete that gives you three choices:

| 1. | | WPP Group can sell enough stock to cover the required income tax withholding, and send you certificates for the remaining stock. |

| 2. | | You can send Ogilvy cheque to cover the required tax withholding, in which case you will receive certificates for the full amount of your stock. |

| 3. | | You can sell all of your stock and receive cash less any amount required to cover income tax withholding. |

Once you have your WPP Group shares, you are free to hold or sell them.

Can I take out loans against the value of my LTIP Performance Shares?

There is no loan feature under the Long Term Incentive Plan.

Am I at financial risk by being a participant of the LTlP?

No. The LTIP does not require you to make a personal financial investment, therefore, you will not lose money. However, the value of your Performance Shares is variable, as is the market value of WPP Group Stock.

For more answers, please direct your questions about the Long Term Incentive Plan to:

Inside North America

Joe Panetta

Partner, Director of Compensation

Ogilvy & Mather

212.237.4886

joe.panetta@ogilvy.com

Outside North America

Steve Goldstein

Chief Financial Officer

Ogilvy & Mather

212.237.7860

steve.goldstein@ogilvy.com

Glossary of terms

Grant Date

Performance Shares are granted effective 1 January of any year. The Grant Date is the first day of the three-year performance period of the LTIP.

Operating Profit

Revenue less operating costs, plus depreciation, less capital expenditures not related to the refurbishment of certain specified buildings under long-term leases. Includes annual and long-term incentives and equity income. Excludes foreign and exchange losses and gains, interest income and expense, loss or gain of fixed assets, cash discounts and miscellaneous income expense and goodwill.

Financial exchange rates will be used to calculate the average operating profit over the three-year performance period based on the monthly average actual exchange rates.

Operating Profit Margin

This is arrived at by dividing the average operating profit by the average revenue including the relevant revenue from associates over the three-year performance period. Margin percentage calculations will be rounded to one decimal place.

Payout Date

Following the Valuation Date, usually in March each year.

Performance Period

A three-year period beginning on the Grant Date (1 January each year).

Performance Share

A unit of value which is granted to LTIP members. Performance Shares do not constitute an equity interest in Ogilvy or the WPP Group.

Qualifying Retirement

You are able to receive a benefit under an Ogilvy-sponsored retirement plan and/or the company confirms in writing that you are considered retired.

Valuation Date

The 31 December which is three years after each Grant Date.

WPP Group restricted stock

WPP Group ordinary shares which are held in trust on your behalf. You do not have ownership rights to the stock until the end of the restriction period, when the restricted stock vests. 50% of your stock is subject to a restriction period of one year after the Valuation Date, and 50% of your stock is subject to a restriction period of two years.

WPP

[Address]