Exhibit 4.41

WPP

INCENTIVE PLAN

2004-2006 Long Term Incentive Plan:

Participant Guide

Objectives

The Long Term Incentive Plan (LTIP) is an important part of your total compensation. This guide is intended to help you understand how it works and its value to you.

The LTIP has the following objectives:

| • | | To incentivise executives to achieve outstanding long-term financial performance for their company. |

| • | | To allow executives to participate directly in the profitable growth of their company and the WPP Group. |

| • | | To reinforce the importance of the goals which are established as part of each WPP company’s three-year strategic business plan. |

| • | | To increase ownership of WPP stock by executives working within WPP companies. |

| • | | To ensure that executives have the opportunity to earn competitive total compensation. |

Please note:

| 1. | This booklet is designed for executives who are considered to be eligible and who are working in companies owned by WPP. |

| 2. | Terms beginning with capital letters, e.g. Performance Shares, are defined in the Glossary on the inside back cover of this booklet. |

| 3. | For illustrative purposes only, financial examples are shown in US dollars. |

Overview

WPP’s Long Term Incentive Plans (LTIP) reward you for helping to achieve exceptional financial performance against your company’s three-year business plan. The Plans pay rewards in the form of WPP stock.

Key facts

| • | | Three-year Plan. The LTIP is a three-year rolling Plan. This means each year a new three-year Plan begins. |

| • | | Awards in Performance Shares. Each year, you will be told how many Performance Shares you will receive if your company reaches its financial targets. The number of ‘on target’ Performance Shares you receive is based largely on your role and contribution. Details of Performance Shares and the award process are explained on page 2. |

| • | | Payouts based on financial performance. Financial performance targets are set for your company for each three-year Plan. The extent to which these targets are achieved will determine the actual number of Performance Shares you receive at the end of the Performance Period. This number can be more or less than the ‘on target’ number, depending on your company’s performance. |

| • | | Payouts at end of each three-year cycle. Performance Shares represent a Contingent Right to receive WPP stock. You will own the WPP stock only after the actual number of Performance Shares are determined and granted at the end of each three-year plan. Payouts are explained in more detail on pages 2 and 3 of this booklet. |

| • | | Value of Shares. The Shares are bought in at the start of the Performance Period. They will therefore be subject to any increases or decreases in WPP’s stock price over the Performance Period. |

| • | | If you leave your company. Generally, if you retire from your company, become disabled, die or take another position within the WPP Group, you keep a pro-rated portion of your LTIP Performance Shares. Otherwise, you forfeit all Performance Shares if you leave your company. |

LTIP timeline

| | | | | | | | |

Year 1: | | | | | | Year 3: | | Year 4: |

Jan 1 | | | | | | Dec 31 | | Mar |

v | | | | | | v | | v |

| | | Performance Period | | | | | | |

^ | | < Continued employment > | | ^ | | ^ |

Award Date | | | | | | End of LTIP

Performance

Period | | Payout

Date |

| | | | |

| | | | | | | Performance

Measurement

Date | | |

1

Plan details

Rolling three-year Plan

The LTIP is a rolling three-year Plan - your company will implement a new Plan every year. This means that providing your company’s financial targets are met and you continue to participate in the Plan, you will start receiving an annual payout in your fourth year, based on performance over the prior three-year Performance Period, as shown below.

Payout schedule

Targets based on profitability

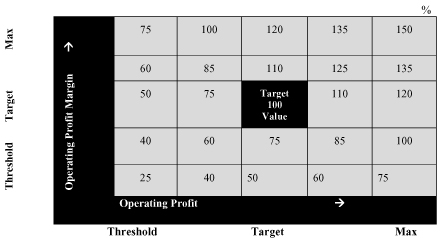

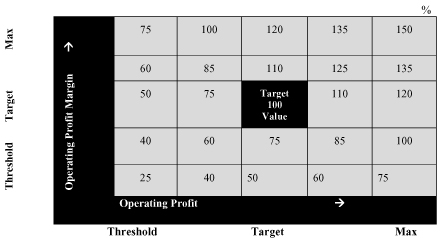

Financial targets will be set at the start of each three-year plan. These determine how performance will be assessed. The targets are based on two measures, usually either the average operating profit and average operating profit margin over the three-year period or the average PBT (profit before tax) and average PBT margin over the three-year period.

Precise details of the targets and the definitions of the measures will be communicated in writing to each operating company.

For each measure WPP will define a target level of performance, as well as a threshold performance level and a maximum. The threshold performance level is usually the prior year’s performance.

In the example below, the company’s operating profit in the prior year is $100 and the target is to grow 10% per year with a maximum 15% above prior year, the averages are calculated as follows:

| | | | | | |

| | Threshold | | Target | | Max |

Year 1 | | 100 | | 110 | | 115 |

Year 2 | | 110 | | 121 | | 126.5 |

Year 3 | | 121 | | 133.1 | | 139.1 |

Average | | 110.3 | | 121.4 | | 126.9 |

Your award

Your award will be granted in Performance Shares. Each Performance Share is a Contingent Right to receive a WPP Share. If you are based in Europe, these Shares will be represented by WPP ordinary shares which are traded on the London Stock Exchange. If you are outside Europe, these Shares will be represented by American Depositary Shares (ADSs) which are traded on Nasdaq in New York.

2

Performance Share terms

During the first year of each three-year Plan, a member of your company’s leadership team will write to you setting out the financial performance targets which will determine the actual number of Performance Shares that you will receive. Each Performance Period starts on January 1 and you should receive your notification of allocation early in Q3.

The number of Performance Shares awarded to you is based on your ability to influence current performance and your potential to contribute to your company’s long-term success. LTIP participation is discretionary and there is no guarantee that you will participate every year.

You should also note that you will not own any stock or receive dividends until the payout date when the actual number of Performance Shares is determined.

3

Performance Share grants

The actual number of Performance Shares you will receive depends on your company’s financial performance. It can be as much as 150% of the number of ‘on target’ Performance Shares. The number of Performance Shares you will receive at threshold performance level is 25% of the ‘on target’ number. If actual performance is below threshold there is no pay out.

The chart above demonstrates the award mechanism. For example, if you were awarded 500 Performance Shares, the actual number of Shares you receive can range from 0 to 750 Performance Shares, depending on your company’s three-year performance against its financial targets.

Your company will complete a performance assessment at the end of each three-year plan to determine the actual number of Performance Shares you will receive.

LTIP payouts

LTIP payouts are usually made in March of the year following the three-year Performance Period. Your payout is entirely in WPP stock, with no further restrictions.

Final value of LTIP payout

The final value of your LTIP payout will depend on two things:

| 1. | The actual number of Performance Shares you receive, based on your company’s financial performance. |

| 2. | The price per share of WPP stock at the time the payout is made. |

Taxation

In terms of paying tax on your LTIP payouts, current UK and US tax laws provide that:

| • | | You do not have to pay tax at the start of, or during, the three-year Performance Period. |

4

| • | | Tax becomes due at the Payout Date. |

The tax situation is subject to change and you should consult your own accountant or qualified financial advisor. You are responsible for paying all taxes that arise from your LTIP payouts.

If you change jobs or leave your company

If you move to a new job within your company or another WPP company, you keep your Performance Shares and receive an LTIP payout on the same schedule you would have had you not moved job. As with any LTIP grant, any new Performance Shares you are awarded under later plans will depend on your performance, contribution and role in your new company.

If you comply with Qualifying Retirement terms, your LTIP payout will be pro-rated to reflect your service up until the date you left your company. You generally do not receive a payout at the time you leave your company - you receive the pro-rated payout at the same time as other Plan participants, i.e. at the Payout Date.

If you become disabled or die, you or your estate will receive a pro-rated LTIP payout reflecting your service up until the date of your disability or death. This pro-rated payout will be made at the end of the three-year LTIP, at the same time as other Plan participants.

If you leave your company for any other reason - for example, if you leave to take a position outside the WPP Group or you are dismissed from your company - you forfeit all outstanding Performance Shares.

5

Your questions answered

Do my company’s financial targets remain unchanged for the three-year plan cycle, or can they be amended during that time?

Once the financial targets are set at the start of each Performance Period they do not change. The Plan is designed to balance ups and downs from year to year by measuring results over the full three-year period.

Does the LTIP include any measures linked to WPP’s performance?

Performance measures are based solely on your company’s performance. However, as your LTIP payout is in WPP stock, the value of your payout is also influenced by the market value of WPP’s stock.

What if I take on a broader leadership role - will my Performance Share award increase?

The number of Performance Shares awarded under a particular LTIP remains fixed. However, keep in mind that new LTIP awards are made each year, so if your company determines that you have assumed a role with a broader scope and greater impact on profitable growth, you may be awarded a greater number of Performance Shares under the following year’s Plan.

Is the performance assessment at the end of each three-year Performance Period strictly formula-driven, or is adjustment possible in light of special business or market conditions?

The assessment is driven solely by financial performance against the targets established at the start of each Performance Period.

What are the choices at the end of an LTIP Performance Period?

At the Payout Date, when your actual number of Performance Shares is known, the WPP LTIP administrator will send you a form that gives you three choices:

| 1. | WPP can sell enough of the WPP stock to cover the required tax and transfer the remaining WPP stock to you. |

| 2. | You can give your company the money to cover the required tax. You will then receive the full amount of WPP stock due to you. |

| 3. | You can sell all or any part of your WPP stock and receive cash, less any amount required to cover the required tax. |

Can I take out loans against the value of my LTIP?

There is no loan feature under this Long Term Incentive Plan.

Am I at financial risk by participating in the LTIP?

No. The Plan does not require you to make a personal financial investment so you cannot lose any money. However, keep in mind that the actual number of Performance Shares you receive depends on your company’s financial performance, and that the market value of WPP stock may fall as well as rise.

If you have further questions about the Long Term Incentive Plan, please contact the office of your company’s chief financial or compensation officer.

6

Glossary of terms

Award Date

The Award Date is the first day of the LTIP’s three-year Performance Period. Performance Shares are allocated effective of January 1 in any Plan year, although notification of awards is not made to participants until later in the year.

Contingent Right

A right to receive a WPP Share that is set aside in a trust on the collective behalf of all WPP LTIP participants. Participants have no rights of ownership over these shares until the Payout Date.

Payout Date

This follows the Performance Measurement Date and is usually in the March following the three-year Performance Period.

Performance Measurement Date

December 31 three years after the Award Date.

Performance Period

The three-year period of the Plan cycle, beginning on January 1 each year.

Performance Shares

Each Performance Share represents a Contingent Right to receive a WPP Share. The final number of Shares received depends on the company’s performance.

Qualifying Retirement

The condition under which a person is able to receive a benefit under a company-sponsored retirement plan and/or the company confirms that the person is considered retired.

WPP Shares

WPP ordinary shares or American Depositary Shares (ADS) which are held in trust on a Plan participant’s behalf until the end of the Performance Period when performance is measured and the actual number of shares to be granted is determined.

7

WPP

WPP, 27 Farm Street, London W1J 5RJ T +44(0)20 7408 2204. F +44(0)20 7493 6819.

WPP, 125 Park Avenue, New York NY 10017-5529 T +1-212 632-2200. F +1-212 632-2222.

www.wpp.com

Registered Number: 1003653. Registered Office: Industrial Estate, Hythe, Kent CT21 6PE

8