Roth China Discover Tour

May 17, 2007

Winner Medical Group Inc.

(OTCBB: WMDG)

Safe Harbor Statement

This presentation contains certain statements that may include ''forward looking

statements'' within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. All statements,

other than statements of historical fact included herein are "forward-looking statements"

including statements regarding Winner Medical Group Inc. and its subsidiary companies

business strategy, plans and objective and statements of non-historical information. These

forward looking statements are often identified by the use of forward-looking terminology

such as "believes," "expects" or similar expressions, involve known and unknown risks and

uncertainties. Although Winner Medical Group Inc. believes that the expectations reflected

in these forward-looking statements are reasonable, they do involve assumptions, risks

and uncertainties, and these expectations may prove to be incorrect. You should not place

undue reliance on these forward-looking statements, which speak only as of the date of

this press release. Winner Medical Group Inc.'s actual results could differ materially from

those anticipated in these forward-looking statements as a result of a variety of factors,

including those discussed in Winner Medical Group Inc.'s periodic reports that are filed with

and available from the Securities and Exchange Commission. All forward-looking

statements attributable to Winner Medical Group Inc. or persons acting on its behalf are

expressly qualified in their entirety by these factors. Other than as required under the

securities laws, Winner Medical Group Inc. does not assume a duty to update these

forward-looking statements.

2

Investment Highlights

Premier manufacturer of cotton surgical dressings and disposable medical

products

Patented comprehensive product portfolio with significant competitive advantages

Leading Chinese exporter of medical disposables

#1 ranked Chinese exporter of cotton wadding, gauze and bandage supplies 2002-2005

Winner Medical’s products account for ~10% of China’s total medical disposables exports market

Long standing relationships with tier one international distribution channels

Partnerships with world-class medical supply OEMs in Japan, Europe and the U.S.

Typical customer relationship averages 8+ years

U.S. FDA approved for direct import of sterilized surgical dressings

One of few Chinese companies approved for direct import of sterilized products into U.S.

Winner Shenzhen benefits from special tax exempt status

Granted by Shenzhen Bureau of Science Technology & Information – April 2006

50% tax exemption until 2011

3

Strong Base of Existing Business

~75% total sales generated through

OEM channels

World-class customer base

~55% of FY 2006 total sales derived from

top 10 customers

~62% of revenues in first six months of

FY 2007 derived from customers in

Europe and Japan

Current Main Customers

U.S. & Australia

Netherlands

Sweden

United Kingdom

Italy

Germany

Japan

Germany

United States

4

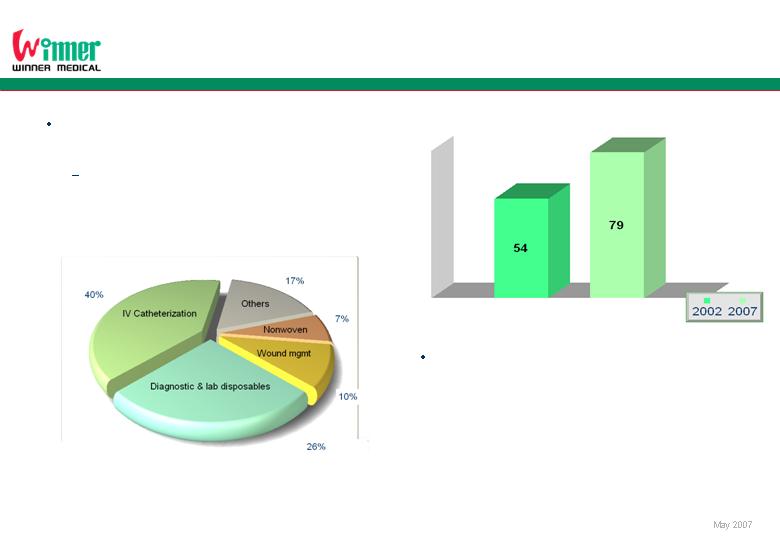

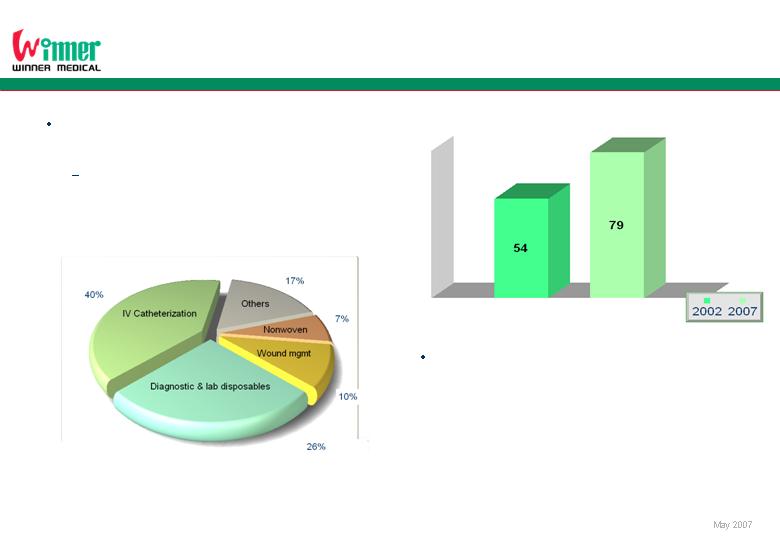

Medical Disposable Supplies Market – U.S.

Total U.S. medical disposable

supplies market was $54 billion 2002

Non-woven and wound management

disposables accounted for 7% and 10%

respectively

Total U.S. medical disposable

supplies market is expected to grow

to $79 billion by 2007

Source: Freedonia Group www.freedoniagroup.com, www.the-infoshop.com

US Disposable Medical Supplies Market – $$54 billion in 2002

US Disposables Market – $in $billions

5

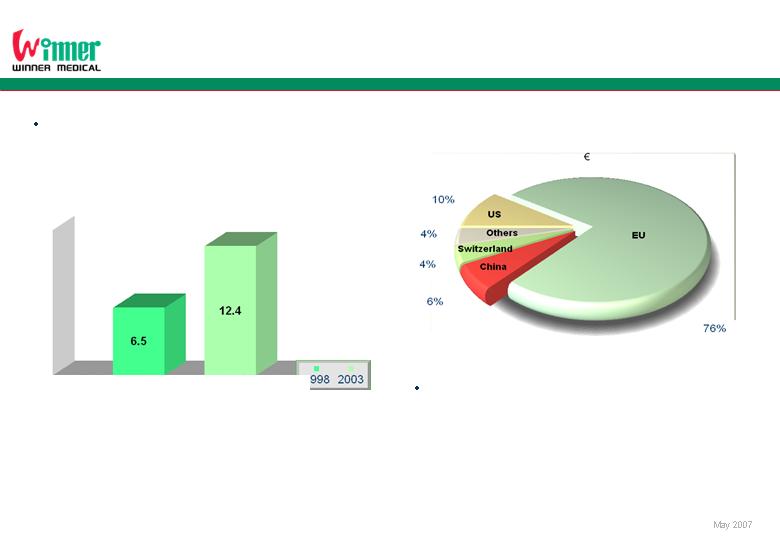

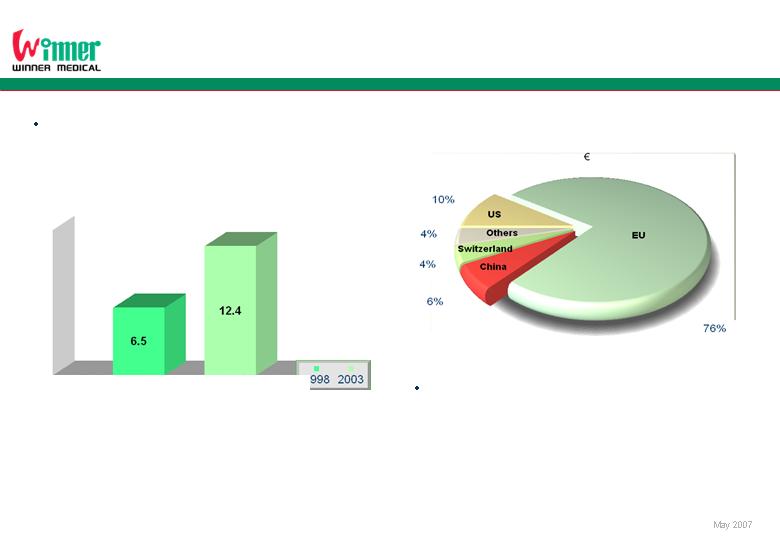

Medical Disposable Supplies Market – Europe

The EU medical disposable supplies

market increased from €6.5 billion in

1998 to € 12.4 billion in 2003

Chinese imports accounted for ~6%

of the total EU imports of cotton

wadding, gauze and bandages

Source: CBI - the Centre for the Promotion of Imports from developing countries, is an agency of

the Netherlands Ministry of Foreign Affairs. www.cbi.nl

2004 EU Imports of Wadding, Gauze and Bandages

EU disposables consumption in Billion €

6

Growth Strategy

Nano assisted antibiotic materials

(Projected to be additive to future woven gauze products)

Revenue anticipated FY 2008

Cohesive and Self-Adhesive bandage materials

Revenue generation effective first quarter of CY 2006

PurCotton™

NEW - Non-woven, cotton spunlace product

Revenue expected to commence in the first half of FY 2007

Sterilized products

Higher gross margins

Non-sterilized products

Transition from low margin to high margin products

Leverage R&D to introduce new products

7

Growth Strategy – Market Expansion

International Strategy

Leverage existing OEM partnerships to aggressively market new Winner Medical

products in Japan, Europe and the U.S.

Shift product focus to higher margin, sterilized products

Develop new OEM relationships

Continually seek new distributors to extend Winner Medical’s reach into new markets

and expand reach in existing markets

Domestic Strategy

Aggressively market Winner Medical products in China

Regional Strategy

Market the “Winner” brand in Middle East, Southeast Asia, Latin America and Africa

In February 2007, established joint venture, Winner Medical Jordan Limited, to design,

manufacture and market “Winner” brand products in the Gulf region

These emerging markets offer dramatic growth potential and substantial opportunity for

the sale of “low cost, high quality alternatives” to products produced by large

multinational companies

8

Chinese Export Growth Potential

Total US and EU cotton wadding, gauze and bandage supplies market was ~$5.3

billion in 2004

Chinese exports accounted for ~11% of this market, or ~$600 million

Winner Medical has commanded the leading China export position since 2002

Source: CBI, Freedonia Group, China ecommerce network, Winner management estimates

9

Product Portfolio Highlights

Wide-ranging portfolio of medical supply

products

Surgical dressings, dressing packs, wound care

dressings, protective products, medical instruments,

dental products and hygiene products for the

institutional and home care markets

PurCotton™ – patented, potential “category

killer” cotton product

Winner Medical-developed, technology-driven product

Possesses similar advantages to cotton gauze

products (absorbent, non-allergenic, biodegradable),

without the disadvantages (micro-organism

attachment, fiber loss, shredding, raw edges, etc.)

Low manufacturing costs

Cohesive (self-adhering) bandage material

Winner Medical-developed, technology-driven product

Significant competitive advantage due to unique

weaving pattern

Low manufacturing costs

10

Sample Product Offering

11

Sample Product Offering

12

Sterilized Products

Higher margin products

U.S. FDA approved for direct export of

sterilized surgical dressings

One of few Chinese companies approved

for direct export to U.S.

Direct shipment allows for customers to

take advantage of Winner Medical’s

lower labor costs and more efficient

workflow process

Most Chinese manufacturers ship product

in bulk to U.S., where it is then sterilized

and repacked, increasing the cost of the

product

Winner plans to capitalize on its FDA

registration to:

Grow sales from a competitive advantage

Improve gross margin through sale of

higher margin products

13

PurCotton™

Patented, potential “category killer” cotton product

Revolutionary new manufacturing process makes the PurCotton™ technology proprietary to

Winner Medical

Anticipate PurCotton patent in China will be issued by end of Q3 2007

Non-woven spunlace material utilizing cotton rather than petrochemical fiber

(polyester/rayon) as the raw material

Non-woven products are the largest and fast-growing segment within the medical

disposables market

Product Advantages:

Strong, durable fabric

Absorbency is superior to traditional cotton gauze

PurCotton™ has higher tensile strength and lower weight than woven alternatives

Does not produce the extraneous fibers and shredding characteristic of traditional cotton gauze, which

is known to exacerbate microbial infection propensity and increase wound healing complications

Significantly lower manufacturing cost than woven gauze

The technology is expected to eliminate ~90% of labor costs and significantly reduce production cycle

time

“Green” product that is non-allergenic and fully biodegradable

14

PurCotton™ Target Markets

Traditional woven cotton market

Significant product and cost advantages of PurCotton™ are expected to generate immediate

interest and demand for the product

Global medical disposables market is expected to grow 5-6% annually through 2010, with the

non-woven segment growth projected to be 7-8% annually

Industrial and home hygiene markets

Strong application for the industrial and home hygiene markets

Primary applications are expected to be wipes, cloths, etc.

Rolls of PurCotton™ will be produced according to specifications from finished product

manufacturers and shipped in bulk to the manufacturers’ factories for final finishing,

packaging and shipment.

Source: CBI, Freedonia Group

15

PurCotton™ Sample Product Offering

16

Additional Product Opportunities

Self-Adhesive and Cohesive Bandages

Technologically superior products at lower cost

Product design enables uniform tearing

without use of ancillary tools

(weaving technology)

Product cost advantages:

Fully integrated production in low cost

Winner Medical factories

Revolutionary adhesive coating technology eliminates

approximately 80% of adhesive application waste

New 70% Cotton / 30% Polyester Nonwoven Products

Uses cotton instead of rayon as the raw material

Will compete with traditional nonwoven fabrics on price

Expected to supercede Winner Medical’s traditional

synthetic nonwoven products

Nano Antibiotic Material Products

Advantages:

Anti-inflammation and anti-bacterial

Increase ventilation, anti-viral and wound-cleansing properties and

enhance efficacy

17

Facilities

2 Winner industrial parks (Shenzhen

and Huanggang)

8 factories in Hubei Province, Shanghai, and

Zhuhai

All facilities in China: nearly 600,000 square

meters

New PurCotton™ facility in Huanggang

ISO 9001: 2000, ISO 13485: 2003 and CE

certification

R&D efforts

Joint research program with Hong Kong

Polytechnic University

18

FINANCIALS

Selected Quarterly Income Statement Highlights

$ 5.8 M

$ 6.3 M

$ 6.5 M

$ 11.3 M

$ 17.5 M

$ 63.9 M

Fiscal Year

2006

09/30/06

Second Quarter

FY 2006

03/31/06

Second Quarter

FY 2007

03/31/07

$ 1.4 M

$ 1.2 M

Net Income

(including Minority Interest)

$ 1.5 M

$ 0.98 M

Pre-tax Income

$ 1.5 M

$ 1.1 M

Operating Income

$ 2.2 M

$ 2.5 M

SG&A and other expenses

$ 3.5 M

$ 3.4 M

Gross Profit

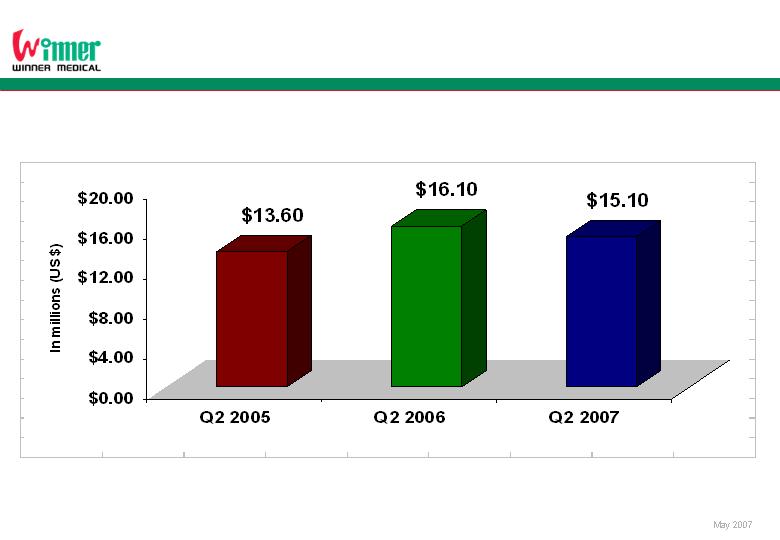

$ 16.1 M

$ 15.1 M

Revenues

20

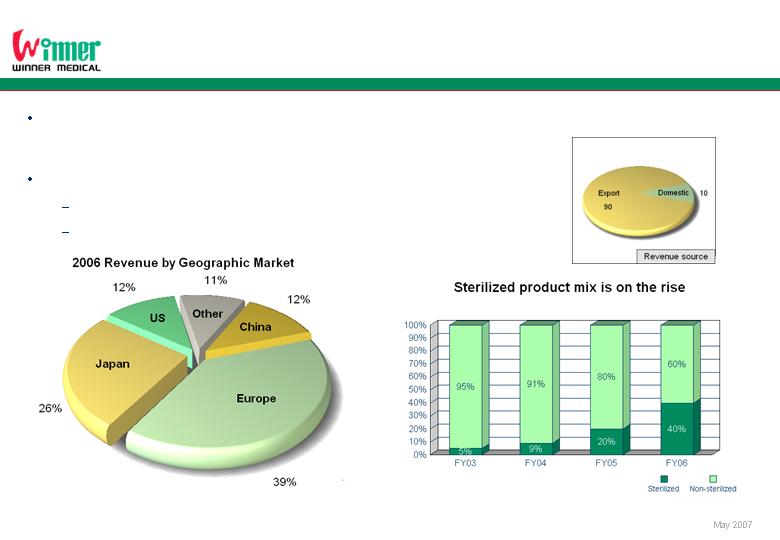

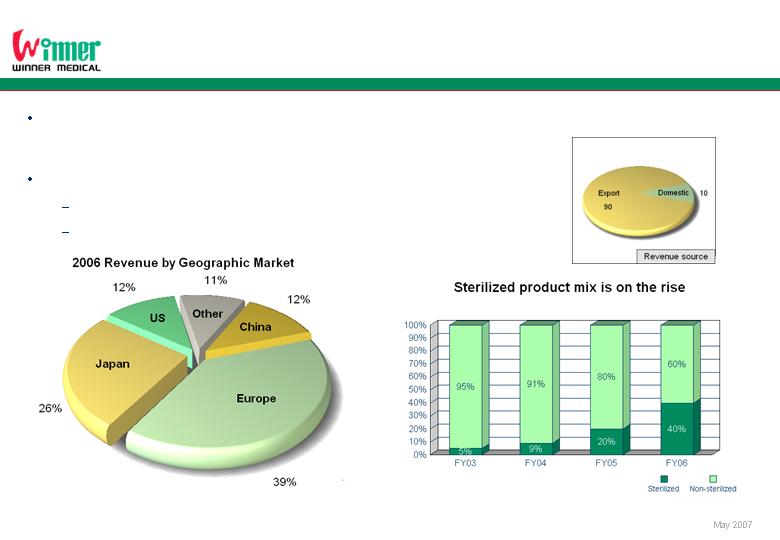

Revenue Mix and Sources

Winner Medical’s products are exported to approximately 80 countries and

120 firms worldwide

Distribution channels

U.S., Japan and Europe: OEM suppliers

Developing countries: Winner brand

21

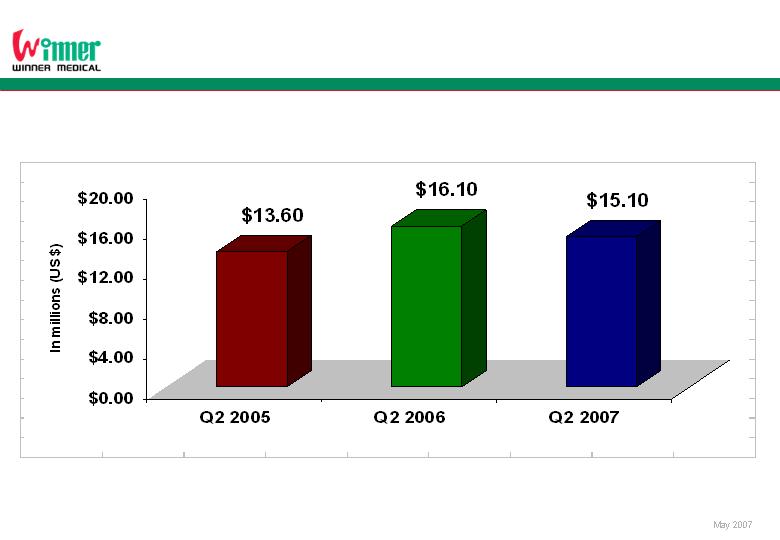

Q2 Net Sales – Past Three Years

22

Net Sales – Fiscal Year Comparison

23

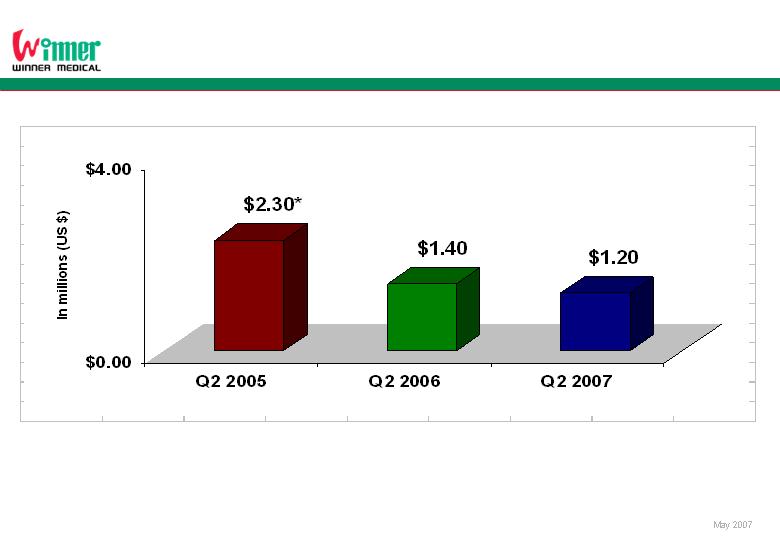

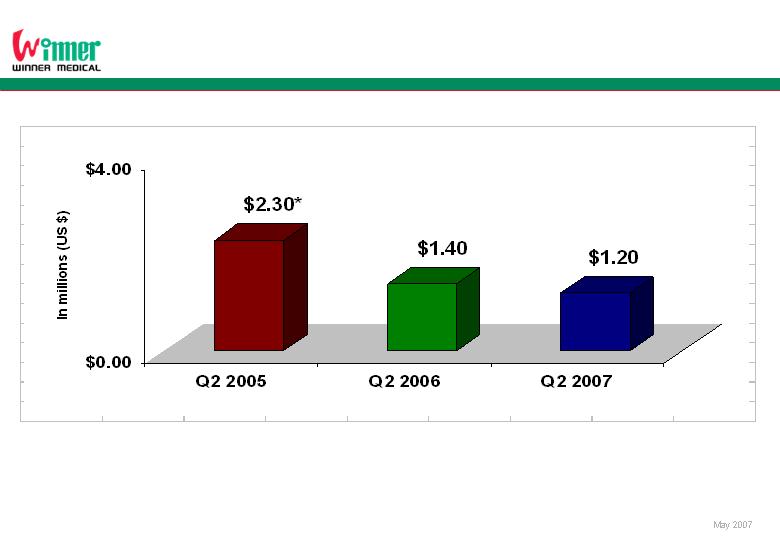

Q2 Net Income – Past Three Years

* Q2’05 net income includes one time gain of approximately 1.05 M from the disposable of a subsidiary

24

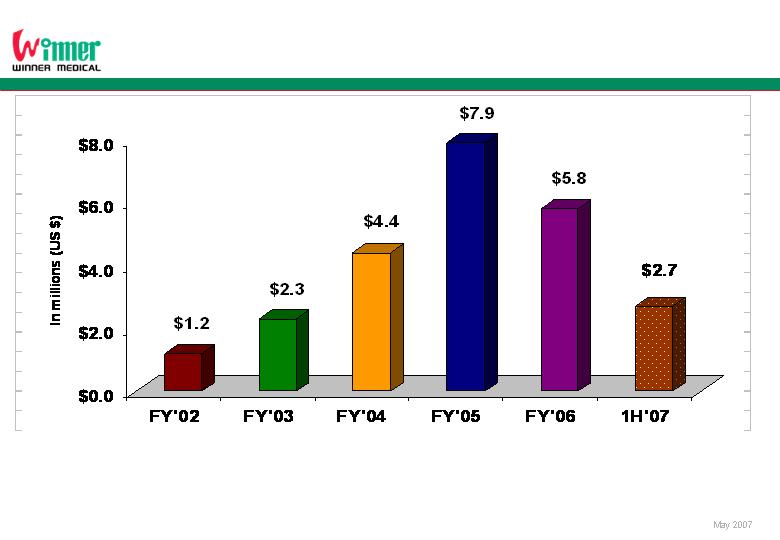

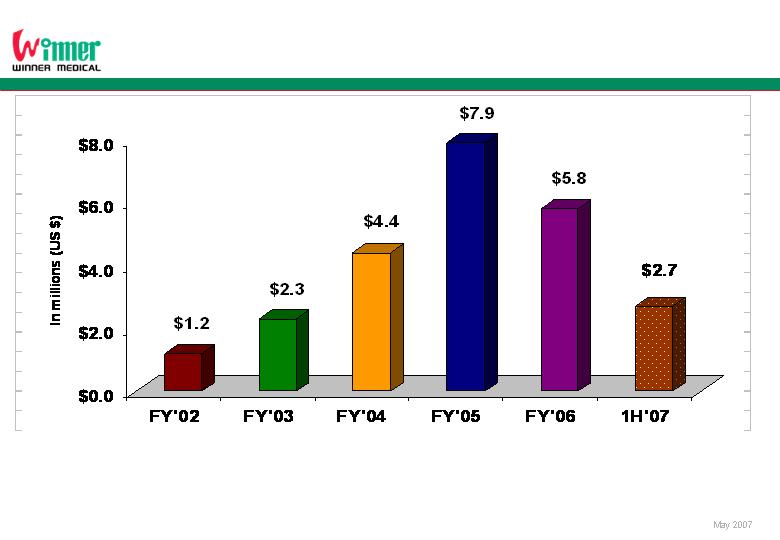

Net Income – Fiscal Year Comparison

* FY’05 net income includes one time gain of approximately 1.05 M from the disposable of a subsidiary

** FY’06 includes the first three quarters that Winner Medical was a U.S. listed company

25

Selected Quarterly Balance Sheet Highlights

$ 67.2 M

$ 52.3 M

$ 0.1 M

$ 14.7 M

$ 67.2 M

$ 35.8 M

$ 29.8 M

$ 11.3 M

$ 4.3 M

September 30

2006

$ 41.4 M

Property, Plant & Equipment, net

$ 13.1 M

Inventories, net

$ 29.4 M

Total Current Assets

$ 72.5 M

Total Liabilities and Stockholders’

Equity

$ 56.2 M

Total Stockholders’ Equity

$ 0.2 M

Minority Interests

$ 16.1 M

Total Current Liabilities

$ 72.5 M

Total Assets

$ 4.2 M

Cash & Cash Equivalents

March 31

2007

26

Capital Market Summary

Ticker Symbol WMDG

Market & nbsp; OTC Bulletin Board

Fiscal Year End September 30

Recent Price (as of May 11, 2007) $3.50

Shares Outstanding 44.7 million

Market Capitalization $156.5 million

Cash Position (as of Mar 31, 2007) $4.2 million

Working Capital (as of Mar 31, 2007) $13.3 million

Total Debt (as of Mar 31, 2007) $8.4 million

27

Summary

Winner Medical is the “best in class” manufacturer of cotton surgical dressings

and disposable medical products with a strong base of revenues, customers

and capabilities

Global surgical dressings and medical disposable supplies market is expected to

continue to generate strong demand

Winner Medical’s strategies of superior products/product quality, cost

advantage and logistics excellence have created long term competitive

advantage

Sales growth and gross margin improvement will come from shift in product mix to

higher margin sterilized products, especially new products such as PurCotton™,

Cohesive and Self-adhesive bandages

Winner Medical is well positioned with R&D capabilities to both create and

capitalize on significant future opportunities

28

Thank you

investors@winnermedical.com

www.winnermedical.com

29