UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Winner Medical Group Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | 1) Title of each class of securities to which transaction applies: |

| | |

| | 2) Aggregate number of securities to which transaction applies: |

| | |

| | 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | 4) Proposed maximum aggregate value of transaction: |

| | |

| | 5) Total fee paid: |

| | |

| | o Fee paid previously with preliminary materials. |

| | |

| | o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | 1) Amount Previously Paid: |

| | |

| | 2) Form, Schedule or Registration Statement No.: |

| | |

| | 3) Filing Party: |

| | |

| | 4) Date Filed: |

WINNER MEDICAL GROUP INC.

Notice Of Annual Meeting Of Stockholders

To Be Held On April 30, 2010

The Annual Meeting of Stockholders of Winner Medical Group Inc., the “Company”, will be held on April 30, 2010 at 10 a.m. local time at Winner Industrial Park, Bulong Road, Longhua, Shenzhen City, 518109, People’s Republic of China for the following purposes, as more fully described in the accompanying proxy statement:

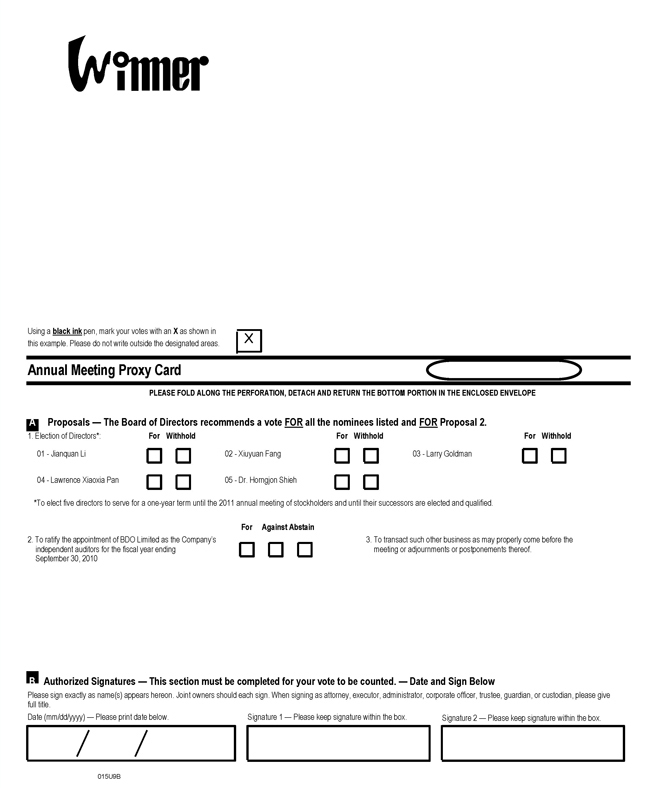

1. To elect five directors to hold office until the 2011 Annual Meeting of Stockholders and until their successors are elected and qualified.

2. To ratify the appointment of BDO Limited as the Company’s independent auditors for the fiscal year ending September 30, 2010.

3. To transact such other business as may properly come before the meeting or any adjournments or postponements thereof.

Only stockholders of record at the close of business on March 11, 2010 will be entitled to notice of, and to vote at, such meeting or any adjournments or postponements thereof.

| | | |

| | BY ORDER OF THE BOARD OF DIRECTORS |

| | | |

| | /s/ Jianquan Li |

| | Jianquan Li |

| | Chairman |

Shenzhen, People's Republic of China

March 19, 2010

YOUR VOTE IS IMPORTANT!

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE COMPLETE, SIGN, DATE AND MAIL PROMPTLY THE ACCOMPANYING PROXY CARD IN THE ENCLOSED RETURN ENVELOPE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES. THIS WILL ENSURE THE PRESENCE OF A QUORUM AT THE MEETING. IF YOU ATTEND THE MEETING, YOU MAY VOTE IN PERSON IF YOU WISH TO DO SO EVEN IF YOU HAVE PREVIOUSLY SENT IN YOUR PROXY CARD.

WINNER MEDICAL GROUP INC.

Winner Industrial Park, Bulong Road Longhua, Shenzhen City, 518109 People’s Republic of China |

(86) 755-28138888

2010 ANNUAL MEETING OF STOCKHOLDERS

Winner Medical Group Inc., the “Company”, is furnishing this proxy statement and the enclosed proxy in connection with the solicitation of proxies by the Board of Directors of the Company for use at the Annual Meeting of Stockholders to be held on April 30, 2010, Wednesday, at 10 a.m. local time, at 4F, Winner Industrial Park, Bulong Road, Longhua, Shenzhen City, Guangdong Province, China / Post Code: 518109, and at any adjournments thereof, the “Annual Meeting”.

Important Notice Regarding the Availability of Proxy Materials for the Stockholders Meeting to be Held on April 30, 2010 — the Company’s Annual Report and this Proxy Statement are available at www.edocumentview.com/WWIN.

Only holders of the Company’s common stock as of the close of business on March 11, 2010, the “Record Date”, are entitled to vote at the Annual Meeting. Stockholders who hold shares of the Company in “street name” may vote at the Annual Meeting only if they hold a valid proxy from their broker. As of the Record Date, there were 22,363,675 shares of common stock outstanding.

On October 6, 2009, the Company’s Board of Directors approved and authorized the Company to complete a one-for-two reverse split of the Company’s common stock, decreasing the Company’s authorized capital to 247,500,000 shares of common stock and 2,500,000 shares of preferred stock, par value $0.001 per share. Pursuant to the Nevada Revised Statues, shareholder approval of this action was not required.

A majority of the outstanding shares of common stock entitled to vote at the Annual Meeting must be present in person or by proxy in order for there to be a quorum at the meeting. Stockholders of record who are present at the meeting in person or by proxy and who abstain from voting, including brokers holding customers’ shares of record who cause abstentions to be recorded at the meeting, will be included in the number of stockholders present at the meeting for purposes of determining whether a quorum is present.

Each stockholder of record is entitled to one vote at the Annual Meeting for each share of common stock held by such stockholder on the Record Date. Stockholders do not have cumulative voting rights. Stockholders may vote their shares by using the proxy card enclosed with this proxy statement. All proxy cards received by the Company, which are properly signed and have not been revoked will be voted in accordance with the instructions contained in the proxy cards. If a signed proxy card is received which does not specify a vote or an abstention, the shares represented by that proxy card will be voted for the nominees to the Board of Directors listed on the proxy card and in this proxy statement, and for the ratification of the appointment of BDO Limited as the Company’s independent auditors for the fiscal year ending September 30, 2010. The Company is not aware, as of the date hereof, of any matters to be voted upon at the Annual Meeting other than those stated in this proxy statement and the accompanying Notice of Annual Meeting of Stockholders. If any other matters are properly brought before the Annual Meeting, the enclosed proxy card gives discretionary authority to the persons named as proxies to vote the shares represented by the proxy card in their discretion.

Under Nevada law and the Company’s Certificate of Incorporation and Bylaws, if a quorum exists at the meeting, the affirmative vote of a plurality of the votes cast at the meeting is required for the election of directors. A properly executed proxy marked “Withhold authority” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum. For each other item, the affirmative vote of the holders of a majority of the shares represented in person or by proxy and entitled to vote on the item will be required for approval. A properly executed proxy marked “Abstain” with respect to any such matter will not be voted, although it will be counted for purposes of determining whether there is a quorum. Accordingly, an abstention will have the effect of a negative vote.

For shares held in “street name” through a broker or other nominee, the broker or nominee may not be permitted to exercise voting discretion with respect to some of the matters to be acted upon. Thus, if stockholders do not give their broker or nominee specific instructions, their shares may not be voted on those matters and will not be counted in determining the number of shares necessary for approval. Shares represented by such “broker non-votes” will, however, be counted in determining whether there is a quorum.

A stockholder of record may revoke a proxy at any time before it is voted at the Annual Meeting by (a) delivering a proxy revocation or another duly executed proxy bearing a later date to Mr. Xiuyuan Fang, the Secretary of the Company, at Winner Industrial Park, Bulong Road, Longhua, Shenzhen City, 518109, the People’s Republic of China, or (b) attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not revoke a proxy unless the stockholder actually votes in person at the meeting.

The proxy card accompanying this proxy statement is solicited by the Board of Directors of the Company. The Company will pay all of the costs of soliciting proxies. In addition to solicitation by mail, officers, directors and employees of the Company may solicit proxies personally, or by telephone, without receiving additional compensation. The Company, if requested, will also pay brokers, banks and other fiduciaries who hold shares of Common Stock for beneficial owners for their reasonable out-of-pocket expenses of forwarding these materials to stockholders.

BOARD OF DIRECTORS

The name, age and year in which the term expires of each member of the Board of Directors of the Company is set forth below:

| Name | | Age | | Position | | Term Expires on the Annual Meeting held in the Year |

| Jianquan Li | | 54 | | Chief Executive Officer and President, and Chairman of the Board | | 2011 |

| Xiuyuan Fang | | 41 | | Chief Financial Officer, Vice President, Treasurer and Director | | 2011 |

| Larry Goldman | | 53 | | Director | | 2011 |

| Lawrence Xiaoxia Pan | | 48 | | Director | | 2011 |

| Dr. Horngjon Shieh | | 49 | | Director | | 2011 |

At the Annual Meeting, the stockholders will vote on the election of Jianquan Li, Xiuyuan Fang, Larry Goldman, Lawrence Xiaoxia Pan and Dr. Horngjon Shieh as directors to serve for a one-year term until the annual meeting of stockholders in 2011 and until their successors are elected and qualified. All directors will hold office until the annual meeting of stockholders at which their terms expire and the election and qualification of their successors.

NOMINEES AND CONTINUING DIRECTORS

The following individuals have been nominated for election to the Board of Directors or will continue to serve on the Board of Directors after the Annual Meeting:

Jianquan Li. Mr. Li has served as our Chief Executive Officer, President and director since December 16, 2005. Mr. Li is the founder of Winner Group and has served as its Chairman and CEO since its subsidiary companies’ formation in 1991. As Chairman and CEO, Mr. Li oversaw the implementation of the business plan of Winner Group and was key to the development of its strategic vision. Mr. Li is a graduate of the Hubei Foreign Trade University with a major in International Trade.

Xiuyuan Fang. Mr. Fang has been our Chief Financial Officer, Vice President and Treasurer since December 16, 2005 and our director since January 7, 2006. Mr. Fang has been employed by Winner Group since 1999. Mr. Fang has served as Winner Group’s director since 1999 and as a Vice President since 2001. Mr. Fang is a certified public accountant and has extensive experience in financial management, capital management and tax planning. He was responsible for Winner Group’s financial management and capital management programs. He graduated from Zhongnan University of Economics and Law.

Larry Goldman, CPA. Mr. Goldman has been the Company’s director since May 8, 2006. Mr. Goldman is a certified public accountant with approximately 30 years experience and currently serves as the consultant of Lightbridge Corporation. (Nasdaq: LTBR), a nuclear fuel consulting and technology company. Prior to joining Lightbridge Corporation, Mr. Goldman worked as the Chief Financial Officer, Treasurer and Vice President of Finance of WinWin Gaming, Inc., a multi-media developer and publisher of sports, lottery and other games (OTCBB: WNWN). Prior to his employment with WinWin Gaming, Inc., Mr. Goldman was an audit partner with Livingston Wachtell & Co., LLP where he acted as an auditor for several publicly traded companies in a variety of industries, located both in the United States and China.

Lawrence Xiaoxia Pan. Mr. Pan has been our director since January 14, 2010. Mr. Pan is the Founding Partner of China SageWater Capital Partners. Mr. Pan has invested in and advised Chinese companies specializing in traditional industries of mass consumption, retail, healthcare, high-end manufacturing and mining. He is also the former China Chief Representative and Director of Asia Pacific Region of NASDAQ from 2004 until 2007. Mr. Pan has previously held senior positions in corporate finance and asset management at Morgan Stanley, providing advice to a variety of Chinese companies and banks seeking to access the US capital markets. Mr. Pan has a B.S. and M.S. in Materials Science from Beijing Institute of Science an EMBA in International Business from University of London and a Certificate in Financial Analysis from New York University.

Dr. Horngjon Shieh. Dr. Shieh has been our director since May 8, 2006. Dr. Shieh has served as an Assistant Professor at the City University of Hong Kong for the past seven years, where he has teaching experience in Enterprise Resource Planning, Accounting Information Systems, Accounting Information Systems Security and Control, Financial Accounting, Managerial Accounting, Financial Management, Financial Statement Analysis, International Accounting, and International Financial Statement Analysis and research experience in international accounting, information content and usefulness of financial statements, corporate governance, as well as disclosure requirements and capital market access.

There are no family relationships among any of the Company’s directors or executive officers.

DIRECTOR NOMINATION

Criteria for Board Membership. In recommending candidates for appointment or re-election to the Board, the governance and nominating committee, the “governance and nominating committee”, considers the appropriate balance of experience, skills and characteristics required of the Board of Directors. It seeks to ensure that at least three directors are independent under the rules of the Nasdaq Stock Market, or the New York Stock Exchange AMEX, as applicable, that members of the Company’s audit committee meet the financial literacy and sophistication requirements under the rules of the Nasdaq Stock Market or the New York Stock Exchange AMEX, as applicable, and at least one member of the Board qualifies as an “audit committee financial expert” under the rules of the Securities and Exchange Commission. Nominees for director are recommended on the basis of their depth and breadth of experience, integrity, ability to make independent analytical inquiries, understanding of the Company’s business environment, and willingness to devote adequate time to Board duties.

Stockholder Nominees. The governance and nominating committee will consider written proposals from stockholders for nominees for director. Any such nominations should be submitted to the governance and nominating committee, c/o Mr. Xiuyuan Fang, the Secretary of the Company, and should include the following information: (a) all information relating to such nominee that is required to be disclosed pursuant to Regulation 14A under the Securities Exchange Act of 1934, including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected; (b) the names and addresses of the stockholders making the nomination and the number of shares of the Company’s common stock which are owned beneficially and of record by such stockholders; and (c) appropriate biographical information and a statement as to the qualification of the nominee, and should be submitted in the time frame described in the Bylaws of the Company and under the caption, “Stockholder Proposals for 2010 Annual Meeting” below.

Process for Identifying and Evaluating Nominees. The governance and nominating committee believes the Company is well-served by its current directors. In the ordinary course, absent special circumstances or a material change in the criteria for Board membership, the governance and nominating committee will renominate incumbent directors who continue to be qualified for Board service and are willing to continue as directors. If an incumbent director is not standing for re-election, or if a vacancy on the Board occurs between annual stockholder meetings, the governance and nominating committee will seek out potential candidates for Board appointment who meet the criteria for selection as a nominee and have the specific qualities or skills being sought. Director candidates will be selected based on input from members of the Board, senior management of the Company and, if the governance and nominating committee deems appropriate, a third-party search firm. The governance and nominating committee will evaluate each candidate's qualifications and check relevant references; in addition, such candidates will be interviewed by at least one member of the governance and nominating committee. Candidates meriting serious consideration will meet with all members of the Board. Based on this input, the governance and nominating committee will evaluate which of the prospective candidates is qualified to serve as a director and whether the committee should recommend to the Board that this candidate be appointed to fill a current vacancy on the Board, or presented for the approval of the stockholders, as appropriate.

The Company has never received a proposal from a stockholder to nominate a director. Although the governance and nominating committee has not adopted a formal policy with respect to stockholder nominees, the committee expects that the evaluation process for a stockholder nominee would be similar to the process outlined above.

Board Nominees for the 2010 Annual Meeting. Each of the nominees listed in this proxy statement are current directors standing for re-election.

DIRECTOR COMPENSATION

Under the terms of the Independent Directors’ Contracts with each independent director and as increased for fiscal 2009, Mr. Goldman is entitled to $50,000, Mr. Pan is entitled to $50,000 and Dr. Shieh is entitled to $15,000 as compensation for the services to be provided by them as our independent directors, and as chairpersons of various board committees, as applicable. Mr. Goodner, who has resigned as a director effective from January 14, 2010, was entitled to $25,000 during his term of service for fiscal 2009.

| Name and Position | | Number of options granted | | | Option exercise price | | Expiration date |

| | | 4,167 | | | $ | 9.25 | | May 8, 2009 |

| Director | | | 10,000 | | | $ | 4.75 | | February 6, 2010 |

| Richard Goodner | | | 4,167 | | | $ | 9.25 | | May 8, 2009 |

| Director | | | 10,000 | | | $ | 4.75 | | February 6, 2010 |

Under the terms of the Indemnification Agreements, we agreed to indemnify the independent directors against expenses, judgments, fines, penalties or other amounts actually and reasonably incurred by the independent directors in connection with any proceeding if the independent director acted in good faith and in the best interests of our company.

None of the employee directors receives additional compensation solely as a result of his position as a director.

BOARD MEETINGS AND COMMITTEES

The Company’s Board of Directors met by conference call four (4) times during fiscal 2009. The audit committee met five (5) times, the compensation committee met once and the governance and nominating committee met once during fiscal 2009. Each member of the Board attended 75% or more of the aggregate number of Board meetings, and committee meetings on which each director served, during the dates on which he served.

The Board has determined that the following directors for fiscal 2009 are “independent” under the current rules of the Nasdaq Stock Market or the New York Stock Exchange AMEX, as applicable: Larry Goldman, Richard Goodner and Dr. Horngjon Shieh. Lawrence Xiaoxia Pan has become a director since January 14, 2010 and the Board has determined that he is “independent” under the current rules of the Nasdaq Stock Market or the New York Stock Exchange AMEX, as applicable.

The Board of Directors has standing audit, compensation and governance and nominating committees.

Audit Committee. During fiscal 2009, the audit committee consists of Larry Goldman, chairman, Richard Goodner and Dr. Horngjon Shieh. Lawrence Xiaoxia Pan became a member of the audit committee since January 14, 2010, in replacement of Richard Goodner. The Board has determined that all members of the audit committee are independent directors under the rules of the Nasdaq Stock Market or the New York Stock Exchange AMEX, as applicable, and each of them is able to read and understand fundamental financial statements. The Board has determined that Larry Goldman qualifies as an “audit committee financial expert” as defined by the rules of the Securities and Exchange Commission. The purpose of the audit committee is to oversee the accounting and financial reporting processes of the Company and audits of its financial statements. The audit committee reviews and monitors our internal controls, financial reports and accounting practices, as well as the scope and extent of the audits performed by both the independent and internal auditors, reviews the nature and scope of our internal audit program and the results of internal audits, and meets with the independent auditors. The audit committee operates under a written charter that was disclosed on the company’s website at http://ir.winnermedical.com/phoenix.zhtml?c=184377&p=irol-govhighlights ..

Compensation Committee. During fiscal 2009, the compensation committee consists of Dr. Horngjon Shieh, chairman, Larry Goldman and Richard Goodner. Lawrence Xiaoxia Pan became a member of the compensation committee since January 14, 2010, in replacement of Richard Goodner. The Board has determined that all members of the compensation committee are independent directors under the rules of the Nasdaq Stock Market or the New York Stock Exchange AMEX, as applicable. The compensation committee oversees our compensation and employee benefit plans and practices and produces a report on executive compensation. The compensation committee operates under a written charter that was disclosed on the company’s website at http://ir.winnermedical.com/phoenix.zhtml?c=184377&p=irol-govhighlights ..

Governance and nominating Committee. During fiscal 2009, the governance and nominating committee currently consists of Richard Goodner, chairman, Dr. Horngjon Shieh and Larry Goldman. Lawrence Xiaoxia Pan became the chairman of the governance and nominating committee since January 14, 2010, in replacement of Richard Goodner. The Board has determined that all members of the governance and nominating are independent directors under the rules of the Nasdaq Stock Market or the New York Stock Exchange AMEX, as applicable. The primary purpose of governance and nominating committee is to identify and to recommend to the board individuals qualified to serve as directors of our company and on committees of the board, advise the board with respect to the board composition, procedures and committees, develop and recommend to the board a set of corporate governance principles and guidelines applicable to us; and oversee the evaluation of the board and our management. The governance and nominating committee operates under a written charter that was disclosed on the company’s website at http://ir.winnermedical.com/phoenix.zhtml?c=184377&p=irol-govhighlights ..

COMMUNICATIONS WITH DIRECTORS

Stockholders interested in communicating directly with our Directors may send an e-mail to askboard@winndermedical.com., These communications will be reviewed by one or more employees of the Company designated by the Board, who will review all such correspondence and will regularly forward to the Board of Directors copies of all such correspondence that deals with the functions of the Board or committees thereof or that he otherwise determines requires their attention. Directors may at any time review all of the correspondence received that is addressed to members of the Board of Directors and request copies of such correspondence. Concerns relating to accounting, internal controls or auditing matters will immediately be brought to the attention of the Audit Committee and handled in accordance with procedures established by the Audit Committee with respect to such matters.

The Company has a policy of encouraging all directors to attend the annual stockholder meetings. This will be the first Annual Meeting since the Company's current management took over the Company in December 16, 2005.

CODE OF CONDUCT AND ETHICS

The Company has adopted a code of conduct and ethics that applies to all directors, officers and employees, including its principal executive officer, principal financial officer and controller. This code of conduct and ethics was filed as Exhibit 14.1 to our current report on Form 8-K filed on May 11, 2006 filed with the Securities and Exchange Commission.

OFFICERS AND CERTAIN BENEFICIAL OWNERS

The following table sets forth certain information known to the Company with respect to the beneficial ownership of the Company's Common Stock as of March 3, 2010 by (i) each person who is known by the Company to own beneficially more than 5% of the Company's Common Stock, (ii) each of the Company's directors and executive officers, and (iii) all executive officers and directors as a group. Except as otherwise listed below, the address of each person is c/o Winner Medical Group Inc., Winner Industrial Park, Bulong Road, Longhua, Shenzhen City, 518109, People’s Republic of China. Percentage ownership is based upon 22,363,675 shares outstanding as of December 31, 2009.

| Title of Class | | Name & Address of Beneficial Owner | | Office, If Any | | Amount & Nature of Beneficial Ownership1 | | Percent of Class2 | |

Common Stock $0.001 par value | | Jianquan Li 3 Ping Tse 3 6-15D, Donghai Garden, Futian District, Shenzhen, China | | Chairman, CEO and Director | | | 18,042,264 | | 80.68 | % |

Common Stock $0.001 par value | | Xiuyuan Fang Room 5B Building 2 Jun’an Garden, Futian District, Shenzhen City, Guangdong Province, China | | CFO, Vice President, Treasurer and Director | | | 232,256 | | 1.04 | % |

Common Stock $0.001 par value | | Larry Goldman 5 Victory Road, Suffern, NY 10901 | | Director | | | 0 | | * | |

Common Stock $0.001 par value | | Lawrence Xiaoxia Pan 1210, Tower E1, Oriental Plaza, No. 1 East Chang’an Avenue, Beijing, China 100738 | | Director | | | 0 | | * | |

Common Stock $0.001 par value | | Dr. Horngjon Shieh Flat 37B, Tower 3e The Victoria Towers 188 Canton Road, TST Kowloon, Hong Kong | | Director | | | 0 | | * | |

Common Stock $0.001 par value | | Nianfu Huo Hai Yi Wan Pan, No. 333 Jin Tang Road, Tang Jia Wan Zhuhai, China 519000 | | Senior Vice President and Chairman of Supervisory Board of Winner Group Limited | | | 98,417 | | * | |

Common Stock $0.001 par value | | Pinnacle China Fund, L.P. 4 4965 Preston Park Blvd. Suite 240, Plano, Texas 75093 | | | | | 1,276,973 | | 5.71 | % |

Common Stock $0.001 par value | | All officers and directors as a group (7 persons named above) | | | | | 18,372,937 | | 82.16 | % |

* Less than 1%

1Beneficial Ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Each of the beneficial owners listed above has direct ownership of and sole voting power and investment power with respect to the shares of the Company’s common stock.

2A total of 22,363,675 shares of the Company’s Common Stock are considered to be outstanding pursuant to SEC Rule 13d-3(d)(1). For each Beneficial Owner above, any options exercisable within 60 days have been included in the denominator.

3 Mr. Jianquan Li and his wife, Ping Tse, hold a total of 18,042,264 shares of the Company’s Common Stock. Mr. Jianquan Li disclaims the power to vote and dispose of the 4,510,565 shares of the Company’s Common Stock owned by Ping Tse. As such, Mr. Jianquan owns 13,531,699 shares of the Company’s Common Stock.

4 Barry Kitt is the sole officer of Pinnacle China Advisors, L.P. which is the general partner of Pinnacle China Fund, L.P.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Mr. Jianquan Li, a director with a controlling interest in Safe Secure Packing (Shenzhen) Co., Ltd., “Safe Secure”, sold all of his controlling interest in Safe Secure to a third party as of September 30, 2007. During the year ended September 30 2007, the Company sold goods to Safe Secure for US$1,740 and purchased goods from it for US$491,463.

During the years ended September 30, 2009, 2008 and 2007, the Company sold goods to Winner Medical & Textile (H.K.) Limited for US$Nil, US$894,560 and US$809,168 respectively. During the years ended September 30, 2009, 2008 and 2007, the Company purchased goods from Winner Medical & Textile (HK) Limited for US$5,846, US$Nil and US$Nil respectively. Mr. Jianquan Li, director of the Company, has a controlling interest in Winner Medical & Textile (H.K.) Limited. As of September 30, 2009, 2008 and 2007, the outstanding balance due from Winner Medical &Textile (HK.) Limited were US$Nil, US$183,247 and US$252,999 respectively.

During the years ended September 30, 2009, 2008 and 2007, the Company purchased goods from L+L Healthcare Hubei Co., Ltd. for US$67,848, US$716,248, and US$490,818 respectively. As of September 30, 2009, 2008 and 2007, amount due from L+L was US$Nil, US$166,112 and US$150,796 respectively. As of September 30, 2009, 2008 and 2007, amount due to L+L was US$56,349, US$24,219 and US$41,809 respectively.

The amounts due from/to the above affiliated companies with the exception of L+L Healthcare Hubei are unsecured, interest free and payable according to the trading credit terms. The amount due from L+L Healthcare Hubei Co., Ltd. are unsecured, 5% interest bearing and payable according to the trading credit terms.

Our independent directors approve the related party transactions based on their fiduciary duties under Nevada state law and based on the best interest of the company.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under Section 16(a) of the Securities Exchange Act of 1934, the “Exchange Act”, and SEC rules, the Company’s directors, executive officers and beneficial owners of more than 10% of any class of equity security are required to file periodic reports of their ownership, and changes in that ownership, with the SEC. Based solely on its review of copies of these reports and representations of such reporting persons, the Company believes that during fiscal year 2009, such SEC filing requirements were satisfied, except for Nianfu Huo, an executive officer did not file Form 3 until November 1, 2006. Subsequent to the reverse merger on December 16, 2005, the Company determined that Mr. Huo, the Senior Vice President of Winner Medical Group Limited and the General Manager of Winner Zhuhai, both subsidiaries of the Company, Winner Zhuhai was completed deregistration procedures since January 2010, should have been considered an executive officer of the Company.

Director Compensation On May 8, 2006, we entered into separate Independent Directors’ Contracts and Indemnification Agreements with each of the independent directors. Under the terms of the Independent Directors’ Contracts and as increased for fiscal 2009, Mr. Goldman is entitled to $35,000. Mr. Goodner, who has resigned as a director effective from January 14, 2010, was entitled to $25,000 during his term of service for fiscal 2009, and Dr. Shieh is entitled to $15,000 as compensation for the services to be provided by them as our independent directors, and as chairpersons of various board committees, as applicable.

The following table summarizes director compensation during the fiscal year 2009. | Name | | Fees Earned or Paid in Cash | | Stock Awards | | Option Awards | | Non-Equity Incentive Plan Compensation | | Change in Pension Value and Nonqualified Deferred Compensation Earnings | | All Other Compensation | | Total | |

| Jianquan Li, | | - | | - | | - | | - | | - | | - | | - | |

| Xiuyuan Fang | | - | | - | | - | | - | | - | | - | | - | |

| Larry Goldman | | $ | 35,000 | | - | | | - | | - | | | - | | - | | $ | 35,000 | |

| Richard Goodner | | $ | 25,000 | | - | | | - | | - | | | - | | - | | $ | 25,000 | |

| Horngjon Shieh | | $ | 15,000 | | - | | | - | | - | | | - | | - | | $ | 15,000 | |

Under the terms of the Indemnification Agreements, we agreed to indemnify the independent directors against expenses, judgments, fines, penalties or other amounts actually and reasonably incurred by the independent directors in connection with any proceeding if the independent director acted in good faith and in the best interests of our company. The Independent Directors’ Contracts and Indemnification Agreements were filed as Exhibits 10.1 through 10.6 to our current report on Form 8-K filed on May 11, 2006.

None of the employee directors receives additional compensation solely as a result of his position as a director.

Summary Compensation Table

The following table sets forth information regarding compensation for the fiscal year ended September 30, 2009 received by the individual who served as the Company’s Chief Executive Officer as well as one individual who served as the Company’s Chief Financial Officer, “Named Executive Officers”. The total compensation of other executive officers did not exceed $100,000 per year.

Name And Principal Position | | Year | | Salary (1) (3) | | Bonus (1) | | Stock Awards (1) | | Option Awards | | Nonequity Incentive Plan Compensation | | Change in Pension Value & Nonqualified Deferred Compensation | | All Other Compensation (2) | | Total (1) | |

| Jianquan Li, | | | 2009 | | 113,547 | | | 46,477 | | - | | | - | | - | | | - | | - | | | 160,024 | |

| | | 2008 | | 100,280 | | | 49,820 | | - | | | - | | - | | | - | | - | | | 150,100 | |

| President | | | 2007 | | 77,823 | | | 51,882 | | - | | | - | | - | | | - | | - | | | 129,705 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Xiuyuan Fang, CFO, | | | 2009 | | 63,017 | | | 16,301 | | - | | | - | | - | | | - | | - | | | 79,318 | |

| Vice President, | | | 2008 | | 49,350 | | | 13,310 | | - | | | - | | - | | | - | | - | | | 62,660 | |

| and Treasurer | | | 2007 | | 35,799 | | | 23,995 | | - | | | - | | - | | | - | | - | | | 59,794 | |

(1) Salary, bonus amounts, stock awards and total compensation are reported in United States dollars.

(2) During fiscal year 2009, the executive officers of the Company were not granted any perquisites or other personal benefits other than an arrangement with Mr. Li to use a company car. The total value of this perquisite is less than $10,000, therefore we have not disclosed any amount in the Summary Compensation Table as permitted under Item 402(c)(2)(ix)(A).

(3) On August 20, 2005, the board of directors of our subsidiary, Winner Group Limited, declared a dividend to all shareholder of Winner Group Limited. As a stockholder, Mr. Li received such dividend in the amount of $1,352,515.72 and $504,315.90 from Winner Group Limited in fiscal year 2006 and fiscal year 2007.

Option Exercises and Stock Vested. None of our executive officers exercised any options during the last fiscal year, nor did any such officer hold any restricted stock that vested during the last fiscal year.

Under the guidance of a written charter adopted by the Board of Directors, the purpose of the Audit Committee is to oversee the accounting and financial reporting processes of the Company and audits of its financial statements. The responsibilities of the Audit Committee include appointing and providing for the compensation of the independent accountants. Each of the members of the Audit Committee meets the independence requirements of Nasdaq or the New York Stock Exchange AMEX (“AMEX”), as applicable.

Management has primary responsibility for the system of internal controls and the financial reporting process. The independent accountants have the responsibility to express an opinion on the financial statements based on an audit conducted in accordance with generally accepted auditing standards.

In this context and in connection with the audited financial statements contained in the Company’s Annual Report on Form 10-K for 2009, the Audit Committee:

| · | reviewed and discussed the audited financial statements as of and for the fiscal year ended September 30, 2009 with the Company’s management and the independent accountants; |

| · | discussed with BDO Limited, the Company’s independent auditors, the matters required to be discussed by Statement of Auditing Standards No. 61, Communication with Audit Committees, as amended by Statement of Auditing Standards No. 90, Audit Committee Communications; |

| · | reviewed the written disclosures and the letter from BDO Limited required by the Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, discussed with the auditors their independence, and concluded that the non-audit services performed by BDO Limited are compatible with maintaining their independence; |

| · | based on the foregoing reviews and discussions, recommended to the Board of Directors that the audited financial statements be included in the Company’s 2009 Annual Report on Form 10-K for the fiscal year ended September 30, 2009 filed with the Securities and Exchange Commission; and |

| · | instructed the independent auditors that the Audit Committee expects to be advised if there are any subjects that require special attention. |

AUDIT COMMITTEE

Larry Goldman (chairman), Richard B. Goodner and Dr. Horngjon Shieh

Audit Committee’s Pre-Approval Policy

During fiscal years ended September 30, 2009, the Audit Committee of the Board of Directors adopted policies and procedures for the pre-approval of all audit and non-audit services to be provided by the Company’s independent auditor and for the prohibition of certain services from being provided by the independent auditor. The Company may not engage the Company’s independent auditor to render any audit or non-audit service unless the service is approved in advance by the Audit Committee or the engagement to render the service is entered into pursuant to the Audit Committee’s pre-approval policies and procedures. On an annual basis, the Audit Committee may pre-approve services that are expected to be provided to the Company by the independent auditor during the fiscal year. At the time such pre-approval is granted, the Audit Committee specifies the pre-approved services and establishes a monetary limit with respect to each particular pre-approved service, which limit may not be exceeded without obtaining further pre-approval under the policy. For any pre-approval, the Audit Committee considers whether such services are consistent with the rules of the Securities and Exchange Commission on auditor independence. During the fiscal year ended September 30, 2009, we did not hire our independent auditor for any non-audit services.

Principal Accountant Fees and Services

The Audit Committee has appointed BDO Limited as the Company’s independent auditors for the fiscal year ending September 30, 2009.

The following table shows the fees paid or accrued by the Company for the audit and other services provided by BDO Limited for fiscal 2009 and 2008.

| | | 2009 | | | 2008 | |

| | | | | | | |

| Audit Fees | | $ | 190,000 | | | $ | 241,500 | |

Audit-Related Fees (1) | | | — | | | | — | |

Tax Fees (2) | | | — | | | | — | |

| All other Fees | | | — | | | | — | |

| | | | | | | | | |

| Total | | $ | 190,000 | | | $ | 241,500 | |

| (1) Includes accounting and reporting consultations related to acquisitions and internal control procedures. |

| |

| (2) Includes fees for service related to tax compliance services, preparation and filing of tax returns and tax consulting services. |

At the Annual Meeting, the stockholders will vote on the election of five directors to serve for a one-year term until the 2011 annual meeting of stockholders and until their successors are elected and qualified. The Board of Directors has unanimously approved the nomination of Jianquan Li, Xiuyuan Fang, Larry Goldman, Lawrence Xiaoxia Pan and Dr. Horngjon Shieh for election to the Board of Directors. The nominees have indicated that they are willing and able to serve as directors. If any of these individuals becomes unable or unwilling to serve, the accompanying proxy may be voted for the election of such other person as shall be designated by the Board of Directors. The Directors will be elected by a plurality of the votes cast, in person or by proxy, at the Annual Meeting, assuming a quorum is present. Stockholders do not have cumulative voting rights in the election of directors.

The Board of Directors recommends a vote “for” the election of Jianquan Li, Xiuyuan Fang, Larry Goldman, Lawrence Xiaoxia Pan and Dr. Horngjon Shieh as directors.

Unless otherwise instructed, it is the intention of the persons named in the accompanying proxy card to vote shares represented by properly executed proxy cards for the election of Jianquan Li, Xiuyuan Fang, Larry Goldman, Lawrence Xiaoxia Pan and Dr. Horngjon Shieh.

PROPOSAL 2 — RATIFICATION OF INDEPENDENT AUDITORS

At the Annual Meeting, the stockholders will be asked to ratify the appointment of BDO Limited as the Company’s independent auditors for the fiscal year ending September 30, 2010. Representatives of BDO Limited are expected to be present at the Annual Meeting and will have the opportunity to make statements if they desire to do so. Such representatives are also expected to be available to respond to appropriate questions.

The Board of Directors recommends a vote “for” the ratification of the appointment of BDO Limited as the Company’s independent auditors for the fiscal year ending September 30, 2010.

OTHER MATTERS

As of the time of preparation of this proxy statement, neither the Board of Directors nor management intends to bring before the meeting any business other than the matters referred to in the Notice of Annual Meeting and this proxy statement. If any other business should properly come before the meeting, or any adjournment thereof, the persons named in the proxy will vote on such matters according to their best judgment.

STOCKHOLDER PROPOSALS FOR 2011 ANNUAL MEETING

Under the rules of the Securities and Exchange Commission, stockholders who wish to submit proposals for inclusion in the proxy statement of the Board of Directors for the 2010 Annual Meeting of Stockholders must submit such proposals so as to be received by the Company at Winner Industrial Park, Bulong Road, Longhua, Shenzhen City, 518109, People's Republic of China, on or before November 2, 2010. In addition, if the Company is not notified by the secretary of the Company of a proposal to be brought before the 2010 Annual Meeting by a stockholder on or before January 14, 2011, then proxies held by management may provide the discretion to vote against such proposal even though it is not discussed in the proxy statement for such meeting.

| | By Order of the Board of Directors |

| | Jianquan Li Chairman |

Shenzhen, People's Republic of China

March 19, 2010

YOUR VOTE IS IMPORTANT!

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE COMPLETE, SIGN, DATE AND MAIL PROMPTLY THE ACCOMPANYING PROXY CARD IN THE ENCLOSED RETURN ENVELOPE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES. THIS WILL ENSURE THE PRESENCE OF A QUORUM AT THE MEETING. IF YOU ATTEND THE MEETING, YOU MAY VOTE IN PERSON IF YOU WISH TO DO SO EVEN IF YOU HAVE PREVIOUSLY SENT IN YOUR PROXY CARD.