Leonard Kiely

VP and GM of Power Systems Division

10 years with SPS Technologies/Precision Castparts Corp.

Various operations leadership positions including President of their Precision Tool group

VP of Business Development

9 years with Raychem Corporation

Positions included Controller, Operations Manager and General Manager of Irish operations

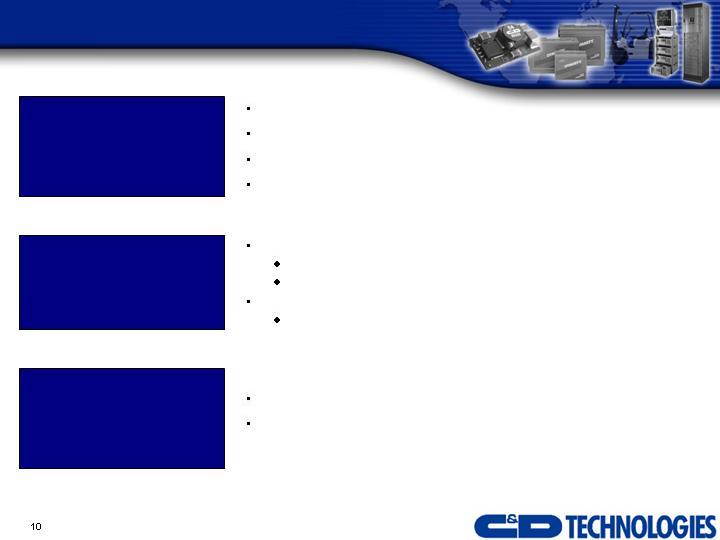

C&D Management Team

Dr. Bill Bachrach

VP and GM, Power Electronics Division

Extensive experience in manufacturing of highly engineered products

Worked with Jeff Graves on strategic planning for KEMET

Founded InphoMatch

Worked for General Electric for over ten years.

James Dee

VP, General Counsel & Corporate Secretary

Formerly with Montgomery, McCracken, Walker & Rhoads

From 1997-2004, last served as Vice President, General Counsel and Corporate Secretary

at SPS Technologies

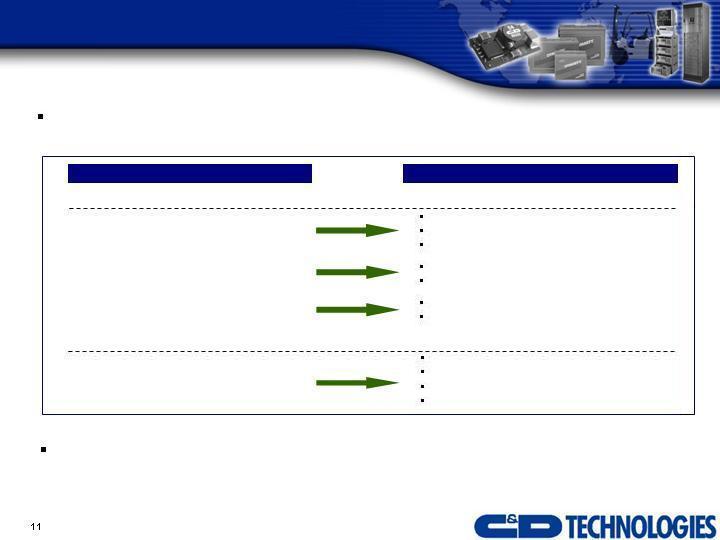

C&D Accomplishments

New management team has made significant strides to address key operating

challenges within both its battery and power electronics segments

With a renewed focus on execution, customer satisfaction, quality and technology

development, C&D is well positioned for growth and profitability

Reynosa plant migration

Batteries

Responses

New plant management

Quality focus/fix

Labor force retention

New leadership

Strategic turnaround plan developed and in process

Continue to push price increases

Hedging programs and contractual arrangements

Power Electronics

New divisional GM/Other management changes

Bolstered quality and logistics resources

Stabilization of revenue base

Focus on supply chain management

Acquisition integration

Motive Power performance

Lead costs and pricing

Key Challenges

Segment Overview

Power Systems Division

Standby Power

Standby Power– Overview

LTM1: $265.0 million net sales

Applications

Standby batteries & electronics

Wireline / fiber

Wireless cell sites / pager sites

Cable TV

Power generation / utilities

Uninterruptible Power Supply (“UPS”)

Key customers

AT&T, Cingular, Verizon, US

Cellular, Sprint, Qwest, Eaton,

Emerson, Schneider, Alpha

Products

Reserve batteries

Integrated reserve power systems

Power rectifiers / chargers

System monitors

Power boards and chargers

Representative Products

Battery Products

Power Systems

Note:

1 LTM as of 7/31/06

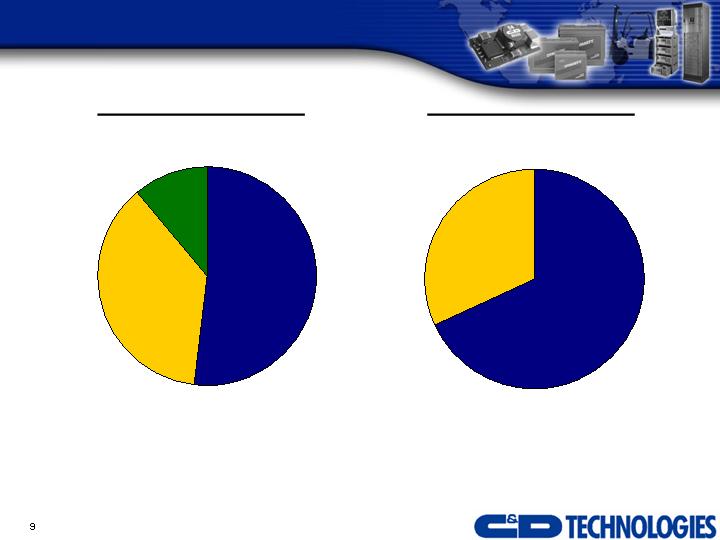

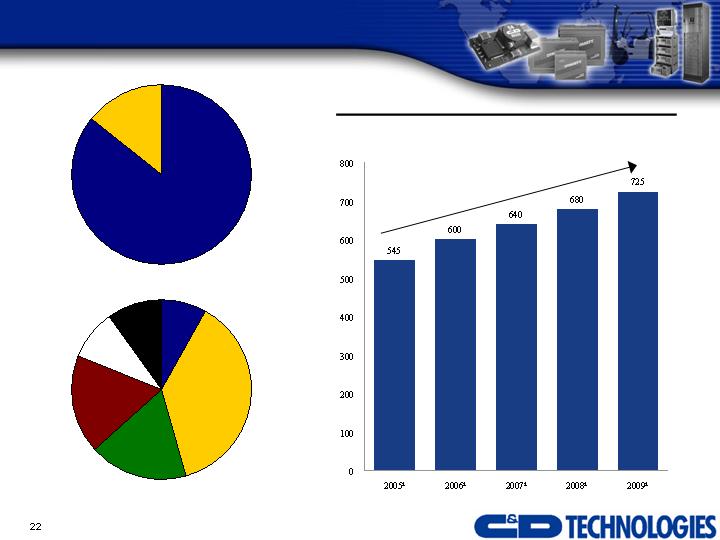

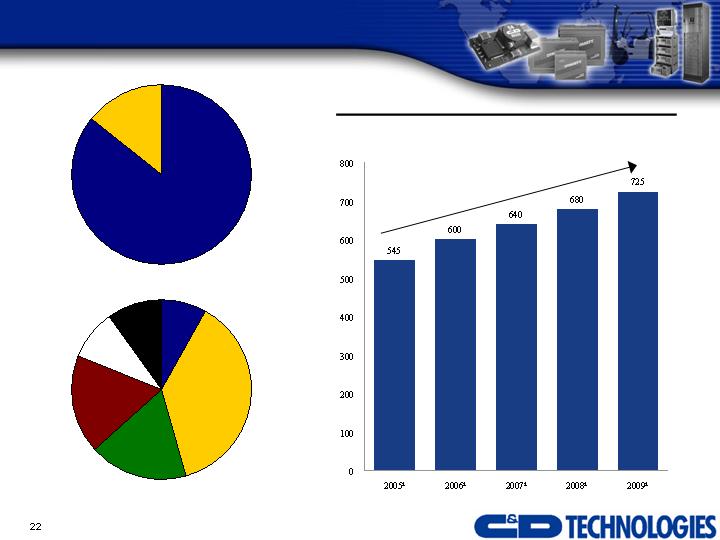

Standby Power– End Uses

Wireline Telecom

Wireless Telecom

Computer Backup

Critical

Communications

Nuclear

Utilities

Cable TV

Source: Company

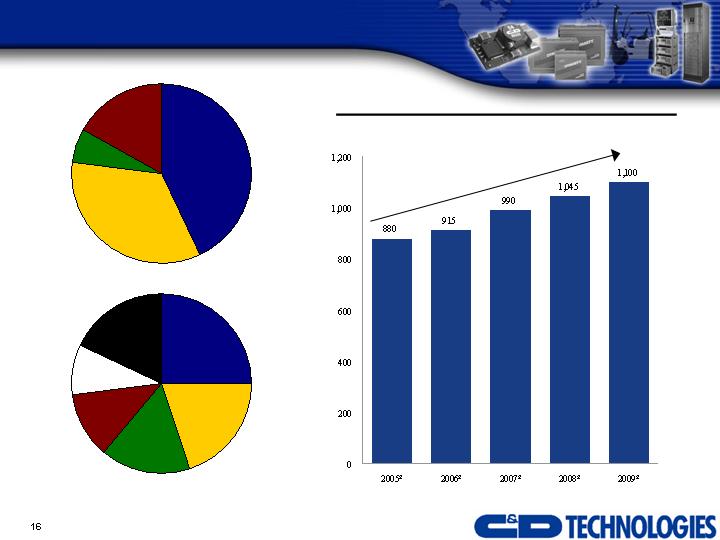

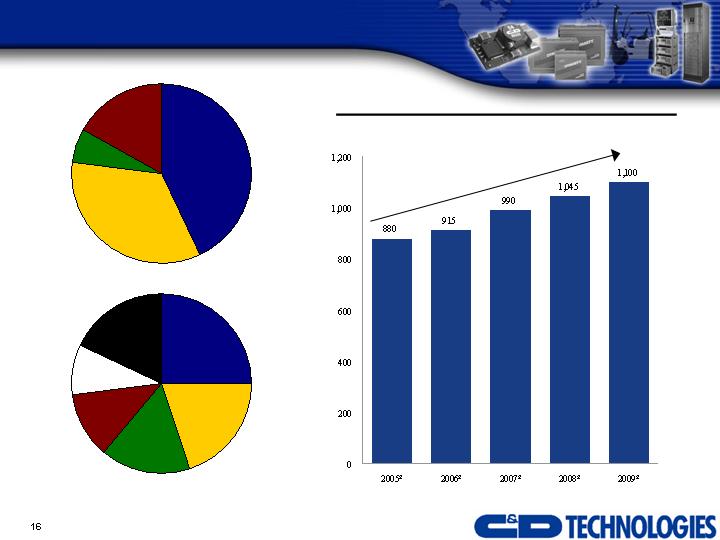

North American Standby Power Market Size ($mm)

North American Standby Market

Competitive Split1,3

Other

18%

Enersys

20%

Exide

16%

E. Penn

12%

Crown

9%

C&D

25%

Tel

43%

Other

17%

20061,2 - $915 million

CAGR 5.7%

UPS

34%

Util. 6%

Source: BCI, Frost & Sullivan, ITA, Management Estimates

Note: 1 Market size and share based on all sizes of lead acid batteries for the standby market including

<25Ahr

2 Calendar year

3 6 months ending 7/31/06

Standby Power Accomplishments and Focus

Launched highly profitable msEndur® product line

$25+ million run-rate revenue

Achieved continued growth in FY 2007 in international business

Successfully realigned distribution channels

New manufacturing facility under construction in China

Taken industry leadership position in driving pricing

New business wins

Leadership changes

Pricing

China plant relocation

Global sales growth through industry focus – utilities, oil & gas and emerging

markets

Cost and quality improvements – low cost manufacturing, Lean and Six Sigma

Recent Accomplishments

Fiscal 2007 focus

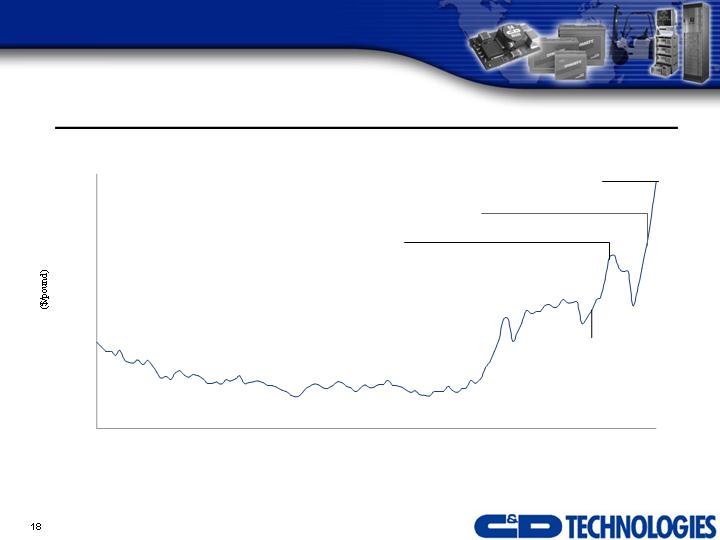

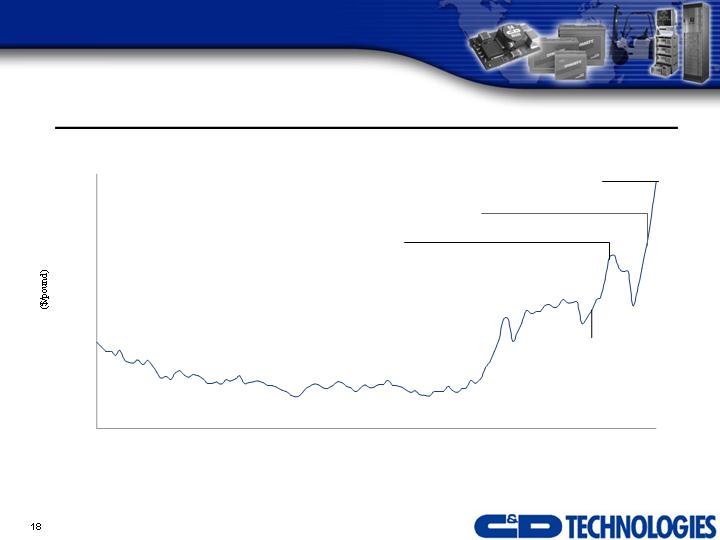

Lead Price History

Historical Lead Price

Source: London Metal Exchange

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

$0.70

$0.80

Oct-96

Jan-98

Apr-99

Jul-00

Oct-01

Jan-03

Apr-04

Jul-05

Nov-06

9/27/2006:

Announced 6% price

increase implementation

on all motive and standby

power products, effective

November 15, 2006

1/19/2006:

Announced price increase of

8% on all 10- and 20-year

battery products effective

with orders placed starting

March 1, 2006

9/28/2005:

Announced price increase

of 5% on all 10- and 20-year

battery products effective

with orders placed starting

January 1, 2006

11/15/2006:

The Company plans to

announce lead surcharge

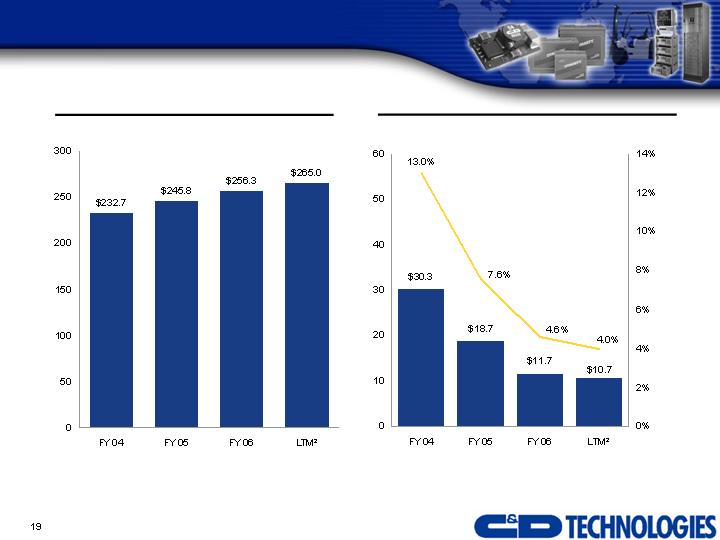

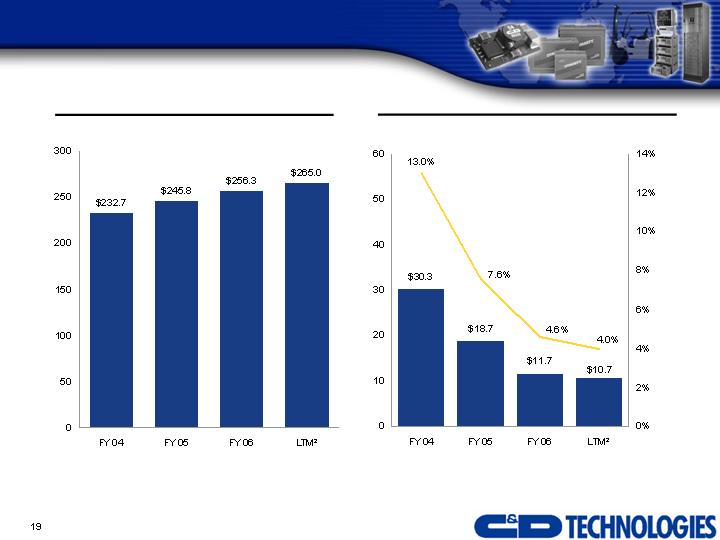

Standby Power Division– Recent Performance

Historical Revenue ($mm)

Historical Operating Income ($mm) and Margin 1

Notes:

1 Excludes non-recurring charges in all periods

2 LTM as of 7/31/06

Power Systems Division

Motive Power

Motive Power Division – Overview

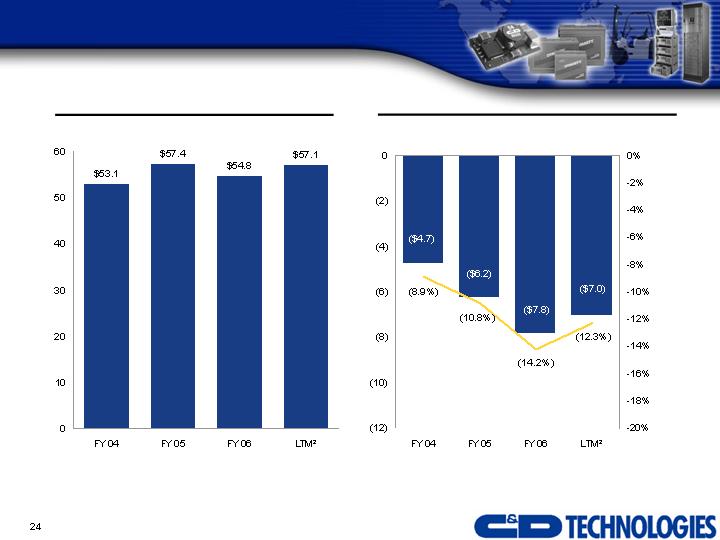

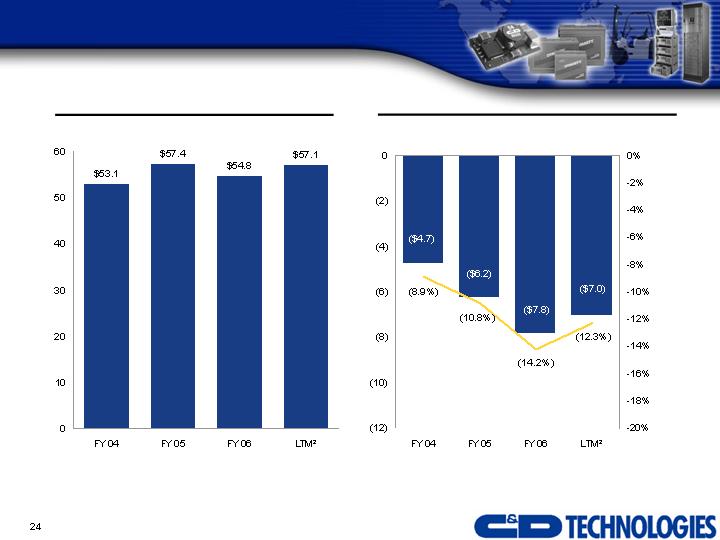

LTM1: $57.1 million net sales

Applications

Electric powered forklift trucks

Other material handling equipment

Automatic guided vehicles

Airline ground support vehicles

Key Customers

John Deere, Toyota, HEB, C&S

Wholesale, Safeway, US Cold Storage

Products

Motive power batteries

Chargers

Electronic monitoring modules

Computerized management systems

Geographic Focus on North America

Representative Products

Note:

1 LTM as of 7/31/06

North American Motive Power Market Size ($mm)

North American Motive Market

Competitive Split2

Other

9%

Enersys

38%

Exide

18%

E. Penn

18%

Crown

9%

C&D

8%

Batteries

$600M

Charger

$100M

CAGR 7.4%

20061 - $700 million

Source: BCI, Frost & Sullivan, ITA, Management Estimates

Note: 1 Calendar Year

2 Six months ending 7/31/06

Motive Power Accomplishments and Focus

New management team and improved workforce retention

Enhanced quality

Established Texas distribution center

Shed unprofitable business – replaced with new opportunities

Recent Accomplishments

Fiscal 2007 Focus

Closure of Huguenot, NY facility and transfer of production to Reynosa, Mexico

completed in October 2006

Pricing

Investments to extend product offerings

Establishment of new/additional distribution center in Leola, PA

Continued focus on cost and quality

Motive Power Division– Recent Performance

Historical Revenue ($mm)

Historical Operating Income ($mm) and Margin1

Note:

1 Excludes non-recurring charges in all periods

2 LTM as of 7/31/06

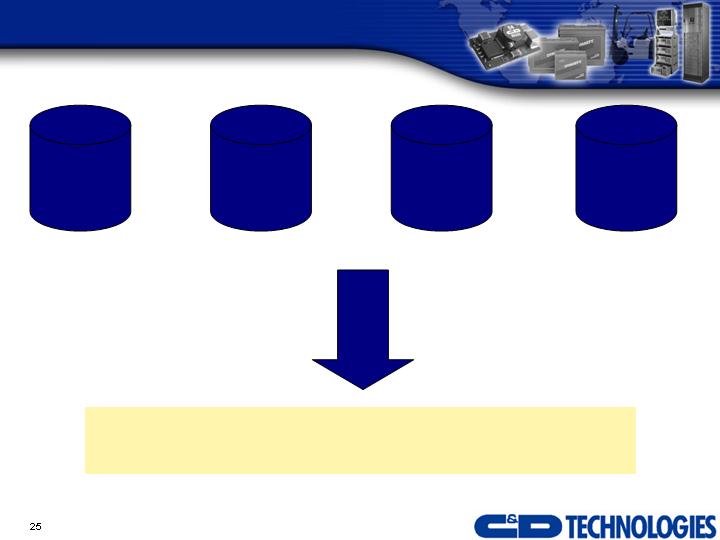

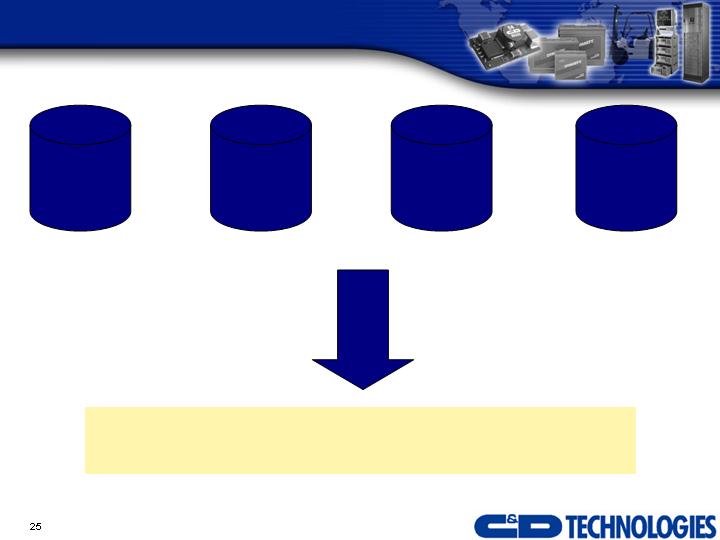

The “New” C&D Cost Improvement Opportunity

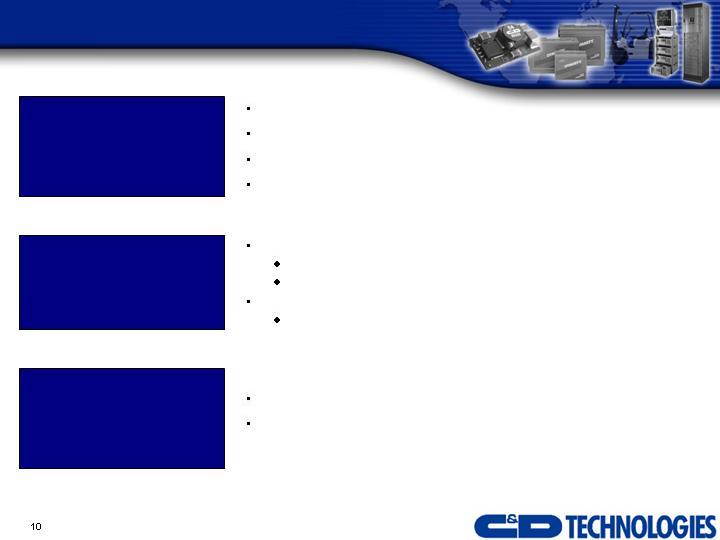

Sourcing

Structure

Operations

Estimated Annual Savings of

$25–$30 million per year

Design

Power Electronics Division

BUSS Converters

Power Electronics – Overview

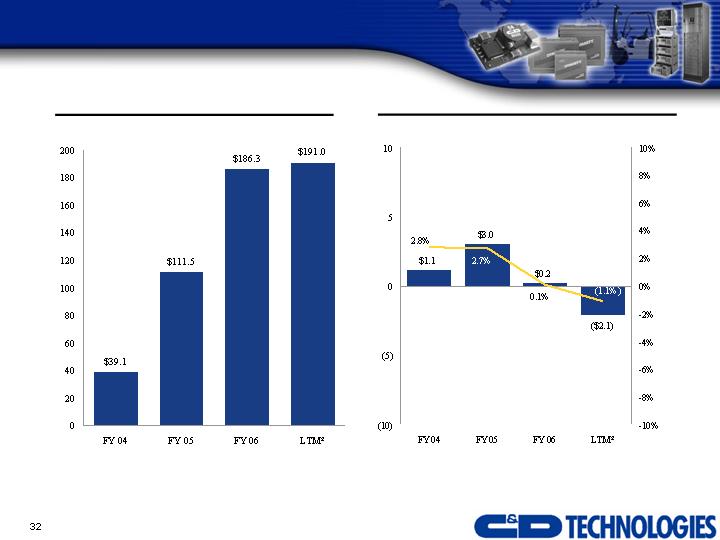

LTM1: $191.0 million net sales

Applications

Telecom

Office equipment

Networking equipment

Cable TV

Military

Key Customers

Cisco Systems, Sun Microsystems,

Huawei, HP, IBM, Xerox, Daktronics

Products

DC/DC converters (bricks)

Single In-Line Packages (“SIPs”)

Voltage Regulator Module (“VRMs”)

Power pods

AC/DC front ends

Representative Products

High Performance

DC/DC Converters

Point of Load

Converters

AC/DC Converters

Note:

1 LTM as of 7/31/06

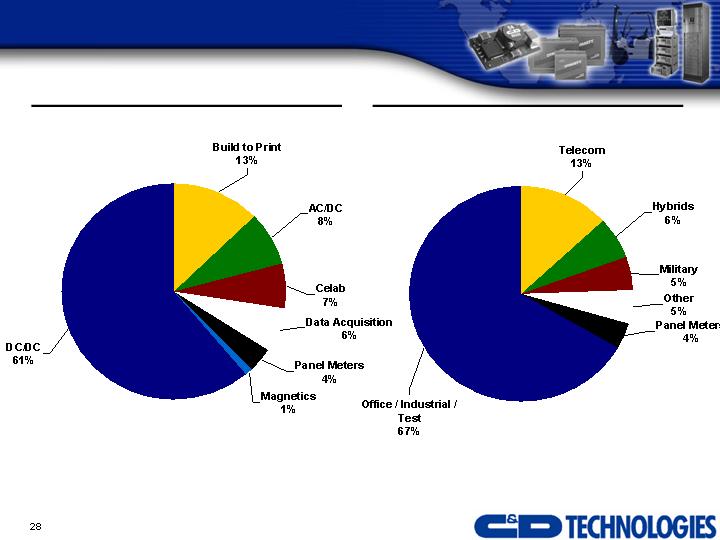

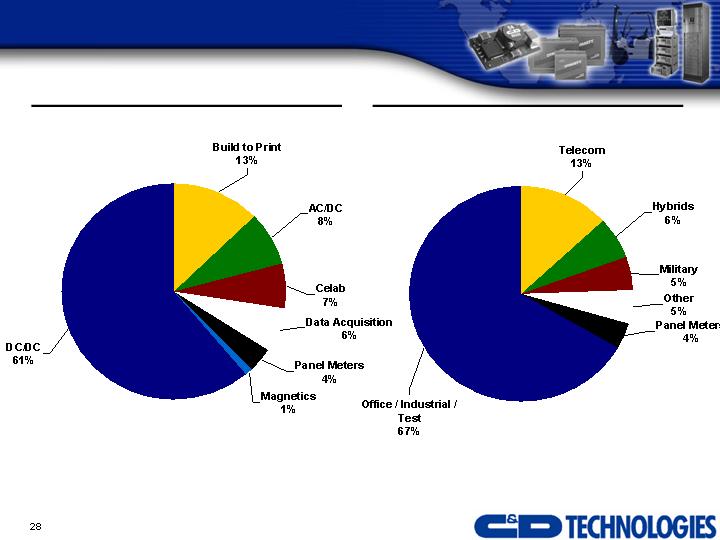

Power Electronics – Products and End Uses

FY06 Net Sales by Product Breakdown

FY06 Net Sales by End Market

Source: Company Estimates

FY06 Net Sales = $186 million

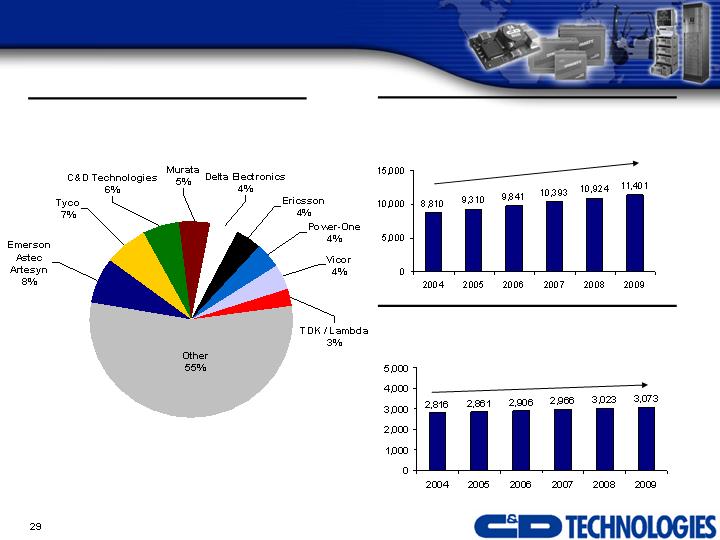

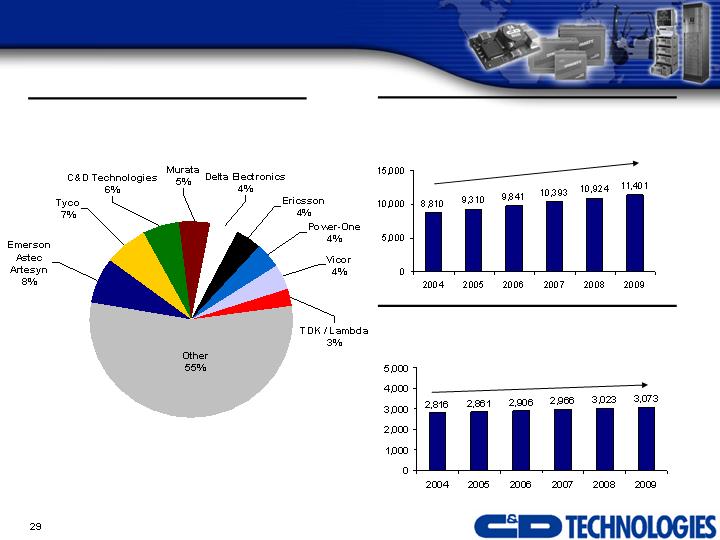

Power Electronics – Market Overview

Source: Micro-Tech Consultants, 2005

Emerson acquired Artesyn early 2006

Artesyn data combined with Emerson/Astec

Invensys sold its Lambda Division to TDK Corporation in 2005

CAGR 5.3%

CAGR 1.8%

Global Consumption of Merchant AC/DC

Switchers ($mm)

Global Merchant DC/DC Market

Total = $2.8 billion

Global Consumption of Merchant DC/DC

Converters ($mm)

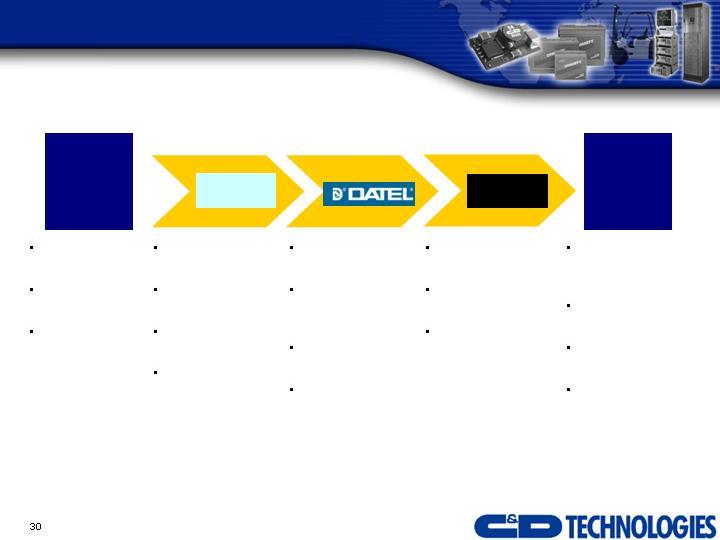

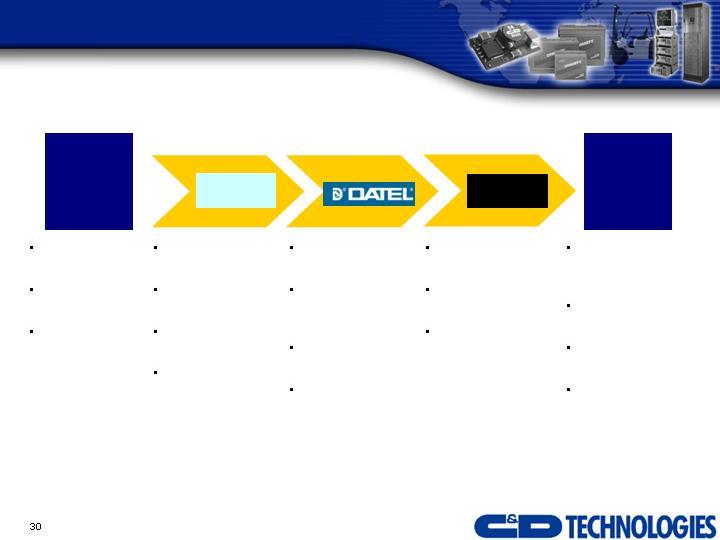

Low to Medium

Power products

Serves Tier 2 and

Tier 3 OEMs

Well developed

channels to market

Medium Power

products

Long-established

international

presence

Broad customer

base

Complementary

product lines

High power

products

Access to Tier 1

OEMs

Premier engineering

/ technology

capabilities

Customized

Power products

Military market

focus

International

presence

Highly profitable

Celab

CPS

Power Electronics – Acquisitions

One-Stop

Power

Electronics

Solution

Legacy

PED

One-stop power

electronics solution

provider

Cross-selling

opportunities

Manufacturing

synergies

Broadened customer

base and expanded

geographic markets

Acquired 5/04

Acquired 6/04

Acquired 9/04

Power Electronics Accomplishments and Focus

Reversed post-acquisition trends with record revenue achievement in Q4 Fiscal 2006

Continued integration of acquisitions

New management team in place

Recent Accomplishments

Fiscal 2007 Focus

RoHS compliance conversion

Celestica separation and outsourcing to new contract manufacturers

Other supply chain infrastructure changes

Accelerating design lifecycle

Leverage technology expertise in AC/DC markets

Consolidate Portland facility into Toronto and Mansfield facilities

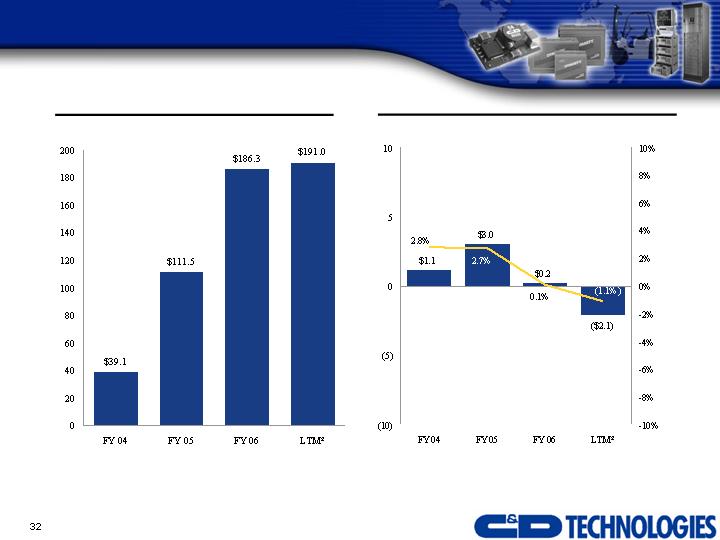

Power Electronics Division – Recent Performance

Historical Revenue ($mm)

Historical Operating Income ($mm) and Margin 1

Notes:

1 Excludes non-recurring charges in all periods

2 LTM as of 7/31/06

Exploring Strategic Alternatives for PED

C&D has decided to explore strategic alternatives for the Power Electronics business

PED operations have stabilized

PED now operates as a standalone entity from the battery business

No synergies between PED and PSD

To be announced in conjunction with convertible financing

Exploring Strategic Alternatives for PED (Cont’d)

Potential sale would allow focus on growing the core “energy storage” business

Great foundation: strong customer & brand position

Growing markets with high barriers to entry

Technology and service differentiation important, along with price competitiveness

Continue to implement low-cost manufacturing strategy

Improve synergies between standby and motive businesses

Leverage leading position in US to continue international expansion

Flexibility to invest in new technology and accelerate cost improvement actions

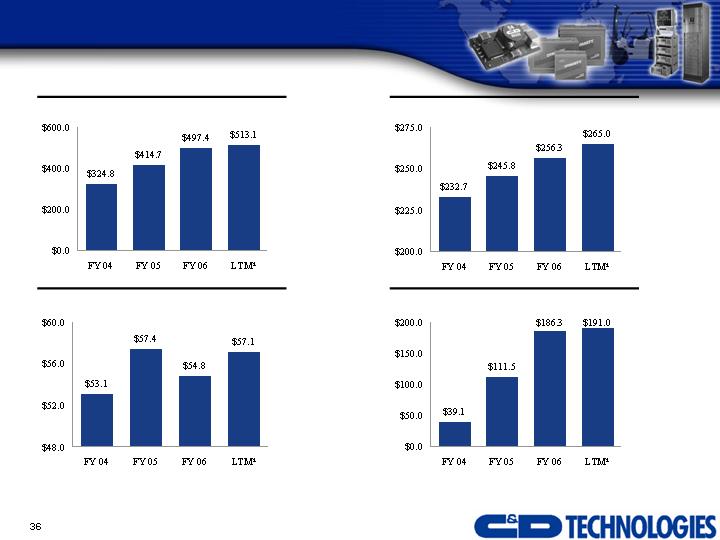

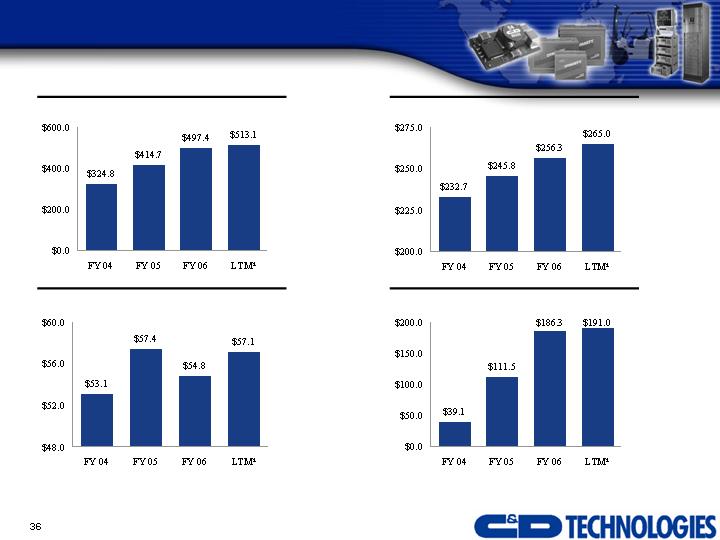

Financial Overview

Financial Performance

Fiscal Years Ending January 31 ($mm)

Total Net Sales

Motive Power Net Sales

Standby Power Net Sales

Power Electronics Net Sales

Source: Company 10-K and 10-Qs

Note:

1 LTM as of 7/31/06

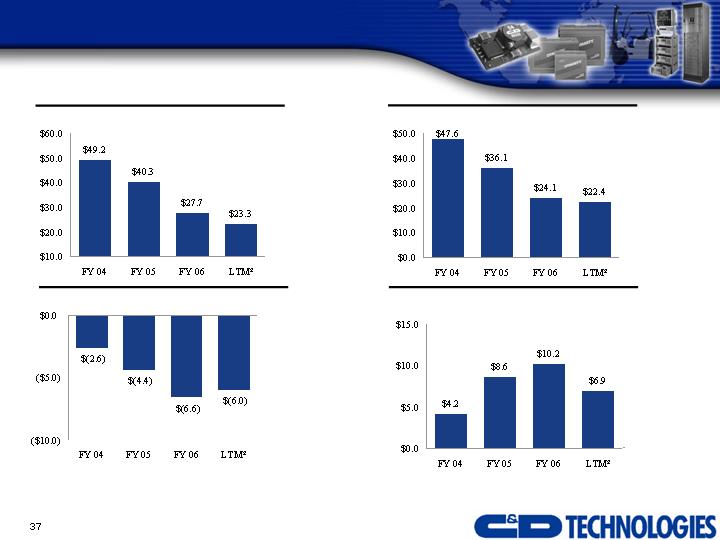

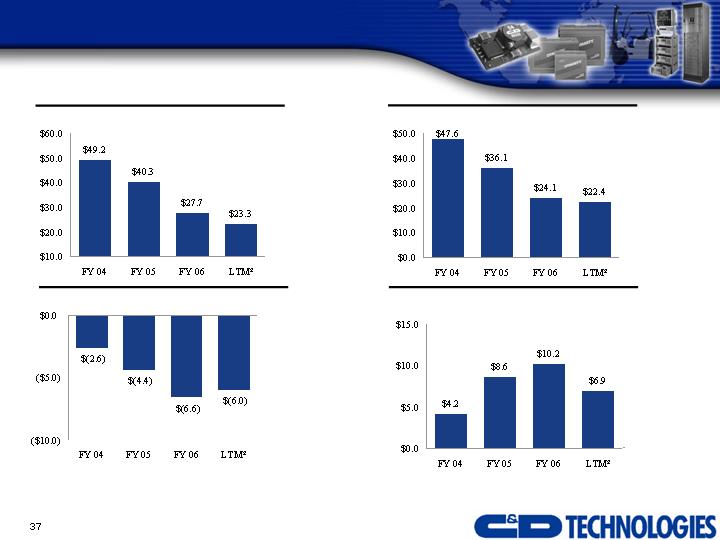

Financial Performance (Cont’d)

Fiscal Years Ending January 31 ($mm)1

Total Adjusted EBITDA

Motive Adjusted EBITDA

Standby Adjusted EBITDA

Power Electronics Adjusted EBITDA

Notes:

1 Excludes non-recurring charges in all periods

2 LTM as of 7/31/06

Source: Company 10-K and 10-Qs

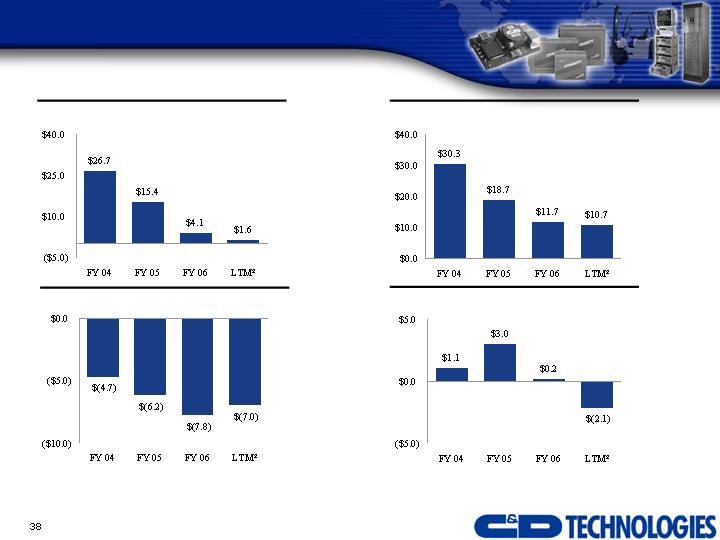

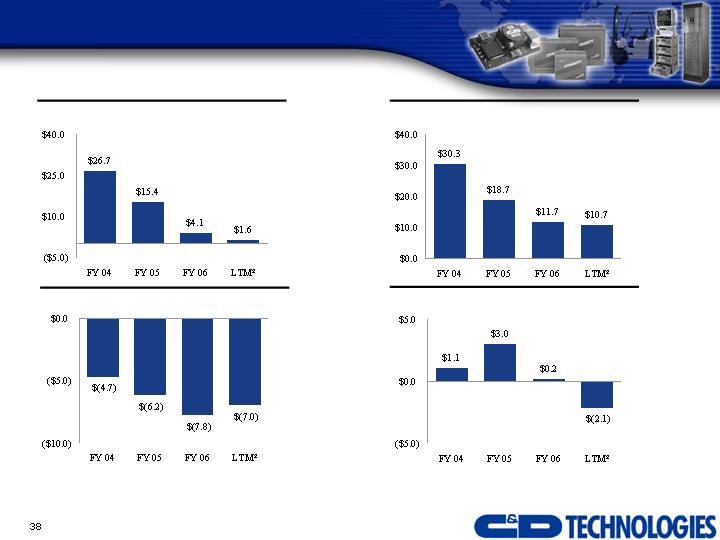

Financial Performance (Cont’d)

Fiscal Years Ending January 31 ($mm)1

Total Operating Income

Motive Operating Income

Standby Operating Income

Power Electronics Operating Income

Notes:

1 Excludes non-recurring charges in all periods

2 LTM as of 7/31/06

Source: Company 10-K and 10-Qs

Conclusion

Investment Highlights

Leading market shares in key markets

#1 market position in the North American standby power market

#2 board mounted power supply manufacturer globally

Positive industry fundamentals

Powerful global manufacturing platform

Industry-leading technology and robust R&D capabilities

Diversified, world-class customer base

Significant upside from restructuring/cost improvement opportunities

Potential sale of PED will allow for renewed focus and growth for PSD

Convertible financing and potential sale of PED will provide stable and flexible

capital structure

New and experienced management team

Appendix

Global Manufacturing and R&D Platform

14 Manufacturing Facilities and 10 Engineering Locations Around the World

Source: Company 10-K and 10-Qs

Toronto, Canada

Portland, OR

(to be closed)

Tucson, AZ

Nogales, Mexico

Reynosa, Mexico

Mansfield, MA

Milton Keynes, UK

Bordon, UK

Shanghai, China

Guangzhou, China

Blue Bell, PA

Leola, PA

Dunlap, TN

Milwaukee, WI

Attica, IN

Conyers, GA

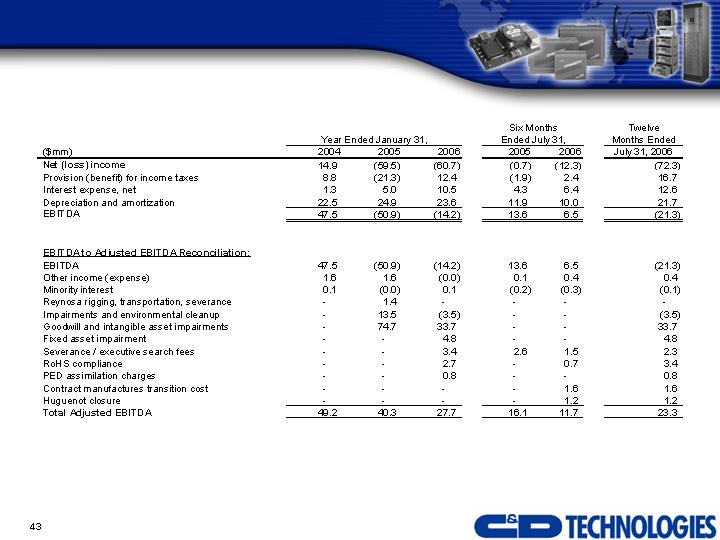

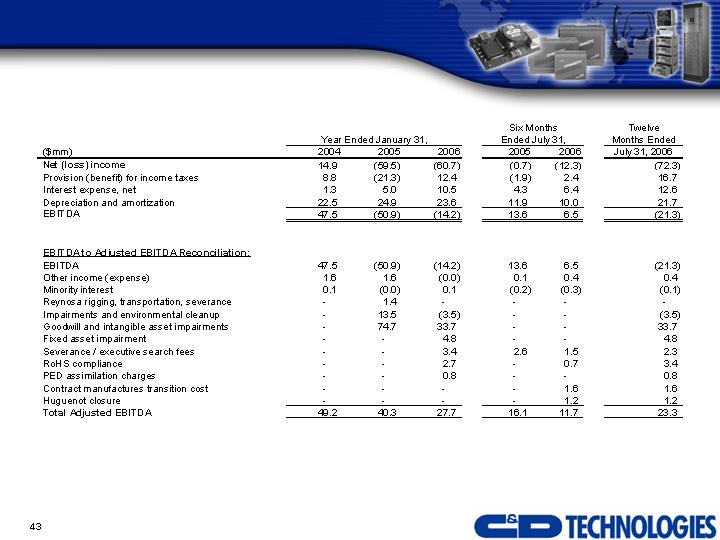

Adjusted EBITDA Reconciliation

Source: Company

Adjusted Operating Income Reconciliation

Source: Company

Year Ended January 31,

Twelve

Months

Ended July 31,

($

mm

)

2004

2005

2006

2006

Operating Income

26

.7

(74

.2

)

(37

.8

)

(42

.8

)

Adjustments:

Severance/executive search fees

-

-

3.4

2.3

RoHS compliance

-

-

2.7

3.4

PED assimilation

-

-

0.

8

0.

8

Fixed asset impairment

-

-

4.8

4.8

Contract manufacturers transition cost

-

-

-

1.6

Impairments and environmental cleanup

-

13.5

(3.5)

(3.5)

Reynosa rigging, transportation and severance

-

1.4

-

-

Huguenot closure

-

-

-

1.2

Goodwill

and intangible asset impairment

-

74.7

33.7

33.7

Adjusted Operating Income

26

.7

15

.4

4

.1

1

.6

Standby Power – Adjusted Operating Income and

EBITDA Reconciliation

Source: Company

Year Ended January 31,

Twelve

Months

Ended July 31,

($mm

)

2004

2005

2006

2006

Operating Income

30.3

9.2

12.6

11.9

Adjustments:

Severance/

executive search fees

-

-

1.5

1.3

RoHS

c

ompliance

-

-

-

-

PED

a

ssimilation

-

-

-

-

Fixed

a

sset

i

mp

airment

-

-

-

-

Contract

manufacturers transition cost

-

-

-

-

Impairments and

environmental cleanup

-

8.9

(2.5)

(2.5)

Reynosa

rigging, transportation and severance

-

0.6

-

-

Huguenot

closure

-

-

-

-

Goodwill and

intangible asset impairment

-

-

-

-

Adjusted Operating Income

30.3

18.7

11.7

10.

7

Depreciation and amortization

17.3

17.4

12.4

11.7

Adjusted

EBITDA

47.6

36.1

24.1

22.4

Motive Power – Adjusted Operating Income and EBITDA

Reconciliation

Source: Company

Year Ended January 31,

Twelve

Months

Ended July 31,

($mm

)

2004

2005

2006

2006

Operating Income

(4.7)

(11.7)

(9.9)

(10.0)

Adjustments:

Severance/

executive search fees

-

-

0.5

0.2

RoHS

c

ompliance

-

-

-

-

PED

a

ssimilation

-

-

-

-

Fixed

a

s

set

i

mpairment

-

-

2.6

2.6

Contract

manufacturers transition cost

-

-

-

-

Impairments and

environmental cleanup

-

4.6

(1.0)

(1.0)

Reynosa

rigging, transportation and severance

-

0.8

-

-

Huguenot

closure

-

-

-

1.2

Goodwill and

intangible asset imp

airment

-

-

-

-

Adjusted Operating Income

(4.7)

(6.2)

(7.8)

(7.0)

Depreciation and amortization

2.1

1.8

1.

2

1.0

Adjusted

EBITDA

(2.6)

(4.

4

)

(6.6)

(6.0)

Power Electronics Division– Adjusted Operating Income

and EBITDA Reconciliation

Source: Company

Year Ended January 31,

Twelve

Months

Ended July 31,

($mm

)

2004

2005

2006

2006

Operating Income

1.1

(71.7)

(40.5)

(44.6)

Adjustments:

-

-

-

-

Severance/

executive search fees

-

-

1.4

0.8

RoHS

c

ompliance

-

-

2.7

3.4

PED

a

ssimilation

-

-

0.8

0.

8

Fixed

a

sset

i

mpairment

-

-

2.2

2.2

Contract

manufacturers transition cost

-

-

-

1.6

Impairments and

environmental cleanup

-

-

-

-

Reynosa

rigging, transportation and severance

-

-

-

-

Huguenot

closure

-

-

-

-

Goo

dwill and

intangible asset impairment

-

74.7

33.7

33.7

Adjusted Operating Income

1.1

3.0

0.2

(2.1)

Depreciation and amortization

3.

1

5.

6

10.1

9.0

Adjusted

EBITDA

4.

2

8.

6

10.2

6.9

Investor Presentation

November 2006