SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

and Exchange Act of 1934 (Amendment No. __ )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ X ] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12

Meritage Hospitality Group Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[ X ] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) | | Title of each class of securities to which transaction applies: |

| (2) | | Aggregate number of securities to which transaction applies: |

| (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | | Proposed maximum aggregate value of transaction: |

[ ] Fee paid previously with preliminary materials:

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of this filing. |

| (1) | | Amount previously paid: |

| (2) | | Form, Schedule or Registration Statement No.: |

MERITAGE HOSPITALITY GROUP INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held May 16, 2006

Dear Shareholder:

We invite you to attend our Annual Meeting of Shareholders at 9:00 a.m. Eastern Time on May 16, 2006 at the Meritage Hospitality Group Inc. corporate offices, 3210 Eagle Run Drive, N.E., Suite 100, Grand Rapids, Michigan. The purposes of this Annual Meeting are:

| | 1. | to elect six directors to serve for a term of one year; |

| | 2. | to ratify the appointment of Plante & Moran PLLC as the Company’s independent auditors for fiscal 2006; and |

| | 3. | to transact such other business as may properly come before the meeting or any adjournment thereof. |

At the meeting, you will also hear a report on our operations and have a chance to meet our directors and executives.

This booklet includes the formal notice of the Annual Meeting and the Proxy Statement. The Proxy Statement tells you more about the agenda and procedures for the meeting. It also describes how the Board of Directors operates and provides personal information about our directors and officers. Even if you own only a few shares, we want your shares to be represented at the meeting. I urge you to complete, sign, date and return your Proxy Card promptly in the enclosed envelope.

| Dated: March 20, 2006 | | Very truly yours,

/s/Robert E. Schermer, Sr.

Robert E. Schermer, Sr.

Chairman of the Board of Directors |

WHETHERORNOTYOUPLANTOATTENDTHEMEETING,PLEASEVOTE,SIGN,DATEAND PROMPTLYRETURNYOURPROXYCARDINTHEENCLOSEDENVELOPE.PROXIESMAYBEREVOKED BYWRITTENNOTICEOFREVOCATION,THESUBMISSIONOFALATERPROXY,ORBY ATTENDINGTHEMEETINGANDVOTINGINPERSON.

MERITAGE HOSPITALITY GROUP INC.

3210 Eagle Run Drive, N.E., Suite 100

Grand Rapids, Michigan 49525

Telephone: (616) 776-2600

P R O X Y S T A T E M E N T

Annual Meeting of Shareholders

May 16, 2006

The Board of Directors of Meritage Hospitality Group Inc. is requesting your Proxy for use at the Annual Meeting of Shareholders on May 16, 2006, and at any adjournment thereof, pursuant to the foregoing Notice. The approximate mailing date of this Proxy Statement and the accompanying Proxy Card is April 7, 2006.

VOTING AT THE ANNUAL MEETING

General

Shareholders may vote in person or by Proxy. Proxies given may be revoked at any time by filing with Meritage either a written revocation or a duly executed Proxy Card bearing a later date, or by appearing at the Annual Meeting and voting in person. All shares will be voted as specified on each properly executed Proxy Card. If no choice is specified, the shares will be voted as recommended by the Board of Directors on Proposals 1 and 2, and in the discretion of the named proxies on any other matters voted on at the meeting. Abstentions and shares not voted for any reason, including broker non-votes, will have no effect on the outcome of any vote taken at the Annual Meeting.

As of March 20, 2006, the record date for determining shareholders entitled to notice of and to vote at the Annual Meeting, Meritage had 5,439,781 common shares outstanding. Each share is entitled to one vote. Only shareholders of record at the close of business on March 20, 2006 will be entitled to vote at the Annual Meeting.

Principal Shareholders

Other than certain of Meritage’s directors and officers as identified in the “Directors and Executive Officers” section below, no other shareholders are known by the Company to beneficially own 5% or more of the Company’s outstanding common shares as of March 20, 2006, except as follows:

Title of Class

| Name and Address of

Beneficial Owner

| Amount and Nature of

Beneficial Ownership

| Percent of Class

|

|---|

| Common Shares | Paul C. Drueke | 271,580 | 5.0% |

| | 2100 Raybrook, Suite 301 | | |

| | Grand Rapids, MI 49546 | | |

| | | | |

| Common Shares | JB Resources, LLC | 500,000 | 8.8% |

| | 32 Market Avenue, S.W. | | |

| | Grand Rapids, MI 49503 | | |

| | | | |

| Common Shares | Peter D. Wierenga | 271,109 | 5.0% |

| | 3703 S. Division Avenue | | |

| | Grand Rapids, MI 49503 | | |

Proposal 1 — Election of Directors

Meritage’s Bylaws require that the Board of Directors consist of not less than 5 nor more than 15 directors, with the exact number to be established by the Board of Directors. The Board has established the number of directors to be elected at the Annual Meeting at six. The Nominating & Corporate Governance Committee of the Board of Directors has nominated for reelection as directors the following individuals: James P. Bishop, Duane F. Kluting, Joseph L. Maggini, Brian N. McMahon, Robert E. Schermer, Sr., and Robert E. Schermer, Jr. You can find information regarding each of these nominees below under “Management — Directors and Executive Officers.”

All directors elected at the Annual Meeting will be elected to hold office until the next Annual Meeting. Shareholders are not entitled to cumulate their votes in the election of directors. If any nominee should be unable to serve, proxies will be voted for a substitute nominated by the Board of Directors.

TheBoardrecommendsavoteFORtheelectionofeachofthenomineesfor Director.Nomineesreceivingthehighestnumberofvotescastfortheopen positionswillbeelected.

Proposal 2 – Ratification of Appointment of Independent Auditors

The Audit Committee of the Board of Directors appointed Plante & Moran, PLLC as Meritage’s independent auditors for the fiscal year ending November 26, 2006. Although not required by law, the Committee is seeking shareholder ratification of this selection. The affirmative vote of a majority of shares voting at the Annual Meeting is required for ratification. If ratification is not obtained, the Audit Committee intends to continue engaging the services of Plante & Moran through fiscal 2006 but would consider selecting another auditing firm for the ensuing year. Representatives of Plante & Moran are expected to be present at the Annual Meeting and will be given an opportunity to comment if they desire, and to respond to appropriate questions that may be asked by shareholders.

TheBoardrecommendsavoteFORtheratificationofPlante&Moran,PLLCas Meritage’sindependentauditorsforthefiscalyearendingNovember26,2006. Adoptionrequirestheaffirmativevoteofamajorityofsharesvoting.

Change in Meritage’s Independent Auditors

On September 7, 2005, for itself and on behalf of its subsidiaries, the Audit Committee of the Board of Directors dismissed the Company’s independent auditors, Ernst and Young, LLP. On that same date, the Audit Committee engaged Plante & Moran as its new independent auditors after interviewing prospective auditing firms and reviewing their respective proposals. Ernst & Young audited the fiscal 2003 and 2004 consolidated financial statements contained in Meritage’s Annual Report on Form 10-K while Plante & Moran audited the fiscal 2005 report.

Ernst & Young’s reports on the Company’s consolidated financial statements for the fiscal years ended November 28, 2004 and November 30, 2003 did not contain an adverse opinion or disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting principles. During the last two fiscal years ended November 28, 2004, and through the date of dismissal (the “Relevant Period”), (1) there were no disagreements with Ernst & Young on any matters of accounting principles or practices, financial statement disclosure, or auditing scope or procedures which, if not resolved to the satisfaction of Ernst & Young, would have caused Ernst & Young to make reference to the subject matter of the disagreement(s) in connection with its reports on the Company’s consolidated financial statements

for such years; and (2) there were no “reportable events” with respect to Meritage as described in Item 304(a)(1)(v) of Regulation S-K, other than in connection with the audit of, and the issuance of an unqualified report on, the consolidated financial statements for the year ended November 28, 2004, wherein Ernst & Young identified certain deficiencies in the design and operation of internal controls related to accounting, analysis and documentation of income taxes, which collectively represented a material weakness in internal control over financial reporting. This reportable event was discussed between Meritage’s Audit Committee and Ernst & Young.

During the Relevant Period, neither the Company nor anyone acting on its behalf, consulted with Plante & Moran regarding (i) the application of accounting principles to a specified transaction, either completed or contemplated, (ii) the type of audit opinion that might be rendered on the Company’s consolidated financial statements, or (iii) any matter that was the subject of either a disagreement or a reportable event.

Independent Auditors’ Fees

The Audit Committee of the Board engaged Plante & Moran as the Company’s independent auditors for the 2005 fiscal year, and Ernst & Young for the 2004 fiscal year. The aggregate fees billed by the Company’s independent auditors in the last two fiscal years are summarized below:

| | 2005

| 2004

|

|---|

| | | Audit Fees (1) | | $74,000 | | $ 72,000 | | |

| | | Audit-Related Fees (2) | | -- | | 15,500 | | |

| | | Tax Fees (3) | | 17,000 | | 51,165 | | |

| | | All Other Fees (4) | | -- | | -- | | |

| |

| |

| | |

| | | Total | | $91,000 | | $138,665 | | |

| |

| |

| | |

| | (1) | Audit fees are the fees billed for professional services rendered by Meritage’s independent auditors for their audit of Meritage’s consolidated annual financial statements for the years ended November 27, 2005 and November 28, 2004, and reviews of the unaudited quarterly consolidated financial statements contained in reports on Form 10-Q filed by Meritage. |

| | (2) | Audit-related fees are the fees billed for assurance and related services that are reasonably related to the performance of the audit or review of Meritage’s financial statements. |

| | (3) | Tax fees are the fees billed for services related to tax compliance, tax advice and tax planning. Tax services performed for Meritage by its independent auditors included compliance, planning and advice with respect to Meritage and its subsidiaries. |

| | (4) | All other fees are the fees billed for services other than those in the three categories previously described. |

The Audit Committee has determined that the provision of the foregoing non-audit services was compatible with maintaining the auditors’ independence. The services described above were approved by the Audit Committee pursuant to the policy described below.

Other Matters

Any other matters considered at the Annual Meeting which properly come before the meeting (including an adjournment of the meeting) require the affirmative vote of a majority of shares voting.

Voting by Proxy

All Proxy Cards properly signed will, unless a different choice is indicated, be voted “FOR” election of all nominees for director proposed by the Board of Directors, and “FOR” ratification of the selection of independent auditors. If any other matters come before the Annual Meeting or any adjournment thereof, each Proxy will be voted in the discretion of the individual named as proxy.

Shareholder Proposals

Shareholders who desire to include proposals in the Notice for the 2007 Annual Shareholders’ Meeting must submit the written proposals to Meritage’s Corporate Secretary no later than November 19, 2006. Shareholders who desire to present proposals or board nominations at the 2007 Annual Shareholders’ Meeting must provide written notice to Meritage’s Corporate Secretary no later than March 16, 2007.

The form of Proxy for this meeting grants authority to the designated proxies to vote in their discretion on any matters that come before the meeting except those set forth in Meritage’s Proxy Statement and except for matters as to which adequate notice is received. For notice to be deemed adequate for the 2007 Annual Shareholders’ Meeting, it must be received prior to March 16, 2007. If there is a change in the anticipated date of next year’s Annual Shareholders’ Meeting or these deadlines by more than 30 days, we will notify you of this change through our Form 10-Q filings.

MANAGEMENT

Directors and Executive Officers

The following is information concerning the current directors and executive officers of the Company as of March 20, 2006:

| | Common Shares

Beneficially Owned

|

|---|

Name and Age (1)

| Position

| Amount

| Percentage

|

|---|

Robert E. Schermer, Sr. (2)(3)(4)

70 | | | Chairman of the Board of Directors | | | | 832,076 | | | 15.2 | % |

| | | | | | | | | | | | |

Robert E. Schermer, Jr. (3)(5)(6)

47 | | | Chief Executive Officer, President and Director | | | | 1,431,702 | | | 23.4 | % |

| | | | | | | | | | | | |

Robert H. Potts (6)

52 | | | Vice President of Real Estate | | | | 194,085 | | | 3.5 | % |

| | | | | | | | | | | | |

Gary A. Rose (6)

43 | | | Vice President, Chief Financial Officer,

Chief Operating Officer & Treasurer | | | | 23,000 | | | * | |

| | | | | | | | | | | | |

James R. Saalfeld (6)

38 | | | Vice President, Chief Administrative Officer,

General Counsel & Secretary | | | | 225,301 | | | 4.0 | % |

| | | | | | | | | | | | |

James P. Bishop (2)(3)(7)(8)(9)

65 | | | Director | | | | 82,116 | | | 1.5 | % |

| | | | | | | | | | | | |

Duane F. Kluting (2)(8)

56 | | | Director | | | | 6,468 | | | * | |

| | | | | | | | | | | | |

Joseph L. Maggini (2)(7)(9)(10)

66 | | | Director | | | | 802,641 | | | 13.8 | % |

| | | | | | | | | | | | |

Brian N. McMahon (2)(7)(8)(9)

53 | | | Director | | | | 35,946 | | | * | |

| | | | | | | | | | | | |

All Current Executive Officers and

Directors as a Group (9 persons) | | | | | | | 3,633,335 | | | 52.2 | % |

*Less than 1%

| | (1) | Unless otherwise indicated, the persons named have sole voting and investment power and beneficial ownership of the securities. |

| | (2) | Includes options held by non-employee directors that are presently exercisable, or exercisable within 60 days, pursuant to the 1996 Directors’ Share Option Plan, the 2001 Directors’ Share Option Plan and the 2004 Directors’ Share Equity Plan as follows: for Mr. Schermer, Sr. 35,750 shares, for Mr. Bishop 38,750 shares, for Mr. Kluting 5,000 shares, for Mr. Maggini 35,750 shares, and for Mr. McMahon 33,750 shares. |

| | (3) | Executive Committee Member. |

| | (4) | Includes 8,500 shares held by Mr. Schermer, Sr.‘s wife and 725,431 shares held by the Robert E. Schermer Revocable Living Trust U/A Dated 4/28/97 of which Mr. Schermer, Sr. is sole trustee. |

| | (5) | Includes (i) 9,450 shares held by Mr. Schermer, Jr. as a custodian for his minor children, (ii) 100,000 common shares and 100,000 shares underlying warrants beneficially owned by Mr. Schermer by virtue of his 40% ownership interest in a limited liability company that owns 250,000 common shares and 250,000 warrants, and (iii) 179,533 shares underlying 100,000 Series B Convertible Preferred Shares beneficially owned by Mr. Schermer by virtue of his 50% ownership of a limited liability company that owns the Convertible Preferred Shares. |

| | (6) | Includes options presently exercisable, or exercisable within 60 days, pursuant to the 1996 Management Equity Incentive Plan and the 2002 Management Equity Incentive Plan as follows: for Mr. Schermer, Jr. 286,836 shares, for Mr. Potts 145,382 shares, for Mr. Rose 20,000 shares, and for Mr. Saalfeld 200,098 shares. |

| | (7) | Compensation Committee Member. |

| | (8) | Audit Committee Member. |

| | (9) | Nominating & Corporate Governance Committee Member. |

| | (10) | Includes 166,000 shares underlying warrants beneficially owned by Mr. Maggini and 179,533 shares underlying 100,000 Series B Convertible Preferred Shares beneficially owned by Mr. Maggini. |

Robert E. Schermer, Sr. has been Chairman of the Board of Directors since January 25, 1996. Mr. Schermer is currently retired. From 1990 through 2005, he was Senior Vice President and a Managing Director of Robert W. Baird & Co. Incorporated, an investment banking and securities brokerage firm headquartered in Milwaukee, Wisconsin. He is the father of Robert E. Schermer, Jr.

Robert E. Schermer, Jr. has been a director of the Company since January 1996. He has been Chief Executive Officer of the Company since October 1998. Mr. Schermer also served as President of the Company from October 1998 through October 2000, and since February 2004.

Robert H. Potts has been Vice President of Real Estate for the Company since March 2001. From 1989 to 2001, Mr. Potts was with Meijer Inc., a supermarket and general merchandise retailer, where he held the position of Senior Counsel. Mr. Potts is a licensed member of the Michigan Bar.

Gary A. Rose has been Vice President, Chief Financial Officer and Treasurer of the Company since April 2005, and Chief Operating Officer since March 2006. From July 2004 through April 2005, Mr. Rose served as coordinator of condominium development for Robert Grooters Development Company. From December 2000 through July 2004, Mr. Rose served as Vice President and Chief Financial Officer of Consolidated Vendors Corporation, a multi-state owner and operator of vending machines.

James R. Saalfeld has been Vice President, Secretary and General Counsel of the Company since March 1996, and was appointed Chief Administrative Officer in May 2005. Mr. Saalfeld also held the position of Treasurer from June 2002 through April 2005. From 1992 until 1996, Mr. Saalfeld was with Dykema Gossett PLLC, a law firm headquartered in Detroit, Michigan. Mr. Saalfeld is a licensed member of the Michigan Bar.

James P. Bishop has been a director of the Company since July 1998. He is a CPA and a principal of Seber Tans PLC accounting firm in Kalamazoo, Michigan. Prior to that, Mr. Bishop was the President and majority owner of the Bishop, Gasperini & Flipse, P.C. accounting firm in Kalamazoo, Michigan, where he worked since 1973. Mr. Bishop was appointed by Michigan’s Governor to the Administrative Committee on Public Accountancy in 1993.

Duane F. Kluting has been a director of the Company since July 2005. Mr. Kluting is currently retired. From 1992 through 2003, Mr. Kluting served as Vice President, Chief Financial Officer and Corporate Secretary of X-Rite, Incorporated, a developer and manufacturer of color measurement instrumentation and software used in graphic arts, retail and industrial applications.

Joseph L. Maggini has been a director of the Company since January 1996. Since founding the company in 1974, Mr. Maggini has served as President and Chairman of the Board of Magic Steel Corporation, a steel service center located in Grand Rapids, Michigan.

Brian N. McMahon has been a director of the Company since August 2003. Mr. McMahon has been a partner with the law firm of Shumaker, Loop & Kendrick, LLP since 1995. Previously, he was General Counsel for Checkers Drive-In Restaurants, Inc. and served as Senior Legal Counsel for Wendy’s International, Inc.

Corporate Governance

Board of Directors

Meritage is a Michigan corporation and, as such, is governed by the corporate laws of the State of Michigan. Its common shares are publicly traded on the American Stock Exchange, it files reports with the Securities and Exchange Commission, and it is subject to various provisions of federal securities laws as modified by the Sarbanes-Oxley Act of 2002. Governance is placed in the hands of the directors who, in turn, elect officers to manage the business operations. The Board oversees the management of Meritage on your behalf. During fiscal 2005, the Board of Directors met six times and took action in writing on five occasions. Meritage expects all of its directors to attend shareholder, board and committee meetings on which they serve. In fiscal 2005, each incumbent director attended all such meetings except for Mr. Maggini who missed one meeting due to a family emergency. Shareholders may communicate with the full Board or individual directors on matters concerning the Company by mail, in care of the Corporate Secretary. These communications will be forwarded directly to the recipient.

Executive Committee

The Executive Committee possesses, and may exercise, all of the powers of the Board of Directors in the management and control of the business of Meritage to the extent permitted by law. During fiscal 2005, the Executive Committee was comprised of Messrs. Schermer, Sr. (Chairman), Schermer, Jr. and Bishop. The Executive Committee met one time during fiscal 2005 but took no formal action.

Audit Committee

The Audit Committee is responsible for appointing, approving the compensation of, and overseeing our independent auditors. The Committee operates pursuant to a Charter which sets forth the full responsibilities of the Committee. In fiscal 2005, the Audit Committee was comprised of Messrs. Bishop, McMahon and Stephen L. Gulis through June 2005, after which Mr. Kluting replaced Mr. Gulis (who resigned) for the remainder of the fiscal year. Mr. Bishop has served as Chairman of the Audit Committee since May 2003. Throughout fiscal 2005, the Committee was composed of outside directors who met all applicable standards for independence, and who are financially literate and able to read and understand fundamental financial statements. Mr. Bishop was designated as the Audit Committee financial expert consistent with the applicable standards. The Audit Committee met seven times during fiscal 2005 and took action in writing on five occasions. A copy of the Audit Committee Charter (which was attached to the Proxy Statement for the Annual Shareholders’ Meeting held in May 2004) and the Code of Ethics (adopted by the Committee in December 2003) will be sent, without charge, upon request to Meritage’s Corporate Secretary.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-AuditServices

of Independent Auditors

The Audit Committee has adopted a Policy Regarding the Approval of Audit and Permissible Non-Audit Services that sets forth the guidelines and procedures pursuant to which the Company must follow before engaging any firm to provide audit services on behalf of the Company. These services may include audit services, audit-related services, tax services and other services. Any pre-approval is detailed as to the particular service or category of services, and is subject to a specific budgeted amount. For services provided by the independent auditors, the Audit Committee considers whether such services are consistent with SEC rules on auditor independence, as well as whether the independent auditor is best positioned to provide the most effective and efficient service, for reasons such as its familiarity with the Company’s business, people, culture, accounting systems, risk profile and other factors, and whether the service might enhance the Company’s ability to manage or control risk or improve audit quality. Management and the independent auditors periodically report to the Audit Committee regarding the extent of services in accordance with the pre-approvals, and the fees for the services performed to date.

The Committee has submitted the following report to shareholders:

Report of the Audit Committee

In accordance with its written Charter, the Audit Committee assists the Board in fulfilling its oversight responsibilities regarding the quality and integrity of the accounting, auditing and financial reporting practices of Meritage. The Audit Committee Charter, which was adopted by the Board of Directors in 2004, fully outlines the responsibilities and activities of the Committee. The Audit Committee reviews the Charter on an annual basis, and the responsibilities and duties set forth in the Charter at each Committee meeting.

Management is responsible for the preparation, presentation and integrity of the Company’s financial statements, and financial reporting principles, internal controls and procedures designed to ensure compliance with accounting standards, applicable laws and regulations. Plante & Moran, PLLC, Meritage’s independent auditor for Fiscal 2005 (the “Auditor”), was responsible for performing an independent audit of the consolidated financial statements and expressing an opinion on the conformity of those financial statements with generally accepted accounting principles.

At its meeting in October 2005, the Committee met with the Auditor and management to review the scope, planning and staffing of the 2005 audit, and authorized the 2005 audit to be conducted. At meetings in January and February 2006, the Committee (i) reviewed and discussed the results of the 2005 audit and fiscal year-end audited financial statements with the Company’s management and the Auditor; (ii) discussed with the Auditor the matters required to be discussed by Statement of Auditing Standards No. 61, Communications with Audit Committees, as amended; and (iii) received, reviewed and discussed with the Auditor written confirmation from the Auditor of its independence as required by Independence Standards No. 1, Independence Discussions with Audit Committees, as amended by the Independence Standards Board.

Based on the review and discussions referred to above, the Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended November 27, 2005.

| | Audit Committee of the

Board of Directors

James P. Bishop, Chairman

Duane F. Kluting*

Brian N. McMahon |

* Mr. Kluting did not join the Audit Committee until July 2005, and therefore did not participate in the actions of the Committee prior to that time.

Compensation Committee

The Compensation Committee (i) establishes Meritage’s general compensation policies, (ii) establishes the compensation and incentive awards for management, and (iii) administers the Company’s compensation and equity incentive plans. The Committee was comprised of Messrs. Maggini (Chairman), Bishop and McMahon during fiscal 2005 except for the period from late December 2004 through May 2005 when Mr. Gulis replaced Mr. McMahon on the Committee. All members of the Compensation Committee met the applicable standards for independence. The Compensation Committee met two times and took action in writing on three occasions in fiscal 2005.

The Committee has submitted the following report to shareholders:

Report of the Compensation Committee

The Compensation Committee establishes compensation for executive officers by setting salaries, establishing bonus ranges, making bonus awards and granting stock options on an annual basis. The Committee believes it is important to provide competitive levels of compensation that will enable the Company to attract and retain the most qualified executives and to provide incentive plans that emphasize stock ownership, in order to better align the interests of management with the shareholders of the Company.

At its meeting in December 2004, the Committee established fiscal 2005 base salaries for the Company’s officers by subjectively evaluating each officer’s (i) performance, (ii) level of responsibility, (iii) potential for continued employment, (iv) duties for the upcoming fiscal year, and (v) contribution in conjunction with the Company’s accomplishments during the past year. The Committee took into account the recommendations of the Chief Executive Officer in establishing the salaries for officers other than the CEO’s salary. The Committee determined the Chief Executive Officer’s salary separately and without his participation, but followed the same evaluation procedure as with the other officers. Based on the foregoing factors, salary increases for all officers ranged from 4% to 8% above their 2004 base salary, as reflected in the Summary Compensation Table. There was no other qualitative or quantitative measurement against the performance of Meritage utilized in making the determination regarding salary raises. The Committee also approved option grants as reflected in the Option Grants Table. The Committee awarded the options using the same subjective criteria utilized in establishing the fiscal 2005 base salaries, and as a continuing incentive to meet the Company’s objectives.

At its meeting in February 2005, the Committee approved an executive performance incentive plan for fiscal 2005 that objectively linked the officers’ bonus awards to the Company’s actual financial performance. Under this plan, incentive awards were based on a formula that compared (i) the Company’s food and beverage revenue, (ii) the Company’s earnings before income taxes, and (iii) the achievement of specific management objectives with the Company’s financial forecast approved at the beginning of the fiscal year. If designated levels or objectives were achieved, an incentive award was granted by multiplying an officer’s base compensation by a percentage keyed to designated levels or objectives, up to a pre-established maximum percentage bonus. The plan also permitted discretionary incentive awards for exceptional performance. At its meeting in December 2005, the Committee approved incentive awards under the plan. The bonus awards are reflected in the Summary Compensation Table. The incentives awarded were based on the achievement of the specified management objectives and on the discretionary authority under the Plan associated with factors such as the successful implementation and execution of the Company’s sale and leaseback program which, in fiscal 2005, generated $20.5 million in sales, $8.4 million in cash and $12.2 million in long-term debt reduction, achieving the highest operating standards in both franchise systems, achieving significant cost savings and efficiencies, and steps taken to implement the Company’s new strategic growth platform. All salaries and cash bonuses were fully deductible by the Company for federal income tax purposes for 2005.

| | Compensation Committee

of the Board of Directors

Joseph L. Maggini, Chairman

James P. Bishop

Brian N. McMahon* |

* Mr. McMahon did not sit on the Compensation Committee from late December 2004 through May 2005, and therefore did not participate in the actions of the Committee during that period.

Nominating & Corporate Governance Committee

The Nominating & Corporate Governance Committee’s responsibilities include identifying and recommending qualified nominees for the Board of Directors and its various committees, and considering and making recommendations regarding matters of corporate governance. The Committee operates pursuant to a Charter which sets forth the full responsibilities of the Committee. In fiscal 2005, the Nominating & Corporate Governance Committee was comprised of Messrs. McMahon (Chairman), Bishop and Maggini. All members of the Committee met the applicable standards for independence. The Committee met three times during fiscal 2005. A copy of the Nominating & Corporate Governance Committee Charter (which was attached to the Proxy Statement for the Annual Shareholders’ Meeting held in May 2005) will be sent, without charge, upon request to Meritage’s Corporate Secretary. The Committee will evaluate and consider candidates recommended by directors, officers and shareholders. Shareholders desiring to submit recommendations for nominations should direct them to the Committee Chairman, in care of the Company’s Corporate Secretary, at the address listed at the end of this Proxy Statement. A recommendation should include relevant information concerning the qualifications of the person recommended. The Committee will evaluate these recommendations in the same manner as any other recommendations received from directors, officers or other shareholders.

Director Compensation

Non-employee directors receive a retainer of $1,000 for each meeting of the Board of Directors attended, and $1,000 for each committee meeting attended. The committee meeting fee is reduced by 50% if the committee meeting is held on the same day as a Board meeting. Compensation is paid quarterly in arrears in, at the election of each director, cash or Company common shares which are priced at the average fair market value during the five trading days prior to the end of the fiscal quarter. In addition, additional quarterly compensation of $1,500 cash is paid to each member of the Audit Committee.

Each non-employee director is also granted an option to purchase 5,000 common shares upon initial election to the Board, and another option to purchase 5,000 shares upon each annual election by shareholders. The exercise price is the last closing sale price reported on the date of grant. A director who is also an employee of Meritage is not separately compensated for serving as a director.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s officers, directors and persons owning more than ten percent of the Company’s common shares to file reports of ownership with the SEC and to furnish the Company with copies of these reports. Based solely upon its review of reports received by it, or upon written representation from certain reporting persons that no reports were required, the Company believes that during fiscal 2005 all filing requirements were met.

Executive Compensation

The following table sets forth information regarding compensation paid by Meritage to its Chief Executive Officer and executive officers earning in excess of $100,000 in fiscal 2005:

SUMMARY COMPENSATION TABLE

| | ANNUAL COMPENSATION

| LONG-TERM COMPENSATION

| |

|---|

Name and Principal Position

| Fiscal

Year

| Salary

| (1)

Bonus

| Securities

Underlying

Options

| Other Annual

Compensation

|

|---|

| Robert E. Schermer, Jr | | | | 2005 | | $ | 192,000 | (2) | $ | 34,580 | | | 0 | | | -- | |

| Chief Executive Officer & President | | | | 2004 | | $ | 185,000 | (2) | $ | 73,655 | | | 125,000 | | | -- | |

| | | | | 2003 | | $ | 171,000 | (2) | $ | 46,743 | | | 25,000 | | | -- | |

| | | | | | | | | | | | | | | | | | |

| James R. Saalfeld | | | | 2005 | | $ | 131,529 | | $ | 26,600 | | | 10,000 | | | $7,216 | (3) |

| Vice President, General | | | | 2004 | | $ | 116,844 | | $ | 44,182 | | | 100,000 | | | -- | |

| Counsel, Secretary & Treasurer | | | | 2003 | | $ | 112,350 | | $ | 33,020 | | | 20,000 | | | -- | |

| | | | | | | | | | | | | | | | | | |

| Gary A. Rose | | | | 2005 | | $ | 99,400 | (4) | $ | 26,600 | | | 20,000 | | | -- | |

| Vice President, Chief Financial | | | | | | | | | | | | | | | | | |

| Officer, Chief Operating Officer & Treasurer | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Robert H. Potts | | | | 2005 | | $ | 121,518 | | $ | 23,088 | | | 10,000 | | | $7,566 | (3) |

| Vice President of Real Estate | | | | 2004 | | $ | 112,350 | | $ | 43,059 | | | 100,000 | | | -- | |

| | | | | 2003 | | $ | 112,350 | | $ | 33,520 | | | 20,000 | | | -- | |

| | | | | | | | | | | | | | | | | | |

| Roger L. Zingle (5) | | | | 2005 | | $ | 182,000 | (2) | $ | 32,680 | | | 20,000 | | | -- | |

| Former Chief Operating Officer | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | (1) | Includes bonuses earned during the fiscal year but paid in the next fiscal year. |

| | (2) | Includes annual automobile allowance. |

| | (3) | The Company paid Messrs Saalfeld and Potts $0.35 per option for unvested stock options that the Company purchased and cancelled in October 2005 when the remaining unvested options issued under the 1996 and 2002 Management Equity Incentive Plan were accelerated. The options were purchased and cancelled (instead of being accelerated) to avoid causing these options to no longer qualify as incentive stock options. |

| | (4) | Reflects compensation for a partial year. Upon commencement of his appointment (April 14, 2005), Mr. Rose received an unrestricted stock award of 3,000 common shares under the 2002 Management Equity Incentive Plan. |

| | (5) | Mr. Zingle’s compensation and bonus also included payments received as President & Chief Operating Officer of O’Charley’s of Michigan, a subsidiary of Meritage. Mr. Zingle resigned from these positions in March 2006. |

Stock Options

The following tables contain information concerning the grant of stock options to the executives and employees identified in the Summary Compensation Table and the appreciation of such options:

OPTION GRANTS IN FISCAL 2005

Name

| Number of

Securities

Underlying

Options Granted

| % of Total

Options

Granted to

Employees in

Fiscal 2004

| Exercise

Price ($

per share)

| Expiration

Date

| Potential Realizable

Value at Assumed Annual

Rates of Stock Price

Appreciation for Option

Term

5% 10%

|

|---|

| Robert E. Schermer, Jr | | | | 0 | | | -- | | | -- | | -- | | | | -- | | | -- | |

| James R. Saalfeld | | | | 10,000 | | | 15.4 | % | $ | 5.05 | | 12/16/14 | | | $ | 31,759 | | $ | 80,484 | |

| Gary A. Rose | | | | 20,000 | | | 30.8 | % | $ | 4.96 | | 5/17/15 | | | $ | 62,386 | | $ | 158,099 | |

| Robert H. Potts | | | | 10,000 | | | 15.4 | % | $ | 5.05 | | 12/16/14 | | | $ | 31,759 | | $ | 80,484 | |

| Roger L. Zingle | | | | 20,000 | | | 30.8 | % | $ | 5.05 | | 12/16/14 | | | $ | 63,518 | | $ | 160,968 | |

FISCAL 2005 OPTION EXERCISES AND FISCAL YEAR-END OPTION VALUES

Name

| Shares Acquired

on Exercise

| Value Realized

| Number of Securities

Underlying Unexercised

Options at Fiscal Year End

Exercisable/Unexercisable

| Value of Unexercised

In-the-Money Options at

Fiscal Year End

Exercisable/Unexercisable

|

|---|

| Robert E. Schermer, Jr | | | | 140,000 | | | $419,600 | | | 286,836/0 | | | $116,314/0 | |

| James R. Saalfeld | | | | 28,543 | | | $91,932 | | | 200,098/0 | | | $90,040/0 | |

| Gary A. Rose | | | | -- | | | -- | | | 20,000/0 | | | $0/0 | |

| Robert H. Potts | | | | -- | | | -- | | | 145,382/0 | | | $56,400/0 | |

| Roger L. Zingle | | | | -- | | | -- | | | 120,000/0 | | | $0/0 | |

Securities Authorized for Issuance Under Equity Compensation Plans

The following is information as of March 20, 2006:

EQUITY COMPENSATION PLAN INFORMATION

Plan Category

| Number of securities

to be issued upon

exercise of

outstanding options,

warrants, and rights

(a)

| Weighted-average

exercise price of

outstanding

options, warrants

and rights

(b)

| Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a))

(c)

|

|---|

| Equity compensation plans approved by | | | | | | | | | | | |

| security holders: | | |

| 1996 Management Equity Incentive Plan | | | | 409,287 | | | $3.12 | | | 1,475 | |

| 1996 Directors' Share Option Plan (1) | | | | 62,000 | | | $5.31 | | | 0 | |

| 2002 Management Equity Incentive Plan | | | | 710,494 | | | $4.99 | | | 286,506 | |

| 2004 Directors' Share Equity Plan | | | | 55,000 | | | $5.00 | | | 95,000 | |

| | | | | | | | | | | | |

| Equity compensation plans not approved by | | |

| security holders: | | |

| 1999 Directors' Compensation Plan | | | | (2) | | | (2) | | | (2) | |

| 2001 Directors' Share Option Plan (3) | | | | 92,000 | | | $4.69 | | | 0 | |

| | | | | | | | | | | | |

| Total | | | | 1,323,781 | | | $4.41 | | | 387,981 | |

| (1) | The 1996 Directors’ Share Option Plan terminated in April 2001. Certain options granted under the Plan remain outstanding. |

| (2) | The 1999 Directors’ Compensation Plan was adopted by the Board of Directors in February 1999. Pursuant to the Plan, as amended, all non-employee directors receive a retainer of $1,000 for each meeting of the Board of Directors attended, and $1,000 for each committee meeting attended. The committee fees are reduced by 50% if the committee meeting is held on the same day as a Board meeting. Compensation is paid quarterly in arrears. At the election of the director, compensation is paid in cash or with Company common shares which are priced at the average fair market value during the five trading days prior to the end of the fiscal quarter. The Plan will terminate pursuant to its terms on November 30, 2008. |

| (3) | The 2001 Directors’ Share Option Plan terminated in May 2004. Certain options granted under the Plan remain outstanding. The Plan was adopted by the Board of Directors in May 2001. The Plan, as amended, provided for 120,000 common shares to be the subject of options which may be granted to non-employee directors. Under the Plan, non-employee directors were granted an option to purchase 5,000 common shares upon initial election to the Board, and another option to purchase 5,000 common shares upon each subsequent election. The committee administering the Plan could also grant additional options on such terms and conditions as the committee may determine. |

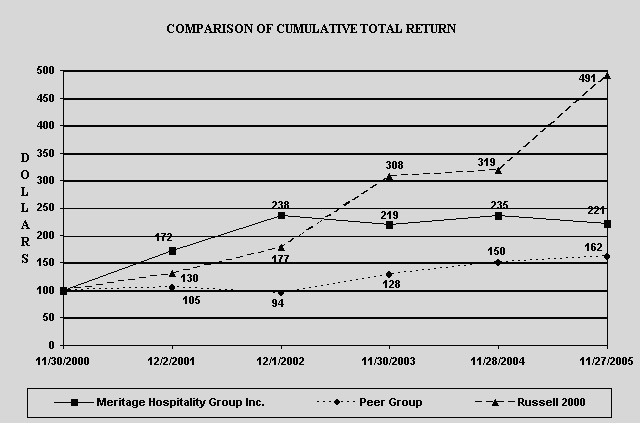

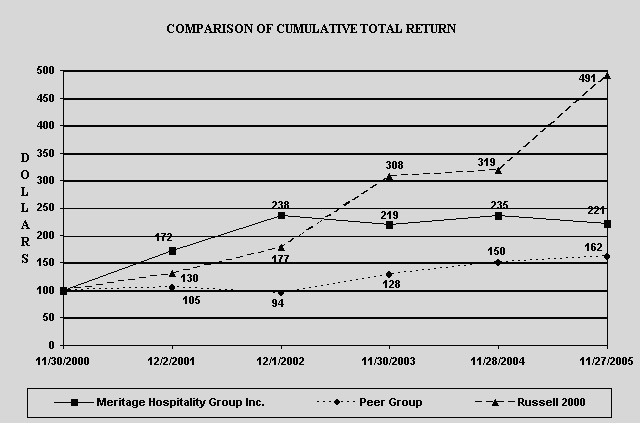

Corporate Performance Graph

The following graph demonstrates the yearly percentage change in Meritage’s cumulative total shareholder return on its common shares (as measured by dividing the difference between Meritage’s share price at the beginning and end of the periods presented by the share price at the beginning of the periods presented) from November 30, 2000 through November 27, 2005, with the cumulative total return on the Russell 2000 Index and a Peer Group Index. The comparison assumes $100 was invested on November 30, 2000 in Meritage’s common shares and in each of the indexes presented.

The Peer Group members include Back Yard Burgers Inc., BJ’s Restaurants, Inc. (f/k/a Chicago Pizza and Brewery Inc.), Boston Restaurants Assocs. Inc., EACO Corporation (f/k/a Family Steak Houses of Florida Inc.), Flanigans Enterprises Inc., Grill Concepts Inc. and Morgans Foods Inc.

Certain Relationships and Related Transactions

In January 2004, the Company sold to Mr. Schermer, Jr. its 19% interest in a real estate investment company that is the landlord of one of the Company’s Wendy’s restaurants. The selling price was $190,000. The agreement was authorized by a special committee of disinterested independent directors that obtained a fairness opinion regarding the transaction. As a result of this sale, the Company’s rent payments under the lease (i.e., approximately $9,600 per month) have been and will continue to be made to an entity that is owned, in part, by a related party. In fiscal 2005, the Company’s total rent paid under this lease was $115,560.

Other Matters

Meritage is not aware of any other matters to be presented at the Annual Meeting other than those specified in the Notice. If you have questions or need more information about the Annual Meeting, please write or call:

James R. Saalfeld, Corporate Secretary

Meritage Hospitality Group Inc.

3210 Eagle Run Drive, N.E., Suite 100

Grand Rapids, Michigan 49525

(616) 776-2600

For more information about your record holdings, you may contact LaSalle Bank Shareholder Services at (800) 246-5761.

| March 20, 2006 | | By Order of the Board of Directors,

/s/ James R. Saalfeld

James R. Saalfeld

Vice President & Corporate Secretary |

MERITAGE HOSPITALITY GROUP INC.

PROXY

FOR

ANNUAL

MEETING

| The undersigned hereby appoints ROBERT E. SCHERMER, JR. and JAMES R. SAALFELD, or either of them, proxies of the undersigned, each with the power of substitution, to vote all common shares which the undersigned would be entitled to vote on the matters specified below and in their discretion with respect to such other business as may properly come before the Annual Meeting of Shareholders of Meritage Hospitality Group Inc. to be held on Tuesday, May 16, 2006 at 9:00 a.m. Eastern Time at the Meritage corporate offices, 3210 Eagle Run Drive, N.E., Suite 100, Grand Rapids, Michigan, or any adjournment of such Annual Meeting. |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE FOLLOWING PROPOSALS:

1. Authority to elect as directors the six nominees listed below.

| | FOR __________ | WITHHOLD AUTHORITY __________ | FOR ALL EXCEPT ___________________ |

JAMES P. BISHOP, DUANE F. KLUTING, JOSEPH L. MAGGINI, BRIAN N. McMAHON, ROBERT E. SCHERMER, SR.

AND ROBERT E. SCHERMER, JR.

WRITE THE NAME OF ANY NOMINEE(S) FOR WHOM AUTHORITY TO VOTE IS WITHHELD:

2. Ratification of the appointment of Plante & Moran PLLC as independent auditors for the fiscal year ending November 26, 2006.

FOR __________

| AGAINST __________ | ABSTAIN __________ |

THIS PROXY WILL BE VOTED AS RECOMMENDED BY THE BOARD OF DIRECTORS UNLESS A CONTRARY CHOICE IS SPECIFIED.

(This proxy is continued and is to be signed on the reverse side)

| | Date _______________________, 2006

_______________________________

_______________________________

(Important: Please sign exactly as name appears hereon indicating, where proper, official position or representative capacity. In the case of joint holders, all should sign.) |

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS