UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-04998

T. Rowe Price Spectrum Fund, Inc.

(Exact name of registrant as specified in charter)

100 East Pratt Street, Baltimore, MD 21202

(Address of principal executive offices)

David Oestreicher

100 East Pratt Street, Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1

Annual Shareholder Report

December 31, 2024

This annual shareholder report contains important information about Spectrum Income Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary. This report describes changes to the fund that occurred during the reporting period.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Spectrum Income Fund - Investor Class | $62 | 0.61% |

|---|

What drove fund performance during the past 12 months?

U.S. taxable investment-grade bonds produced positive returns in 2024. Bonds in developed non-U.S. markets produced negative returns in U.S. dollar terms due to weaker currencies versus the dollar and rising bond yields in some countries. Easing inflation pressures enabled the European Central Bank to reduce short-term interest rates four times starting in June. Emerging markets bond returns were mixed. U.S. stocks advanced during the period, buoyed by generally favorable corporate earnings and continuing interest in companies expected to benefit from artificial intelligence developments. High yield corporate bonds produced solid gains and strongly outperformed the investment-grade bond market.

Versus the Bloomberg U.S. Aggregate Bond Index, results were supported by an out-of-benchmark exposure to dividend-paying equities. Similarly, the inclusion of high yield bonds as a diversifying exposure within the fund was additive during the period.

On the negative side, an out-of-benchmark exposure to long-term U.S. Treasury bonds was detrimental to results over the period. Security selection among high yield bonds also weighed on results.

The Spectrum Income Fund seeks a high level of current income with moderate share price fluctuation. The fund invests in a diversified group of underlying T. Rowe Price domestic bond funds, foreign bond funds, money market funds, and income-oriented stock funds. The diversifying sectors also provide exposures to key attributes that aim to support the overall portfolio’s risk and return profile over a range of market environments.

How has the fund performed?

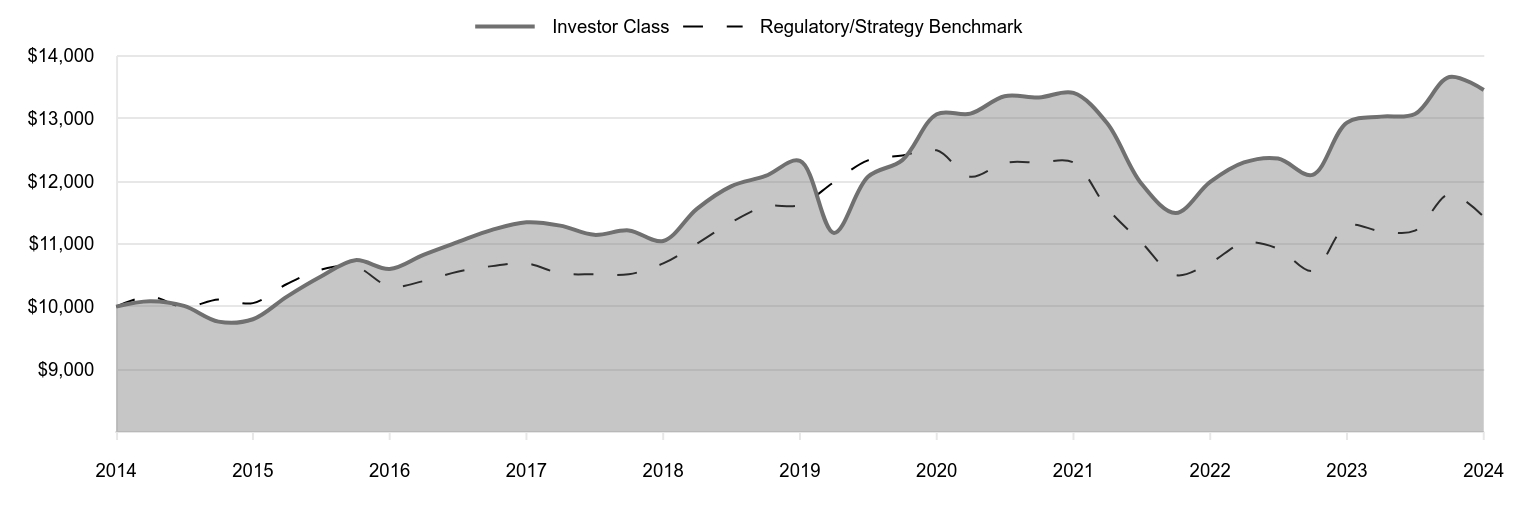

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| Investor Class | Regulatory/Strategy Benchmark |

|---|

| 2014 | 10,000 | 10,000 |

|---|

| 2015 | 10,085 | 10,161 |

|---|

| 2015 | 10,010 | 9,990 |

|---|

| 2015 | 9,760 | 10,113 |

|---|

| 2015 | 9,798 | 10,055 |

|---|

| 2016 | 10,159 | 10,360 |

|---|

| 2016 | 10,479 | 10,589 |

|---|

| 2016 | 10,740 | 10,638 |

|---|

| 2016 | 10,600 | 10,321 |

|---|

| 2017 | 10,826 | 10,406 |

|---|

| 2017 | 11,028 | 10,556 |

|---|

| 2017 | 11,223 | 10,645 |

|---|

| 2017 | 11,344 | 10,687 |

|---|

| 2018 | 11,291 | 10,531 |

|---|

| 2018 | 11,144 | 10,514 |

|---|

| 2018 | 11,215 | 10,516 |

|---|

| 2018 | 11,046 | 10,688 |

|---|

| 2019 | 11,558 | 11,003 |

|---|

| 2019 | 11,917 | 11,341 |

|---|

| 2019 | 12,083 | 11,599 |

|---|

| 2019 | 12,322 | 11,620 |

|---|

| 2020 | 11,175 | 11,985 |

|---|

| 2020 | 12,069 | 12,332 |

|---|

| 2020 | 12,336 | 12,409 |

|---|

| 2020 | 13,068 | 12,492 |

|---|

| 2021 | 13,076 | 12,071 |

|---|

| 2021 | 13,354 | 12,291 |

|---|

| 2021 | 13,335 | 12,298 |

|---|

| 2021 | 13,407 | 12,299 |

|---|

| 2022 | 12,922 | 11,569 |

|---|

| 2022 | 11,963 | 11,026 |

|---|

| 2022 | 11,491 | 10,502 |

|---|

| 2022 | 11,987 | 10,699 |

|---|

| 2023 | 12,298 | 11,016 |

|---|

| 2023 | 12,360 | 10,923 |

|---|

| 2023 | 12,101 | 10,570 |

|---|

| 2023 | 12,933 | 11,291 |

|---|

| 2024 | 13,029 | 11,203 |

|---|

| 2024 | 13,071 | 11,210 |

|---|

| 2024 | 13,661 | 11,793 |

|---|

| 2024 | 13,453 | 11,432 |

|---|

202501-4140694, 202502-4108930

Average Annual Total Returns

| | 1 Year | 5 Years | 10 Years |

|---|

| Spectrum Income Fund (Investor Class) | 4.02% | 1.77% | 3.01% |

|---|

| Bloomberg U.S. Aggregate Bond Index (Regulatory/Strategy Benchmark) | 1.25 | -0.33 | 1.35 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$5,894,081

- Number of Portfolio Holdings22

- Investment Advisory Fees Paid (000s)$30,014

- Portfolio Turnover Rate38.7%

What did the fund invest in?

Asset Allocation (as a % of Net Assets)

| Domestic Bond Funds | 58.7% |

| International Bond Funds | 29.9 |

| Corporate Securities | 7.1 |

| Domestic Equity Funds | 2.7 |

| Short-Term and Other | 1.6 |

Top Ten Holdings (as a % of Net Assets)

| T. Rowe Price High Yield Fund | 14.7% |

| T. Rowe Price New Income Fund | 11.5 |

| T. Rowe Price GNMA Fund | 10.3 |

| T. Rowe Price Emerging Markets Bond Fund | 7.5 |

| T. Rowe Price U.S. High Yield ETF | 7.1 |

| T. Rowe Price International Bond Fund (USD Hedged) | 6.1 |

| T. Rowe Price Floating Rate Fund | 5.7 |

| T. Rowe Price Short-Term Bond Fund | 5.3 |

| T. Rowe Price Dynamic Global Bond Fund | 5.2 |

| T. Rowe Price Dynamic Credit Fund | 5.1 |

How has the fund changed?

This is a summary of certain material changes to Spectrum Income Fund. Effective March 1, 2025, the fund will no longer invest in other funds that focus on dividend-paying stocks and will use derivatives as a principal strategy. The adviser also lowered the class’s all-inclusive fee to 0.61%. The fund’s March 1, 2025 prospectus contains more information.

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Bloomberg does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Spectrum Income Fund

Investor Class (RPSIX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

December 31, 2024

This annual shareholder report contains important information about Spectrum Income Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary. This report describes changes to the fund that occurred during the reporting period.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Spectrum Income Fund - I Class | $47 | 0.46% |

|---|

What drove fund performance during the past 12 months?

U.S. taxable investment-grade bonds produced positive returns in 2024. Bonds in developed non-U.S. markets produced negative returns in U.S. dollar terms due to weaker currencies versus the dollar and rising bond yields in some countries. Easing inflation pressures enabled the European Central Bank to reduce short-term interest rates four times starting in June. Emerging markets bond returns were mixed. U.S. stocks advanced during the period, buoyed by generally favorable corporate earnings and continuing interest in companies expected to benefit from artificial intelligence developments. High yield corporate bonds produced solid gains and strongly outperformed the investment-grade bond market.

Versus the Bloomberg U.S. Aggregate Bond Index, results were supported by an out-of-benchmark exposure to dividend-paying equities. Similarly, the inclusion of high yield bonds as a diversifying exposure within the fund was additive during the period.

On the negative side, an out-of-benchmark exposure to long-term U.S. Treasury bonds was detrimental to results over the period. Security selection among high yield bonds also weighed on results.

The Spectrum Income Fund seeks a high level of current income with moderate share price fluctuation. The fund invests in a diversified group of underlying T. Rowe Price domestic bond funds, foreign bond funds, money market funds, and income-oriented stock funds. The diversifying sectors also provide exposures to key attributes that aim to support the overall portfolio’s risk and return profile over a range of market environments.

How has the fund performed?

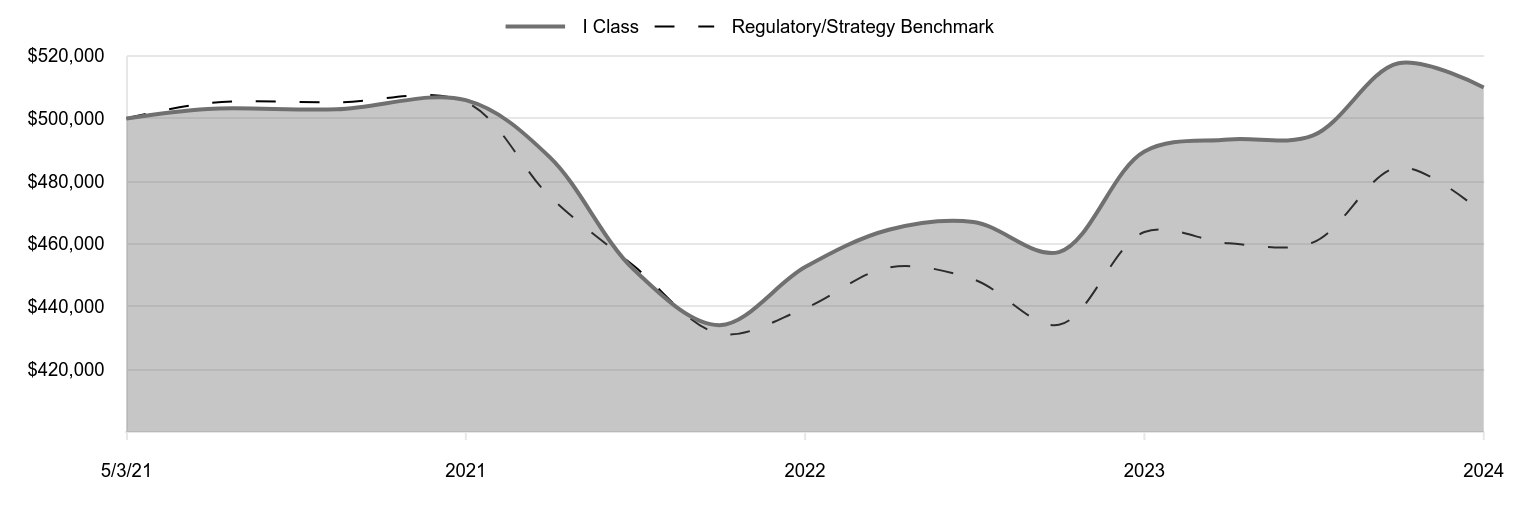

Cumulative Returns of a Hypothetical $500,000 Investment as of December 31, 2024

| I Class | Regulatory/Strategy Benchmark |

|---|

| 5/3/21 | 500,000 | 500,000 |

|---|

| 6/30/21 | 503,039 | 504,893 |

|---|

| 9/30/21 | 502,899 | 505,154 |

|---|

| 12/31/21 | 505,825 | 505,213 |

|---|

| 3/31/22 | 487,736 | 475,234 |

|---|

| 6/30/22 | 451,733 | 452,929 |

|---|

| 9/30/22 | 434,078 | 431,404 |

|---|

| 12/31/22 | 452,584 | 439,484 |

|---|

| 3/31/23 | 464,500 | 452,502 |

|---|

| 6/30/23 | 466,982 | 448,681 |

|---|

| 9/30/23 | 457,383 | 434,184 |

|---|

| 12/31/23 | 489,465 | 463,783 |

|---|

| 3/31/24 | 493,279 | 460,185 |

|---|

| 6/30/24 | 494,586 | 460,485 |

|---|

| 9/30/24 | 517,582 | 484,412 |

|---|

| 12/31/24 | 509,878 | 469,581 |

|---|

202501-4140694, 202502-4108930

Average Annual Total Returns

| | 1 Year | Since Inception 5/3/21 |

|---|

| Spectrum Income Fund (I Class) | 4.17% | 0.54% |

|---|

| Bloomberg U.S. Aggregate Bond Index (Regulatory/Strategy Benchmark) | 1.25 | -1.70 |

|---|

The preceding line graph shows the value of a hypothetical $500,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$5,894,081

- Number of Portfolio Holdings22

- Investment Advisory Fees Paid (000s)$30,014

- Portfolio Turnover Rate38.7%

What did the fund invest in?

Asset Allocation (as a % of Net Assets)

| Domestic Bond Funds | 58.7% |

| International Bond Funds | 29.9 |

| Corporate Securities | 7.1 |

| Domestic Equity Funds | 2.7 |

| Short-Term and Other | 1.6 |

Top Ten Holdings (as a % of Net Assets)

| T. Rowe Price High Yield Fund | 14.7% |

| T. Rowe Price New Income Fund | 11.5 |

| T. Rowe Price GNMA Fund | 10.3 |

| T. Rowe Price Emerging Markets Bond Fund | 7.5 |

| T. Rowe Price U.S. High Yield ETF | 7.1 |

| T. Rowe Price International Bond Fund (USD Hedged) | 6.1 |

| T. Rowe Price Floating Rate Fund | 5.7 |

| T. Rowe Price Short-Term Bond Fund | 5.3 |

| T. Rowe Price Dynamic Global Bond Fund | 5.2 |

| T. Rowe Price Dynamic Credit Fund | 5.1 |

How has the fund changed?

This is a summary of certain material changes to Spectrum Income Fund. Effective March 1, 2025, the fund will no longer invest in other funds that focus on dividend-paying stocks and will use derivatives as a principal strategy. The adviser also lowered the class’s all-inclusive fee to 0.46%. The fund’s March 1, 2025 prospectus contains more information.

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Bloomberg does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Spectrum Income Fund

I Class (TSPNX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Item 1. (b) Notice pursuant to Rule 30e-3.

Not applicable.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors has determined that Mr. Paul F. McBride qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. McBride is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

| | | | | | | | | | | | | | | | |

| | | | 2024 | | | | | | 2023 | | | |

| | Audit Fees | | $ | 14,377 | | | | | | | $ | 14,113 | |

| | Audit-Related Fees | | | - | | | | | | | | - | |

| | Tax Fees | | | - | | | | | | | | - | |

| | All Other Fees | | | - | | | | | | | | - | |

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,262,000 and $1,524,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a – b) Report pursuant to Regulation S-X.

Financial

Highlights

Portfolio

of

Investments

Financial

Statements

and

Notes

Additional

Fund

Information

Financial

Statements

and

Other

Information

For

more

insights

from

T.

Rowe

Price

investment

professionals,

go

to

troweprice.com

.

T.

ROWE

PRICE

RPSIX

Spectrum

Income

Fund

TSPNX

Spectrum

Income

Fund–

.

I Class

T.

ROWE

PRICE

Spectrum

Income

Fund

For

a

share

outstanding

throughout

each

period

Investor

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

11.30

$

10.94

$

12.83

$

13.00

$

12.73

Investment

activities

Net

investment

income

(1)(2)

0.50

0.43

0.34

0.33

0.34

Net

realized

and

unrealized

gain/loss

(0.06)

0.41

(1.69)

—

(3)

0.41

Total

from

investment

activities

0.44

0.84

(1.35)

0.33

0.75

Distributions

Net

investment

income

(0.51)

(0.48)

(0.39)

(0.34)

(0.38)

Net

realized

gain

(0.05)

—

(0.15)

(0.16)

(0.10)

Total

distributions

(0.56)

(0.48)

(0.54)

(0.50)

(0.48)

NET

ASSET

VALUE

End

of

period

$

11.18

$

11.30

$

10.94

$

12.83

$

13.00

Ratios/Supplemental

Data

Total

return

(2)(4)(5)

4.02%

7.89%

(10.59)%

2.59%

6.06%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

payments

by

Price

Associates

(5)

0.62%

0.62%

0.62%

0.45%

0.00%

Net

expenses

after

payments

by

Price

Associates

(5)

0.61%

0.62%

0.62%

0.45%

0.00%

Weighted

average

net

expenses

of

underlying

Price

Funds

(6)

0.00%

0.00%

0.00%

0.14%

0.65%

Effective

net

expenses

0.61%

0.62%

0.62%

0.59%

0.65%

Net

investment

income

(5)

4.45%

3.92%

2.88%

2.52%

2.77%

Portfolio

turnover

rate

(5)

38.7%

23.6%

20.7%

15.1%

29.9%

Net

assets,

end

of

period

(in

millions)

$1,620

$1,869

$1,983

$4,778

$6,890

0%

0%

0%

0%

0%

T.

ROWE

PRICE

Spectrum

Income

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

Effective

March

24,

2021,

the

fund

began

charging

an

all-inclusive

management

fee

based

on

the

class'

average

daily

net

assets.

On

that

same

date,

the

fund

converted

its

investments

from

each

underlying

Price

Fund’s

Investor

Class

to

its

Z

Class,

which

has

a

net

expense

ratio

of

less

than

0.01%.

(3)

Amounts

round

to

less

than

$0.01

per

share.

(4)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

The

fund's

total

return

may

be

higher

or

lower

than

the

investment

results

of

the

individual

underlying

Price

Funds.

(5)

Reflects

the

activity

of

the

fund,

and

does

not

include

the

activity

of

the

underlying

Price

Funds.

However,

investment

performance

of

the

fund

is

directly

related

to

the

investment

performance

of

the

underlying

Price

Funds

in

which

it

invests.

(6)

Reflects

the

indirect

expense

impact

to

the

fund

from

its

investment

in

the

underlying

Price

Funds,

based

on

the

actual

expense

ratio

of

each

underlying

Price

Fund

weighted

for

the

fund's

relative

average

investment

therein.

T.

ROWE

PRICE

Spectrum

Income

Fund

For

a

share

outstanding

throughout

each

period

I

Class

(1)

..

Year

..

..

Ended

.

5/3/21

(1)

Through

12/31/21

12/31/24

12/31/23

12/31/22

NET

ASSET

VALUE

Beginning

of

period

$

11.31

$

10.94

$

12.84

$

13.10

Investment

activities

Net

investment

income

(2)(3)

0.52

0.45

0.38

0.24

Net

realized

and

unrealized

gain/loss

(0.06)

0.42

(1.72)

(0.09)

(4)

Total

from

investment

activities

0.46

0.87

(1.34)

0.15

Distributions

Net

investment

income

(0.53)

(0.50)

(0.41)

(0.25)

Net

realized

gain

(0.05)

—

(0.15)

(0.16)

Total

distributions

(0.58)

(0.50)

(0.56)

(0.41)

NET

ASSET

VALUE

End

of

period

$

11.19

$

11.31

$

10.94

$

12.84

Ratios/Supplemental

Data

Total

return

(3)(5)(6)

4.17%

8.15%

(10.53)%

1.16%

Ratios

to

average

net

assets:

(3)

Gross

expenses

before

payments

by

Price

Associates

(6)

0.47%

0.47%

0.47%

0.47%

(7)

Net

expenses

after

payments

by

Price

Associates

(6)

0.46%

0.47%

0.47%

0.47%

(7)

Net

investment

income

(6)

4.65%

4.09%

3.33%

2.79%

(7)

Portfolio

turnover

rate

(6)

38.7%

23.6%

20.7%

15.1%

Net

assets,

end

of

period

(in

millions)

$4,274

$4,099

$3,945

$2,422

0%

0%

0%

0%

(1)

Inception

date

(2)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(3)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(4)

The

amount

presented

is

inconsistent

with

the

fund's

aggregate

gains

and

losses

because

of

the

timing

of

sales

and

redemptions

of

fund

shares

in

relation

to

fluctuating

market

values

for

the

investment

portfolio.

(5)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

Total

return

is

not

annualized

for

periods

less

than

one

year.

The

fund's

total

return

may

be

higher

or

lower

than

the

investment

results

of

the

individual

underlying

Price

Funds.

T.

ROWE

PRICE

Spectrum

Income

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

(6)

Reflects

the

activity

of

the

fund,

and

does

not

include

the

activity

of

the

underlying

Price

Funds.

However,

investment

performance

of

the

fund

is

directly

related

to

the

investment

performance

of

the

underlying

Price

Funds

in

which

it

invests.

(7)

Annualized

T.

ROWE

PRICE

Spectrum

Income

Fund

December

31,

2024

Portfolio

of

Investments

(1)

(1)

$

Value

12/31/23

$

Purchase

Cost

(2)

$

Sales

Cost

(2)

Shares

$

Value

12/31/24

(Cost

and

value

in

$000s)

BOND

FUNDS

95.7%

T.

Rowe

Price

Funds:

High

Yield

Fund

883,900

83,302

104,547

146,628,617

866,575

New

Income

Fund

805,391

49,446

169,162

86,381,312

678,957

GNMA

Fund

632,148

43,303

57,731

76,180,249

607,157

Emerging

Markets

Bond

Fund

474,943

40,483

88,029

48,290,945

441,862

U.S.

High

Yield

ETF

–

418,593

–

8,033,501

418,545

International

Bond

Fund

(USD

Hedged)

225,654

152,788

27,642

41,897,753

357,388

Floating

Rate

Fund

338,473

37,201

41,974

36,030,251

335,442

Short-Term

Bond

Fund

292,932

38,924

21,296

68,162,963

313,550

Dynamic

Global

Bond

Fund

283,766

33,966

18,169

39,312,067

306,241

Dynamic

Credit

Fund

262,646

46,468

6,842

34,244,128

303,060

Corporate

Income

Fund

267,259

21,750

26,233

32,850,946

261,165

U.S.

Treasury

Long-Term

Index

Fund

303,627

20,062

161,018

27,153,530

192,790

Emerging

Markets

Local

Currency

Bond

Fund

198,619

17,702

19,878

40,212,229

183,770

International

Bond

Fund

277,594

13,034

125,634

24,614,713

167,134

Limited

Duration

Inflation

Focused

Bond

Fund

85,325

55,867

23,707

25,927,438

119,266

Inflation

Protected

Bond

Fund

–

91,199

2,948

8,560,298

86,459

U.S.

Treasury

Intermediate

Index

Fund

482

20

–

97,982

486

Total

Bond

Funds

(Cost

$5,857,215)

5,639,847

EQUITY

FUNDS

2.7%

T.

Rowe

Price

Funds:

Equity

Income

Fund

598,339

35,837

277,177

4,667,056

161,854

Total

Equity

Funds

(Cost

$75,064)

161,854

SHORT-TERM

INVESTMENTS

1.4%

Money

Market

Funds

1.4%

T.

Rowe

Price

U.S.

Treasury

Money

Fund,

4.52% (3)

38,361

628,624

583,593

83,392,444

83,392

Total

Short-Term

Investments

(Cost

$83,392)

83,392

Total

Investments

in

Securities

99.8%

of

Net

Assets

(Cost

$6,015,671)

$

5,885,093

T.

ROWE

PRICE

Spectrum

Income

Fund

(1)

Each

underlying

Price

Fund

is

an

affiliated

company;

the

fund

is

invested

in

the

Z

Class

of

each

underlying

Price

Fund,

except

for

the

Transition

Fund

and

ETFs,

if

held,

which

are

single

class

funds.

Additional

information

about

each

underlying

Price

Fund

is

available

by

calling

1-877-495-1138

and

at

www.troweprice.com.

(2)

Purchase

cost

and

Sales

cost

for

affiliates

not

held

at

period

end

totaled

$474,087

and

$474,087,

respectively.

(3)

Seven-day

yield

ETF

Exchange-Traded

Fund

T.

ROWE

PRICE

Spectrum

Income

Fund

FUTURES

CONTRACTS

($000s)

Expiration

Date

Notional

Amount

Value

and

Unrealized

Gain

(Loss)

Short,

545

S&P

500

E-Mini

Index

contracts

3/25

(161,749)

$

5,491

Long,

523

U.S.

Treasury

Notes

five

year

contracts

3/25

55,597

(237)

Long,

1,494

U.S.

Treasury

Notes

ten

year

contracts

3/25

162,473

(1,613)

Net

payments

(receipts)

of

variation

margin

to

date

(3,390)

Variation

margin

receivable

(payable)

on

open

futures

contracts

$

251

T.

ROWE

PRICE

Spectrum

Income

Fund

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

AFFILIATED

COMPANIES

($000s)

The

fund

may

invest

in

certain

securities

that

are

considered

affiliated

companies.

As

defined

by

the

1940

Act,

an

affiliated

company

is

one

in

which

the

fund

owns

5%

or

more

of

the

outstanding

voting

securities,

or

a

company

that

is

under

common

ownership

or

control.

The

following

securities

were

considered

affiliated

companies

for

all

or

some

portion

of

the

year

ended

December

31,

2024.

Net

realized

gain

(loss),

investment

income,

and

change

in

net

unrealized

gain/loss

reflect

all

activity

for

the

period

then

ended.

Affiliate

Net

Realized

Gain

(Loss)

Change

in

Net

Unrealized

Gain/Loss

Investment

Income

T.

Rowe

Price

Funds:

Corporate

Income

Fund

$

(2,939)

$

(1,611)

$

14,154

Dynamic

Credit

Fund

(31)

788

21,368

Dynamic

Global

Bond

Fund

(1,408)

6,678

12,348

Emerging

Markets

Bond

Fund

(12,939)

14,465

30,055

Emerging

Markets

Local

Currency

Bond

Fund

(559)

(12,673)

6,749

Equity

Income

Fund

268,601

(195,145)

11,546

Floating

Rate

Fund

(1,082)

1,742

29,726

GNMA

Fund

(4,936)

(10,563)

25,576

High

Yield

Fund

(5,356)

3,920

63,163

Inflation

Protected

Bond

Fund

15

(1,792)

3,513

International

Bond

Fund

(14,788)

2,140

—

International

Bond

Fund

(USD

Hedged)

(2,278)

6,588

11,384

Limited

Duration

Inflation

Focused

Bond

Fund

(1,027)

1,781

5,193

New

Income

Fund

(16,511)

(6,718)

35,417

Short-Term

Bond

Fund

(187)

2,990

14,056

U.S.

High

Yield

ETF

22

(48)

6,195

U.S.

Treasury

Intermediate

Index

Fund

—

(16)

20

U.S.

Treasury

Long-Term

Index

Fund

(55,780)

30,119

9,192

U.S.

Treasury

Money

Fund,

4.52%

—

—

2,051

Affiliates

not

held

at

period

end

2,072

—

456

Totals

$

150,889#

$

(157,355)

$

302,162+

#

Capital

gain

distributions

from

underlying

Price

funds

represented

$10,967

of

the

net

realized

gain

(loss).

+

Investment

income

comprised

$302,162

of

income

distributions

from

underlying

Price

Funds.

T.

ROWE

PRICE

Spectrum

Income

Fund

December

31,

2024

Statement

of

Assets

and

Liabilities

($000s,

except

shares

and

per

share

amounts)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Assets

Investments

in

securities,

at

value

(cost

$6,015,671)

$

5,885,093

Cash

deposits

on

futures

contracts

11,693

Receivable

for

investment

securities

sold

5,149

Receivable

for

shares

sold

3,064

Variation

margin

receivable

on

futures

contracts

251

Total

assets

5,905,250

Liabilities

Payable

for

shares

redeemed

5,675

Investment

management

and

administrative

fees

payable

2,899

Payable

for

investment

securities

purchased

1,500

Other

liabilities

1,095

Total

liabilities

11,169

NET

ASSETS

$

5,894,081

Net

Assets

Consist

of:

Total

distributable

earnings

(loss)

$

(384,605)

Paid-in

capital

applicable

to

526,880,630

shares

of

$0.01

par

value

capital

stock

outstanding;

2,000,000,000

shares

of

the

Corporation

authorized

6,278,686

NET

ASSETS

$

5,894,081

NET

ASSET

VALUE

PER

SHARE

Investor

Class

(Net

assets:

$1,620,135;

Shares

outstanding:

144,884,704)

$

11.18

I

Class

(Net

assets:

$4,273,946;

Shares

outstanding:

381,995,926)

$

11.19

T.

ROWE

PRICE

Spectrum

Income

Fund

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Year

Ended

12/31/24

Investment

Income

(Loss)

Income

Income

distributions

from

underlying

Price

Funds

$

302,162

Interest

136

Total

income

302,298

Expenses

Investment

management

and

administrative

expense

30,513

Waived

/

paid

by

Price

Associates

(499)

Total

expenses

30,014

Net

investment

income

272,284

Realized

and

Unrealized

Gain

/

Loss

–

Net

realized

gain

(loss)

Sales

of

underlying

Price

Funds

139,922

Futures

(26,297)

Capital

gain

distributions

from

underlying

Price

Funds

10,967

Net

realized

gain

124,592

Change

in

net

unrealized

gain

/

loss

Underlying

Price

Funds

(157,355)

Futures

3,641

Change

in

net

unrealized

gain

/

loss

(153,714)

Net

realized

and

unrealized

gain

/

loss

(29,122)

INCREASE

IN

NET

ASSETS

FROM

OPERATIONS

$

243,162

T.

ROWE

PRICE

Spectrum

Income

Fund

Statement

of

Changes

in

Net

Assets

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Year

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Ended

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12/31/24

12/31/23

Increase

(Decrease)

in

Net

Assets

Operations

Net

investment

income

$

272,284

$

237,324

Net

realized

gain

(loss)

124,592

(116,735)

Change

in

net

unrealized

gain

/

loss

(153,714)

331,937

Increase

in

net

assets

from

operations

243,162

452,526

Distributions

to

shareholders

Net

earnings

Investor

Class

(87,527)

(83,788)

I

Class

(215,784)

(179,581)

Decrease

in

net

assets

from

distributions

(303,311)

(263,369)

Capital

share

transactions

*

Shares

sold

Investor

Class

184,226

157,934

I

Class

652,529

703,464

Distributions

reinvested

Investor

Class

81,979

78,148

I

Class

209,360

173,348

Shares

redeemed

Investor

Class

(498,784)

(410,563)

I

Class

(643,032)

(850,813)

Decrease

in

net

assets

from

capital

share

transactions

(13,722)

(148,482)

Net

Assets

Increase

(decrease)

during

period

(73,871)

40,675

Beginning

of

period

5,967,952

5,927,277

End

of

period

$

5,894,081

$

5,967,952

*Share

information

(000s)

Shares

sold

Investor

Class

16,334

14,338

I

Class

58,026

63,698

Distributions

reinvested

Investor

Class

7,278

7,099

I

Class

18,565

15,744

Shares

redeemed

Investor

Class

(44,132)

(37,311)

I

Class

(56,992)

(77,508)

Decrease

in

shares

outstanding

(921)

(13,940)

T.

ROWE

PRICE

Spectrum

Income

Fund

NOTES

TO

FINANCIAL

STATEMENTS

T.

Rowe

Price

Spectrum

Fund,

Inc.

(the

corporation)

is

registered

under

the

Investment

Company

Act

of

1940

(the

1940

Act).

The Spectrum

Income

Fund (the

fund)

is

a diversified,

open-end

management

investment

company

established

by

the

corporation.

The

fund broadly

diversifies

its

assets

within

specified

ranges

among

a

set

of

T.

Rowe

Price

mutual

funds

or

exchange-

traded

funds

(ETFs)

(underlying

Price

Funds)

representing

specific

market

segments.

The

fund

seeks

a

high

level

of

current

income

with

moderate

share

price

fluctuation.

The fund

has

two

classes

of

shares

as

follows:

Spectrum

Income

Fund (Investor

Class)

and

Spectrum

Income

Fund –

I

Class

(I

Class).

I

Class

shares

require

a

$500,000

initial

investment

minimum,

although

the

minimum

generally

is

waived

or

reduced

for

financial

intermediaries,

eligible

retirement

plans

and

certain

other

accounts.

Each

class

has

exclusive

voting

rights

on

matters

related

solely

to

that

class;

separate

voting

rights

on

matters

that

relate

to

both

classes;

and,

in

all

other

respects,

the

same

rights

and

obligations

as

the

other

class.

NOTE

1

-

SIGNIFICANT

ACCOUNTING

POLICIES

Basis

of

Preparation

The fund

is

an

investment

company

and

follows

accounting

and

reporting

guidance

in

the

Financial

Accounting

Standards

Board

Accounting

Standards

Codification

Topic

946

(ASC

946).

The

accompanying

financial

statements

were

prepared

in

accordance

with

accounting

principles

generally

accepted

in

the

United

States

of

America

(GAAP),

including,

but

not

limited

to,

ASC

946.

GAAP

requires

the

use

of

estimates

made

by

management.

Management

believes

that

estimates

and

valuations

of

the

underlying

Price

Funds

are

appropriate;

however,

actual

results

may

differ

from

those

estimates,

and

the

valuations

reflected

in

the

accompanying

financial

statements

may

differ

from

the

value

ultimately

realized

upon

sale

of

the

underlying

Price

Funds.

Investment

Transactions,

Investment

Income,

and

Distributions

Investment

transactions are

accounted

for

on

the

trade

date

basis.

Income

and

expenses

are

recorded

on

the

accrual

basis.

Realized

gains

and

losses are

reported

on

the

identified

cost

basis.

Income

tax-related

interest

and

penalties,

if

incurred,

are

recorded

as

income

tax

expense.

Dividends

received

from

underlying

Price

Fund

investments

are

reflected

as income;

capital

gain

distributions

are

reflected

as

realized

gain/loss.

Income

and

capital

gain

distributions

from

the

T.

ROWE

PRICE

Spectrum

Income

Fund

underlying

Price

Funds

are

recorded

on

the

ex-dividend

date.

Distributions

to

shareholders

are

recorded

on

the

ex-dividend

date.

Income

distributions,

if

any,

are

declared

by

each

class

daily

and

paid

monthly.

A

capital

gain

distribution,

if

any, may

also

be

declared

and

paid

by the

fund

annually.

Class

Accounting

Investment

management

and

administrative

expenses

incurred

by

each

class

are

charged

directly

to

the

class

to

which

they

relate.

Expenses

common

to

all

classes,

investment

income,

and

realized

and

unrealized

gains

and

losses

are

allocated

to

the

classes

based

upon

the

relative

daily

net

assets

of

each

class.

Capital

Transactions

Each

investor’s

interest

in

the

net

assets

of the

fund

is

represented

by

fund

shares. The

fund’s

net

asset

value

(NAV)

per

share

is

computed

at

the

close

of

the

New

York

Stock

Exchange

(NYSE),

normally

4

p.m.

Eastern

time,

each

day

the

NYSE

is

open

for

business.

However,

the

NAV

per

share

may

be

calculated

at

a

time

other

than

the

normal

close

of

the

NYSE

if

trading

on

the

NYSE

is

restricted,

if

the

NYSE

closes

earlier,

or

as

may

be

permitted

by

the

SEC.

Purchases

and

redemptions

of

fund

shares

are

transacted

at

the

next-computed

NAV

per

share,

after

receipt

of

the

transaction

order

by

T.

Rowe

Price

Associates,

Inc.,

or

its

agents.

Indemnification

In

the

normal

course

of

business,

the fund

may

provide

indemnification

in

connection

with

its

officers

and

directors,

service

providers

and/or

private

company

investments. The

fund’s

maximum

exposure

under

these

arrangements

is

unknown;

however,

the

risk

of

material

loss

is

currently

considered

to

be

remote.

NOTE

2

-

VALUATION

The fund’s

financial

instruments

are

valued

at

the

close

of

the

NYSE

and

are

reported

at

fair

value,

which

GAAP

defines

as

the

price

that

would

be

received

to

sell

an

asset

or

paid

to

transfer

a

liability

in

an

orderly

transaction

between

market

participants

at

the

measurement

date.

Investments

in

the

underlying

Price

Funds

are

valued

at

their

closing

NAV

per

share

on

the

day

of

valuation.

Futures

contracts

are

valued

at

closing

settlement

prices. Assets

and

liabilities

other

than

financial

instruments,

including

short-term

receivables

and

payables,

are

carried

at

cost,

or

estimated

realizable

value,

if

less,

which

approximates

fair

value.

T.

ROWE

PRICE

Spectrum

Income

Fund

The

fund’s

Board

of

Directors

(the

Board) has

designated

T.

Rowe

Price

Associates,

Inc.

as

the fund’s

valuation

designee

(Valuation

Designee).

Subject

to

oversight

by

the

Board,

the

Valuation

Designee

performs

the

following

functions

in

performing

fair

value

determinations:

assesses

and

manages

valuation

risks;

establishes

and

applies

fair

value

methodologies;

tests

methodologies;

and

evaluates

pricing

vendors

and

pricing

agents.

The

duties

and

responsibilities

of

the

Valuation

Designee

are

performed

by

its

Valuation

Committee.

The

Valuation Designee

provides

periodic

reporting

to

the

Board

on

valuation

matters.

Various

valuation

techniques

and

inputs

are

used

to

determine

the

fair

value

of

financial

instruments.

GAAP

establishes

the

following

fair

value

hierarchy

that

categorizes

the

inputs

used

to

measure

fair

value:

Level

1 – quoted

prices

(unadjusted)

in

active

markets

for

identical

financial

instruments

that

the

fund

can

access

at

the

reporting

date

Level

2 – inputs

other

than

Level

1

quoted

prices

that

are

observable,

either

directly

or

indirectly

(including,

but

not

limited

to,

quoted

prices

for

similar

financial

instruments

in

active

markets,

quoted

prices

for

identical

or

similar

financial

instruments

in

inactive

markets,

interest

rates

and

yield

curves,

implied

volatilities,

and

credit

spreads)

Level

3 – unobservable

inputs

(including

the

Valuation Designee’s

assumptions

in

determining

fair

value)

Observable

inputs

are

developed

using

market

data,

such

as

publicly

available

information

about

actual

events

or

transactions,

and

reflect

the

assumptions

that

market

participants

would

use

to

price

the

financial

instrument.

Unobservable

inputs

are

those

for

which

market

data

are

not

available

and

are

developed

using

the

best

information

available

about

the

assumptions

that

market

participants

would

use

to

price

the

financial

instrument.

GAAP

requires

valuation

techniques

to

maximize

the

use

of

relevant

observable

inputs

and

minimize

the

use

of

unobservable

inputs.

When

multiple

inputs

are

used

to

derive

fair

value,

the

financial

instrument

is

assigned

to

the

level

within

the

fair

value

hierarchy

based

on

the

lowest-level

input

that

is

significant

to

the

fair

value

of

the

financial

instrument.

Input

levels

are

not

necessarily

an

indication

of

the

risk

or

liquidity

associated

with

financial

instruments

at

that

level

but

rather

the

degree

of

judgment

used

in

determining

those

values.

On

December

31,

2024,

all

of

the

fund’s

financial

instruments

were

classified

as

Level

1,

based

on

the

inputs

used

to

determine

their

fair

values.

T.

ROWE

PRICE

Spectrum

Income

Fund

NOTE

3

-

DERIVATIVE

INSTRUMENTS

The fund

may

use

derivatives

in

an

effort

to

manage

cash

flows

efficiently,

remain

fully

invested,

or

facilitate

asset

allocation

and

rebalancing.

As

defined

by

GAAP,

a

derivative

is

a

financial

instrument

whose

value

is

derived

from

an

underlying

security

price,

foreign

exchange

rate,

interest

rate,

index

of

prices

or

rates,

or

other

variable;

it

requires

little

or

no

initial

investment

and

permits

or

requires

net

settlement

or

delivery

of

cash

or

other

assets.

The fund

invests in

derivatives

only

if

the

expected

risks

and

rewards

are

consistent

with

its

investment

objectives,

policies,

and

overall

risk

profile,

as

described

in

its

prospectus

and

Statement

of

Additional

Information.

The

risks

associated

with

the

use

of

derivatives

are

different

from,

and

potentially

much

greater

than,

the

risks

associated

with

investing

directly

in

the

instruments

on

which

the

derivatives

are

based.

The fund

values

its derivatives

at

fair

value

and

recognizes

changes

in

fair

value

currently

in its

results

of

operations.

Accordingly,

the fund

does not

follow

hedge

accounting,

even

for

derivatives

employed

as

economic

hedges.

Generally,

the fund

accounts for its

derivatives

on

a

gross

basis. It

does not

offset

the

fair

value

of

derivative

liabilities

against

the

fair

value

of

derivative

assets

on its financial

statements,

nor does

it offset

the

fair

value

of

derivative

instruments

against

the

right

to

reclaim

or

obligation

to

return

collateral. The

following

table

summarizes

the

fair

value

of

the

fund’s

futures

contracts

held

as

of

December

31,

2024,

and

the

related

location

on

the

accompanying

Statement

of

Assets

and

Liabilities,

presented

by

primary

underlying

risk

exposure:

($000s)

Location

on

Statement

of

Assets

and

Liabilities

Fair

Value*

Assets

Equity

derivatives

Futures

$

5,491

*

Total

$

5,491

*

Liabilities

Interest

rate

derivatives

Futures

$

1,850

Total

$

1,850

T.

ROWE

PRICE

Spectrum

Income

Fund

Additionally,

the

amount

of

gains

and

losses

on futures

recognized

in

fund

earnings

during

the

year ended

December

31,

2024,

and

the

related

location

on

the

accompanying

Statement

of

Operations,

is

summarized

in

the

following

table

by

primary

underlying

risk

exposure:

Counterparty

Risk

and

Collateral

The fund

invests in

exchange-

traded

futures.

Counterparty

risk

on

such

derivatives

is

minimal

because

the

clearinghouse

provides

protection

against

counterparty

defaults.

For

futures,

the fund

is required

to

deposit

collateral

in

an

amount

specified

by

the

clearinghouse

and

the

clearing

firm

(margin

requirement)

and

the

margin

requirement

must

be

maintained

over

the

life

of

the

contract.

Each

clearinghouse

and

clearing

firm,

in

its

sole

discretion,

may

adjust

the

margin

requirements

applicable

to

the

fund.

Collateral

may

be

in

the

form

of

cash

or

debt

securities

issued

by

the

U.S.

government

or

related

agencies.

Cash

posted

by

the

fund

is

reflected

as

cash

deposits

in

the

accompanying

financial

statements

and

generally

is

restricted

from

withdrawal

by

the

fund;

securities

posted

by

the

fund

are

so

noted

in

the

accompanying

Portfolio

of

Investments;

both

remain

in

the

fund’s

assets.

While

typically

not

sold

in

the

same

manner

as

equity

or

fixed

*

The

fair

value

presented

includes

cumulative

gain

(loss)

on

open

futures

contracts;

however,

the

value

reflected

on

the

accompanying

Statement

of

Assets

and

Liabilities

is

only

the

unsettled

variation

margin

receivable

(payable)

at

that

date.

($000s)

Location

of

Gain

(Loss)

on

Statement

of

Operations

Futures

Realized

Gain

(Loss)

Interest

rate

derivatives

$

(9,791

)

Equity

derivatives

(16,506

)

Total

$

(26,297

)

Change

in

Unrealized

Gain

(Loss)

Interest

rate

derivatives

$

(1,850

)

Equity

derivatives

5,491

Total

$

3,641

T.

ROWE

PRICE

Spectrum

Income

Fund

income

securities,

exchange-traded

derivatives

may

be

closed

out

only

on

the

exchange

or

clearinghouse

where

the

contracts

were

cleared.

This

ability

is

subject

to

the

liquidity

of

underlying

positions.

As

of

December

31,

2024,

cash

of $11,693,000 had

been

posted

by

the fund

for

exchange-traded

derivatives.

Futures

Contracts

A

futures

contract

provides

for

the

future

sale

by

one

party

and

purchase

by

another

of

a

specified

amount

of

a

specific

underlying

financial

instrument

at

an

agreed

upon

price,

date,

time,

and

place.

The fund currently invests only

in

exchange-traded

futures,

which

generally

are

standardized

as

to

maturity

date,

underlying

financial

instrument,

and

other

contract

terms.

Payments

are

made

or

received

by

the

fund

each

day

to

settle

daily

fluctuations

in

the

value

of

the

contract

(variation

margin),

which

reflect

changes

in

the

value

of

the

underlying

financial

instrument.

Variation

margin

is

recorded

as

unrealized

gain

or

loss

until

the

contract

is

closed.

The

value

of

a

futures

contract

included

in

net

assets

is

the

amount

of

unsettled

variation

margin;

net

variation

margin

receivable

is

reflected

as

an

asset

and

net

variation

margin

payable

is

reflected

as

a

liability

on

the

accompanying

Statement

of

Assets

and

Liabilities.

When

a

contract

is

closed,

a

realized

gain

or

loss

is

recorded

on

the

accompanying

Statement

of

Operations.

Risks

related

to

the

use

of

futures

contracts

include

possible

illiquidity

of

the

futures

markets,

contract

prices

that

can

be

highly

volatile

and

imperfectly

correlated

to

movements

in

hedged

security

values

and/or

interest

rates,

and

potential

losses

in

excess

of

the

fund’s

initial

investment.

During

the

year ended

December

31,

2024,

the

volume

of

the

fund’s

activity

in

futures,

based

on

underlying

notional

amounts,

was

generally

between

0%

and

8%

of

net

assets.

NOTE

4

-

INVESTMENTS

IN

UNDERLYING

PRICE

FUNDS

Purchases

and

sales

of

the

underlying

Price

Funds

other

than

in-kind

transactions,

if

any,

during

the

year

ended

December

31,

2024,

aggregated

$2,302,656,000

and

$2,347,928,000,

respectively.

T.

ROWE

PRICE

Spectrum

Income

Fund

NOTE

5

-

FEDERAL

INCOME

TAXES

Generally,

no

provision

for

federal

income

taxes

is

required

since

the

fund

intends

to continue

to

qualify

as

a

regulated

investment

company

under

Subchapter

M

of

the

Internal

Revenue

Code

and

distribute

to

shareholders

all

of

its taxable

income

and

gains.

Distributions

determined

in

accordance

with

federal

income

tax

regulations

may

differ

in

amount

or

character

from

net

investment

income

and

realized

gains

for

financial

reporting

purposes.

The

fund

files

U.S.

federal,

state,

and

local

tax

returns

as

required.

The

fund’s

tax

returns

are

subject

to

examination

by

the

relevant

tax

authorities

until

expiration

of

the

applicable

statute

of

limitations,

which

is

generally

three

years

after

the

filing

of

the

tax

return

but

which

can

be

extended

to

six

years

in

certain

circumstances.

Tax

returns

for

open

years

have

incorporated

no

uncertain

tax

positions

that

require

a

provision

for

income

taxes.

Capital

accounts

within

the

financial

reporting

records

are

adjusted

for

permanent

book/tax

differences

to

reflect

tax

character

but

are

not

adjusted

for

temporary

differences.

The

permanent

book/tax

adjustments,

if

any,

have

no

impact

on

results

of

operations

or

net

assets.

The

permanent

book/

tax

adjustments

relate

primarily

to

an

over-distribution

of

taxable

income

not

deemed

a

return

of

capital

for

tax

purposes

and

the

recharacterization

of

distributions.

The

tax

character

of

distributions

paid

for

the

periods

presented

was

as

follows:

($000s)

December

31,

2024

December

31,

2023

Ordinary

income

(including

short-term

capital

gains,

if

any)

$

276,982

$

263,369

Long-term

capital

gain

26,329

—

Total

distributions

$

303,311

$

263,369

T.

ROWE

PRICE

Spectrum

Income

Fund

At

December

31,

2024,

the

tax-basis

cost

of

investments

(including

derivatives,

if

any)

and

gross

unrealized

appreciation

and

depreciation

were as

follows:

At

December

31,

2024,

the

tax-basis

components

of

accumulated

net

earnings

(loss)

were

as

follows:

Temporary

differences

between

book-basis

and

tax-basis

components

of

total

distributable