UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-4998

| T. Rowe Price Spectrum Fund, Inc. |

|

| (Exact name of registrant as specified in charter) |

| |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Address of principal executive offices) |

| |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2011

Item 1. Report to Shareholders

| Spectrum Funds | December 31, 2011 |

The views and opinions in this report were current as of December 31, 2011. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our E-mail Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Manager’s Letter

Fellow Shareholders

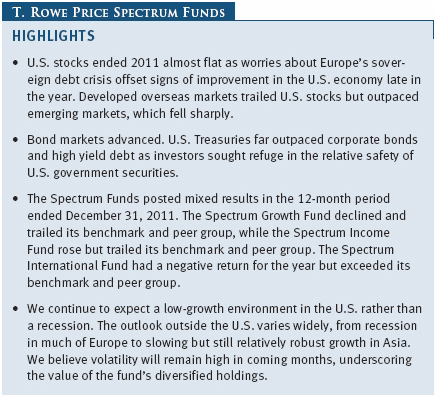

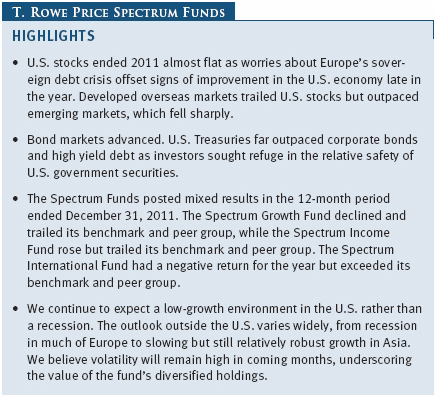

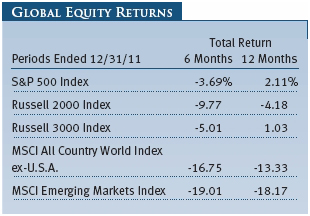

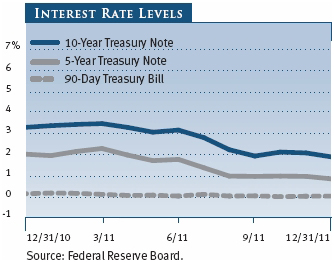

U.S. stocks rallied in the first four months of 2011 but retraced most of their gains by year-end as concerns about Europe’s sovereign debt crisis overshadowed signs of improvement in the U.S. economy. Worries about European policymakers’ inability to contain the eurozone’s financial crisis spurred investors to retreat from stocks in favor of more conservative assets like U.S. Treasuries, pushing much of the Treasury yield curve down to historic lows. Outside the U.S., European markets fell sharply amid slowing growth, the implementation of fiscal austerity measures, and waning confidence in policymakers’ ability to fix the region’s debt problems. Emerging markets stocks lagged their developed peers as several countries tightened monetary policy to curb inflation and the turmoil in Europe led investors to shed riskier assets.

MARKET ENVIRONMENT

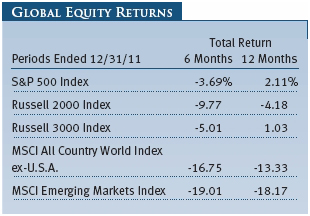

U.S. stocks rallied in the first four months of 2011, as encouraging economic data overcame political unrest in the Middle East and North Africa, an ensuing spike in oil prices, and a devastating earthquake and tsunami in Japan. However, a string of mixed reports starting in the spring raised doubts about the strength of the U.S. recovery, while weakening growth in emerging and developed overseas markets raised talk about another global downturn after the 2008 crisis. Rising anxiety over Europe’s inability to stem its debt crisis led investors to seek refuge in the relative safety of U.S. government debt, causing the price of Treasuries to soar across the board. Partisan U.S. politics also drained investor confidence, as a divided Congress and President Barack Obama wrangled over the ballooning deficit and fiscal policy. Lawmakers engaged in a strident debate over raising the federal debt ceiling that took the U.S. to the brink of default, which resulted in Standard & Poor’s stripping the U.S. of its AAA credit rating in August. Financial markets’ volatility soared starting in the late summer, and the S&P 500 fell to a year low in early October. Despite the political turmoil, a string of better-than-expected economic data in the fourth quarter showed that the U.S. recovery was picking up. The jobless rate declined to 8.5% in December, its lowest level in nearly three years, after hovering at roughly 9% for most of 2011. Still, high unemployment, the depressed housing market, and Europe’s long-running debt crisis threatened to undermine the recovery. Most sectors within the S&P 500 advanced for the year, but the financials sector sank roughly 17% amid worries about regulatory changes, sluggish domestic growth, and exposure to troubled European banks.

Overseas developed stock markets underperformed U.S. stocks, partly because the dollar strengthened against other currencies. European stock markets tumbled amid contracting growth across the eurozone and fallout from the debt crisis, while developed Asian markets including Japan also fell. Emerging markets stocks fared even worse than developed markets as key countries like Brazil, India, and China tightened monetary policy to curb inflation, although some reversed course and loosened policy to shore up growth in the year’s second half. All the major emerging markets regions posted double-digit declines, led by emerging Europe.

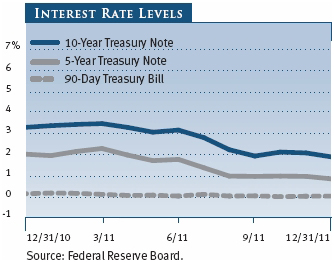

U.S. bonds produced strong returns over the last year—largely due to Treasuries—as weakening global growth and the European debt crisis spurred demand for less risky investments. In September, the Federal Reserve announced it would move $400 billion of its short-term Treasury holdings into longer-term issues in an effort to drive down long-term interest rates, a move that further supported the Treasury market. High yield bonds trailed investment-grade issues as risk aversion rose and credit spreads widened in the year’s second half, offsetting gains from earlier in the year. Outside the U.S., local currency government bonds in developed markets rose overall, though a stronger dollar limited gains. European bond markets were restrained by sharply rising yields in several peripheral countries as leaders struggled to contain the debt crisis. Dollar-denominated government bonds in emerging markets outperformed government bonds in developed markets—a testament to their lower debt levels and stronger growth outlook compared with the developed world.

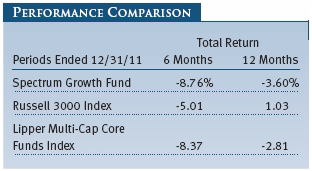

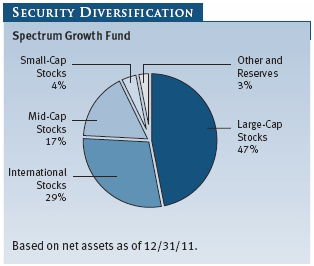

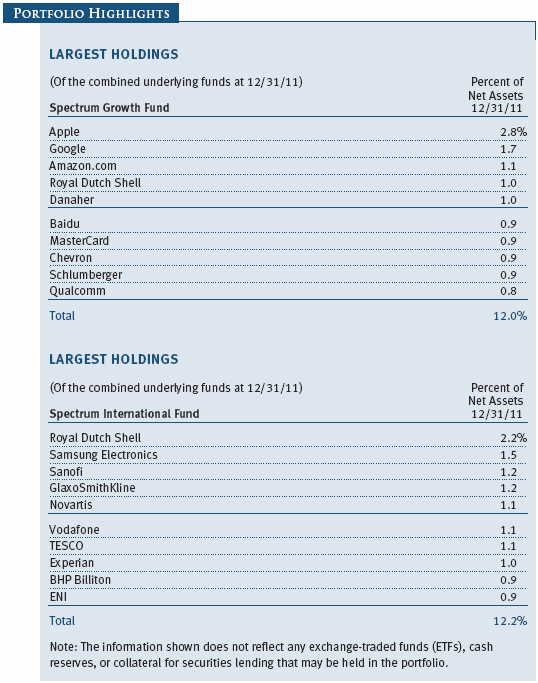

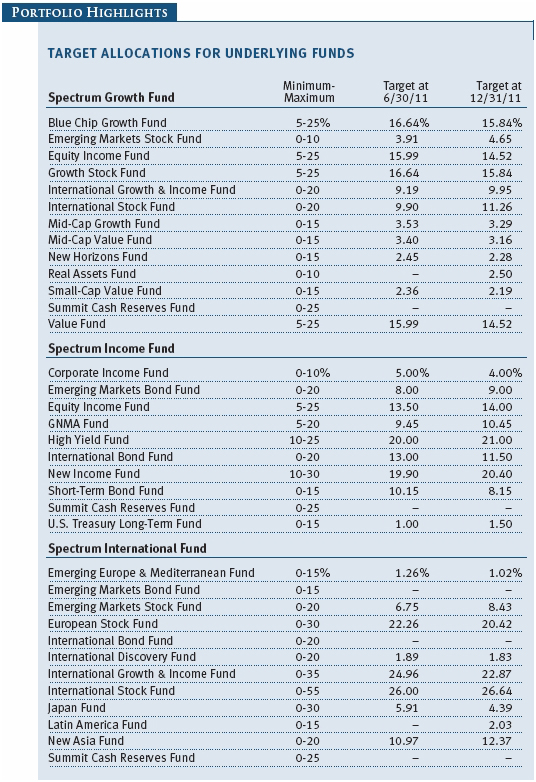

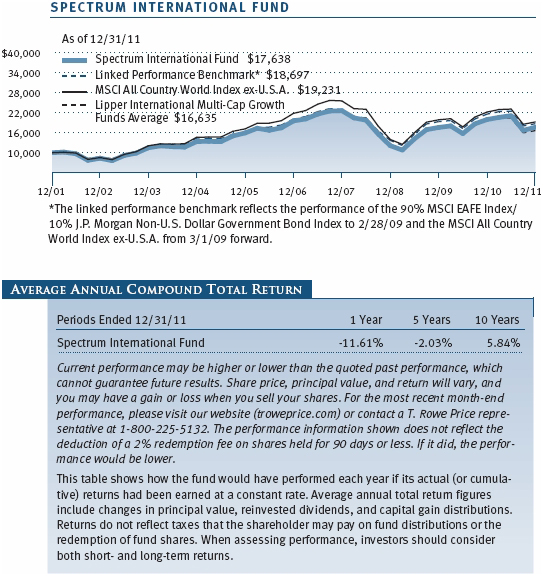

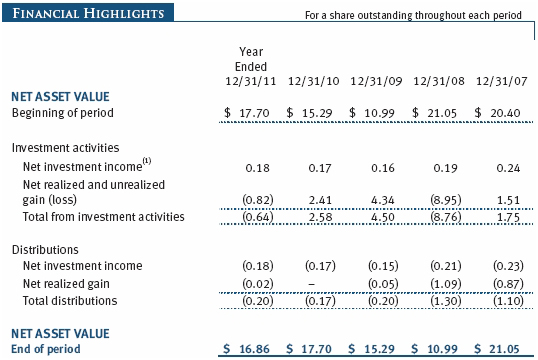

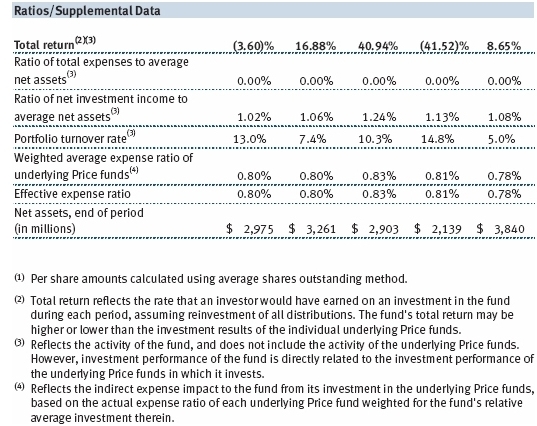

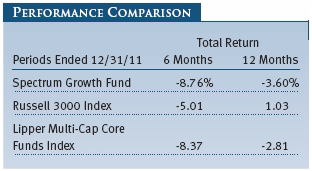

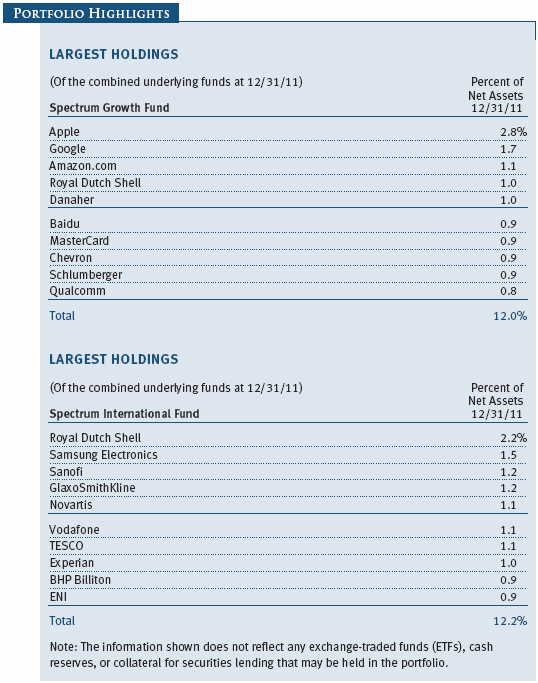

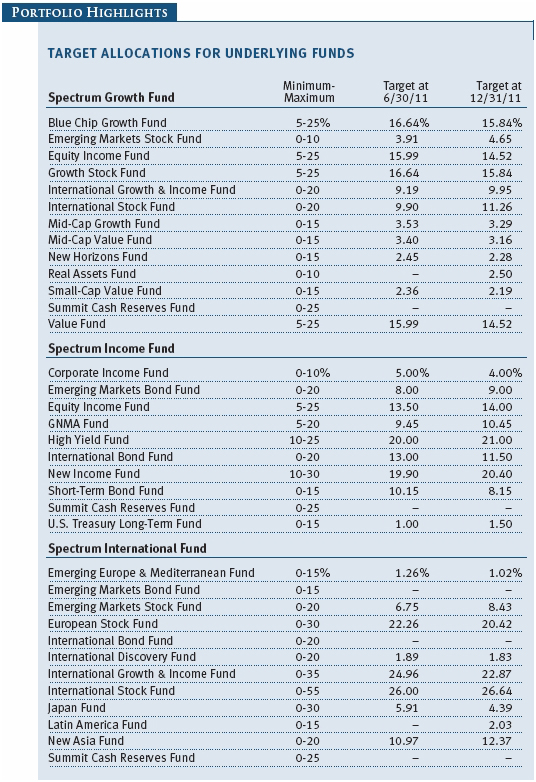

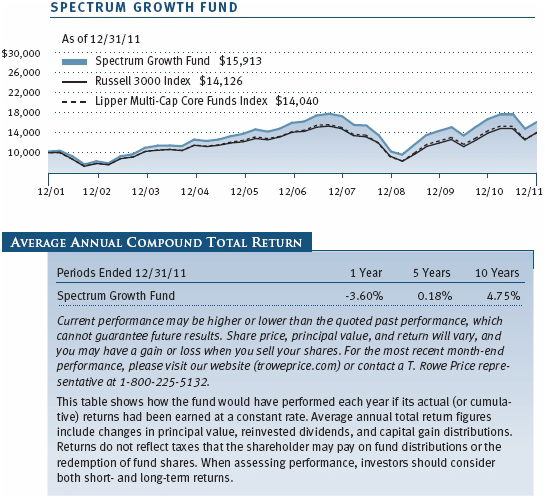

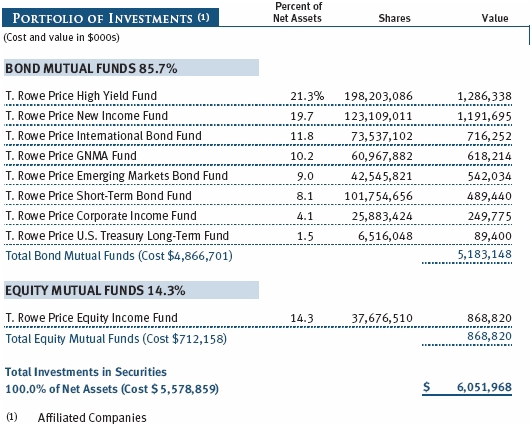

SPECTRUM GROWTH FUND

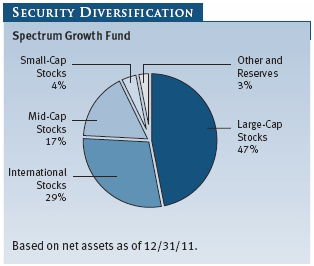

The Spectrum Growth Fund returned -3.60% for the 12 months ended December 31, 2011, trailing both the Russell 3000 Index and the Lipper Multi-Cap Core Funds Index. The fund’s allocation to international stocks hurt performance as non-U.S. stocks overall lagged the Russell 3000 Index, which represents the broad U.S. equity market. Each of the fund’s underlying international funds—International Stock Fund, International Growth & Income Fund, and the Emerging Markets Stock Fund—posted negative returns for the year. Underperformance in underlying domestic equity funds, including the Growth Stock Fund, Value Fund, Equity Income Fund, and Blue Chip Growth Fund, further detracted from relative returns. However, the portfolio benefited from strong stock selection in the Small-Cap Value and the New Horizons Funds. Our underweight to small- and mid-cap stocks also boosted relative results as small- and mid-cap stocks underperformed their large-cap counterparts.

The Spectrum Growth Fund invests in a range of underlying funds that focus on domestic stocks across the capitalization scale, international stocks in developed and emerging markets, and growth and value stocks. We are neutral between U.S. and non-U.S. stock markets because we think that a slowdown in developed markets including Europe will offset stronger growth in emerging markets. We increased our overweight to emerging markets stocks, which we believe are more attractively valued and may benefit from stronger economic growth than developed markets stocks over the next several years. Growth in China, Brazil, and other key emerging markets has cooled in response to monetary tightening in recent months. However, emerging markets generally carry far less debt than developed markets, and many developing countries have implemented conservative fiscal policies that make them better equipped to withstand a global crisis than in previous years. For valuation reasons, we are underweight small-cap stocks in favor of large-caps and increased our overweight to growth stocks over value.

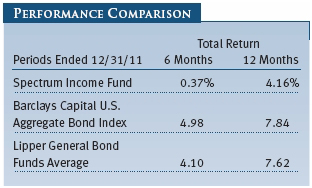

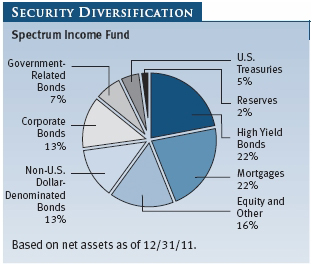

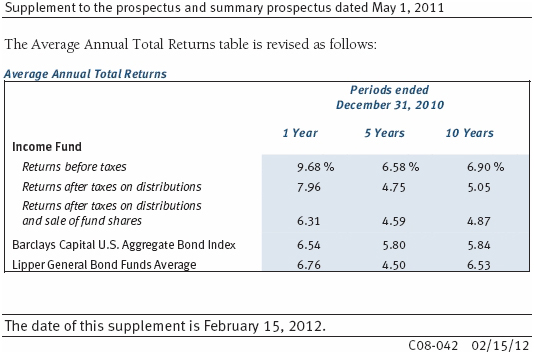

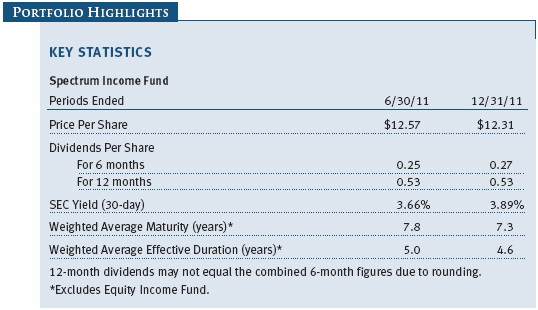

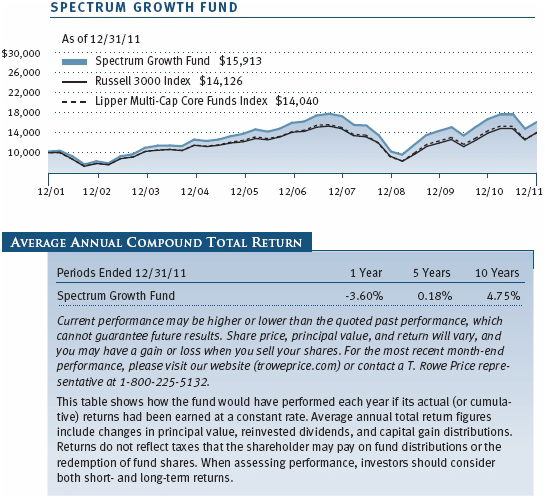

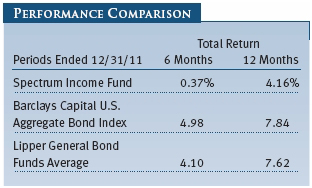

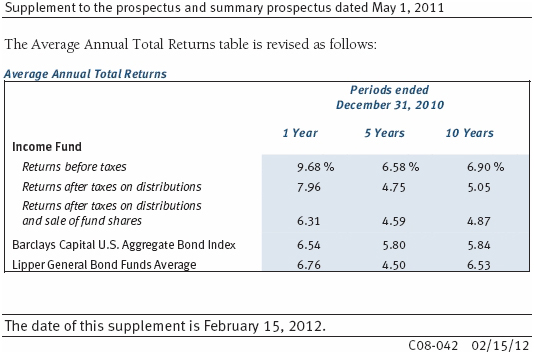

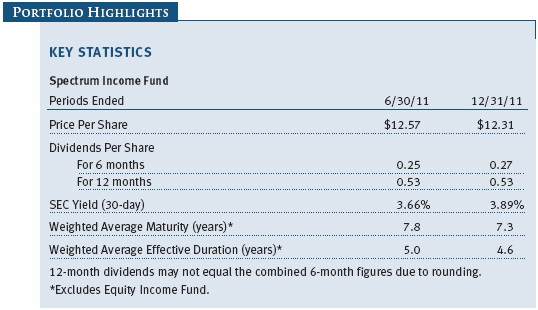

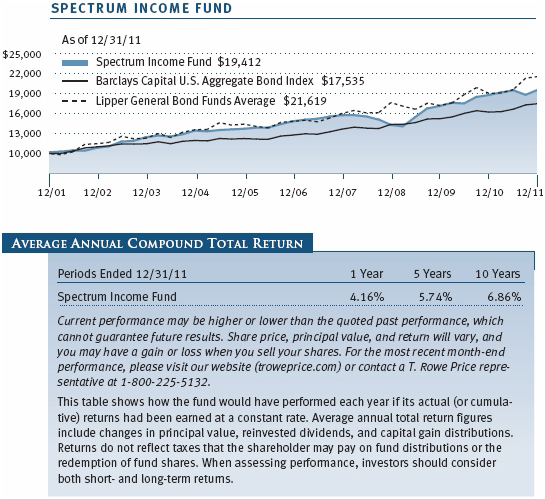

SPECTRUM INCOME FUND

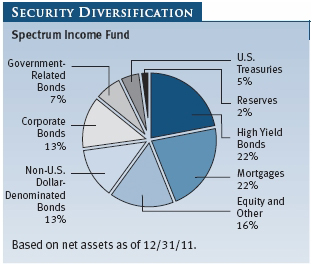

The Spectrum Income Fund returned 4.16% for the 12 months ended December 31, 2011, trailing both the Barclays Capital U.S. Aggregate Bond Index and the Lipper General Bond Funds Average. The fund posted a positive return, but its allocations to dividend-paying stocks, high yield bonds, and non-U.S. bonds hurt performance against the Barclays index, which represents the broad U.S. investment-grade bond market. Additionally, our holdings in the High Yield Fund and Emerging Markets Bond Fund, both of which lagged their respective benchmarks, weighed on returns. An underweight to Treasuries, which benefited from their safe-haven status as risk sentiment deteriorated over the year, further detracted from performance.

Although our allocations to high yield bonds, non-U.S. bonds, and dividend-paying stocks hurt performance last year, the inclusion of these diversifying segments are a hallmark of the Spectrum Income Fund’s design and have contributed to outperformance against the Barclays index since the fund’s 1990 inception and over the past 10 years, as seen in the Growth of $10,000 chart on page 13. We continue to favor high yield over investment-grade bonds given their attractive yields. We don’t expect a recession in the U.S. but rather a low-growth environment, which should be supportive for the high yield sector as many issuers have taken advantage of low interest rates to refinance debt and extend maturities. We increased our overweight to emerging market bonds, given the stronger fiscal position of many emerging market sovereign issuers compared with major developed countries that are grappling with high debt and low growth.

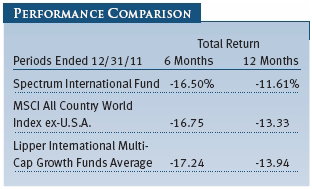

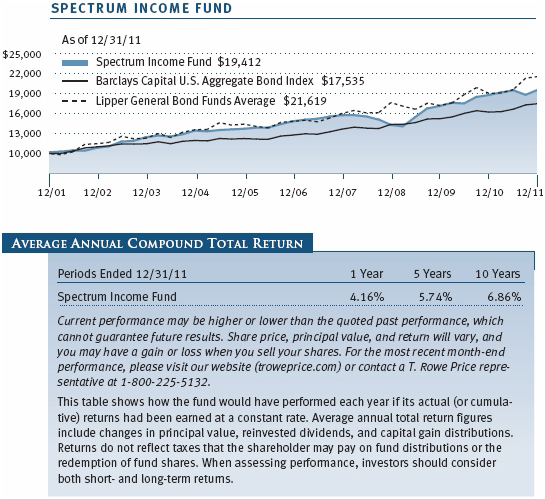

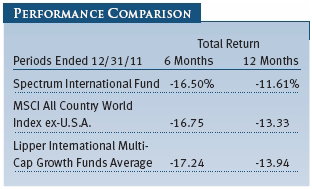

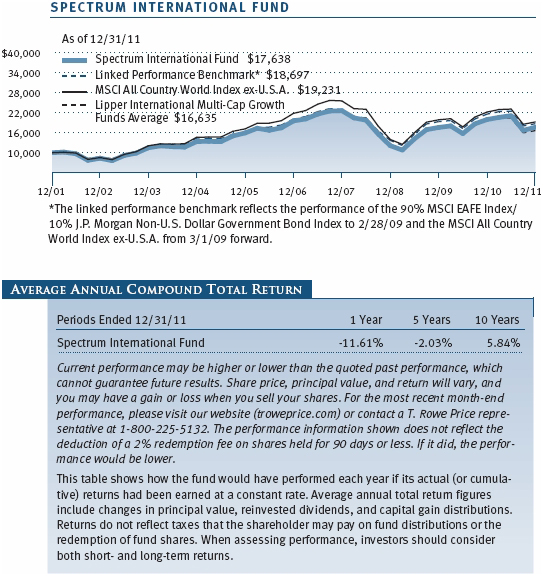

SPECTRUM INTERNATIONAL FUND

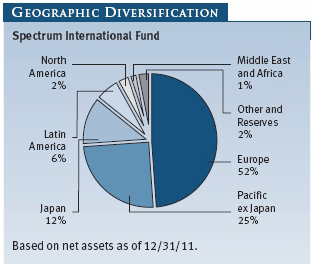

The Spectrum International Fund returned -11.61% for the 12 months ended December 31, 2011. Despite the fund’s negative return for the year, it outperformed its benchmark, the MSCI All Country World Index ex-U.S.A., as well as the Lipper International Multi-Cap Growth Funds Average. The fund’s relatively large position in the UK, one of Europe’s better-performing countries in 2011, lifted relative returns, as did favorable stock selection in Japan and Germany. Conversely, our allocation to India weighed on performance. India has been struggling with soaring inflation, slowing domestic growth, corruption scandals, and a falling currency—all of which have deterred foreign investment and hurt corporate earnings.

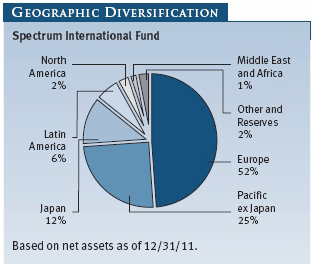

The fund’s allocations stayed roughly unchanged over the reporting period, with the International Stock Fund, International Growth & Income Fund, and European Stock Fund continuing to account for the top three funds. Europe remains the portfolio’s largest regional exposure, followed by the Pacific ex-Japan. As we stated before, we increased our overweight to emerging markets stocks due to their stronger long-term growth potential over developed markets. While growth in China, India, and Brazil has cooled in recent months due to tighter monetary policy and slowing demand from Europe, emerging markets are unfettered by the deep-seated debt and fiscal problems facing the U.S. and Europe and have greater flexibility to respond to financial challenges that may arise. Rapid growth of the middle class, improving living standards, and rising consumption are hallmarks of emerging markets, and we believe these factors will continue to drive strong growth over time.

OUTLOOK

Global financial markets face numerous near-term risks that have intensified since the summer. These headwinds include the European debt crisis, a weak global growth outlook, and a loss of faith in policymakers to fix deep-rooted economic problems. Recent events have made it clear that the direction of global financial markets is closely tied to government actions in the U.S. and Europe, making outcomes hard to predict and risk management challenging. Until policymakers can decisively resolve Europe’s debt problems, we believe that risk aversion will remain high and financial markets volatile.

We expect U.S. interest rates to rise over the long term as the economy continues its recovery. In the near term, we believe Treasury yields and credit spreads will be range-bound and volatility will remain high. Unfortunately, much of the current risk aversion stems from issues that have no quick or easy solution. For more than two years, fiscal policymakers in the U.S. and Europe have been struggling without success to address the twin challenges of reducing debt and increasing growth. This near-term geopolitical uncertainty underscores the value of the Spectrum Funds’ diversified holdings and investment approach. More than ever, we believe that a high level of diversification, rigorous fundamental research, and thoughtful security selection can help mitigate risks while still providing opportunity to profit from market volatility. Good performance will rely increasingly on comprehensive research into individual securities, and overseas markets will continue to offer some of the best combinations of risk and return, in our view.

Respectfully submitted,

Charles M. Shriver

Portfolio manager, Spectrum Income and Spectrum Growth Funds

Chris Alderson

Portfolio manager, Spectrum International Fund

January 23, 2012

Spectrum Income Fund

GLOSSARY

Barclays Capital U.S. Aggregate Index: An unmanaged index that tracks investment-grade corporate and government bonds.

J.P. Morgan Non-U.S. Dollar Government Bond Index: An unmanaged index that tracks the performance of major non-U.S. bond markets.

Lipper indexes: Fund benchmarks that consist of a small number of the largest mutual funds in a particular category as tracked by Lipper Inc.

MSCI All Country World Index ex-U.S.A.: An index that measures equity market performance of developed and emerging countries, excluding the U.S.

MSCI EAFE Index: An unmanaged index that tracks the stocks of about 1,000 companies in Europe, Australasia, and the Far East (EAFE).

MSCI Emerging Markets Index: An unmanaged index that tracks stocks in 26 emerging market countries.

Russell 2000 Index: An unmanaged index that tracks the stocks of 2,000 small U.S. companies.

Russell 3000 Index: An index that tracks the performance of the 3,000 largest U.S. companies, representing approximately 98% of the investable U.S. equity market.

S&P 500 Index: An unmanaged index that tracks the stocks of 500 primarily large-cap U.S. companies.

Weighted average effective duration (years): A measure of a security’s price sensitivity to changes in interest rates. Securities with longer durations are more sensitive to changes in interest rates than securities of shorter durations.

Weighted average maturity: A measure of a fund’s interest rate sensitivity. In general, the longer the average maturity, the greater the fund’s sensitivity to interest rate changes. The weighted average maturity may take into account interest rate readjustment dates for certain securities. Money funds must maintain a weighted average maturity of less than 60 days.

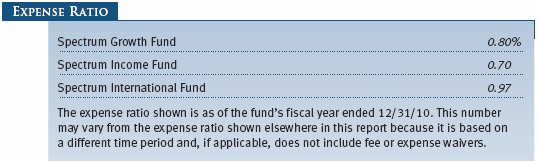

Performance and Expenses

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

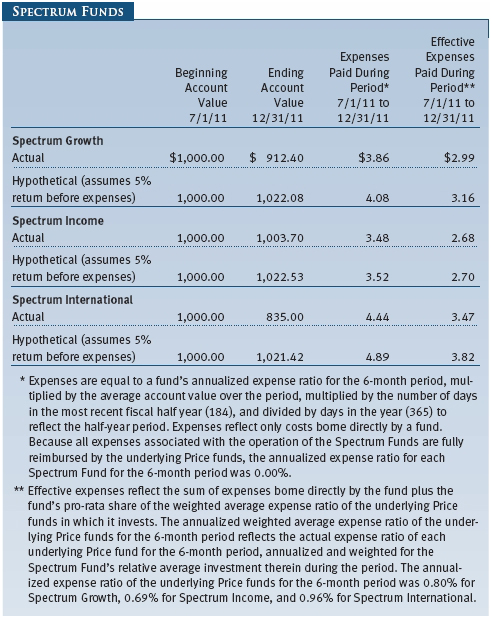

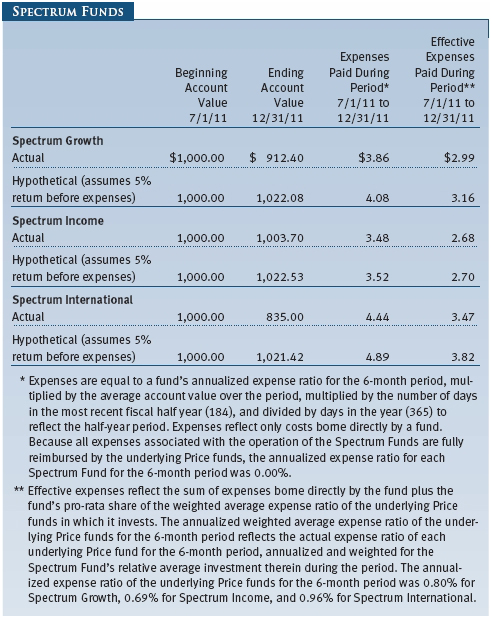

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Actual Expenses

The first line of the following table (“Actual”) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information on this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (“Hypothetical”) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an annual account service fee of $20, generally for accounts with less than $10,000 ($1,000 for UGMA/UTMA). The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $50,000 or more; accounts employing automatic investing; accounts electing to receive electronic delivery of account statements, transaction confirmations, prospectuses, and shareholder reports; accounts of an investor who is a T. Rowe Price Preferred Services, Personal Services, or Enhanced Personal Services client (enrollment in these programs generally requires T. Rowe Price assets of at least $100,000); and IRAs and other retirement plan accounts that utilize a prototype plan sponsored by T. Rowe Price (although a separate custodial or administrative fee may apply to such accounts). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

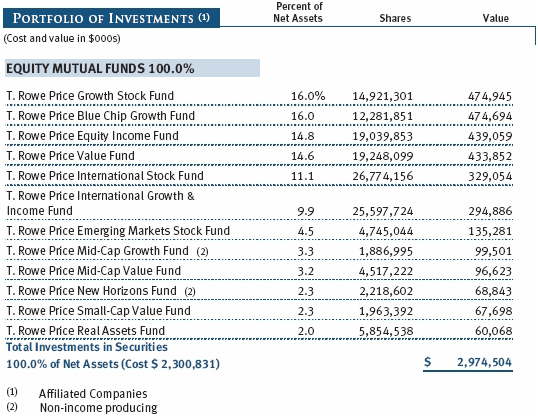

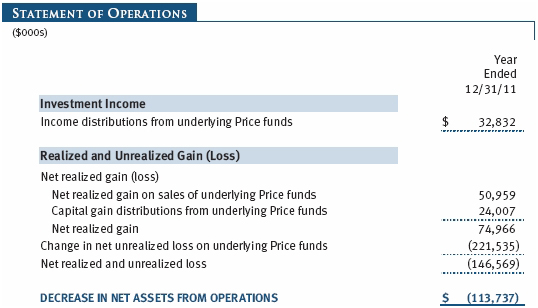

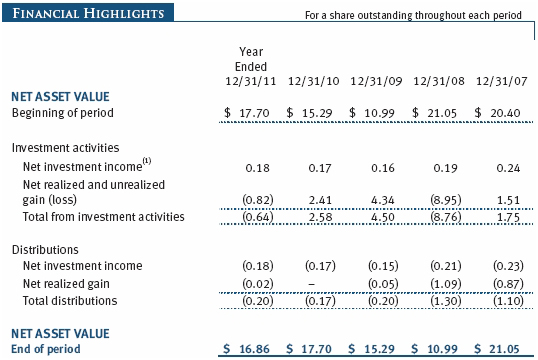

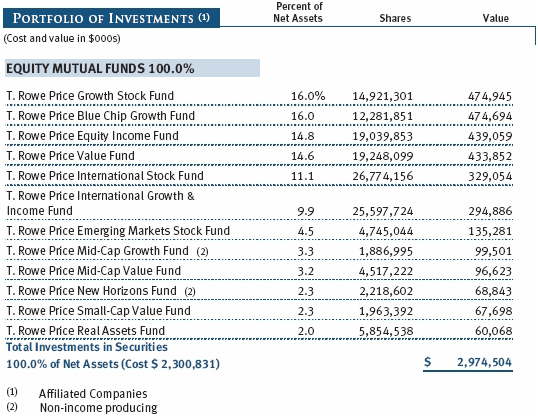

| T. Rowe Price Spectrum Growth Fund |

|

The accompanying notes are an integral part of these financial statements.

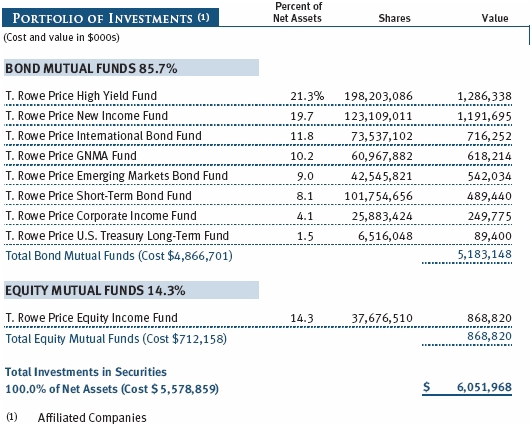

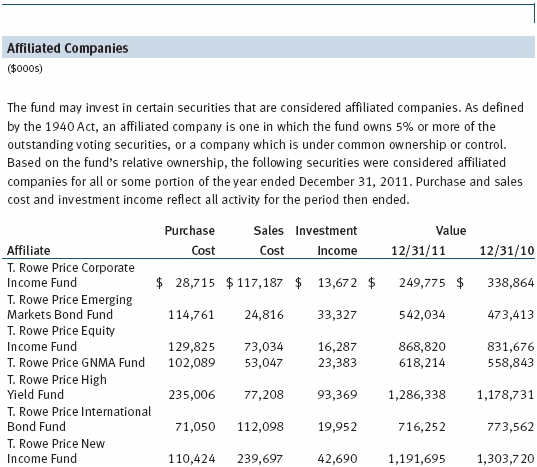

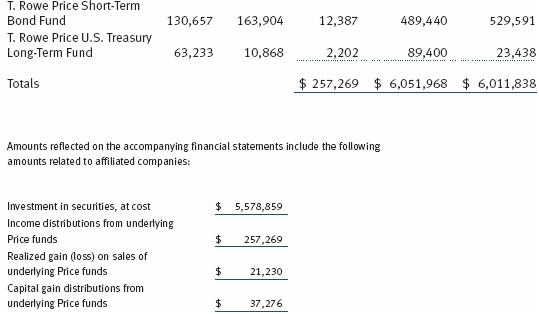

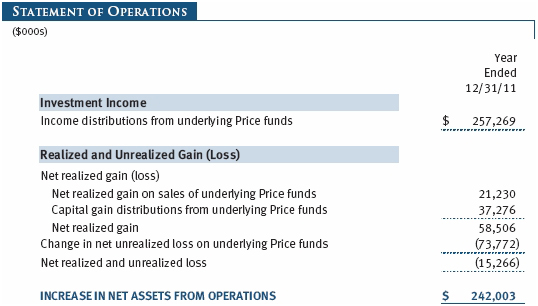

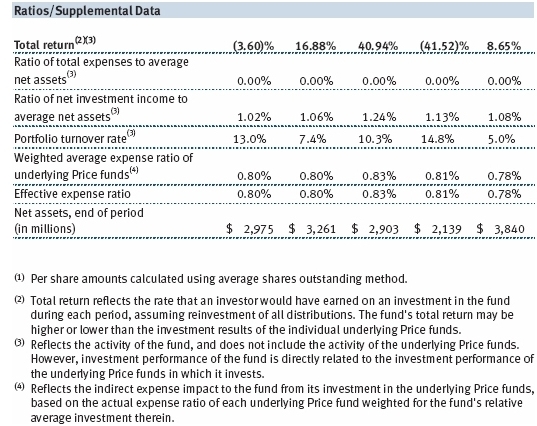

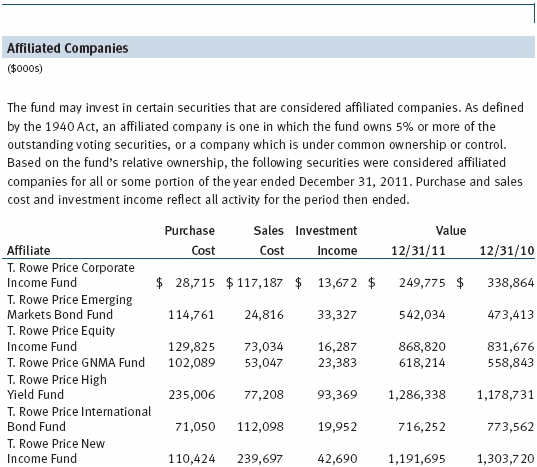

| T. Rowe Price Spectrum Income Fund |

|

The accompanying notes are an integral part of these financial statements.

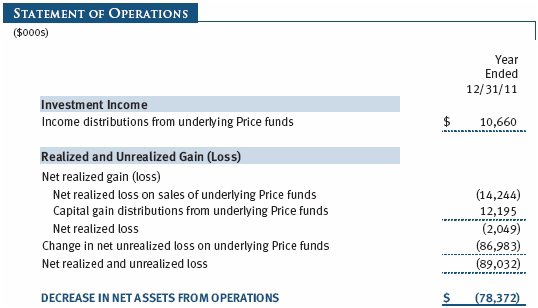

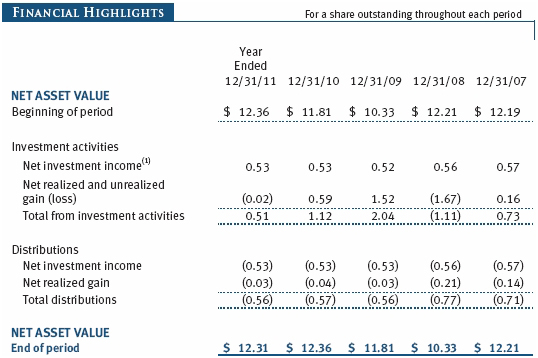

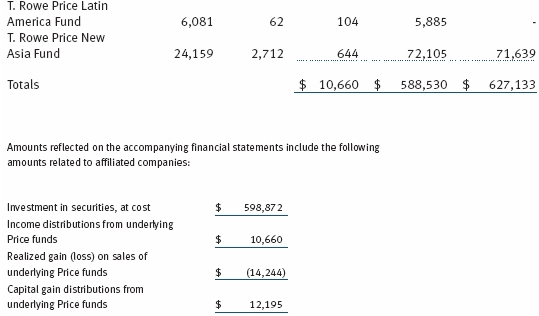

| T. Rowe Price Spectrum International Fund |

|

The accompanying notes are an integral part of these financial statements.

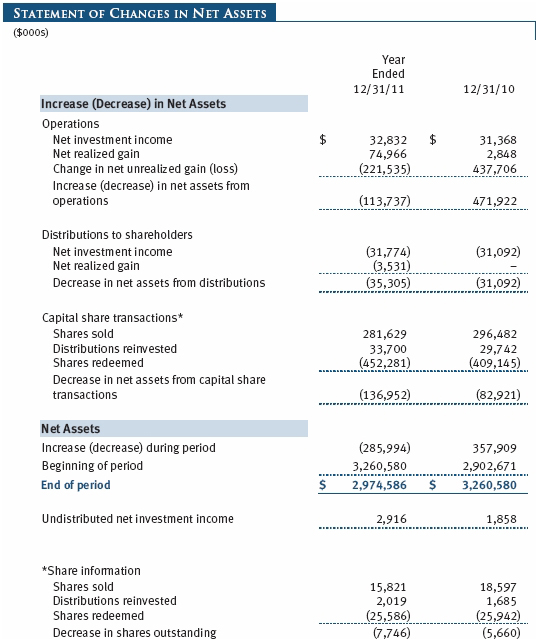

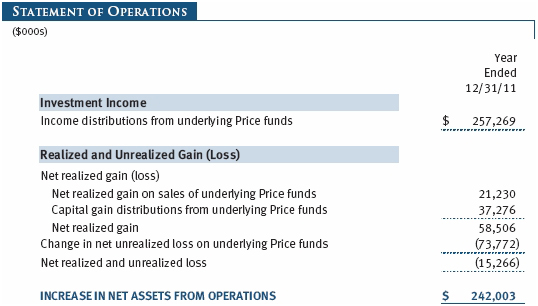

| T. Rowe Price Spectrum Growth Fund |

|

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

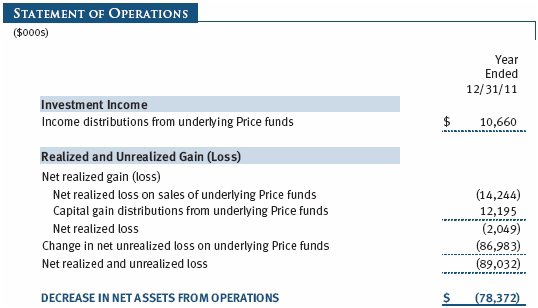

| T. Rowe Price Spectrum Income Fund |

|

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

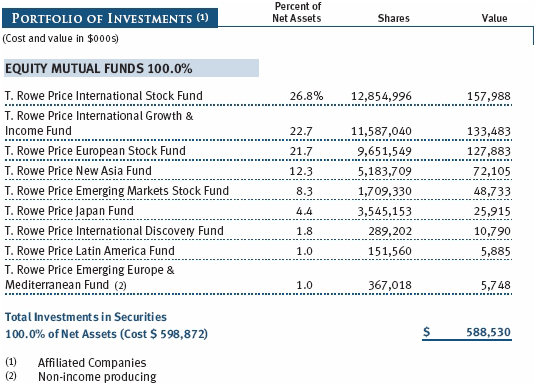

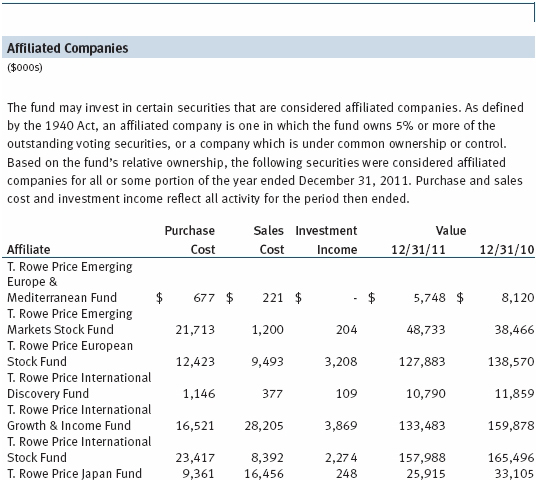

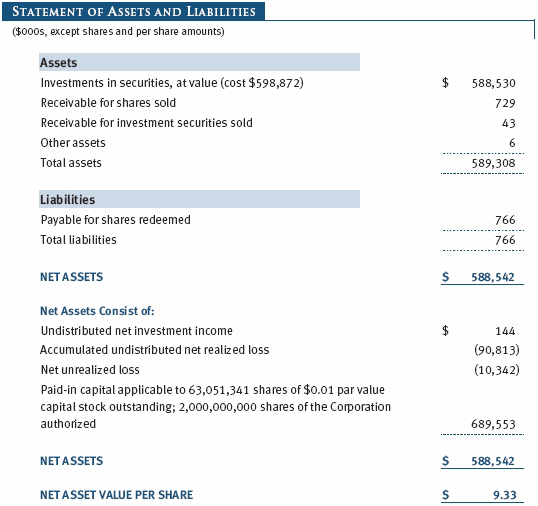

| T. Rowe Price Spectrum International Fund |

|

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

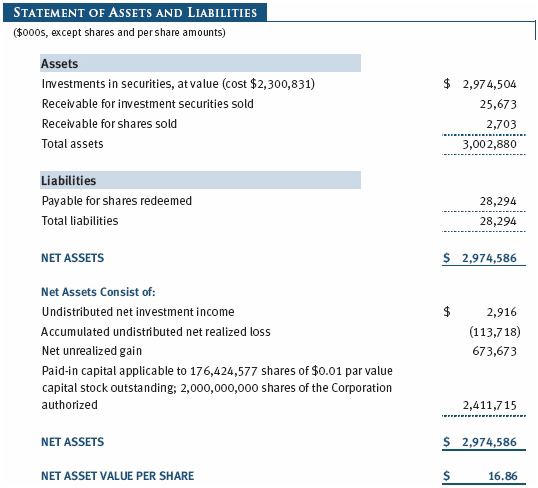

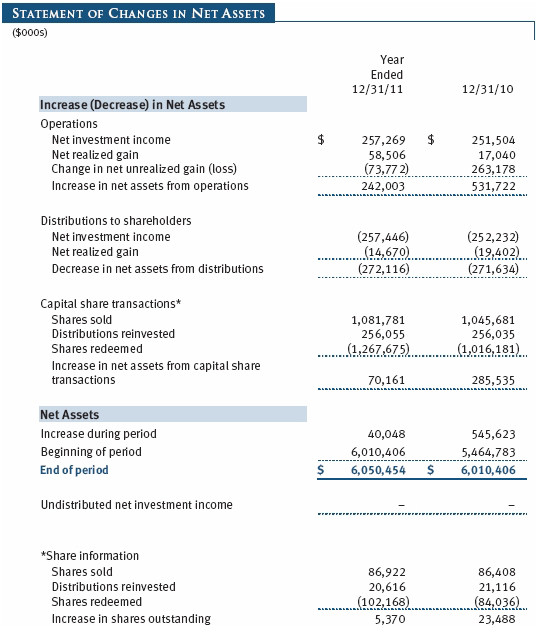

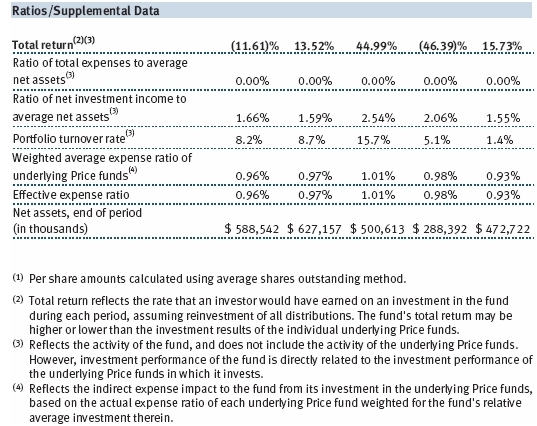

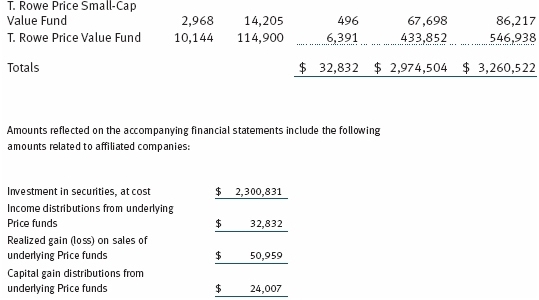

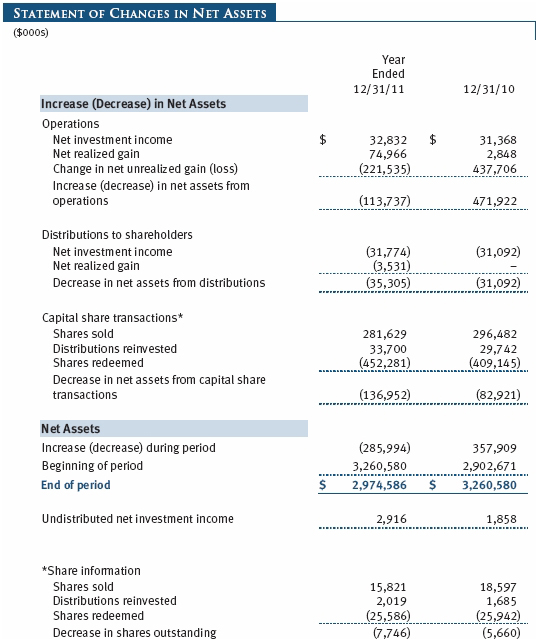

| T. Rowe Price Spectrum Growth Fund |

|

The accompanying notes are an integral part of these financial statements.

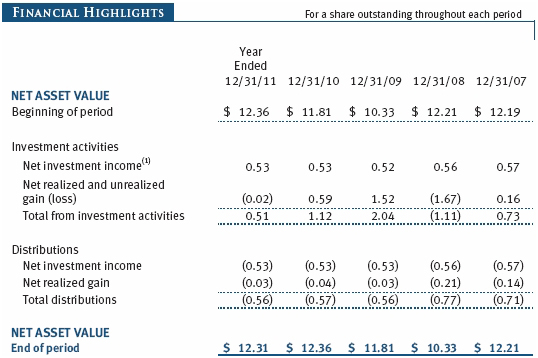

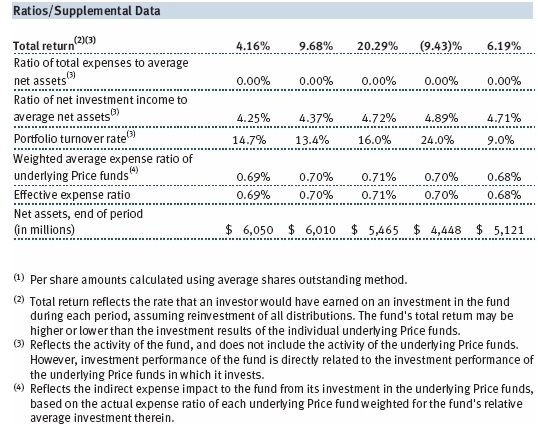

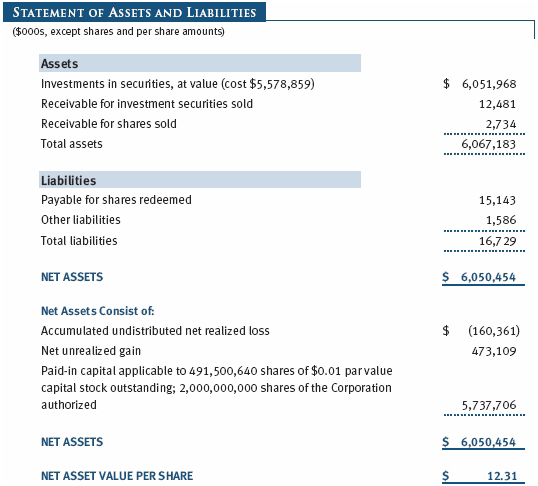

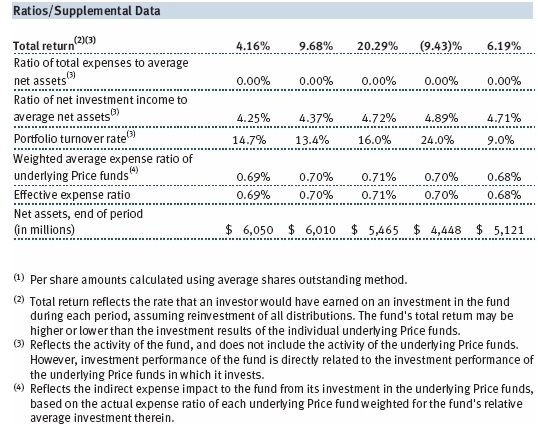

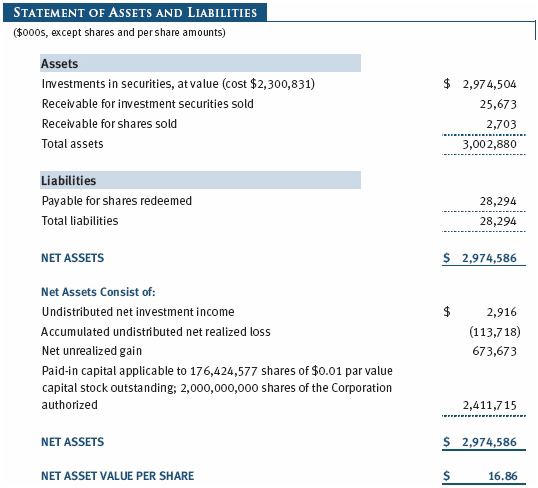

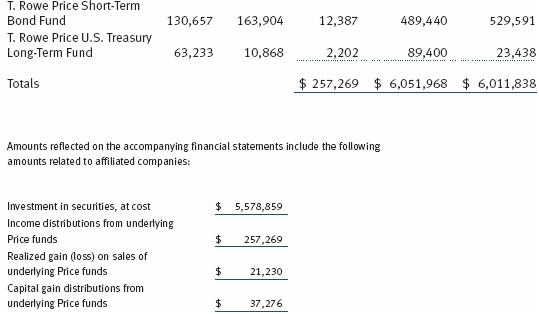

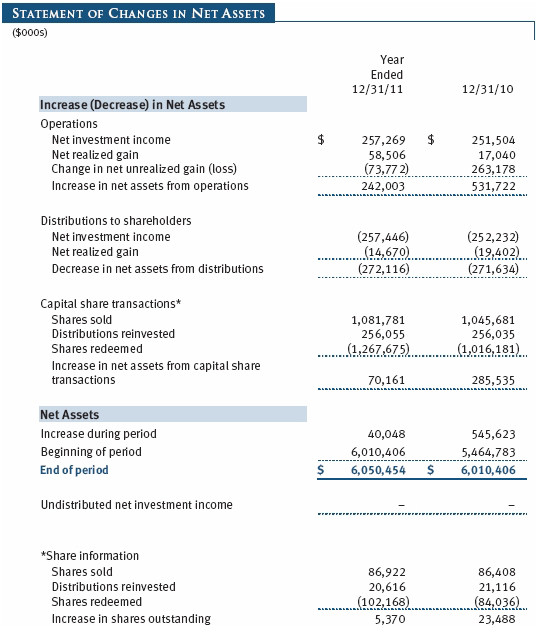

| T. Rowe Price Spectrum Income Fund |

|

The accompanying notes are an integral part of these financial statements.

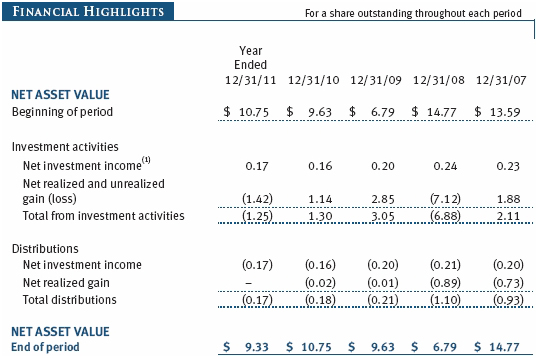

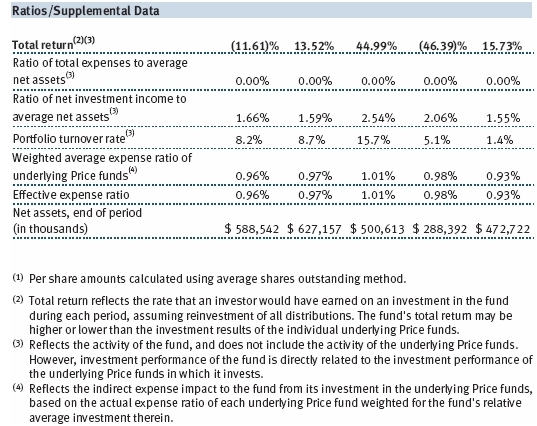

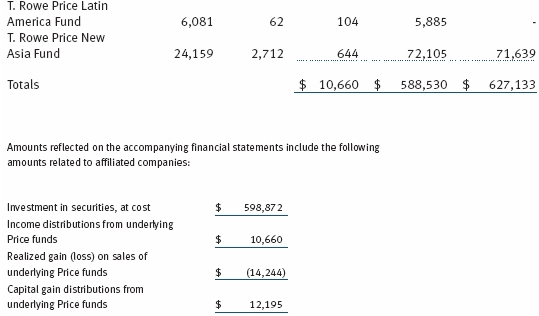

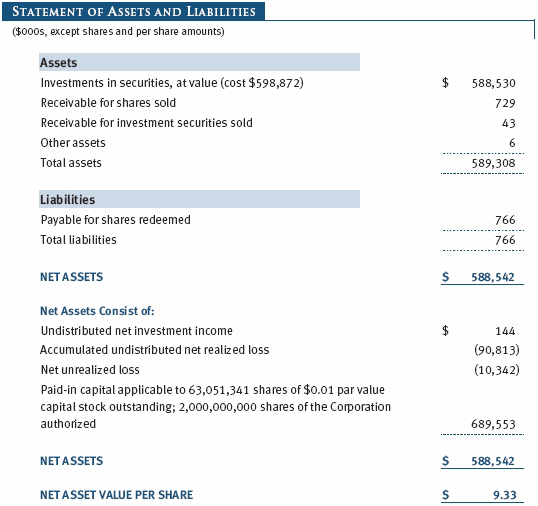

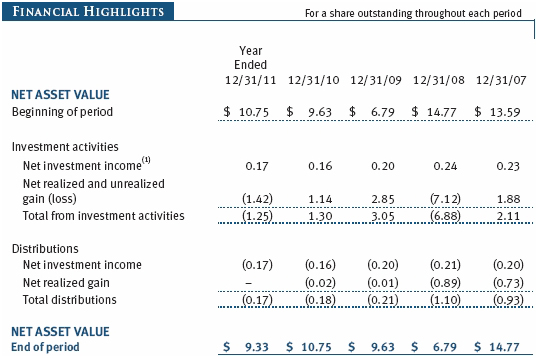

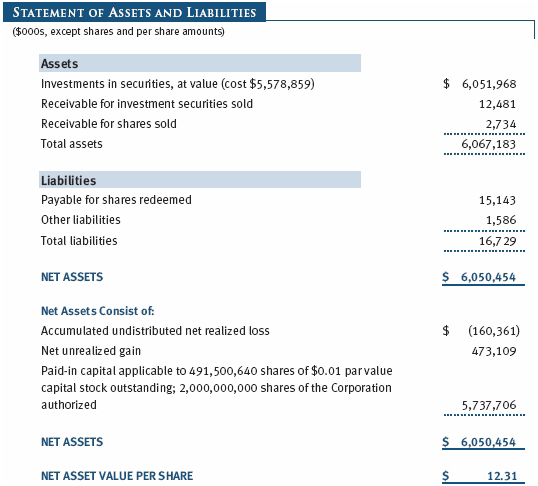

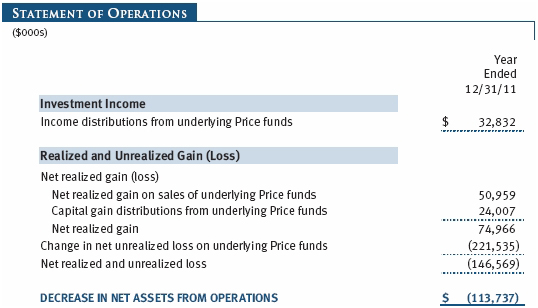

| T. Rowe Price Spectrum International Fund |

|

The accompanying notes are an integral part of these financial statements.

| T. Rowe Price Spectrum Growth Fund |

|

The accompanying notes are an integral part of these financial statements.

| T. Rowe Price Spectrum Income Fund |

|

The accompanying notes are an integral part of these financial statements.

| T. Rowe Price Spectrum International Fund |

|

The accompanying notes are an integral part of these financial statements.

| Notes to Financial Statements |

T. Rowe Price Spectrum Fund, Inc. (the corporation), is registered under the Investment Company Act of 1940 (the 1940 Act) as a nondiversified, open-end management investment company. Spectrum Growth Fund, Spectrum Income Fund, and Spectrum International Fund (collectively, the Spectrum Funds) are three portfolios established by the corporation. Spectrum Growth and Spectrum Income commenced operations on June 29, 1990, and Spectrum International commenced operations on December 31, 1996.

Each Spectrum Fund diversifies its assets within set limits among specific underlying T. Rowe Price funds (underlying Price funds). Spectrum Growth seeks long-term capital appreciation and growth of income with current income a secondary objective. Spectrum Income seeks a high level of current income with moderate share price fluctuation. Spectrum International seeks long-term capital appreciation.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), which require the use of estimates made by management. Management believes that estimates and valuations of the underlying Price funds are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately received upon sale of the underlying Price funds.

Investment Transactions, Investment Income, and Distributions Income is recorded on the accrual basis. Income and capital gain distributions from the underlying Price funds are recorded on the ex-dividend date. Purchases and sales of the underlying Price funds are accounted for on the trade date. Gains and losses realized on sales of the underlying Price funds are reported on the identified cost basis. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared by Spectrum Income daily and paid monthly. Income distributions are declared and paid by Spectrum Growth and Spectrum International annually. Capital gain distributions, if any, generally are declared and paid by each fund annually.

Redemption Fees A 2% fee is assessed on redemptions of Spectrum International shares held for 90 days or less to deter short-term trading and to protect the interests of long-term shareholders. Redemption fees are withheld from proceeds that shareholders receive from the sale or exchange of fund shares and are paid to the fund. Redemption fees received by Spectrum International are allocated to each underlying Price fund in proportion to the average daily value of its shares owned by the fund. Accordingly, redemption fees have no effect on the net assets of Spectrum International.

New Accounting Pronouncement In December 2011, the Financial Accounting Standards Board issued amended guidance to enhance disclosure for offsetting assets and liabilities. The guidance is effective for fiscal years and interim periods beginning on or after January 1, 2013; adoption will have no effect on the fund’s net assets or results of operations.

NOTE 2 - VALUATION

Each fund’s financial instruments are reported at fair value as defined by GAAP. Each fund values its financial instruments and computes its net asset value per share at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day that the NYSE is open for business. Investments in the underlying Price funds are valued at their closing net asset value per share on the day of valuation. Financial instruments for which these valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the T. Rowe Price Valuation Committee, established by the funds’ Board of Directors.

Various inputs are used to determine the value of financial instruments. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical financial instruments

Level 2 – observable inputs other than Level 1 quoted prices (including, but not limited to, quoted prices for similar financial instruments, interest rates, prepayment speeds, and credit risk)

Level 3 – unobservable inputs

Observable inputs are those based on market data obtained from sources independent of the Spectrum Funds, and unobservable inputs reflect the Spectrum Funds’ own assumptions based on the best information available. The input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level. On December 31, 2011, all investments in the underlying Price funds were classified as Level 1, based on the inputs used to determine their values.

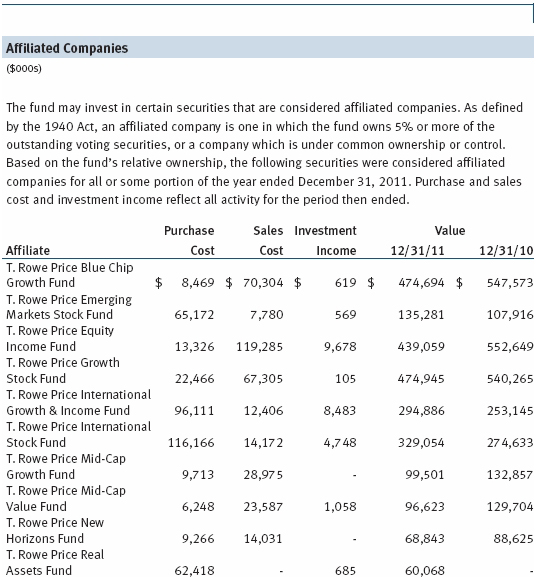

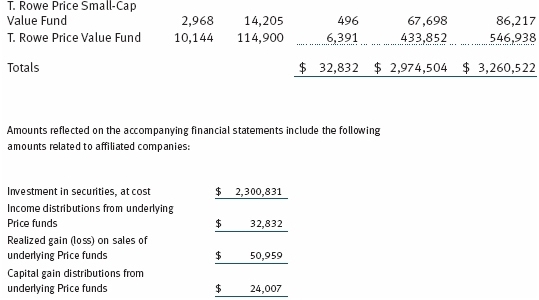

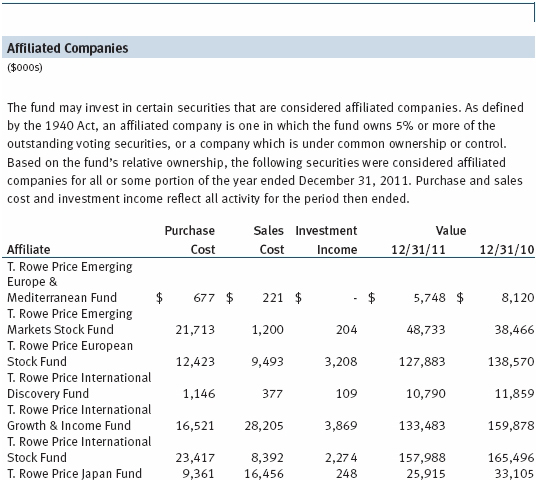

NOTE 3 - INVESTMENTS IN UNDERLYING PRICE FUNDS

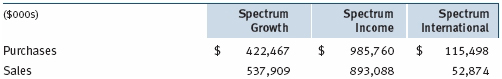

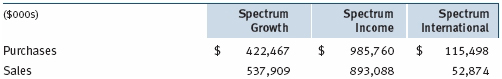

Purchases and sales of the underlying Price funds during the year ended December 31, 2011, were as follows:

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since each fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

Each fund files U.S. federal, state, and local tax returns as required. Each fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return but which can be extended to six years in certain circumstances. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

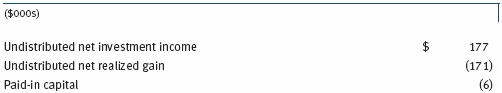

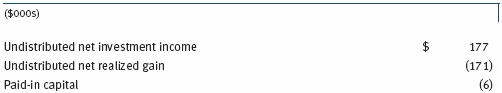

For Spectrum Income, reclassifications between income and gain relate primarily to the character of distributions from the underlying Price funds. For the year ended December 31, 2011, the following reclassifications were recorded to reflect tax character; the reclassifications had no impact on results of operations or net assets:

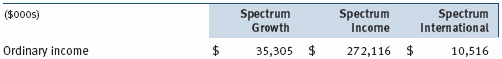

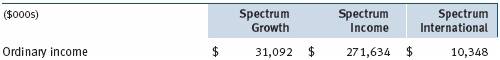

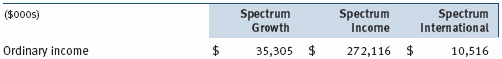

Distributions during the year ended December 31, 2011, were characterized for tax purposes as follows:

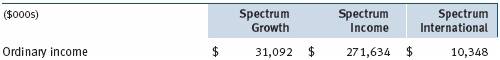

Distributions during the prior year ended December 31, 2010, were characterized for tax purposes as follows:

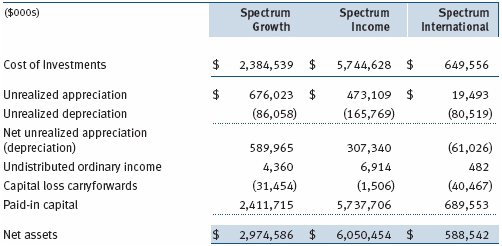

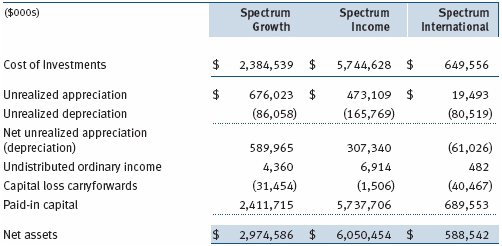

At December 31, 2011, the tax-basis costs of investments and components of net assets were as follows:

The difference between book-basis and tax-basis net unrealized appreciation (depreciation) is attributable to the deferral of losses from wash sales for tax purposes. Each fund intends to retain realized gains to the extent of available capital loss carryforwards. During the year ended December 31, 2011, Spectrum Growth, Spectrum Income, and Spectrum International utilized $62,452,000, $41,483,000, and $4,430,000, respectively, of capital loss carryforwards. Spectrum Growth’s available capital loss carryforwards as of December 31, 2011, all expire in 2017. Spectrum Income’s available capital loss carryforwards as of December 31, 2011, all expire in 2017. Additionally, Spectrum International’s available capital loss carryforwards as of December 31, 2011, expire as follows: $33,275,000 in 2017 and $7,192,000 in 2018. As a result of the Regulated Investment Company Modernization Act of 2010, net capital losses realized in future years may be carried forward for an unlimited period but must be used before capital loss carryforwards with expiration dates. It is possible that all or a portion of a fund’s current capital loss carryforwards could expire unused.

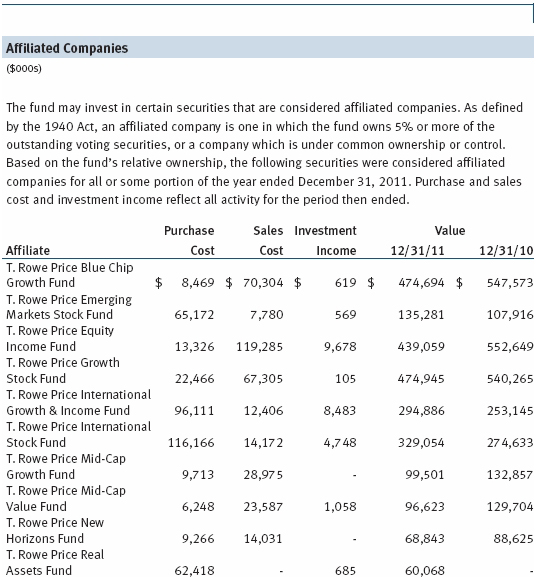

NOTE 5 - RELATED PARTY TRANSACTIONS

The Spectrum Funds are managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). Price Associates, directly or through sub-advisory agreements with its wholly owned subsidiaries, also provides investment management services to all the underlying Price funds. Previously, Spectrum International and the international underlying Price funds were managed by T. Rowe Price International, Inc. (Price International), which was merged into its parent company, Price Associates, effective at the close of business on December 31, 2010. Thereafter, Price Associates assumed responsibility for all of Price International’s existing investment management contracts, and Price International ceased all further operations. The corporate reorganization was designed to simplify Price Group’s corporate structure related to its international business and was intended to result in no material changes in the nature, quality, level, or cost of services provided to the T. Rowe Price funds.

Pursuant to various service agreements, Price Associates and its wholly owned subsidiaries provide shareholder servicing and administrative, transfer and dividend disbursing, accounting, marketing, and certain other services to the Spectrum Funds. Certain officers and directors of the Spectrum Funds are also officers and directors of Price Associates and its subsidiaries and of the underlying Price funds.

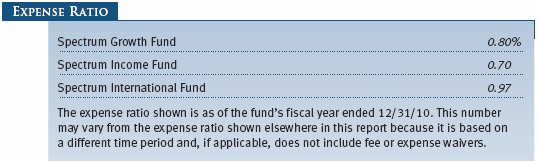

The Spectrum Funds pay no management fees; however, Price Associates receives management fees from the underlying Price funds. The Spectrum Funds operate in accordance with the investment management and special servicing agreements between and among the corporation, the underlying Price funds and Price Associates. Pursuant to these agreements, expenses associated with the operation of the Spectrum Funds are borne by each underlying Price fund to the extent of estimated savings to it and in proportion to the average daily value of its shares owned by the Spectrum Funds. Therefore, each Spectrum Fund operates at a zero expense ratio. However, each Spectrum Fund indirectly bears its proportionate share of the management fees and operating costs of the underlying Price funds in which it invests.

The Spectrum Funds do not invest in the underlying Price funds for the purpose of exercising management or control; however, investments by the Spectrum Funds may represent a significant portion of an underlying Price fund’s net assets. At December 31, 2011, Spectrum Growth and Spectrum International each held less than 25% of the outstanding shares of any underlying Price fund; Spectrum Income held approximately 44% of the outstanding shares of the Corporate Income Fund and 36% of the GNMA Fund.

Additionally, Spectrum Income is one of several mutual funds in which certain college savings plans managed by Price Associates may invest. Shareholder servicing costs associated with each college savings plan are allocated to Spectrum Income in proportion to the average daily value of its shares owned by the college savings plan and, in turn, are borne by the underlying Price funds in accordance with the terms of the investment management and special servicing agreements. At December 31, 2011, approximately 20% of the outstanding shares of Spectrum Income were held by the college savings plans.

As of December 31, 2011, T. Rowe Price Group, Inc., and/or its wholly owned subsidiaries owned 2,061,790 shares of Spectrum Growth, representing 1% of the fund’s net assets.

| Report of Independent Registered Public Accounting Firm |

To the Board of Directors of T. Rowe Price Spectrum Fund, Inc. and

Shareholders of Spectrum Growth Fund, Spectrum Income Fund, and

Spectrum International Fund

In our opinion, the accompanying statements of assets and liabilities, including the portfolios of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Spectrum Growth Fund, Spectrum Income Fund and Spectrum International Fund (the funds comprising T. Rowe Price Spectrum Fund, Inc., hereafter referred to as the “Funds”) at December 31, 2011, and the results of each of their operations, the changes in each of their net assets and the financial highlights for each of the periods indicated therein, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Funds’ management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of the underlying funds at December 31, 2011 by correspondence with the transfer agent, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore, Maryland

February 17, 2012

| Tax Information (Unaudited) for the Tax Year Ended 12/31/11 |

SPECTRUM GROWTH FUND

We are providing this information as required by the Internal Revenue Code. The amounts shown may differ from those elsewhere in this report because of differences between tax and financial reporting requirements.

The fund’s distributions to shareholders included $3,530,000 from short-term capital gains.

For taxable non-corporate shareholders, $32,985,000 of the fund’s income represents qualified dividend income subject to the 15% rate category.

For corporate shareholders, $19,809,000 of the fund’s income qualifies for the dividends-received deduction.

The fund will pass through foreign source income of $15,178,000 and foreign taxes paid of $1,031,000.

SPECTRUM INCOME FUND

We are providing this information as required by the Internal Revenue Code. The amounts shown may differ from those elsewhere in this report because of differences between tax and financial reporting requirements.

The fund’s distributions to shareholders included $14,841,000 from short-term capital gains.

For taxable non-corporate shareholders, $18,154,000 of the fund’s income represents qualified dividend income subject to the 15% rate category.

For corporate shareholders, $17,220,000 of the fund’s income qualifies for the dividends-received deduction.

SPECTRUM INTERNATIONAL FUND

We are providing this information as required by the Internal Revenue Code. The amounts shown may differ from those elsewhere in this report because of differences between tax and financial reporting requirements.

For taxable non-corporate shareholders, $10,010,000 of the fund’s income represents qualified dividend income subject to the 15% rate category.

For corporate shareholders, $26,000 of the fund’s income qualifies for the dividends-received deduction.

The fund will pass through foreign source income of $11,816,000 and foreign taxes paid of $1,080,000.

| Information on Proxy Voting Policies, Procedures, and Records |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information, which you may request by calling 1-800-225-5132 or by accessing the SEC’s website, sec.gov. The description of our proxy voting policies and procedures is also available on our website, troweprice.com. To access it, click on the words “Our Company” at the top of our corporate homepage. Then, when the next page appears, click on the words “Proxy Voting Policies” on the left side of the page.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through our website, follow the directions above, then click on the words “Proxy Voting Records” on the right side of the Proxy Voting Policies page.

| How to Obtain Quarterly Portfolio Holdings |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s website (sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 450 Fifth St. N.W., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| About the Fund’s Directors and Officers |

Your fund is overseen by a Board of Directors (Board) that meets regularly to review a wide variety of matters affecting the fund, including performance, investment programs, compliance matters, advisory fees and expenses, service providers, and other business affairs. The Board elects the fund’s officers, who are listed in the final table. At least 75% of the Board’s members are independent of T. Rowe Price Associates, Inc. (T. Rowe Price), and its affiliates; “inside” or “interested” directors are employees or officers of T. Rowe Price. The business address of each director and officer is 100 East Pratt Street, Baltimore, Maryland 21202. The Statement of Additional Information includes additional information about the fund directors and is available without charge by calling a T. Rowe Price representative at 1-800-638-5660.

| Independent Directors | | |

| |

| Name | | |

| (Year of Birth) | | Principal Occupation(s) During Past Five Years and Directorships of |

| Year Elected* | | Other Public Companies |

| | | |

| William R. Brody, M.D., | | President and Trustee, Salk Institute for Biological Studies (2009 |

| Ph.D. | | to present); Director, Novartis, Inc. (2009 to present); Director, IBM |

| (1944) | | (2007 to present); President and Trustee, Johns Hopkins University |

| 2009 | | (1996 to 2009); Chairman of Executive Committee and Trustee, |

| | Johns Hopkins Health System (1996 to 2009) |

| | | |

| Jeremiah E. Casey | | Retired |

| (1940) | | |

| 2005 | | |

| | | |

| Anthony W. Deering | | Chairman, Exeter Capital, LLC, a private investment firm (2004 |

| (1945) | | to present); Director, Under Armour (2008 to present); Director, |

| 2001 | | Vornado Real Estate Investment Trust (2004 to present); Director, |

| | Mercantile Bankshares (2002 to 2007); Director and Member of the |

| | Advisory Board, Deutsche Bank North America (2004 to present) |

| | | |

| Donald W. Dick, Jr. | | Principal, EuroCapital Partners, LLC, an acquisition and management |

| (1943) | | advisory firm (1995 to present) |

| 1999 | | |

| | | |

| Karen N. Horn | | Senior Managing Director, Brock Capital Group, an advisory and |

| (1943) | | investment banking firm (2004 to present); Director, Eli Lilly and |

| 2003 | | Company (1987 to present); Director, Simon Property Group (2004 |

| | to present); Director, Norfolk Southern (2008 to present); Director, |

| | Fannie Mae (2006 to 2008) |

| | | |

| Theo C. Rodgers | | President, A&R Development Corporation (1977 to present) |

| (1941) | | |

| 2005 | | |

| | | |

| John G. Schreiber | | Owner/President, Centaur Capital Partners, Inc., a real estate |

| (1946) | | investment company (1991 to present); Cofounder and Partner, |

| 2001 | | Blackstone Real Estate Advisors, L.P. (1992 to present); Director, |

| | General Growth Properties, Inc. (2010 to present) |

| | | |

| Mark R. Tercek | | President and Chief Executive Officer, The Nature Conservancy (2008 |

| (1957) | | to present); Managing Director, The Goldman Sachs Group, Inc. |

| 2009 | | (1984 to 2008) |

| |

| *Each independent director oversees 130 T. Rowe Price portfolios and serves until retirement, resignation, or election of a successor. |

| |

| Inside Directors | | |

| |

| Name | | |

| (Year of Birth) | | |

| Year Elected* | | |

| [Number of T. Rowe Price | | Principal Occupation(s) and Directorships of Public Companies and |

| Portfolios Overseen] | | Other Investment Companies During the Past Five Years |

| | | |

| Edward C. Bernard | | Director and Vice President, T. Rowe Price; Vice Chairman of the |

| (1956) | | Board, Director, and Vice President, T. Rowe Price Group, Inc.; |

| 2006 | | Chairman of the Board, Director, and President, T. Rowe Price |

| [130] | | Investment Services, Inc.; Chairman of the Board and Director, |

| | T. Rowe Price Retirement Plan Services, Inc., T. Rowe Price Savings |

| | Bank, and T. Rowe Price Services, Inc.; Chairman of the Board, Chief |

| | Executive Officer, and Director, T. Rowe Price International; Chief |

| | Executive Officer, Chairman of the Board, Director, and President, |

| | T. Rowe Price Trust Company; Chairman of the Board, all funds |

| | | |

| Brian C. Rogers, CFA, CIC | | Chief Investment Officer, Director, and Vice President, T. Rowe Price; |

| (1955) | | Chairman of the Board, Chief Investment Officer, Director, and Vice |

| 2006 | | President, T. Rowe Price Group, Inc.; Vice President, T. Rowe Price |

| [74] | | Trust Company; Vice President, Spectrum Funds |

| |

| *Each inside director serves until retirement, resignation, or election of a successor. |

| Officers | | |

| |

| Name (Year of Birth) | | |

| Position Held With Spectrum Funds | | Principal Occupation(s) |

| | | |

| Christopher D. Alderson (1962) | | Director and President–International Equity, |

| Executive Vice President | | T. Rowe Price International; Company’s |

| | Representative, Director, and Vice President, |

| | Price Hong Kong; Director and Vice President, |

| | Price Singapore; Vice President, T. Rowe Price |

| | Group, Inc. |

| | | |

| Roger L. Fiery III, CPA (1959) | | Vice President, Price Hong Kong, Price |

| Vice President | | Singapore, T. Rowe Price, T. Rowe Price Group, |

| | Inc., T. Rowe Price International, and T. Rowe |

| | Price Trust Company |

| | | |

| John R. Gilner (1961) | | Chief Compliance Officer and Vice President, |

| Chief Compliance Officer | | T. Rowe Price; Vice President, T. Rowe Price |

| | Group, Inc., and T. Rowe Price Investment |

| | Services, Inc. |

| | | |

| Gregory S. Golczewski (1966) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Trust Company |

| | | |

| Gregory K. Hinkle, CPA (1958) | | Vice President, T. Rowe Price, T. Rowe Price |

| Treasurer | | Group, Inc., and T. Rowe Price Trust Company; |

| | | formerly Partner, PricewaterhouseCoopers LLP |

| | (to 2007) |

| | | |

| John H. Laporte, CFA (1945) | | Vice President, T. Rowe Price, T. Rowe Price |

| Executive Vice President | | Group, Inc., and T. Rowe Price Trust Company |

| | | |

| Patricia B. Lippert (1953) | | Assistant Vice President, T. Rowe Price and |

| Secretary | | T. Rowe Price Investment Services, Inc. |

| | | |

| Raymond A. Mills, Ph.D., CFA (1960) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., T. Rowe Price International, and |

| | T. Rowe Price Trust Company |

| | | |

| David Oestreicher (1967) | | Director and Vice President, T. Rowe Price |

| Vice President | | Investment Services, Inc., T. Rowe Price |

| | Retirement Plan Services, Inc., T. Rowe |

| | Price Services, Inc., and T. Rowe Price Trust |

| | Company; Vice President, Price Hong Kong, |

| | Price Singapore, T. Rowe Price, T. Rowe Price |

| | Group, Inc., and T. Rowe Price International |

| | | |

| Deborah D. Seidel (1962) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., and T. Rowe Price Investment |

| | Services, Inc.; Assistant Treasurer and Vice |

| | President, T. Rowe Price Services, Inc. |

| | | |

| Charles M. Shriver, CFA (1967) | | Vice President, T. Rowe Price and T. Rowe Price |

| President | | Group, Inc., T. Rowe Price International, and |

| | T. Rowe Price Trust Company |

| | | |

| Robert W. Smith (1961) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., and T. Rowe Price Trust Company |

| | | |

| Julie L. Waples (1970) | | Vice President, T. Rowe Price |

| Vice President | | |

| |

| Unless otherwise noted, officers have been employees of T. Rowe Price or T. Rowe Price International for at least 5 years. |

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors/Trustees has determined that Mr. Anthony W. Deering qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Deering is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

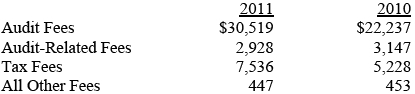

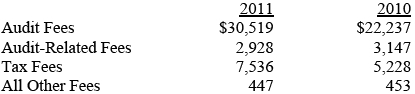

(a) – (d) Aggregate fees billed to the registrant for the last two fiscal years for professional services rendered by the registrant’s principal accountant were as follows:

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,764,000 and $1,417,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is attached.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

T. Rowe Price Spectrum Fund, Inc.

| | By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date February 17, 2012 | | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date February 17, 2012 | | |

| |

| |

| By | /s/ Gregory K. Hinkle |

| | Gregory K. Hinkle |

| | Principal Financial Officer |

| |

| Date February 17, 2012 | | |