May 2006

NYSE: NAV

Navistar International

Corporation

Investor Presentation

Information provided and statements contained in the presentation that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act, Section 21E of the Exchange Act, and the Private Securities Litigation Reform Act of 1995. Such forward-looking statements only speak as of the date of the presentation and the company assumes no obligation to update the information included in the presentation. Such forward-looking statements include information concerning our possible or assumed future results of operations, including descriptions of our business strategy. These statements often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate” or similar expressions. These statements are not guarantees of performance or results and they involve risks, uncertainties and assumptions, including the risk of continued delay in the completion of our financial statements and the consequences thereof, the availability of funds, either through cash on hand or the company’s other liquidity sources, to repay any amounts due should any of the company’s debt become accelerated, and decisions by suppliers and other vendors to restrict or eliminate customary trade and other credit terms for the company’s future orders and other services, which would require the company to pay cash and which could have a material adverse effect on the company’s liquidity position and financial condition. Although we believe that these forward-looking statements are based on reasonable assumptions, there are many factors that could affect our actual financial results or results of operations and could cause actual results to differ materially from those in the forward-looking statements. For a further description of these factors, see Exhibit 99.1 to our Form 8-K filed on April 6, 2006. In addition, until the previously announced review by the company of its accounts is concluded, no assurance can be given with respect to the financial statement adjustments, impacts and period resulting from such review, if any, nor can there be any assurance that additional adjustments to the financial statements of the company will not be identified.

Forward Looking Information

2

Parts Organization

•

Parts revenue and earnings provide non-cyclical earnings

•

Double digit growth in revenue and earnings

•

Most extensive distribution channel in Class 6-8 trucks and mid-range diesel engines

•

Wholesale – floor planning for

dealers

•

Retail financing for customers

•

Balance growth with prudent credit

and appropriate leverage

•

Focus on International’s truck dealer

and customer needs

•

Grow in higher margin related

segments

Finance Corporation

•

North American market share

leader with RV/Stripped chassis,

Class 6-7 trucks, Severe Service

and Regional haul Class 8 trucks

Class 6-7 trucks, Severe Service

and Regional haul Class 8 trucks

•

Manufacturing locations in U.S.,

Canada and Mexico

•

Trucks sold under the International® brand

•

Buses sold under the IC® brand

Truck Group

•

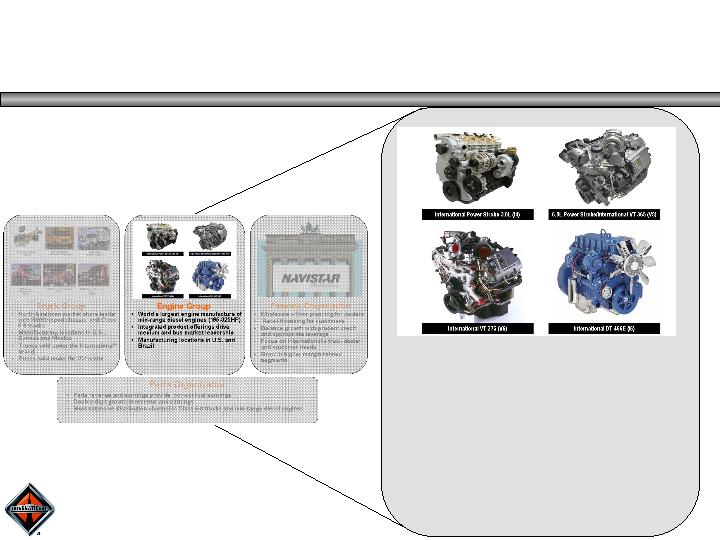

World’s largest engine manufacturer

of mid-range diesel engines

(165-325HP)

(165-325HP)

•

Integrated product offerings drive

medium and bus market leadership

•

Manufacturing locations in U.S. and

Brazil

Engine Group

On April 6, 2006, the company announced that the company’s previously issued audited financial statements and the independent auditors' reports thereon for the years ended October 31, 2002 through 2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

Corporate Overview

3

Great Products

Growth

Competitive Cost

Structure

Deliver On Our

Commitments

On April 6, 2006, the company announced that the company’s previously issued audited financial statements and the independent auditors' reports thereon for the years ended October 31, 2002 through 2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

4

•

World’s largest engine manufacturer of mid-range diesel engines (165-325HP)

•

Integrated product offerings drive medium and bus market leadership

•

Manufacturing locations in U.S. and Brazil

Engine Group

On April 6, 2006, the company announced that the company’s previously issued audited financial statements and the independent auditors' reports thereon for the years ended October 31, 2002 through 2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

Navistar – Diesel Engine Group

5

DT 466E (I6)

49% market share leader in

Class 6-7 Truck

and School Bus

Class 6-7 Truck

and School Bus

70,000 units*

6.0L Power Stroke

Approximately 50% market share

in heavy duty

diesel

pickup/vans

in heavy duty

diesel

pickup/vans

340,000 units*

Keys to Success - Great Products:

Performance and Quality

V6

For LCF

Class 4-5

10,000 units*

I4 / I6

50,000 units* – IESA

90,000 units* - MWM

South America Complete line of 3 - 7L products

MaxxForce Big Bore

MaxxForce 11 and 13 Liter Big Bore

Late 2007 Launch

*Annualized volumes

On April 6, 2006, the company announced that the company’s previously issued audited financial statements and the independent auditors' reports thereon for the years ended October 31, 2002 through 2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

Engine Group Strategy:

Grow Revenues to $4 Billion 10% ROS

6

On April 6, 2006, the company announced that the company’s previously issued audited financial

statements and the independent auditors' reports

thereon for the years ended October 31, 2002 through

2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

statements and the independent auditors' reports

thereon for the years ended October 31, 2002 through

2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

6.0L Power Stroke Diesel

•

HD pickup market and

dieselization continues to

grow

grow

•

Ford dieselization rate

above 70%

•

Power Stroke continues

to be the market leader

7

International Big Bore

11 to 13 liter range

“MaxxForce”

On April 6, 2006, the company announced that the company’s previously issued audited financial statements and the independent auditors' reports thereon for the years ended October 31, 2002 through

2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

Big Bore Diesel – Control our Destiny

•

Late 2007 launch

–

Only in Class 8 International Trucks

•

Cost competitive

–

Leverage scale in development and

procurement

•

Proven world-class performance,

fuel economy and NVH

•

Integrated Truck-Engine design

and development

•

Developed for North American

applications and emissions

8

Turning emissions requirements for 2007 into opportunities

•

Improved Performance in HP/Torque

•

Minimal impact to fuel economy and maintenance intervals

§

New Standards Are More Frequent and

Stringent

w

Higher Technology Spending

w

Capital Investments

w

Product Cost Increase

§

World Wide Regulations are Converging

w

Europe, South America, Asia and U.S.

Off Road

w

Big Challenge for Small Engine/Vehicle

Manufacturers

w

Scale

U.S. EPA On-Highway Emissions

NoX (gm/k W-hr)

2.4

.01

.10

.02

4.0

1.1

EPA 2007

EPA

2010

EPA 2004

EPA 2000

EURO + Off-Highway Emissions

NoX (gm/k W-hr)

.01

.10

.02

2.4

4.0

1.1

.15

5.0

EURO

V 2009

EURO

IV 2006

EURO III

2002

EURO II

Off road

2010

‘07 vs ‘04

90% PM

50%

NoX

90% PM

50%

NoX

.15

5.0

On April 6, 2006, the company announced that the company’s previously issued audited financial statements and the independent auditors' reports thereon for the years ended October 31, 2002 through 2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

Emissions Impacts

9

On April 6, 2006, the company announced that the company’s previously issued audited financial statements and the independentauditors' reports thereon for the years ended October 31, 2002 through 2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

Growth Provides Diversification

Keys to Success - Growth:

•

Base Business Growth

•

Integration of MWM in South America

•

Expanded Product Line/Scale

•

New Customers

10

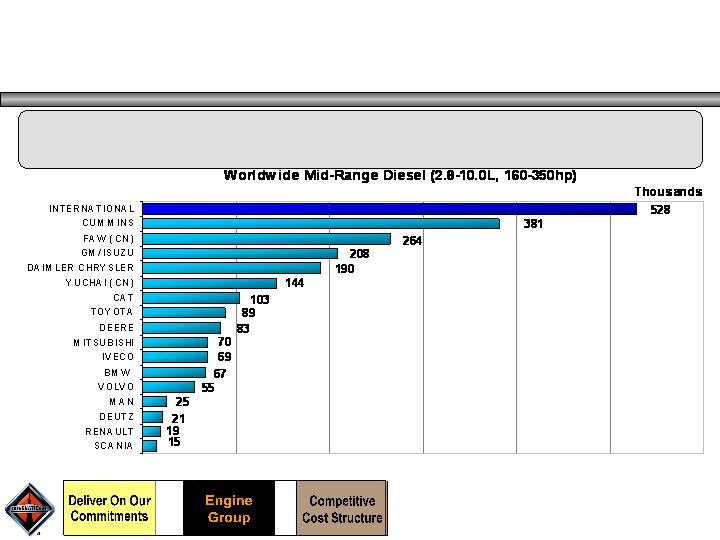

World Mid-range Diesel Leader

0

100

200

300

400

500

600

The acquisition of MWM has furthered leadership in

Mid-range diesel engine production

2005 Volume in thousands (000’s)

On April 6, 2006, the company announced that the company’ spreviously issued audited financial statements and the independent auditors' reports thereon for the years ended October 31, 2002 through 2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

11

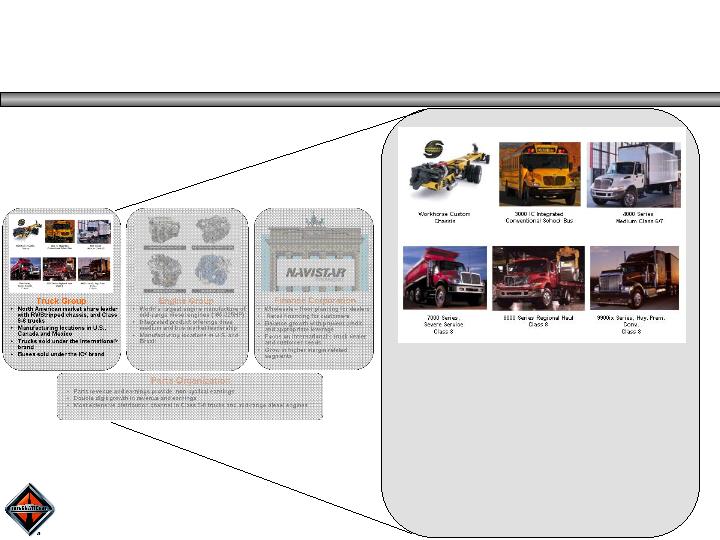

•

North American market share leader Class 6-8 trucks with RV/Stripped chassis

•

Manufacturing locations in U.S., Canada and Mexico

•

Trucks sold under the International® brand

•

Buses sold under the IC® brand

Truck Group

On April 6, 2006, the company announced that the company’s previously issued audited financial statements and the independent auditors' reports thereon for the years ended October 31, 2002 through 2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

Navistar - Truck Group

12

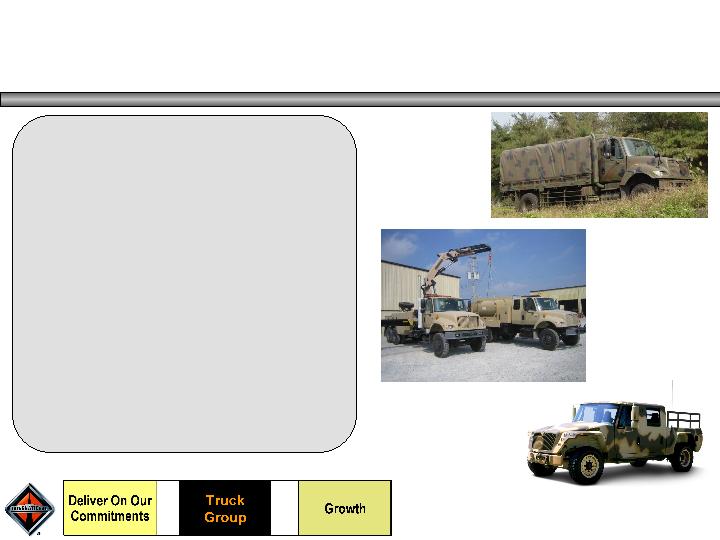

Mahindra International

On April 6, 2006, the company announced that the company’s previously issued audited financial statements and the independent auditors' reports thereon for the years ended October 31, 2002 through 2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

Truck Group

Our core business

•

International® brand trucks (CL 6-8)

•

IC® brand school buses

Now, we also have…

•

Military vehicles

•

Class 4-5 trucks

•

RV chassis, Workhorse® brand

•

Presence in Asia

13

School districts & local

municipalities

Local & regional delivery of beverage refrigeration, utilities, tow, municipalities & emergency rescue

Construction, waste management & other

on-off highway

applications

on-off highway

applications

Severe Service – 23.8%

Line-haul, local & regional delivery

Heavy (LH & RH) – 17.1%

2005 Combined Market Share – 27%

School Bus

Class 6-7

Combined Class 8 – 18.8%

Class 8

Medium – 39.5%

School Bus Chassis – 64.5%

School Buses Body – 60.7%

On April 6, 2006, the company announced that the company’s previously issued audited financial statements and the independent auditors' reports thereon for the years ended October 31, 2002 through 2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

North American Market Share Leader in

Class 6-8 Trucks and School Bus

14

Benefits

On April 6, 2006, the company announced that the company’s previously issued audited financial statements and the independent auditors' reports thereon for the years ended October 31, 2002 through 2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

The ProStar will deliver best in class fuel economy, lowest cost of ownership, unparalleled driver satisfaction, and unprecedented uptime.

•

Supports the $6,000

per truck cost reduction

•

Generates Excitement

•

4%+ Fuel Economy

15

Vehicles for Afghanistan

MXT-MV

On April 6, 2006, the company announced that the company’s previously issued audited financial statements and the independent auditors' reports thereon for the years ended October 31, 2002 through 2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

Delivering New Markets…

Military Business

14 contracts won to date

•

Total potential value = > $1B

•

1,300 units delivered in 2005

•

Potential for 10,000 more units

over next 5 years

•

FTTS Development Agreement

International Advantage

•

Existing platforms

•

Scale

•

Aggressive Delivery

•

Best Value

16

Tires

Korea

Stampings

India

Castings

India

12%

Gross

savings

25%

Gross

savings

Examples

23%

Gross

savings

On April 6, 2006, the company announced that the company’s previously issued audited financial statements and the independent auditors' reports thereon for the years ended October 31, 2002 through 2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

Delivering…

World-Class Competitive Costs

Global Sourcing

Buying more materials from lower-cost countries, $200M by end of 2006

17

Combined Class 8

Class 6-8

On April 6, 2006, the company announced that the company’s previously issued audited financial statements and the independent auditors' reports thereon for the years ended October 31, 2002 through 2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

Retail Class 6-8 Industry Landscape

18

New products and markets will enhance the growth of our business

while our cost structure drives increasing profitability

2007

2004*

Consolidated Sales and

Revenue of $9.7 Billion

5.8% Segment Margins

Diluted EPS of $3.20

Total NA Industry

Demand 344,700

Total NA Industry

Demandê

2005 Actual

414,500 Units

2006 Forecast

425,000 Units

Offset:

Truck Parts é

Cost Reductions é

Military é

Workhorse é

Export é

India é

Total NA Industry Demand

* As reported in the 2004 Annual Report/10K. On April 6, 2006, the company announced that the company’s previously issued audited financial statements and the independent auditors' reports thereon for the years ended October 31, 2002 through 2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

What it Means for Truck Group in

2007 and beyond

19

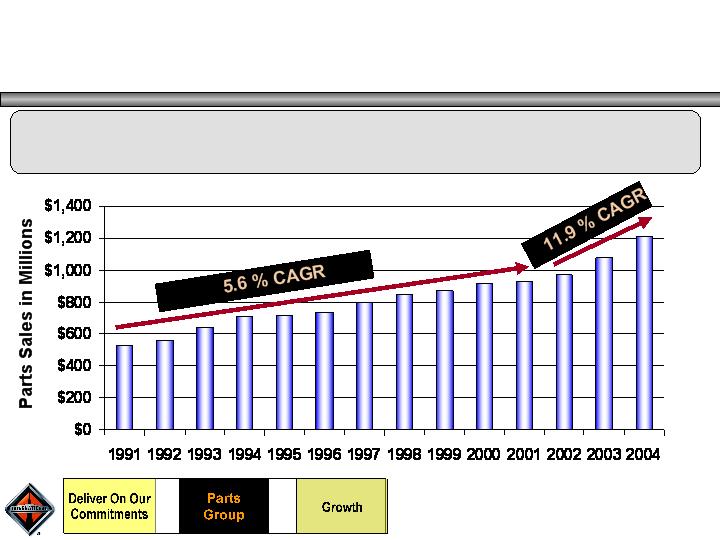

Parts Organization

•

Parts revenue and earnings provide non-cyclical earnings

•

Double digit growth in revenue and earnings

•

Most extensive distribution channel in Class 6-8 trucks and mid-range diesel engines

On April 6, 2006, the company announced that the company’s previously issued audited financial statements and the independent auditors' reports thereon for the years ended October 31, 2002 through 2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

Navistar – Parts Organization

20

Parts Group Value Proposition: Provide unparalleled service

to our customers while delivering consistent results

On April 6, 2006, the company announced that the company’s previously issued audited financial statements and the independent auditors' reports thereon for the years ended October 31, 2002 through 2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

Parts Organization

•

Through unparalleled service to our customers, the Parts business:

–

Provides our dealer and customer base with a world-class parts

distribution network

–

Plays an integral role in the value proposition in support of selling

trucks

–

Plays a primary role in maintaining customer perceptions of

International’s quality

•

Non-Cyclical Business with Richer Margins

21

Provide consistent results while delivering steady growth

On April 6, 2006, the company announced that the company’s previously issued audited financial statements and the independent auditors' reports thereon for the years ended October 31, 2002 through 2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

Parts Delivers Non-Cyclical Results

22

Examples of opportunities for significant growth

•

Military

Part usage 4 - 5 x more per truck

due to rugged environment

•

International Big Bore Engine

On April 6, 2006, the company announced that the company’s previously issued audited financial statements and the independent auditors' reports thereon for the years ended October 31, 2002 through 2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

Additional Growth Opportunities

•

Workhorse / UpTime Parts

865 retail locations plus an established

direct parts sales business

23

•

Support the Navistar strategy by providing funding and liquidity to International, its Dealers, and Customers

•

Wholesale and Retail financing

•

Balance growth with prudent credit

and appropriate leverage

•

Focus on International’s truck dealer

and customer needs

Finance Corporation

On April 6, 2006, the company announced that the company’s previously issued audited financial statements and the independentauditors' reports thereon for the years ended October 31, 2002 through 2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

Navistar – Finance Corporation

24

Provides consistency of income and creates liquidity for ITEC receivables

On April 6, 2006, the company announced that the company’s previously issued audited financial statements and the independent auditors' reports thereon for the years ended October 31, 2002 through 2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

Finance Corporation

•

Provide Consistent Income Over the Cycle

–

Last 10 Yrs: Min PBT $75M, Max PBT $124M

–

Next 10 Yrs: Expect to deliver Min PBT $100M consistently

•

Facilitate wholesale ($1.5B Portfolio) and retail ($3.7B Portfolio) Truck Sales

–

Finance 95% of U.S. International dealers’ wholesale floorplan

–

Provide retail financing to International customers

•

Total FMS Goal: Grow from 15% to 20% but with better credit

•

85% commercial, fleet

•

Support International’s Cash Flow Requirements

–

International has almost zero A/R

–

Last 10 Yrs Dividends and Tax Payments paid to International: $622M

25

*As reported in the 2003 and 2004 Annual Report/10K. On April 6, 2006, the company announced that the company’s previously issued audited financial statements and the independent auditors' reports thereon for the years ended October 31, 2002 through 2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements. Note: Deal Cor Revenues excluded from information shown above

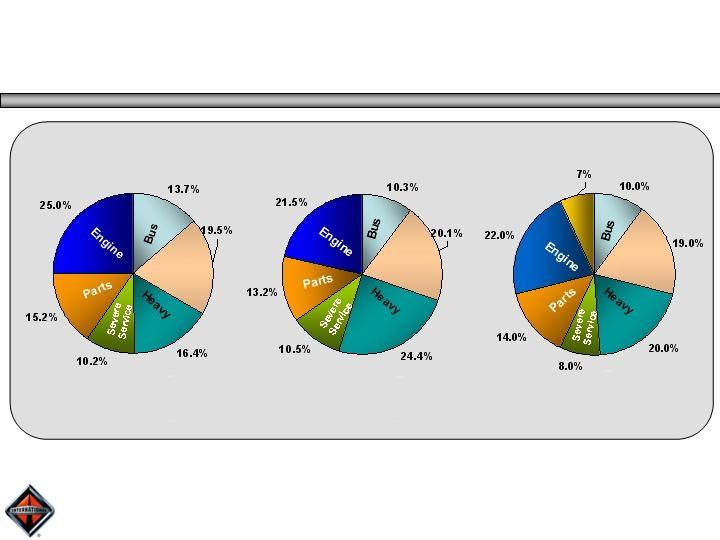

FY 2003*

FY 2004*

FY 2009 Fcst

Medium

Medium

Medium

GVW/

Military

Consolidated Revenues of

$7.6 Billion

Prior Trough

Consolidated Revenues of

$9.7 Billion

Cycle Midpoint

$15 Billion Revenue Goal

Next Peak

Manufacturing Revenues*

26

Total Industry Demand

Cycle Midpoint

344,700 Units

Focused on Creating Shareholder Value by

having good returns at all points in the cycle

>10 % Ave Segment

Margins

Record EPS

2004*

Consolidated Sales and

Revenue of $9.7 Billion

2009 Goal

Consolidated Sales and

Revenue of $15 Billion

5.8% Ave Segment

Margins

EPS of $3.20

2003*

Consolidated Sales and

Revenue of $7.6 Billion

2.1% Ave Segment

Margins

Total Industry Demand

Prior Trough

263,400 Units

UP

EPS of ($0.31)

*As reported in the 2003 and 2004 Annual Report/10K. On April 6, 2006, the company announced that the company’s previously issued audited financial statements and the independent auditors' reports thereon for the years ended October 31, 2002 through 2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

Navistar – Expanding Beyond Traditional Markets

27

*As reported September 7th, 2005 3rd Quarter conference call. On April 6, 2006, the company announced that the company’s previously issued audited financial statements and the independent auditors' reports thereon for the years ended October 31, 2002 through 2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements.

§

As of 7/31/05 manufacturing debt was $1,803. This consist of $1,435 of outstanding public notes and the remaining

$368 is primarily wholly owned dealer debt.*

§

02/24/06 Obtained $1.5 Billion Bridge loan Facility (floating rate)

§

03/07/06 Navistar borrowed ~$545 million to repurchase

Ø

$276 million 9.375% senior (exit tender)

Ø

$234 million 7.5% senior (exit tender)

§

03/24/06 Navistar borrowed ~$614 million to repurchase

Ø

$217 million 4.75% convertible notes (98.6% tendered)

Ø

$400 million 6.25% senior notes (100% accelerated)

Fixed Rate

2005

2006

2007

2008

2009

2010+

9 3/8% Senior Public Debt Due 6/2006

-

393

-

-

-

-

2 1/2% Senior Convertible Debt Due 12/2007

-

-

-

190

-

-

4 3/4% Convertible Debt Due 4/2009

-

-

-

-

202

-

7 1/2% Senior Public Debt Due 6/2011

-

-

-

-

-

250

6 1/4% Senior Public Debt Due 3/2012

-

-

-

-

-

400

Total

-

$

393

$

-

$

190

$

202

$

650

$

NAVISTAR FISCAL YEAR (

as of 07/31/05

)*

($Millions)

Manufacturing Debt

28