- NAV Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Navistar International (NAV) 8-KRegulation FD Disclosure

Filed: 8 May 07, 12:00am

EXHIBIT 99.1

| Navistar International Corporation Other OTC: NAVZ May 2007 |

| Forward Looking Information Information provided and statements contained in the presentation that are not purely historical are forward -looking statements within the meaning of Section 27A of the Securities Act, Section 21E of the Exchange Act, and the Private Securities Litigation Reform Act of 1995. Such forward-looking statements only speak as of the date of the presentation and the company assumes no obligation to update the information included in the presentation. Such forward-looking statements include information concerning our possible or assumed future results of operations, including descriptions of our business strategy. These statements often include words such as "believe," "expect," "anticipate," "intend," "plan," "estimate" or similar expressions. These statements are not guarantees of performance or results and they involve risks, uncertainties and assumptions , including the risk of continued delay in the completion of our financial statements and the consequences thereof, the availability of funds, either through cash on hand or the company's other liquidity sources, to repay any amounts due should any of the company's debt become accelerated, and decisions by suppliers and other vendors to restrict or eliminate customary trade and other credit terms for the company's future orders and other services, which would require the company to pay cash and which could have a material adverse effect on the company's liquidity position and financial condition. Although we believe that these forward-looking statements are based on reasonable assumptions, there are many factors that could affect our actual financial results or results of operations and could cause actual results to differ materially from those in the forward-looking statements. For a further description of these factors, see Exhibit 99.1 to our Form 8-K filed on April 6, 2006. In addition, until the previously announced review by the company of its accounts is concluded, no assurance can be given with respect to the financial statement adjustments, impacts and period resulting from such review, if any, nor can there be any assurance that additional adjustments to the financial statements of the company will not be identified. |

| Other Cautionary Legends As announced on April 6, 2006, the company's previously issued audited financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements. On November 8, 2006, the company's finance subsidiary, Navistar Financial Corporation (NFC), announced that its previously issued audited financial statements for the years ended October 31, 2002 through 2004 and all quarterly financial statements for the periods after November 1, 2002 should no longer be relied on because of errors in such financial statements. Until the company and NFC complete the review of their accounts and the restatement of financial statements, no assurance can be given with respect to the financial statement adjustments and impacts resulting from such review. The financial data presented in this package for the 2005 fourth quarter, the 2006 first, second, third and fourth quarters and the 2007 first quarter are preliminary and unaudited and are subject to change based on the completion of our on-going review of accounting matters, the completion of our 2005 fourth quarter, 2006 first, second, third and fourth quarters and 2007 first quarter financial statements and the completion of the restatement of our financial results for the fiscal years 2002 through 2004 and for the first nine months of fiscal 2005. It is likely that the process of restating the prior year financial statements will require changes to the company's financial statements for 2005 and financial information for 2005, 2006, and 2007 due to revised application of certain accounting principles and methodologies that, individually or in the aggregate, may be material. |

| 1943 1918 1942 1936 1924 1950s 1912 1909 Over 100 years of building and shaping history 2007 2001 |

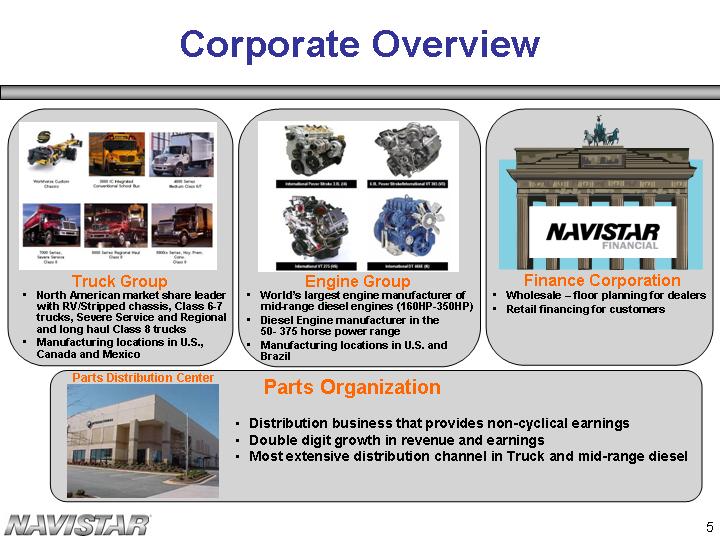

| Corporate Overview Parts Organization Distribution business that provides non-cyclical earnings Double digit growth in revenue and earnings Most extensive distribution channel in Truck and mid-range diesel Wholesale - floor planning for dealers Retail financing for customers Finance Corporation North American market share leader with RV/Stripped chassis, Class 6-7 trucks, Severe Service and Regional and long haul Class 8 trucks Manufacturing locations in U.S., Canada and Mexico Truck Group World's largest engine manufacturer of mid-range diesel engines (160HP-350HP) Diesel Engine manufacturer in the 50- 375 horse power range Manufacturing locations in U.S. and Brazil Engine Group Parts Distribution Center |

| Traditional U.S. and Canada Retail Class 6 - 8 Industry Landscape Combined Class 8 Class 6 - 8 *Navistar's fiscal year is 11/1-10/31 |

| Our strategy expected to enable us to deliver our 2009 goal Competitive Cost Structure Profitable Growth Great Products Leveraging what we have and what others have built FY 2009 Goals $15 Billion Revenue $1.5 Billion Segment Margins >10% Average Segment Margins Improve cost structure while developing synergistic niche businesses with richer margins Improve conversion rate of operating income into net income Reduce cyclicality Grow Parts Non-Traditional |

| U.S. and Canada Market Share Leader in Class 6-8 Trucks and School Bus Best 1st quarter in 4 years We expect full-year 2007 Bus market share to be same as 2006 Medium Q107 market share - 36.1% We expect full-year 2007 Medium market share to be same as 2006 Severe Service Q107 market share - 24.1% Heavy (LH &RH) Q107 market share - 15.7% Combined Q107 Class 8 market share - 17.9% We expect to gain 1% market share in line- haul Class 8 by end of FY07 *Market Share (1,2) - Information is compiled using Wards, ACT and POLK data combined with company internal reports. Market share information reflects retail sales in the United States and Canada for School Bus and Classes 6-8. COMBINED CLASS 8 CLASS 6-7 BUS |

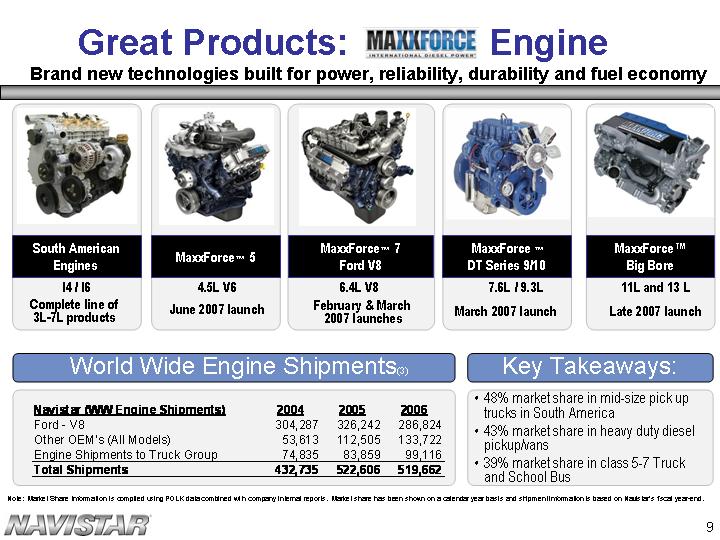

| MaxxForce (tm) DT Series 9/10 MaxxForce(tm) 7 Ford V8 Brand new technologies built for power, reliability, durability and fuel economy MaxxForce(tm) 5 South American Engines MaxxForce(tm) Big Bore 11L and 13 L Late 2007 launch 6.4L V8 4.5L V6 7.6L / 9.3L Great Products: Engine Note: Market Share Information is compiled using POLK data combined with company internal reports. Market share has been shown on a calendar year basis and shipment information is based on Navistar's fiscal year-end. World Wide Engine Shipments(3) March 2007 launch February & March 2007 launches June 2007 launch 48% market share in mid-size pick up trucks in South America 43% market share in heavy duty diesel pickup/vans 39% market share in class 5-7 Truck and School Bus Complete line of 3L-7L products Key Takeaways: I4 / I6 |

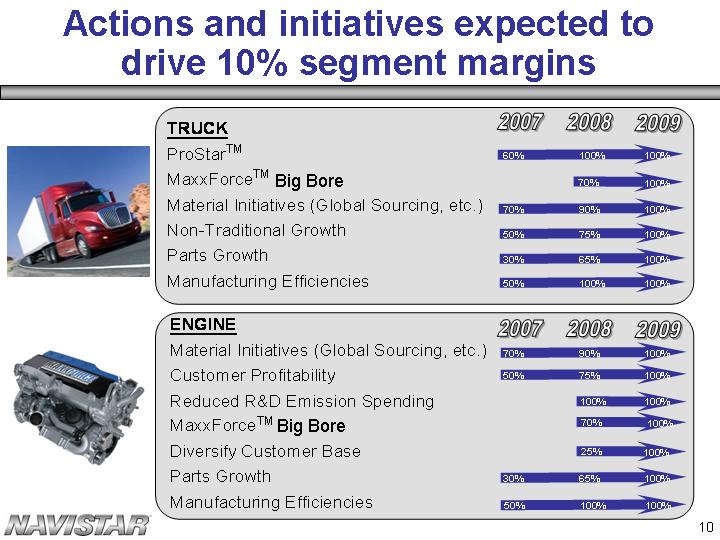

| Actions and initiatives expected to drive 10% segment margins 2007 2008 2009 2007 2008 2009 60% 100% 100% 70% 100% 70% 90% 100% 50% 75% 100% 30% 65% 100% 50% 100% 100% 50% 75% 100% 70% 90% 100% 30% 65% 100% 50% 100% 100% 25% 100% 70% 100% 100% 100% Big Bore Big Bore |

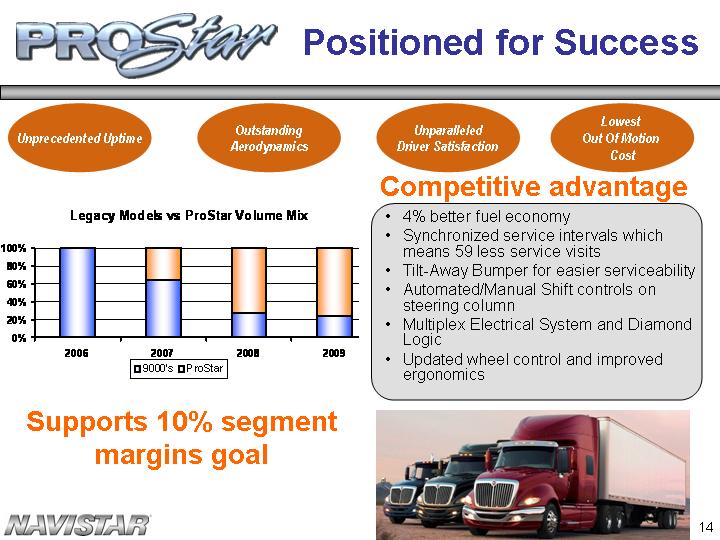

| Unparalleled Driver Satisfaction Unprecedented Uptime Outstanding Aerodynamics Lowest Out Of Motion Cost Superior product with reduced cost structure |

| Aerodynamics *Based on Full Scale Wind Tunnel Test of nearest competitor using competitor's latest model at time of testing ProStar ProStar 9.4% Improvement versus nearest competitor* 4-5% Fuel Efficiency We expect MaxxForce(tm) Big Bore will further increase fuel efficiency Drag Coefficients from Wind Tunnel Worst Best Competition |

| Out of Motion Cost Driver Satisfaction Unprecedented Uptime Over six million miles of road testing Two years of real-world testing with customers running in their actual applications Ten simulated years in shaker durability tests Result: Tested and proven road-ready vehicles at launch |

| Positioned for Success 4% better fuel economy Synchronized service intervals which means 59 less service visits Tilt-Away Bumper for easier serviceability Automated/Manual Shift controls on steering column Multiplex Electrical System and Diamond Logic Updated wheel control and improved ergonomics Competitive advantage Unparalleled Driver Satisfaction Unprecedented Uptime Outstanding Aerodynamics Lowest Out Of Motion Cost Supports 10% segment margins goal |

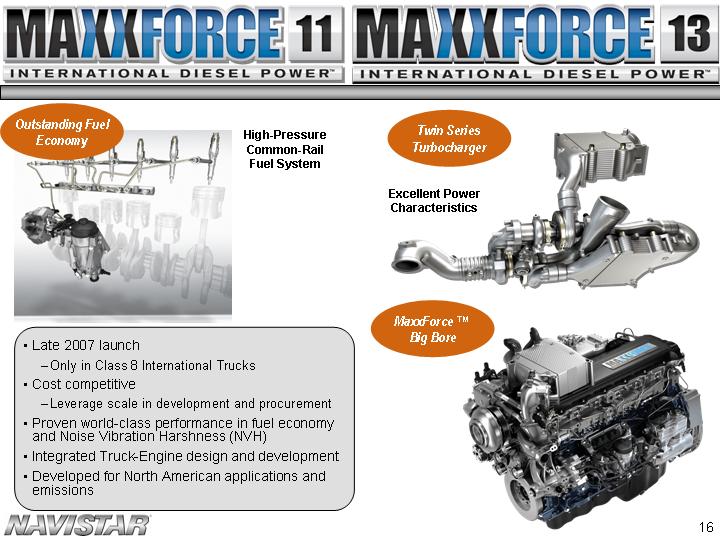

| Path to 10% Segment Margins -ENGINE Focus is on customer base and recovering emissions Broaden Customer Base: Profitability Required from all Customers Recovery of Emissions Global Sourcing MaxxForce(tm) Big Bore Competitive Advantage in 2010 Emissions Technology Parts Growth Manufacturing Efficiencies Engine plans to achieve 2009 goals MaxxForce (tm) Big Bore 11 liter & 13 liter |

| Outstanding Fuel Economy Twin Series Turbocharger MaxxForce (tm) Big Bore Late 2007 launch Only in Class 8 International Trucks Cost competitive Leverage scale in development and procurement Proven world-class performance in fuel economy and Noise Vibration Harshness (NVH) Integrated Truck-Engine design and development Developed for North American applications and emissions High-Pressure Common-Rail Fuel System Excellent Power Characteristics |

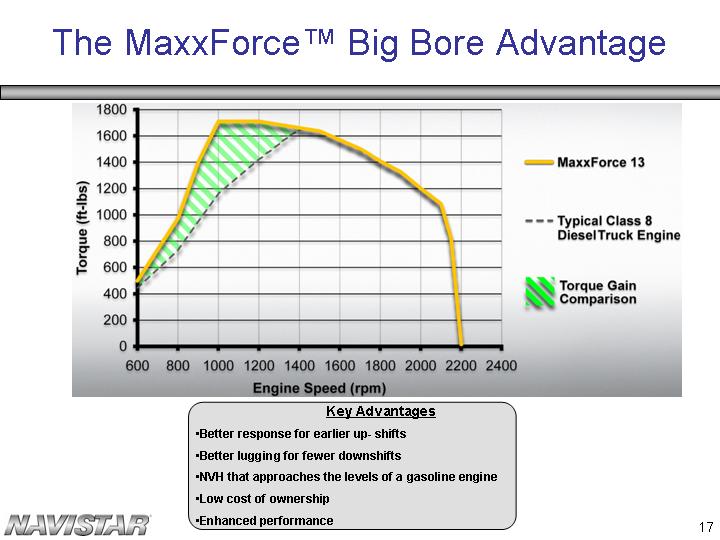

| The MaxxForce(tm) Big Bore Advantage Key Advantages Better response for earlier up- shifts Better lugging for fewer downshifts NVH that approaches the levels of a gasoline engine Low cost of ownership Enhanced performance |

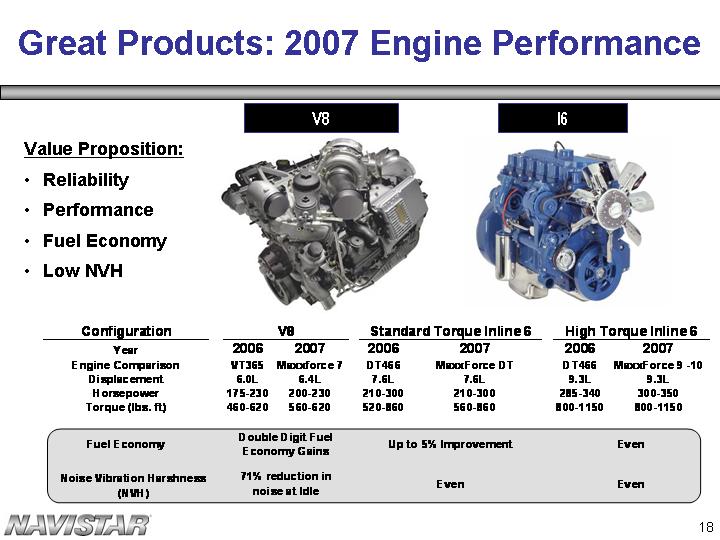

| I6 V8 Great Products: 2007 Engine Performance Value Proposition: Reliability Performance Fuel Economy Low NVH |

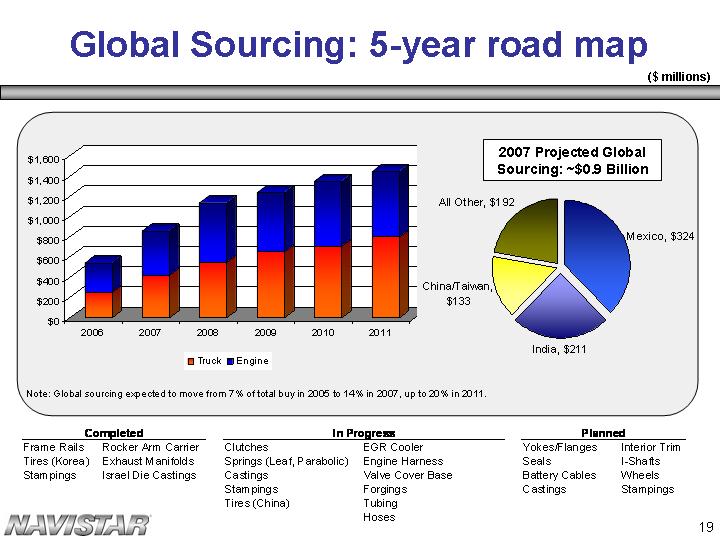

| Global Sourcing: 5-year road map 2007 Projected Global Sourcing: ~$0.9 Billion ($ millions) Note: Global sourcing expected to move from 7% of total buy in 2005 to 14% in 2007, up to 20% in 2011. |

| Growth in non-traditional segments Utilizing what we have and what others have built Non-Traditional Military Export (Mexico and all other countries) Small Bus and Commercial Bus Workhorse (Commercial Chassis and RV's) Class 4/5 LCF Class 5 Conventional Non-Traditional Big Bore Engine New Engine Customers Non-Traditional Big Bore Engine Parts Military and Export Parts Small Bus and Commercial Bus Parts Class 4 and 5 Parts Workhorse Parts |

| Mexico & Export Increase export market share 9400 CE 300 Traditional U.S and Canada Bus and Class 6-8 Industry (Last 5 years market ranges from 263K - 455K units) 4400 Military Units delivered: FY 2005 - ~1,300 FY 2006 - ~2,900 Commercial Bus Industry ranges from 9K - 13K CF and Conventional Class 4/5 Industry ranges from 20K - 30K Industry ranges from 45K - 60K Workhorse Cl 3-7 Industry ranges* from 35K - 45K 2007 Non-Traditional Opportunities - We expect to ship 35,000 to 40,000 units *Includes Commercial Chassis and RV units Great Products: Growth |

| Delivering Profitable Growth Military 155 MM Test "Equal if not greater than threat levels that we deal with in Iraq and Afghanistan" Government Contractor unit used throughout Iraq IED/Land Mine Attack ***Contractor Survived*** Demonstrator delivered March 2007 |

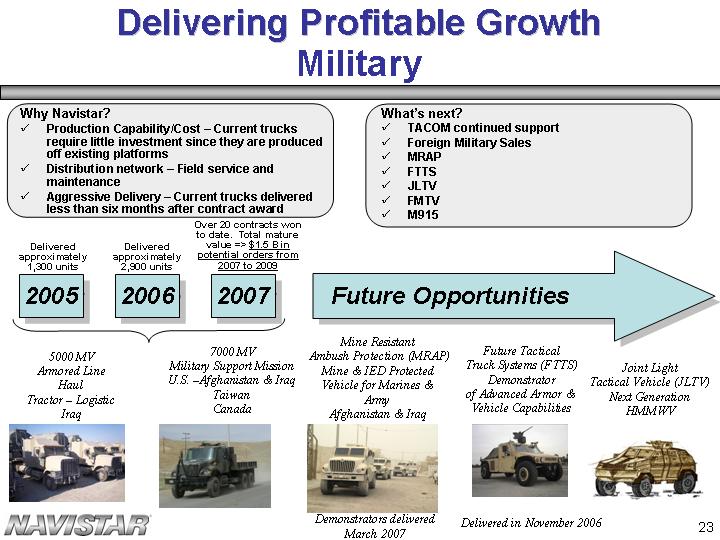

| Delivering Profitable Growth Military 2005 2006 2007 Delivered approximately 1,300 units Over 20 contracts won to date. Total mature value => $1.5 B in potential orders from 2007 to 2009 Future Opportunities Delivered approximately 2,900 units 5000 MV Armored Line Haul Tractor - Logistic Iraq 7000 MV Military Support Mission U.S. -Afghanistan & Iraq Taiwan Canada Future Tactical Truck Systems (FTTS) Demonstrator of Advanced Armor & Vehicle Capabilities Mine Resistant Ambush Protection (MRAP) Mine & IED Protected Vehicle for Marines & Army Afghanistan & Iraq Joint Light Tactical Vehicle (JLTV) Next Generation HMMWV Why Navistar? Production Capability/Cost - Current trucks require little investment since they are produced off existing platforms Distribution network - Field service and maintenance Aggressive Delivery - Current trucks delivered less than six months after contract award What's next? TACOM continued support Foreign Military Sales MRAP FTTS JLTV FMTV M915 Delivered in November 2006 Demonstrators delivered March 2007 |

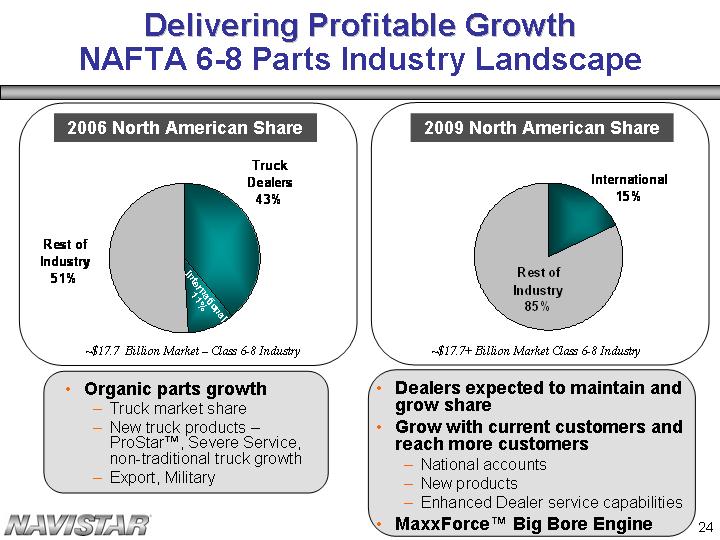

| Organic parts growth Truck market share New truck products - ProStar(tm), Severe Service, non-traditional truck growth Export, Military International Rest of Industry 2.993 13.707 Delivering Profitable Growth NAFTA 6-8 Parts Industry Landscape Truck Dealers Rest of Industry 0.43 0.11 0.56 ~$17.7 Billion Market - Class 6-8 Industry ~$17.7+ Billion Market Class 6-8 Industry Dealers expected to maintain and grow share Grow with current customers and reach more customers National accounts New products Enhanced Dealer service capabilities MaxxForce(tm) Big Bore Engine 2006 North American Share 2009 North American Share International 11% |

| Actions and initiatives expected to drive 10% segment margins 2007 2008 2009 2007 2008 2009 60% 100% 100% 70% 100% 70% 90% 100% 50% 75% 100% 30% 65% 100% 50% 100% 100% 50% 75% 100% 70% 90% 100% 30% 65% 100% 50% 100% 100% 25% 100% 70% 100% 100% 100% Big Bore Big Bore |

| Total U.S. & Canada Industry ? What it Means for Navistar in 2007 and beyond Total U.S. & Canada Industry Demand *On April 6, 2006, the company announced that the company's previously issued audited financial statements and the independent auditors' reports thereon for the years ended October 31, 2002 through 2004, and all quarterly financial statements for periods after November 1, 2002 should no longer be relied upon because of errors in such financial statements. 2007 Offset: Cost Reductions ? Parts ? Military ? Workhorse ? Export ? India ? MWM ? Reduced Breakeven Record EPS >10% Average Segment Margins 2009 Goal Consolidated Sales and Revenue of $15 Billion Great Products Competitive Cost Structure Profitable Growth 3 Pillar Strategy Leveraging what we have and what others have built |

| Q&A |