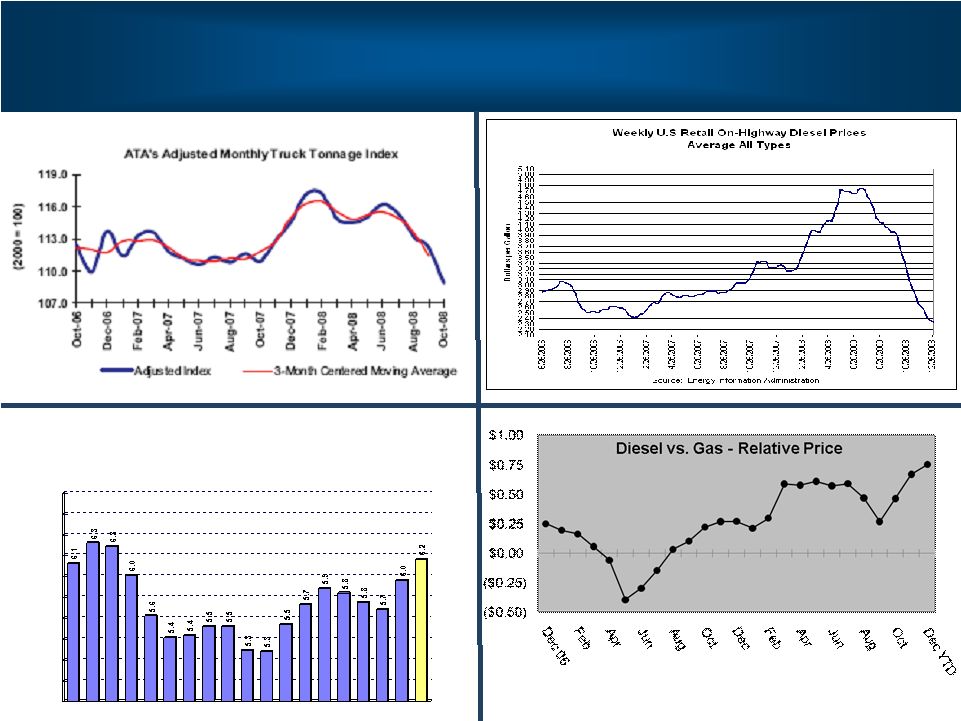

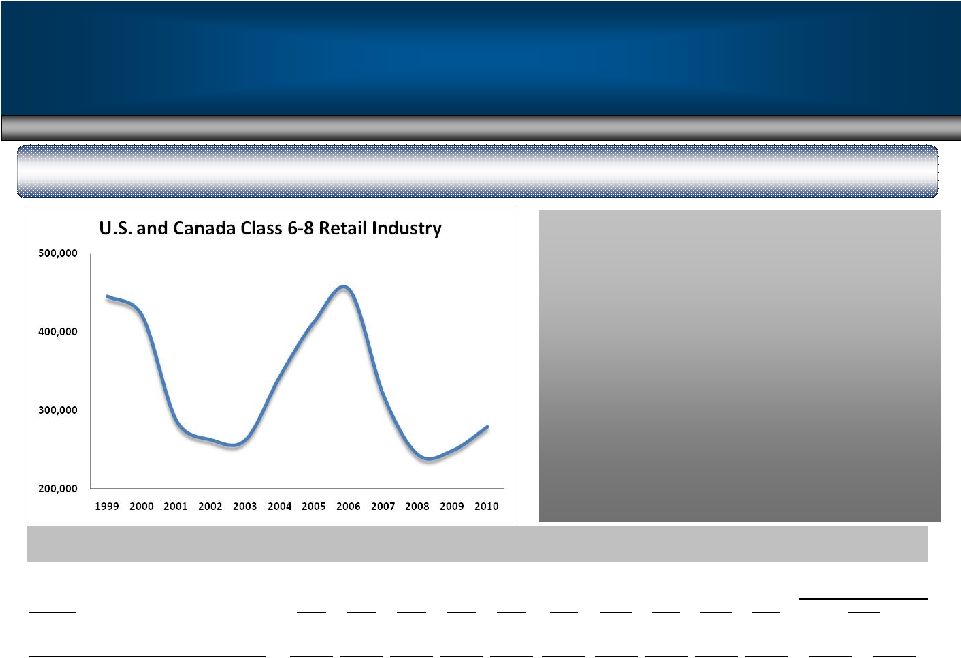

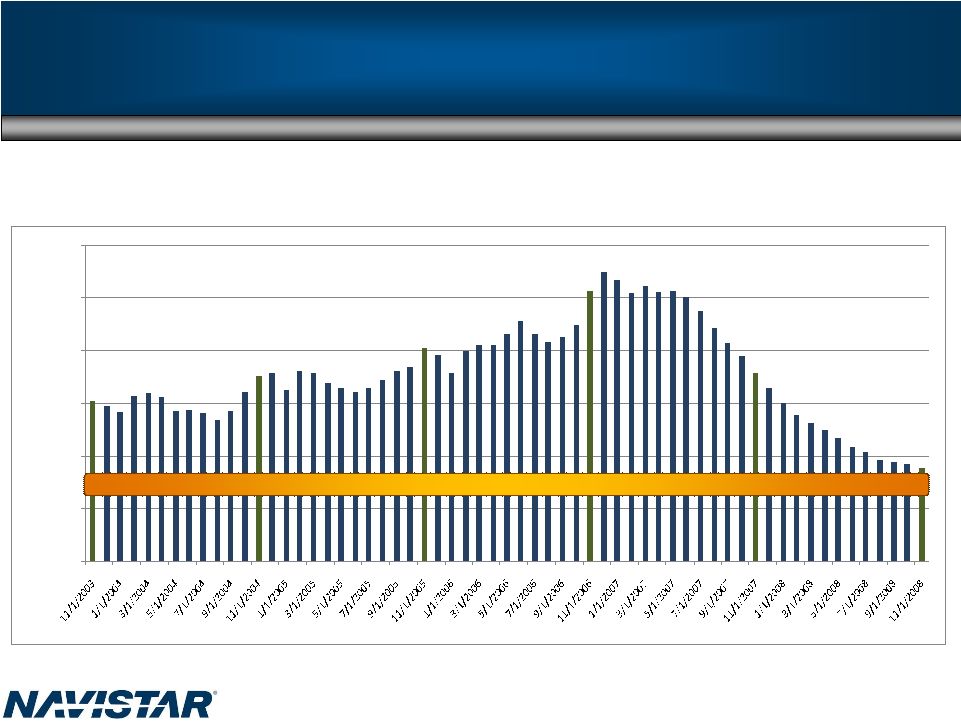

Industry Moving More Into Diesel 20 Exxon boosts diesel output as others scale back Exxon Mobil, which had $37 billion in cash at the end of the third quarter, will expand production at its refineries in Baton Rouge, La., Baytown, Texas, and Antwerp, Belgium. Baytown is the largest U.S. refinery. The Associated Press 12/16/2008 HOUSTON — Exxon Mobil Corp., the world's biggest oil refiner, will spend more than $1 billion in the next couple of years to increase its global production of cleaner-burning diesel by about 10 percent, the company said Monday. The announcement comes as many oil producers and refiners scale back spending because of the sharp decline in crude prices, dismal expectations for energy demand in 2009 and tight credit markets that have put many big capital expenditures out of reach. When the upgrades are completed in 2010, Irving, Texas-based Exxon Mobil will account for about 8 percent of the world's diesel output, up about 1 percent from current levels, said Sherman Glass, the oil giant's president of refining and supply. Exxon Mobil, which had $37 billion in cash at the end of the third quarter, will expand production at its refineries in Baton Rouge, La., Baytown, Texas, and Antwerp, Belgium. Baytown is the largest U.S. refinery. While acknowledging the global economic downturn and its significant impact on energy consumption, Glass said there is growing global demand for ultra-low-sulfur diesel, also known as ULSD. "We test our investments against a variety of scenarios, regardless of what the short-term economic environment is," Glass said. "Our view is these projects will be robust for a long period of time to come." ULSD, which helps reduce emissions, was introduced for highway use in 2006 and already is available at gas stations across the United States. By December 2010, it will be the only highway diesel available at retail outlets, as mandated by the U.S. Environmental Protection Agency. Over the next few years, locomotives and marine vessels also will be required to make the switch to cleaner-burning diesel to meet new federal emission standards. "Virtually all the diesel here in the U.S. will be ... ultra-low sulfur by 2012," said Al Mannato, a fuels expert at the American Petroleum Institute. Demand also is growing overseas. During the past decade, diesel demand in Europe has risen more than 15 percent, while gasoline demand has actually fallen 22 percent, according to statistics on the API Web site. Mannato said fewer European exports coupled with rising diesel consumption at home are two reasons diesel is nearly $1-a-gallon more costly than gasoline in the United States. Some Exxon competitors have recently delayed refining projects because of volatile global markets. ConocoPhillips and the state-run Saudi Arabian Oil Co. said last month they'd postponed construction of a multibillion-dollar refinery in Saudi Arabia. The project was in the construction-bidding process, and the two partners said they'll rebid it in the second quarter of 2009. Marathon Oil Co. also has delayed expansion of a gasoline refinery in Detroit because of market conditions. Sen. James Inhofe (R-Okla.), Ranking Member of the Environment and Public Works Committee, joined fellow GOP Senators and members of the U.S. trucking industry to call for lower gas prices to help truckers ship goods, met with Oklahoma business leaders of NAVISTAR to discuss diesel prices. "Today I joined with Senate Republicans and leaders from the trucking industry to once again emphasize the need for the United States Senate to act on bringing down the price of gas at the pump," Senator Inhofe said. "From transporting goods across the country, to finding ways to pay for our nation's infrastructure, high gas prices impact every aspect of our lives." |