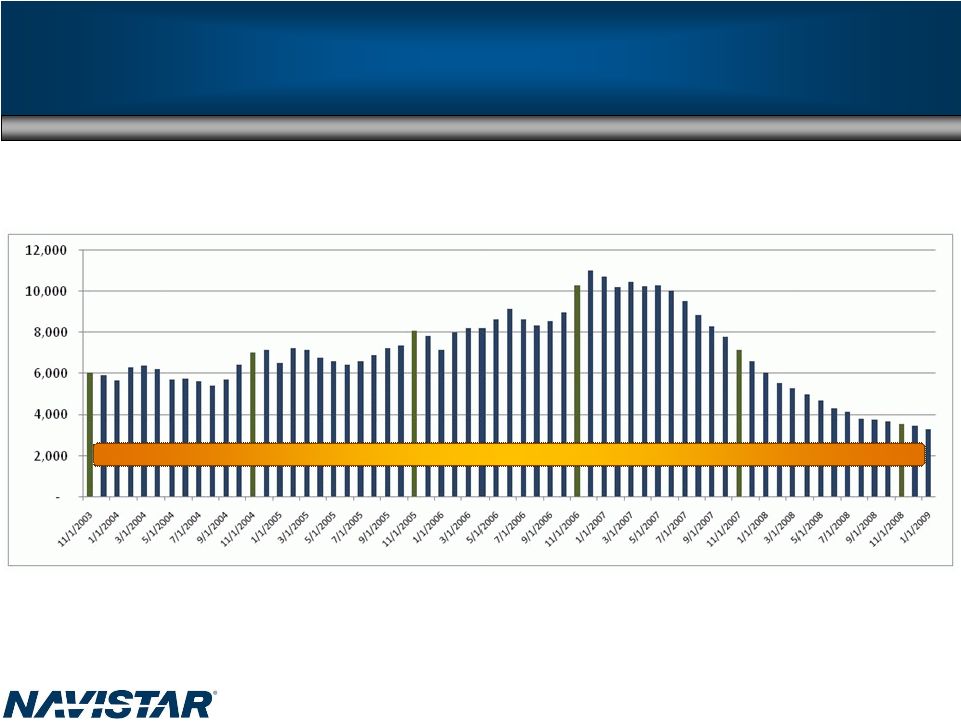

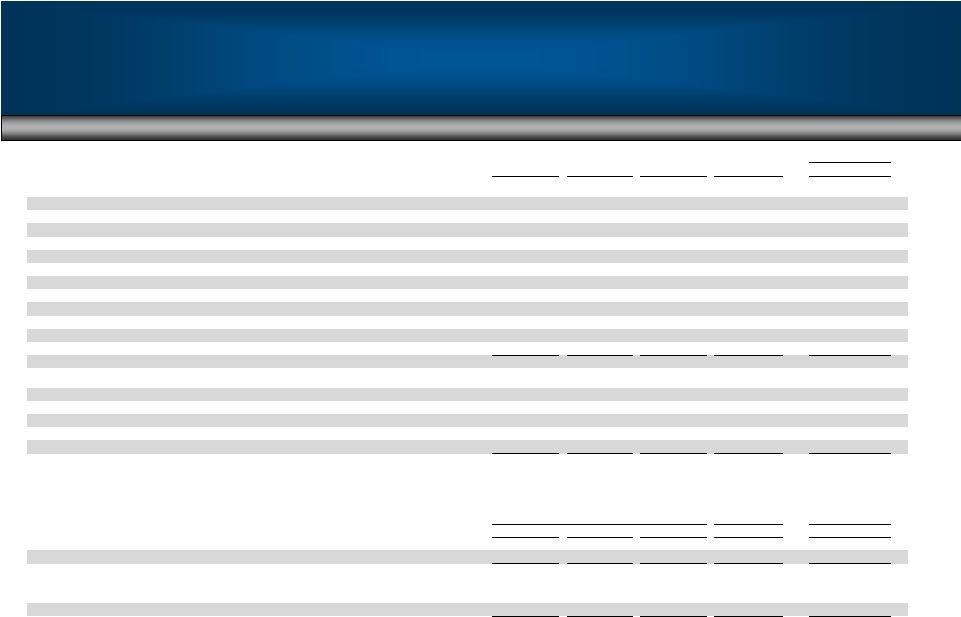

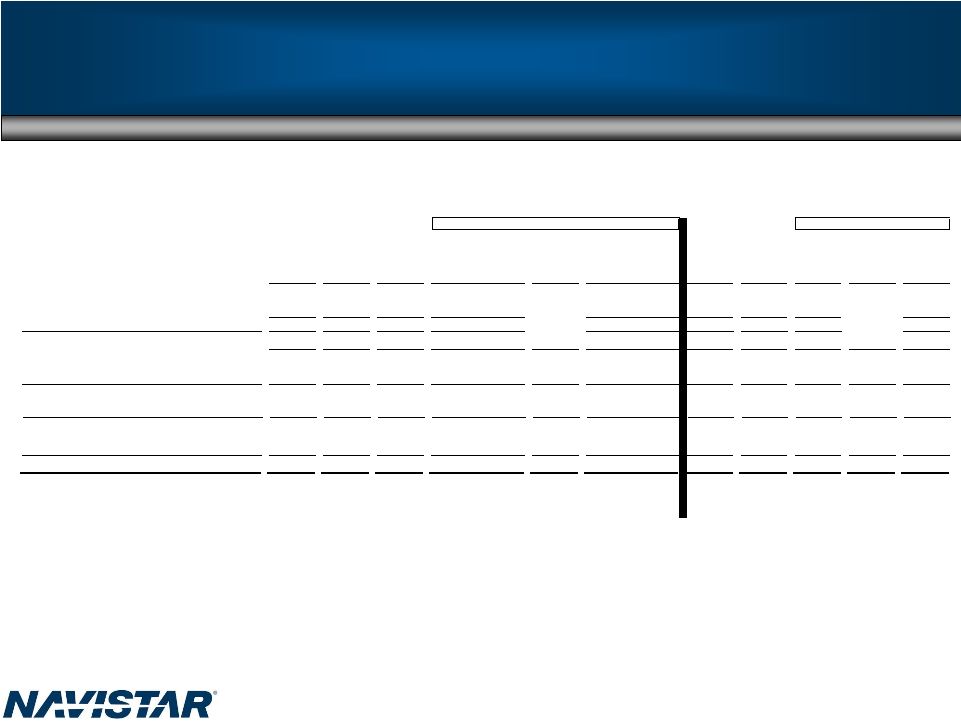

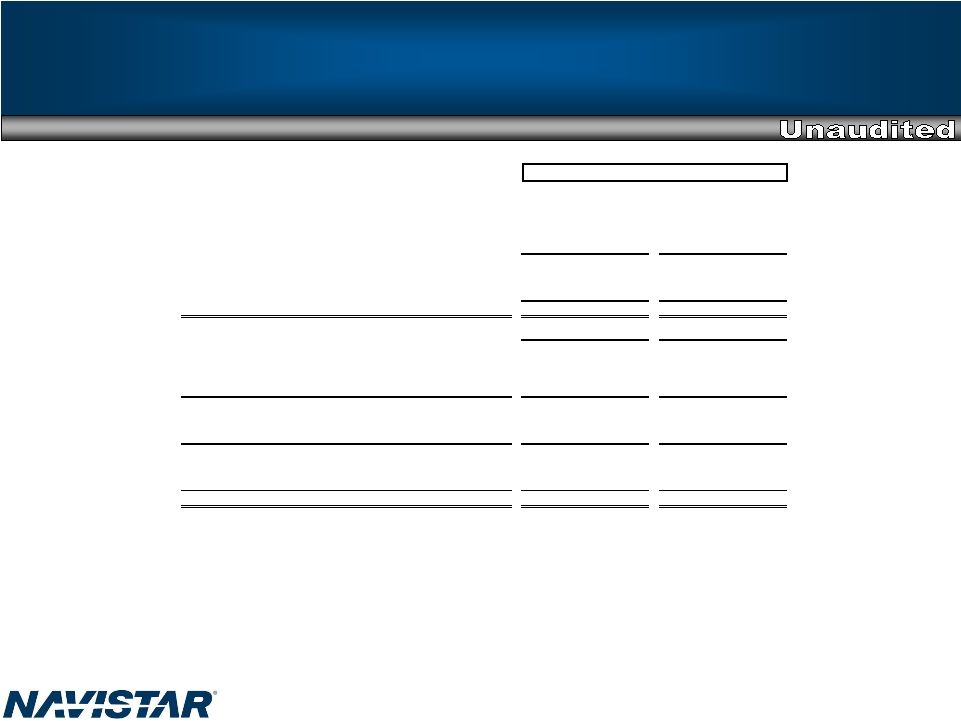

61 SEC Regulation G (Unaudited) DEBT YE 2005 YE 2006 YE 2007 YE 2008 2009 - 1Q (in millions) Manufacturing operations January 2007 Loan Facility (Libor + 325 matures January 2012) - $ - $ 1,330 $ 1,330 $ 1,330 $ Bridge Loan Facility (Libor + 500) - 1,500 - - - Financing arrangements and capital lease obligations 408 401 369 306 297 6.25% Senior Notes 400 - - - - 9.375% Senior Notes 393 - - - - 7.5% Senior Notes, due 2011 249 15 15 15 15 Majority owned dealership debt 245 484 267 157 164 4.75% Subordinated Exchangeable Notes, due 2009 202 1 1 1 1 2.5% Senior Convertible Notes 190 - - - - 9.95% Senior Notes, due 2011 13 11 8 6 5 Other 24 60 39 19 17 Total manufacturing operations debt 2,124 (Audited) 2,472 2,029 1,834 1,829 Financial services operations Borrowing secured by asset-backed securities, at variable rates, due serially through 2015 2,779 $ 3,104 $ 2,748 $ 2,076 $ 1,747 $ Bank revolvers, at fixed and variable rates, due dates from 2009 through 2013 838 1,426 1,354 1,370 1,129 Revolving retail warehouse facility, at variable rates, due 2010 500 500 500 500 500 Commercial Paper, at variable rates, due 2010 - 28 117 162 65 Borrowing secured by operating and finance leases, at various rate, due serially through 2015 148 116 133 132 135 Total financial services operations debt 4,265 $ 5,174 $ 4,852 $ 4,240 $ 3,576 $ (Unaudited) Cash & Cash Equivalents YE 2005 YE 2006 YE 2007 YE 2008 2009 - 1Q Manufacturing non-GAAP (Unaudited) 776 $ 1,078 $ 716 $ 775 $ 433 $ Financial Services non-GAAP (Unaudited) 53 79 61 86 64 Consolidated US GAAP (Audited) 829 $ 1,157 $ 777 $ 861 $ 497 $ Manufacturing Cash & Cash Equivalents non-GAAP (Unaudited) 776 $ 1,078 $ 716 $ 775 $ 433 $ Manufacturing Marketable Securities non-GAAP (Unaudited) 91 136 6 2 149 Manufacturing Cash, Cash Equivalents & Marketable Securities non-GAAP (Unaudited) 867 $ 1,214 $ 722 $ 777 $ 582 $ This presentation is not in accordance with, or an alternative for, U.S. generally accepted accounting principles (GAAP). The non-GAAP financial information presented herein should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. However, we believe that non-GAAP reporting, giving effect to the adjustments shown in the reconciliation above, provides meaningful information and therefore we use it to supplement our GAAP reporting by identifying items that may not be related to the core manufacturing business. Management often uses this information to assess and measure the performance of our operating segments. We have chosen to provide this supplemental information to investors, analysts and other interested parties to enable them to perform additional analyses of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments shown in the above reconciliations and to provide an additional measure of performance. |