Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

NAV similar filings

- 16 Feb 10 Entry into a Material Definitive Agreement

- 19 Jan 10 Information provided and statements contained in this presentation that are not purely historical

- 12 Jan 10 Regulation FD Disclosure

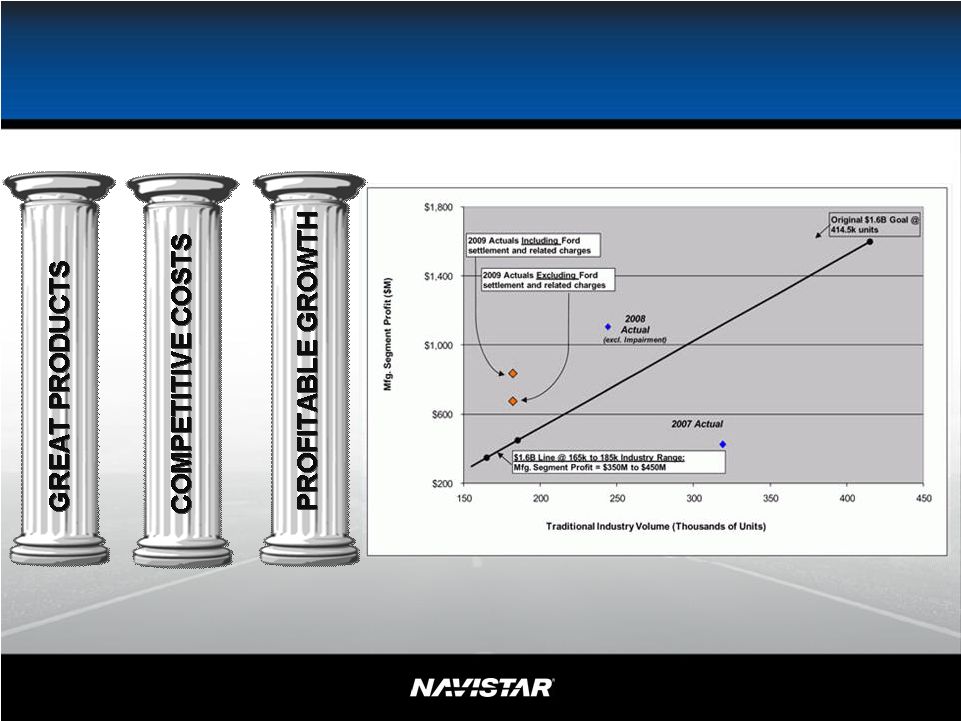

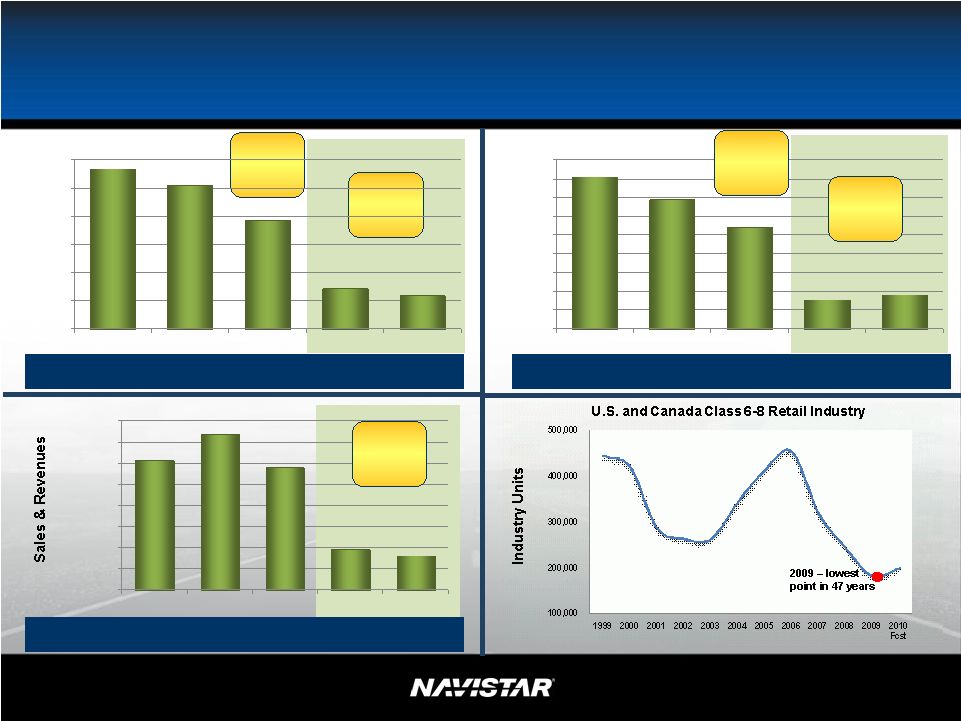

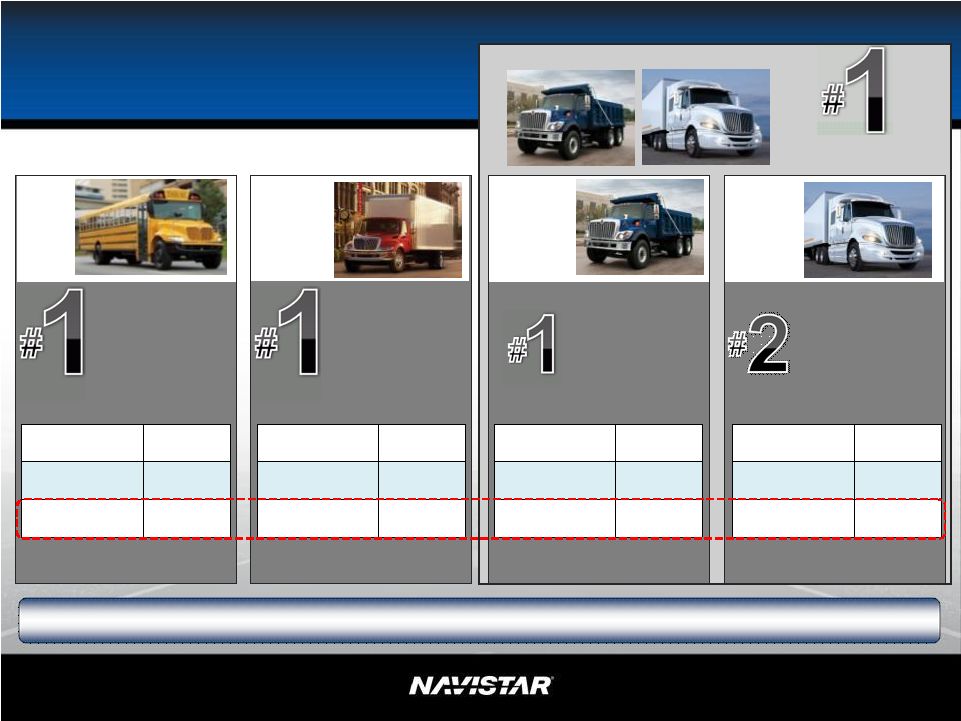

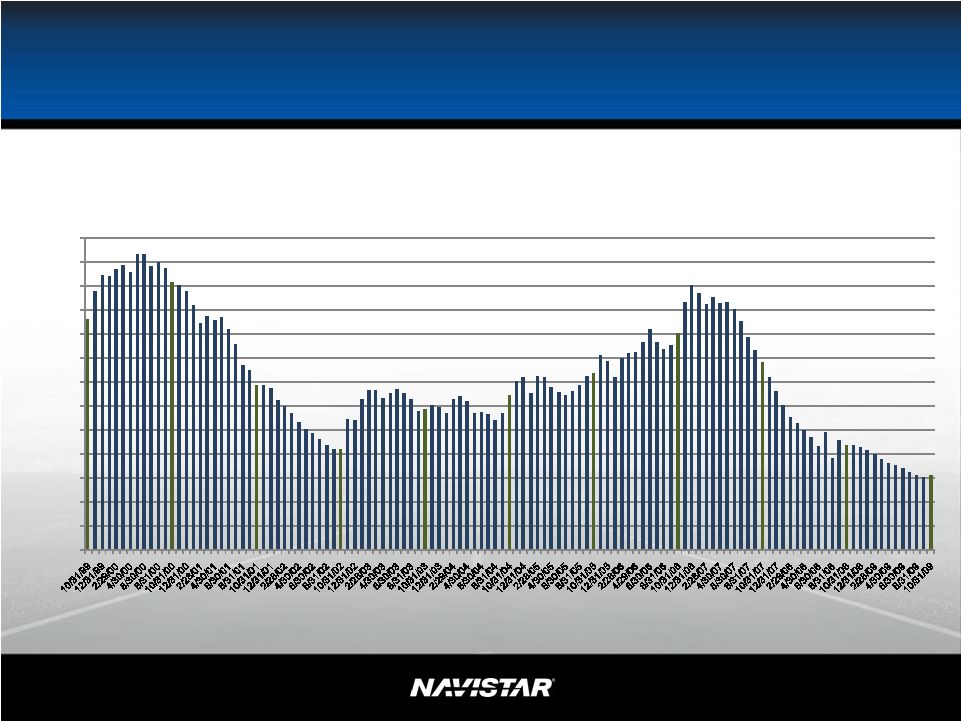

- 22 Dec 09 4th Quarter 2009 Earnings Presentation

- 21 Dec 09 Navistar Reports Solid 4Q, Year-end Net Income As Weakened Truck Market Continues

- 18 Dec 09 Entry into a Material Definitive Agreement

- 17 Dec 09 Regulation FD Disclosure

Filing view

External links