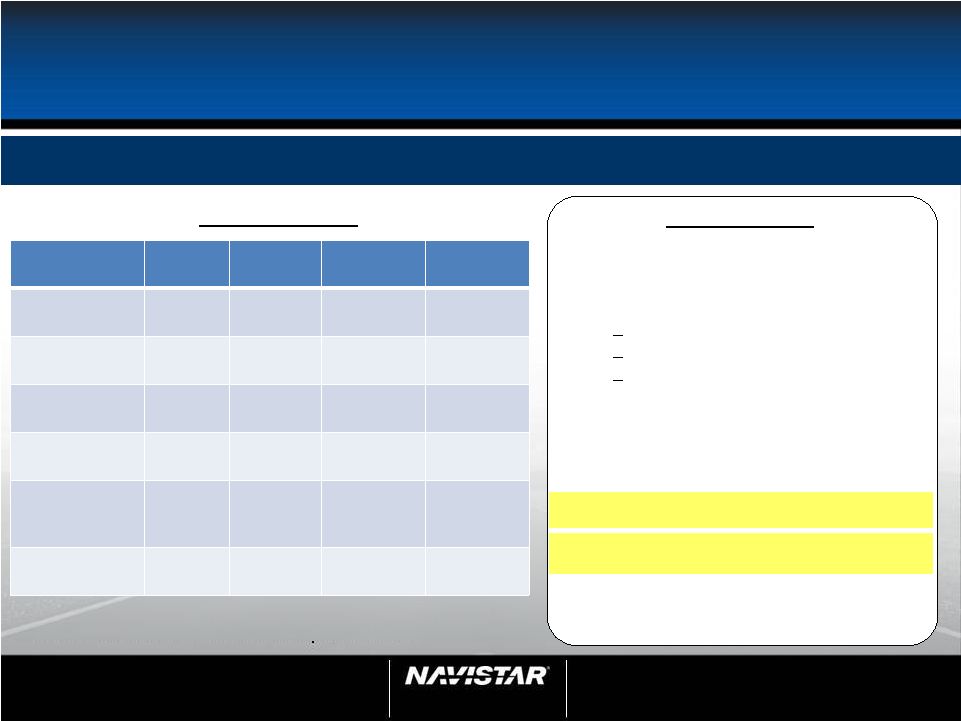

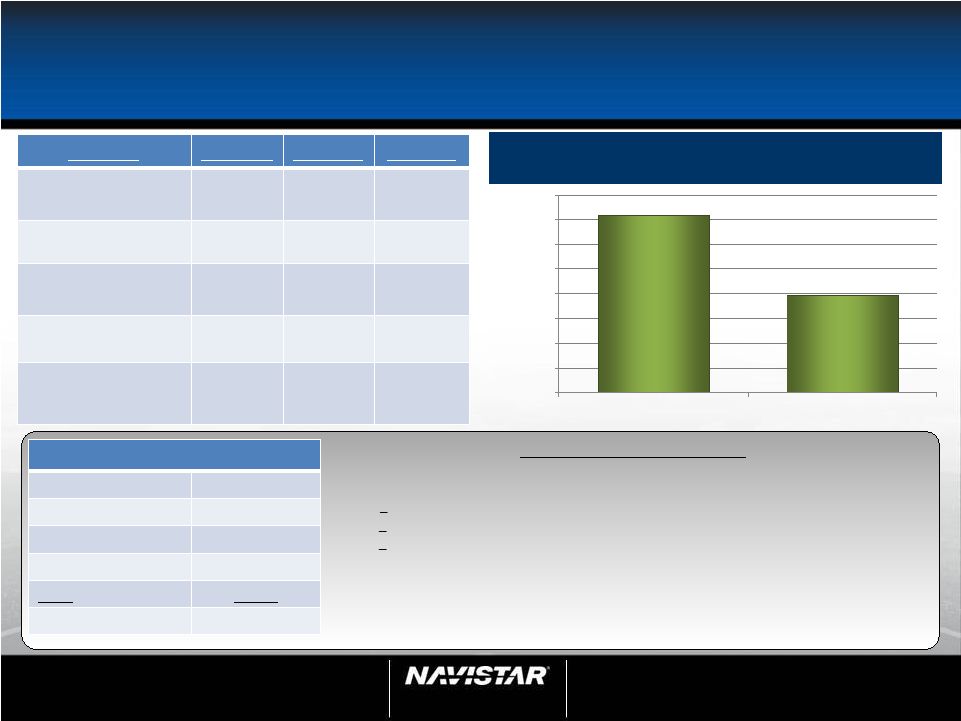

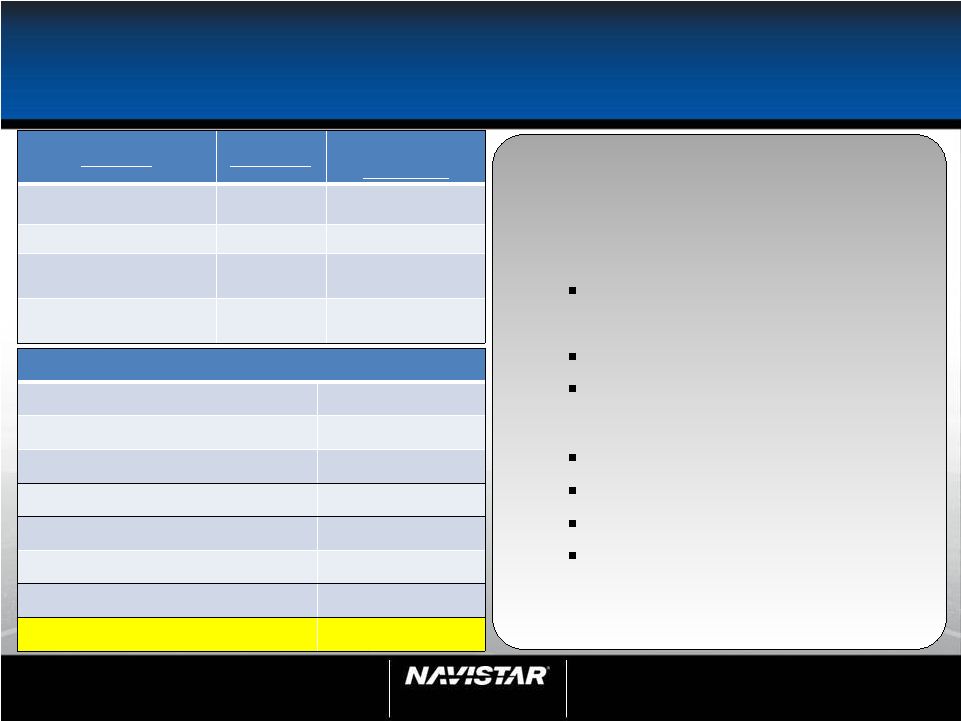

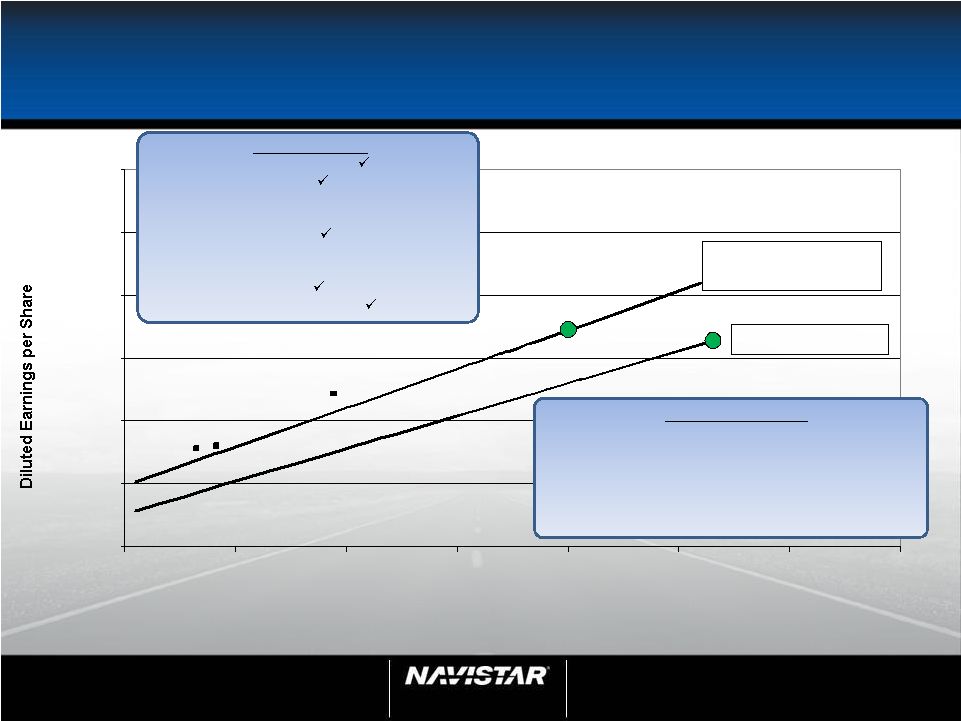

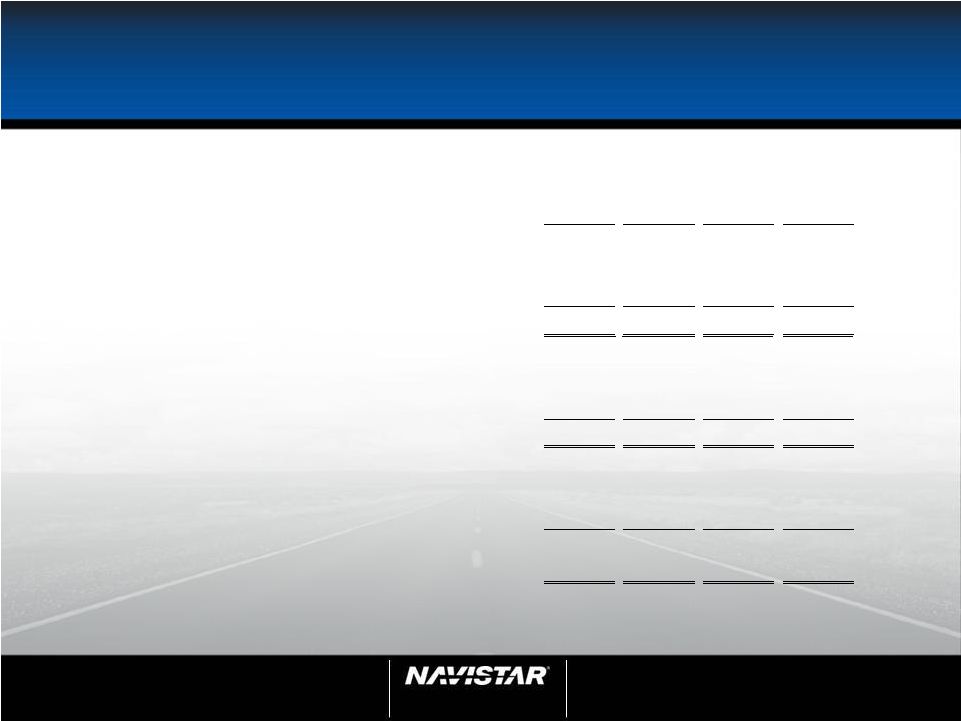

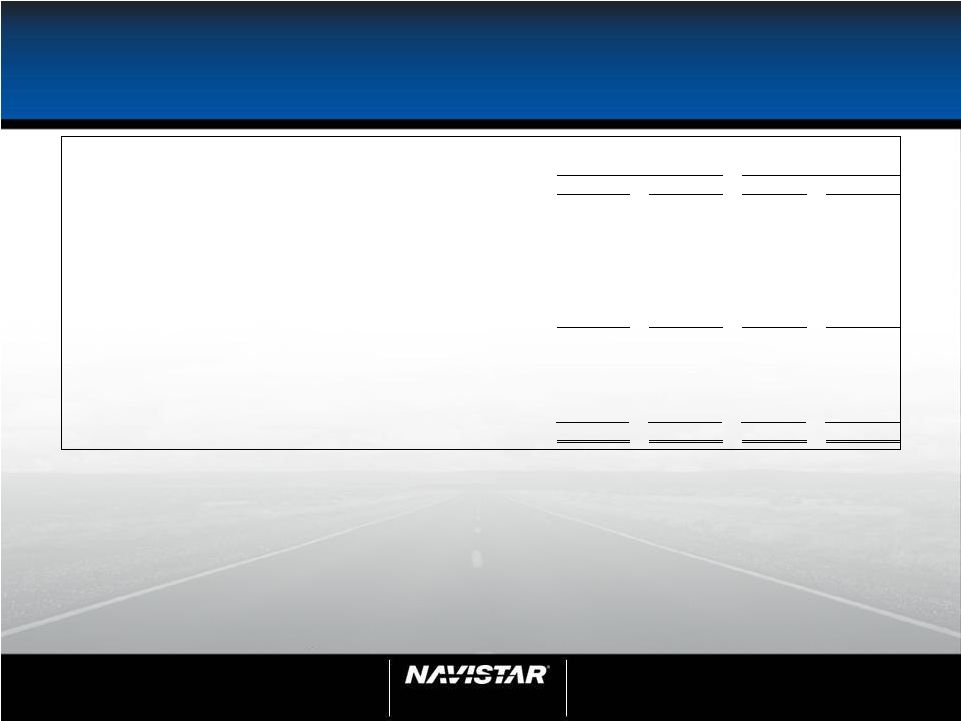

60 60 NYSE: NAV 3 Quarter 2011 Earnings Call Sept. 7, 2011 rd SEC Regulation G – 2011 Guidance (A) Engineering integration costs relate to the consolidation of our truck and engine engineering operations as well as the move of our world headquarters. We continue to develop plans for efficient transitions related to these activities and the optimization of our operations and management structure. We expect to incur approximately $77 million of engineering integration costs in fiscal 2011 with approximately $67 million of the costs to be recognized by our manufacturing segment and approximately $10 million of corporate charges. (B) Restructuring of North American manufacturing operations are charges primarily related to our plans to close our Chatham, Ontario heavy truck plant and Workhorse chassis plant in Union City, Indiana, and to significantly scale back operations at our Monaco recreational vehicle headquarters and motor coach manufacturing plant in Coburg, Oregon. We expect to incur $100 million to $140 million of restructuring, impairment and related charges in fiscal 2011 with approximately $3 million of corporate charges and the remainder of the costs to be recognized by our manufacturing segments. (C) In the third quarter of 2011, the Company recognized an income tax benefit of $1.476 billion from the release of a portion of our income tax valuation allowance. (D) Adjusted income tax expense excludes the income tax benefit from the release of a portion of our income tax valuation allowance and incremental income taxes that may result from this partial release of the income tax valuation allowance. (E) Approximate diluted weighted shares outstanding based on assumed average share price of $65 per share during the period. Lower Upper (in millions, except per share data) Net income attributable to Navistar International Corporation 1,647 1,764 Plus: Engineering integration costs (A) 77 77 Restructuring of North American manufacturing operations (B) 140 100 Less: Income tax valuation allowance release (C) 1,476 1,476 Adjusted net income attributable to Navistar International Corporation $ 388 $ 465 Plus: Adjusted income tax expense (D) 42 60 Adjusted Profit Excluding Tax $ 430 $ 525 Diluted earnings per share attributable to Navistar International Corporation $ 21.13 $ 22.13 Effect of adjustments on diluted earnings per share attributable to Navistar International Corporation (16.13) (16.13) Adjusted diluted earnings per share attributable to Navistar International Corporation $ 5.00 $ 6.00 Approximate diluted weighted shares outstanding (E) 77.6 77.6 Lower Upper (in millions) Net income (loss) attributable to Navistar International Corporation $ 1,647 $ 1,764 Less: Financial services segment profit, Corporate and eliminations, and income taxes 1,004 981 Manufacturing segment profit 643 783 Engineering integration costs (A) 67 67 Restructuring of North American manufacturing operations (B) 137 100 Adjusted manufacturing segment profit $ 847 $ 950 Fiscal 2011 guidance: adjusted net income and diluted earnings per share attributable to Navistar International Corporation reconciliation: Fiscal 2011 guidance: manufacturing segment profit and adjusted manufacturing segment profit reconciliation: |