Exhibit 99.1 |

Gabelli 35th Annual Automotive

Aftermarket Symposium

October 31st, 2011

For More than 175 years

we’ve been helping people from every corner of the world

move the goods that move the welfare of entire nations.

NYSE: NAV

1

|

Safe Harbor Statement & Other Cautionary Notes

Information provided and statements contained in this presentation that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Such forward-looking statements only speak as of the date of this presentation and the Company assumes no obligation to update the information included in this presentation. Such forward-looking statements include information concerning our possible or assumed future results of operations, including descriptions of our business strategy. These statements often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” or similar expressions. These statements are not guarantees of performance or results and they involve risks, uncertainties, and assumptions. For a further description of these factors, see Item 1A, Risk Factors, included within our Form 10-K for the year ended October 31, 2010, which was filed on December 21, 2010, and Part II, Item 1A, Risk Factors, included within our Form 10-Q for the period ended July 31, 2011, which was filed on September 7, 2011. Although we believe that these forward-looking statements are based on reasonable assumptions, there are many factors that could affect our actual financial results or results of operations and could cause actual results to differ materially from those in the forward-looking statements. All future written and oral forward-looking statements by us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to above. Except for our ongoing obligations to disclose material information as required by the federal securities laws, we do not have any obligations or intention to release publicly any revisions to any forward-looking statements to reflect events or circumstances in the future or to reflect the occurrence of unanticipated events.

The financial information herein contains audited and unaudited information and has been prepared by management in good faith and based on data currently available to the Company.

Certain Non-GAAP measures are used in this presentation to assist the reader in understanding our core manufacturing business. We believe this information is useful and relevant to assess and measure the performance of our core manufacturing business as it illustrates manufacturing performance without regard to selected historical legacy costs (i.e. pension and other postretirement costs). It also excludes financial services and other items that may not be related to the core manufacturing business or underlying results. Management often uses this information to assess and measure the performance of our operating segments. A reconciliation to the most appropriate GAAP number is included in the appendix of this presentation.

2

NYSE: NAV

|

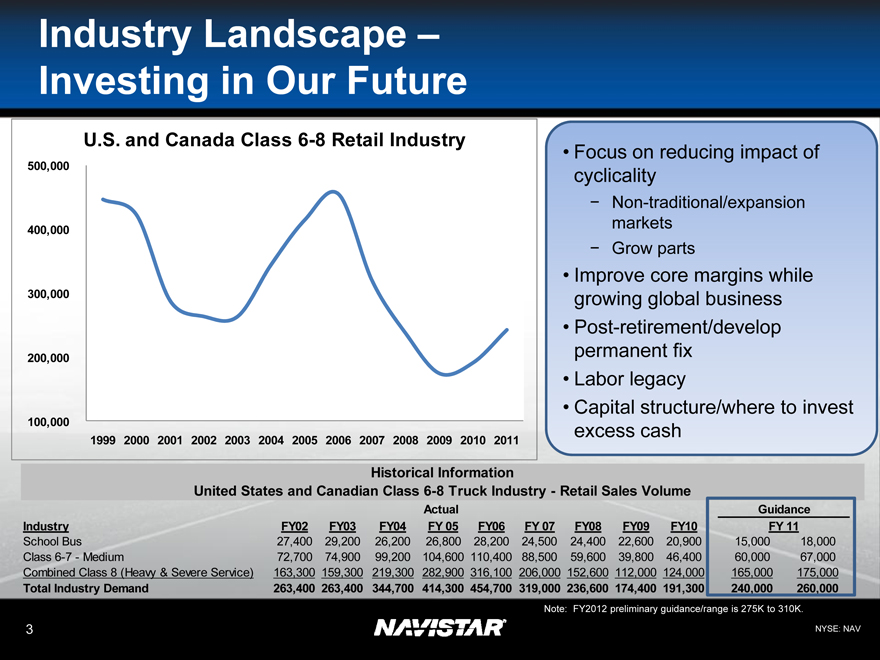

Industry Landscape – Investing in Our Future

U.S. and Canada Class 6-8 Retail Industry

500,000 400,000 300,000 200,000 100,000

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

• Focus on reducing impact of cyclicality

– Non-traditional/expansion markets

– Grow parts

• Improve core margins while growing global business

• Post-retirement/develop permanent fix

• Labor legacy

• Capital structure/where to invest excess cash

Historical Information

United States and Canadian Class 6-8 Truck Industry - Retail Sales Volume

Actual Guidance

Industry FY02 FY03 FY04 FY 05 FY06 FY 07 FY08 FY09 FY10 FY 11

School Bus 27,400 29,200 26,200 26,800 28,200 24,500 24,400 22,600 20,900 15,000 18,000

Class 6-7 - Medium 72,700 74,900 99,200 104,600 110,400 88,500 59,600 39,800 46,400 60,000 67,000

Combined Class 8 (Heavy & Severe Service) 163,300 159,300 219,300 282,900 316,100 206,000 152,600 112,000 124,000 165,000 175,000

Total Industry Demand 263,400 263,400 344,700 414,300 454,700 319,000 236,600 174,400 191,300 240,000 260,000

Note: FY2012 preliminary guidance/range is 275K to 310K.

NYSE: NAV

3

|

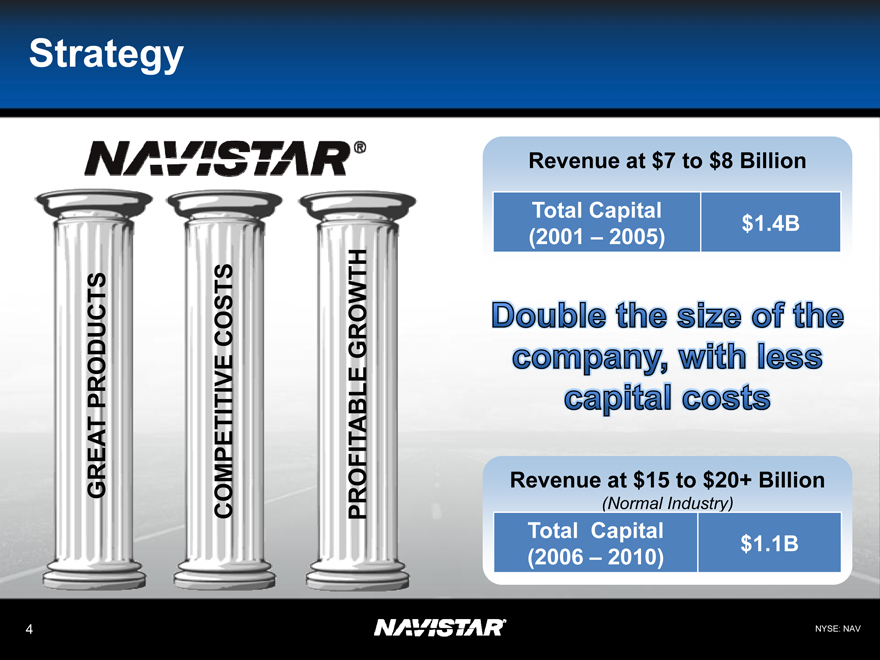

Strategy

GREAT PRODUCTS

COMPETITIVE COSTS

PROFITABLE GROWTH

Revenue at $7 to $8 Billion

Total Capital $1.4B

(2001 – 2005)

Double the Size of the company, with less capital costs

Revenue at $15 to $20+ Billion

(Normal Industry)

Total Capital $1.1B

(2006 – 2010)

4

NYSE: NAV

|

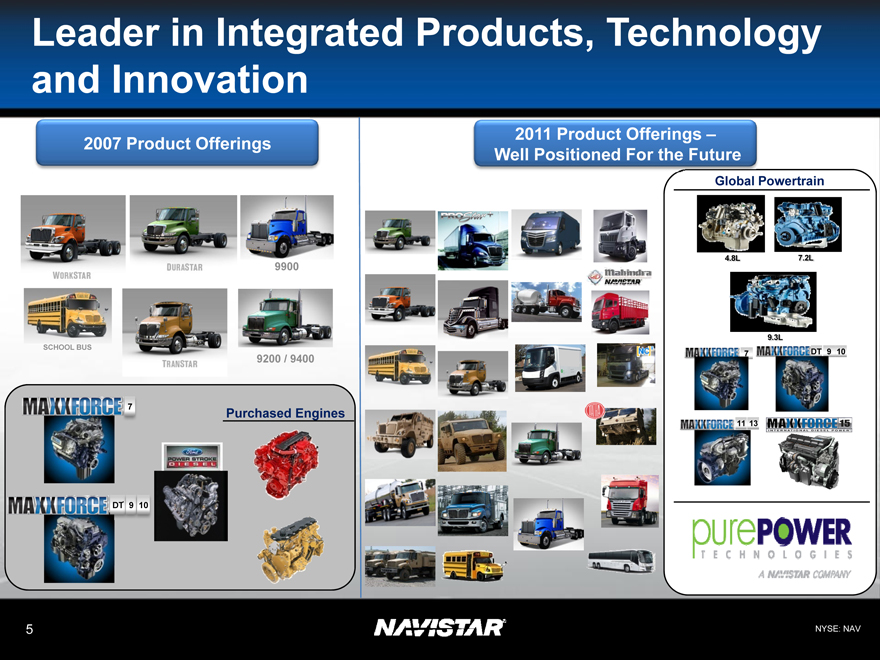

Leader in Integrated Products, Technology and Innovation

2007 Product Offerings

7

Purchased Engines

DT 9 10

2011 Product Offerings –Well Positioned For the Future

Global Powertrain

4.8L

7.2L

9.3L

7

DT 9 10

11 13

5

NYSE: NAV

|

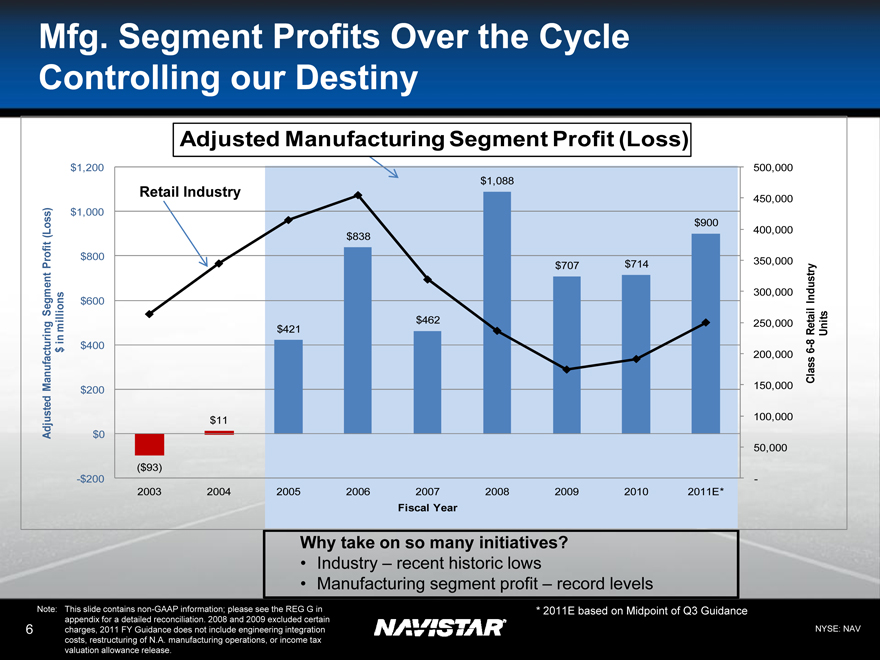

Mfg. Segment Profits Over the Cycle Controlling our Destiny

Adjusted Manufacturing Segment Profit (Loss)

Adjusted Manufacturing Segment Profit (Loss) $ in millions

$1,200 $1,000 $800 $600 $400 $200 $0

-$200

Retail Industry

($93)

$11

$421

$838

$462

$1,088

$707

$714

$900

2003 2004 2005 2006 2007 2008 2009 2010 2011E*

Fiscal Year

500,000 450,000 400,000 350,000 300,000 250,000 200,000 150,000 100,000 50,000 -

Class 6-8 Retail Industry Units

Why take on so many initiatives?

• Industry – recent historic lows

• Manufacturing segment profit – record levels

6

Note: This slide contains non-GAAP information; please see the REG G in appendix for a detailed reconciliation. 2008 and 2009 excluded certain charges, 2011 FY Guidance does not include engineering integration costs, restructuring of N.A. manufacturing operations, or income tax valuation allowance release.

* 2011E based on Midpoint of Q3 Guidance

NYSE: NAV

|

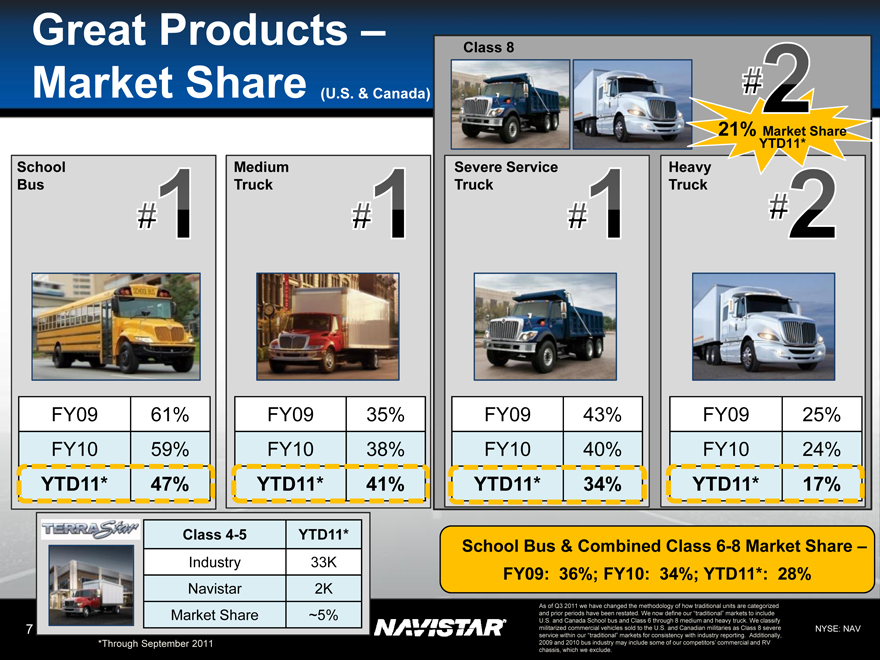

Great Products –

Market Share (U.S. & Canada)

Class 8

21% YTD11* Market Share

School Bus

Medium Truck

Severe Service Truck

Heavy Truck

FY09 61%

FY10 59%

YTD11* 47%

FY09 35%

FY10 38%

YTD11* 41%

FY09 43%

FY10 40%

YTD11* 34%

FY09 25%

FY10 24%

YTD11* 17%

Class 4-5 YTD11*

Industry 33K

Navistar 2K

Market Share ~5%

School Bus & Combined Class 6-8 Market Share –FY09: 36%; FY10: 34%; YTD11*: 28%

7

*Through September 2011

As of Q3 2011 we have changed the methodology of how traditional units are categorized and prior periods have been restated. We now define our “traditional” markets to include U.S. and Canada School bus and Class 6 through 8 medium and heavy truck. We classify

militarized commercial vehicles sold to the U.S. and Canadian militaries as Class 8 severe service within our “traditional” markets for consistency with industry reporting. Additionally, 2009 and 2010 bus industry may include some of our competitors’ commercial and RV chassis, which we exclude.

NYSE: NAV

|

U.S. and Canada Heavy Strategy –Launch of Derivative Products

Continue to Broaden Product Offering

Combined Class 8

Severe Service

Heavy

Available now

Expected Q1 2012

ProStar® with MaxxForce® 15

LoneStar® with 500HP MaxxForce® 13

MaxxForce 9900 with ® 15

CAT CT660

Sloped Nose WorkStar® MaxxForce® 11/13

PayStar® with MaxxForce® 15

8

NYSE: NAV

|

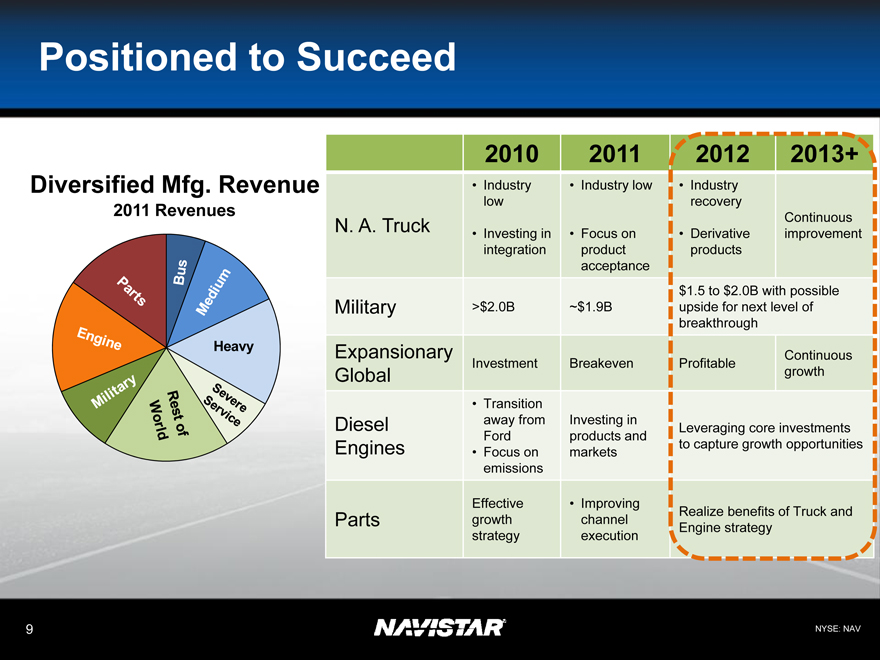

Positioned to Succeed

Diversified Mfg. Revenue

2011 Revenues

2010 2011 2012 2013+

• Industry • Industry low • Industry

low recovery

N. A. Truck Continuous

• Investing in • Focus on • Derivative improvement

integration product products

acceptance

$1.5 to $2.0B with possible

Military >$2.0B ~$1.9B upside for next level of

breakthrough

Expansionary Continuous

Investment Breakeven Profitable

Global growth

• Transition

Diesel away from Investing in Leveraging core investments

Ford products and

Engines • Focus on markets to capture growth opportunities

emissions

Effective • Improving

Parts growth channel Engine Realize strategy benefits of Truck and

strategy execution

9

NYSE: NAV

|

Products – New and Differentiated Leveraged Off Our Core Investments

Expanded Integrated Product Line

10

NYSE: NAV

|

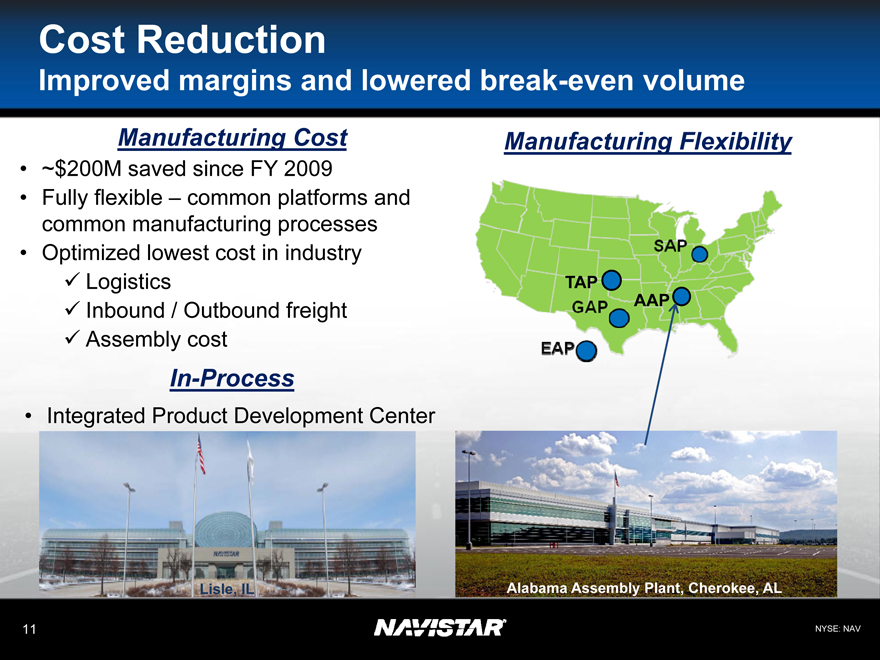

Cost Reduction

Improved margins and lowered break-even volume

Manufacturing Cost

• ~$200M saved since FY 2009

• Fully flexible – common platforms and common manufacturing processes

• Optimized lowest cost in industry

Logistics

Inbound / Outbound freight

Assembly cost

In-Process

• Integrated Product Development Center

Manufacturing Flexibility

SAP TAP AAP GAP EAP

Alabama Assembly Plant, Cherokee, AL

11

NYSE: NAV

|

Sustainable Military Business

2008 2009 2010 2011

> $2B > $2B > $2B ~$1.9B

School Class 6 Combined Engines

Bus and 7 Class 8

Era of efficiency - government will look to industry for:

Higher quality

Lower cost

Quicker development

Sustainment of existing vehicle fleets will continue (increase)

12

NYSE: NAV

|

Leveraging Commercial Platforms

13

NYSE: NAV

|

Leveraging Commercial Resources

Class 4 and 5

Saratoga

Impressive in Testing

14

NYSE: NAV

|

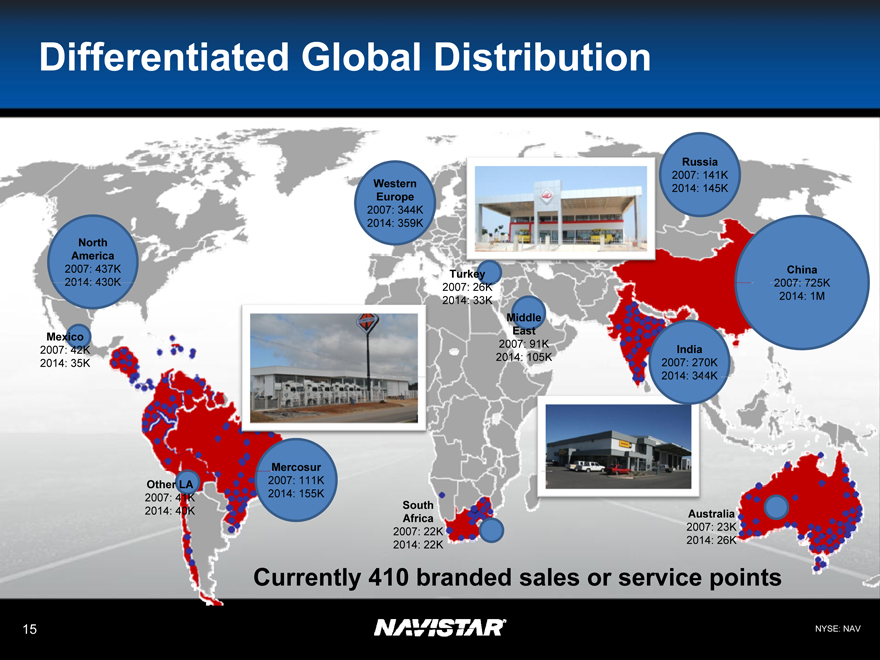

Differentiated Global Distribution

North America

2007: 437K

2014: 430K

Mexico

2007: 42K 2014: 35K

Other LA

2007: 41K 2014: 40K

Mercosur

2007: 111K 2014: 155K

Western Europe

2007: 344K 2014: 359K

Turkey

2007: 26K 2014: 33K

Middle East

2007: 91K 2014: 105K

South Africa

2007: 22K 2014: 22K

Russia

2007: 141K

2014: 145K

India

2007: 270K 2014: 344K

China

2007: 725K

2014: 1M

Australia

2007: 23K 2014: 26K

Currently 410 branded sales or service points

15

NYSE: NAV

|

Expansionary Global

Global Truck: Latin America & Caribbean

12,000 10,000 8,000 6,000 4,000 2,000 0

3,000

5,000

10,000 – 11,500

FY 2010 FY 2011 YTD July FY 2011 FCST

(This represents retail deliveries)

ProStar®

TranStar®

WorkStar®

Number of Global Dealers catching up to North America! … Over 400+ locations

Global Class 8 Truck – AeroStar

Launched at Brazil Fenatran Truck Show

• Significant growth outside

North America (units more than doubled from 2010 to 2011)

• Continued success in 2012

• Goal: Move from breakeven to profitable with additional units

Global Units* (Outside U.S./Canada)

Units (Thousands)

30 25 20 15 10 5 0

2010 2011 2012 Proj

*Includes only >14T

16

NYSE: NAV

|

Engine – Leveraging Core Investments to Capture Growth Opportunities

Acteon 3.0L Sprint 4.1L MaxxForce® 7 MaxxForce® DT

MaxxForce® 9 MaxxForce® 10 MaxxForce® 11 MaxxForce® 13 MaxxForce® 15

Global Growth

Build on Success in South America OEM Business

OEM

Captive

TRUCK GROUP

Components

& Parts

“Improve Core Business” Cost, Scale, & Quality

“Grow the Business” OEM & Components

17

NYSE: NAV

|

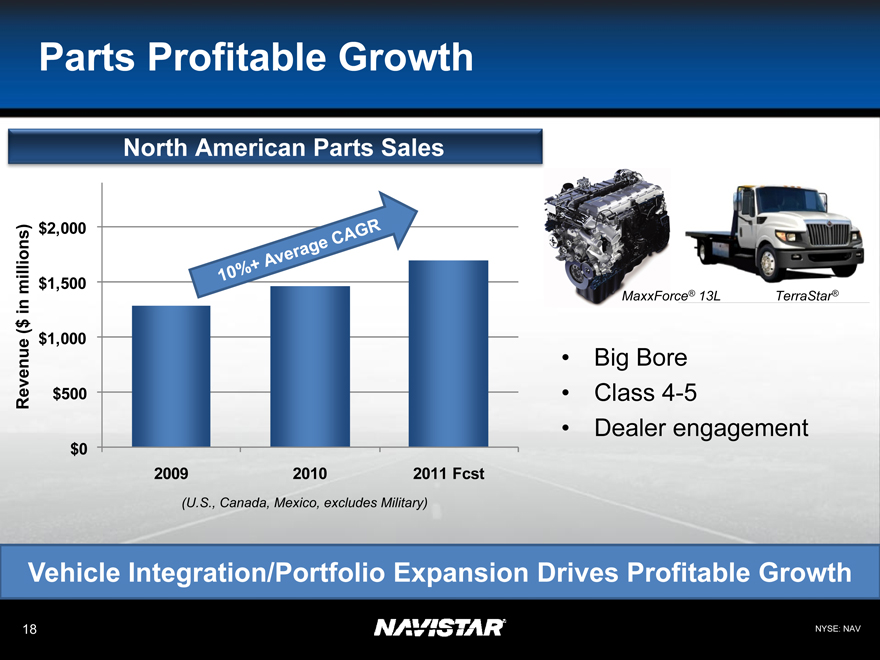

Parts Profitable Growth

North American Parts Sales

Revenue (in $ millions)

$2,000 $1,500 $1,000 $500 $0

2009 2010 2011 Fcst

(U.S., Canada, Mexico, excludes Military)

10%+ Average CAGR

MaxxForce® 13L TerraStar®

• Big Bore

• Class 4-5

• Dealer engagement

Vehicle Integration/Portfolio Expansion Drives Profitable Growth

18

NYSE: NAV

|

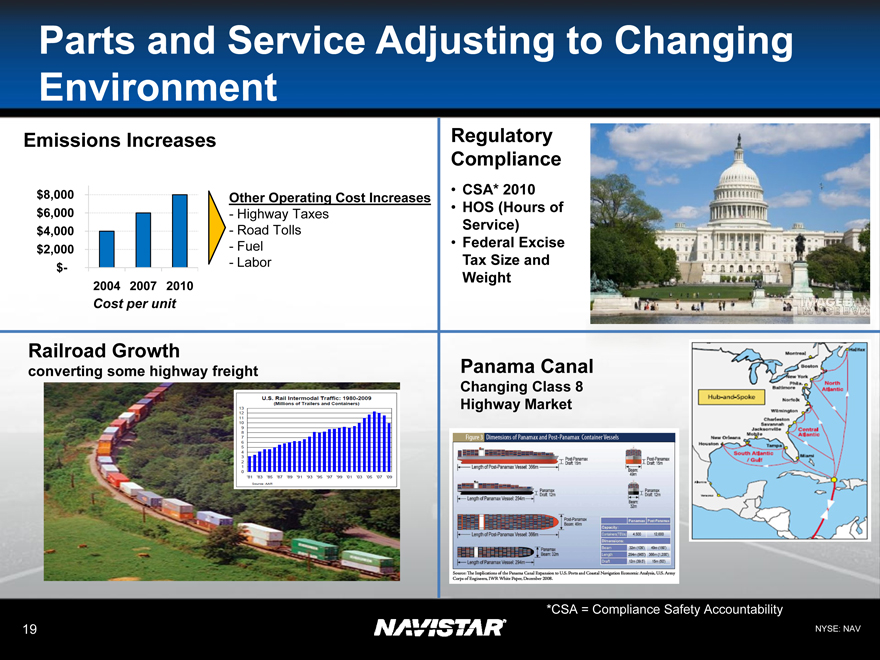

Parts and Service Adjusting to Changing Environment

Emissions Increases

$8,000 $6,000 $4,000 $2,000 $-

Other Operating Cost Increases

- Highway Taxes

- Road Tolls

- Fuel

- Labor

2004 2007 2010

Cost per unit

Regulatory Compliance

• CSA* 2010

• HOS (Hours of Service)

• Federal Excise Tax Size and Weight

Railroad Growth

converting some highway freight

Panama Canal

Changing Class 8 Highway Market

*CSA = Compliance Safety Accountability

19

NYSE: NAV

|

Unmatched Dealer Support in Nearly 700 Locations

SERVICE LOCATIONS

United States and Canada

276 328 355 665

When you buy an International® ProStar®+ with MaxxForce® 13, you get:

• Nearly 700 dealer locations

• 8,000 technicians

• 10,000 service bays

• Nearly 200 body shops

20

NYSE: NAV

|

Next Steps to Increase Shareholder Value

GREAT PRODUCTS

COMPETITIVE COSTS

PROFITABLE GROWTH

Leveraging Assets/ Controlling Destiny

Next Steps

• Volume

• Distribution

• Integrated Product Development Center

• Postretirement

• ROIC (Return on Invested Capital)

21

NYSE: NAV

|

ROIC (Return of Invested Capital)

$175M share repurchase program to be initiated and executed over the upcoming months

• Completed $100M share repurchase

• Expand strategic focus... from primarily Investing to also Returning Value to our shareholders

• Using excess liquidity to:

– Improve shareholder returns

– Manage long-term liabilities

• Additional actions to increase shareholder value to be announced at Analyst Day

North America

Global

Leveraging

22

NYSE: NAV

|

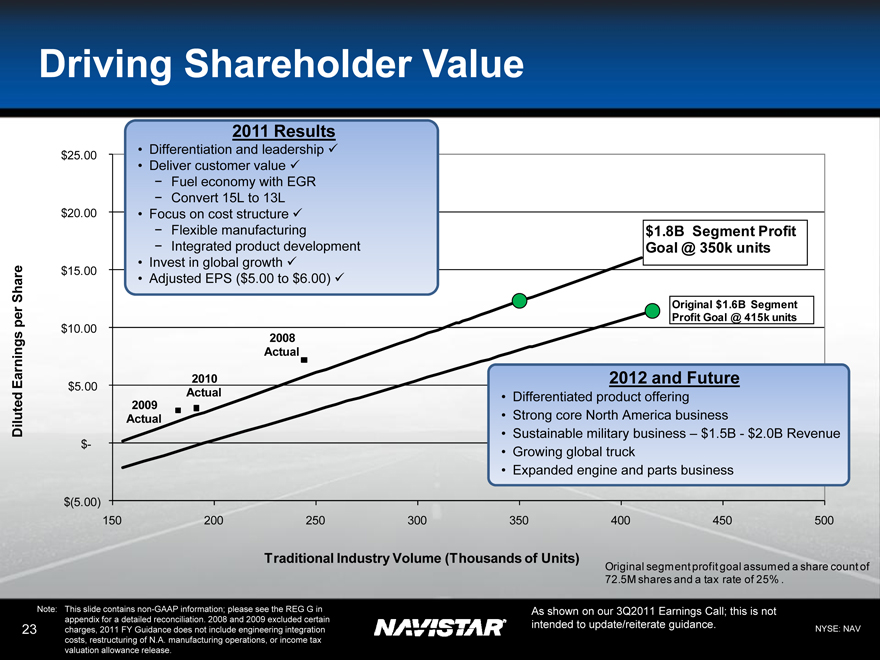

Driving Shareholder Value

Diluted Earnings per Share

$25.00

$20.00

$15.00

$10.00

$5.00 $-

$(5.00)

150 200 250 300 350 400 450 500

2011 Results

• Differentiation and leadership

• Deliver customer value

Fuel economy with EGR

Convert 15L to 13L

• Focus on cost structure

Flexible manufacturing

Integrated product development

• Invest in global growth

• Adjusted EPS ($5.00 to $6.00)

$1.8B Segment Profit Goal @ 350k units

Original $1.6B Segment Profit Goal @ 415k units

2008 Actual

2010 Actual

2009 Actual

2012 and Future

• Differentiated product offering

• Strong core North America business

• Sustainable military business – $1.5B—$2.0B Revenue

• Growing global truck

• Expanded engine and parts business

Traditional Industry Volume (Thousands of Units)

Original segment profit goal assumed a share count of 72.5M shares and a tax rate of 25% .

Note: This slide contains non-GAAP information; please see the REG G in appendix for a detailed reconciliation. 2008 and 2009 excluded certain charges, 2011 FY Guidance does not include engineering integration costs, restructuring of N.A. manufacturing operations, or income tax valuation allowance release.

As shown on our 3Q2011 Earnings Call; this is not intended to update/reiterate guidance.

23

NYSE: NAV

|

Appendix

24

NYSE: NAV

|

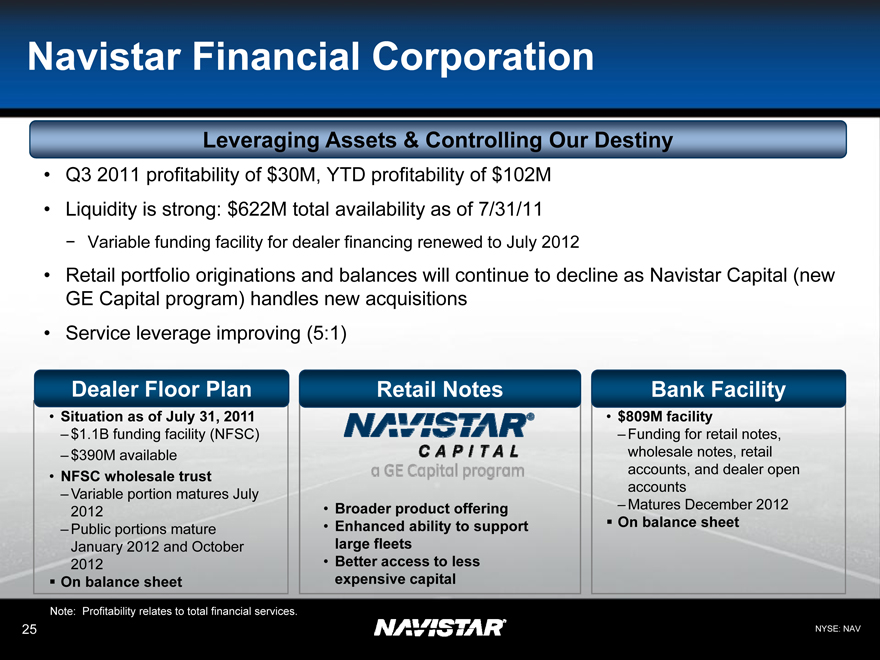

Navistar Financial Corporation

Leveraging Assets & Controlling Our Destiny

• Q3 2011 profitability of $30M, YTD profitability of $102M

• Liquidity is strong: $622M total availability as of 7/31/11

Variable funding facility for dealer financing renewed to July 2012

• Retail portfolio originations and balances will continue to decline as Navistar Capital (new GE Capital program) handles new acquisitions

• Service leverage improving (5:1)

Dealer Floor Plan

• Situation as of July 31, 2011

– $1.1B funding facility (NFSC)

– $390M available

• NFSC wholesale trust

– Variable portion matures July 2012

– Public portions mature January 2012 and October 2012

• On balance sheet

Retail Notes

• Broader product offering

• Enhanced ability to support large fleets

• Better access to less expensive capital

Bank Facility

• $809M facility

– Funding for retail notes, wholesale notes, retail accounts, and dealer open accounts

– Matures December 2012

• On balance sheet

Note: Profitability relates to total financial services.

25

NYSE: NAV

|

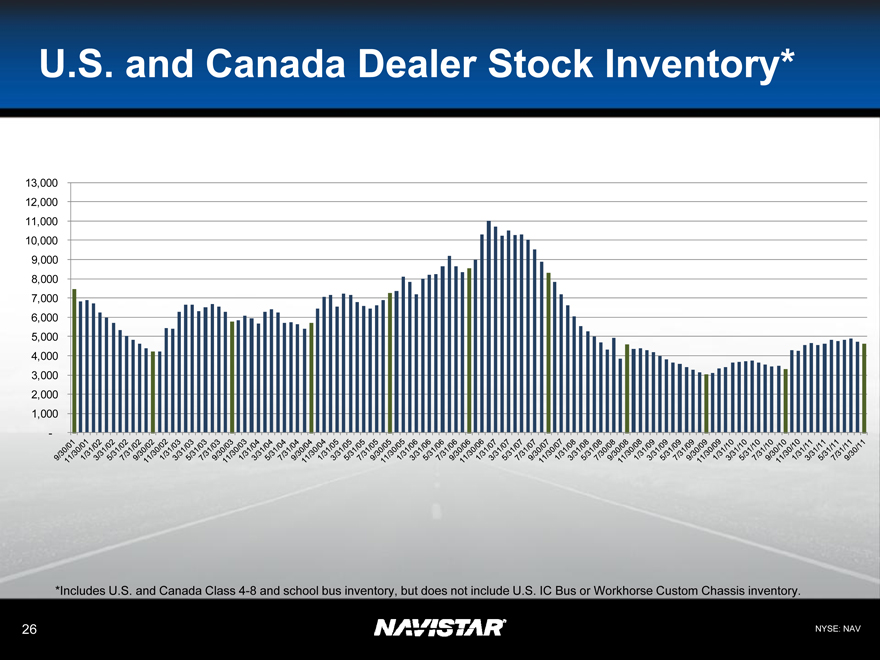

U.S. and Canada Dealer Stock Inventory*

13,000 12,000 11,000 10,000 9,000 8,000 7,000 6,000 5,000 4,000 3,000 2,000 1,000 -

9/30/01 11/30/01 1/31/02 3/31/02 5/31/02 7/31/02 9/30/02 11/30/02 1/31/03 3/31/03 5/31/03 7/31/03 9/30/03 11/30/03 1/31/04 3/31/04 5/31/04 7/31/04 9/30/04 11/30/04 1/31/05 3/31/05 5/31/05 7/31/05 9/30/05 11/30/05 1/31/06 3/31/06 5/31/06 7/31/06 9/30/06

11/30/06 1/31/07 3/31/07 5/31/07 7/31/07 9/30/07 11/30/07 1/31/08 3/31/08 5/31/08 7/30/08 9/30/08 11/30/08 1/31/09 3/31/09 5/31/09 7/31/09 9/30/09 11/30/09 1/31/10 3/31/10 5/31/10 7/31/10 9/30/10 11/30/10

1/31/11

3/31/11

5/31/11

7/31/11

9/30/11

*Includes U.S. and Canada Class 4-8 and school bus inventory, but does not include U.S. IC Bus or Workhorse Custom Chassis inventory.

26

NYSE: NAV

|

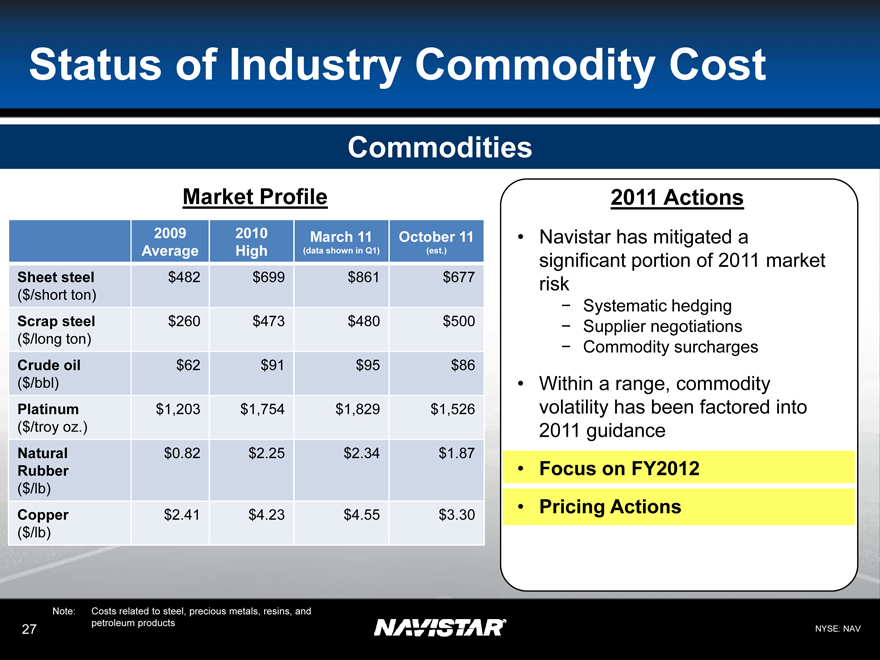

Status of Industry Commodity Cost

Commodities

Market Profile

2009 2010 March 11 October 11

Average High(data shown in Q1)(est.)

Sheet steel $482 $699 $861 $677

($/short ton)

Scrap steel $260 $473 $480 $500

($/long ton)

Crude oil $62 $91 $95 $86

($/bbl)

Platinum $1,203 $1,754 $1,829 $1,526

($/troy oz.)

Natural $0.82 $2.25 $2.34 $1.87

Rubber

($/lb)

Copper $2.41 $4.23 $4.55 $3.30

($/lb)

2011 Actions

• Navistar has mitigated a significant portion of 2011 market risk

—Systematic hedging

—Supplier negotiations

—Commodity surcharges

• Within a range, commodity volatility has been factored into 2011 guidance

• Focus on FY2012

• Pricing Actions

Note: Costs related to steel, precious metals, resins, and petroleum products

27

NYSE: NAV

|

SEC Regulation G –

Non-GAAP Reconciliation

The financial measures presented below are unaudited and not in accordance with, or an alternative for, financial measures presented in accordance with U.S. generally accepted accounting principles (GAAP). The non-GAAP financial information presented herein should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

Manufacturing Segment Results: We believe manufacturing segment results, which includes the segment results of our Truck, Engine, and Parts reporting segments, provide meaningful information of our core manufacturing business and therefore we use it to supplement our GAAP reporting by identifying items that may not be related to the core manufacturing business. Management often uses this information to assess and measure the performance of our operating segments. We have chosen to provide this supplemental information to investors, analysts and other interested parties to enable them to perform additional analyses of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments shown in the below reconciliation, and to provide an additional measure of performance.

Adjusted Net Income and Diluted Earnings Per Share Attributable To Navistar International Corporation and Adjusted Manufacturing Segment Profit: We believe that adjusted net income, diluted earnings per share attributable to Navistar International Corporation, and adjusted manufacturing segment profit excluding certain adjustments which are not considered to be part of our ongoing business, improve the comparability of year to year results and are representative of our underlying performance. We have chosen to provide this supplemental information to investors, analysts, and other interested parties to enable them to perform additional analyses of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments shown in the below reconciliations, and to provide an additional measure of performance.

28

NYSE: NAV

|

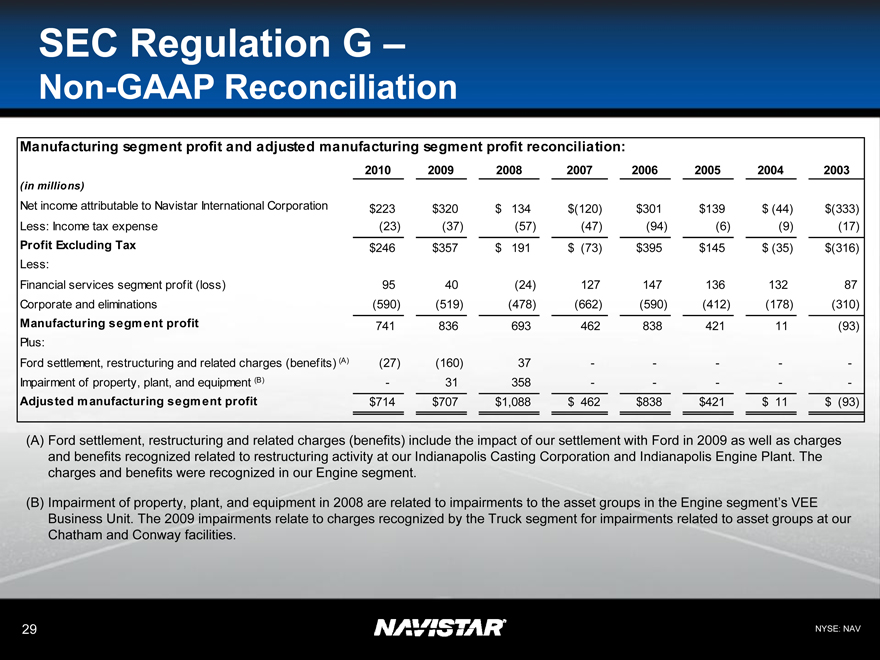

SEC Regulation G –

Non-GAAP Reconciliation

Manufacturing segment profit and adjusted manufacturing segment profit reconciliation:

2010 2009 2008 2007 2006 2005 2004 2003

(in millions)

Net income attributable to Navistar International Corporation $223 $320 $ 134 $(120) $301 $139 $ (44) $(333)

Less: Income tax expense(23)(37)(57)(47)(94)(6)(9)(17)

Profit Excluding Tax $246 $357 $ 191 $ (73) $395 $145 $ (35) $(316)

Less:

Financial services segment profit (loss) 95 40(24) 127 147 136 132 87

Corporate and eliminations(590)(519)(478)(662)(590)(412)(178)(310)

Manufacturing segment profit 741 836 693 462 838 421 11(93)

Plus:

Ford settlement, restructuring and related charges (benefits) (A)(27)(160) 37- - - - -

Impairment of property, plant, and equipment (B) - 31 358- - - - -

Adjusted manufacturing segment profit $714 $707 $1,088 $ 462 $838 $421 $ 11 $ (93)

(A) Ford settlement, restructuring and related charges (benefits) include the impact of our settlement with Ford in 2009 as well as charges and benefits recognized related to restructuring activity at our Indianapolis Casting Corporation and Indianapolis Engine Plant. The charges and benefits were recognized in our Engine segment.

(B) Impairment of property, plant, and equipment in 2008 are related to impairments to the asset groups in the Engine segment’s VEE Business Unit. The 2009 impairments relate to charges recognized by the Truck segment for impairments related to asset groups at our Chatham and Conway facilities.

29

NYSE: NAV

|

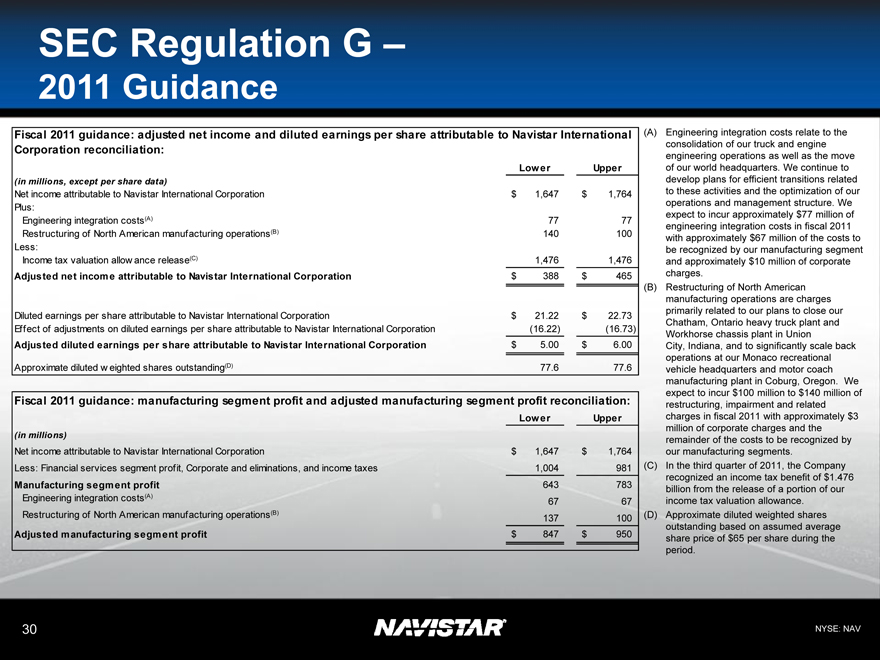

SEC Regulation G –

2011 Guidance

Fiscal 2011 guidance: adjusted net income and diluted earnings per share attributable to Navistar International

Corporation reconciliation:

Lower Upper

(in millions, except per share data)

Net income attributable to Navistar International Corporation $ 1,647 $ 1,764

Plus:

Engineering integration costs(A) 77 77

Restructuring of North American manufacturing operations(B) 140 100

Less:

Income tax valuation allowance release(C) 1,476 1,476

Adjusted net income attributable to Navistar International Corporation $ 388 $ 465

Diluted earnings per share attributable to Navistar International Corporation $ 21.22 $ 22.73

Effect of adjustments on diluted earnings per share attributable to Navistar International Corporation(16.22)(16.73)

Adjusted diluted earnings per share attributable to Navistar International Corporation $ 5.00 $ 6.00

Approximate diluted weighted shares outstanding(D) 77.6 77.6

Fiscal 2011 guidance: manufacturing segment profit and adjusted manufacturing segment profit reconciliation:

Lower Upper

(in millions)

Net income attributable to Navistar International Corporation $ 1,647 $ 1,764

Less: Financial services segment profit, Corporate and eliminations, and income taxes 1,004 981

Manufacturing segment profit 643 783

Engineering integration costs(A) 67 67

Restructuring of North American manufacturing operations(B) 137 100

Adjusted manufacturing segment profit $ 847 $ 950

(A) Engineering integration costs relate to the consolidation of our truck and engine engineering operations as well as the move of our world headquarters. We continue to develop plans for efficient transitions related to these activities and the optimization of our operations and management structure. We expect to incur approximately $77 million of engineering integration costs in fiscal 2011 with approximately $67 million of the costs to be recognized by our manufacturing segment and approximately $10 million of corporate charges.

(B) Restructuring of North American manufacturing operations are charges primarily related to our plans to close our Chatham, Ontario heavy truck plant and Workhorse chassis plant in Union City, Indiana, and to significantly scale back operations at our Monaco recreational vehicle headquarters and motor coach manufacturing plant in Coburg, Oregon. We expect to incur $100 million to $140 million of restructuring, impairment and related charges in fiscal 2011 with approximately $3 million of corporate charges and the remainder of the costs to be recognized by our manufacturing segments.

(C) In the third quarter of 2011, the Company recognized an income tax benefit of $1.476 billion from the release of a portion of our income tax valuation allowance.

(D) Approximate diluted weighted shares outstanding based on assumed average share price of $65 per share during the period.

NYSE: NAV

30

|

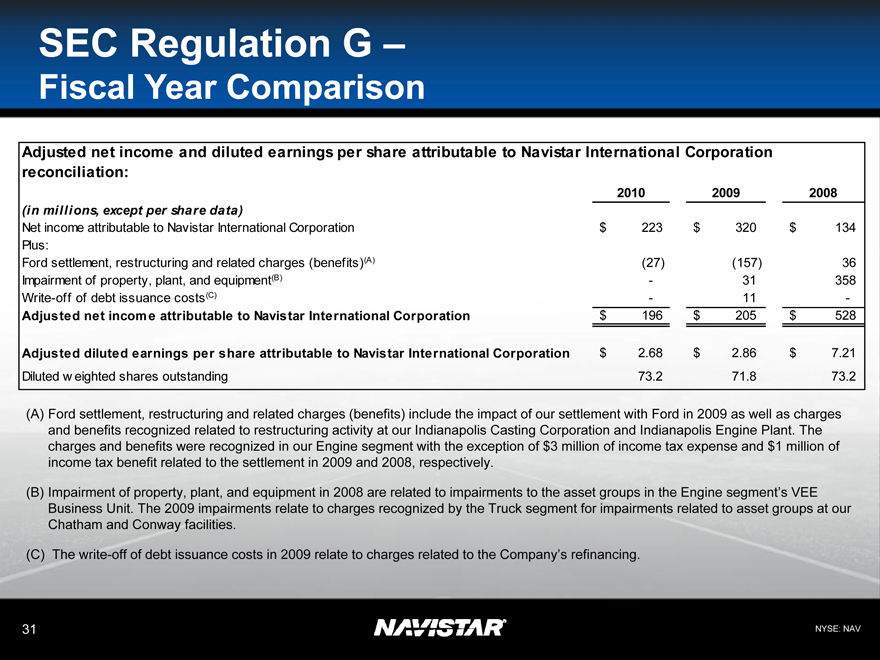

SEC Regulation G –

Fiscal Year Comparison

Adjusted net income and diluted earnings per share attributable to Navistar International Corporation reconciliation:

2010 2009 2008

(in millions, except per share data)

Net income attributable to Navistar International Corporation $ 223 $ 320 $ 134

Plus:

Ford settlement, restructuring and related charges (benefits)(A) (27) (157) 36

Impairment of property, plant, and equipment(B) - 31 358

Write-off of debt issuance costs(C) - 11 -

Adjusted net income attributable to Navistar International Corporation $ 196 $ 205 $ 528

Adjusted diluted earnings per share attributable to Navistar International Corporation $ 2.68 $ 2.86 $ 7.21

Diluted weighted shares outstanding 73.2 71.8 73.2

(A) Ford settlement, restructuring and related charges (benefits) include the impact of our settlement with Ford in 2009 as well as charges and benefits recognized related to restructuring activity at our Indianapolis Casting Corporation and Indianapolis Engine Plant. The charges and benefits were recognized in our Engine segment with the exception of $3 million of income tax expense and $1 million of income tax benefit related to the settlement in 2009 and 2008, respectively.

(B) Impairment of property, plant, and equipment in 2008 are related to impairments to the asset groups in the Engine segment’s VEE Business Unit. The 2009 impairments relate to charges recognized by the Truck segment for impairments related to asset groups at our Chatham and Conway facilities.

(C) The write-off of debt issuance costs in 2009 relate to charges related to the Company’s refinancing.

31

NYSE: NAV

|

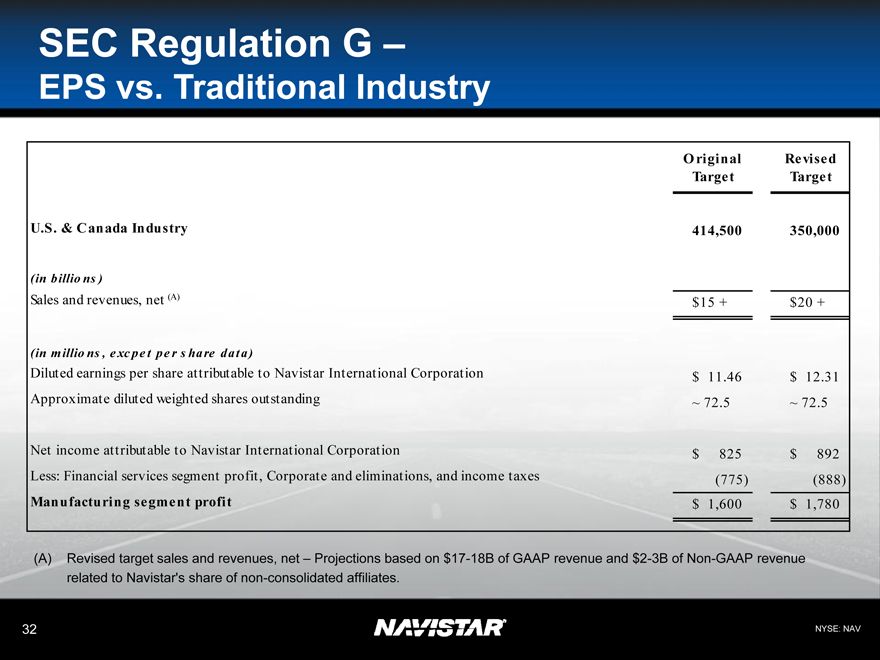

SEC Regulation G –

EPS vs. Traditional Industry

Original Revised

Target Target

U.S. & Canada Industry 414,500 350,000

(in billions)

Sales and revenues, net (A) $15 + $20 +

(in millions, excpet per share data)

Diluted earnings per share attributable to Navistar International Corporation $ 11.46 $ 12.31

Approximate diluted weighted shares outstanding ~ 72.5 ~ 72.5

Net income attributable to Navistar International Corporation $ 825 $ 892

Less: Financial services segment profit, Corporate and eliminations, and income taxes(775)(888)

Manufacturing segment profit $ 1,600 $ 1,780

(A) Revised target sales and revenues, net – Projections based on $17-18B of GAAP revenue and $2-3B of Non-GAAP revenue related to Navistar’s share of non-consolidated affiliates.

32

NYSE: NAV