Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No._ )

Filed by the Registrant: | X | |

____ | ||

Filed by a Party other than the Registrant: | ____ | |

Check the appropriate box:

| ||

X | ||

_______ | Preliminary Proxy Statement | |

_______ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

_______ | Definitive Proxy Statement | |

_______ | Definitive Additional Materials | |

_______ | Soliciting Material Pursuant to §240.14a-12 | |

Navistar International Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

X | ||

_______ | No fee required. | |

_______ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

(1) Title of each class of securities to which transaction applies: | ||

(2) Aggregate number of securities to which transaction applies: | ||

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

(4) Proposed maximum aggregate value of transaction: | ||

(5) Total fee paid: | ||

_______ | Fee paid previously with preliminary materials. | |

_______ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

(1) Amount Previously Paid: | ||

(2) Form, Schedule or Registration Statement No.: | ||

(3) Filing Party: | ||

(4) Date Filed: | ||

Table of Contents

NAVISTAR INTERNATIONAL CORPORATION

2701 NAVISTAR DRIVE

LISLE, ILLINOIS 60532

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TUESDAY, FEBRUARY 21, 2012

11:00 A.M. – CENTRAL TIME

HYATT LISLE HOTEL

1400 CORPORETUM DRIVE

LISLE, ILLINOIS 60532

January 23, 2012

To our stockholders:

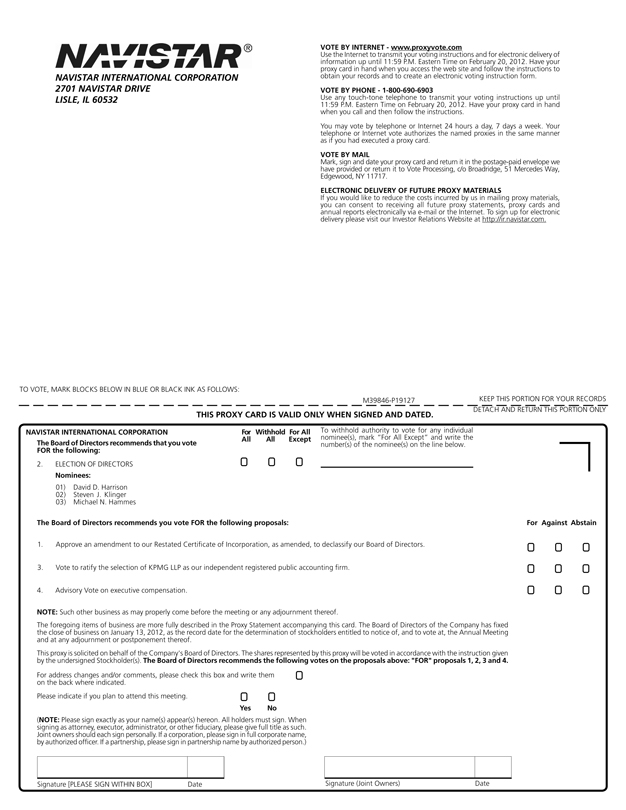

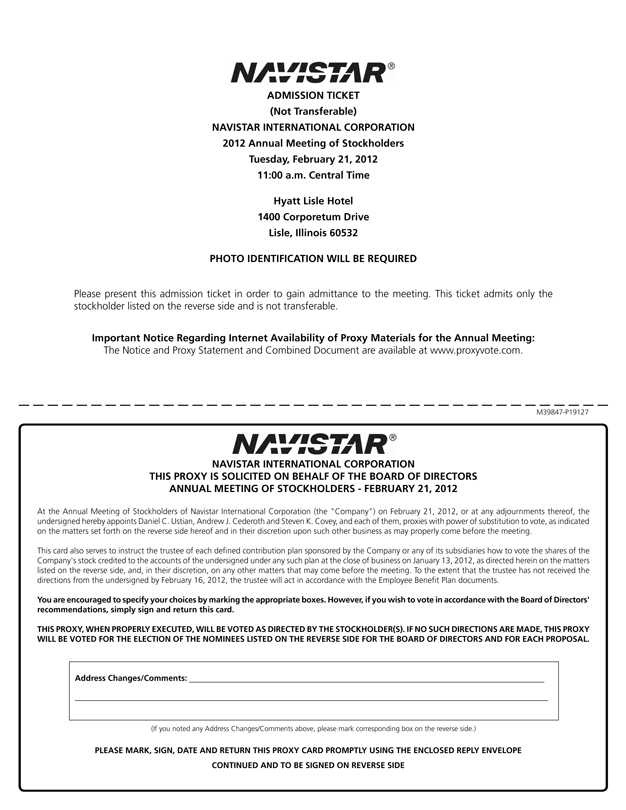

On behalf of the Board of Directors of Navistar International Corporation you are cordially invited to attend our 2012 Annual Meeting of Stockholders, which will be held on February 21, 2012, at 11:00 a.m. Central Time, at the Hyatt Lisle Hotel, 1400 Corporetum Drive, Lisle, Illinois 60532. At our Annual Meeting, our stockholders will be asked to:

| ¨ | Approve an amendment to our Restated Certificate of Incorporation, as amended, to declassify our Board of Directors; |

| ¨ | Elect as directors the nominees named in the accompanying proxy statement; |

| ¨ | Ratify the appointment of our independent registered public accounting firm; |

| ¨ | Act on an advisory vote on executive compensation; and |

| ¨ | Conduct any other business properly brought before the meeting. |

The accompanying proxy statement and the form of proxy are first being made available to our stockholders on January 23, 2012. In order to attend our 2012 Annual Meeting of Stockholders, you must have an admission ticket to attend. Procedures for requesting an admission ticket are detailed on page 80 of the accompanying proxy statement. Attendance and voting is limited to stockholders of record at the close of business on January 13, 2012.

By Order of the Board of Directors, | ||

| ||

Curt A. Kramer Secretary | ||

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDERS MEETING TO BE HELD ON FEBRUARY 21, 2012:

THE ANNUAL REPORT AND PROXY STATEMENT ARE AVAILABLE AT

HTTP://IR.NAVISTAR.COM/ANNUALPROXY.CFM

Table of Contents

| 2 | ||||

PROPOSAL 1 – APPROVE AN AMENDMENT TO OUR RESTATED CERTIFICATE OF INCORPORATION | 8 | |||

| 10 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 19 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

PERSONS OWNING MORE THAN FIVE PERCENT OF NAVISTAR COMMON STOCK | 26 | |||

NAVISTAR COMMON STOCK OWNED BY EXECUTIVE OFFICERS AND DIRECTORS | 29 | |||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| 33 | ||||

| 48 | ||||

| 68 | ||||

| 69 | ||||

| 73 | ||||

PROPOSAL 3 – RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 75 | |||

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FEE INFORMATION | 76 | |||

| 77 | ||||

| 79 | ||||

| 79 | ||||

| 79 | ||||

Matters Raised at the Meeting not Included in this Proxy Statement | 79 | |||

| 80 | ||||

| A-1 | ||||

| B-1 |

| Page 1 | ||||

Table of Contents

FREQUENTLY ASKED QUESTIONS REGARDING ATTENDANCE AND VOTING

|

Q: Why am I receiving this proxy statement?

A: You are receiving this proxy statement because the Board of Directors (the “Board”) of Navistar International Corporation (“Navistar” or the “Company”) is soliciting your proxy to vote your shares at our 2012 Annual Meeting of Stockholders (the “Annual Meeting”). This proxy statement includes information that we are required to provide to you under the rules of the U.S. Securities and Exchange Commission (“SEC”) and is designed to assist you in voting your shares.

Q: What is the purpose of the Annual Meeting?

A: The purpose of the Annual Meeting is to have stockholders act upon the matters outlined in the notice of annual meeting and this proxy statement, which include (i) Proposal 1 – the approval of an amendment to our Restated Certificate of Incorporation, as amended, (our “Certificate of Incorporation”) to declassify our Board, (ii) Proposal 2 – the election of the nominees named in this proxy statement as directors, (iii) Proposal 3 – the ratification of the appointment of Navistar’s independent registered public accounting firm, and (iv) Proposal 4 – an advisory vote on executive compensation, a so-called “Say-on-Pay” proposal. In addition, management may report on the performance of Navistar and respond to appropriate questions from stockholders.

Q: How does the Board recommend that I vote?

A. The Board recommends that you vote:

| • | FOR the approval of the amendment to our Certificate of Incorporation to declassify our Board (Proposal 1); |

| • | FOR the election of each of the director nominees (Proposal 2); |

| • | FOR the ratification of the appointment of KPMG LLP, as our independent registered public accounting firm (Proposal 3); and |

| • | FOR the approval of the advisory vote on executive compensation (Proposal 4). |

Q: Who can attend the Annual Meeting?

A: Anyone wishing to attend the Annual Meeting must have an admission ticket issued in his or her name. Admission is limited to:

| • | Stockholders of record on January 13, 2012; |

| • | An authorized proxy holder of a stockholder of record on January 13, 2012; or |

| • | An authorized representative of a stockholder of record who has been designated to present a properly-submitted stockholder proposal. |

You must provide evidence of your ownership of shares with your ticket request. The specific requirements for obtaining an admission ticket are specified in the “Admission and Ticket Request Procedure” on page 80 of this proxy statement.

| Page 2 | ||||

Table of Contents

Q: What is a stockholder of record?

A: A stockholder of record or registered stockholder is a stockholder whose ownership of Navistar stock is reflected directly on the books and records of our transfer agent, BNY Mellon Investor Services (the “Transfer Agent”). If you hold Navistar stock through a bank, broker or other intermediary, you hold your shares in “street name” and are not a stockholder of record. For shares held in a street name, the stockholder of record of the shares is your bank, broker or other intermediary. Navistar only has access to ownership records for the stockholders of record. So, if you are not a stockholder of record, for the purpose of requesting a ticket to attend the Annual Meeting, we will need additional documentation to evidence your stock ownership as of the record date, such as, a copy of your brokerage account statement, a letter from your broker, bank or other nominee or a copy of your voting instruction card.

Q: When is the record date and who is entitled to vote?

A: The Board has set January 13, 2012, as the record date for the Annual Meeting. Holders of shares of Navistar common stock (“Common Stock”) on that date are entitled to one vote per share. As of January 13, 2012, there were approximately [ ] shares of Common Stock outstanding. If you are a participant in any of the Company’s 401(k) or retirement savings plans, your proxy card will represent the number of shares allocated to your account under the plan and will serve as a direction to the plan’s trustee as to how the shares in your account are to be voted.

A list of all registered holders will be available for examination by stockholders during normal business hours at 2701 Navistar Drive, Lisle, Illinois 60532 at least ten (10) days prior to the Annual Meeting and will also be available for examination at the Annual Meeting.

Q: How do I vote?

A: For stockholders of record: You may vote by any of the following methods:

| • | in person – stockholders who obtain an admission ticket (following the specified procedure) and attend the Annual Meeting in person will receive a ballot for voting. |

| • | by mail– use the proxy and/or voting instruction card provided. |

| • | by phone or via the Internet– follow the instructions on the enclosed proxy and/or voting instruction card. |

If you vote by phone or via the Internet, please have your proxy and/or voting instruction card available. The control number appearing on your card is necessary to process your vote. A phone or Internet vote authorizes the named proxies in the same manner as if you marked, signed and returned the card by mail.

For holders in street name: You will receive instructions from your bank or broker that you must follow in order for your shares to be voted.

Q: How can I change or revoke my proxy?

A: For stockholders of record:You may change or revoke your proxy at any time before it is exercised by (i) submitting a written notice of revocation to Navistar c/o the Corporate Secretary at 2701 Navistar Drive, Lisle, Illinois 60532, (ii) signing and returning a new proxy card with a later date, (iii) validly submitting a later-dated vote by telephone or via the Internet on or before 11:59 pm EST on February 20, 2012 or (iv) attending the Annual Meeting and voting in person. For all methods of voting, the last vote cast will supersede all previous votes.

| Page 3 | ||||

Table of Contents

For holders in street name:You may change or revoke your voting instructions by following the specific directions provided to you by your bank or broker.

Q: Is my vote confidential?

A: Yes. Proxy cards, ballots and voting tabulations that identify stockholders are kept confidential. There are exceptions for contested proxy solicitations or when necessary to meet legal requirements. Broadridge Financial Solutions, Inc., the independent proxy tabulator used by Navistar, counts the votes and acts as the inspector of elections for the Annual Meeting.

Q: Will my shares be voted if I do not provide my proxy?

A: For stockholders of record: If you are the stockholder of record and you do not vote by proxy card, by telephone or via the Internet or in person at the Annual Meeting, your shares will not be voted at the Annual Meeting.

For holders in street name: If your shares are held in street name, your shares may be voted even if you do not provide the brokerage firm with voting instructions. Under New York Stock Exchange (“NYSE”) rules, your broker may vote shares held in street name on certain “routine” matters. NYSE rules considers the approval of the amendment to our Certificate of Incorporation to declassify our Board (Proposal 1) and the ratification of the appointment of our independent registered public accounting firm (Proposal 3) to be routine matters. As a result, your broker is permitted to vote your shares on those matters at its discretion without instruction from you.

When a proposal is not a routine matter, such as the election of directors (Proposal 2) and the Say-On-Pay proposal (Proposal 4), and you have not provided voting instructions to the bank or brokerage firm with respect to that proposal, the bank or brokerage firm cannot vote the shares on that proposal. The missing votes for these non-routine matters are called “broker non-votes.”

Q: What is the quorum requirement for the Annual Meeting?

A: Under Navistar’s Amended and Restated By-Laws (the “By-Laws”), holders of at least one-third of the shares of Common Stock outstanding on the record date must be present in person or represented by proxy in order to constitute a quorum. Abstentions and broker non-votes are counted as present for purposes of establishing a quorum.

Q: What vote is necessary for action to be taken on proposals?

A: It will depend on each proposal.

| • | Proposal 1 (amendment to our Certificate of Incorporation) requires the affirmative vote of at least a majority of the outstanding shares of our Common Stock. |

| • | Proposal 2 (election of directors) requires a plurality vote of the shares present or represented by proxy at the Annual Meeting and entitled to vote, meaning that the director nominees with the greatest number of affirmative votes are elected to fill the available seats. As outlined in our Corporate Governance Guidelines, any director who receives more “withheld” votes than “for” votes in an uncontested election is required to tender his or her resignation to the Nominating and Governance Committee for consideration and recommendation to the Board. |

| • | Proposal 3 (ratification of the appointment of our independent registered public accounting firm) requires the affirmative vote of a majority of the shares present or represented by proxy at the Annual Meeting and entitled to vote. |

| Page 4 | ||||

Table of Contents

| • | Proposal 4 (Say-On-Pay proposal) represents an advisory vote and the results will not be binding on the Board or the Company. The affirmative vote of a majority of the shares present or represented by proxy at the Annual Meeting and entitled to vote on the matter will constitute the stockholders’ non-binding approval with respect to our executive compensation programs. Our Board will review the voting results and take them into consideration when making future decisions regarding executive compensation. |

With respect to Proposals 1, 3 and 4 you may vote FOR, AGAINST or ABSTAIN. If you abstain from voting on any of these proposals, the abstention will have the same effect as an AGAINST vote. With respect to Proposal 2, you may vote FOR all nominees, WITHHOLD your vote as to all nominees, or FOR all nominees except those specific nominees from whom you WITHHOLD your vote. A properly executed proxy marked WITHHOLD with respect to the election of one or more directors will not be voted with respect to the director or directors indicated. Proxies may not be voted for more than three directors and stockholders may not cumulate votes in the election of directors. If you abstain from voting on Proposal 1, the abstention will not have an effect on the outcome of the vote.

Broker non-votes will not affect the outcome on a proposal that requires a plurality vote (Proposal 2) or on a proposal that requires the approval of a majority of the votes present in person or represented by proxy and entitled to vote (Proposals 3 and 4), but will have the effect of a vote against matters that require approval of a majority of the outstanding shares entitled to vote (Proposal 1).

Votes submitted by mail, telephone or Internet will be voted by the individuals named on the card (or the individual properly authorized) in the manner indicated. If you do not specify how you want your shares voted, they will be voted in accordance with management’s recommendations. If you hold shares in more than one account, you must vote each proxy and/or voting instruction card you receive to ensure that all shares you own are voted.

Q: What is house-holding?

A: If you and other residents at your mailing address own shares of Common Stock in street name, your broker or bank may have notified you that your household will receive only one annual report and proxy statement for the Company if you hold stock through that broker or bank. In this practice known as “house-holding,” you were deemed to have consented to that process. House-holding benefits both you and the Company because it reduces the volume of duplicate information received at your household and helps the Company to reduce expenses. Accordingly, the Company and your broker or bank will send one copy of our annual report and proxy statement to your address. Each stockholder will continue to receive a separate proxy card or voting instruction card. We will promptly deliver an additional copy of either document to you if you call or write us at the following address or phone number: Investor Relations, Navistar International Corporation, 2701 Navistar Drive, Lisle, Illinois 60532, (331) 332-2143.

Q: What does it mean if I receive more than one proxy card?

A: Whenever possible, registered shares and plan shares for multiple accounts with the same registration will be combined into the same proxy card. Shares with different registrations cannot be combined and as a result, the stockholder may receive more than one proxy card. For example, registered shares held individually by John Doe will not be combined on the same proxy card as registered shares held jointly by John Doe and his wife.

Shares held in street name are not combined with registered or plan shares and may result in the stockholder receiving more than one proxy card. For example, street shares held by a broker for John Doe will not be combined with registered shares for John Doe.

| Page 5 | ||||

Table of Contents

If you hold shares in more than one account, you must vote each proxy and/or voting instruction card you receive to ensure that all shares you own are voted. If you receive more than one card for accounts that you believe could be combined because the registration is the same, contact our stock transfer agent (for registered shares) or your broker (for shares held in street name) to request that the accounts be combined for future mailings.

Q: Who pays for the solicitation of proxies?

A: Navistar pays the cost of soliciting proxies. This solicitation is being made by mail, but also may be made by telephone, e-mail or in person. We have hired Alliance Advisors to assist in the solicitation of proxies. Alliance Advisors’ fees are estimated to be $9,000, plus out-of-pocket expenses, to assist in the solicitation. Proxies may also be solicited by our directors, officers and employees who will not be additionally compensated for those activities. We will reimburse brokerage firms and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for sending proxy materials to stockholders and obtaining their votes.

Q: When are stockholder proposals or nominations due for the 2013 Annual Meeting?

A: Our annual meeting of stockholders is typically held on the third Tuesday in February. Accordingly, we expect to hold our 2013 annual meeting of stockholders on or around February 19, 2013. Any stockholder proposal for inclusion in the Company’s proxy materials for the 2013 annual meeting pursuant to SEC Rule 14a-8 under the Exchange Act must be received by the Company’s Corporate Secretary no later than September 25, 2012. Any proposal may be included in next year’s proxy statement only if such proposal complies with the Company’s By-Laws and the rules and regulations promulgated by the SEC, including Rule 14a-8.

In addition, the Company’s By-Laws require that the Company be given advance written notice of nominations for election to the Board and other matters that stockholders wish to present for action at an annual meeting of stockholders (other than matters included in the Company’s proxy materials in accordance with Rule 14a-8 under the Exchange Act). For matters to be presented at the 2013 annual meeting, the Company’s Corporate Secretary must receive such notice no earlier than August 25, 2012, and no later than October 24, 2012. The notice must contain, and be accompanied by, certain information as specified in the Company’s By-Laws. The Company recommends that any stockholder wishing to nominate a director at, or bring any other item before, an annual meeting of stockholders review the Company’s By-Laws, which are available on the Company’s website athttp://ir.navistar.com/documents.cfm. All stockholder proposals and director nominations must be delivered to Navistar by mail c/o the Corporate Secretary at 2701 Navistar Drive, Lisle, Illinois 60532.

Q: Are there any matters to be voted on at the Annual Meeting that are not included in the proxy?

A: We do not know of any matters to be acted upon at the Annual Meeting other than those discussed in this proxy statement. If any other matter is properly presented, proxy holders will vote on the matter in their discretion.

Q: May stockholders ask questions at the Annual Meeting?

A: Yes. During the Annual Meeting, stockholders may ask questions or make remarks directly related to the matters being voted on. In order to ensure an orderly meeting, we ask that stockholders direct questions and comments to the Chairman. In order to provide the opportunity to every stockholder who wishes to speak, each stockholder’s remarks will be limited to two minutes. Stockholders may speak a second time only after all other stockholders who wish to speak have had their turn.

| Page 6 | ||||

Table of Contents

Q: How can I find the results of the Annual Meeting?

A: Preliminary results will be announced at the Annual Meeting. Final results will be published in a Current Report on Form 8-K to be filed with the SEC within four business days after the Annual Meeting. If the official results are not available at that time, we will provide preliminary voting results in the Form 8-K and will provide the final results in an amendment to the Form 8-K as soon as they become available.

| Page 7 | ||||

Table of Contents

PROPOSAL 1—APPROVE AN AMENDMENT TO OUR RESTATED CERTIFICATE OF INCORPORATION

|

Article Seventh of our Certificate of Incorporation currently divides the Board into three classes (Class I, Class II and Class III). One additional director not in any class is elected by the United Automobiles, Aerospace and Agricultural Implement Workers of America, as holders of the Company’s Series B Preference Stock. Each member of a class is elected for a three-year term, with the terms staggered so that approximately one-third of directors stand for election each year. There are currently three Class I directors, whose term expires at the 2012 annual meeting; three Class II directors, whose term expires at the 2013 annual meeting; and three Class III directors, whose term expires at the 2014 annual meeting.

Classified boards provide effective protection against hostile takeover tactics and proxy contests because they make it difficult to gain control of the board of directors without the cooperation or approval of incumbent directors. A classified board also fosters continuity and stability, not only on the board but also in the overall business of a company, since a majority of directors will always have prior experience as directors of the company.

However, annually elected boards are perceived as increasing accountability of directors to stockholders as they provide stockholders with the opportunity to register their views at each annual meeting on the performance of the entire board of directors over the prior year. Many institutional investors believe that the election of directors is the primary means for stockholders to influence corporate governance policies and to hold management accountable for implementing those policies. Others support declassification because it removes an anti-takeover defense for the board of directors the stockholders prefer to have in their own hands.

After careful consideration, and as part of an agreement reached with some of our stockholders, the Board has determined that it would be in the best interests of the Company and its stockholders to amend our Certificate of Incorporation as set forth inAppendix A of this proxy statement, to phase out classification of our Board and provide instead for the annual election of directors as further described below (the “Declassification Amendment”). The Board unanimously approved, and recommends that the stockholders approve, the Declassification Amendment.

If the Declassification Amendment is approved by the stockholders, then we will amend our Certificate of Incorporation and directors elected at the Annual Meeting and thereafter will be elected for one-year terms at each annual meeting of stockholders. Therefore, the Class I directors would stand for election at the Annual Meeting for one-year terms, the Class I and Class II directors would stand for election at the 2013 annual meeting for one-year terms, and beginning with the 2014 annual meeting, the Board will be completely declassified and all directors will be subject to annual election to one-year terms. Consistent with Delaware law, the Declassification Amendment also provides that once declassification of the Board is accomplished at the 2014 annual meeting, thereafter directors may be removed with or without cause.

If the Declassification Amendment is not approved by the stockholders, our Board will remain classified and our directors will continue to be subject to our Certificate of Incorporation’s current classification. In such case, the three Class I directors to be elected at the Annual Meeting would be elected to a three-year term to serve until the 2015 annual meeting and until their respective successors are duly elected and qualified. Similarly, the Class II and Class III directors would continue to be elected to three-year terms as provided in our existing Certificate of Incorporation.

To be approved at the Annual Meeting, the Declassification Amendment requires the affirmative vote of at least a majority of the outstanding shares of our Common Stock. An abstention will have the same

| Page 8 | ||||

Table of Contents

effect as a vote against the proposal. If approved, the Declassification Amendment will become effective during the Annual Meeting and prior to the election of directors, so that persons elected directors at the Annual Meeting will be elected to a one-year term.

The general description of the proposed amendment to the Certificate of Incorporation set forth above is qualified in its entirety by reference to the text of the proposed amendment to the Certificate of Incorporation, which is attached asAppendix A to this proxy statement.

YOUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL 1.

| Page 9 | ||||

Table of Contents

PROPOSAL 2—ELECTION OF DIRECTORS

|

Our Board consists of 10 directors.1 One director is appointed by the United Automobiles, Aerospace and Agricultural Implement Workers of America (the “UAW”) and is not part of our classified Board. The remaining nine directors are divided into three equal classes for purposes of election (i.e., Class I, Class II and Class III). Only the three members of Class I of our classified Board are up for election at the Annual Meeting.

As explained in further detail on page 8 of this proxy statement, the Board is proposing to amend our Certificate of Incorporation to move to annual elections of all our directors. This action cannot take place, however, until approved by stockholders. Accordingly, if the proposed amendment in Proposal 1 is not approved by our stockholders, the three Class I nominees will be elected to a three-year term extending until the 2015 annual meeting. If our stockholders approve Proposal 1 to amend our Certificate of Incorporation to move to annual election of all our directors, then the Class I nominees will be elected to a one-year term at the Annual Meeting extending until the 2013 annual meeting.

If a nominee is unavailable for election, proxy holders will vote for another nominee proposed by the Board or, as an alternative, the Board may reduce the number of directors to be elected at the Annual Meeting. We know of no reason why any nominee would be unable to accept nomination or election. All nominees have consented to be named in this proxy statement and to serve if elected.

The following summarizes additional information about each of the nominees and continuing directors as of the date of this proxy statement, including their business experience, director positions held currently or at any time during the last five years, involvement in certain legal or administrative proceedings, if applicable, and the experiences, qualifications, attributes or skills that qualify our nominees and continuing directors to serve as directors of the Company. The nominees were evaluated and recommended by the Nominating and Governance Committee in accordance with the process for nominating directors as found on page 20 of this proxy statement.

YOUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE NOMINEES PRESENTED IN PROPOSAL 2.

Class I Directors Whose Term Expires at the Annual Meeting– THIS IS THE ONLY CLASS OF DIRECTORS UP FOR ELECTION AT THE ANNUAL MEETING

|

David D. Harrison,* 64, Director since 2007(Committees: Audit and Compensation). Mr. Harrison served as Executive Vice President and Chief Financial Officer of Pentair, Inc., a $3 billion global manufacturing company, with more than 13,000 employees, from 2000 until his retirement in February 2007. He also served as Executive Vice President and Chief Financial Officer of Pentair, Inc. from 1994 to 1996. Prior to joining Pentair, he held several executive positions with General Electric Co. and Borg Warner Corp from 1972 through 1994. Mr. Harrison is currently managing partner of HCI, Inc., a real estate investment firm, and has served in that capacity since 2007. He is also a director of National Oilwell Varco, Inc.(Committee: Audit (Chair)), a leading global manufacturer of oil well drilling equipment, and James Hardie(Committees: Audit and Compensation (Chair)), a world leader in fibre cement technology. |

| Page 10 | ||||

Table of Contents

Mr. Harrison is an experienced director having spent over 40 years in manufacturing. He has a distinguished finance background (BA in Accounting, MBA in Finance and is a Certified Management Accountant), having significant expertise in corporate finance roles and information technology, as well as international operations experience in Western Europe, Eastern Europe and Canada and public company director experience. In addition to those described above, Mr. Harrison has skills and experience in accounting, corporate governance, human resources, compensation and employee benefits, mergers and acquisitions, tax and treasury matters, which well qualifies him to serve on our Board. | ||

| Steven J. Klinger,* 52, Director since 2008(Committees: Audit and Compensation). Mr. Klinger was President and Chief Operating Officer of Smurfit-Stone Container Corporation, a global paperboard and paper-based packaging company, from 2006 until his retirement in December 2010. Prior to this position, he served as Executive Vice President, Packaging, Pulp & Global Procurement at Georgia-Pacific Corporation, a pulp and paper company, from 2003 to 2006, and President of Packaging at Georgia-Pacific from 2000 to 2002. Prior to 2000, he held numerous other positions within Georgia-Pacific and acquired significant experience in international and domestic sales, heavy process manufacturing and acquisitions and divestures during 28 years in the pulp and paper industry. Mr. Klinger also served as a director of Smurfit-Stone Container Corporation from December 2008 to December 2010. On January 26, 2009, Smurfit-Stone Container Corporation filed for voluntary reorganization under Chapter 11 of the U.S. Bankruptcy Code and emerged from bankruptcy on June 20, 2010.

Mr. Klinger has served in accounting roles as a former Internal Auditor, Division Controller and Assistant Operations Controller, and as a Director of Corporate Development he led over $2 billion of divestitures and participated in over $10 billion of mergers and acquisitions. He has experience selling products and running operations internationally in Canada, Mexico, China, South America, Europe, the Middle East, Central America and Southeast Asia and has been responsible for multiple joint ventures in the US, Canada, China, Central America and Southeast Asia. As a result of these professional and other experiences, Mr. Klinger possesses particular knowledge and experience in a variety of areas, including accounting, finance, manufacturing (domestic and international), sales and marketing (domestic and international), mergers and acquisitions, purchasing and union/labor relations, which contributes greatly to the Board’s composition and well qualifies him to serve on our Board. | |

| Michael N. Hammes,* 70, Director since 1996(Committees: Compensation, Finance (Chair), Nominating and Governance (Chair) and Executive). Mr. Hammes has also served as Lead Director of the Company since December 2007. He served as Chairman and Chief Executive Officer of Sunrise Medical Inc., which designs, manufacturers and markets home medical equipment worldwide, from 2000 until his retirement as Chief Executive Officer in 2007 and as Chairman in 2008. He was Chairman and Chief Executive Officer of the Guide Corporation, an automotive lighting business, from 1998 to 2000. He was also Chairman and Chief Executive Officer of The Coleman Company, Inc., a manufacturer and distributor of camping and outdoor recreational products and hardware/home products, from 1993 to 1997, and held a variety of executive positions with Ford and Chrysler including President of | |

| Page 11 | ||||

Table of Contents

Chrysler’s International Operations and President of Ford’s European Truck Operations. He is Chairman of James Hardie(Committees: Audit, Compensation and Nominating and Governance), the world leader in fibre cement technology, and a director of DynaVox Mayer-Johnson(Committee: Nominating and Governance and Audit), the leading provider of speech generating devices and symbol-adapted special education software. Mr. Hammes is also a member of the Board of Directors of DeVilbiss, which is involved in medical equipment for the health care industry.

As a result of these professional and other experiences, including his experience as a member of other public company boards of directors, Mr. Hammes possesses particular knowledge and experience in a variety of areas, including accounting, corporate governance, distribution, finance, manufacturing (domestic and international), marketing, non-U.S. sales/distribution and product development, which strengthens the Board’s collective knowledge, capabilities and experience. Likewise, his experience and leadership in serving as Chairman and Chief Executive Officer for three different companies for fifteen years well qualifies him to serve on our Board.

|

THE FOLLOWING CLASSES OF DIRECTORS ARE NOT UP FOR ELECTION AT THE ANNUAL MEETING.

Class II Directors Whose Term Expires at the 2013 Annual Meeting

| Eugenio Clariond,* 68, Director since 2002(Committees: Finance and Nominating and Governance). Mr. Clariond retired as Chairman of the Board of Directors and Chief Executive Officer of Group IMSA, S.A., a producer of steel processed products, steel and plastic construction products and aluminum and other related products, in 2006. He served as Chief Executive Officer from 1985 through 2006 and as Chairman from 2003 through 2006. He is also a director of Texas Industries, Inc.(Committees: Audit and Governance (Chair)), a producer of construction materials, Johnson Controls, Inc.(Committees: Finance and Compensation), a global diversified company in the building and automotive industries, and Mexichem S.A. (Committees: Audit and Governance), a Mexican chemical company. Mr. Clariond served as Chairman of Verzatec, S.A., producer of aluminum and plastic construction parts, from 2004 to 2010, as director of the Mexico Fund, Inc. from 2005 to 2010, and as director of Grupo Financiero Banorte, S.A., a Mexican bank, from 2000 to June 2011. He was also Chairman of the Mexican Fund for Nature Conservancy, a founding member and past Vice-Chairman of the World Business Council for Sustainable Development, and Chairman of the United States-Mexico Business Committee of the Mexican Business Council for Foreign Trade. He is also a director of Monterrey Tech and the Center of Studies from the Private Sector for Sustainable Development. He is on the Advisory Board of the McCombs School of Business at the University of Texas at Austin, the Harte Research Institute for Gulf of Mexico Studies and the Jacobs School of Engineering of the University of California at San Diego. He has also been active in promoting Mexico’s foreign trade and was involved in the negotiation of the North American Free Trade Agreement. As a result of the positions and experience described above, Mr. Clariond has leadership experience with large, complex and diverse organizations, including in the automotive industry, and experience in strategic planning which well qualifies him to serve on our Board. His years of service on other public company boards provide him with additional perspectives from which to view the Company’s operations and the Board’s activities. Mr. Clariond’s skills in accounting, corporate governance, finance, human resources/compensation/employee benefits, manufacturing (domestic and international), marketing, mergers and acquisitions and non-U.S. sales and distribution strengthen the Board’s collective knowledge, capabilities and experience. |

| Page 12 | ||||

Table of Contents

| Diane H. Gulyas,* 55, Director since 2009 (Committee: Finance). Ms. Gulyas is the President responsible for E.I. DuPont De Nemours and Company’s (“DuPont”) performance polymers, which contains three business units – engineering polymers, elastomers and films, with annual revenues of approximately $5 billion. She joined DuPont in 1978 and spent her first 10 years in a variety of sales, marketing, technical and systems development positions, primarily in the company’s polymers business. She later served as vice president and general manager for DuPont’s advanced fiber business and then group vice president of the $3 billion electronic and communication technologies platform. In April 2004, she was named chief marketing and sales officer, where she was responsible for corporate branding and marketing communications, market research, e-business and marketing/sales capability worldwide. She was named to her current position in October 2009.

As a result of these professional and other experiences, Ms. Gulyas possesses executive and management experience that well qualifies her to serve on our Board. Her skills in engineering, manufacturing (domestic and international), marketing and non-U.S. sales and distribution contribute greatly to the Board’s composition. | |

| General Stanley A. McChrystal, 57, Director since 2011 (Committee: Finance). Gen. McChrystal, is a retired 34-year U.S. Army veteran of multiple wars. He commanded the U.S. and NATO’s security mission in Afghanistan, served as the director of the Joint Staff and was the Commander of Joint Special Operations Command, where he was responsible for the nation’s deployed military counter terrorism efforts. Gen. McChrystal is a graduate of the United States Military Academy at West Point, the United States Naval Command and Staff College and was a military fellow at both the Council on Foreign Relations and the Kennedy School of Government at Harvard University. Currently the General is a member of the Board of Directors of JetBlue Airways Corporation (Committees: Compensation, Corporate Governance and Nominating and Airline Safety), a commercial airline, Chairman of the board of Siemens Government Technologies, Inc., a wholly-owned indirect subsidiary and a Federal Business Entity of Siemens AG, since December 2011, and since August 2011 a member of the Board of Advisors of General Atomics, a world leader of resources for high-technology systems ranging from the nuclear fuel cycle to remotely operated surveillance aircraft, airborne sensors, and advanced electric, electronic, wireless and laser technologies. He also teaches a seminar on leadership at the Jackson Institute for Global Affairs at Yale University and serves alongside his wife on the Board of Directors for the Yellow Ribbon Fund, a non-profit organization committed to helping wounded veterans and their families.

As a former senior military leader, Gen. McChrystal has experience in logistics, talent management and experience with government and regulatory affairs and military contracting. Gen. McChrystal’s years of military leadership and service are of great value to the Board as the Company expands its global and military businesses. | |

| Page 13 | ||||

Table of Contents

Class III Directors Whose Term Expires at the 2014 Annual Meeting

| James H. Keyes,* 71, Director since 2002(Committees: Audit (Chair),Compensation, Nominating and Governance and Executive). Mr. Keyes retired as Chairman of the Board of Johnson Controls, Inc., an automotive system and facility management and control company, in 2003, a position he had held since 1993. He served as Chief Executive Officer of Johnson Controls, Inc. from 1988 until 2002. He is a director of Pitney Bowes, Inc.(Committees: Compensation, Governance and Executive) and is a member of the Board of Trustees of Fidelity Mutual Funds(Committees: Audit and Compliance). He was also formerly a director of LSI Logic Corporation, an electronics company that designs semiconductors and software that accelerate storage and networking in datacenters and mobile networks.

Mr. Keyes has broad experience as former chief executive officer of a public company, experience as a certified public accountant, experience as a member of other public company boards of directors, and he has a Masters in Business Administration. He possesses strong skills and experience in accounting, corporate governance, finance, human resources/compensation/employee benefits, manufacturing (domestic and international), mergers and acquisitions and treasury matters, which well qualifies him to serve on our Board. | |

| John D. Correnti,* 64, Director since 1994(Committees: Audit, Nominating and Governance and Compensation (Chair)). Mr. Correnti serves as Chairman and Chief Executive Officer of Steel Development Company, LLC, a steel mill operational and development company, since 2007. Prior to this position he was President and Chief Executive Officer of SeverCorr, LLC, a manufacturer of high quality flat-rolled steel products, from 2005 until 2008. He was Chairman and Chief Executive Officer of SteelCorr, LLC from 2002 to 2005, and Chairman and Chief Executive Officer of Birmingham Steel Corporation, a manufacturer of steel and steel products, from 1999 to 2002. On June 3, 2002, Birmingham Steel Corporation filed for voluntary reorganization under Chapter 11 of the U.S. Bankruptcy Code. Mr. Correnti served as Chief Executive Officer, President and Vice Chairman of Nucor Company, a mini mill manufacturer of steel products, from 1996 to 1999, and as its President and Chief Operating Officer and as a director from 1991 to 1996. He is Executive Chairman of the Board of Directors of Calisolar, a private solar cells manufacturer, and a director of Corrections Corporation of America, a public provider of correctional solutions(Committee: Compensation). He also serves on the Clarkson University Board of Trustees and the Mississippi University for Women Foundation Board.

Mr. Correnti’s executive leadership and experience gained through his service as a chief executive of established and start-up companies, both public and private, and his public company director experience contributes significantly to the Board’s composition. His skills and experience in accounting, corporate governance, distribution, engineering, human resources, compensation, and employee benefits, manufacturing (domestic and international), marketing, mergers and acquisitions, domestic sales and distribution and purchasing matters well qualifies him to serve on our Board. | |

| Page 14 | ||||

Table of Contents

| Daniel C. Ustian, 61, Director since 2002(Committee: Executive). Mr. Ustian serves as President and Chief Executive Officer of Navistar since 2003 and Chairman of the Board since 2004. He has also held numerous positions with Navistar, Inc., including serving as Chairman of the Board of Directors of Navistar, Inc. since 2004, President and Chief Executive Officer since 2003 and a director since 2002. Prior to these positions he served as President and Chief Operating Officer of Navistar, Inc., from 2002 to 2003, President of the Engine Group of Navistar, Inc. from 1999 to 2002, and Group Vice President and General Manager of the Engine & Foundry Group of Navistar, Inc. from 1993 to 1999. He is a member of the Business Roundtable and the Society of Automotive Engineers and has served as a director of AGCO Corporation, a leading global manufacturer of agricultural equipment, since March 2011.

Mr. Ustian’s knowledge of the Company and its operations, including his experience running the engine business, the foundry and other experiences at the Company over the last 37 years, is invaluable to the Board in evaluating and directing the Company’s future. As a result of his professional and other experiences, Mr. Ustian possesses particular knowledge and experience in a variety of areas, including corporate governance, distribution, engineering, manufacturing (domestic and international), marketing, mergers and acquisitions, sales/military/government and union/labor relations, which strengthens the Board’s collective knowledge, capabilities and experience and well qualifies him to serve on our Board. | |

Additional Director Who Is Not Elected by Stockholders

| Dennis D. Williams,* ** 58, Director since 2006.(Committee: Finance). Mr. Williams has served as UAW’s Secretary Treasurer and Director, Agricultural Implement and Transnational Departments since June 2010. Prior to this position, Mr. Williams served as Director of UAW Region 4 from 2001 to June 2010 and as Assistant Director of Region 4 from 1995 to 2001. Prior to joining the UAW, Mr. Williams was employed by Case Company from 1977 to 1988. Mr. Williams also served for four years in the United States Marine Corps. |

| (1) | Mr. William H. Osborne, age 51 and a director since 2009, resigned as director in April 2011. He was replaced by Gen. Stanley A. McChrystal in April 2011. Mr. Osborne was President and Chief Executive Officer of Federal Signal Corporation, a manufacturer and marketer of fire, safety and municipal infrastructure equipment, from September 2008 until November 2010. Prior to joining Federal Signal Corporation he served in a number of senior-level positions with Ford Motor Company. Most recently, he served as President and Chief Executive Officer of Ford of Australia from February 2008 to September 2008. Previously, he served as President and Chief Executive Officer of Ford of Canada from November 2005 to January 2008, and as Executive Director, Pickup Truck and Commercial Vehicles, North American Truck Business of Ford Motor Company from December 2003 to November 2005. His earlier assignments included a variety of roles in product design, development and engineering. Prior to joining Ford, he held positions at Chrysler and General Motors from 1977 to 1990. He also served as a director of Federal Signal Corporation. Mr. Osborne currently works for Navistar, Inc. as Vice President Custom Products (see Related Party Transactions and Approval Policy on page 17 for more detail). |

| * | Indicates each director deemed independent in accordance with our Corporate Governance Guidelines and Section 303A of the NYSE Listed Company Manual Corporate Governance Standards. |

| ** | In July 1993, we restructured our postretirement health care and life insurance benefits pursuant to a settlement agreement, which required, among other things, the addition of a seat on our Board. The director’s seat is filled by a person appointed by the UAW. This director is not part of our classified Board and is not elected by stockholders at the Annual Meeting. Mr. Williams was elected as a director in June 2006 to fill the seat previously held by David McAllister, the former UAW director who held this position from 2001 until his removal by the UAW in June 2006. |

| Page 15 | ||||

Table of Contents

Involvement in Certain Legal Proceedings

On August 5, 2010, the SEC announced that a final administrative settlement had been reached with the Company and certain current and former employees of the Company, including Mr. Ustian, the Company’s Chairman, President and Chief Executive Officer, regarding the SEC’s investigation of matters surrounding the Company’s restatement of its financial results from 2002 through the first three quarters of 2005. As part of the administrative settlement, without admitting or denying any wrongdoing, Mr. Ustian consented to a cease and desist order requiring future compliance with an internal accounting control provision of the federal securities laws and, pursuant to Section 304 of the Sarbanes-Oxley Act of 2002, agreed to return to the Company an aggregate of $1,320,000 (paid through the tender of shares of Common Stock) representing his fiscal 2004 monetary bonus, the only bonus that he received during the restatement period.

| Page 16 | ||||

Table of Contents

|

CORPORATE GOVERNANCE GUIDELINES

Our Board has adopted Corporate Governance Guidelines, which are available on the Investor Relations section of our website athttp://ir.navistar.com/documents.cfm. These guidelines reflect the Board’s commitment to oversee the effectiveness of policy and decision-making both at the Board and management level, with a view to enhancing stockholder value over the long term.

RELATED PARTY TRANSACTIONS AND APPROVAL POLICY

Our Policy and Procedures with Respect to Related Person Transactions governs the review, approval and ratification of transactions involving the Company and related persons where the amount involved exceeds $120,000. Related persons include our executive officers, directors, director nominees, 5% stockholders and immediate family members of such persons, and entities in which one of these persons has a direct or indirect material interest. Under this policy, prior to entering into any related-person transaction, the General Counsel or Corporate Secretary of Navistar is to be notified of the facts and circumstances of the proposed transaction, including: (i) the related person’s relationship to the Company and interest in the transaction; (ii) the material facts of the proposed transaction, including the proposed aggregate value of such transaction or, in the case of indebtedness, the amount of principal that would be involved; (iii) the benefits to the Company of the proposed transaction; (iv) if applicable, the availability of other sources of comparable products or services; and (v) an assessment of whether the proposed transaction is on terms that are comparable to the terms available to an unrelated third party or to employees generally.

The General Counsel or Corporate Secretary then assesses whether the proposed transaction is a related-person transaction for purposes of the policy and SEC rules. If the General Counsel or Corporate Secretary determines that the proposed transaction is a related-person transaction, the proposed transaction is then submitted to the Audit Committee of the Board for its consideration. The Audit Committee considers all of the relevant facts and circumstances available, including (if applicable) but not limited to: (i) the benefits to the Company; (ii) the impact on a director’s independence, in the event such person is a director; (iii) the availability of other sources for comparable products or services; (iv) the terms of the transaction; and (v) the terms available to unrelated third parties or to employees generally. No member of the Audit Committee shall participate in any review, consideration or approval of any related-person transaction with respect to which such member or any of his or her immediate family members is the related person. The Audit Committee approves only those proposed transactions that are in, or are not inconsistent with, the best interests of the Company and its stockholders, as determined by the Audit Committee in good faith. In the event that the Company becomes aware of a related-person transaction that has not been previously approved or ratified, a similar process will be undertaken in order to determine if the existing transaction should continue or be terminated and/or if any disciplinary action is appropriate. The General Counsel or Corporate Secretary may also develop, implement and maintain from time to time certain administrative procedures to ensure the effectiveness of this policy.

A copy of our Policy and Procedures with Respect to Related Person Transactions is available on the Investor Relations section of our website athttp://ir.navistar.com/documents.cfm.

Since the beginning of fiscal year 2011, the following four related-person transactions occurred:

| • | The first originally occurred in August 2008 and relates to our Vice President and Treasurer, James M. Moran, in regards to his wife Kristin Moran’s employment as the General Counsel of our finance subsidiary, Navistar Financial Corporation. As General Counsel of Navistar |

| Page 17 | ||||

Table of Contents

Financial Corporation, Mrs. Moran received annual compensation and benefits for fiscal 2011 of less than $255,000, which includes base salary, annual incentive, company 401(k) matching contributions and other standard benefits available to all employees generally, and was granted 1,250 stock options and 500 cash-settled restricted stock units. Mrs. Moran’s compensation and benefits are comparable to other employees with equivalent qualifications, experience, and responsibilities at the Company. Moreover, Mrs. Moran’s annual compensation is market bench-marked periodically by our Corporate Compensation Department and determined outside of the related person’s reporting structure. Since Mrs. Moran’s employment pre-dated Mr. Moran’s appointment as our Vice President and Treasurer, that relationship was permissible under the applicable provisions of our Policy and Procedures with Respect to Related Person Transactions and did not require Audit Committee approval. Any material change in the terms of Mrs. Moran’s employment would, however, need to be approved by the Audit Committee. |

| • | The second originally occurred in September 2009 and relates to our Chief Financial Officer, Andrew Cederoth, whose brother-in-law, Daniel McEachern, is a materials manager at Navistar Defense, LLC. As materials manager at Navistar Defense, Mr. McEachern received annual compensation and benefits for fiscal 2011 of less than $172,000, which includes base salary, annual incentive, company 401(k) matching contributions and other standard benefits available to all employees generally. Mr. McEachern’s compensation and benefits are comparable to other employees with equivalent qualifications, experience, and responsibilities at the Company. Moreover, Mr. McEachern’s annual compensation is market bench-marked periodically by our Corporate Compensation Department and determined outside of the related person’s reporting structure. Since Mr. McEachern’s employment predated Mr. Cederoth’s appointment as our Executive Vice President and Chief Financial Officer, that relationship was permissible under the applicable provisions of our Policy and Procedures with Respect to Related Person Transactions and did not require Audit Committee approval. Any material change in the terms of Mr. McEachern’s employment would, however, need to be approved by the Audit Committee. |

| • | The third occurred in April 2011 and relates to our Vice President—Custom Products, William H. Osborne. Mr. Osborne served as one of our directors from August 2009 through April 2011, at which time he resigned as director and accepted his current position. As Vice President—Custom Products, Mr. Osborne received annual compensation and benefits for fiscal 2011 of less than $652,000, which includes base salary, bonus, perquisites, company 401(k) matching contributions and other standard benefits available for all employees generally, and was granted 10,000 stock options and 4,000 cash-settled performance shares. Mr. Osborne’s compensation and benefits are comparable to other employees with equivalent qualifications, experience, and responsibilities at the Company. Moreover, Mr. Osborne’s annual compensation is market bench-marked periodically by our Corporate Compensation Department. The Audit Committee determined that Mr. Osborne’s appointment as Vice President Custom Products was in the best interests of the Company and approved the transaction. |

| • | The fourth occurred during fiscal year 2011 and relates to our Chief Executive Officer, Daniel Ustian, whose son, Eric Ustian, collaborated with Wild Eyes Productions, a company specializing in documentaries, feature films and 3D technologies, to produce a 3D marketing video for the International ProStar. Eric Ustian and the principals of Wild Eyes Production are currently forming a joint venture to provide media production services to corporate clients such as Navistar. The Company paid Wild Eyes Productions $170,326.13 through the date hereof, which covered production costs and labor. The Audit Committee determined that Eric Ustian’s involvement with Wild Eyes was not inconsistent with the best interests of the Company and approved and ratified the transaction. |

| Page 18 | ||||

Table of Contents

DIRECTOR INDEPENDENCE DETERMINATIONS

We believe that a majority of our members of our Board should be independent non-employee directors. Our Board has affirmatively determined that nine of our ten directors, each of Messrs. Clariond, Correnti, Hammes, Harrison, Keyes, Klinger, McChrystal and Williams and Ms. Gulyas, qualifies as an “independent director” in accordance with the NYSE’s independence requirements and our own internal guidelines for determining director independence. Each of these directors has also been determined to be financially literate. All of the members of our Audit Committee, Compensation Committee, Finance Committee and the Nominating and Governance Committee are independent and financially literate.

Both the NYSE requirements and our own guidelines include a series of objective tests for determining the independence of a director, such as that the director is not an employee of Navistar and has not engaged in various types of commercial or charitable relationships with Navistar. A copy of our existing guidelines for determining director independence, as included in our Corporate Governance Guidelines, is available on the Investor Relations section of our website athttp://ir.navistar.com/documents.cfm. Our Board has made a determination as to each independent director that no relationship exists which, in the opinion of the Board, would interfere with the exercise of the director’s independent judgment in carrying out his or her responsibilities as a director. In making these determinations, our Board reviewed and discussed information provided by the directors and Navistar with regard to each director’s business and personal activities as they may relate to Navistar, its management and/or its independent registered public accounting firm.

The Company’s Corporate Governance Guidelines allow the Board to select the Chairman of the Board and the CEO and to determine from time to time whether the positions are combined and filled by one person or separated and filled by two persons. Currently, our Board leadership structure consists of a Chairman (who is also our CEO), an independent Lead Director and strong committee chairs. The Board has determined that selecting our CEO as Chairman is in the best interests of the Company and its stockholders because this leadership structure promotes a unified vision for our Company, strengthens the ability of the CEO to develop and implement strategic initiatives and facilitates our Board’s efficient and effective functioning.

The Board also believes the combination of Chairman and CEO position is appropriate in light of the independent oversight provided by the Board and the appointment of an independent Lead Director. On October 18, 2011, the Board reappointed Mr. Michael N. Hammes to serve as Lead Director for a one-year term. Our Lead Director’s duties and responsibilities include: (i) facilitating communications and information sharing among the independent directors; (ii) advising on Board meeting agendas; (iii) advising on meeting materials; (iv) participating in the evaluation and selection of candidates for selection to the Board; (v) participating in the recruiting of new directors; (vi) overseeing the Board self-evaluation process and individual director evaluations, if such individual director evaluations are performed; (vii) participating in the evaluation of the CEO; (viii) participating in the development of recommendations to the Board for the election of Board committee members and the appointment of committee chairs; (ix) chairing Board meetings in the absence of the Chair; (x) making recommendations about retention of consultants reporting to the Board; (xi) attending all Board committee meetings; and (xii) consulting with the CEO prior to the CEO’s personal transactions in the Company’s securities. In addition, the Lead Director provides feedback to the CEO regarding the other directors’ comments and concerns.

Our Board has overall responsibility for the oversight of risk management at our Company. Day-to-day risk management is the responsibility of management, which has implemented an Enterprise Risk

| Page 19 | ||||

Table of Contents

Management process to identify, assess, manage and monitor risks that face our Company. Enterprise Risk Management operates within our Internal Audit and Sarbanes-Oxley Compliance department and coordinates its efforts with this department. Our Board, either as a whole or through its committees, regularly discusses with management our major risk exposures, their potential impact on our Company, and the steps we take to monitor and control such exposures.

While our Board has general oversight responsibility for risk at our Company, the Board has delegated some of its risk oversight duties to the various Board committees. In particular, the Audit Committee is responsible for generally reviewing and discussing the Company’s policies and guidelines with respect to risk assessment and risk management. It also focuses on the management of financial risk exposure and oversees financial statement compliance and control environment risk exposure. The Nominating and Governance Committee oversees risks related to corporate governance, including risk related to the political environment. The Compensation Committee assists our Board in overseeing the management of risks arising from our compensation policies and programs and programs related to assessment, selection, succession planning, training and development of executives of the Company. Finally, the Finance Committee is responsible for overseeing policies with respect to financial risk assessment and financial risk management including, without limitation, risks relating to liquidity/access to capital and macroeconomic trends/environment risks. Each of the Board committees periodically reviews these risks and then discusses the process and results with the full Board.

The Board believes the combined role of Chairman and CEO is an effective structure for the Board to understand the risks associated with the Company’s strategic plans and objectives. Additionally, maintaining an independent Board with a Lead Director permits open discussion and assessment of the Company’s ability to manage these risks.

You may recommend any person as a candidate for director by writing to our Corporate Secretary at 2701 Navistar Drive, Lisle, Illinois 60532 and complying with the procedures set forth in our By-Laws. Your letter must be received by the Company’s Corporate Secretary no earlier than August 25, 2012, and no later than October 24, 2012, and must include all of the information required by our By-Laws including, but not limited to, the proposed nominee’s biographical information and principal occupation; the number of shares of capital stock of the Company which are owned by the proposed nominee, appropriate information about the proposed nominee that would be required to be included in a proxy statement under the rules of the SEC, the number of shares held by you, information about the relationship between the proposed nominee and you, and a representation that you intend to appear in person or by proxy at the meeting to nominate the proposed nominee. Your letter must be accompanied by the written consent of the proposed nominee to being named as a nominee and to serve as a director if elected. You may only recommend a candidate for director if you hold shares of the Company’s stock on the date you give the notice described above and on the record date for the annual meeting of stockholders at which you propose such nominee be elected.

The Nominating and Governance Committee identifies nominees for directors from various sources, including suggestions from Board members and management, and in the past has used third party consultants to assist in identifying and evaluating potential nominees. The Nominating and Governance Committee will consider persons recommended by the stockholders in the same manner as a committee-recommended nominee. The Nominating and Governance Committee has specified the following minimum qualifications that it believes must be met by a nominee for a position on the Board:

| • | knowledge and contacts in the Company’s industry and other relevant industries; |

| • | positive reputation in the business community; |

| Page 20 | ||||

Table of Contents

| • | the highest personal and professional ethics and integrity and values that are compatible with the Company’s values; |

| • | experiences and achievements that provide the nominee with the ability to exercise good business judgment; |

| • | ability to make significant contributions to the Company’s success; |

| • | ability to work successfully with other directors; |

| • | willing to devote the necessary time to the work of the Board and its committees which includes being available for the entire time of meetings; |

| • | ability to assist and evaluate the Company’s management; |

| • | is involved only in other activities or interests that do not create a conflict with his or her responsibilities to the Company and its stockholders; |

| • | understands and meets his or her responsibilities to the Company’s stockholders including the duty of care (making informed decisions) and the duty of loyalty (maintaining confidentiality and avoiding conflicts of interest); and |

| • | potential to serve on the Board for at least five years. |

The Nominating and Governance Committee believes that consideration should also be given to having a diversity of backgrounds, skills, and perspectives among the directors, and that generally directors should not be persons whose primary activity is investment banking, law, accounting, or consulting. In addition, the selection of directors should consider the need to strengthen the Board by providing a diversity of persons in terms of their expertise, age, sex, race, ethnicity, education, and other attributes which contribute to the Board’s diversity.

The satisfaction of the above criteria is implemented and assessed through ongoing consideration of directors and nominees by the Nominating and Governance Committee and the Board, as well as the Board’s self-evaluation process. Based upon these activities and its review of the current composition of the Board, the Nominating and Governance Committee and the Board believe that these criteria have been satisfied.

As outlined in our Corporate Governance Guidelines, any director who receives more “withheld” votes than “for” votes in an uncontested election is required to tender his or her resignation to the Nominating and Governance Committee for consideration and recommendation to the Board. The Board will publicly disclose its decision.

The Board documented its governance practices in our Corporate Governance Guidelines. These governance standards embody many of our long-standing practices, policies and procedures, which are the foundation of our commitment to best practices. In October 2011, the Board conducted an evaluation of the directors, the committees and the Board.

The Board has five standing committees: an Audit Committee, a Compensation Committee, an Executive Committee, a Finance Committee and a Nominating and Governance Committee. Each of the committees, except for the Executive Committee, is governed by a written charter, copies of which are available on the Investor Relations section of our website athttp://ir.navistar.com/documents.cfm. The provisions governing our Executive Committee are set forth in Article III of our By-Laws, a copy of which is available on the Investor Relations section of our website athttp://ir.navistar.com/documents.cfm.

| Page 21 | ||||

Table of Contents

In fiscal year 2011, the full Board met ten times. In addition, the Board’s independent directors met three times in regularly scheduled executive sessions to (i) evaluate the performance of the Chief Executive Officer, (ii) discuss corporate strategies and (iii) discuss the Board’s self-evaluation. The Chairs of our Audit, Compensation, Nominating and Governance and Finance committees of the Board each preside as the chair at meetings or executive sessions of outside directors at which the principal items to be considered are within the scope of the authority of his or her committee.

During fiscal year 2011, each of the directors except Dennis Williams attended 93% or more of all the meetings of the Board and the committees on which he or she serves. The average attendance of all directors in fiscal 2011 was 96%. Dennis Williams attended 63% of the Board and committee meetings on which he serves. Mr. Williams’ absence from these meetings was due to his attendance at UAW negotiations, which he is required to attend as UAW Secretary Treasurer and Director, Agricultural Implement and Transnational Departments. We encourage all Board members to attend all meetings, including the Annual Meeting. All of our directors attended our 2011 annual meeting.

Below is a table indicating committee membership and a description of each committee of the Board.

Committee Membership (as of December 31, 2011) | ||||||||||||||||||||

Audit

| Compensation

| Executive

| Finance

| Nominating &

| ||||||||||||||||

Eugenio Clariond | ü | ü | ||||||||||||||||||

John D. Correnti | ü | ü | * | ü | ||||||||||||||||

Diane H. Gulyas | ü | |||||||||||||||||||

Michael N. Hammes | ü | ü | ü | * | ü | * | ||||||||||||||

David D. Harrison | ü | ü | ||||||||||||||||||

James H. Keyes | ü | * | ü | ü | ü | |||||||||||||||

Steven J. Klinger | ü | ü | ||||||||||||||||||

Stanley A. McChrystal | ü | |||||||||||||||||||

Daniel C. Ustian | ü | * | ||||||||||||||||||

Dennis D. Williams | ü | |||||||||||||||||||

| * | Indicates the chair of the committee |

Audit Committee– The Audit Committee assists the Board in fulfilling its responsibility for oversight of the Company’s financial reporting process, the Company’s legal and regulatory compliance, the independence, qualifications and performance of the Company’s independent registered public accounting firm and the performance of the Company’s internal audit function. The Audit Committee reviewed the fiscal year 2011 audit plans of the Company’s independent registered public accounting firm and internal audit staff, reviewed the audit of the Company’s accounts with the independent registered public accounting firm and the internal auditors, considered the adequacy of audit scope and reviewed and discussed with the auditors and management the auditors’ reports. The Audit Committee also reviewed environmental surveys and compliance activities for the Company’s facilities and the expense accounts of executive officers and directors. The Audit Committee reviews and decides on conflicts of interest and related person transactions that may affect executive officers and directors and also discusses policies and guidelines with respect to risk assessment and risk management. Additional information on the roles and responsibilities of the Audit Committee is provided under “Audit Committee Reports” on page 25 of this proxy statement. The Board designated Mr. John D. Correnti, Mr. David D. Harrison, Mr. James H. Keyes and Mr. Steven J. Klinger as “audit committee financial experts,” as defined by applicable law, rules and regulations. In fiscal year 2011, the Audit Committee held nine meetings. The Audit Committee conducted an evaluation of its performance in October 2011.

| Page 22 | ||||

Table of Contents

Compensation Committee– The Compensation Committee makes recommendations to the Board with respect to the election and responsibilities of all executive officers, reviews and approves the compensation of executive officers who are not also directors of the Company, reviews and approves the Company’s compensation strategy and any associated risk, recommends to the independent members of the Board the compensation of executive officers who also are directors of the Company, administers the Company’s equity compensation plans, furnishes an annual Compensation Committee Report on executive compensation and reviews and discusses the Compensation Discussion & Analysis (“CD&A”) with management and recommends to the Board the inclusion of the CD&A in the Company’s proxy statement. Upon management’s recommendation, the Compensation Committee reviews basic changes to non-represented employees’ base compensation and incentive and benefit plans. The Compensation Committee also oversees the development and implementation of succession plans for senior executives (with the exception of our CEO) and positions as needed. Additional information on the roles and responsibilities of the Compensation Committee is provided in the CD&A on page 31 of this proxy statement. The Compensation Committee held four meetings in fiscal year 2011. The Compensation Committee conducted an evaluation of its performance in October 2011.

Executive Committee – The Executive Committee is comprised of three directors, two of whom are independent directors. The Executive Committee represents the Board between meetings for the purpose of consulting with officers, considering matters of importance and either taking action or making recommendations to the Board. The Executive Committee held two meetings in fiscal year 2011.

Finance Committee – The Finance Committee reviews the Company’s financing requirements, custody and management of assets which fund the pension and retirement savings plans of the Company’s subsidiaries, procedures by which projections and estimates of cash flow are developed, dividend policy and investment spending and capital expenditure budgets. The Finance Committee also oversees the Company’s policies with respect to financial risk assessment and financial risk management. The Finance Committee held six meetings in fiscal year 2011. The Finance Committee conducted an evaluation of its performance in October 2011.

Nominating and Governance Committee – The Nominating and Governance Committee is responsible for the organizational structure of the Board and its committees, recommending to the Board the directors to serve on the standing Board committees, reviewing and making recommendations to the Board concerning nominees for election as directors, CEO succession planning and reviewing, recommending corporate governance practices, policies of the Company and changes to the Company’s charter and By-Laws and overseeing risks related to corporate governance. In addition, the Nominating and Governance Committee leads the Board in its self-evaluation process. The Nominating and Governance Committee held six meetings in fiscal year 2011. The Nominating and Governance Committee conducted an evaluation of its performance in October 2011.

Interested parties may communicate with any of our directors, our Board as a group, our non-employee directors as a group or any committees of the Board by sending an e-mail topresiding.director@navistar.comor by writing to the Presiding Director, c/o the Corporate Secretary, at 2701 Navistar Drive, Lisle, Illinois 60532. The Board has given the Corporate Secretary the discretion to distribute communications to the director or directors, after ascertaining whether the communications are appropriate to duties and responsibilities of the Board. Communications that relate to ordinary business matters that are not within the scope of the Board’s responsibilities will be forwarded to the appropriate employee within the Company. Solicitations, junk email and obviously frivolous or inappropriate communications will not be forwarded. You will receive a written acknowledgement from the Corporate Secretary’s Office upon receipt of your communication.

| Page 23 | ||||

Table of Contents