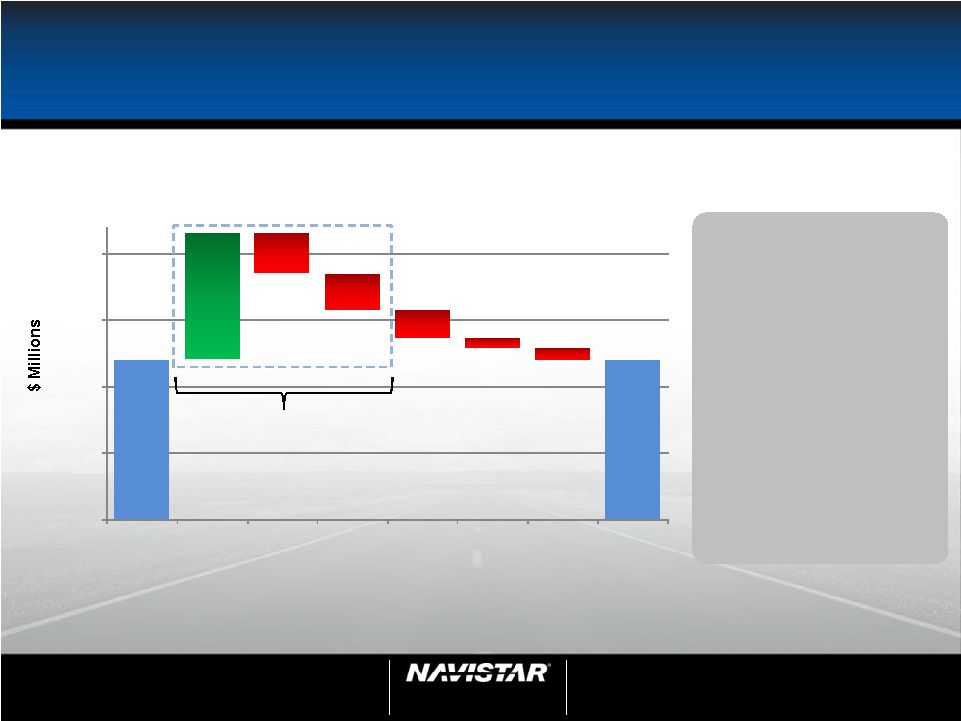

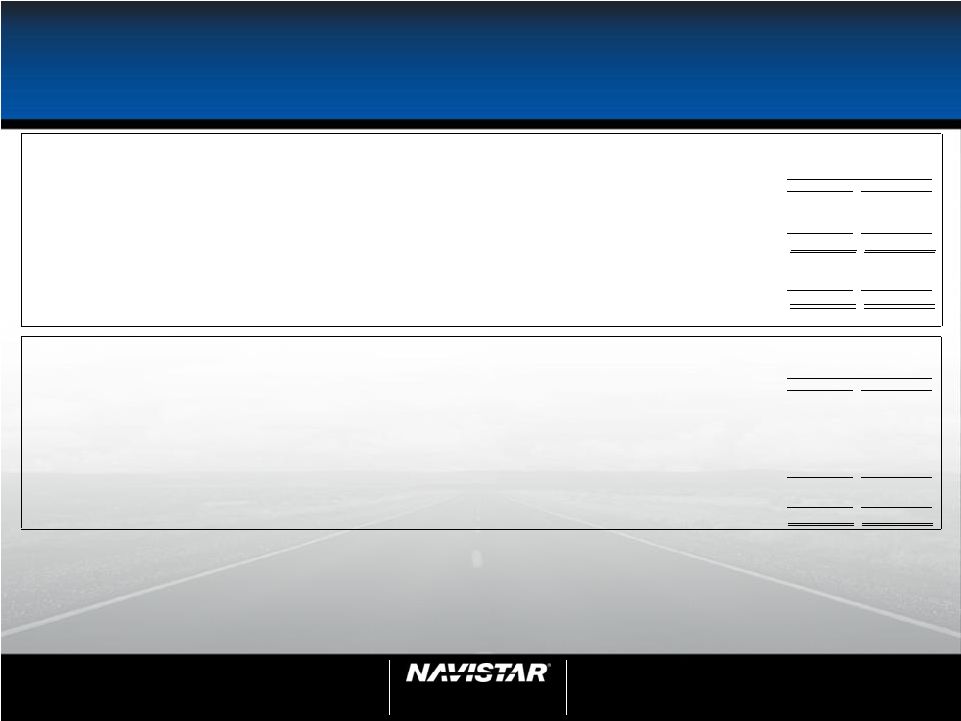

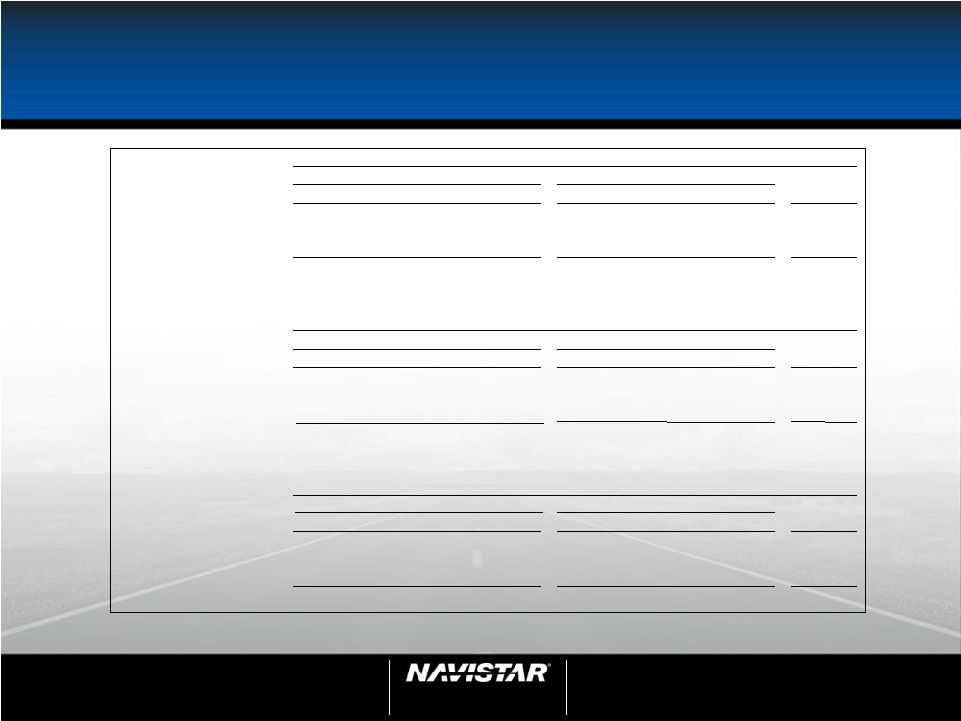

NYSE: NAV 52 52 1 st Quarter 2012 Earnings Call March 8, 2012 SEC Regulation G – Pro Forma Net Income, Diluted EPS and Manufacturing Segment Profit – Three Months Ended January 31, 2012 (A) Engineering integration costs relate to the consolidation of our truck and engine engineering operations, as well as the relocation of our world headquarters. For the three months ended January 31, 2012, the charge included related costs of $12 million, offset by a tax benefit of $4 million. For the three months ended January 31, 2011, all costs were recognized as restructuring charges. Our Manufacturing segment recognized pre-tax costs of $9 million and $18 million relating to these actions, for the three months ended January 31, 2012 and 2011, respectively. The adjustment for the three months ended January 31, 2011 was not adjusted to reflect its income tax effect, as the Company's income tax expense on U.S. and Canadian operations was limited to current state income taxes, alternative minimum tax net of refundable credits, and other discrete items, during the period the adjustment was recorded. (B ) The warranty adjustment represents an unanticipated increase in warranty spend for certain 2007 and 2010 emission standard engines, with the majority relating to the initial build of 2010 emission standard engines. Component complexity associated with meeting new emission standards have contributed to higher repair costs, which have exceeded those that we have historically experienced. In the first quarter of 2012, our Engine segment recorded adjustments for changes in estimates of $112 million, or $1.60 per diluted share. Net of tax, the adjustments for changes in estimates amounted to $74 million, or $1.06 per diluted share. Adjusted net loss attributable to Navistar International Corporation excluding warranty adjustment reconciliation: ($ in millions, except per share data) Net loss attributable to Navistar International Corporation Plus: Engineering integration costs, net of tax (A) Adjusted net loss attributable to Navistar International Corporation Plus: Warranty adjustment, net of tax (B) Adjusted net loss attributable to Navistar International Corporation excluding warranty adjustment Diluted loss per share attributable to Navistar International Corporation Effect of adjustments on diluted loss per share attributable to Navistar International Corporation Adjusted diluted loss per share attributable to Navistar International Corporation excluding warranty adjustment Diluted weighted shares outstanding (B) Adjusted manufacturing segment profit (loss) excluding warranty adjustment reconciliation: ($ in millions) Net loss attributable to Navistar International Corporation Less: Financial services segment profit, Corporate and eliminations, and income taxes Manufacturing segment loss Plus: Engineering integration costs (A) Adjusted manufacturing segment loss Plus: Warranty adjustment (B) Adjusted manufacturing segment profit excluding warranty adjustment ($ in millions) Loss before income tax benefit Plus: Engineering integration costs (A) Adjusted loss before income tax benefit Plus: Warranty adjustment (B) Adjusted loss before income tax benefit excluding warranty adjustment (102) 112 $ 10 112 $ (97) (42) $ (153) (111) 9 $ (221) 12 (209) $ (153) 8 (145) $ (2.19) 1.17 Three Months Ended January 31, 2012 Three Months Ended January 31, 2012 Adjusted loss before income tax benefit excluding warranty adjustment reconciliation: Three Months Ended January 31, 2012 $ (1.02) 69.9 74 $ (71) |