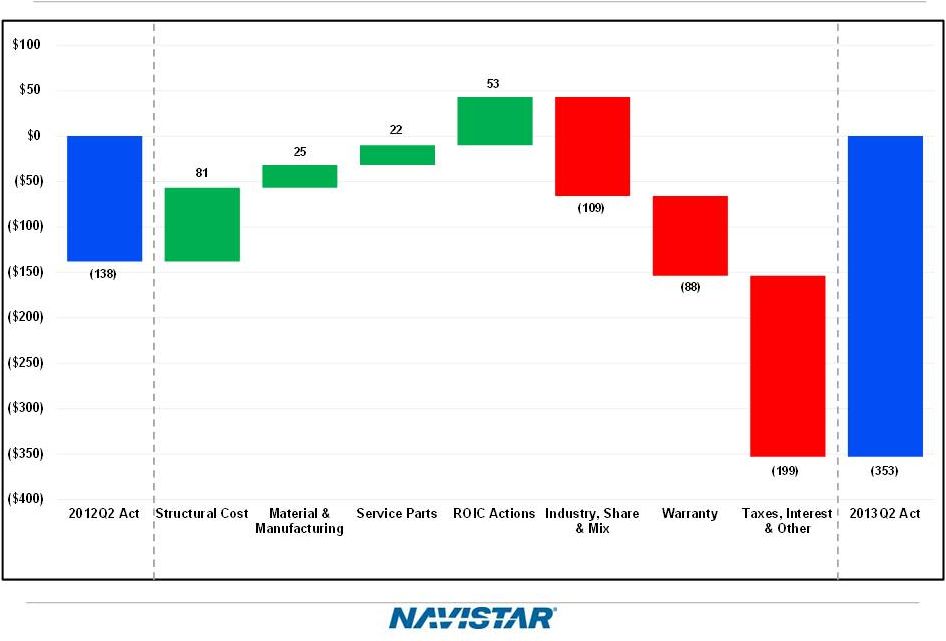

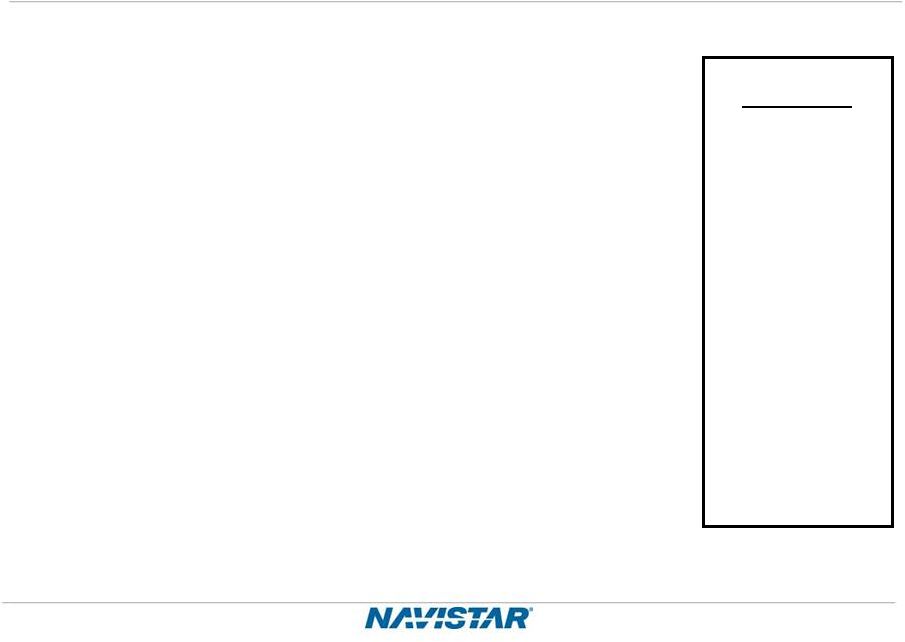

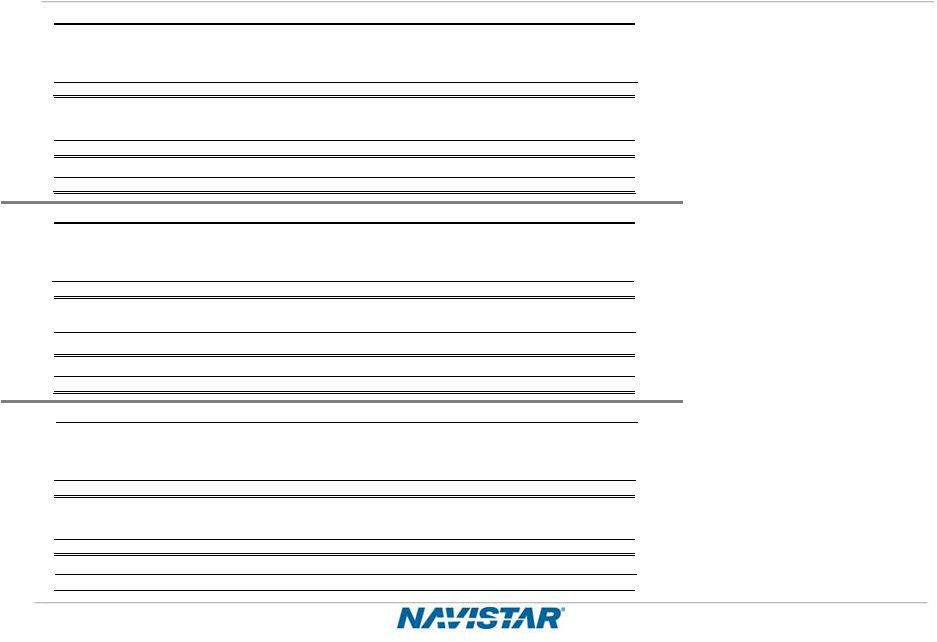

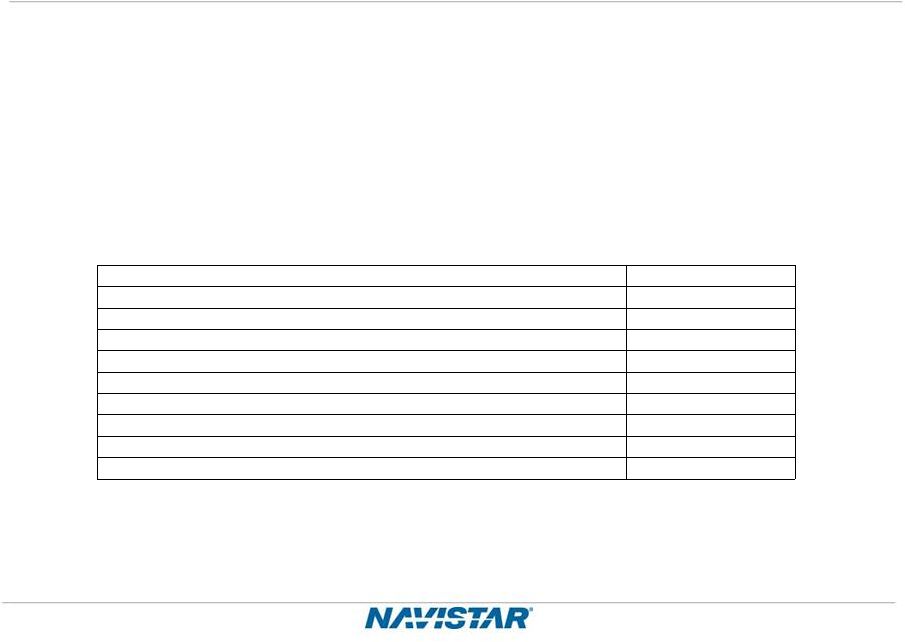

2Q 2013 Earnings – 6/10/2013 NYSE: NAV SEC Regulation G – Significant Items Included Within Our Results Three Months Ended April 30, Six Months Ended April 30, (in millions) 2013 2012 2013 2012 Expense (income): Adjustments to pre-existing warranties (A) .................................................................................... $ 164 $ 138 $ 204 $ 219 Charges related to the Monaco RV divestiture (B) ........................................................................... 25 — 25 — Charges for non-conformance penalties (C) ................................................................................... 12 10 22 10 Accelerated depreciation (D) ................................................................................................................ 10 — 35 — Gain on sales of the Mahindra Joint Ventures (E) (28) — (28) — Legal settlement (F) ............................................................................................................................ — — (35) — Impairment charges related to idling the WCC business (G) — 37 — 37 Income tax valuation allowance release (H) ........................................................................................ — (181) — (181) .......................................................... ............................................................................. (A) The warranty adjustment represents an unanticipated increase in warranty spend for certain 2007 and 2010 emission standard engine, with the majority relating to the initial build of 2010 emission standard engines. In the second quarter and first half of 2013, the Company incurred charges of $164 million and $204 million, respectively, for adjustments to pre- existing warranties. Included in the adjustments to pre-existing warranties is a warranty recovery of $13 million and $40 million, of which the $13 million in the second quarter of 2013 was included in the Loss from discontinued operations. During the second quarter and first half of 2012, the Company incurred charges of $104 million and $227 million, respectively, for adjustments to pre-existing warranties, and the tax impact of the adjustments was income tax expense of $34 million and income tax benefit of $8 million, respectively. In the second quarter and first half of 2013, our Engine segment recognized charges for adjustments to pre-existing warranties of $107 million and $136 million, respectively, compared to $78 million and $190 million in the respective prior year periods. In the second quarters of 2013 and 2012, the Truck segment recorded charges of $33 million and $24 million, respectively, both related to the extended warranty contracts on our 2010 emission standard MaxxForce Big-Bore engines, of which the majority of these changes are included in the adjustments to pre-existing warranties. (B) In May 2013, we divested substantially all of our interest in these operations of Monaco for approximately $19 million of cash. As a result of the divestiture, in the second quarter of 2013, we recorded charges of $25 million relating to the impairment of certain assets and the expected loss from the divestiture, which is included in the Loss from discontinued operations. (C) The Engine segment recorded charges for non-conformance penalties, primarily for certain 13L engine sales. The charges did not have a material impact on income taxes. (D) In the second quarter and first half of 2013, of the total charges for accelerated depreciation, $8 million and $20 million, respectively, was related to certain assets related to the planned closure of our Garland Facility, and $2 million and $15 million, respectively, was primarily related to certain assets affected by the discontinuation of certain engine programs, particularly the MaxxForce15L. The Truck segment recognized charges of $8 million and $23 million, respectively, and the Engine segment recognized charges of $2 million and $12 million, respectively. (E) In the second quarter of 2013, the Company sold its stake in the Mahindra Joint Ventures to Mahindra for $33 million and recognized a gain of $28 million, of which the Truck and Engine segments recognized $16 million and $12 million, respectively. (F) As a result of the legal settlement with Deloitte and Touch LLP in December 2012, we received cash proceeds of $35 million in the first quarter of 2013. (G) In the second quarter and first half 2012, the impairment charges of $38 million were the result of our decision to idle WCC business. The tax impact of the adjustments was an income tax benefit of $1 million. The WCC, which is reported in the Loss from discontinued operations, and Parts segment recognized charges of $28 million and $10 million, respectively. (H) In the second quarter of 2012, we recognized an income tax benefit of $181 million from the release of a significant portion of our income tax valuation allowance on our Canadian deferred tax assets. The above items relating to 2013 did not have a material impact on taxes due to the valuation allowances on our U.S. deferred tax assets, which was established in the fourth quarter of 2012. The above items relating to charges in 2012 have been adjusted to reflect the impact of income taxes which are calculated based on the respective periods estimated annual effective tax rate. The income tax impact of the second quarter of 2012 adjustments reflects the impact of a change in the quarter to the Company's 2012 estimated annual effective tax rate. The change is the result of updates to the forecasted earnings and the jurisdictional mix. 46 |