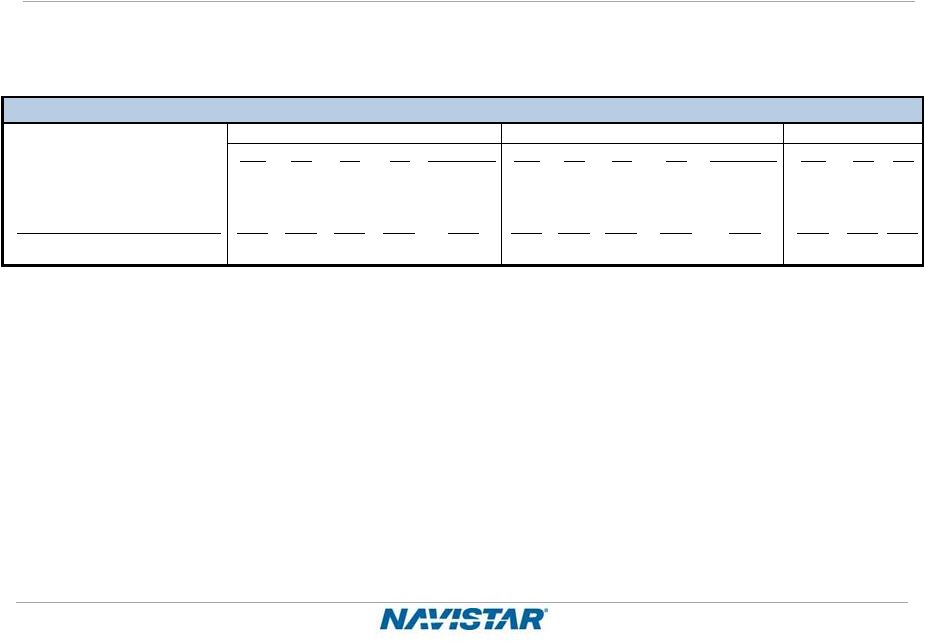

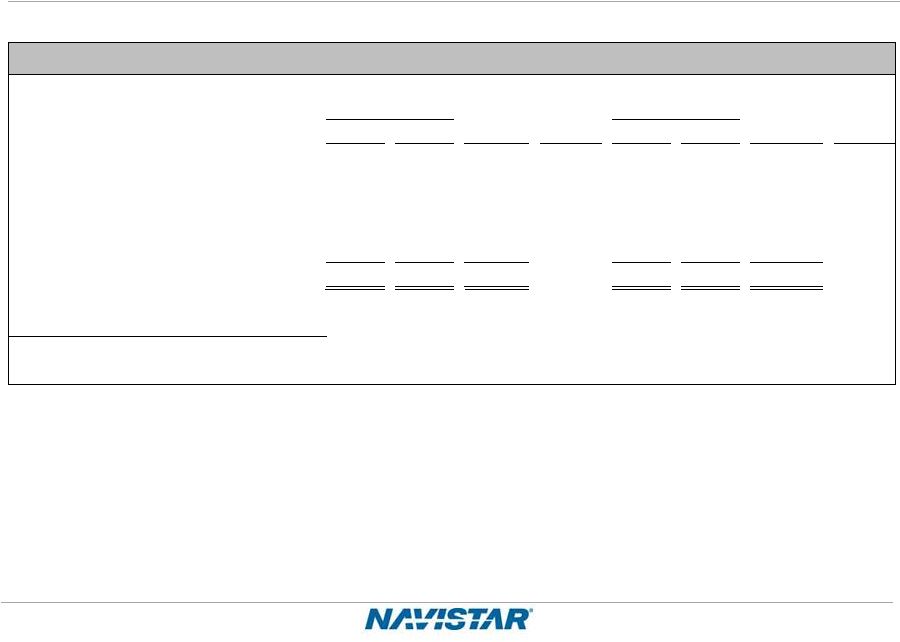

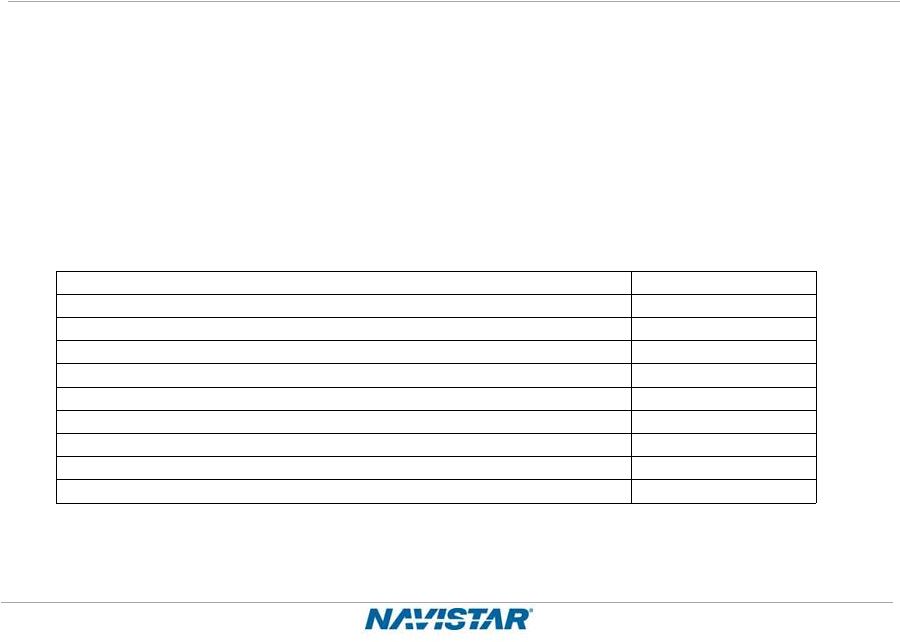

47 NYSE: NAV Q3 2013 Earnings – 09/04/2013 SEC Regulation G – Significant Items Included Within Our Results (A) In the third quarter and first nine months of 2013, the Company incurred charges for adjustments to pre-existing warranties of $48 million and $252 million, respectively. During the third quarter and first nine months of 2012, the Company recorded charges for adjustments to pre-existing warranties of $30 million and $259 million, respectively. For the third quarter and first nine months of 2012, the associated tax impact of the charges were income tax benefits of $101 million and $102 million, respectively. (B) In the third quarter of 2013, the Company recorded asset impairment charges of $17 million, of which $13 million was recognized by the Truck segment and $4 million was recognized by the Engine segment. These charges are the result of our ongoing evaluation of our portfolio of assets to validate their strategic and financial fit, which led to the discontinuation of certain engineering programs related to products that were determined to be outside of our core operations or not performing to our expectations. In the second quarter of 2012, the Company recognized asset impairment charges of $38 million that resulted from the decision to idle Workhorse Custom Chassis business, of which, $28 million was recognized in the Income (loss) from discontinued operations, net of tax and $10 million was recognized by the Parts segment. In the third quarter and first nine months of 2012, the associated tax impact of the adjustments recognized in Income (loss) from discontinued operations, net of tax were income tax benefits of $3 million and $10 million, respectively. For both the third quarter and first nine months of 2012 the associated tax impact of the charges related to continuing operations were an income tax benefit of $4 million. (C) In the third quarter and first nine months of 2013, the Engine segment recorded charges for non-conformance penalties of $7 million and $29 million, respectively, primarily for certain 13L engine sales. In the third quarter and first nine months of 2012, the Engine segment recorded charges for non-conformance penalties of $10 million and $20 million, respectively. For both the third quarter and first nine months of 2012, the associated tax impact of the adjustments were an income tax benefit of $8 million. (D) Of the total charges for accelerated depreciation in the first nine months of 2013, $20 million was related to certain assets related to the closure of our Garland Facility, and $19 million, which included the $4 million recognized in the third quarter of 2013, was primarily related to certain assets affected by the discontinuation of certain engine programs, particularly the MaxxForce15L. The Truck segment recognized charges of $23 million in the first nine months of 2013, and the Engine segment recognized charges of $4 million and $16 million, in the third quarter and first nine months of 2013, respectively. (E) In the second quarter of 2013, the Company sold its stake in the Mahindra Joint Ventures to Mahindra. The first nine months of 2013 results include a gain of $26 million from the divestiture, of which the Truck and Engine segments recognized $15 million and $11 million, respectively. (F) In May 2013, we divested substantially all of our interest in the operations of Monaco. As a result of the divestiture, we impaired certain assets and recognized a loss totaling $24 million in the first nine months of 2013. The loss was included in the Income (loss) from discontinued operations, net of tax. (G) As a result of the legal settlement with Deloitte and Touche LLP in December 2012, we received cash proceeds of $35 million in the first quarter of 2013. (H) In the second quarter of 2012, we recognized an income tax benefit of $181 million from the release of a significant portion of our income tax valuation allowance on our Canadian deferred tax assets. The above items relating to 2013 did not have a material impact on taxes due to the valuation allowances on our U.S. deferred tax assets, which was established in the fourth quarter of 2012. The above items relating to charges in 2012 have been adjusted to reflect the impact of income taxes which are calculated based on the respective periods estimated annual effective tax rate. The income tax impact of the third quarter of 2012 adjustments reflects the impact of a change in the third quarter of 2012 to the Company's 2012 estimated annual effective tax rate. The change is the result of updates to the forecasted earnings and the jurisdictional mix. Three Months Ended July 31, Nine Months Ended July 31, (in millions) 2013 2012 2013 2012 Expense (income): Adjustments to pre-existing warranties (A) $ 48 $ (71) $ 252 $ 157 Asset impairment charges (B) 17 (7) 17 24 Charges for non-conformance penalties (C) 7 2 29 12 Accelerated depreciation (D) 4 — 39 — Mahindra Joint Ventures divestiture (E) 2 — (26) — Monaco RV divestiture (F) (1) — 24 — Legal settlement (G) — — (35) — Income tax valuation allowance release (H) — — — (181) |