Q4 2016 EARNINGS PRESENTATION December 20, 2016 Exhibit 99.2

Safe Harbor Statement and Other Cautionary Notes Information provided and statements contained in this presentation that are not purely historical are forward-looking statements within the meaning of the federal securities laws. Such forward-looking statements only speak as of the date of this presentation and Navistar International Corporation assumes no obligation to update the information included in this presentation. Such forward-looking statements include information concerning our possible or assumed future results of operations, including descriptions of our business strategy. These statements often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” or similar expressions. These statements are not guarantees of performance or results and they involve risks, uncertainties, and assumptions. For a further description of these factors, see the risk factors set forth in our filings with the Securities and Exchange Commission, including our annual report on Form 10-K for the year ended October 31, 2016. Although we believe that these forward-looking statements are based on reasonable assumptions, there are many factors that could affect our results of operations and could cause actual results to differ materially from those in the forward-looking statements. All future written and oral forward-looking statements by us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained herein or referred to above. Except for our ongoing obligations to disclose material information as required by the federal securities laws, we do not have any obligations or intention to release publicly any revisions to any forward-looking statements to reflect events or circumstances in the future or to reflect the occurrence of unanticipated events. The financial information herein contains audited and unaudited information and has been prepared by management in good faith and based on data currently available to the Company. Certain non-GAAP measures are used in this presentation to assist the reader in understanding our core manufacturing business. We believe this information is useful and relevant to assess and measure the performance of our core manufacturing business as it illustrates manufacturing performance. It also excludes financial services and other items that may not be related to the core manufacturing business or underlying results. Management often uses this information to assess and measure the underlying performance of our operating segments. We have chosen to provide this supplemental information to investors, analysts, and other interested parties to enable them to perform additional analyses of operating results. The non-GAAP numbers are reconciled to the most appropriate GAAP number in the appendix of this presentation.

2016 Accomplishments Narrowed net loss, and delivered 4th consecutive year of adjusted EBITDA improvement Improved adjusted EBITDA margin to 6.3%, up 140 basis points Lowered break-even point with over $350 million of total cost savings Achieved 3rd consecutive year of record Parts profits Expanded Fleetrite offering, sales up double digits Launched several major products LT and HX series Expanding powertrain options Expanded connected vehicle leadership Grew vehicles on OCC to over 250,000 Launched over-the-air programming Announced a significant strategic alliance with Volkswagen Truck & Bus Targeting to close in the first quarter of calendar 2017

Building on a Solid Foundation GROW THE CORE BUSINESS Invest in Products Increase Consideration Improve Channel Effectiveness DRIVE OPERATIONAL EXCELLENCE Product Cost Structural Cost Manufacturing Cost BUILD NEW SOURCES OF REVENUE Grow Core Services Expand Parts Business Build on OnCommand Connection Goal: Steadily grow revenue and achieve profitability at all points of the cycle

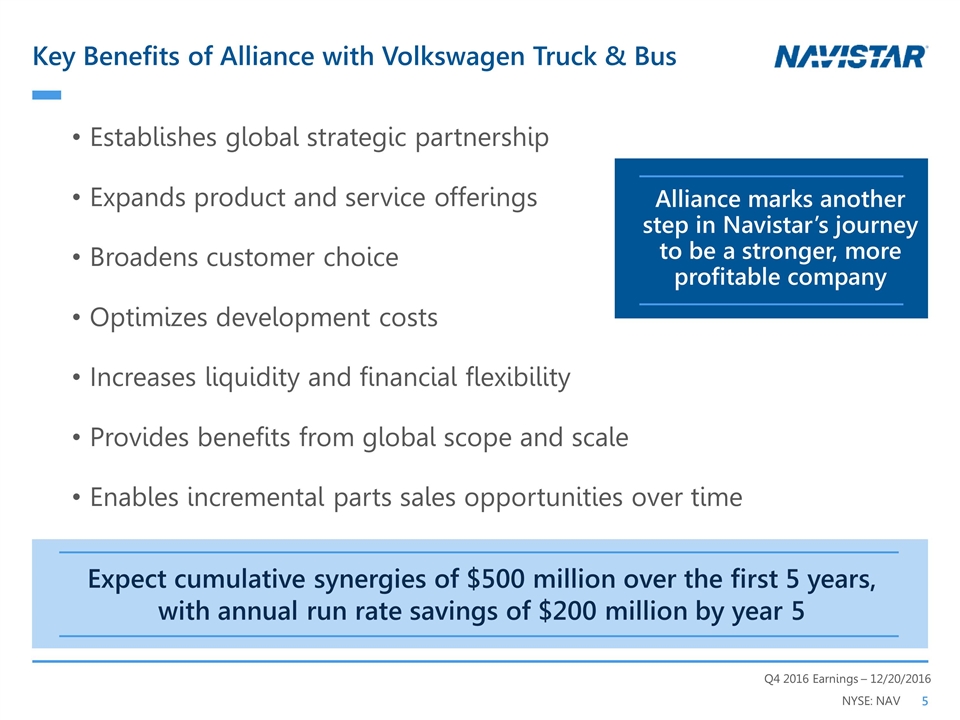

Key Benefits of Alliance with Volkswagen Truck & Bus Establishes global strategic partnership Expands product and service offerings Broadens customer choice Optimizes development costs Increases liquidity and financial flexibility Provides benefits from global scope and scale Enables incremental parts sales opportunities over time Expect cumulative synergies of $500 million over the first 5 years, with annual run rate savings of $200 million by year 5 Alliance marks another step in Navistar’s journey to be a stronger, more profitable company

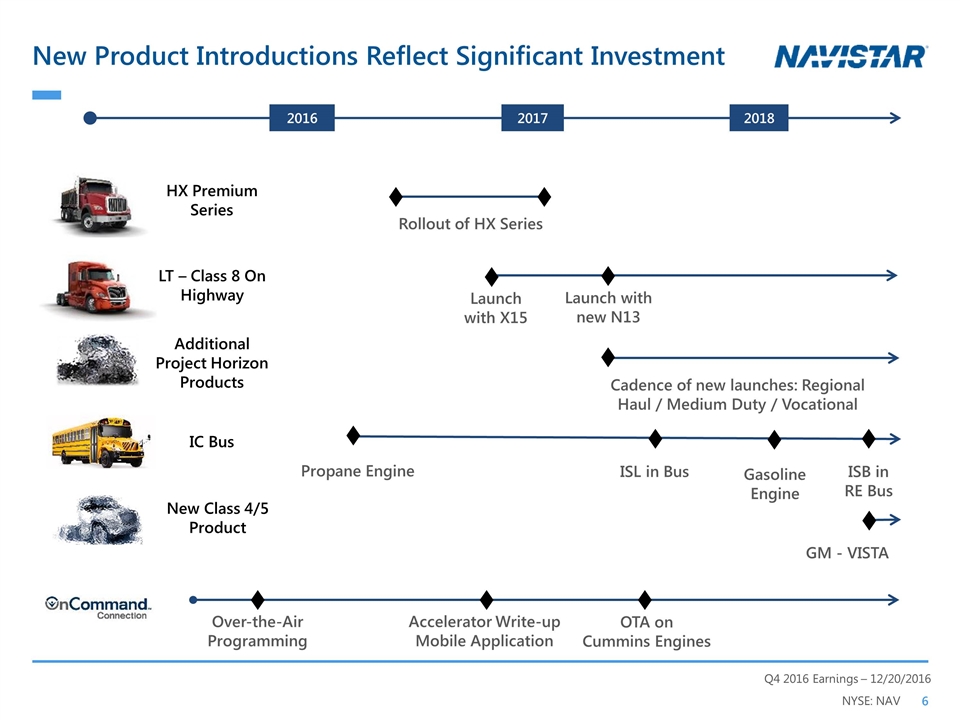

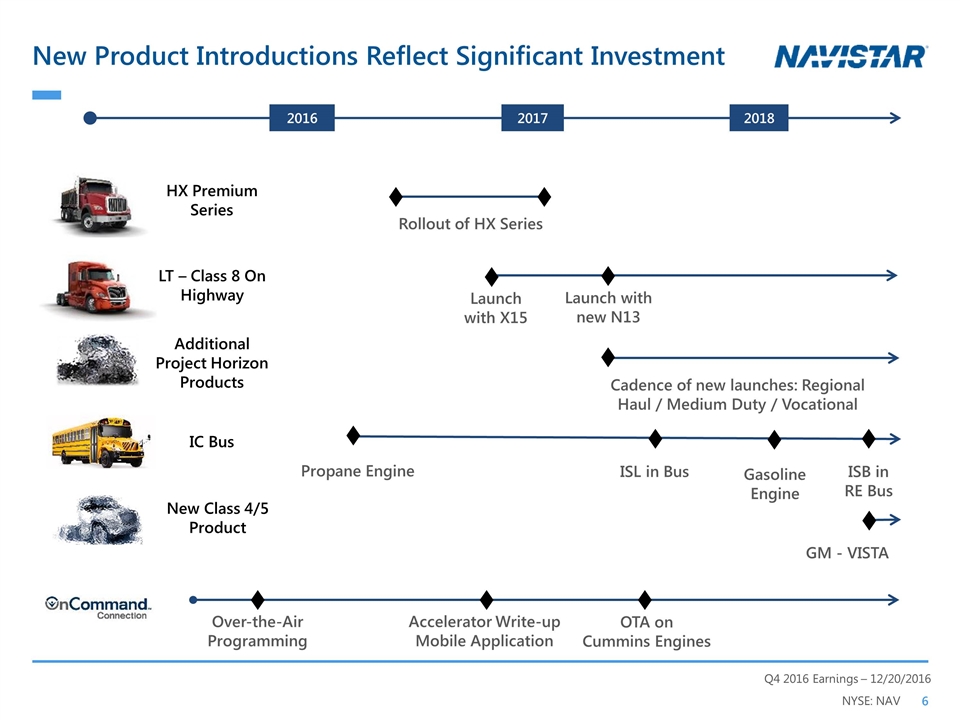

2016 New Product Introductions Reflect Significant Investment Launch with new N13 LT – Class 8 On Highway Launch with X15 Propane Engine IC Bus Gasoline Engine New Class 4/5 Product GM - VISTA HX Premium Series Additional Project Horizon Products Cadence of new launches: Regional Haul / Medium Duty / Vocational Over-the-Air Programming OTA on Cummins Engines Accelerator Write-up Mobile Application 2017 2018 ISB in RE Bus ISL in Bus Rollout of HX Series ♦ ♦ ♦ ♦ ♦ ♦ ♦ ♦ ♦ ♦ ♦ ♦ ♦

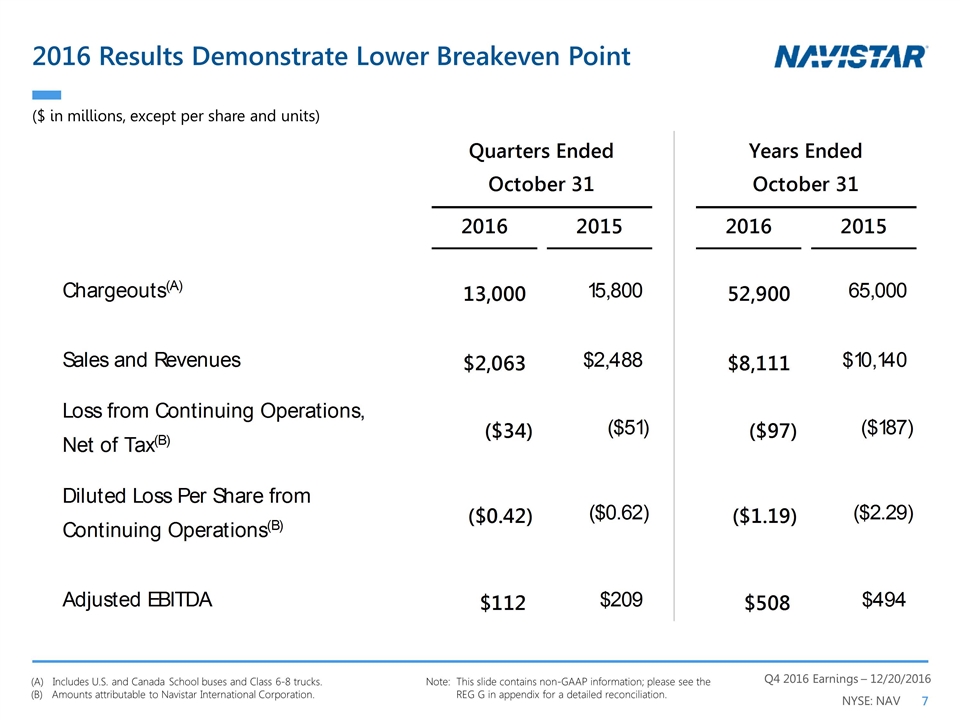

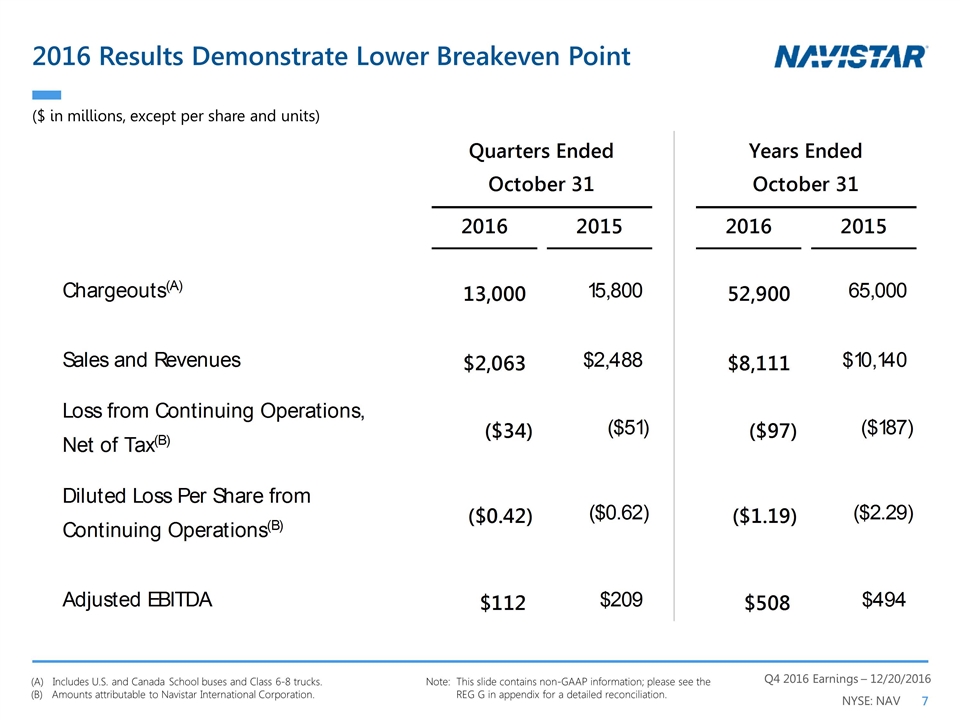

2016 Results Demonstrate Lower Breakeven Point Note:This slide contains non-GAAP information; please see the REG G in appendix for a detailed reconciliation. (A) Includes U.S. and Canada School buses and Class 6-8 trucks. (B) Amounts attributable to Navistar International Corporation. ($ in millions, except per share and units)

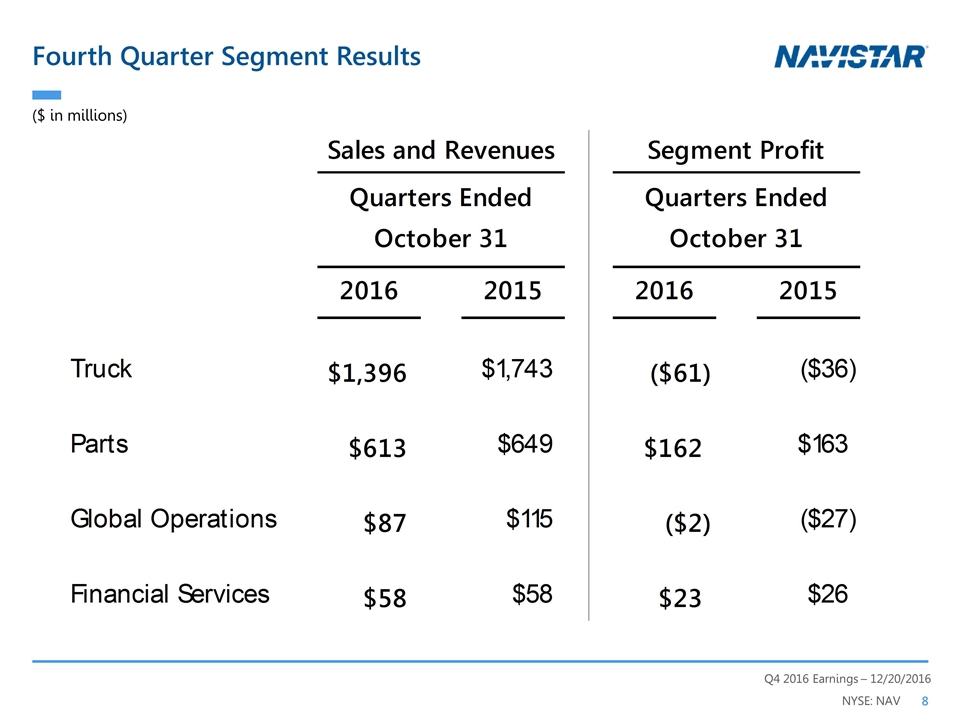

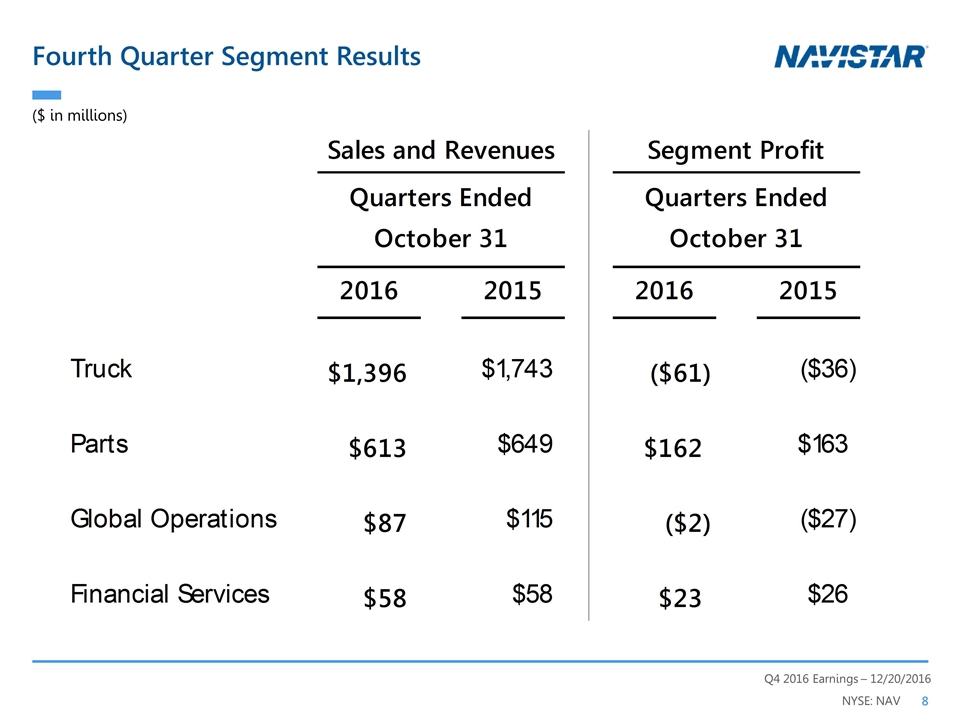

Fourth Quarter Segment Results ($ in millions)

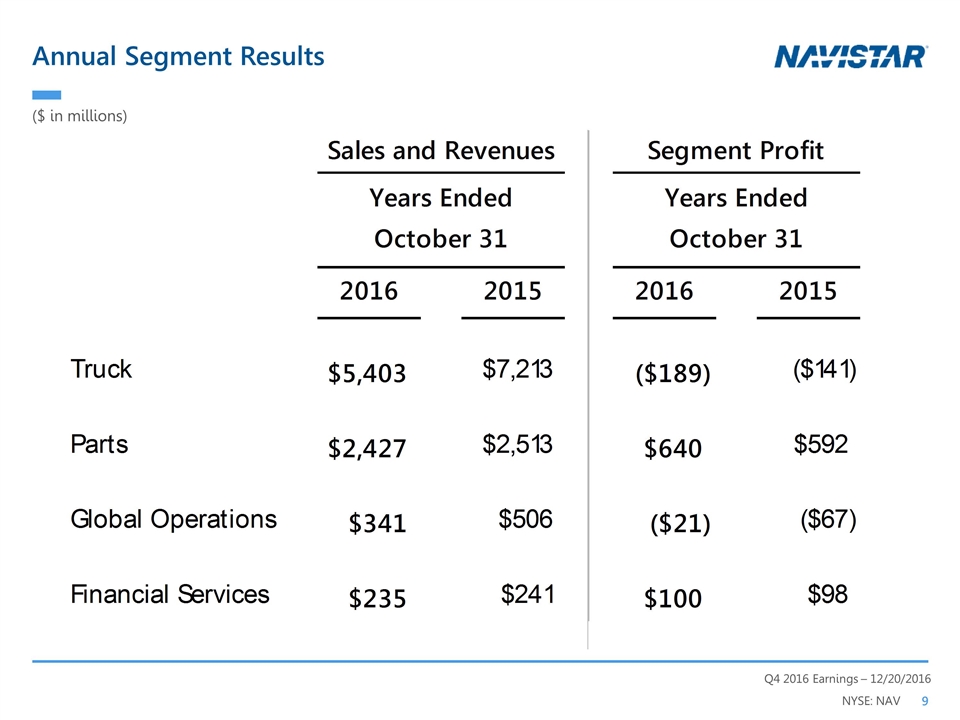

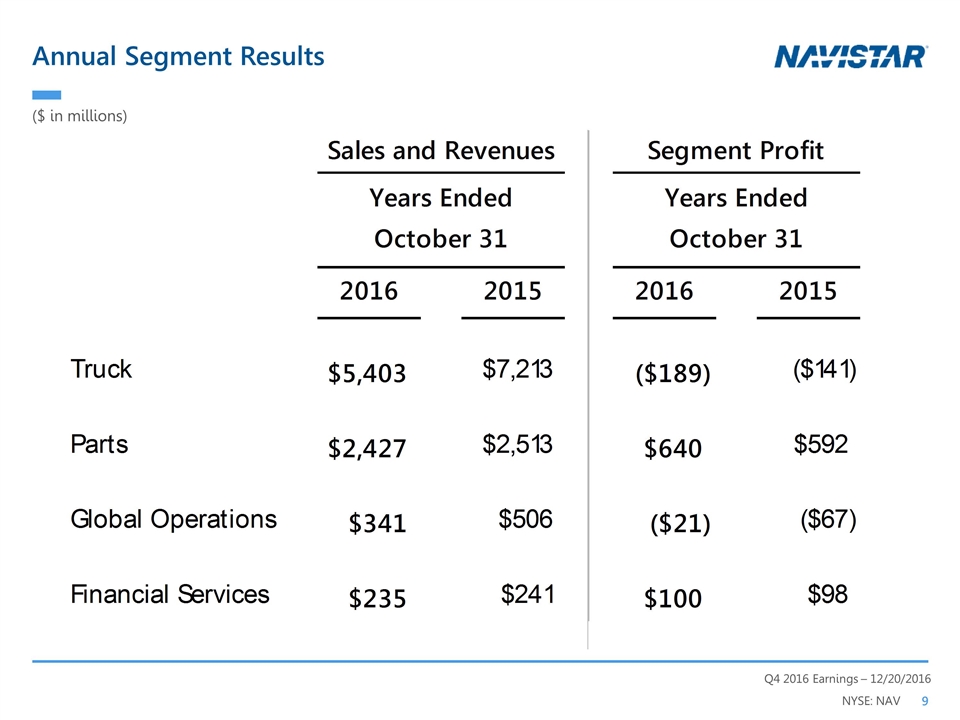

Annual Segment Results ($ in millions)

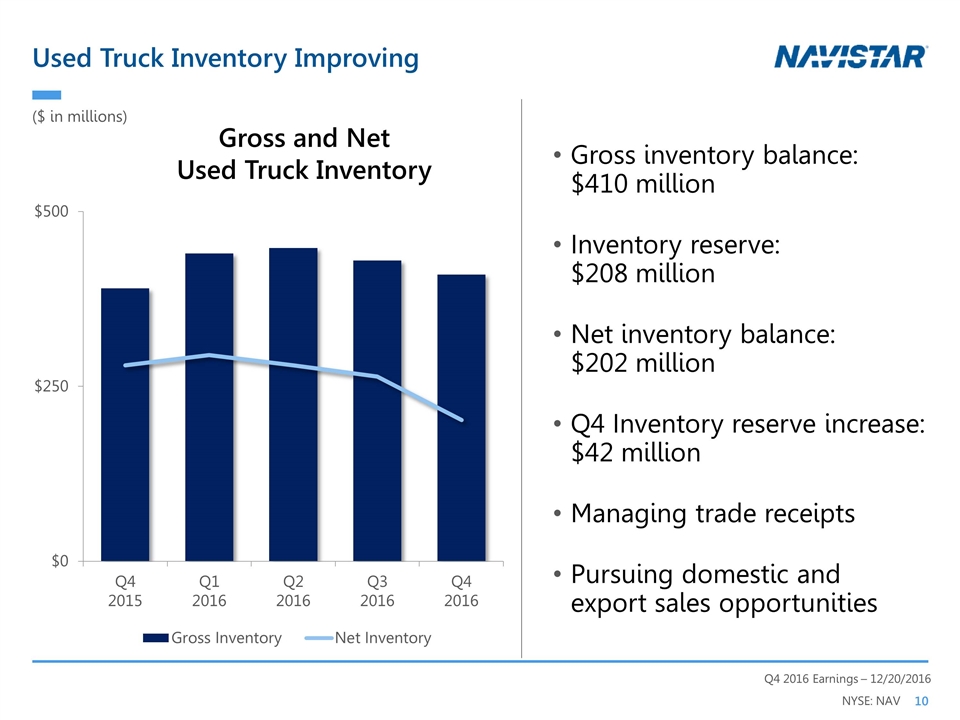

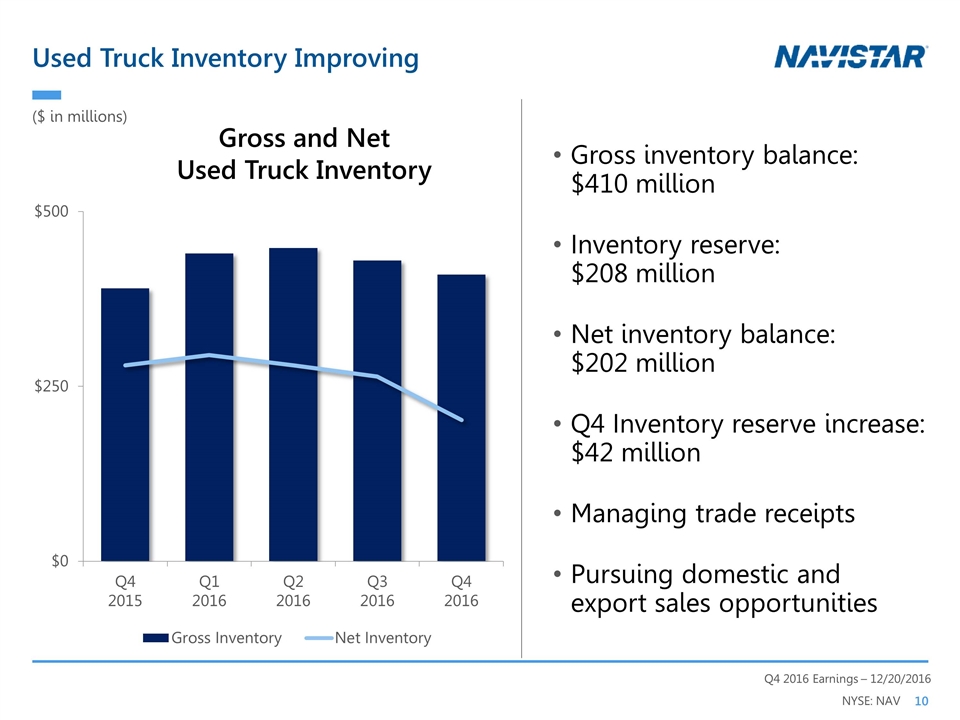

Used Truck Inventory Improving Gross inventory balance: $410 million Inventory reserve: $208 million Net inventory balance: $202 million Q4 Inventory reserve increase: $42 million Managing trade receipts Pursuing domestic and export sales opportunities Gross and Net Used Truck Inventory ($ in millions)

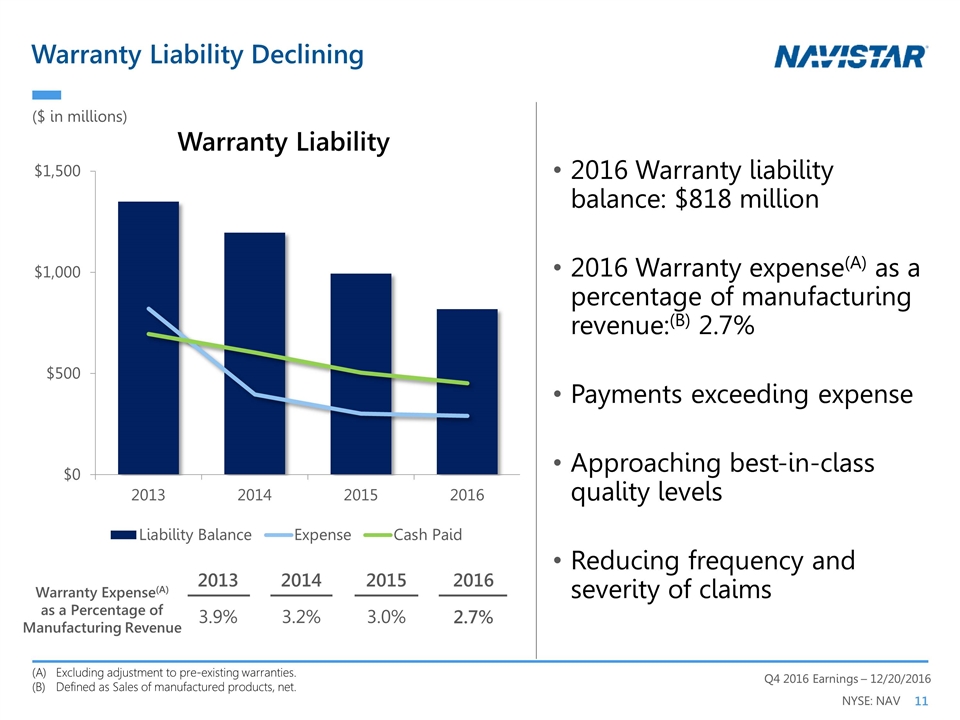

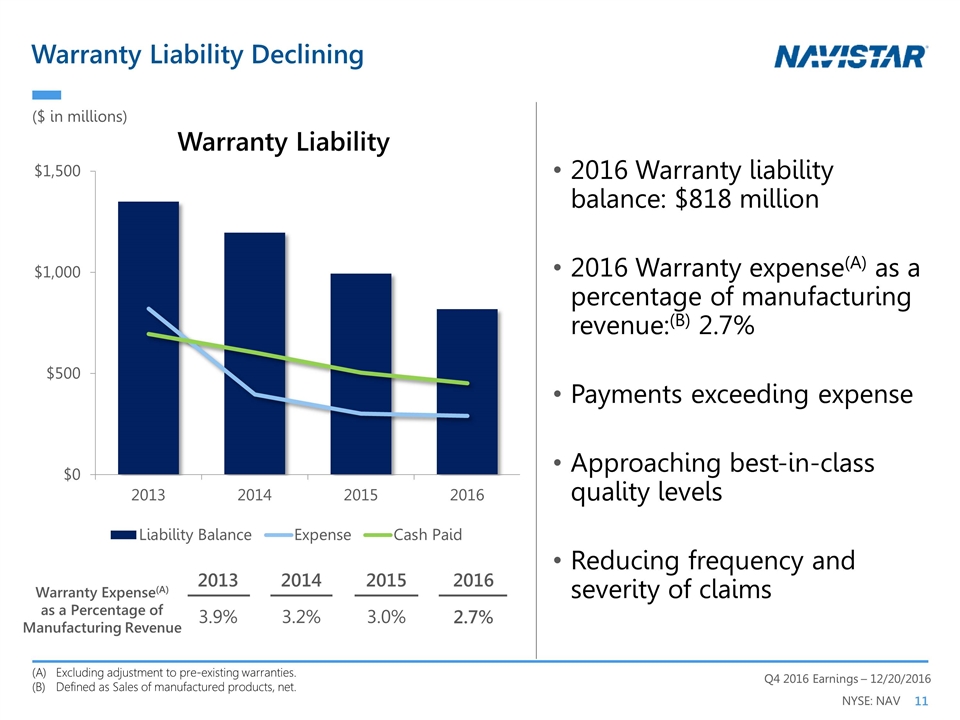

Warranty Liability Declining 2016 Warranty liability balance: $818 million 2016 Warranty expense(A) as a percentage of manufacturing revenue:(B) 2.7% Payments exceeding expense Approaching best-in-class quality levels Reducing frequency and severity of claims Warranty Liability ($ in millions) Excluding adjustment to pre-existing warranties. Defined as Sales of manufactured products, net. Warranty Expense(A) as a Percentage of Manufacturing Revenue 2013 2014 2015 2016 3.9% 3.2% 3.0% 2.7%

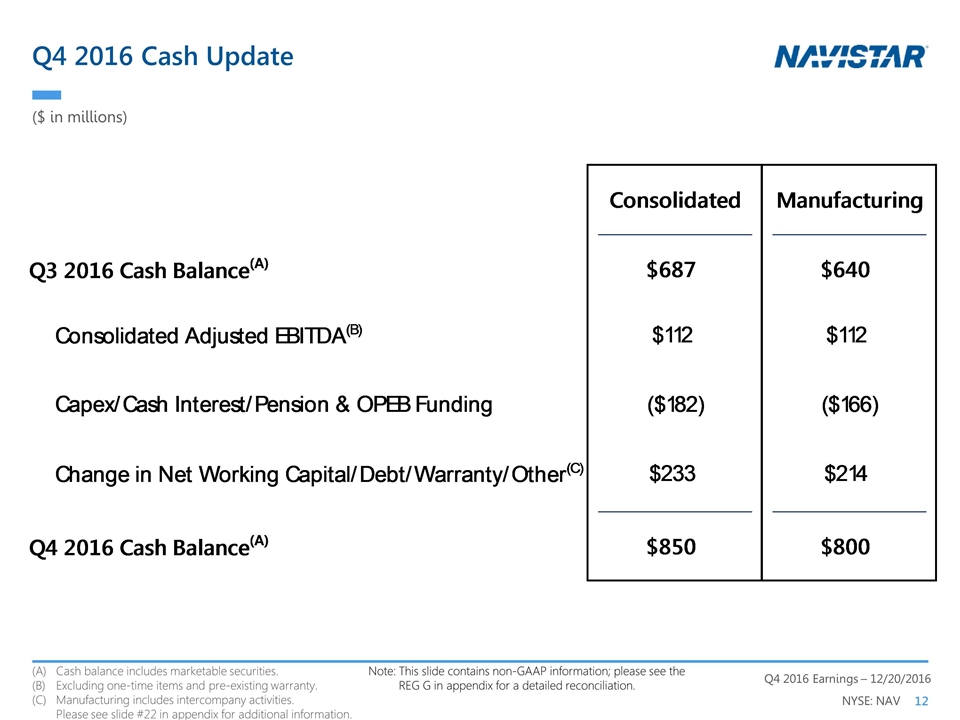

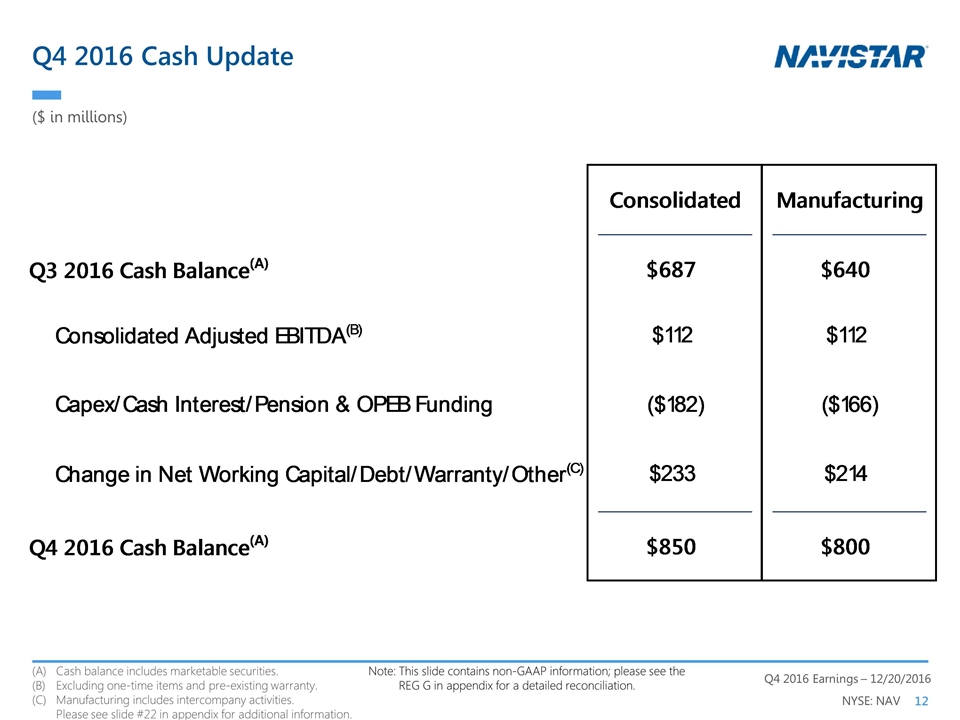

Cash balance includes marketable securities. Excluding one-time items and pre-existing warranty. Manufacturing includes intercompany activities. Please see slide #22 in appendix for additional information. Q4 2016 Cash Update ($ in millions) Note:This slide contains non-GAAP information; please see the REG G in appendix for a detailed reconciliation.

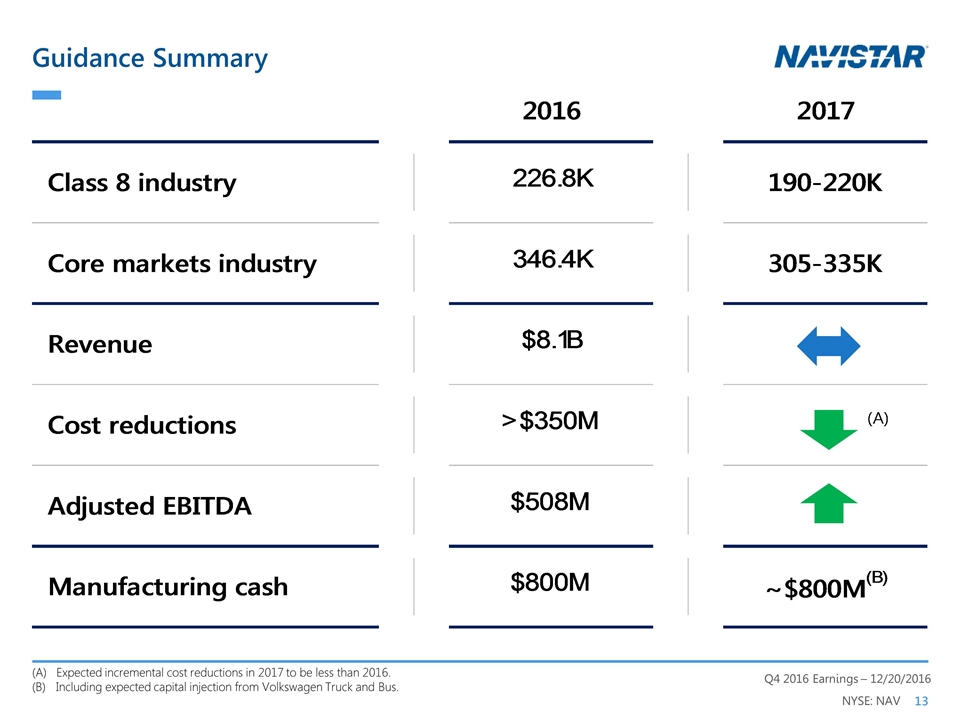

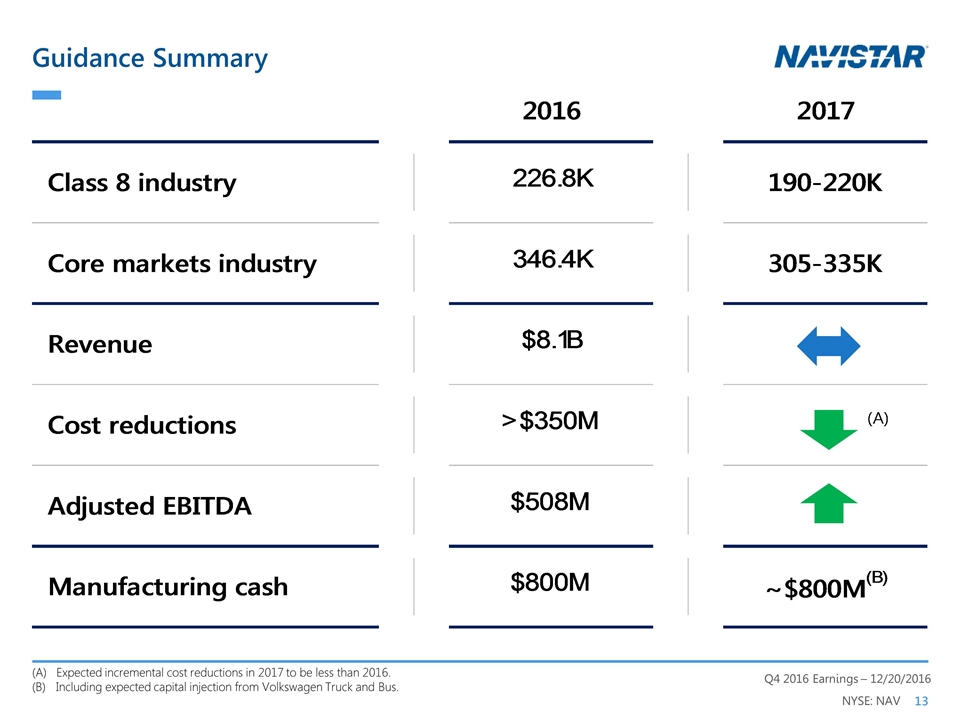

Guidance Summary (A) Expected incremental cost reductions in 2017 to be less than 2016. (B)Including expected capital injection from Volkswagen Truck and Bus.

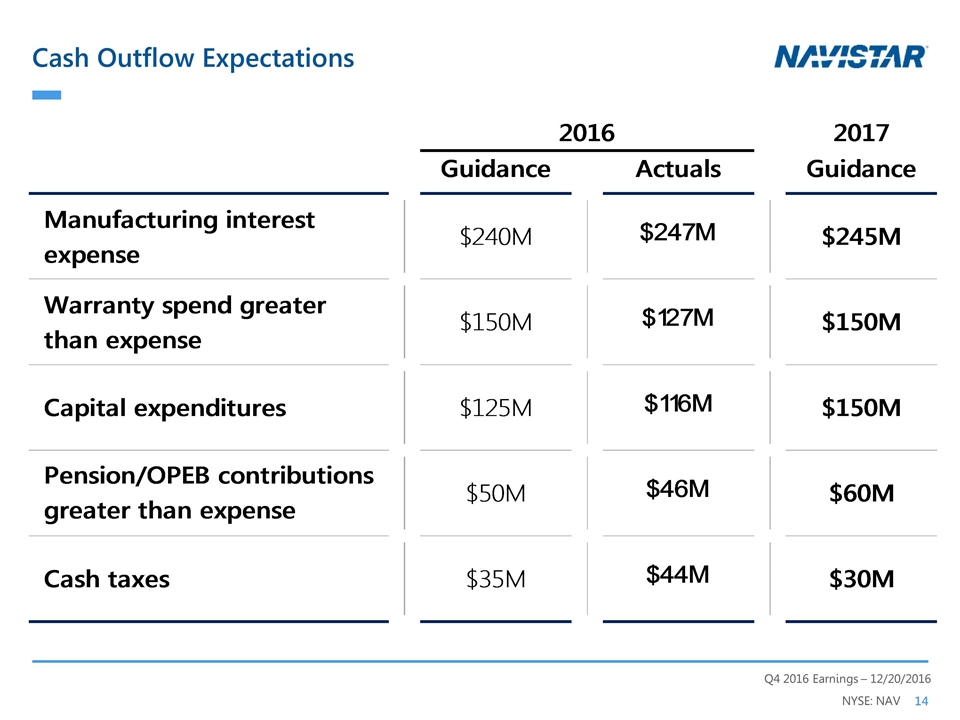

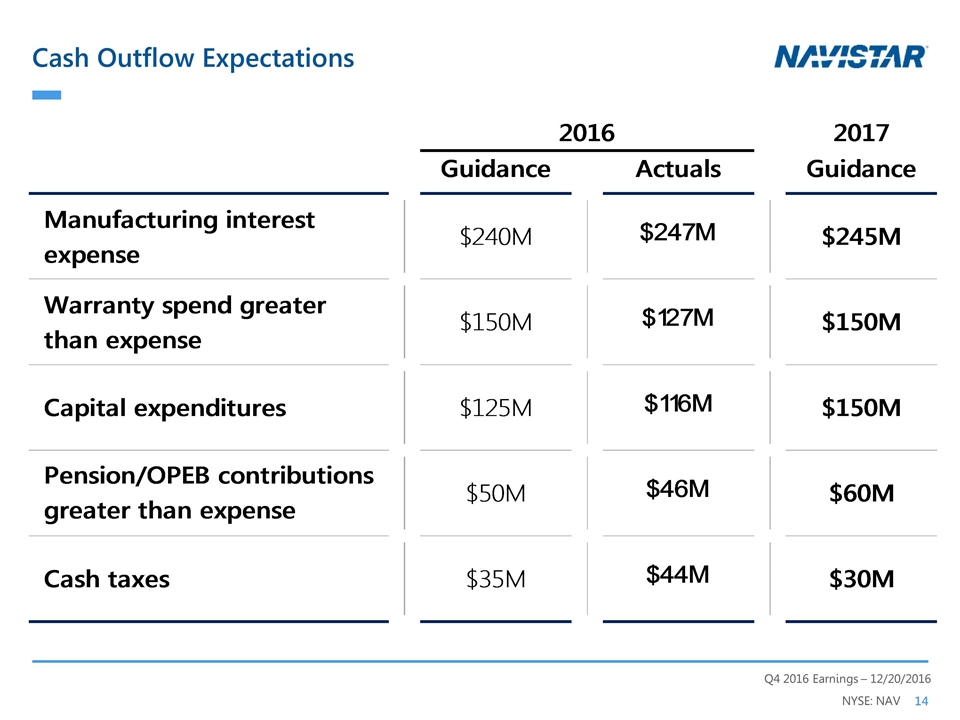

Cash Outflow Expectations

Appendix

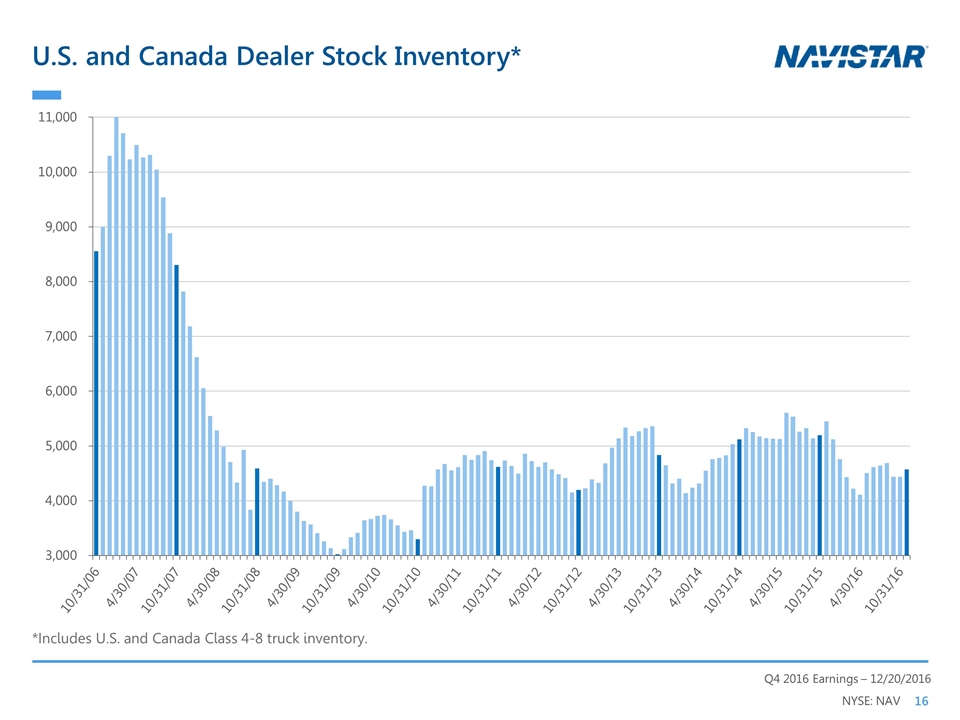

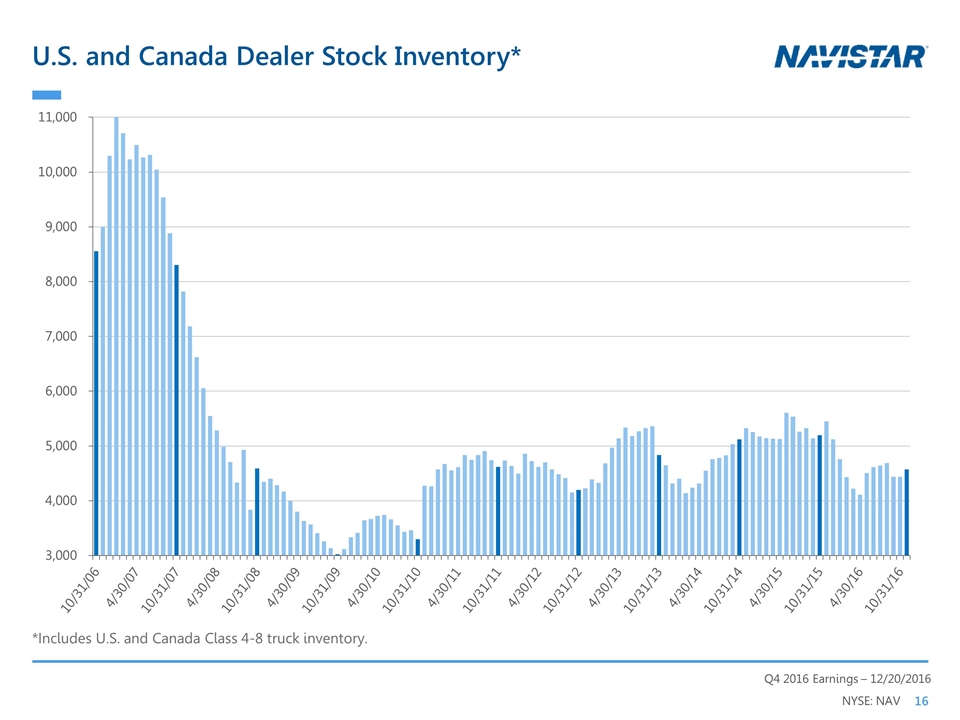

U.S. and Canada Dealer Stock Inventory* *Includes U.S. and Canada Class 4-8 truck inventory.

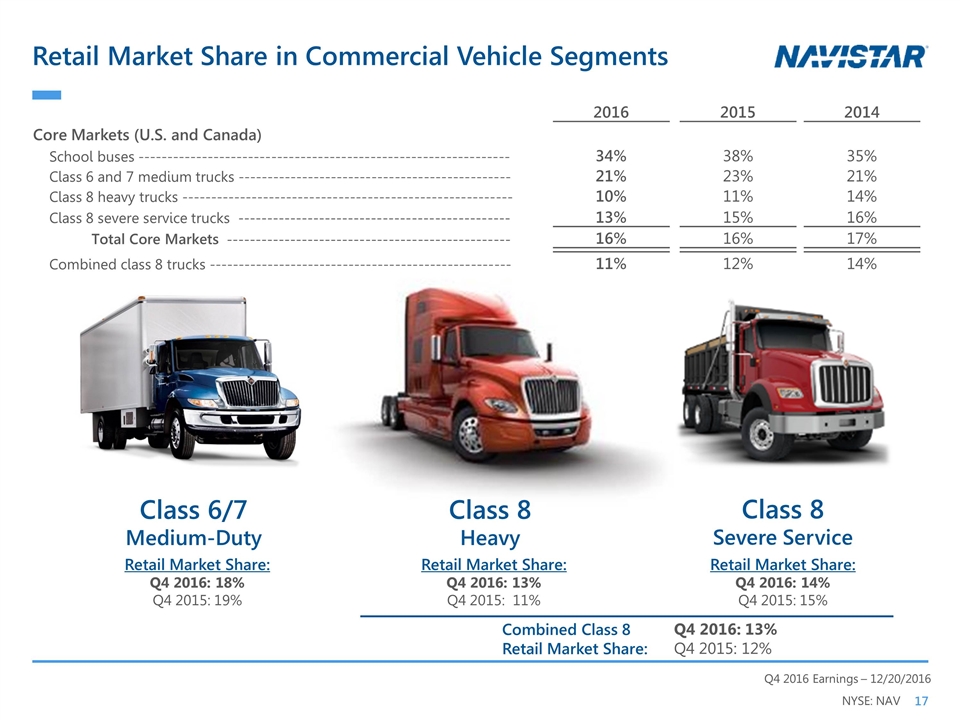

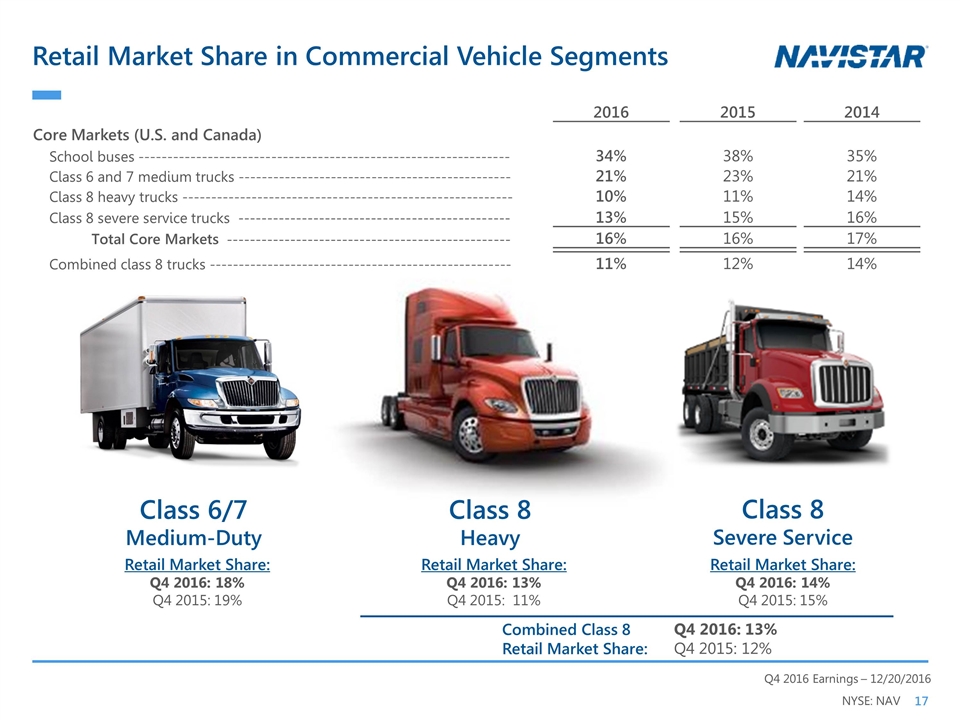

Retail Market Share in Commercial Vehicle Segments Class 6/7 Medium-Duty Class 8 Severe Service 2016 2015 2014 Core Markets (U.S. and Canada) School buses ---------------------------------------------------------------- 34% 38% 35% Class 6 and 7 medium trucks ----------------------------------------------- 21% 23% 21% Class 8 heavy trucks --------------------------------------------------------- 10% 11% 14% Class 8 severe service trucks ----------------------------------------------- 13% 15% 16% Total Core Markets ------------------------------------------------- 16% 16% 17% Combined class 8 trucks ---------------------------------------------------- 11% 12% 14% Class 8 Heavy Retail Market Share: Q4 2016: 13% Q4 2015: 11% Retail Market Share: Q4 2016: 18% Q4 2015: 19% Retail Market Share: Q4 2016: 14% Q4 2015: 15% Combined Class 8 Retail Market Share: Q4 2016: 13% Q4 2015: 12%

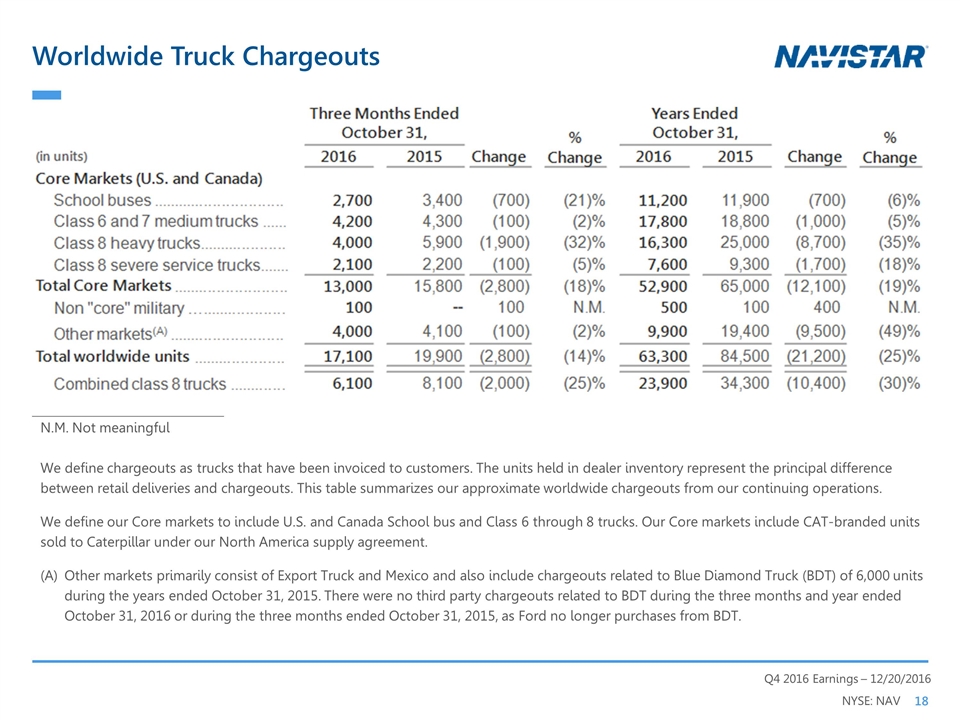

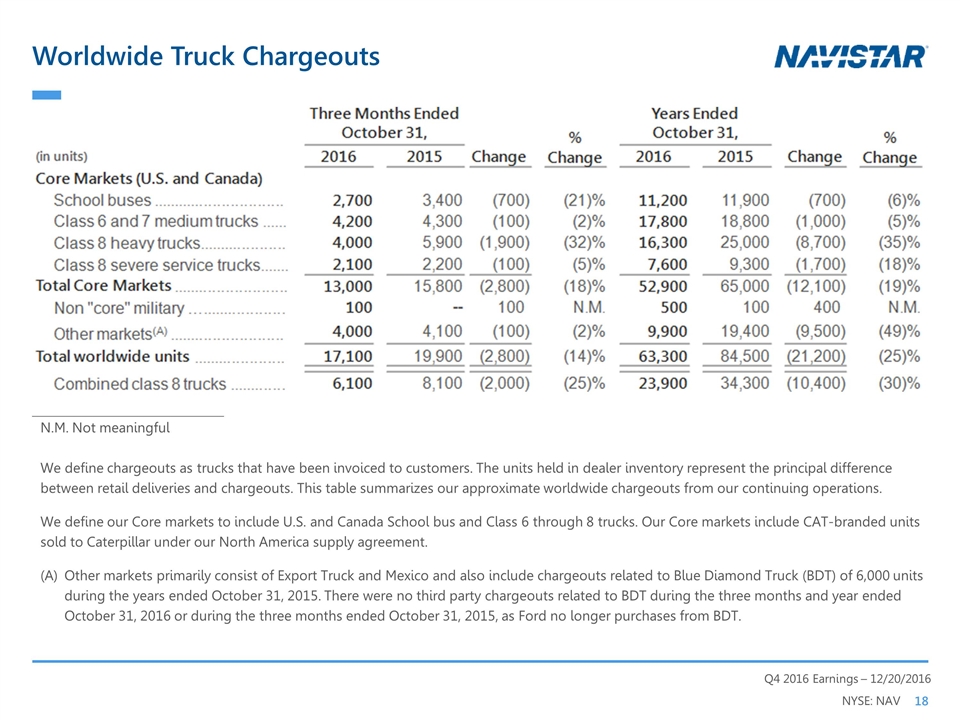

Worldwide Truck Chargeouts N.M. Not meaningful We define chargeouts as trucks that have been invoiced to customers. The units held in dealer inventory represent the principal difference between retail deliveries and chargeouts. This table summarizes our approximate worldwide chargeouts from our continuing operations. We define our Core markets to include U.S. and Canada School bus and Class 6 through 8 trucks. Our Core markets include CAT-branded units sold to Caterpillar under our North America supply agreement. Other markets primarily consist of Export Truck and Mexico and also include chargeouts related to Blue Diamond Truck (BDT) of 6,000 units during the years ended October 31, 2015. There were no third party chargeouts related to BDT during the three months and year ended October 31, 2016 or during the three months ended October 31, 2015, as Ford no longer purchases from BDT.

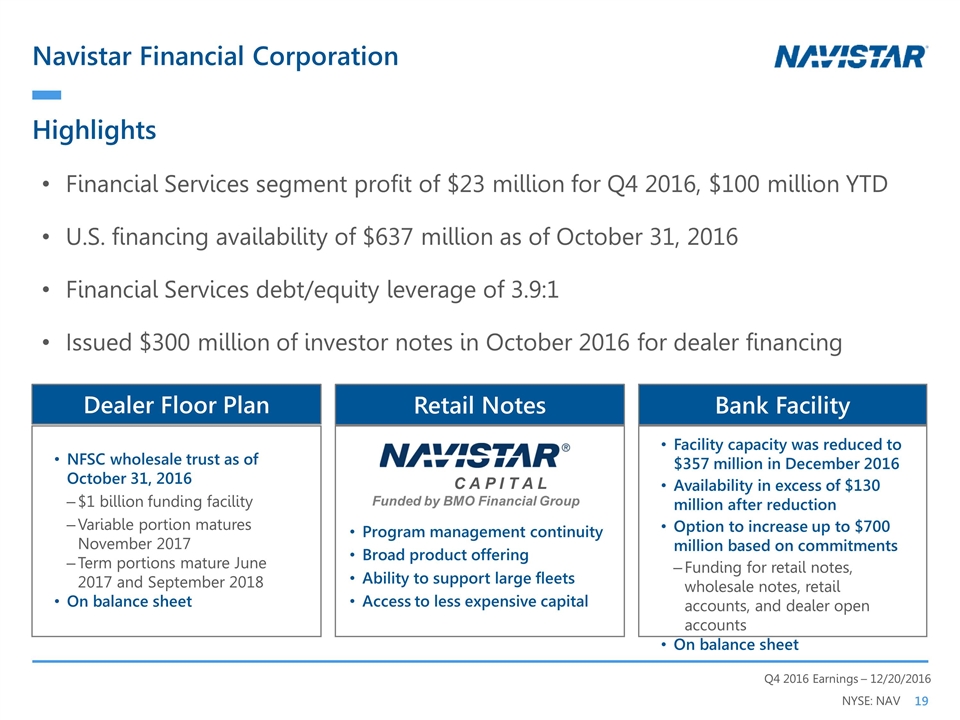

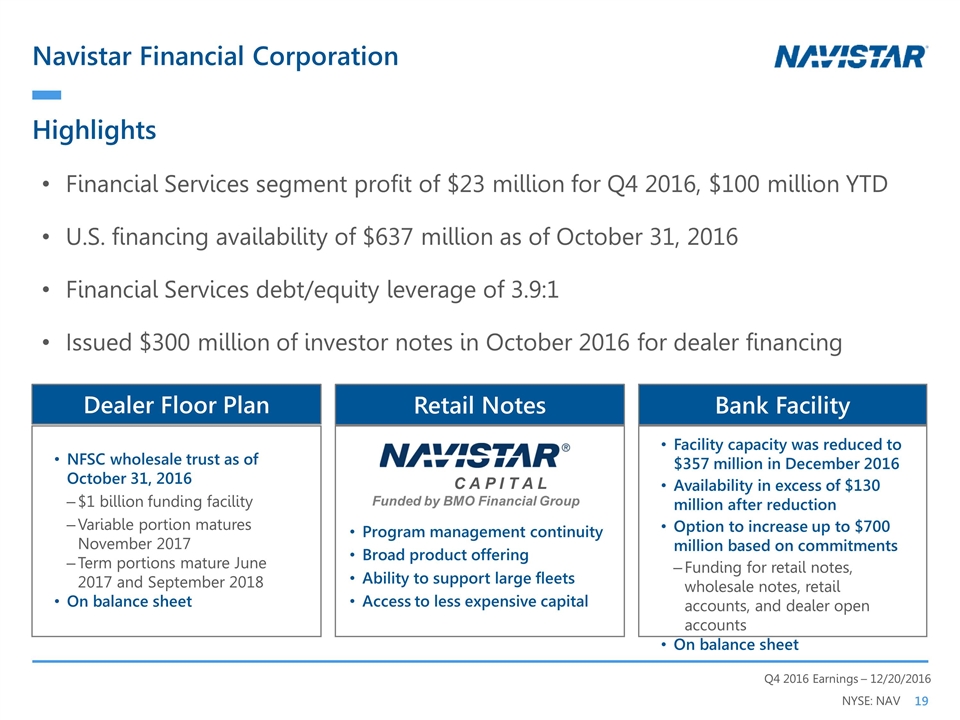

Navistar Financial Corporation Highlights Financial Services segment profit of $23 million for Q4 2016, $100 million YTD U.S. financing availability of $637 million as of October 31, 2016 Financial Services debt/equity leverage of 3.9:1 Issued $300 million of investor notes in October 2016 for dealer financing Retail Notes Bank Facility Dealer Floor Plan Facility capacity was reduced to $357 million in December 2016 Availability in excess of $130 million after reduction Option to increase up to $700 million based on commitments Funding for retail notes, wholesale notes, retail accounts, and dealer open accounts On balance sheet NFSC wholesale trust as of October 31, 2016 $1 billion funding facility Variable portion matures November 2017 Term portions mature June 2017 and September 2018 On balance sheet Program management continuity Broad product offering Ability to support large fleets Access to less expensive capital C A P I T A L Funded by BMO Financial Group

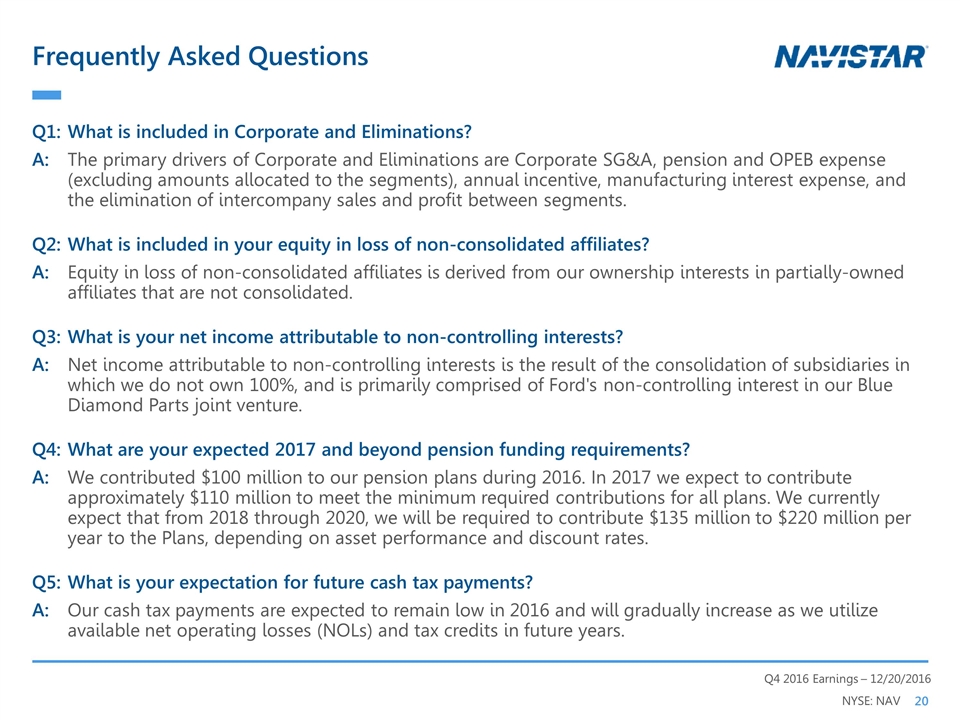

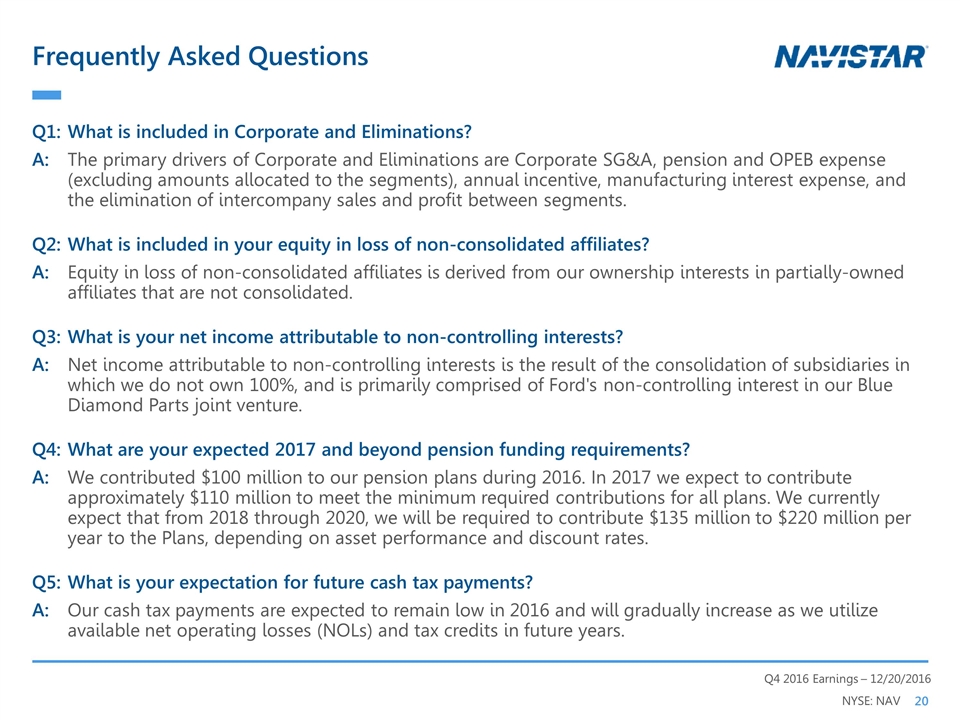

Frequently Asked Questions Q1: What is included in Corporate and Eliminations? A:The primary drivers of Corporate and Eliminations are Corporate SG&A, pension and OPEB expense (excluding amounts allocated to the segments), annual incentive, manufacturing interest expense, and the elimination of intercompany sales and profit between segments. Q2: What is included in your equity in loss of non-consolidated affiliates? A:Equity in loss of non-consolidated affiliates is derived from our ownership interests in partially-owned affiliates that are not consolidated. Q3: What is your net income attributable to non-controlling interests? A:Net income attributable to non-controlling interests is the result of the consolidation of subsidiaries in which we do not own 100%, and is primarily comprised of Ford's non-controlling interest in our Blue Diamond Parts joint venture. Q4:What are your expected 2017 and beyond pension funding requirements? A: We contributed $100 million to our pension plans during 2016. In 2017 we expect to contribute approximately $110 million to meet the minimum required contributions for all plans. We currently expect that from 2018 through 2020, we will be required to contribute $135 million to $220 million per year to the Plans, depending on asset performance and discount rates. Q5:What is your expectation for future cash tax payments? A:Our cash tax payments are expected to remain low in 2016 and will gradually increase as we utilize available net operating losses (NOLs) and tax credits in future years.

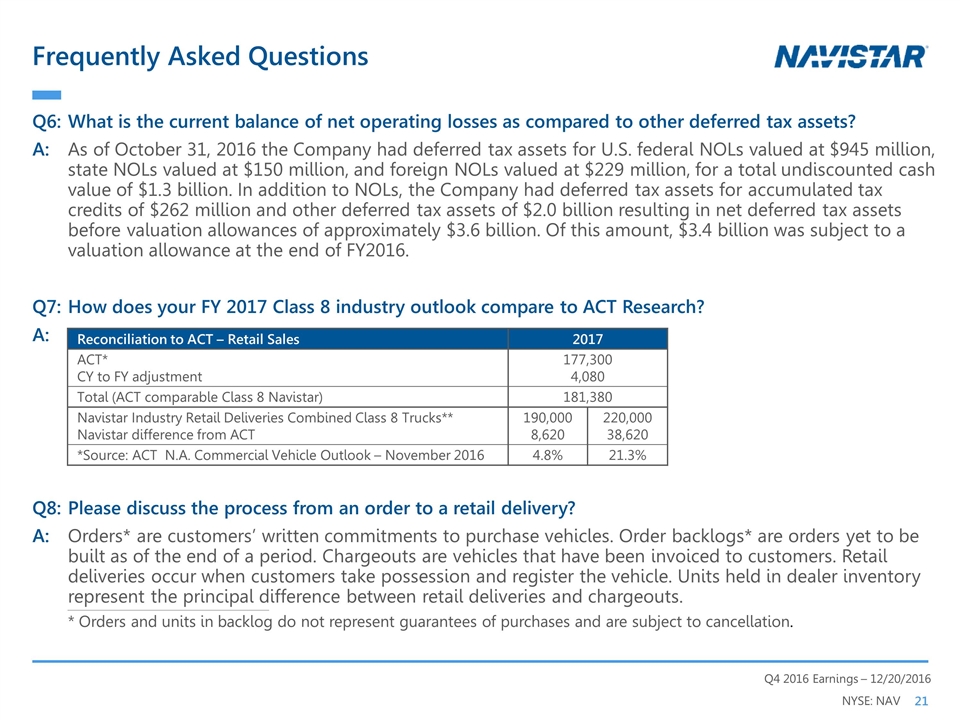

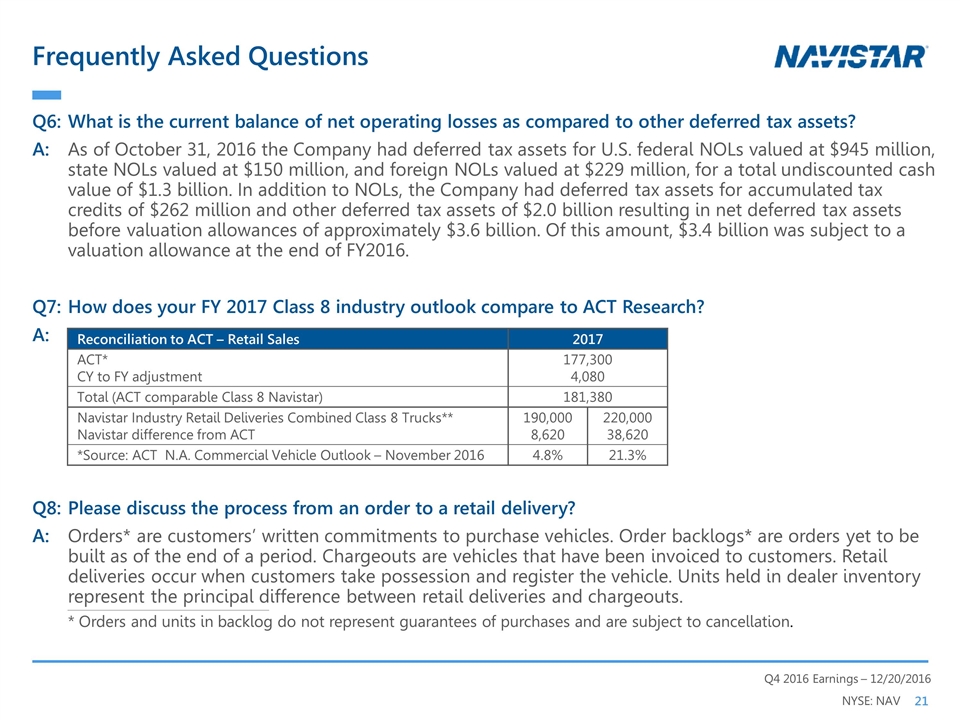

Frequently Asked Questions Q6:What is the current balance of net operating losses as compared to other deferred tax assets? A: As of October 31, 2016 the Company had deferred tax assets for U.S. federal NOLs valued at $945 million, state NOLs valued at $150 million, and foreign NOLs valued at $229 million, for a total undiscounted cash value of $1.3 billion. In addition to NOLs, the Company had deferred tax assets for accumulated tax credits of $262 million and other deferred tax assets of $2.0 billion resulting in net deferred tax assets before valuation allowances of approximately $3.6 billion. Of this amount, $3.4 billion was subject to a valuation allowance at the end of FY2016. Q7:How does your FY 2017 Class 8 industry outlook compare to ACT Research? A: Q8:Please discuss the process from an order to a retail delivery? A: Orders* are customers’ written commitments to purchase vehicles. Order backlogs* are orders yet to be built as of the end of a period. Chargeouts are vehicles that have been invoiced to customers. Retail deliveries occur when customers take possession and register the vehicle. Units held in dealer inventory represent the principal difference between retail deliveries and chargeouts. * Orders and units in backlog do not represent guarantees of purchases and are subject to cancellation. Reconciliation to ACT – Retail Sales 2017 ACT* CY to FY adjustment 177,300 4,080 Total (ACT comparable Class 8 Navistar) 181,380 Navistar Industry Retail Deliveries Combined Class 8 Trucks** Navistar difference from ACT 190,000 8,620 220,000 38,620 *Source: ACT N.A. Commercial Vehicle Outlook – November 2016 4.8% 21.3%

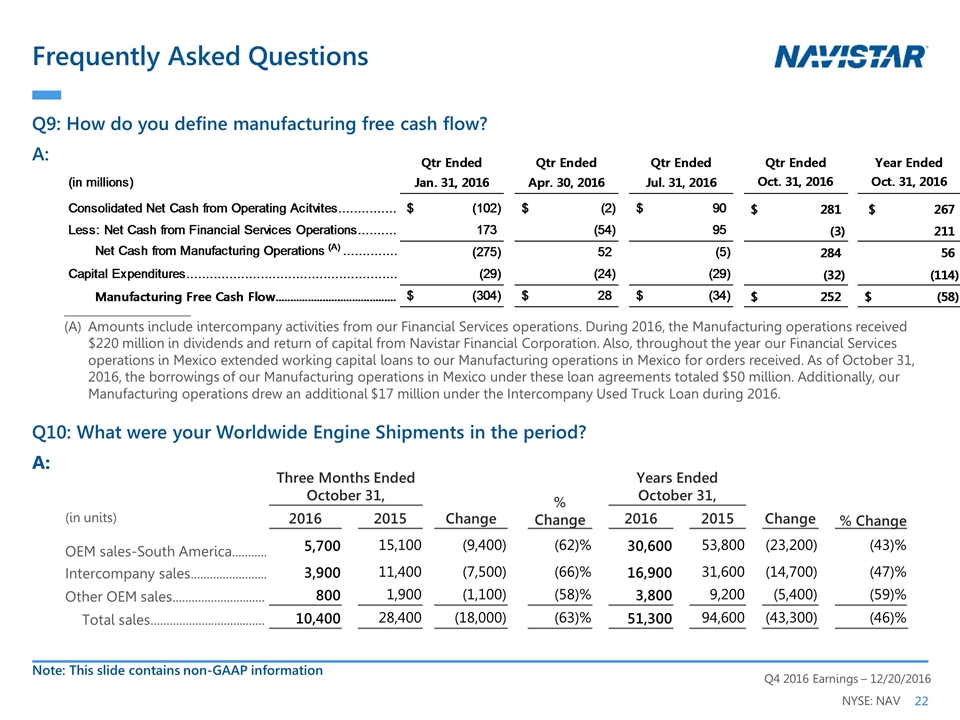

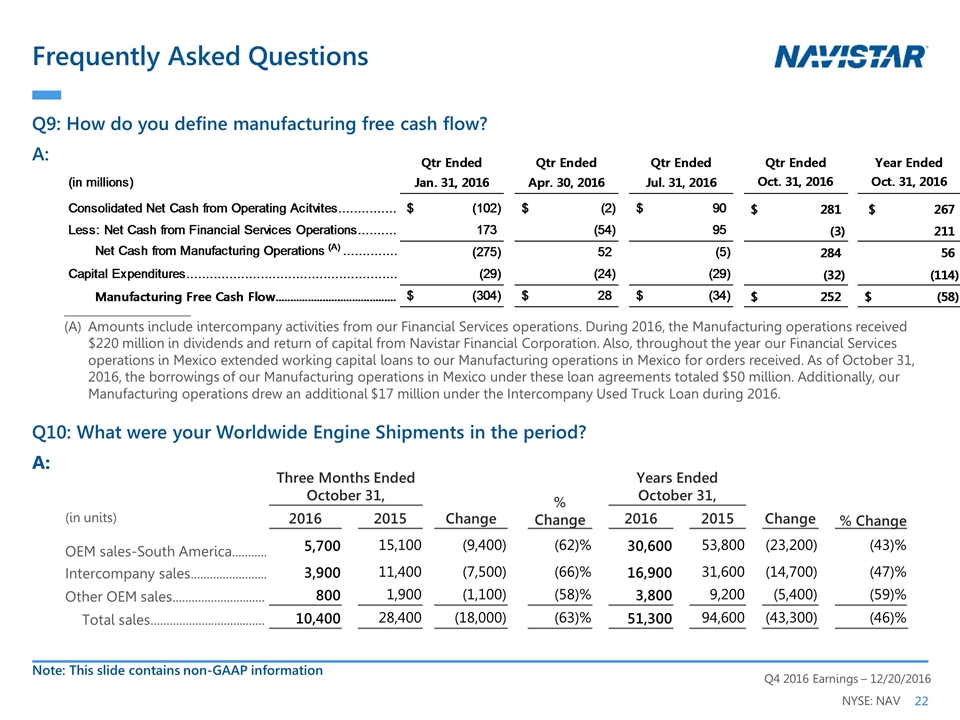

Three Months Ended October 31, % Change Years Ended October 31, % Change (in units) 2016 2015 Change 2016 2015 Change OEM sales-South America........... 5,700 15,100 (9,400) (62)% 30,600 53,800 (23,200) (43)% Intercompany sales........................ 3,900 11,400 (7,500) (66)% 16,900 31,600 (14,700) (47)% Other OEM sales............................. 800 1,900 (1,100) (58)% 3,800 9,200 (5,400) (59)% Total sales.................................... 10,400 28,400 (18,000) (63)% 51,300 94,600 (43,300) (46)% Frequently Asked Questions Q9: How do you define manufacturing free cash flow? A: Q10: What were your Worldwide Engine Shipments in the period? A: ______________________ Amounts include intercompany activities from our Financial Services operations. During 2016, the Manufacturing operations received $220 million in dividends and return of capital from Navistar Financial Corporation. Also, throughout the year our Financial Services operations in Mexico extended working capital loans to our Manufacturing operations in Mexico for orders received. As of October 31, 2016, the borrowings of our Manufacturing operations in Mexico under these loan agreements totaled $50 million. Additionally, our Manufacturing operations drew an additional $17 million under the Intercompany Used Truck Loan during 2016. Note: This slide contains non-GAAP information Qtr Ended Qtr Ended Qtr Ended Qtr Ended Year Ended (in millions) Jan. 31, 2016 Apr. 30, 2016 Jul. 31, 2016 Oct. 31, 2016 Oct. 31, 2016 Consolidated Net Cash from Operating Acitvites $-,102 $-2 $90 $281 $267 Less: Net Cash from Financial Services Operations 173 -54 95 -3 211 Net Cash from Manufacturing Operations (A) .............. -,275 52 -5 284 56 Capital Expenditures -29 -24 -29 -32 -,114 Manufacturing Free Cash Flow $-,304 $28 $-34 $252 $-58

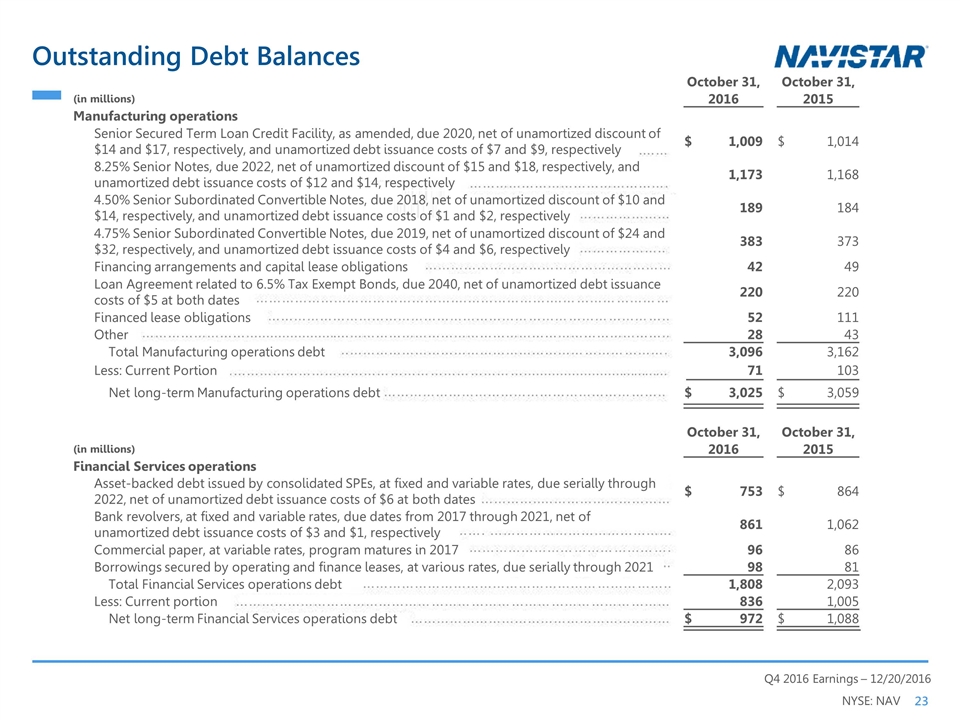

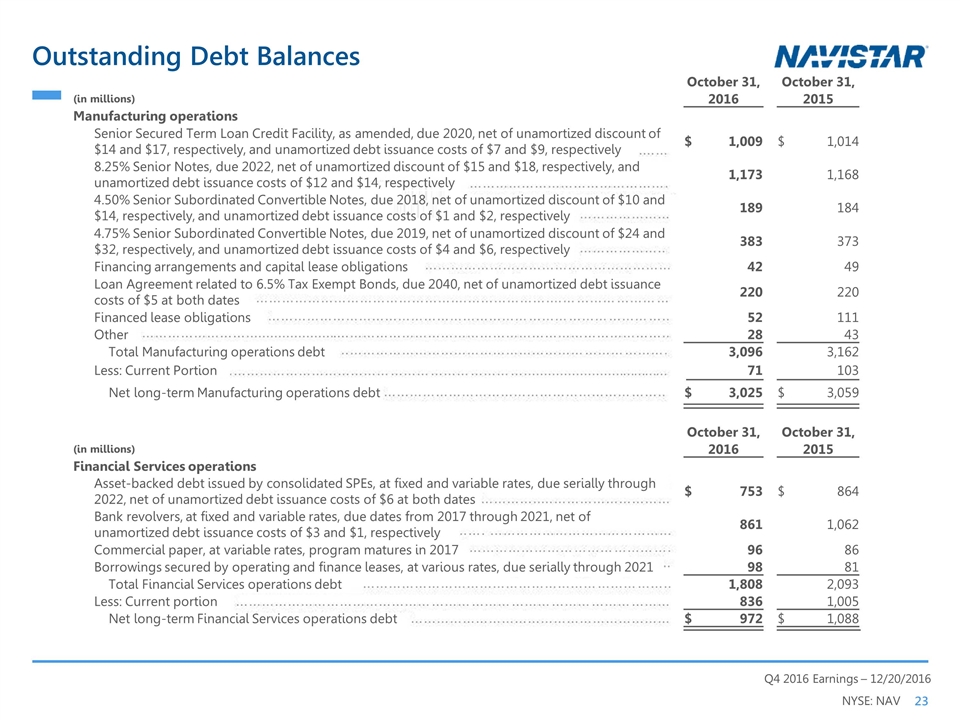

Outstanding Debt Balances October 31, October 31, (in millions) 2016 2015 Manufacturing operations Senior Secured Term Loan Credit Facility, as amended, due 2020, net of unamortized discount of $14 and $17, respectively, and unamortized debt issuance costs of $7 and $9, respectively $ 1,009 $ 1,014 8.25% Senior Notes, due 2022, net of unamortized discount of $15 and $18, respectively, and unamortized debt issuance costs of $12 and $14, respectively 1,173 1,168 4.50% Senior Subordinated Convertible Notes, due 2018, net of unamortized discount of $10 and $14, respectively, and unamortized debt issuance costs of $1 and $2, respectively 189 184 4.75% Senior Subordinated Convertible Notes, due 2019, net of unamortized discount of $24 and $32, respectively, and unamortized debt issuance costs of $4 and $6, respectively 383 373 Financing arrangements and capital lease obligations 42 49 Loan Agreement related to 6.5% Tax Exempt Bonds, due 2040, net of unamortized debt issuance costs of $5 at both dates 220 220 Financed lease obligations 52 111 Other 28 43 Total Manufacturing operations debt 3,096 3,162 Less: Current Portion 71 103 Net long-term Manufacturing operations debt $ 3,025 $ 3,059 October 31, October 31, (in millions) 2016 2015 Financial Services operations Asset-backed debt issued by consolidated SPEs, at fixed and variable rates, due serially through 2022, net of unamortized debt issuance costs of $6 at both dates $ 753 $ 864 Bank revolvers, at fixed and variable rates, due dates from 2017 through 2021, net of unamortized debt issuance costs of $3 and $1, respectively 861 1,062 Commercial paper, at variable rates, program matures in 2017 96 86 Borrowings secured by operating and finance leases, at various rates, due serially through 2021 98 81 Total Financial Services operations debt 1,808 2,093 Less: Current portion 836 1,005 Net long-term Financial Services operations debt $ 972 $ 1,088

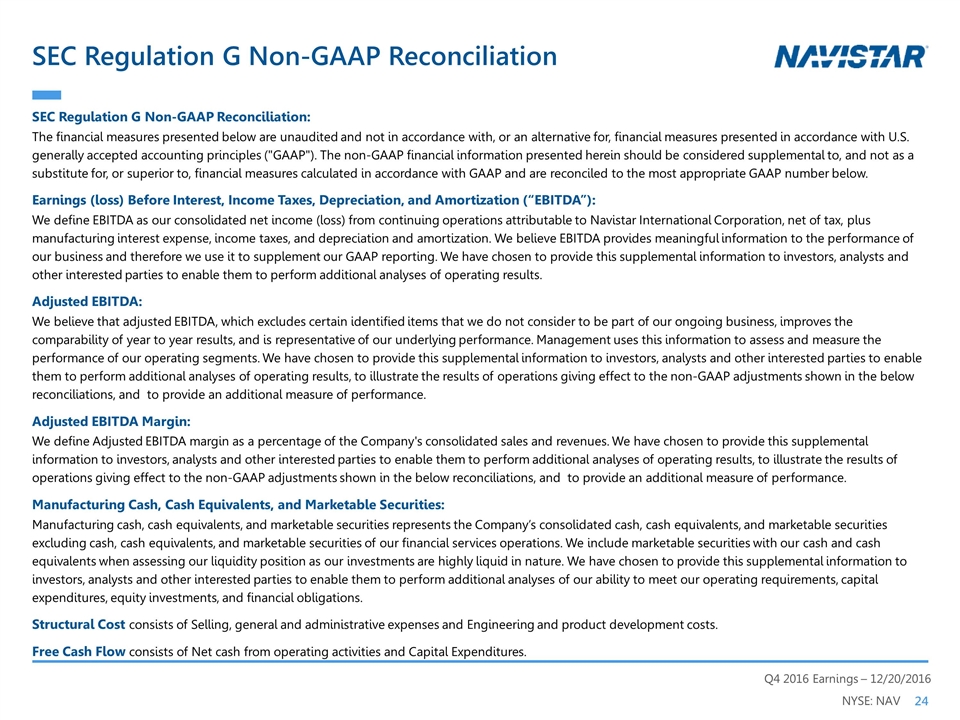

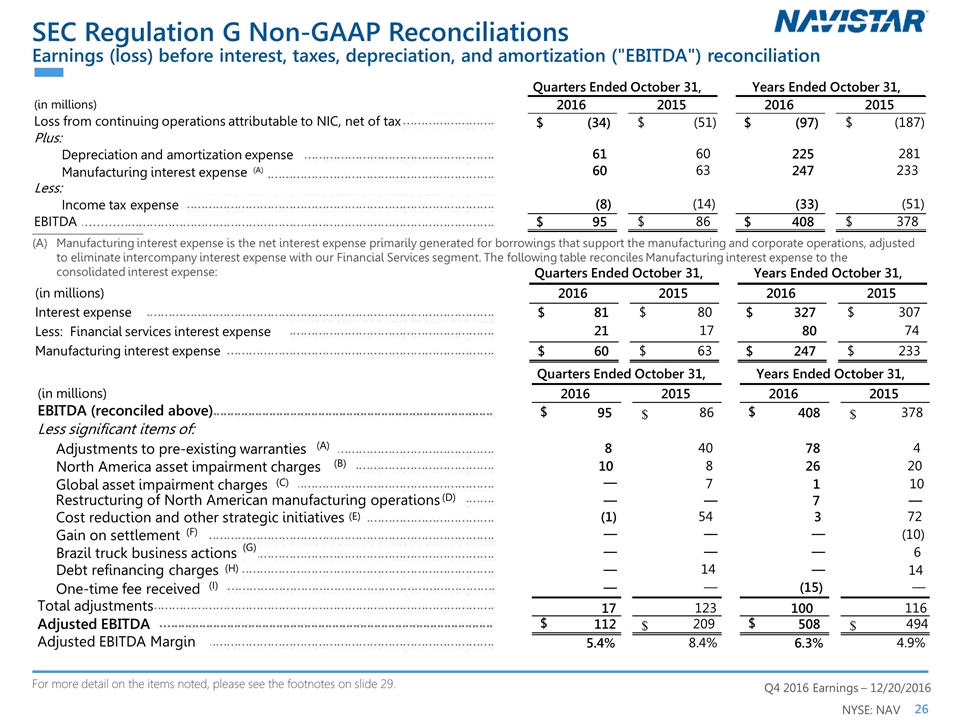

SEC Regulation G Non-GAAP Reconciliation SEC Regulation G Non-GAAP Reconciliation: The financial measures presented below are unaudited and not in accordance with, or an alternative for, financial measures presented in accordance with U.S. generally accepted accounting principles ("GAAP"). The non-GAAP financial information presented herein should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP and are reconciled to the most appropriate GAAP number below. Earnings (loss) Before Interest, Income Taxes, Depreciation, and Amortization (“EBITDA”): We define EBITDA as our consolidated net income (loss) from continuing operations attributable to Navistar International Corporation, net of tax, plus manufacturing interest expense, income taxes, and depreciation and amortization. We believe EBITDA provides meaningful information to the performance of our business and therefore we use it to supplement our GAAP reporting. We have chosen to provide this supplemental information to investors, analysts and other interested parties to enable them to perform additional analyses of operating results. Adjusted EBITDA: We believe that adjusted EBITDA, which excludes certain identified items that we do not consider to be part of our ongoing business, improves the comparability of year to year results, and is representative of our underlying performance. Management uses this information to assess and measure the performance of our operating segments. We have chosen to provide this supplemental information to investors, analysts and other interested parties to enable them to perform additional analyses of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments shown in the below reconciliations, and to provide an additional measure of performance. Adjusted EBITDA Margin: We define Adjusted EBITDA margin as a percentage of the Company's consolidated sales and revenues. We have chosen to provide this supplemental information to investors, analysts and other interested parties to enable them to perform additional analyses of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments shown in the below reconciliations, and to provide an additional measure of performance. Manufacturing Cash, Cash Equivalents, and Marketable Securities: Manufacturing cash, cash equivalents, and marketable securities represents the Company’s consolidated cash, cash equivalents, and marketable securities excluding cash, cash equivalents, and marketable securities of our financial services operations. We include marketable securities with our cash and cash equivalents when assessing our liquidity position as our investments are highly liquid in nature. We have chosen to provide this supplemental information to investors, analysts and other interested parties to enable them to perform additional analyses of our ability to meet our operating requirements, capital expenditures, equity investments, and financial obligations. Structural Cost consists of Selling, general and administrative expenses and Engineering and product development costs. Free Cash Flow consists of Net cash from operating activities and Capital Expenditures.

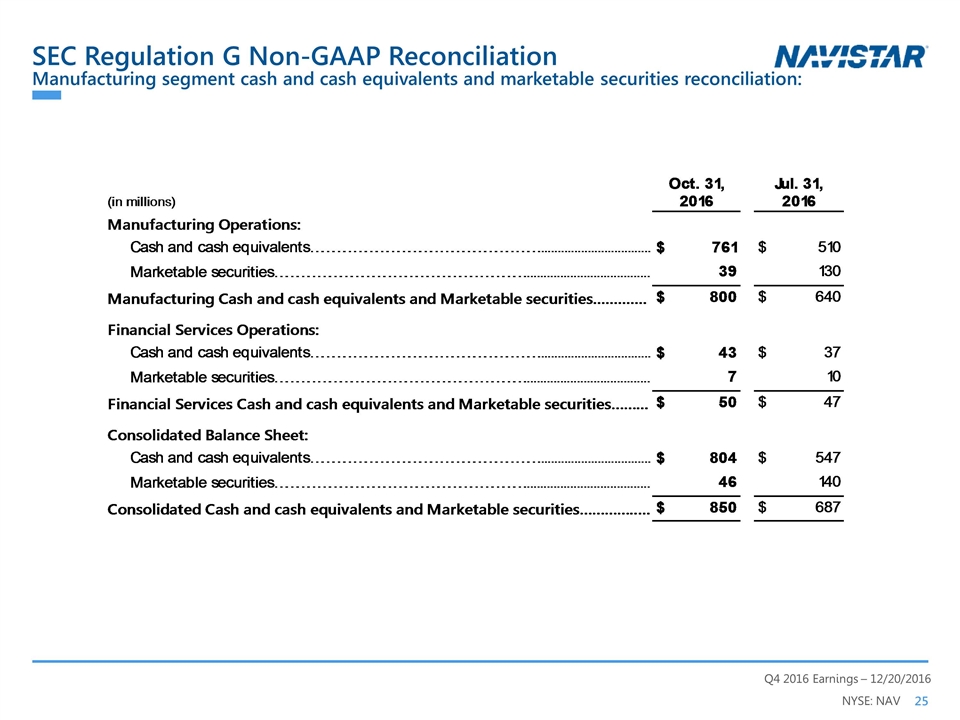

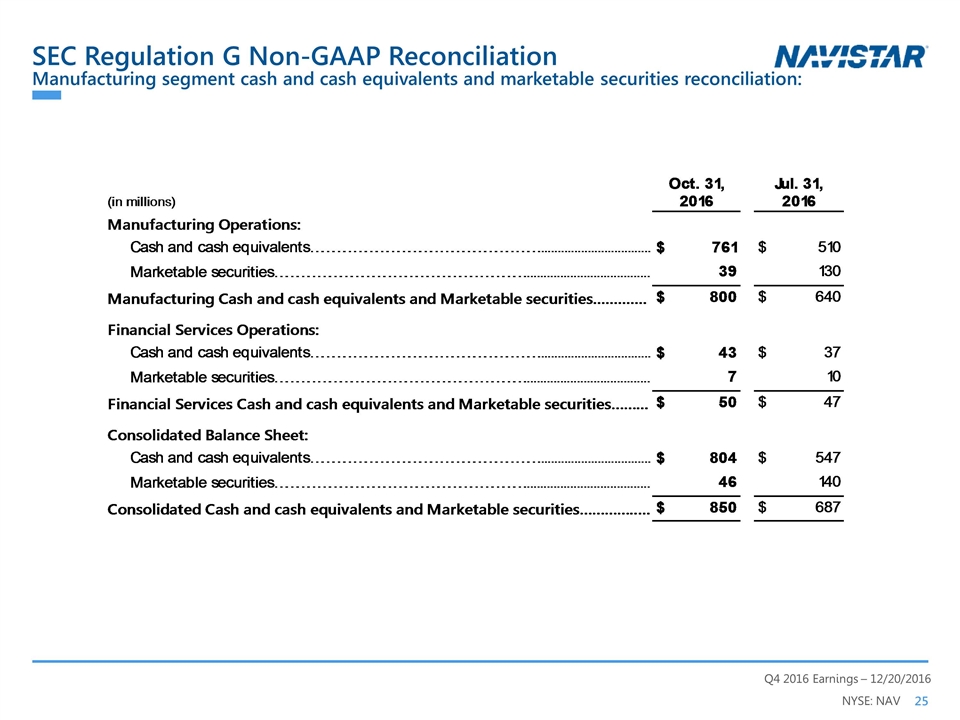

Manufacturing segment cash and cash equivalents and marketable securities reconciliation: SEC Regulation G Non-GAAP Reconciliation

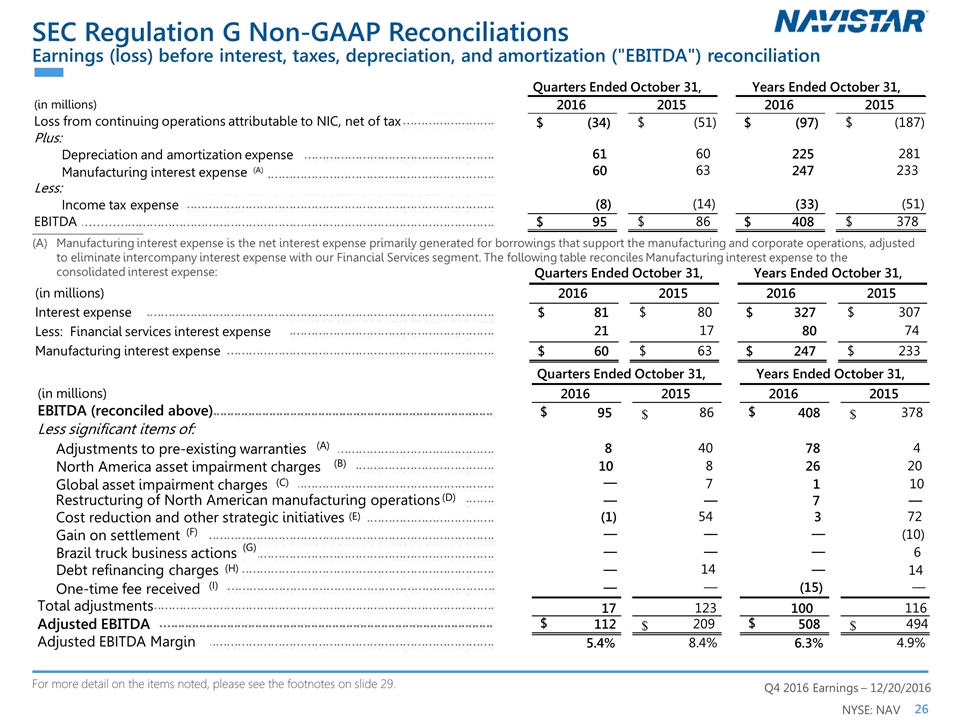

SEC Regulation G Non-GAAP Reconciliations ______________________ (A) Manufacturing interest expense is the net interest expense primarily generated for borrowings that support the manufacturing and corporate operations, adjusted to eliminate intercompany interest expense with our Financial Services segment. The following table reconciles Manufacturing interest expense to the consolidated interest expense: For more detail on the items noted, please see the footnotes on slide 29. Earnings (loss) before interest, taxes, depreciation, and amortization ("EBITDA") reconciliation (in millions) Loss from continuing operations attributable to NIC, net of tax $ (34) $ (51) $ (97) $ (187) Plus: Depreciation and amortization expense 61 60 225 281 Manufacturing interest expense (A) 60 63 247 233 Less: Income tax expense (8) (14) (33) (51) EBITDA $ 95 $ 86 $ 408 $ 378 Quarters Ended October 31, Years Ended October 31, 2015 2015 2016 2016 (in millions) Interest expense $ 81 $ 80 $ 327 $ 307 Less: Financial services interest expense 21 17 80 74 Manufacturing interest expense $ 60 $ 63 $ 247 $ 233 2015 2015 2016 Quarters Ended October 31, Years Ended October 31, 2016 (in millions) $ 95 $ 86 $ 408 $ 378 Less significant items of: Adjustments to pre-existing warranties (A) 8 40 78 4 North America asset impairment charges (B) 10 8 26 20 Global asset impairment charges (C) 7 1 10 Cost reduction and other strategic initiatives (E) (1) 54 3 72 Gain on settlement (F) — — — (10) Brazil truck business actions — — — 6 Debt refinancing charges — 14 — 14 One-time fee received (I) — — (15) — Total adjustments 17 123 100 116 $ 112 $ 209 $ 508 $ 494 Adjusted EBITDA Margin 5.4% 8.4% 6.3% 4.9% Quarters Ended October 31, 2016 2015 2015 2016 Years Ended October 31, (H) Restructuring of North American manufacturing operations (D) NYSE: NAV Q4 2016 Earnings – 12/20/2016 — — — 7 — EBITDA (reconciled above) (G) Adjusted EBITDA

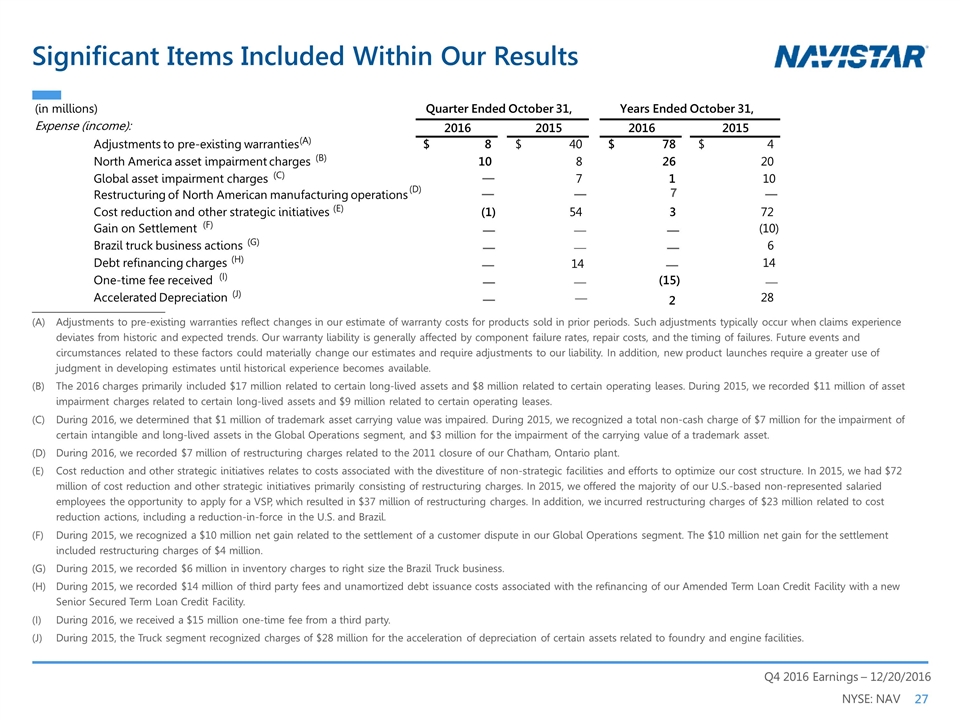

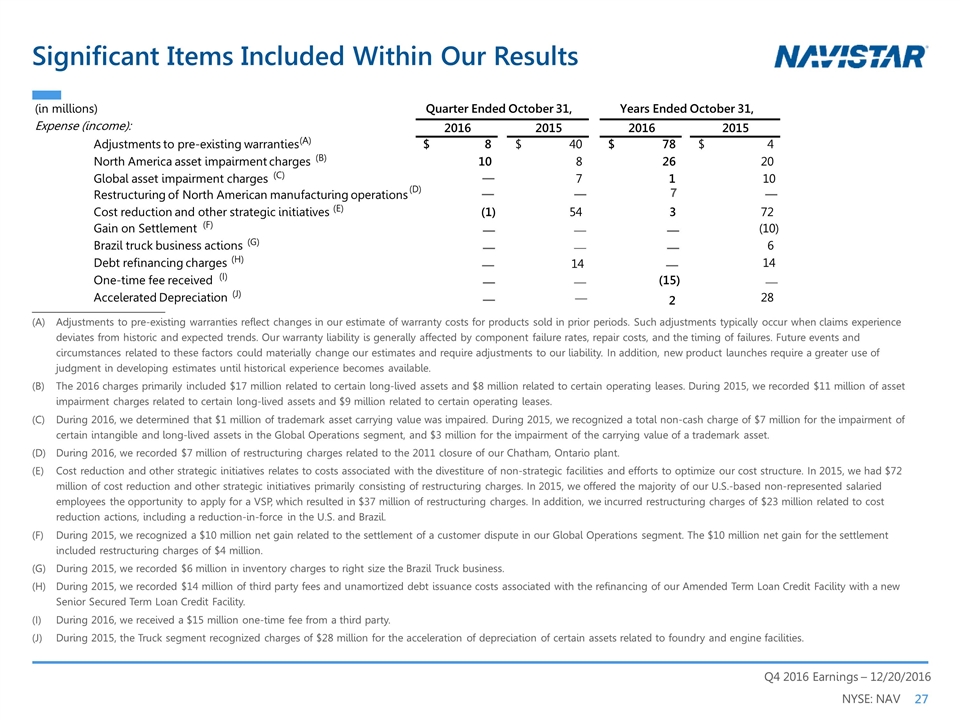

______________________ Adjustments to pre-existing warranties reflect changes in our estimate of warranty costs for products sold in prior periods. Such adjustments typically occur when claims experience deviates from historic and expected trends. Our warranty liability is generally affected by component failure rates, repair costs, and the timing of failures. Future events and circumstances related to these factors could materially change our estimates and require adjustments to our liability. In addition, new product launches require a greater use of judgment in developing estimates until historical experience becomes available. The 2016 charges primarily included $17 million related to certain long-lived assets and $8 million related to certain operating leases. During 2015, we recorded $11 million of asset impairment charges related to certain long-lived assets and $9 million related to certain operating leases. During 2016, we determined that $1 million of trademark asset carrying value was impaired. During 2015, we recognized a total non-cash charge of $7 million for the impairment of certain intangible and long-lived assets in the Global Operations segment, and $3 million for the impairment of the carrying value of a trademark asset. During 2016, we recorded $7 million of restructuring charges related to the 2011 closure of our Chatham, Ontario plant. Cost reduction and other strategic initiatives relates to costs associated with the divestiture of non-strategic facilities and efforts to optimize our cost structure. In 2015, we had $72 million of cost reduction and other strategic initiatives primarily consisting of restructuring charges. In 2015, we offered the majority of our U.S.-based non-represented salaried employees the opportunity to apply for a VSP, which resulted in $37 million of restructuring charges. In addition, we incurred restructuring charges of $23 million related to cost reduction actions, including a reduction-in-force in the U.S. and Brazil. During 2015, we recognized a $10 million net gain related to the settlement of a customer dispute in our Global Operations segment. The $10 million net gain for the settlement included restructuring charges of $4 million. During 2015, we recorded $6 million in inventory charges to right size the Brazil Truck business. During 2015, we recorded $14 million of third party fees and unamortized debt issuance costs associated with the refinancing of our Amended Term Loan Credit Facility with a new Senior Secured Term Loan Credit Facility. During 2016, we received a $15 million one-time fee from a third party. During 2015, the Truck segment recognized charges of $28 million for the acceleration of depreciation of certain assets related to foundry and engine facilities. Significant Items Included Within Our Results (in millions) Expense (income): 2016 2015 2016 2015 Adjustments to pre-existing warranties (A) 8 $ 40 $ 78 $ 4 $ North America asset impairment charges (B) 10 8 26 20 Global asset impairment charges (C) — 7 1 10 Cost reduction and other strategic initiatives (E) (1) 54 3 72 Gain on Settlement (F) — — — (10) Brazil truck business actions (G) — — — 6 Debt refinancing charges (H) — 14 — 14 One-time fee received (I) — — (15) — Accelerated Depreciation (J) — 2 28 Quarter Ended October 31, Years Ended October 31, — NYSE: NAV Q4 2016 Earnings – 12/20/2016 Restructuring of North American manufacturing operations — — 7 (D) —