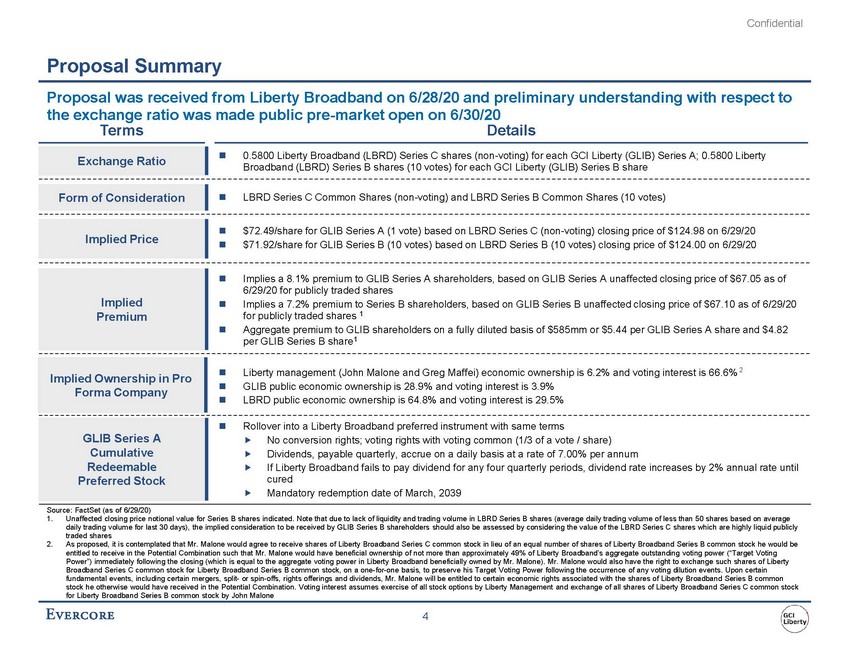

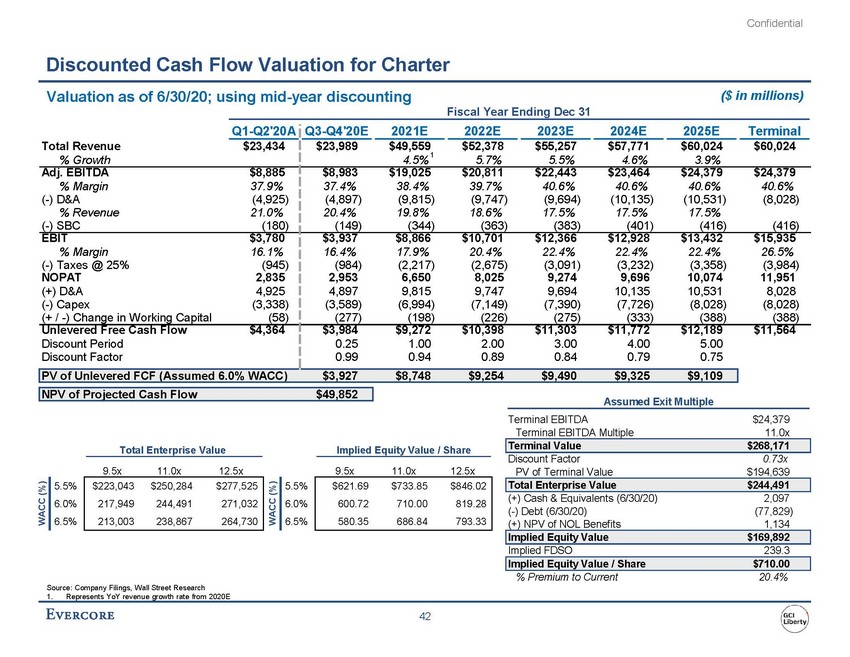

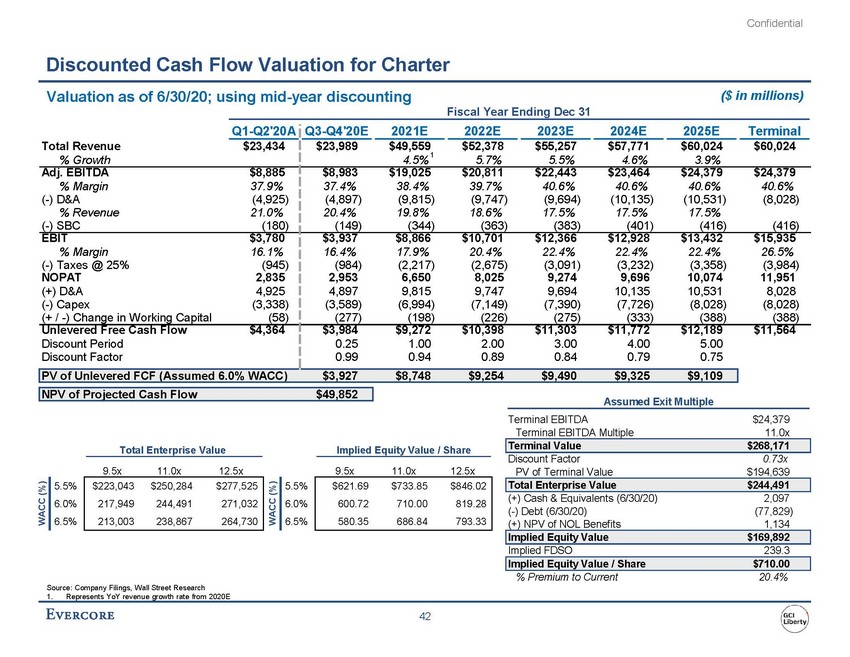

| Valuation as of 6/30/20; using mid-year discounting ($ in millions) Fiscal Year Ending Dec 31 Q1-Q2'20A Q3-Q4'20E 2021E 2022E 2023E 2024E 2025E Terminal Total Revenue $23,434 $23,989 $49,559 $52,378 $55,257 $57,771 $60,024 $60,024 % Growth 4.5% 1 5.7% 5.5% 4.6% 3.9% Adj. EBITDA $8,885 $8,983 $19,025 $20,811 $22,443 $23,464 $24,379 $24,379 % Margin 37.9% 37.4% 38.4% 39.7% 40.6% 40.6% 40.6% 40.6% (-) D&A (4,925) (4,897) (9,815) (9,747) (9,694) (10,135) (10,531) (8,028) % Revenue 21.0% 20.4% 19.8% 18.6% 17.5% 17.5% 17.5% (-) SBC (180) (149) (344) (363) (383) (401) (416) (416) EBIT $3,780 $3,937 $8,866 $10,701 $12,366 $12,928 $13,432 $15,935 % Margin 16.1% 16.4% 17.9% 20.4% 22.4% 22.4% 22.4% 26.5% (-) Taxes @ 25% (945) (984) (2,217) (2,675) (3,091) (3,232) (3,358) (3,984) NOPAT 2,835 2,953 6,650 8,025 9,274 9,696 10,074 11,951 (+) D&A 4,925 4,897 9,815 9,747 9,694 10,135 10,531 8,028 (-) Capex (3,338) (3,589) (6,994) (7,149) (7,390) (7,726) (8,028) (8,028) (+ / -) Change in Working Capital (58) (277) (198) (226) (275) (333) (388) (388) Unlevered Free Cash Flow $4,364 $3,984 $9,272 $10,398 $11,303 $11,772 $12,189 $11,564 Discount Period 0.25 1.00 2.00 3.00 4.00 5.00 Discount Factor 0.99 0.94 0.89 0.84 0.79 0.75 PV of Unlevered FCF (Assumed 6.0% WACC) $3,927 $8,748 $9,254 $9,490 $9,325 $9,109 NPV of Projected Cash Flow $49,852 Total Enterprise Value Implied Equity Value / Share 9.5x 11.0x 12.5x 9.5x 11.0x 12.5x WACC (%) WACC (%) 6.0% 217,949 244,491 271,032 6.0% 600.72 710.00 819.28 6.5% 213,003 238,867 264,730 6.5% 580.35 686.84 793.33 Source: Company Filings, Wall Street Research 1.Represents YoY revenue growth rate from 2020E Assumed Exit Multiple Terminal EBITDA $24,379 Terminal EBITDA Multiple 11.0x Terminal Value $268,171 Discount Factor 0.73x PV of Terminal Value $194,639 Total Enterprise Value $244,491 (+) Cash & Equivalents (6/30/20) 2,097 (-) Debt (6/30/20) (77,829) (+) NPV of NOL Benefits 1,134 Implied Equity Value $169,892 Implied FDSO 239.3 Implied Equity Value / Share $710.00 % Premium to Current 20.4% |