UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | | 811-04973 |

| | | |

| Exact name of registrant as specified in charter: | | Voyageur Insured Funds |

| | | |

| Address of principal executive offices: | | 2005 Market Street |

| | | Philadelphia, PA 19103 |

| | | |

| Name and address of agent for service: | | David F. Connor, Esq. |

| | | 2005 Market Street |

| | | Philadelphia, PA 19103 |

| | | |

| Registrant’s telephone number, including area code: | | (800) 523-1918 |

| | | |

| Date of fiscal year end: | | August 31 |

| | | |

| Date of reporting period: | | August 31, 2010 |

Item 1. Reports to Stockholders

Annual report Delaware Tax-Free Arizona Fund Delaware Tax-Free California Fund Delaware Tax-Free Colorado Fund Delaware Tax-Free Idaho Fund Delaware Tax-Free New York Fund August 31, 2010 Fixed income mutual funds |

This annual report is for the information of Delaware Tax-Free Arizona Fund, Delaware Tax-Free California Fund, Delaware Tax-Free Colorado Fund, Delaware Tax-Free Idaho Fund, and Delaware Tax-Free New York Fund shareholders, but it may be used with prospective investors when preceded or accompanied by a current prospectus for Delaware Tax-Free Arizona Fund, Delaware Tax-Free California Fund, Delaware Tax-Free Colorado Fund, Delaware Tax-Free Idaho Fund, and Delaware Tax-Free New York Fund. The figures in the annual report for Delaware Tax-Free Arizona Fund, Delaware Tax-Free California Fund, Delaware Tax-Free Colorado Fund, Delaware Tax-Free Idaho Fund, and Delaware Tax-Free New York Fund represent past results, which are not a guarantee of future results. The return and principal value of an investment in the Funds will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. You should consider the investment objectives, risks, charges, and expenses of the Funds carefully before investing. The Delaware Tax-Free Arizona Fund, Delaware Tax-Free California Fund, Delaware Tax-Free Colorado Fund, Delaware Tax-Free Idaho Fund, and Delaware Tax-Free New York Fund prospectus contains this and other important information about the Funds. Prospectuses for all open-end funds in the Delaware Investments® Family of Funds are available from your financial advisor, online at www.delawareinvestments.com, or by phone at 800 523-1918. Please read the prospectus carefully before you invest or send money. |

You can obtain shareholder reports and prospectuses online instead of in the mail.

Visit www.delawareinvestments.com/edelivery. |

Experience Delaware Investments

Delaware Investments is committed to the pursuit of consistently superior asset management and unparalleled client service. We believe in our investment processes, which seek to deliver consistent results, and in convenient services that help add value for our clients.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Investments or obtain a prospectus for Delaware Tax-Free Arizona Fund, Delaware Tax-Free California Fund, Delaware Tax-Free Colorado Fund, Delaware Tax-Free Idaho Fund, and Delaware Tax-Free New York Fund at www.delawareinvestments.com.

Manage your investments online

- 24-hour access to your account information

- Obtain share prices

- Check your account balance and recent transactions

- Request statements or literature

- Make purchases and redemptions

Delaware Management Holdings, Inc., and its subsidiaries (collectively known by the marketing name of Delaware Investments) are wholly owned subsidiaries of Macquarie Group Limited, a global provider of banking, financial, advisory, investment and funds management services.

Investments in Delaware Tax-Free Arizona Fund, Delaware Tax-Free California Fund, Delaware Tax-Free Colorado Fund, Delaware Tax-Free Idaho Fund, and Delaware Tax-Free New York Fund are not and will not be deposits with or liabilities of Macquarie Bank Limited ABN 46 008 583 542 and its holding companies, including their subsidiaries or related companies (Macquarie Group), and are subject to investment risk, including possible delays in repayment and loss of income and capital invested. No Macquarie Group company guarantees or will guarantee the performance of the Funds, the repayment of capital from the Funds, or any particular rate of return.

| Table of contents | |

| Portfolio management review | 1 |

| Performance summaries | 8 |

| Disclosure of Fund expenses | 23 |

| Sector allocations | 27 |

| Statements of net assets | 32 |

| Statements of operations | 72 |

| Statements of changes in net assets | 74 |

| Financial highlights | 84 |

| Notes to financial statements | 114 |

| Report of independent registered | |

| public accounting firm | 128 |

| Other Fund information | 129 |

| Board of trustees/directors and | |

| officers addendum | 130 |

| About the organization | 140 |

Unless otherwise noted, views expressed herein are current as of Aug. 31, 2010, and are subject to change.

Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested.

Mutual fund advisory services provided by Delaware Management Company, a series of Delaware Management Business Trust, which is a registered investment advisor. Delaware Investments, a member of Macquarie Group, refers to Delaware Management Holdings, Inc. and its subsidiaries, including the Funds’ distributor, Delaware Distributors, L.P. Macquarie Group refers to Macquarie Group Limited and its subsidiaries and affiliates worldwide.

© 2010 Delaware Management Holdings, Inc.

All third-party trademarks cited are the property of their respective owners.

| Portfolio management review | | |

| Delaware multiple state tax-free funds | | September 7, 2010 |

| Performance preview (for the year ended August 31, 2010) | | |

| Delaware Tax-Free Arizona Fund (Class A shares) | 1-year return | | +10.27% |

| Barclays Capital Municipal Bond Index (benchmark) | 1-year return | | +9.78% |

| Lipper Arizona Municipal Debt Funds Average | 1-year return | | +11.53% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Tax-Free Arizona Fund, please see the table on page 8.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

The Lipper Arizona Municipal Debt Funds Average compares funds that limit assets to those securities that are exempt from taxation in Arizona (double tax-exempt) or a city in Arizona (triple tax-exempt). |

| Delaware Tax-Free California Fund (Class A shares) | 1-year return | | +13.92% |

| Barclays Capital Municipal Bond Index (benchmark) | 1-year return | | +9.78% |

| Lipper California Municipal Debt Funds Average | 1-year return | | +11.99% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Tax-Free California Fund, please see the table on page 11.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. The Lipper California Municipal Debt Funds Average compares funds that limit assets to those securities that are exempt from taxation in California (double tax-exempt) or a city in California (triple tax-exempt). |

| Delaware Tax-Free Colorado Fund (Class A shares) | 1-year return | | +10.74% |

| Barclays Capital Municipal Bond Index (benchmark) | 1-year return | | +9.78% |

| Lipper Colorado Municipal Debt Funds Average | 1-year return | | +10.15% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Tax-Free Colorado Fund, please see the table on page 14.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. The Lipper Colorado Municipal Debt Funds Average compares funds that limit assets to those securities that are exempt from taxation in Colorado (double tax-exempt) or a city in Colorado (triple tax-exempt). |

1

Portfolio management review

Delaware multiple state tax-free funds

| Delaware Tax-Free Idaho Fund (Class A shares) | 1-year return | | +9.44% |

| Barclays Capital Municipal Bond Index (benchmark) | 1-year return | | +9.78% |

| Lipper Other States Municipal Debt Funds Average | 1-year return | | +9.29% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Tax-Free Idaho Fund, please see the table on page 17.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. The Lipper Other States Municipal Debt Funds Average compares funds that limit assets to those securities that are exempt from taxation on a specified city or state basis. |

| Delaware Tax-Free New York Fund (Class A shares) | 1-year return | | +11.02% |

| Barclays Capital Municipal Bond Index (benchmark) | 1-year return | | +9.78% |

| Lipper New York Municipal Debt Funds Average | 1-year return | | +10.67% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Tax-Free New York Fund, please see the table on page 20.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. The Lipper New York Municipal Debt Funds Average compares funds that limit assets to those securities that are exempt from taxation in New York (double tax-exempt) or a city in New York (triple tax-exempt). |

Economic environment

The Funds’ fiscal year, which ended Aug. 31, 2010, was one of continued economic challenges. When the period began, however, financial markets were bolstered by a broad-based sense of optimism about the economy:

- During the third quarter of 2009, the U.S. economy, as measured by gross domestic product (GDP), rose by an annualized 1.6%, marking the economy’s first quarterly expansion in more than a year.

- Growth in the fourth quarter of 2009 was even stronger. Annualized GDP expansion of 5.0% during those three months represented the fastest quarterly growth for the U.S. economy since early 2006.

Source: U.S. Commerce Department.

As the reporting period progressed, however, indications began to mount that the U.S. economic environment was slowing once again. For example:

- Unemployment in the United States remained stubbornly high. The jobless rate peaked at 10.1% in October 2009 and finished the Funds’ fiscal period at a still-elevated 9.6%.

(Source: U.S. Labor Department.) - The rate of expansion in GDP decreased to 3.7% in the first three months of 2010, followed by a sluggish 1.6% in the year’s second quarter. This trend led some economists to worry about the potential for a “double-dip” recession. (Source: U.S. Commerce Department.)

- Investors focused their attention on the high levels of sovereign debt across the developed world (and particularly

2

in Greece), fearing that reductions in government spending could exacerbate declining economic growth.

- The U.S. housing market, weighed down by significant foreclosure activity and declining sales, continued to struggle.

Encouragingly, inflation remained low throughout the reporting period, with the Consumer Price Index rising by just 1.2% for the 12 months ending July 31, 2010 (the most recent data available as this report was being prepared). With inflation well under control, the Federal Reserve Board (the Fed) kept its benchmark short-term interest rate under 1%, where it has stood since the depths of the financial crisis in late 2008. The low rates were part of the Fed’s ongoing effort to stimulate economic growth — an effort that included a program announced late in the period to buy significant quantities of U.S. government debt.

Economic environment by state

We believe the effect of Arizona’s housing downturn has been significant, leading to a recovery period that may be longer than that of most other states. The unemployment rate in July 2010 was 9.6%, slightly above the national rate of 9.5%, while Arizona’s personal income per capita is below the national level. In addition, revenues have declined here more than in most other states, and preliminary fiscal 2010 revenues are approximately 1% below estimates. Amid falling revenue, Arizona has turned to borrowing to cover its operating costs.

The state’s fiscal 2011 budget faces a gap of $3 billion. Measures intended to close the gap include expenditure cuts, deficit bonds, payment delays, fund shifts, and a one-cent per-dollar increase in the sales tax for three years. (Sources: www.bls.gov, Moody’s Investors Service.)

California’s unemployment rate as of July 2010 was 12.3%, well above the national rate of 9.5%. California enjoys a large, diverse, and wealthy economy that mirrors that of the nation. However, its progressive tax structure makes the state tax-revenue system vulnerable to small shifts in income levels at the high end. The state has been hard hit by the national housing slowdown, and while most housing indicators remain negative, there has been some improvement. (Sources: www.bls.gov, Controller Monthly Reports, Legislative Analyst’s Office.)

Colorado’s economy is arguably quite diverse, with below-average employment concentration in manufacturing and strength in a variety of service sectors. Its economic outlook is favorable, reflecting a growing population and workforce, relatively low costs of living and doing business, and a mix of technology and service industries. While nonfarm employment lagged the rest of the nation, the unemployment rate in July 2010 was 8.0%, well below the national rate of 9.5%. (Sources: www.bls.gov, Colorado Office of State Planning and Budgeting, Moody’s Investors Service.)

In Idaho, the unemployment rate as of July 2010 was 8.8%, below the national rate. Idaho’s economy has expanded and diversified in recent years. However, the state continues to have an above-average dependence on the natural resource sector. Idaho ended fiscal 2010 approximately $8 million short. However, this figure represented a marked improvement over estimates earlier this year, when the deficit appeared on track to exceed $50 million. The State Board of Examiners decided to handle the shortfall in a way that we believe should have little effect on most government agencies, by pulling

3

Portfolio management review

Delaware multiple state tax-free funds

money from the permanent building fund. (Sources: U.S. Labor Department, Idaho Division of Management, State of Idaho, Office of the State Controller.)

In New York, the unemployment rate in July 2010 was 8.2%. Job losses in the state have not been as severe as in the nation as a whole. However, employment figures themselves are not as meaningful here as they are in other states, due to New York’s high reliance on taxes paid by individuals in the financial services industry. The state has lost roughly 55,000 finance jobs in the recent economic downturn. Fiscal 2010 general fund receipts totaled $37.1 billion, representing a 2.3% decline from fiscal 2009. (Sources: U.S. Labor Department, New York Division of Budget, Moody’s Investors Service.)

Municipal bond market environment

While the sluggish economic backdrop hampered the U.S. equity market, the effect on the municipal market was relatively muted because of a favorable balance between supply and demand. Despite concerns about state and local government finances, tax-exempt bonds of all maturity lengths and credit-quality ratings gained ground throughout most of the reporting period.

Overall, investor demand for tax-exempt securities remained generally strong, driven in part by a growing expectation of higher income-tax rates in the future, while at the same time supply of municipal bonds became increasingly limited. A major factor behind this shift between supply and demand can be attributed to the introduction of the Build America Bond program, a feature of the February 2009 federal economic stimulus package. As a result of this program, many bond issues that traditionally would have come to market as tax-exempt municipal bonds were instead issued as taxable debt. This left far fewer new issues in the traditional tax-exempt municipal bond market, providing a very positive backdrop for the municipal bond asset class and driving the Funds’ returns throughout the fiscal period. (Source: Barclays Capital.)

Although all types of municipal bonds earned positive returns during the reporting period, those with longer maturity dates and lower credit ratings generally outperformed their shorter-maturity and higher-rated counterparts by a wide margin, as investors tended to favor longer-dated securities — despite their higher interest rate risk — for the potential to earn more income.

A similar situation occurred with regard to credit quality. Many investors increasingly exhibited a willingness to buy higher-yielding bonds, even if it meant taking on more credit risk.

Commitment to our longtime approach

In all five Funds profiled in this report, we continued to follow our basic investment philosophy and approach. We believe successful bond investing requires rigorous credit analysis. In our opinion, there is no substitute for thorough credit research. On a bond-by-bond basis, we scrutinize each security that the Funds hold — or consider holding. It is important to us to ensure our comfort level with a bond issue’s financial outlook and to feel confident that any risks are likely offset by the potential income the security provides. Through this strategy, we believe we can find opportunities that other investors with less experience and research diligence might overlook.

Our investment approach often leads us to an increased focus on bonds with credit ratings of BBB and A — which represent the lower

4

tier of the investment grade bond universe — and a relative de-emphasis of higher-rated bonds, such as those rated AAA and AA. We generally feel that there tends to be an opportunity for us to obtain the most value for shareholders from the lower-rated types of investment grade municipal bonds.

As the Funds’ fiscal year progressed, our tactics for managing the Funds became more selective as credit spreads narrowed — meaning that the premium paid to investors for buying riskier, lower-rated bonds declined — and bond prices rose. As these trends continued and interest rates on municipal bonds fell during the period, many of the bonds the Funds already held offered considerably higher levels of income than bonds that became available during the reporting period. For example, the Funds had purchased a number of bonds at the peak of the financial crisis, when tax-exempt municipal bond yields were extremely high because of investors’ concerns about the solvency of bond issuers. Careful research allowed us to eventually get comfortable with the credit quality of these issues. As a result, we were able to add some highly rated municipal bonds paying yields that, at the end of the Funds’ fiscal year, were com parable to what lower-rated A and even some BBB securities were offering.

Because bonds in the marketplace were paying the lower prevailing yields, we felt it was important to look at potential new purchases with an even more discerning eye. It often made little sense to us to sell higher-yielding bonds already in the Funds’ portfolio holdings in favor of new bonds reflecting the lower-interest-rate environment. We often said throughout 2010 that new bonds had to “fight their way into the portfolio.” In other words, we had to feel confident that new bonds offered sufficient value opportunities relative to their potential risks.

When we did add new securities to the Funds’ portfolio holdings as a result of Fund inflows (to accommodate cash generated by maturing bonds, for instance) we continued to follow our “bottom-up” investment strategy, carefully evaluating each issuer to become familiar with its financial position and to assess whether the bond’s return potential was commensurate with the risks involved with holding the securities.

Market conditions in California periodically offered attractive but temporary buying opportunities. California was a prolific issuer of debt during the Fund’s fiscal year, as the state sought to manage its serious budget challenges. This gave us the opportunity to buy existing bonds at what we considered attractive prices. We took advantage of this situation twice during the fiscal year, and in both cases our willingness to invest against the grain was rewarded: we generated additional income within Delaware Tax-Free California Fund, and the bonds the team selected for purchase subsequently rose off of their depressed levels.

Notable sectors and securities

As we mentioned above, lower-rated bonds generally outperformed higher-rated issues throughout the majority of the Funds’ fiscal year. As a result, many of the individual bonds that made the strongest performance contributions across all five Funds were lower-rated issues. The best-performing sectors were often those with a significant amount of lower-rated bond issuance. In

5

Portfolio management review

Delaware multiple state tax-free funds

a favorable market environment for tax-exempt debt, even the worst performers tended to earn modestly positive returns. Generally speaking, the bonds that lagged the overall municipal market were those with higher credit ratings (meaning less credit risk) and shorter maturities (meaning less interest rate risk). With interest rates declining, municipal bond investors looked for ways to capture additional levels of income, leading them toward lower-rated, longer-dated bonds.

Within Delaware Tax-Free Colorado Fund and Delaware Tax-Free Arizona Fund, the best-performing group overall was industrial development revenue bonds, a sector that featured a number of securities benefiting from their lower credit ratings and relatively higher yields. The top contributors overall within Delaware Tax-Free California Fund included special-tax bonds, which are projects funded by a dedicated tax stream. The lease sector made the strongest performance contribution to total return within Delaware Tax-Free New York Fund, while utility bonds did the best as a group within Delaware Tax-Free Idaho Fund.

Across all five Funds, nearly all of the most notable individual performers were lower-rated bonds. Within Delaware Tax-Free Arizona Fund, for example, a Pima County Industrial Development Authority revenue bond for a charter school in Tucson was among the strongest performers. The bond, rated BBB- by S&P, benefited from its lower credit rating in an environment of increased risk tolerance.

Delaware Tax-Free Arizona Fund and Delaware Tax-Free Idaho Fund were supported by a Puerto Rico sales-tax bond. Bonds issued by U.S. territories are generally fully tax-exempt for residents of all 50 states. Territorial bonds can help provide valuable portfolio diversification, especially in Funds for smaller states such as Idaho, where it can be difficult to obtain a wide variety of securities. We were attracted to the relatively high yields offered by this bond, and felt confident about the territory’s financial situation. Of course, diversification may not protect against market risk.

Delaware Tax-Free Idaho Fund also benefited from BB-rated (by S&P) Idaho Housing and Finance Association charter school bonds. Despite these securities’ below-investment-grade credit rating, we were very comfortable with their credit quality and felt they offered favorable performance potential relative to their risk.

Topping the list of performers within Delaware Tax-Free California Fund were California Statewide Community Development Authority bonds for Valley Care Hospital, an unrated bond issue with a 2031 maturity date. Land-development district bonds issued by the Fremont Community Development District aided the Fund as well.

Delaware Tax-Free Colorado Fund saw strong results from its holdings in nonrated Colorado Health Facility for Christian Living Communities continuing care retirement community (CCRC) bonds. CCRCs are residential communities for seniors, ranging from independent-living to skilled-nursing-care facilities. In addition, Puerto Rico infrastructure bonds rated BBB+ by S&P with a maturity date of 2046 were among the strongest performers within the Fund.

The leading performers within Delaware Tax-Free New York Fund included industrial development revenue bonds issued on behalf of ARRIS, a communications

6

technology company, and New York Industrial Authority bonds for Orange County Regional Medical Center.

As we mentioned, even the weakest-performing bonds across the Funds posted modestly positive results — an indication of the highly favorable market conditions enjoyed by municipal bond investors during the Funds’ fiscal year. The sector making the smallest contribution to total return across the Funds was prerefunded bonds. These bonds are short-maturity issues, and, because they are typically backed by U.S. Treasury bonds or other very high-quality securities, they are considered high in credit quality. In an environment in which investors preferred lower-quality to higher-quality bonds, and longer-dated to shorter-dated issues, prerefunded bonds were left behind.

Within Delaware Tax-Free Arizona Fund, for example, the weakest contributors included prerefunded University of Arizona bonds due in June 2021. Colorado Educational and Cultural Facility bonds for the University of Denver, due in March 2012, were among the weakest contributors within Delaware Tax-Free Colorado Fund; University of Idaho bonds coming due in April 2031 brought up the rear within Delaware Tax-Free Idaho Fund, while Albany Parking Authority bonds, scheduled to mature in July 2025, were among the weakest contributors within Delaware Tax-Free New York Fund.

Delaware Tax-Free California Fund was most hindered by California Community Development Authority multifamily housing bonds. Although these were not prerefunded bonds, these AAA-rated securities faced a near-term call date, so they lagged other bonds whose prices reflected a longer expected holding period.

7

| Performance summaries | |

| Delaware Tax-Free Arizona Fund | August 31, 2010 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data current for the most recent month end by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Fund’s prospectus and, if available, its summary prospectus, which may be obtained by visiting www.delawareinvestments.com or calling 800 523-1918. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

| Fund performance | | Average annual total returns through Aug. 31, 2010 |

| | | 1 year | | 5 years | | 10 years |

| Class A (Est. April 1, 1991) | | | | | | | | | | | | |

| Excluding sales charge | | | +10.27% | | | | +4.48% | | | | +5.19% | |

| Including sales charge | | | +5.33% | | | | +3.53% | | | | +4.70% | |

| Class B (Est. March 10, 1995) | | | | | | | | | | | | |

| Excluding sales charge | | | +9.35% | | | | +3.68% | | | | +4.56% | |

| Including sales charge | | | +5.35% | | | | +3.42% | | | | +4.56% | |

| Class C (Est. May 26, 1994) | | | | | | | | | | | | |

| Excluding sales charge | | | +9.43% | | | | +3.71% | | | | +4.42% | |

| Including sales charge | | | +8.43% | | | | +3.71% | | | | +4.42% | |

Returns reflect the reinvestment of all distributions and any applicable sales charges as noted in the following paragraphs.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Expense limitations were in effect for certain classes during some of the periods shown in the “Fund performance” chart and in the “Performance of a $10,000 investment” chart. The current expenses for each class are listed on the “Fund expense ratios” chart. (Note that all charts and graphs referred to in the “Performance summaries” section of this report are found on pages 8 through 10.) Performance would have been lower had the expense limitations not been in effect.

The Fund offers Class A, B, and C shares.

Class A shares are sold with a maximum front-end sales charge of up to 4.50%, and have an annual distribution and service fee of up to 0.25% of average daily net assets.

8

Class B shares may be purchased only through dividend reinvestment and certain permitted exchanges as described in the prospectus. Please see the prospectus for additional information on Class B purchase and sales charges. Class B shares have a contingent deferred sales charge that declines from 4.00% to zero depending on the period of time the shares are held.

Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

Ten-year performance figures for Class B shares reflect conversion to Class A shares after approximately eight years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Fund may be prepaid prior to maturity, potentially forcing the Fund to reinvest that money at a lower interest rate.

High yielding, noninvestment grade bonds (junk bonds) involve higher risk than investment grade bonds.

Substantially all dividend income derived from tax-free funds is exempt from federal income tax. Some income may be subject to the federal alternative minimum tax (AMT) that applies to certain investors. Capital gains, if any, are taxable.

Funds that invest primarily in one state may be more susceptible to the economic, regulatory, and other factors of that state than funds that invest more broadly.

The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” chart.

| Fund expense ratios | Class A | | Class B | | Class C | |

| Total annual operating expenses | 0.91% | | 1.66% | | 1.66% | |

| (without fee waivers) | | | | | | |

| Net expenses | 0.91% | | 1.66% | | 1.66% | |

| (including fee waivers, if any) | | | | | | |

| Type of waiver | n/a | | n/a | | n/a | |

9

Performance summaries

Delaware Tax-Free Arizona Fund

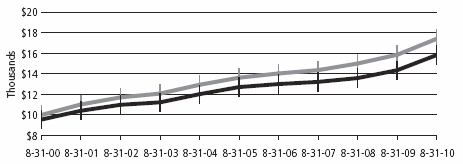

Performance of a $10,000 investment

Average annual total returns from Aug. 31, 2000, through Aug. 31, 2010

| For period beginning Aug. 31, 2000, through Aug. 31, 2010 | Starting value | Ending value |

| | Barclays Capital Municipal Bond Index | $10,000 | $17,400 |

| | Delaware Tax-Free Arizona Fund — Class A Shares | $9,550 | $15,822 |

The chart assumes $10,000 invested in the Fund on Aug. 31, 2000, and includes the effect of a 4.50% front-end sales charge and the reinvestment of all distributions. Please note additional details on these fees in the “Performance summaries” section of this report, which includes pages 8 through 10.

The chart also assumes $10,000 invested in the Barclays Capital Municipal Bond Index as of Aug. 31, 2000.

The Barclays Capital Municipal Bond Index measures the total return performance of the long-term, investment grade tax-exempt bond market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

The “Fund performance” chart and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes shareholders would pay on Fund distributions or redemptions of Fund shares.

| | | Nasdaq symbols | | CUSIPs | |

| Class A | | VAZIX | | 928916204 | |

| Class B | | DVABX | | 928928639 | |

| Class C | | DVACX | | 928916501 | |

10

| Delaware Tax-Free California Fund | August 31, 2010 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data current for the most recent month end by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Fund’s prospectus and, if available, its summary prospectus, which may be obtained by visiting www.delawareinvestments.com or calling 800 523-1918. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

| Fund performance | Average annual total returns through Aug. 31, 2010 |

| | | 1 year | | 5 years | | 10 years | |

| Class A (Est. March 2, 1995) | | | | | |

| Excluding sales charge | | +13.92% | | +4.42% | | +5.66% | |

| Including sales charge | | +8.80% | | +3.46% | | +5.18% | |

| Class B (Est. Aug. 23, 1995) | | | | | |

| Excluding sales charge | | +12.93% | | +3.63% | | +5.01% | |

| Including sales charge | | +8.93% | | +3.37% | | +5.01% | |

| Class C (Est. April 9, 1996) | | | | | |

| Excluding sales charge | | +13.06% | | +3.65% | | +4.87% | |

| Including sales charge | | +12.06% | | +3.65% | | +4.87% | |

Returns reflect the reinvestment of all distributions and any applicable sales charges as noted in the following paragraphs.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Expense limitations were in effect during the periods shown in the “Fund performance” chart and in the “Performance of a $10,000 investment” chart. The current expenses for each class are listed on the “Fund expense ratios” chart. (Note that all charts and graphs referred to in the “Performance summaries” section of this report are found on pages 11 through 13.) Performance would have been lower had the expense limitations not been in effect.

The Fund offers Class A, B, and C shares.

Class A shares are sold with a maximum front-end sales charge of up to 4.50%, and have an annual distribution and service fee of up to 0.25% of average daily net assets.

Class B shares may be purchased only through dividend reinvestment and certain permitted exchanges as described in the prospectus.

11

Performance summaries

Delaware Tax-Free California Fund

Please see the prospectus for additional information on Class B purchase and sales charges. Class B shares have a contingent deferred sales charge that declines from 4.00% to zero depending on the period of time the shares are held.

Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

Ten-year performance figures for Class B shares reflect conversion to Class A shares after approximately eight years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Fund may be prepaid prior to maturity, potentially forcing the Fund to reinvest that money at a lower interest rate.

High yielding, noninvestment grade bonds (junk bonds) involve higher risk than investment grade bonds.

Substantially all dividend income derived from tax-free funds is exempt from federal income tax. Some income may be subject to the federal alternative minimum tax (AMT) that applies to certain investors. Capital gains, if any, are taxable.

Funds that invest primarily in one state may be more susceptible to the economic, regulatory, and other factors of that state than funds that invest more broadly.

The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” chart. Delaware Investments has voluntarily agreed to reimburse certain expenses and/or waive certain fees in order to prevent total fund operating expenses from exceeding 0.57% of the Fund’s average daily net assets. Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements.

| Fund expense ratios | Class A | | Class B | | Class C | |

| Total annual operating expenses | 0.97% | | 1.72% | | 1.72% | |

| (without fee waivers) | | | | | | |

| Net expenses | 0.82% | | 1.57% | | 1.57% | |

| (including fee waivers, if any) | | | | | | |

| Type of waiver | Voluntary | | Voluntary | | Voluntary | |

12

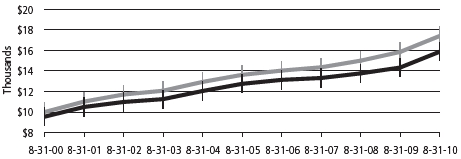

Performance of a $10,000 investment

Average annual total returns from Aug. 31, 2000, through Aug. 31, 2010

| For period beginning Aug. 31, 2000, through Aug. 31, 2010 | Starting value | Ending value |

| | Barclays Capital Municipal Bond Index | $10,000 | $17,400 |

| | Delaware Tax-Free California Fund — Class A Shares | $9,550 | $16,543 |

The chart assumes $10,000 invested in the Fund on Aug. 31, 2000, and includes the effect of a 4.50% front-end sales charge and the reinvestment of all distributions. Please note additional details on these fees in the “Performance summaries” section of this report, which includes pages 11 through 13.

The chart also assumes $10,000 invested in the Barclays Capital Municipal Bond Index as of Aug. 31, 2000.

The Barclays Capital Municipal Bond Index measures the total return performance of the long-term, investment grade tax-exempt bond market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

The “Fund performance” chart and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes shareholders would pay on Fund distributions or redemptions of Fund shares.

| | | Nasdaq symbols | | CUSIPs | |

| Class A | | DVTAX | | 928928829 | |

| Class B | | DVTFX | | 928928811 | |

| Class C | | DVFTX | | 928928795 | |

13

| Performance summaries | |

| Delaware Tax-Free Colorado Fund | August 31, 2010 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data current for the most recent month end by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Fund’s prospectus and, if available, its summary prospectus, which may be obtained by visiting www.delawareinvestments.com or calling 800 523-1918. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

| Fund performance | Average annual total returns through Aug. 31, 2010 |

| | | 1 year | | 5 years | | 10 years | |

| Class A (Est. April 23, 1987) | | | | | | | | |

| Excluding sales charge | | +10.74% | | | +4.48% | | +5.22% | |

| Including sales charge | | +5.75% | | | +3.52% | | +4.74% | |

| Class B (Est. March 22, 1995) | | | | | | | | |

| Excluding sales charge | | +9.91% | | | +3.72% | | +4.59% | |

| Including sales charge | | +5.91% | | | +3.46% | | +4.59% | |

| Class C (Est. May 6, 1994) | | | | | | | | |

| Excluding sales charge | | +9.90% | | | +3.71% | | +4.45% | |

| Including sales charge | | +8.90% | | | +3.71% | | +4.45% | |

Returns reflect the reinvestment of all distributions and any applicable sales charges as noted in the following paragraphs.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Expense limitations were in effect for certain classes during some of the periods shown in the “Fund performance” chart and in the “Performance of a $10,000 investment” chart. The current expenses for each class are listed on the “Fund expense ratios” chart. (Note that all charts and graphs referred to in the “Performance summaries” section of this report are found on pages 14 through 16.) Performance would have been lower had the expense limitations not been in effect.

The Fund offers Class A, B, and C shares.

Class A shares are sold with a maximum front-end sales charge of up to 4.50%, and have an annual distribution and service fee of up to 0.25% of average daily net assets.

Class B shares may be purchased only through dividend reinvestment and certain permitted exchanges as described in the prospectus. Please see the prospectus for additional information on Class B purchase and sales charges. Class B shares have a contingent deferred sales charge that declines from 4.00%

14

to zero depending on the period of time the shares are held.

Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

Ten-year performance figures for Class B shares reflect conversion to Class A shares after approximately eight years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Fund may be prepaid prior to maturity, potentially forcing the Fund to reinvest that money at a lower interest rate.

High yielding, noninvestment grade bonds (junk bonds) involve higher risk than investment grade bonds.

The Fund may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivative transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

Substantially all dividend income derived from tax-free funds is exempt from federal income tax. Some income may be subject to the federal alternative minimum tax (AMT) that applies to certain investors. Capital gains, if any, are taxable.

Funds that invest primarily in one state may be more susceptible to the economic, regulatory, and other factors of that state than funds that invest more broadly.

The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” chart.

| Fund expense ratios | Class A | | Class B | | Class C | |

| Total annual operating expenses | 0.95 | % | | 1.70 | % | | 1.70 | % | |

| (without fee waivers) | | | | | | | | | |

| Net expenses | 0.95 | % | | 1.70 | % | | 1.70 | % | |

| (including fee waivers, if any) | | | | | | | | | |

| Type of waiver | n/a | | | n/a | | | n/a | | |

15

Performance summaries

Delaware Tax-Free Colorado Fund

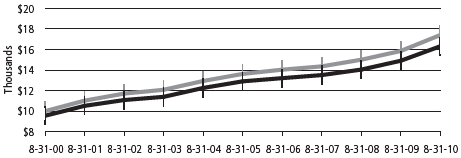

Performance of a $10,000 investment

Average annual total returns from Aug. 31, 2000, through Aug. 31, 2010

| For period beginning Aug. 31, 2000, through Aug. 31, 2010 | Starting value | Ending value |

| | Barclays Capital Municipal Bond Index | $10,000 | $17,400 |

| | Delaware Tax-Free Colorado Fund — Class A Shares | $9,550 | $15,870 |

The chart assumes $10,000 invested in the Fund on Aug. 31, 2000, and includes the effect of a 4.50% front-end sales charge and the reinvestment of all distributions. Please note additional details on these fees in the “Performance summaries” section of this report, which includes pages 14 through 16.

The chart also assumes $10,000 invested in the Barclays Capital Municipal Bond Index as of Aug. 31, 2000.

The Barclays Capital Municipal Bond Index measures the total return performance of the long-term, investment grade tax-exempt bond market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

The “Fund performance” chart and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes shareholders would pay on Fund distributions or redemptions of Fund shares.

| | | Nasdaq symbols | | CUSIPs | |

| Class A | | VCTFX | | 928920107 | |

| Class B | | DVBTX | | 928928787 | |

| Class C | | DVCTX | | 92907R101 | |

16

| Delaware Tax-Free Idaho Fund | August 31, 2010 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data current for the most recent month end by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Fund’s prospectus and, if available, its summary prospectus, which may be obtained by visiting www.delawareinvestments.com or calling 800 523-1918. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

| Fund performance | Average annual total returns through Aug. 31, 2010 |

| | | 1 year | | 5 years | | 10 years | |

| Class A (Est. Jan. 4, 1995) | | | | | | | |

| Excluding sales charge | | +9.44% | | +4.80% | | +5.51% | |

| Including sales charge | | +4.53% | | +3.83% | | +5.02% | |

| Class B (Est. March 16, 1995) | | | | | | | |

| Excluding sales charge | | +8.64% | | +4.03% | | +4.87% | |

| Including sales charge | | +4.64% | | +3.77% | | +4.87% | |

| Class C (Est. Jan. 11, 1995) | | | | | | | |

| Excluding sales charge | | +8.63% | | +4.00% | | +4.72% | |

| Including sales charge | | +7.63% | | +4.00% | | +4.72% | |

Returns reflect the reinvestment of all distributions and any applicable sales charges as noted in the following paragraphs.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Expense limitations were in effect for certain classes during some of the periods shown in the “Fund performance” chart and in the “Performance of a $10,000 investment” chart. The current expenses for each class are listed on the “Fund expense ratios” chart. (Note that all charts and graphs referred to in the “Performance summaries” section of this report are found on pages 17 through 19.) Performance would have been lower had the expense limitations not been in effect.

The Fund offers Class A, B, and C shares.

Class A shares are sold with a maximum front-end sales charge of up to 4.50%, and have an annual distribution and service fee of up to 0.25% of average daily net assets.

Class B shares may be purchased only through dividend reinvestment and certain permitted exchanges as described in the prospectus.

17

Performance summaries

Delaware Tax-Free Idaho Fund

Please see the prospectus for additional information on Class B purchase and sales charges. Class B shares have a contingent deferred sales charge that declines from 4.00% to zero depending on the period of time the shares are held.

Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

Ten-year performance figures for Class B shares reflect conversion to Class A shares after approximately eight years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Fund may be prepaid prior to maturity, potentially forcing the Fund to reinvest that money at a lower interest rate.

High yielding, noninvestment grade bonds (junk bonds) involve higher risk than investment grade bonds.

Substantially all dividend income derived from tax-free funds is exempt from federal income tax. Some income may be subject to the federal alternative minimum tax (AMT) that applies to certain investors. Capital gains, if any, are taxable.

Funds that invest primarily in one state may be more susceptible to the economic, regulatory, and other factors of that state than funds that invest more broadly.

The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” chart.

| Fund expense ratios | Class A | | Class B | | Class C | |

| Total annual operating expenses | 0.96 | % | | 1.71 | % | | 1.71 | % | |

| (without fee waivers) | | | | | | | | | |

| Net expenses | 0.96 | % | | 1.71 | % | | 1.71 | % | |

| (including fee waivers, if any) | | | | | | | | | |

| Type of waiver | n/a | | | n/a | | | n/a | | |

18

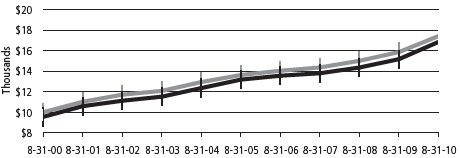

Performance of a $10,000 investment

Average annual total returns from Aug. 31, 2000, through Aug. 31, 2010

| For period beginning Aug. 31, 2000, through Aug. 31, 2010 | Starting value | Ending value |

| | Barclays Capital Municipal Bond Index | $10,000 | $17,400 |

| | Delaware Tax-Free Idaho Fund — Class A Shares | $9,550 | $16,307 |

The chart assumes $10,000 invested in the Fund on Aug. 31, 2000, and includes the effect of a 4.50% front-end sales charge and the reinvestment of all distributions. Please note additional details on these fees in the “Performance summaries” section of this report, which includes pages 17 through 19.

The chart also assumes $10,000 invested in the Barclays Capital Municipal Bond Index as of Aug. 31, 2000.

The Barclays Capital Municipal Bond Index measures the total return performance of the long-term, investment grade tax-exempt bond market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

The “Fund performance” chart and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes shareholders would pay on Fund distributions or redemptions of Fund shares.

| | | Nasdaq symbols | | CUSIPs | |

| Class A | | VIDAX | | 928928704 | |

| Class B | | DVTIX | | 928928746 | |

| Class C | | DVICX | | 928928803 | |

19

| Performance summaries | |

| Delaware Tax-Free New York Fund | August 31, 2010 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data current for the most recent month end by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Fund’s prospectus and, if available, its summary prospectus, which may be obtained by visiting www.delawareinvestments.com or calling 800 523-1918. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

| Fund performance | Average annual total returns through Aug. 31, 2010 |

| | | 1 year | | 5 years | | 10 years | |

| Class A (Est. Nov. 6, 1987) | | | | | | | | |

| Excluding sales charge | | +11.02% | | | +5.02% | | +5.84% | |

| Including sales charge | | +6.05% | | | +4.07% | | +5.36% | |

| Class B (Est. Nov. 14, 1994) | | | | | | | | |

| Excluding sales charge | | +10.21% | | | +4.25% | | +5.20% | |

| Including sales charge | | +6.21% | | | +3.99% | | +5.20% | |

| Class C (Est. April 26, 1995) | | | | | | | | |

| Excluding sales charge | | +10.20% | | | +4.25% | | +5.05% | |

| Including sales charge | | +9.20% | | | +4.25% | | +5.05% | |

Returns reflect the reinvestment of all distributions and any applicable sales charges as noted in the following paragraphs.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Expense limitations were in effect for certain classes during the periods shown in the “Fund performance” chart and in the “Performance of a $10,000 investment” chart. The current expenses for each class are listed on the “Fund expense ratios” chart. (Note that all charts and graphs referred to in the “Performance summaries” section of this report are found on pages 20 through 22.) Performance would have been lower had the expense limitations not been in effect.

The Fund offers Class A, B, and C shares.

Class A shares are sold with a maximum front-end sales charge of up to 4.50%, and have an annual distribution and service fee of up to 0.25% of average daily net assets.

Class B shares may be purchased only through dividend reinvestment and certain permitted exchanges as described in the prospectus.

20

Please see the prospectus for additional information on Class B purchase and sales charges. Class B shares have a contingent deferred sales charge that declines from 4.00% to zero depending on the period of time the shares are held.

Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

Ten-year performance figures for Class B shares reflect conversion to Class A shares after approximately eight years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Fund may be prepaid prior to maturity, potentially forcing the Fund to reinvest that money at a lower interest rate.

High yielding, noninvestment grade bonds (junk bonds) involve higher risk than investment grade bonds.

Substantially all dividend income derived from tax-free funds is exempt from federal income tax. Some income may be subject to the federal alternative minimum tax (AMT) that applies to certain investors. Capital gains, if any, are taxable.

Funds that invest primarily in one state may be more susceptible to the economic, regulatory, and other factors of that state than funds that invest more broadly.

The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” chart. Delaware Investments has voluntarily agreed to reimburse certain expenses and/or waive certain fees in order to prevent total fund operating expenses from exceeding 0.55% of the Fund’s average daily net assets. Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements.

| Fund expense ratios | Class A | | Class B | | Class C | |

| Total annual operating expenses | 1.10% | | 1.85% | | 1.85% | |

| (without fee waivers) | | | | | | |

| Net expenses | 0.80% | | 1.55% | | 1.55% | |

| (including fee waivers, if any) | | | | | | |

| Type of waiver | Voluntary | | Voluntary | | Voluntary | |

21

Performance summaries

Delaware Tax-Free New York Fund

Performance of a $10,000 investment

Average annual total returns from Aug. 31, 2000, through Aug. 31, 2010

| For period beginning Aug. 31, 2000, through Aug. 31, 2010 | Starting value | Ending value |

| | Barclays Capital Municipal Bond Index | $10,000 | $17,400 |

| | Delaware Tax-Free New York Fund — Class A Shares | $9,550 | $16,832 |

The chart assumes $10,000 invested in the Fund on Aug. 31, 2000, and includes the effect of a 4.50% front-end sales charge and the reinvestment of all distributions. Please note additional details on these fees in the “Performance summaries” section of this report, which includes pages 20 through 22.

The chart also assumes $10,000 invested in the Barclays Capital Municipal Bond Index as of Aug. 31, 2000.

The Barclays Capital Municipal Bond Index measures the total return performance of the long-term, investment grade tax-exempt bond market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

The “Fund performance” chart and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes shareholders would pay on Fund distributions or redemptions of Fund shares.

| | | Nasdaq symbols | | CUSIPs | |

| Class A | | FTNYX | | 928928274 | |

| Class B | | DVTNX | | 928928266 | |

| Class C | | DVFNX | | 928928258 | |

22

Disclosure of Fund expenses

For the six-month period March 1, 2010 to August 31, 2010

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. These following examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from March 1, 2010 to August 31, 2010.

Actual expenses

The first section of the tables shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the tables shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of each table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Delaware Tax-Free California Fund and Delaware Tax-Free New York Fund’s expenses shown in the tables reflect fee waivers in effect. The expenses shown in each table assume reinvestment of all dividends and distributions.

23

Disclosure of Fund expenses

Delaware Tax-Free Arizona Fund

Expense analysis of an investment of $1,000

| | Beginning | | Ending | | | | | Expenses |

| | Account Value | | Account Value | | Annualized | | Paid During Period |

| | 3/1/10 | | 8/31/10 | | Expense Ratio | | 3/1/10 to 8/31/10* |

| Actual Fund return | | | | | | | | | | | | | | | |

| Class A | $ | 1,000.00 | | | $ | 1,057.50 | | | 0.91 | % | | | $ | 4.72 | |

| Class B | | 1,000.00 | | | | 1,052.60 | | | 1.66 | % | | | | 8.59 | |

| Class C | | 1,000.00 | | | | 1,053.40 | | | 1.66 | % | | | | 8.59 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | | | | |

| Class A | $ | 1,000.00 | | | $ | 1,020.62 | | | 0.91 | % | | | $ | 4.63 | |

| Class B | | 1,000.00 | | | | 1,016.84 | | | 1.66 | % | | | | 8.44 | |

| Class C | | 1,000.00 | | | | 1,016.84 | | | 1.66 | % | | | | 8.44 | |

Delaware Tax-Free California Fund

Expense analysis of an investment of $1,000

| | Beginning | | Ending | | | | | Expenses |

| | Account Value | | Account Value | | Annualized | | Paid During Period |

| | 3/1/10 | | 8/31/10 | | Expense Ratio | | 3/1/10 to 8/31/10* |

| Actual Fund return | | | | | | | | | | | | | | | |

| Class A | $ | 1,000.00 | | | $ | 1,071.50 | | | 0.82 | % | | | $ | 4.28 | |

| Class B | | 1,000.00 | | | | 1,066.30 | | | 1.57 | % | | | | 8.18 | |

| Class C | | 1,000.00 | | | | 1,067.40 | | | 1.57 | % | | | | 8.18 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | | | | |

| Class A | $ | 1,000.00 | | | $ | 1,021.07 | | | 0.82 | % | | | $ | 4.18 | |

| Class B | | 1,000.00 | | | | 1,017.29 | | | 1.57 | % | | | | 7.98 | |

| Class C | | 1,000.00 | | | | 1,017.29 | | | 1.57 | % | | | | 7.98 | |

24

Delaware Tax-Free Colorado Fund

Expense analysis of an investment of $1,000

| | Beginning | | Ending | | | | | Expenses |

| | Account Value | | Account Value | | Annualized | | Paid During Period |

| | 3/1/10 | | 8/31/10 | | Expense Ratio | | 3/1/10 to 8/31/10* |

| Actual Fund return | | | | | | | | | | | | | | | |

| Class A | $ | 1,000.00 | | | $ | 1,056.50 | | | 0.95 | % | | | $ | 4.92 | |

| Class B | | 1,000.00 | | | | 1,053.50 | | | 1.70 | % | | | | 8.80 | |

| Class C | | 1,000.00 | | | | 1,053.40 | | | 1.70 | % | | | | 8.80 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | | | | |

| Class A | $ | 1,000.00 | | | $ | 1,020.42 | | | 0.95 | % | | | $ | 4.84 | |

| Class B | | 1,000.00 | | | | 1,016.64 | | | 1.70 | % | | | | 8.64 | |

| Class C | | 1,000.00 | | | | 1,016.64 | | | 1.70 | % | | | | 8.64 | |

Delaware Tax-Free Idaho Fund

Expense analysis of an investment of $1,000

| | Beginning | | Ending | | | | | Expenses |

| | Account Value | | Account Value | | Annualized | | Paid During Period |

| | 3/1/10 | | 8/31/10 | | Expense Ratio | | 3/1/10 to 8/31/10* |

| Actual Fund return | | | | | | | | | | | | | | | |

| Class A | $ | 1,000.00 | | | $ | 1,052.30 | | | 0.95 | % | | | $ | 4.91 | |

| Class B | | 1,000.00 | | | | 1,048.40 | | | 1.70 | % | | | | 8.78 | |

| Class C | | 1,000.00 | | | | 1,048.40 | | | 1.70 | % | | | | 8.78 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | | | | |

| Class A | $ | 1,000.00 | | | $ | 1,020.42 | | | 0.95 | % | | | $ | 4.84 | |

| Class B | | 1,000.00 | | | | 1,016.64 | | | 1.70 | % | | | | 8.64 | |

| Class C | | 1,000.00 | | | | 1,016.64 | | | 1.70 | % | | | | 8.64 | |

25

Disclosure of Fund expenses

Delaware Tax-Free New York Fund

Expense analysis of an investment of $1,000

| | Beginning | | Ending | | | | | Expenses |

| | Account Value | | Account Value | | Annualized | | Paid During Period |

| | 3/1/10 | | 8/31/10 | | Expense Ratio | | 3/1/10 to 8/31/10* |

| Actual Fund return | | | | | | | | | | | | | | | |

| Class A | $ | 1,000.00 | | | $ | 1,057.50 | | | 0.80 | % | | | $ | 4.15 | |

| Class B | | 1,000.00 | | | | 1,053.70 | | | 1.55 | % | | | | 8.02 | |

| Class C | | 1,000.00 | | | | 1,053.60 | | | 1.55 | % | | | | 8.02 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | | | | |

| Class A | $ | 1,000.00 | | | $ | 1,021.17 | | | 0.80 | % | | | $ | 4.08 | |

| Class B | | 1,000.00 | | | | 1,017.39 | | | 1.55 | % | | | | 7.88 | |

| Class C | | 1,000.00 | | | | 1,017.39 | | | 1.55 | % | | | | 7.88 | |

*“Expenses Paid During Period” are equal to a Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

26

| Sector allocations | |

| Delaware Tax-Free Arizona Fund | As of August 31, 2010 |

Sector designations may be different than the sector designations presented in other Fund materials.

| Sector | | Percentage of net assets |

| Municipal Bonds | | 99.13 | % |

| Corporate Revenue Bonds | | 8.27 | % |

| Education Revenue Bonds | | 11.69 | % |

| Electric Revenue Bonds | | 8.17 | % |

| Healthcare Revenue Bonds | | 12.74 | % |

| Housing Revenue Bond | | 0.01 | % |

| Lease Revenue Bonds | | 10.58 | % |

| Local General Obligation Bonds | | 4.55 | % |

| Pre-Refunded Bonds | | 8.44 | % |

| Special Tax Revenue Bonds | | 13.51 | % |

| State & Territory General Obligation Bonds | | 6.38 | % |

| Transportation Revenue Bonds | | 6.67 | % |

| Water & Sewer Revenue Bonds | | 8.12 | % |

| Short-Term Investment | | 1.05 | % |

| Total Value of Securities | | 100.18 | % |

| Liabilities Net of Receivables and Other Assets | | (0.18 | %) |

| Total Net Assets | | 100.00 | % |

27

| Sector allocations | |

| Delaware Tax-Free California Fund | As of August 31, 2010 |

Sector designations may be different than the sector designations presented in other Fund materials.

| Sector | | Percentage of net assets |

| Municipal Bonds | | 97.06 | % |

| Corporate Revenue Bonds | | 6.58 | % |

| Education Revenue Bonds | | 9.13 | % |

| Electric Revenue Bonds | | 6.65 | % |

| Healthcare Revenue Bonds | | 14.59 | % |

| Housing Revenue Bonds | | 6.61 | % |

| Lease Revenue Bonds | | 7.35 | % |

| Local General Obligation Bonds | | 5.88 | % |

| Pre-Refunded Bonds | | 3.83 | % |

| Resource Recovery Revenue Bond | | 1.17 | % |

| Special Tax Revenue Bonds | | 20.02 | % |

| State General Obligation Bonds | | 8.33 | % |

| Transportation Revenue Bonds | | 4.51 | % |

| Water & Sewer Revenue Bonds | | 2.41 | % |

| Short-Term Investments | | 1.59 | % |

| Total Value of Securities | | 98.65 | % |

| Receivables and Other Assets Net of Liabilities | | 1.35 | % |

| Total Net Assets | | 100.00 | % |

28

| Delaware Tax-Free Colorado Fund | As of August 31, 2010 |

Sector designations may be different than the sector designations presented in other Fund materials.

| Sector | | Percentage of net assets |

| Municipal Bonds | | 98.63 | % |

| Corporate Revenue Bond | | 1.14 | % |

| Education Revenue Bonds | | 11.68 | % |

| Electric Revenue Bonds | | 8.51 | % |

| Healthcare Revenue Bonds | | 23.22 | % |

| Housing Revenue Bonds | | 2.10 | % |

| Lease Revenue Bonds | | 3.59 | % |

| Local General Obligation Bonds | | 13.38 | % |

| Pre-Refunded/Escrowed to Maturity Bonds | | 11.92 | % |

| Special Tax Revenue Bonds | | 10.52 | % |

| State & Territory General Obligation Bonds | | 5.78 | % |

| Transportation Revenue Bonds | | 4.49 | % |

| Water & Sewer Revenue Bonds | | 2.30 | % |

| Short-Term Investment | | 0.15 | % |

| Total Value of Securities | | 98.78 | % |

| Receivables and Other Assets Net of Liabilities | | 1.22 | % |

| Total Net Assets | | 100.00 | % |

29

| Sector allocations | |

| Delaware Tax-Free Idaho Fund | As of August 31, 2010 |

Sector designations may be different than the sector designations presented in other Fund materials.

| Sector | | Percentage of net assets |

| Municipal Bonds | | 98.42 | % |

| Corporate Revenue Bonds | | 3.43 | % |

| Education Revenue Bonds | | 10.95 | % |

| Electric Revenue Bonds | | 5.85 | % |

| Healthcare Revenue Bonds | | 3.62 | % |

| Housing Revenue Bonds | | 5.97 | % |

| Lease Revenue Bonds | | 3.12 | % |

| Local General Obligation Bonds | | 20.04 | % |

| Pre-Refunded Bonds | | 12.29 | % |

| Special Tax Revenue Bonds | | 17.27 | % |

| State General Obligation Bonds | | 6.41 | % |

| Transportation Revenue Bonds | | 7.06 | % |

| Water & Sewer Revenue Bonds | | 2.41 | % |

| Short-Term Investments | | 2.11 | % |

| Total Value of Securities | | 100.53 | % |

| Liabilities Net of Receivables and Other Assets | | (0.53 | %) |

| Total Net Assets | | 100.00 | % |

30

| Delaware Tax-Free New York Fund | As of August 31, 2010 |

Sector designations may be different than the sector designations presented in other Fund materials.

| Sector | Percentage of net assets |

| Municipal Bonds | 95.94 | % |

| Corporate Revenue Bonds | 6.47 | % |

| Education Revenue Bonds | 23.75 | % |

| Electric Revenue Bonds | 5.44 | % |

| Healthcare Revenue Bonds | 8.89 | % |

| Housing Revenue Bonds | 1.48 | % |

| Lease Revenue Bonds | 8.45 | % |

| Local General Obligation Bonds | 3.56 | % |

| Pre-Refunded Bonds | 4.44 | % |

| Special Tax Revenue Bonds | 19.77 | % |

| State & Territory General Obligation Bonds | 4.50 | % |

| Transportation Revenue Bonds | 6.69 | % |

| Water & Sewer Revenue Bonds | 2.50 | % |

| Short-Term Investments | 2.31 | % |

| Total Value of Securities | 98.25 | % |

| Receivables and Other Assets Net of Liabilities | 1.75 | % |

| Total Net Assets | 100.00 | % |

31

| Statements of net assets | |

| Delaware Tax-Free Arizona Fund | August 31, 2010 |

| | | Principal amount | | Value |

| Municipal Bonds – 99.13% | | | | | | | |

| Corporate Revenue Bonds – 8.27% | | | | | | | |

| | Maricopa County Pollution Control (Palo Verde Project) | | | | | | | |

| | Series A 5.05% 5/1/29 (AMBAC) | | $ | 2,000,000 | | | $ | 2,000,060 |

| | •Series B 5.20% 6/1/43 | | | 1,500,000 | | | | 1,562,775 |

| • | Navajo County Pollution Control Revenue | | | | | | | |

| | (Arizona Public Services-Cholla) | | | | | | | |

| | Series D 5.75% 6/1/34 | | | 1,500,000 | | | | 1,626,570 |

| | Pima County Industrial Development Authority Pollution | | | | | | | |

| | Control Revenue (Tucson Electric Power-San Juan) | | | | | | | |

| | 5.75% 9/1/29 | | | 750,000 | | | | 776,805 |

| | Series A 4.95% 10/1/20 | | | 1,500,000 | | | | 1,592,925 |

| | Puerto Rico Port Authority Revenue (American Airlines) | | | | | | | |

| | Series A 6.25% 6/1/26 | | | 1,115,000 | | | | 956,949 |

| | Salt Verde Financial Corporation, Senior Gas Revenue | | | | | | | |

| | 5.00% 12/1/37 | | | 1,395,000 | | | | 1,331,039 |

| | | | | | | | | 9,847,123 |

| Education Revenue Bonds – 11.69% | | | | | | | |

| | Arizona Board of Regents | | | | | | | |

| | University of Arizona System Revenue Series A | | | | | | | |

| | 5.00% 6/1/21 | | | 1,255,000 | | | | 1,457,770 |

| | 5.00% 6/1/39 | | | 1,500,000 | | | | 1,595,490 |

| | Arizona Health Facilities Authority Healthcare Education | | | | | | | |

| | Revenue (Kirksville College) | | | | | | | |

| | 5.125% 1/1/30 | | | 1,500,000 | | | | 1,538,505 |

| | Arizona State University Certificates of Participation | | | | | | | |

| | (Research Infrastructure Project) | | | | | | | |

| | 5.00% 9/1/30 (AMBAC) | | | 2,000,000 | | | | 2,055,380 |

| | Arizona State University Energy Management Revenue | | | | | | | |

| | (Arizona State University-Tempe Campus II Project) | | | | | | | |