UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number : 811-1660

Prudential’s Gibraltar Fund, Inc.

(Exact name of registrant as specified in charter)

| | |

Gateway Center 3, 100 Mulberry Street, Newark, New Jersey | | 07102 |

| (Address of principal executive offices) | | (Zip code) |

Jonathan D. Shain

Gateway Center 3,

100 Mulberry Street,

Newark, New Jersey 07102

(Name and address of agent for service)

Registrant’s telephone number, including area code: 973-802-6469

Date of fiscal year end: 12/31/03

Date of reporting period: 12/31/03

Item 1 – Reports to Stockholders – [ INSERT REPORT ]

| | | | |

| PRUDENTIAL’S FINANCIAL SECURITY PROGRAM | | ANNUAL REPORT | | DECEMBER 31, 2003 |

Prudential’s Gibraltar Fund, Inc.

| | |

The Prudential Insurance Company of America

751 Broad Street, Newark, NJ 07102-3777 IFS-A073249 AR Ed. 01/30/2004 | |  |

This report is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus. Investors should carefully consider the contract and the underlying portfolio’s investment objective, risks, and charges and expenses before investing. The contract prospectus and the underlying portfolio prospectus contain information relating to investment objectives, risks, and charges and expenses, as well as other important information. Read them carefully before investing or sending money. Prudential’s Gibraltar Fund, Inc. is distributed by Prudential Investment Management Services LLC, Three Gateway Center, 14th Floor, Newark, NJ 07102-4077, a Prudential Financial company and member SIPC.

Prudential Financial and the Rock logo are registered service marks of The Prudential Insurance Company of America, Newark, NJ, and its affiliates.

| | |

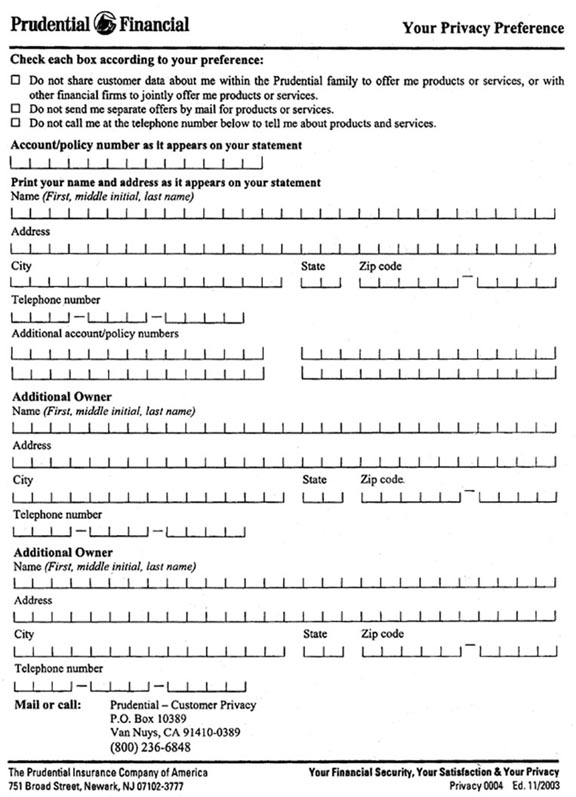

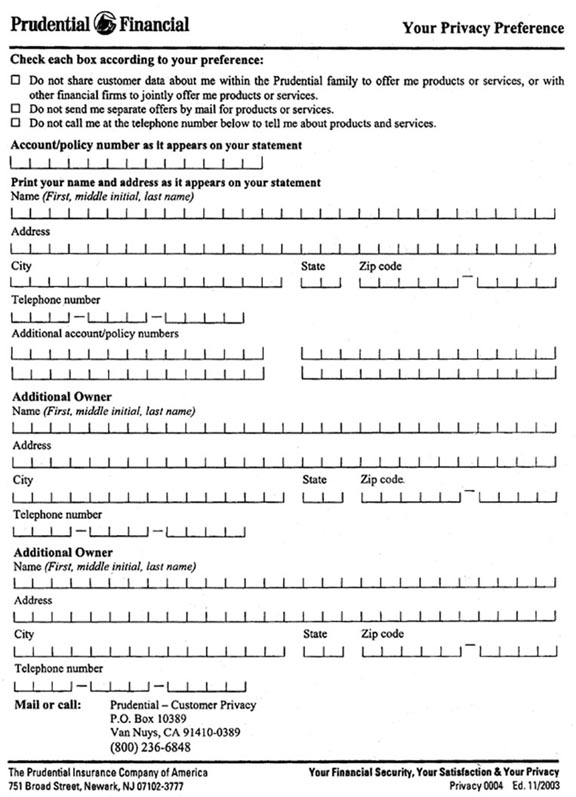

| | Important Privacy Information and Choices |

Privacy Preference

Please read this Notice. It is from the Prudential Financial companies listed on the next page, and it applies to your relationships with us. It describes how we handle information about you, how we protect it, and the choices you have.

Information We Collect

We collect information about you so we can serve you and offer products to you.

It includes information:

| | • | You give us (such as name, address, Social Security number, income). |

| | • | About the Prudential products you have (such as the kinds of products you have with us, account balances, amount of insurance). |

| | • | Others give us (such as medical information for life insurance applications, creditworthiness information from credit reports, employee identifying information for group products, such as Social Security number). |

| | • | From visits to our websites (such as data from web forms, site visit data, and data from web “cookies”). |

We call this information “customer data”.

Protecting Customer Information

The only persons who are authorized to have access to customer data are those who need it to do their jobs. They must protect it and keep it confidential. We maintain physical, electronic, and procedural safeguards that comply with federal and state regulations to protect customer data.

Sharing Information Inside Prudential

We may share the customer data described above with other Prudential Financial businesses, such as our insurance companies and agencies, our broker-dealers, and our banks. We may share it to serve you or maintain your account, or so our companies can tell you about other products or services.

Other Reasons Information Is Shared

We may share the customer data described above with other companies that perform services for us or on our behalf. This includes firms that provide mailing or marketing services for us, or develop and maintain software for us. We may also share it with financial firms outside Prudential, such as banks or securities brokers or dealers, when we have agreements to jointly sponsor or offer other financial products. We do this only if the applicable federal or state law allows the disclosure. Medical and driving record information is never shared for this purpose. We may disclose it as permitted or required by law, for example, to law enforcement officials, in response to subpoenas, to regulators, or to prevent fraud.

Employers and others have relationships with us to provide services in connection with benefits that they provide for their employees or members, for example, group insurance policies or 40 1(k) plans. They may limit our sharing of customer data about their employees or members. When they do, we honor those restrictions.

It’s Your Choice

We may share customer data within the Prudential family to tell you about other Prudential products and services. We may also share it with non-Prudential firms to jointly sponsor or offer other financial products. Customers tell us they want this information. If you don’t want us to share customer data about you for those offers, please let us know. We call this “opting out.”

We may mail information about other products or services to you, or we may call you to tell you about them. If you would rather not receive information in these ways, please tell us.

You can do that using the attached form. Mail it to the address or call us at the toll-free number provided. We will process your request as quickly as possible. It may take us four to six weeks in some cases for marketing campaigns that have already started.

If you ask to be removed from our mailing lists for corporate offers, we will continue to send you information about your policies and accounts. We may include inserts about other products or services in these mailings. Opting out will not affect your relationship with your Prudential professional.

We are mailing this Notice to the address we have for you. If there is more than one owner of a product or account, we send this Notice to the same address that we use to mail statements. Each owner may opt out for himself or herself, and may also opt out for the other owners.

The law requires us to send Notices at least once a year. If you have more than one Prudential product or service, ycu may receive multiple copies of this Notice. If you do choose to opt out, you only need to tell us once. We will honor your choices until you tell us to change them.

Former Customers

If your relationship with us ends, we will continue to handle information about you as this Notice describes.

To Reach Us, Write or Call

Prudential – Customer Privacy

P.O. Box 10389

Van Nuys, CA 91410-0389

(800) 236-6848

| | |

| Prudential Financial and the Rock logo are service marks of The Prudential Insurance Company of America, Newark, NJ and its affiliates. | | Your Financial Security,

Your Satisfaction & Your Privacy |

| |

The Prudential Insurance Company of America 751 Broad Street, Newark, NJ 07102-3777 | | Privacy 0004 Ed. 11/2003(A) |

Many Prudential Financial companies are required to send privacy notices to their customers.

This notice is being provided to customers of the Prudential Financial companies listed below:

Insurance Companies and Agencies

Prudential Insurance Company of America, The

Prudential Direct Insurance Agency of Texas, Inc.

Prudential Direct Insurance Agency of Alabama, Inc.

Prudential Direct Insurance Agency of Massachusetts, Inc.

Prudential Direct Insurance Agency of New Mexico, Inc.

Prudential Direct Insurance Agency of Ohio, Inc.

Prudential Direct Insurance Agency of Wyoming, Inc.

Prudential Direct, Inc.

Prudential General Agency of Ohio, Inc.

Prudential General Insurance Agency of Florida, Inc.

Prudential General Insurance Agency of Kentucky, Inc.

Prudential General Insurance Agency of Massachusetts, Inc.

Prudential General Insurance Agency of Mississippi, Inc.

Prudential General Insurance Agency of Nevada, Inc.

Prudential General Insurance Agency of New Mexico, Inc.

Prudential General Insurance Agency of Texas, Inc.

Prudential General Insurance Agency of Wyoming, Inc.

Prudential Insurance Brokerage, Inc.

Prudential Select Life Insurance Company of America

Pruco Life Insurance Company

Pruco Life Insurance Company of New Jersey

Hochman & Baker Insurance Services, Inc.

Merastar Insurance Company

Broker-Dealers and Registered Investment Advisers

Hochman & Baker Investment Advisory Services, Inc.

Hochman & Baker Securities, Inc.

Jennison Associates LLC

Pruco Securities Corporation

Prudential Asset Management Company

Prudential Equity Investors, Inc.

Prudential Investment Management, Inc.

Prudential Investment Management Services LLC

Prudential Investments LLC

Prudential Securities Futures Management Inc.

Prudential Equity Group, Inc.

Seaport Futures Management, Inc.

Bank and Trust Companies

Prudential Bank and Trust Company, The

Prudential Savings Bank, F.S.B., The

Prudential Trust Company

Investment Companies and Other Investment Vehicles

Cash Accumulation Trust

COMMAND Mutual Funds

High Yield Income Fund, Inc., The

JennisonDryden Mutual Funds

MoneyMart Assets, Inc.

Nicholas-Applegate Fund, Inc.

Prudential Capital Partners, L.P.

Prudential Equity Investors III, L.P.

Prudential Institutional Liquidity Portfolio, Inc.

Special Money Market Fund, Inc.

Strategic Partners Mutual Funds

Target Portfolio Trust, The

2

Letter to Planholders

Prudential’s Gibraltar Fund, Inc.

n F I N A N C I A L R E P O R T S

| | | | | | |

A1 | | Financial Statements | | | | |

B1 | | Schedule of Investments | | | | |

C1 | | Notes to Financial Statements | | | | |

D1 | | Financial Highlights | | | | |

E1 | | Report of Independent Auditors | | | | |

F1 | | Management of Prudential’s Gibraltar Fund, Inc. | | | | |

Prudential’s Financial Security Program is the only account investing in Prudential’s Gibraltar Fund, Inc.

| | | | |

| Prudential’s Gibraltar Fund, Inc. | | Annual Report | | December 31, 2003 |

Letter to Planholders

| | | | |

| | | | |  |

| | | | | PRESIDENT DAVID R. ODENATH, JR. |

nDEAR PLANHOLDER

The past year presented a welcome change for equity investors. Several years of corporate belt-tightening paid off in a swift upswing in profits when economic growth picked up. Stock prices rose in anticipation of further profitability improvements in 2004. The gradual economic acceleration raised no fears of inflation or industrial bottlenecks, so interest rates stayed low. As a result, bondholders also had a good year.

The year 2003 was noteworthy for Prudential Financial. We successfully joined American Skandia and Prudential Annuities to create a strong, innovative organization. More clients are entrusting their retirement savings to us, and our market share continues to grow. As of September 30, we ranked sixth in advisor-sold variable annuity sales.

Despite this good news the industry faces a number of challenges. Market timing and late trading have been the subject of attention by the regulators and investment management industry. Please be assured that Prudential Financial takes these issues very seriously. We are committed to protecting the interests of our contract holders.

Thank you for your confidence in our products. We look forward to continuing to serve your investment needs.

Sincerely,

David R. Odenath, Jr.

President,

| | |

| Prudential’s Gibraltar Fund, Inc. | | January 30, 2004 |

| | | | |

| Prudential’s Gibraltar Fund, Inc. | | Annual Report | | December 31, 2003 |

n MANAGED BY: JENNISON ASSOCIATES LLC

We believe the trends that drove performance in 2003 remain in place, and we are well positioned to benefit from them. Besides these themes, we also see potential opportunities in areas that we feet have been relatively neglected by the market (atch as large-cap pharmaceuticals), where improving fundamentals may not be fully reflected by stock prices. In addition, we are gradually adding to a number of traditionally value-oriented stocks, which have lagged the current rally but continue to generate strong free cash flow and attractive dividend yields.

n PERFORMANCE SUMMARY

| | | | | | | | | | |

| Average Annual Total Return Percentages1 | | Six

Month

| | 1-Year

| | 3-Year

| | 5-Year

| | 10-Year

|

Prudential’s Gibraltar Fund, Inc. | | 16.67% | | 29.99% | | -7.14% | | 2.45% | | 9.69% |

S&P 500 Index | | 15.14% | | 28.67% | | -4.05% | | -0.57% | | 11.06% |

Lipper (VIP) Large-Cap Core Funds Average | | 13.97% | | 26.43% | | -6.02% | | -1.22% | | 8.68% |

Prudential’s Gibraltar Fund, Inc. inception date: 3/11/1968.

Prudential’s Gibraltar Fund, Inc. returned 29.99% in 2003, while the S&P 500 Index rose 28.67%, and the Lipper (VIP) Large-Cap Core Funds Average was 26.43%.

n PERFORMANCE REVIEW

The year began with investor attention focused on the looming conflict in the Middle East. Equity markets struggled under this cautious sentiment, but turned up strongly as the airprisingly quick campaign in Iraq removed some uncertainties from investors’ minds. The Fund produced impressive gains in this environment, outperforming the S&P 500 Index and its Lipper peer group average by sizable margins. Two secular trends had material impacts on the portfolio:

Emerging signs of new technology spending cycle. Technology stocks, particularly the cyclically sensitive semiconductor stocks, were strong performers this year. The conclusion of major combat in Iraq alleviated some of the market’s bearish sentiments, and investors became more willing to discount semiconductor stocks’ potential for strong cyclical earnings growth. We were able to gain relative outperformance in this area through prudent selection and timely purchases during the earlier market downturn when we felt market pessimism was excessive. We have trimmed some of our stronger performers in this area, but continue to believe they should experience a strong cyclical earnings upswing as a new capital spending cycle gathers steam. Besides the enterprise market, we think the digital revolution in consumer electronics should Continue to drive greater demand for semiconductors, as items such as DVD and MP3 players become more affordable and ubiquitous.

Constrained energy supply. Natural gas inventory remained at record low levels in 2003, while declining hydrocarbon basins of the major oil companies continued to exert upward presaire on prices. Despite the fundamental situation unfolding closely to our expectations (low inventory, healthy demand, high energy prices, increased drilling rig count), the Fund’s energy holdings trailed the overall market in 2003, and were a source of relative underperformance. However, we believe supply will remain constrained, and our energy holdings should be relative outperformers going forward.

1Past performance is not indicative of future returns. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Portfolio performance is net of investment fees and fund expenses, but not product charges. If product charges were included, the performance quoted would be significantly lower. Six-month returns arc not annualized. Source, Prudential Investments LLC and Lipper Inc.

2The S&P 500 Index is an unmanaged, market value-weighted index of 500 stocks generally representative of the broad stock market.

3Thc Lipper (VIP) Large-Cap Core Funds Average is calculated by Lipper Analytical Services, Inc., and reflects the investment return of certain portfolios underlying variable life and annuity products. These returns arc net of investment fees and Fund expenses, but not product charges. Investors cannot invest directly in a market index or average.

For a complete list of holdings, refer to the Schedule of Investments section of this report.

| | | | |

| | |

| | |

| | |

| | | PRUDENTIAL'S GIBRALTAR FUND, INC. | | |

| | |

| | |

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2003

| | | | |

| ASSETS | | | | |

Investments, at value (cost $198,111,512) | | $ | 233,632,665 | |

Cash | | | 210 | |

Receivable for investments sold | | | 1,709,948 | |

Interest and dividends receivable | | | 122,396 | |

Foreign tax reclaim receivable | | | 14,311 | |

Prepaid expenses | | | 2,364 | |

| | |

|

|

|

Total assets | | | 235,481,894 | |

| | |

|

|

|

| LIABILITIES | | | | |

Payable for investments purchased | | | 2,870,735 | |

Management fee payable | | | 105,869 | |

Accrued expenses and other liabilities | | | 47,182 | |

| | |

|

|

|

Total liabilities | | | 3,023,786 | |

| | |

|

|

|

| NET ASSETS | | $ | 232,458,108 | |

| | |

|

|

|

Net assets were comprised of: | | | | |

Common stock, at $1 par value | | $ | 31,507,953 | |

Paid-in capital, in excess of par | | | 263,384,912 | |

| | |

|

|

|

| | | | 294,892,865 | |

Undistributed net investment income | | | 66,802 | |

Accumulated net realized loss on investments | | | (98,022,712 | ) |

Net unrealized appreciation on investments | | | 35,521,153 | |

| | |

|

|

|

Net assets, December 31, 2003 | | $ | 232,458,108 | |

| | |

|

|

|

Net asset value and redemption price per share, 31,507,953 outstanding shares of common stock (authorized 150,000,000 shares) | | $ | 7.38 | |

| | |

|

|

|

STATEMENT OF OPERATIONS

Year Ended December 31, 2003

| | | | |

| INVESTMENT INCOME | | | | |

Dividends (net of $33,136 foreign withholding tax) | | $ | 1,802,063 | |

Interest | | | 88,849 | |

| | |

|

|

|

| | | | 1,890,912 | |

| | |

|

|

|

| EXPENSES | | | | |

Management fee | | | 1,169,765 | |

Custodian's fees and expenses | | | 104,000 | |

Audit fee | | | 27,000 | |

Directors’ fees | | | 21,000 | |

Legal fees and expenses | | | 21,000 | |

Miscellaneous | | | 3,335 | |

| | |

|

|

|

Total expenses | | | 1,346,100 | |

Less: custodian fee credit | | | (837 | ) |

| | |

|

|

|

Net expenses | | | 1,345,263 | |

| | |

|

|

|

| NET INVESTMENT INCOME | | | 545,649 | |

| | |

|

|

|

| NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | |

Net realized loss on investments | | | (6,079,642 | ) |

Net change in unrealized appreciation (depreciation) on

investments | | | 61,945,265 | |

| | |

|

|

|

| NET GAIN ON INVESTMENTS | | | 55,865,623 | |

| | |

|

|

|

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 56,411,272 | |

| | |

|

|

|

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | |

| | |

| | | Year Ended

December 31, 2003

| | | Year Ended

December 31, 2002

| |

| INCREASE (DECREASE) IN NET ASSETS | | | | | | | | |

| OPERATIONS: | | | | | | | | |

Net investment income | | $ | 545,649 | | | $ | 2,150,935 | |

Net realized loss on investments | | | (6,079,642 | ) | | | (50,855,030 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | 61,945,265 | | | | (27,117,546 | ) |

| | |

|

|

| |

|

|

|

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | | 56,411,272 | | | | (75,821,641 | ) |

| | |

|

|

| |

|

|

|

| DIVIDENDS: | | | | | | | | |

Dividends from net investment income | | | (485,320 | ) | | | (2,142,494 | ) |

| | |

|

|

| |

|

|

|

| CAPITAL STOCK TRANSACTIONS:(a) | | | | | | | | |

Capital stock sold | | | 79,461 | | | | — | |

Capital stock issued in reinvestment of dividends | | | 485,320 | | | | 2,114,176 | |

Capital stock repurchased | | | (24,242,979 | ) | | | (21,907,815 | ) |

| | |

|

|

| |

|

|

|

NET DECREASE IN NET ASSETS RESULTING FROM CAPITAL STOCK TRANSACTIONS | | | (23,678,198 | ) | | | (19,793,639 | ) |

| | |

|

|

| |

|

|

|

| TOTAL (INCREASE) DECREASE IN NET ASSETS | | | 32,247,754 | | | | (97,757,774 | ) |

| NET ASSETS: | | | | | | | | |

Beginning of year | | | 200,210,354 | | | | 297,968,128 | |

| | |

|

|

| |

|

|

|

End of year (b) | | $ | 232,458,108 | | | $ | 200,210,354 | |

| | |

|

|

| |

|

|

|

(a) TRANSACTIONS IN SHARES OF COMMON STOCK: | | | | | | | | |

Shares sold | | | 11,160 | | | | — | |

Shares issued in reinvestment of dividends | | | 72,313 | | | | 344,382 | |

Shares repurchased | | | (3,782,141 | ) | | | (3,366,820 | ) |

| | |

|

|

| |

|

|

|

NET DECREASE IN SHARES OUTSTANDING | | | (3,698,668 | ) | | | (3,022,438 | ) |

| | |

|

|

| |

|

|

|

(b) Includes undistributed net investment income of: | | $ | 66,802 | | | $ | 6,473 | |

| | |

|

|

| |

|

|

|

SEE NOTES TO FINANCIAL STATEMENTS.

A1

| | | | |

| | |

| | |

| | |

| | | PRUDENTIAL’S GIBRALTAR FUND, INC. | | |

| | |

| | |

SCHEDULE OF INVESTMENTS | December 31, 2003 |

| | | | | |

| LONG-TERM INVESTMENTS — 97.6% | | Value (Note 1)

|

| COMMON STOCKS | | Shares

| |

Automobiles — 0.9% | | | | | |

Harley-Davidson, Inc. | | 46,200 | | $ | 2,195,886 |

| | | | |

|

|

Biotechnology — 5.3% | | | | | |

Amgen, Inc.(a) | | 119,800 | | | 7,403,640 |

Gilead Sciences, Inc.(a) | | 58,400 | | | 3,395,376 |

MedImmune, Inc.(a) | | 56,800 | | | 1,442,720 |

| | | | |

|

|

| | | | | | 12,241,736 |

| | | | |

|

|

Capital Markets — 5.3% | | | | | |

Goldman Sachs Group, Inc. | | 45,600 | | | 4,502,088 |

Merrill Lynch & Co., Inc. | | 70,400 | | | 4,128,960 |

State Street Corp. | | 68,900 | | | 3,588,312 |

| | | | |

|

|

| | | | | | 12,219,360 |

| | | | |

|

|

Commercial Services & Supplies — 1.0% | | | | | |

Apollo Group, Inc.(a) | | 35,200 | | | 2,393,600 |

| | | | |

|

|

Communications Equipment — 4.8% | | | | | |

Cisco Systems, Inc.(a) | | 379,200 | | | 9,210,768 |

Motorola, Inc. | | 36,500 | | | 513,555 |

Nokia Oyj, ADR (Finland) | | 40,900 | | | 695,300 |

QUALCOMM, Inc. | | 12,700 | | | 684,911 |

| | | | |

|

|

| | | | | | 11,104,534 |

| | | | |

|

|

Computers & Peripherals — 7.1% | | | | | |

Dell, Inc.(a) | | 161,100 | | | 5,470,956 |

EMC Corp.(a) | | 245,000 | | | 3,165,400 |

Hewlett-Packard Co. | | 101,900 | | | 2,340,643 |

International Business Machines Corp. (IBM) | | 60,500 | | | 5,607,140 |

| | | | |

|

|

| | | | | | 16,584,139 |

| | | | |

|

|

Consumer Finance — 2.9% | | | | | |

American Express Co. | | 138,400 | | | 6,675,032 |

| | | | |

|

|

Diversified Financial Services — 2.6% | | | | | |

Citigroup, Inc. | | 124,966 | | | 6,065,850 |

| | | | |

|

|

Electronic Equipment & Instruments — 2.0% | | | |

Agilent Technologies, Inc.(a) | | 155,800 | | | 4,555,592 |

| | | | |

|

|

Energy Equipment & Services — 2.4% | | | | | |

BJ Services Co.(a) | | 91,200 | | | 3,274,080 |

Weatherford International, Ltd. (Bermuda)(a) | | 60,700 | | | 2,185,200 |

| | | | |

|

|

| | | | | | 5,459,280 |

| | | | |

|

|

Food and Staples Retailing — 4.1% | | | | | |

Costco Wholesale Corp.(a) | | 62,100 | | | 2,308,878 |

Wal-Mart Stores, Inc. | | 85,900 | | | 4,556,995 |

Whole Foods Market, Inc.(a) | | 40,300 | | | 2,705,339 |

| | | | |

|

|

| | | | | | 9,571,212 |

| | | | |

|

|

Health Care Equipment & Supplies — 1.6% | | | | | |

Alcon, Inc.(a) | | 16,700 | | | 1,011,018 |

Medtronic, Inc. | | 57,300 | | | 2,785,353 |

| | | | |

|

|

| | | | | | 3,796,371 |

| | | | |

|

|

Health Care Providers & Services — 0.7% | | | | | |

Caremark Rx, Inc.(a) | | 62,700 | | | 1,588,191 |

| | | | |

|

|

Hotels, Restaurants & Leisure — 3.8% | | | | | |

Marriott International, Inc. (Class “A” Stock) | | 25,100 | | | 1,159,620 |

| | | | | |

COMMON STOCKS (Continued) | | Shares

| | Value (Note 1)

|

Hotels, Restaurants & Leisure (cont’d.) | | | | | |

McDonald’s Corp. | | 117,200 | | $ | 2,910,076 |

Starbucks Corp.(a) | | 141,100 | | | 4,664,766 |

| | | | |

|

|

| | | | | | 8,734,462 |

| | | | |

|

|

Household Durables — 0.2% | | | | | |

Harman International Industries, Inc. | | 7,600 | | | 562,248 |

| | | | |

|

|

Industrial Conglomerates — 3.6% | | | | | |

3M Co. | | 30,400 | | | 2,584,912 |

General Electric Co. | | 187,500 | | | 5,808,750 |

| | | | |

|

|

| | | | | | 8,393,662 |

| | | | |

|

|

Insurance — 3.0% | | | | | |

American International Group, Inc. | | 45,390 | | | 3,008,449 |

Loews Corp. | | 80,200 | | | 3,965,890 |

| | | | |

|

|

| | | | | | 6,974,339 |

| | | | |

|

|

Internet & Catalog Retail — 2.3% | | | | | |

eBay, Inc.(a) | | 48,700 | | | 3,145,533 |

InterActiveCorp(a) | | 67,900 | | | 2,303,847 |

| | | | |

|

|

| | | | | | 5,449,380 |

| | | | |

|

|

Internet Software & Services — 1.6% | | | | | |

Yahoo!, Inc.(a) | | 79,800 | | | 3,604,566 |

| | | | |

|

|

Media — 7.1% | | | | | |

Clear Channel Communications, Inc. | | 56,000 | | | 2,622,480 |

Hughes Electronics Corp.(a) | | 80,181 | | | 1,327,000 |

Univision Communications, Inc. (Class “A” Stock)(a) | | 101,400 | | | 4,024,567 |

Viacom, Inc. (Class “B” Stock) | | 191,866 | | | 8,515,013 |

| | | | |

|

|

| | | | | | 16,489,060 |

| | | | |

|

|

Metals & Mining — 1.1% | | | | | |

Alumina, Ltd., ADR (Australia) | | 131,600 | | | 2,638,580 |

| | | | |

|

|

Oil & Gas — 2.1% | | | | | |

Total SA, ADR (France) | | 53,600 | | | 4,958,536 |

| | | | |

|

|

Personal Products — 1.3% | | | | | |

Avon Products, Inc. | | 43,200 | | | 2,915,568 |

| | | | |

|

|

Pharmaceuticals — 9.2% | | | | | |

Allergan, Inc. | | 31,800 | | | 2,442,558 |

AstraZeneca PLC, ADR

(United Kingdom) | | 54,500 | | | 2,636,710 |

Forest Laboratories, Inc.(a) | | 18,500 | | | 1,143,300 |

Novartis AG, ADR (Switzerland) | | 60,500 | | | 2,776,345 |

Pfizer, Inc. | | 158,822 | | | 5,611,181 |

Roche Holdings AG, ADR (Switzerland) | | 34,500 | | | 3,479,988 |

Teva Pharmaceutical Industries, Ltd.,

ADR (Israel) | | 59,400 | | | 3,368,574 |

| | | | |

|

|

| | | | | | 21,458,656 |

| | | | |

|

|

Semiconductors & Semiconductor Equipment — 10.7% | | | | | |

Altera Corp.(a) | | 119,700 | | | 2,717,190 |

Analog Devices, Inc. | | 42,100 | | | 1,921,865 |

Applied Materials, Inc.(a) | | 82,700 | | | 1,856,615 |

Intel Corp. | | 262,000 | | | 8,436,400 |

KLA-Tencor Corp.(a) | | 60,000 | | | 3,520,200 |

SEE NOTES TO FINANCIAL STATEMENTS.

B1

| | | | |

| | |

| | |

| | |

| | | PRUDENTIAL’S GIBRALTAR FUND, INC. (Continued) | | |

| | |

| | |

SCHEDULE OF INVESTMENTS | December 31, 2003 |

| | | | | |

COMMON STOCKS (Continued) | | Shares

| | Value (Note 1)

|

Semiconductors & Semiconductor Equipment (cont’d.) | | | | | |

Marvell Technology Group, Ltd. (Bermuda)(a) | | 15,800 | | $ | 599,294 |

Texas Instruments, Inc. | | 199,400 | | | 5,858,372 |

| | | | |

|

|

| | | | | | 24,909,936 |

| | | | |

|

|

Software — 6.6% | | | | | |

Ascential Software Corp.(a) | | 11,140 | | | 288,860 |

Electronic Arts, Inc.(a) | | 49,800 | | | 2,379,444 |

Microsoft Corp. | | 239,000 | | | 6,582,060 |

PeopleSoft, Inc.(a) | | 82,700 | | | 1,885,560 |

SAP AG, ADR (Germany) | | 101,300 | | | 4,210,028 |

| | | | |

|

|

| | | | | | 15,345,952 |

| | | | |

|

|

Specialty Retail — 3.0% | | | | | |

Bed Bath & Beyond, Inc.(a) | | 119,400 | | | 5,175,990 |

CarMax, Inc.(a) | | 61,500 | | | 1,902,195 |

| | | | |

|

|

| | | | | | 7,078,185 |

| | | | |

|

|

Wireless Telecommunication Services — 1.3% |

Vodafone Group PLC, ADR (United Kingdom) | | 118,800 | | | 2,974,752 |

| | | | |

|

|

TOTAL LONG-TERM INVESTMENTS

(cost $191,417,512) | | | 226,938,665 |

| | | | |

|

|

| | | | | | | | |

Interest Rate

| | Maturity

Date

| | Principal Amount (000)

| | Value

(Note 1)

| |

| SHORT-TERM INVESTMENTS — 2.9% | |

Commercial Paper | |

American Express Credit Corp. | |

| 0.50% | | 1/2/04 | | $3,000 | | $ | 3,000,000 | |

General Electric Capital Corp. | |

| 0.75% | | 1/2/04 | | 3,694 | | | 3,694,000 | |

| | | | | | |

|

|

|

TOTAL SHORT-TERM INVESTMENTS

(cost $6,694,000) | | | 6,694,000 | |

| | | | | | |

|

|

|

TOTAL INVESTMENTS — 100.5%

(cost $198,111,512; Note 4) | | | 233,632,665 | |

LIABILITIES IN EXCESS OF OTHER

ASSETS — (0.5)% | | | (1,174,557 | ) |

| | | | | | |

|

|

|

NET ASSETS — 100% | | $ | 232,458,108 | |

| | | | | | |

|

|

|

The following abbreviation is used in portfolio descriptions:

| | |

| ADR | | American Depository Receipt |

| (a) | Non-income producing security. |

SEE NOTES TO FINANCIAL STATEMENTS.

B2

NOTES TO THE FINANCIAL STATEMENTS OF

PRUDENTIAL’S GIBRALTAR FUND, INC.

Prudential’s Gibraltar Fund, Inc. (the “Fund”) was originally incorporated in the State of Delaware on March 14, 1968 and was reincorporated in the State of Maryland effective May 1, 1997. It is registered as an open-end, diversified management investment company under the Investment Company Act of 1940, as amended. The investment objective of the fund is growth of capital to the extent compatible with a concern for preservation of principal by investing in common stocks and other securities convertible into common stock. The Fund was organized by The Prudential Insurance Company of America (“PICA”) to serve as the investment medium for the variable contract accounts of The Prudential Financial Security Program (“FSP”). The Fund does not sell its shares to the public. The accounts will redeem shares of the Fund to the extent necessary to provide benefits under the contracts or for such other purposes as may be consistent with the contracts.

| Note 1: | | Accounting Policies |

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Securities Valuation: Securities listed on a securities exchange are valued at the last sale price on such exchange on the day of valuation or, if there was no sale on such day, at the mean between the last reported bid and asked price, or at the last bid price on such day in the absence of an asked price. Securities that are actively traded via Nasdaq are valued at the official closing price as provided by Nasdaq. Securities traded in the over-the-counter market, including listed securities for which the primary market is believed by Prudential Investments LLC (“PI” or “Manager”) in consultation with the subadviser, to be over-the-counter, are valued at market value using prices provided by an independent pricing agent or principal market maker. Securities for which market quotations are not readily available, or whose values have been affected by events occurring after the close of the security’s foreign market and before the Fund’s normal pricing time, are valued at fair value in accordance with the Board of Directors’ approved fair valuation procedures.

Short-term securities which mature in sixty days or less are valued at amortized cost, which approximates market value. The amortized cost method involves valuing a security at its cost on the date of purchase and thereafter assuming a constant amortization to maturity of the difference between the principal amount due at maturity and cost. Short-term securities which mature in more than sixty days are valued at current market quotations.

Securities Transactions and Net Investment Income: Securities transactions are recorded on the trade date. Realized and unrealized gains and losses from security and currency transactions are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date. Interest income, including amortization of premium and accretion of discount on debt securities, as required, is recorded on the accrual basis.

Custody Fee Credits: The Fund has an arrangement with its custodian bank, whereby uninvested monies earn credits which reduce the fees charged by the custodian. Such custody fee credits are presented as a reduction of gross expenses in the accompanying statement of operations.

Dividends and Distributions: The Fund expects to pay dividends of net investment income semi-annually and distributions of net realized capital gains, if any, at least annually. Dividends and distributions to shareholders, which are determined in accordance with federal income tax regulations and which may differ from generally accepted accounting principles, are recorded on the ex-dividend date. Permanent book/tax differences relating to income and gains are reclassified amongst undistributed net investment income, accumulated net realized gain or loss and paid-in capital in excess of par, as appropriate.

Taxes: It is the Fund’s policy to continue to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable net income and capital gains, if any, to its shareholders. Therefore, no federal income tax provision is required.

Withholding taxes on foreign dividends are recorded net of receivable amounts, at the time the related income is earned.

Estimates: The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from these estimates.

C1

| Note 2: | | Management Fee Agreement |

The Fund has a management agreement with Prudential Investments LLC (“PI”). Pursuant to this agreement, PI has responsibility for all investment advisory services and supervises the subadviser’s performance of such services. PI has entered into a subadvisory agreement with Jennison Associates LLC (“Jennison”). The subadvisory agreement provides that Jennison will furnish investment advisory services in connection with the management of the Fund. PI pays for the services of Jennison, compensation of officers of the Fund, costs related to shareholder reporting, occupancy and certain clerical and administrative expenses of the Fund. The Fund bears all other costs and expenses.

The management fee paid to PI is computed daily and payable monthly, at an annual rate of 0.55 of 1% of the Fund’s average daily net assets.

The Fund has a distribution agreement with Prudential Investment Series LLC (“PIMS”) which acts as distributor of the shares of the Fund. No distribution or Service Fees are paid to PIMS as distributor of Shares of the Fund.

PI, PICA, PIMS and Jennison are indirect, wholly-owned subsidiaries of Prudential Financial, Inc.

| Note 3: | | Portfolio Securities |

Purchases and sales of investment securities, other than short-term investments, for year ended December 31, 2003 aggregated $162,451,548 and $179,396,791, respectively.

| Note 4: | | Distributions and Tax Information |

The United States federal income tax basis of the Fund’s investments and the net unrealized appreciation as of December 31, 2003 were as follows:

| | | | | | |

Tax Basis

| | Appreciation

| | Depreciation

| | Net Unrealized

Appreciation

|

$201,671,226 | | $34,496,114 | | $2,534,675 | | $31,961,439 |

The difference between book basis and tax basis is attributable to deferred losses on wash sales.

The tax character of dividends paid, as reflected in the Statement of Changes in Net Assets, was $485,320 of ordinary income for the year ended December 31, 2003 and $2,142,494 of ordinary income for the year ended December 31, 2002.

As of December 31, 2003, the accumulated undistributed earnings on a tax basis was $66,802 of ordinary income.

For federal income tax purposes, the Fund had a capital loss carryforward at December 31, 2003 of approximately $94,463,000 of which, $26,559,000 expires in 2009, $54,968,000 expires in 2010 and $12,936,000 expires in 2011. Accordingly, no capital gains distributions are expected to be paid to shareholders until net gains have been realized in excess of such carryforward.

C2

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| | | Prudential’s Gibraltar Fund, Inc.

| |

| | | Year Ended

December 31,

| |

| | | 2003

| | | 2002

| | | 2001

| | | 2000

| | | 1999

| |

Per Share Operating Performance: | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, beginning of year | | $ | 5.69 | | | $ | 7.79 | | | $ | 9.99 | | | $ | 15.67 | | | $ | 12.43 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income From Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.02 | | | | 0.06 | | | | 0.08 | | | | 0.09 | | | | 0.10 | |

Net realized and unrealized gains (losses) on investments | | | 1.69 | | | | (2.10 | ) | | | (1.69 | ) | | | 0.25 | | | | 4.57 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total from investment operations | | | 1.71 | | | | (2.04 | ) | | | (1.61 | ) | | | 0.34 | | | | 4.67 | |

| | |

|

|

| |

|

|

| |

|

|

| �� |

|

|

| |

|

|

|

Less Dividends & Distributions: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.02 | ) | | | (0.06 | ) | | | (0.08 | ) | | | (0.09 | ) | | | (0.09 | ) |

Distributions from net realized gains | | | — | | | | — | | | | (0.05 | ) | | | (5.93 | ) | | | (1.34 | ) |

Tax return of capital distributions | | | — | | | | — | | | | (0.46 | ) | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total distributions | | | (0.02 | ) | | | (0.06 | ) | | | (0.59 | ) | | | (6.02 | ) | | | (1.43 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net Asset Value, end of year | | $ | 7.38 | | | $ | 5.69 | | | $ | 7.79 | | | $ | 9.99 | | | $ | 15.67 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Investment Return(a) | | | 29.99 | % | | | (26.23 | )% | | | (16.45 | )% | | | 1.59 | % | | | 38.92 | % |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (in millions) | | $ | 232.5 | | | $ | 200.2 | | | $ | 298.0 | | | $ | 423.5 | | | $ | 451.3 | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 0.63 | % | | | 0.23 | % | | | 0.13 | % | | | 0.13 | % | | | 0.13 | % |

Net investment income | | | 0.26 | % | | | 0.87 | % | | | 0.87 | % | | | 0.57 | % | | | 0.63 | % |

Portfolio turnover rate | | | 80 | % | | | 89 | % | | | 69 | % | | | 82 | % | | | 39 | % |

| (a) | Total investment return is calculated assuming a purchase of shares on the first day and a sale on the last day of each year reported and includes reinvestment of dividends and distributions. |

SEE NOTES TO FINANCIAL STATEMENTS.

D1

REPORT OF INDEPENDENT AUDITORS

TO THE BOARD OF DIRECTORS AND SHAREHOLDERS OF PRUDENTIAL’S GIBRALTAR FUND, INC.:

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Prudential’s Gibraltar Fund, Inc. (the “Fund”) at December 31, 2003, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with auditing standards generally accepted in the United States of America, which require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2003 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

New York, New York

February 13, 2004

Tax Information (Unaudited)

We are required by the Internal Revenue Code to advise you within 60 days of the Fund’s fiscal year end (December 31, 2003) as to the federal tax status of dividends paid by the Fund during such fiscal year. Accordingly, we are advising you that in the fiscal year ended December 31, 2003, the Fund paid $0.02 per share from ordinary income. Further, we wish to advise you that all of the ordinary income dividends paid in the fiscal year ended November 30, 2003, qualified for the corporate dividends received deduction available to corporate taxpayers.

The Fund intends to designate the maximum amount of dividends, qualified for the reduced tax rate under the Jobs and Growth Tax Relief Reconciliation Act of 2003, allowable.

E1

Supplemental Proxy Information (Unaudited)

A special meeting of shareholders was held on July 17, 2003. At such meeting the shareholders approved the following proposals:

1) To approve the election of ten (10) Directors to the Board of Directors, as follows:

Saul K. Fenster

Delayne Dedrick Gold

Robert F. Gunia

W. Scott McDonald, Jr.

Thomas T. Mooney

Thomas M. O’Brien

David R. Odenath

John A. Pileski

F. Don Schwartz

Louis A. Weil, III

The results of the proxy solicitation on the preceding matter were:

| | | | | | | | |

Matter

| | Votes For

| | Votes

Against

| | Votes

Withheld

| | Abstentions

|

Saul K. Fenster | | 28,837,333 | | — | | 1,037,064 | | — |

Delayne Dedrick Gold | | 28,878,022 | | — | | 996,375 | | — |

Robert F. Gunia | | 28,853,191 | | — | | 1,021,206 | | — |

W. Scott McDonald, Jr. | | 28,887,274 | | — | | 987,123 | | |

Thomas T. Mooney | | 28,886,094 | | — | | 988,303 | | — |

Thomas M. O’Brien | | 28,886,094 | | — | | 988,303 | | — |

David R. Odenath | | 28,849,610 | | — | | 1,024,787 | | — |

John A. Pileski | | 28,870,593 | | — | | 1,003,804 | | — |

F. Don Schwartz | | 28,877,711 | | — | | 996,686 | | — |

Louis A. Weil, III | | 28,876,866 | | — | | 997,531 | | — |

| 2A) | To approve amendments to the Fund’s Articles of Incorporation, relating to: future charter amendments |

| | | | |

Votes For

| | Votes Against

| | Abstentions

|

26,923,325 | | 1,227,293 | | 1,723,779 |

| 2B) | To approve amendments to the Fund’s Articles of Incorporation, relating to: redemption provisions |

| | | | |

Votes For

| | Votes Against

| | Abstentions

|

26,802,550 | | 1,251,836 | | 1,820,011 |

| 2C) | To approve amendments to the Fund’s Articles of Incorporation, relating to: quorum requirements |

| | | | |

Votes For

| | Votes Against

| | Abstentions

|

27,205,907 | | 1,003,825 | | 1,664,665 |

| 2D) | To approve amendments to the Fund’s Articles of Incorporation, relating to: master/feeder transactions |

| | | | |

Votes For

| | Votes Against

| | Abstentions

|

26,388,834 | | 1,560,433 | | 1,925,130 |

| 2E) | To approve amendments to the Fund’s Articles of Incorporation, relating to: determinations made by the board and limitations on liability |

| | | | |

Votes For

| | Votes Against

| | Abstentions

|

26,312,396 | | 1,835,782 | | 1,726,219 |

| 2F) | To approve amendments to the Fund’s Articles of Incorporation, relating to: indemnification |

| | | | |

Votes For

| | Votes Against

| | Abstentions

|

26,120,848 | | 1,591,423 | | 2,162,126 |

E2

MANAGEMENT OF THE FUND

(Unaudited)

Information pertaining to the Directors of the Fund is set forth below. Directors who are not deemed to be “interested persons” of the Fund as defined in the Investment Company Act are referred to as “Independent Directors.” Directors who are deemed to be “interested persons” of the Fund are referred to as “Interested Directors.” “Fund Complex” consists of the Fund and any other investment companies managed by PI.

| | | | | | |

Name, Address**, and Age | | Position with Fund* Term of Office*** Length of Time Served | | Number of Portfolios In Fund Complex

Overseen by Director | | Other Directorships Held by the Director**** |

|

| | | |

Saul K. Fenster, Ph.D. ( 70) | | Director, Since 1985 | | 81 | | Member (since 2000), Board of Directors of IDT Corporation |

|

| Principal Occupations During Past 5 Years – President Emeritus of New Jersey Institute of Technology (since 2002); formerly President (1978-2002) of New Jersey Institute of Technology; Commissioner (1998-2002) of the Middle States Association Commission on Higher Education; Commissioner (1985-2002) of the New Jersey Commission on Science and Technology; Director (since 1998) Society of Manufacturing Engineering Education Foundation, Director (since 1995) of Prosperity New Jersey; formerly a director or trustee of Liberty Science Center, Research and Development Council of New Jersey, New Jersey State Chamber of Commerce, and National Action Council for Minorities in Engineering. |

|

| | | |

Delayne Dedrick Gold (65) | | Director, Since 2001 | | 85 | | — |

|

| Principal Occupations During Past 5 Years – Marketing Consultant (1982-present); formerly Senior Vice President and Member of the Board of Directors, Prudential Bache Securities, Inc. |

|

| | | |

W. Scott McDonald, Jr. (66) | | Director, Since 1985 | | 81 | | — |

|

| Principal Occupations During Past 5 Years – Management Consultant (since 1997) at Kaludis Consulting Group, Inc. (company serving higher education); Formerly, principal (1995-1997), Scott McDonald & Associates, Chief Operating Officer (1991-1995), Fairleigh Dickinson University, Executive Vice President and Chief Operating Officer (1975-1991), Drew University, interim President (1988-1990), Drew University and former Director of School, College and University Underwriters Ltd. |

|

| | | |

Thomas T. Mooney (62) | | Director, Since 2003 | | 81 | | Director (since 1988) of The High Yield Plus Fund, Inc. |

|

| Principal Occupations During Past 5 Years – Chief Executive Officer, the Rochester Business Alliance, formerly President of the Greater Rochester Metro Chamber of Commerce, Rochester City Manager; formerly Deputy Monroe County Executive; Director of Blue Cross of Rochester and Executive Service Corps of Rochester; Director of the Rochester Individual Practice Association; Director of Rural Metro Ambulance Rochester (since 2003). |

|

| | | |

Thomas M. O’Brien (53) | | Director, Since 2003 | | 78 | | Director (December 1996-May 2000) of North Fork Bank; Director (since May 2000) of Atlantic Bank of New York. |

|

| Principal Occupations During Past 5 Years – President and Chief Executive Officer (since May 2000) of Atlantic Bank of New York; Vice Chairman (January 1997-April 2000) of North Fork Bank; President and Chief Executive Officer (December 1984-December 1996) of North Side Savings Bank. |

|

| | | |

John A. Pileski (64) | | Director, Since 2003 | | 78 | | Director (since April 2001) of New York Community Bank; Director (since January 1997) of Queens Museum of Art; Director (since May 1980) of Surf Club of Quogue, Inc. |

|

| Principal Occupations During Past 5 Years – Retired since June 2000; Tax Partner (July 1974-June 2000) of KPMG, LLP. |

|

| | | |

F. Don Schwartz (68) | | Director, Since 2003 | | 78 | | — |

|

| Principal Occupations During Past 5 Years – Management Consultant (since April 1985). |

|

| | | |

Louis A. Weil, III (62) | | Director, Since 2003 | | 80 | | — |

|

| Principal Occupations During Past 5 Years – Formerly Chairman (January 1999-July 2000), President and Chief Executive Officer (January 1996-July 2000) and Director (since September 1991) of Central Newspapers, Inc.; formerly Chairman of the Board (January 1996-July 2000), Publisher and Chief Executive Officer (August 1991-December 1995) of Phoenix Newspapers, Inc. |

|

F1

Interested Directors

| | | | | | |

Name, Address**, and Age | | Position with Fund* Term of Office***

Length of Time Served | | Number of Portfolios In

Fund Complex Overseen by Director | | Other Directorships

Held by the Director**** |

|

| | | |

*David R. Odenath (46) | | President and Director Since 1999 | | 79 | | — |

|

| Principal Occupations During Past 5 Years – President of Prudential Annuities (since August 2002); Executive Vice President (since May 2003) of American Skandia Investment Services, Inc.; Chief Executive Officer and Director (since May 2003) of American Skandia Life Assurance Corporation, American Skandia Information Services and Technology Corporation and Skandia U.S. Inc.; President, Chief Executive Officer and Director (since May 2003) of American Skandia Marketing, Inc.; Formerly President, Chief Executive Officer, Chief Operating Officer and Officer-In-Charge (1999-2003) of Prudential Investments LLC (PI); Senior Vice President (since June 1999) of The Prudential Insurance Company of America (Prudential Insurance); formerly Senior Vice President (August 1993-May 1999) of PaineWebber Group, Inc. |

|

| | | |

*Robert F. Gunia (57) | | Vice President and Director since 2003 | | 179 | | Vice President and Director (since May 1989) and Treasurer (since 1999) of The Asia Pacific Fund, Inc. |

|

| Principal Occupations During Past 5 Years – Chief Administrative Officer (since June 1999) of PI; Executive Vice President and Treasurer (since January 1996) of PI; President (since April 1999) of Prudential Investment Management Services LLC (PIMS); Corporate Vice President (since September 1997) of Prudential Insurance; Director, Executive Vice President and Chief Administrative Officer (since May 2003) of American Skandia Investment Services, Inc., American Skandia Advisory Services, Inc., and American Skandia Fund Services, Inc.; President (since April 1999) of Prudential Investment Management Services LLC; Executive Vice President (since March 1999) and Treasurer (since May 2000) of Prudential Mutual Fund Services LLC; formerly Senior Vice President (March 1987-May 1999) of Prudential Securities Incorporated (Prudential Securities). |

|

|

| Officers |

Name, Address**, and Age | | Position with Fund* Term of Office*** Length of Time Served | | Principal Occupations During Past 5 Years |

|

| | |

Grace C. Torres ( 44 ) | | Treasurer and Principal Financial and Accounting Officer Since 1997 | | Senior Vice President (since January 2000) of PI; Senior Vice President and Assistant Treasurer (since

May 2003) of American Skandia Investment Services, Inc. and American Skandia Advisory Services,

Inc.; formerly First Vice President (December 1996-January 2000) of PI and First Vice President

(March 1993-1999) of Prudential Securities. |

|

| | |

Jeffrey M. Scarbel (40) | | Assistant Treasurer Since 2000 | | Vice President (since November 2000) of PI; formerly Director (October 1996-November 2000) of PI. |

|

| | |

Jonathan D. Shain (45) | | Secretary Since 2001 | | Vice President and Corporate Counsel (since August 1998) of Prudential Insurance; Vice President

and Assistant Secretary (since May 2003) of American Skandia Investment Services, Inc. and

American Skandia Fund Services, Inc.; formerly Attorney with Fleet Bank, N.A. (January 1997-July

1998). |

|

| | |

Marguerite E. H. Morrison (47) | | Assistant Secretary Since 2002; Chief Legal Officer Since 2003 | | Vice President and Chief Legal Officer-Mutual Funds and Unit Investment Trusts (since August 2000)

of Prudential Insurance; Senior Vice President and Secretary (since April 2003) of PI; Senior Vice

President and Secretary (since May 2003) of American Skandia Investment Services, Inc., American

Skandia Advisory Services, Inc., and American Skandia Fund Services, Inc.; Vice President and

Assistant Secretary of PIMS (since October 2001), previously Senior Vice President and Assistant

Secretary (February 2001-April 2003) of PI, Vice President and Associate General Counsel

(December 1996-February 2001) of PI. |

|

| | |

Edward P. Macdonald (36) | | Assistant Secretary Since 2003 | | Vice President and Assistant Secretary (since May 2003) of American Skandia Investment Services,

Inc.; Chief Counsel, Investment Management of American Skandia, Inc. (ASI) (since July 2002);

Senior Counsel, Securities of ASI (September 2000-June 2002); Counsel of ASI (December 1999-

August 2000); Senior Associate of Counsel of ASI (April 1999-December 1999); Branch Chief, Senior

Counsel and Attorney at the U.S. Securities and Exchange Commission (October 1994-April 1999). |

|

| | |

Maryanne Ryan (39 ) | | Anti-Money Laundering Compliance Officer Since 2002 | | Vice President, Prudential Insurance (since November 1998), First Vice President Prudential Securities

(March 1997-May 1998); Anti-Money Laundering Compliance Officer (since 2003) of American

Skandia Investment Services, Inc., American Skandia Advisory Services, Inc. and American Skandia

Marketing, Inc. |

|

* “Interested” Director, as defined in the Investment Company Act, by reason of employment with the Manager (as defined below), and/or the Distributor (as defined below).

** Unless otherwise noted, the address of the Directors and Officers is c/o: Prudential Investments LLC, Gateway Center Three, 100 Mulberry Street, Newark, New Jersey 07102.

*** There is no set term of office for Directors and Officers. The Independent Directors have adopted a retirement policy, which calls for the retirement of Directors on December 31 of the year in which they reach the age of 75. The table shows how long they have served as Director and/or Officer.

**** This column includes only directorships of companies required to register, or file reports with the SEC under the Securities Exchange Act of 1934 (i.e., “public companies”) or other investment companies registered under the Investment Company Act.

F2

This report is not authorized for distribution unless preceded or accompanied by a current prospectus. The prospectus contains complete information regarding risks, charges, and expenses, and should be read carefully before you invest or send money.

Variable annuities contain exclusions, limitations, reductions of benefits, and terms for keeping them in force. For costs and complete details, refer to the prospectus or contact your licensed financial professional.

For service-related questions, please contact the Annuity Service Center at (888) 778-2888.

The 2003 Audited Financial Statements of The Prudential Insurance Company of America will be available commencing April 30, 2004. You may call (888) 778-2888 to obtain a free copy of the Audited Financial Statements.

Prudential Financial and the Rock logo are registered service marks of The Prudential Insurance Company of America, Newark, NJ, and its affiliates.

| | |

Prudential Annuity Service Center

PO Box 13467

Philadelphia, PA 19101 | | Presorted

Standard

U.S. Postage

PAID

Prudential |

| | | | |

| IFS-A073249 FSP AR Ed. 01/30/2004 | |  | | |

Item 2 – Code of Ethics — See Exhibit (a)

As of the end of the period covered by this report, the registrant has adopted a code of ethics (the “Section 406 Standards for Investment Companies – Ethical Standards for Principal Executive and Financial Officers”) that applies to the registrant’s Principal Executive Officer and Principal Financial Officer; the registrant’s Principal Financial Officer also serves as the Principal Accounting Officer.

The registrant hereby undertakes to provide any person, without charge, upon request, a copy of the code of ethics. To request a copy of the code of ethics, contact the registrant 973-802-6469, and ask for a copy of the Section 406 Standards for Investment Companies – Ethical Standards for Principal Executive and Financial Officers.

Item 3 – Audit Committee Financial Expert –

The registrant’s Board has determined that Mr. John A. Pileski, member of the Board’s Audit Committee is an “audit committee financial expert,” and that he is “independent,” for purposes of this Item.

Item 4 – Principal Accountant Fees and Services –

Form N-CSR, Item 4. Principal Accountant Fees and Services

For each of the fiscal years ended December 31, 2003 and December 31, 2002 PricewaterhouseCoopers LLP (“PwC”), the Registrant’s principal accountant, billed the Registrant $27,000 for professional services rendered for the audit of the Registrant’s annual financial statements or services that are normally provided in connection with statutory and regulatory filings.

None.

None.

None.

(e) (1) Audit Committee Pre-Approval Policies and Procedures

THE PRUDENTIAL MUTUAL FUNDS

AUDIT COMMITTEE POLICY

on

Pre-Approval of Services Provided by the Independent Accountants

The Audit Committee of each Prudential Mutual Fund is charged with the responsibility to monitor the independence of the Fund’s independent accountants. As part of this responsibility, the Audit Committee must pre-approve any independent accounting firm’s engagement to render audit and/or permissible non-audit services, as required by law. In evaluating a proposed engagement of the independent accountants, the Audit Committee will assess the effect that the engagement might reasonably be expected to have on the accountant’s independence. The Committee’s evaluation will be based on:

| | • | a review of the nature of the professional services expected to be provided, |

| | • | a review of the safeguards put into place by the accounting firm to safeguard independence, and |

| | • | periodic meetings with the accounting firm. |

Policy for Audit and Non-Audit Services Provided to the Funds

On an annual basis, the scope of audits for each Fund, audit fees and expenses, and audit-related and non-audit services (and fees proposed in respect thereof) proposed to be performed by the Fund’s independent accountants will be presented by the Treasurer and the independent accountants to the Audit Committee for review and, as appropriate, approval prior to the initiation of such services. Such presentation shall be accompanied by confirmation by both the Treasurer and the independent accountants that the proposed services will not adversely affect the independence of the independent accountants. Proposed services shall be described in sufficient detail to enable the Audit Committee to assess the appropriateness of such services and fees, and the compatibility of the provision of such services with the auditor’s independence. The Committee shall receive periodic reports on the progress of the audit and other services which are approved by the Committee or by the Committee Chair pursuant to authority delegated in this Policy.

The categories of services enumerated under “Audit Services”, “Audit-related Services”, and “Tax Services” are intended to provide guidance to the Treasurer and the independent accountants as to those categories of services which the Committee believes are generally consistent with the independence of the independent accountants and which the Committee (or the Committee Chair) would expect upon the presentation of specific proposals to pre-approve.

The enumerated categories are not intended as an exclusive list of audit, audit-related or tax services which the Committee (or the Committee Chair) would consider for pre-approval.

Audit Services

The following categories of audit services are considered to be consistent with the role of the Fund’s independent accountants

| | Ø | Annual Fund financial statement audits |

| | Ø | Seed audits (related to new product filings, as required) |

| | Ø | SEC and regulatory filings and consents |

Audit-related Services

The following categories of audit-related services are considered to be consistent with the role of the Fund’s independent accountants:

| | Ø | Accounting consultations |

| | Ø | Fund merger support services |

| | Ø | Agreed Upon Procedure Reports |

| | Ø | Other Internal Control Reports |

Individual audit-related services that fall within one of these categories and are not presented to the Audit Committee as part of the annual pre-approval process will be subject to pre-approval by the Committee Chair (or any other Committee member on whom this responsibility has been delegated) so long as the estimated fee for those services does not exceed $50,000.

Tax Services

The following categories of tax services are considered to be consistent with the role of the Fund’s independent accountants:

| | Ø | Tax compliance services related to the filing or amendment of the following: |

| | n | Federal, state and local income tax compliance; and, |

| | n | Sales and use tax compliance |

| | Ø | Timely RIC qualification reviews |

| | Ø | Tax distribution analysis and planning |

| | Ø | Tax authority examination services |

| | Ø | Tax appeals support services |

| | Ø | Accounting methods studies |

| | Ø | Fund merger support services |

| | Ø | Tax consulting services and related projects |

Individual tax services that fall within one of these categories and are not presented to the Audit Committee as part of the annual pre-approval process will be subject to pre-approval by the

Committee Chair (or any other Committee member on whom this responsibility has been delegated) so long as the estimated fee for those services does not exceed $50,000.

Other Non-audit Services

Certain non-audit services that the independent accountants are legally permitted to render will be subject to pre-approval by the Committee or by one or more Committee members to whom the Committee has delegated this authority and who will report to the full Committee any pre-approval decisions made pursuant to this Policy. Non-audit services presented for pre-approval pursuant to this paragraph will be accompanied by a confirmation from both the Treasurer and the independent accountants that the proposed services will not adversely affect the independence of the independent accountants.

Proscribed Services

The Fund’s independent accountants will not render services in the following categories of non-audit services:

| | Ø | Bookkeeping or other services related to the accounting records or financial statements of the Fund |

| | Ø | Financial information systems design and implementation |

| | Ø | Appraisal or valuation services, fairness opinions, or contribution-in-kind reports |

| | Ø | Internal audit outsourcing services |

| | Ø | Management functions or human resources |

| | Ø | Broker or dealer, investment adviser, or investment banking services |

| | Ø | Legal services and expert services unrelated to the audit |

| | Ø | Any other service that the Public Company Accounting Oversight Board determines, by regulation, is impermissible. |

Pre-approval of Non-Audit Services Provided to Other Entities Within the Prudential Fund Complex

Certain non-audit services provided to Prudential Investments LLC or any of its affiliates that also provide ongoing services to the Prudential Mutual Funds will be subject to pre-approval by the Audit Committee. The only non-audit services provided to these entities that will require pre-approval are those related directly to the operations and financial reporting of the Funds. Individual projects that are not presented to the Audit Committee as part of the annual pre-approval process, will be subject to pre-approval by the Committee Chair (or any other Committee member on whom this responsibility has been delegated) so long as the estimated fee for those services does not exceed $50,000. Services presented for pre-approval pursuant to this paragraph will be accompanied by a confirmation from both the Treasurer and the independent accountants that the proposed services will not adversely affect the independence of the independent accountants.

Although the Audit Committee will not pre-approve all services provided to Prudential Investments LLC and its affiliates, the Committee will receive an annual report from the Fund’s independent accounting firm showing the aggregate fees for all services provided to Prudential Investments and its affiliates.

(e)-(2) Percentage of services referred to in 4(b)- (4)(d) that were approved by the audit committee – Not applicable.

| (f) | Percentage of hours expended attributable to work performed by other than full time employees of principal accountant if greater than 50%. |

Not applicable.

N/A to Registrant. The aggregate non-audit fees billed by PwC for services rendered to the registrant’s investment adviser and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant for each of the last two fiscal years 2003 and 2002 were $1,715,979 and $1,601,295 respectively.

(h) Principal Accountants Independence

The Registrant’s Audit Committee has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to Rule 2-01(c)(7)(ii) of Regulation S-X is compatible with maintaining PwC’s independence.

Item 5 – Reserved

Item 6 – Reserved

Item 7 – Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies – Not required in this filing

Item 8 – Reserved

Item 9 – Controls and Procedures

| | (a) | It is the conclusion of the registrant’s principal executive officer and principal financial officer that the effectiveness of the registrant’s current disclosure controls and procedures (such disclosure controls and procedures having been evaluated within 90 days of the date of this filing) provide reasonable assurance that the information required to be disclosed by the registrant has been recorded, processed, summarized and reported within the time period specified in the Commission’s rules and forms and that the information required to be disclosed by the registrant has been accumulated and communicated to the registrant’s principal executive officer and principal financial officer in order to allow timely decisions regarding required disclosure. |

| | (b) | There have been no significant changes in the registrant’s internal controls or in other factors that could significantly affect these controls subsequent to the date of their evaluation, including any corrective actions with regard to significant deficiencies and material weaknesses. |

Item 10 – Exhibits

| | (a) | Code of Ethics – attached hereto |

| | (b) | Certifications pursuant to Section 302 and 906 of the Sarbanes-Oxley Act – Attached hereto |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

(Registrant) | | Prudential’s Gibraltar Fund, Inc.

|

| |

| By (Signature and Title)* | | /s/ Jonathan D. Shain |

| |

|

| | Jonathan D. Shain |

| | Secretary |

| |

Date | | February 12, 2004

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | | | |

| |

| By (Signature and Title)* | | /s/ David R. Odenath |

| |

|

| | David R. Odenath |

| | President and Principal Executive Officer |

| |

Date | | February 12, 2004

|

| | | | |

| |

| By (Signature and Title)* | | /s/ Grace C. Torres

|

| | Grace C. Torres |

| | Treasurer and Principal Financial Officer |

| |

Date | | February 12, 2004

|

| * | Print the name and title of each signing officer under his or her signature. |