0000809593americanbeacon:AMERICANBEACONINDEXRUSSELL2000GROWTHINDEX7099AdditionalIndexMember2016-08-310000809593americanbeacon:C000110032Member2021-09-300000809593americanbeacon:AMERICANBEACONINDEXSP500TR7108BroadBasedIndexMember2023-07-310000809593americanbeacon:AMERICANBEACONINDEXRUSSELL1000VALUEINDEX7095AdditionalIndexMember2017-12-310000809593americanbeacon:AMERICANBEACONINDEXSP500TR6935BroadBasedIndexMember2020-10-310000809593americanbeacon:C000144088Member2022-06-300000809593americanbeacon:AMERICANBEACONINDEXSP500TR6725BroadBasedIndexMember2019-05-310000809593americanbeacon:AMERICANBEACONINDEXSP500TR6722BroadBasedIndexMember2022-07-310000809593americanbeacon:C000244411Memberamericanbeacon:FRTSRTop10COFFEECTIMember2024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-4984

AMERICAN BEACON FUNDS

(Exact name of registrant as specified in charter)

220 East Las Colinas Boulevard, Suite 1200

Irving, Texas 75039

(Address of principal executive offices)-(Zip code)

GREGORY J. STUMM, PRESIDENT

220 East Las Colinas Boulevard, Suite 1200

Irving, Texas 75039

(Name and address of agent for service)

Registrant’s telephone number, including area code: (817) 391-6100

Date of fiscal year end: December 31, 2024

Date of reporting period: December 31, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Shareholders

Stephens Small Cap Growth Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about American Beacon Stephens Small Cap Growth Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $138 | 1.28% |

|---|

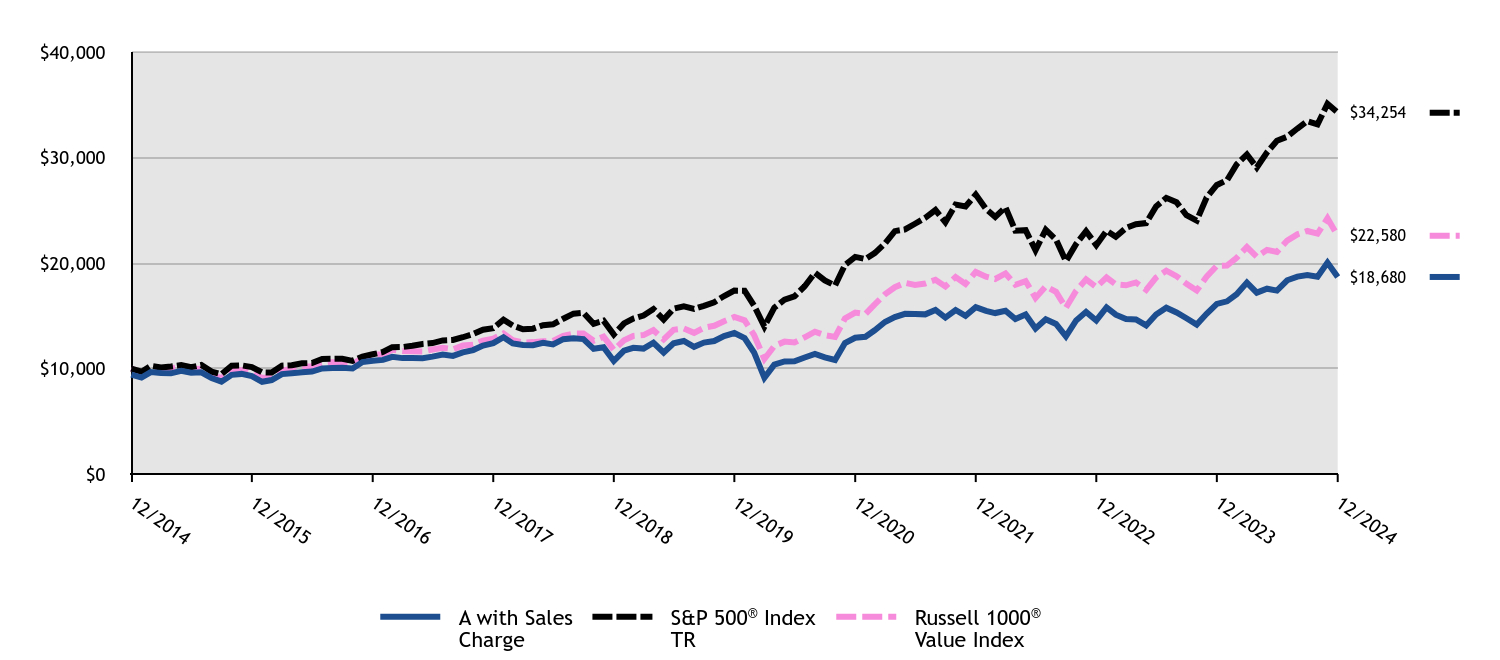

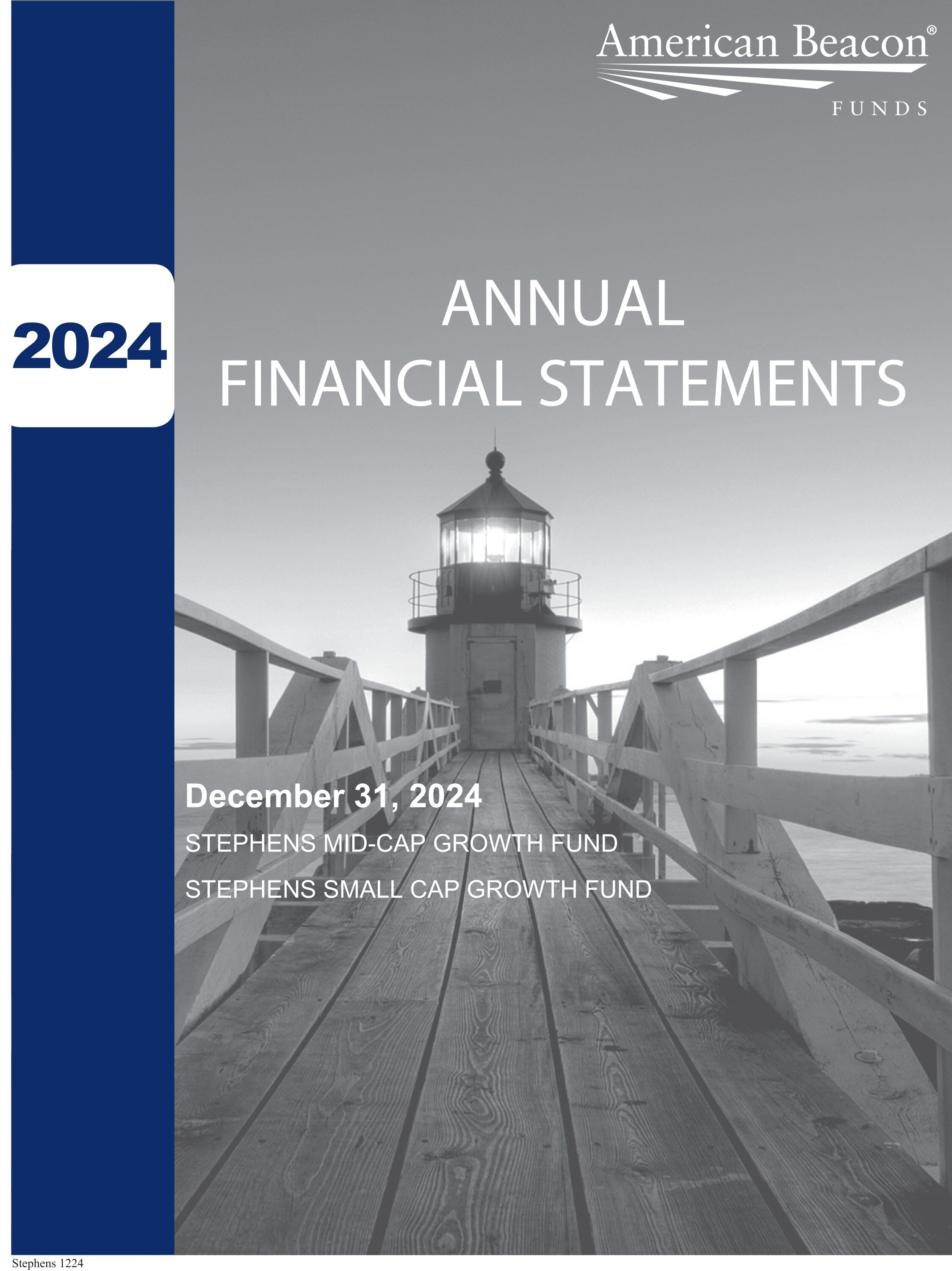

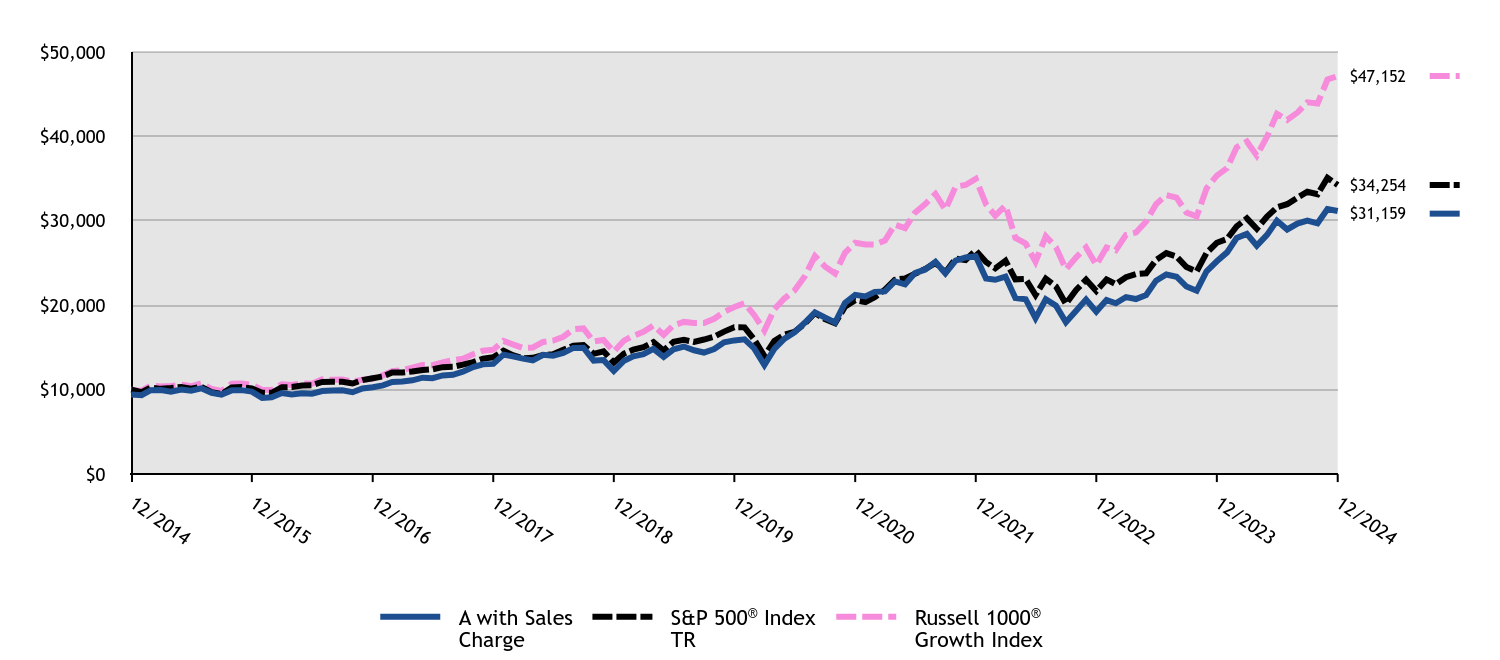

How did the Fund perform and what affected its performance?

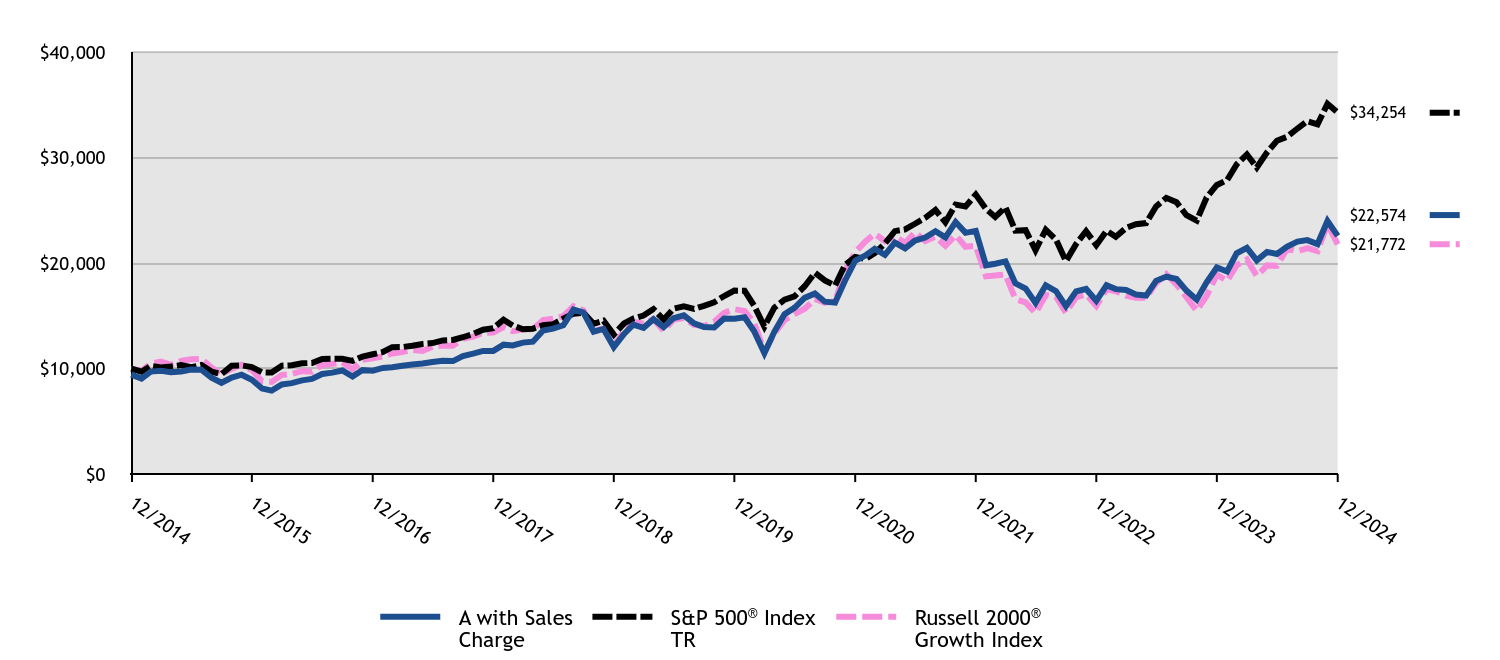

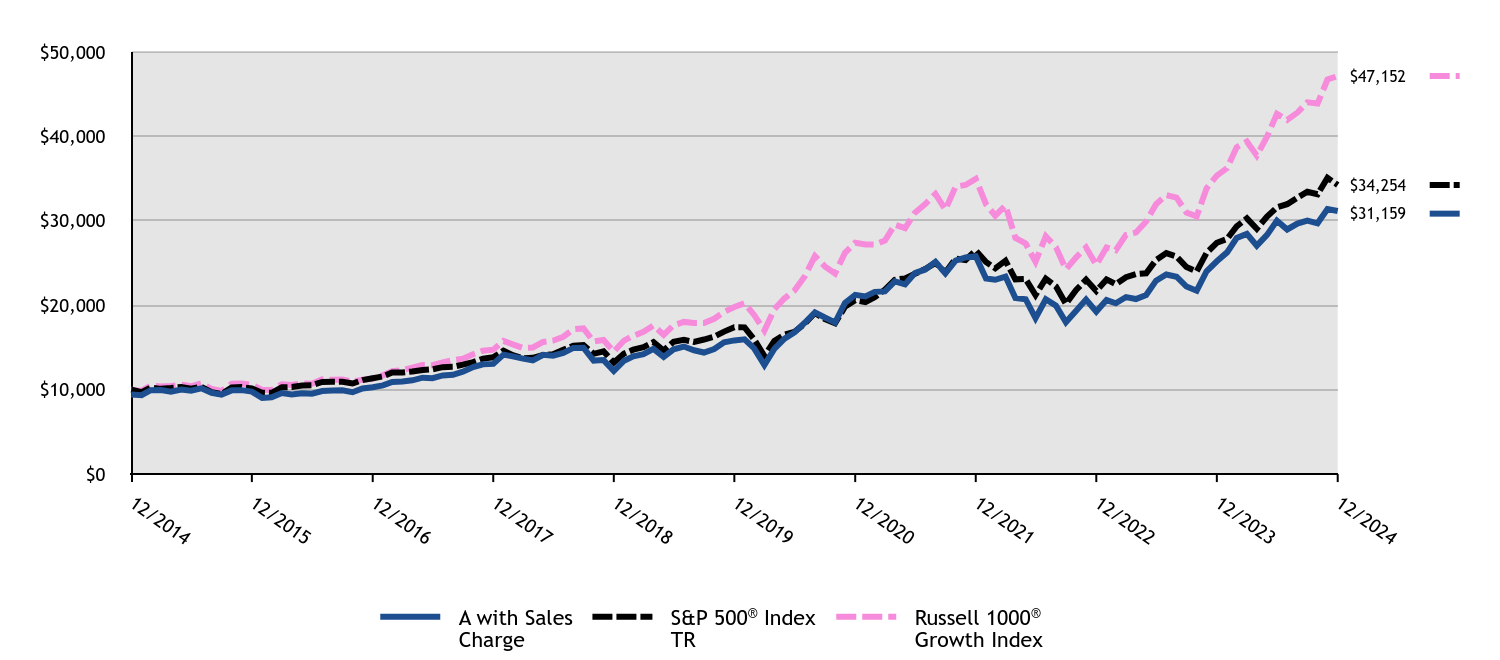

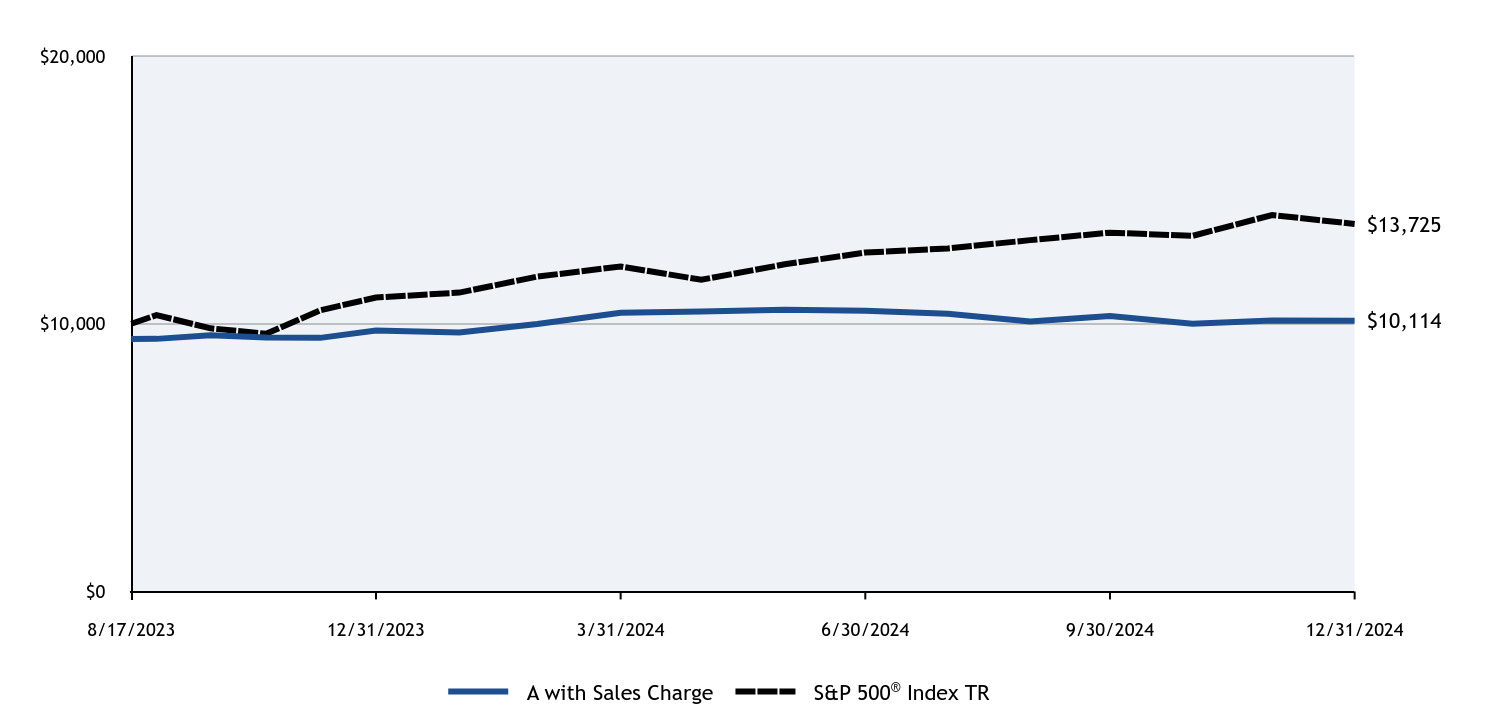

The A Class of the Fund returned 8.69% (with sales charges) and 15.31% (without sales charges) for the twelve months ended December 31, 2024, compared to the S&P 500 Index return of 25.02% and the Russell 2000 Growth Index return of 15.15%.

• Overall market performance during the period was driven by mega-cap growth companies, while the Fund focuses its investments on small capitalization companies.

• The Fund’s performance was positive in all sectors where it invested. Holdings in the Energy and Financials sectors contributed materially to the Fund’s outperformance of the Russell 2000® Growth Index, while holdings in the Information Technology sector detracted.

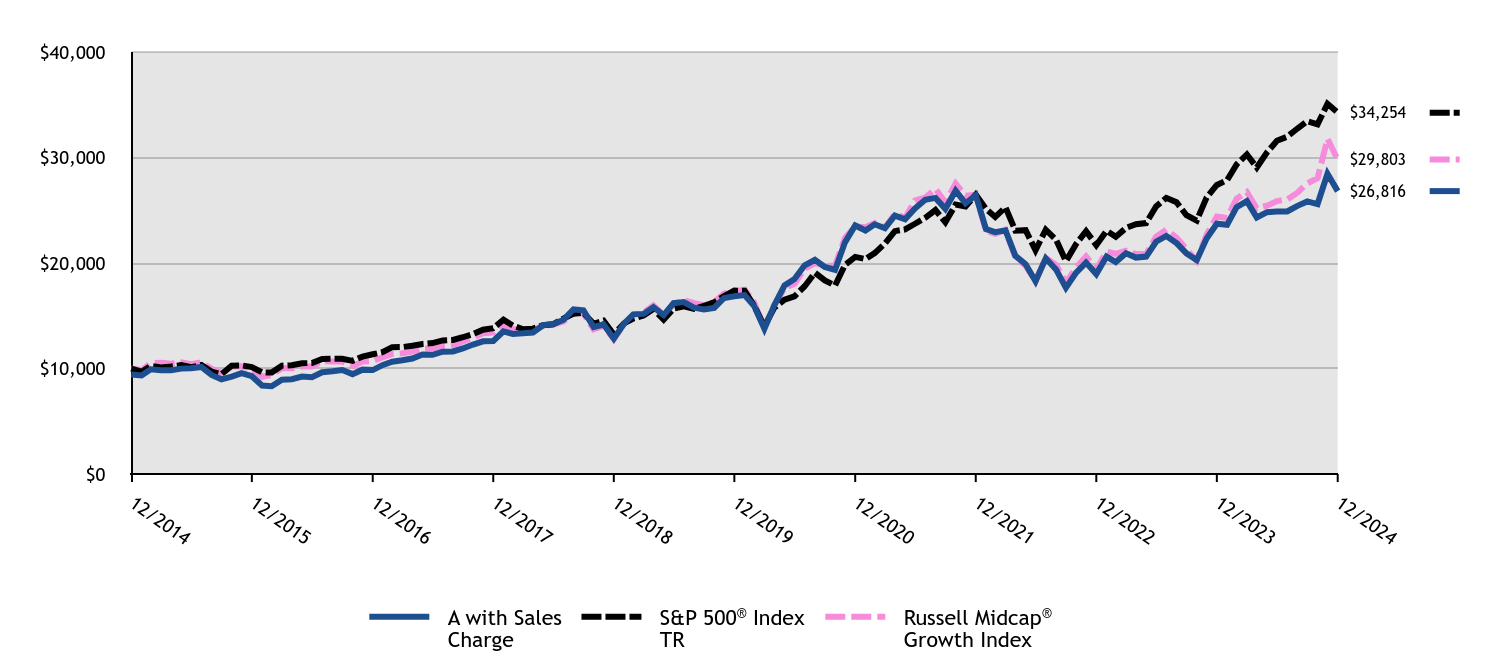

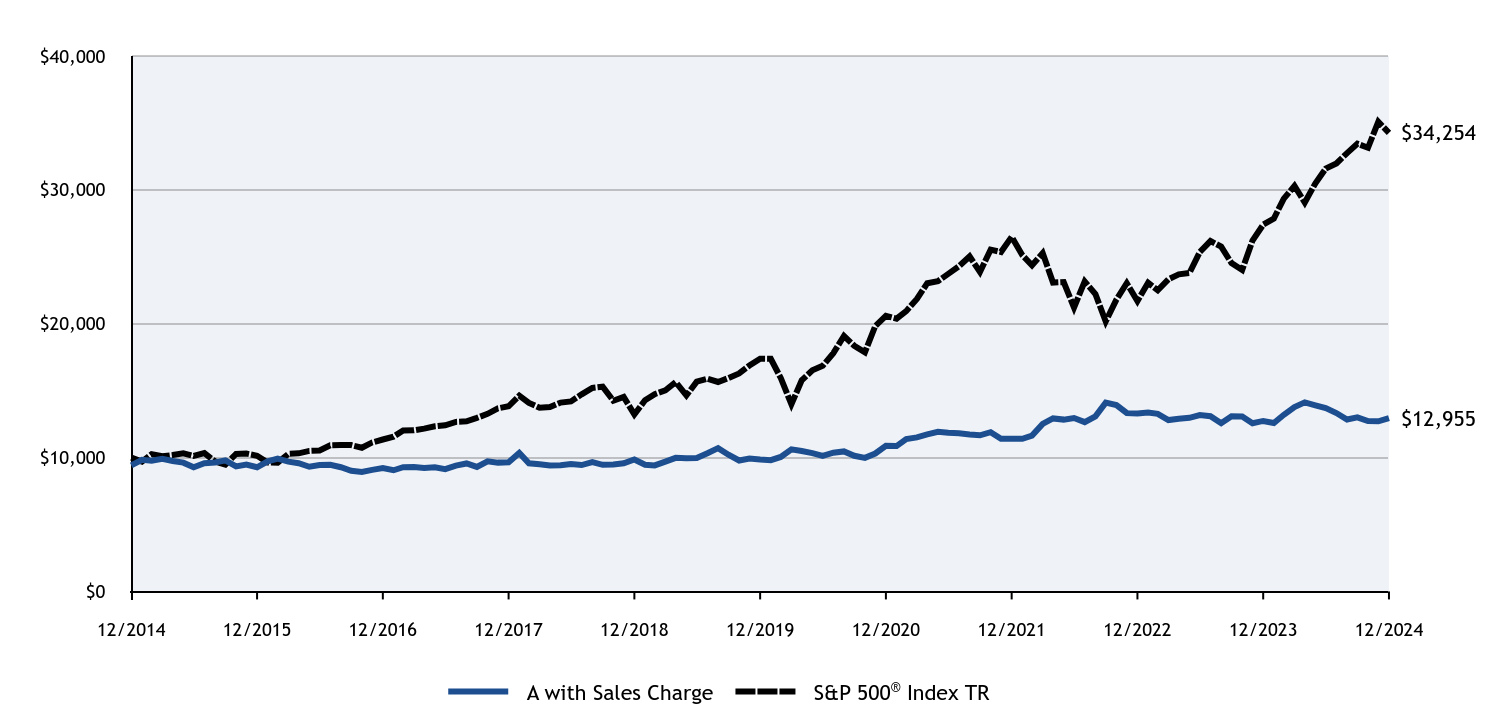

Cumulative Performance from December 31, 2014 through December 31, 2024

The initial investment, based on a $10,000 investment, is adjusted to reflect the maximum applicable sales charge, if any.

| A with Sales Charge | S&P 500® Index TR | Russell 2000® Growth Index |

|---|

| 12/2014 | $9,426 | $10,000 | $10,000 |

|---|

| 01/2015 | $9,046 | $9,700 | $9,772 |

|---|

| 02/2015 | $9,710 | $10,257 | $10,475 |

|---|

| 03/2015 | $9,789 | $10,095 | $10,663 |

|---|

| 04/2015 | $9,662 | $10,192 | $10,349 |

|---|

| 05/2015 | $9,716 | $10,323 | $10,730 |

|---|

| 06/2015 | $9,909 | $10,123 | $10,874 |

|---|

| 07/2015 | $9,897 | $10,335 | $10,918 |

|---|

| 08/2015 | $9,124 | $9,712 | $10,091 |

|---|

| 09/2015 | $8,653 | $9,471 | $9,453 |

|---|

| 10/2015 | $9,149 | $10,270 | $9,990 |

|---|

| 11/2015 | $9,414 | $10,301 | $10,356 |

|---|

| 12/2015 | $8,945 | $10,138 | $9,862 |

|---|

| 01/2016 | $8,107 | $9,635 | $8,793 |

|---|

| 02/2016 | $7,904 | $9,622 | $8,731 |

|---|

| 03/2016 | $8,488 | $10,275 | $9,400 |

|---|

| 04/2016 | $8,621 | $10,315 | $9,494 |

|---|

| 05/2016 | $8,881 | $10,500 | $9,750 |

|---|

| 06/2016 | $9,021 | $10,527 | $9,705 |

|---|

| 07/2016 | $9,490 | $10,915 | $10,339 |

|---|

| 08/2016 | $9,611 | $10,931 | $10,449 |

|---|

| 09/2016 | $9,820 | $10,933 | $10,600 |

|---|

| 10/2016 | $9,243 | $10,733 | $9,941 |

|---|

| 11/2016 | $9,864 | $11,131 | $10,830 |

|---|

| 12/2016 | $9,804 | $11,351 | $10,978 |

|---|

| 01/2017 | $10,060 | $11,566 | $11,156 |

|---|

| 02/2017 | $10,124 | $12,025 | $11,430 |

|---|

| 03/2017 | $10,259 | $12,039 | $11,565 |

|---|

| 04/2017 | $10,393 | $12,163 | $11,778 |

|---|

| 05/2017 | $10,476 | $12,334 | $11,671 |

|---|

| 06/2017 | $10,617 | $12,411 | $12,073 |

|---|

| 07/2017 | $10,745 | $12,666 | $12,176 |

|---|

| 08/2017 | $10,707 | $12,705 | $12,161 |

|---|

| 09/2017 | $11,174 | $12,967 | $12,823 |

|---|

| 10/2017 | $11,411 | $13,270 | $13,022 |

|---|

| 11/2017 | $11,667 | $13,677 | $13,396 |

|---|

| 12/2017 | $11,674 | $13,829 | $13,411 |

|---|

| 01/2018 | $12,264 | $14,621 | $13,934 |

|---|

| 02/2018 | $12,191 | $14,082 | $13,538 |

|---|

| 03/2018 | $12,457 | $13,724 | $13,720 |

|---|

| 04/2018 | $12,543 | $13,777 | $13,733 |

|---|

| 05/2018 | $13,611 | $14,108 | $14,598 |

|---|

| 06/2018 | $13,777 | $14,195 | $14,712 |

|---|

| 07/2018 | $14,096 | $14,724 | $14,965 |

|---|

| 08/2018 | $15,596 | $15,203 | $15,897 |

|---|

| 09/2018 | $15,310 | $15,290 | $15,525 |

|---|

| 10/2018 | $13,499 | $14,245 | $13,560 |

|---|

| 11/2018 | $13,757 | $14,535 | $13,772 |

|---|

| 12/2018 | $12,028 | $13,223 | $12,163 |

|---|

| 01/2019 | $13,287 | $14,282 | $13,568 |

|---|

| 02/2019 | $14,156 | $14,741 | $14,444 |

|---|

| 03/2019 | $13,863 | $15,027 | $14,248 |

|---|

| 04/2019 | $14,683 | $15,636 | $14,682 |

|---|

| 05/2019 | $13,922 | $14,642 | $13,593 |

|---|

| 06/2019 | $14,781 | $15,674 | $14,640 |

|---|

| 07/2019 | $15,044 | $15,899 | $14,783 |

|---|

| 08/2019 | $14,283 | $15,648 | $14,145 |

|---|

| 09/2019 | $13,931 | $15,940 | $14,029 |

|---|

| 10/2019 | $13,892 | $16,286 | $14,428 |

|---|

| 11/2019 | $14,742 | $16,877 | $15,278 |

|---|

| 12/2019 | $14,731 | $17,386 | $15,628 |

|---|

| 01/2020 | $14,862 | $17,379 | $15,456 |

|---|

| 02/2020 | $13,541 | $15,949 | $14,340 |

|---|

| 03/2020 | $11,455 | $13,979 | $11,601 |

|---|

| 04/2020 | $13,486 | $15,771 | $13,329 |

|---|

| 05/2020 | $15,157 | $16,522 | $14,589 |

|---|

| 06/2020 | $15,757 | $16,850 | $15,149 |

|---|

| 07/2020 | $16,697 | $17,801 | $15,670 |

|---|

| 08/2020 | $17,111 | $19,080 | $16,589 |

|---|

| 09/2020 | $16,336 | $18,355 | $16,234 |

|---|

| 10/2020 | $16,249 | $17,867 | $16,357 |

|---|

| 11/2020 | $18,324 | $19,823 | $19,241 |

|---|

| 12/2020 | $20,218 | $20,585 | $21,040 |

|---|

| 01/2021 | $20,717 | $20,377 | $22,054 |

|---|

| 02/2021 | $21,339 | $20,939 | $22,782 |

|---|

| 03/2021 | $20,766 | $21,856 | $22,066 |

|---|

| 04/2021 | $21,935 | $23,022 | $22,547 |

|---|

| 05/2021 | $21,387 | $23,183 | $21,903 |

|---|

| 06/2021 | $22,130 | $23,724 | $22,930 |

|---|

| 07/2021 | $22,410 | $24,288 | $22,095 |

|---|

| 08/2021 | $23,007 | $25,026 | $22,496 |

|---|

| 09/2021 | $22,435 | $23,863 | $21,634 |

|---|

| 10/2021 | $23,884 | $25,534 | $22,647 |

|---|

| 11/2021 | $22,861 | $25,357 | $21,541 |

|---|

| 12/2021 | $23,047 | $26,494 | $21,636 |

|---|

| 01/2022 | $19,787 | $25,123 | $18,736 |

|---|

| 02/2022 | $19,938 | $24,371 | $18,818 |

|---|

| 03/2022 | $20,151 | $25,276 | $18,904 |

|---|

| 04/2022 | $18,073 | $23,071 | $16,585 |

|---|

| 05/2022 | $17,573 | $23,114 | $16,272 |

|---|

| 06/2022 | $16,224 | $21,206 | $15,264 |

|---|

| 07/2022 | $17,892 | $23,161 | $16,973 |

|---|

| 08/2022 | $17,331 | $22,217 | $16,814 |

|---|

| 09/2022 | $15,920 | $20,170 | $15,301 |

|---|

| 10/2022 | $17,315 | $21,804 | $16,754 |

|---|

| 11/2022 | $17,543 | $23,022 | $17,026 |

|---|

| 12/2022 | $16,424 | $21,696 | $15,933 |

|---|

| 01/2023 | $17,895 | $23,059 | $17,518 |

|---|

| 02/2023 | $17,527 | $22,496 | $17,329 |

|---|

| 03/2023 | $17,439 | $23,322 | $16,901 |

|---|

| 04/2023 | $17,019 | $23,686 | $16,705 |

|---|

| 05/2023 | $16,914 | $23,789 | $16,708 |

|---|

| 06/2023 | $18,315 | $25,361 | $18,093 |

|---|

| 07/2023 | $18,717 | $26,176 | $18,939 |

|---|

| 08/2023 | $18,490 | $25,759 | $17,953 |

|---|

| 09/2023 | $17,387 | $24,531 | $16,769 |

|---|

| 10/2023 | $16,529 | $24,015 | $15,476 |

|---|

| 11/2023 | $18,175 | $26,208 | $16,885 |

|---|

| 12/2023 | $19,578 | $27,399 | $18,906 |

|---|

| 01/2024 | $19,204 | $27,859 | $18,300 |

|---|

| 02/2024 | $20,929 | $29,347 | $19,787 |

|---|

| 03/2024 | $21,445 | $30,291 | $20,340 |

|---|

| 04/2024 | $20,253 | $29,054 | $18,774 |

|---|

| 05/2024 | $21,054 | $30,494 | $19,779 |

|---|

| 06/2024 | $20,858 | $31,589 | $19,746 |

|---|

| 07/2024 | $21,569 | $31,973 | $21,363 |

|---|

| 08/2024 | $22,032 | $32,749 | $21,126 |

|---|

| 09/2024 | $22,174 | $33,448 | $21,407 |

|---|

| 10/2024 | $21,800 | $33,145 | $21,123 |

|---|

| 11/2024 | $23,987 | $35,090 | $23,713 |

|---|

| 12/2024 | $22,574 | $34,254 | $21,772 |

|---|

Average Annual Total Returns (%)

| HEADER | 1 Year | 5 Years | 10 Years |

|---|

Class A without Sales ChargeFootnote Reference1 | 15.31% | 8.91% | 9.13% |

|---|

Class A with Maximum Sales Charge - 5.75%Footnote Reference1 | 8.69% | 7.63% | 8.48% |

|---|

S&P 500® Index TR | 25.02% | 14.53% | 13.10% |

|---|

Russell 2000® Growth Index | 15.15% | 6.86% | 8.09% |

|---|

| Footnote | Description |

Footnote1 | Return may differ from actual shareholder return due to accounting adjustments for financial reporting purposes. |

Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit americanbeaconfunds.com or call 800-967-9009. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. The Fund's performance benefited from fee waivers. For more information, visit americanbeaconfunds.com/Performance_Disclaimers.aspx.

The S&P 500 Index TR is replacing the Russell 2000 Growth Index as broad-based securities market index to comply with a new regulatory requirement. The Russell 2000 Growth Index reflects the market sectors in which the Fund invests.

| Total Net Assets | $364,382,179 |

|---|

| # of Portfolio Holdings | 105 |

|---|

| Portfolio Turnover Rate | 37% |

|---|

| Total Management Fees Paid | $2,854,258 |

|---|

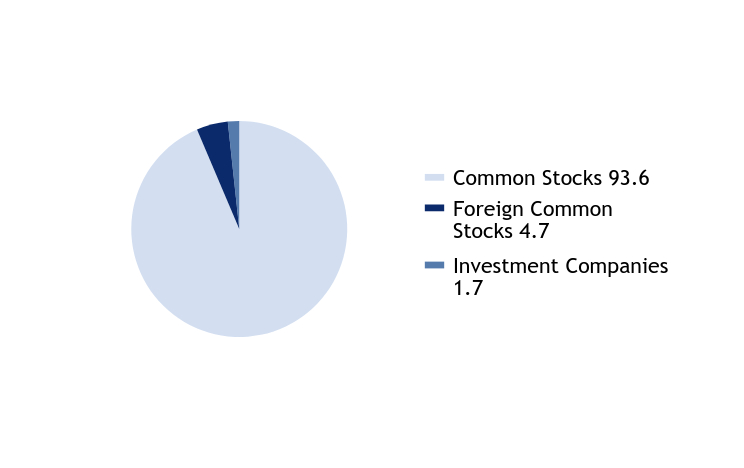

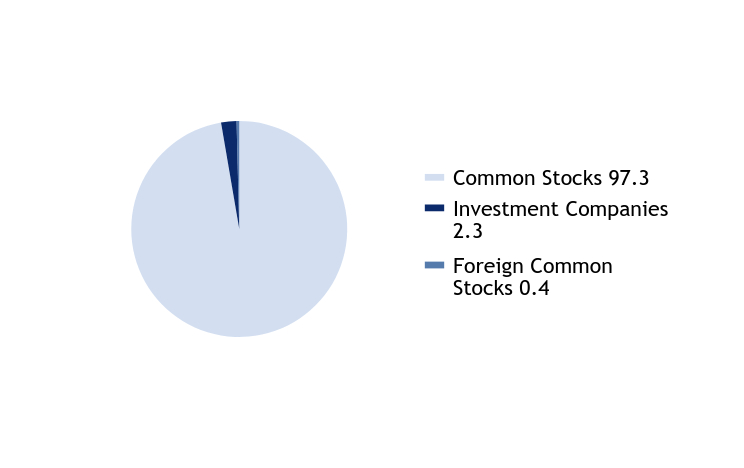

What did the Fund invest in?

Top Ten Holdings - % Net Assets

| CyberArk Software Ltd. | 2.2 |

| BellRing Brands, Inc. | 2.1 |

| Kratos Defense & Security Solutions, Inc. | 2.0 |

| Viper Energy, Inc. | 1.9 |

| Manhattan Associates, Inc. | 1.7 |

| HealthEquity, Inc. | 1.7 |

| Leonardo DRS, Inc. | 1.6 |

| RBC Bearings, Inc. | 1.6 |

| Ryan Specialty Holdings, Inc. | 1.5 |

| Descartes Systems Group, Inc. | 1.5 |

Excludes cash equivalents.

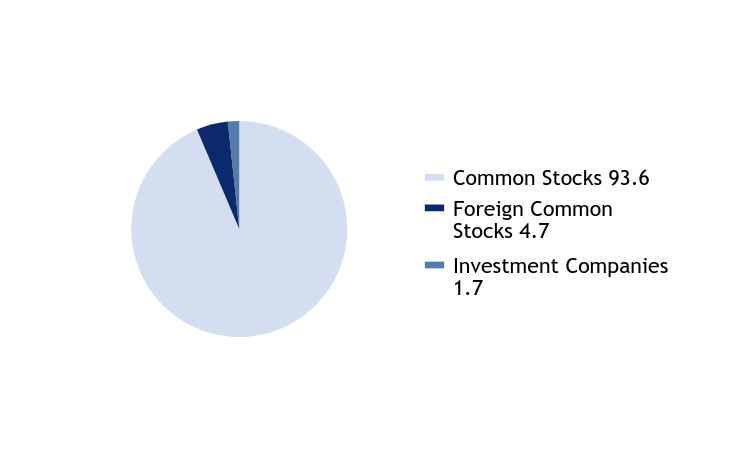

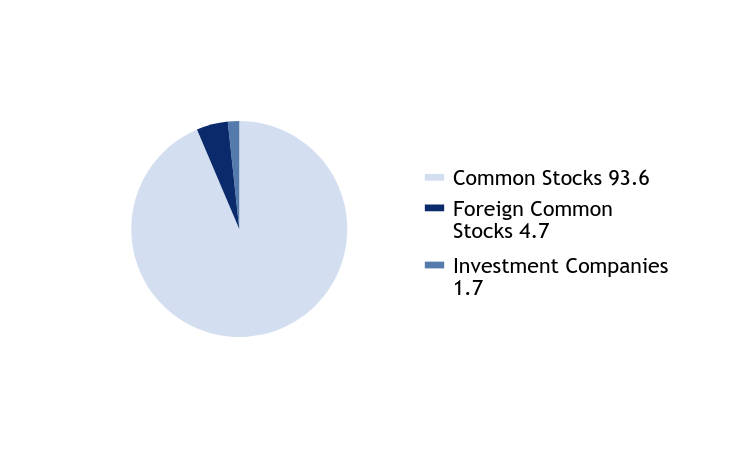

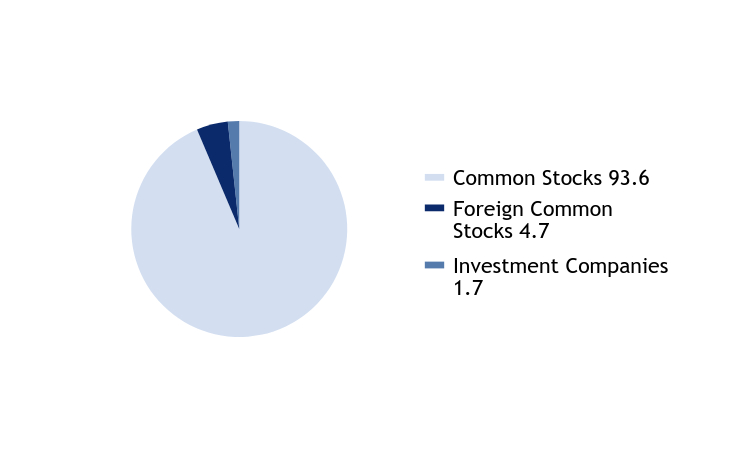

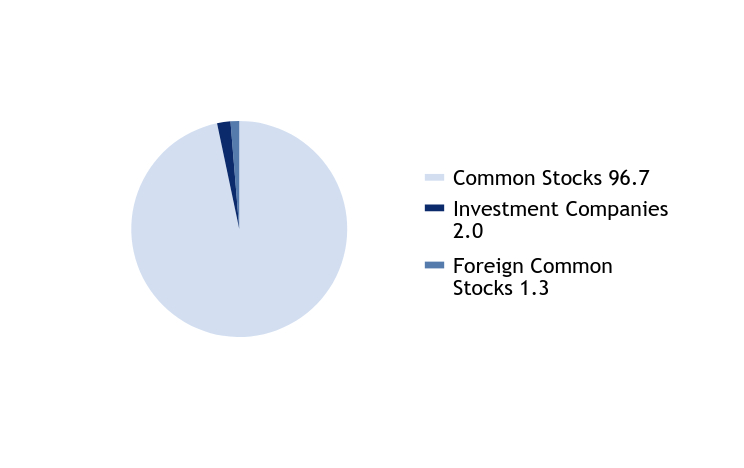

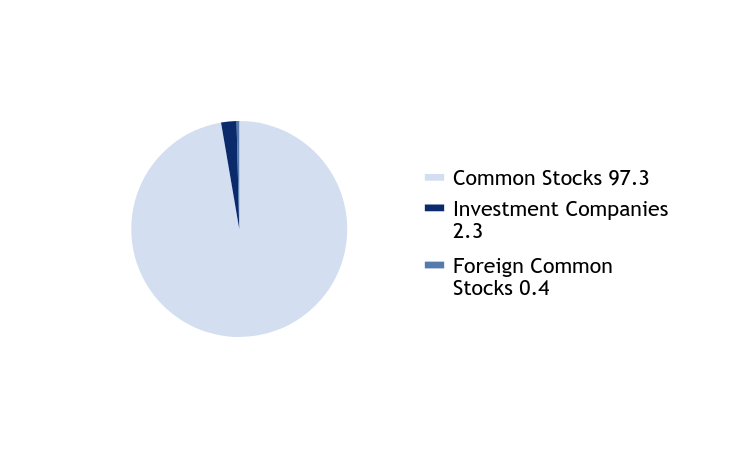

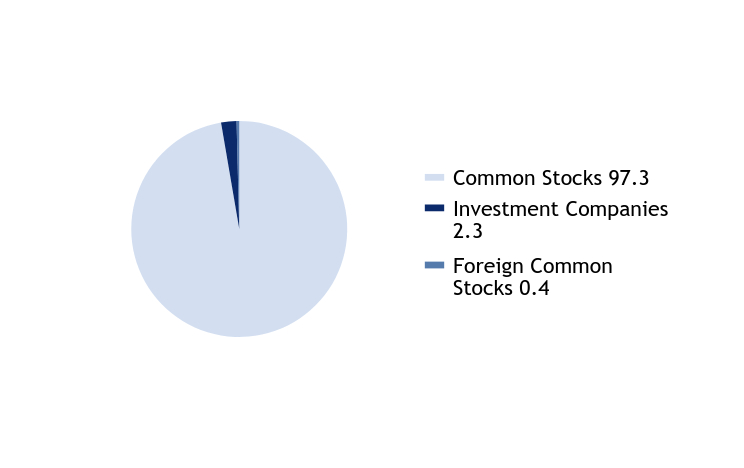

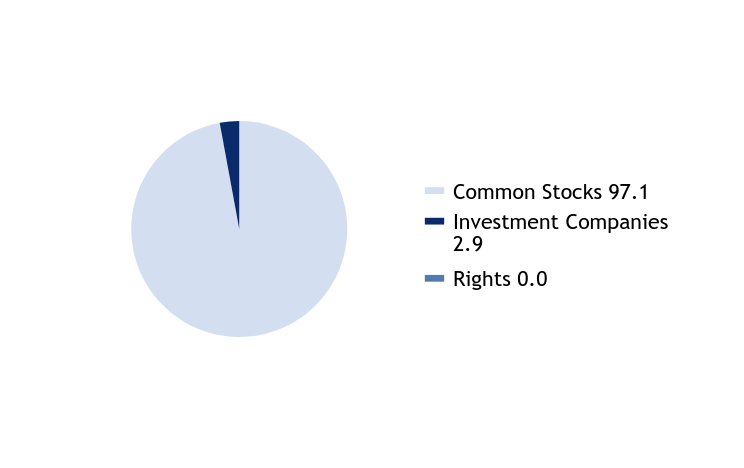

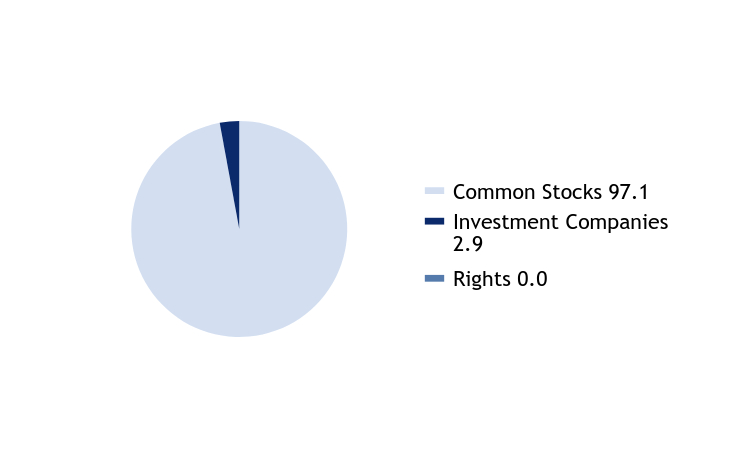

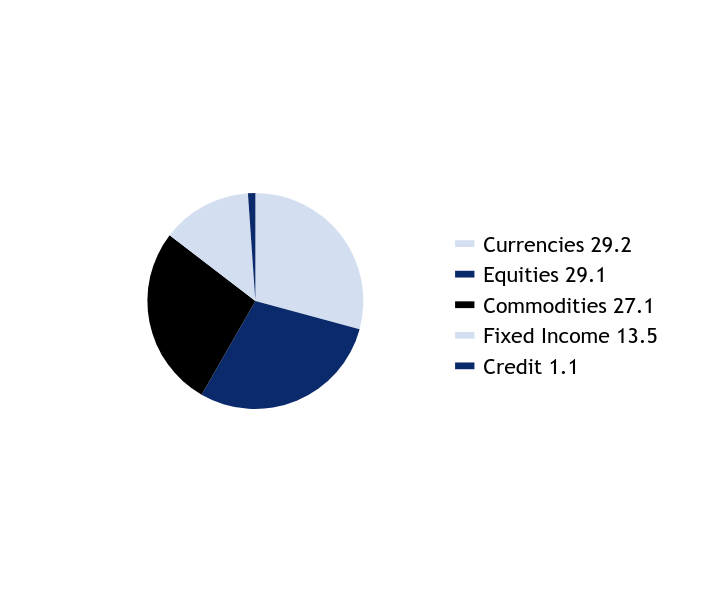

Asset Allocation - % Investments

| Value | Value |

|---|

| Common Stocks | 93.6 |

| Foreign Common Stocks | 4.7 |

| Investment Companies | 1.7 |

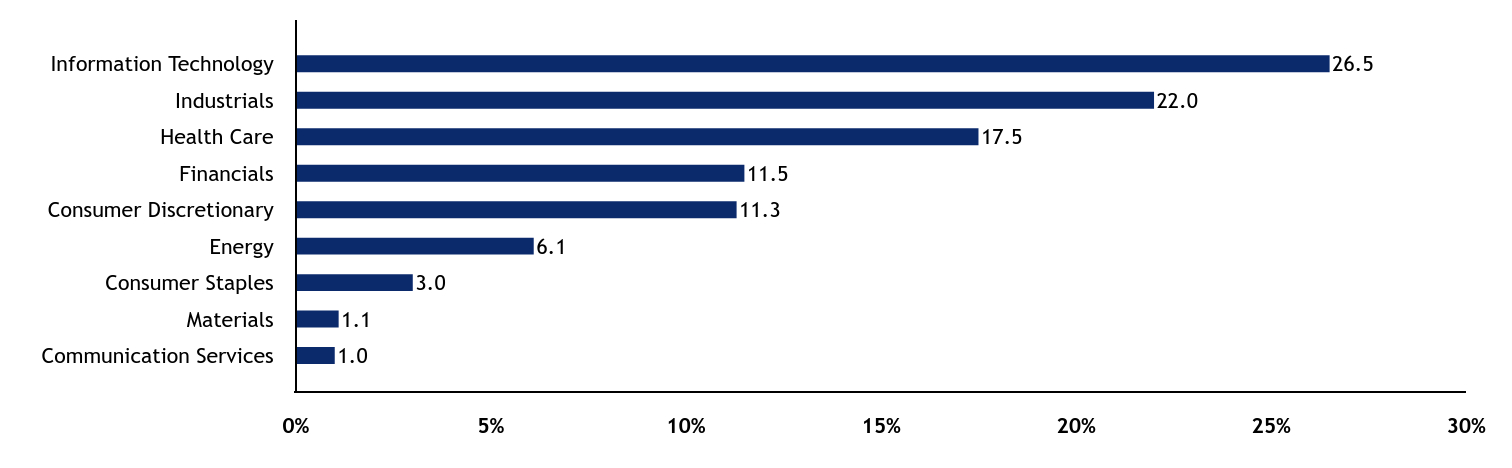

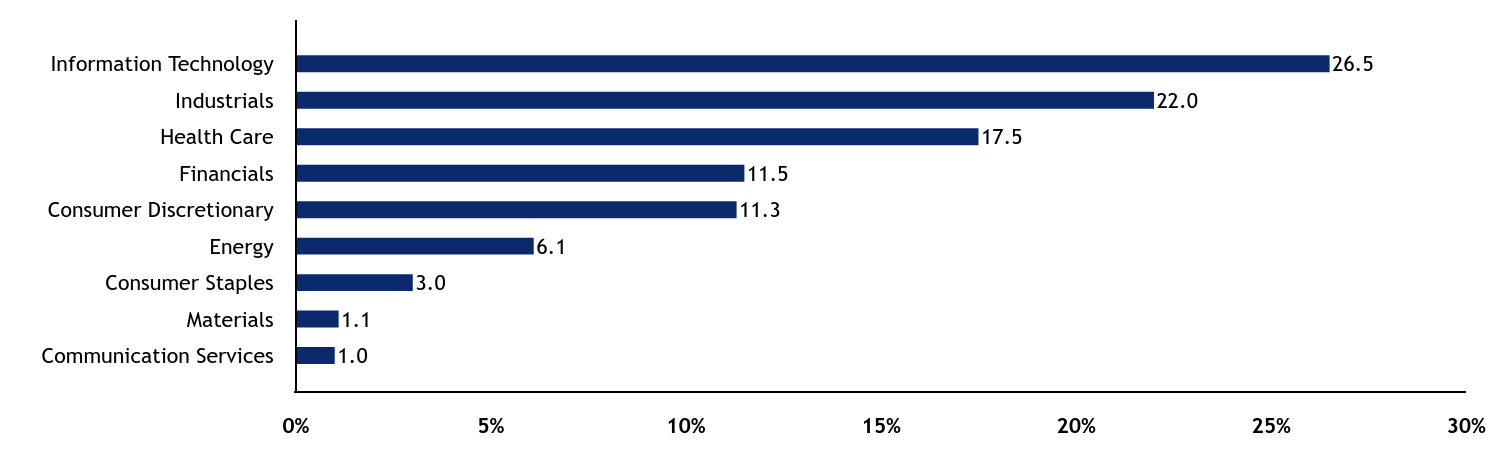

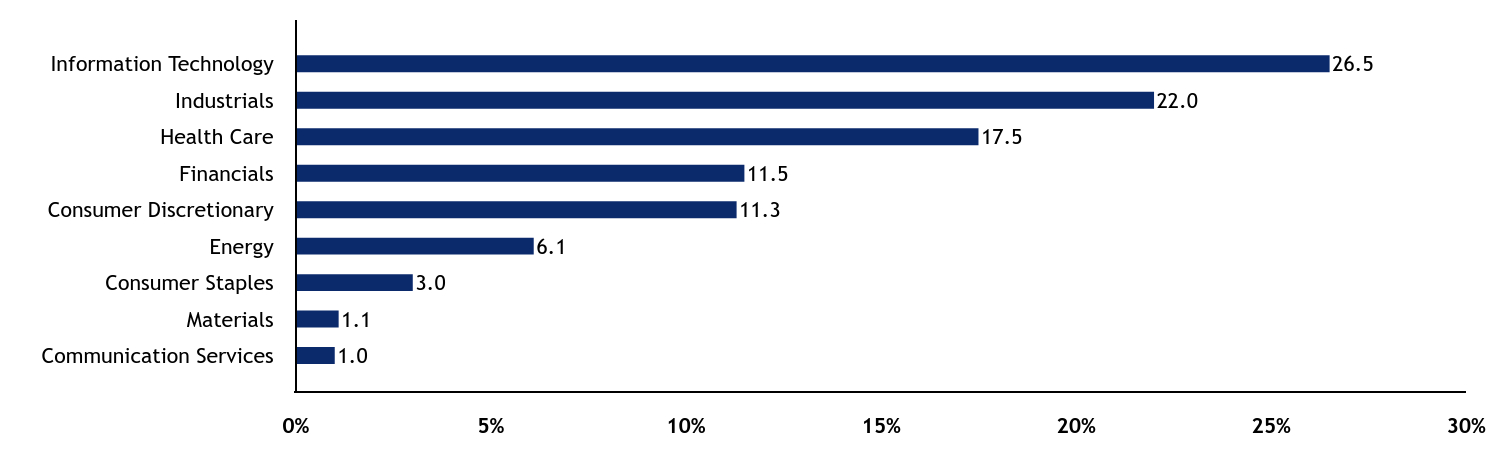

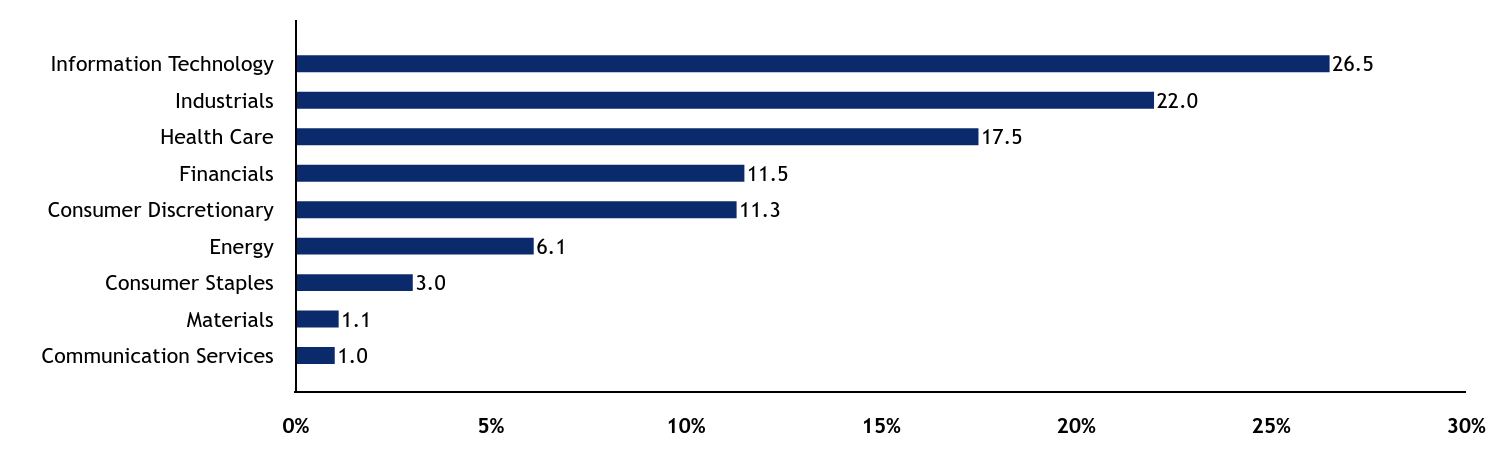

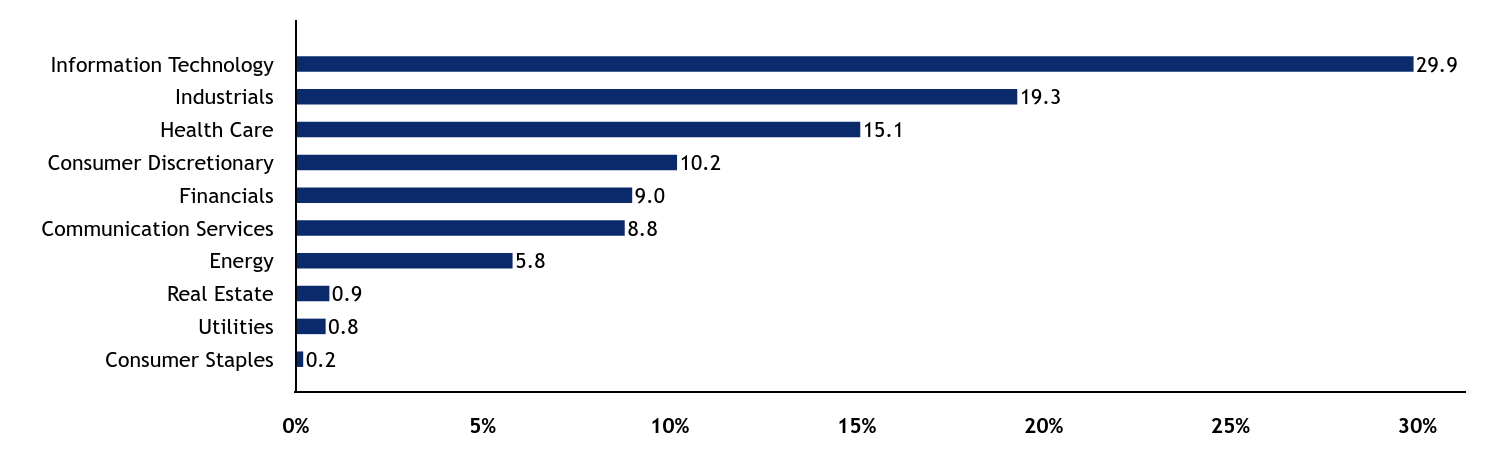

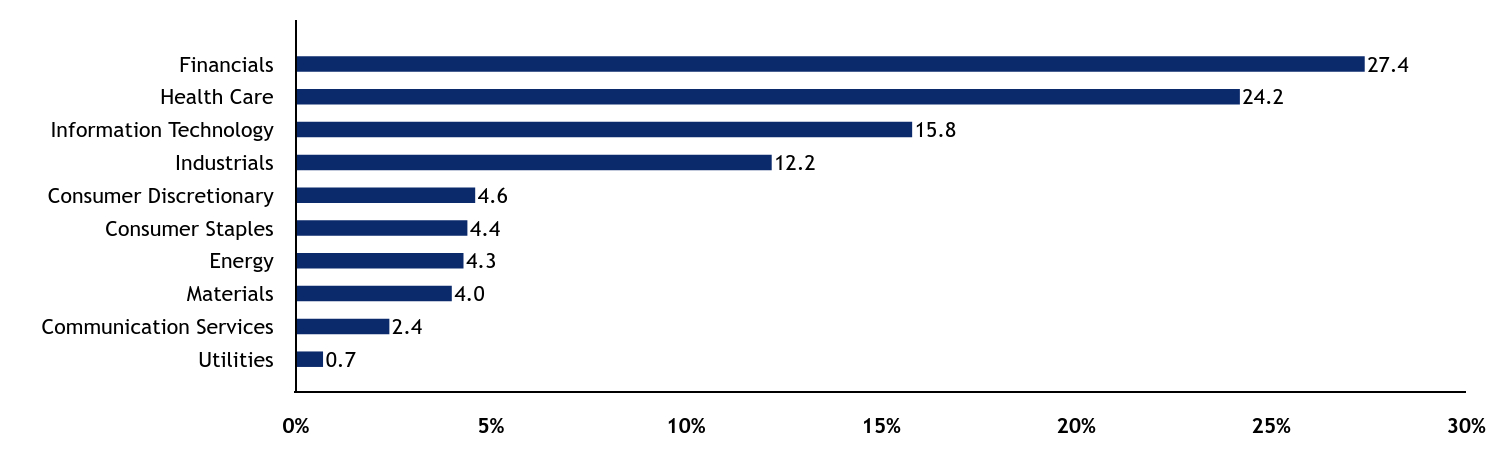

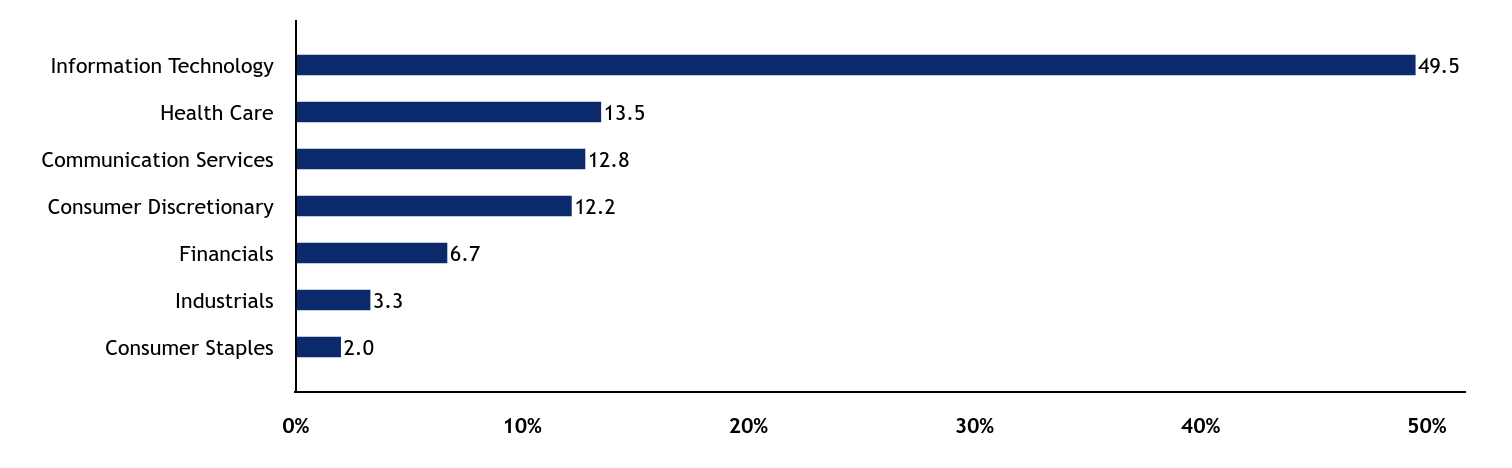

Sector Allocation - % Equities

| Value | Value |

|---|

| Communication Services | 1.0 |

| Materials | 1.1 |

| Consumer Staples | 3.0 |

| Energy | 6.1 |

| Consumer Discretionary | 11.3 |

| Financials | 11.5 |

| Health Care | 17.5 |

| Industrials | 22.0 |

| Information Technology | 26.5 |

For additional information about the Fund, including its prospectus, financial statements, holdings, and proxy voting information, please visit www.americanbeaconfunds.com/literature or call 1-800-658-5811.

If your financial institution mailed only one copy of this Report to an address shared by more than one account, you can request an individual copy by contacting your financial institution.

Stephens Small Cap Growth Fund

Distributed by:

Resolute Investment Distributors, Inc.

Annual Shareholder Report - December 31, 2024

Stephens Small Cap Growth Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about American Beacon Stephens Small Cap Growth Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $221 | 2.06% |

|---|

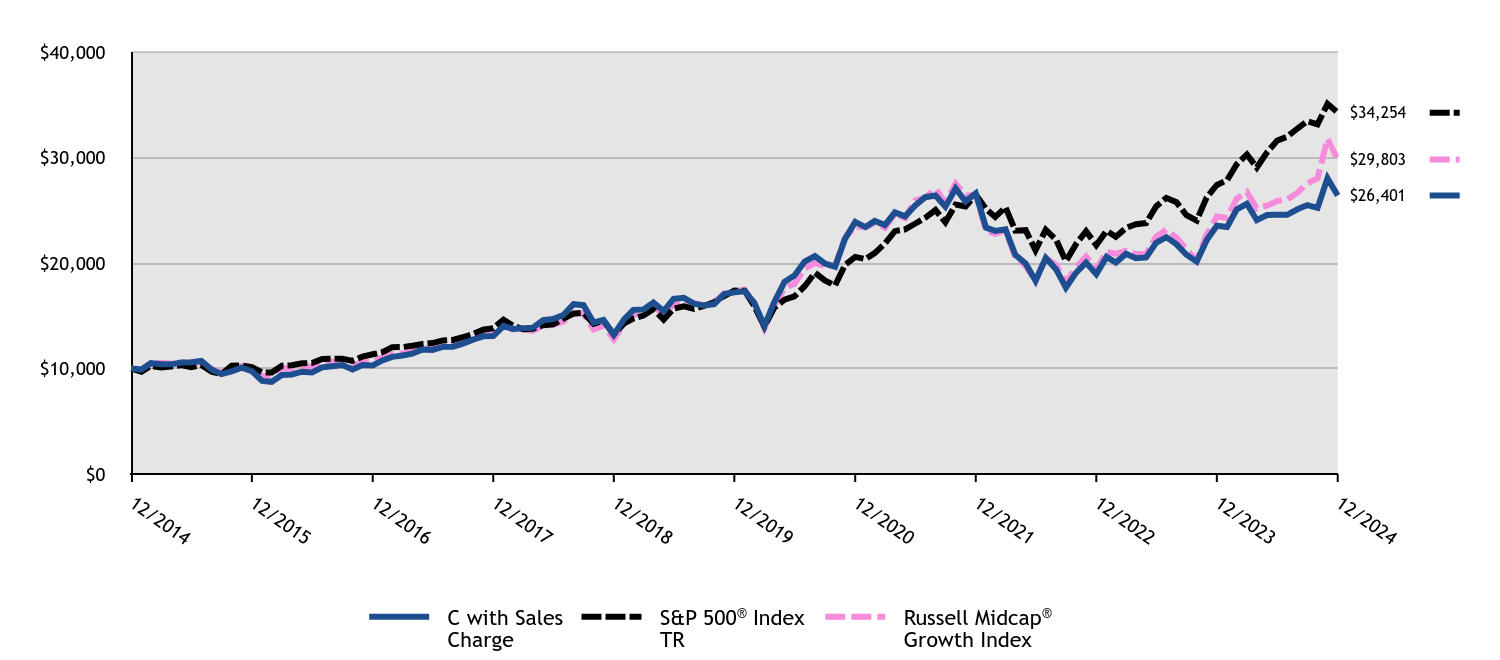

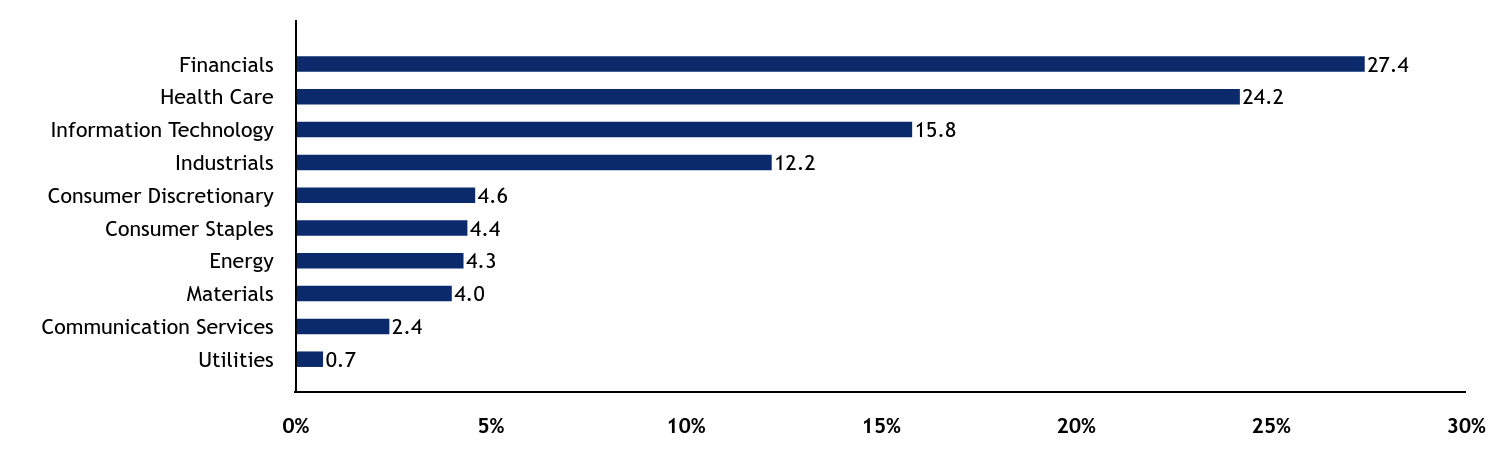

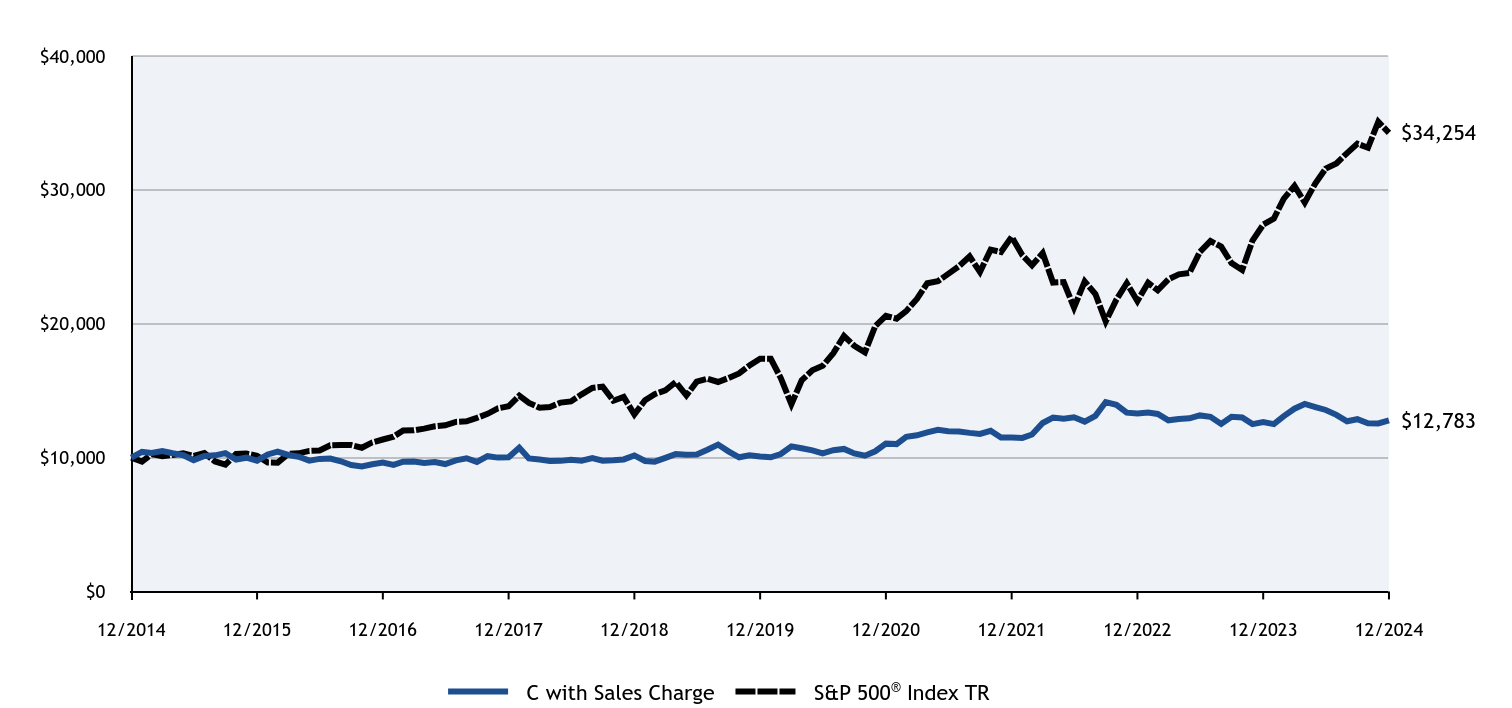

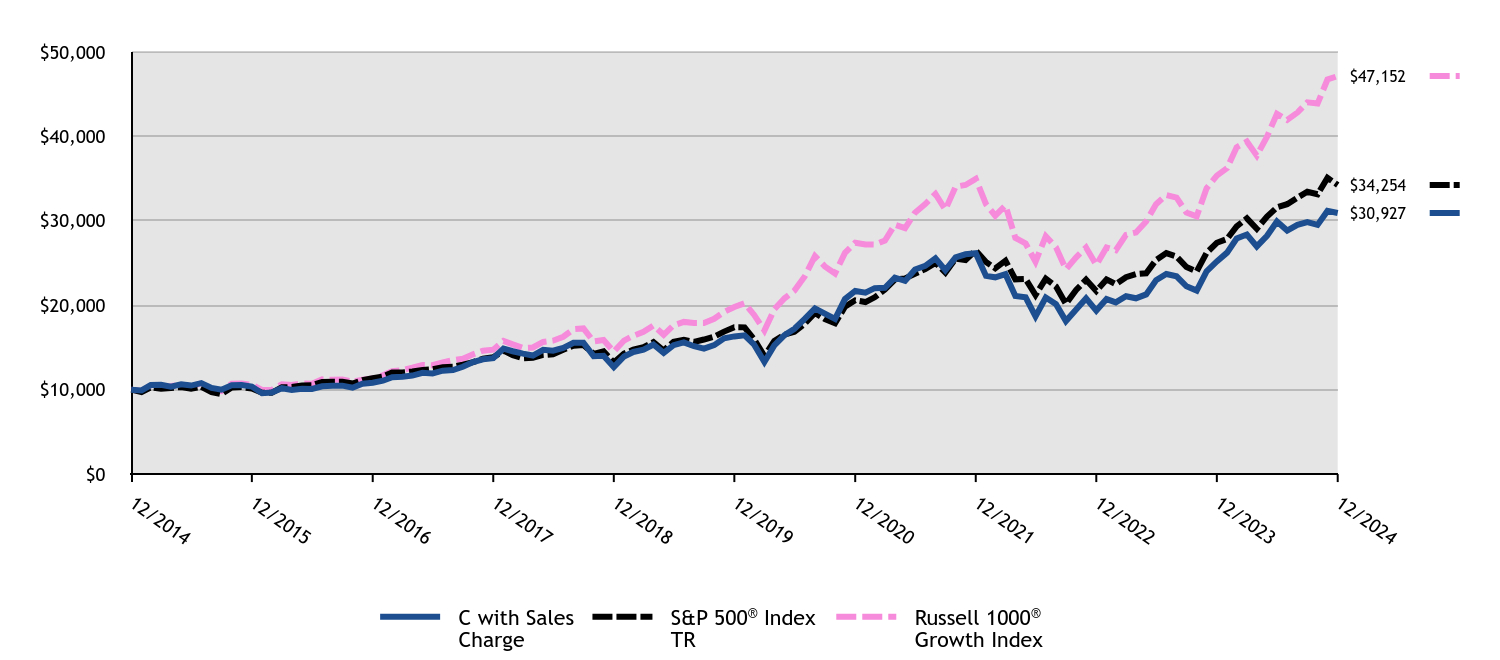

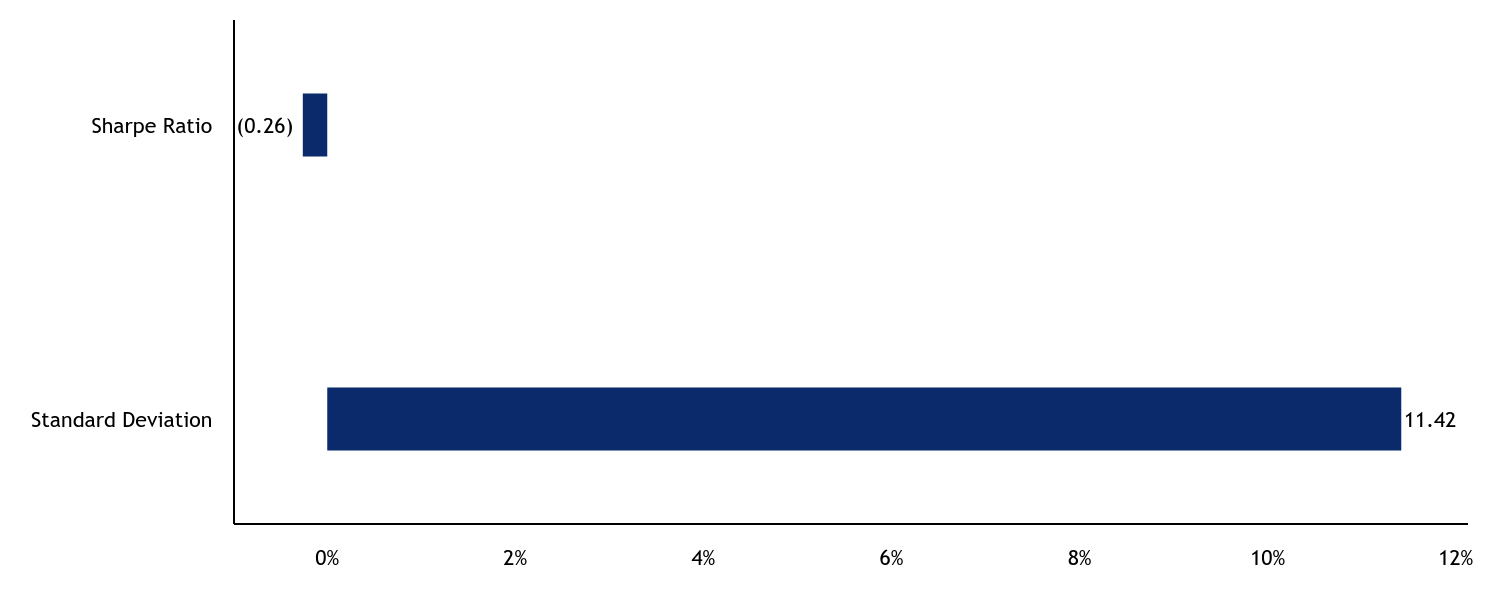

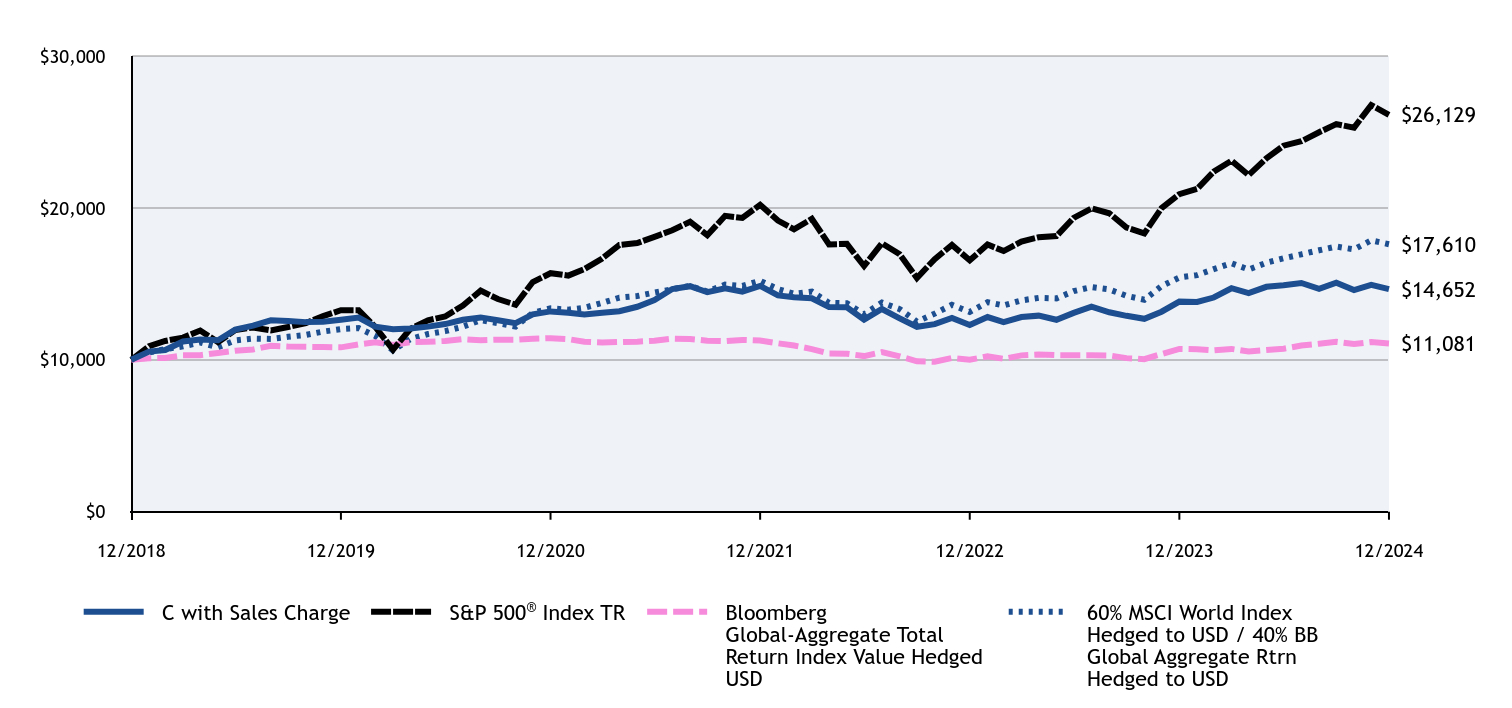

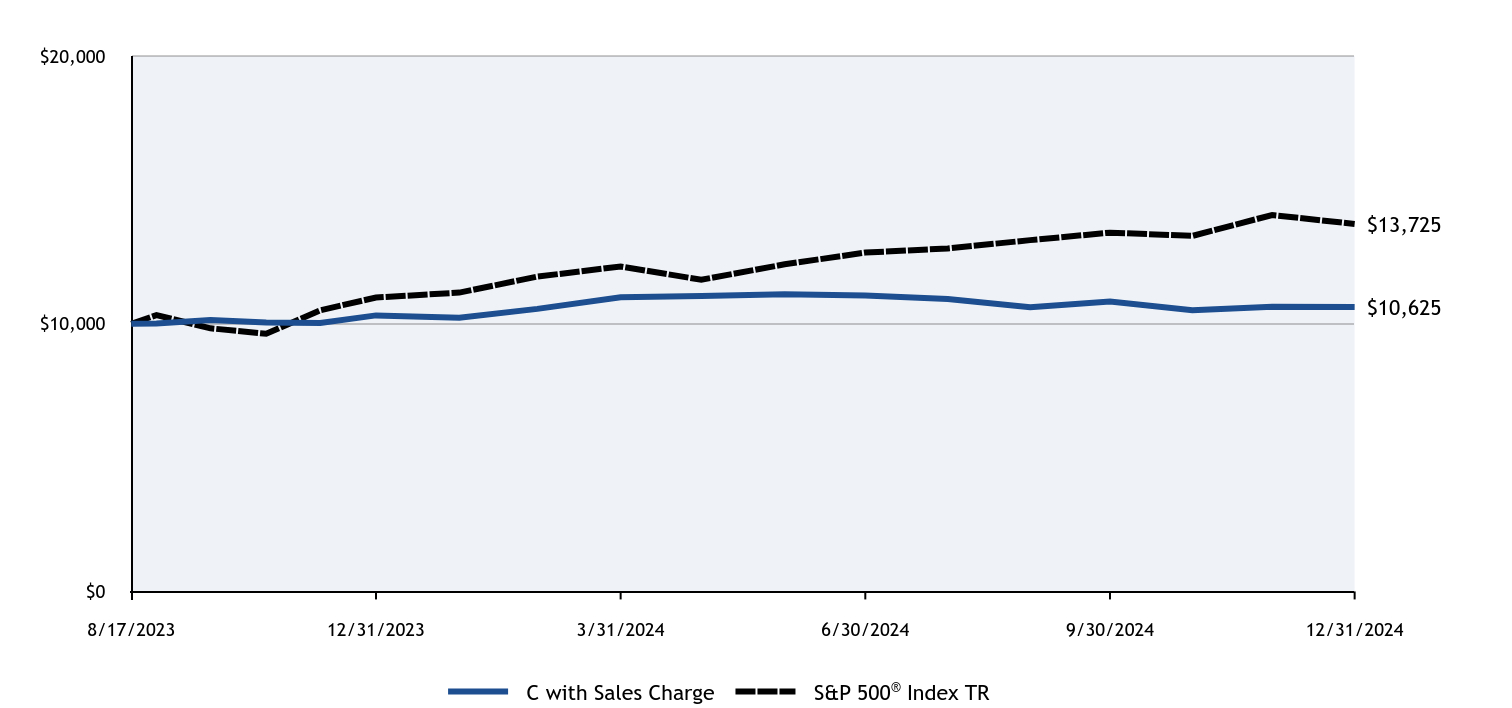

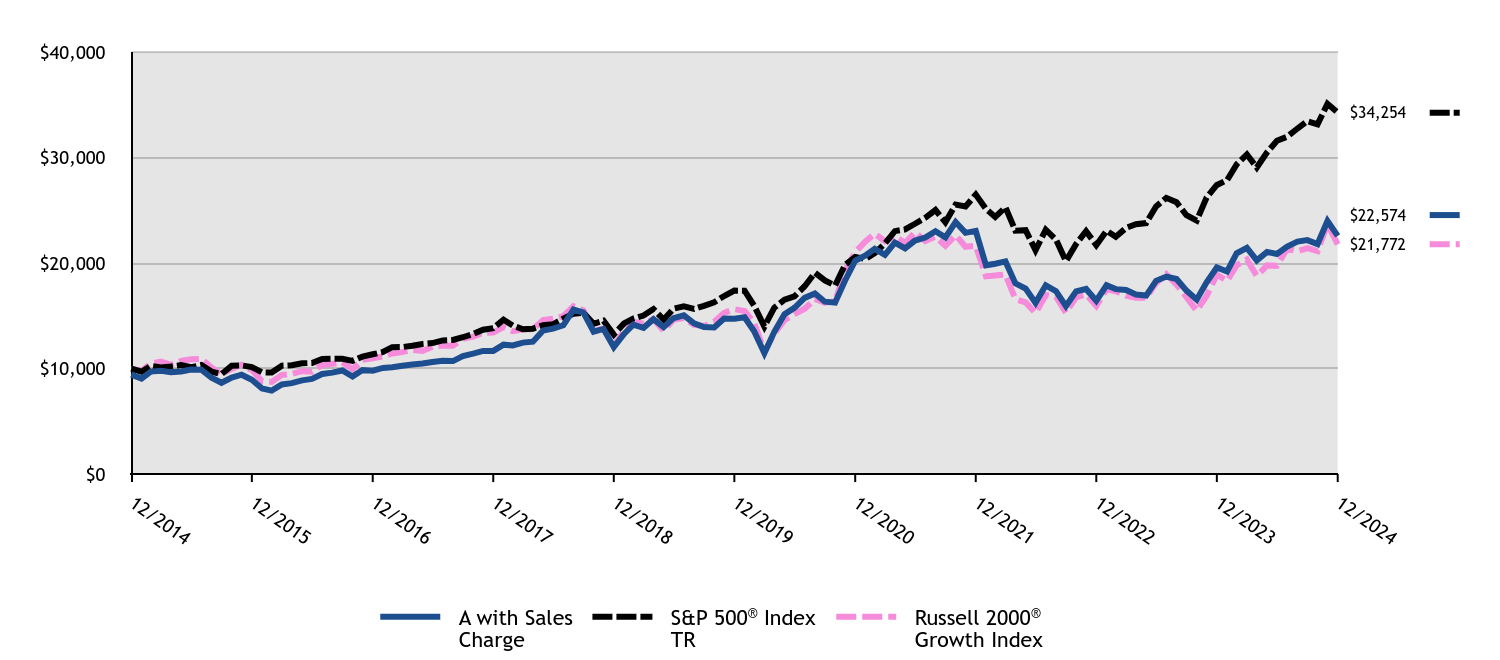

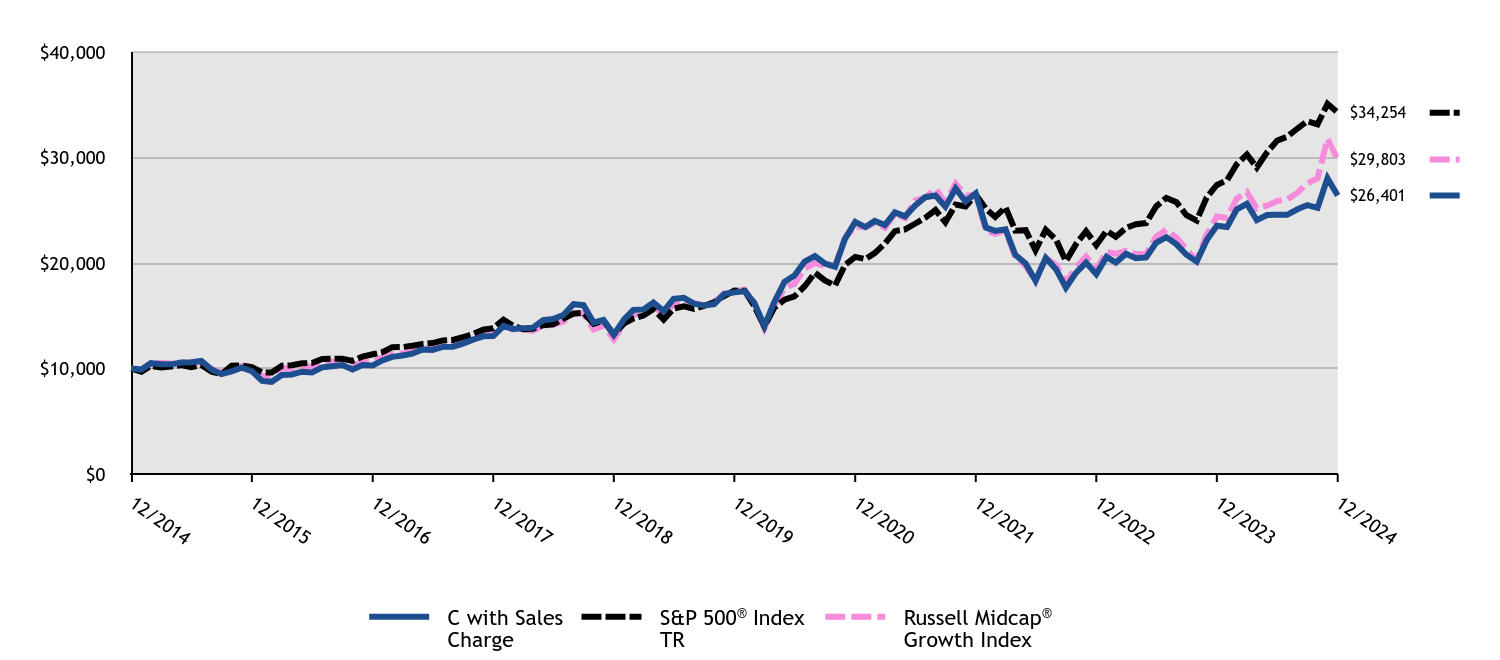

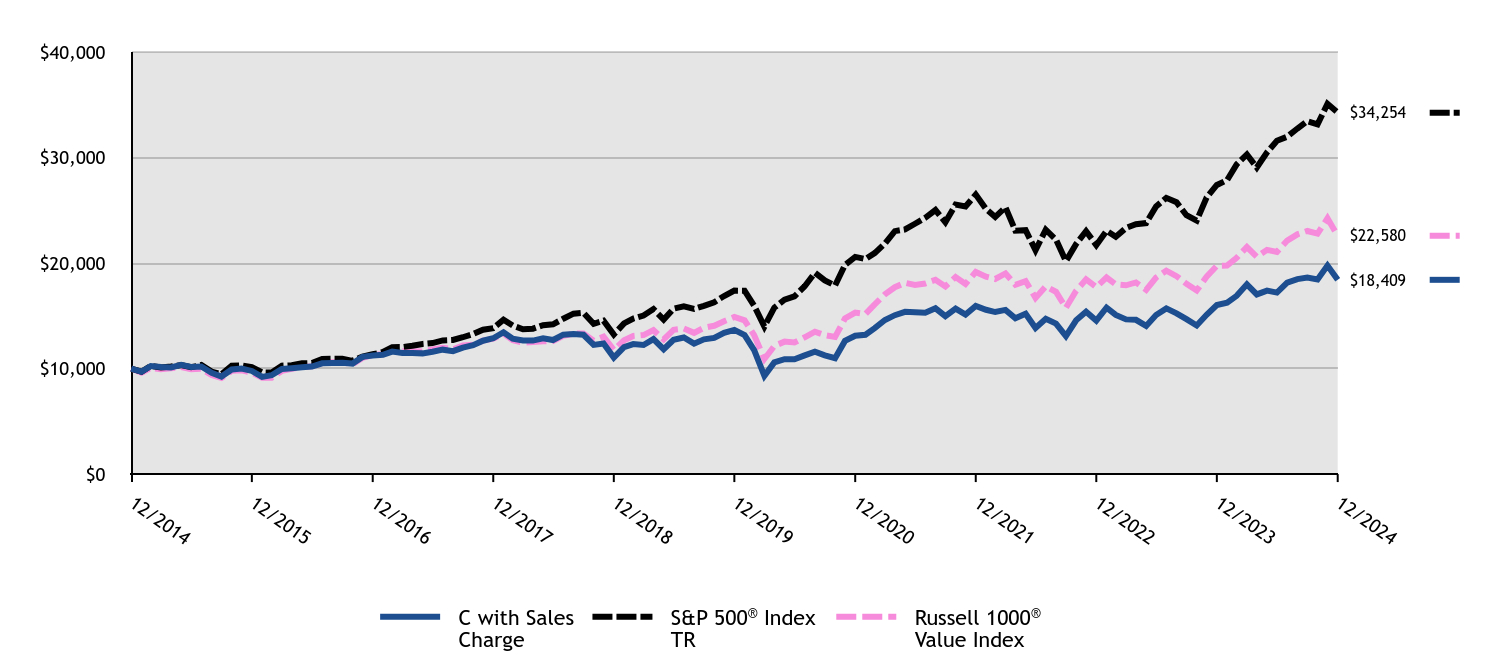

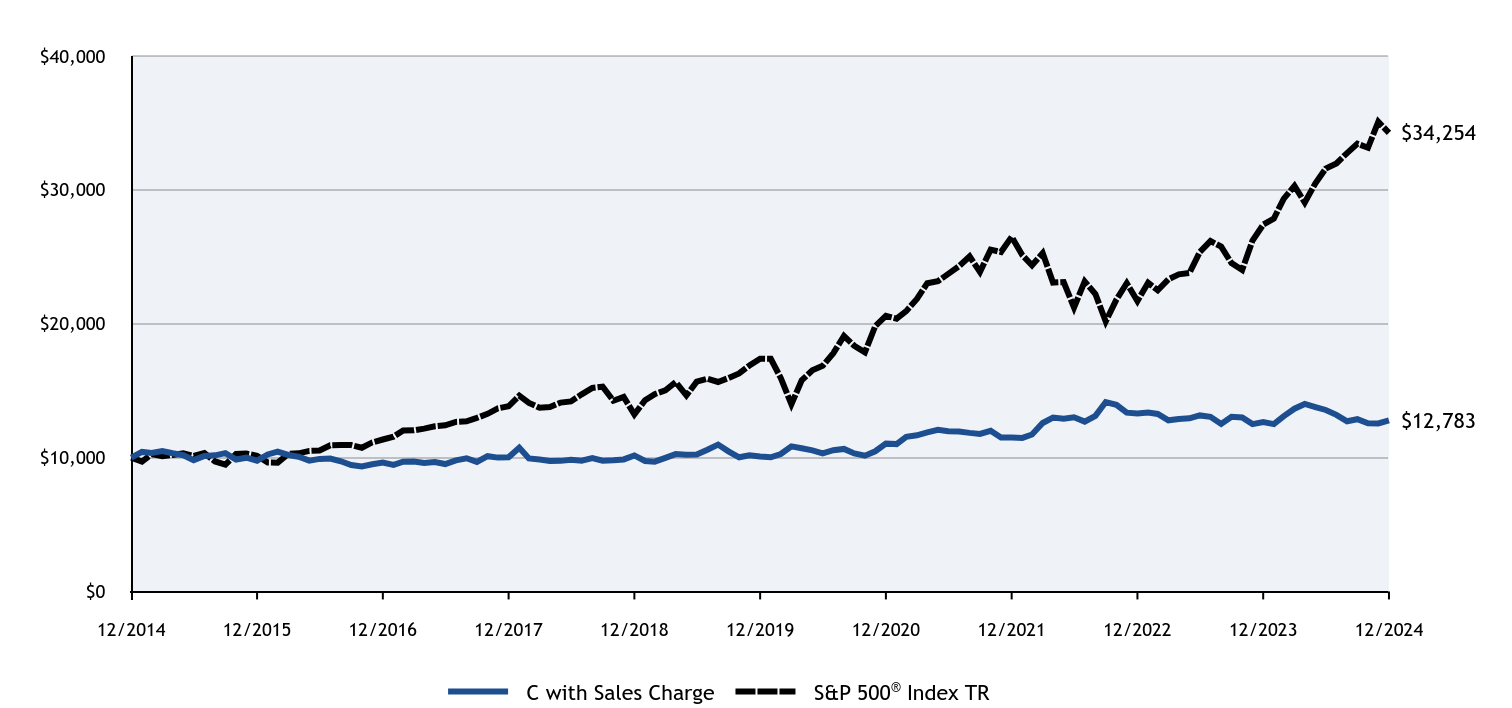

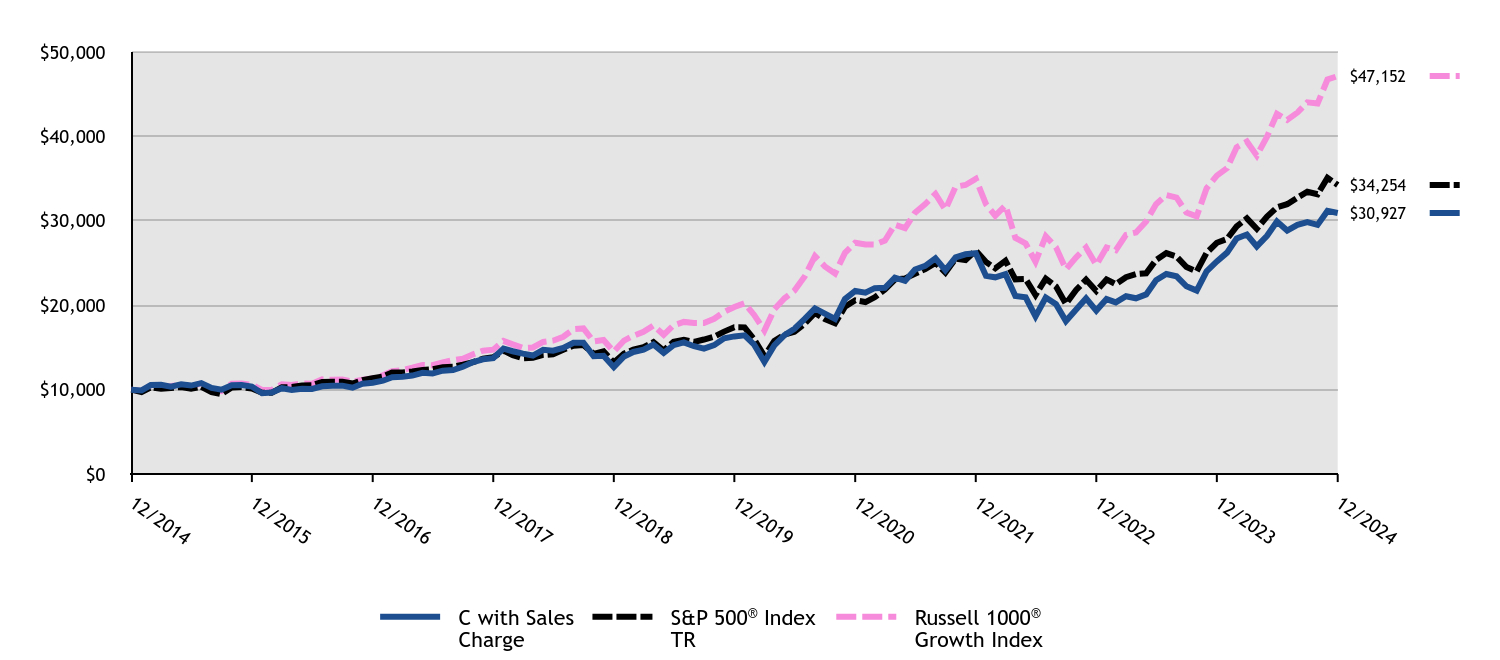

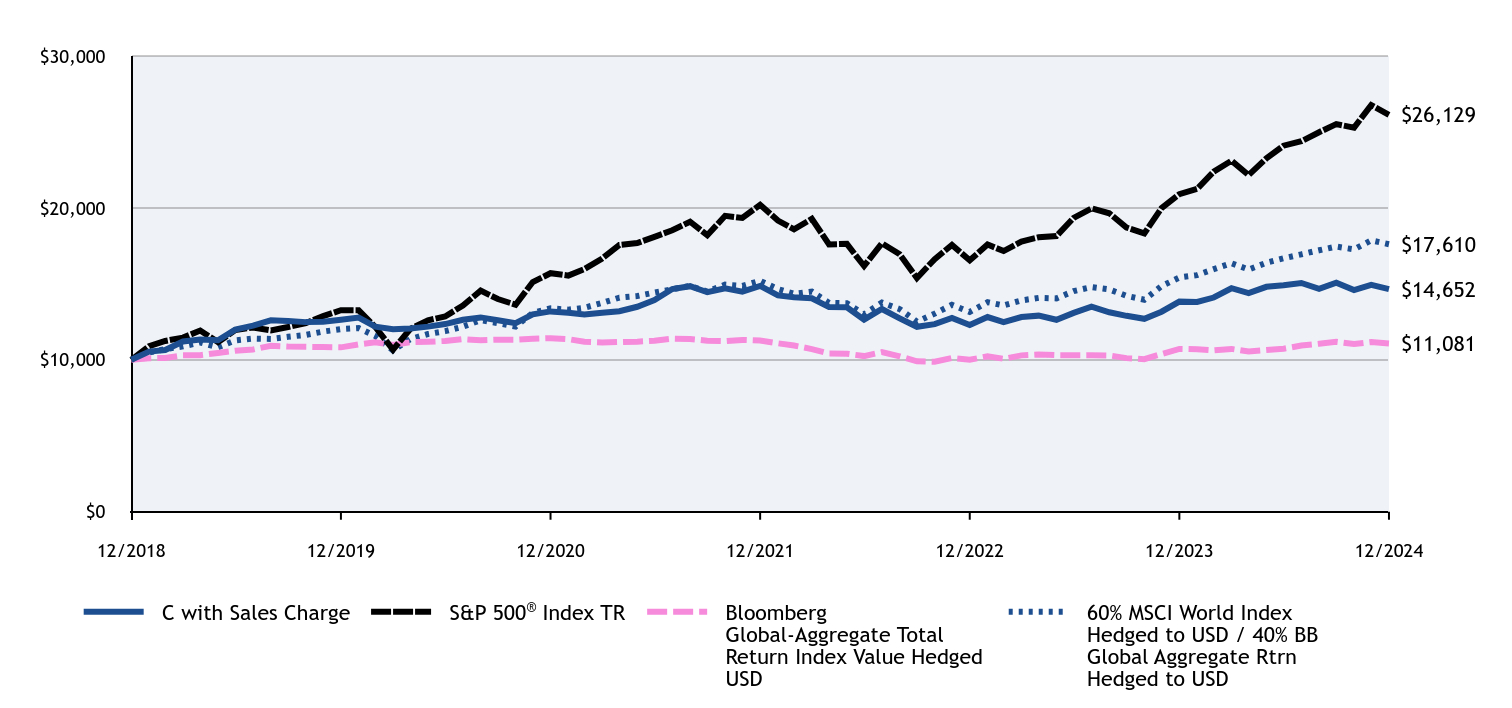

How did the Fund perform and what affected its performance?

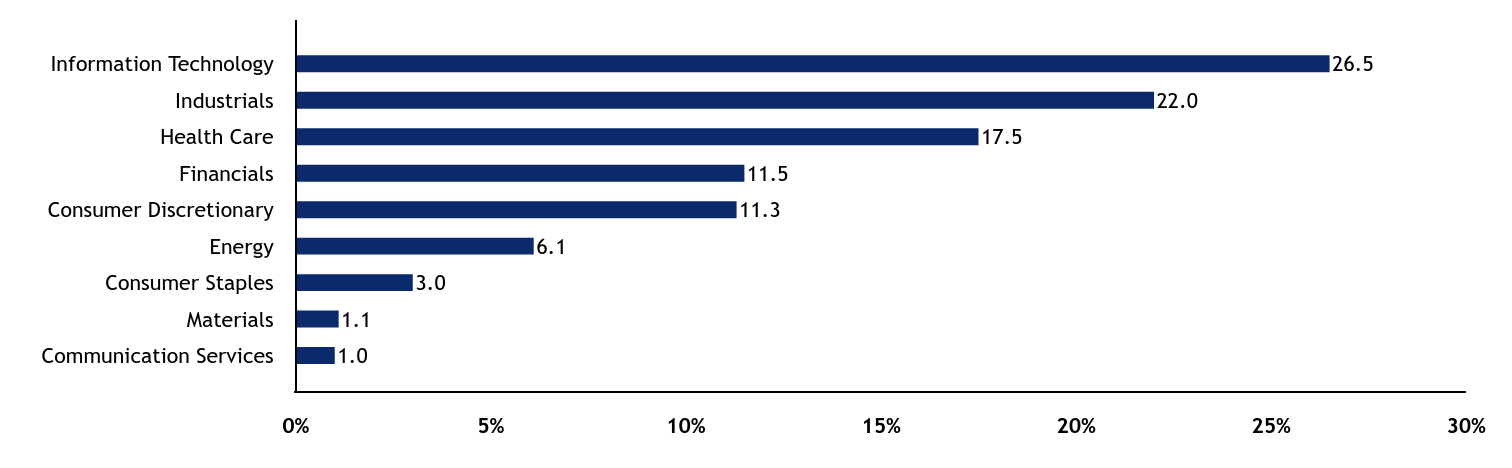

The C Class of the Fund returned 13.51% (with sales charges) and 14.51% (without sales charges) for the twelve months ended December 31, 2024, compared to the S&P 500 Index return of 25.02% and the Russell 2000 Growth Index return of 15.15%.

• Overall market performance during the period was driven by mega-cap growth companies, while the Fund focuses its investments on small capitalization companies.

• The Fund’s performance was positive in all sectors where it invested. Holdings in the Energy and Financials sectors contributed materially to the Fund’s outperformance of the Russell 2000® Growth Index, while holdings in the Information Technology sector detracted.

Cumulative Performance from December 31, 2014 through December 31, 2024

The initial investment, based on a $10,000 investment, is adjusted to reflect the maximum applicable sales charge, if any.

| C with Sales Charge | S&P 500® Index TR | Russell 2000® Growth Index |

|---|

| 12/2014 | $10,000 | $10,000 | $10,000 |

|---|

| 01/2015 | $9,587 | $9,700 | $9,772 |

|---|

| 02/2015 | $10,282 | $10,257 | $10,475 |

|---|

| 03/2015 | $10,360 | $10,095 | $10,663 |

|---|

| 04/2015 | $10,223 | $10,192 | $10,349 |

|---|

| 05/2015 | $10,275 | $10,323 | $10,730 |

|---|

| 06/2015 | $10,465 | $10,123 | $10,874 |

|---|

| 07/2015 | $10,452 | $10,335 | $10,918 |

|---|

| 08/2015 | $9,633 | $9,712 | $10,091 |

|---|

| 09/2015 | $9,122 | $9,471 | $9,453 |

|---|

| 10/2015 | $9,640 | $10,270 | $9,990 |

|---|

| 11/2015 | $9,915 | $10,301 | $10,356 |

|---|

| 12/2015 | $9,411 | $10,138 | $9,862 |

|---|

| 01/2016 | $8,529 | $9,635 | $8,793 |

|---|

| 02/2016 | $8,308 | $9,622 | $8,731 |

|---|

| 03/2016 | $8,922 | $10,275 | $9,400 |

|---|

| 04/2016 | $9,053 | $10,315 | $9,494 |

|---|

| 05/2016 | $9,322 | $10,500 | $9,750 |

|---|

| 06/2016 | $9,460 | $10,527 | $9,705 |

|---|

| 07/2016 | $9,942 | $10,915 | $10,339 |

|---|

| 08/2016 | $10,066 | $10,931 | $10,449 |

|---|

| 09/2016 | $10,273 | $10,933 | $10,600 |

|---|

| 10/2016 | $9,667 | $10,733 | $9,941 |

|---|

| 11/2016 | $10,308 | $11,131 | $10,830 |

|---|

| 12/2016 | $10,236 | $11,351 | $10,978 |

|---|

| 01/2017 | $10,500 | $11,566 | $11,156 |

|---|

| 02/2017 | $10,563 | $12,025 | $11,430 |

|---|

| 03/2017 | $10,695 | $12,039 | $11,565 |

|---|

| 04/2017 | $10,827 | $12,163 | $11,778 |

|---|

| 05/2017 | $10,910 | $12,334 | $11,671 |

|---|

| 06/2017 | $11,043 | $12,411 | $12,073 |

|---|

| 07/2017 | $11,175 | $12,666 | $12,176 |

|---|

| 08/2017 | $11,126 | $12,705 | $12,161 |

|---|

| 09/2017 | $11,599 | $12,967 | $12,823 |

|---|

| 10/2017 | $11,843 | $13,270 | $13,022 |

|---|

| 11/2017 | $12,100 | $13,677 | $13,396 |

|---|

| 12/2017 | $12,101 | $13,829 | $13,411 |

|---|

| 01/2018 | $12,708 | $14,621 | $13,934 |

|---|

| 02/2018 | $12,628 | $14,082 | $13,538 |

|---|

| 03/2018 | $12,889 | $13,724 | $13,720 |

|---|

| 04/2018 | $12,975 | $13,777 | $13,733 |

|---|

| 05/2018 | $14,060 | $14,108 | $14,598 |

|---|

| 06/2018 | $14,226 | $14,195 | $14,712 |

|---|

| 07/2018 | $14,544 | $14,724 | $14,965 |

|---|

| 08/2018 | $16,076 | $15,203 | $15,897 |

|---|

| 09/2018 | $15,780 | $15,290 | $15,525 |

|---|

| 10/2018 | $13,901 | $14,245 | $13,560 |

|---|

| 11/2018 | $14,161 | $14,535 | $13,772 |

|---|

| 12/2018 | $12,366 | $13,223 | $12,163 |

|---|

| 01/2019 | $13,667 | $14,282 | $13,568 |

|---|

| 02/2019 | $14,542 | $14,741 | $14,444 |

|---|

| 03/2019 | $14,235 | $15,027 | $14,248 |

|---|

| 04/2019 | $15,066 | $15,636 | $14,682 |

|---|

| 05/2019 | $14,279 | $14,642 | $13,593 |

|---|

| 06/2019 | $15,154 | $15,674 | $14,640 |

|---|

| 07/2019 | $15,405 | $15,899 | $14,783 |

|---|

| 08/2019 | $14,618 | $15,648 | $14,145 |

|---|

| 09/2019 | $14,246 | $15,940 | $14,029 |

|---|

| 10/2019 | $14,203 | $16,286 | $14,428 |

|---|

| 11/2019 | $15,055 | $16,877 | $15,278 |

|---|

| 12/2019 | $15,032 | $17,386 | $15,628 |

|---|

| 01/2020 | $15,156 | $17,379 | $15,456 |

|---|

| 02/2020 | $13,808 | $15,949 | $14,340 |

|---|

| 03/2020 | $11,667 | $13,979 | $11,601 |

|---|

| 04/2020 | $13,721 | $15,771 | $13,329 |

|---|

| 05/2020 | $15,428 | $16,522 | $14,589 |

|---|

| 06/2020 | $16,022 | $16,850 | $15,149 |

|---|

| 07/2020 | $16,962 | $17,801 | $15,670 |

|---|

| 08/2020 | $17,383 | $19,080 | $16,589 |

|---|

| 09/2020 | $16,579 | $18,355 | $16,234 |

|---|

| 10/2020 | $16,480 | $17,867 | $16,357 |

|---|

| 11/2020 | $18,571 | $19,823 | $19,241 |

|---|

| 12/2020 | $20,468 | $20,585 | $21,040 |

|---|

| 01/2021 | $20,958 | $20,377 | $22,054 |

|---|

| 02/2021 | $21,587 | $20,939 | $22,782 |

|---|

| 03/2021 | $21,000 | $21,856 | $22,066 |

|---|

| 04/2021 | $22,161 | $23,022 | $22,547 |

|---|

| 05/2021 | $21,587 | $23,183 | $21,903 |

|---|

| 06/2021 | $22,329 | $23,724 | $22,930 |

|---|

| 07/2021 | $22,595 | $24,288 | $22,095 |

|---|

| 08/2021 | $23,182 | $25,026 | $22,496 |

|---|

| 09/2021 | $22,637 | $23,863 | $21,634 |

|---|

| 10/2021 | $24,316 | $25,534 | $22,647 |

|---|

| 11/2021 | $23,490 | $25,357 | $21,541 |

|---|

| 12/2021 | $23,916 | $26,494 | $21,636 |

|---|

| 01/2022 | $20,515 | $25,123 | $18,736 |

|---|

| 02/2022 | $19,781 | $24,371 | $18,818 |

|---|

| 03/2022 | $19,960 | $25,276 | $18,904 |

|---|

| 04/2022 | $17,884 | $23,071 | $16,585 |

|---|

| 05/2022 | $17,382 | $23,114 | $16,272 |

|---|

| 06/2022 | $16,040 | $21,206 | $15,264 |

|---|

| 07/2022 | $17,687 | $23,161 | $16,973 |

|---|

| 08/2022 | $17,114 | $22,217 | $16,814 |

|---|

| 09/2022 | $15,700 | $20,170 | $15,301 |

|---|

| 10/2022 | $17,078 | $21,804 | $16,754 |

|---|

| 11/2022 | $17,275 | $23,022 | $17,026 |

|---|

| 12/2022 | $16,168 | $21,696 | $15,933 |

|---|

| 01/2023 | $17,619 | $23,059 | $17,518 |

|---|

| 02/2023 | $17,235 | $22,496 | $17,329 |

|---|

| 03/2023 | $17,150 | $23,322 | $16,901 |

|---|

| 04/2023 | $16,723 | $23,686 | $16,705 |

|---|

| 05/2023 | $16,595 | $23,789 | $16,708 |

|---|

| 06/2023 | $17,960 | $25,361 | $18,093 |

|---|

| 07/2023 | $18,365 | $26,176 | $18,939 |

|---|

| 08/2023 | $18,131 | $25,759 | $17,953 |

|---|

| 09/2023 | $17,022 | $24,531 | $16,769 |

|---|

| 10/2023 | $16,168 | $24,015 | $15,476 |

|---|

| 11/2023 | $17,768 | $26,208 | $16,885 |

|---|

| 12/2023 | $19,114 | $27,399 | $18,906 |

|---|

| 01/2024 | $18,745 | $27,859 | $18,300 |

|---|

| 02/2024 | $20,419 | $29,347 | $19,787 |

|---|

| 03/2024 | $20,898 | $30,291 | $20,340 |

|---|

| 04/2024 | $19,723 | $29,054 | $18,774 |

|---|

| 05/2024 | $20,484 | $30,494 | $19,779 |

|---|

| 06/2024 | $20,289 | $31,589 | $19,746 |

|---|

| 07/2024 | $20,985 | $31,973 | $21,363 |

|---|

| 08/2024 | $21,420 | $32,749 | $21,126 |

|---|

| 09/2024 | $21,528 | $33,448 | $21,407 |

|---|

| 10/2024 | $21,159 | $33,145 | $21,123 |

|---|

| 11/2024 | $23,268 | $35,090 | $23,713 |

|---|

| 12/2024 | $21,889 | $34,254 | $21,772 |

|---|

Average Annual Total Returns (%)

| HEADER | 1 Year | 5 Years | 10 Years |

|---|

Class C without Deferred Sales ChargeFootnote Reference1 | 14.51% | 7.80% | 8.15% |

|---|

Class C with Maximum Deferred Sales Charge -1.00%Footnote Reference1 | 13.51% | 7.80% | 8.15% |

|---|

S&P 500® Index TR | 25.02% | 14.53% | 13.10% |

|---|

Russell 2000® Growth Index | 15.15% | 6.86% | 8.09% |

|---|

| Footnote | Description |

Footnote1 | Return may differ from actual shareholder return due to accounting adjustments for financial reporting purposes. |

Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit americanbeaconfunds.com or call 800-967-9009. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. The Fund's performance benefited from fee waivers. For more information, visit americanbeaconfunds.com/Performance_Disclaimers.aspx.

The S&P 500 Index TR is replacing the Russell 2000 Growth Index as broad-based securities market index to comply with a new regulatory requirement. The Russell 2000 Growth Index reflects the market sectors in which the Fund invests.

| Total Net Assets | $364,382,179 |

|---|

| # of Portfolio Holdings | 105 |

|---|

| Portfolio Turnover Rate | 37% |

|---|

| Total Management Fees Paid | $2,854,258 |

|---|

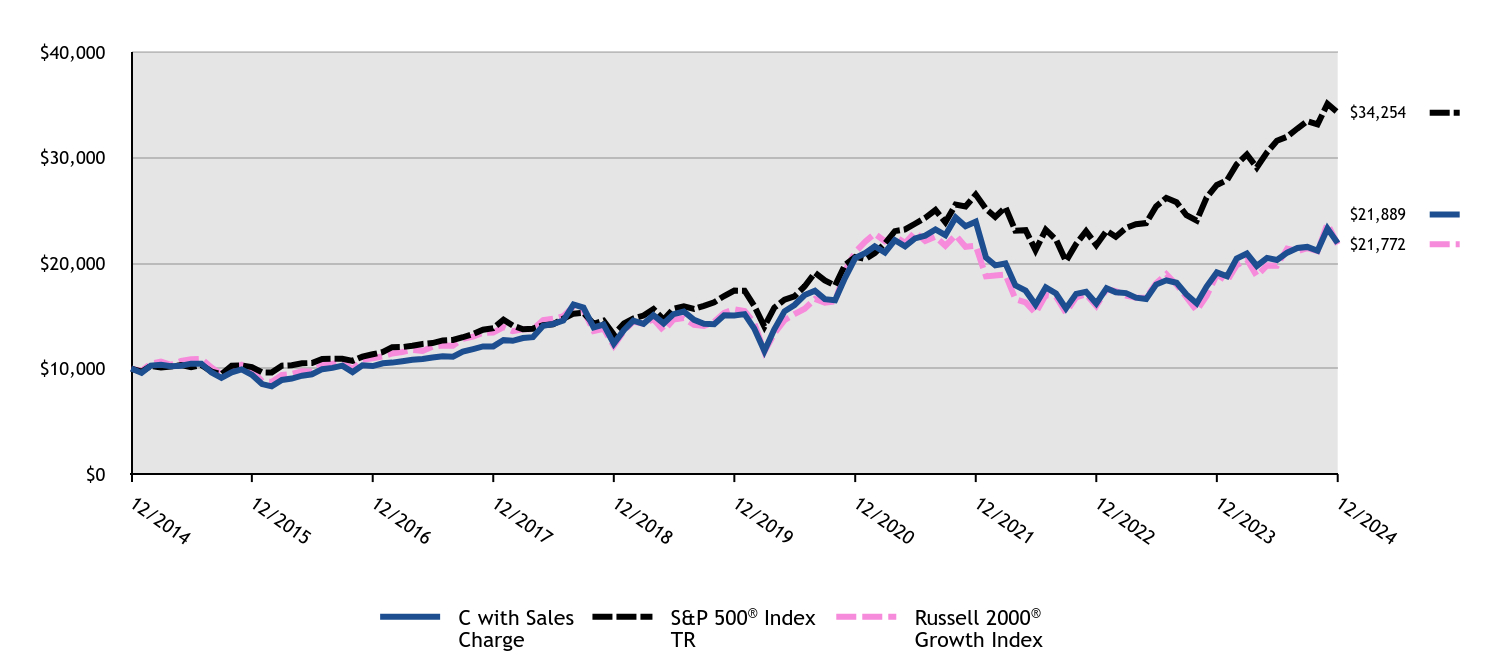

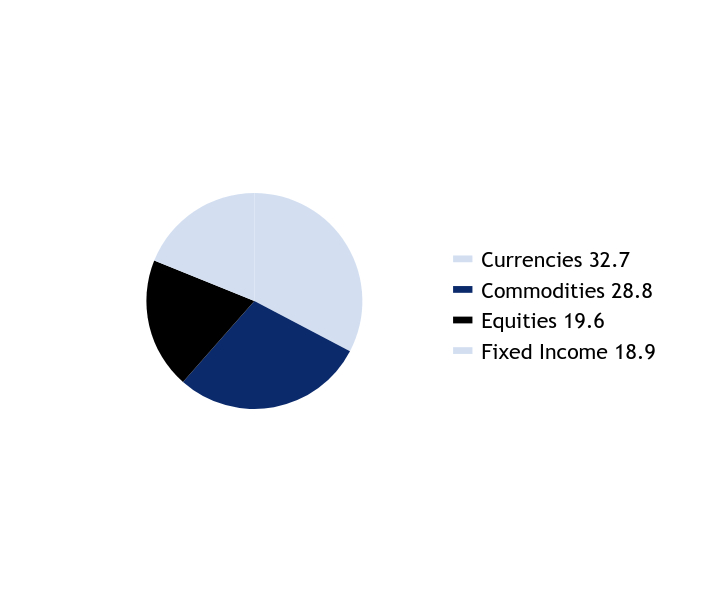

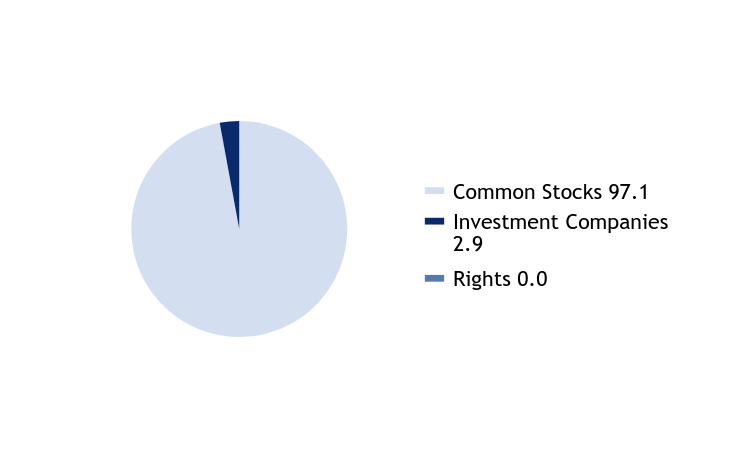

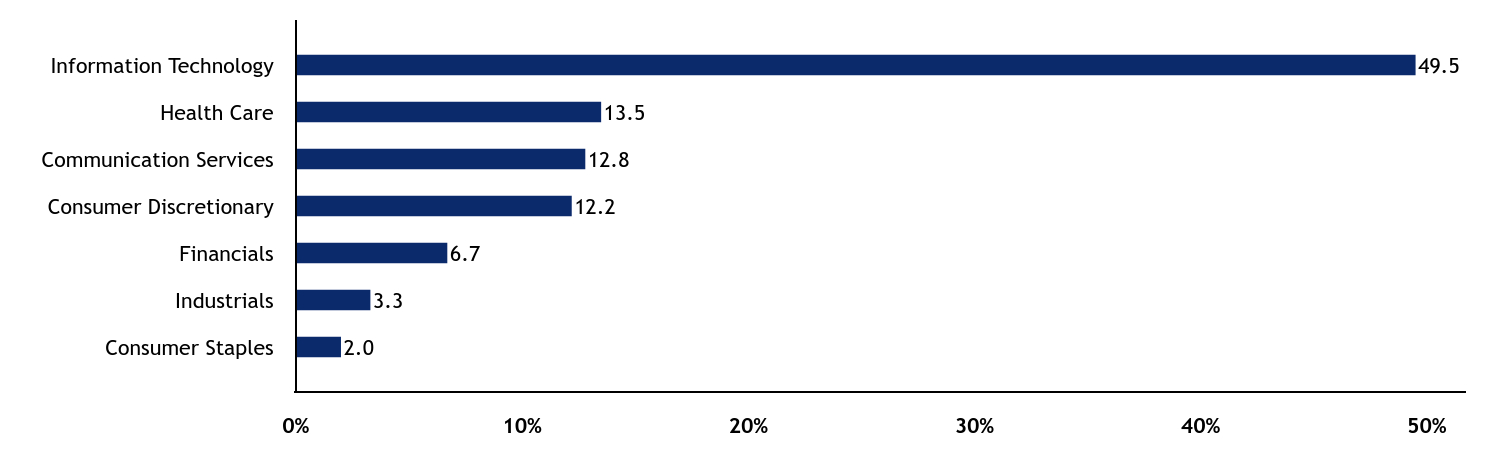

What did the Fund invest in?

Top Ten Holdings - % Net Assets

| CyberArk Software Ltd. | 2.2 |

| BellRing Brands, Inc. | 2.1 |

| Kratos Defense & Security Solutions, Inc. | 2.0 |

| Viper Energy, Inc. | 1.9 |

| Manhattan Associates, Inc. | 1.7 |

| HealthEquity, Inc. | 1.7 |

| Leonardo DRS, Inc. | 1.6 |

| RBC Bearings, Inc. | 1.6 |

| Ryan Specialty Holdings, Inc. | 1.5 |

| Descartes Systems Group, Inc. | 1.5 |

Excludes cash equivalents.

Asset Allocation - % Investments

| Value | Value |

|---|

| Common Stocks | 93.6 |

| Foreign Common Stocks | 4.7 |

| Investment Companies | 1.7 |

Sector Allocation - % Equities

| Value | Value |

|---|

| Communication Services | 1.0 |

| Materials | 1.1 |

| Consumer Staples | 3.0 |

| Energy | 6.1 |

| Consumer Discretionary | 11.3 |

| Financials | 11.5 |

| Health Care | 17.5 |

| Industrials | 22.0 |

| Information Technology | 26.5 |

For additional information about the Fund, including its prospectus, financial statements, holdings, and proxy voting information, please visit www.americanbeaconfunds.com/literature or call 1-800-658-5811.

If your financial institution mailed only one copy of this Report to an address shared by more than one account, you can request an individual copy by contacting your financial institution.

Stephens Small Cap Growth Fund

Distributed by:

Resolute Investment Distributors, Inc.

Annual Shareholder Report - December 31, 2024

Stephens Small Cap Growth Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about American Beacon Stephens Small Cap Growth Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

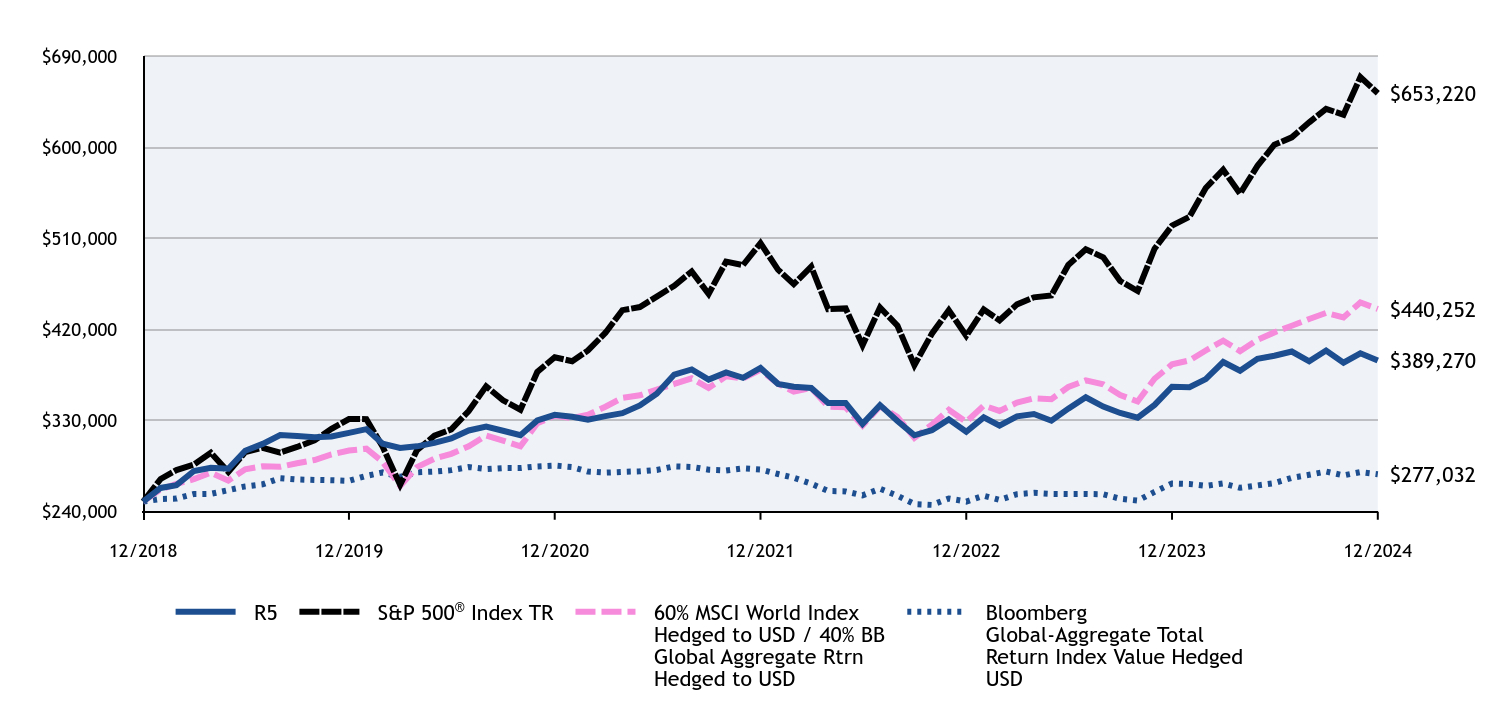

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| R5 | $107 | 0.99% |

|---|

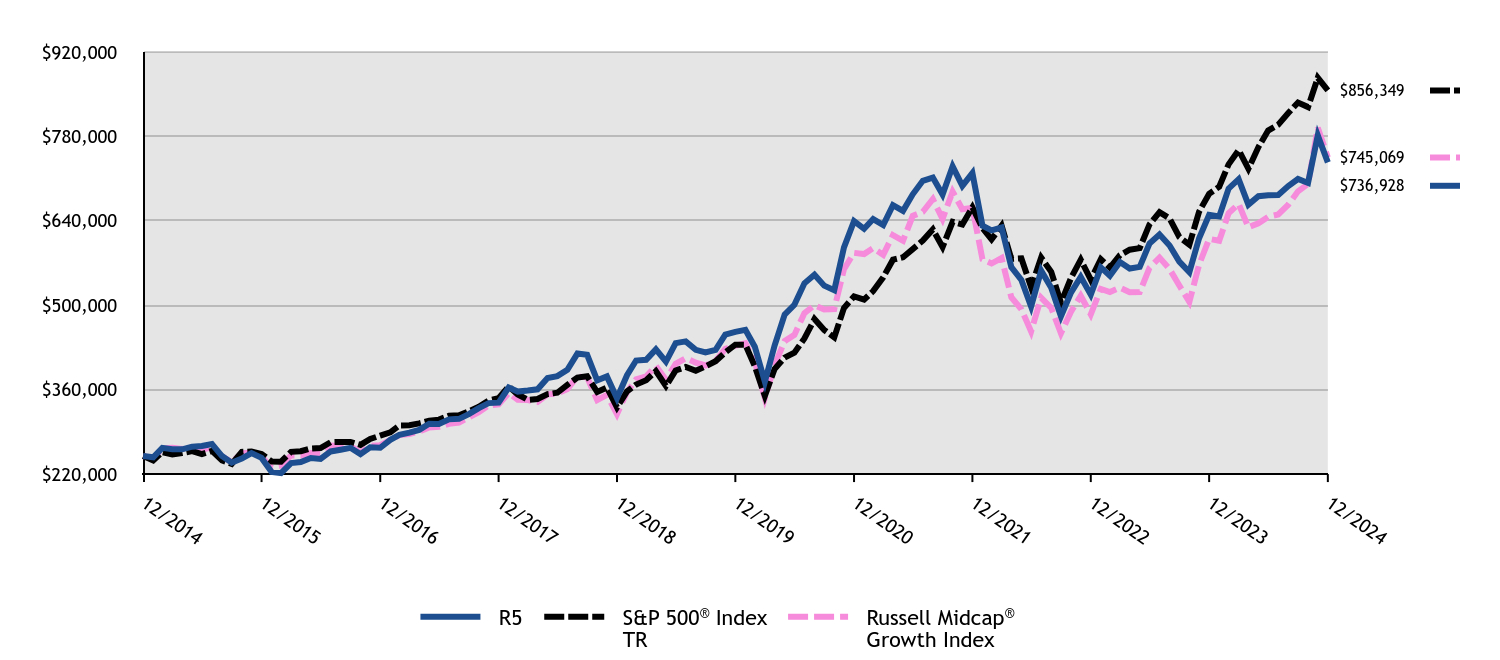

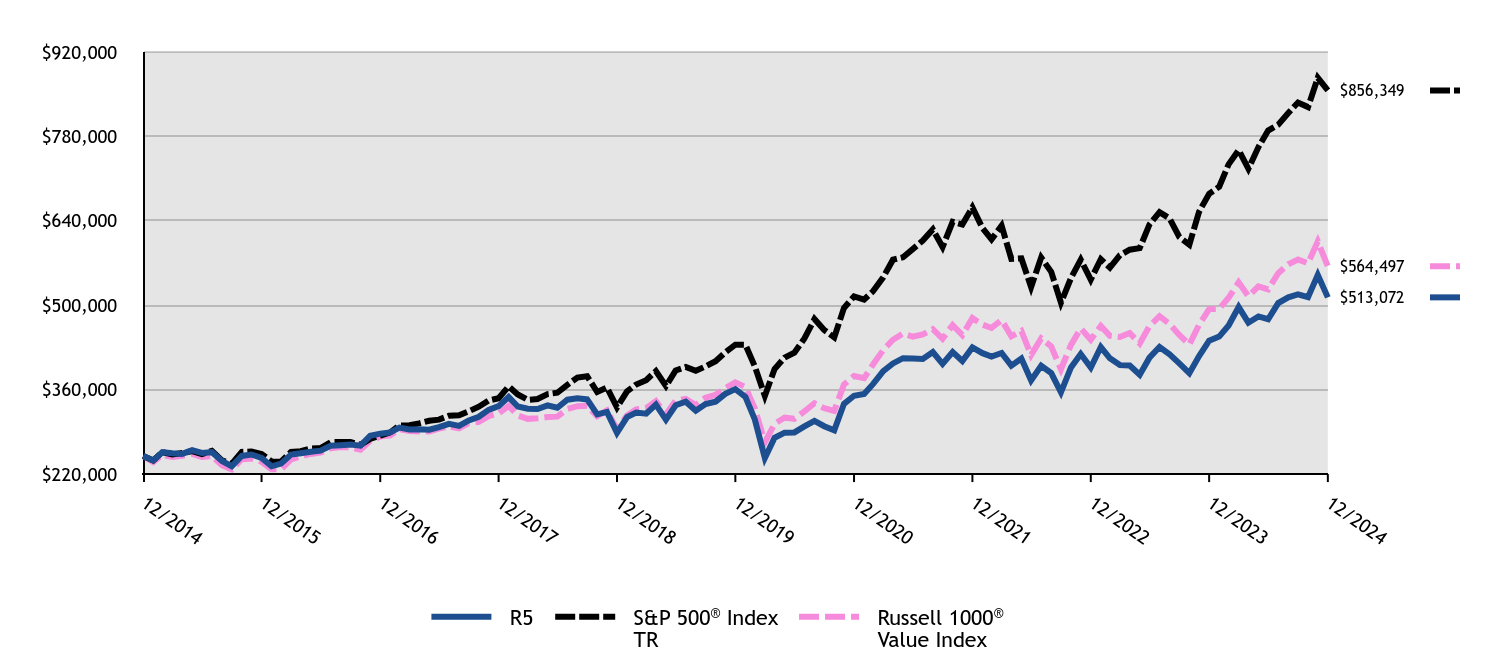

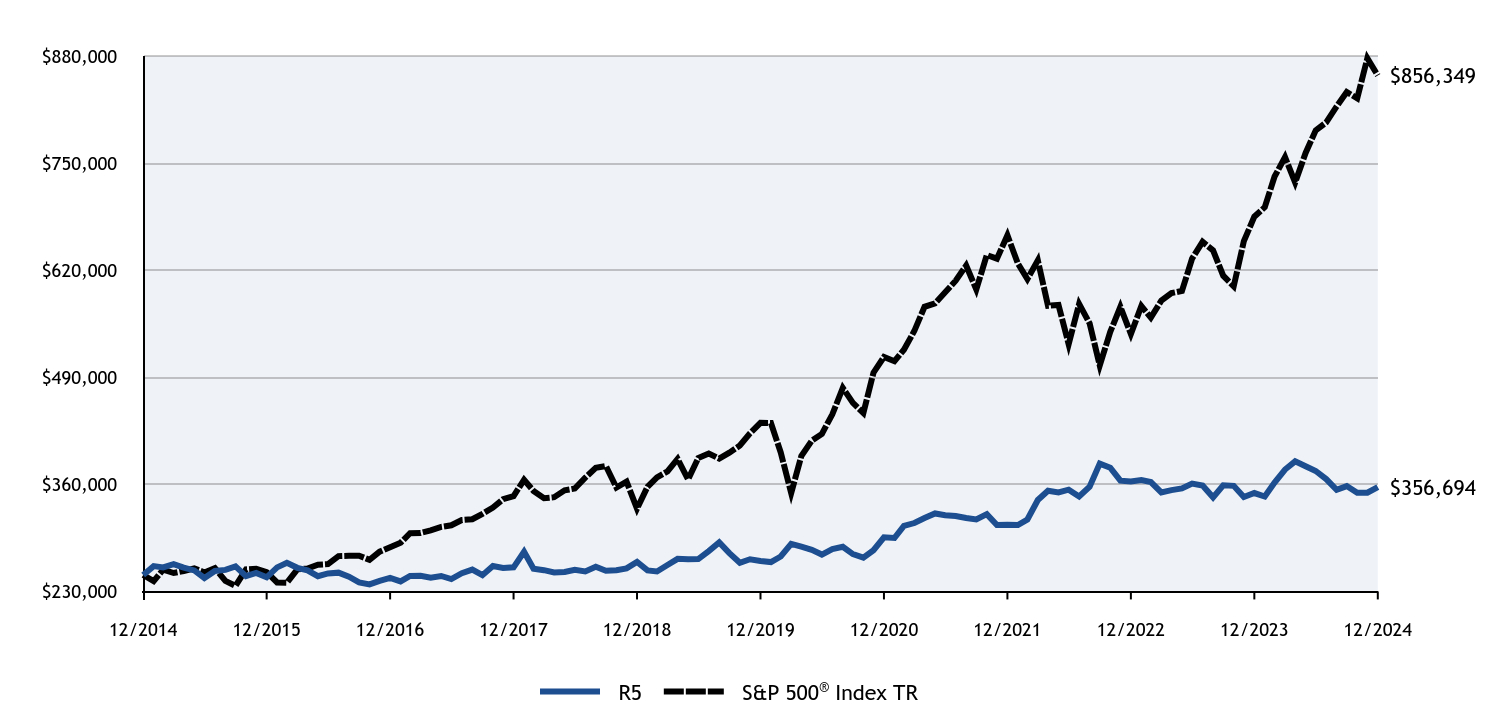

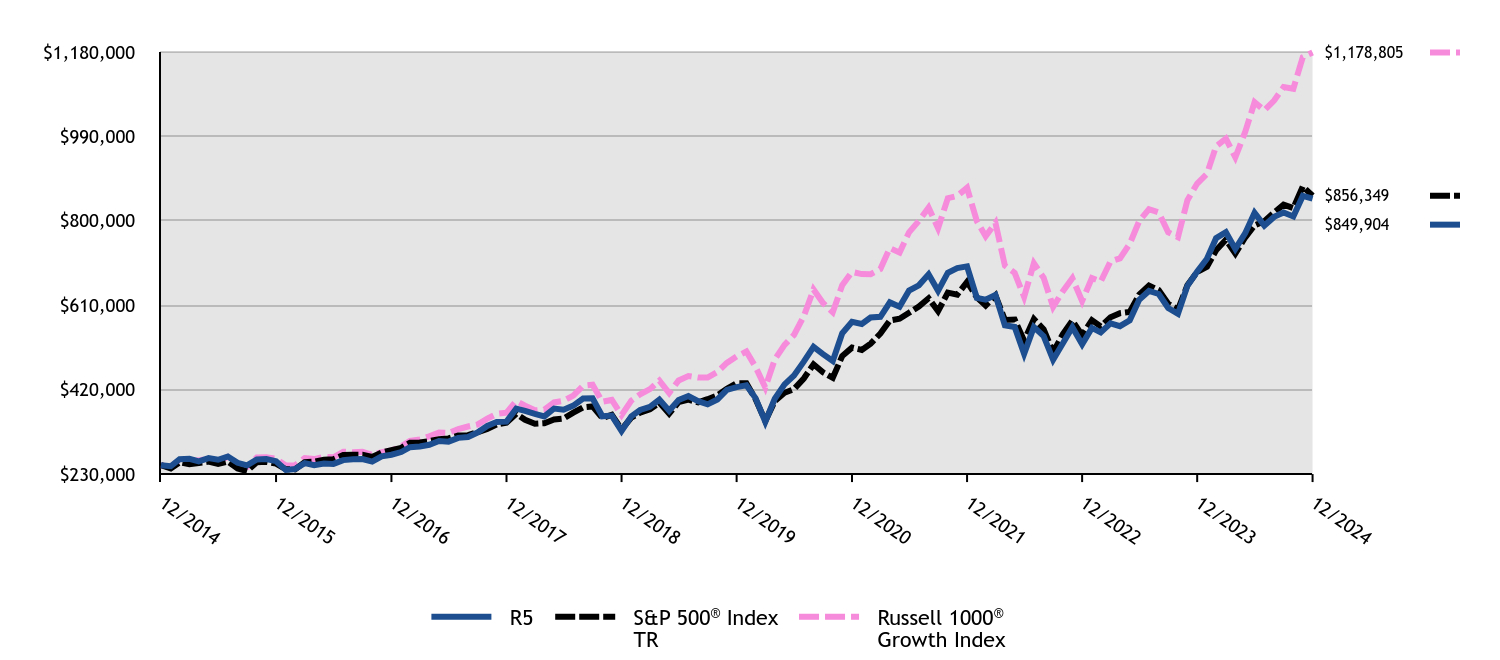

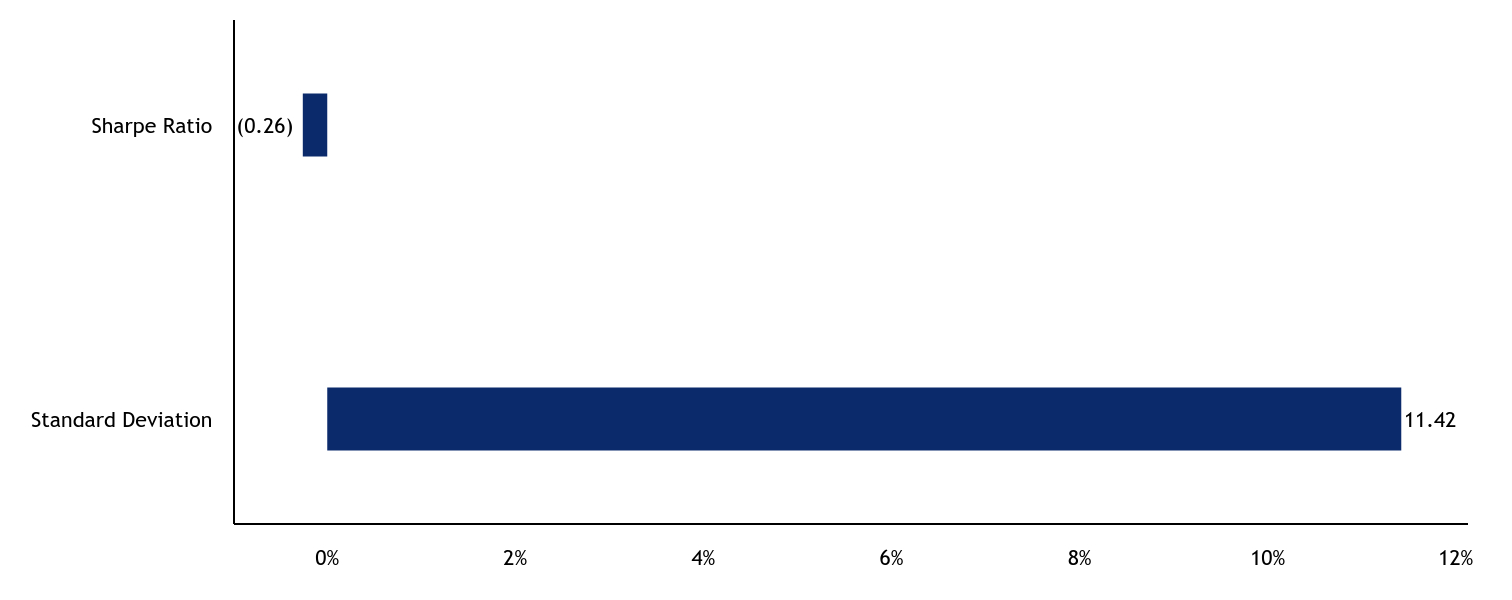

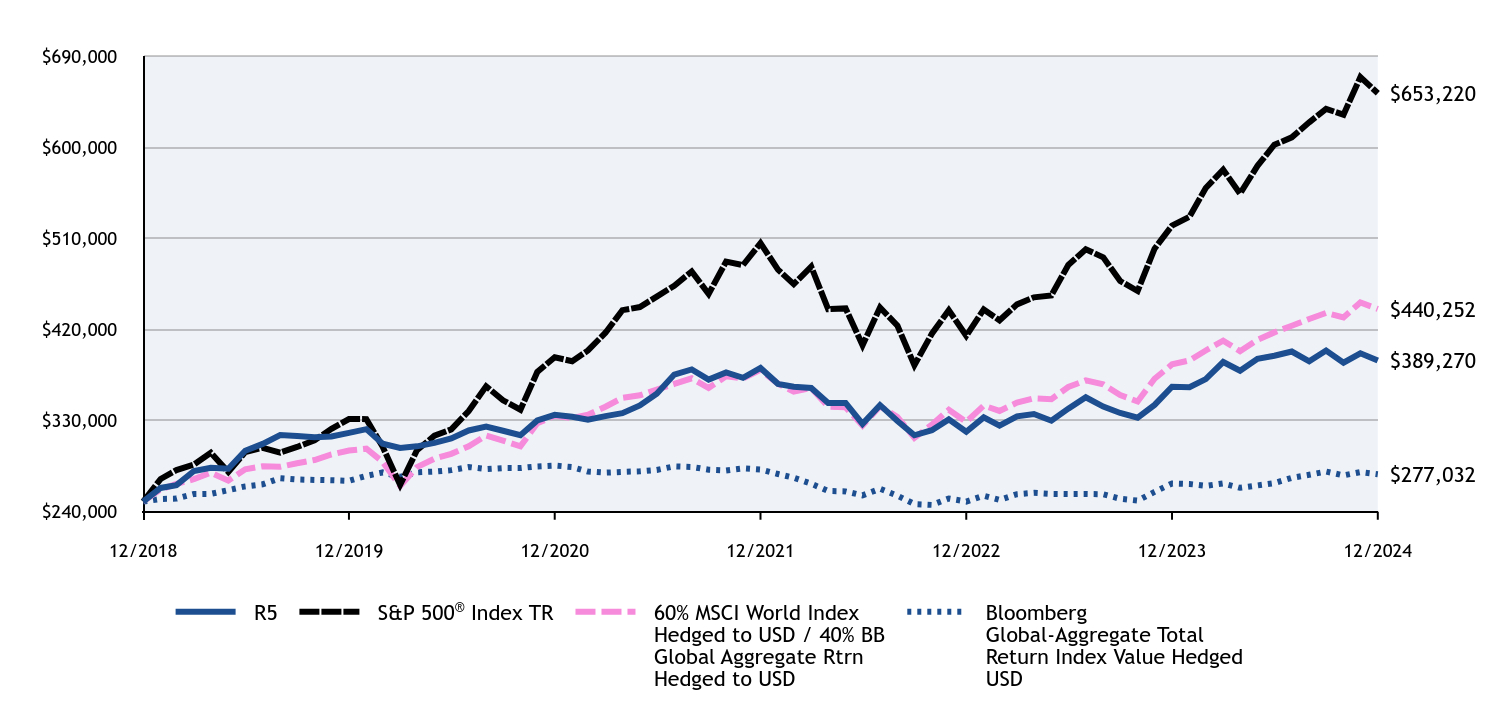

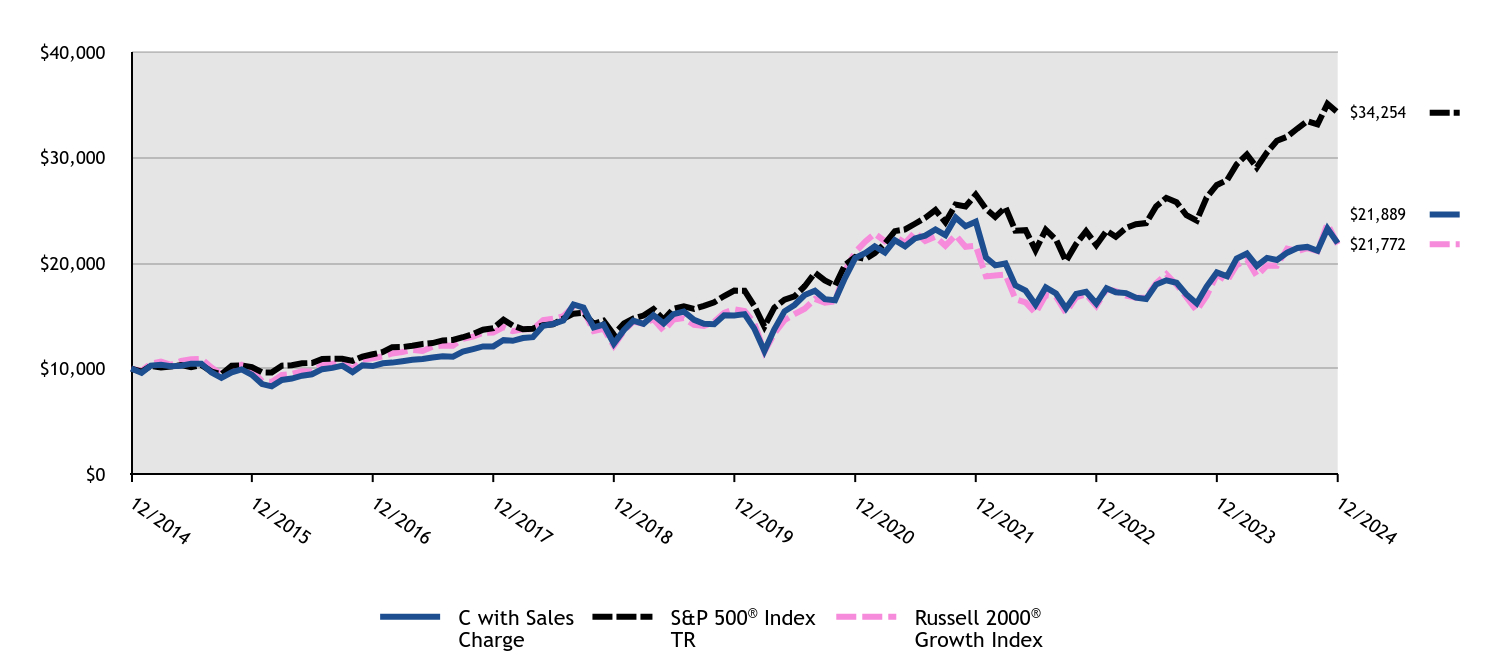

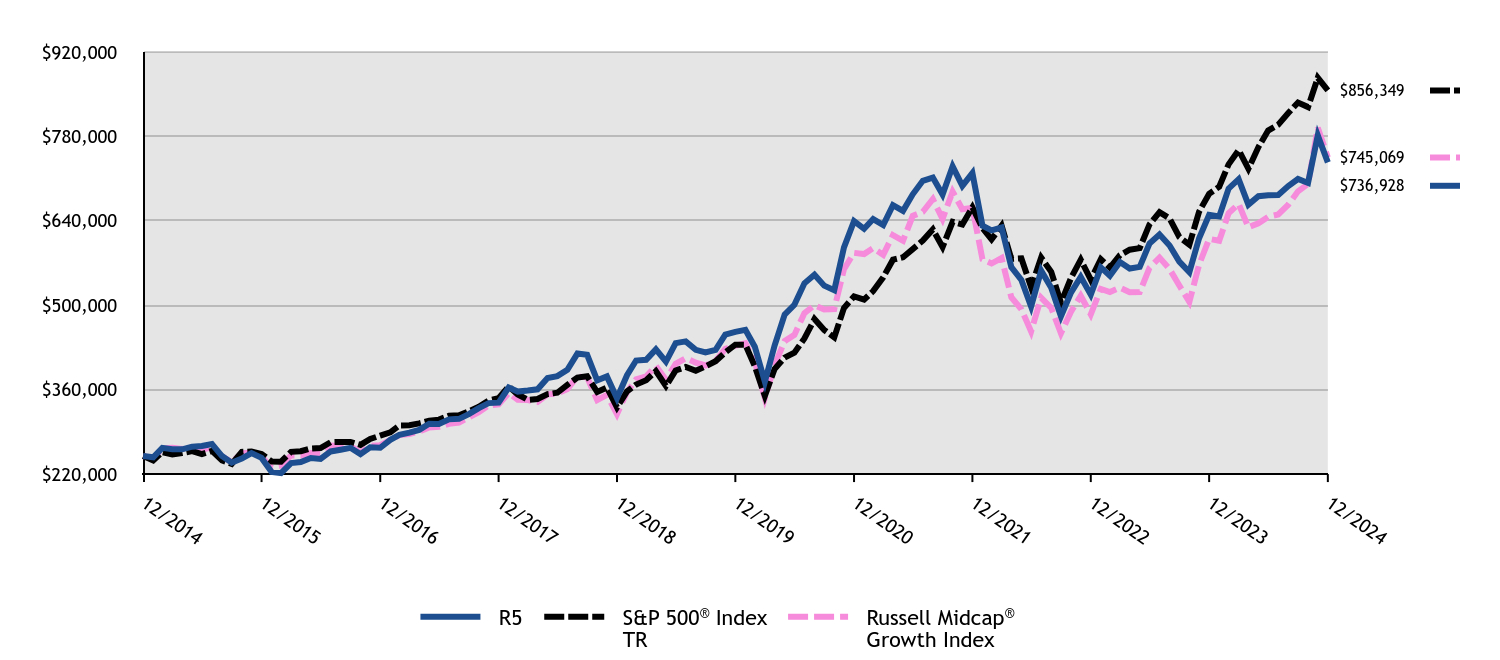

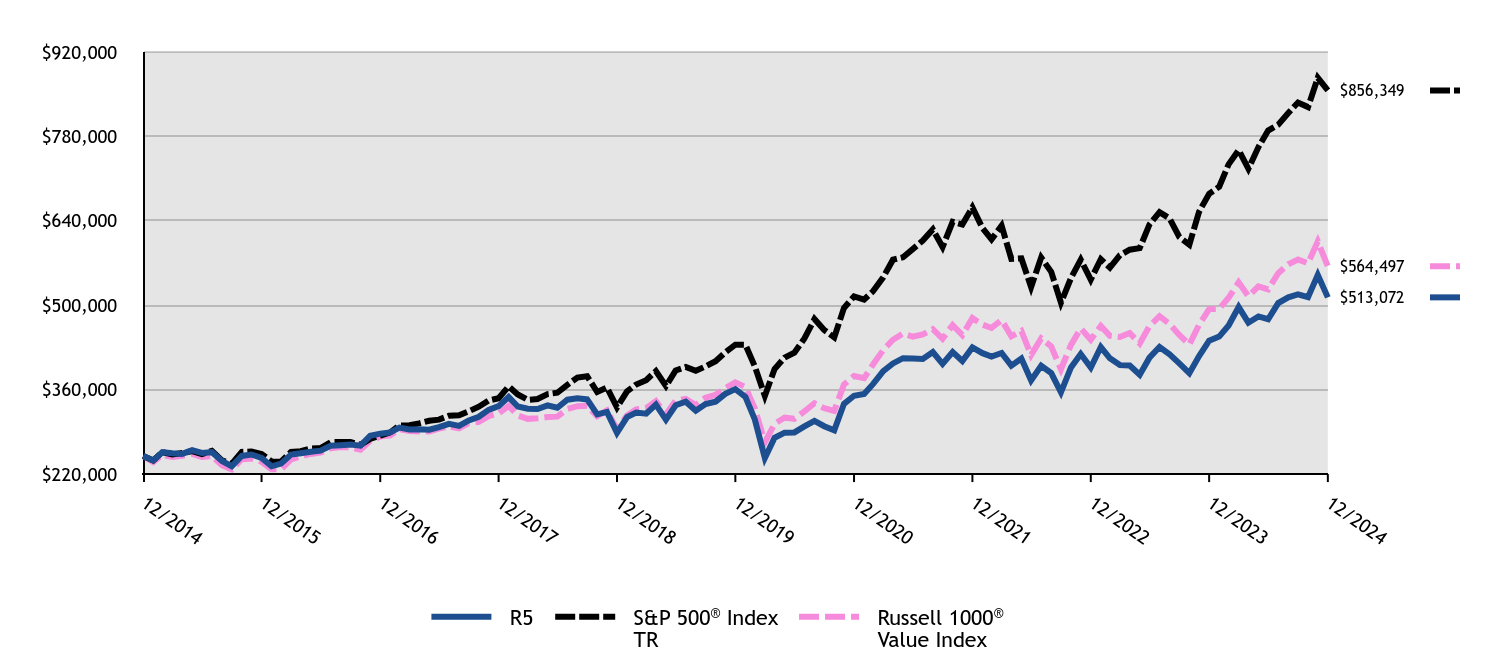

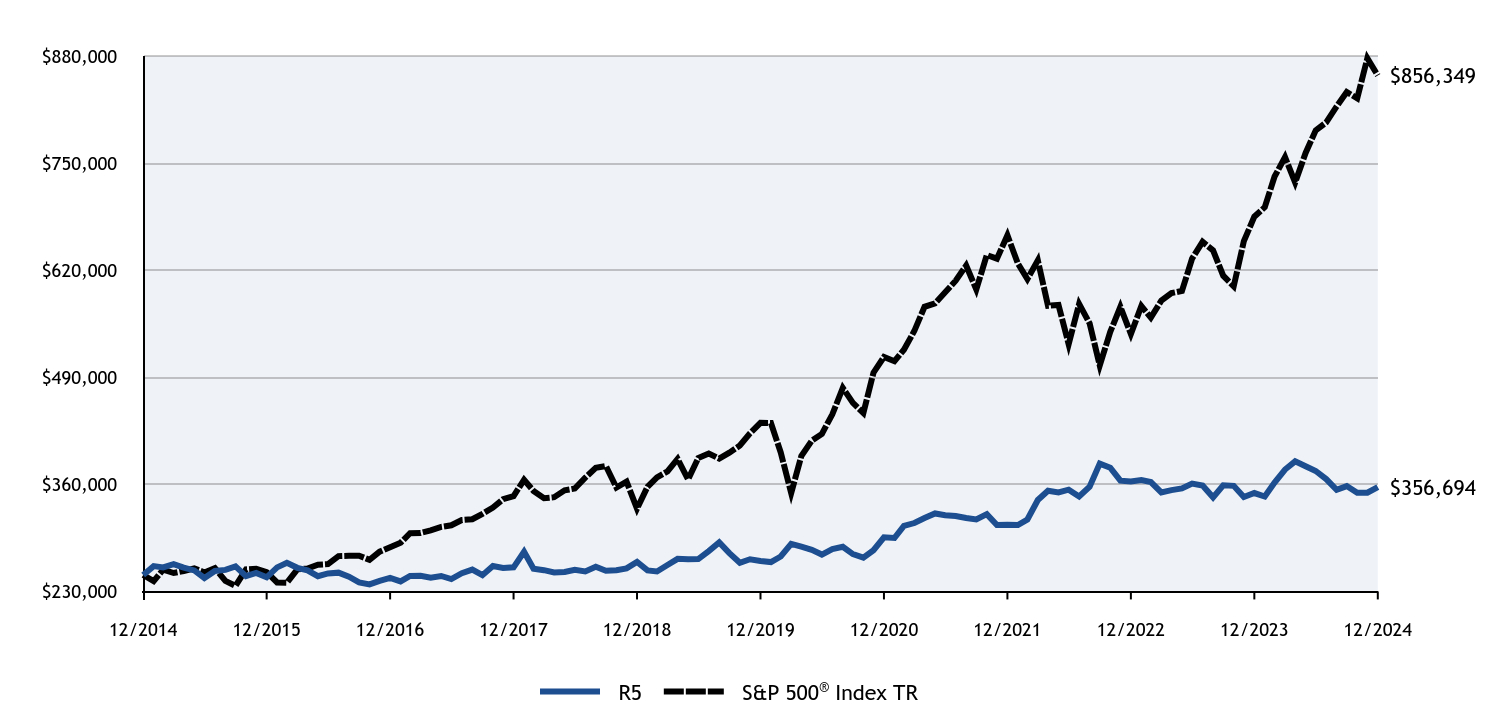

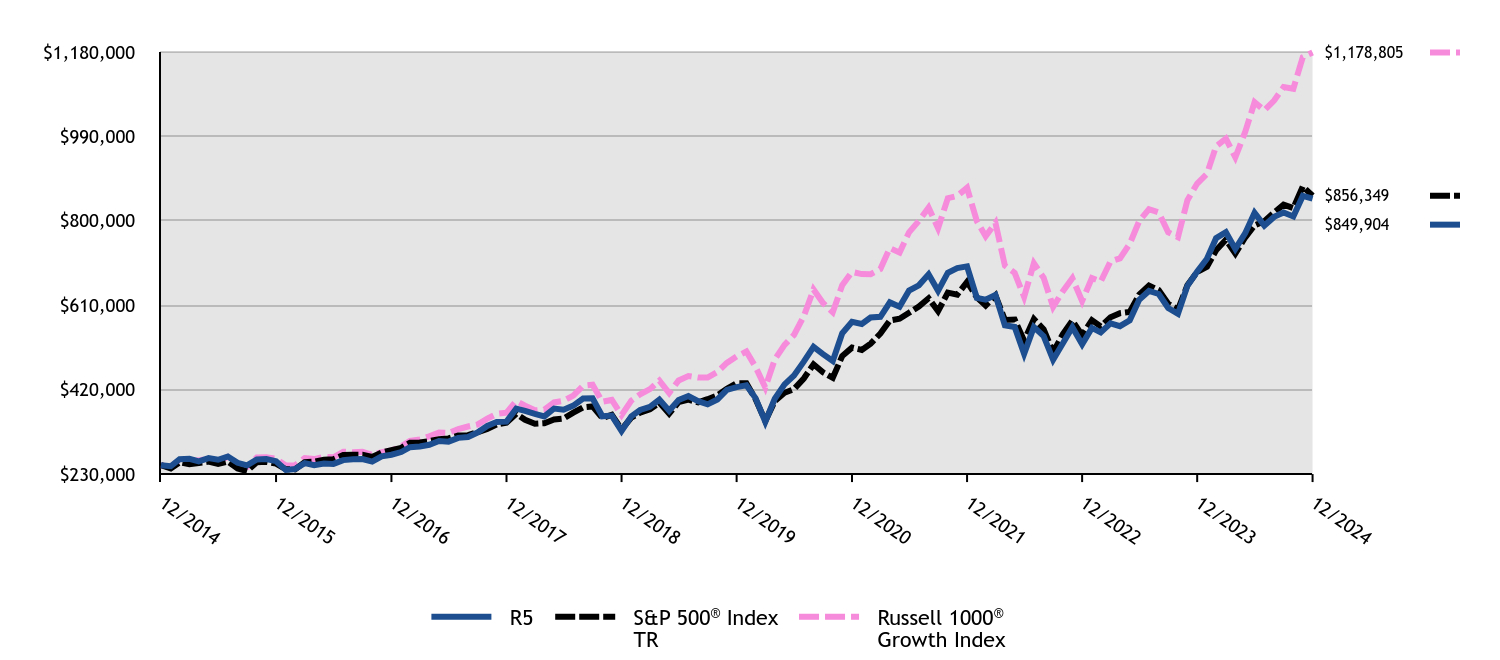

How did the Fund perform and what affected its performance?

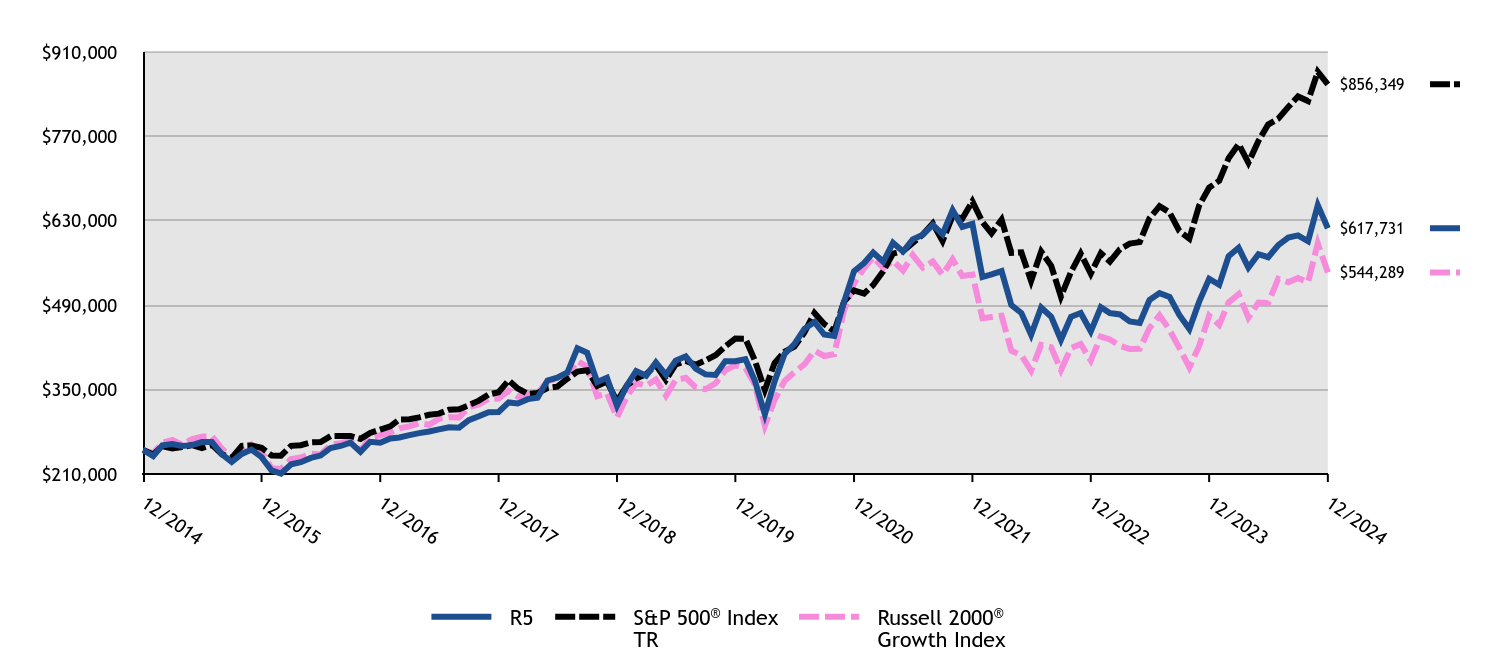

The R5 Class of the Fund returned 15.69% for the twelve months ended December 31, 2024, compared to the S&P 500 Index return of 25.02% and the Russell 2000 Growth Index return of 15.15%.

• Overall market performance during the period was driven by mega-cap growth companies, while the Fund focuses its investments on small capitalization companies.

• The Fund’s performance was positive in all sectors where it invested. Holdings in the Energy and Financials sectors contributed materially to the Fund’s outperformance of the Russell 2000® Growth Index, while holdings in the Information Technology sector detracted.

Cumulative Performance from December 31, 2014 through December 31, 2024

The initial investment, based on a $250,000 investment, is adjusted to reflect the maximum applicable sales charge, if any.

| R5 | S&P 500® Index TR | Russell 2000® Growth Index |

|---|

| 12/2014 | $250,000 | $250,000 | $250,000 |

|---|

| 01/2015 | $239,747 | $242,495 | $244,293 |

|---|

| 02/2015 | $257,539 | $256,432 | $261,873 |

|---|

| 03/2015 | $259,650 | $252,376 | $266,574 |

|---|

| 04/2015 | $256,484 | $254,798 | $258,733 |

|---|

| 05/2015 | $257,992 | $258,074 | $268,239 |

|---|

| 06/2015 | $263,118 | $253,078 | $271,844 |

|---|

| 07/2015 | $263,118 | $258,381 | $272,955 |

|---|

| 08/2015 | $242,762 | $242,791 | $252,270 |

|---|

| 09/2015 | $230,097 | $236,784 | $236,337 |

|---|

| 10/2015 | $243,366 | $256,758 | $249,743 |

|---|

| 11/2015 | $250,603 | $257,521 | $258,895 |

|---|

| 12/2015 | $238,129 | $253,459 | $246,546 |

|---|

| 01/2016 | $216,021 | $240,882 | $219,833 |

|---|

| 02/2016 | $210,652 | $240,557 | $218,279 |

|---|

| 03/2016 | $226,285 | $256,876 | $235,000 |

|---|

| 04/2016 | $229,759 | $257,872 | $237,344 |

|---|

| 05/2016 | $236,865 | $262,503 | $243,738 |

|---|

| 06/2016 | $240,655 | $263,183 | $242,617 |

|---|

| 07/2016 | $253,288 | $272,886 | $258,481 |

|---|

| 08/2016 | $256,604 | $273,269 | $261,229 |

|---|

| 09/2016 | $262,131 | $273,320 | $264,989 |

|---|

| 10/2016 | $246,972 | $268,335 | $248,522 |

|---|

| 11/2016 | $263,552 | $278,273 | $270,757 |

|---|

| 12/2016 | $262,058 | $283,773 | $274,450 |

|---|

| 01/2017 | $268,904 | $289,155 | $278,906 |

|---|

| 02/2017 | $270,655 | $300,637 | $285,745 |

|---|

| 03/2017 | $274,476 | $300,987 | $289,130 |

|---|

| 04/2017 | $277,978 | $304,078 | $294,455 |

|---|

| 05/2017 | $280,526 | $308,357 | $291,777 |

|---|

| 06/2017 | $284,188 | $310,282 | $301,819 |

|---|

| 07/2017 | $287,690 | $316,662 | $304,388 |

|---|

| 08/2017 | $286,894 | $317,632 | $304,033 |

|---|

| 09/2017 | $299,312 | $324,184 | $320,587 |

|---|

| 10/2017 | $305,840 | $331,749 | $325,554 |

|---|

| 11/2017 | $312,686 | $341,924 | $334,901 |

|---|

| 12/2017 | $313,017 | $345,725 | $335,287 |

|---|

| 01/2018 | $328,825 | $365,519 | $348,357 |

|---|

| 02/2018 | $327,013 | $352,047 | $338,439 |

|---|

| 03/2018 | $334,259 | $343,101 | $342,996 |

|---|

| 04/2018 | $336,728 | $344,417 | $343,332 |

|---|

| 05/2018 | $365,214 | $352,712 | $364,948 |

|---|

| 06/2018 | $369,825 | $354,882 | $367,804 |

|---|

| 07/2018 | $378,387 | $368,089 | $374,127 |

|---|

| 08/2018 | $418,729 | $380,083 | $397,419 |

|---|

| 09/2018 | $411,154 | $382,247 | $388,118 |

|---|

| 10/2018 | $362,745 | $356,120 | $339,008 |

|---|

| 11/2018 | $369,660 | $363,377 | $344,310 |

|---|

| 12/2018 | $323,212 | $330,567 | $304,078 |

|---|

| 01/2019 | $357,333 | $357,058 | $339,194 |

|---|

| 02/2019 | $380,704 | $368,522 | $361,099 |

|---|

| 03/2019 | $372,991 | $375,683 | $356,212 |

|---|

| 04/2019 | $395,193 | $390,895 | $367,059 |

|---|

| 05/2019 | $374,627 | $366,054 | $339,827 |

|---|

| 06/2019 | $397,998 | $391,852 | $366,001 |

|---|

| 07/2019 | $405,242 | $397,484 | $369,578 |

|---|

| 08/2019 | $384,677 | $391,188 | $353,630 |

|---|

| 09/2019 | $375,328 | $398,507 | $350,727 |

|---|

| 10/2019 | $374,394 | $407,138 | $360,708 |

|---|

| 11/2019 | $397,297 | $421,917 | $381,938 |

|---|

| 12/2019 | $397,282 | $434,651 | $390,691 |

|---|

| 01/2020 | $400,636 | $434,481 | $386,389 |

|---|

| 02/2020 | $365,293 | $398,715 | $358,492 |

|---|

| 03/2020 | $309,054 | $349,468 | $290,030 |

|---|

| 04/2020 | $363,745 | $394,268 | $333,227 |

|---|

| 05/2020 | $409,407 | $413,046 | $364,717 |

|---|

| 06/2020 | $425,401 | $421,261 | $378,732 |

|---|

| 07/2020 | $450,941 | $445,013 | $391,747 |

|---|

| 08/2020 | $462,292 | $477,001 | $414,729 |

|---|

| 09/2020 | $441,396 | $458,877 | $405,842 |

|---|

| 10/2020 | $439,074 | $446,674 | $408,926 |

|---|

| 11/2020 | $495,313 | $495,568 | $481,033 |

|---|

| 12/2020 | $546,504 | $514,622 | $525,996 |

|---|

| 01/2021 | $560,117 | $509,426 | $551,356 |

|---|

| 02/2021 | $577,417 | $523,474 | $569,561 |

|---|

| 03/2021 | $562,103 | $546,400 | $551,639 |

|---|

| 04/2021 | $593,583 | $575,560 | $563,667 |

|---|

| 05/2021 | $579,119 | $579,580 | $547,569 |

|---|

| 06/2021 | $599,255 | $593,110 | $573,250 |

|---|

| 07/2021 | $606,912 | $607,200 | $552,371 |

|---|

| 08/2021 | $623,361 | $625,662 | $562,410 |

|---|

| 09/2021 | $607,763 | $596,563 | $540,846 |

|---|

| 10/2021 | $647,467 | $638,359 | $566,172 |

|---|

| 11/2021 | $619,958 | $633,936 | $538,520 |

|---|

| 12/2021 | $624,855 | $662,346 | $540,906 |

|---|

| 01/2022 | $536,808 | $628,072 | $468,409 |

|---|

| 02/2022 | $541,245 | $609,266 | $470,453 |

|---|

| 03/2022 | $546,705 | $631,888 | $472,604 |

|---|

| 04/2022 | $490,396 | $576,786 | $414,619 |

|---|

| 05/2022 | $477,087 | $577,845 | $406,789 |

|---|

| 06/2022 | $440,913 | $530,147 | $381,607 |

|---|

| 07/2022 | $486,301 | $579,029 | $424,333 |

|---|

| 08/2022 | $470,944 | $555,415 | $420,345 |

|---|

| 09/2022 | $432,723 | $504,262 | $382,530 |

|---|

| 10/2022 | $470,944 | $545,088 | $418,840 |

|---|

| 11/2022 | $477,087 | $575,550 | $425,661 |

|---|

| 12/2022 | $446,772 | $542,390 | $398,337 |

|---|

| 01/2023 | $486,690 | $576,470 | $437,961 |

|---|

| 02/2023 | $477,094 | $562,405 | $433,216 |

|---|

| 03/2023 | $474,791 | $583,053 | $422,527 |

|---|

| 04/2023 | $463,277 | $592,154 | $417,618 |

|---|

| 05/2023 | $460,590 | $594,728 | $417,693 |

|---|

| 06/2023 | $498,588 | $634,024 | $452,326 |

|---|

| 07/2023 | $510,103 | $654,392 | $473,473 |

|---|

| 08/2023 | $503,962 | $643,973 | $448,827 |

|---|

| 09/2023 | $474,024 | $613,270 | $419,222 |

|---|

| 10/2023 | $450,610 | $600,375 | $386,891 |

|---|

| 11/2023 | $495,518 | $655,205 | $422,113 |

|---|

| 12/2023 | $533,950 | $684,971 | $472,661 |

|---|

| 01/2024 | $523,846 | $696,481 | $457,503 |

|---|

| 02/2024 | $571,257 | $733,670 | $494,663 |

|---|

| 03/2024 | $585,247 | $757,276 | $508,497 |

|---|

| 04/2024 | $552,603 | $726,345 | $469,343 |

|---|

| 05/2024 | $574,754 | $762,361 | $494,477 |

|---|

| 06/2024 | $569,702 | $789,716 | $493,653 |

|---|

| 07/2024 | $589,521 | $799,329 | $534,064 |

|---|

| 08/2024 | $602,346 | $818,718 | $528,151 |

|---|

| 09/2024 | $605,843 | $836,203 | $535,170 |

|---|

| 10/2024 | $596,128 | $828,620 | $528,069 |

|---|

| 11/2024 | $655,974 | $877,261 | $592,819 |

|---|

| 12/2024 | $617,731 | $856,349 | $544,289 |

|---|

Average Annual Total Returns (%)

| HEADER | 1 Year | 5 Years | 10 Years |

|---|

Class R5Footnote Reference1 | 15.69% | 9.23% | 9.47% |

|---|

S&P 500® Index TR | 25.02% | 14.53% | 13.10% |

|---|

Russell 2000® Growth Index | 15.15% | 6.86% | 8.09% |

|---|

| Footnote | Description |

Footnote1 | Return may differ from actual shareholder return due to accounting adjustments for financial reporting purposes. |

Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit americanbeaconfunds.com or call 800-967-9009. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. The Fund's performance benefited from fee waivers. For more information, visit americanbeaconfunds.com/Performance_Disclaimers.aspx.

The S&P 500 Index TR is replacing the Russell 2000 Growth Index as broad-based securities market index to comply with a new regulatory requirement. The Russell 2000 Growth Index reflects the market sectors in which the Fund invests.

| Total Net Assets | $364,382,179 |

|---|

| # of Portfolio Holdings | 105 |

|---|

| Portfolio Turnover Rate | 37% |

|---|

| Total Management Fees Paid | $2,854,258 |

|---|

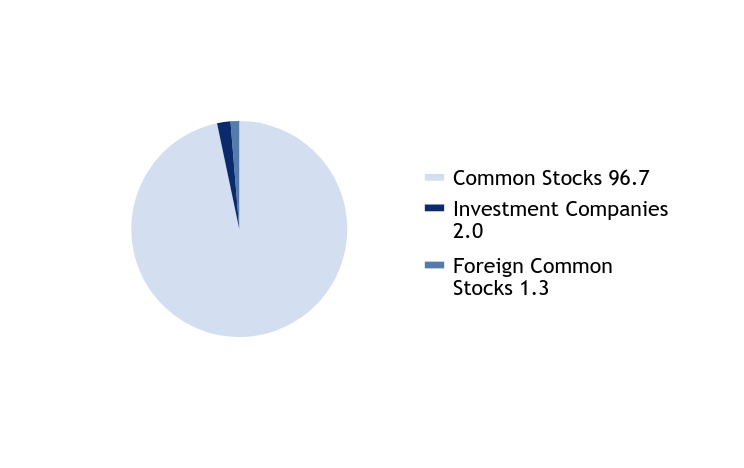

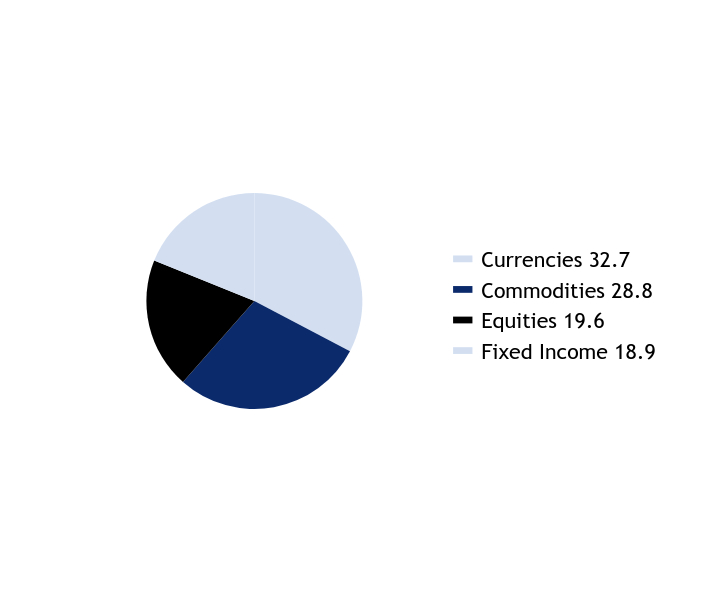

What did the Fund invest in?

Top Ten Holdings - % Net Assets

| CyberArk Software Ltd. | 2.2 |

| BellRing Brands, Inc. | 2.1 |

| Kratos Defense & Security Solutions, Inc. | 2.0 |

| Viper Energy, Inc. | 1.9 |

| Manhattan Associates, Inc. | 1.7 |

| HealthEquity, Inc. | 1.7 |

| Leonardo DRS, Inc. | 1.6 |

| RBC Bearings, Inc. | 1.6 |

| Ryan Specialty Holdings, Inc. | 1.5 |

| Descartes Systems Group, Inc. | 1.5 |

Excludes cash equivalents.

Asset Allocation - % Investments

| Value | Value |

|---|

| Common Stocks | 93.6 |

| Foreign Common Stocks | 4.7 |

| Investment Companies | 1.7 |

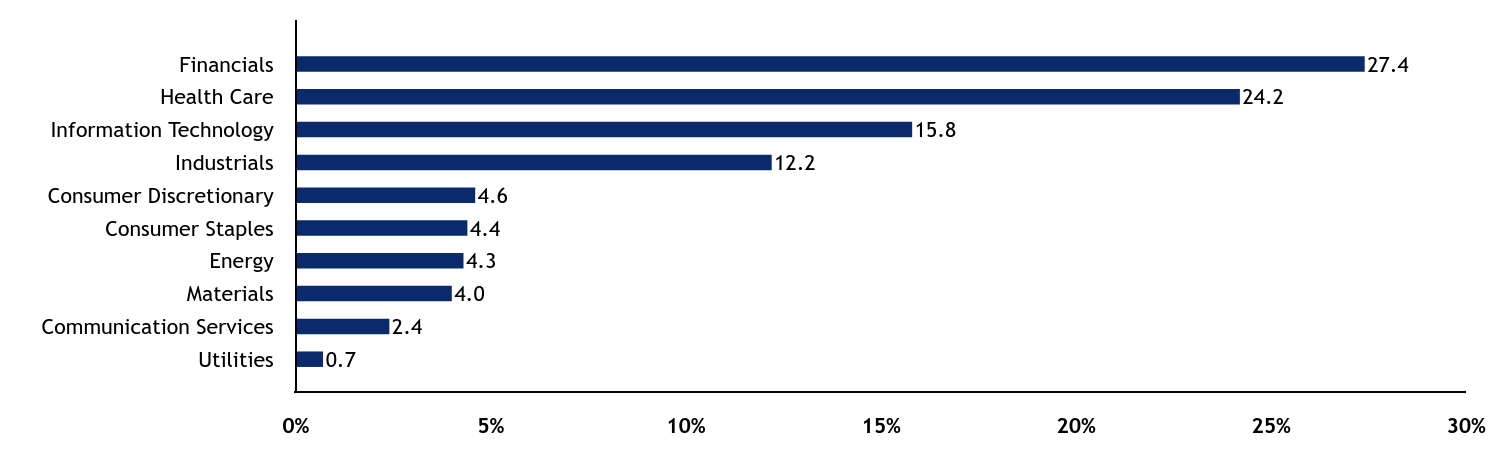

Sector Allocation - % Equities

| Value | Value |

|---|

| Communication Services | 1.0 |

| Materials | 1.1 |

| Consumer Staples | 3.0 |

| Energy | 6.1 |

| Consumer Discretionary | 11.3 |

| Financials | 11.5 |

| Health Care | 17.5 |

| Industrials | 22.0 |

| Information Technology | 26.5 |

For additional information about the Fund, including its prospectus, financial statements, holdings, and proxy voting information, please visit www.americanbeaconfunds.com/literature or call 1-800-658-5811.

If your financial institution mailed only one copy of this Report to an address shared by more than one account, you can request an individual copy by contacting your financial institution.

Stephens Small Cap Growth Fund

Distributed by:

Resolute Investment Distributors, Inc.

Annual Shareholder Report - December 31, 2024

Stephens Small Cap Growth Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about American Beacon Stephens Small Cap Growth Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

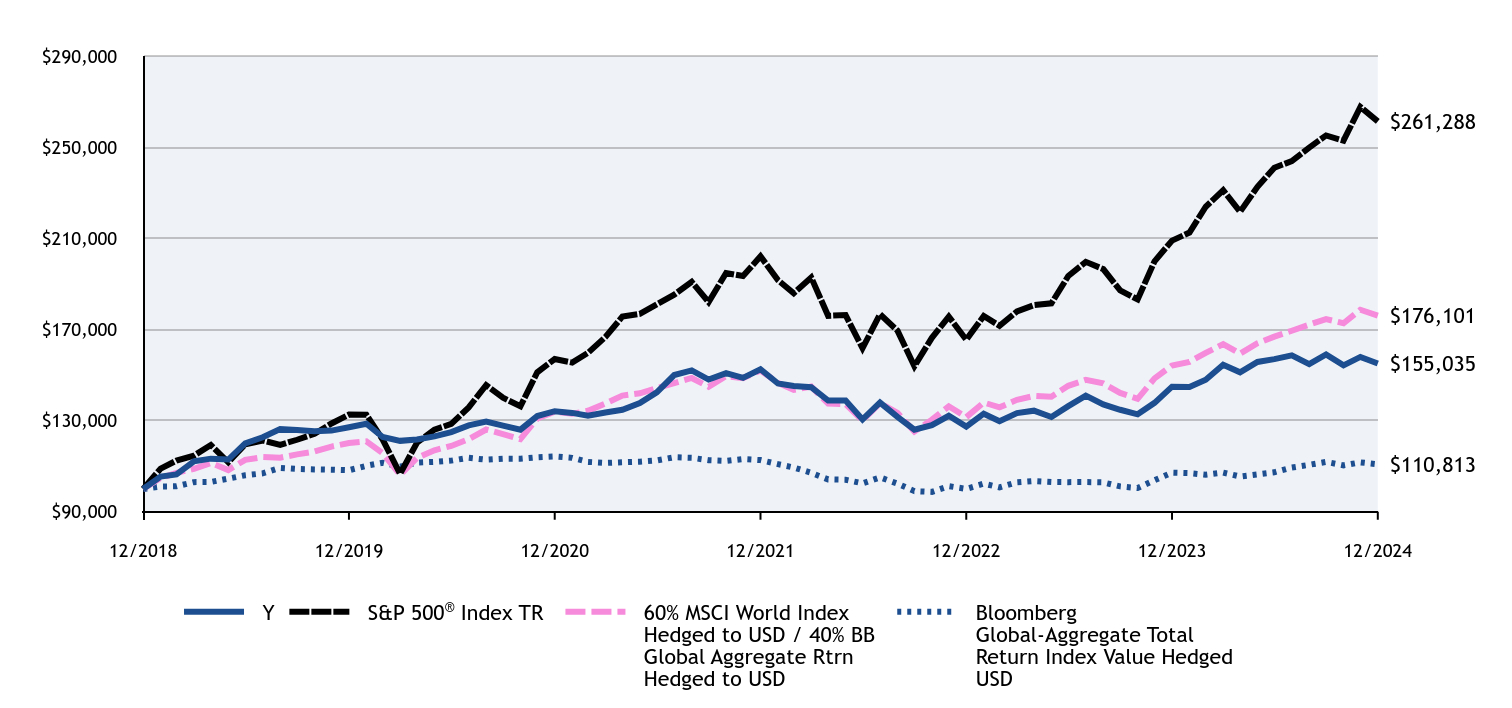

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Y | $113 | 1.05% |

|---|

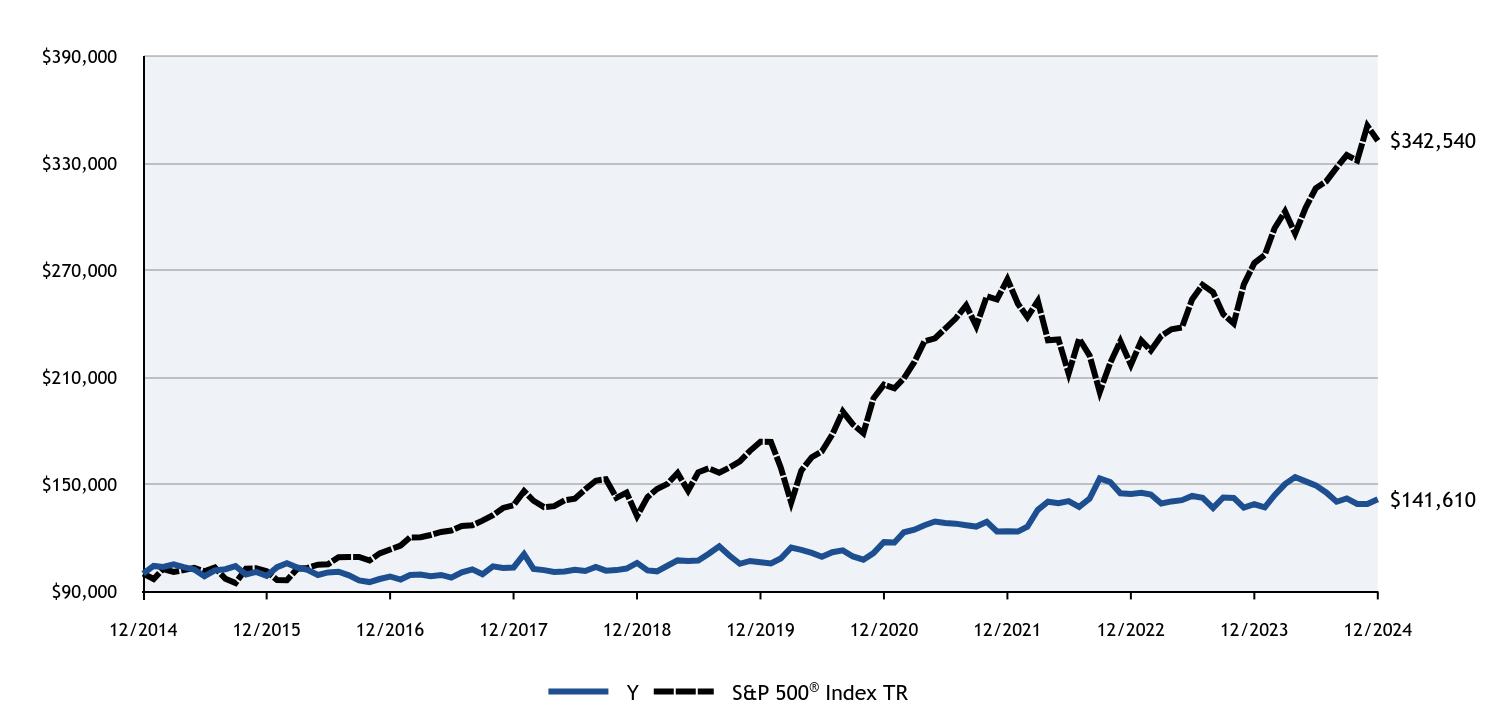

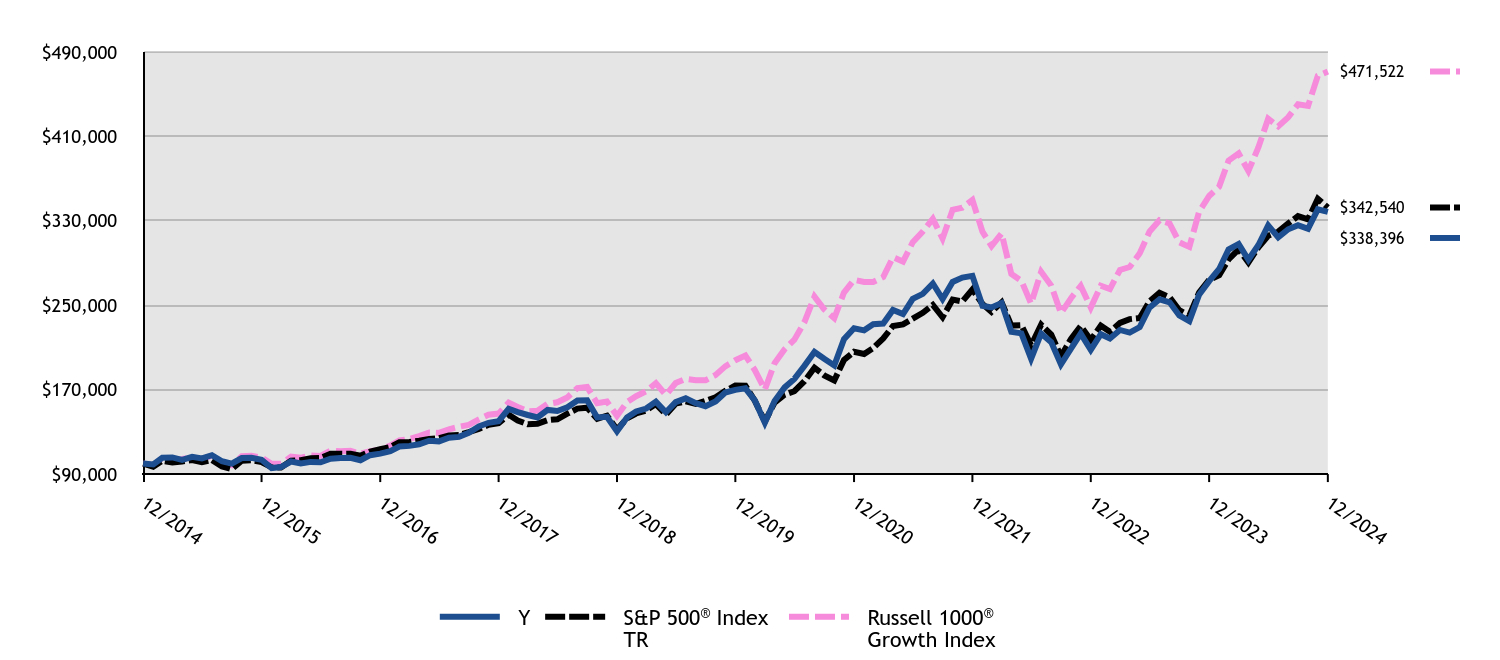

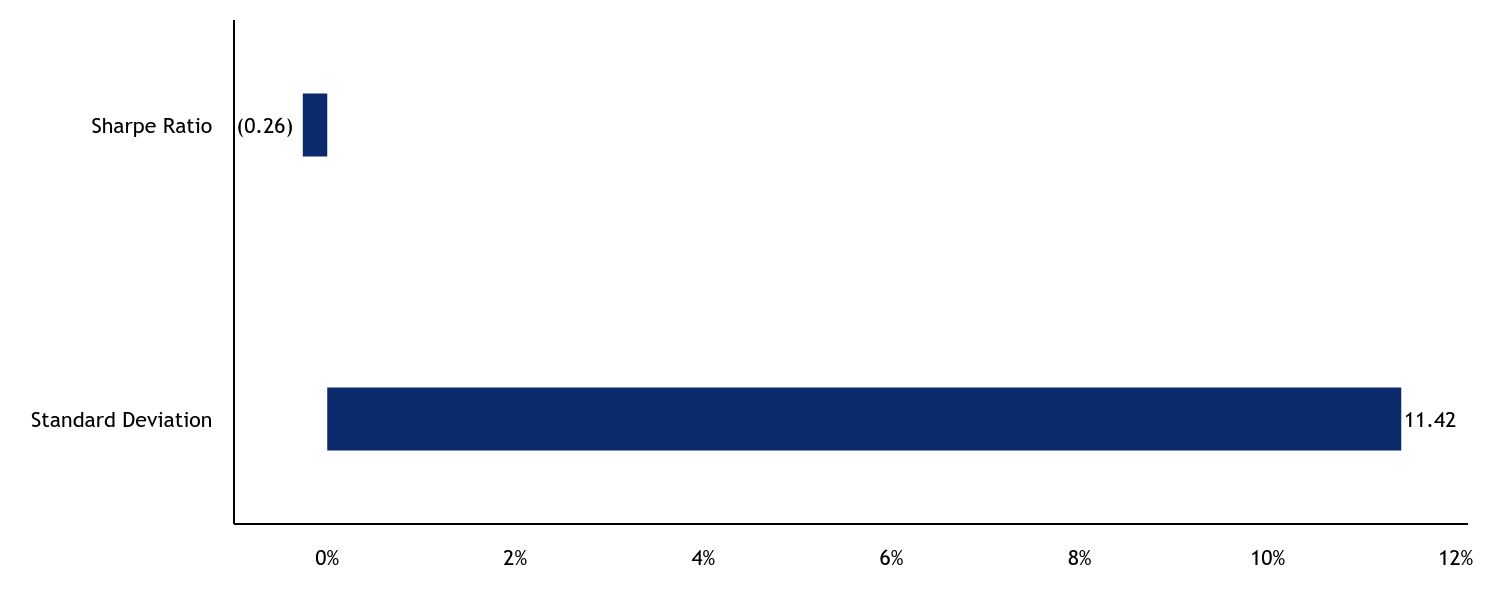

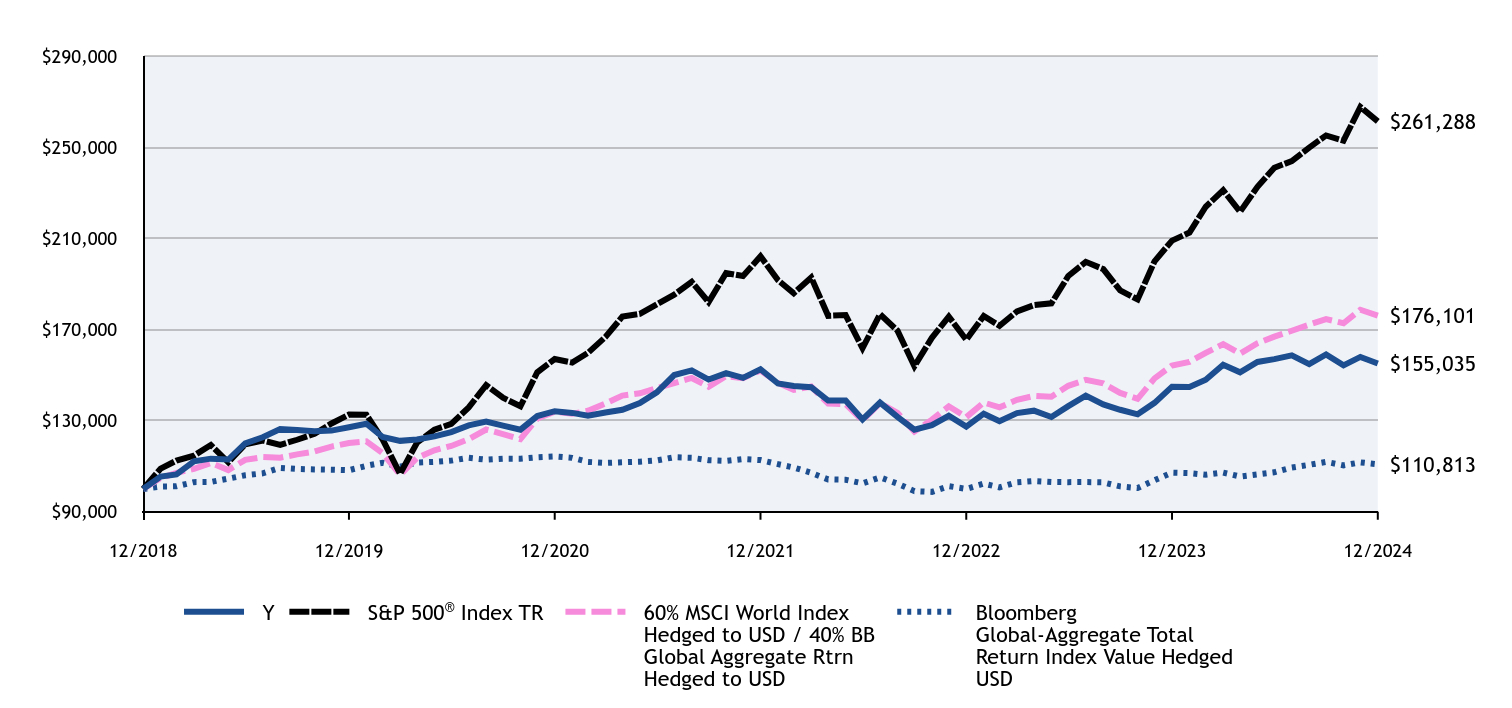

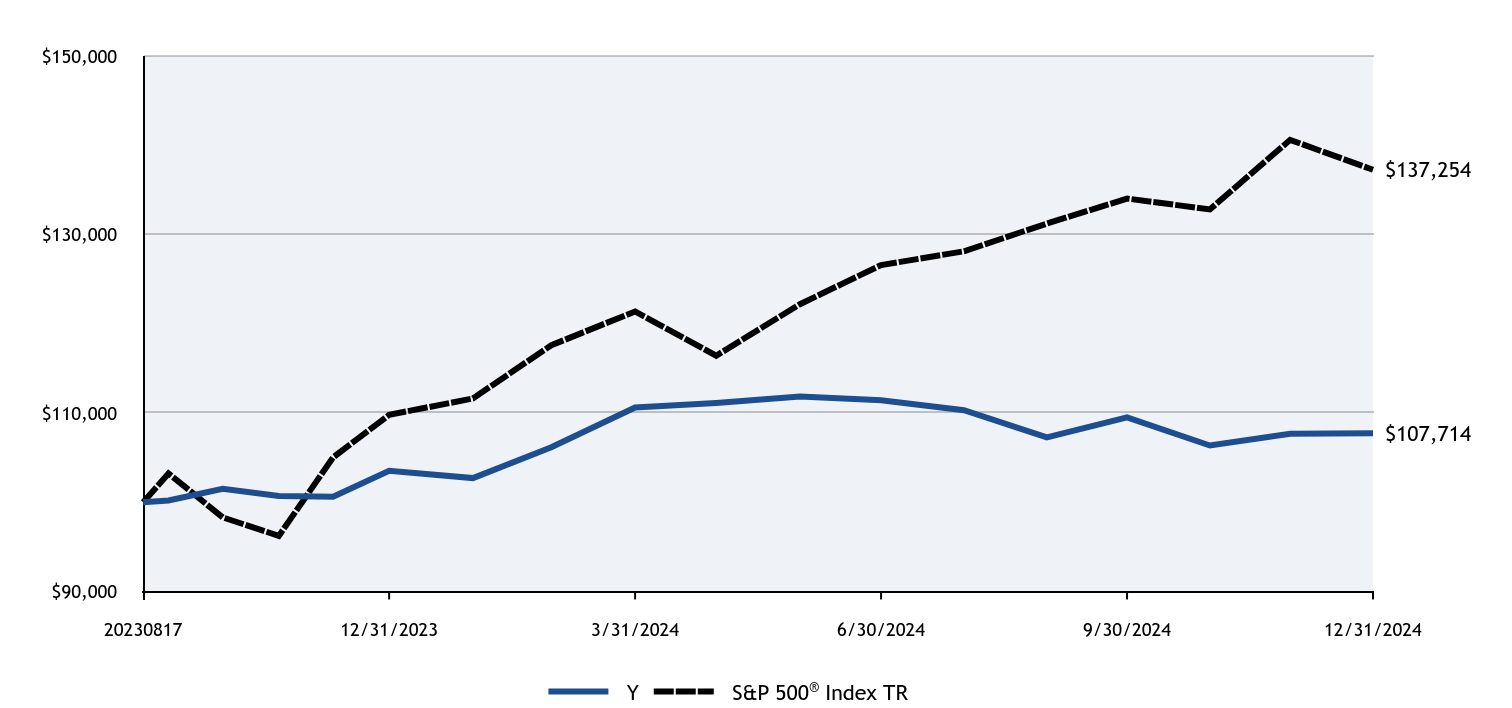

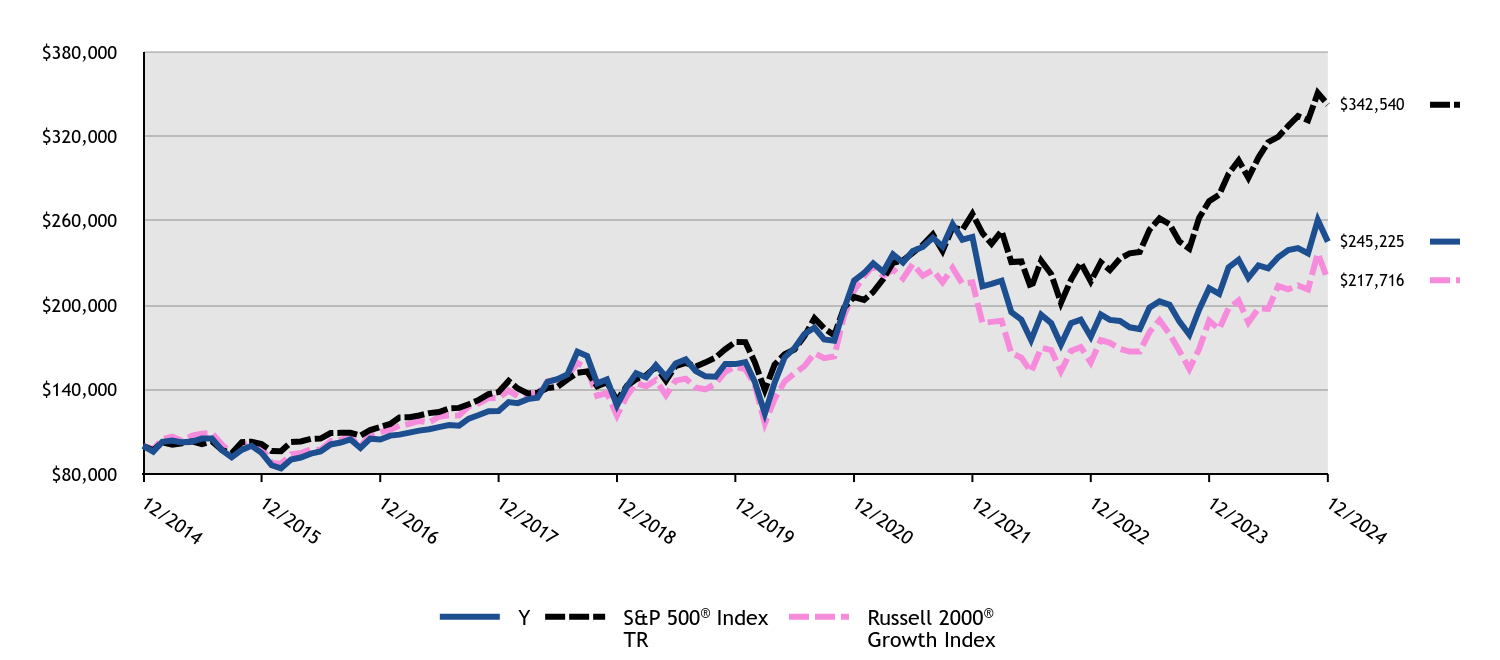

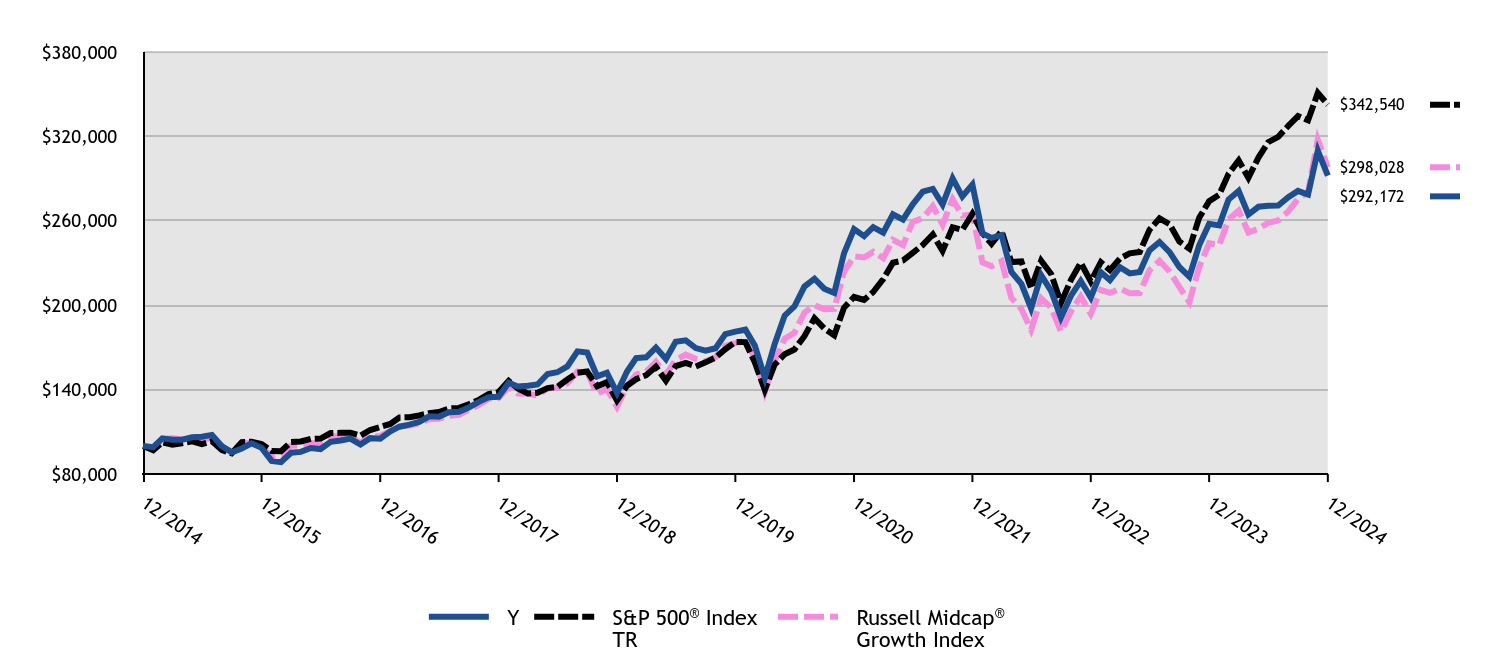

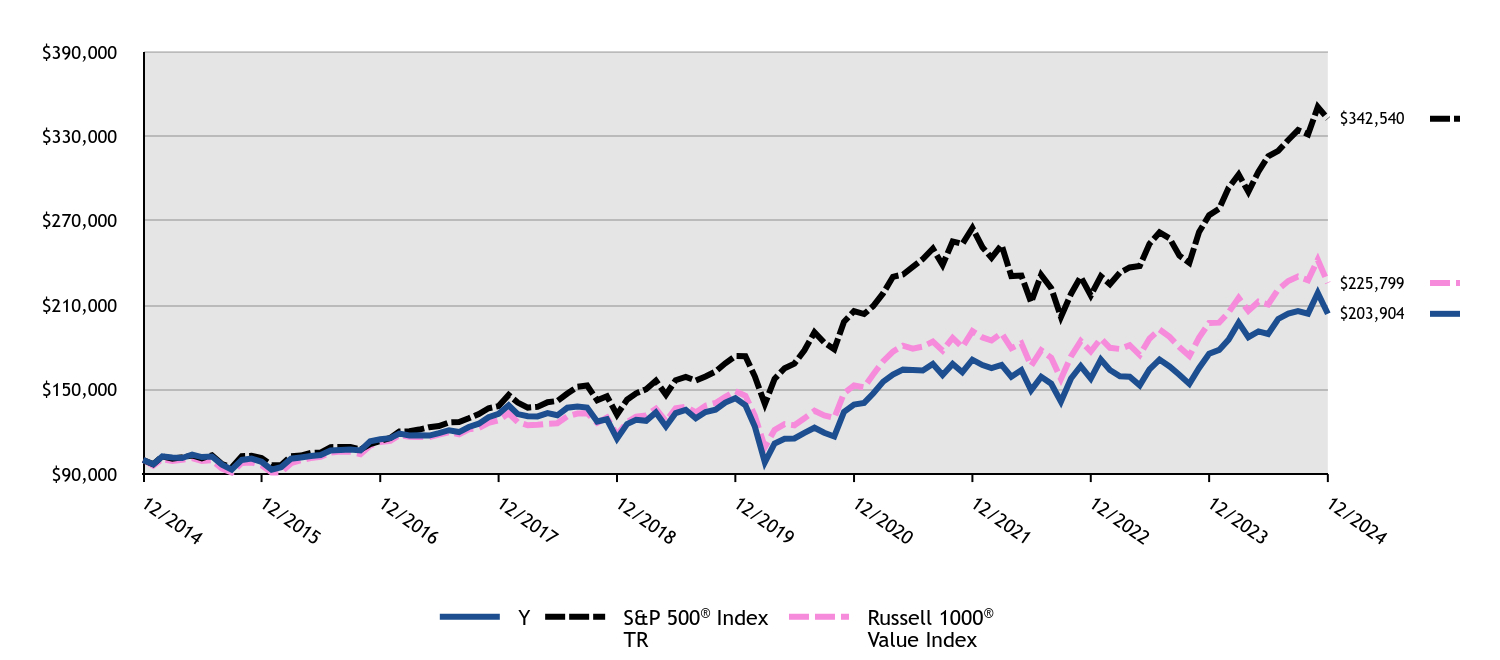

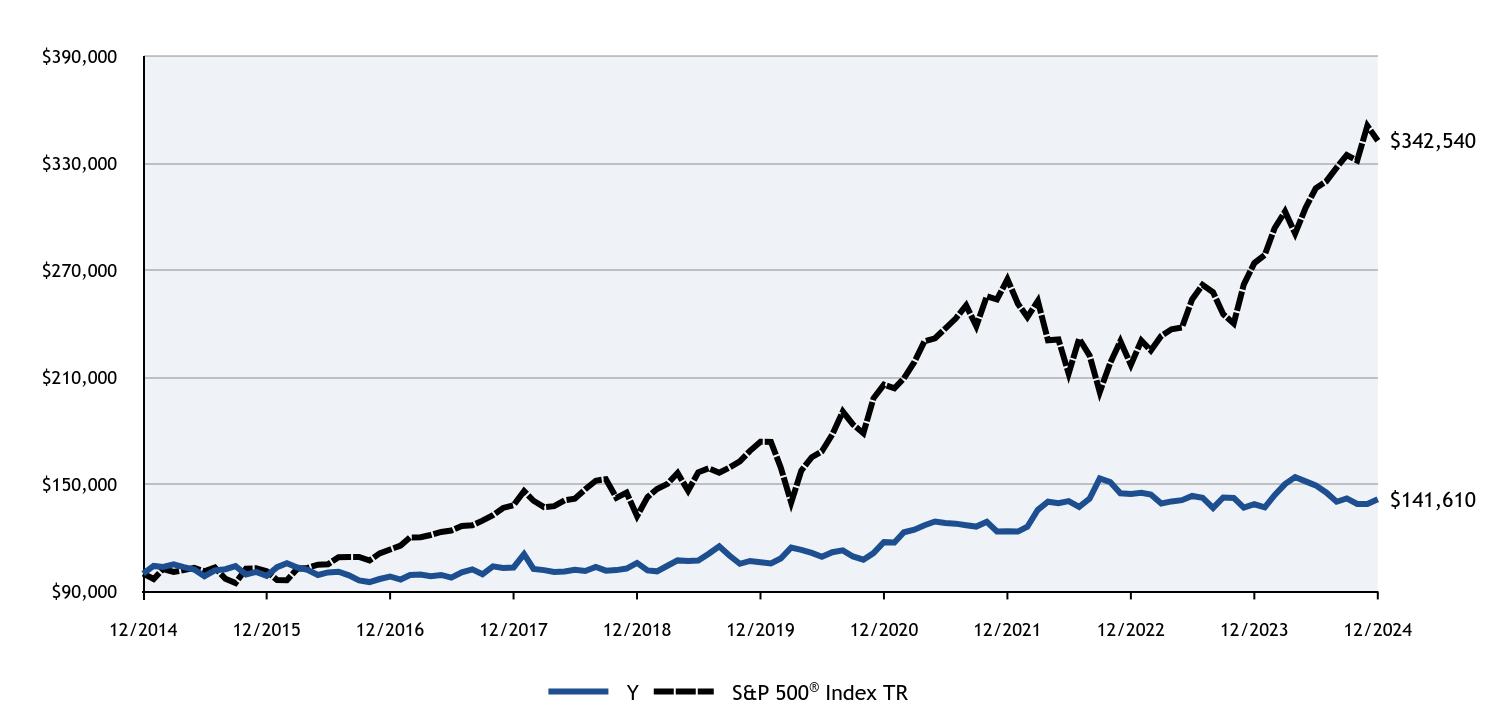

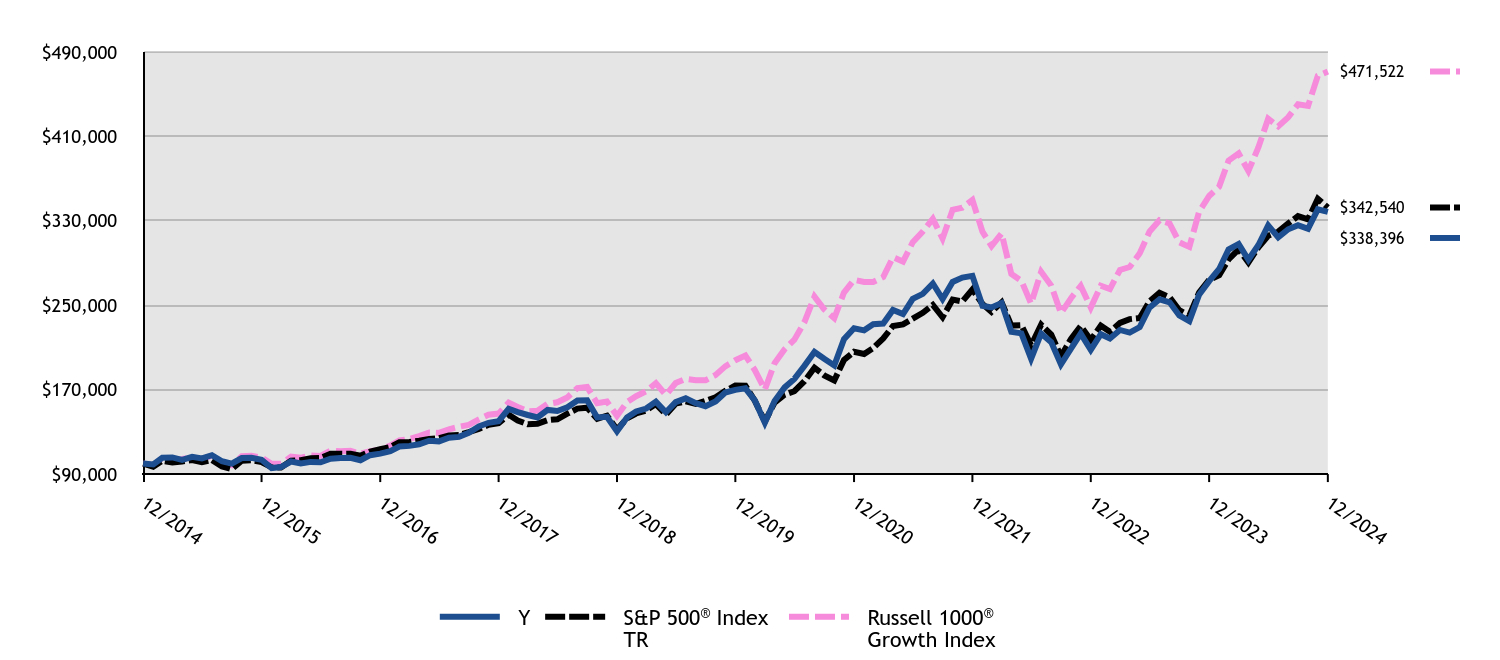

How did the Fund perform and what affected its performance?

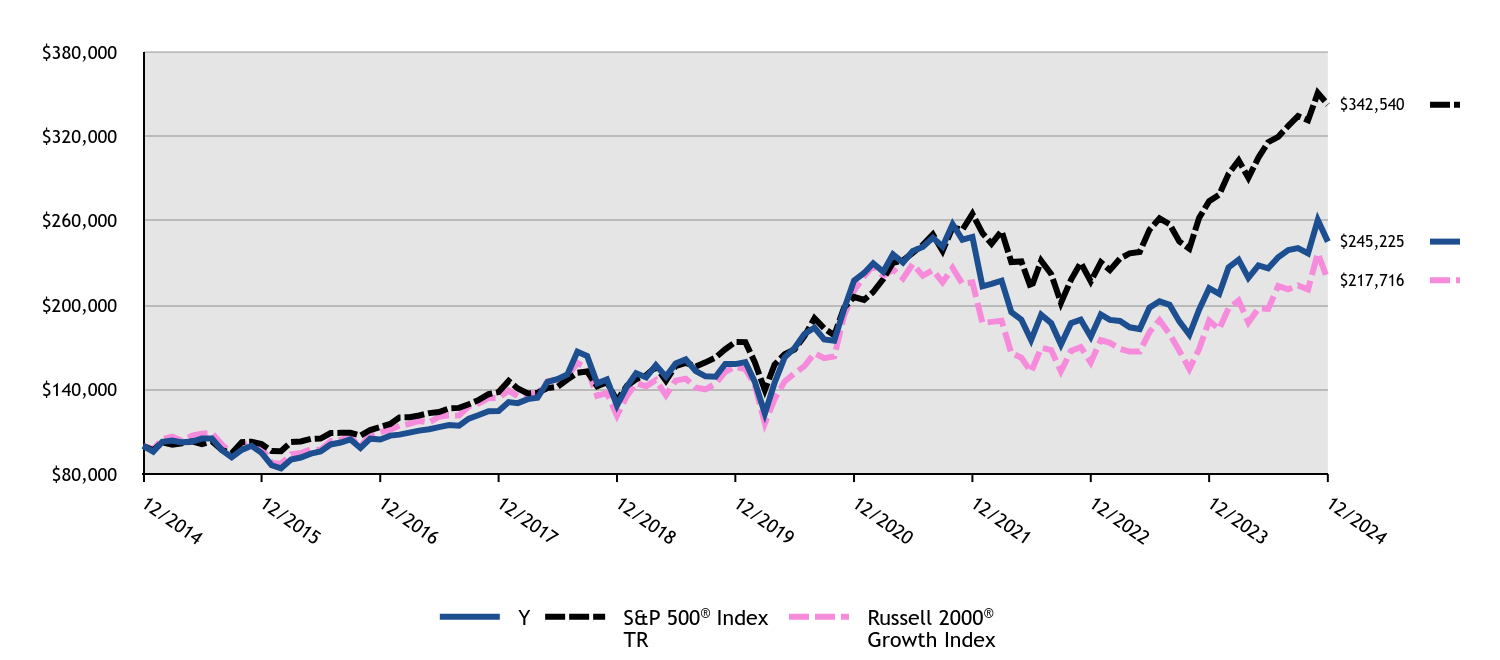

The Y Class of the Fund returned 15.61% for the twelve months ended December 31, 2024, compared to the S&P 500 Index return of 25.02% and the Russell 2000 Growth Index return of 15.15%.

• Overall market performance during the period was driven by mega-cap growth companies, while the Fund focuses its investments on small capitalization companies.

• The Fund’s performance was positive in all sectors where it invested. Holdings in the Energy and Financials sectors contributed materially to the Fund’s outperformance of the Russell 2000® Growth Index, while holdings in the Information Technology sector detracted.

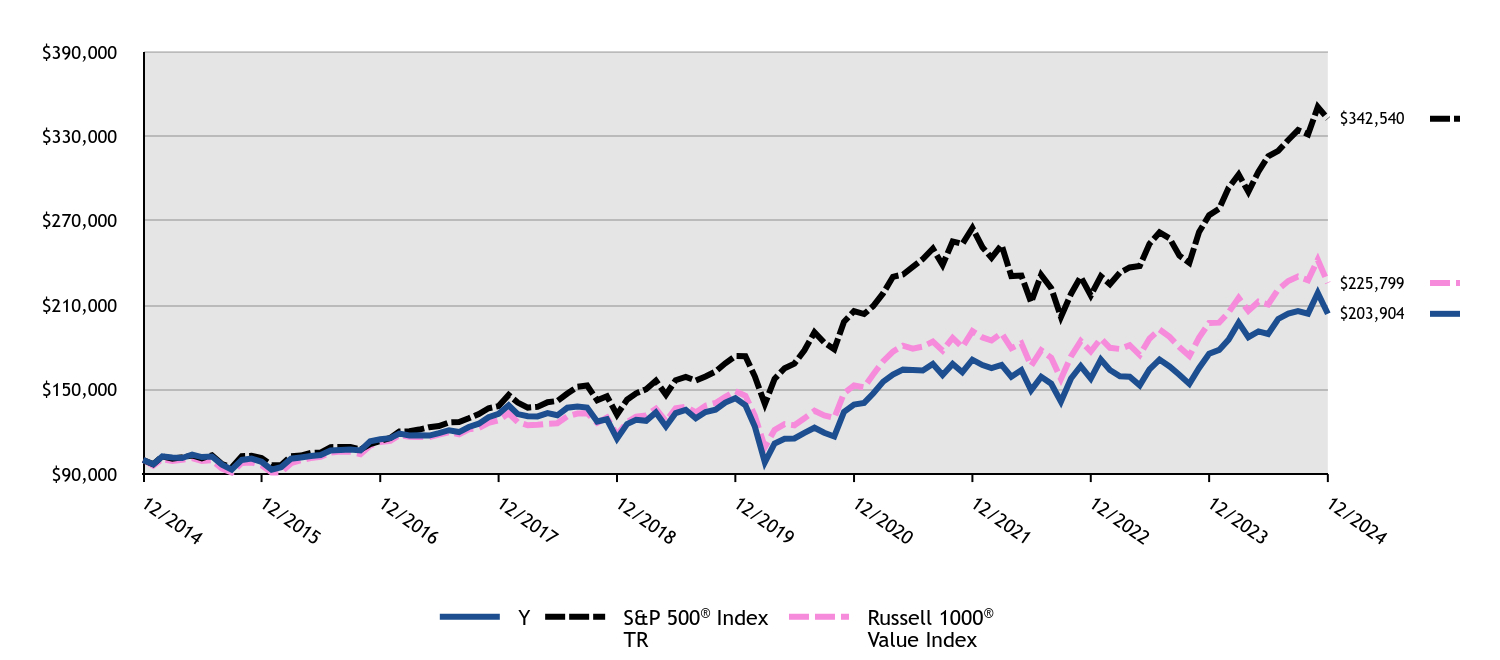

Cumulative Performance from December 31, 2014 through December 31, 2024

The initial investment, based on a $100,000 investment, is adjusted to reflect the maximum applicable sales charge, if any.

| #ERROR:A result could not be returned because the conditional could not be evaluated to a True/False value (#ERROR:Invalid Formula (#!=""), 'Multiple values from an iterator cannot be used in a formula unless they are aggregrated.') | Y | S&P 500® Index TR | Russell 2000® Growth Index |

|---|

| 12/2014 | $100,000 | $100,000 | $100,000 |

|---|

| 01/2015 | $95,952 | $96,998 | $97,717 |

|---|

| 02/2015 | $102,961 | $102,573 | $104,749 |

|---|

| 03/2015 | $103,867 | $100,951 | $106,630 |

|---|

| 04/2015 | $102,538 | $101,919 | $103,493 |

|---|

| 05/2015 | $103,142 | $103,230 | $107,295 |

|---|

| 06/2015 | $105,196 | $101,231 | $108,738 |

|---|

| 07/2015 | $105,196 | $103,352 | $109,182 |

|---|

| 08/2015 | $96,918 | $97,117 | $100,908 |

|---|

| 09/2015 | $91,903 | $94,714 | $94,535 |

|---|

| 10/2015 | $97,160 | $102,703 | $99,897 |

|---|

| 11/2015 | $100,060 | $103,008 | $103,558 |

|---|

| 12/2015 | $95,059 | $101,384 | $98,618 |

|---|

| 01/2016 | $86,262 | $96,353 | $87,933 |

|---|

| 02/2016 | $84,110 | $96,223 | $87,311 |

|---|

| 03/2016 | $90,312 | $102,750 | $94,000 |

|---|

| 04/2016 | $91,768 | $103,149 | $94,938 |

|---|

| 05/2016 | $94,552 | $105,001 | $97,495 |

|---|

| 06/2016 | $96,071 | $105,273 | $97,047 |

|---|

| 07/2016 | $101,071 | $109,154 | $103,392 |

|---|

| 08/2016 | $102,400 | $109,308 | $104,491 |

|---|

| 09/2016 | $104,615 | $109,328 | $105,996 |

|---|

| 10/2016 | $98,540 | $107,334 | $99,409 |

|---|

| 11/2016 | $105,185 | $111,309 | $108,303 |

|---|

| 12/2016 | $104,522 | $113,509 | $109,780 |

|---|

| 01/2017 | $107,330 | $115,662 | $111,562 |

|---|

| 02/2017 | $108,032 | $120,255 | $114,298 |

|---|

| 03/2017 | $109,499 | $120,395 | $115,652 |

|---|

| 04/2017 | $110,903 | $121,631 | $117,782 |

|---|

| 05/2017 | $111,860 | $123,343 | $116,711 |

|---|

| 06/2017 | $113,328 | $124,113 | $120,728 |

|---|

| 07/2017 | $114,796 | $126,665 | $121,755 |

|---|

| 08/2017 | $114,413 | $127,053 | $121,613 |

|---|

| 09/2017 | $119,390 | $129,674 | $128,235 |

|---|

| 10/2017 | $121,942 | $132,700 | $130,222 |

|---|

| 11/2017 | $124,686 | $136,769 | $133,960 |

|---|

| 12/2017 | $124,819 | $138,290 | $134,115 |

|---|

| 01/2018 | $131,156 | $146,208 | $139,343 |

|---|

| 02/2018 | $130,430 | $140,819 | $135,376 |

|---|

| 03/2018 | $133,268 | $137,240 | $137,199 |

|---|

| 04/2018 | $134,258 | $137,767 | $137,333 |

|---|

| 05/2018 | $145,611 | $141,085 | $145,979 |

|---|

| 06/2018 | $147,459 | $141,953 | $147,121 |

|---|

| 07/2018 | $150,826 | $147,236 | $149,651 |

|---|

| 08/2018 | $166,931 | $152,033 | $158,968 |

|---|

| 09/2018 | $163,895 | $152,899 | $155,247 |

|---|

| 10/2018 | $144,555 | $142,448 | $135,603 |

|---|

| 11/2018 | $147,327 | $145,351 | $137,724 |

|---|

| 12/2018 | $128,783 | $132,227 | $121,631 |

|---|

| 01/2019 | $142,403 | $142,823 | $135,678 |

|---|

| 02/2019 | $151,703 | $147,409 | $144,440 |

|---|

| 03/2019 | $148,697 | $150,273 | $142,485 |

|---|

| 04/2019 | $157,432 | $156,358 | $146,824 |

|---|

| 05/2019 | $149,260 | $146,422 | $135,931 |

|---|

| 06/2019 | $158,560 | $156,741 | $146,400 |

|---|

| 07/2019 | $161,472 | $158,994 | $147,831 |

|---|

| 08/2019 | $153,205 | $156,475 | $141,452 |

|---|

| 09/2019 | $149,448 | $159,403 | $140,291 |

|---|

| 10/2019 | $149,166 | $162,855 | $144,283 |

|---|

| 11/2019 | $158,278 | $168,767 | $152,775 |

|---|

| 12/2019 | $158,177 | $173,861 | $156,276 |

|---|

| 01/2020 | $159,630 | $173,792 | $154,556 |

|---|

| 02/2020 | $145,514 | $159,486 | $143,397 |

|---|

| 03/2020 | $122,992 | $139,787 | $116,012 |

|---|

| 04/2020 | $144,892 | $157,707 | $133,291 |

|---|

| 05/2020 | $162,951 | $165,219 | $145,887 |

|---|

| 06/2020 | $169,386 | $168,504 | $151,493 |

|---|

| 07/2020 | $179,558 | $178,005 | $156,699 |

|---|

| 08/2020 | $184,021 | $190,801 | $165,891 |

|---|

| 09/2020 | $175,718 | $183,551 | $162,337 |

|---|

| 10/2020 | $174,783 | $178,669 | $163,570 |

|---|

| 11/2020 | $197,098 | $198,227 | $192,413 |

|---|

| 12/2020 | $217,589 | $205,849 | $210,398 |

|---|

| 01/2021 | $222,958 | $203,771 | $220,542 |

|---|

| 02/2021 | $229,811 | $209,390 | $227,824 |

|---|

| 03/2021 | $223,757 | $218,560 | $220,656 |

|---|

| 04/2021 | $236,207 | $230,224 | $225,467 |

|---|

| 05/2021 | $230,382 | $231,832 | $219,027 |

|---|

| 06/2021 | $238,492 | $237,244 | $229,300 |

|---|

| 07/2021 | $241,461 | $242,880 | $220,948 |

|---|

| 08/2021 | $247,972 | $250,265 | $224,964 |

|---|

| 09/2021 | $241,804 | $238,625 | $216,338 |

|---|

| 10/2021 | $257,566 | $255,344 | $226,469 |

|---|

| 11/2021 | $246,601 | $253,574 | $215,408 |

|---|

| 12/2021 | $248,558 | $264,939 | $216,363 |

|---|

| 01/2022 | $213,423 | $251,229 | $187,364 |

|---|

| 02/2022 | $215,214 | $243,707 | $188,181 |

|---|

| 03/2022 | $217,419 | $252,755 | $189,042 |

|---|

| 04/2022 | $195,098 | $230,715 | $165,848 |

|---|

| 05/2022 | $189,725 | $231,138 | $162,716 |

|---|

| 06/2022 | $175,258 | $212,059 | $152,643 |

|---|

| 07/2022 | $193,307 | $231,612 | $169,733 |

|---|

| 08/2022 | $187,245 | $222,166 | $168,138 |

|---|

| 09/2022 | $172,089 | $201,705 | $153,012 |

|---|

| 10/2022 | $187,245 | $218,035 | $167,536 |

|---|

| 11/2022 | $189,725 | $230,220 | $170,264 |

|---|

| 12/2022 | $177,625 | $216,956 | $159,335 |

|---|

| 01/2023 | $193,462 | $230,588 | $175,184 |

|---|

| 02/2023 | $189,581 | $224,962 | $173,287 |

|---|

| 03/2023 | $188,804 | $233,221 | $169,011 |

|---|

| 04/2023 | $184,302 | $236,861 | $167,047 |

|---|

| 05/2023 | $183,059 | $237,891 | $167,077 |

|---|

| 06/2023 | $198,276 | $253,610 | $180,930 |

|---|

| 07/2023 | $202,778 | $261,757 | $189,389 |

|---|

| 08/2023 | $200,294 | $257,589 | $179,531 |

|---|

| 09/2023 | $188,494 | $245,308 | $167,689 |

|---|

| 10/2023 | $179,023 | $240,150 | $154,756 |

|---|

| 11/2023 | $196,878 | $262,082 | $168,845 |

|---|

| 12/2023 | $212,115 | $273,988 | $189,064 |

|---|

| 01/2024 | $208,026 | $278,593 | $183,001 |

|---|

| 02/2024 | $226,895 | $293,468 | $197,865 |

|---|

| 03/2024 | $232,398 | $302,910 | $203,399 |

|---|

| 04/2024 | $219,505 | $290,538 | $187,737 |

|---|

| 05/2024 | $228,310 | $304,944 | $197,791 |

|---|

| 06/2024 | $226,266 | $315,886 | $197,461 |

|---|

| 07/2024 | $234,128 | $319,732 | $213,626 |

|---|

| 08/2024 | $239,160 | $327,487 | $211,260 |

|---|

| 09/2024 | $240,575 | $334,481 | $214,068 |

|---|

| 10/2024 | $236,801 | $331,448 | $211,228 |

|---|

| 11/2024 | $260,544 | $350,904 | $237,127 |

|---|

| 12/2024 | $245,225 | $342,540 | $217,716 |

|---|

Average Annual Total Returns (%)

| HEADER | 1 Year | 5 Years | 10 Years |

|---|

Class YFootnote Reference1 | 15.61% | 9.17% | 9.38% |

|---|

S&P 500® Index TR | 25.02% | 14.53% | 13.10% |

|---|

Russell 2000® Growth Index | 15.15% | 6.86% | 8.09% |

|---|

| Footnote | Description |

Footnote1 | Return may differ from actual shareholder return due to accounting adjustments for financial reporting purposes. |

Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit americanbeaconfunds.com or call 800-967-9009. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. The Fund's performance benefited from fee waivers. For more information, visit americanbeaconfunds.com/Performance_Disclaimers.aspx.

The S&P 500 Index TR is replacing the Russell 2000 Growth Index as broad-based securities market index to comply with a new regulatory requirement. The Russell 2000 Growth Index reflects the market sectors in which the Fund invests.

| Total Net Assets | $364,382,179 |

|---|

| # of Portfolio Holdings | 105 |

|---|

| Portfolio Turnover Rate | 37% |

|---|

| Total Management Fees Paid | $2,854,258 |

|---|

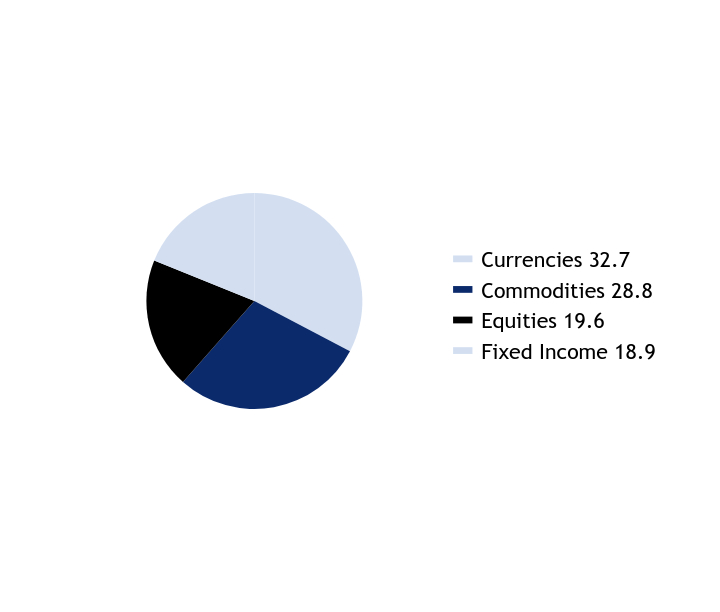

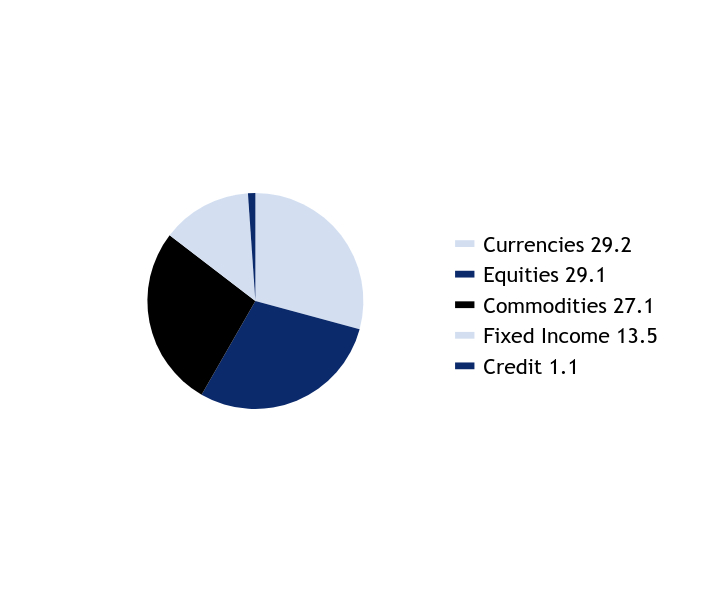

What did the Fund invest in?

Top Ten Holdings - % Net Assets

| CyberArk Software Ltd. | 2.2 |

| BellRing Brands, Inc. | 2.1 |

| Kratos Defense & Security Solutions, Inc. | 2.0 |

| Viper Energy, Inc. | 1.9 |

| Manhattan Associates, Inc. | 1.7 |

| HealthEquity, Inc. | 1.7 |

| Leonardo DRS, Inc. | 1.6 |

| RBC Bearings, Inc. | 1.6 |

| Ryan Specialty Holdings, Inc. | 1.5 |

| Descartes Systems Group, Inc. | 1.5 |

Excludes cash equivalents.

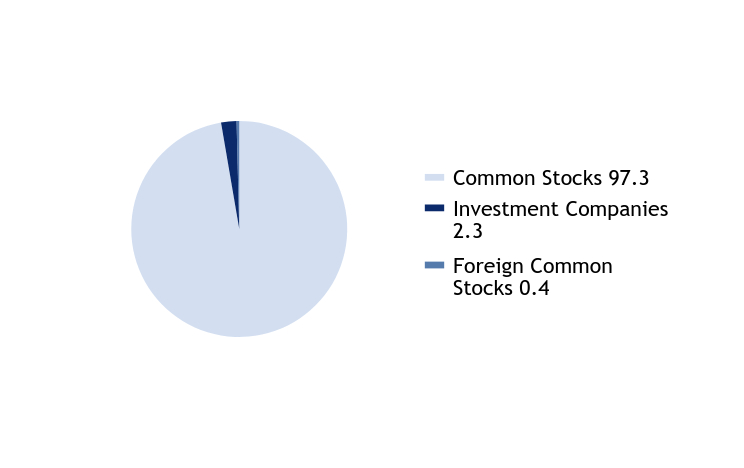

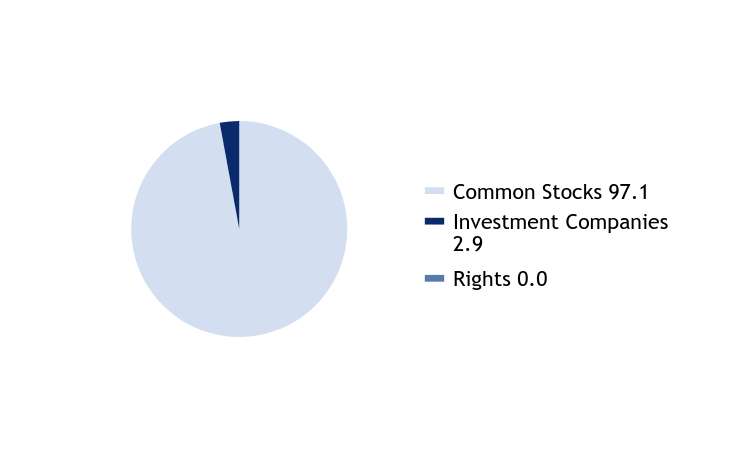

Asset Allocation - % Investments

| Value | Value |

|---|

| Common Stocks | 93.6 |

| Foreign Common Stocks | 4.7 |

| Investment Companies | 1.7 |

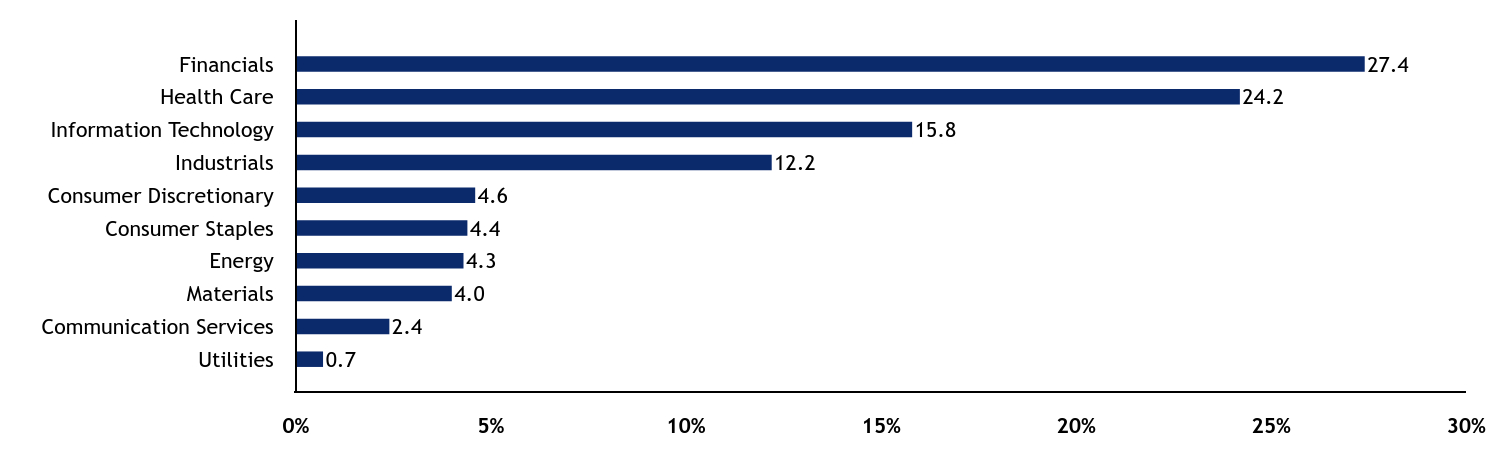

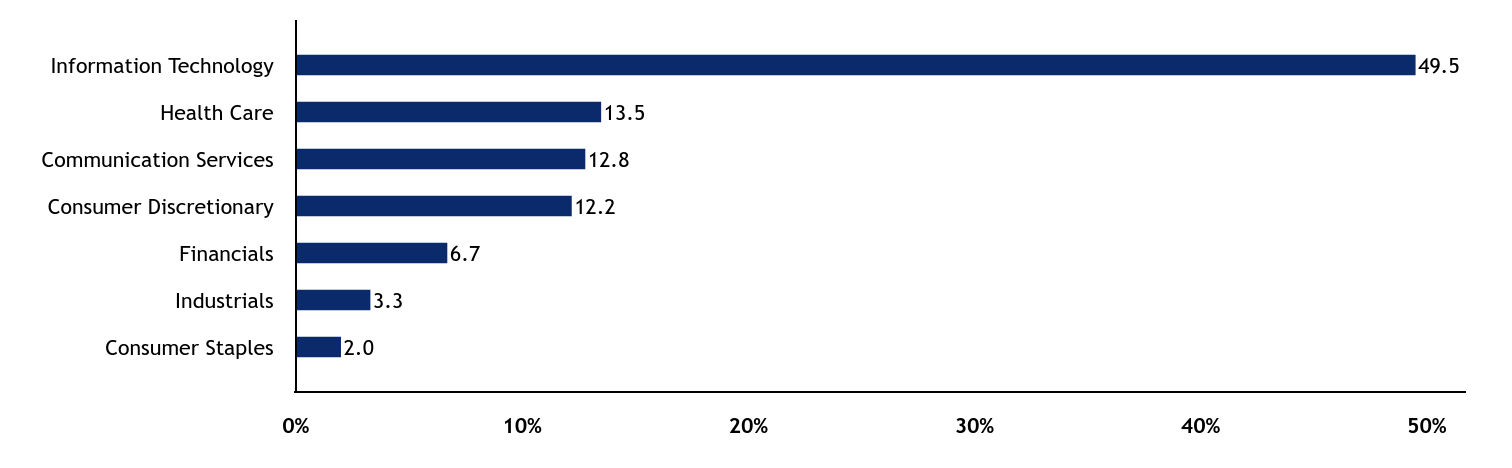

Sector Allocation - % Equities

| Value | Value |

|---|

| Communication Services | 1.0 |

| Materials | 1.1 |

| Consumer Staples | 3.0 |

| Energy | 6.1 |

| Consumer Discretionary | 11.3 |

| Financials | 11.5 |

| Health Care | 17.5 |

| Industrials | 22.0 |

| Information Technology | 26.5 |

For additional information about the Fund, including its prospectus, financial statements, holdings, and proxy voting information, please visit www.americanbeaconfunds.com/literature or call 1-800-658-5811.

If your financial institution mailed only one copy of this Report to an address shared by more than one account, you can request an individual copy by contacting your financial institution.

Stephens Small Cap Growth Fund

Distributed by:

Resolute Investment Distributors, Inc.

Annual Shareholder Report - December 31, 2024

Stephens Small Cap Growth Fund

Annual Shareholder Report - December 31, 2024

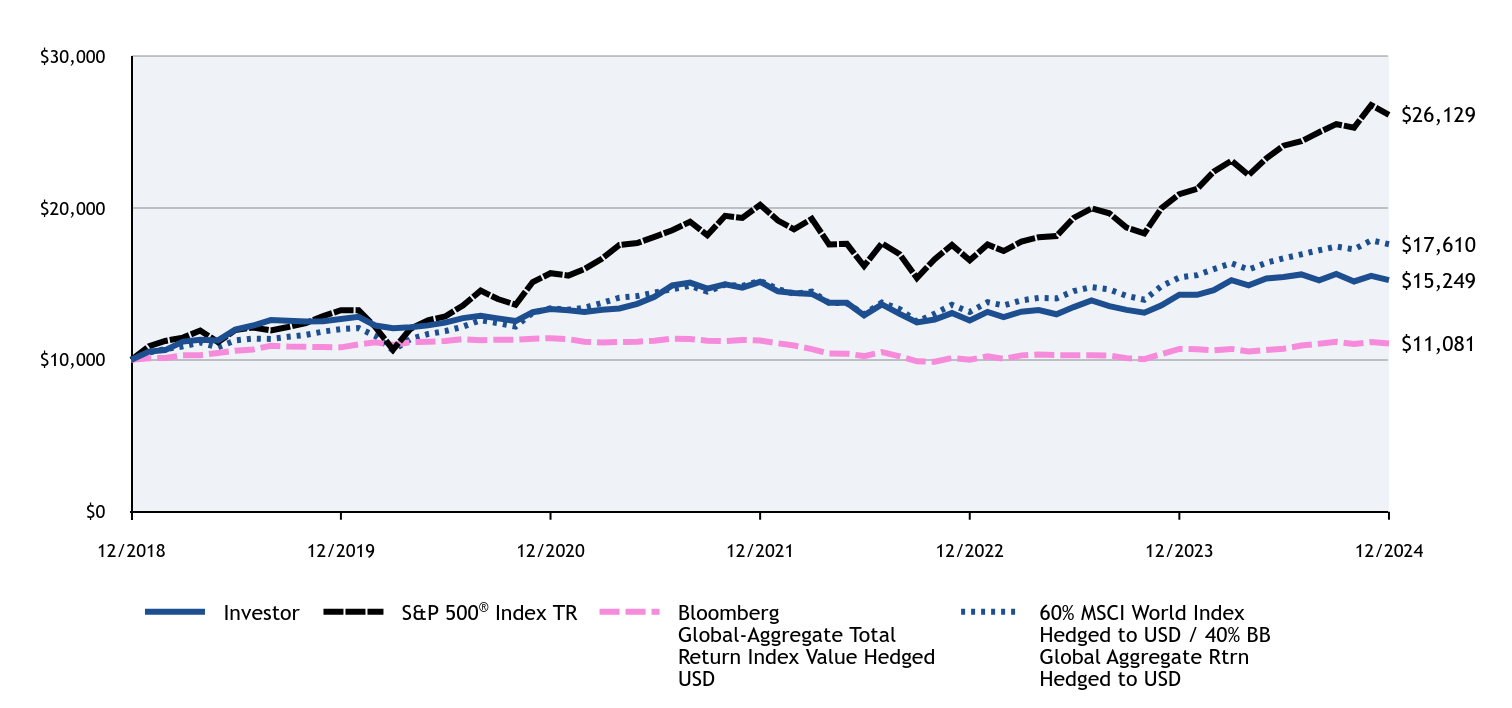

This annual shareholder report contains important information about American Beacon Stephens Small Cap Growth Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor | $137 | 1.27% |

|---|

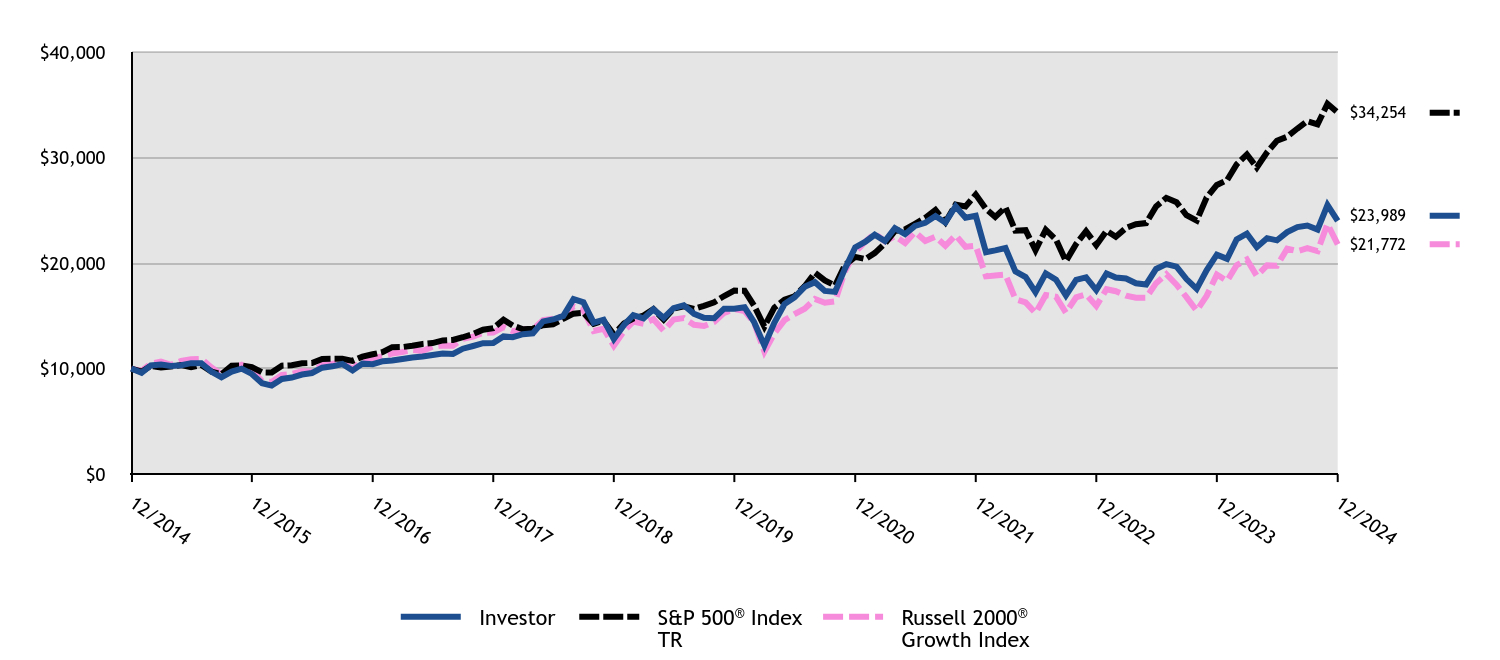

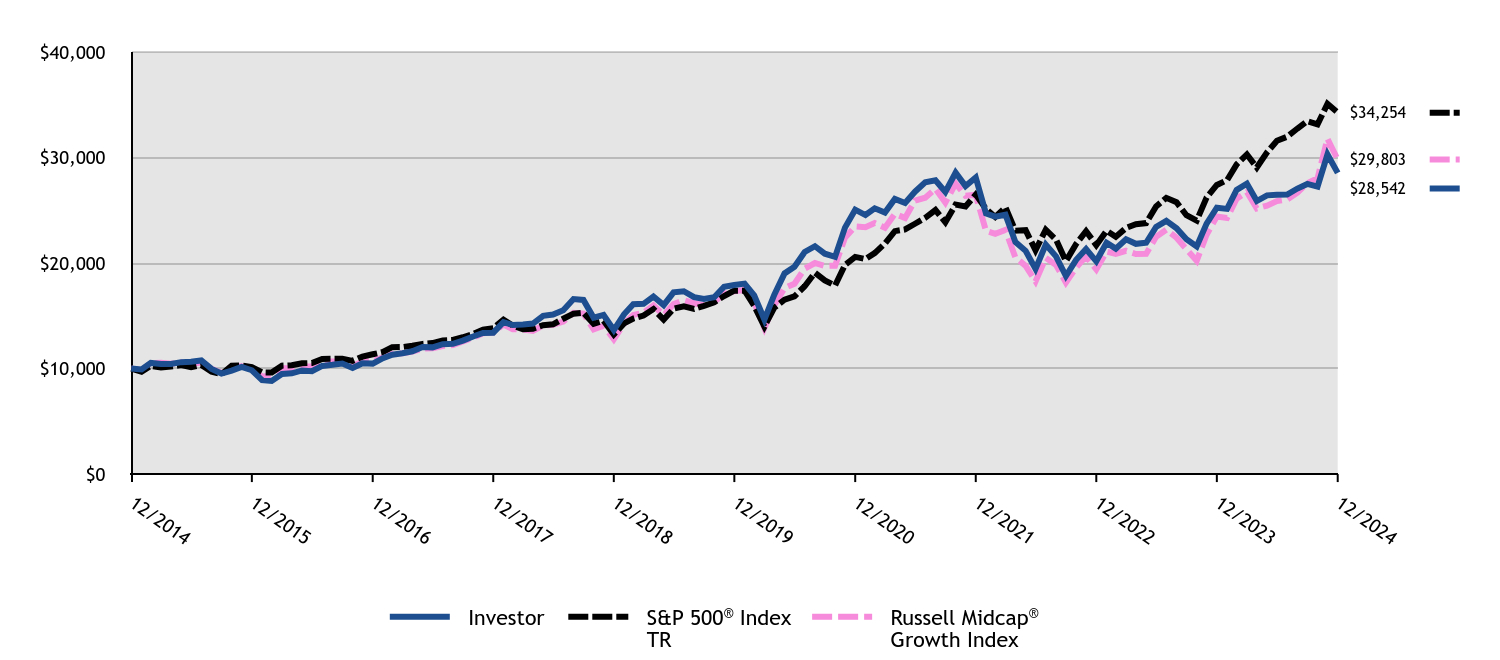

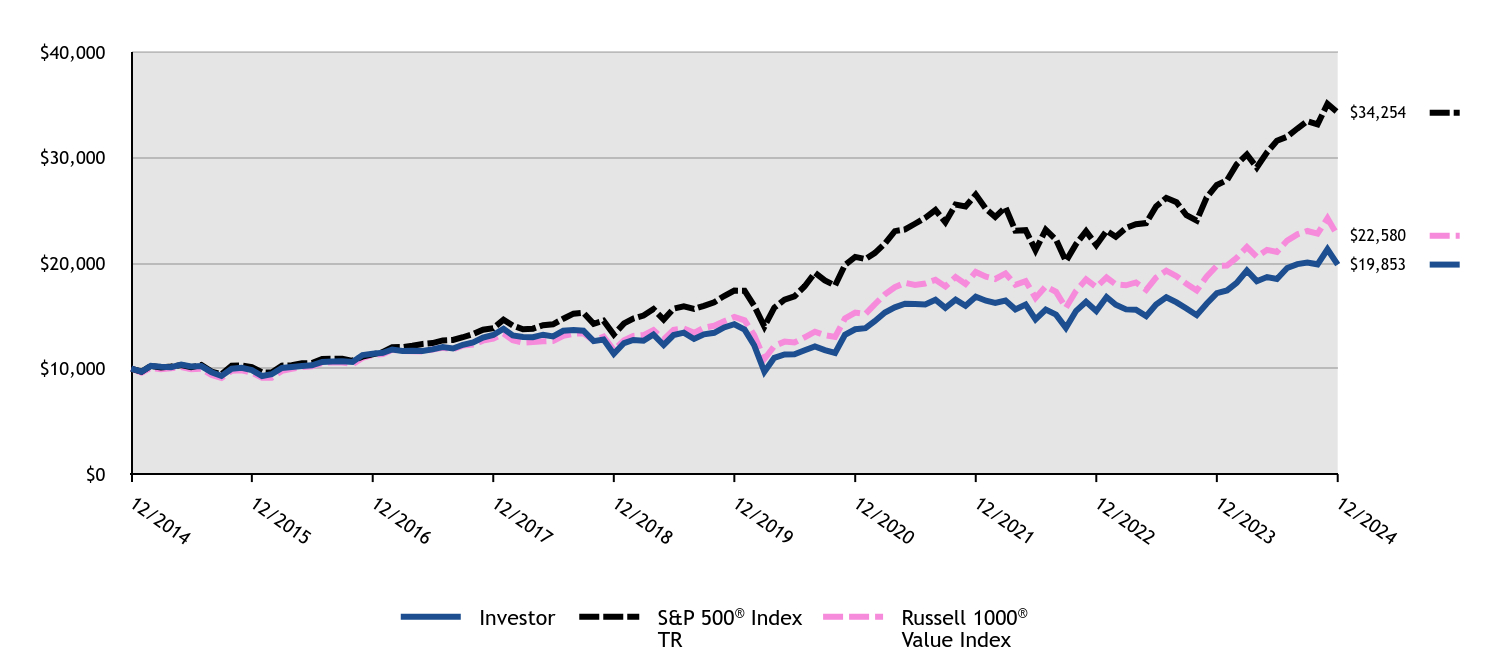

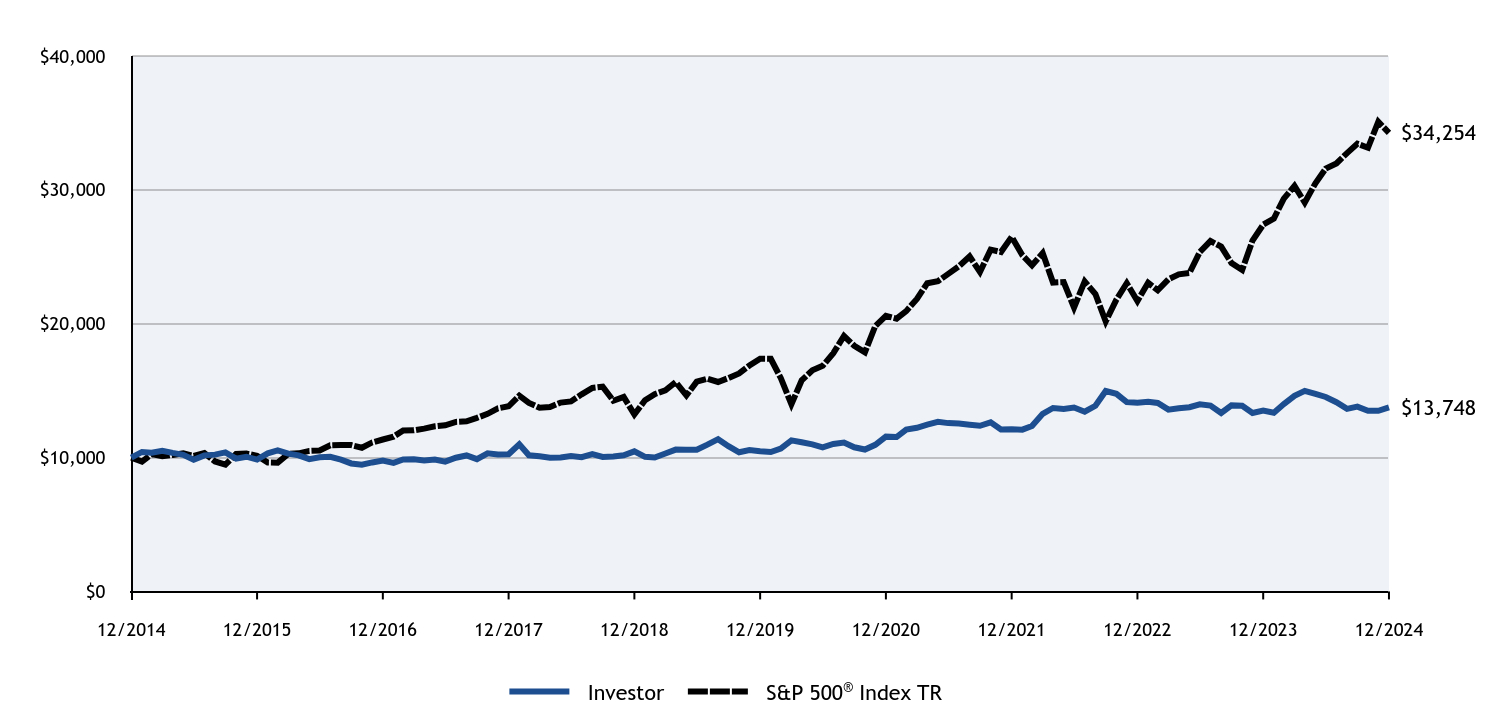

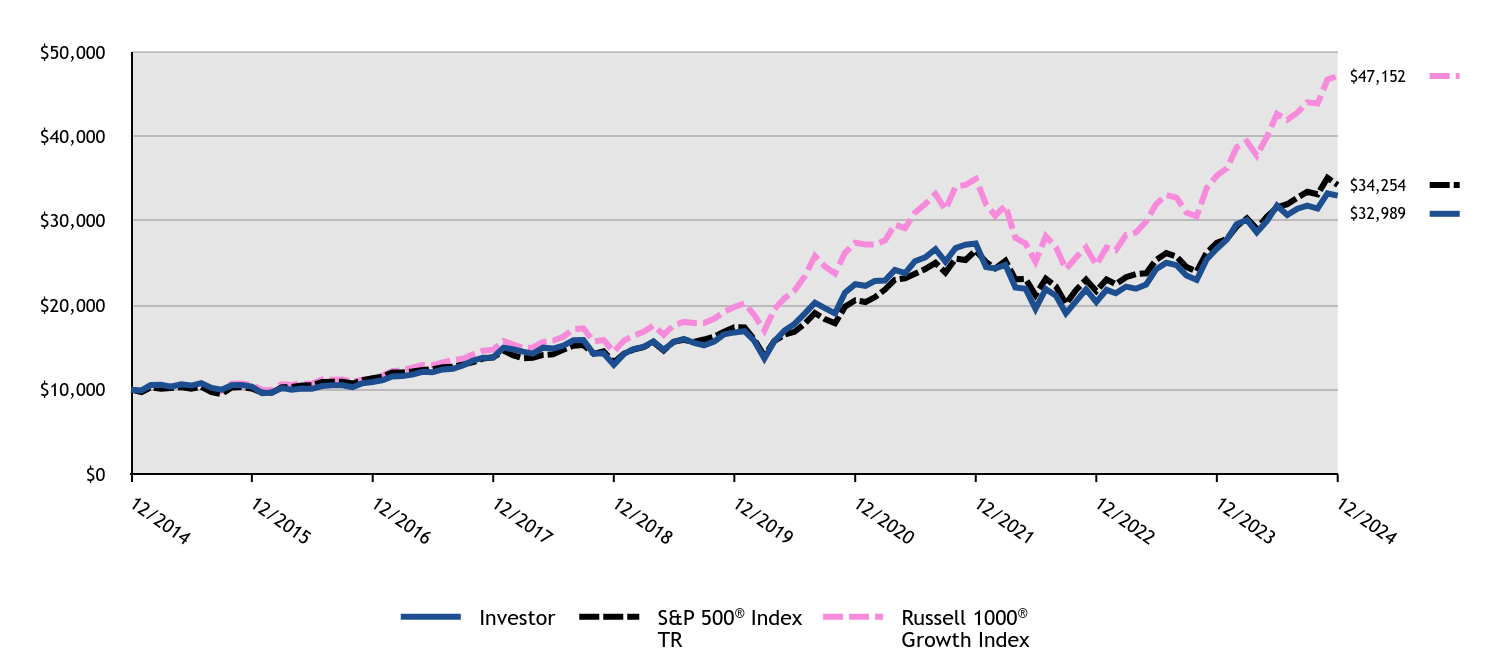

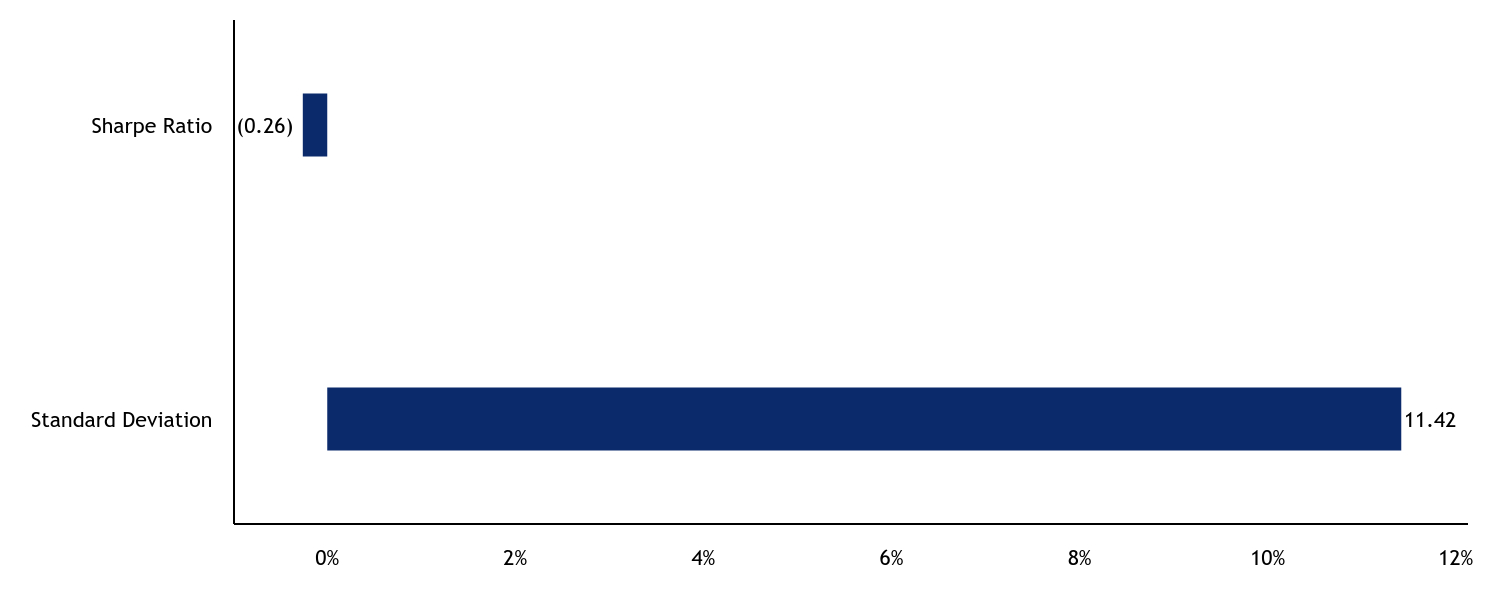

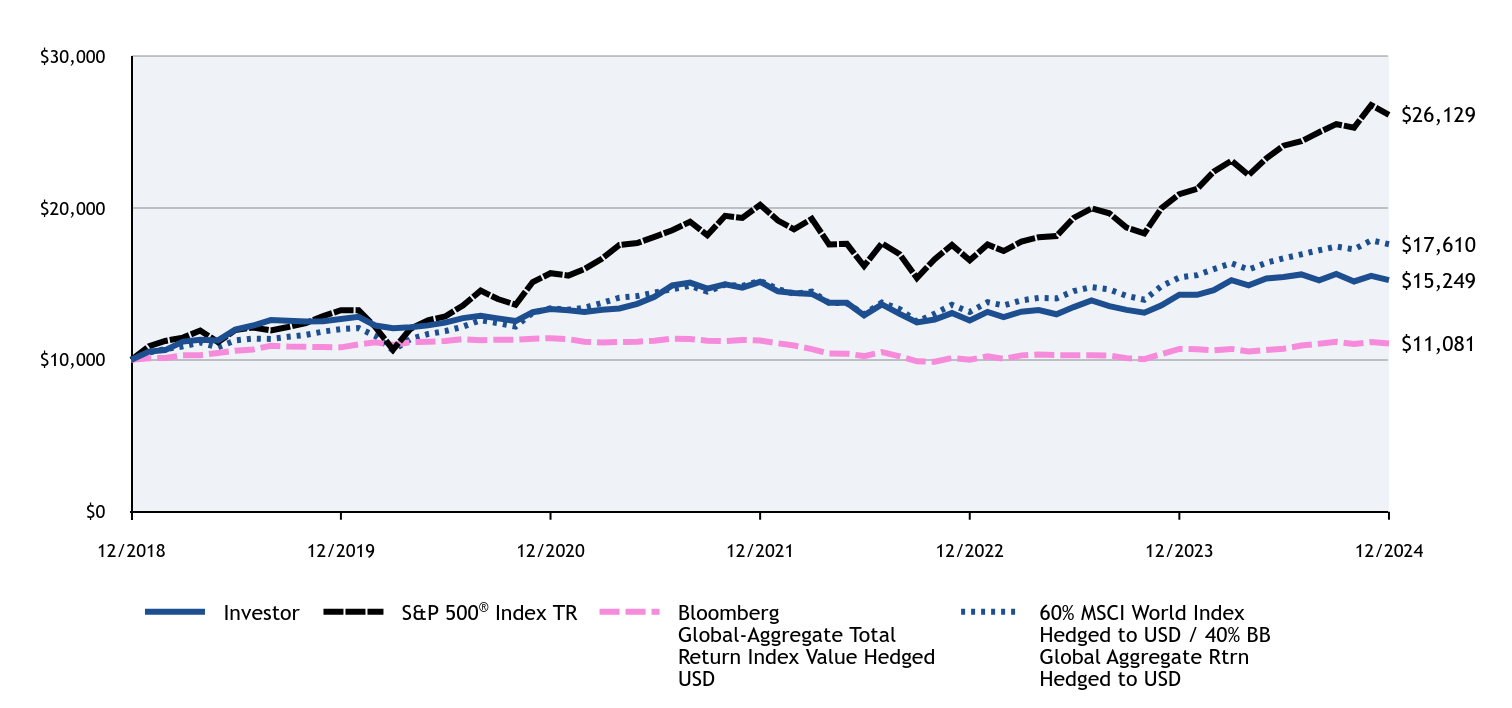

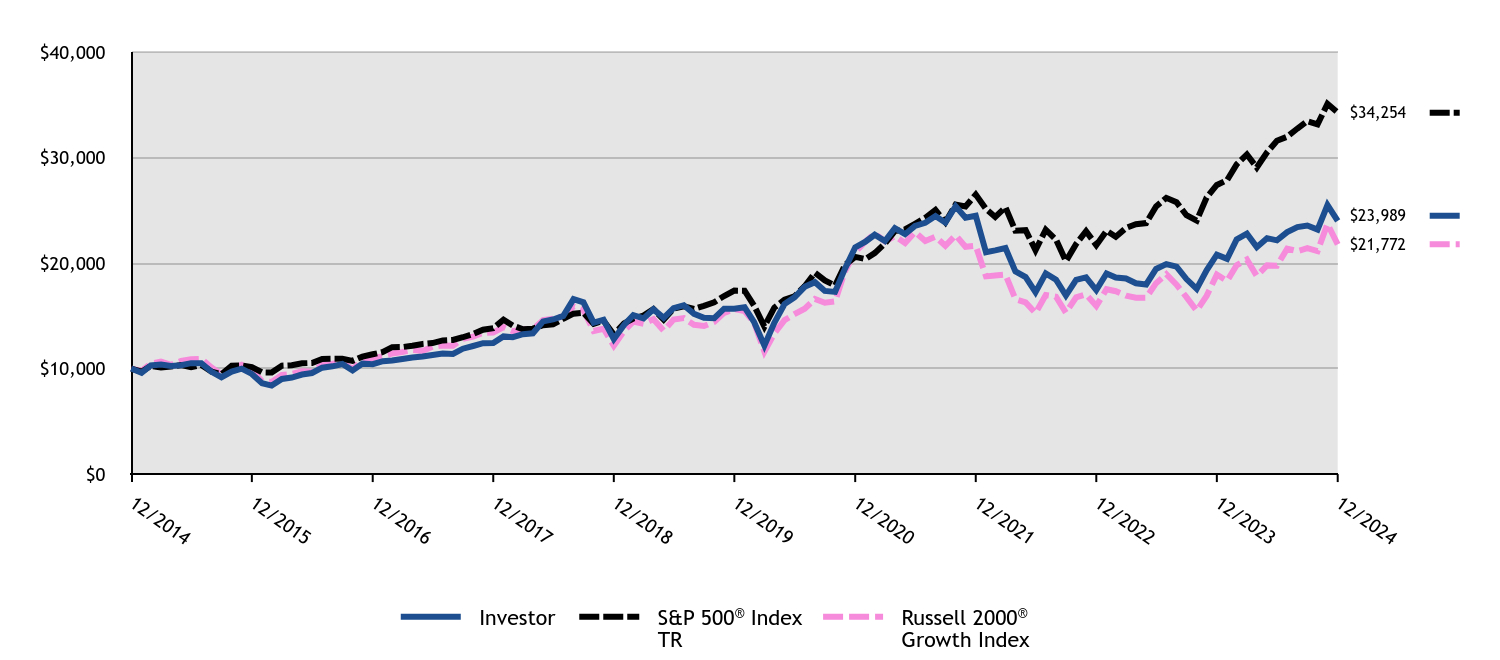

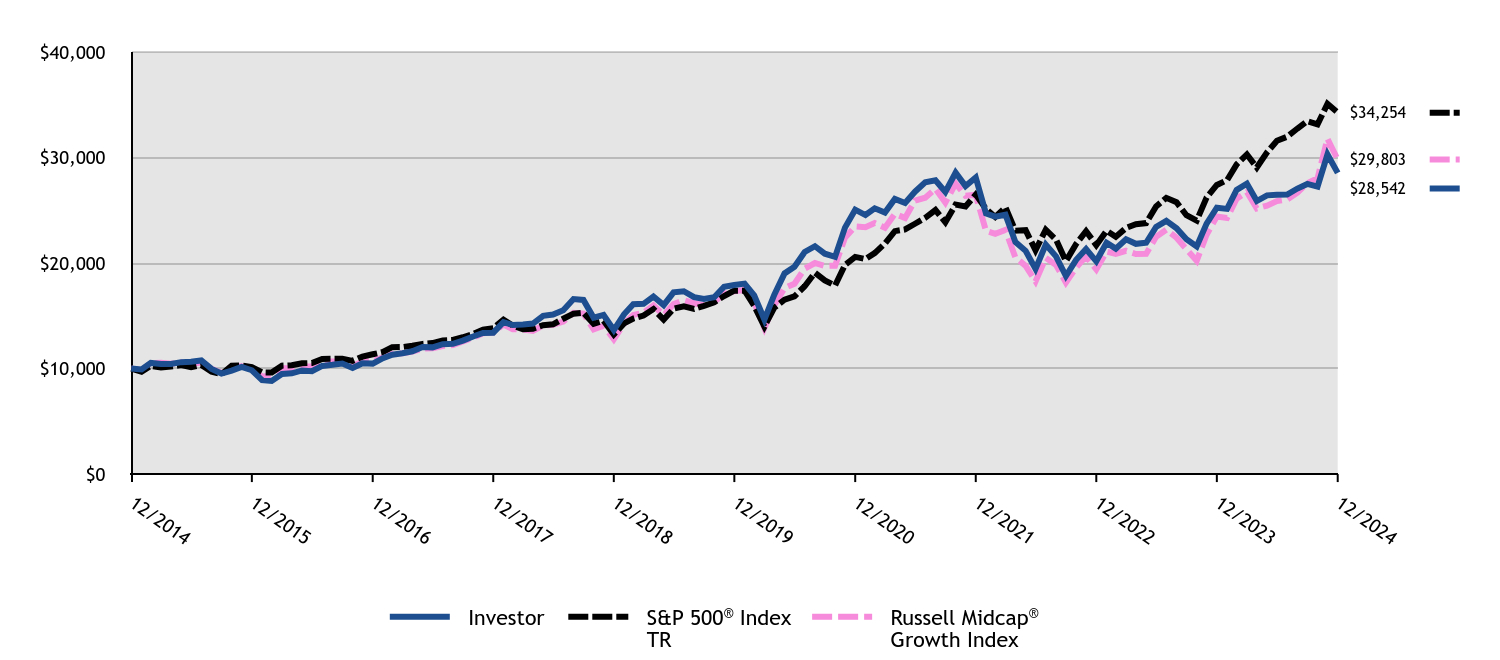

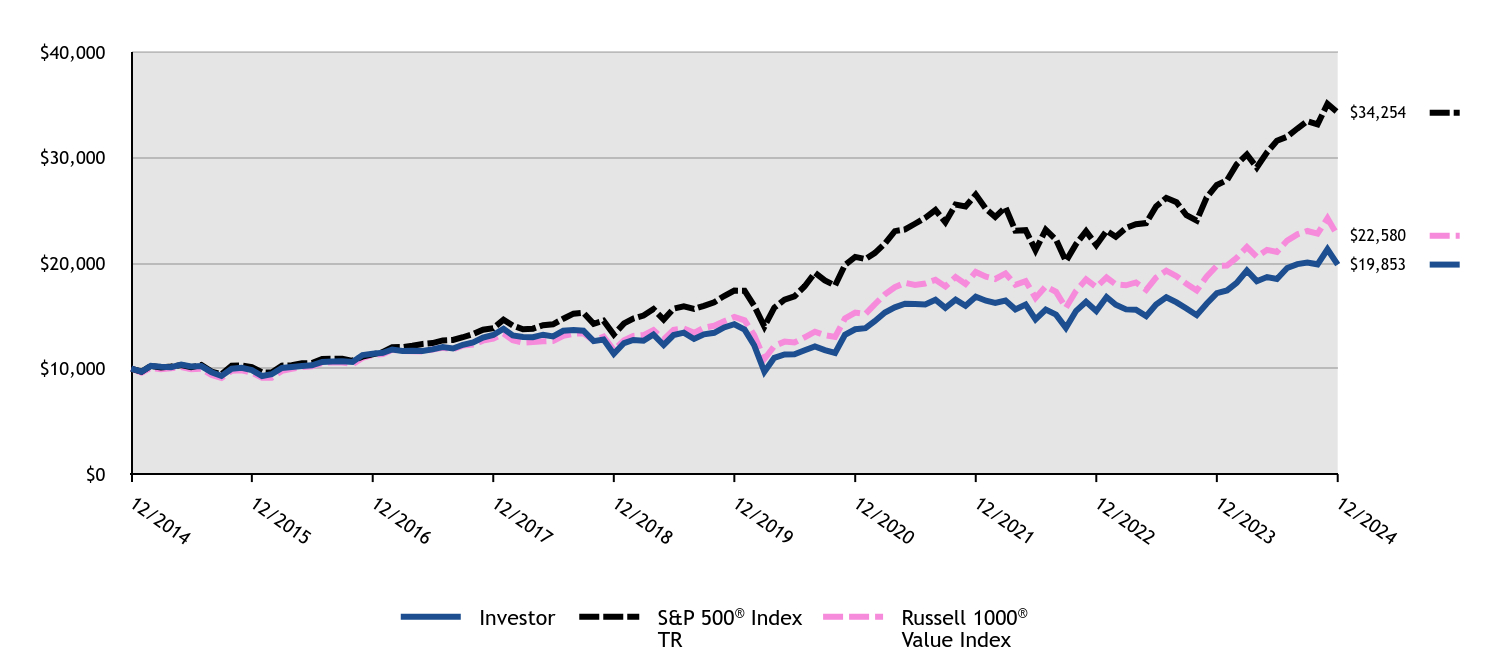

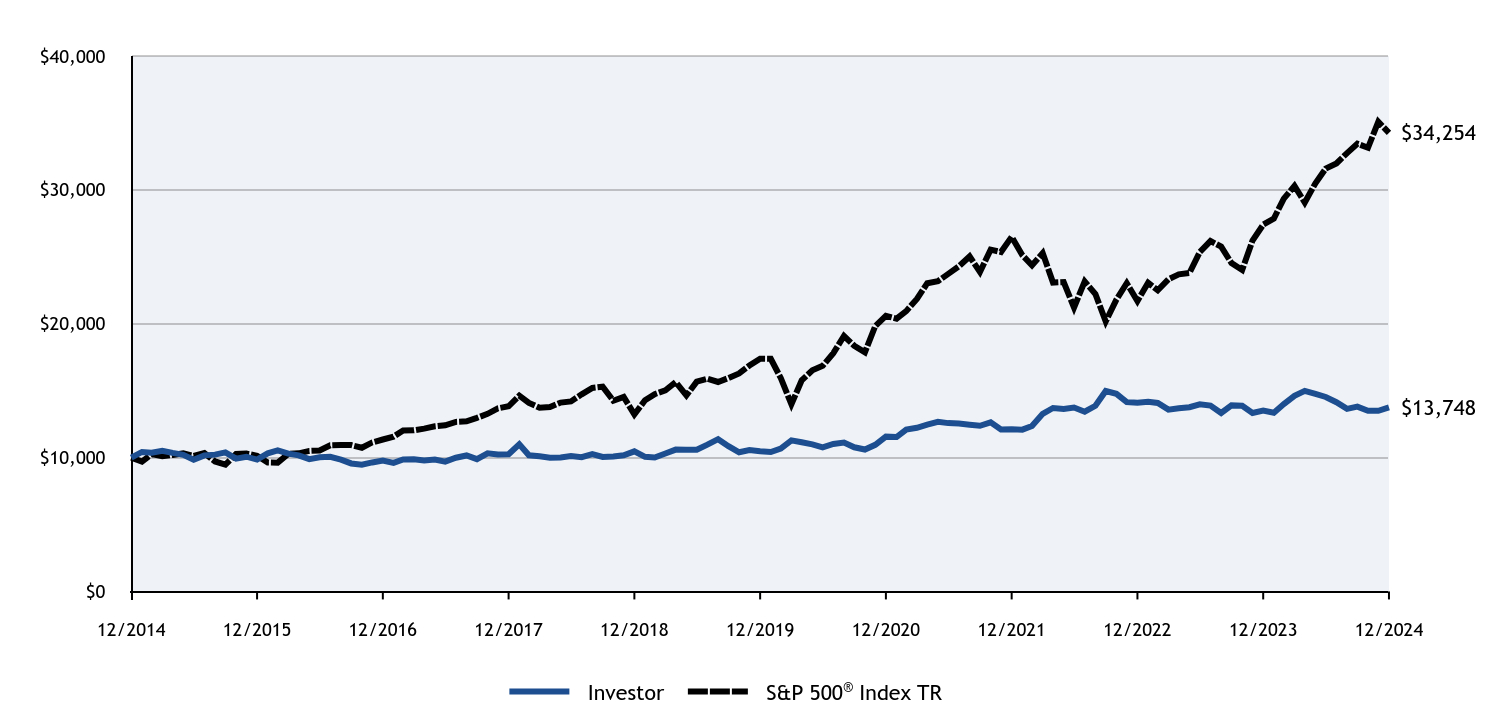

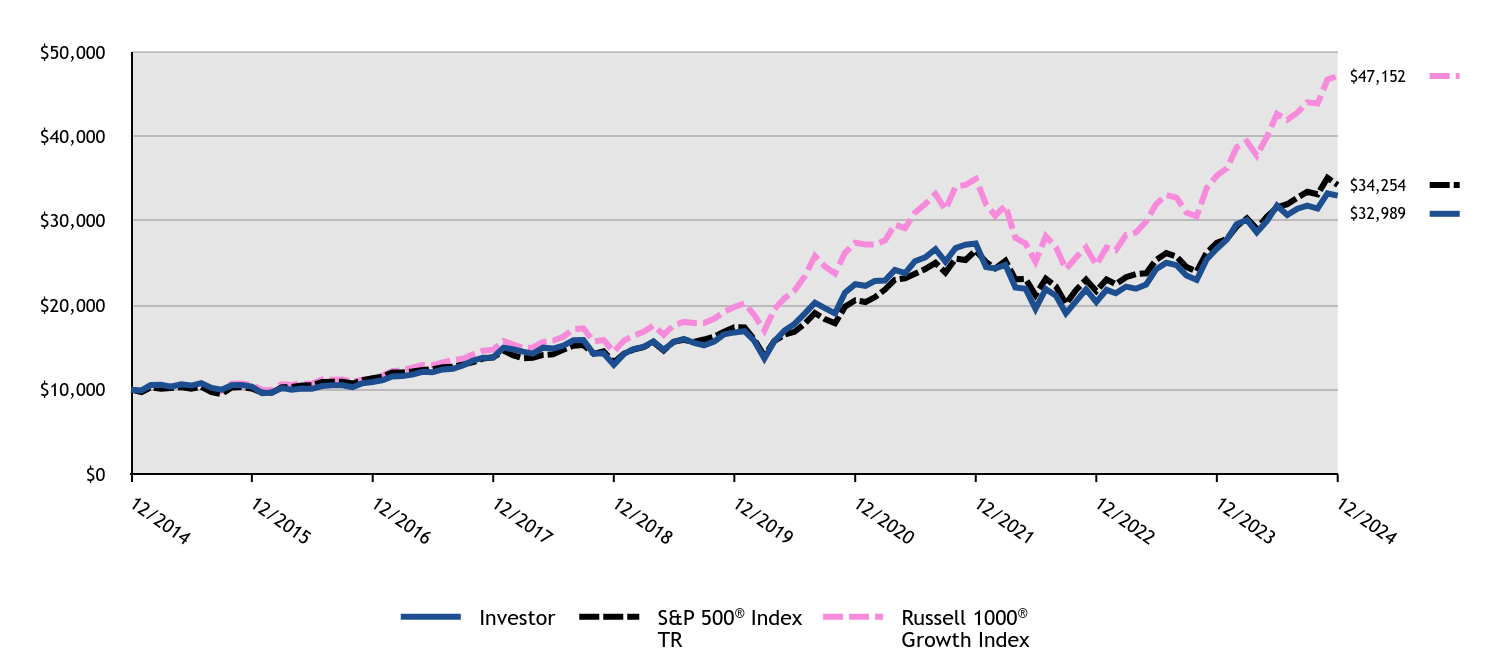

How did the Fund perform and what affected its performance?

The Investor Class of the Fund returned 15.40% for the twelve months ended December 31, 2024, compared to the S&P 500 Index return of 25.02% and the Russell 2000 Growth Index return of 15.15%.

• Overall market performance during the period was driven by mega-cap growth companies, while the Fund focuses its investments on small capitalization companies.

• The Fund’s performance was positive in all sectors where it invested. Holdings in the Energy and Financials sectors contributed materially to the Fund’s outperformance of the Russell 2000® Growth Index, while holdings in the Information Technology sector detracted.

Cumulative Performance from December 31, 2014 through December 31, 2024

The initial investment, based on a $10,000 investment, is adjusted to reflect the maximum applicable sales charge, if any.

| Investor | S&P 500® Index TR | Russell 2000® Growth Index |

|---|

| 12/2014 | $10,000 | $10,000 | $10,000 |

|---|

| 01/2015 | $9,593 | $9,700 | $9,772 |

|---|

| 02/2015 | $10,299 | $10,257 | $10,475 |

|---|

| 03/2015 | $10,382 | $10,095 | $10,663 |

|---|

| 04/2015 | $10,248 | $10,192 | $10,349 |

|---|

| 05/2015 | $10,312 | $10,323 | $10,730 |

|---|

| 06/2015 | $10,509 | $10,123 | $10,874 |

|---|

| 07/2015 | $10,509 | $10,335 | $10,918 |

|---|

| 08/2015 | $9,688 | $9,712 | $10,091 |

|---|

| 09/2015 | $9,179 | $9,471 | $9,453 |

|---|

| 10/2015 | $9,707 | $10,270 | $9,990 |

|---|

| 11/2015 | $9,994 | $10,301 | $10,356 |

|---|

| 12/2015 | $9,492 | $10,138 | $9,862 |

|---|

| 01/2016 | $8,610 | $9,635 | $8,793 |

|---|

| 02/2016 | $8,389 | $9,622 | $8,731 |

|---|

| 03/2016 | $9,011 | $10,275 | $9,400 |

|---|

| 04/2016 | $9,151 | $10,315 | $9,494 |

|---|

| 05/2016 | $9,432 | $10,500 | $9,750 |

|---|

| 06/2016 | $9,579 | $10,527 | $9,705 |

|---|

| 07/2016 | $10,080 | $10,915 | $10,339 |

|---|

| 08/2016 | $10,214 | $10,931 | $10,449 |

|---|

| 09/2016 | $10,435 | $10,933 | $10,600 |

|---|

| 10/2016 | $9,820 | $10,733 | $9,941 |

|---|

| 11/2016 | $10,482 | $11,131 | $10,830 |

|---|

| 12/2016 | $10,418 | $11,351 | $10,978 |

|---|

| 01/2017 | $10,695 | $11,566 | $11,156 |

|---|

| 02/2017 | $10,762 | $12,025 | $11,430 |

|---|

| 03/2017 | $10,911 | $12,039 | $11,565 |

|---|

| 04/2017 | $11,045 | $12,163 | $11,778 |

|---|

| 05/2017 | $11,147 | $12,334 | $11,671 |

|---|

| 06/2017 | $11,288 | $12,411 | $12,073 |

|---|

| 07/2017 | $11,430 | $12,666 | $12,176 |

|---|

| 08/2017 | $11,389 | $12,705 | $12,161 |

|---|

| 09/2017 | $11,882 | $12,967 | $12,823 |

|---|

| 10/2017 | $12,138 | $13,270 | $13,022 |

|---|

| 11/2017 | $12,408 | $13,677 | $13,396 |

|---|

| 12/2017 | $12,422 | $13,829 | $13,411 |

|---|

| 01/2018 | $13,044 | $14,621 | $13,934 |

|---|

| 02/2018 | $12,974 | $14,082 | $13,538 |

|---|

| 03/2018 | $13,254 | $13,724 | $13,720 |

|---|

| 04/2018 | $13,344 | $13,777 | $13,733 |

|---|

| 05/2018 | $14,470 | $14,108 | $14,598 |

|---|

| 06/2018 | $14,652 | $14,195 | $14,712 |

|---|

| 07/2018 | $14,987 | $14,724 | $14,965 |

|---|

| 08/2018 | $16,581 | $15,203 | $15,897 |

|---|

| 09/2018 | $16,280 | $15,290 | $15,525 |

|---|

| 10/2018 | $14,351 | $14,245 | $13,560 |

|---|

| 11/2018 | $14,624 | $14,535 | $13,772 |

|---|

| 12/2018 | $12,786 | $13,223 | $12,163 |

|---|

| 01/2019 | $14,138 | $14,282 | $13,568 |

|---|

| 02/2019 | $15,059 | $14,741 | $14,444 |

|---|

| 03/2019 | $14,752 | $15,027 | $14,248 |

|---|

| 04/2019 | $15,612 | $15,636 | $14,682 |

|---|

| 05/2019 | $14,803 | $14,642 | $13,593 |

|---|

| 06/2019 | $15,724 | $15,674 | $14,640 |

|---|

| 07/2019 | $16,001 | $15,899 | $14,783 |

|---|

| 08/2019 | $15,182 | $15,648 | $14,145 |

|---|

| 09/2019 | $14,803 | $15,940 | $14,029 |

|---|

| 10/2019 | $14,772 | $16,286 | $14,428 |

|---|

| 11/2019 | $15,673 | $16,877 | $15,278 |

|---|

| 12/2019 | $15,662 | $17,386 | $15,628 |

|---|

| 01/2020 | $15,799 | $17,379 | $15,456 |

|---|

| 02/2020 | $14,393 | $15,949 | $14,340 |

|---|

| 03/2020 | $12,175 | $13,979 | $11,601 |

|---|

| 04/2020 | $14,336 | $15,771 | $13,329 |

|---|

| 05/2020 | $16,119 | $16,522 | $14,589 |

|---|

| 06/2020 | $16,748 | $16,850 | $15,149 |

|---|

| 07/2020 | $17,743 | $17,801 | $15,670 |

|---|

| 08/2020 | $18,188 | $19,080 | $16,589 |

|---|

| 09/2020 | $17,354 | $18,355 | $16,234 |

|---|

| 10/2020 | $17,262 | $17,867 | $16,357 |

|---|

| 11/2020 | $19,469 | $19,823 | $19,241 |

|---|

| 12/2020 | $21,485 | $20,585 | $21,040 |

|---|

| 01/2021 | $22,020 | $20,377 | $22,054 |

|---|

| 02/2021 | $22,682 | $20,939 | $22,782 |

|---|

| 03/2021 | $22,084 | $21,856 | $22,066 |

|---|

| 04/2021 | $23,306 | $23,022 | $22,547 |

|---|

| 05/2021 | $22,733 | $23,183 | $21,903 |

|---|

| 06/2021 | $23,522 | $23,724 | $22,930 |

|---|

| 07/2021 | $23,815 | $24,288 | $22,095 |

|---|

| 08/2021 | $24,451 | $25,026 | $22,496 |

|---|

| 09/2021 | $23,827 | $23,863 | $21,634 |

|---|

| 10/2021 | $25,380 | $25,534 | $22,647 |

|---|

| 11/2021 | $24,298 | $25,357 | $21,541 |

|---|

| 12/2021 | $24,478 | $26,494 | $21,636 |

|---|

| 01/2022 | $21,022 | $25,123 | $18,736 |

|---|

| 02/2022 | $21,196 | $24,371 | $18,818 |

|---|

| 03/2022 | $21,417 | $25,276 | $18,904 |

|---|

| 04/2022 | $19,207 | $23,071 | $16,585 |

|---|

| 05/2022 | $18,671 | $23,114 | $16,272 |

|---|

| 06/2022 | $17,234 | $21,206 | $15,264 |

|---|

| 07/2022 | $19,018 | $23,161 | $16,973 |

|---|

| 08/2022 | $18,418 | $22,217 | $16,814 |

|---|

| 09/2022 | $16,919 | $20,170 | $15,301 |

|---|

| 10/2022 | $18,402 | $21,804 | $16,754 |

|---|

| 11/2022 | $18,639 | $23,022 | $17,026 |

|---|

| 12/2022 | $17,442 | $21,696 | $15,933 |

|---|

| 01/2023 | $19,005 | $23,059 | $17,518 |

|---|

| 02/2023 | $18,623 | $22,496 | $17,329 |

|---|

| 03/2023 | $18,532 | $23,322 | $16,901 |

|---|

| 04/2023 | $18,078 | $23,686 | $16,705 |

|---|

| 05/2023 | $17,969 | $23,789 | $16,708 |

|---|

| 06/2023 | $19,441 | $25,361 | $18,093 |

|---|

| 07/2023 | $19,895 | $26,176 | $18,939 |

|---|

| 08/2023 | $19,659 | $25,759 | $17,953 |

|---|

| 09/2023 | $18,478 | $24,531 | $16,769 |

|---|

| 10/2023 | $17,551 | $24,015 | $15,476 |

|---|

| 11/2023 | $19,314 | $26,208 | $16,885 |

|---|

| 12/2023 | $20,788 | $27,399 | $18,906 |

|---|

| 01/2024 | $20,400 | $27,859 | $18,300 |

|---|

| 02/2024 | $22,245 | $29,347 | $19,787 |

|---|

| 03/2024 | $22,780 | $30,291 | $20,340 |

|---|

| 04/2024 | $21,507 | $29,054 | $18,774 |

|---|

| 05/2024 | $22,356 | $30,494 | $19,779 |

|---|

| 06/2024 | $22,153 | $31,589 | $19,746 |

|---|

| 07/2024 | $22,927 | $31,973 | $21,363 |

|---|

| 08/2024 | $23,407 | $32,749 | $21,126 |

|---|

| 09/2024 | $23,554 | $33,448 | $21,407 |

|---|

| 10/2024 | $23,167 | $33,145 | $21,123 |

|---|

| 11/2024 | $25,491 | $35,090 | $23,713 |

|---|

| 12/2024 | $23,989 | $34,254 | $21,772 |

|---|

Average Annual Total Returns (%)

| HEADER | 1 Year | 5 Years | 10 Years |

|---|

Investor ClassFootnote Reference1 | 15.40% | 8.90% | 9.14% |

|---|

S&P 500® Index TR | 25.02% | 14.53% | 13.10% |

|---|

Russell 2000® Growth Index | 15.15% | 6.86% | 8.09% |

|---|

| Footnote | Description |

Footnote1 | Return may differ from actual shareholder return due to accounting adjustments for financial reporting purposes. |

Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit americanbeaconfunds.com or call 800-967-9009. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. The Fund's performance benefited from fee waivers. For more information, visit americanbeaconfunds.com/Performance_Disclaimers.aspx.

The S&P 500 Index TR is replacing the Russell 2000 Growth Index as broad-based securities market index to comply with a new regulatory requirement. The Russell 2000 Growth Index reflects the market sectors in which the Fund invests.

| Total Net Assets | $364,382,179 |

|---|

| # of Portfolio Holdings | 105 |

|---|

| Portfolio Turnover Rate | 37% |

|---|

| Total Management Fees Paid | $2,854,258 |

|---|

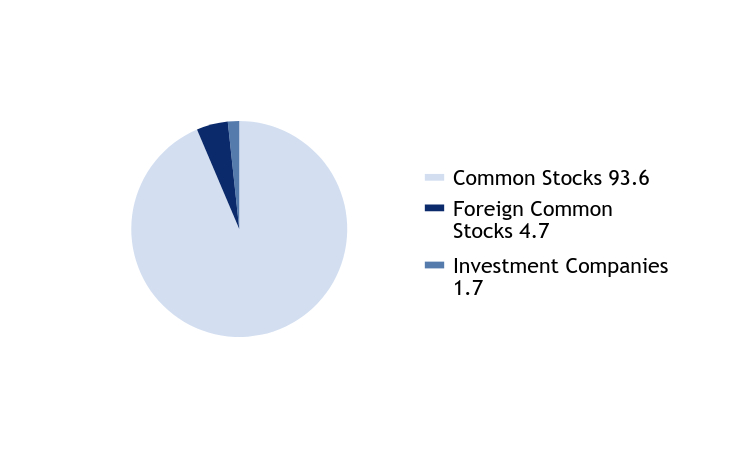

What did the Fund invest in?

Top Ten Holdings - % Net Assets

| CyberArk Software Ltd. | 2.2 |

| BellRing Brands, Inc. | 2.1 |

| Kratos Defense & Security Solutions, Inc. | 2.0 |

| Viper Energy, Inc. | 1.9 |

| Manhattan Associates, Inc. | 1.7 |

| HealthEquity, Inc. | 1.7 |

| Leonardo DRS, Inc. | 1.6 |

| RBC Bearings, Inc. | 1.6 |

| Ryan Specialty Holdings, Inc. | 1.5 |

| Descartes Systems Group, Inc. | 1.5 |

Excludes cash equivalents.

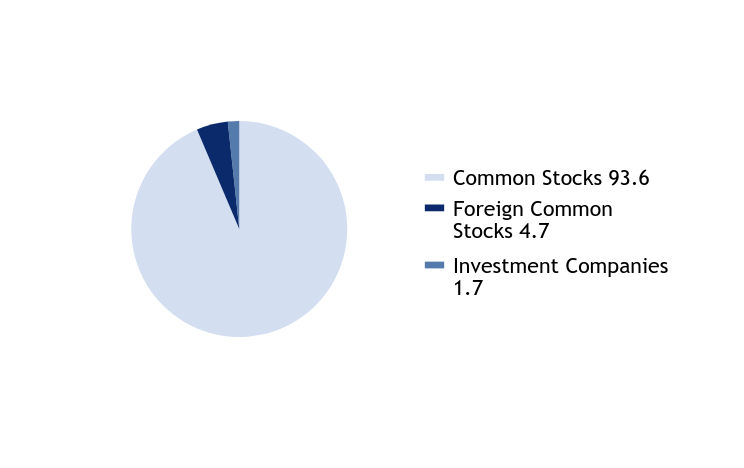

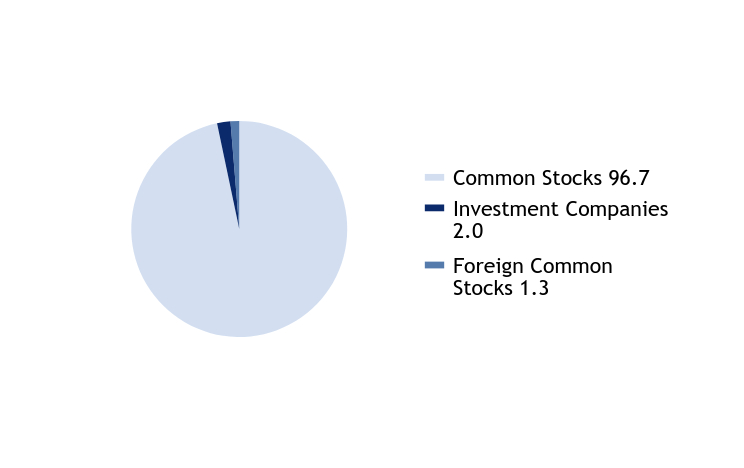

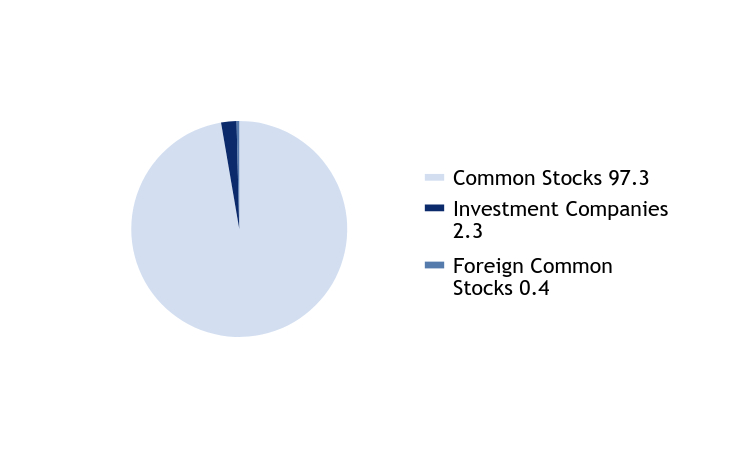

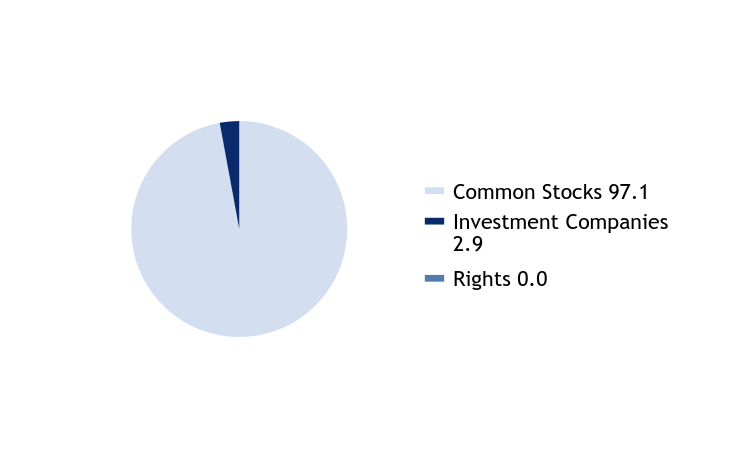

Asset Allocation - % Investments

| Value | Value |

|---|

| Common Stocks | 93.6 |

| Foreign Common Stocks | 4.7 |

| Investment Companies | 1.7 |

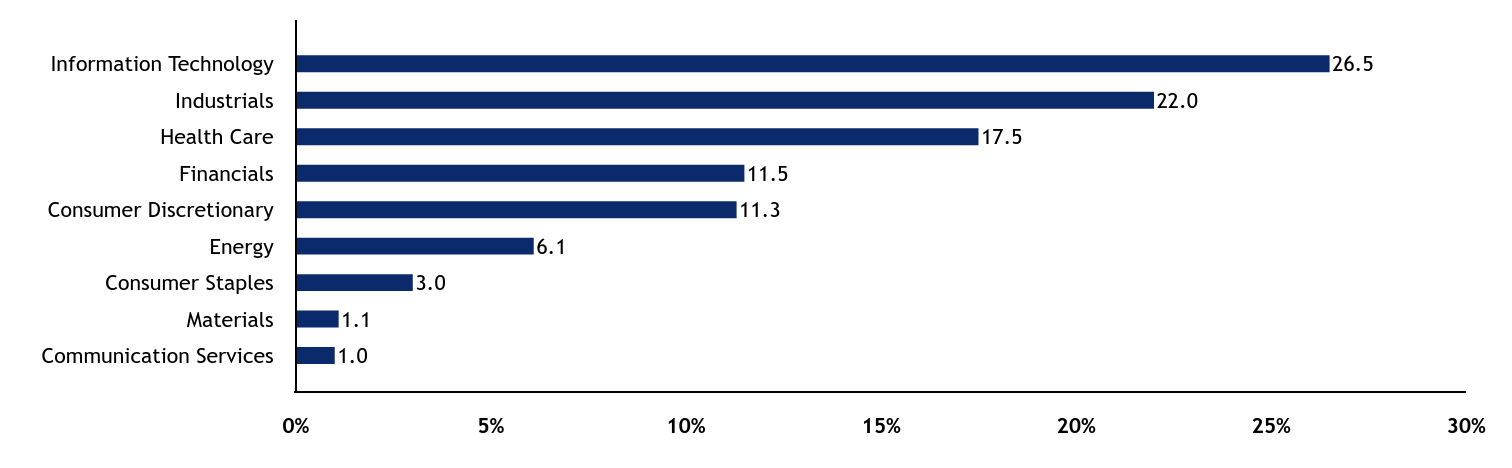

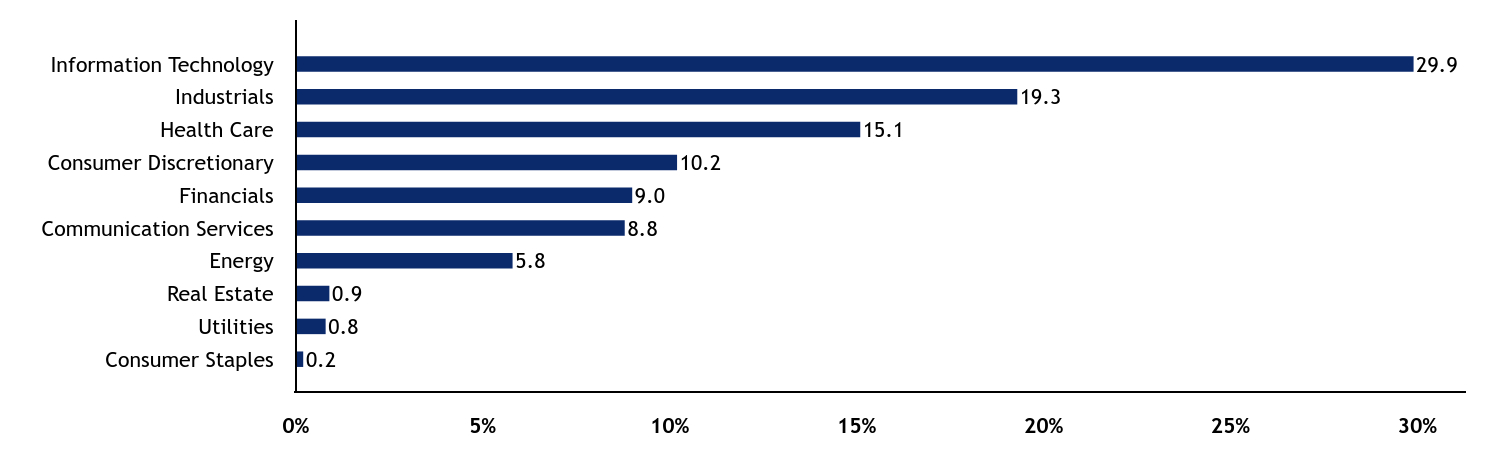

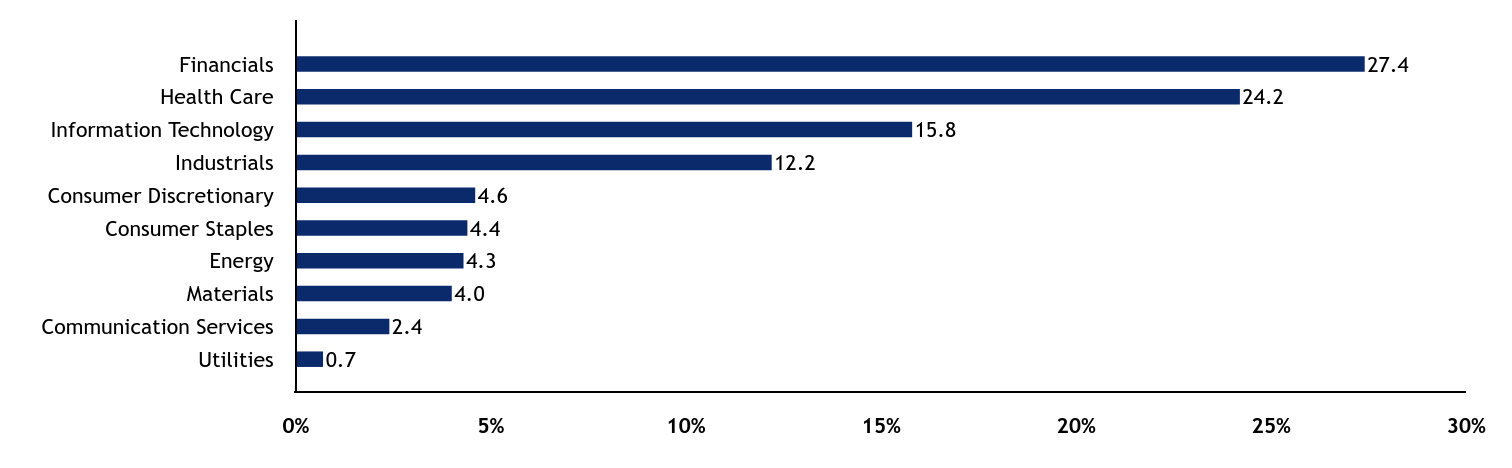

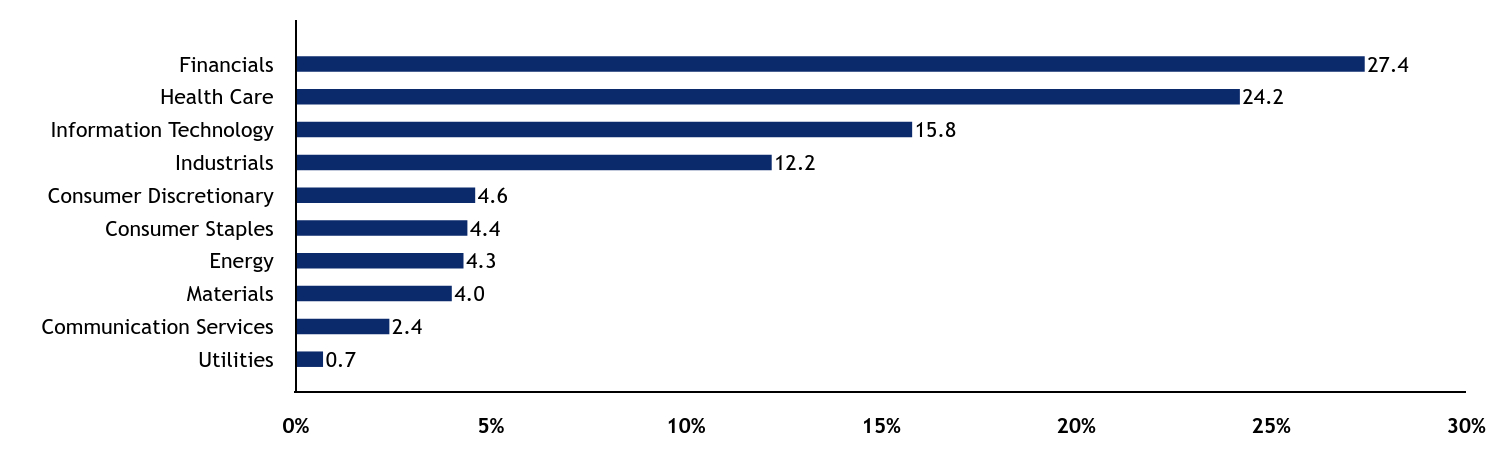

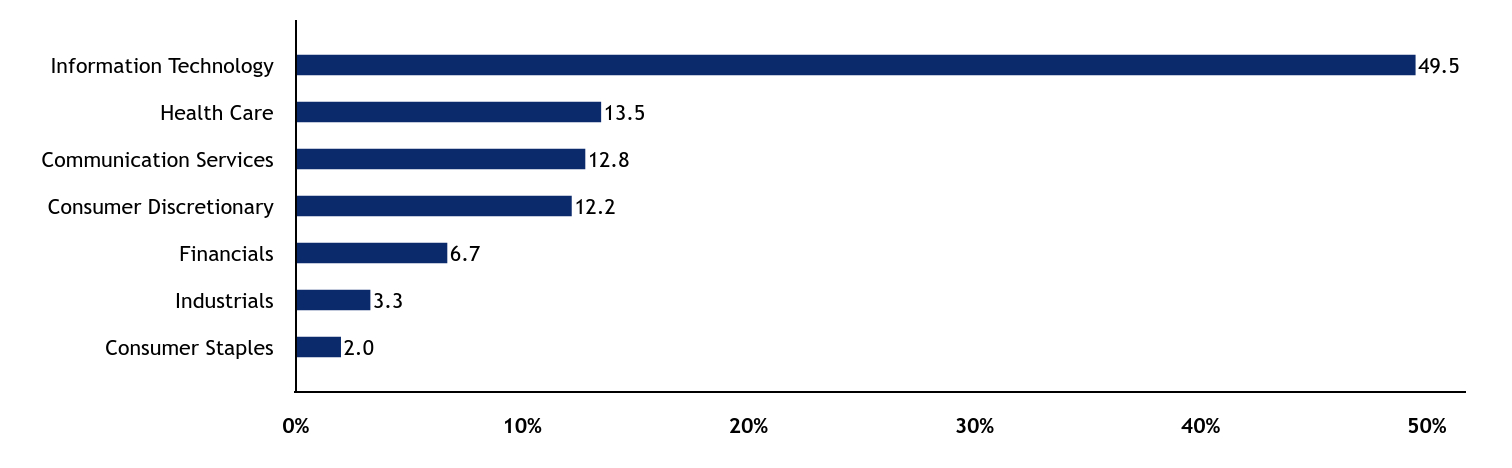

Sector Allocation - % Equities

| Value | Value |

|---|

| Communication Services | 1.0 |

| Materials | 1.1 |

| Consumer Staples | 3.0 |

| Energy | 6.1 |

| Consumer Discretionary | 11.3 |

| Financials | 11.5 |

| Health Care | 17.5 |

| Industrials | 22.0 |

| Information Technology | 26.5 |

For additional information about the Fund, including its prospectus, financial statements, holdings, and proxy voting information, please visit www.americanbeaconfunds.com/literature or call 1-800-658-5811.

If your financial institution mailed only one copy of this Report to an address shared by more than one account, you can request an individual copy by contacting your financial institution.

Stephens Small Cap Growth Fund

Distributed by:

Resolute Investment Distributors, Inc.

Annual Shareholder Report - December 31, 2024

Stephens Small Cap Growth Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about American Beacon Stephens Small Cap Growth Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| R6 | $104 | 0.96% |

|---|

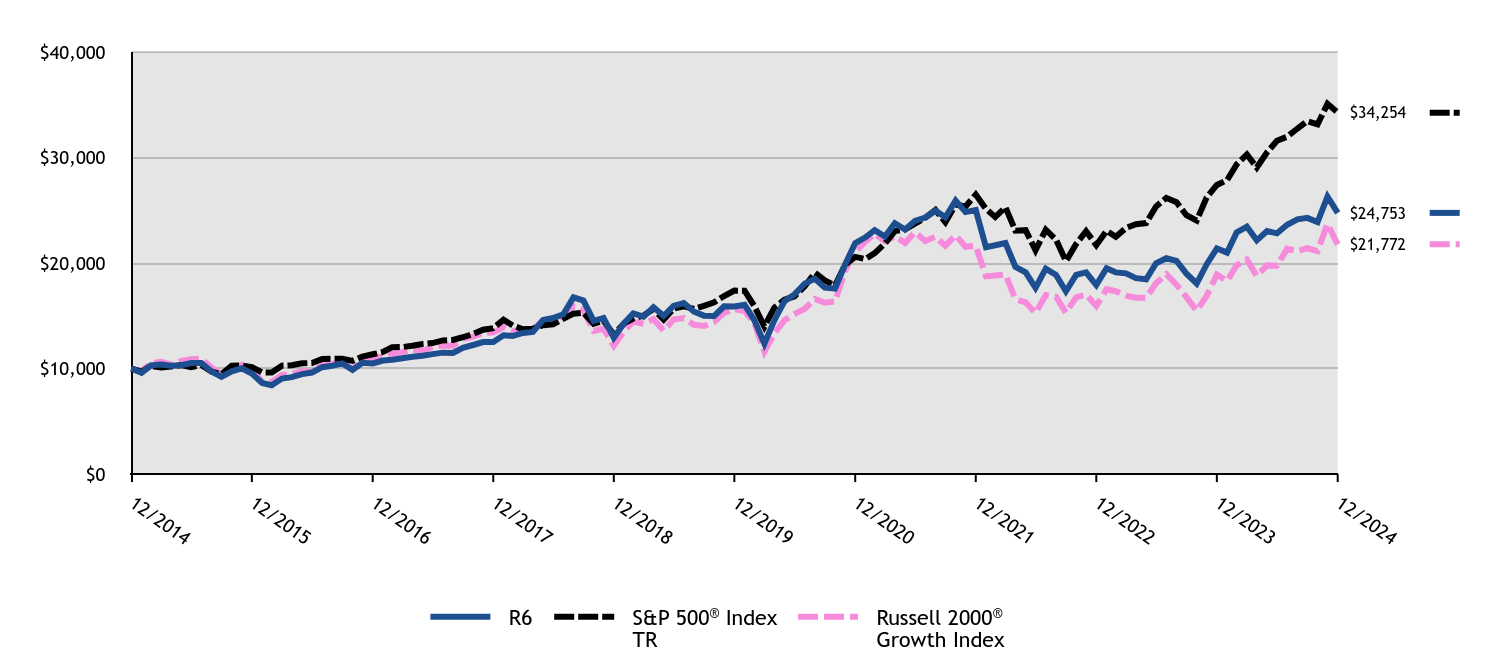

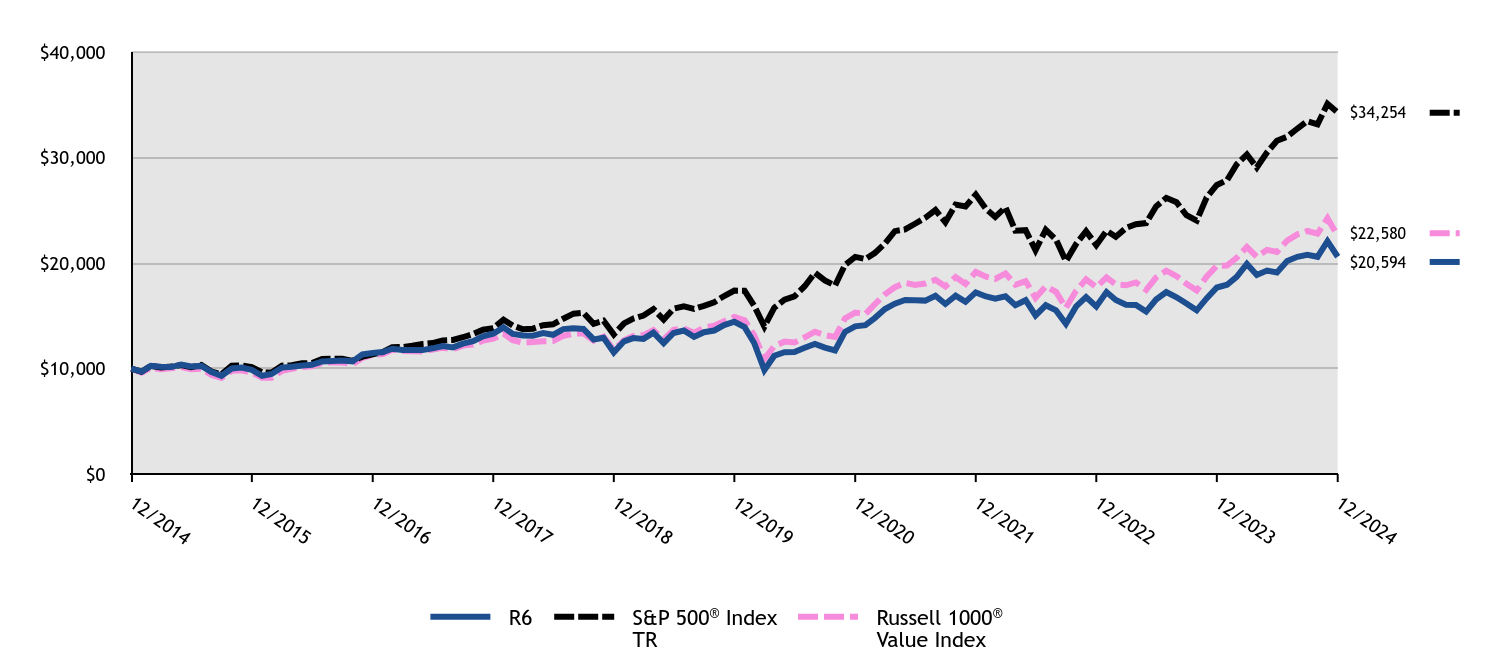

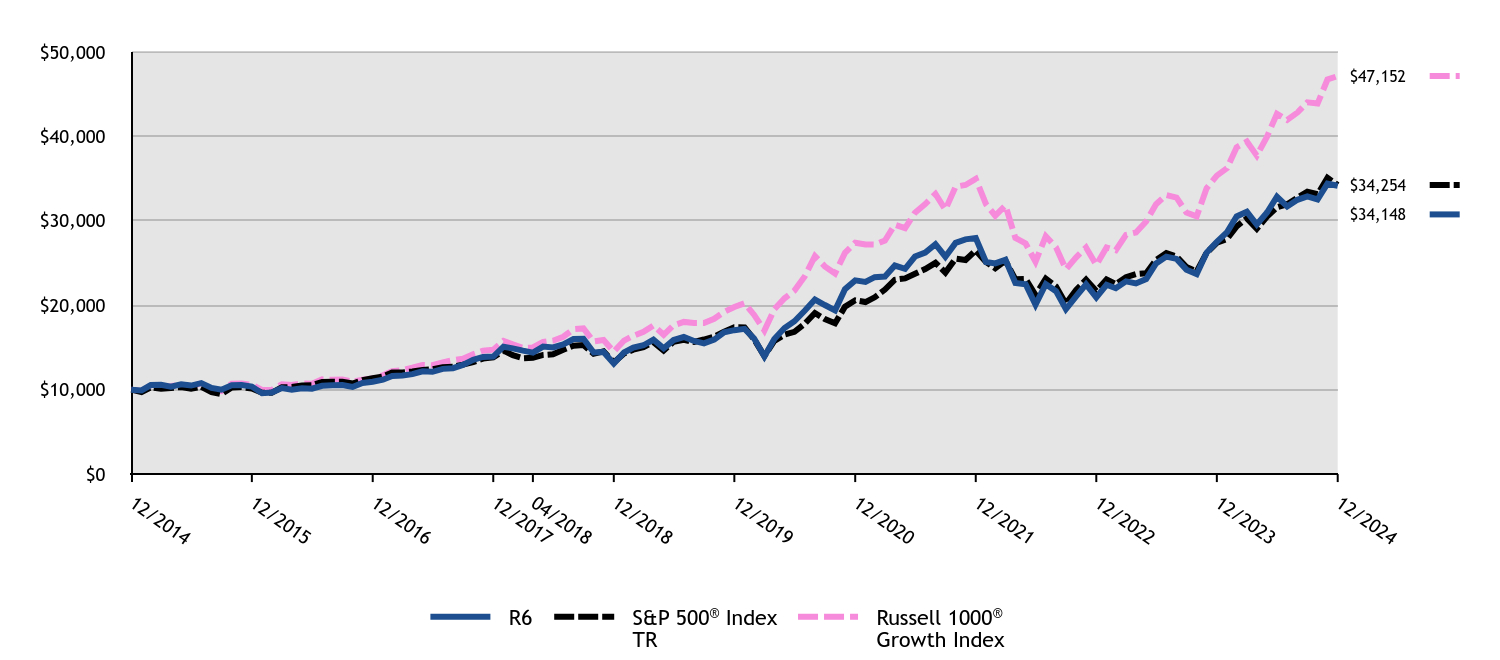

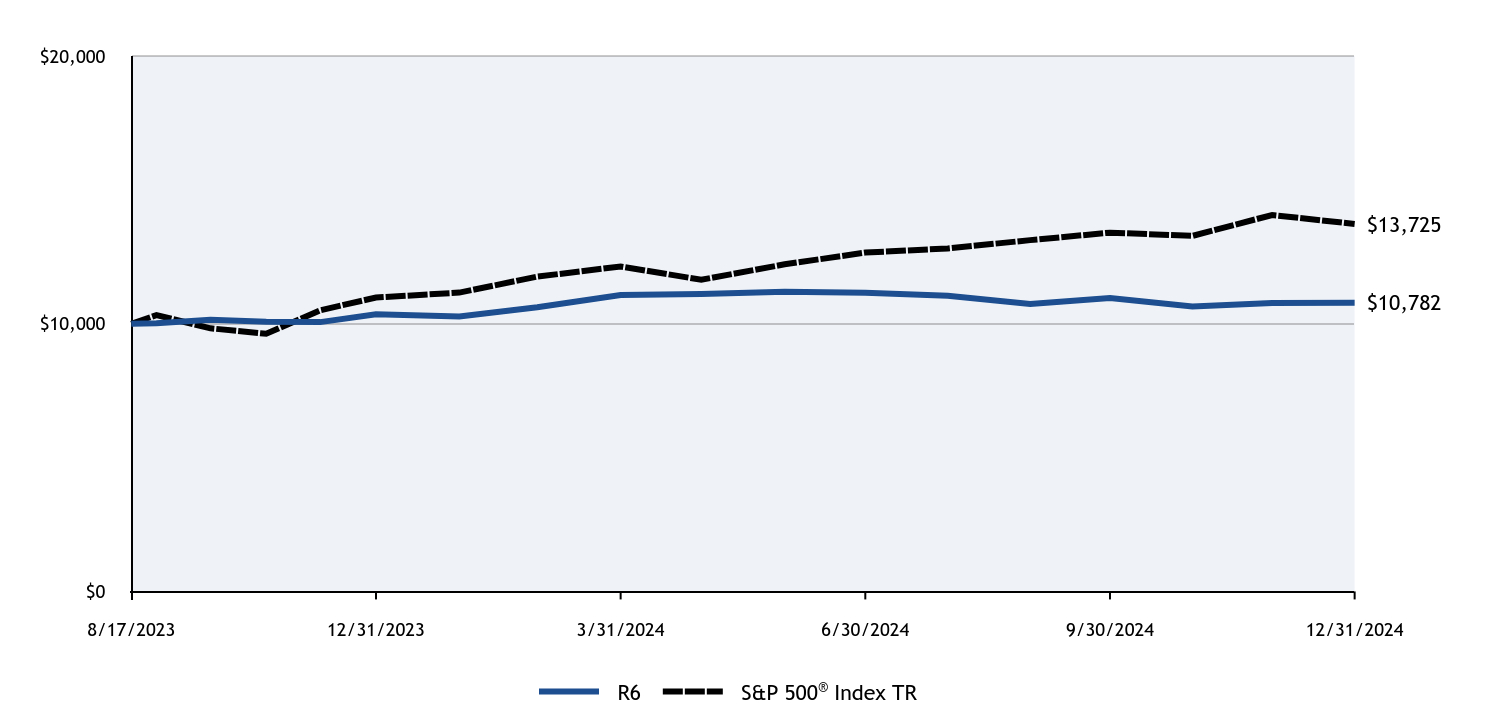

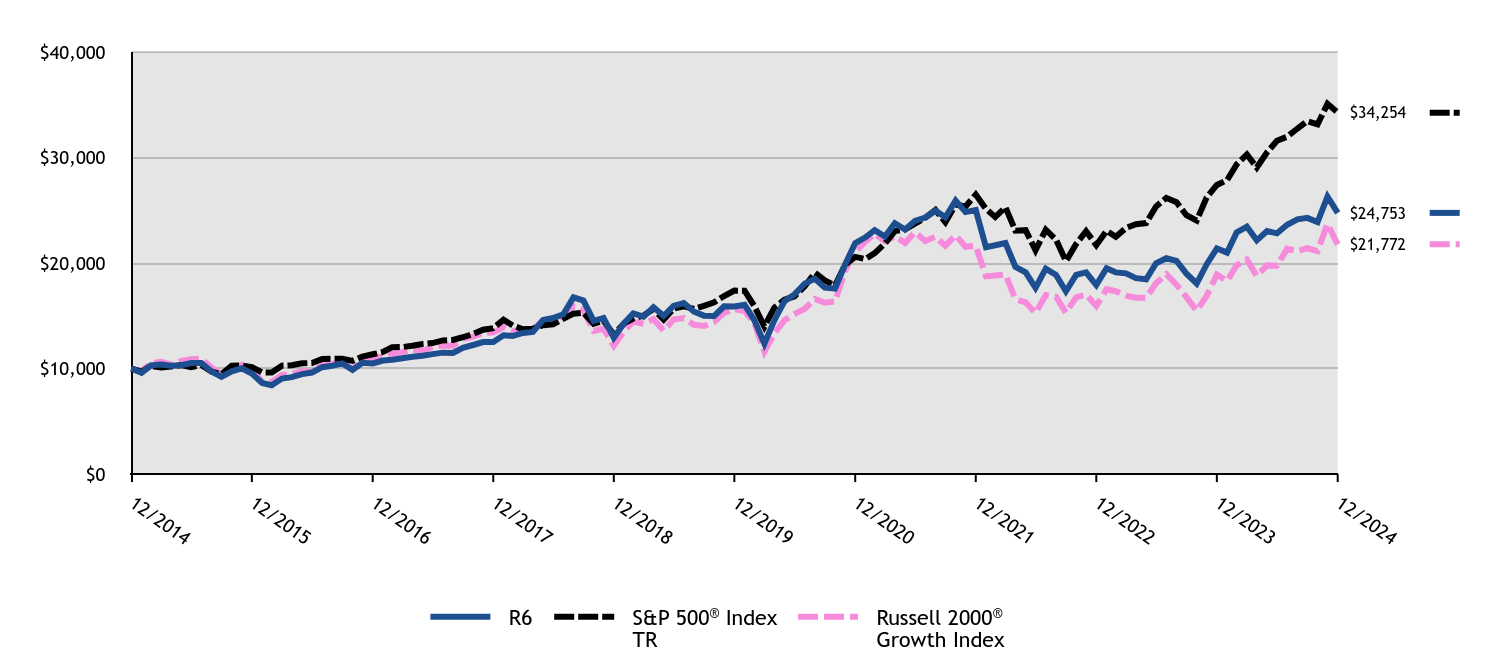

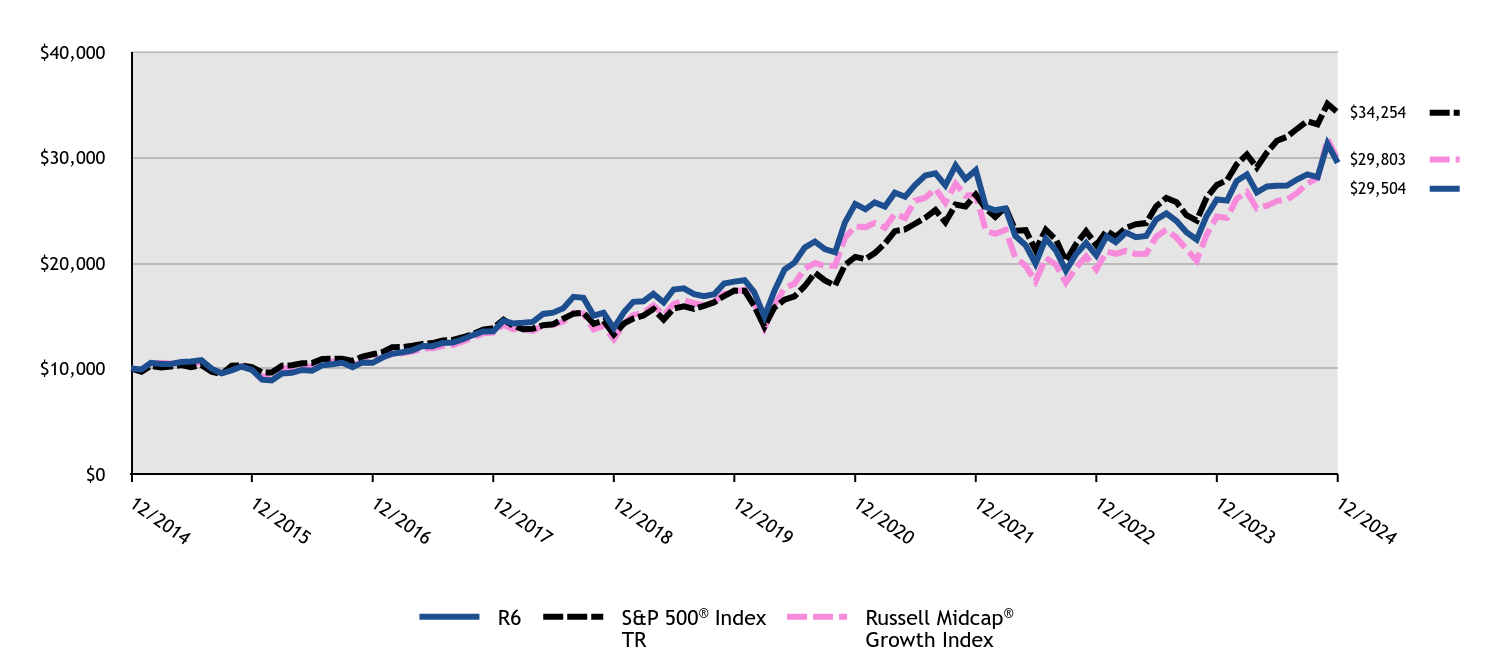

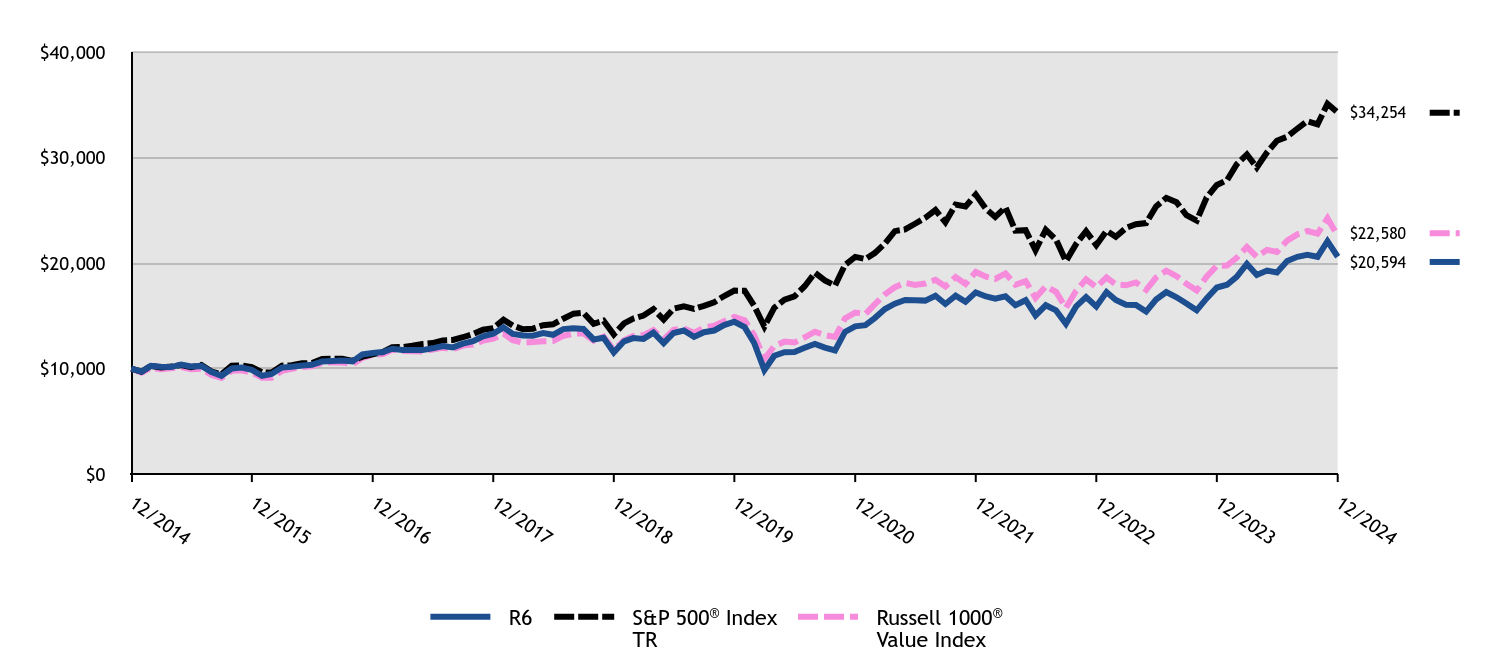

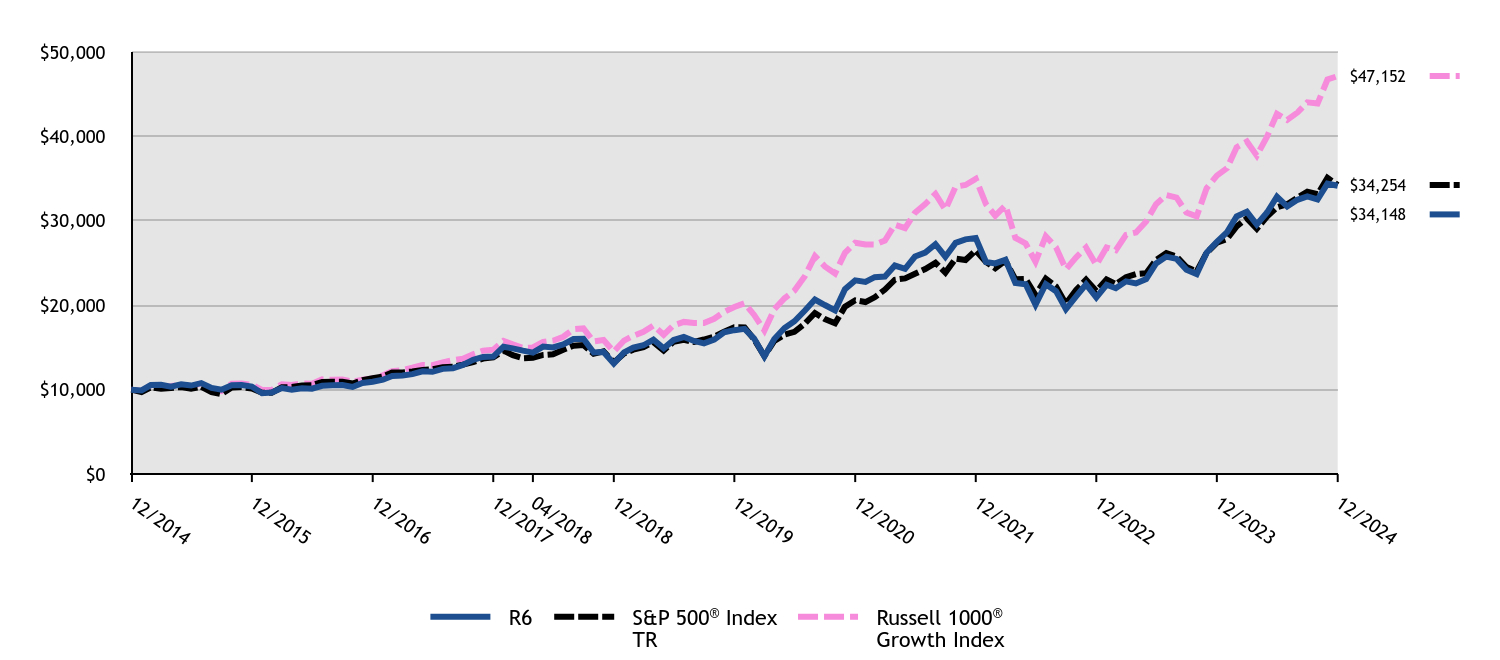

How did the Fund perform and what affected its performance?

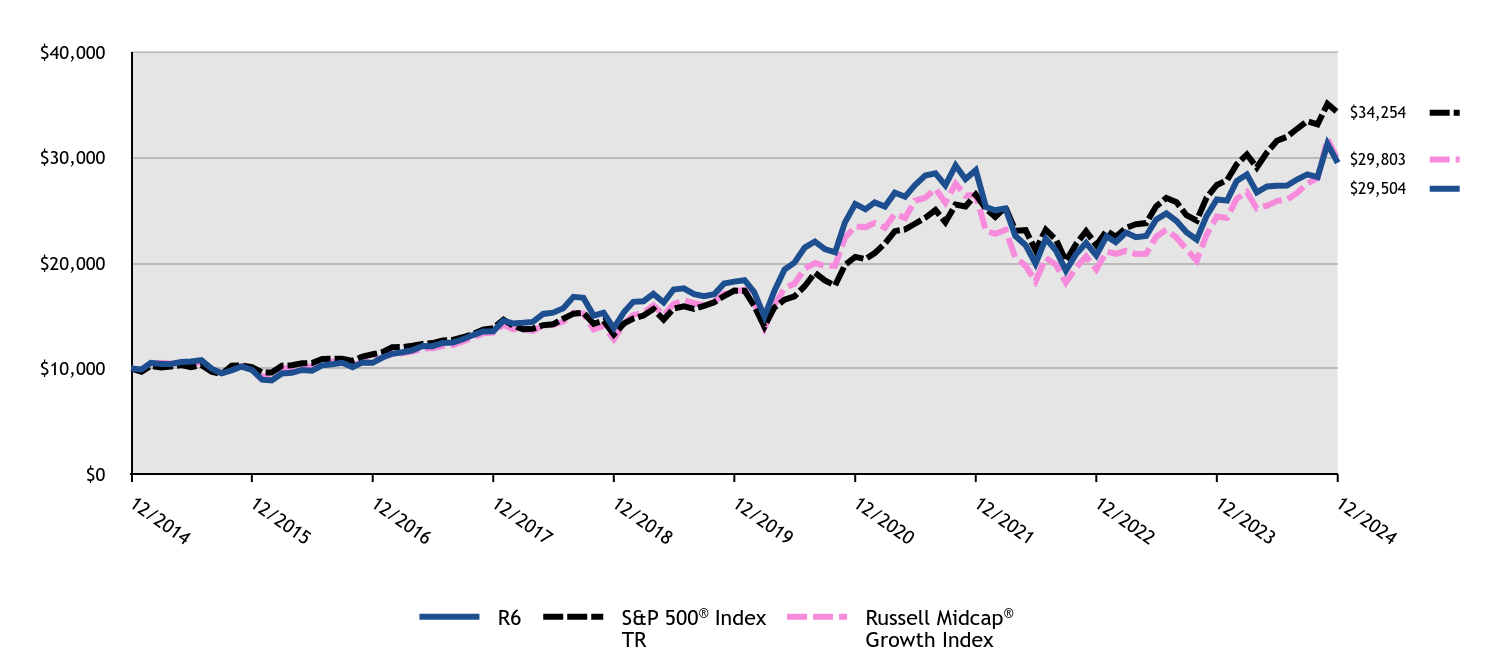

The R6 Class of the Fund returned 15.73% for the twelve months ended December 31, 2024, compared to the S&P 500 Index return of 25.02% and the Russell 2000 Growth Index return of 15.15%.

• Overall market performance during the period was driven by mega-cap growth companies, while the Fund focuses its investments on small capitalization companies.

• The Fund’s performance was positive in all sectors where it invested. Holdings in the Energy and Financials sectors contributed materially to the Fund’s outperformance of the Russell 2000® Growth Index, while holdings in the Information Technology sector detracted.

Cumulative Performance from December 31, 2014 through December 31, 2024

The initial investment, based on a $10,000 investment, is adjusted to reflect the maximum applicable sales charge, if any.

| R6 | S&P 500® Index TR | Russell 2000® Growth Index |

|---|

| 12/2014 | $10,000 | $10,000 | $10,000 |

|---|

| 01/2015 | $9,590 | $9,700 | $9,772 |

|---|

| 02/2015 | $10,302 | $10,257 | $10,475 |

|---|

| 03/2015 | $10,386 | $10,095 | $10,663 |

|---|

| 04/2015 | $10,259 | $10,192 | $10,349 |

|---|

| 05/2015 | $10,320 | $10,323 | $10,730 |

|---|

| 06/2015 | $10,525 | $10,123 | $10,874 |

|---|

| 07/2015 | $10,525 | $10,335 | $10,918 |

|---|

| 08/2015 | $9,710 | $9,712 | $10,091 |

|---|

| 09/2015 | $9,204 | $9,471 | $9,453 |

|---|

| 10/2015 | $9,735 | $10,270 | $9,990 |

|---|

| 11/2015 | $10,024 | $10,301 | $10,356 |

|---|

| 12/2015 | $9,525 | $10,138 | $9,862 |

|---|

| 01/2016 | $8,641 | $9,635 | $8,793 |

|---|

| 02/2016 | $8,426 | $9,622 | $8,731 |

|---|

| 03/2016 | $9,051 | $10,275 | $9,400 |

|---|

| 04/2016 | $9,190 | $10,315 | $9,494 |

|---|

| 05/2016 | $9,475 | $10,500 | $9,750 |

|---|

| 06/2016 | $9,626 | $10,527 | $9,705 |

|---|

| 07/2016 | $10,132 | $10,915 | $10,339 |

|---|

| 08/2016 | $10,264 | $10,931 | $10,449 |

|---|

| 09/2016 | $10,485 | $10,933 | $10,600 |

|---|

| 10/2016 | $9,879 | $10,733 | $9,941 |

|---|

| 11/2016 | $10,542 | $11,131 | $10,830 |

|---|

| 12/2016 | $10,482 | $11,351 | $10,978 |

|---|

| 01/2017 | $10,756 | $11,566 | $11,156 |

|---|

| 02/2017 | $10,826 | $12,025 | $11,430 |

|---|

| 03/2017 | $10,979 | $12,039 | $11,565 |

|---|

| 04/2017 | $11,119 | $12,163 | $11,778 |

|---|

| 05/2017 | $11,221 | $12,334 | $11,671 |

|---|

| 06/2017 | $11,368 | $12,411 | $12,073 |

|---|

| 07/2017 | $11,508 | $12,666 | $12,176 |

|---|

| 08/2017 | $11,476 | $12,705 | $12,161 |

|---|

| 09/2017 | $11,972 | $12,967 | $12,823 |

|---|

| 10/2017 | $12,234 | $13,270 | $13,022 |

|---|

| 11/2017 | $12,507 | $13,677 | $13,396 |

|---|

| 12/2017 | $12,521 | $13,829 | $13,411 |

|---|

| 01/2018 | $13,153 | $14,621 | $13,934 |

|---|

| 02/2018 | $13,081 | $14,082 | $13,538 |

|---|

| 03/2018 | $13,370 | $13,724 | $13,720 |

|---|

| 04/2018 | $13,469 | $13,777 | $13,733 |

|---|

| 05/2018 | $14,609 | $14,108 | $14,598 |

|---|

| 06/2018 | $14,793 | $14,195 | $14,712 |

|---|

| 07/2018 | $15,135 | $14,724 | $14,965 |

|---|

| 08/2018 | $16,749 | $15,203 | $15,897 |

|---|

| 09/2018 | $16,446 | $15,290 | $15,525 |

|---|

| 10/2018 | $14,510 | $14,245 | $13,560 |

|---|

| 11/2018 | $14,786 | $14,535 | $13,772 |

|---|

| 12/2018 | $12,928 | $13,223 | $12,163 |

|---|

| 01/2019 | $14,293 | $14,282 | $13,568 |

|---|

| 02/2019 | $15,228 | $14,741 | $14,444 |

|---|

| 03/2019 | $14,920 | $15,027 | $14,248 |

|---|

| 04/2019 | $15,808 | $15,636 | $14,682 |

|---|

| 05/2019 | $14,994 | $14,642 | $13,593 |

|---|

| 06/2019 | $15,929 | $15,674 | $14,640 |

|---|

| 07/2019 | $16,210 | $15,899 | $14,783 |

|---|

| 08/2019 | $15,387 | $15,648 | $14,145 |

|---|

| 09/2019 | $15,013 | $15,940 | $14,029 |

|---|

| 10/2019 | $14,985 | $16,286 | $14,428 |

|---|

| 11/2019 | $15,901 | $16,877 | $15,278 |

|---|

| 12/2019 | $15,891 | $17,386 | $15,628 |

|---|

| 01/2020 | $16,036 | $17,379 | $15,456 |

|---|

| 02/2020 | $14,622 | $15,949 | $14,340 |

|---|

| 03/2020 | $12,362 | $13,979 | $11,601 |

|---|

| 04/2020 | $14,560 | $15,771 | $13,329 |

|---|

| 05/2020 | $16,387 | $16,522 | $14,589 |

|---|

| 06/2020 | $17,026 | $16,850 | $15,149 |

|---|

| 07/2020 | $18,048 | $17,801 | $15,670 |

|---|

| 08/2020 | $18,512 | $19,080 | $16,589 |

|---|

| 09/2020 | $17,666 | $18,355 | $16,234 |

|---|

| 10/2020 | $17,584 | $17,867 | $16,357 |

|---|

| 11/2020 | $19,833 | $19,823 | $19,241 |

|---|

| 12/2020 | $21,891 | $20,585 | $21,040 |

|---|

| 01/2021 | $22,436 | $20,377 | $22,054 |

|---|

| 02/2021 | $23,116 | $20,939 | $22,782 |

|---|

| 03/2021 | $22,515 | $21,856 | $22,066 |

|---|

| 04/2021 | $23,774 | $23,022 | $22,547 |

|---|

| 05/2021 | $23,184 | $23,183 | $21,903 |

|---|

| 06/2021 | $24,001 | $23,724 | $22,930 |

|---|

| 07/2021 | $24,307 | $24,288 | $22,095 |

|---|

| 08/2021 | $24,965 | $25,026 | $22,496 |

|---|

| 09/2021 | $24,341 | $23,863 | $21,634 |

|---|

| 10/2021 | $25,929 | $25,534 | $22,647 |

|---|

| 11/2021 | $24,829 | $25,357 | $21,541 |

|---|

| 12/2021 | $25,022 | $26,494 | $21,636 |

|---|

| 01/2022 | $21,502 | $25,123 | $18,736 |

|---|

| 02/2022 | $21,680 | $24,371 | $18,818 |

|---|

| 03/2022 | $21,898 | $25,276 | $18,904 |

|---|

| 04/2022 | $19,647 | $23,071 | $16,585 |

|---|

| 05/2022 | $19,115 | $23,114 | $16,272 |

|---|

| 06/2022 | $17,655 | $21,206 | $15,264 |

|---|

| 07/2022 | $19,469 | $23,161 | $16,973 |

|---|

| 08/2022 | $18,869 | $22,217 | $16,814 |

|---|

| 09/2022 | $17,327 | $20,170 | $15,301 |

|---|

| 10/2022 | $18,869 | $21,804 | $16,754 |

|---|

| 11/2022 | $19,115 | $23,022 | $17,026 |

|---|

| 12/2022 | $17,904 | $21,696 | $15,933 |

|---|

| 01/2023 | $19,500 | $23,059 | $17,518 |

|---|

| 02/2023 | $19,116 | $22,496 | $17,329 |

|---|

| 03/2023 | $19,024 | $23,322 | $16,901 |

|---|

| 04/2023 | $18,564 | $23,686 | $16,705 |

|---|

| 05/2023 | $18,457 | $23,789 | $16,708 |

|---|

| 06/2023 | $19,976 | $25,361 | $18,093 |

|---|

| 07/2023 | $20,451 | $26,176 | $18,939 |

|---|

| 08/2023 | $20,206 | $25,759 | $17,953 |

|---|

| 09/2023 | $18,994 | $24,531 | $16,769 |

|---|

| 10/2023 | $18,058 | $24,015 | $15,476 |

|---|

| 11/2023 | $19,868 | $26,208 | $16,885 |

|---|

| 12/2023 | $21,389 | $27,399 | $18,906 |

|---|

| 01/2024 | $20,985 | $27,859 | $18,300 |

|---|

| 02/2024 | $22,896 | $29,347 | $19,787 |

|---|

| 03/2024 | $23,439 | $30,291 | $20,340 |

|---|

| 04/2024 | $22,150 | $29,054 | $18,774 |

|---|

| 05/2024 | $23,035 | $30,494 | $19,779 |

|---|

| 06/2024 | $22,818 | $31,589 | $19,746 |

|---|

| 07/2024 | $23,626 | $31,973 | $21,363 |

|---|

| 08/2024 | $24,138 | $32,749 | $21,126 |

|---|

| 09/2024 | $24,278 | $33,448 | $21,407 |

|---|

| 10/2024 | $23,890 | $33,145 | $21,123 |

|---|

| 11/2024 | $26,297 | $35,090 | $23,713 |

|---|

| 12/2024 | $24,753 | $34,254 | $21,772 |

|---|

Average Annual Total Returns (%)

| HEADER | 1 Year | 5 Years | 10 Years |

|---|

R6 ClassFootnote Reference1 | 15.73% | 9.27% | 9.49% |

|---|

S&P 500® Index TR | 25.02% | 14.53% | 13.10% |

|---|

Russell 2000® Growth Index | 15.15% | 6.86% | 8.09% |

|---|

| Footnote | Description |

Footnote1 | Return may differ from actual shareholder return due to accounting adjustments for financial reporting purposes. |

Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit americanbeaconfunds.com or call 800-967-9009. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. The Fund's performance benefited from fee waivers. Performance includes historical performance of another Class of the Fund. For more information, visit americanbeaconfunds.com/Performance_Disclaimers.aspx.

The S&P 500 Index TR is replacing the Russell 2000 Growth Index as broad-based securities market index to comply with a new regulatory requirement. The Russell 2000 Growth Index reflects the market sectors in which the Fund invests.

| Total Net Assets | $364,382,179 |

|---|

| # of Portfolio Holdings | 105 |

|---|

| Portfolio Turnover Rate | 37% |

|---|

| Total Management Fees Paid | $2,854,258 |

|---|

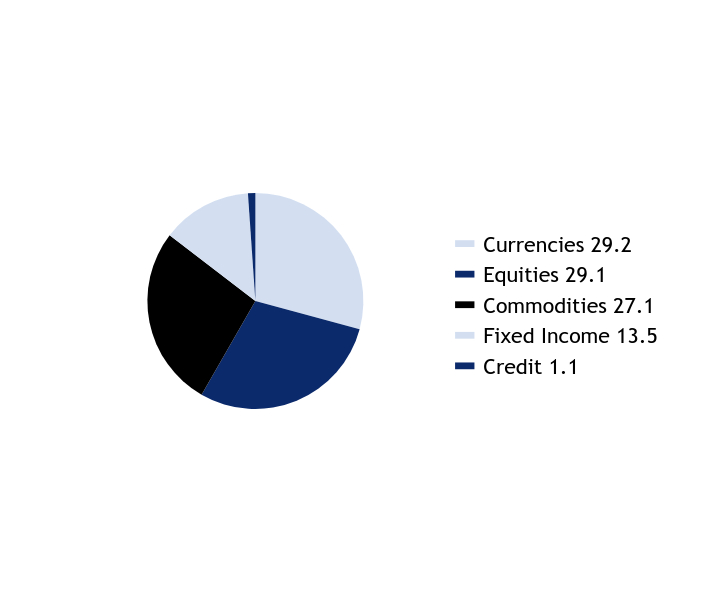

What did the Fund invest in?

Top Ten Holdings - % Net Assets

| CyberArk Software Ltd. | 2.2 |

| BellRing Brands, Inc. | 2.1 |

| Kratos Defense & Security Solutions, Inc. | 2.0 |

| Viper Energy, Inc. | 1.9 |

| Manhattan Associates, Inc. | 1.7 |

| HealthEquity, Inc. | 1.7 |

| Leonardo DRS, Inc. | 1.6 |

| RBC Bearings, Inc. | 1.6 |

| Ryan Specialty Holdings, Inc. | 1.5 |

| Descartes Systems Group, Inc. | 1.5 |

Excludes cash equivalents.

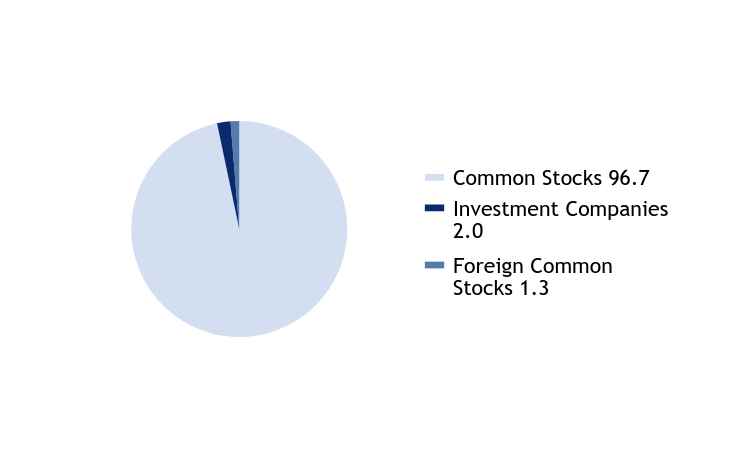

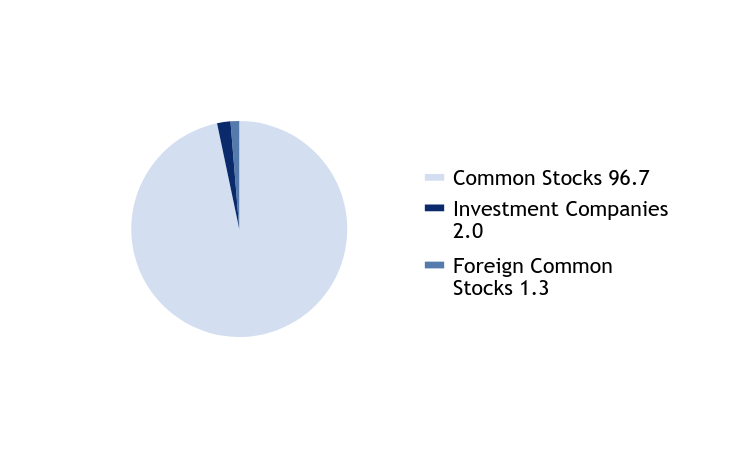

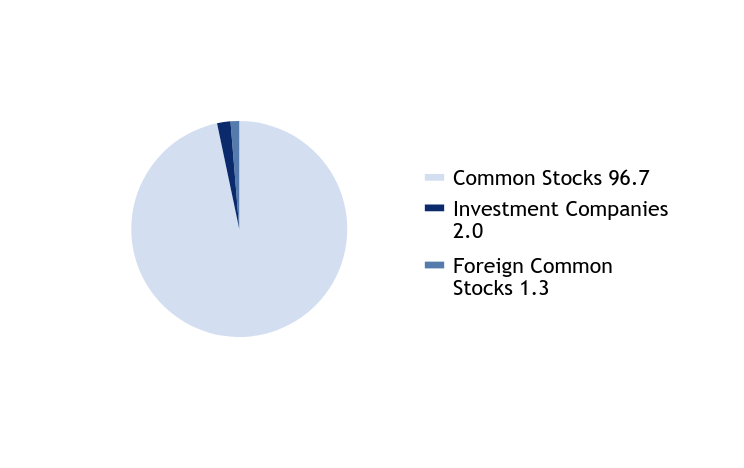

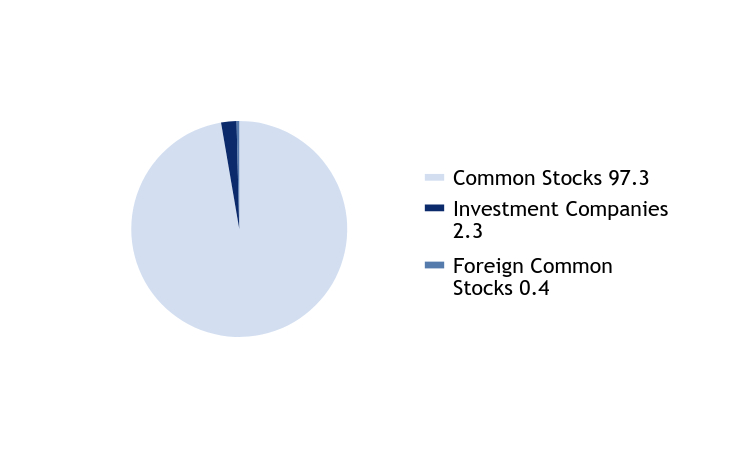

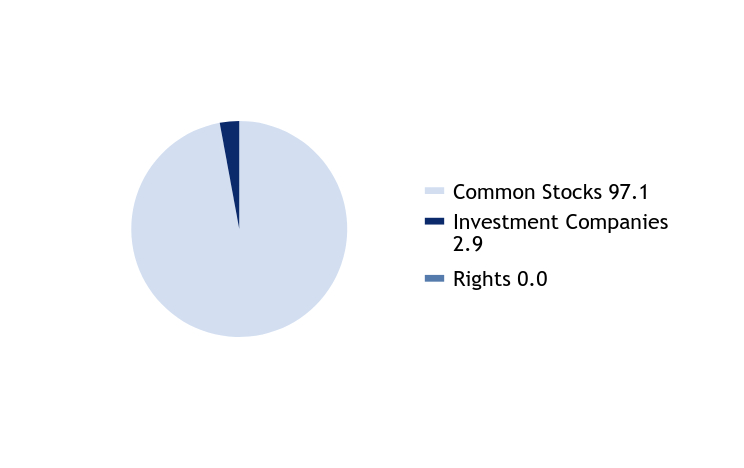

Asset Allocation - % Investments

| Value | Value |

|---|

| Common Stocks | 93.6 |

| Foreign Common Stocks | 4.7 |

| Investment Companies | 1.7 |

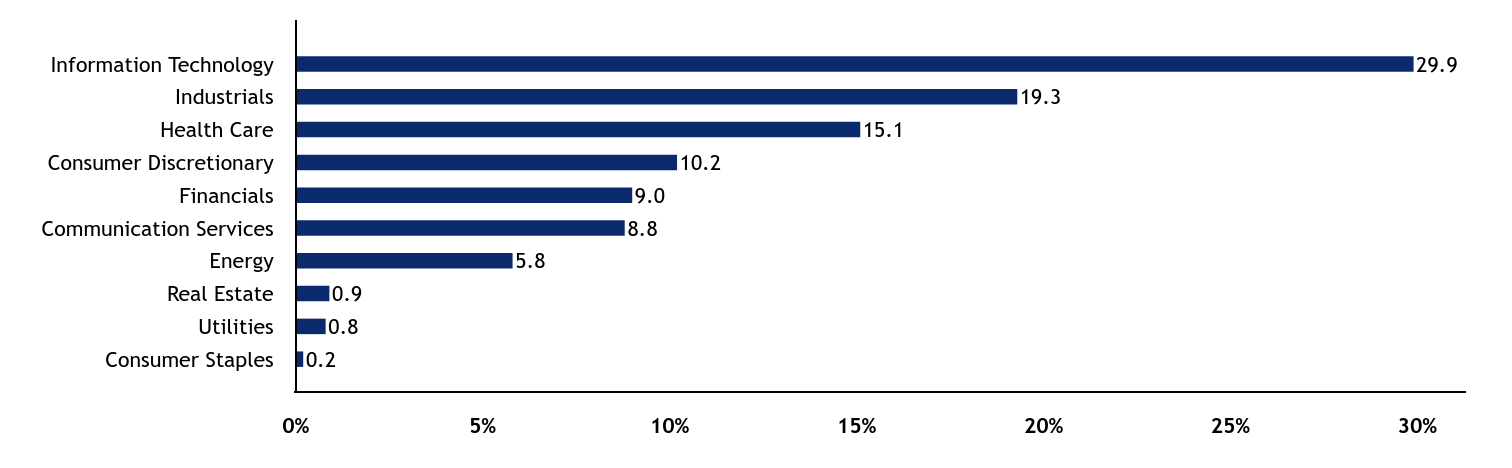

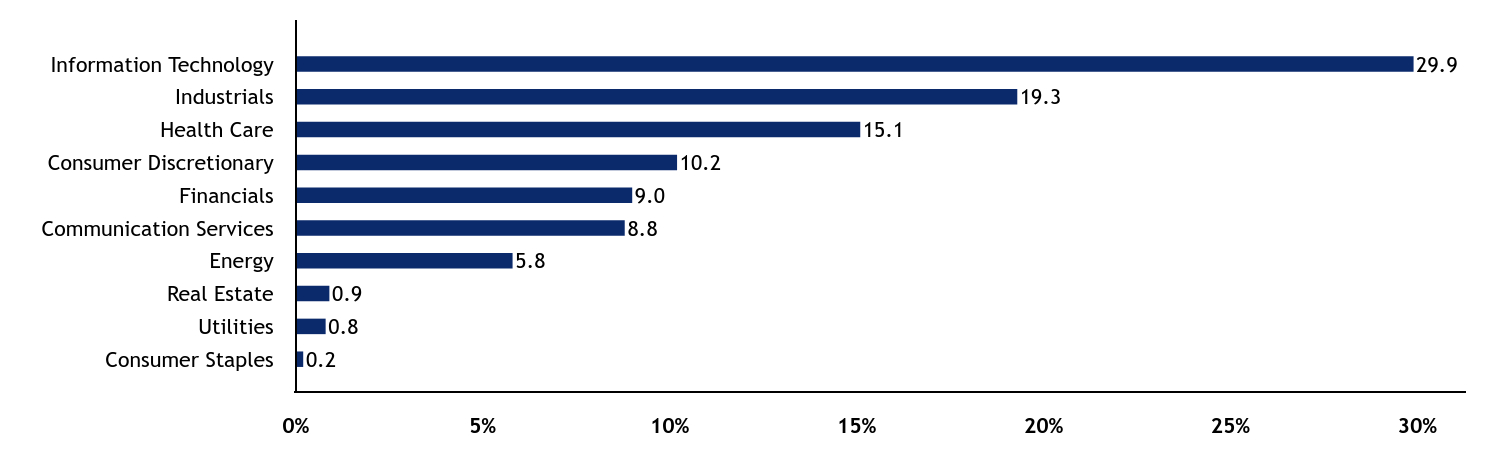

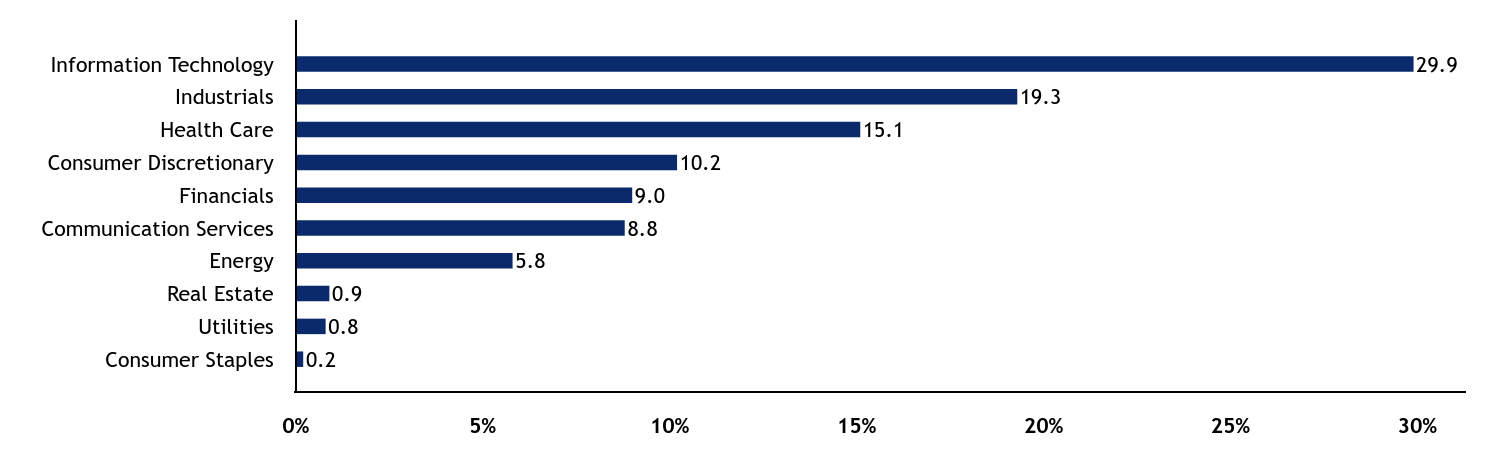

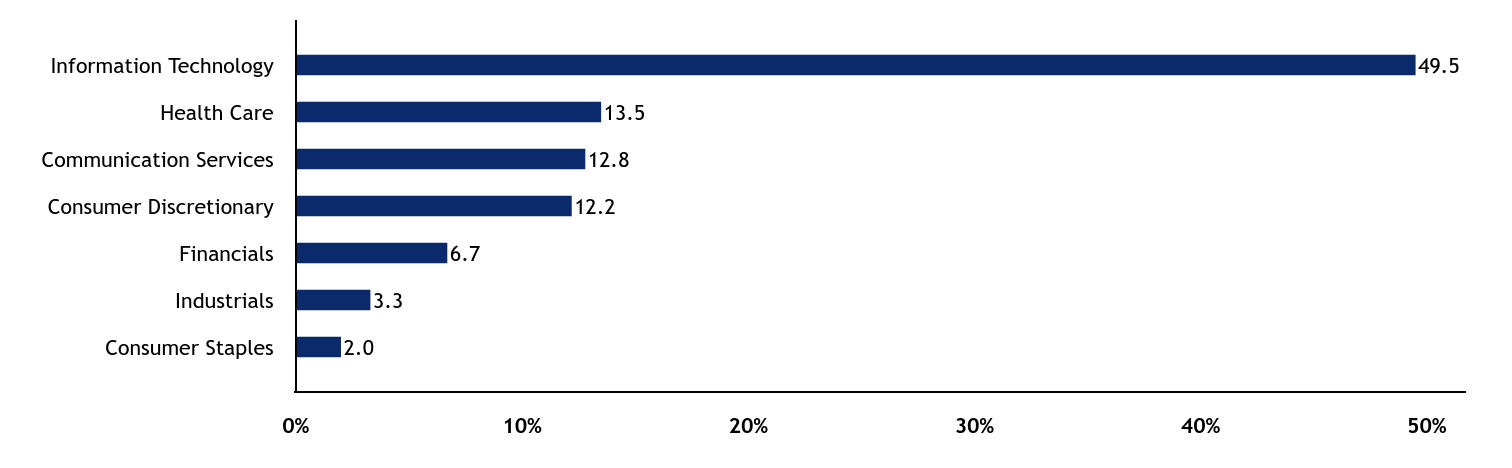

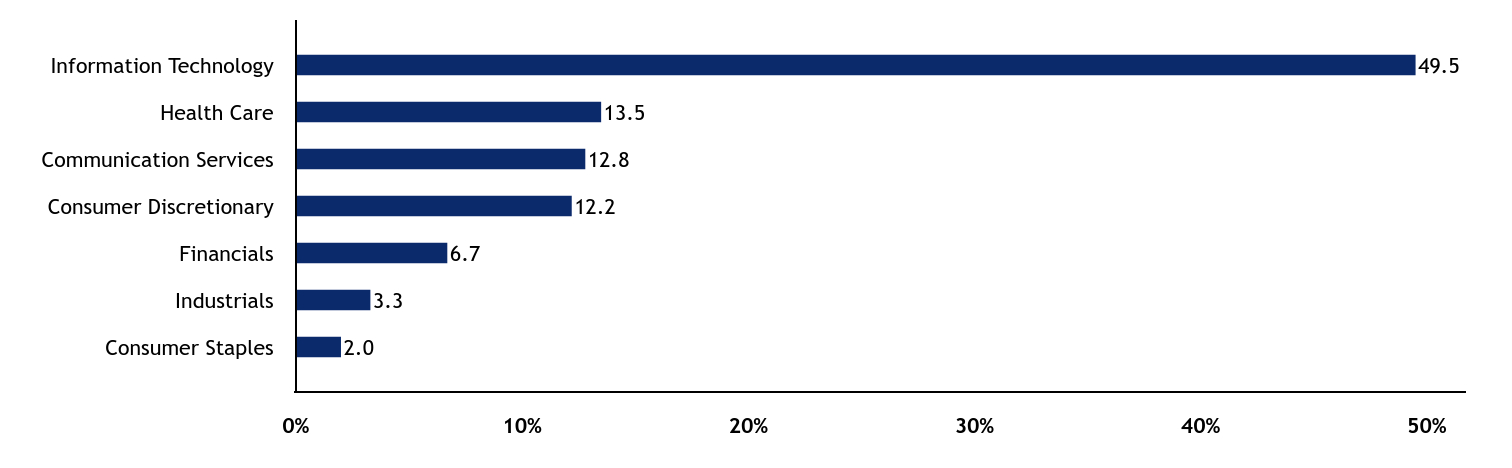

Sector Allocation - % Equities

| Value | Value |

|---|

| Communication Services | 1.0 |

| Materials | 1.1 |

| Consumer Staples | 3.0 |

| Energy | 6.1 |

| Consumer Discretionary | 11.3 |

| Financials | 11.5 |

| Health Care | 17.5 |

| Industrials | 22.0 |

| Information Technology | 26.5 |

For additional information about the Fund, including its prospectus, financial statements, holdings, and proxy voting information, please visit www.americanbeaconfunds.com/literature or call 1-800-658-5811.

If your financial institution mailed only one copy of this Report to an address shared by more than one account, you can request an individual copy by contacting your financial institution.

Stephens Small Cap Growth Fund

Distributed by:

Resolute Investment Distributors, Inc.

Annual Shareholder Report - December 31, 2024

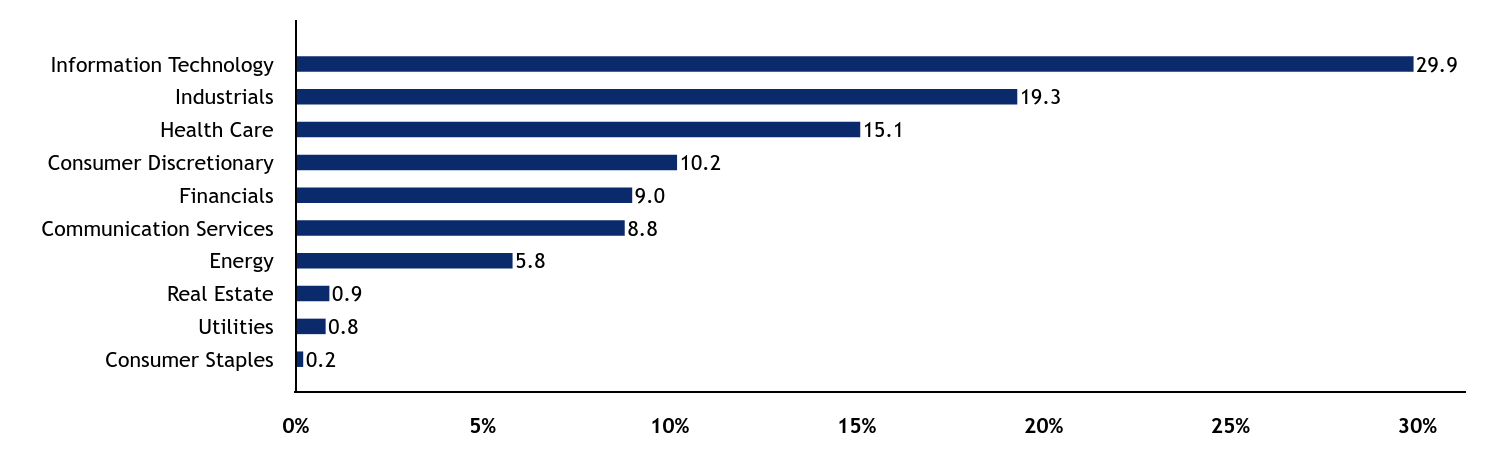

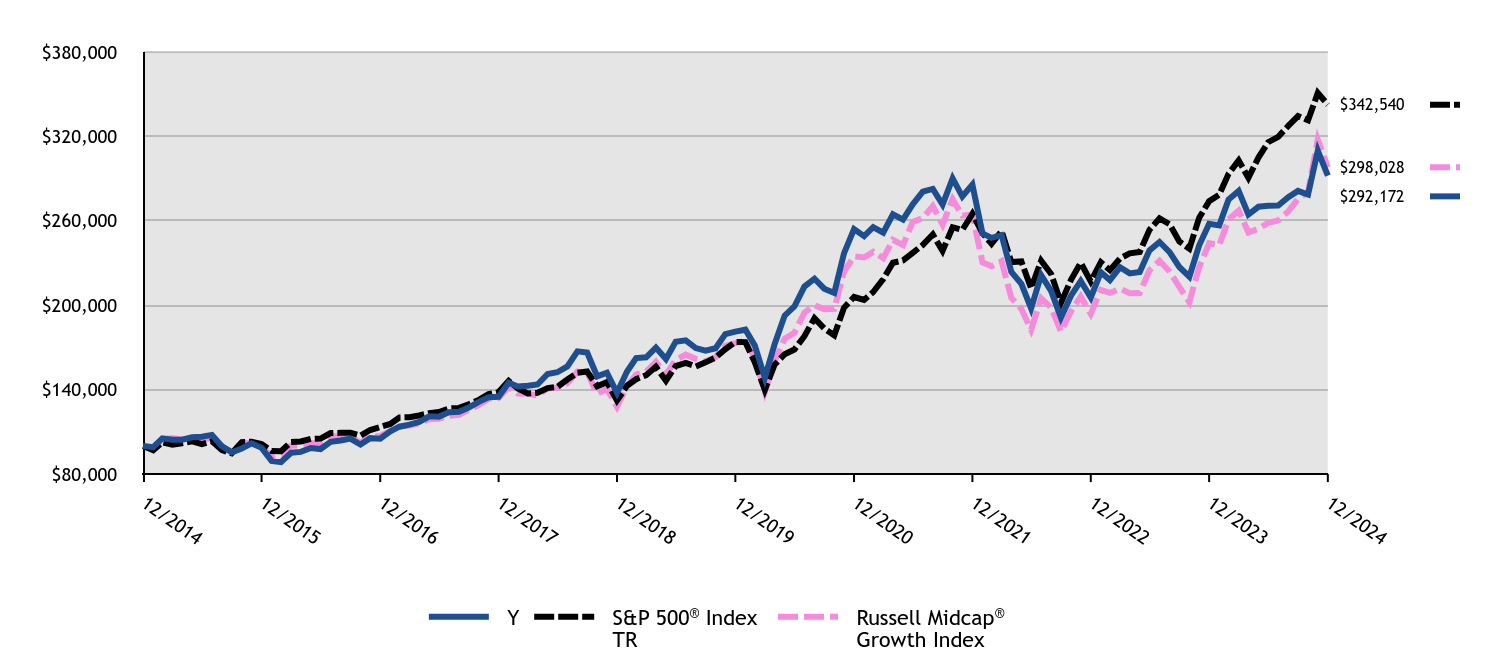

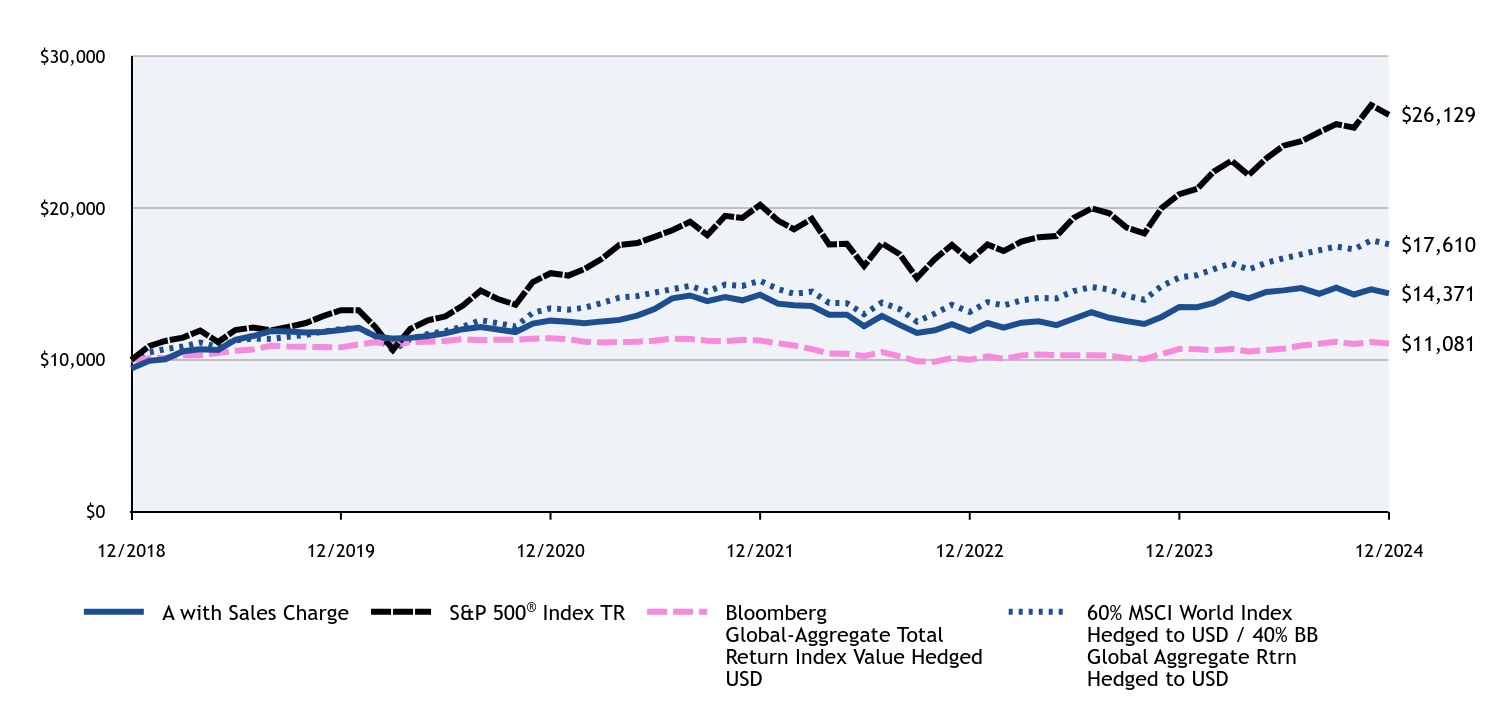

Stephens Mid-Cap Growth Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about American Beacon Stephens Mid-Cap Growth Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.americanbeaconfunds.com/literature. You can also request this information by contacting us at 800-658-5811.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $128 | 1.20% |

|---|

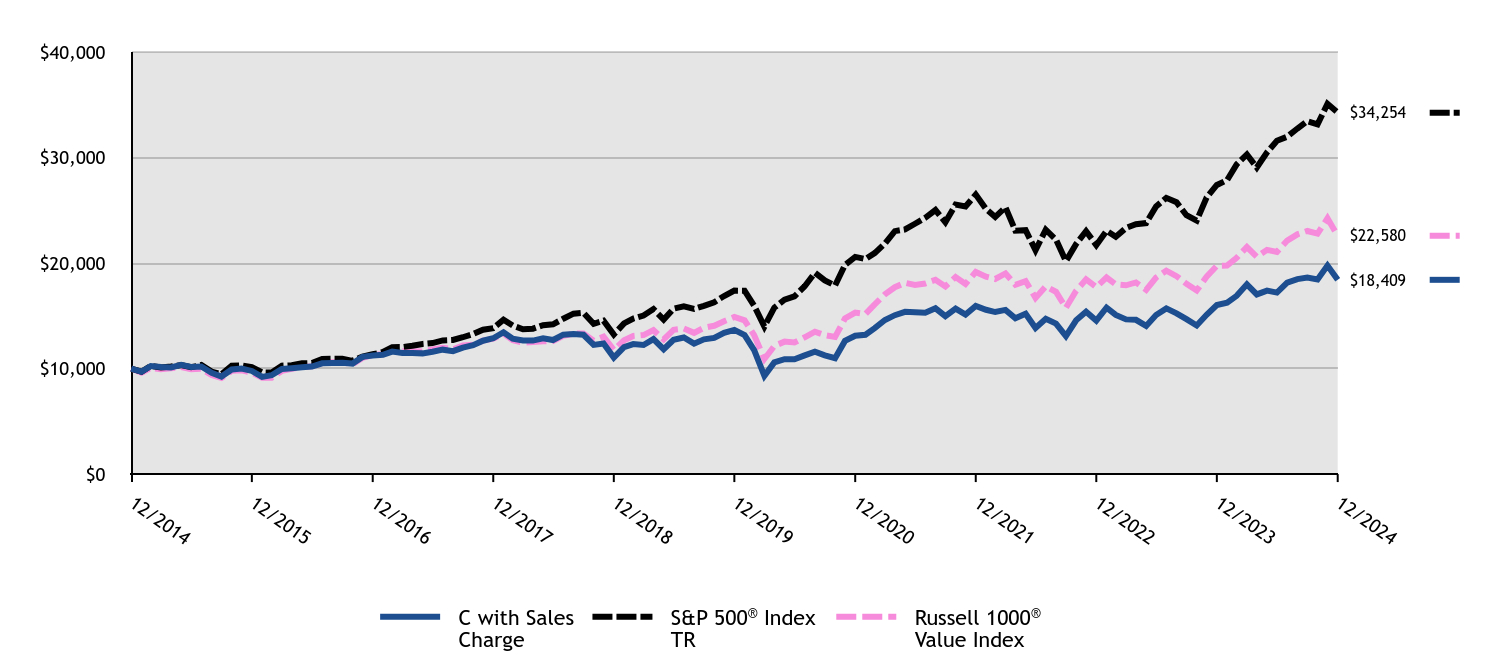

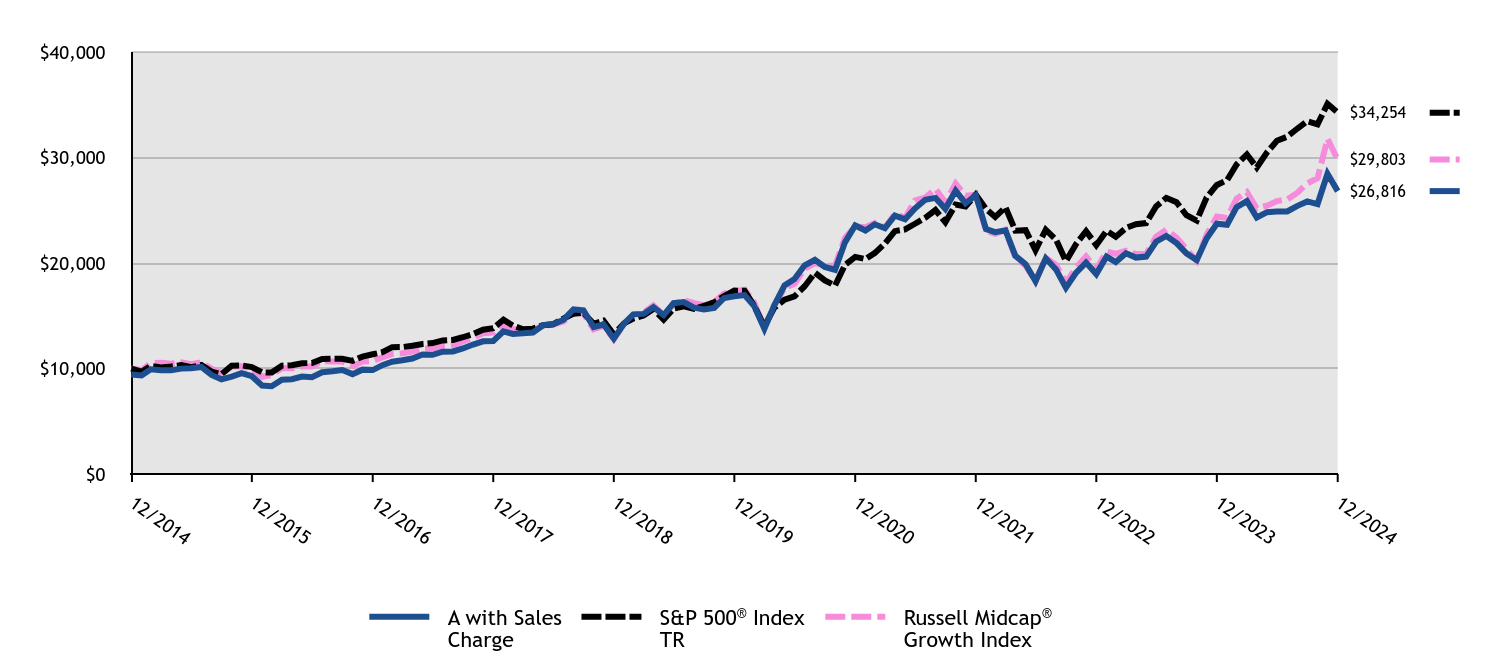

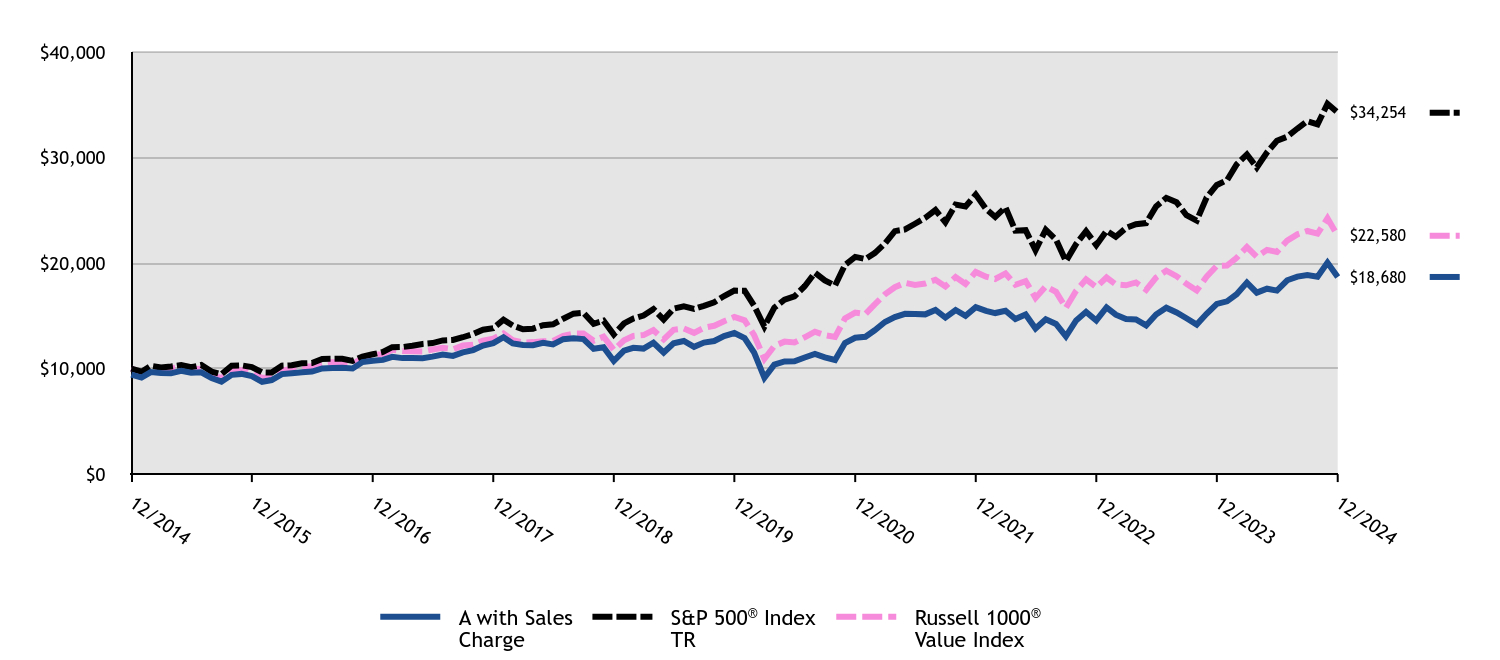

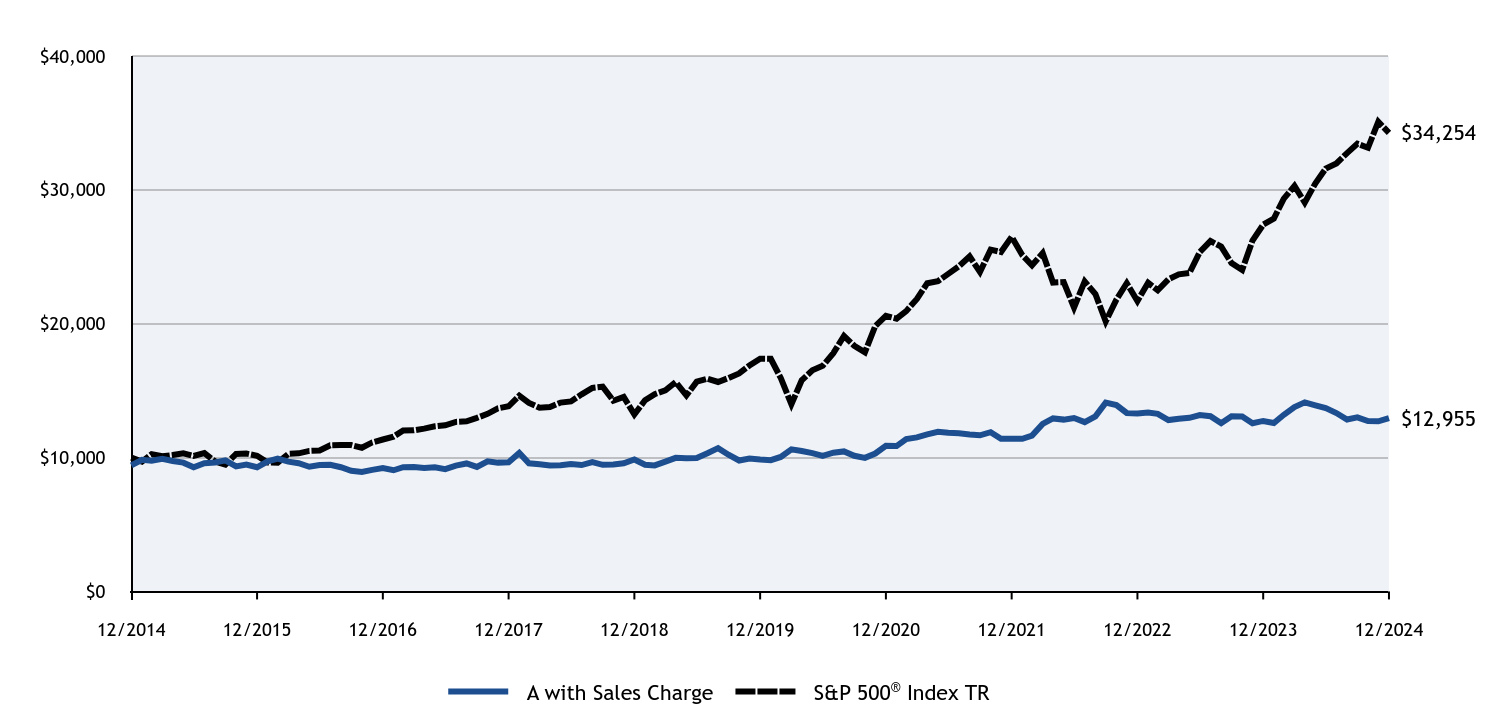

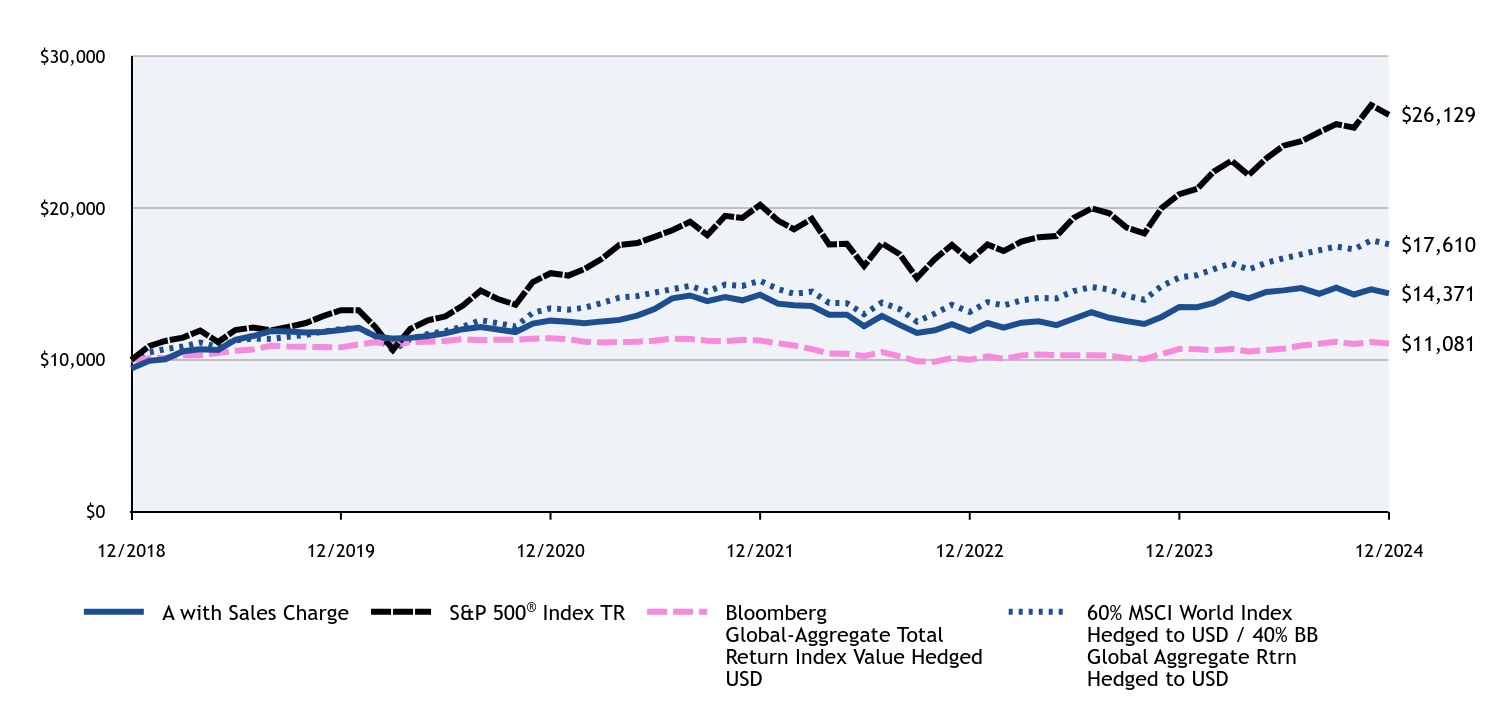

How did the Fund perform and what affected its performance?

The A Class of the Fund returned 6.51% (with sales charges) and 13.03% (without sales charges) for the twelve months ended December 31, 2024, compared to the S&P 500 Index return of 25.02% and the Russell Midcap Growth Index return of 22.10%.

• Overall market performance during the period was driven by mega-cap growth companies, while the Fund focuses its investments on medium-capitalization companies.

• The Fund’s performance was mixed across all sectors where it invested. The Fund saw positive performance in all sectors except Consumer Staples, Real Estate and Health Care. The Fund’s holdings in the Information Technology, Consumer Discretionary, and Health Care sectors detracted materially from performance relative to the Russell Midcap® Growth Index.

Cumulative Performance from December 31, 2014 through December 31, 2024

The initial investment, based on a $10,000 investment, is adjusted to reflect the maximum applicable sales charge, if any.

| A with Sales Charge | S&P 500® Index TR | Russell Midcap® Growth Index |

|---|

| 12/2014 | $9,427 | $10,000 | $10,000 |

|---|