UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number: 811-04997

Exact name of registrant as specified in charter:

Delaware Group® Equity Funds V

Address of principal executive offices:

2005 Market Street

Philadelphia, PA 19103

Name and address of agent for service:

David F. Connor, Esq.

2005 Market Street

Philadelphia, PA 19103

Registrant’s telephone number, including area code: (800) 523-1918

Date of fiscal year end: November 30

Date of reporting period: November 30, 2008

Item 1. Reports to Stockholders

|  |

| Annual report | |

Delaware Small Cap Value Fund | |

| November 30, 2008 | |

| Value equity mutual fund |

Table of contents

| Portfolio management review | 1 | |

| Performance summary | 4 | |

| Disclosure of Fund expenses | 8 | |

| Sector allocation and top 10 holdings | 10 | |

| Statement of net assets | 12 | |

| Statement of operations | 17 | |

| Statements of changes in net assets | 18 | |

| Financial highlights | 20 | |

| Notes to financial statements | 30 | |

| Report of independent registered public accounting firm | 40 | |

| Other Fund information | 41 | |

| Board of trustees/directors and officers addendum | 42 | |

| About the organization | 50 |

Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested.

Mutual fund advisory services provided by Delaware Management Company, a series of Delaware Management

Business Trust, which is a registered investment advisor.

© 2009 Delaware Distributors, L.P.

All third-party trademarks cited are the property of their respective owners.

| Portfolio management review | |

| Delaware Small Cap Value Fund | Dec. 9, 2008 |

The managers of Delaware Small Cap Value Fund provided the answers to the questions below as a review of the Fund’s activities for the fiscal year that ended Nov. 30, 2008.

Please discuss the investment climate during the last 12 months.

Dramatic events in the financial markets and concerns about the overall health of the global economy drove stock prices down significantly during the fiscal year. The combined effects of the troubled housing market and the escalating credit crisis sent many major indices into significantly negative territory. In late September, the market, as measured by the benchmark S&P 500-stock index, plunged almost 9%, its third-largest single-day decline since World War II.

Merrill Lynch and Lehman Brothers (now largely owned by Barclays Capital) were among several financial institutions that collapsed because of mortgage-related debt exposure. As a result, the U.S. Treasury and Federal Reserve Board took unprecedented steps to inject liquidity into the system in an effort to help stabilize the financial markets.

For small company stocks specifically, economic malaise and credit tightening created a challenging environment. Cheap financing and increased liquidity had fueled merger and acquisition activity in recent years. The tightening credit market made financing terms less attractive for potential buyers. This led to a significant decline in merger and acquisition activity among smaller companies.

At the close of the fiscal year, investors struggled with continued stock market volatility and dismal economic news both at home and abroad. Oil prices, which had risen above $140 a barrel by mid-July, reversed course and fell below $40 a barrel by the end of the period. Although lower oil prices were positive news for consumers, consumer spending continued to be weighed down by falling home prices, market volatility, and general uncertainty.

How did the Fund perform relative to its benchmark index for the one-year period ended Nov. 30, 2008?

Class A shares of Delaware Small Cap Value Fund returned -34.55% at net asset value and -38.33% at their maximum offer price (both figures reflect all distributions reinvested). The Fund’s benchmark, the Russell 2000® Value Index, returned -33.61% during the same 12-month period. For the complete annualized performance of Delaware Small Cap Value Fund, please see the table on page 4.

How did you manage the Fund over the past 12 months and what factors affected performance?

Investors found few, if any, places to seek shelter from market turbulence. All sectors of the Russell 2000 Value Index posted negative returns during the 12-month period. Consumer cyclicals were the worst performers, fueled by the dramatic slowdown in housing and auto sales. Traditionally less susceptible to market volatility, sectors such as utilities, healthcare, and consumer staples posted steep declines. Real estate investment trusts (REITs) and consumer services fell even further.

At the beginning of the fiscal year period, the Fund seemed positioned to take advantage of an economic rebound, holding a significant overweight position in economically sensitive

The views expressed are current as of the date of this report and are subject to change.

Data for this portfolio management review were provided by Bloomberg unless otherwise noted.

1

Portfolio management review

Delaware Small Cap Value Fund

areas such as energy, capital spending, and basic industries. The Fund’s overweight in energy aided performance through the second quarter. However, these stocks deteriorated after mid-July as energy prices fell because of fears about weaker global demand. In anticipation of further economic slowing, we trimmed our weighting in basic industries, capital spending, and energy stocks. In hindsight, we failed to reduce our energy weighting enough, which had negative consequences for performance.

At the same time, the Fund held a significant underweight in interest rate–sensitive sectors such as REITs and financials. In July, we began to increase our weighting in financial stocks to take advantage of compelling valuations and bring the Fund more in line with our benchmark, the Russell 2000 Value Index.

Which holdings were among the most significant underperformers?

One of our worst performers was AbitibiBowater, a leading forest products manufacturer. This company’s high debt level was compounded by the credit crunch, which made refinancing at reasonable rates difficult. The stock price fell sharply and we subsequently sold our position at a sizeable loss.

One of the world’s largest providers of shallow water drilling, Hercules Offshore, was a holding that came under pressure as natural gas prices fell. We slightly reduced our exposure during the period, but continued to hold it at the end of the fiscal period because we believed the stock offered attractive long-term value.

Another significant performance detractor was Boston Private Financial Holdings. The corporation’s subsidiary, Boston Private Bank & Trust, provides personal and business banking services in major metropolitan areas around the country. The combined effects of mortgage delinquencies in the southern California market and market depreciation of assets under management drove the stock price down. However, we held on to our position at the end of the period based on our belief that it still offered attractive long-term prospects.

Which stocks performed well during the period?

Although the economic turmoil had a negative effect on overall fund performance, several holdings offered relative strength. Dollar Tree Stores, a discount retail chain, posted double-digit returns as cash-strapped consumers sought bargains. We trimmed our weighting, but owned a sizeable position at the end of the period.

W-H Energy Services, an oil field service company that manufactures a rotary steering tool for drilling, also delivered positive performance. The company announced that it was being acquired by Smith International, and we sold the stock soon after this announcement.

Infinity Property & Casualty, a leading nonstandard personal auto insurer, posted strong results. The company benefited from profitable underwriting related to the recent increase in auto insurance prices, and we held this stock at the end of the reporting period.

2

What factors were important as you positioned the Fund at period end?

Despite an extremely volatile year, we made no changes to the Fund’s time-tested strategy in 2008. Our bottom-up approach (focusing first on researching individual securities) continued to emphasize companies with positive free cash flow generation and attractive long-term potential. We believe that the actions of the Federal Reserve and Treasury during the fiscal year will have a positive impact on market liquidity in the future.

| Fund basics | |||||

| Delaware Small Cap Value Fund | As of Nov. 30, 2008 | ||||

| Fund objective | The Fund seeks capital appreciation. | ||||

| Total Fund net assets | $298 million | ||||

| Number of holdings | 91 | ||||

| Fund start date | June 24, 1987 | ||||

| Nasdaq symbols | CUSIPs | ||||

| Class A | DEVLX | 246097109 | |||

| Class B | DEVBX | 246097307 | |||

| Class C | DEVCX | 246097406 | |||

| Class R | DVLRX | 246097505 | |||

| Institutional Class | DEVIX | 246097208 | |||

3

| Performance summary | |

| Delaware Small Cap Value Fund | Nov. 30, 2008 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data for the most recent month end by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

You should consider the investment objectives, risks, charges, and expenses of the investment company carefully before investing. The Delaware Small Cap Value Fund prospectus contains this and other important information about the investment company. Please request a prospectus through your financial advisor by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com. Read the prospectus carefully before you invest or send money.

| Fund performance | Average annual total returns through Nov. 30, 2008 | |||||||

| 1 year | 5 years | 10 years | Lifetime | |||||

| Class A (Est. June 24, 1987) | ||||||||

| Excluding sales charge | -34.55% | -0.94% | +4.79% | +9.75% | ||||

| Including sales charge | -38.33% | -2.11% | +4.17% | +9.44% | ||||

| Class B (Est. Sept. 6, 1994) | ||||||||

| Excluding sales charge | -35.08% | -1.66% | +4.19% | +6.95% | ||||

| Including sales charge | -37.41% | -1.93% | +4.19% | +6.95% | ||||

| Class C (Est. Nov. 29, 1995) | ||||||||

| Excluding sales charge | -35.05% | -1.65% | +4.05% | +6.30% | ||||

| Including sales charge | -35.64% | -1.65% | +4.05% | +6.30% | ||||

Returns reflect the reinvestment of all distributions and any applicable sales charges as noted in the following paragraphs.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Expense limitations were in effect for all classes during the periods shown in the Fund performance chart and in the Performance of a $10,000 Investment chart. The current expenses for each class are listed on the “Fund expense ratios” table. (Note that all charts and graphs referred to in the “Performance summary” section of this report are found on pages 4 through 6.) Performance would have been lower had the expense limitation not been in effect.

The Fund offers Class A, B, C, R, and Institutional Class shares. Class A shares are sold with a maximum front-end sales charge of up to 5.75%, and have an annual distribution and service fee of up to 0.30% of average daily net assets.

Class B shares may only be purchased through dividend reinvestment and certain permitted exchanges as described in the prospectus. Please see the prospectus for additional information on Class B purchase and sales charges. Class B shares have a contingent

4

deferred sales charge that declines from 4.00% to zero depending on the period of time the shares are held. Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

Ten-year and lifetime performance figures for Class B shares reflect conversion to Class A shares after approximately eight years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets.

Please see the fee table in the prospectus and your financial professional for a more complete explanation of sales charges.

Class R shares were first made available June 2, 2003, and are available only for certain retirement plan products. They are sold without a sales charge and have an annual distribution and service fee of up to 0.60% of average daily net assets.

The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the “Fund expense ratios” table. Management has contracted to reimburse certain expenses and/or waive its management fees from April 1, 2008, through March 31, 2009. Please see the most recent prospectus for additional information on the fee waivers.

| Fund expense ratios | Class A | Class B | Class C | Class R | Institutional Class | |||||

| Total annual operating expense | 1.42% | 2.12% | 2.12% | 1.72% | 1.12% | |||||

| (without fee waivers) | ||||||||||

| Net expense ratio | 1.37% | 2.12% | 2.12% | 1.62% | 1.12% | |||||

| (including fee waivers, if any)* |

*The applicable fee waivers are discussed in the text on pages 4 and 5.

The average annual total returns for the 1-year, 5-year, and lifetime (since June 2, 2003) periods ended Nov. 30, 2008, for Delaware Small Cap Value Fund Class R shares were -34.74%, -1.20%, and +2.45%, respectively.

The average annual total returns for the 1-year, 5-year, 10-year, and lifetime (since June 24, 1987) periods ended Nov. 30, 2008, for Delaware Small Cap Value Fund Institutional Class shares were - -34.38%, -0.66%, +5.09%, and +9.99%, respectively. Institutional Class shares were first made available Nov. 9, 1992, and are available without sales or asset-based distribution charges only to certain eligible institutional accounts. Institutional Class performance prior to Nov. 9, 1992, is based on Class A performance and was adjusted to eliminate the sales charges, but not the asset-based distribution charge of Class A shares.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

In addition to the normal risks associated with investing, investments in small- and/or medium-sized company stocks typically exhibit greater risk, and higher volatility particularly in the short term, than those investing in larger, more established companies.

5

Performance summary

Delaware Small Cap Value Fund

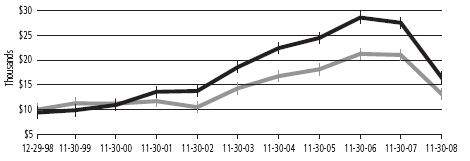

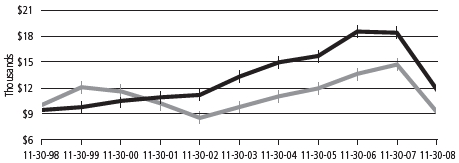

Performance of a $10,000 investment

Average annual total returns from Nov. 30, 1998, through Nov. 30, 2008

| For period beginning Nov. 30 1998, through Nov. 30, 2008 | Starting value | Ending value | ||

| Russel 2000 Value Index | $10,000 | $17,569 | ||

| Delaware Small Cap Value Fund — Class A Shares | $9,425 | $15,044 | ||

The chart assumes $10,000 invested in the Fund on Nov. 30, 1998, and includes the effect of a 5.75% front-end sales charge and the reinvestment of all distributions. Please note additional details on these fees in the “Performance summary” section of this report, which includes pages 4 through 6.

The chart also assumes $10,000 invested in the Russell 2000 Value Index as of Nov. 30, 1998. The Russell 2000 Value Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. The S&P 500 Index, mentioned on page 1, measures the performance of 500 mostly large-cap stocks weighted by market value, and is often used to represent performance of the U.S. stock market. An index is unmanaged and does not reflect the costs of operating a mutual fund, such as the costs of buying, selling, and holding securities. You cannot invest directly in an index.

Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

The chart does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares.

6

Disclosure of Fund expenses

For the period June 1, 2008 to November 30, 2008

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period June 1, 2008 to November 30, 2008.

Actual expenses

The first section of the table shown, “Actual Fund Return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the table shown, “Hypothetical 5% Return,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

8

In addition, if these transactional costs were included, your costs would have been higher. The Fund’s expenses shown in the table reflect fee waivers in effect. The expenses shown in the table assume reinvestment of all dividends and distributions.

Delaware Small Cap Value Fund

Expense analysis of an investment of $1,000

| Beginning | Ending | Expenses | ||||||||||||

| Account Value | Account Value | Annualized | Paid During Period | |||||||||||

| 6/1/08 | 11/30/08 | Expense Ratios | 6/1/08 to 11/30/08* | |||||||||||

| Actual Fund return | ||||||||||||||

| Class A | $1,000.00 | $ | 632.00 | 1.41% | $ | 5.75 | ||||||||

| Class B | 1,000.00 | 629.60 | 2.16% | 8.80 | ||||||||||

| Class C | 1,000.00 | 629.80 | 2.16% | 8.80 | ||||||||||

| Class R | 1,000.00 | 631.20 | 1.66% | 6.77 | ||||||||||

| Institutional Class | 1,000.00 | 632.90 | 1.16% | 4.74 | ||||||||||

| Hypothetical 5% return (5% return before expenses) | ||||||||||||||

| Class A | $1,000.00 | $ | 1,017.95 | 1.41% | $ | 7.11 | ||||||||

| Class B | 1,000.00 | 1,014.20 | 2.16% | 10.88 | ||||||||||

| Class C | 1,000.00 | 1,014.20 | 2.16% | 10.88 | ||||||||||

| Class R | 1,000.00 | 1,016.70 | 1.66% | 8.37 | ||||||||||

| Institutional Class | 1,000.00 | 1,019.20 | 1.16% | 5.86 | ||||||||||

*“Expenses Paid During Period” are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period).

9

| Sector allocation and top 10 holdings | |

| Delaware Small Cap Value Fund | As of November 30, 2008 |

Sector designations may differ from sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications, which may result in the sector designations for one Fund being different than another Fund’s sector designations.

| Sector | Percentage of net assets | |

| Common Stock² | 94.20 | % |

| Basic Industry | 7.15 | % |

| Business Services | 3.13 | % |

| Capital Spending | 7.55 | % |

| Consumer Cyclical | 1.50 | % |

| Consumer Services | 12.13 | % |

| Consumer Staples | 1.81 | % |

| Energy | 6.12 | % |

| Financial Services | 30.45 | % |

| Health Care | 4.54 | % |

| Real Estate | 4.24 | % |

| Technology | 10.29 | % |

| Transportation | 2.62 | % |

| Utilities | 2.67 | % |

| Repurchase Agreement | 6.36 | % |

| Securities Lending Collateral | 10.86 | % |

| Total Value of Securities | 111.42 | % |

| Obligation to Return Securities Lending Collateral | (11.27 | %) |

| Liabilities Net of Receivables and Other Assets | (0.15 | %) |

| Total Net Assets | 100.00 | % |

| ²Narrow industries are utilized for compliance purposes for diversification whereas broad sectors are used for financial reporting. |

10

Holdings are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

| Top 10 Holdings | Percentage of net assets | |

| Berkley (W.R.) | 2.92 | % |

| Selective Insurance Group | 2.58 | % |

| Platinum Underwriters Holdings | 2.52 | % |

| Bank of Hawaii | 2.26 | % |

| Infinity Property & Casualty | 2.02 | % |

| Dollar Tree Stores | 1.99 | % |

| Harleysville Group | 1.95 | % |

| FMC | 1.92 | % |

| Washington Real Restate Investment Trust | 1.92 | % |

| NTB Bancorp | 1.90 | % |

11

| Statement of net assets | |

| Delaware Small Cap Value Fund | November 30, 2008 |

| Number of shares | Value | |||||

| Common Stock – 94.20%² | ||||||

| Basic Industry – 7.15% | ||||||

| * | Albemarle | 181,700 | $ | 3,693,961 | ||

| * | Arch Coal | 66,400 | 1,021,232 | |||

| † | Crown Holdings | 273,900 | 4,396,098 | |||

| Cytec Industries | 90,100 | 1,984,903 | ||||

| FMC | 131,100 | 5,729,070 | ||||

| Kaiser Aluminum | 52,800 | 1,114,608 | ||||

| Valspar | 173,300 | 3,400,146 | ||||

| 21,340,018 | ||||||

| Business Services – 3.13% | ||||||

| Brink’s | 132,900 | 2,893,233 | ||||

| † | Brinks Home Security Holding | 132,900 | 2,658,000 | |||

| † | United Stationers | 118,959 | 3,784,086 | |||

| 9,335,319 | ||||||

| Capital Spending – 7.55% | ||||||

| * | Actuant Class A | 225,000 | 4,036,500 | |||

| †* | Casella Waste Systems | 99,700 | 499,497 | |||

| † | Colfax | 38,700 | 369,972 | |||

| † | Gardner Denver | 126,300 | 3,125,925 | |||

| Harsco | 107,100 | 2,693,565 | ||||

| Insteel Industries | 161,400 | 1,575,264 | ||||

| Mueller Water Products Class B | 164,588 | 976,007 | ||||

| * | Regal Beloit | 73,100 | 2,459,084 | |||

| Timken | 146,100 | 2,119,911 | ||||

| * | Wabtec | 55,700 | 2,149,463 | |||

| * | Walter Industries | 138,300 | 2,522,592 | |||

| 22,527,780 | ||||||

| Consumer Cyclical – 1.50% | ||||||

| MDC Holdings | 143,900 | 4,460,900 | ||||

| 4,460,900 | ||||||

| Consumer Services – 12.13% | ||||||

| * | Advance Auto Parts | 104,000 | 3,157,440 | |||

| Cato Class A | 300,800 | 4,199,168 | ||||

| †* | CEC Entertainment | 139,900 | 2,407,679 | |||

| †* | Dollar Tree Stores | 139,800 | 5,921,928 | |||

| † | Genesco | 94,500 | 1,271,970 | |||

| † | Jack in the Box | 146,700 | 2,567,250 | |||

| Men’s Wearhouse | 191,500 | 2,037,560 | ||||

12

| Number of shares | Value | |||||

| Common Stock (continued) | ||||||

| Consumer Services (continued) | ||||||

| * | Meredith | 82,900 | $ | 1,338,006 | ||

| PETsMART | 156,400 | 2,744,820 | ||||

| * | Ross Stores | 175,300 | 4,645,450 | |||

| * | Stage Stores | 208,500 | 1,205,130 | |||

| † | Warnaco Group | 85,000 | 1,521,500 | |||

| Wolverine World Wide | 109,450 | 2,109,102 | ||||

| † | Zale | 175,800 | 1,042,494 | |||

| 36,169,497 | ||||||

| Consumer Staples – 1.81% | ||||||

| American Greetings Class A | 193,400 | 2,227,968 | ||||

| Del Monte Foods | 537,000 | 3,179,040 | ||||

| 5,407,008 | ||||||

| Energy – 6.12% | ||||||

| †* | Grey Wolf | 581,600 | 3,187,168 | |||

| †* | Hercules Offshore | 166,876 | 971,218 | |||

| † | Newfield Exploration | 171,700 | 3,876,986 | |||

| * | Southwest Gas | 182,100 | 4,716,390 | |||

| † | Whiting Petroleum | 143,500 | 5,496,050 | |||

| 18,247,812 | ||||||

| Financial Services – 30.45% | ||||||

| Bank of Hawaii | 151,300 | 6,749,493 | ||||

| Berkley (W.R.) | 306,600 | 8,716,638 | ||||

| Boston Private Financial Holdings | 324,800 | 2,244,368 | ||||

| Colonial BancGroup | 344,900 | 865,699 | ||||

| Community Bank System | 105,500 | 2,432,830 | ||||

| CVB Financial | 153,200 | 1,720,436 | ||||

| East West Bancorp | 324,100 | 4,796,680 | ||||

| First Midwest Bancorp | 200,600 | 3,693,046 | ||||

| Hancock Holding | 115,100 | 4,961,961 | ||||

| * | Harleysville Group | 154,700 | 5,829,096 | |||

| Independent Bank | 129,600 | 3,070,224 | ||||

| Infinity Property & Casualty | 131,500 | 6,034,535 | ||||

| IPC Holdings | 133,000 | 3,724,000 | ||||

| NBT Bancorp | 213,800 | 5,669,976 | ||||

| Platinum Underwriters Holdings | 244,400 | 7,510,412 | ||||

| Provident Bankshares | 263,600 | 2,483,112 | ||||

| S&T Bancorp | 72,100 | 2,450,679 | ||||

| * | Selective Insurance Group | 335,100 | 7,693,896 | |||

13

Statement of net assets

Delaware Small Cap Value Fund

| Number of shares | Value | |||||

| Common Stock (continued) | ||||||

| Financial Services (continued) | ||||||

| * | StanCorp Financial Group | 89,300 | $ | 2,974,583 | ||

| Sterling Bancshares | 555,900 | 3,724,530 | ||||

| Sterling Financial | 229,768 | 1,222,366 | ||||

| Wesbanco | 87,400 | 2,257,542 | ||||

| 90,826,102 | ||||||

| Health Care – 4.54% | ||||||

| Hill-Rom Holdings | 86,400 | 1,774,656 | ||||

| * | Service Corp International | 562,100 | 3,271,422 | |||

| * | STERIS | 175,500 | 4,852,575 | |||

| * | Universal Health Services Class B | 98,400 | 3,655,560 | |||

| 13,554,213 | ||||||

| Real Estate – 4.24% | ||||||

| * | Brandywine Realty Trust | 252,937 | 1,244,450 | |||

| * | Education Realty Trust | 203,400 | 909,198 | |||

| Highwoods Properties | 200,600 | 4,790,328 | ||||

| Washington Real Estate Investment Trust | 215,800 | 5,712,226 | ||||

| 12,656,202 | ||||||

| Technology – 10.29% | ||||||

| † | Brocade Communications Systems | 351,200 | 1,130,864 | |||

| † | Checkpoint Systems | 162,700 | 1,880,812 | |||

| † | Cirrus Logic | 703,700 | 2,969,614 | |||

| † | Compuware | 399,600 | 2,537,460 | |||

| †* | Parametric Technology | 295,500 | 3,415,980 | |||

| † | Premiere Global Services | 285,150 | 1,739,415 | |||

| * | QAD | 218,000 | 887,260 | |||

| †* | Sybase | 139,400 | 3,434,816 | |||

| †* | Syniverse Holdings | 200,600 | 1,959,862 | |||

| † | Synopsys | 284,800 | 4,565,344 | |||

| † | Tech Data | 233,900 | 4,079,216 | |||

| † | Vishay Intertechnology | 483,000 | 2,105,880 | |||

| 30,706,523 | ||||||

| Transportation – 2.62% | ||||||

| * | Alexander & Baldwin | 164,800 | 4,260,080 | |||

| † | Kirby | 98,800 | 2,512,484 | |||

| † | Saia | 115,200 | 1,026,432 | |||

| 7,798,996 | ||||||

14

| Number of shares | Value | ||||||

| Common Stock (continued) | |||||||

| Utilities – 2.67% | |||||||

| * | Black Hills | 73,500 | $ | 1,897,035 | |||

| † | El Paso Electric | 253,000 | 4,559,060 | ||||

| * | Otter Tail | 80,400 | 1,510,716 | ||||

| 7,966,811 | |||||||

| Total Common Stock (cost $350,352,684) | 280,997,181 | ||||||

| Principal amount | |||||||

| Repurchase Agreement** – 6.36% | |||||||

| BNP Paribas 0.20%, dated 11/28/08, to be repurchased | |||||||

| on 12/1/08, repurchase price $18,972,316 | |||||||

| (collateralized by U.S. Government obligations, | |||||||

| 6/4/09; with market value $19,601,293) | $ | 18,972,000 | 18,972,000 | ||||

| Total Repurchase Agreement (cost $18,972,000) | 18,972,000 | ||||||

| Total Value of Securities Before Securities Lending | |||||||

| Collateral – 100.56% (cost $369,324,684) | 299,969,181 | ||||||

| Number of shares | |||||||

| Securities Lending Collateral*** – 10.86% | |||||||

| Investment Companies | |||||||

| Mellon GSL DBT II Collateral Fund | 33,235,634 | 32,351,566 | |||||

| =Mellon GSL DBT II Liquidation Trust | 392,139 | 32,155 | |||||

| Total Securities Lending Collateral | |||||||

| (cost $33,627,773) | 32,383,721 | ||||||

| Total Value of Securities – 111.42% | |||||||

| (cost $402,952,457) | 332,352,902 | © | |||||

| Obligation to Return Securities Lending | |||||||

| Collateral*** – (11.27%) | (33,627,773 | ) | |||||

| Liabilities Net of Receivables and | |||||||

| Other Assets – (0.15%) | (441,061 | ) | |||||

| Net Assets Applicable to 14,322,660 | |||||||

| Shares Outstanding – 100.00% | $ | 298,284,068 | |||||

15

Statement of net assets

Delaware Small Cap Value Fund

| Net Asset Value – Delaware Small Cap Value Fund | |||||

| Class A ($205,439,545 / 9,627,216 Shares) | $21.34 | ||||

| Net Asset Value – Delaware Small Cap Value Fund | |||||

| Class B ($21,825,386 / 1,140,740 Shares) | $19.13 | ||||

| Net Asset Value – Delaware Small Cap Value Fund | |||||

| Class C ($44,338,836 / 2,318,533 Shares) | $19.12 | ||||

| Net Asset Value – Delaware Small Cap Value Fund | |||||

| Class R ($12,760,731 / 608,453 Shares) | $20.97 | ||||

| Net Asset Value – Delaware Small Cap Value Fund | |||||

| Institutional Class ($13,919,570 / 627,718 Shares) | $22.17 | ||||

| Components of Net Assets at November 30, 2008: | |||||

| Shares of beneficial interest (unlimited authorization – no par) | $ | 369,092,132 | |||

| Undistributed net investment income | 459,074 | ||||

| Accumulated net realized loss on investments | (667,583 | ) | |||

| Net unrealized depreciation of investments | (70,599,555 | ) | |||

| Total net assets | $ | 298,284,068 | |||

| ² | Narrow industries are utilized for compliance purposes for diversification whereas broad sectors are used for financial reporting. |

| † | Non income producing security. |

| = | Security is being fair valued in accordance with the Fund’s fair valuation policy. At November 30, 2008, the aggregate amount of fair valued securities was $32,155, which represented 0.01% of the Fund’s net assets. See Note 1 in “notes to financial statements.” |

| * | Fully or partially on loan. |

| ** | See Note 1 in “Notes to financial statements.” |

| *** | See Note 8 in “Notes to financial statements.” |

| © | Includes $31,943,385 of securities loaned. |

| Net Asset Value and Offering Price Per Share – | |||

| Delaware Small Cap Value Fund | |||

| Net asset value Class A (A) | $ | 21.34 | |

| Sales charge (5.75% of offering price) (B) | 1.30 | ||

| Offering price | $ | 22.64 |

| (A) | Net asset value per share, as illustrated, is the amount which would be paid upon redemption or repurchase of shares. | |

| (B) | See the current prospectus for purchases of $50,000 or more. |

See accompanying notes

16

| Statement of operations | |

| Delaware Small Cap Value Fund | Year Ended November 30, 2008 |

| Investment Income: | ||||||

| Dividends | $ | 6,939,786 | ||||

| Interest | 280,072 | |||||

| Securities lending income | 770,562 | $ | 7,990,420 | |||

| Expenses: | ||||||

| Management fees | 3,534,187 | |||||

| Distribution expenses – Class A | 955,306 | |||||

| Distribution expenses – Class B | 391,178 | |||||

| Distribution expenses – Class C | 725,281 | |||||

| Distribution expenses – Class R | 112,238 | |||||

| Dividend disbursing and transfer agent fees and expenses | 1,674,340 | |||||

| Accounting and administration expenses | 188,720 | |||||

| Reports and statements to shareholders | 87,087 | |||||

| Registration fees | 72,152 | |||||

| Legal and professional fees | 67,290 | |||||

| Audit & Tax | 60,653 | |||||

| Trustees’ fees | 29,230 | |||||

| Custodian fees | 13,738 | |||||

| Insurance fees | 12,306 | |||||

| Consulting | 7,053 | |||||

| Dues and services | 6,442 | |||||

| Pricing fees | 3,060 | |||||

| Taxes (other than taxes on income) | 2,501 | |||||

| Trustees’ expenses | 2,003 | 7,944,765 | ||||

| Less fees waived | (121,474 | ) | ||||

| Less waiver of distribution expenses – Class A | (159,718 | ) | ||||

| Less waiver of distribution expenses – Class R | (18,662 | ) | ||||

| Less expenses paid indirectly | (1,062 | ) | ||||

| Total expenses | 7,643,849 | |||||

| Net Investment Income | 346,571 | |||||

| Net Realized and Unrealized Loss on Investments: | ||||||

| Net realized loss on investments | (283,632 | ) | ||||

| Net change in unrealized appreciation/depreciation of investments | (169,042,827 | ) | ||||

| Net Realized and Unrealized Loss on Investments | (169,326,459 | ) | ||||

| Net Decrease in Net Assets Resulting from Operations | $ | (168,979,888 | ) | |||

See accompanying notes

17

Statements of changes in net assets

Delaware Small Cap Value Fund

| Year Ended | ||||||||

| 11/30/08 | 11/30/07 | |||||||

| Increase (Decrease) in Net Assets from Operations: | ||||||||

| Net investment income (loss) | $ | 346,571 | $ | (2,421,917 | ) | |||

| Net realized gain (loss) on investments and | ||||||||

| foreign currencies | (283,632 | ) | 56,029,521 | |||||

| Net change in unrealized | ||||||||

| appreciation/depreciation of investments | (169,042,827 | ) | (97,258,265 | ) | ||||

| Net decrease in net assets resulting from operations | (168,979,888 | ) | (43,650,661 | ) | ||||

| Dividends and Distributions to Shareholders from: | ||||||||

| Net realized gain on investments: | ||||||||

| Class A | (36,249,009 | ) | (38,697,231 | ) | ||||

| Class B | (5,369,287 | ) | (7,487,846 | ) | ||||

| Class C | (9,806,574 | ) | (12,118,767 | ) | ||||

| Class R | (2,003,395 | ) | (1,670,691 | ) | ||||

| Institutional Class | (2,385,198 | ) | (2,825,209 | ) | ||||

| (55,813,463 | ) | (62,799,744 | ) | |||||

| Capital Share Transactions: | ||||||||

| Proceeds from shares sold: | ||||||||

| Class A | 44,883,012 | 58,097,755 | ||||||

| Class B | 365,548 | 1,197,141 | ||||||

| Class C | 6,866,414 | 6,957,838 | ||||||

| Class R | 7,231,904 | 15,645,466 | ||||||

| Institutional Class | 4,930,839 | 7,208,827 | ||||||

| Net asset value of shares issued upon reinvestment | ||||||||

| of dividends and distributions: | ||||||||

| Class A | 34,396,594 | 36,524,727 | ||||||

| Class B | 5,029,038 | 6,972,418 | ||||||

| Class C | 9,210,483 | 11,396,318 | ||||||

| Class R | 2,003,388 | 1,670,616 | ||||||

| Institutional Class | 2,364,526 | 2,798,205 | ||||||

| 117,281,746 | 148,469,311 | |||||||

18

| Year Ended | ||||||||

| 11/30/08 | 11/30/07 | |||||||

| Capital Share Transactions (continued): | ||||||||

| Cost of shares repurchased: | ||||||||

| Class A | $ | (111,709,459 | ) | $ | (131,609,980 | ) | ||

| Class B | (19,676,154 | ) | (36,484,190 | ) | ||||

| Class C | (33,121,658 | ) | (46,345,644 | ) | ||||

| Class R | (8,648,107 | ) | (13,383,734 | ) | ||||

| Institutional Class | (9,724,384 | ) | (16,190,231 | ) | ||||

| (182,879,762 | ) | (244,013,779 | ) | |||||

| Decrease in net assets derived from capital share transactions | (65,598,016 | ) | (95,544,468 | ) | ||||

| Net Decrease in Net Assets | (290,391,367 | ) | (201,994,873 | ) | ||||

| Net Assets: | ||||||||

| Beginning of year | 588,675,435 | 790,670,308 | ||||||

| End of year (including undistributed net investment | ||||||||

| income of $459,074 and $—, respectively) | $ | 298,284,068 | $ | 588,675,435 | ||||

See accompanying notes

19

Financial highlights

Delaware Small Cap Value Fund Class A

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| Income (loss) from investment operations: |

| Net investment income (loss)1 |

| Net realized and unrealized gain (loss) on investments |

| Total from investment operations |

| Less dividends and distributions: |

| From net realized gain on investments |

| Total dividends and distributions |

| Net asset value, end of period |

| Total return2 |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets |

| prior to fees waived and expense paid indirectly |

| Ratio of net investment income (loss) to average net assets |

| Ratio of net investment income (loss) to average net assets |

| prior to fees waived and expense paid indirectly |

| Portfolio turnover |

1 The average shares outstanding method has been applied for per share information. |

2 Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total investment return reflects waivers by the manager and distributor, as applicable. Performance would have been lower had the waivers not been in effect. |

See accompanying notes

20

| Year Ended | |||||||||||||||

| 11/30/08 | 11/30/07 | 11/30/06 | 11/30/05 | 11/30/04 | |||||||||||

| $36.000 | $41.970 | $39.110 | $39.640 | $35.220 | |||||||||||

| 0.072 | (0.050 | ) | (0.047 | ) | (0.075 | ) | (0.105 | ) | |||||||

| (11.314 | ) | (2.647 | ) | 5.960 | 4.170 | 6.879 | |||||||||

| (11.242 | ) | (2.697 | ) | 5.913 | 4.095 | 6.774 | |||||||||

| (3.418 | ) | (3.273 | ) | (3.053 | ) | (4.625 | ) | (2.354 | ) | ||||||

| (3.418 | ) | (3.273 | ) | (3.053 | ) | (4.625 | ) | (2.354 | ) | ||||||

| $21.340 | $36.000 | $41.970 | $39.110 | $39.640 | |||||||||||

| (34.55% | ) | (6.90% | ) | 16.26% | 11.42% | 20.52% | |||||||||

| $205,439 | $389,129 | $493,193 | $409,567 | $270,332 | |||||||||||

| 1.44% | 1.37% | 1.41% | 1.44% | 1.54% | |||||||||||

| 1.52% | 1.42% | 1.44% | 1.44% | 1.54% | |||||||||||

| 0.25% | (0.12% | ) | (0.12% | ) | (0.20% | ) | (0.30% | ) | |||||||

| 0.17% | (0.17% | ) | (0.15% | ) | (0.20% | ) | (0.30% | ) | |||||||

| 13% | 23% | 36% | 33% | 35% | |||||||||||

21

Financial highlights

Delaware Small Cap Value Fund Class B

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| Income (loss) from investment operations: |

| Net investment loss1 |

| Net realized and unrealized gain (loss) on investments |

| Total from investment operations |

| Less dividends and distributions from: |

| Net realized gain on investments |

| Total dividends and distributions |

| Net asset value, end of period |

| Total return2 |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets |

| prior to fees waived and expense paid indirectly |

| Ratio of net investment loss to average net assets |

| Ratio of net investment loss to average net assets |

| prior to fees waived and expense paid indirectly |

| Portfolio turnover |

1 The average shares outstanding method has been applied for per share information. |

2 Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total investment return reflects a waiver by the manager, as applicable. Performance would have been lower had the waiver not been in effect. |

See accompanying notes

22

| Year Ended | |||||||||||||||

| 11/30/08 | 11/30/07 | 11/30/06 | 11/30/05 | 11/30/04 | |||||||||||

| $32.860 | $38.860 | $36.690 | $37.690 | $33.820 | |||||||||||

| (0.127 | ) | (0.314 | ) | (0.306 | ) | (0.311 | ) | (0.334 | ) | ||||||

| (10.185 | ) | (2.413 | ) | 5.529 | 3.936 | 6.558 | |||||||||

| (10.312 | ) | (2.727 | ) | 5.223 | 3.625 | 6.224 | |||||||||

| (3.418 | ) | (3.273 | ) | (3.053 | ) | (4.625 | ) | (2.354 | ) | ||||||

| (3.418 | ) | (3.273 | ) | (3.053 | ) | (4.625 | ) | (2.354 | ) | ||||||

| $19.130 | $32.860 | $38.860 | $36.690 | $37.690 | |||||||||||

| (35.08% | ) | (7.59% | ) | 15.38% | 10.68% | 19.69% | |||||||||

| $21,825 | $54,684 | $94,495 | $110,684 | $111,348 | |||||||||||

| 2.19% | 2.12% | 2.14% | 2.14% | 2.24% | |||||||||||

| 2.22% | 2.12% | 2.14% | 2.14% | 2.24% | |||||||||||

| (0.50% | ) | (0.87% | ) | (0.85% | ) | (0.90% | ) | (1.00% | ) | ||||||

| (0.53% | ) | (0.87% | ) | (0.85% | ) | (0.90% | ) | (1.00% | ) | ||||||

| 13% | 23% | 36% | 33% | 35% | |||||||||||

23

Financial highlights

Delaware Small Cap Value Fund Class C

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| Income (loss) from investment operations: |

| Net investment loss1 |

| Net realized and unrealized gain (loss) on investments |

| Total from investment operations |

| Less dividends and distributions from: |

| Net realized gain on investments |

| Total dividends and distributions |

| Net asset value, end of period |

| Total return2 |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets |

| prior to fees waived and expense paid indirectly |

| Ratio of net investment loss to average net assets |

| Ratio of net investment loss to average net assets |

| prior to fees waived and expense paid indirectly |

| Portfolio turnover |

1 The average shares outstanding method has been applied for per share information. |

2 Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total investment return reflects a waiver by the manager, as applicable. Performance would have been lower had the waiver not been in effect. |

See accompanying notes

24

| Year Ended | |||||||||||||||

| 11/30/08 | 11/30/07 | 11/30/06 | 11/30/05 | 11/30/04 | |||||||||||

| $32.850 | $38.840 | $36.670 | $37.680 | $33.810 | |||||||||||

| (0.126 | ) | (0.314 | ) | (0.306 | ) | (0.313 | ) | (0.333 | ) | ||||||

| (10.186 | ) | (2.403 | ) | 5.529 | 3.928 | 6.557 | |||||||||

| (10.312 | ) | (2.717 | ) | 5.223 | 3.615 | 6.224 | |||||||||

| (3.418 | ) | (3.273 | ) | (3.053 | ) | (4.625 | ) | (2.354 | ) | ||||||

| (3.418 | ) | (3.273 | ) | (3.053 | ) | (4.625 | ) | (2.354 | ) | ||||||

| $19.120 | $32.850 | $38.840 | $36.670 | $37.680 | |||||||||||

| (35.05% | ) | (7.56% | ) | 15.39% | 10.65% | 19.69% | |||||||||

| $44,339 | $97,428 | $145,385 | $119,968 | $66,313 | |||||||||||

| 2.19% | 2.12% | 2.14% | 2.14% | 2.24% | |||||||||||

| 2.22% | 2.12% | 2.14% | 2.14% | 2.24% | |||||||||||

| (0.50% | ) | (0.87% | ) | (0.85% | ) | (0.90% | ) | (1.00% | ) | ||||||

| (0.53% | ) | (0.87% | ) | (0.85% | ) | (0.90% | ) | (1.00% | ) | ||||||

| 13% | 23% | 36% | 33% | 35% | |||||||||||

25

Financial highlights

Delaware Small Cap Value Fund Class R

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| Income (loss) from investment operations: |

| Net investment loss1 |

| Net realized and unrealized gain (loss) on investments |

| Total from investment operations |

| Less dividends and distributions from: |

| Net realized gain on investments |

| Total dividends and distributions |

| Net asset value, end of period |

| Total return2 |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets |

| prior to fees waived and expense paid indirectly |

| Ratio of net investment loss to average net assets |

| Ratio of net investment loss to average net assets |

| prior to fees waived and expense paid indirectly |

| Portfolio turnover |

1 The average shares outstanding method has been applied for per share information. |

2 Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total investment return reflects waivers by the manager and distributor, as applicable. Performance would have been lower had the waivers not been in effect. |

See accompanying notes

26

| Year Ended | |||||||||||||||

| 11/30/08 | 11/30/07 | 11/30/06 | 11/30/05 | 11/30/04 | |||||||||||

| $35.530 | $41.550 | $38.840 | $39.480 | $35.190 | |||||||||||

| (0.002 | ) | (0.146 | ) | (0.138 | ) | (0.169 | ) | (0.209 | ) | ||||||

| (11.140 | ) | (2.601 | ) | 5.901 | 4.154 | 6.853 | |||||||||

| (11.142 | ) | (2.747 | ) | 5.763 | 3.985 | 6.644 | |||||||||

| (3.418 | ) | (3.273 | ) | (3.053 | ) | (4.625 | ) | (2.354 | ) | ||||||

| (3.418 | ) | (3.273 | ) | (3.053 | ) | (4.625 | ) | (2.354 | ) | ||||||

| $20.970 | $35.530 | $41.550 | $38.840 | $39.480 | |||||||||||

| (34.74% | ) | (7.11% | ) | 15.97% | 11.15% | 20.15% | |||||||||

| $12,761 | $21,126 | $20,564 | $10,574 | $4,539 | |||||||||||

| 1.69% | 1.62% | 1.64% | 1.70% | 1.84% | |||||||||||

| 1.82% | 1.72% | 1.74% | 1.74% | 1.84% | |||||||||||

| — | (0.37% | ) | (0.35% | ) | (0.46% | ) | (0.60% | ) | |||||||

| (0.13% | ) | (0.47% | ) | (0.45% | ) | (0.50% | ) | (0.60% | ) | ||||||

| 13% | 23% | 36% | 33% | 35% | |||||||||||

27

Financial highlights

Delaware Small Cap Value Fund Institutional Class

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| Income (loss) from investment operations: |

| Net investment income1 |

| Net realized and unrealized gain (loss) on investments |

| Total from investment operations |

| Less dividends and distributions: |

| From net realized gain on investments |

| Total dividends and distributions |

| Net asset value, end of period |

| Total return2 |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets |

| prior to fees waived and expense paid indirectly |

| Ratio of net investment income to average net assets |

| Ratio of net investment income to average net assets |

| prior to fees waived and expense paid indirectly |

| Portfolio turnover |

1 The average shares outstanding method has been applied for per share information. |

2 Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total investment return reflects a waiver by the manager, as applicable. Performance would have been lower had the waiver not been in effect. |

See accompanying notes

28

| Year Ended | |||||||||||||||

| 11/30/08 | 11/30/07 | 11/30/06 | 11/30/05 | 11/30/04 | |||||||||||

| $37.190 | $43.140 | $40.020 | $40.350 | $35.700 | |||||||||||

| 0.148 | 0.049 | 0.058 | 0.036 | — | |||||||||||

| (11.750 | ) | (2.726 | ) | 6.115 | 4.259 | 7.004 | |||||||||

| (11.602 | ) | (2.677 | ) | 6.173 | 4.295 | 7.004 | |||||||||

| (3.418 | ) | (3.273 | ) | (3.053 | ) | (4.625 | ) | (2.354 | ) | ||||||

| (3.418 | ) | (3.273 | ) | (3.053 | ) | (4.625 | ) | (2.354 | ) | ||||||

| $22.170 | $37.190 | $43.140 | $40.020 | $40.350 | |||||||||||

| (34.38% | ) | (6.65% | ) | 16.56% | 11.77% | 20.88% | |||||||||

| $13,920 | $26,308 | $37,033 | $30,918 | $23,731 | |||||||||||

| 1.19% | 1.12% | 1.14% | 1.14% | 1.24% | |||||||||||

| 1.22% | 1.12% | 1.14% | 1.14% | 1.24% | |||||||||||

| 0.50% | 0.13% | 0.15% | 0.10% | — | |||||||||||

| 0.47% | 0.13% | 0.15% | 0.10% | — | |||||||||||

| 13% | 23% | 36% | 33% | 35% | |||||||||||

29

Notes to financial statements | |

| Delaware Small Cap Value Fund | November 30, 2008 |

Delaware Group® Equity Funds V (Trust) is organized as a Delaware statutory trust and offers three series: Delaware Dividend Income Fund, Delaware Small-Cap Core Fund, and Delaware Small Cap Value Fund. These financial statements and the related notes pertain to Delaware Small Cap Value Fund (Fund). The Trust is an open-end investment company. The Fund is considered diversified under the Investment Company Act of 1940, as amended, and offers Class A, Class B, Class C, Class R, and Institutional Class shares. Class A shares are sold with a maximum front-end sales charge of up to 5.75%. Class A share purchases of $1,000,000 or more will incur a contingent deferred sales charge (CDSC) of 1% if redeemed during the first year and 0.50% during the second year, provided that Delaware Distributors, L.P. (DDLP) paid a financial advisor a commission on the purchase of those shares. Class B shares may only be purchased through dividend reinvestment and certain permitted exchanges. Prior to June 1, 2007, Class B shares were sold with a CDSC that declined from 4% to zero depending upon the period of time the shares were held. Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. Class C shares are sold with a CDSC of 1%, if redeemed during the first 12 months. Class R and Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors.

The investment objective of the Fund is to seek capital appreciation.

1. Significant Accounting Policies

The following accounting policies are in accordance with U.S. generally accepted accounting principles and are consistently followed by the Fund.

Security Valuation — Equity securities, except those traded on the Nasdaq Stock Market, Inc. (Nasdaq), are valued at the last quoted sales price as of the time of the regular close of the New York Stock Exchange (NYSE) on the valuation date. Securities traded on the Nasdaq are valued in accordance with the Nasdaq Official Closing Price, which may not be the last sales price. If on a particular day an equity security does not trade, then the mean between the bid and ask prices will be used. Short-term debt securities having less than 60 days to maturity are valued at amortized cost, which approximates market value. Investment companies are valued at net asset value per share. Generally, other securities and assets for which market quotations are not readily available are valued at fair value as determined in good faith under the direction of the Fund’s Board of Trustees (Board). In determining whether market quotations are readily available or fair valuation will be used, various factors will be taken into consideration, such as market closures or suspension of trading in a security. The Fund may use fair value pricing more frequently for securities traded primarily in non-U.S. markets because, among other things, most foreign markets close well before the Fund values its securities at 4:00 p.m. Eastern Time. The earlier close of these foreign markets gives rise to the possibility that significant events, including broad market moves, government actions or pronouncements, aftermarket trading or new events, may have occurred in the interim. To account for this, the Fund may frequently value foreign securities using fair value prices based on third-party vendor modeling tools (“international fair value pricing”).

30

Federal Income Taxes — The Fund intends to continue to qualify for federal income tax purposes as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended, and make the requisite distributions to shareholders. Accordingly, no provision for federal income taxes has been made in the financial statements.

Effective May 30, 2008, the Fund adopted FASB Interpretation No. 48 “Accounting for Uncertainty in Income Taxes” (FIN 48). FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, presented, and disclosed in the financial statements. FIN 48 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold are recorded as a tax benefit or expense in the current year. The adoption of FIN 48 did not result in the recording of any tax benefit or expense in the current period.

Class Accounting — Investment income, common expenses and realized and unrealized gain (loss) on investments are allocated to the various classes of the Fund on the basis of daily net assets of each class. Distribution expenses relating to a specific class are charged directly to that class.

Repurchase Agreements — The Fund may invest in a pooled cash account along with other members of the Delaware Investments® Family of Funds pursuant to an exemptive order issued by the Securities and Exchange Commission. The aggregate daily balance of the pooled cash account is invested in repurchase agreements secured by obligations of the U.S. government. The respective collateral is held by the Fund’s custodian bank until the maturity of the respective repurchase agreements. Each repurchase agreement is at least 102% collateralized. However, in the event of default or bankruptcy by the counterparty to the agreement, realization of the collateral may be subject to legal proceedings.

Use of Estimates — The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that may affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Other — Expenses directly attributable to the Fund are charged directly to the Fund. Other expenses common to various funds within the Delaware Investments® Family of Funds are generally allocated amongst such funds on the basis of average net assets. Management fees and some other expenses are paid monthly. Security transactions are recorded on the date the securities are purchased or sold (trade date) for financial reporting purposes. Costs used in calculating realized gains and losses on the sale of investment securities are those of the specific securities sold. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. Distributions received from investments in Real Estate Investment Trusts (REITs) are recorded as dividend income on the ex-dividend date, subject to reclassification upon notice of the character of such distributions by the issuer. The financial statements reflect

31

Notes to financial statements

Delaware Small Cap Value Fund

1. Significant Accounting Policies (continued)

an estimate of the reclassification of the distribution character. The Fund declares and pays dividends from net investment income and distributions from net realized gains on investments, if any, annually.

Subject to seeking best execution, the Fund may direct certain security trades to brokers who have agreed to rebate a portion of the related brokerage commission to the Fund in cash. Such commission rebates are included in realized gain on investments in the accompanying financial statements and totaled $1,714 for the year ended November 30, 2008. In general, best execution refers to many factors, including the price paid or received for a security, the commission charged, the promptness and reliability of execution, the confidentiality and placement accorded the order, and other factors affecting the overall benefit obtained by the Fund on the transaction.

The Fund receives earnings credits from its custodian when positive cash balances are maintained, which are used to offset custody fees. The expense paid under this arrangement is included in custodian fees on the statement of operations with the corresponding expense offset shown as “expense paid indirectly.”

2. Investment Management, Administration Agreements and Other Transactions with Affiliates

In accordance with the terms of its investment management agreement, the Fund pays Delaware Management Company (DMC), a series of Delaware Management Business Trust and the investment manager, an annual fee which is calculated daily at the rate of 0.75% on the first $500 million of average daily net assets of the Fund, 0.70% on the next $500 million, 0.65% on the next $1.5 billion, and 0.60% on average daily net assets in excess of $2.5 billion.

Effective April 1, 2008, DMC has contractually agreed to waive that portion, if any, of its management fee and reimburse the Fund to the extent necessary to ensure that total annual operating expenses (excluding any 12b-1 plan expenses, taxes, interest, inverse floater program expenses, brokerage fees, certain insurance costs, and non-routine expenses or costs including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations (collectively, “non-routine expenses”)) do not exceed 1.16% of average daily net assets of the Fund through March 31, 2009. For purposes of this waiver and reimbursement, non-routine expenses may also include such additional costs and expenses, as may be agreed upon from time to time by the Fund’s Board and DMC. This expense waiver and reimbursement apply only to expenses paid directly by the Fund.

Delaware Service Company, Inc. (DSC), an affiliate of DMC, provides fund accounting and financial administration oversight services to the Fund. For these services, the Fund pays DSC fees based on the aggregate daily net assets of the Delaware Investments® Family of Funds at the following annual rate: 0.0050% of the first $30 billion; 0.0045% of the next $10 billion; 0.0040% of the next $10 billion; and 0.0025% of aggregate average daily net assets in excess of $50 billion. The

32

fees payable to DSC under the service agreement described above are allocated among all Funds in the Delaware Investments® Family of Funds on a relative net asset value basis. For the year ended November 30, 2008, the Fund was charged $23,590 for these services.

DSC also provides dividend disbursing and transfer agency services. The Fund pays DSC a monthly fee based on the number of shareholder accounts for dividend disbursing and transfer agent services.

Pursuant to a distribution agreement and distribution plan, the Fund pays DDLP, the distributor and an affiliate of DMC, an annual distribution and service fee not to exceed 0.30% of the average daily net assets of the Class A shares, 1.00% of the average daily net assets of the Class B and C shares and 0.60% of the average daily net assets of Class R shares. Institutional Class shares pay no distribution and service expenses. DDLP has contracted to waive distribution and service fees through March 31, 2009, in order to prevent distribution and service fees of Class A and Class R shares from exceeding 0.25% and 0.50%, respectively, of average daily net assets.

At November 30, 2008, the Fund had liabilities payable to affiliates as follows:

| Investment management fee payable to DMC | $191,238 | |

| Dividend disbursing, transfer agent and fund accounting | ||

| oversight fees and other expenses payable to DSC | 126,749 | |

| Distribution fees payable to DDLP | 102,800 | |

| Other expenses payable to DMC and affiliates* | 8,470 |

*DMC, as part of its administrative services, pays operating expenses on behalf of the Fund and is reimbursed on a periodic basis. Such expenses include items such as printing of shareholder reports, fees for audit, legal and tax services, registration fees and trustees’ fees.

As provided in the investment management agreement, the Fund bears the cost of certain legal and tax services, including internal legal and tax services provided to the Fund by DMC and/or its affiliates’ employees. For the year ended November 30, 2008, the Fund was charged $32,218 for internal legal and tax services provided by DMC and/or its affiliates’ employees.

For the year ended November 30, 2008, DDLP earned $22,745 for commissions on sales of the Fund’s Class A shares. For the year ended November 30, 2008, DDLP received gross CDSC commissions of $637, $54,702 and $4,923 on redemption of the Fund’s Class A, Class B and Class C shares, respectively, and these commissions were entirely used to offset up-front commissions previously paid by DDLP to broker-dealers on sales of those shares.

Trustees’ fees include expenses accrued by the Fund for each Trustee’s retainer and meeting fees. Certain officers of DMC, DSC and DDLP are officers and/or Trustees of the Trust. These officers and trustees are paid no compensation by the Fund.

33

Notes to financial statements

Delaware Small Cap Value Fund

For the year ended November 30, 2008, the Fund made purchases of $61,644,029 and sales of $197,109,995 of investment securities other than short-term investments.

At November 30, 2008, the cost of investments for federal income purposes was $403,236,086. At November 30, 2008, net unrealized depreciation was $70,883,184, of which $35,598,828 related to unrealized appreciation of investments and $106,482,012 related to unrealized depreciation of investments.

Effective December 1, 2007, the Fund adopted Financial Accounting Standards No. 157, Fair Value Measurements (FAS 157). FAS 157 defines fair value as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. FAS 157 also establishes a framework for measuring fair value, and a three level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions that market participants would use in pricing the asset or liability developed based on the best information available under the circumstances. The Fund’s investment in its entirety is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three-tier hierarchy of inputs is summarized below.

Level 1 – inputs are quoted prices in active markets

Level 2 – inputs are observable, directly or indirectly

Level 3 – inputs are unobservable and reflect assumptions on the part of the reporting entity

The following table summarizes the valuation of the Fund’s investments by the above FAS 157 fair value hierarchy levels as of November 30, 2008:

| Level | Securities | ||

| Level 1 | $299,969,181 | ||

| Level 2 | 32,351,566 | ||

| Level 3 | 32,155 | ||

| Total | $332,352,902 |

34

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value:

| Securities | ||||

| Balance as of 11/30/07 | $ | — | ||

| Net change in unrealized appreciation/depreciation | (359,984 | ) | ||

| Net transfers in and/or out of Level 3 | 392,139 | |||

| Balance as of 11/30/08 | $ | 32,155 | ||

4. Dividend and Distribution Information

Income and long-term capital gain distributions are determined in accordance with federal income tax regulations, which may differ from U.S. generally accepted accounting principles. Additionally, distributions from net short-term gains on sales of investment securities are treated as ordinary income for federal income tax purposes. The tax character of dividends and distributions paid during the years ended November 30, 2008 and 2007 was as follows:

| Year Ended | ||||||

| 11/30/08 | 11/30/07 | |||||

| Ordinary Income | $ | 316,226 | $ | 14,551,917 | ||

| Long-term capital gain | 55,497,237 | 48,247,827 | ||||

| Total | $ | 55,813,463 | $ | 62,799,744 | ||

5. Components of Net Assets on a Tax Basis

As of November 30, 2008, the components of net assets on a tax basis were as follows:

| Shares of beneficial interest | $ | 369,092,132 | ||

| Undistributed ordinary income | 459,074 | |||

| Capital loss carryforward | (383,954 | ) | ||

| Unrealized depreciation of investments | (70,883,184 | ) | ||

| Net assets | $ | 298,284,068 |

The differences between book basis and tax basis components of net assets are primarily attributable to tax deferral of losses on wash sales. The undistributed earnings for the Fund are estimated pending final notification of the tax character of distributions received from investments in REITs.

35

Notes to financial statements

Delaware Small Cap Value Fund

For financial reporting purposes, capital accounts are adjusted to reflect the tax character of permanent book/tax differences. Reclassifications are primarily due to tax treatment of net operating losses and dividends and distributions. Results of operations and net assets were not affected by these reclassifications. For the year ended November 30, 2008, the Fund recorded the following reclassifications.

| Undistributed net investment income | $ | 112,503 | ||

| Accumulated net realized loss | 316,226 | |||

| Paid-in capital | (428,729 | ) |

For federal income tax purposes, capital loss carryforwards may be carried forward and applied against future capital gains. Capital loss carryforwards remaining at November 30, 2008 will expire as follows: $383,954 expires in 2016.

6. Capital Shares

Transactions in capital shares were as follows:

| Year Ended | ||||||

| 11/30/08 | 11/30/07 | |||||

| Shares sold: | ||||||

| Class A | 1,465,800 | 1,463,749 | ||||

| Class B | 13,363 | 32,759 | ||||

| Class C | 258,185 | 192,771 | ||||

| Class R | 244,933 | 397,624 | ||||

| Institutional Class | 156,706 | 177,796 | ||||

| Shares issued upon reinvestment of dividends and distributions: | ||||||

| Class A | 1,044,854 | 952,637 | ||||

| Class B | 169,157 | 197,855 | ||||

| Class C | 310,013 | 323,483 | ||||

| Class R | 61,776 | 44,056 | ||||

| Institutional Class | 69,300 | 70,822 | ||||

| 3,794,087 | 3,853,552 | |||||

| Shares repurchased: | ||||||

| Class A | (3,691,741 | ) | (3,360,466 | ) | ||

| Class B | (705,823 | ) | (998,258 | ) | ||

| Class C | (1,215,902 | ) | (1,292,964 | ) | ||

| Class R | (292,915 | ) | (341,947 | ) | ||

| Institutional Class | (305,651 | ) | (399,673 | ) | ||

| (6,212,032 | ) | (6,393,308 | ) | |||

| Net decrease | (2,417,945 | ) | (2,539,756 | ) | ||

36

For the years ended November 30, 2008 and 2007, 202,901 Class B shares were converted to 183,322 Class A shares valued at $5,984,507 and 357,349 Class B shares were converted to 328,289 Class A shares valued at $13,268,291, respectively. The respective amounts are included in Class B redemptions and Class A subscriptions in the table above and the Statement of changes in the net assets.

7. Line of Credit

The Fund, along with certain other funds in the Delaware Investments® Family of Funds (Participants), was a participant in a $225,000,000 revolving line of credit with The Bank of New York Mellon (BNY Mellon) to be used for temporary or emergency purposes as an additional source of liquidity to fund redemptions of investor shares. Under the agreement, Participants were charged an annual commitment fee, which was allocated across the Participants on the basis of each Participant’s allocation of the entire facility. Participants were permitted to borrow up to a maximum of one third of their net assets under the agreement. The agreement expired on November 18, 2008. The Fund had no loans outstanding as of November 30, 2008, or at any time during the year then ended.

Effective November 18, 2008, the Fund along with the other Participants entered into an amendment to the agreement with BNY Mellon for a $35,000,000 revolving line of credit. The agreement, as amended, is to be used as described above and operates in substantially the same manner as the original agreement. The agreement, as amended, expires on November 17, 2009.

8. Securities Lending

The Fund, along with other funds in the Delaware Investments® Family of Funds, may lend their securities pursuant to a security lending agreement (Lending Agreement) with BNY Mellon. With respect to each loan, if the aggregate market value of securities collateral held plus cash collateral received on any business day is less than the aggregate market value of the securities which are the subject of such loan, the borrower will be notified to provide additional collateral not less than the applicable collateral requirements. Cash collateral received is generally invested in the Mellon GSL DBT II Collateral Fund (the “Collective Trust”) established by BNY Mellon for the purpose of investment on behalf of clients participating in its securities lending programs. The Collective Trust invests in fixed income securities, with a weighted average maturity not to exceed 90 days, rated in one of the top three tiers by Standard & Poor’s Ratings Group or Moody’s Investors Service, Inc. or repurchase agreements collateralized by such securities. The Collective Trust seeks to maintain a net asset value per unit of $1.00, but there can be no assurance that it will always be able to do so. The Fund may incur investment losses as a result of investing securities lending collateral in the Collective Trust. This could occur if an investment in the Collective Trust defaulted or if it were necessary to liquidate assets in the Collective Trust to meet returns on outstanding security loans at a time when the Collective Trust’s net asset value per unit was less than $1.00. Under those circumstances, the Fund may not receive an amount from the Collective Trust that is equal in amount to the collateral the Fund would be required to return to the borrower of the securities and the Fund would be required to make up for this shortfall. During the year ended November 30, 2008, BNY Mellon transferred certain distressed securities from

37

Notes to financial statements

Delaware Small Cap Value Fund

8. Securities Lending (continued)

the Collective Trust into the Mellon GSL DBT II Liquidation Trust. The Fund can also accept U.S. government securities and letters of credit (non-cash collateral) in connection with securities loans. In the event of default or bankruptcy by the lending agent, realization and/or retention of the collateral may be subject to legal proceedings. In the event the borrower fails to return loaned securities and the collateral received is insufficient to cover the value of the loaned securities and provided such collateral shortfall is not the result of investment losses, the lending agent has agreed to pay the amount of the shortfall to the Fund, or at the discretion of the lending agent, replace the loaned securities. The Fund continues to record dividends or interest, as applicable, on the securities loaned and are subject to change in value of the securities loaned that may occur during the term of the loan. The Fund has the right under the Lending Agreement to recover the securities from the borrower on demand. With respect to security loans collateralized by non-cash collateral, the Fund receives loan premiums paid by the borrower. With respect to security loans collateralized by cash collateral, the earnings from the collateral investments are shared among the Fund, the security lending agent and the borrower. The Fund records security lending income net of allocations to the security lending agent and the borrower.

At November 30, 2008, the value of securities on loan was $31,943,385, for which cash collateral was received and invested in accordance with the Lending Agreement. Such investments are presented on the statement of net assets under the caption “Securities Lending Collateral”.

9. Credit and Market Risk

The Fund invests a significant portion of its assets in small companies and may be subject to certain risks associated with ownership of securities of such companies. Investments in small-sized companies may be more volatile than investments in larger companies for a number of reasons, which include more limited financial resources or a dependence on narrow product lines.

The Fund invests in REITs and is subject to some of the risks associated with that industry. If the Fund holds real estate directly as a result of defaults or receives rental income directly from real estate holdings, its tax status as a regulated investment company may be jeopardized. There were no direct real estate holdings during the year ended November 30, 2008. The Fund’s REIT holdings are also affected by interest rate changes, particularly if the REITs it holds use floating rate debt to finance their ongoing operations.

The Fund may invest up to 15% of its net assets in illiquid securities, which may include securities with contractual restrictions on resale, securities exempt from registration under Rule 144A of the Securities Act of 1933, as amended, and other securities which may not be readily marketable. The relative illiquidity of these securities may impair the Fund from disposing of them in a timely manner and at a fair price when it is necessary or desirable to do so. While maintaining oversight, the Fund’s Board has delegated to DMC the day-to-day functions of determining whether individual securities are liquid for purposes of the Fund’s limitation on investments in illiquid assets. Securities eligible for resale pursuant to Rule 144A, which are determined to be liquid, are not subject to the Fund’s 15% limit on investments in illiquid securities. As of November 30, 2008,

38

there were no Rule 144A securities and no securities have been determined to be illiquid under the Fund’s Liquidity Procedures.

10. Contractual Obligations

The Fund enters into contracts in the normal course of business that contain a variety of indemnifications. The Fund’s maximum exposure under these arrangements is unknown. However, the Fund has not had prior claims or losses pursuant to these contracts. Management has reviewed the Fund’s existing contracts and expects the risk of loss to be remote.

11. Tax Information (Unaudited)