QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12

|

BIOJECT MEDICAL TECHNOLOGIES INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Bioject Medical Technologies Inc.

211 Somerville Road, Route 202 North

Bedminster, NJ 07921

May 14, 2003

Dear Shareholders:

You are cordially invited to attend the 2003 annual meeting of the shareholders of BIOJECT MEDICAL TECHNOLOGIES INC., to be held at the Somerset Hills Hotel, 200 Liberty Corner Road, Warren, New Jersey 07059 on Thursday, June 19, 2003 at 9:00 a.m., Eastern Daylight Time.

The matters to be acted upon at the meeting are as follows:

- (i)

- to elect three members of the Board of Directors;

- (ii)

- to approve an amendment to the 2000 Employee Stock Purchase Plan to increase the total number of shares reserved for issuance thereunder from 150,000 to 450,000 shares;

- (iii)

- to approve an amendment to the 1992 Stock Incentive Plan to increase the total number of shares reserved for issuance thereunder from 2,700,000 to 3,900,000 shares; and

- (iv)

- to transact such other business as may properly come before the meeting.

These matters are more fully described in the accompanying proxy statement.

We believe the annual meeting provides an excellent opportunity for shareholders to become better acquainted with Bioject and its board members and officers. Although we would like very much to have each shareholder attend the 2003 meeting, we realize this is not possible. Whether or not you plan to be present at the meeting, it is important that your shares be represented. Therefore, we urge you to complete, sign and return the enclosed proxy as soon as possible.

If you return your proxy promptly, you can help us avoid the expense of follow-up mailings to ensure a quorum so that the meeting can be held. If you decide between now and June 19, 2003 that you can attend the meeting in person, you may revoke your proxy at that time and vote your shares at the meeting.

We appreciate your continued support of Bioject and look forward to either greeting you personally at the meeting or receiving your proxy.

| | Sincerely, |

|

James C. O'Shea

Chairman of the Board, President

and Chief Executive Officer |

BIOJECT MEDICAL TECHNOLOGIES INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the annual meeting of the shareholders (the "Annual Meeting") of BIOJECT MEDICAL TECHNOLOGIES INC. will be held on Thursday, June 19, 2003, at 9:00 a.m., Eastern Daylight Time, at the Somerset Hills Hotel, 200 Liberty Corner Road, Warren, New Jersey 07059 for the following purposes:

- (i)

- to elect three members of the Board of Directors;

- (ii)

- to approve an amendment to the 2000 Employee Stock Purchase Plan to increase the total number of shares reserved for issuance thereunder from 150,000 to 450,000 shares;

- (iii)

- to approve an amendment to the 1992 Stock Incentive Plan to increase the total number of shares reserved for issuance thereunder from 2,700,000 to 3,900,000 shares; and

- (v)

- to transact such other business as may properly come before the meeting.

These matters are more fully described in the proxy statement accompanying this Notice.

Accompanying this Notice of Meeting is a proxy statement and a form of proxy, together with our annual report, which contains the management discussion and analysis, the consolidated financial statements for the nine-month transition period ended December 31, 2002 and the auditors' report on the financial statements. Only holders of common stock of record at the close of business on April 21, 2003, will be entitled to vote at the Annual Meeting and any adjournments thereof.

Shareholders who are unable to attend the Annual Meeting in person are requested to complete, sign, date and return the enclosed form of proxy directly to American Stock Transfer and Trust Co., postage prepaid. A proxy will not be valid unless it is received at the office of American Stock Transfer and Trust Co., 59 Maiden Lane, New York, New York 10038 before the time fixed for the Annual Meeting.

| |

|

|---|

| | | DATED at Bedminster, New Jersey, this 14th day of May 2003. |

|

|

BY ORDER OF THE BOARD |

|

|

James C. O'Shea

Chairman of the Board, President

and Chief Executive Officer |

BIOJECT MEDICAL TECHNOLOGIES INC.

TABLE OF CONTENTS

| MANAGEMENT SOLICITATION | | 1 |

APPOINTMENT AND REVOCABILITY OF PROXIES |

|

1 |

VOTING OF PROXIES |

|

1 |

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF |

|

2 |

EQUITY COMPENSATION PLAN INFORMATION |

|

3 |

CHANGE IN FISCAL YEAR |

|

4 |

PROPOSAL #1: ELECTION OF DIRECTORS |

|

4 |

| |

Directors Compensation |

|

7 |

| |

Meetings and Committees of the Board of Directors |

|

7 |

| |

Audit Committee Report |

|

8 |

EXECUTIVE COMPENSATION AND OTHER TRANSACTIONS |

|

9 |

| |

Biographical Information |

|

9 |

| |

Executive Compensation |

|

11 |

| |

Grant of Stock Options |

|

12 |

| |

Option Exercises and Fiscal Year End Values |

|

13 |

| |

Employment Contracts |

|

13 |

| |

Section 16(a) Beneficial Ownership Reporting Compliance |

|

14 |

REPORT OF COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION |

|

15 |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION |

|

16 |

STOCK PERFORMANCE CHART |

|

17 |

PROPOSAL #2: TO APPROVE AN AMENDMENT TO THE 2000 EMPLOYEE STOCK PURCHASE PLAN |

|

18 |

PROPOSAL #3: TO APPROVE AN AMENDMENT TO THE 1992 STOCK INCENTIVE PLAN |

|

20 |

OTHER MATTERS TO BE ACTED UPON |

|

23 |

SHAREHOLDER PROPOSAL AND NOMINATION PROCEDURES FOR THE ANNUAL MEETING |

|

23 |

ANNUAL REPORT AND INCORPORATION BY REFERENCE |

|

24 |

INDEPENDENT AUDITORS |

|

24 |

PROPOSALS OF SHAREHOLDERS FOR THE 2004 ANNUAL MEETING OF SHAREHOLDERS |

|

25 |

BIOJECT MEDICAL TECHNOLOGIES INC.

PROXY STATEMENT

for

ANNUAL MEETING OF SHAREHOLDERS

To Be Held On June 19, 2003

MANAGEMENT SOLICITATION

This proxy statement and accompanying form of proxy are furnished in connection with the solicitation of proxies by the Board of Directors of BIOJECT MEDICAL TECHNOLOGIES INC. for use at the annual meeting of shareholders (the "Annual Meeting") to be held on Thursday, June 19, 2003, at the time and place and for the purposes set forth in the Notice of Meeting.

The form of proxy accompanying this proxy statement is solicited by our Board of Directors. Proxies may be solicited by our officers, directors and regular supervisory and executive employees, none of whom will receive any additional compensation for their services. In addition, we have retained the services of Allen Nelson & Co. to assist in the solicitation of proxies. Proxies may be solicited personally or by mail, telephone, telex, facsimile, telegraph or messenger. We estimate that we will pay Allen Nelson & Co. its customary and reasonable fees not expected to exceed $6,000, plus reimbursement of certain out-of-pocket expenses, for its services in soliciting proxies. We will also pay persons holding shares of the common stock in their names or in the names of nominees, but not owning such shares beneficially, such as brokerage houses, banks and other fiduciaries, for the expense of forwarding soliciting materials to their principals. The cost of this solicitation will be borne directly by us.

The approximate mailing date of the Notice of Meeting, proxy statement and form of proxy is May 14, 2003.

APPOINTMENT AND REVOCABILITY OF PROXIES

The persons named in the accompanying form of proxy are officers of Bioject.

In addition to revocation in any other manner permitted by law, a proxy may be revoked by:

- (i)

- signing another proxy bearing a later date and depositing it in the manner set forth in the Notice of Meeting;

- (ii)

- signing and dating a written notice of revocation (in the same manner as a proxy is required to be executed) and either depositing it in the manner set forth in the Notice of Meeting at any time before the time fixed for the Annual Meeting or an adjournment thereof or with the chairman of the Annual Meeting on the day of the Annual Meeting or an adjournment thereof; or

- (iii)

- attending the Annual Meeting or an adjournment thereof, and casting a ballot in person.

Such revocation will have effect only in respect of those matters that have not already been acted upon. Additional proxy forms may be obtained by calling or writing to American Stock Transfer & Trust Co., Shareholder Services, 59 Maiden Lane, Plaza Level, New York, NY 10038. Telephone: (800) 937-5449.

VOTING OF PROXIES

The securities represented by the proxy will be voted or withheld from voting in accordance with the instructions of the shareholder on any ballot that may be called for, and if the shareholder specifies a choice with respect to any matter to be acted upon, the securities shall be voted accordingly. The form of proxy confers authority upon the named proxy holder with respect to matters identified in the

1

accompanying Notice of Meeting. If a choice with respect to such matters is not specified, it is intended that James C. O'Shea and John P. Gandolfo, the persons designated by management in the form of proxy, will vote the securities represented by the proxy in favor of each matter identified in the proxy statement and for election of the nominees named in this proxy statement to the Board of Directors. The proxy confers discretionary authority upon the named proxy holder with respect to amendments to or variations in matters identified in the accompanying Notice of Meeting and other matters, which may properly come before the Annual Meeting.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

Our voting securities consist of common stock, without par value (the "common stock"). The Record Date has been fixed in advance by our Board of Directors as April 21, 2003, for the purpose of determining shareholders entitled to notice of and to vote at the Annual Meeting. Each share issued at the time of the Record Date carries the right to one vote at the Annual Meeting. As of April 21, 2003, a total of 10,676,100 shares of our common stock were issued and outstanding.

The following tables set forth certain information concerning the beneficial ownership of our common stock at April 21, 2003, by: (i) each person known by us to own beneficially more than 5 percent of our outstanding capital stock; (ii) each of the directors and named executive officers; and (iii) all current directors and executive officers as a group.

Name of Beneficial Owner

| | Number of

Shares

Beneficially Owned

(1)(2)

| | Percentage

Beneficially

Owned

| |

|---|

Elan Pharmaceutical Investments, Ltd.(3)

Flatt Smiths SL04

Bermuda | | 3,194,470 | | 23.0 | % |

Mazama Capital Management, Inc.(4)

One S.W. Columbia, Suite 1500

Portland, Oregon 97258 | | 1,621,600 | | 15.2 | % |

| Edward L. Flynn(5) | | 473,864 | | 4.4 | % |

| James C. O'Shea | | 354,686 | | 3.2 | % |

| Richard J. Plestina | | 116,250 | | 1.1 | % |

| Michael A. Temple | | 90,215 | | * | |

| J. Michael Redmond | | 89,960 | | * | |

| Richard R. Stout | | 73,182 | | * | |

| John Gandolfo | | 68,313 | | * | |

| John Ruedy, M.D.(6) | | 51,760 | | * | |

| Eric T. Herfindal(7) | | 42,250 | | * | |

| Grace Keeney Fey | | 29,700 | | * | |

| William A. Gouveia | | 22,250 | | * | |

| Sandra Panem, Ph.D. | | 17,250 | | * | |

| All Current Directors and Executive Officers as a Group (15 persons) | | 1,526,910 | | 13.2 | % |

- *

- Less than one percent.

- (1)

- Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and includes shares over which the indicated beneficial owner exercises voting and/or investment power. Shares of common stock subject to options currently exercisable or exercisable within 60 days of April 21, 2003 are deemed outstanding for computing the percentage ownership of the person holding the options but not deemed outstanding for computing the percentage of ownership of any other person. Except as indicated, and subject to community property laws where applicable, the persons named in the table above have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them.

2

- (2)

- Includes options currently exercisable or exercisable within 60 days after April 21, 2003 for shares of our common stock as follows:

Name

| | Shares Subject to Options

|

|---|

| Edward L. Flynn | | 17,250 |

| James C. O'Shea | | 332,102 |

| Richard J. Plestina | | 30,750 |

| Michael A. Temple | | 79,999 |

| J. Michael Redmond | | 73,817 |

| Richard R. Stout | | 63,902 |

| John Gandolfo | | 63,333 |

| John Ruedy, M.D. | | 34,250 |

| Eric T. Herfindal | | 30,750 |

| Grace Keeney Fey | | 26,000 |

| William A. Gouveia | | 18,750 |

| Sandra Panem, Ph.D. | | 12,750 |

| All Current Directors and Executive Officers as a Group | | 870,392 |

- (3)

- Includes warrants to purchase 505,334 shares of common stock, which are presently exercisable. Also includes 952,738 shares of Series A Convertible Preferred Stock, convertible into 1,905,476 shares of common stock, and 391,830 shares of Series C Convertible Preferred Stock, convertible into 783,660 shares of common stock, both of which are presently convertible.

- (4)

- Information provided as of July 8, 2002 in a Schedule 13G filed by the shareholder. Mazama Capital Management is an investment adviser and has sole voting power with respect to 1,064,400 shares and sole dispositive power with respect to 1,621,600 shares.

- (5)

- Includes 24,827 shares held by Mr. Flynn's spouse and 32,044 shares held in his profit sharing plan.

- (6)

- Includes 1,200 shares held by Dr. Ruedy's children.

- (7)

- Includes 8,000 held in a family trust.

EQUITY COMPENSATION PLAN INFORMATION

The following table summarizes equity securities authorized for issuance as of December 31, 2002.

Plan Category

| | Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights(a)

| | Weighted average

exercise price of

outstanding options,

warrants and rights(b)

| | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected

in column(a))(c)

|

|---|

| Equity compensation plans approved by shareholders(1) | | 2,341,624 | | $ | 6.45 | | 97,969 |

| Equity compensation plans not approved by shareholders(2) | | 78,000 | | $ | 5.90 | | 0 |

| | |

| |

| |

|

| | Total | | 2,419,624 | | $ | 6.43 | | 97,969 |

| | |

| |

| |

|

- (1)

- Represents 31,950 shares of common stock available for issuance under our 1992 Stock Incentive Plan and 66,019 shares of common stock available for purchase under our 2000 Employee Stock Purchase Plan. Under the terms of 1992 Stock Incentive Plan, a committee of the Board of Directors may authorize the sales of common stock, grant incentive stock options or nonstatutory stock options, and award stock bonuses and stock appreciation rights to eligible employees, officers

3

and directors and eligible non-employee agents, consultants, advisers and independent contractors of Bioject or any parent or subsidiary.

- (2)

- We have issued warrants to purchase an aggregate of 78,000 shares of common stock to various non-employee consultants. The warrants are fully exercisable and have grant dates ranging from February 1998 to May 2002, terms ranging from three years to five years and exercise prices ranging from $2.80 to $10.34.

CHANGE IN FISCAL YEAR

During 2002, we changed our fiscal year from a March 31 year end to a December 31 year end. Accordingly, information provided in this proxy statement for the current period is referred to as the nine-month transition period ended December 31, 2002.

PROPOSAL #1: ELECTION OF DIRECTORS

Our Amended and Restated Articles of Incorporation provide for the holders of our common stock to elect the Class Two members of the Board of Directors at the 2003 Annual Meeting. Directors hold office for three years or until their successors have been elected and qualified. The Board is divided into three classes. There are no family relationships between any of our directors or executive officers.

At this Annual Meeting, three persons will be nominated to serve as Class Two directors until the Annual Meeting in 2006 and until their successors are elected and duly qualified. The Class Two nominees are Ms. Grace Keeney Fey and Messrs. Eric T. Herfindal and Richard J. Plestina.

The presence in person or by proxy of holders of record of a majority of the outstanding common stock is required to constitute a quorum for the transaction of business at the Annual Meeting. If a quorum is present, the three nominees for election to the Board of Directors who receive the greatest number of votes cast at the Annual Meeting shall be elected directors. Votes may be cast for or withheld from each nominee. Abstentions from voting or non-voting by brokers will be counted for determining whether there is a quorum, but will have no effect on the outcome of the vote.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" THE CLASS TWO NOMINEES LISTED BELOW.

The Board of Directors is currently composed of eight members, one of whom is an employee of Bioject. The following table sets forth the names, ages and certain other information concerning our current directors.

Name

| | Class

| | Age

| | Position

| | Year

Elected

Director

| | Current

Term

Expires

|

|---|

| Edward L. Flynn | | 1 | | 68 | | Director(a)(c) | | 1999 | | 2005 |

| William A. Gouveia | | 1 | | 60 | | Director(b)(c) | | 1994 | | 2005 |

| Grace Keeney Fey | | 2 | | 56 | | Director(c)(d) | | 1995 | | 2003 |

| Eric T. Herfindal | | 2 | | 61 | | Director(a)(c) | | 1996 | | 2003 |

| Richard J. Plestina | | 2 | | 57 | | Director(a)(b)(d) | | 1997 | | 2003 |

| James C. O'Shea | | 3 | | 57 | | Chairman, Chief Executive Officer and President | | 1995 | | 2004 |

| Sandra Panem, Ph.D. | | 3 | | 56 | | Director(c)(d) | | 2001 | | 2004 |

| John Ruedy, M.D. | | 3 | | 71 | | Director(a)(b) | | 1987 | | 2004 |

- (a)

- Member of Compensation Committee

4

- (b)

- Member of Nominating Committee

- (c)

- Member of Audit Committee

- (d)

- Member of Ad Hoc-Financing Committee

Nominees for director to be elected by shareholders for a three-year term expiring in 2006

GRACE K. FEY, CFA, was elected as a director in October 1995. Grace Keeney Fey is an Executive Vice President and Director of Frontier Capital Management Company, a $4 billion investment management firm located in Boston, Massachusetts. Ms. Fey began her career at Alliance Capital Management in 1970, working as an assistant to two senior oil analysts. After leaving Alliance, she worked as an analyst and writer for Babson United, publisher of the United Business Review. In 1978 she joined Keystone Investment Management Corporation as a portfolio manager, working with both institutional and individual clients. From 1980 through 1988, Ms. Fey helped build two small, independent investment management firms in the Boston area. Her activities included portfolio management, equity and fixed income analysis, and marketing. In 1988 she joined Frontier Capital to spearhead the firm's efforts in the wealthy individual and endowment and foundation areas. She currently manages this division for Frontier. Local clients include Society of Jesus, New England, MSPCA, Raytheon, Boston College, Women's Educational and Industrial Union, Rutland Corner House, Visiting Nurses Association, Cooley Dickinson Hospital, Hampshire College, Hampshire Regional YMCA, Nashoba Community Hospital, First Church of Christ Scientist, Goddard Homestead. Other firm clients include Bowdoin College, National Wildlife Federation, Rockefeller Brothers Fund, Bristol Myers, and LL Bean.

Ms. Fey is a chartered Financial Analyst and she is a member of the Association for Investment Management and Research (AIMR) and the Boston Security Analysts Society. She is a member of the Investment Management Consultants Association (IMCA), and a member of the Social Investment Forum. Ms. Fey has been featured in Business Week, USA Today, The Wall Street Journal, Forbes, Wall Street Transcript and Financial Planning on Wall Street. She is a frequent guest on CNBC and CNN/FN. She teaches seminars on topics such as "Managing Money for Endowments and Foundations."

Ms. Fey currently serves as Chairman of the Board of Trustees of the University of Massachusetts, and serves on the Investment Committee of the University of Massachusetts Foundation. She is the Chairman of the Board of Directors of Zoo New England (Franklin Park and Stone Zoos). She is an Overseer of the Huntington Theatre, having chaired the Development Committee for several years and currently chairs the Investment Committee, and is director of The Commonwealth Institute and an overseer of the Boston Center for Adult Education and a Director of the Eric Carle Museum of Picture Book Art. Other public board experience includes Tucker Anthony where she served on the Finance Committee.

ERIC T. HERFINDAL has served as a director since September 1996. Since 2000, Mr. Herfindal has served as President and CEO of National Oncology Alliance, Inc., a company that provides business, clinical, technology and management services to community based oncology practices. From 1995 to 1999, he was Executive Vice President of OnCare Inc., an oncology physician practice management company. Prior to joining OnCare, he was Senior Vice President of Axion, an oncology focused healthcare company. He served for over 20 years as a Professor of Clinical Pharmacy, School of Pharmacy, at the University of California Medical Center in San Francisco, where he is currently a Professor Emeritus. He holds a Doctorate in Pharmacy from the University of California, San Francisco, and a Masters in Public Health from the University of California, Berkeley. He is the author of numerous articles in professional journals and is the editor of a number of books in the field of pharmacy and therapeutics, including the TEXTBOOK OF THERAPEUTICS: DRUG AND DISEASE MANAGEMENT, currently in its seventh edition. Dr. Herfindal has been active in various

5

professional organizations, serves on a number of editorial and advisory boards, and is a frequent lecturer at national and international healthcare meetings.

RICHARD J. PLESTINA was elected as a director in April 1997. Since 1986, Mr. Plestina has served as President of Quelah Corporation, NW, a family owned investment firm. In 1988, he was a consultant for Cologon, Inc. DBA Alpine Glass Company, a large commercial and residential glass company. From 1979 to 1986, he was an Executive Vice President of Orion Capital Corporation, a multi-line insurance company, and President of EBI Companies, which was acquired by Orion Corporation in 1979. From 1974 to 1979 he served as the Vice President and Marketing Manager of EBIC. Mr. Plestina has served previous directorships for Orion Capital Corporation, EBI Companies, Associated Oregon Industries and Northwest Employer's Council.

Directors whose terms expire in 2004

JAMES C. O'SHEA has served as our Chairman, President and Chief Executive Officer since March 1995. From January 1989 to March 1995, Mr. O'Shea was President and Chief Operating Officer of Biopure Corporation, a developer of red blood cell substitutes. Prior to 1989, Mr. O'Shea was Executive Vice President of Marketing and Scientific Affairs at Delmed Inc., a manufacturer of peritoneal dialysis solutions and parenteral products. He is a member of the Board of Directors of PSC, Inc., serving as Chairman of the Compensation Committee.

SANDRA PANEM, Ph.D. was elected as a director in 2001. Since 2000, Ms. Panem has been a partner in Cross Atlantic Partners, Inc., an investment company specializing in biotechnology and healthcare. From 1994 to 1999, Dr. Panem was President of Vector Fund Management, L.P., which focused on later-stage companies. Prior to this, Dr. Panem served as Vice President and Portfolio Manager for the Oppenheimer Global BioTech Fund, a mutual fund that invested in public and private biotechnology companies. Prior to joining Oppenheimer, Dr. Panem was a Vice President at Salomon Brothers Venture Capital, a fund focused on early and later-stage life sciences and technology investments. Dr. Panem serves on the boards of directors of Martek Biosciences, Inc. (MATK) and several private companies.

JOHN RUEDY, MDCM. FRCPC, LLD (hon) has served as a director since 1987. Dr. Ruedy, a physician specialist in internal medicine and clinical pharmacology, has served in a number of key academic positions including Chair of the Department of Pharmacology and Therapeutics, McGill University, Head of the Department of Medicine at St. Paul's Hospital, Vancouver, a teaching hospital of the University of British Columbia, and from 1992-1999 as Dean of the Faculty of Medicine, Dalhousie University. He currently serves as Vice President, Academic Affairs, Capital District Health Authority, Halifax, Nova Scotia, the major clinical teaching facility of the Faculty of Medicine, Dalhousie University. He has extensive experience in clinical trials of drugs and has served on a number of Canadian and international committees dealing with regulatory issues concerning new drugs and devices. He currently is Chairman of the Board of Person to Person Health Care, a tele-technology company based in Nova Scotia, Canada.

Directors whose terms expire in 2005

EDWARD L. FLYNN was elected as a director in September 1999. Since 1972, Mr. Flynn has been owner and Chief Executive Officer of Flynn Meyer Company, a restaurant industry management company. From 1958 to 1972, Mr. Flynn was a securities broker with Merrill Lynch Pierce Fenner and Smith. He serves as a member of the board of directors of Citri-Lite Co. Inc., a soft drink company, and of TGCI Industries, a geophysical service company primarily conducting three dimensional seismic surveys for companies engaged in oil and gas exploration.

WILLIAM A. GOUVEIA was elected as a director in January 1994. Mr. Gouveia has served as Director of Pharmacy at Boston's Tufts-New England Medical Center since 1972. He holds a faculty

6

appointment as Associate Professor of Medicine at Tufts University School of Medicine (1977), and serves on the faculty of the Massachusetts College of Pharmacy and Health Sciences, and at Northeastern University's Bouve College of Health Sciences. He holds an M.S. in Hospital Pharmacy from Northeastern University (1966). He has published over 100 articles in leading healthcare journals, as well as numerous book chapters, and has delivered presentations at U.S. and international health care organizations and colleges. He is a Fellow of the American Society of Health-System Pharmacists (ASHP) and has served as board member of the ASHP.

Director Compensation

We do not pay our directors an annual cash or per meeting compensation for services. Under the terms of our 1992 Stock Incentive Plan, each non-employee director is automatically awarded an option to purchase 3,500 shares of our common stock as a retainer immediately following the close of each annual shareholders' meeting, 1,000 shares for each board meeting attended (4,000 share maximum per calendar year) and 2,000 shares for service as a committee chair, at an exercise price equal to the fair market value on the date of the grant. Such options are vested and exercisable with respect to one-half of the shares at six months from the date of grant with the remaining shares vested and exercisable six months thereafter. The options expire eight years after grant unless previously exercised or terminated due to termination of service. The following table summarizes the options granted to each of the non-employee directors during the nine-month transition period ended December 31, 2002.

Name

| | Shares Covered by

Options Granted

| | Weighted Average

Exercise Price

|

|---|

| Grace Keeney Fey | | 4,500 | | $ | 2.13 |

| Edward L. Flynn | | 6,500 | | | 2.37 |

| William A. Gouveia | | 7,500 | | | 2.31 |

| Eric T. Herfindal | | 8,500 | | | 2.31 |

| Sandra Panem, Ph.D. | | 6,000 | | | 2.28 |

| Richard J. Plestina | | 8,500 | | | 2.31 |

| John Ruedy, M.D. | | 8,500 | | | 2.31 |

Meetings and Committees of the Board of Directors

There were five meetings of the Board of Directors during the nine-month transition period ended December 31, 2002. Each of the directors, except Ms. Fey, attended at least 75% of all of the meetings of the Board of Directors and committees on which they served.

There are four standing committees of the Board of Directors: the Audit Committee, the Compensation Committee, the Nominating Committee and the Ad Hoc-Financing Committee.

The Audit Committee meets with our independent auditors to review the scope and findings of our annual audit and our accounting policies and procedures, which are then reported by the committee to our full Board. The Audit Committee met four times during the nine-month transition period ended December 31, 2002. The members of the Audit Committee are Mss. Fey and Panem and Messrs. Flynn, Gouveia and Herfindal (committee chair).

The Compensation Committee administers our 1992 Stock Incentive Plan and cash compensation for the executive officers. The Compensation Committee met one time during the nine-month transition period ended December 31, 2002. The members of the Compensation Committee are Messrs. Flynn, Herfindal, Plestina and Ruedy (committee chair).

The Nominating Committee reviews and recommends to the full Board nominees for directors to be submitted for election at the next annual shareholders' meeting. While the Nominating Committee will consider nominees recommended by shareholders, it has not yet put in place a procedure for

7

considering such nominees. The Nominating Committee did not meet during the nine-month transition period ended December 31, 2002. The members of the Nominating Committee are Messrs. Gouveia (committee chair), Plestina and Ruedy.

The Ad Hoc Financing Committee monitors our cash reserves and develops strategies for procuring additional capital. The Ad Hoc Financing Committee did not meet during the nine-month transition period ended December 31, 2002. The members of the Ad Hoc Financing Committee are Mss. Fey and Panem and Mr. Plestina (committee chair).

Audit Committee Report

The Audit Committee of the Board of Directors reports to the Board and is comprised of five directors, all of whom meet independence requirements under current Nasdaq Stock Market corporate governance standards. The Audit Committee's activities are governed by a written charter, which was adopted by the Board in May 2000.

Management is responsible for Bioject's internal controls and the financial reporting process. The independent auditors are responsible for performing an independent audit of Bioject's consolidated financial statements in accordance with auditing standards generally accepted in the United States of America and for issuing a report thereon. The Audit Committee's responsibility is to monitor and oversee these processes.

In discharging its responsibilities, the Audit Committee and its individual members have met with management and Bioject's independent auditors, KPMG LLP, to review Bioject's accounting functions, the audited financial statements for the nine-month transition period ended December 31, 2002, and the audit process. The Audit Committee discussed and reviewed with its independent auditors all matters that the independent auditors were required to communicate and discuss with the Audit Committee under applicable auditing standards, including those described in Statement on Auditing Standards No. 61, as amended, regarding communications with audit committees. Audit Committee members also discussed and reviewed the results of the independent auditors' audit of the financial statements, the quality and adequacy of Bioject's internal controls in the context of a financial statement audit, and issues relating to auditor independence. The Audit Committee has obtained a formal written statement relating to independence consistent with Independence Standards Board Standard No. 1, "Independence Discussions with Audit Committees," and discussed with the auditors any relationships that may impact their objectivity and independence.

Based on its review and discussions with management and the independent auditors, the Audit Committee recommended to the Board that the audited financial statements be included in Bioject's Transition Report on Form 10-K for the nine-month transition period ended December 31, 2002, for filing with the United States Securities and Exchange Commission.

Submitted by the Audit Committee of the Board of Directors:

Grace Keeney Fey

Edward L. Flynn

William A. Gouveia

Eric T. Herfindal

Sandra Panem, Ph.D.

8

EXECUTIVE COMPENSATION AND OTHER TRANSACTIONS

The following individuals comprise our executive officers:

Name

| | Age

| | Position

| | Officer Since

|

|---|

James C. O'Shea |

|

57 |

|

Chairman, Chief Executive Officer and President |

|

1995 |

John Gandolfo |

|

42 |

|

Chief Financial Officer and Vice President, Finance |

|

2001 |

Michael A. Temple |

|

53 |

|

Executive Vice President and General Manager |

|

2001 |

Eric Mishkin, Ph.D. |

|

51 |

|

Senior Vice President and Chief Scientific Officer |

|

2002 |

Christopher Pugh |

|

35 |

|

Vice President, Business Development |

|

2002 |

J. Michael Redmond |

|

42 |

|

Senior Vice President, Business Development |

|

1996 |

Ricky Richardson |

|

41 |

|

Vice President, Product Development |

|

2002 |

Richard R. Stout, M. D. |

|

50 |

|

Vice President, Clinical Affairs |

|

1994 |

Biographical Information

JAMES C. O'SHEA. Please see biographical information in section "ELECTION OF DIRECTORS."

JOHN GANDOLFO joined Bioject in October 2001 as Chief Financial Officer and Vice President, Finance. Mr. Gandolfo has more than 15 years of experience as a chief financial officer of publicly held and private businesses with a primary focus in the medical sector. Prior to joining Bioject, Mr. Gandolfo was the Chief Financial Officer of Capital Access Network, Inc., a privately held specialty finance company, from September 2000 through September 2001 and Xceed, Inc., a publicly held Internet consulting firm, from November 1999 through September 2000. From April 1994 through November 1999, Mr. Gandolfo was Chief Financial Officer and Chief Operating Officer of Impath, Inc., a publicly-held, cancer-focused healthcare information company. Mr. Gandolfo's additional experience includes chief financial officer of Medical Resources, Inc. A graduate of Rutgers University, Mr. Gandolfo is a certified public accountant (inactive status) who began his professional career at Price Waterhouse.

MICHAEL A. TEMPLE joined Bioject as Executive Vice President and General Manager in August 2001. He had previously served as Bioject's Chief Financial Officer from April 1998 to August 1999. From August 1999 to August 2001, Mr. Temple was a founder and Chief Financial Officer of Upright Systems Inc., an Internet infrastructure company. Prior to joining Bioject as Chief Financial Officer in 1998, Mr. Temple served varying tenures as chief financial officer for three different companies, Instromedix Inc., a designer and manufacturer of transtelephonic cardiac event monitors, Graziano Produce Company and the Yoshida Group, a collection of operating businesses with activities in manufacturing, logistics and real estate development. Prior to joining the Yoshida Group in 1989, Mr. Temple was a principal in the accounting and business advisory services practice of Laventhol & Horvath, a national public accounting firm.

ERIC MISHKIN, Ph.D.joined Bioject as Senior Vice President and Chief Scientific Officer in June 2002. Dr. Mishkin has more than 15 years of experience in biomedical research and development

9

in academic and industrial settings with a primary focus in vaccine research and development. From August 1999 through May 2002, Dr. Mishkin was Director of Immunology Research of Wyeth-Ayerst Research, the biopharmaceutical division of American Home Products Company, where he led viral vaccine immunology discovery research efforts. Dr. Mishkin's additional healthcare experience includes Associate Director and Department Head of Viral Vaccine Immunology for Wyeth-Lederle Vaccines and Pediatrics from May 1995 through August 1999, Group Leader of Viral Vaccine Immunology Research for Lederle-Praxis Biologics from January 1992 through May 1995 and various research positions in the Department of Viral Vaccine Research and Development for Lederle-Praxis Biologicals from July 1987 through January 1992. Dr. Mishkin received his B.A. from Hofstra University and his M.S. and Ph.D. (1982, Parasitology) from the University of Connecticut. Dr Mishkin served as a Post-Doctoral Fellow and Research Faculty member in the Departments of Pharmacology/Toxicology and Microbiology/Immunology at The Medical College of Virginia, Virginia Commonwealth University, January 1, 1983 through June 1987.

CHRISTOPHER PUGH joined Bioject as Vice President of Business Development in May 2002. Mr. Pugh has over ten years experience in pharmaceuticals. From November 1998 to May 2002 he was Director of Business Development at Guilford Pharmaceuticals. Prior to this he worked for Merck & Co. and GlaxoSmithKline, both research-driven pharmaceutical companies, and P&G (Proctor & Gamble). He holds a Council of National Academic Awards MSc with theory at University of West England (Bristol) and research at University of Cambridge. He holds a joint (hons) undergraduate degree in Zoology & Psychology from University College Swansea.

J. MICHAEL REDMOND joined Bioject in February 1996 as Vice President of Sales and Marketing. He was appointed Vice President of Business Development in February 1998 and promoted to Senior Vice President of Business Development in March 2003. Mr. Redmond has over fifteen years experience in medical marketing and product sales. Prior to joining Bioject he was Director of Business Development and Director of Sales and Marketing for Kollsman Manufacturing Company, a private label developer and manufacturer of medical instrumentation. He also held various sales and marketing positions with Abbott Laboratories Diagnostic division.

RICKY RICHARDSON was promoted to Vice President of Product Development in June 2002. Mr. Richardson joined Bioject as a Senior Manufacturing Engineer in October 1994. From August 1996 to September 1999 he served as Manufacturing Manager. In September 1999 he was promoted to Vice President of Manufacturing. In October 2000, he was promoted to Vice President of Operations. From May 1991 to October 1994 he was employed as a Quality Engineer and Production Supervisor with Baxter Healthcare. From 1987 to April 1991, Mr. Richardson was a Manufacturing Supervisor at Texas Instruments. From 1984 to 1987 he was a Lieutenant, Field Artillery, with the U.S. Army. He holds a Bachelor's degree in engineering from the U.S. Military Academy, West Point, NY.

RICHARD R. STOUT, M.D.joined Bioject in April 1994 as Director of Clinical and Regulatory Affairs. He was promoted to Vice President of Clinical Affairs in December 1994. From 1992 to 1993 he was the Director of Clinical and Regulatory Affairs at EndoVascular Instruments, Inc., a developer of surgical devices and methods for endarterectomy and intraluminal graft placement. Dr. Stout acted as the Manager of Tachycardia Clinical Studies at Telectronics Pacing Systems, an international medical device company involved in manufacturing and distributing cardiac pacemakers and implantable defibrillators, from 1990 to 1992. From 1987 to 1989, Dr. Stout was Director of Medical Programs at Biotronic Inc., also a manufacturer and distributor of implantable cardiac pacemakers.

10

Executive Compensation

The following table sets forth the cash compensation paid by us to our Chief Executive Officer and to the four other most highly compensated executive officers having salary and bonus compensation greater than $100,000 in the nine-month transition period ended December 31, 2002 (collectively the "named executive officers"), for services rendered to during the nine-month transition period ended December 31, 2002 and the fiscal years ended March 31, 2002 and 2001.

SUMMARY COMPENSATION TABLE

| |

| | Annual Compensation

| | Long Term Compensation Awards

| |

|

|---|

Name and Principal

Position

| | Period or

Year

Ended

| | Salary

($)

| | Bonus

($)

| | Other Annual

Compensation

($)

| | Option

Shares

| | All Other

Compensation

($)(1)

|

|---|

James C. O'Shea

Chairman, Chief Executive Officer and President | | 12/31/02

03/31/02

03/31/01 | | $

| 254,439

294,945

242,000 | | $

| —

—

— | | $

| 9,276

8,747

8,043 | (2)

(2)

(2) | 51,000

200,000

70,000 | | $

| 74,858

6,005

5,874 |

John Gandolfo

Chief Financial Officer and Vice President Finance |

|

12/31/02

03/31/02

03/31/01 |

|

|

225,504

135,264

— |

|

|

—

100,000

— |

(3)

|

|

—

—

— |

|

84,000

190,000

— |

|

|

4,016

1,257

— |

J. Michael Redmond

Vice President of Business Development |

|

12/31/02

03/31/02

03/31/01 |

|

|

143,409

149,274

124,000 |

|

|

44,395

72,262

59,744 |

(4)

(4)

(4) |

|

6,000

6,000

6,000 |

(5)

(5)

(5) |

20,625

24,500

22,000 |

|

|

4,119

5,093

4,860 |

Michael A. Temple

Executive Vice President and General Manager |

|

12/31/02

03/31/02

03/31/01 |

|

|

146,684

114,699

— |

|

|

—

—

— |

|

|

—

—

— |

|

59,000

165,000

— |

|

|

4,039

1,461

— |

Christopher Pugh

Vice President of Business Development |

|

12/31/02

03/31/02

03/31/01 |

|

|

103,910

—

— |

|

|

38,500

—

— |

(6)

|

|

—

—

— |

|

50,000

—

— |

|

|

3,232

—

— |

- (1)

- For Mr. O'Shea, the 12/31/02 amount includes $72,075 related to the forgiveness of a loan and the related tax effects. All other amounts represent the value of Bioject common stock contributed to the officer's 401(k) account.

- (2)

- Represents supplemental life and disability insurance premiums paid pursuant to an employment agreement with Mr. O'Shea. No other executive officers are entitled to this benefit.

- (3)

- Represents a signing bonus upon accepting employment.

- (4)

- Represents commission and bonuses received in conjunction with results achieved through Mr. Redmond's business development efforts.

- (5)

- Represents an automobile allowance of $500 per month.

- (6)

- Represents a signing bonus of $13,750 and a bonus of $24,750 related to Mr. Pugh's business development efforts.

11

Grant of Stock Options

Shown below is information regarding grants of stock options pursuant to our 1992 Stock Incentive Plan during the nine-month transition period ended December 31, 2002 to the named executive officers.

OPTION GRANTS IN LAST FISCAL YEAR

Individual Grants

| | Potential

Realizable Value

At Assumed Annual

Rates of Stock Price

Appreciation for

Option Term(1)

|

|---|

Name

| | Number of

Securities

Underlying

Options

Granted(2)

| | % of Total

Options

Granted to

Employees in

Fiscal 2002

| | Exercise

Or Base

Price

($/Sh.)

| | Expiration

Date

| | 5% ($)

| | 10% ($)

|

|---|

| James C. O'Shea | | 51,000 | | 8.6 | % | $ | 2.08 | | 12/19/09 | | $ | 43,185 | | $ | 100,640 |

John Gandolfo |

|

50,000

34,000 |

|

8.4

5.7 |

|

|

2.10

2.08 |

|

10/14/09

12/19/09 |

|

|

42,746

28,790 |

|

|

99,615

67,093 |

J. Michael Redmond |

|

20,625 |

|

3.5 |

|

|

2.08 |

|

12/19/09 |

|

|

17,465 |

|

|

40,700 |

Michael A. Temple |

|

59,000 |

|

9.9 |

|

|

2.08 |

|

12/19/09 |

|

|

49,959 |

|

|

116,427 |

Christopher Pugh |

|

40,000

10,000 |

|

6.7

1.7 |

|

|

3.57

2.08 |

|

04/29/09

12/19/09 |

|

|

58,134

8,468 |

|

|

135,477

19,733 |

- (1)

- Potential realizable value is based on the assumption that the stock price of the common stock appreciates at the annual rate shown (compounded annually) from the date of grant until the end of the applicable option term. These numbers are calculated based on the requirements promulgated by the Securities and Exchange Commission and do not reflect our estimate of future stock price performance. The actual value, if any, which may be realized by any officer will vary based on exercise date and the market price of the related common stock when sold.

- (2)

- All of the options granted vest as to one-third of the total granted on each of the first through third anniversaries of the grant date.

12

Option Exercises and Fiscal Year End Values

Shown below is information with respect to options exercised during the nine-month transition period ended December 31, 2002 and unexercised options to purchase our common stock held by the named executive officers at December 31, 2002.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR END OPTION VALUES

Name

| | Shares

Acquired

On

Exercise

(#)

| | Value

Realized

($)

| | Number of

Securities

Underlying

Unexercised

Options

At FY-End(#)

Exercisable/Unexercisable

| | Value of

Unexercised

In-The-Money Options

At FY-End($)(1)

|

|---|

| James C. O'Shea | | — | | — | | 332,102 / 207,668 | | — / — |

John Gandolfo |

|

— |

|

— |

|

63,333 / 210,667 |

|

— / — |

J. Michael Redmond |

|

— |

|

— |

|

73,817 / 44,293 |

|

— / — |

Michael A. Temple |

|

— |

|

— |

|

54,999 / 169,001 |

|

— / — |

Christopher Pugh |

|

— |

|

— |

|

— / 50,000 |

|

— / — |

- (1)

- Based on the difference between the exercise price and the closing price of our common stock as quoted by the Nasdaq SmallCap Market on December 31, 2002 ($1.95). The actual value, if any, which may be realized by any officer will vary based on exercise date and the market price of the related common stock when sold.

Employment Contracts

In March 1995, we entered into an employment agreement with Mr. O'Shea to serve as Chairman, President and Chief Executive Officer. His salary, which was $345,000 per annum during the nine-month period ended December 31, 2002, is subject to annual adjustment by the Board of Directors and was increased to $358,000 per annum on January 1, 2003. He also receives annual payment of certain disability and life insurance policy premiums. His agreement continues until terminated. In the event he is terminated, he will receive his base salary for up to two years. If he becomes disabled, he will continue at 75% of his then current salary for not less than six months and at 50% of such salary for the successive six months. In the event of his death, his salary will continue for 60 days following the end of the month of his death. Under the agreement, he is permitted to participate in any profit sharing, deferred compensation or other programs. In addition, he is prohibited from competing with Bioject for three years following termination of his employment. Under the terms of this agreement, Mr. O'Shea is also entitled to receive 20,000 shares of our common stock when we first achieve two consecutive quarters of positive earnings per share.

In February 1996, we entered into an employment agreement with Mr. Redmond to serve as Vice President of Sales and Marketing. In February 1998, he was appointed Vice President of Business Development. His salary, $147,700 per annum during the nine-month period ended December 31, 2002, plus $500 per month car allowance, is subject to annual adjustment by the Board of Directors. Effective March 6, 2003 his salary increased to $210,000 per annum. Mr. Redmond's agreement continues until terminated. In the event he is terminated, he will receive his base salary for up to four months. In the event he is disabled, he will continue at 75% of his then current salary for not less than six months and then at 50% of such salary through the end of the current term. In the event of his death, his salary will continue for 60 days following the end of the month of his death. Under the agreement, he is

13

permitted to participate in any profit sharing, deferred compensation or other programs. In addition, he is prohibited from competing with Bioject for three years following termination of his employment.

In March 2002, we entered into an amended and restated employment agreement with Mr. Gandolfo to serve as our Chief Financial Officer and Vice President of Finance. Mr. Gandolfo's salary during the nine-month period ended December 31, 2002 was $316,437 per annum. Mr. Gandolfo's salary remains at $316,437 per annum for 2003. Mr. Gandolfo was awarded an option to purchase 150,000 shares of our common stock upon commencement of employment and received an option to purchase an additional 50,000 shares of our common stock on the first anniversary of his employment. Mr. Gandolfo's agreement has an initial term of two years, beginning October 15, 2001. Upon expiration of the initial term, the agreement will be automatically renewed for successive one-year terms unless either we or Mr. Gandolfo shall, upon three months written notice to the other, elect not to renew this agreement for any year. In the event Mr. Gandolfo is terminated, he will receive his salary and benefits for up to twelve months following the date of termination. In the event he is disabled, he will continue at 75% of his then current salary for not greater than six months and then at 50% of such salary for up to an additional six months. Health and dental insurance and other benefit coverage will continue for the duration of these payments, for a maximum time period not to exceed twelve (12) months. In the event of his death, his salary will continue for 60 days following the end of the month of his death. Under the agreement, Mr. Gandolfo is permitted to participate in any profit sharing, deferred compensation or other programs. In the event of a change in control, as defined by the agreement, and under certain other circumstances, Mr. Gandolfo's unvested options, if any, will immediately vest. Mr. Gandolfo is prohibited from competing with Bioject for two years following termination of his employment.

In March 2002, we entered into an amended and restated employment agreement with Mr. Temple to serve as our Executive Vice President and General Manager. Mr. Temple's salary during the nine-month period ended December 31, 2002 was $220,000 per annum. Mr. Temple's salary remains at $220,000 per annum for 2003. Mr. Temple was awarded an option to purchase 75,000 shares of our common stock upon commencement of employment. Mr. Temple's agreement has an initial term of two years, beginning August 6, 2001. Upon expiration of the initial term, the agreement will be automatically renewed for successive one-year terms unless either we or Mr. Temple shall, upon three months written notice to the other, elect not to renew this agreement for any year. In the event Mr. Temple is terminated, he will receive his salary and benefits for up to twelve months following the date of termination. In the event he is disabled, he will continue at 75% of his then current salary for not greater than six months and then at 50% of such salary for up to an additional six months. Health and dental insurance and other benefit coverage will continue for the duration of these payments, for a maximum time period not to exceed twelve (12) months. In the event of his death, his salary will continue for 60 days following the end of the month of his death. Under the agreement, Mr. Temple is permitted to participate in any profit sharing, deferred compensation or other programs. In the event of a change in control, as defined by the agreement, and under certain other circumstances, Mr. Temple's unvested options, if any, will immediately vest. Mr. Temple is prohibited from competing with Bioject for two years following termination of his employment.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our officers, directors and 10 percent shareholders to file reports of ownership and changes in ownership with the Securities and Exchange Commission (the "Commission"). Officers, directors and 10 percent shareholders are required by Commission regulations to furnish us with all Section 16(a) reports they file. Based solely on our review of the copies of such reports we received and written representations from our officers

14

and directors, we believe that all required reports were timely filed in the nine-month transition period ended December 31, 2002, except for the following:

- •

- Mr. Gandolfo, an executive officer, failed to timely file two Form 4s regarding the grant of stock options; and

- •

- Messrs. Flynn, Gouveia, Herfindal, Plestina, Ruedy, O'Shea, Stout, Redmond, Richardson and Pugh and Ms. Panem and Ms. Fey, all executive officers or directors, each failed to timely file one Form 4 regarding the grant of stock options.

REPORT OF COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

Bioject has maintained a philosophy of seeking to attract and retain a key group of experienced executives capable of successfully managing product development, manufacturing, marketing and sales, while providing strong financial management. Bioject provides a combination of annual cash compensation and stock option grants as incentive to increase long-term shareholder value.

To achieve Bioject's executive compensation objectives, the Compensation Committee adheres to several principles in structuring the compensation packages for the Chief Executive Officer and the other executive officers. Such principles include:

- •

- Compensation that is based on both company and individual performance;

- •

- Competitive compensation as determined by reviewing executive compensation levels at comparable companies;

- •

- Encouraging executive ownership through equity compensation components; and

- •

- Structuring compensation packages to attract and retain qualified executives with leadership skills and other key abilities required to meet our objectives and enhance shareholder value.

Bioject's executive compensation is composed of the following key elements:

Base Salary

This is an amount of annual cash compensation, which the Compensation Committee believes is necessary to attract and retain qualified executives and is administered on behalf of the Board of Directors by the Chief Executive Officer for all executive officers other than the CEO. In the nine-month transition period ended December 31, 2002, Bioject's Chief Executive Officer, Mr. O'Shea, was paid based on an annual salary of $345,000. Mr. O'Shea's current base salary is $358,000. As part of Mr. O'Shea's compensation package, the Board agreed to pay premiums on certain life and disability policies owned by Mr. O'Shea.

Long-Term Incentives

At present, Bioject's primary long-term incentive program is its 1992 Stock Incentive Plan, which is available to all employees, executive officers and non-employee consultants. The Compensation Committee of the Board of Directors grants all options to officers pursuant to the 1992 Stock Incentive Plan. Generally, upon joining Bioject, executive officers are granted options vesting over a three year period at current fair market value in amounts, which in the Compensation Committee's opinion, are consistent with their positions and responsibilities. In addition, based on individual annual performance and contribution to the long-term goals of Bioject, executive officers may receive additional stock option grants. The amount and terms of such options are discretionary and are determined by the Compensation Committee taking into account Bioject's and individual performance. These options vest over varying periods and are intended to focus all employees on achieving the long-term goals of Bioject and to directly reward them for corresponding increases in shareholder value.

15

Bioject also has the 2000 Employee Stock Purchase Plan (the "ESPP"), which is available to all full-time employees and executive officers. The ESPP allows for the purchase of shares of Bioject's common stock at a discount utilizing payroll deductions.

Bioject also has a 401(k) Retirement Benefit Plan for its employees, including its executive officers, which provides for voluntary employer matches of employee contributions up to 6% of salary and for discretionary profit sharing contributions to all employees. In the nine-month transition period ended December 31, 2002, the named executive officers received the following contributions under this plan:

Name

| | Number of Shares

| | Value of Shares

|

|---|

| James C. O'Shea | | 961 | | $ | 2,783 |

| John Gandolfo | | 1,861 | | | 4,016 |

| J. Michael Redmond | | 1,923 | | | 4,119 |

| Michael A. Temple | | 1,880 | | | 4,039 |

| Christopher Pugh | | 1,741 | | | 3,232 |

Other

Due to the availability of operating loss carryforwards, the Compensation Committee determined Mr. O'Shea's and the other executive officers' compensation packages without regard to the limitations of deductibility imposed by Internal Revenue Code Section 162(m).

Bioject is engaged in a highly competitive industry. In order to succeed, Bioject believes that it must be able to attract and retain qualified executives. The Compensation Committee and the full Board of Directors believes that the above described compensation structure will help Bioject achieve these objectives.

Compensation Committee:

Edward Flynn

Eric T. Herfindal

Richard J. Plestina

John Ruedy, M.D.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Executive compensation is administered by the Compensation Committee. The Compensation Committee is composed of Messrs. Flynn, Herfindal, Plestina and Ruedy. All members of the Compensation Committee are non-employee, outside directors. James O'Shea, our Chairman, President and Chief Executive Officer, while not a member of the Compensation Committee, participated in deliberations concerning executive officer compensation, but abstained from deliberations concerning his own compensation.

16

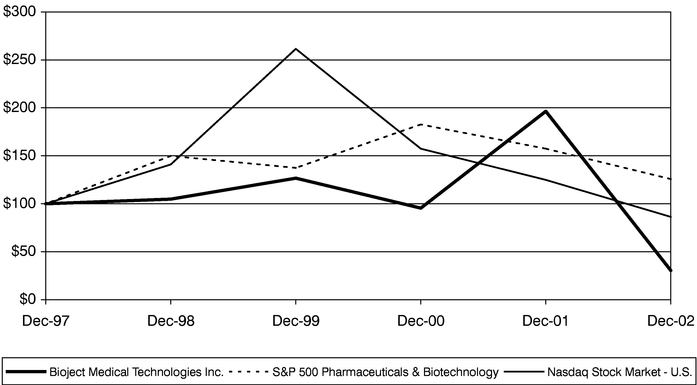

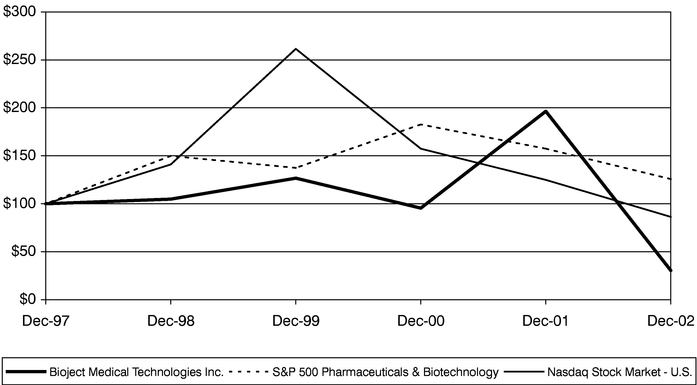

STOCK PERFORMANCE CHART

The following chart compares the yearly stock market (U.S.) percentage change in the cumulative total stockholder return on our common stock during the five fiscal years ended December 31, 2002 with the cumulative total return on the Nasdaq Stock Market (U.S.) Index and the S&P 500 Pharmaceutical and Biotechnology Index. The comparison assumes $100 was invested on December 31, 1997, in our common stock and in each of the foregoing indices and assumes reinvestment of dividends.

| |

| | Indexed Returns

Year Ending

|

|---|

Company/Index

| | Base

Period

12/31/97

|

|---|

| | 12/31/98

| | 12/31/99

| | 12/31/00

| | 12/31/01

| | 12/31/02

|

|---|

| Bioject | | $ | 100.00 | | $ | 104.84 | | $ | 126.68 | | $ | 95.48 | | $ | 196.41 | | $ | 30.42 |

| S&P 500 Pharmaceutical & Biotech Index | | | 100.00 | | | 149.87 | | | 137.43 | | | 182.68 | | | 157.43 | | | 125.77 |

| Nasdaq Stock Market—U.S. | | | 100.00 | | | 140.99 | | | 261.48 | | | 157.42 | | | 124.89 | | | 86.33 |

17

PROPOSAL #2: PROPOSAL TO AMEND THE 2000 EMPLOYEE STOCK PURCHASE PLAN

Our 2000 Employee Stock Purchase Plan (the "ESPP"), is intended to provide a convenient and practical means by which employees may participate in our stock ownership. The Board of Directors believes that the opportunity to acquire a proprietary interest in our success through the acquisition of shares of common stock pursuant to the ESPP is an important aspect of our ability to attract and retain highly qualified and motivated employees. As of March 31, 2003, out of the shares of common stock reserved for issuance under the ESPP, only 66,019 shares remained available for issuance. Accordingly, the Board has approved an amendment to the ESPP, subject to shareholder approval, to reserve an additional 300,000 shares for the ESPP and thus increase the total number of shares reserved for issuance under the ESPP from 150,000 to 450,000 shares.

Key provisions of the ESPP are described below. The complete text of the ESPP, marked to show the proposed amendment, is attached to this document asAppendix A.

Shares Reserved for ESPP

We have reserved a total of 150,000 shares for issuance under the ESPP. If this proposal to amend the ESPP is approved, the number of shares reserved for issuance under the ESPP will be increased to 450,000. The number of shares issuable under the ESPP is subject to adjustment in the event of stock dividends, reverse or forward stock splits, combinations of shares, recapitalizations or other changes in the outstanding common stock.

Eligibility

Except as described below, all of our full-time employees, as defined in the ESPP, and our participating subsidiaries are eligible to participate in the ESPP. Any employee who would, immediately after an offering, and after including the number of shares that could be purchased in that offering, own or could be considered to own five percent or more of the voting power or value of all classes of our stock, or any of our subsidiaries, will be ineligible to participate in that offering.

No option may permit the purchase of more than 10,000 shares, and no option may be granted under the ESPP that would allow an employee's right to purchase shares under all of our stock purchase plans and our subsidiaries' to which Section 423 of the Internal Revenue Code (the "Code") applies to accrue at a rate that exceeds $25,000 of the fair market value, as determined on the date of grant, for each calendar year that the option is outstanding.

ESPP Offerings

The ESPP is implemented by a series of overlapping two-year offerings, with a new offering commencing on May 15 and November 15 of each year. Accordingly, up to four separate offerings may be in process at any time. The first day of each offering is the "offering date" for that offering and each offering ends on the second anniversary of its offering date. Each offering is divided into four six-month purchase periods, one of which ends on each May 15 and November 15 during the term of the offering. The last day of each purchase period is a "purchase date" for the applicable offering. An employee may participate in only one offering at a time and may purchase shares only through payroll deductions permitted under the ESPP. Payroll deductions must be a whole percentage of not less than one percent nor more than 15 percent of a participant's gross amount of base pay plus commissions, if any.

Purchase Price

The price at which shares may be purchased on any purchase date in an offering will be the lower of (a) 85 percent of the fair market value of a share of common stock on the offering date of the

18

offering or (b) 85 percent of the fair market value of a share of common stock on the purchase date. The fair market value of a share of common stock on any date will be the closing price on the immediately preceding trading day as reported by the Nasdaq Small Cap Market or, if the common stock is not reported on the Nasdaq Small Cap Market, such other reported value of the common stock as may be specified by the Board of Directors.

Termination and Amendment

The ESPP will terminate when all of the shares reserved for purposes of the ESPP have been purchased, provided that the Board of Directors in its sole discretion may terminate the ESPP at any time. The Board may at any time amend the ESPP in any and all respects, provided that the Board may not, without shareholder approval, (i) increase the number of shares reserved for the ESPP, except for those adjustments authorized by the ESPP, or (ii) decrease the purchase price of shares offered pursuant to the ESPP.

Federal Income Tax Consequences

The ESPP is intended to qualify as an "employee stock purchase plan" within the meaning of Section 423 of the Code. Under the Code, employees will not recognize taxable income or gain with respect to shares purchased under the ESPP either at the offering date of, or at any purchase date in, an offering. If an employee disposes of shares purchased under the ESPP more than two years after the offering date and more than one year after the purchase date, or in the event of the employee's death at any time, the employee or the employee's estate generally will be required to report as ordinary compensation income for the taxable year of disposition or death an amount equal to the lesser of (1) the excess of the fair market value of the shares at the time of disposition or death over the applicable purchase price, or (2) 15 percent of the fair market value of the shares on the offering date. In the case of such a disposition or death, Bioject will not be entitled to any deduction from income. Any gain on the disposition in excess of the amount treated as ordinary compensation income generally will be capital gain.

If an employee disposes of shares purchased under the ESPP within two years after the offering date or within one year after the purchase date, the employee generally will be required to report the excess of the fair market value of the shares on the purchase date over the applicable purchase price as ordinary compensation income for the year of disposition. If the disposition is by sale, any difference between the fair market value of the shares on the purchase date and the disposition price generally will be capital gain or loss. In the event of a disposition within two years after the offering date or within one year after the purchase date, subject to certain limitations, such as the $1,000,000 cap on deductibility under Section 162(m) of the Code, Bioject generally will be entitled to a deduction from income in the year of such disposition equal to the amount the employee is required to report as ordinary compensation income.

Recommendation of the Board

The Board of Directors recommends the stockholders vote FOR the proposal to amend the ESPP as described above. Approval of the amendment to the ESPP by the shareholders will require that the votes cast in favor of the proposal at the Annual Meeting exceed the votes cast against the proposal. Accordingly, abstentions and broker non-votes will have no effect on the results of the vote.

19

PROPOSAL #3: PROPOSAL TO AMEND THE 1992 STOCK INCENTIVE PLAN

The Board of Directors believes that the availability of stock options and other stock-based incentives under our 1992 Stock Incentive Plan (the "Plan") is important to our ability to attract and retain experienced employees and to provide an incentive for them to exert their best efforts on our behalf. In 2001, the shareholders approved an increase in the number of shares of common stock reserved for issuance under the Plan to 2,700,000 shares. As of March 31, 2003, out of the 2,700,000 shares of common stock reserved for issuance under the Plan, only 21,030 shares remained available for grant.

The Board of Directors believes additional shares will be needed under the Plan to provide appropriate incentives to key employees. Accordingly, on March 13, 2003 the Board of Directors approved an amendment to the Plan, subject to shareholder approval, to reserve an additional 1,200,000 shares for the Plan, thereby increasing the total number of shares reserved for issuance under the Plan to 3,900,000 shares.

In addition, shareholder approval of this proposal will constitute re-approval of the per-employee limit on grants of options and stock appreciation rights under the Plan of 200,000 shares annually. This re-approval is required every five years for continued compliance with regulations under Section 162(m) of the Code. See "Tax Consequences."

The complete text of the Plan, marked to show the proposed amendment, is attached to this proxy statement as Appendix B. The following description of the Plan is a summary of certain provisions and is qualified in its entirety by reference to Appendix B.

Awards and Eligibility

The Plan provides for stock-based awards to (i) employees and officers of Bioject and our subsidiaries, (ii) selected non-employee agents, consultants, advisors and independent contractors of Bioject or any parent or subsidiary, and (iii) outside (non-employee) directors of Bioject. Awards which may be granted under the Plan include stock options, stock bonuses, stock appreciation rights, and specified sales of stock (collectively, "Awards"). The Compensation Committee of the Board of Directors (the "Committee") administers the Plan and determines the key employees and non-employee advisors who are to receive Awards under the Plan and the types, amounts, and terms of such Awards. The Committee currently consists of Mr. Flynn, Mr. Herfindal, Dr. Ruedy and Mr. Plestina. The Committee has delegated authority to Bioject's Chief Executive Officer to grant options to non-officer employees, provided that he may not grant options for more than 10,000 shares to any new employee and he may not grant options for more than 5,000 shares to any other employee in any calendar year. No Awards may be granted under the Plan on or after June 30, 2010.

At March 31, 2003, a total of 80 persons were eligible for Awards under the Plan, including each of our executive officers, 65 other employees, and each of our seven outside (non-employee) directors.

Purposes

The purpose of the Plan is to promote and advance the interests of Bioject and its shareholders by enabling us to attract, retain, and reward key employees, non-employee advisors and directors. The Plan is also intended to strengthen the commonality of interests between our shareholders and such employees, non-employee advisors and directors by offering equity-based incentive Awards to promote a proprietary interest in pursuing our long-term growth, profitability, and financial success.

Options

Options granted under the Plan may be either incentive stock options meeting the requirements of Section 422 of the Code or nonqualified options. The Committee or, in limited circumstances, Bioject's

20

Chief Executive Officer, determines the number of shares of common stock subject to options granted, the option price, the term of the option, the time or times at which the option may be exercised and whether an option is an incentive or nonqualified stock option. Incentive stock options, however, may be exercisable not more than ten years from the date of grant. The Plan does not limit the maximum term or amount of award for nonqualified options. The exercise price per share for options granted under the Plan generally must be at least 100 percent (for incentive stock options) or 75 percent (for nonqualified options) of the fair market value of a share of common stock on the date the option is granted. The purchase price for options may be paid in cash or, at the discretion of the Committee, in whole or in part in shares of common stock. In the event that the employment or service of the optionee with us or our parent or subsidiary corporation terminates for any reason other than for death or physical disability, vested options may be exercised at any time prior to the earlier of the expiration date of the option or (i) the expiration of one year after the date of such termination in the case of executive officers; (ii) the expiration of two years after the date of such termination in the case of outside directors and (iii) the expiration of 90 days after the date of such termination for all other optionees. In the event of termination of employment due to death or disability, the options may be exercised at any time prior to the earlier of the expiration date of the option or the expiration of one year after the date of such termination.

Stock Bonuses

The Committee may award shares under the Plan as stock bonuses. Shares awarded as a stock bonus shall be subject to such terms, conditions, and restrictions as shall be determined by the Committee, all of which shall be evidenced in a writing signed by the recipient prior to receiving the bonus shares.

Stock Sales

The Committee may issue shares under the Plan for such consideration (including promissory notes and services) as determined by the Committee, provided that in no event shall the consideration be less than 75 percent of the fair market value of the shares at the time of issuance. Shares so issued shall be subject to the terms, conditions and restrictions determined by the Committee. The restrictions may include restrictions concerning transferability, repurchase by us and forfeiture of the shares issued, together with such other restrictions as may be determined by the Committee.

Stock Appreciation Rights