Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

PLAB similar filings

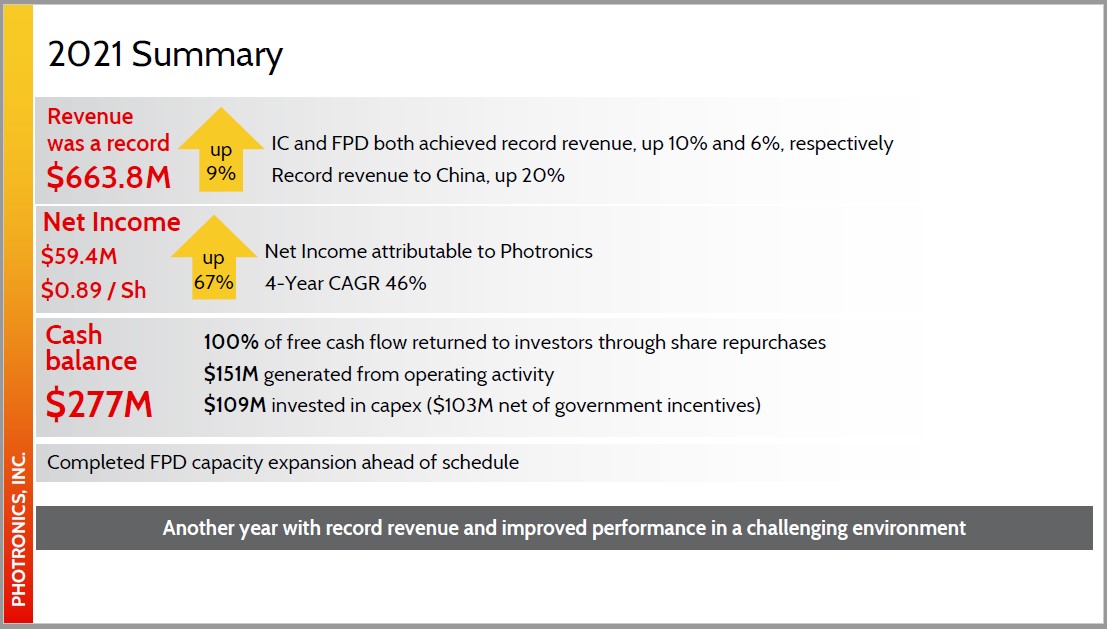

- 20 May 22 Departure of Directors or Certain Officers

- 14 Mar 22 Departure of Directors or Certain Officers

- 23 Feb 22 Photronics Reports First Quarter Fiscal 2022 Results

- 13 Jan 22 Regulation FD Disclosure

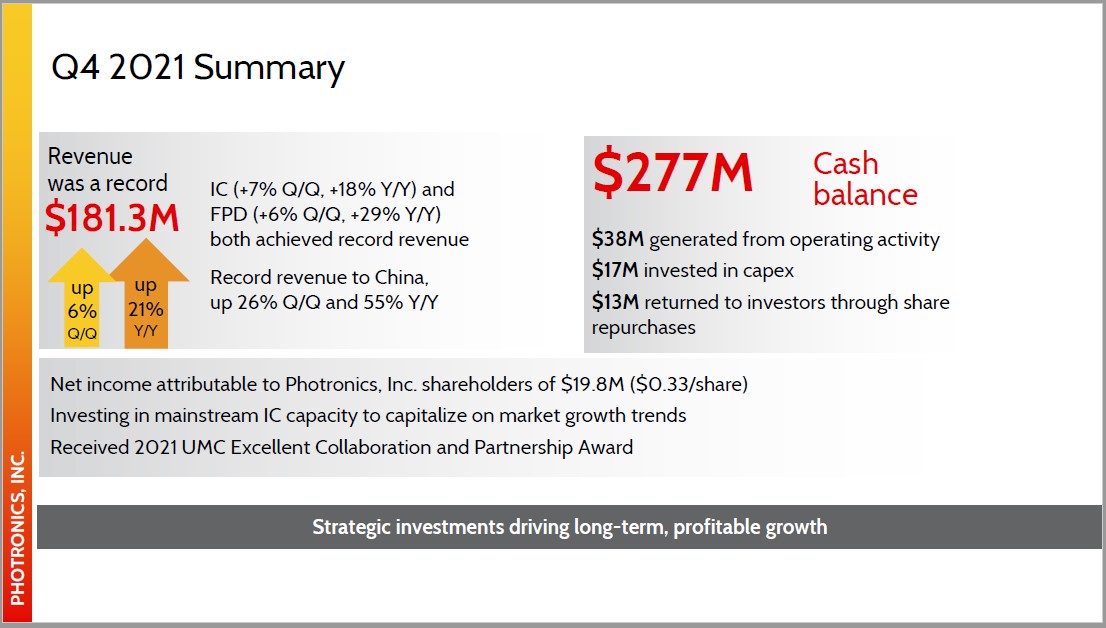

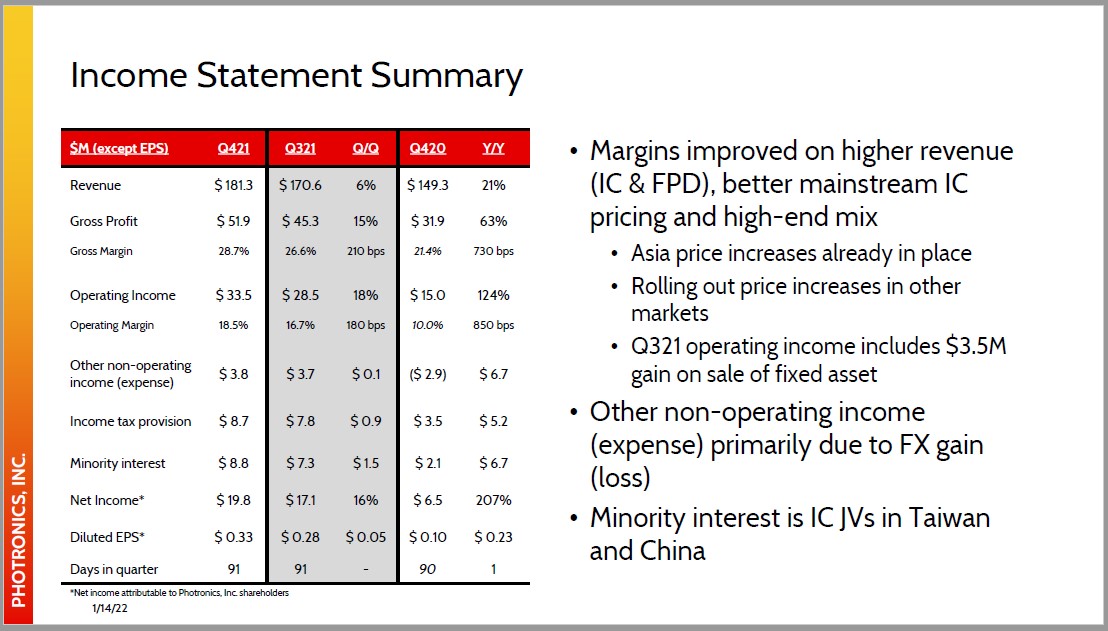

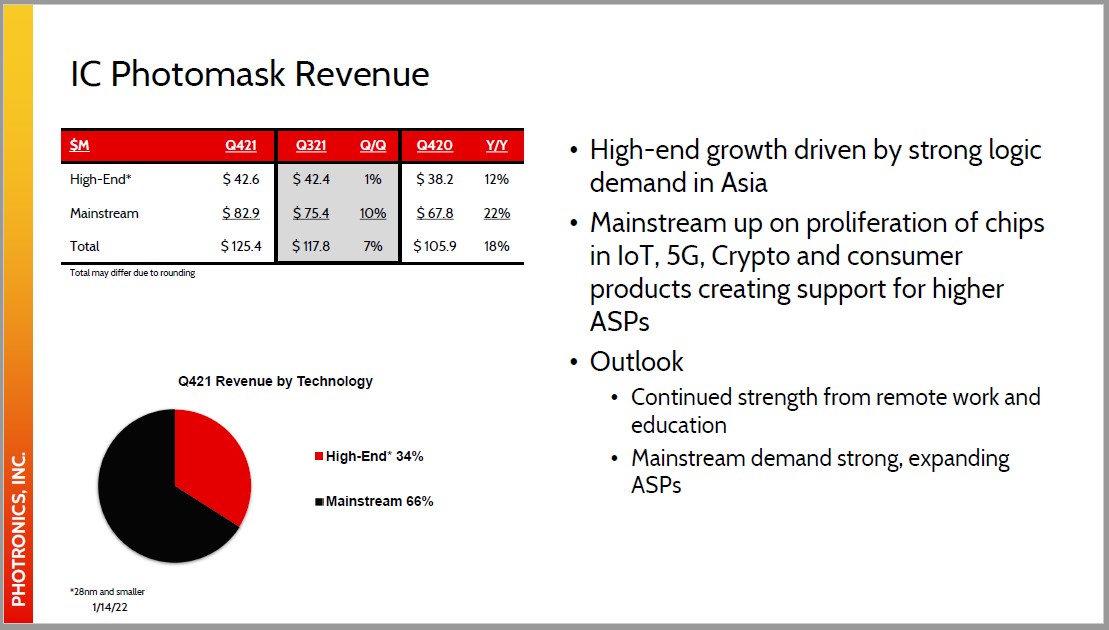

- 8 Dec 21 Photronics Reports Full Year and Fourth Quarter Fiscal 2021 Results

- 25 Aug 21 Photronics Reports Third Quarter Fiscal 2021 Results

- 26 May 21 Photronics Reports Second Quarter Fiscal 2021 Results

Filing view

External links