- PLAB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Photronics (PLAB) DEF 14ADefinitive proxy

Filed: 14 Feb 25, 4:41pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

Schedule 14A

(Rule 14a-101)

___________________

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant | ☒ | |

Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

☐ | Preliminary Proxy Statement | |

☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material Under Rule 14a-12 |

PHOTRONICS, INC.

(Name of Registrant as Specified In Its Charter)

_________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (check all boxes that apply):

☒ | No fee required. | |

☐ | Fee paid previously with preliminary materials. | |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

PHOTRONICS, INC.

15 Secor Road

Brookfield, Connecticut 06804

(203) 775-9000

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 2, 2025

TO THE SHAREHOLDERS OF PHOTRONICS, INC.:

Notice is hereby given that the annual meeting of the holders of common stock of Photronics, Inc. (the “Shareholders” or “you”) as of the record date specified herein will be held on Wednesday, April 2, 2025 at 8:30 am Eastern Time (the “Annual Meeting”). The Annual Meeting will be held in person at the offices of Photronics, Inc., 15 Secor Road, Building 1, Brookfield, CT 06804 and in live virtual format by means of remote communication at https://web.viewproxy.com/plab/2025. Shareholders will be allowed to participate in the meeting in person or virtually by voting their shares and submitting questions in person or electronically during the meeting. We have designed the format of the Annual Meeting to provide Shareholders attending virtually the same rights and opportunities to participate as they would have at an in-person meeting.

The live audio webcast of the Annual Meeting will begin promptly at 8:30 am Eastern Time. You should ensure that you have a strong internet connection to participate in the Annual Meeting, and you should allow plenty of time to log in to ensure that you can hear the streaming audio prior to the start of the Annual Meeting. To attend the meeting virtually, you must first register at https://web.viewproxy.com/plab/2025 by 11:59 p.m. Eastern Time on April 1, 2025. After registering, you will receive an e-mail containing a unique link and password that will enable you to attend the meeting and vote at the meeting and at any adjournment or postponement thereof.

Shareholders may submit questions for the Annual Meeting after logging in. If you wish to submit a question, you may do so by logging into the virtual meeting platform using your unique link and password, typing your question into the “Questions/Chat Panel” field, and clicking “Submit.” Please submit any questions before the start time of the meeting.

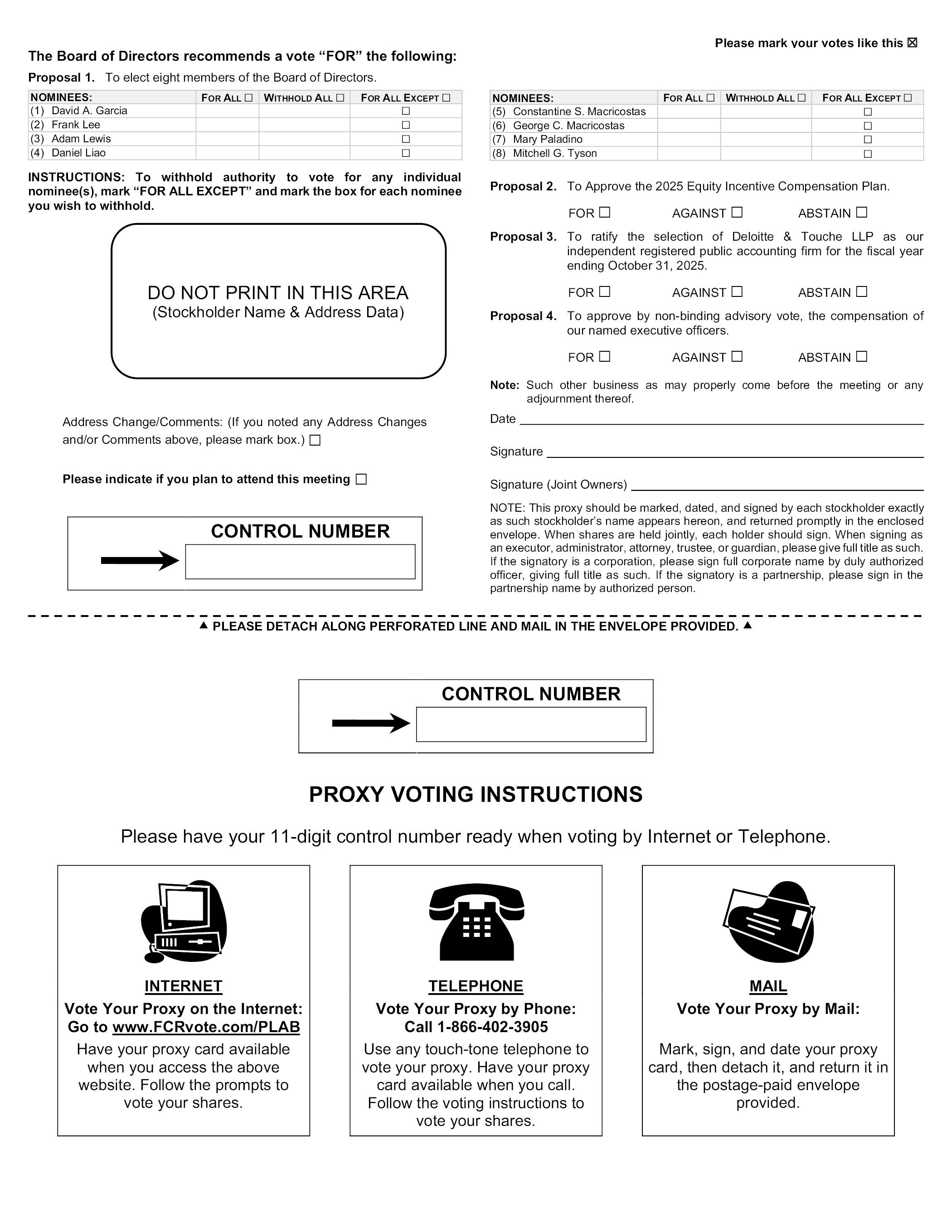

The Annual Meeting will be held for the following purposes:

1) To elect eight members of the Board of Directors;

2) To approve the 2025 Equity Incentive Compensation Plan;

3) To ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending October 31, 2025; and

4) To approve, by non-binding advisory vote, the compensation of our named executive officers.

The Shareholders will also act on any other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

The Board of Directors has fixed February 7, 2025, as the record date for determining the holders of common stock entitled to notice of and to vote at the meeting. A list of those Shareholders entitled to vote will be available for inspection by any of our Shareholders for any purpose germane to the Annual Meeting, during regular business hours at the principal executive offices of Photronics, Inc., for twenty (20) days prior to the Annual Meeting.

YOUR VOTE IS IMPORTANT. ALL SHAREHOLDERS ARE CORDIALLY INVITED TO PARTICIPATE IN THE MEETING IN PERSON OR VIRTUALLY. TO ENSURE YOUR REPRESENTATION AT THE MEETING, YOU ARE REQUESTED TO COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ENCLOSED ENVELOPE OR AUTHORIZE THE VOTING OF YOUR SHARES BY INTERNET OR TELEPHONE PRIOR TO THE DEADLINE SPECIFIED ON YOUR PROXY CARD. NO POSTAGE IS REQUIRED FOR MAILING IN THE UNITED STATES.

We thank you for your continued support.

By Order of the Board of Directors, | ||

/s/ Christopher J. Lutzo | ||

Christopher J. Lutzo | ||

Vice President, | ||

General Counsel and Secretary |

PHOTRONICS, INC.

15 Secor Road

Brookfield, Connecticut 06804

(203) 775-9000

PROXY STATEMENT

For the Annual Meeting of Shareholders to be held on April 2, 2025

GENERAL INFORMATION

The enclosed proxy is solicited by the Board of Directors (the “Board” or “Board of Directors”) of Photronics, Inc. (“Photronics”, the “Company”, “we”, “our” or “us”), to be voted at the Annual Meeting of the Shareholders or any adjournments or postponements thereof (the “Annual Meeting”) to be held on Wednesday, April 2, 2025, at 8:30 am Eastern Time. The Annual Meeting will be held in person at the offices of Photronics, Inc., 15 Secor Road, Building 1, Brookfield, CT 06804 and in live virtual format, by means of remote communication at https://web.viewproxy.com/plab/2025. Shareholders will be allowed to participate in the Annual Meeting virtually online, vote their shares electronically, and submit questions during the meeting. This proxy statement and the enclosed proxy card are being filed with the Securities and Exchange Commission (the “SEC”) on February 14, 2025, and on the same day, the Company will begin sending the proxy statement and proxy card to all Shareholders entitled to vote at the Annual Meeting. Our annual report on Form 10-K for the fiscal year ended October 31, 2024 (the “Annual Report”), as filed with the SEC, is also being sent to our Shareholders with this proxy statement.

The persons named as proxies on the accompanying proxy card have informed the Company of their intention, if no contrary instructions are given, to vote the shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”), represented by such proxies “FOR” each of the director nominees named herein in Proposal 1 and “FOR” Proposals 2, 3 and 4 and at their discretion on any other matters which may come before the Annual Meeting. The Board of Directors does not know of any business to be brought before the Annual Meeting other than as set forth in the Notice of Annual Meeting of Shareholders.

Any Shareholder who executes and delivers a proxy may revoke it at any time prior to its use. Such revocation would be effective upon: (a) receipt by the Secretary of the Company of written notice of such revocation; (b) receipt by the Secretary of the Company of a properly executed proxy bearing a later date; (c) appearance by the Shareholder at the Annual Meeting and voting (although attendance at the meeting will not by itself constitute a revocation of proxy); or (d) virtual appearance by the Shareholder at the Annual Meeting and voting (although virtual attendance at the meeting will not by itself constitute a revocation of proxy). Any such notice or proxy should be sent to Photronics, Inc., 15 Secor Road, Brookfield, Connecticut 06804, Attention: Secretary. Appearance at the Annual Meeting without a request to revoke a proxy will not revoke a previously executed and delivered proxy.

1

QUORUM; REQUIRED VOTES

Only Shareholders of record at the close of business on February 7, 2025, are entitled to notice of and to vote at the Annual Meeting. As of February 7, 2025, there were 63,560,209 shares of Common Stock issued and outstanding, each of which is entitled to one vote. At the Annual Meeting, the virtual presence of, or our receipt of proxies from, holders of a majority of the total number of shares of outstanding Common Stock will be necessary to constitute a quorum. Assuming a quorum is present, the matters to come before the Annual Meeting that are listed in the Notice of Annual Meeting of Shareholders require the following votes to be approved: Proposal 1 (Election of Directors) — a plurality of the votes cast by the Shareholders entitled to vote at the Annual Meeting is required to elect eight members of the Board of Directors subject to the Company’s policy that requires that any nominee who does not receive at least a majority of votes cast by Shareholders must tender their resignation; Proposal 2 (2025 Equity Incentive Compensation Plan) — a majority of the votes cast by the Shareholders entitled to vote at the Annual Meeting is required to approve the plan; Proposal 3 (Ratification of Selection of Independent Registered Public Accounting Firm for the Fiscal Year Ending October 31, 2025) — a majority of the votes cast by the Shareholders entitled to vote at the Annual Meeting is required to ratify the selection of Deloitte & Touche LLP; and Proposal 4 (Executive Compensation) — a majority of the votes cast by the Shareholders entitled to vote at the Annual Meeting is required to approve the non-binding advisory resolution approving the compensation of the Named Executive Officers (as defined herein), as described in the Compensation Discussion and Analysis, compensation tables and the narrative disclosure included in this proxy statement. The result of the advisory vote on Proposal 4 will neither be binding on the Company or the Board of Directors nor will it create or imply any change to our fiduciary duties or create or imply any additional fiduciary duties for the Company or the Board of Directors.

Shareholders who hold their shares through a broker (in “street name”), must provide specific instructions to their brokers as to how to vote their shares, in the manner prescribed by their broker. Pursuant to the rules that govern brokers and nominees who have record ownership of shares that are held in “street name” for account holders (who are the beneficial owners of the shares), brokers and nominees typically have the discretion to vote such shares on routine matters but not on non-routine matters. If a broker or nominee has not received voting instructions from an account holder and does not have discretionary authority to vote shares on a particular item because it is a non-routine matter, a “broker-non-vote” occurs. Under the rules governing brokers, an uncontested director election is considered a non-routine matter for which brokers do not have discretionary authority to vote shares held by an account holder. Additionally, as required by Section 957 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), advisory votes on executive compensation and on the frequency of such votes are also considered non-routine matters for which brokers do not have discretionary authority to vote shares held by account holders. Of the four proposals listed in the Notice of Annual Meeting of Shareholders only the ratification of the selection of our independent registered public accounting firm under Proposal 3 is considered a routine matter. Abstentions and broker non-votes will be considered as present but will not be considered as votes cast on any matter.

2

CORPORATE GOVERNANCE AND ETHICS

Photronics is committed to the values of effective corporate governance and high ethical standards. Our Board believes that these values are essential to running our business efficiently, to maintaining our integrity in the marketplace, long-term performance and to ensure that the Company is managed for the long-term benefit of its Shareholders. The Board recognizes that maintaining and ensuring good corporate governance is a continuous process. The Board periodically reevaluates our policies to ensure they meet the Company’s needs. Set forth below are a few of the corporate governance practices and policies that we have adopted:

• Related Party Transaction Policy. The Board’s audit committee (the “Audit Committee”) is responsible for approving or ratifying transactions involving the Company and related parties and determining if such transactions are, or are not, consistent with the best interests of the Company and our Shareholders.

• Code of Conduct Questionnaire. Every employee of the Company and its majority owned subsidiaries is required to complete the Code of Conduct Questionnaire on an annual basis in order to confirm the employee’s understanding of, and adherence to, the Company’s code of ethics and corporate governance policy (the “Code of Conduct”).

• Executive Sessions. The Board of Directors’ meetings regularly include executive sessions without the presence of management, including the Company’s chief executive officer (the “Chief Executive Officer” or the “CEO”).

The Common Stock is listed for trading on the NASDAQ Global Select Market (“NASDAQ”). The Photronics Board takes a thoughtful approach to its composition and is focused on maintaining a board that demonstrates a diversity of organizational and professional experience, education, skills, and other personal qualities that enable the Board to perform its duties in an effective manner. The Board currently contains one woman and two ethnically diverse individuals among its nine members. These gender and ethnically diverse members are included in the eight nominees for re-election.

3

BOARD OF DIRECTORS’ POLICIES, COMMITTEE CHARTERS, AND CODE OF ETHICS

The Board of Directors has responsibility for establishing broad corporate policies and reviewing overall performance rather than day-to-day operations of the Company. The Board’s primary responsibility is to oversee management and, in doing so, to serve the Company’s best interests and those of its Shareholders. Company management keeps the Board of Directors informed of Company activities through periodic updates when necessary, written reports and presentations at Board and Board committee meetings.

The Company has adopted a Code of Conduct to assist the Board and its committees in the exercise of their responsibilities. The Code of Conduct applies generally to the Board and the Company’s Named Executive Officers. Each of the Board committees has a written charter that sets forth the goals and responsibilities of the committee. The Company’s Code of Conduct and Board committee charters for each committee can be found on the Company’s website at wwww.photronics.com. Shareholders may also request a free copy of the Company’s Code of Conduct from: Photronics, Inc., 15 Secor Road, Brookfield, Connecticut 06804, Attention: General Counsel. We will disclose any amendments to, or waivers from, a provision of our code of ethics that applies to the principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions that relate to any element of the code of ethics as defined in Item 406 of Regulation S-K, by posting such information on our website.

The Board of Directors has assessed each of its eight nominees for director against the NASDAQ standards for independence and determined that Messrs. Garcia, Lewis, Liao, Tyson, and Ms. Paladino meet the requirements of an independent director as set forth by NASDAQ.

The number of directors on the Board is not permitted to be less than three or more than fifteen members under the Company’s bylaws. Currently, the Board has fixed the number of directors at nine. However, as disclosed on the Form 8-K Current Report filed on January 24, 2025, Mr. Walter Fiederowicz notified the Company of his decision not to stand for re-election at this year’s annual shareholder meeting. Accordingly, the Board will reduce the number of directors to eight and only eight directors are nominated for reelection. The Board is responsible for nominating members to the Board and for filling vacancies on the Board that may occur between annual meetings of Shareholders, in each case upon the recommendation of its nominating committee (the “Nominating Committee”). The Nominating Committee seeks input from other Board members and senior management and may engage a search firm to identify and evaluate potential candidates. The Board and each of the committees of the Board conduct annual self-assessments to determine their effectiveness. Additionally, each committee reviews the adequacy of its charter annually and considers any proposed changes.

4

BOARD LEADERSHIP STRUCTURE

Mr. Walter Fiederowicz has served as lead independent director (“Lead Independent Director”) since 2013 and has notified the Company of his intention not to stand for re-election at this year’s Annual Meeting. The Board has not appointed a new Lead Independent Director and may revisit the efficacy of a Lead Independent Director in the future. The Board believes the duties and responsibilities of the former Lead Independent Director are adequately fulfilled by other directors, including the current committee chairpersons. Each director remains free to communicate directly with the Chief Executive Officer, and Mr. George C. Macricostas, who was appointed Executive Chairman on January 6, 2025.

The Company has a retirement policy that stipulates each independent, non-employee director cannot be nominated for a term that begins after his or her 75th birthday. Our Board may waive this policy on a case-by-case basis if it deems a waiver to be in the best interests of the Company. The Board has waived this policy for Mr. Constantine S. Macricostas in the past upon approval of a majority of the Board because it believes that having Mr. Constantine S. Macricostas is in the best interests of our Company and our Shareholders. The appointment of Mr. George C. Macricostas (the son of Mr. Constantine S. Macricostas) to the position of Executive Chairman results in Mr. Constantine S. Macricostas no longer being considered independent, so such a waiver is no longer necessary.

The Board will continue to reexamine our corporate governance policies and leadership structure on an ongoing basis to ensure that such policies and leadership structure continue to meet the Company’s needs.

THE BOARD OF DIRECTORS’ ROLE IN RISK OVERSIGHT AND ASSESSMENT

The Company has a risk management program overseen by senior management and approved by the Board of Directors. The Board’s risk oversight processes build upon management’s regular risk assessment and mitigation processes, which include standardized reviews conducted with members of management across and throughout the Company in areas such as financial and management controls, strategic and operational planning, regulatory compliance, and environmental compliance. The results of these reviews are then discussed and analyzed at the most senior level of management, which assesses both the level of risk posed in these areas and the likelihood of their occurrence, coupled with planning for the mitigation of such risks and occurrences.

Risks are identified and prioritized by senior management and each prioritized risk is assigned to either a Board committee or the full Board for oversight. For example, strategic risks are overseen by the full Board; financial and business conduct risks are overseen by the Audit Committee or, depending on the nature of the risk and its potential severity, the full Board; risks associated with related party transactions are overseen by the Audit Committee; risks related to cyber security are overseen by the cyber security committee (the “Cyber Security Committee”); and compensation risks are overseen by the Board’s Compensation Committee (the “Compensation Committee”). Management regularly reports these and other various risks to the relevant Board committee or the Board. Additional review or reporting of risks is conducted as needed or as requested by the Board or relevant Board committee.

5

PLURALITY-PLUS VOTING FOR DIRECTORS

The Board of Directors has adopted a “plurality plus” voting standard for uncontested elections of directors.

EMPLOYEE, OFFICER AND DIRECTOR HEDGING

The Company has stock ownership guidelines, which are further described in the Compensation Discussion and Analysis section of this proxy statement. Further, as illustrated in the Ownership of Common Stock by Directors, Officers, and Certain Beneficial Owners Table, all directors and Named Executive Officers are beneficial owners of Common Stock and are in compliance with the ownership guidelines. In 2025, the Company amended its Insider Trading Policy to include the adoption of policies that prohibit employees (including officers) or directors of the Company, or any of their designees, to purchase financial instruments (prepaid variable forward contracts, equity swaps, collars, and exchange funds) or otherwise engage in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of the Company’s equity securities, without prior approval of the Company’s General Counsel.

INSIDER TRADING POLICIES AND PROCEDURES

We maintain insider trading policies and procedures governing the purchase, sale, and other dispositions of Company securities that are applicable to the Company itself, all of our directors, officers and employees of the Company and all members of their immediate families and households. Our insider trading policies and procedures are reasonably designed to promote compliance with insider trading laws, rules and regulations, and NASDAQ listing standards.

POLICIES WITH RESPECT TO TIMING OF STOCK-BASED AWARDS

AND EXERCISE PRICE OF STOCK OPTIONS

Annual awards of equity to executive officers are approved at the Compensation Committee’s regular December meeting, in order that full fiscal year performance may be considered, and the awards are granted at least two business days after the Company’s full year earnings have been released, to better align grant date value with the Shareholders’ experience. The Committee also grants equity awards at other dates to newly hired or promoted executives, and such awards are issued during the next open trading window after hire. Options must be granted at an exercise price that is at least equal to 100% of the fair market value of the Company’s common stock on the date of grant. Fair market value on a given day is defined as the closing market price on that day.

6

OWNERSHIP OF COMMON STOCK BY DIRECTORS, OFFICERS

AND CERTAIN BENEFICIAL OWNERS

The following table sets forth certain information on the beneficial ownership of the Company’s Common Stock as of February 7, 2025, by: (i) beneficial owners of more than five percent of the Common Stock; (ii) each director; (iii) each Named Executive Officer in the Summary Compensation Table set forth below; and (iv) all directors and currently employed Named Executive Officers of the Company as a group.

Amount and Nature of Beneficial | ||||||

Name and Address of Beneficial Owner(1) | Ownership(2) | Percentage of | ||||

Black Rock, Inc. | 10,419,641 | (3) | 16.4 | % | ||

Dimensional Fund Advisors | 4,769,232 | (4) | 7.5 | % | ||

Vanguard Group | 5,449,896 | (5) | 8.6 | % | ||

Officers and Directors |

|

| ||||

Walter M. Fiederowicz | 32,000 |

| * |

| ||

David A. Garcia | 0 |

| * |

| ||

Frank Lee | 562,100 | (6) | 1.0 | % | ||

Adam Lewis | 22,250 |

| * |

| ||

Daniel Liao | 60,000 |

| * |

| ||

Constantine S. Macricostas | 482,575 |

| * |

| ||

George C. Macricostas | 168,000 |

| * |

| ||

Mary Paladino | 69,000 |

| * |

| ||

H.K. Park | 118,000 |

| * |

| ||

Christopher J. Progler | 230,591 |

| * |

| ||

Eric Rivera | 102,774 | (6) | * |

| ||

Mitchell G. Tyson | 52,000 |

| * |

| ||

David Wang | 136,250 |

| * |

| ||

Richelle Burr | 188,854 | (7) | * |

| ||

John P. Jordan | 138,756 | (7) | * |

| ||

Directors and Current Named Executive Officers as a group (13 persons) | 2,049,919 | (8) | 3.2 | % | ||

____________

* Less than 1%

(1) The address for all officers and directors is 15 Secor Road, Brookfield, Connecticut 06804.

(2) Except as otherwise indicated, the named person has the sole voting and investment power with respect to the shares of Common Stock set forth opposite such person’s name.

(3) Based on Schedule 13G/A filed January 22, 2024.

(4) Based on Schedule 13G/A filed February 9, 2024.

(5) Based on Schedule 13G/A filed February 13, 2024.

(6) Includes shares of Common Stock underlying stock options exercisable as of February 7, 2025, (or within 60 days thereof), as follows: Dr. Lee: 83,000; and Mr. Rivera: 1,000.

(7) Information based on Company records and Form 144s and/or Form 4s filed by each former officer after their respective separation dates.

(8) Includes the shares of Common Stock underlying stock options listed in note (6) above; does not include former NEOs Richelle Burr and John P. Jordan.

7

PROPOSAL 1

ELECTION OF DIRECTORS

The Board has nominated eight directors to be elected at the 2025 Annual Meeting to serve for a one-year term. Each of the eight directors of the Company that is elected at the Annual Meeting will serve until the 2026 Annual Meeting of Shareholders (unless such director resigns or otherwise leaves the Board beforehand). Each nominee is currently a director of the Company and has agreed to serve if elected. The names of, and certain information with respect to, the nominees for election as directors are set forth below.

If, for any reason, any of the nominees shall become unable to stand for election, the individuals named in the enclosed proxy may exercise their discretion to vote for any substitutes chosen by the Board of Directors, unless the Board of Directors should decide to reduce the number of directors to be elected at the Annual Meeting. The Company has no reason to believe that any nominee will be unable to serve as a director.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE FOLLOWING NOMINEES:

Name and (Age) | Director Since | Position(s) with the Company | ||

David A. Garcia | 2024 | Director | ||

Dr. Frank Lee | 2022 | Director/Chief Executive Officer | ||

Adam Lewis | 2022 | Director | ||

Daniel Liao | 2020 | Director | ||

Constantine S. Macricostas | 1974 | Director | ||

George C. Macricostas | 2002 | Director/Executive Chairman | ||

Mary Paladino | 2019 | Director | ||

Mitchell G. Tyson | 2004 | Director |

Messrs. Garcia, Lewis, Liao, and Tyson and Ms. Paladino qualify as independent under applicable NASDAQ rules.

In addition to the information set forth in the table above, the following provides certain information about each nominee for election as director, including his or her principal occupation for at least the past five years. Also set forth below is a brief discussion of the specific experience, qualifications, attributes or skills that led to the conclusion that each nominee and director should serve as a director as of the date of this proxy statement.

Mr. David Garcia was appointed by the Board in 2024 and brings approximately 30 years of legal expertise, counseling both publicly and privately held companies on corporate governance and strategic transactions. Mr. Garcia has played a key role in structuring corporate partnerships, technology development agreements and distributing and licensing

8

agreements. After beginning his legal career in Silicon Valley, he practiced with Hale Lane in Reno, Nevada until its combination with Holland & Hart in July 2008, and with Holland & Hart for the remainder of his time in private practice before becoming a strategic advisor in March 2023. Mr. Garcia holds an A.B. in Sociology with a concentration in organizational behavior from Stanford University and a Juris Doctor from Harvard Law School. Mr. Garcia serves as Chairman of the Compensation Committee and a member of the Nominating Committee.

Dr. Frank Lee was promoted to Chief Executive Officer and elected to the Board of Directors in May 2022 due to his long and successful record of accomplishment. Prior to assuming the CEO position, he was appointed President in March 2022. Before joining Photronics in 2006, Dr. Lee was CEO of NSMC. His career also included roles at Fairchild Semiconductor, Intel and Soliconix. As Vice President of Operations at Texas Instruments-Acer (a TI/Acer joint venture) in Taiwan, Dr. Lee has also held leadership positions at TSMC-Acer and UMC — both in Taiwan. His ability to lead the organization through its next phase of growth is based on his proven track record in all the positions he has successfully held. Dr. Lee holds a BS in Nuclear Engineering from Tsinghua University and a M.S. and Ph.D. in Materials Science from the University of Cincinnati.

Mr. Adam Lewis has over 20 years of experience in investment banking, executive financial management and private equity. Mr. Lewis joined DH Capital, a division of Citizens Bank, in 2007 and has advised digital infrastructure companies and investors on over 100 transactions, representing over $40 billion in aggregate transaction value. Prior to joining DH Capital, Mr. Lewis was Vice President of Finance at InfoHighway Communications where he was involved in the structuring and execution of highly strategic transactions that culminated in the successful exit to Broadview Networks in 2007. Mr. Lewis is a graduate of the University of Vermont and currently serves on the boards of SilverSky, Verge, Stackpath, Drive Sally, Kasi Cloud and Lokker. Mr. Lewis serves as Chairman of the Nominating Committee and a member of the Audit Committee.

Mr. Daniel Liao is a Co-Founder of Eunodata Co., Ltd in Taiwan, an integrated data service provider for the semiconductor manufacturing industry. Mr. Liao served as Senior Advisor of Asia Pacific Regions for Lam Research Corporation (“Lam”), a leading semiconductor process equipment company, from March 2020 to February 2022, after his retirement from Lam in 2020. Mr. Liao joined Lam in 1993 and had served in a range of senior executive roles, including Chairman of Lam Asia Pacific Operations (Taiwan, China and Southeast Asia) from May 2017 to Feb 2020, President and General Manager of Lam Asia Pacific Operations from August 1993 to April 2017. During his career at Lam, he was a major contributor to the global product development, strategic planning, and growth of Lam’s Asia Pacific business. Prior to joining Lam, Mr. Liao held Engineering Management and Technology leadership positions at Integrated Device Technology in Santa Clara from 1988 to 1993, and Intel Corporation in Livermore and Santa Clara, CA from 1983 to 1988. Mr. Liao holds a Bachelor’s degree in Electrical Engineering from National Cheng Kung University in Taiwan and a Masters degree in Electrical Engineering and Applied Physics from Case Western Reserve University in Cleveland, Ohio. Mr. Liao became a member of Photronics Board of Directors in September 2020; and is currently a member of the board of directors of Amkor Technology. He is also a member of the International Corporate Board of WU Vienna University of Economics and Business. Mr. Liao serves as a member of the Compensation Committee and the Nominating Committee.

Mr. Constantine S. Macricostas is a member of the Board. Mr. Macricostas is also founder of the Company. Mr. Macricostas was Executive Chairman of the Company until January 20, 2018, and Chairman of the Board until January 6, 2025 upon the appointment of his son, Mr. George C. Macricostas, as Executive Chairman. Mr. Macricostas previously served as Chief Executive Officer of the Company on three different occasions from 1974 until August 1997, from February 2004 to June 2005, and from April 2009 until May 2015. Mr. Macricostas is also a former director of RagingWire Data Centers, Inc. As founder of the Company, Mr. Macricostas’ knowledge of the Company and its operations, as well as the industry, is invaluable to the Board of Directors in evaluating and directing the Company’s future. Through his long service to the Company and his vast experience in the photomask industry, he has developed extensive knowledge in the areas of leadership, safety, risk oversight, management, and corporate governance, each of which provides great value to the Board of Directors. Mr. Macricostas is the founder and director of The Macricostas Family Foundation, Inc., formed 2001, as a 501(c)(3) charitable organization. The foundation, administered by Mr. Constantine S. Macricostas, Ms. Marie C. Macricostas, Mr. George C. Macricostas, and Mr. Stephen Macricostas, provides grants and funding to educational, literary, and international institutions. Mr. Macricostas holds a Foundation board seat at Western Connecticut State University and is associated with the American School of Classical Studies at Athens. As an Overseer at the ASCSA’s Gennadius Library, Mr. Macricostas made possible the library’s Makriyiannis Wing. Mr. Macricostas is a member of the Company’s Cyber Security Committee.

9

Mr. George C. Macricostas has been a member of the Photronics Board since 2002, serving on the Nominating and Cybersecurity Committees, and most recently as Chairman of the Compensation Committee. He was appointed as Executive Chairman of the Company in January 2025. Previously, he was a senior vice president at Photronics, Inc., where he was responsible for all aspects of the company’s IT infrastructure. Mr. Macricostas is an investor and entrepreneur, and was a Founder, Chairman and CEO of RagingWire Data Centers, Inc., a provider of mission critical data center colocation facilities. Mr. Macricostas guided the company through an 80% sale to NTT of Japan in 2014 and completed the sale in 2018. Mr. Macricostas has over 30 years of technical and business management experience in business operations and information technology. From 2006, Mr. Macricostas has served as a director of the Jane Goodall Institute, a non-profit organization. Mr. Macricostas also serves as a Board Member of the Macricostas Family Foundation, a non-profit organization that funds philanthropic, educational and environmental causes. Mr. Macricostas brings industry, risk management, leadership and business experience to the Board. Mr. Macricostas is the son of Constantine S. Macricostas.

Ms. Mary Paladino is a certified public accountant with over thirty years of experience providing accounting, auditing, and advisory services to multi-national companies in a diverse range of industries. Ms. Paladino currently serves as the Executive Vice President and Chief Financial Officer for Quality Medical Management Services USA, LLC, a management service organization that provides non-clinical services to one of the largest specialty medical practices in the United States. Prior to her current position, Ms. Paladino was a partner and the audit and assurance practice leader for the White Plains, NY location of Citrin Cooperman, one of the nation’s largest professional services firms. Prior to joining this firm in 2008, Ms. Paladino held various leadership roles in the auditing group of Deloitte & Touche, LLP and BDO Seidman, LLP. Ms. Paladino’s broad experience in complex financial accounting and reporting matters, combined with her comprehensive understanding of effective corporate governance policies and internal control over financial reporting contribute to her service on the Board of Directors of the Company. Ms. Paladino is a member of the Audit Committee and the Compensation Committee.

Mr. Mitchell G. Tyson is an independent business strategy and clean energy consultant and serves on multiple industry, government, non-profit and private corporate boards of directors. He is a managing partner at the Clean Energy Venture Group, Venture Partner in the Clean EnergyVenture Fund, and co-founder and former chair of the Northeast Clean Energy Council. He also serves on a number of corporate boards and mentors numerous start-ups. Previously, Mr. Tyson served as the Chief Executive Officer of PRI Automation, a publicly traded corporation that supplied automation systems including hardware, software and services to the semiconductor industry. From 1987 to 2002, he held positions of increasing management responsibility and helped transform PRI Automation from a small robotics manufacturer to the world’s leading supplier of semiconductor fab automation systems. Prior to joining PRI Automation, Mr. Tyson worked at GCA Corporation from 1985 to 1987 as Director of Product Management and served as science advisor and legislative assistant to the late U.S. Senator Paul Tsongas from 1979 to 1985. Mr. Tyson is Chairman of the Cyber Security Committee and a member of the Audit Committee of the Company. Mr. Tyson brings leadership and extensive business experience as well as finance expertise to the Board.

In light of the decision by Mr. Walter M. Fiederowicz not to stand for re-election at this year’s Annual Meeting of Shareholders, the Board will elect a new Chairman of the Audit Committee at its regular meeting on April 2, 2025.

10

MEETINGS AND COMMITTEES OF THE BOARD

The Board of Directors met six (6) times during the 2024 fiscal year. During fiscal 2024, each director attended at least 75% of the meetings of the Board of Directors and committee meetings of the Board on which such director served.

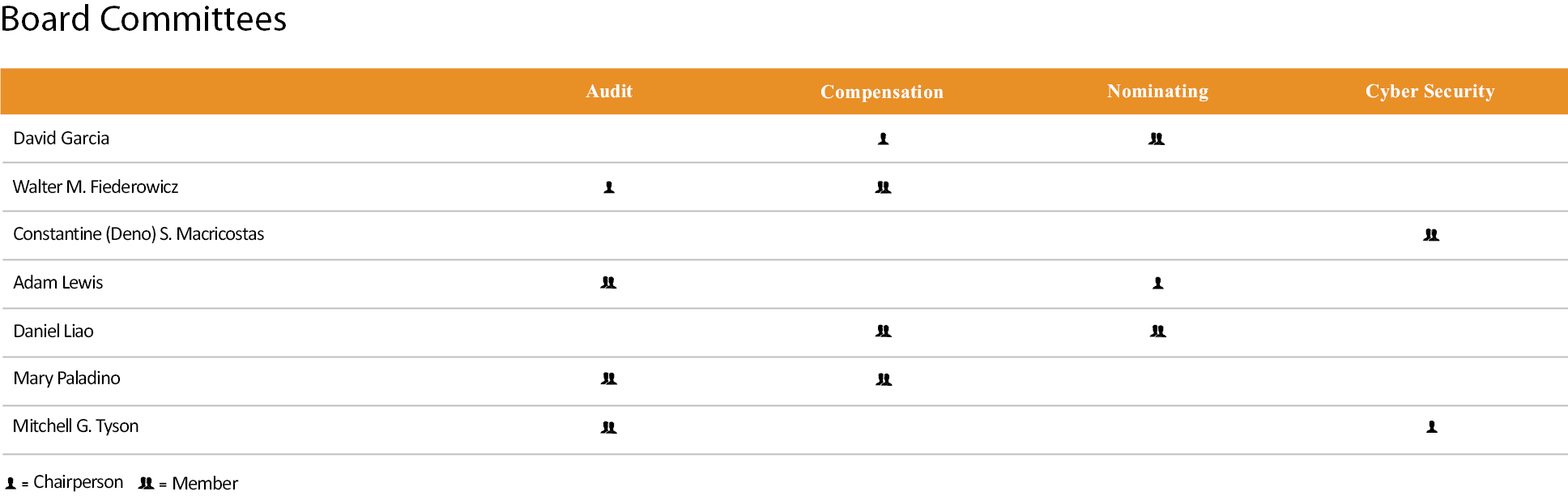

The Company’s Board of Directors has Audit, Compensation, Cyber Security and Nominating Committees. Members of the Audit, Compensation, and Nominating Committees are entirely comprised of independent, non-employee directors under applicable NASDAQ rules and Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The Audit Committee’s functions include the appointment of the Company’s independent registered public accounting firm, and then reviewing with such accountants the plan for and results of their auditing engagement as well as periodically assessing their independence. The Audit Committee pre-approves all audit and non-audit services provided to the Company. Messrs. Fiederowicz, Lewis, and Tyson and Ms. Paladino are the members of the Audit Committee. All members of this Committee are independent, non-employee directors under applicable NASDAQ rules and Rule 10A-3 under the Exchange Act. Mr. Lewis and Ms. Paladino qualify as audit committee financial experts as defined under Item 407 of Regulation S-K. The Audit Committee held eighteen (18) meetings during the 2024 fiscal year. Mr. Fiederowicz serves as Chairman of the Audit Committee. The Board will elect a new Chairman of the Audit Committee at its regular meeting scheduled for the afternoon of April 2, 2025.

The Compensation Committee’s functions include establishing the compensation levels for our executive officers and overseeing compensation policies and programs for the executive officers of the Company and administration of the Company’s equity and stock plans. This includes setting corporate goals and objectives relevant to compensation of our executive officers and evaluating performance against these goals and objectives. The Committee also reviews and makes recommendations to the Board with respect to director compensation. Members of management, including the Chairman of the Board, the Chief Executive Officer, and now the Executive Chairman, participate in Compensation Committee meetings when requested by the Committee to present and discuss the materials provided, including recommendations considered to be relative to executive pay and competitive market practices. These members of management assist the Committee in understanding the Company’s business plan and long-term strategic direction, developing the performance targets for our performance-based compensation and understanding the technical or regulatory considerations, as well as the motivational factors of the decisions that are intended to drive executive and company performance. Although the Committee solicits input and perspective from management, the ultimate decision on executive compensation is made solely by the Compensation Committee, and decisions regarding the Chief Executive Officer’s and Executive Chairman’s compensation are made by the Compensation Committee outside the presence of the Chief Executive Officer and Executive Chairman. Messrs. George C. Macricostas, Fiederowicz and Liao and Ms. Paladino were the members of the Compensation Committee through January 6, 2025, at which time Mr. George C. Macricostas was succeeded as Compensation Committee Chairman and member by Mr. David A. Garcia. All members of this Committee are independent, non-employee directors under applicable NASDAQ rules. The Compensation Committee held six (6) meetings during the 2024 fiscal year.

The Nominating Committee’s functions include the consideration and nomination of candidates for election to the Board. Messrs. Lewis, Liao and George C. Macricostas were members of the Nominating Committee during fiscal 2024 and until January 6, 2025, at which time Mr. Macricostas was succeeded by Mr. Garcia. All members of this Committee were independent, non-employee directors under applicable NASDAQ rules for fiscal 2024. This Committee held one (1) meeting during the 2024 fiscal year.

The Nominating Committee is committed to adding highly qualified candidates, who can also bring diverse experiences and perspectives to our Board. The minimum qualifications for nominees to be considered by the Nominating Committee are experience as a business or technology leader, the highest ethical standards, the ability to deliver value and leadership to the Company, and the ability to understand, in a comprehensive manner, the technology utilized by the Company and its customers for the production of semiconductors and flat panel displays. If an opening for a director arises, the Board will conduct a search for qualified candidates. The Nominating Committee utilizes its network of contacts to compile a list of potential candidates but may also engage, if it deems appropriate, a professional search firm. The Nominating Committee will also consider qualified candidates for director suggested by Shareholders in written submissions sent to Photronics, Inc., 15 Secor Road, Brookfield, Connecticut 06804, Attention: Secretary.

11

The Nominating Committee also recognizes that diversity of backgrounds, diverse skills and professional experience are important considerations for determination of the Board’s composition. In this regard, the Committee’s selection of a nominee also gives significant consideration to the backgrounds of the other directors, so that the Board of Directors as a whole has an appropriate mix of backgrounds, professional skills, and breadth of experience. The Nominating Committee reviews its effectiveness in balancing these considerations through its ongoing consideration of directors and nominees, as well as the Nominating Committee’s annual self-evaluation process. The Nominating Committee evaluates candidates in the same manner, whether the candidate was recommended by a Shareholder or not.

The Nominating Committee did not receive any director nominations from a Shareholder for the Annual Meeting.

The purpose of the Cyber Security Committee is to assist the Board and the Company’s management in fulfilling its oversight responsibilities to the Shareholders by reviewing and reporting on cybersecurity risks, protection, and mitigation. Messrs. Tyson and Constantine S. Macricostas are the members of the Cyber Security Committee, and Mr. Tyson is the Chairman. The Committee held one (1) meeting during the 2024 fiscal year.

General

The Board provides a process for Shareholders to send communications to the Board or to any director individually. Shareholders may send written communications to the Board or to any director c/o Photronics, Inc., 15 Secor Road, Brookfield, Connecticut 06804, Attention: Secretary. All communications will be compiled by the Secretary and submitted to the Board or the individual directors on a periodic basis.

It is the Company’s policy that the directors who stand for election at the Annual Meeting attend the Annual Meeting unless the director has an irreconcilable conflict and attendance has been excused by the remainder of the Board. All of the persons who were directors during the last fiscal year were in attendance at the 2024 Annual Meeting of Shareholders, and all current nominees are expected to be in attendance at the 2025 Annual Meeting.

12

AUDIT COMMITTEE REPORT

The Audit Committee consists of four directors, each of whom meets the independence requirements of NASDAQ and Rule 10A-3 under the Exchange Act. The Audit Committee operates under a written charter adopted by the Board of Directors of the Company. The Audit Committee met 18 times during the 2024 fiscal year. The Audit Committee also prepares a written self-performance evaluation of the Committee’s performance on an annual basis.

The Audit Committee relies on the expertise and knowledge of management, the internal auditor, and Deloitte & Touche LLP (the Company’s independent registered public accounting firm) in carrying out its oversight responsibilities. Company management is responsible for the Company’s internal controls and the financial reporting process. In carrying out its responsibilities for the fiscal year ended October 31, 2024, the Audit Committee, among other things:

• Reviewed and discussed the audited financial statements with the Company’s management and Deloitte & Touche LLP;

• Reviewed and discussed with Deloitte & Touche LLP matters required by the Public Company Accounting Oversight Board (“PCAOB”) and the SEC;

• Received and reviewed the written disclosures and the letter from Deloitte & Touche LLP required by the PCAOB and discussed with Deloitte & Touche LLP its independence from the Company and its management;

• Met with management periodically to review the Company’s Sarbanes-Oxley Section 404 compliance efforts related to internal control over financial reporting;

• Reviewed and discussed with management and Deloitte & Touche LLP management’s report on internal control over financial reporting and Deloitte & Touche LLP’s related opinions;

• Reviewed and discussed with management and Deloitte & Touche LLP the results of the internal review disclosed in the Company’s Form 8-K filed on June 12, 2024;

• Reviewed the policies and procedures for the engagement of Deloitte & Touche LLP, including the scope of the audit, audit fees, auditor independence matters, performance of the independent auditors, and the extent to which the independent registered public accounting firm may be retained to perform non-audit services; and

• Reviewed complaints and inquiries about accounting and auditing matters and violations of Company policy, if applicable.

Based on the foregoing meetings, reviews, and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements for fiscal year 2024 be included in the Company’s Annual Report on Form 10-K. Further, the Audit Committee has appointed Deloitte & Touche LLP as the Company’s independent registered public accounting firm for fiscal 2025 and is submitting such appointment to the Shareholders for ratification at the Annual Meeting.

This report is submitted by:

Walter M. Fiederowicz, Chairman

Adam Lewis

Mary Paladino

Mitchell G. Tyson

13

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FEES

For the fiscal years ended October 31, 2024 and October 31, 2023, the aggregate fees for professional services rendered by Deloitte & Touche LLP were as follows:

Fiscal 2024 | Fiscal 2023 | |||||

Audit Fees(a) | $ | 2,215,069 | $ | 1,973,521 | ||

Audit-Related Fees(b) | $ | 0 | $ | 0 | ||

Tax Fees(c) | $ | 43,125 | $ | 40,458 | ||

All Other Fees(d) | $ | 10,952 | $ | 11,425 | ||

Total | $ | 2,269,146 | $ | 2,025,404 | ||

____________

(a) Represents aggregate fees in connection with the audit of the Company’s annual financial statements, internal control over financial reporting, and review of the Company’s quarterly financial statements or services normally provided by Deloitte & Touche LLP.

(b) Represents assurance and other activities that are reasonably related to the audit of the Company’s financial statements.

(c) Represents aggregate fees in connection with tax compliance, tax advice and tax planning.

(d) Represents aggregate fees for professional services not included in the categories above, including services related to other permissible advisory services and regulatory reporting requirements, and other assurance services that are required by statute or regulation.

POLICY FOR APPROVAL OF AUDIT AND PERMITTED NON-AUDIT SERVICES

The Company maintains an auditor independence policy that, among other things, prohibits our independent registered public accounting firm from performing non-financial consulting services. This policy mandates that the Audit Committee approve in advance the audit and permissible non-audit services to be performed by the independent registered public accounting firm and the related budget, and that the Audit Committee be provided with routine reporting on actual spending. This policy also mandates that the Company may not enter into engagements with its independent registered accounting firm for non-audit services without the express pre-approval of the Audit Committee.

14

EXECUTIVE OFFICERS

The names of the executive officers of the Company are set forth below together with the positions held by each person in the Company. All such executive officers are appointed by the Board of Directors annually and serve until their successors are duly elected and qualified.

|

| Served as an | ||

Dr. Frank Lee, 72 | Chief Executive Officer | 2018 | ||

George C. Macricostas, 55 | Executive Chairman | 2025 | ||

H. K. Park, 56 | Senior Vice President | 2018 | ||

Dr. Christopher J. Progler, 61 | Executive Vice President | 2006 | ||

Eric Rivera, 48 | Executive Vice President | 2024 | ||

David Wang, 60 | Senior Vice President | 2024 |

Dr. Frank Lee was appointed Chief Executive Officer on May 16, 2022. Prior to his appointment as Chief Executive Officer, Dr. Lee was serving as President of our joint venture in Taiwan (formerly PSMC) since 2006. Prior to that he was CEO, NSMC, Ning-PO from 2004 to 2006 and was Fab Director and Senior Advisor for UMC, Hsin-Chu, Taiwan from 2001 to 2004 and, prior to that, he was Executive Vice President of Grace Semiconductor, Shanghai, China from 2000-2001.

George C. Macricostas was appointed Executive Chairman of the Company on January 6, 2025. He has been a Board member since 2002, serving on the Nominating and Cybersecurity Committees, and most recently as Chairman of the Compensation Committee. Previously, he was a senior vice president at Photronics, Inc., where he was responsible for all aspects of the company’s IT infrastructure

H.K. Park is currently Senior Vice President of Photronics, Inc. and General Manager of FPD Operations. Mr. Park joined Photronics in 2004. He has over twenty-five (25) years of experience in the semiconductor industry and was appointed Vice President of Photronics, Inc. and General Manager of China FPD Operations in 2018.

Dr. Christopher J. Progler became an executive officer on June 21, 2006. Dr. Progler was promoted to Executive Vice President in January 2020. Dr. Progler has been employed by Photronics since 2001 starting with the position of Corporate Chief Scientist. He was promoted to Vice President and Chief Technology Officer in 2004. In 2011, Dr. Progler assumed the added responsibility of Strategic Planning for the Company. His current work includes global R&D, product development and strategic ventures. Dr. Progler serves on the management boards of Asia-based photomask joint venture companies PDMC and PDMCX.

Eric Rivera was named Chief Financial Officer on May 23, 2024. Mr. Rivera previously held the role of Interim Chief Financial Officer since February 2024 and has served as Chief Accounting Officer since 2020. Mr. Rivera joined Photronics in 2016 as corporate controller. He is the Company’s Principal Financial Officer and Principal Accounting Officer and has 24 years of experience and held several positions in accounting and financial reporting prior to joining Photronics, including at IBM and Thomson Reuters. He holds a bachelor’s degree in accounting from Mercy University and is a certified public accountant.

David Wang joined PDMC (Photronics DNP Mask Corporation) in 1998. From 2000 to 2003, Mr. Wang served as the General Manager of Photronics Singapore, and from 2007 to 2010, he was the General Manager of Photronics Shanghai. David participated in the expansion of the Taichung plant in 2009, the merger with Dai Nippon Printing (DNP) in 2014, and the establishment and operational integration of Xiamen Photomask Corporation (PDMCX) in 2016. Taiwan Photomask and Xiamen Photomask are now the largest commercial semiconductor photomask manufacturing bases in the world. David graduated National United University in Taiwan, with a B.S. in Industrial Engineering and Management.

15

COMPENSATION DISCUSSION AND ANALYSIS

The Compensation Committee is responsible for setting and administering the policies governing compensation of our executive officers. The Compensation Committee reviews and approves, among other things, overall compensation, long-term and annual performance-based compensation for the Named Executive Officers (identified in the Summary Compensation Table) as well as certain other key employees. The purpose of this Compensation Discussion and Analysis is to provide material information about the Company’s compensation objectives and policies for its Named Executive Officers and to put into perspective the tabular disclosures and related narratives. The following report provides information about our compensation programs and policies and the outcomes and achievements that resulted in the determination of compensation to our Named Executive Officers. Specific fiscal 2024 compensation information for our Chief Executive Officer and the other Named Executive Officers will be outlined in a series of tables following this Compensation Discussion and Analysis.

Corporate Summary

Photronics is one of the world’s leading manufacturers of photomasks, which are high precision photographic quartz plates containing microscopic images of electronic circuits. Photomasks are a key element in the manufacture of semiconductors and flat panel displays (“FPD”) and are used as masters to transfer circuit patterns onto semiconductor wafers and flat panel substrates during the fabrication of integrated circuits (“IC”) and a variety of FPDs and, to a lesser extent, other types of electrical and optical components. The Company presently operates principally from eleven manufacturing facilities, two of which are located in Europe, three in Taiwan, one in Korea, two in China and three in the United States. Currently, research and development of photomask activities for ICs are focused on 14 nanometer node and below and, for FPDs, on AMOLED resolution enhancement (display device technology used in smart watches, mobile devices, laptops and televisions) and introduction of photomasks for Generation 10.5+ large glass substrates (3370 x 2940mm or greater).

In 2024, Photronics achieved slightly lower sales in both IC and FPD. IC revenue was driven by strong high-end sales, particularly in the US, while FPD was led by mainstream demand. Photomask demand trends were favorable as we ended the year and we are cautiously optimistic that these trends will continue into 2025, driven by megatrends such as AI, supply chain regionalization, and edge computing. For the year, overall revenue decreased $25.2 million from fiscal 2023, with IC revenue of $638.1 million, down $13.2 million or 2.0% from fiscal 2023 due to less demand for mainstream products earlier in the year which was partially offset by strong demand for high-end products. FPD revenue was $228.8 million, down $12.0 million or 5.0%, driven by a $6.5 million or 16.3% decrease in revenue from mainstream products due to a decrease in G8 products. Despite these challenges, the year concluded with substantial financial achievements, including $130.7 million in GAAP net income.

Compensation Philosophy

It is important that the Company be able to attract, motivate and retain highly talented individuals at all levels of the organization who are committed to the Company’s values and objectives. Accordingly, the Company’s compensation philosophy is based on rewarding the Company’s executives for their individual and collective efforts and contributions to the Company in a manner that fosters teamwork and leads to the long-term success of the Company. We feel this is in the best interest of our Shareholders. The Company also believes that delivering a substantial portion of such rewards in the form of restricted stock aligns the interests of the Company’s executives with the interests of its Shareholders. Our current design and structure of the Company’s executive compensation program have been consistent for several years and are designed to attract, motivate and retain talented employees by providing adequate incentives to achieve our business objectives while not encouraging excessively risky behavior.

16

We believe that our executive compensation program supports our business strategies and talent management objectives and is consistent with governance best practices that serve our Shareholders’ long-term interests. The following are some of the highlights of our program design and pay practices for our Named Executive Officers:

What We Do | What We Don’t Do | |

Maintain stock ownership guidelines to reinforce the alignment of executive officer and Shareholder interests | No guarantee of salary increases, bonuses, compensation or equity grants for our executive officers | |

Generally require four year vesting periods on equity awards | No non-statutory pension plans or other post-employment benefit plans | |

Evaluate the results from the most recent Shareholder advisory vote on executive compensation. |

Compensation Objectives

Consistent with the Company’s philosophy, the Company believes that executive compensation must be competitive with other comparable employers in order for qualified employees to be attracted to, and retained by, the Company and that the Company’s compensation practices should provide incentives for driving better business performance and increasing Shareholder value. Accordingly, the four primary objectives of the Company’s compensation program, as administered by the Compensation Committee are:

• to provide competitive compensation to attract, retain and motivate talented employees and foster teamwork as well as support the Company’s achievement of its financial and strategic goals;

• to advance the goals of the Company by aligning executives’ interests with Shareholder interests;

• to minimize risks associated with compensation; and

• to balance the incentives associated with the program in a way that provides incentives for executives to assess and manage risks associated with the Company’s business appropriately, in the context of the Company’s business strategy.

Elements of Compensation

The Compensation Committee uses three principal components to achieve the Company’s primary objectives: base salary, annual cash incentives and stock-based awards. The Company minimizes the perquisites available to its employees as a whole, including its executives.

The Compensation Committee believes the three principal components of the Company’s executive compensation result in a compensation program that is competitive and aligns the Named Executive Officers’ interests with Shareholder value creation.

Base Salary

Base salaries provide each executive with a fixed, minimum level of cash compensation. The Company believes it is important for retention, stability, and continuity of leadership that base salaries be competitive with the Company’s peers. Base salaries may be increased or decreased depending upon changes in duties or economic conditions.

Annual Cash Incentives

Annual cash incentives are used to promote the achievement of specific goals of the Company and are evaluated on an annual basis subject to discretion of the Compensation Committee.

Stock-Based Awards

Stock-based awards are the Company’s preferred approach to both align the interests of Shareholders with the executives, as well as enhance the Company’s retention goals. By virtue of the stock-based awards, the Named Executive Officers are Shareholders themselves and participate in any gains in value of the Common Stock.

17

Determination of Total Compensation

When determining total compensation, the Compensation Committee assesses five primary factors:

• the overall performance of the Company;

• the Named Executive Officer’s role in that performance;

• the compensation earned by the Named Executive Officer;

• the compensation of similarly situated executive officers working for peer group companies; and

• Shareholder feedback.

When linking the Company’s performance and the total compensation of the Named Executive Officers in fiscal 2024, the Compensation Committee used the performance measures provided under the 2011 Equity Incentive Compensation Plan (“2011 EICP”), as well as its subjective assessment of the performance of the Company and individual Named Executive Officer’s contributions.

The Compensation Committee meets with the Chief Executive Officer and formerly the Chief Administrative Officer, now the Executive Chairman, to obtain recommendations with respect to the Company’s compensation programs and practices for executives and other employees. The Compensation Committee takes management’s recommendations into consideration but is not bound by management’s recommendations with respect to executive compensation. When the Compensation Committee evaluates the role of each Named Executive Officer in the performance of the Company it considers both the recommendation and evaluation of such Named Executive Officer by the Chief Executive Officer and Executive Chairman (neither of which evaluate their own performance) and the Compensation Committee’s assessment of each Named Executive Officer’s leadership qualities, paying particular attention to the scope of his or her duties and the collaboration of such Named Executive Officer with other team members.

The Compensation Committee periodically reviews the Company’s approach to executive compensation in light of the general economic conditions in the semiconductor industry and the Company’s performance. The Compensation Committee also reviews the compensation practices of its peers and periodically, when appropriate, consults with outside advisors and annually reviews the Company’s pay practices and salary ranges. This review includes looking at peer data, such as grant summaries, past grants, executive analysis (e.g. base salary, stock, bonus, etc.), long-term incentives, world-wide salary increase projections, paid for data, and other publicly available data. After the close of fiscal 2024 the Compensation Committee retained Meridian Compensation Partners (“MCP”) as compensation consultants to prepare a market analysis comparing director compensation and executive salary data to published survey data and market peer group data. This market analysis was also utilized by the Compensation Committee after fiscal 2024 to set bonus compensation for 2024 and to adjust base salaries for 2025. In making this retention, the Compensation Committee conducted its independence assessment in accordance with applicable law and did not believe such services performed by MCP presented a conflict of interest. MCP evaluated the competitiveness of Photronics’ Board of Directors pay program against a renewed benchmarking peer group of 19 companies, and made recommendations intended to align the structural aspects of the Company’s director compensation program within peer and market best practice and also re-align total compensation to be within the range of such peer group. In addition, the Compensation Committee engaged MCP to conduct a benchmarking analysis of pay opportunities for the Company’s CEO and other Named Executive Officers, in order to assess the competitiveness of Photronics’ current compensation structure and levels. MPC was retained subsequent to the conclusion of fiscal 2024 and was not paid for any of these services during the 2024 fiscal year.

In establishing compensation levels for the Named Executive Officers for fiscal 2024, the Compensation Committee considered compensation at nineteen publicly traded companies in the semiconductor/electronics industries with similar levels of sales and market capitalization. These companies are shown on the chart below. Information regarding these companies and their compensation practices is drawn from their proxy statements. Generally, the Compensation

18

Committee believes that the compensation of its executive officers should be set near the median compensation of this comparison group; however, it is also important to the Compensation Committee that compensation reflect individual performance and the Company’s results which may warrant compensation above or below median.

Compensation Peer Group | ||

Advanced Energy Industries, Inc. | Allegro MicroSystems, Inc. | |

Alpha and Omega Semiconductor Limited | Axcelis Technologies, Inc. | |

Cirrus Logic, Inc. | Cohu, Inc. | |

Entegris, Inc. | FormFactor, Inc. | |

Ichor Holdings, Ltd. | Kulicke and Soffa Industries, Inc. | |

MACOM Technology Solutions Holdings, Inc. | Onto Innovation Inc. | |

OSI Systems, Inc. | Penguin Solutions, Inc. | |

Power Integrations, Inc. | Semtech Corporation | |

Silicon Laboratories Inc. | Ultra Clean Holdings, Inc. | |

Veeco Instruments Inc. | ||

In addition, when establishing its compensation policies for a given year, the Compensation Committee will evaluate the results from the most recent Shareholder advisory vote on compensation to consider the implications of such advisory vote for the compensation policies and determine whether changes are appropriate. At the 2024 Annual Shareholders Meeting, 83.95% of the votes cast with respect to the advisory vote on executive compensation were cast in favor of the executive compensation paid in fiscal 2023. In light of this vote, as well as the Compensation Committee’s review of the compensation arrangements discussed above, general market pay practices for its executives, and its assessments of individual and corporate performance, the Compensation Committee determined that no significant change in its executive compensation policies would be made. The Compensation Committee will consider the results from this year’s and future Shareholder advisory votes regarding future executive compensation decisions.

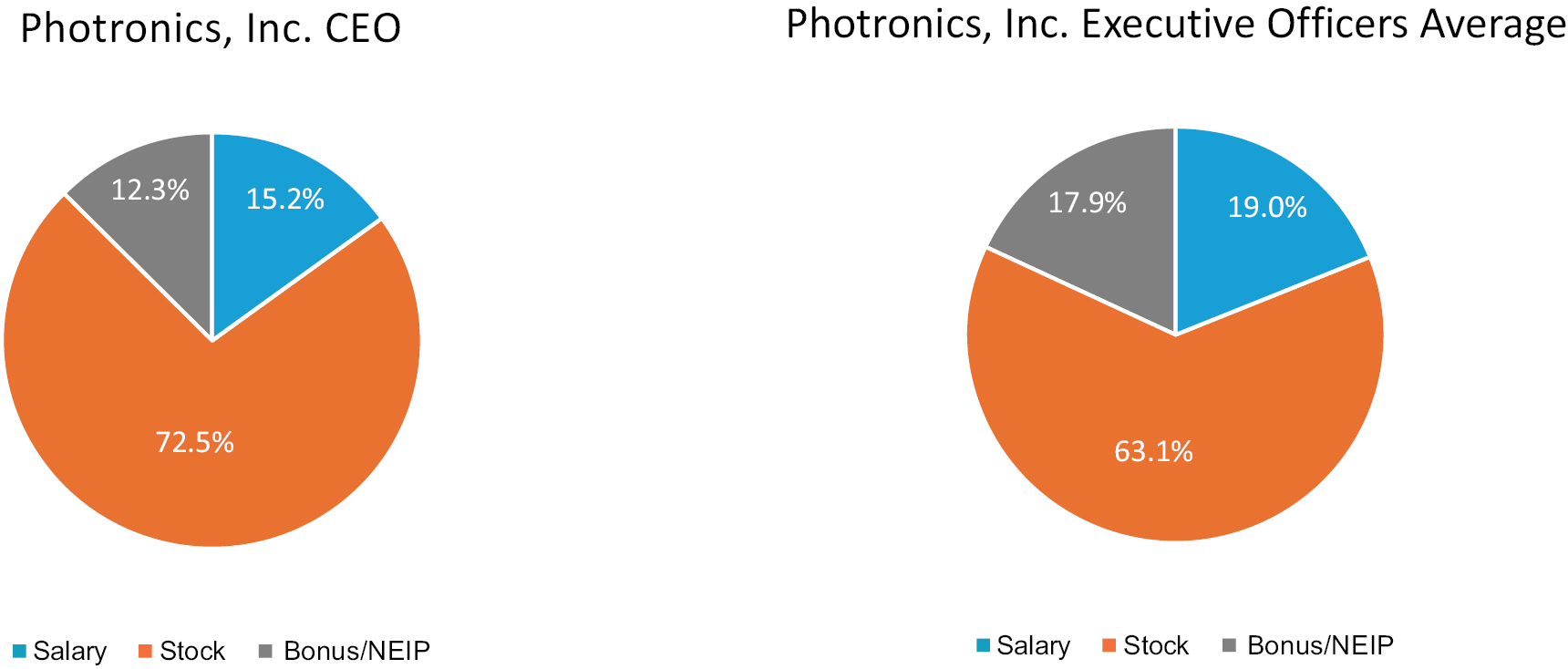

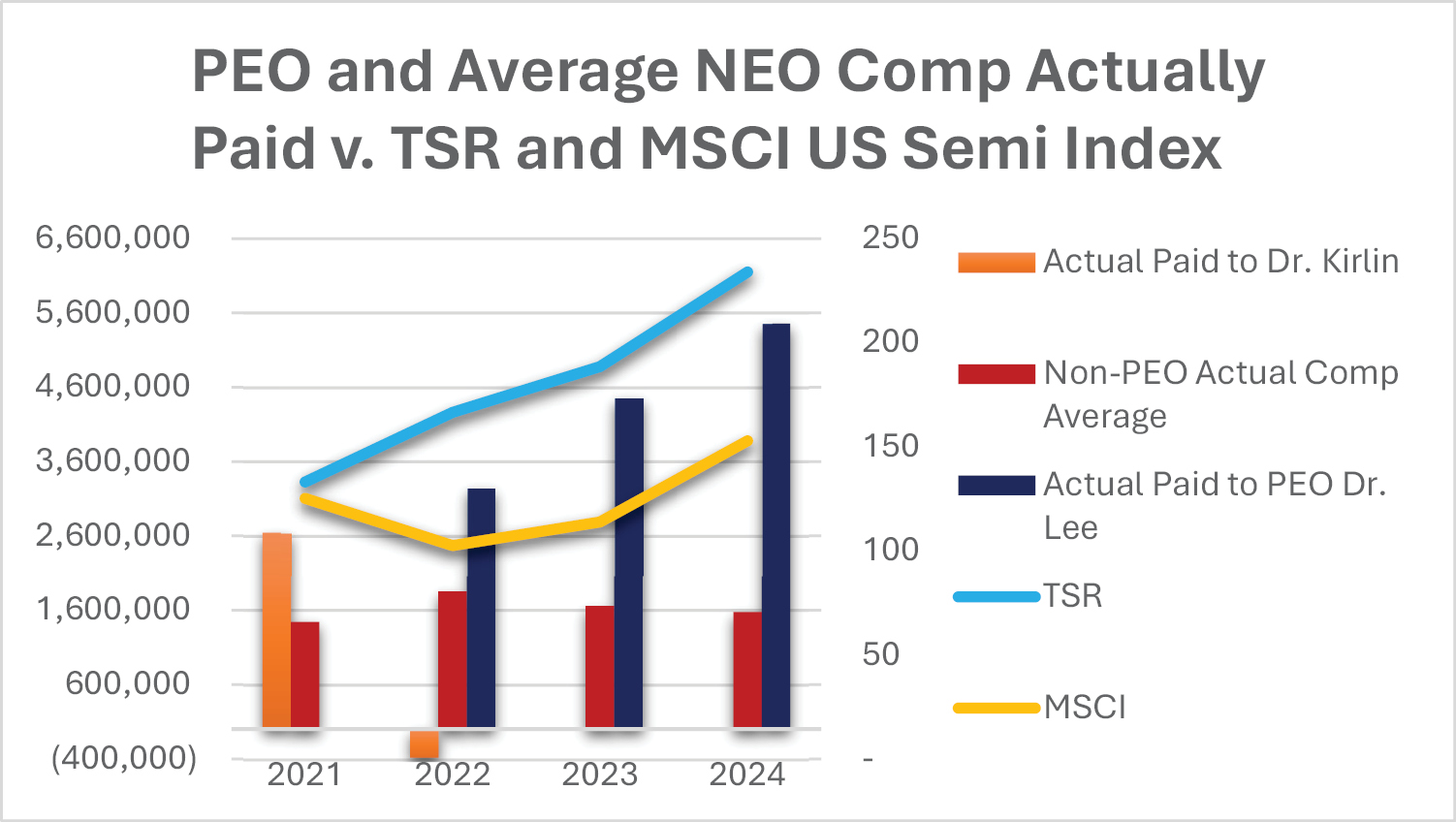

The charts below reflect Photronics information based on the 2024 compensation as set forth in our Summary Compensation Table. The Photronics Executive Officer Average reflects our Named Executive Officers as set forth in the Summary Compensation Table excluding the Chief Executive Officer. The amounts shown for stock are calculated based on the closing price of the common stock on the date of grant multiplied by the number of shares awarded in accordance with ASC No 718 and are derived from the information set forth in the Summary Compensation Table that follows this report. A majority of CEO and Named Executive Officer compensation is variable or at-risk through bonus and stock.

19

Compensation Awards in Fiscal 2024

Base Salary

The Compensation Committee evaluates and establishes base salary levels in light of economic conditions (generally and in the regions where executives work) and in comparison to other similarly situated companies. Base salary is designed to recognize an executive’s knowledge, experience level, skill, ability, level of responsibility, and ongoing performance. The Compensation Committee targets base salary for all executives to be at a level consistent with our assessment of their value relative to their peers in the labor market, while also taking into account our need to manage costs. Any recommendations for salary changes to any of the Named Executive Officers (other than the Chief Executive Officer) are made by the Chief Executive Officer and presented to the Compensation Committee for approval.

In fiscal 2024, Mr. Rivera received a 12.5% salary increase from $311,313 to $350,009 over fiscal 2023. For fiscal 2025, Mr. Rivera received a 36.6% salary increase from $350,009 to $425,261 over fiscal 2024. Eash increase was as a result of additional responsibility and alignment of salary to the role of Chief Financial Officer, and the fiscal 2025 increase was also based on the results of MCP’s benchmarking analysis. Dr. Lee and Dr. Progler received no salary increase for fiscal 2024 over fiscal 2023, and for fiscal 2025 over fiscal 2024, in order to maintain their respective salaries against the peer group baseline. In fiscal 2024 Mr. Park received a 2.2% salary increase from $319,800 to $327,117 over fiscal 2023. For fiscal 2025, Mr. Park received a 2.5% salary increase from $327,117 to $335,295 over fiscal 2024, consistent with the Company’s annual cost of living increase practices. In fiscal 2024 Mr. Wang received a 1.8% salary increase from $308,048 to $313,593 over fiscal 2023. For fiscal 2025, Mr. Wang received a 2.5% salary increase from $313,593 to $321,433 over fiscal 2024, consistent with the Company’s annual cost of living increase practices.

Ms. Burr retired as Chief Administrative Officer, General Counsel and Secretary on September 30, 2024.

Annual Cash Incentives

Our Named Executive Officers participated in an annual cash incentive program in fiscal 2024.

In January 2024, the Compensation Committee met and established criteria for bonus for the first quarter of fiscal 2024 as part of the annual cash incentive program. The Compensation Committee established that the Company would accrue bonus amounts on a percentage of operating income based on the performance of the Company after deduction of the bonus accrual. In February 2024, the Compensation Committee met and revised the objectives for the second, third and fourth quarter based on ranges of the operating income and gross margin. The Company exceeded the percentages for each quarter and accrued bonus amounts based on historical percentages that included the percentages established by the Compensation Committee with respect to operating income and gross margin but also allowed for discretionary bonuses as have been historically granted by the Compensation Committee. The criteria for gross margin and operating income are competitively sensitive and therefore in accordance with Instruction 4 to Item 402 of Regulations S-K are not disclosed, as disclosure would result in competitive harm to the company. The criteria chosen coordinates with our financial and strategic objectives and appropriately balances our short- and long-term goals. Our goals are designed to incentivize building a business with resilience and growth capability as well as long-term sustainable growth. We believe the goals are aggressive but achievable in the difficult and highly competitive industry in which we operate, and the criteria set are difficult to achieve.

The Compensation Committee met several times after the conclusion of fiscal 2024 and decided to award the bonuses detailed below to the Named Executive Officers based on the gross margin and operating income achieved by the Company. Furthermore, based on the fact that the Company generated acceptable results in the face of industry headwinds and achieved $131 million in GAAP net income the Compensation Committee awarded the following bonuses to the Named Executive Officers in December 2024. Based on the Company’s financial discipline and achievements for fiscal 2024, the Compensation Committee used its discretion to award bonuses to the Named Executive Officers as set forth below. The Compensation Committee noted that the 2011 Executive Incentive Compensation Plan (the “2011 EICP”) provided that bonuses could not exceed 65% of base salary. However, based on the individual performance

20

of certain Named Executive Officers, the Compensation Committee decided to grant the Named Executive Officers discretionary bonuses outside of the 2011 EICP. The amount of total bonuses awarded to the Named Executive Officers including the discretionary bonuses granted outside of the 2011 EICP in December 2024 were as follows:

Dr. Frank Lee | $ | 603,835 | |

Mr. H.K. Park | $ | 294,406 | |

Dr. Christopher J. Progler | $ | 222,903 | |

Mr. Eric Rivera | $ | 315,008 | |

Mr. David Wang | $ | 282,234 |

Ms. Burr and Mr. Jordan did not receive bonuses for fiscal 2024 as they were not employed by the Company at the conclusion of the fiscal year.

The Compensation Committee plans to establish goals for fiscal 2025 pursuant to the terms of the 2011 EICP related to gross margin and operating income. The targets for gross margin and operating income are competitively sensitive and therefore in accordance with Instruction 4 to Item 402 of Regulations S-K will not be disclosed, as disclosure would result in competitive harm to the company.

Stock-Based Awards

The Company’s long-term incentive program used restricted stock for fiscal 2024. The Company’s equity incentive plan described below allows for the grant of stock options and restricted stock awards to directors, executive officers of the Company, and other employees of the Company. The Compensation Committee believes that the grant of restricted stock awards provides a strong link between executive compensation and Shareholder return, aligning the long-term interests of its executives with those of the Shareholders and thereby promoting strategic planning while minimizing excessive risk.

For the purpose of aiding the Company and its subsidiaries in attracting, retaining, and motivating qualified personnel, the Company adopted a long-term equity incentive compensation plan (the “LTEIP”) in 2016. In fiscal 2023, the LTEIP was amended with Shareholder approval (the “Amended LTEIP”). The Company has proposed a new Equity Incentive Plan for 2025 (the “2025 Equity Incentive Plan”) to supersede and replace the Amended LTEIP, as disclosed in Proposal 2.

The Amended LTEIP is administered by the Compensation Committee. The Compensation Committee has the authority to determine, subject to the provisions of the Amended LTEIP, who will be granted awards, the terms and conditions of awards, and the number of shares subject to, or the cash amount payable with respect to, an award. The Compensation Committee may also make factual determinations in connection with the administration or interpretation of the Amended LTEIP. To the extent not prohibited by applicable laws, rules, and regulations, the Compensation Committee may also, from time to time, delegate some or all of its authority under the Amended LTEIP to a subcommittee or to other persons or groups of persons as it deems necessary, appropriate, or advisable. Additionally, subject to applicable laws, rules and regulations, any authority or responsibility that, under the terms of the Amended LTEIP may be exercised by the Compensation Committee, may alternatively be exercised by the Board of Directors of the Company.

Grants of equity awards under the Amended LTEIP are generally decided every November or December and awards are usually granted in January. Grants to Named Executive Officers under the Amended LTEIP are based on job responsibilities and the potential for individual contribution impacting the Company’s overall performance. When considering grants, the Compensation Committee exercises judgment and discretion, looking at each executive’s scope of responsibility and individual performance as well as the performance of the Company, and also considers previous stock award grants to align generally with its overall compensation philosophy. For example, the Compensation Committee may consider reducing grants in a particular year when a Named Executive Officer has large realizable gains from stock award grants in previous years. Other than inducement awards to new officers or other awards permitted to be granted outside of a Shareholder approved equity plan under NASDAQ rules, the Company makes all grants of restricted stock pursuant to the terms of the Amended LTEIP.

The annual stock grant is a collaborative process between the Compensation Committee and the Chief Executive Officer for determining the total pool of shares available for award. The Compensation Committee approves the total number of shares available for grant. The Chief Executive Officer then provides individual grant recommendations to

21