| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| FORM N-CSR |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| INVESTMENT COMPANIES |

| Investment Company Act file number 811-5021 |

| DREYFUS PREMIER SHORT INTERMEDIATE MUNICIPAL BOND FUND |

| (Exact name of Registrant as specified in charter) |

| c/o The Dreyfus Corporation |

| 200 Park Avenue |

| New York, New York 10166 |

| (Address of principal executive offices) (Zip code) |

| |

| Mark N. Jacobs, Esq. |

| 200 Park Avenue |

| New York, New York 10166 |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: (212) 922-6000 |

| Date of fiscal year end: | | 3/31 |

| Date of reporting period: | | 9/30/06 |

FORM N-CSR

Item 1. Reports to Stockholders.

| | Dreyfus Premier

Short-Intermediate

Municipal Bond Fund

|

SEMIANNUAL REPORT September 30, 2006

Save time. Save paper. View your next shareholder report online as soon as it's available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It's simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| | | Contents |

| |

| | | THE FUND |

| |

|

| 2 | | Letter from the Chairman |

| 3 | | Discussion of Fund Performance |

| 6 | | Understanding Your Fund's Expenses |

| 6 | | Comparing Your Fund's Expenses |

| | | With Those of Other Funds |

| 7 | | Statement of Investments |

| 18 | | Statement of Assets and Liabilities |

| 19 | | Statement of Operations |

| 20 | | Statement of Changes in Net Assets |

| 22 | | Financial Highlights |

| 24 | | Notes to Financial Statements |

| 30 | | Information About the Review and Approval |

| | | of the Fund's Management Agreement |

| | | FOR MORE INFORMATION |

| |

|

| | | Back Cover |

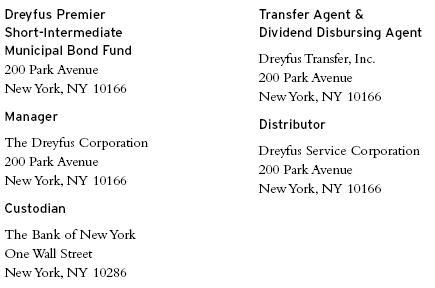

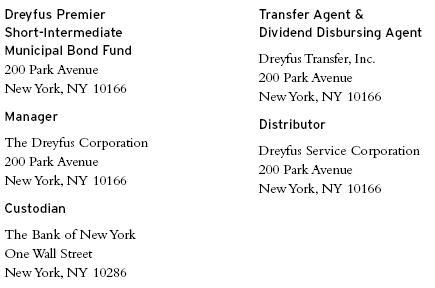

| | Dreyfus Premier

Short-Intermediate

Municipal Bond Fund

|

The Fund

LETTER FROM THE CHAIRMAN

Dear Shareholder:

We are pleased to present this semiannual report for Dreyfus Premier Short-Intermediate Municipal Bond Fund, covering the six-month period from April 1, 2006, through September 30, 2006.

After more than two years of steady and gradual increases, the Federal Reserve Board (the "Fed") held short-term interest rates unchanged at its meetings in August and September.The Fed has indicated that the U.S. economy has moved to a slower-growth phase of its cycle, as evidenced by softening housing markets in many regions of the United States.Yet, energy prices have moderated from record highs, calming fears that the economy may fall into a full-blown recession.

Most sectors of the U.S. fixed-income market rallied in anticipation of and in response to the pause in the Fed's tightening campaign, including municipal bonds. Investors apparently are optimistic that higher borrowing costs and moderating home values may wring current inflationary pressures from the economy. In addition, most states and municipalities have continued to report higher-than-expected tax receipts as a result of the recovering economy, helping to support the credit quality of many municipal bond issuers. As always, we encourage you to talk with your financial advisor about these and other developments to help ensure that your portfolio remains aligned with your current tax-managed needs and future investment goals.

For information about how the fund performed during the reporting period, as well as market perspectives, we have provided a Discussion of Fund Performance given by the fund's portfolio manager.

Thank you for your continued confidence and support.

Sincerely,

Stephen E. Canter

Chairman and Chief Executive Officer

The Dreyfus Corporation

October 16, 2006

|

2

DISCUSSION OF FUND PERFORMANCE

Monica S. Wieboldt, Senior Portfolio Manager

How did Dreyfus Premier Short-Intermediate Municipal Bond Fund perform relative to its benchmark?

For the six-month period ended September 30, 2006, the fund produced total returns of 1.38% for Class B shares and 1.85% for Class D shares.1 In comparison, the Lehman Brothers 3-Year Municipal Bond Index (the "Index"), the fund's benchmark, provided a total return of 2.28% for the reporting period.2 In addition, the average total return for all funds reported in the Lipper Short Intermediate Municipal Debt Funds category was 1.81% .3

A market rally over the summer of 2006 more than offset market weakness that occurred in the spring as slowing U.S. economic growth helped ease investors' inflation fears. The fund produced lower returns than its benchmark, while the fund's Class D shares produced higher returns than its Lipper category average, primarily due to its focus on shorter-term securities early in the reporting period as interest rates rose.

What is the fund's investment approach?

The fund seeks to maximize current income exempt from federal income tax to the extent consistent with the preservation of capital.To pursue this goal, the fund normally invests substantially all of its assets in municipal bonds that provide income exempt from federal personal income tax.The fund will invest only in municipal bonds rated investment grade or the unrated equivalent as determined by Dreyfus, but may continue to hold bonds which are subsequently downgraded to below investment grade.The fund invests primarily in municipal bonds with remaining maturities of five years or less and generally maintains a dollar-weighted average portfolio maturity of two to three years.

We may buy and sell bonds based on credit quality, market outlook and yield potential. In selecting municipal bonds for investment, we may assess the current interest-rate environment and the municipal bond's

The Fund 3

DISCUSSION OF FUND PERFORMANCE (continued)

potential volatility in different rate environments. We focus on bonds with the potential to offer attractive current income, typically looking for bonds that can provide consistently attractive current yields or that are trading at competitive market prices. A portion of the fund's assets may be allocated to "discount" bonds, which are bonds that sell at a price below their face value, or to "premium" bonds, which are bonds that sell at a price above their face value.The fund's allocation to either discount bonds or to premium bonds will change along with our changing views of the current interest-rate and market environment.We also may look to select bonds that are most likely to obtain attractive prices when sold.

What other factors influenced the fund's performance?

The municipal bond market encountered heightened volatility soon after the start of the reporting period, as strengthening labor markets, resurgent commodity prices and hawkish comments from members of the Federal Reserve Board (the "Fed") raised inflation concerns and caused investors to revise upward their expectations for short-term interest rates. Indeed, the Fed continued to raise the interest rates at its meetings in May and June, hiking the overnight federal funds rate to 5.25% .

Investor sentiment soon began to change, however, as a softening housing market and moderating employment gains indicated that U.S. economic growth was slowing.The Fed lent credence to this view in August, when it held short-term interest rates steady for the first time in more than two years.The Fed also left interest rates unchanged in September, noting that the slowing economy should relieve prevailing inflationary pressures. Municipal bonds generally rallied as investors first anticipated and then reacted to the Fed's pause, causing yield differences between shorter- and longer-term bonds to narrow toward historical lows. By the end of the reporting period, only 23 basis points separated the yields of two- and 10-year bonds.

In addition, municipal bond prices were supported by supply-and-demand influences. Many states and municipalities took in more tax revenue than originally projected, reducing their need to borrow.

4

Consequently, the supply of newly issued bonds declined compared to the same period one year earlier. At the same time, demand remained robust from investors seeking competitive levels of tax-exempt income.

Because we believed at the start of the reporting period that narrow yield differences left few opportunities for significantly higher income among intermediate-term bonds, we generally maintained the fund's focus toward the shorter end of its one- to five-year maturity range. Later in the reporting period we believed it was prudent to extend the fund's duration.With the Fed on hold, there was value in moving further out on the curve.

What is the fund's current strategy?

Given the downturn in the housing market, economic data has continued to indicate that U.S. economic growth is moderating with relatively little risk of recession.This suggests that the Fed is on hold for the foreseeable future.Therefore, we have continued to look for opportunities to enhance the fund's income component. In addition, while spreads currently are narrow, we expect an eventual return toward historical norms. Therefore, we have extended the fund's average duration in an attempt to lock in current yields for a longer period.

October 16, 2006

1 Total return includes reinvestment of dividends and any capital gains paid, and does not take into

consideration the applicable contingent deferred sales charge imposed on redemptions in the case of

Class B shares. Had these charges been reflected, returns would have been lower. Past performance

is no guarantee of future results. Share price, yield and investment return fluctuate such that upon

redemption, fund shares may be worth more or less than their original cost. Income may be subject

to state and local taxes, and some income may be subject to the federal alternative minimum tax

(AMT) for certain investors. Capital gains, if any, are fully taxable.

2 SOURCE: LIPPER INC. — Reflects reinvestment of dividends and, where applicable, capital

gain distributions.The Lehman Brothers 3-Year Municipal Bond Index is an unmanaged total

return performance benchmark for the investment-grade, geographically unrestricted 3-year tax-

exempt bond market, consisting of municipal bonds with maturities of 2-4 years. Index returns do

not reflect the fees and expenses associated with operating a mutual fund.

3 Source: Lipper Inc.

|

The Fund 5

UNDERSTANDING YOUR FUND'S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund's prospectus or talk to your financial adviser.

Review your fund's expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Premier Short-Intermediate Municipal Bond Fund from April 1, 2006 to September 30, 2006. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| Expenses and Value of a $1,000 Investment | | |

| assuming actual returns for the six months ended September 30, 2006 |

| | | Class B Shares | | Class D Shares |

| |

| |

|

| Expenses paid per $1,000 † | | $ 8.73 | | $ 3.90 |

| Ending value (after expenses) | | $1,013.80 | | $1,018.50 |

COMPARING YOUR FUND'S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

|

Using the SEC's method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund's expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| Expenses and Value of a $1,000 Investment | | |

| assuming a hypothetical 5% annualized return for the six months ended September 30, 2006 |

| | | Class B Shares | | Class D Shares |

| |

| |

|

| Expenses paid per $1,000 † | | $ 8.74 | | $ 3.90 |

| Ending value (after expenses) | | $1,016.39 | | $1,021.21 |

† Expenses are equal to the fund's annualized expense ratio of .1.73% for Class B, .77% for Class D; multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period).

STATEMENT OF INVESTMENTS

September 30, 2006 (Unaudited)

|

| Long-Term Municipal | | Coupon | | Maturity | | Principal | | |

| Investments—93.2% | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Alabama—3.8% | | | | | | | | |

| Choctaw County, | | | | | | | | |

| Limited Obligation School | | | | | | | | |

| Warrants (Insured; ACA) | | 3.63 | | 3/1/09 | | 1,655,000 | | 1,639,940 |

| Jefferson County, | | | | | | | | |

| Limited Obligation School | | | | | | | | |

| Warrants | | 5.00 | | 1/1/07 | | 1,500,000 | | 1,505,055 |

| Jefferson County, | | | | | | | | |

| Limited Obligation School | | | | | | | | |

| Warrants | | 5.00 | | 1/1/08 | | 1,000,000 | | 1,016,430 |

| Jefferson County, | | | | | | | | |

| Limited Obligation School | | | | | | | | |

| Warrants | | 5.00 | | 1/1/09 | | 2,000,000 | | 2,058,060 |

| Arizona—1.2% | | | | | | | | |

| Chandler Industrial Development | | | | | | |

| Authority, IDR (Intel Corp. | | | | | | | | |

| Project) | | 4.38 | | 12/1/10 | | 2,000,000 | | 2,034,380 |

| California—4.4% | | | | | | | | |

| California Statewide Communities | | | | | | |

| Development Authority, Revenue | | | | | | |

| (Kaiser Permanente) | | 3.88 | | 4/1/10 | | 5,000,000 | | 5,003,250 |

| Imperial Redevelopment Agency, | | | | | | |

| Subordinate Tax Allocation | | | | | | | | |

| Revenue (Imperial | | | | | | | | |

| Redevelopment Project) | | 4.50 | | 12/1/11 | | 1,300,000 | | 1,296,659 |

| Truckee-Donner Public Utility | | | | | | | | |

| District, COP (Insured; ACA) | | 4.00 | | 1/1/07 | | 1,000,000 | | 1,000,730 |

| Colorado—1.8% | | | | | | | | |

| Countrydale Metropolitan District | | | | | | |

| (LOC; Compass Bank) | | 3.50 | | 12/1/07 | | 3,000,000 | | 2,987,850 |

| Connecticut—.3% | | | | | | | | |

| Greenwich Housing Authority, | | | | | | | | |

| MFHR (Greenwich Close | | | | | | | | |

| Apartments) | | 6.05 | | 9/1/07 | | 330,000 | | 334,511 |

| Mohegan Tribe of Indians of | | | | | | | | |

| Connecticut Gaming Authority, | | | | | | |

| Priority Distribution Payment | | | | | | |

| Public Improvement | | 5.00 | | 1/1/08 | | 200,000 | | 202,524 |

The Fund 7

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| Long-Term Municipal | | Coupon | | Maturity | | Principal | | |

| Investments (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Florida—4.1% | | | | | | | | |

| Hillsborough County Industrial | | | | | | | | |

| Development Authority, HR | | | | | | | | |

| (Tampa General Hospital | | | | | | | | |

| Project) | | 4.00 | | 10/1/06 | | 1,640,000 | | 1,640,033 |

| Lee County Industrial Development | | | | | | | | |

| Authority, Healthcare | | | | | | | | |

| Facilities Revenue (Cypress | | | | | | | | |

| Cove at Healthpack | | | | | | | | |

| Florida, Inc. Project) | | 4.75 | | 10/1/08 | | 3,000,000 | | 3,002,400 |

| Tampa, | | | | | | | | |

| Health System Revenue | | | | | | | | |

| (Catholic Health East Issue) | | | | | | | | |

| (Insured; MBIA) | | 5.00 | | 11/15/09 | | 1,000,000 | | 1,038,470 |

| West Orange Healthcare District, | | | | | | | | |

| Revenue | | 5.30 | | 2/1/07 | | 1,155,000 | | 1,160,879 |

| Georgia—5.3% | | | | | | | | |

| Development Authority of the City | | | | | | | | |

| of Milledgeville and Baldwin | | | | | | | | |

| County, Revenue (Georgia | | | | | | | | |

| College and State University | | | | | | | | |

| Foundation Property III, LLC | | | | | | | | |

| Student Housing System Project) | | 5.00 | | 9/1/07 | | 640,000 | | 646,093 |

| Development Authority of the City | | | | | | | | |

| of Milledgeville and Baldwin | | | | | | | | |

| County, Revenue (Georgia | | | | | | | | |

| College and State University | | | | | | | | |

| Foundation Property III, LLC | | | | | | | | |

| Student Housing System Project) | | 5.00 | | 9/1/08 | | 835,000 | | 850,706 |

| Development Authority of the City | | | | | | | | |

| of Milledgeville and Baldwin | | | | | | | | |

| County, Revenue (Georgia | | | | | | | | |

| College and State University | | | | | | | | |

| Foundation Property III, LLC | | | | | | | | |

| Student Housing System Project) | | 5.00 | | 9/1/09 | | 1,045,000 | | 1,072,212 |

| Municipal Electric Authority of | | | | | | | | |

| Georgia (Project One | | | | | | | | |

| Subordinated) (Insured; AMBAC) | | 5.00 | | 1/1/09 | | 5,000,000 | | 5,150,600 |

| Private Colleges and Universities | | | | | | | | |

| Authority, Student Housing | | | | | | | | |

| Revenue (Mercer Housing | | | | | | | | |

| Corporation Project) | | 6.00 | | 6/1/11 | | 1,140,000 | | 1,192,144 |

8

| Long-Term Municipal | | Coupon | | Maturity | | Principal | | |

| Investments (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Hawaii—.3% | | | | | | | | |

| Kuakini, | | | | | | | | |

| Health System Special Purpose | | | | | | | | |

| Revenue | | 5.00 | | 7/1/07 | | 430,000 | | 433,350 |

| Illinois—1.6% | | | | | | | | |

| Chicago Park District, | | | | | | | | |

| GO (Insured; FGIC) | | 5.00 | | 1/1/10 | | 2,500,000 | | 2,610,000 |

| Indiana—1.3% | | | | | | | | |

| Indiana Development Finance | | | | | | | | |

| Authority, EIR (USX | | | | | | | | |

| Corporation Project) | | 5.25 | | 12/2/11 | | 2,000,000 | | 2,136,940 |

| Iowa—2.3% | | | | | | | | |

| Coralville, | | | | | | | | |

| GO Annual Appropriation | | | | | | | | |

| Corporate Purpose | | 5.00 | | 6/1/07 | | 1,000,000 | | 1,006,350 |

| Eddyville, | | | | | | | | |

| PCR (Cargill Inc. Project) | | 5.40 | | 10/1/06 | | 2,760,000 | | 2,760,248 |

| Kansas—2.4% | | | | | | | | |

| Burlington, | | | | | | | | |

| EIR, Series A (Kansas City | | | | | | | | |

| Power and Light Co. Project) | | 4.75 | | 10/1/07 | | 1,000,000 | | 1,009,290 |

| Burlington, | | | | | | | | |

| EIR, Series B (Kansas City | | | | | | | | |

| Power and Light Co. Project) | | 4.75 | | 10/1/07 | | 2,000,000 | | 2,012,880 |

| Burlington, | | | | | | | | |

| EIR, Series D (Kansas City | | | | | | | | |

| Power and Light Co. Project) | | 4.75 | | 10/1/07 | | 1,000,000 | | 1,006,440 |

| Kentucky—1.2% | | | | | | | | |

| Northern Kentucky Water District, | | | | | | |

| Revenue, BAN | | 3.25 | | 5/1/07 | | 2,000,000 | | 1,991,660 |

| Louisiana—3.8% | | | | | | | | |

| Calcasieu Parish Industrial | | | | | | | | |

| Development Board, PCR | | | | | | | | |

| (Occidental Petroleum Project) | | 4.80 | | 12/1/06 | | 3,000,000 | | 3,003,300 |

| Louisiana Public Facilities | | | | | | | | |

| Authority, Revenue (Pennington | | | | | | |

| Medical Foundation Project) | | 4.00 | | 7/1/11 | | 1,000,000 | | 1,003,610 |

| Plaquemines Parish Law Enforcement | | | | | | |

| District, Certificates of | | | | | | | | |

| Indebtedness (Insured; FGIC) | | 4.00 | | 3/1/10 | | 1,095,000 | | 1,105,271 |

The Fund 9

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| Long-Term Municipal | | Coupon | | Maturity | | Principal | | |

| Investments (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Louisiana (continued) | | | | | | | | |

| Plaquemines Parish Law Enforcement | | | | | | |

| District, Certificates of | | | | | | | | |

| Indebtedness (Insured; FGIC) | | 4.50 | | 3/1/11 | | 1,145,000 | | 1,181,216 |

| Maine—1.4% | | | | | | | | |

| Maine Educational Loan Marketing | | | | | | | | |

| Corp., Subordinate Loan Revenue | | 6.50 | | 11/1/09 | | 2,195,000 | | 2,262,716 |

| Massachusetts—1.6% | | | | | | | | |

| Massachusetts Industrial Finance | | | | | | | | |

| Agency, RRR (Ogden Haverhill | | | | | | | | |

| Project) | | 5.15 | | 12/1/07 | | 1,550,000 | | 1,566,724 |

| Massachusetts Industrial Finance | | | | | | | | |

| Agency, RRR (Ogden Haverhill | | | | | | | | |

| Project) | | 5.35 | | 12/1/10 | | 1,000,000 | | 1,042,380 |

| Michigan—1.9% | | | | | | | | |

| Michigan Hospital Finance | | | | | | | | |

| Authority, HR (Oakwood | | | | | | | | |

| Obligated Group) | | 5.00 | | 11/1/10 | | 1,500,000 | | 1,567,125 |

| Michigan Hospital Finance | | | | | | | | |

| Authority, HR (Sparrow | | | | | | | | |

| Obligated Group) | | 5.00 | | 11/15/06 | | 1,500,000 | | 1,502,325 |

| Missouri—1.2% | | | | | | | | |

| Saint Louis Industrial Development | | | | | | | | |

| Authority, MFHR (Vaughn | | | | | | | | |

| Elderly Apartments Project) | | 4.00 | | 12/20/06 | | 2,000,000 | | 1,996,480 |

| Nebraska—1.9% | | | | | | | | |

| University of Nebraska, | | | | | | | | |

| University Revenues (Lincoln | | | | | | | | |

| Memorial Stadium) | | 5.00 | | 11/1/07 | | 3,035,000 | | 3,080,677 |

| New Jersey—2.1% | | | | | | | | |

| Bayonne, | | | | | | | | |

| BAN | | 5.00 | | 10/27/06 | | 1,000,000 | | 1,000,280 |

| Bayonne, | | | | | | | | |

| TAN | | 5.00 | | 10/13/06 | | 1,500,000 | | 1,500,075 |

| Bayonne, | | | | | | | | |

| TAN | | 5.00 | | 12/11/06 | | 1,000,000 | | 1,000,400 |

| New Mexico—1.7% | | | | | | | | |

| Farmington, | | | | | | | | |

| PCR (Southern California | | | | | | | | |

| Edison Co. Four Corners | | | | | | | | |

| Project) (Insured; FGIC) | | 3.55 | | 4/1/10 | | 2,000,000 | | 1,984,060 |

10

| Long-Term Municipal | | Coupon | | Maturity | | Principal | | |

| Investments (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| New Mexico (continued) | | | | | | | | |

| Jicarilla Apache Nation, | | | | | | | | |

| Revenue | | 4.00 | | 9/1/08�� | | 765,000 | | 768,611 |

| New York—13.8% | | | | | | | | |

| Dutchess County Industrial | | | | | | | | |

| Development Agency, IDR | | | | | | | | |

| (IBM Project) | | 5.45 | | 12/1/09 | | 5,000,000 | | 5,239,050 |

| New York City Housing Development | | | | | | |

| Corporation, MFHR | | 4.25 | | 5/1/10 | | 2,000,000 | | 2,024,640 |

| New York City Industrial | | | | | | | | |

| Development Agency, Special | | | | | | | | |

| Facility Revenue (Terminal One | | | | | | | | |

| Group Association, L.P. | | | | | | | | |

| Project) | | 5.00 | | 1/1/08 | | 1,000,000 | | 1,014,270 |

| New York City Industrial | | | | | | | | |

| Development Agency, Special | | | | | | | | |

| Facility Revenue (Terminal One | | | | | | | | |

| Group Association, L.P. | | | | | | | | |

| Project) | | 5.00 | | 1/1/10 | | 3,000,000 | | 3,099,810 |

| New York State Dormitory | | | | | | | | |

| Authority, Revenue | | | | | | | | |

| (City University System | | | | | | | | |

| Consolidated Fifth | | | | | | | | |

| General Resolution) | | 5.25 | | 1/1/09 | | 2,000,000 | | 2,070,540 |

| New York State Dormitory | | | | | | | | |

| Authority, LR Court Facilities | | | | | | | | |

| (New York City Issue) | | 5.00 | | 5/15/07 | | 3,500,000 | | 3,534,020 |

| New York State Dormitory | | | | | | | | |

| Authority, Revenue (South | | | | | | | | |

| Nassau Communities Hospital) | | 5.25 | | 7/1/09 | | 945,000 | | 977,215 |

| New York State Power Authority, | | | | | | | | |

| Revenue | | 5.00 | | 11/15/09 | | 2,000,000 | | 2,087,940 |

| Suffolk County Industrial | | | | | | | | |

| Development Agency, Continuing | | | | | | |

| Care Retirement Community | | | | | | | | |

| Revenue (Jefferson's Ferry | | | | | | | | |

| Project) | | 4.20 | | 11/1/08 | | 845,000 | | 848,279 |

| Tobacco Settlement Financing Corp. | | | | | | |

| of New York, Asset-Backed | | | | | | | | |

| Revenue Bonds (State | | | | | | | | |

| Contingency Contract Secured) | | 5.00 | | 6/1/07 | | 2,000,000 | | 2,019,480 |

The Fund 11

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| Long-Term Municipal | | Coupon | | Maturity | | Principal | | |

| Investments (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| North Carolina—3.7% | | | | | | | | |

| Fayetteville Public Works | | | | | | | | |

| Commission, Revenue | | | | | | | | |

| (Insured; FSA) | | 3.55 | | 1/15/08 | | 2,000,000 | | 1,997,680 |

| North Carolina Medical Care | | | | | | | | |

| Commission, Health Care | | | | | | | | |

| Facilities First Mortgage | | | | | | | | |

| Revenue (Deerfield Episcopal | | | | | | |

| Retirement Community) | | 3.80 | | 11/1/09 | | 500,000 | | 498,935 |

| North Carolina Medical Care | | | | | | | | |

| Commission, Retirement | | | | | | | | |

| Facilities First Mortgage | | | | | | | | |

| Revenue (Cypress Glen | | | | | | | | |

| Retirement Community) | | 3.80 | | 10/1/07 | | 3,650,000 | | 3,621,785 |

| Ohio—6.3% | | | | | | | | |

| Hamilton County, | | | | | | | | |

| Local District Cooling | | | | | | | | |

| Facilities Revenue | | | | | | | | |

| (Trigen-Cinergy Solutions of | | | | | | |

| Cincinnati LLC Project) | | 4.60 | | 6/1/09 | | 2,000,000 | | 1,989,800 |

| Lorain County, | | | | | | | | |

| Hospital Facilities Revenue | | | | | | | | |

| and Improvement (Catholic | | | | | | | | |

| Healthcare Partners) | | 5.25 | | 10/1/07 | | 3,515,000 | | 3,570,889 |

| Ohio, | | | | | | | | |

| Common Schools GO | | 2.45 | | 9/14/07 | | 2,000,000 | | 1,970,520 |

| Ohio Water Development Authority, | | | | | | |

| PCR (Cleveland Electric | | | | | | | | |

| Illuminating Co. Project) | | 3.75 | | 10/1/08 | | 3,000,000 | | 2,985,960 |

| Oklahoma—3.2% | | | | | | | | |

| Oklahoma Development Finance | | | | | | |

| Authority, LR (Oklahoma State | | | | | | |

| System Higher Education) | | | | | | | | |

| (Insured; MBIA) | | 3.00 | | 12/1/08 | | 1,000,000 | | 983,130 |

| Tulsa County Independent School | | | | | | |

| District Number 1, Combined | | | | | | |

| Purpose (Insured; MBIA) | | 0.00 | | 8/1/07 | | 2,000,000 | | 1,940,580 |

| Tulsa County Independent School | | | | | | |

| District Number 5, | | | | | | | | |

| Combined Purpose | | 4.00 | | 7/1/07 | | 1,125,000 | | 1,129,072 |

| Long-Term Municipal | | Coupon | | Maturity | | Principal | | |

| Investments (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Oklahoma (continued) | | | | | | | | |

| Tulsa County Independent School | | | | | | | | |

| District Number 5, Combined | | | | | | | | |

| Purpose | | 4.00 | | 7/1/08 | | 1,160,000 | | 1,169,245 |

| Pennsylvania—5.3% | | | | | | | | |

| Pennsylvania Higher Educational | | | | | | | | |

| Facilites Authority, Revenue | | | | | | | | |

| (Association of Independent | | | | | | | | |

| Colleges and Universities of | | | | | | | | |

| Pennsylvania Financing | | | | | | | | |

| Program) (LOC; Allied Irish Bank) | | 3.19 | | 11/1/06 | | 3,750,000 | | 3,747,712 |

| Philadelphia Hospitals and Higher | | | | | | | | |

| Education Facilities | | | | | | | | |

| Authority, Revenue | | | | | | | | |

| (Jefferson Health System) | | 5.00 | | 5/15/09 | | 1,795,000 | | 1,845,637 |

| Philadelphia Hospitals and Higher | | | | | | | | |

| Education Facilities | | | | | | | | |

| Authority, Revenue | | | | | | | | |

| (Jefferson Health System) | | 5.00 | | 5/15/09 | | 2,310,000 | | 2,378,884 |

| Pittsburgh Urban Redevelopment | | | | | | | | |

| Authority, MFHR (Lou Mason Jr. | | | | | | | | |

| Replacement Housing | | | | | | | | |

| Facility Project) | | 5.00 | | 12/1/07 | | 1,000,000 | | 1,005,880 |

| Rhode Island—.6% | | | | | | | | |

| Rhode Island Health and | | | | | | | | |

| Educational Building Corp., | | | | | | | | |

| Hospital Financing Revenue | | | | | | | | |

| (Lifespan Obligated | | | | | | | | |

| Group Issue) | | 5.00 | | 5/15/11 | | 1,000,000 | | 1,046,380 |

| Tennessee—3.3% | | | | | | | | |

| Johnson City Power Board, | | | | | | | | |

| Electric System, RAN | | 3.50 | | 9/1/10 | | 3,360,000 | | 3,347,971 |

| Memphis-Shelby County Airport | | | | | | | | |

| Authority, Special Facilities | | | | | | | | |

| Revenue (Federal Express Corp.) | | 5.00 | | 9/1/09 | | 2,000,000 | | 2,055,960 |

| Virginia—5.2% | | | | | | | | |

| Fairfax County Economic | | | | | | | | |

| Development Authority, RRR | | | | | | | | |

| (Insured; AMBAC) | | 6.05 | | 2/1/09 | | 3,000,000 | | 3,161,160 |

The Fund 13

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| Long-Term Municipal | | Coupon | | Maturity | | Principal | | |

| Investments (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Virginia (continued) | | | | | | | | |

| Hopewell, | | | | | | | | |

| Public Improvement | | 5.00 | | 7/15/09 | | 3,250,000 | | 3,284,125 |

| Louisa Industrial Development | | | | | | | | |

| Authority, Solid Waste and | | | | | | | | |

| Sewage Disposal Revenue | | | | | | | | |

| (Virginia Electric and Power | | | | | | | | |

| Co. Project) | | 2.30 | | 3/1/07 | | 1,000,000 | | 990,930 |

| Peninsula Ports Authority, | | | | | | | | |

| Coal Terminal Revenue | | | | | | | | |

| (Dominion Terminal Associates | | | | | | | | |

| Project—DETC Issue) | | 3.30 | | 10/1/08 | | 1,135,000 | | 1,119,939 |

| Washington—1.3% | | | | | | | | |

| Washington, | | | | | | | | |

| COP (Department of Ecology) | | | | | | | | |

| (Insured; AMBAC) | | 4.50 | | 4/1/08 | | 1,000,000 | | 1,013,290 |

| Washington Public Power Supply | | | | | | | | |

| System, Revenue (Nuclear | | | | | | | | |

| Project Number 2) | | 5.75 | | 7/1/09 | | 1,000,000 | | 1,056,800 |

| Wisconsin—2.8% | | | | | | | | |

| Badger Tobacco Asset | | | | | | | | |

| Securitization Corp., Tobacco | | | | | | | | |

| Settlement Asset-Backed Bonds | | 5.50 | | 6/1/10 | | 1,500,000 | | 1,563,810 |

| Racine, | | | | | | | | |

| SWDR (Republic Services | | | | | | | | |

| Project) | | 3.25 | | 4/1/09 | | 2,000,000 | | 1,945,060 |

| Wisconsin Health and Educational | | | | | | | | |

| Facilities Authority, Revenue | | | | | | | | |

| (Froedtert and Community | | | | | | | | |

| Health, Inc. Obligated Group) | | 5.00 | | 4/1/10 | | 1,000,000 | | 1,041,370 |

| U.S. Related—2.1% | | | | | | | | |

| Puerto Rico Public Buildings | | | | | | | | |

| Authority (Government | | | | | | | | |

| Facilities) | | 4.50 | | 7/1/07 | | 3,405,000 | | 3,422,161 |

| Total Long-Term | | | | | | | | |

| Municipal Investments | | | | | | | | |

| (cost $154,585,785) | | | | | | | | 154,165,243 |

| Short-Term Municipal | | Coupon | | Maturity | | Principal | | |

| Investments—5.5% | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Arizona—1.2% | | | | | | | | |

| The Industrial Development | | | | | | | | |

| Authorities of the City of | | | | | | | | |

| Tucson and the County of Pima, | | | | | | | | |

| Joint SFMR (GIC; Trinity | | | | | | | | |

| Funding Corporation and LOC: | | | | | | | | |

| FHLMC, FNMA and GNMA) | | 4.90 | | 8/3/07 | | 2,000,000 | | 2,016,580 |

| South Carolina—1.8% | | | | | | | | |

| South Carolina Association of | | | | | | | | |

| Governmental Organizations, | | | | | | | | |

| COP, TAN | | 4.25 | | 4/13/07 | | 3,000,000 | | 3,011,940 |

| U.S. Related—2.5% | | | | | | | | |

| Governmental Development Bank of | | | | | | | | |

| Puerto Rico, CP | | 3.85 | | 10/5/06 | | 4,000,000 | | 3,999,800 |

| Total Short-Term | | | | | | | | |

| Municipal Investments | | | | | | | | |

| (cost $9,018,267) | | | | | | | | 9,028,320 |

| |

| |

| |

| |

|

| |

| Total Investments (cost $163,604,052) | | | | | | 98.7% | | 163,193,563 |

| Cash and Receivables (Net) | | | | | | 1.3% | | 2,135,354 |

| Net Assets | | | | | | 100.0% | | 165,328,917 |

The Fund 15

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| Summary of Combined Ratings (Unaudited) | | |

| |

| Fitch | | or | | Moody's | | or | | Standard & Poor's | | Value (%)† |

| |

| |

| |

| |

| |

|

| AAA | | | | Aaa | | | | AAA | | 14.7 |

| AA | | | | Aa | | | | AA | | 15.4 |

| A | | | | A | | | | A | | 37.0 |

| BBB | | | | Baa | | | | BBB | | 16.4 |

| BB | | | | Ba | | | | BB | | .1 |

| F1 | | | | MIG1/P1 | | | | SP1/A1 | | 7.4 |

| Not Rated a | | | | Not Rated a | | | | Not Rated a | | 9.0 |

| | | | | | | | | | | 100.0 |

| | † Based on total investments.

a Securities which, while not rated by Fitch, Moody's and Standard & Poor's, have been determined by the Manager to

be of comparable quality to those rated securities in which the fund may invest.

See notes to financial statements.

|

The Fund 17

| | STATEMENT OF ASSETS AND LIABILITIES

September 30, 2006 (Unaudited)

|

| | | Cost | | Value |

| |

| |

|

| Assets ($): | | | | |

| Investments in securities—See Statement of Investments | | 163,604,052 | | 163,193,563 |

| Interest receivable | | | | 2,400,453 |

| Receivable for shares of Beneficial Interest subscribed | | | | 187,686 |

| Prepaid expenses | | | | 23,964 |

| | | | | 165,805,666 |

| |

| |

|

| Liabilities ($): | | | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(c) | | | | 93,431 |

| Cash overdraft due to Custodian | | | | 168,753 |

| Payable for shares of Beneficial Interest redeemed | | | | 153,657 |

| Accrued expenses | | | | 60,908 |

| | | | | 476,749 |

| |

| |

|

| Net Assets ($) | | | | 165,328,917 |

| |

| |

|

| Composition of Net Assets ($): | | | | |

| Paid-in capital | | | | 172,286,937 |

| Accumulated undistributed investment income—net | | | | 38,174 |

| Accumulated net realized gain (loss) on investments | | | | (6,585,705) |

| Accumulated net unrealized appreciation | | | | |

| (depreciation) on investments | | | | (410,489) |

| |

| |

|

| Net Assets ($) | | | | 165,328,917 |

| Net Asset Value Per Share | | | | |

| | | Class B | | Class D |

| |

| |

|

| Net Assets ($) | | 973,054 | | 164,355,863 |

| Shares Outstanding | | 77,056 | | 13,013,578 |

| |

| |

|

| Net Asset Value Per Share ($) | | 12.63 | | 12.63 |

See notes to financial statements.

18

STATEMENT OF OPERATIONS

Six Months Ended September 30, 2006 (Unaudited)

|

| Investment Income ($): | | |

| Interest Income | | 3,081,700 |

| Expenses: | | |

| Management fee—Note 3(a) | | 438,379 |

| Distribution fees—Note 3(b) | | 90,986 |

| Shareholder servicing costs—Note 3(c) | | 48,165 |

| Professional fees | | 30,892 |

| Registration fees | | 28,186 |

| Custodian fees | | 11,881 |

| Prospectus and shareholders' reports | | 10,138 |

| Trustees' fees and expenses—Note 3(d) | | 4,017 |

| Loan commitment fees—Note 2 | | 592 |

| Miscellaneous | | 13,776 |

| Total Expenses | | 677,012 |

| Investment Income—Net | | 2,404,688 |

| |

|

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): |

| Net realized gain (loss) on investments | | (393,270) |

| Net unrealized appreciation (depreciation) on investments | | 1,150,048 |

| Net Realized and Unrealized Gain (Loss) on Investments | | 756,778 |

| Net Increase in Net Assets Resulting from Operations | | 3,161,466 |

See notes to financial statements.

The Fund 19

STATEMENT OF CHANGES IN NET ASSETS

| | | Six Months Ended | | |

| | | September 30, 2006 | | Year Ended |

| | | (Unaudited) | | March 31, 2006 a |

| |

| |

|

| Operations ($): | | | | |

| Investment income—net | | 2,404,688 | | 5,277,369 |

| Net realized gain (loss) on investments | | (393,270) | | (767,545) |

| Net unrealized appreciation | | | | |

| (depreciation) on investments | | 1,150,048 | | (606,931) |

| Net Increase (Decrease) in Net Assets | | | | |

| Resulting from Operations | | 3,161,466 | | 3,902,893 |

| |

| |

|

| Dividends to Shareholders from ($): | | | | |

| Investment income—net: | | | | |

| Class A shares | | — | | (302,414) |

| Class B shares | | (9,055) | | (19,036) |

| Class D shares | | (2,357,459) | | (4,908,831) |

| Class P shares | | — | | (37,680) |

| Total Dividends | | (2,366,514) | | (5,267,961) |

| |

| |

|

| Beneficial Interest Transactions ($): | | | | |

| Net proceeds from shares sold: | | | | |

| Class A shares | | — | | 11,375,494 |

| Class B shares | | 142,117 | | 194,514 |

| Class D shares | | 9,501,447 | | 52,130,717 |

| Class P shares | | — | | 673,808 |

| Dividends reinvested: | | | | |

| Class A shares | | — | | 265,501 |

| Class B shares | | 5,832 | | 14,650 |

| Class D shares | | 2,056,549 | | 4,179,336 |

| Class P shares | | — | | 20,726 |

| Cost of shares redeemed: | | | | |

| Class A shares | | — | | (24,838,172) |

| Class B shares | | (200,964) | | (975,398) |

| Class D shares | | (40,820,674) | | (85,457,803) |

| Class P shares | | — | | (3,525,705) |

| Increase (Decrease) in Net Assets | | | | |

| from Beneficial Interest Transactions | | (29,315,693) | | (45,942,332) |

| Total Increase (Decrease) in Net Assets | | (28,520,741) | | (47,307,400) |

| |

| |

|

| Net Assets ($): | | | | |

| Beginning of Period | | 193,849,658 | | 241,157,058 |

| End of Period | | 165,328,917 | | 193,849,658 |

| Undistributed investment income—net | | 38,174 | | — |

| | | Six Months Ended | | |

| | | September 30, 2006 | | Year Ended |

| | | (Unaudited) | | March 31, 2006 a |

| |

| |

|

| Capital Share Transactions: | | | | |

| Class Ab | | | | |

| Shares sold | | — | | 899,259 |

| Shares issued for dividends reinvested | | — | | 21,007 |

| Shares redeemed | | — | | (1,968,299) |

| Net Increase (Decrease) in Shares Outstanding | | — | | (1,048,033) |

| |

| |

|

| Class B b | | | | |

| Shares sold | | 11,315 | | 15,432 |

| Shares issued for dividends reinvested | | 463 | | 1,159 |

| Shares redeemed | | (15,995) | | (77,122) |

| Net Increase (Decrease) in Shares Outstanding | | (4,217) | | (60,531) |

| |

| |

|

| Class D | | | | |

| Shares sold | | 755,328 | | 4,132,328 |

| Shares issued for dividends reinvested | | 163,571 | | 330,674 |

| Shares redeemed | | (3,247,079) | | (6,762,831) |

| Net Increase (Decrease) in Shares Outstanding | | (2,328,180) | | (2,299,829) |

| |

| |

|

| Class P | | | | |

| Shares sold | | — | | 53,413 |

| Shares issued for dividends reinvested | | — | | 1,638 |

| Shares redeemed | | — | | (279,099) |

| Net Increase (Decrease) in Shares Outstanding | | — | | (224,048) |

a On January 26, 2006, the fund's Board of Directors approved, effective as of the close of business on March 24,

2006 (the Effective Date) reclassifying all of the fund's Class A and Class P shares as Class D shares of the fund.

b During the period ended September 30, 2006, 289 Class B shares representing $3,624 were automatically

converted to 289 Class D shares and during the period ended March 31, 2006, 12,053 Class B shares representing

$152,888 were automaticaly converted to 12,055 class A shares.

See notes to financial statements.

|

The Fund 21

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund's financial statements.

| Six Months Ended | | | | | | | | |

| September 30, 2006 | | | | Year Ended March 31, | | |

| |

| |

| |

|

| Class B Shares | | (Unaudited) | | 2006 | | 2005 | | 2004 | | 2003 a |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, | | | | | | | | | | |

| beginning of period | | 12.57 | | 12.65 | | 12.93 | | 12.98 | | 13.06 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net b | | .11 | | .19 | | .18 | | .22 | | .01 |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | .06 | | (.08) | | (.28) | | (.05) | | (.08) |

| Total from Investment Operations | | .17 | | .11 | | (.10) | | .17 | | (.07) |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.11) | | (.19) | | (.18) | | (.22) | | (.01) |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | — | | — | | (.00)c | | — | | — |

| Total Distributions | | (.11) | | (.19) | | (.18) | | (.22) | | (.01) |

| Net asset value, end of period | | 12.63 | | 12.57 | | 12.65 | | 12.93 | | 12.98 |

| |

| |

| |

| |

| |

|

| Total Return (%) d | | 1.38e | | .88 | | (.74) | | 1.35 | | (.50)e |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.73f | | 1.70 | | 1.65 | | 1.69 | | 1.83f |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | | 1.73f | | 1.70 | | 1.65 | | 1.69 | | 1.83f |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | 1.82f | | 1.50 | | 1.42 | | 1.67 | | 1.91f |

| Portfolio Turnover Rate | | 17.14e | | 45.00 | | 33.55 | | 38.06 | | 77.91 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 973 | | 1,021 | | 1,795 | | 1,292 | | 106 |

a From March 12, 2003 (commencement of initial offering) to March 31, 2003.

b Based on average shares outstanding at each month end.

c Amount represents less than $.01 per share.

d Exclusive of sales charge.

e Not annualized.

f Annualized.

See notes to financial statements.

|

22

| Six Months Ended | | | | | | | | | | |

| September 30, 2006 | | | | Year Ended March 31, | | |

| |

| |

| |

|

| Class D Shares | | (Unaudited) | | 2006 a | | 2005 | | 2004 | | 2003 | | 2002 |

| |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | | | |

| Net asset value, | | | | | | | | | | | | |

| beginning of period | | 12.57 | | 12.66 | | 12.93 | | 12.98 | | 12.91 | | 13.01 |

| Investment Operations: | | | | | | | | | | | | |

| Investment income—net b | | .17 | | .31 | | .30 | | .35 | | .43 | | .52 |

| Net realized and unrealized | | | | | | | | | | | | |

| gain (loss) on investments | | .06 | | (.09) | | (.27) | | (.05) | | .08 | | (.10) |

| Total from Investment Operations | | .23 | | .22 | | .03 | | .30 | | .51 | | .42 |

| Distributions: | | | | | | | | | | | | |

| Dividends from investment | | | | | | | | | | | | |

| income—net | | (.17) | | (.31) | | (.30) | | (.35) | | (.44) | | (.52) |

| Dividends from net realized | | | | | | | | | | | | |

| gain on investments | | — | | — | | (.00)c | | — | | (.00)c | | — |

| Total Distributions | | (.17) | | (.31) | | (.30) | | (.35) | | (.44) | | (.52) |

| Net asset value, end of period | | 12.63 | | 12.57 | | 12.66 | | 12.93 | | 12.98 | | 12.91 |

| |

| |

| |

| |

| |

| |

|

| Total Return (%) | | 1.85d | | 1.75 | | .26 | | 2.31 | | 3.99 | | 3.24 |

| |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | | | |

| to average net assets | | .77e | | .76 | | .74 | | .75 | | .72 | | .69 |

| Ratio of net expenses | | | | | | | | | | | | |

| to average net assets | | .77e | | .76 | | .74 | | .75 | | .72 | | .69 |

| Ratio of net investment income | | | | | | | | | | | | |

| to average net assets | | 2.75e | | 2.44 | | 2.34 | | 2.68 | | 3.34 | | 3.98 |

| Portfolio Turnover Rate | | 17.14d | | 45.00 | | 33.55 | | 38.06 | | 77.91 | | 54.94 |

| |

| |

| |

| |

| |

| |

|

| Net Assets, end of period | | | | | | | | | | | | |

| ($ x 1,000) | | 164,356 | | 192,828 | | 223,267 | | 276,976 | | 321,379 | | 356,127 |

a On January 26, 2006, the fund's Board of Directors approved, effective as of the close of business on March 24,

2006 (the Effective Date) reclassifying all of the fund's Class A and Class P shares as Class D shares of the fund.

b Based on average shares outstanding at each month end.

c Amount represents less than $.01 per share.

d Not annualized.

e Annualized.

See notes to financial statements.

|

The Fund 23

NOTES TO FINANCIAL STATEMENTS (Unaudited)

NOTE 1—Significant Accounting Policies:

Dreyfus Premier Short-Intermediate Municipal Bond Fund (the "fund") is registered under the Investment Company Act of 1940, as amended (the "Act"), as a non-diversified open-end management investment company. The fund's investment objective is to provide investors with as high a level of current income exempt from federal income tax as is consistent with the preservation of capital. The Dreyfus Corporation (the "Manager" or "Dreyfus") serves as the fund's investment adviser. The Manager is a wholly-owned subsidiary of Mellon Financial Corporation ("Mellon Financial").

Dreyfus Service Corporation (the "Distributor"), a wholly-owned subsidiary of the Manager, is the distributor of the fund's shares.The fund is authorized to issue an unlimited number of $.001 par value shares of Beneficial Interest in each of the following classes of shares: Class B and Class D. Class B shares are subject to a contingent deferred sales charge ("CDSC") imposed on Class B share redemptions made within six years of purchase and automatically convert to Class D shares after six years. Class D shares are sold at net asset value per share directly by Dreyfus and through certain banks and fund supermarkets, and as a part of certain wrap-fee programs. Other differences between the classes include the services offered to and the expenses borne by each class and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

Effective June 1, 2006, the fund no longer offers Class B shares, except in connection with dividend reinvestment and permitted exchanges of Class B shares.

The fund's financial statements are prepared in accordance with U.S. generally accepted accounting principles, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

24

The fund enters into contracts that contain a variety of indemnifications. The fund's maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: Investments in securities are valued each business day by an independent pricing service (the "Service") approved by the Board of Trustees. Investments for which quoted bid prices are readily available and are representative of the bid side of the market in the judgment of the Service are valued at the mean between the quoted bid prices (as obtained by the Service from dealers in such securities) and asked prices (as calculated by the Service based upon its evaluation of the market for such securities). Other investments (which constitute a majority of the portfolio securities) are carried at fair value as determined by the Service, based on methods which include consideration of: yields or prices of municipal securities of comparable quality, coupon, maturity and type; indications as to values from dealers; and general market conditions.

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gain and loss from securities transactions are recorded on the identified cost basis. Interest income, adjusted for accretion of discount and amortization premium on investments, is earned from settlement date and recognized on the accrual basis. Securities purchased or sold on a when-issued or delayed-delivery basis may be settled a month or more after the trade date.

The fund has an arrangement with the custodian bank whereby the fund receives earnings credits from the custodian when positive cash balances are maintained, which are used to offset custody fees. For financial reporting purposes, the fund includes net earnings credits, if any, as an expense offset in the Statements of Operations.

(c) Dividends to shareholders: It is the policy of the fund to declare dividends daily from investment income-net. Such dividends are paid

The Fund 25

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

monthly. Dividends from net realized capital gain, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the "Code").To the extent that net realized capital gain can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gain.

(d) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, which can distribute tax exempt dividends, by complying with the applicable provisions of the Code, and to make distributions of income and net realized capital gain sufficient to relieve it from substantially all federal income and excise taxes.

On July 13, 2006, the Financial Accounting Standards Board (FASB) released FASB Interpretation No. 48 "Accounting for Uncertainty in Income Taxes" (FIN 48). FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. FIN 48 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the fund's tax returns to determine whether the tax positions are "more-likely-than-not" of being sustained by the applicable tax authority.Tax positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax benefit or expense in the current year. Adoption of FIN 48 is required for fiscal years beginning after December 15, 2006 and is to be applied to all open tax years as of the effective date. At this time, management is evaluating the implications of FIN 48 and its impact in the financial statements has not yet been determined.

The fund has an unused capital loss carryover of $5,721,624 available for federal income tax purposes to be applied against future net securities profits, if any, realized subsequent to March 31, 2006. If not applied, $5,399,245 of the carryover expires in fiscal 2011, $44,004 expires in fiscal 2012 and $278,375 expires in fiscal 2014.

26

The tax character of distributions paid to shareholders during the fiscal year ended March 31, 2006 was as follows: tax exempt income $5,267,961. The tax character of current year distributions will be determined at the end of the current fiscal year.

NOTE 2—Bank Line of Credit:

The fund participates with other Dreyfus-managed funds in a $350 million redemption credit facility (the "Facility") to be utilized for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the fund has agreed to pay commitment fees on its pro rata portion of the Facility. Interest is charged to the fund based on prevailing market rates in effect at the time of borrowings. During the period ended September 30, 2006, the fund did not borrow under the Facility.

NOTE 3—Management Fee and Other Transactions With Affiliates:

(a) Pursuant to a management agreement ("Agreement") with the Manager, the management fee is computed at the annual rate of .50% of the value of the fund's average daily net assets and is payable monthly. The Agreement provides that if in any full fiscal year the aggregate expenses, exclusive of taxes, brokerage fees, interest on borrowings, commitment fees and extraordinary expenses, exceed with respect to Class D shares, 1 1 / 2% of the value of the fund's average daily net assets, attributable to Class D shares, the fund may deduct from payments to be made to the Manager, or the Manager will bear such excess expense. During the period ended September 30, 2006, there was no expense reimbursement pursuant to the Agreement.

During the period ended September 30, 2006, the Distributor retained $1,396 from CDSC on redemptions on the fund's Class B shares.

The Fund 27

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

(b) Under the Distribution Plan (the "Plan") adopted pursuant to Rule 12b-1 under the Act, Class B and Class D shares pay the Distributor for distributing their shares at an annual rate of .75% of the value of the average daily net assets of Class B shares and .10% of the value of the average daily net assets of Class D shares. During the period ended September 30, 2006, Class B and Class D shares were charged $3,819 and $87,167, respectively, pursuant to the Plan.

(c) Under the Shareholder Services Plan, Class B shares pay the distributor at an annual rate of .25% of the value of the average daily net assets of Class B shares, for the provision of certain services.The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding Class B shares and providing reports and other information, and services related to the maintenance of shareholder accounts. The Distributor may make payments to Service Agents (a securities dealer, financial institution or other industry professional) in respect of these services. The Distributor determines the amounts to be paid to Service Agents. During the period ended September 30, 2006, Class B shares was charged $1,273, pursuant to the Shareholder Services Plan.

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of the Manager, under a transfer agency agreement for providing personnel and facilities to perform transfer agency services for the fund. During the period ended September 30, 2006, the fund was charged $28,414 pursuant to the transfer agency agreement.

During the period ended September 30, 2006, the fund was charged $2,274 for services performed by the Chief Compliance Officer.

The components of Due to The Dreyfus Corporation and affiliates in the Statement of Assets and Liabilities consists of: management fees $68,338, Rule 12b-1 distribution plan fees $14,190, shareholder services plan fees $200, chief compliance officer fees $2,274 and transfer agency per account fees $8,429.

28

(d) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended September 30, 2006, amounted to $29,094,805 and $63,736,719, respectively.

At September 30, 2006, accumulated net unrealized depreciation on investments was $410,489, consisting of $217,032 gross unrealized appreciation and $627,521 gross unrealized depreciation.

At September 30, 2006, the cost of investments for federal income tax purposes was substantially the same as the cost for financial reporting purposes (see the Statement of Investments).

The Fund 29

| | INFORMATION ABOUT THE REVIEW AND APPROVAL

OF THE FUND'S MANAGEMENT AGREEMENT (Unaudited)

|

At a meeting of the fund's Board of Trustees held on July 11 and 12, 2006, the Board considered the re-approval for an annual period (through August 31, 2007) of the fund's Management Agreement with Dreyfus, pursuant to which Dreyfus provides the fund with investment advisory and administrative services. The Board members, none of whom are "interested persons" (as defined in the Investment Company Act of 1940, as amended) of the fund were assisted in their review by independent legal counsel and met with counsel in executive session separate from representatives of Dreyfus.

Analysis of Nature, Extent and Quality of Services Provided to the Fund. The Board members received a presentation from representatives of Dreyfus regarding services provided to the fund and other funds in the Dreyfus fund complex, and discussed the nature, extent and quality of the services provided to the fund pursuant to its Management Agreement. Dreyfus' representatives reviewed the fund's distribution of accounts and the relationships Dreyfus has with various intermediaries and the different needs of each. Dreyfus' representatives noted the distribution channels for the fund as well as the diversity of distribution among the funds in the Dreyfus fund complex, and Dreyfus' corresponding need for broad, deep, and diverse resources to be able to provide ongoing shareholder services to each distribution channel, including those of the fund. Dreyfus also provided the number of accounts investing in the fund, as well as the fund's asset size.

The Board members also considered Dreyfus' research and portfolio management capabilities and that Dreyfus also provides oversight of day-to-day fund operations, including fund accounting and administration and assistance in meeting legal and regulatory requirements. The Board members also considered Dreyfus' extensive administrative, accounting and compliance infrastructure.

Comparative Analysis of the Fund's Performance and Management Fee and Expense Ratio. The Board members reviewed the fund's performance and placed significant emphasis on comparisons to a group of retail no-load short municipal debt funds (the "Performance Group")

30

and to a larger universe of funds, consisting of all retail no-load short municipal debt funds (the "Performance Universe") selected and provided by Lipper, Inc., an independent provider of investment company data.The Board was provided with a description of the methodology Lipper used to select the Performance Group and Performance Universe, as well as the Expense Group and Expense Universe (discussed below). The Board members discussed the results of the comparisons for various periods ended May 31, 2006.The Board members noted that the fund's Class D share total return performance was variously above and below the Performance Group and Performance Universe medians for the periods shown, but also noted the relatively narrow deviation of the fund's performance from the Performance Group and the Performance Universe medians for most of the periods. The Board members noted that the fund's yield for one year periods ended May 31st for 1997 - 2006 was above the Performance Group and Performance Universe medians for each period, except the one-year period. Dreyfus also provided a comparison of the fund's calendar year total returns to the returns of its benchmark index.

The Board members also discussed the fund's management fee and expense ratio and reviewed the range of advisory fees and Class D expense ratios as compared to a comparable group of funds (the "Expense Group") and a broader group of funds (the "Expense Universe"), each selected and provided by Lipper.The Board members noted that the fund's management fee and total expense ratio were higher than the Expense Group and Expense Universe medians.

Representatives of Dreyfus stated that there was one other mutual fund managed by Dreyfus or its affiliates with similar investment objectives, policies and strategies and included within the fund's Lipper category (the "Similar Fund"), and no other accounts managed by Dreyfus or its affiliates with similar investment objectives, policies and strategies as the fund. The Board members considered the relevance of the fee information provided for the Similar Fund managed by Dreyfus to evaluate the appropriateness and reasonableness of the fund's management fee.

The Fund 31

INFORMATION ABOUT THE REVIEW AND APPROVAL OF THE

FUND'S MANAGEMENT AGREEMENT (Unaudited) (continued)

|

Analysis of Profitability and Economies of Scale. Dreyfus' representatives reviewed the dollar amount of expenses allocated and profit received by Dreyfus and the method used to determine such expenses and profit.The Board considered information, previously provided and discussed, prepared by an independent consulting firm regarding Dreyfus' approach to allocating costs to, and determining the profitability of, individual funds and the entire Dreyfus mutual fund complex. The Board members also considered that the methodology had also been reviewed by an independent registered public accounting firm which, like the consultant, found the methodology to be reason-able.The consulting firm also analyzed where any economies of scale might emerge in connection with the management of the fund. The Board members evaluated the profitability analysis in light of the relevant circumstances for the fund and the extent to which economies of scale would be realized if the fund grows and whether fee levels reflect these economies of scale for the benefit of fund investors.The Board members also considered potential benefits to Dreyfus from acting as investment adviser and noted that there were no soft dollar arrangements with respect to trading the fund's investments.

It was noted that the Board members should consider Dreyfus' profitability with respect to the fund as part of their evaluation of whether the fees under the Management Agreement bear a reasonable relationship to the mix of services provided by Dreyfus, including the nature, extent and quality of such services and that a discussion of economies of scale is predicated on increasing assets and that, if a fund's assets had been decreasing, the possibility that Dreyfus may have realized any economies of scale would be less. It also was noted that the profitability percentage for managing the fund was within ranges determined by appropriate court cases to be reasonable given the services rendered and generally superior service levels provided.

32

At the conclusion of these discussions, the Board agreed that it had been furnished with sufficient information to make an informed business decision with respect to continuation of the Management Agreement. Based on the discussions and considerations as described above, the Board made the following conclusions and determinations.

- The Board concluded that the nature, extent and quality of the ser- vices provided by Dreyfus are adequate and appropriate.

- The Board generally was satisfied with the fund's yield.The Board noted the fund's varying total return performance, but also noted the relatively narrow deviation of the fund's performance from the Performance Group and the Performance Universe medians for most of the periods.

- The Board concluded that the fee paid by the fund to Dreyfus was reasonable in light of the services provided, comparative perfor- mance, expense and advisory fee information, costs of the services provided and profits to be realized and benefits derived or to be derived by Dreyfus from its relationship with the fund.

- The Board determined that the economies of scale which may accrue to Dreyfus and its affiliates in connection with the manage- ment of the fund had been adequately considered by Dreyfus in connection with the management fee rate charged to the fund and that, to the extent in the future it were determined that material economies of scale had not been shared with the fund, the Board would seek to have those economies of scale shared with the fund.

The Board members considered these conclusions and determinations, along with information received on a routine and regular basis throughout the year, and, without any one factor being dispositive, the Board determined that re-approval of the Management Agreement was in the best interests of the fund and its shareholders.

The Fund 33

For More Information

Telephone Call your financial representative or 1-800-554-4611

| | Mail The Dreyfus Premier Family of Funds

144 Glenn Curtiss Boulevard, Uniondale, NY 11556-0144

|

The fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission ("SEC") for the first and third quarters of each fiscal year on Form N-Q. The fund's Forms N-Q are available on the SEC's website at http://www.sec.gov and may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-202-551-8090.

A description of the policies and procedures that the fund uses to determine how to vote proxies relating to portfolio securities, and information regarding how the fund voted these proxies for the 12-month period ended June 30, 2006, is available at http://www.dreyfus.com and on the SEC's website at http://www.sec.gov. The description of the policies and procedures is also available without charge, upon request, by calling 1-800-645-6561.

© 2006 Dreyfus Service Corporation 0591SA0906

| Item 2. | | Code of Ethics. |

| | | Not applicable. |

| Item 3. | | Audit Committee Financial Expert. |

| | | Not applicable. |

| Item 4. | | Principal Accountant Fees and Services. |

| | | Not applicable. |

| Item 5. | | Audit Committee of Listed Registrants. |

| | | Not applicable. |

| Item 6. | | Schedule of Investments. |

| | | Not applicable. |

| Item 7. | | Disclosure of Proxy Voting Policies and Procedures for Closed-End Management |

| | | Investment Companies. |

| | | Not applicable. |

| Item 8. | | Portfolio Managers of Closed-End Management Investment Companies. |

| | | Not applicable. |

| Item 9. | | Purchases of Equity Securities by Closed-End Management Investment Companies and |

| | | Affiliated Purchasers. |

| | | Not applicable. [CLOSED-END FUNDS ONLY] |

| Item 10. | | Submission of Matters to a Vote of Security Holders. |

The Registrant has a Nominating Committee (the "Committee"), which is responsible for selecting and nominating persons for election or appointment by the Registrant's Board as Board members. The Committee has adopted a Nominating Committee Charter (the "Charter"). Pursuant to the Charter, the Committee will consider recommendations for nominees from shareholders submitted to the Secretary of the Registrant, c/o The Dreyfus Corporation Legal Department, 200 Park Avenue, 8th Floor East, New York, New York 10166. A nomination submission must include information regarding the recommended nominee as specified in the Charter. This information includes all information relating to a recommended nominee that is required to be disclosed in solicitations or proxy statements for the election of Board members, as well as information sufficient to evaluate the factors to be considered by the Committee, including character and integrity, business and professional experience, and whether the person has the ability to apply sound and independent business judgment and would act in the interests of the Registrant and its shareholders.

Nomination submissions are required to be accompanied by a written consent of the individual to stand for election if nominated by the Board and to serve if elected by the shareholders, and such additional information must be provided regarding the recommended nominee as reasonably requested by the Committee.

Item 11. Controls and Procedures.

(a) The Registrant's principal executive and principal financial officers have concluded, based on their evaluation of the Registrant's disclosure controls and procedures as of a date within 90 days of the filing date of this report, that the Registrant's disclosure controls and procedures are reasonably designed to ensure that information required to be disclosed by the Registrant on Form N-CSR is recorded, processed, summarized and reported within the required time periods and that information required to be disclosed by the Registrant in the reports that it files or submits on Form N-CSR is accumulated and communicated to the Registrant's management, including its principal executive and principal financial officers, as appropriate to allow timely decisions regarding required disclosure.

(b) There were no changes to the Registrant's internal control over financial reporting that occurred during the second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the Registrant's internal control over financial reporting.

Item 12. Exhibits.

| (a)(1) | | Not applicable. |

| (a)(2) | | Certifications of principal executive and principal financial officers as required by Rule 30a-2(a) |

| under the Investment Company Act of 1940. |

| (a)(3) | | Not applicable. |

| (b) | | Certification of principal executive and principal financial officers as required by Rule 30a-2(b) |

| under the Investment Company Act of 1940. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

DREYFUS PREMIER SHORT INTERMEDIATE MUNICIPAL BOND FUND

| By: | | /s/ Stephen E. Canter |

| | | Stephen E. Canter |

| | | President |

| |

| Date: | | November 28, 2006 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this Report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

| By: | | /s/ Stephen E. Canter |

| | | Stephen E. Canter |

| | | Chief Executive Officer |

| |

| Date: | | November 28, 2006 |

| |

| By: | | /s/ James Windels |

| | | James Windels |

| | | Chief Financial Officer |

| |

| Date: | | November 28, 2006 |

| |

| EXHIBIT INDEX |

| |

| | | (a)(2) Certifications of principal executive and principal financial officers as required by Rule 30a- |

| | | 2(a) under the Investment Company Act of 1940. (EX-99.CERT) |

| |

| | | (b) Certification of principal executive and principal financial officers as required by Rule 30a- |

| | | 2(b) under the Investment Company Act of 1940. (EX-99.906CERT) |