Exhibit 99

Public Service Enterprise Group

NYC Investor Meeting

February 14, 2007

Forward-Looking Statement

The statements contained in this communication about our and our subsidiaries’

future performance, including, without limitation, future revenues, earnings,

strategies, prospects and all other statements that are not purely historical, are

forward-looking statements for purposes of the safe harbor provisions under The

Private Securities Litigation Reform Act of 1995. Although we believe that our

expectations are based on information currently available and on reasonable

assumptions, we can give no assurance they will be achieved. There are a

number of risks and uncertainties that could cause actual results to differ

materially from the forward-looking statements made herein. A discussion of

some of these risks and uncertainties is contained in our Annual Report on Form

10-K and subsequent reports on Form 10-Q and Form 8-K filed with the

Securities and Exchange Commission (SEC), and available on our website:

http://www.pseg.com. These documents address in further detail our business,

industry issues and other factors that could cause actual results to differ

materially from those indicated in this communication. In addition, any forward-

looking statements included herein represent our estimates only as of today and

should not be relied upon as representing our estimates as of any subsequent

date. While we may elect to update forward-looking statements from time to time,

we specifically disclaim any obligation to do so, even if our estimates change,

unless otherwise required by applicable securities laws.

1

Operations

PSE&G consistently demonstrates top reliability performance

Significant improvement in nuclear operations

Regulatory

PSE&G settlement demonstrates return to constructive environment

Environmental – achieved NJ coal solution

Energy Markets

Power benefiting from higher prices and lower risk through forward hedges

Utility customers benefit from staggered BGS – another auction complete

Financial

International – reduced exposure, improved stability

Improving cash flows and credit measures

Strong earnings growth in 2007 and 2008

We have made steady progress across a variety of areas.

Our objective is to build on these results to make a

strong company even stronger.

2

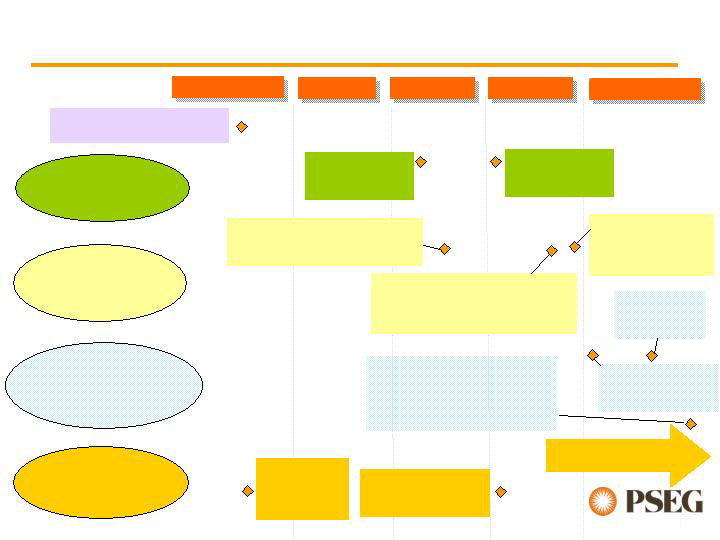

Much has been accomplished since the termination of

the merger…

September 2006

October

November

December

January 2007

9/14 – Merger Termination

Announced

11/16–

PSE&G named America’s Most

Reliable Electric Utility

1/2 – Sale of

Lawrenceburg

announced

11/9 –

PSE&G Rate

Settlements

12/20– PSEG resumes direct

management of Nuclear stations

and Exelon’s senior management

team joins PSEG.

11/30- PSEG

Power Consent

Decree

1/31 - Operating Earnings at

upper end of guidance;

Confirmed strong ’07-’08

outlook; Improved Balance

Sheet

9/25 –

CEO

Succession

Announced

Regulatory

Operations

Management

Financial /

Asset

Rationalization

12/7 –

New Senior Team

Announced

1/16 –

Dividend

Increase

Organizational Design

& Staffing in progress

12/31 – Power

completes 96%

2006 capacity

factor

3

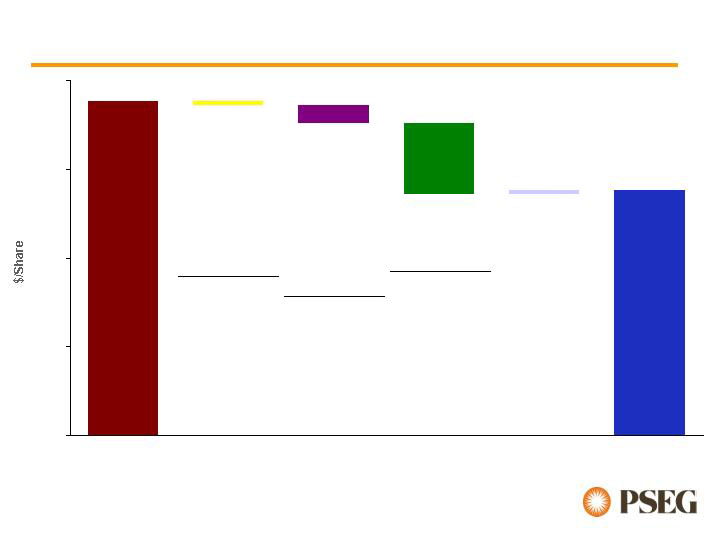

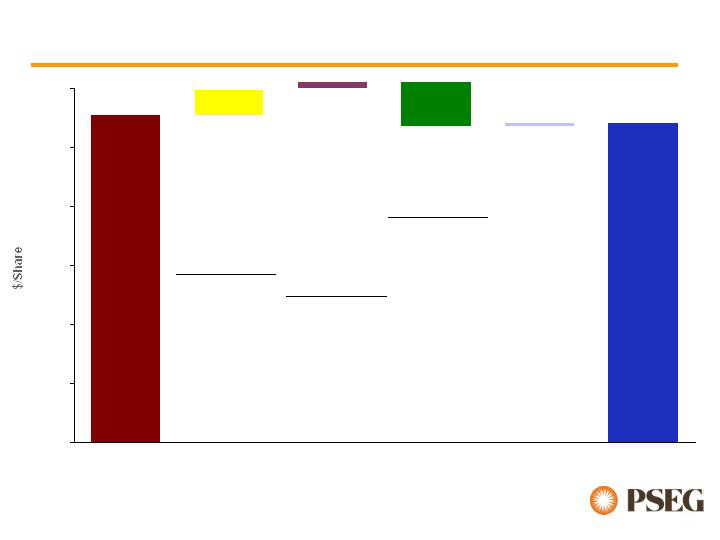

0.00

0.25

0.50

0.75

1.00

Power

Re-contracting &

Higher Margins

$.22

Depreciation,

Interest & Other

$.06

O&M $.03

Nuclear Operations

$.02

BGSS ($.11)

Turbine Impairment

($.10)

New Assets ($.06)

NDT ($.05)

MTM ($.05)

Shares O/S ($.01)

PSE&G

O&M & Other

$.02

Transmission

$.02

Demand $.02

Effective Tax

Rate $.02

Weather ($.06)

Expiration of

Depreciation

Credit ($.03)

4Q 2006

Operating

Earnings**

4Q 2005

Operating

Earnings*

*Excludes ($.02) Merger Costs, Cumulative Effect of an Accounting Change ($.07) and ($.02) Discontinued Operations

**Excludes ($.87) Discontinued Operations

Holdings

Lower taxes $.08

Lower Interest &

Other $.04

Gain on sale of

Seminole lease in

2005 ($.18)

TIE – MTM &

Operations ($.08)

RGE Sale ($.04)

Turboven

Impairment ($.02)

Enterprise

Interest

Savings $.01

4Q 2006 Results - Earnings Variance

$0.94

(.01)

(.05)

(.20)

.01

$0.69

4

2006 Results - Earnings Variance

1.00

1.50

2.00

2.50

3.00

3.50

4.00

Power

Re-contracting &

Higher Margins

$.84

Nuclear

Operations $.20

Depreciation,

Interest & Other

$.04

New Assets ($.23)

BGSS ($.22)

NDT ($.13)

Turbine

Impairment ($.10)

Shares O/S ($.07)

Environmental

Reserve ($.06)

O&M ($.06)

PSE&G

Transmission

$.06

Other $.01

Weather ($.19)

Expiration of

Depreciation

Credit ($.15)

O&M ($.04)

Depr./Amort.

($.04)

Shares O/S

($.03)

2006

Operating

Earnings**

2005

Operating

Earnings*

Holdings

Texas Ops $.21,

including MTM of

$.13

Lower Interest &

Taxes $.18

2005 UAL Write-

off $.05

FX Gains/Losses

$.03

Prior Year Gains:

Eagle Point,

Seminole,

SEGS, MPC

($.31)

RGE Sale ($.06)

Turboven

Impairment

($.02)

Enterprise

Interest

Savings $.03

.21

.08

(.38)

.03

$3.77

$3.71

*Excludes ($.14) Merger Costs, Cumulative Effect of an Accounting Change ($.07) and ($.85) Discontinued Operations

**Excludes ($.03) Merger Costs, ($.70) Loss on Sale of RGE and ($.05) Discontinued Operations

5

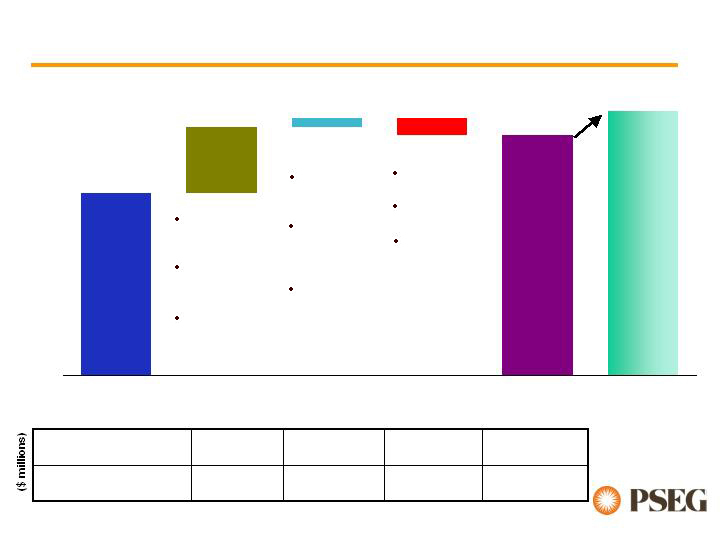

PSEG 2007 Earnings Outlook & Drivers

2006 EPS

Power

PSE&G

Holdings

2007 Guidance

2008

$3.71

Excess of

10% Growth

Forward

Hedging

Re-contracting

- PJM/NE

Capacity

Market Design

Gas Rate

Case

Electric

Financial

Review

Weather

Texas

Asset Sales

New

Accounting

Standard

Increase/(Decrease) vs.

2006 Operating Earnings

2007 Forecast Operating

Earnings Ranges

$232 - $357

($97) – ($82)

$68 - $88

$255 - $335

$1170 - $1295

$130 - $145

$330 - $350

$770 - $850

$4.60 - $5.00

2006

Operating

Earnings:

$938M*

*Excludes Loss on Sale of RGE of $178M ($.70 per share), Merger Costs of $8M ($.03 per share) and Discontinued

Operations of $13M ($.05 per share)

6

PSE&G

PSE&G Overview

Electric

Distribution

$3.2B

Gas Distribution

$2.1B

Electric

Transmission

$0.7B

Rate Base

(As of December 31, 2006)

2.1 M electric customers

1.7 M gas customers

2,600 sq miles in service

territory

8

Fair outcomes on recent gas and electric cases will

help ensure…

Settlement agreement with BPU staff, Public Advocate, and other parties

Gas Base Rate case provides for $79M of gas margin

$40M increase in rates

$39M decrease in non-cash expenses

Electric Distribution financial review provides $47M of additional revenues

Base rates remain effective until November 2009

New Jersey regulatory climate providing a fair return to investors

Opportunity to earn a ROE of 10%

…our continued ability to provide safe, reliable

service to customers and fair returns to shareholders.

9

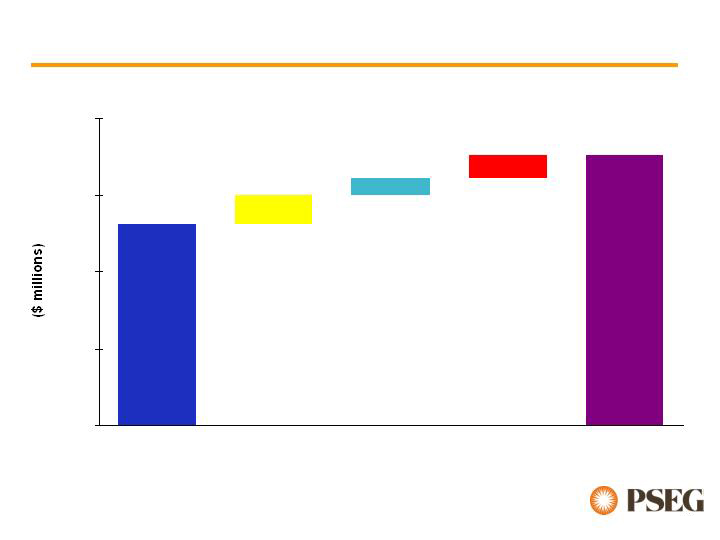

Rate relief and normal weather…

$0

$100

$200

$300

$400

2006 Operating

Earnings*

Gas Rate Relief

Electric Financial

Review

Weather

2007 Guidance

$262M

$30M - $40M

$20M - $25M

$330M

to

$350M

$20M - $30M

… provide opportunity to earn allowed returns.

* Excludes $1M of Merger Costs

10

Looking Forward PSE&G…

Continues to invest in its assets for the future

Distribution System Reinforcements

Transmission Investments

Customer Service

Is committed to meeting customer needs and

expectations

Is supporting NJ’s Energy Master Plan process, which

may create opportunities for additional investments

Advanced Metering, Solar Installations/other renewables and Energy

Efficiency

Endeavors to maintain constructive regulatory relations

regarding traditional utility matters

11

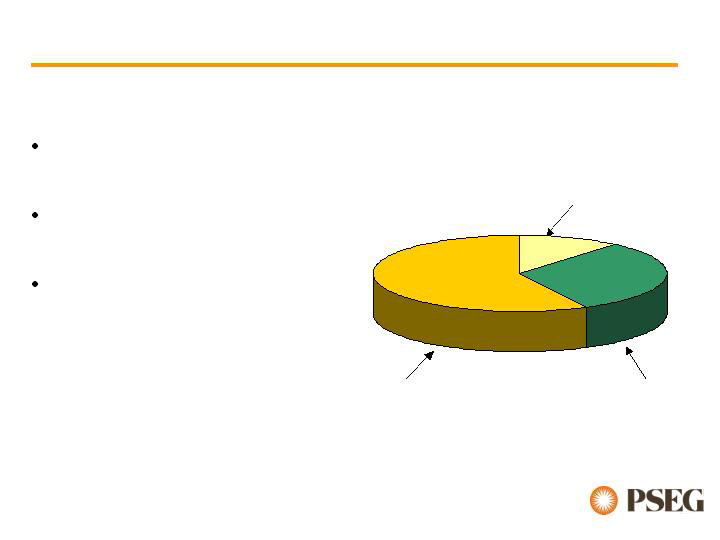

PSEG Power

PSEG Power Overview

Diverse asset mix mitigates risk

and provides strong returns

13,600* MW of nuclear, coal, gas,

oil and hydro facilities

Low-cost portfolio

Strong cash generator

Regional focus with demonstrated

BGS success

Assets favorably located

Many units east of PJM constraint

Southern NEPOOL/Connecticut

constraint

Near customers/load centers

Integrated generation and portfolio

management optimizes asset-

based revenues

18 %

47 %

8 %

26 %

Fuel Diversity – 2007*

Coal

Gas

Oil

Nuclear

Pumped

Storage

1%

(MWs)

* After sale of Lawrenceberg

Energy Produced - 2006

(MWhrs)

55%

27%

16%

Oil 1%

Pumped

Storage

1%

Nuclear

Coal

Gas

Total MWhrs: 53,617

13

Capacity Factors

82%

90%

96%

77%

89%

96%

2004

2005

2006

*Uprate of 127MW scheduled for Fall 2007

Strong operational performance

Capacity factors: Year -end ~96%

Summer ~100%

Outage management

Site records achieved, including most

recent 21 day refueling outage at

Salem 2

Nuclear Operating Services

Agreement (NOSA)

PSEG to resume direct management of

Salem and Hope Creek

Exelon’s senior management team

joins PSEG

Hope Creek*

Salem

1 & 2

Peach Bottom

2 & 3

PSEG MW

Owned

1,059MW*

1,323MW

1,112MW

Ownership

PSEG Owned

Jointly Owned

Jointly Owned

Operations

PSEG

Operated

(NOSA)

PSEG

Operated

(NOSA)

Exelon

Operated

Total

Fleet:

3,494 MW

Strong Nuclear Operations

NJ Fleet:

2,382MW

14

Strong Fossil Operations round out a diverse portfolio…

0

5,000

10,000

15,000

20,000

25,000

2002

2003

2004

2005

2006

Coal

Combined Cycle

Peaking & Other

Total Fossil Output (Gwh)

A Diverse 10,000 MW Fleet

2,400 MW coal

3,200 MW combined cycle

4,400 MW peaking and other

Strong Performance

Continued growth in output

Improved fleet performance

Achieved resolution regarding

Hudson / Mercer

…in which over 80% of fleet output is from low cost coal

and nuclear facilities.

15

Strengthening of capacity market design…

Total Generating Capacity

PSEG Power

PJM

NY

NE

Total Capacity 13,600MW

(1,500MW under RMR)

New England

Forward Capacity Market (FCM) began 12/1/06

Transition period prices have been established

Grows from $37/kw-yr to $49/kw-yr

through 2010

First auction scheduled in 2008 for June 2010

delivery

PJM

FERC Approved 12/22/06

Locational pricing

4 zones initally, 23 in 2010

Anticipated implementation 6/1/07

Auction schedule:

2007-2008 April 2007

2008-2009 July 2007

2009-2010 October 2007

2010-2011 January 2008

…provides meaningful market signals, and enhances

margin for Power’s generating fleet.

16

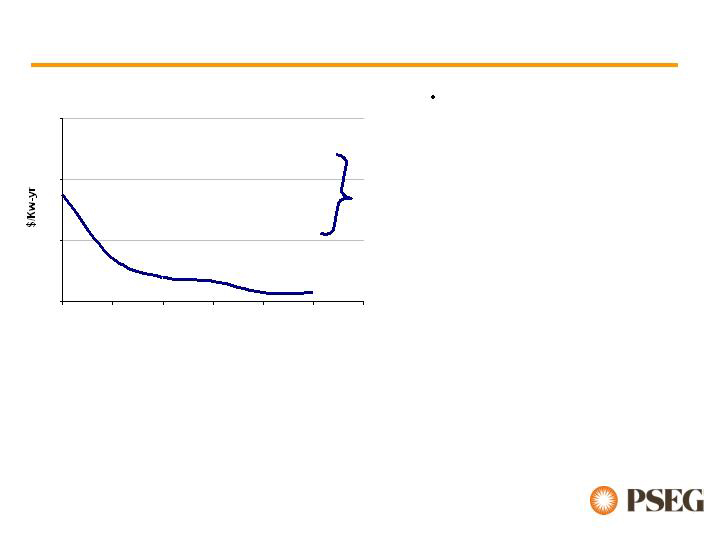

The 1st RPM-year spans June 2007 through May 2008,

and will cover similar one year (BGS) intervals

thereafter. Recent market activity has shown

considerable price increases for the 2007/2008 year.

PJM’s Reliability Pricing Model

RPM reflects a change in

market design

- More structured, forward-

looking, transparent pricing model

- Gives prospective investors in

new generating facilities more

clarity on future value of capacity

- Sends pricing signal to

encourage expansion of capacity

where needed for future market

demands

Capacity Prices

Capacity revenues, driven by RPM, provide a meaningful increase in Power’s

margin - $100 - $150 million for 2007 - and is anticipated to increase in future

years due to full year PJM impact and as more capacity

comes off existing contracts

$0

$20

$40

$60

2001

2002

2003

2004

2005

2006

2007

Feb 2007

Sept 2006

Range of

recent prices

for ’07 – ’08

year

17

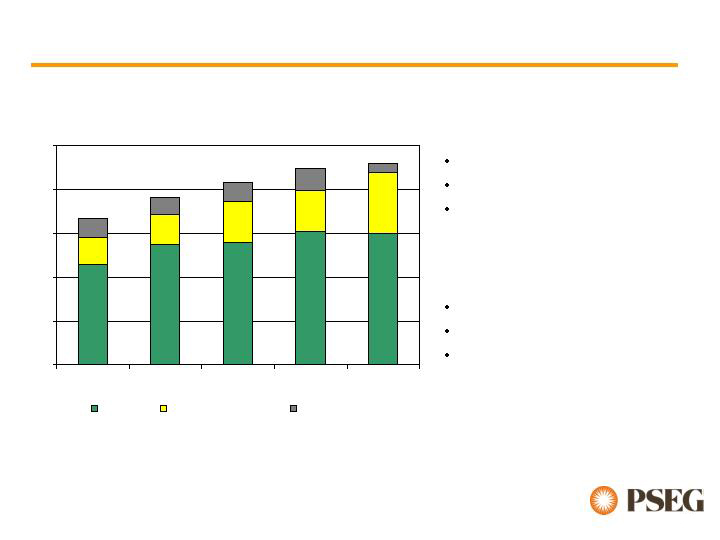

20,000

4,000

8,000

12,000

16,000

2002

2003

2004

2005

2006

2007

2008

2002 FP

Auction

1 Year

170

Tranches

2003 FP

Auction

10

months

104

Tranches

2003 FP Auction

34 months

51 Tranches

2004 FP

Auction - 1 Yr.

50 Tranches

2004 FP Auction - 3 Years

51 Tranches

2006 FP Auction Load

54 Tranches

2005 FP Auction Load

50 Tranches

2007 FP Auction Load

(projected)

New Jersey BGS Auction Structure

The BGS structure in New Jersey successfully mitigates

risk for both suppliers and for customers.

18

2003 Auction

2004 Auction

2005 Auction

2006 Auction

2007 Auction

Market Viewpoint - BGS Auction Results

Capacity

Load shape

Transmission

Congestion

Ancillary services

Risk premium

Full Requirements

Round the Clock

PJM West

Forward Energy

Price

$33 - $34

$36 - $37

$55.59

$55.05

$65.91

$44 - $46

~ $21

~ $18

~ $21

$102.21

$67 - $70

~ $32

Increase in Full Requirements Component Due to:

Increased Congestion (East/West Basis)

Increase in Capacity Markets/RPM

Volatility in Market Increases Risk Premium

$98.88

~ $41

$58-$60

Power has been a successful participant in each BGS auction.

19

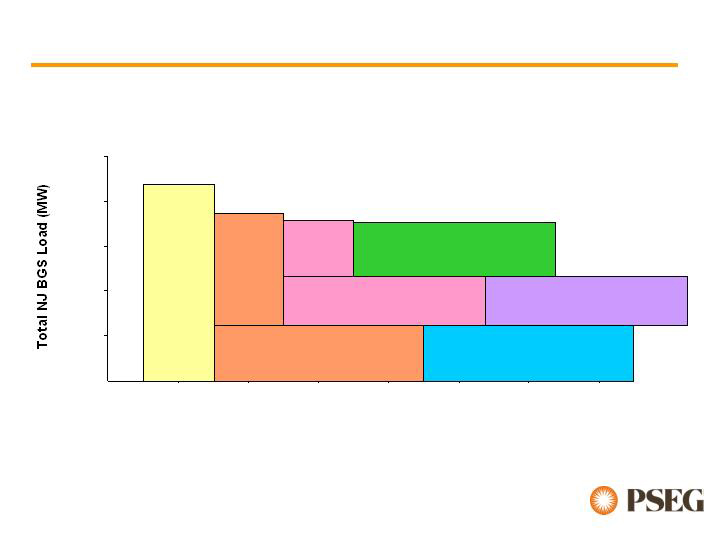

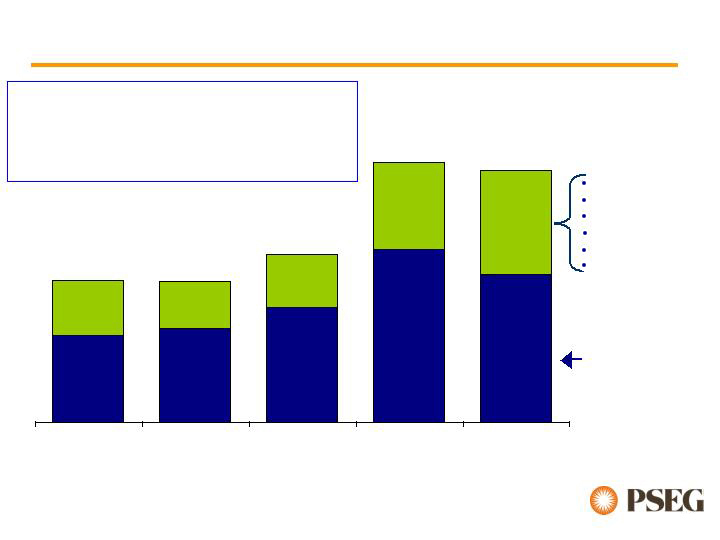

$250

$500

$750

$1,000

2006

2007

2008

The year over year improvements…

Energy

Capacity

Other

…drive growth in PSEG’s 2007 earnings guidance

with further improvements in 2008.

$515M

Power drives 2008 earnings

guidance in excess of 10%

over 2007

Full year of capacity

Recontracting of 2005 BGS

$200M - $240M

$50M - $80M

$770M

to

$850M

$5M - $15M

20

Looking Forward PSEG Power…

Transitions its New Jersey nuclear plants to independent

operations

Moves forward to enhance environmental profile through

Consent Decree compliance

Anticipates energy markets to provide attractive growth

Energy hedges roll with increased margin

Capacity markets increasing – RPM auctions will provide visibility

Positions balance sheet for growth

21

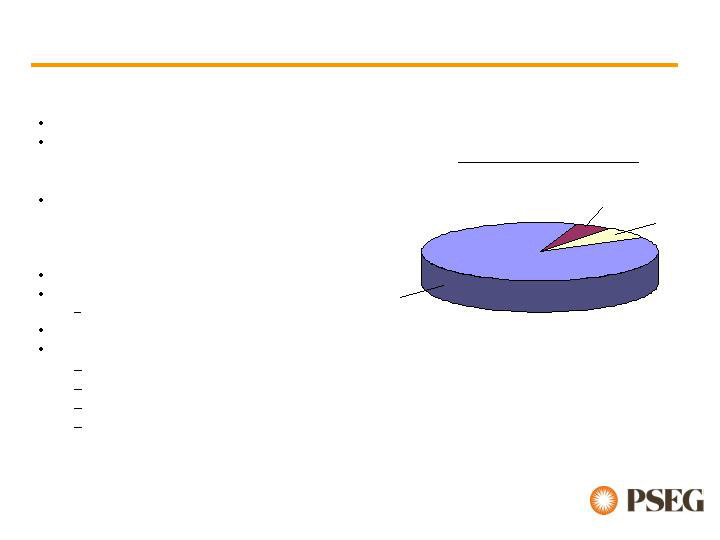

PSEG Energy Holdings

6%

15%

3%

45%

31%

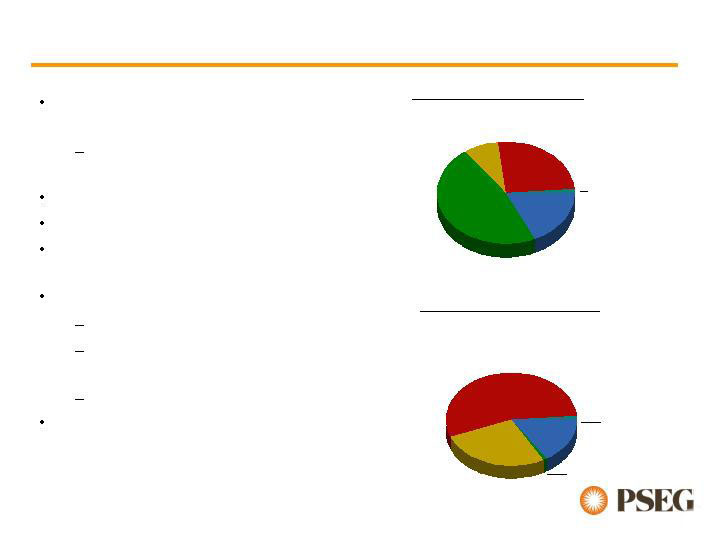

PSEG Energy Holdings Overview

Other Resources Investments

TOTAL ASSETS $6.2 B – 12/31/06

PSEG Global

Domestic

Generation

PSEG Resources

Leveraged Leases

Other International Generation

Chile & Peru

Generation and

Distribution

Two businesses with redirected strategy to maximize value of existing

investments

Balance and diversity: over 60 total investments; no single investment

more than 11% of Holdings assets

23

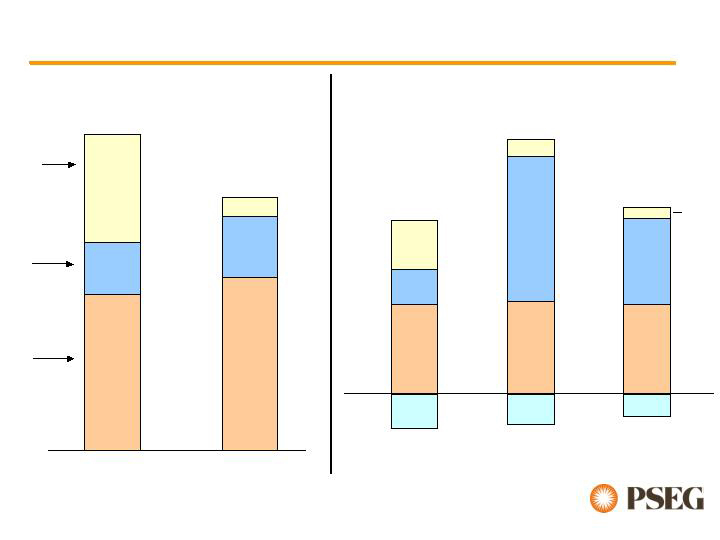

Improved risk profile by opportunistically reducing

capital invested in non-strategic assets…

…while increasing returns and sharpening focus on G&A.

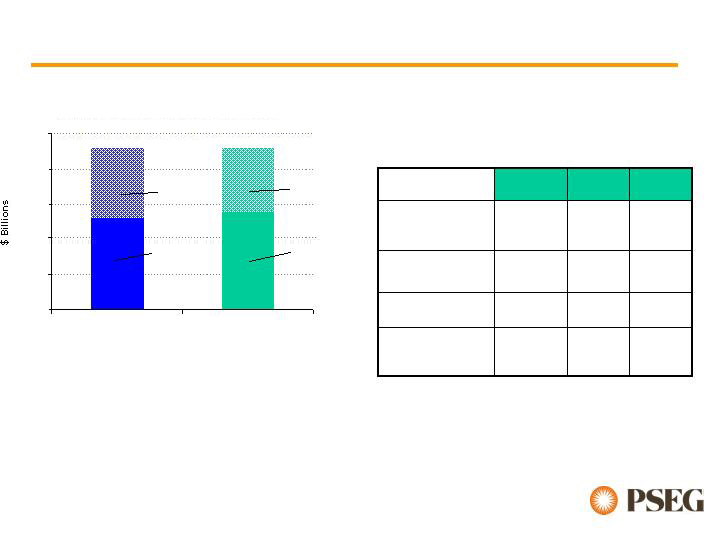

2004

2006

$2.6B

$2.0B

Chile & Peru

US

Other

$900M

$400M

$1.3B

$160M

$500M

$1.4B

34%

16%

50%

8%

24%

68%

$104

$108

$41

$168

$57

$20

$(40)

$(35)

$(25)

$296M

48%

45%

2004

2006

2007 Est.

$202M

$210M-$230M

Composition of Global’s Pre-tax

Equity-in-Earnings

G&A

Chile

& Peru

US

Other

28%

20%

51%

6%

57%

37%

7%

Global’s Invested Capital

24

Holdings has provided meaningful earnings and

cash flow…

…which has supported debt reduction and return

of capital to PSEG.

Sources & Uses of Cash from 2004 - 2006

$0.0

$0.5

$1.0

$1.5

$2.0

$2.5

Sources

Uses

Asset

Sales

Cash Ops/

Cash on

Hand

Reduced

Debt

Return

Capital/

Dividends

Significant de-capitalization

totaling $2.3B from 2004 -

2006

$609M

-

$311M

Net Debt

Reduction

47%

3.4x

$491M

2004

36%

41%

Recourse

Debt/Capital

4.5x

2.5x

FFO/Interest

$520M

$412M

Dividends & ROC

2006

2005

Debt Reduction & Dividends from 2004 - 2006

25

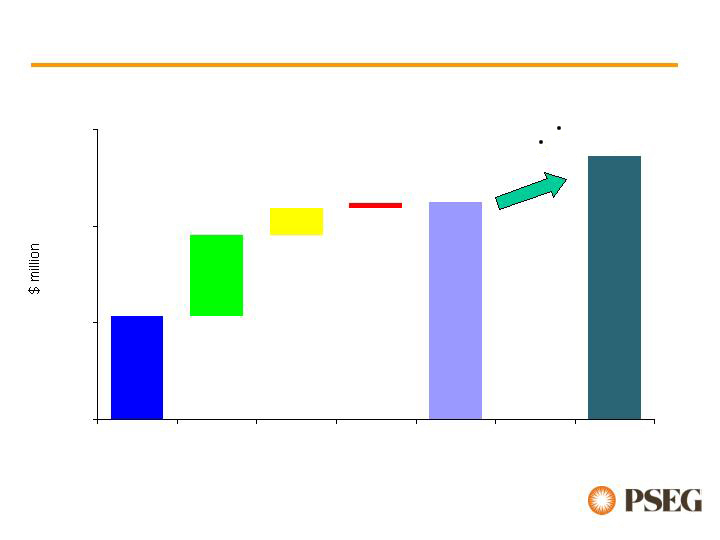

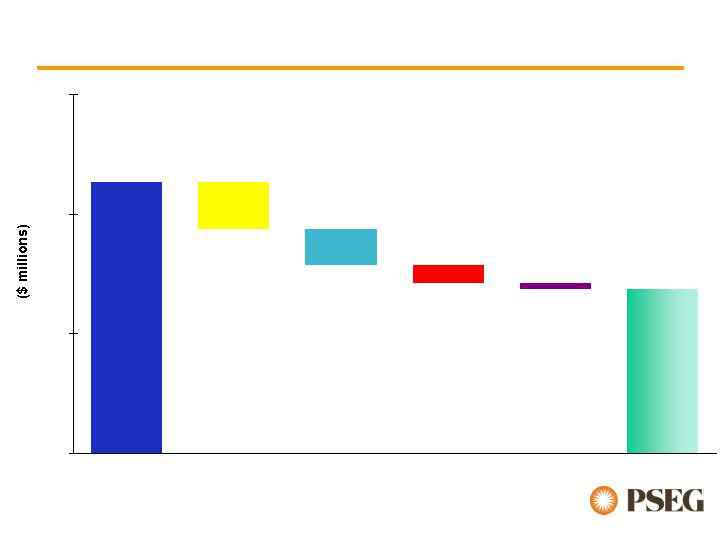

PSEG Energy Holdings – 2007 Drivers

$0

$100

$200

$300

2006 Operating

Earnings *

Texas

FIN 48

Taxes

Asset Sales

2007 Guidance

$227M

$25M - $35M

$10M - $20M

$130M

to

$145M

$5M - $10M

$35M - $45M

*Excludes $178M Loss on Sale of RGE

26

Looking Forward Energy Holdings…

Global’s Portfolio – Allocation of Invested Capital

Improved risk profile

Chile - Investment Grade; Peru - approaching

US – Texas is merchant; others are contracted

Stable earnings and cash distributions

Continue opportunistic monetization of non-strategic assets

Optimizes returns on Global’s current portfolio

Attractive market opportunities for Texas assets

Continue to seek increased returns in Chile and Peru

Other opportunities (eg. G&A)

Monitors Resources’ lease portfolio

Lessee credit risks exist, but has subsided

Current weighted average rating: A-/A3

Adoption of FIN 48 decreases earnings

Continue to monitor tax landscape

27

Looking Forward PSEG…

Financial

Strength

We will focus on the basics of operational excellence...

…to produce financial strength that will be deployed

through disciplined investment.

Operational

Excellence

Disciplined

Investment

29

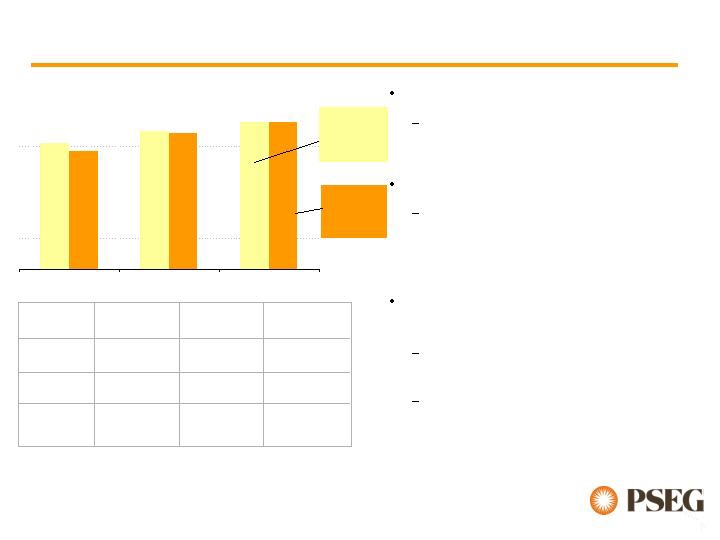

Strong earnings and cash flows will be used to

further de-lever the balance sheet.

Improving our credit profile will enable us to

maximize growth opportunities.

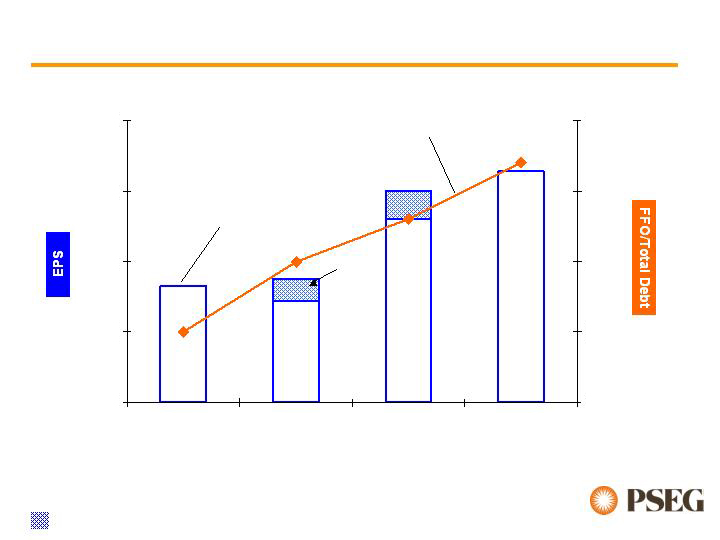

$2.00

$3.00

$4.00

$5.00

$6.00

2005 Actual

2006 Guidance

2007 Guidance

2008 Est.

10%

15%

20%

25%

30%

Excess

of 10%

Growth

FFO/

Total Debt

EPS

YE ‘06

EPS:

$3.71

Guidance range: ’06: $3.45 - $3.75

’07: $4.60 - $5.00

YE ‘05

EPS:

$3.77

30

…and capitalize on multiple alternatives to grow the generation and

delivery business.

From a position of financial strength, we will make

disciplined investments…

Near-term:

Capitalize on opportunities for rate base growth

Distribution, transmission, customer service

Optimize our existing generation portfolio

Environmental improvements at NJ coal stations

Nuclear uprate

Take a hard look at international assets

Longer-term:

Flexibility to pursue growth in core businesses and regions

PSE&G integrating with NJ Energy Master Plan initiatives

Advanced metering

Renewables

Demand side management

Power well positioned for growth in attractive Northeast markets

Strong and improving operations

Site expansion capability

Attractive cash flow

Consider a range of strategic alternatives

31

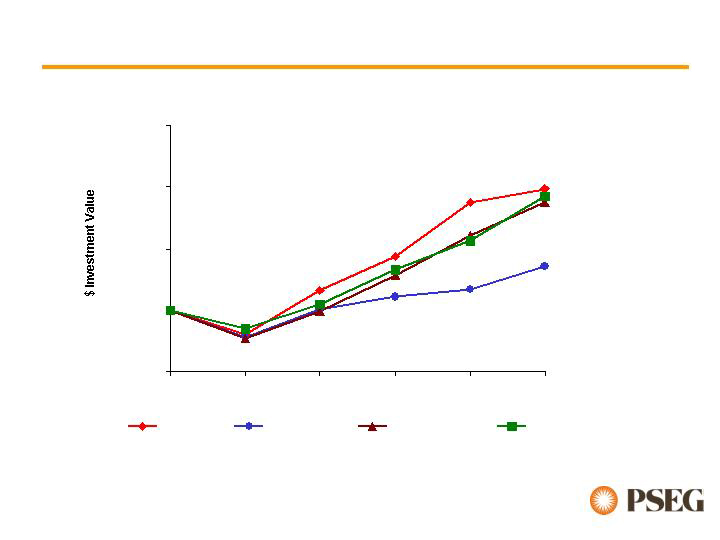

$50.00

$100.00

$150.00

$200.00

$250.00

2001

2002

2003

2004

2005

2006

PSEG

S&P 500

DJ Utilities

S&P Electrics

Creating Shareholder Value

Focused on producing superior shareholder return

5-Year Cumulative Total Comparative Returns

(as of December 31, 2006)

32