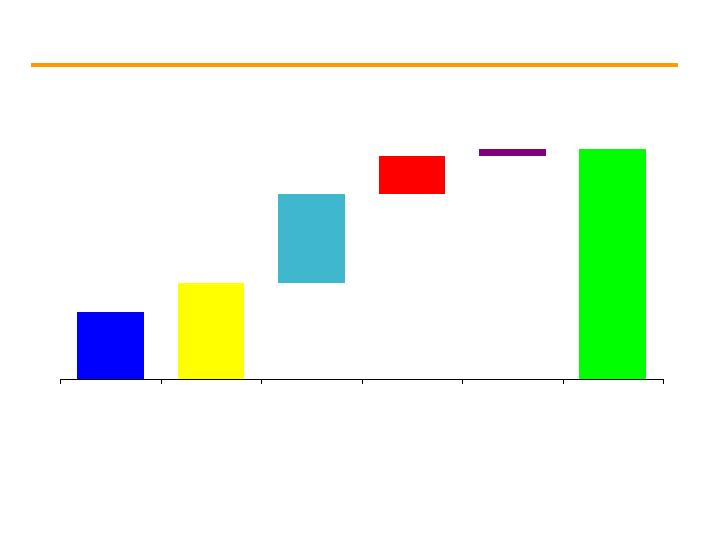

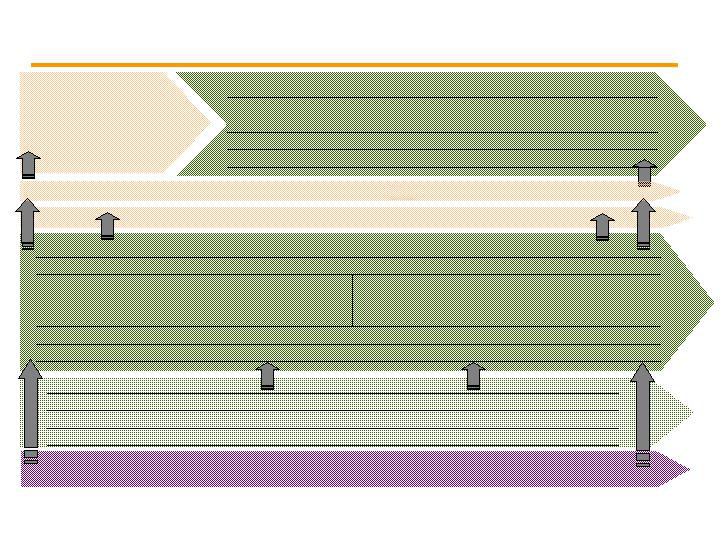

Growth opportunities …

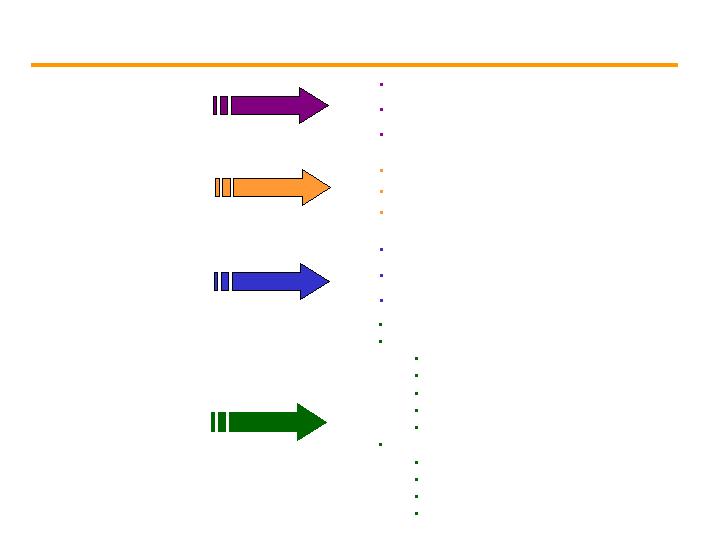

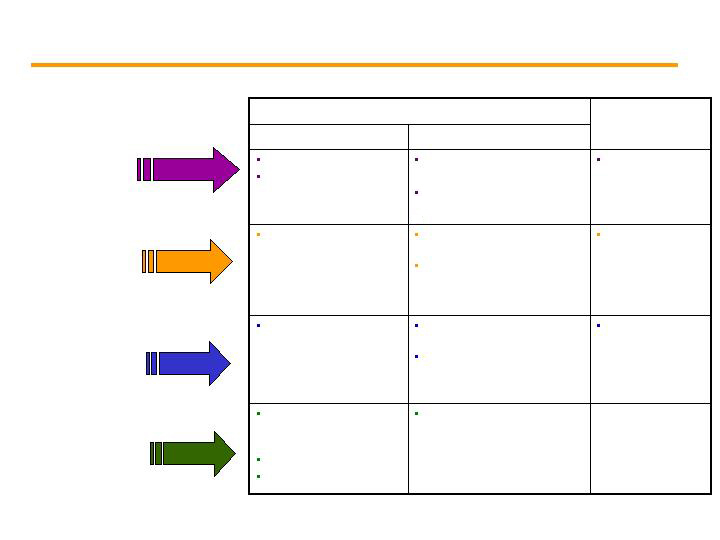

Achieve Credit Targets

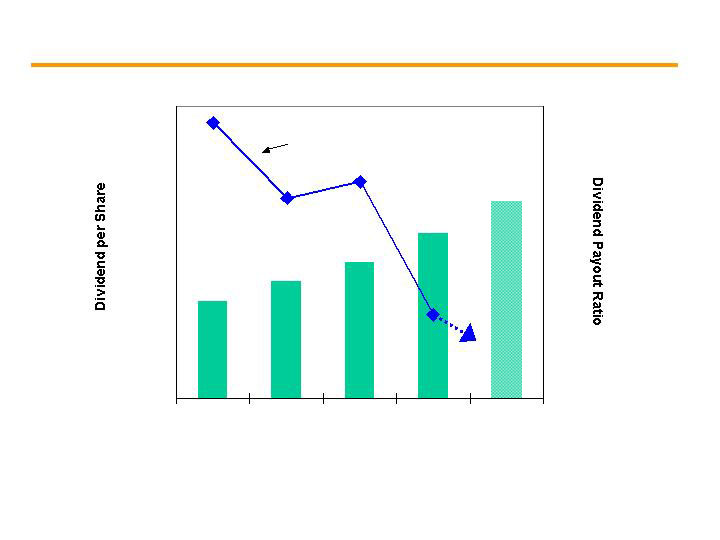

Sustainable and Growing Dividend Increases

Operational Excellence Builds Financial Strength

… Near-Term, Long-Term, with Manageable Risk.

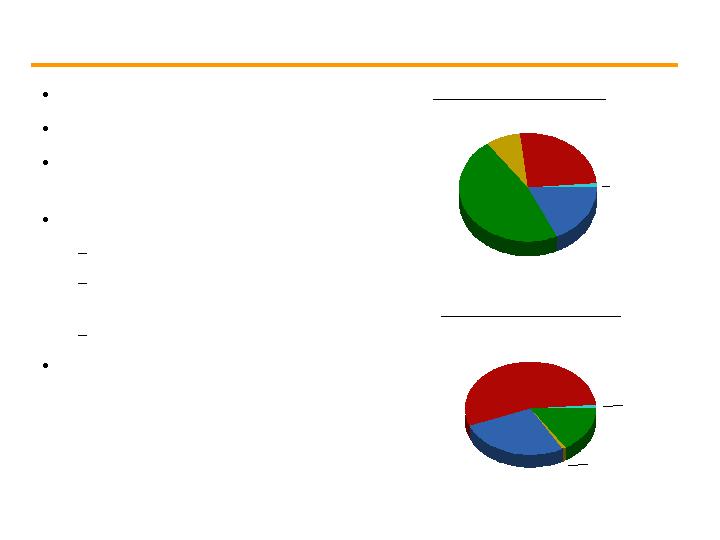

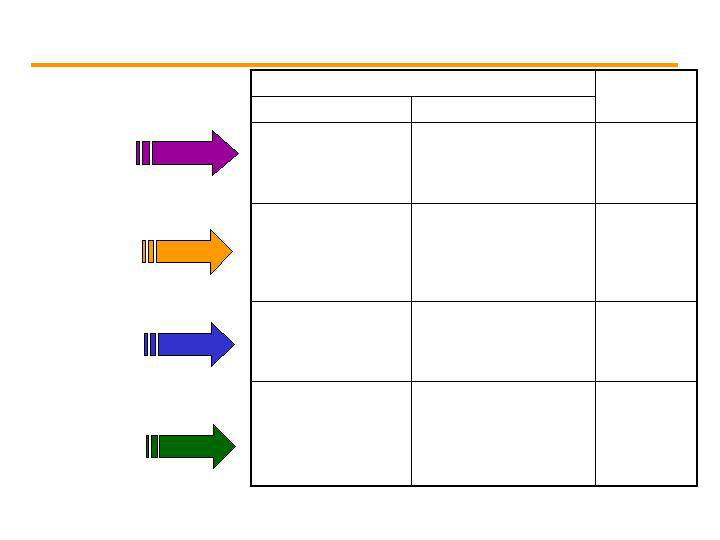

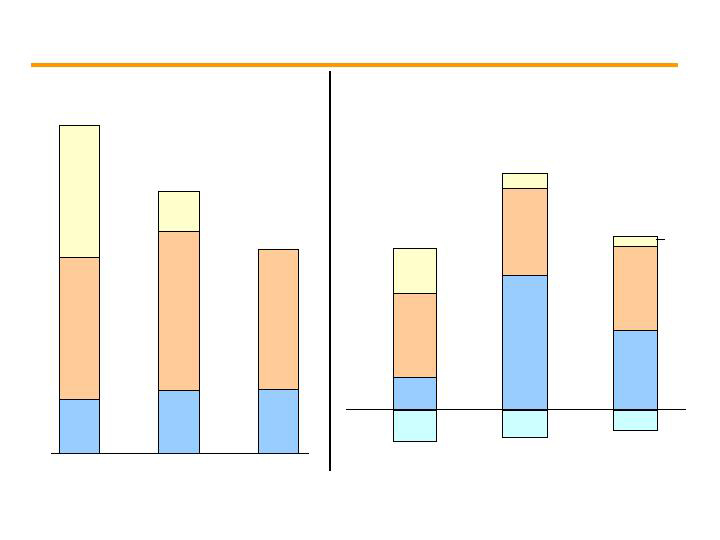

Power

PSE&G

Holdings

Manageable Risk

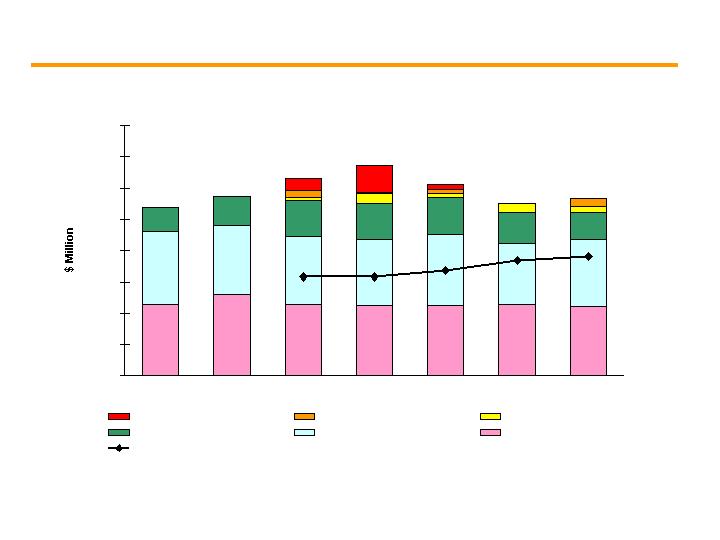

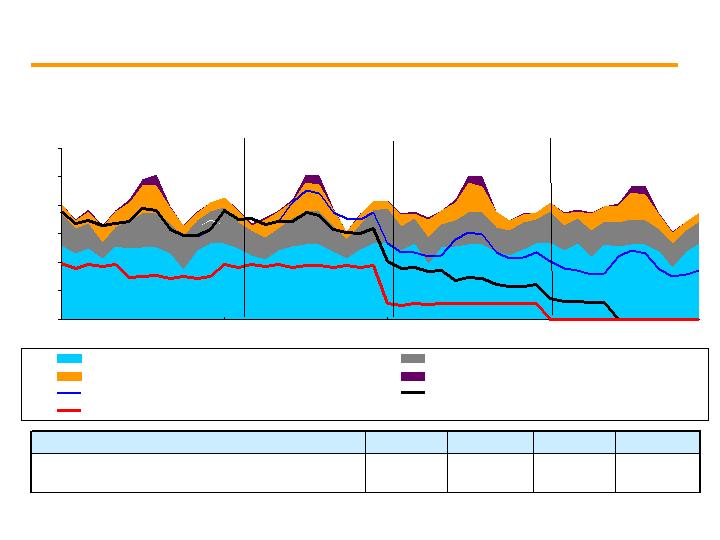

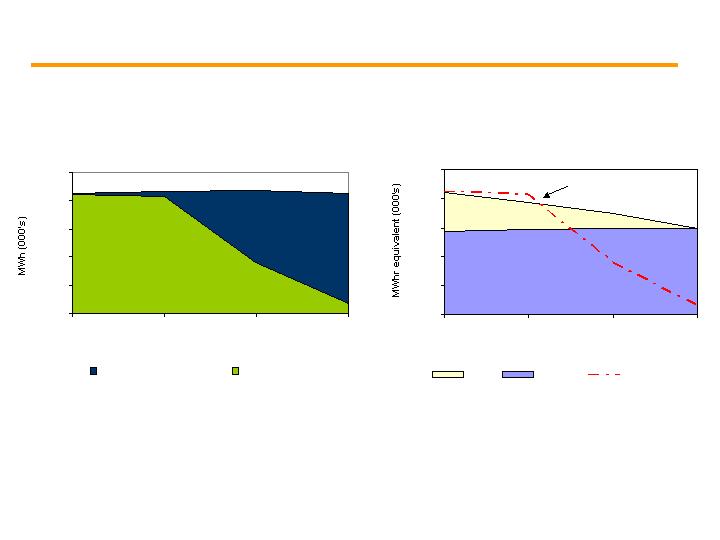

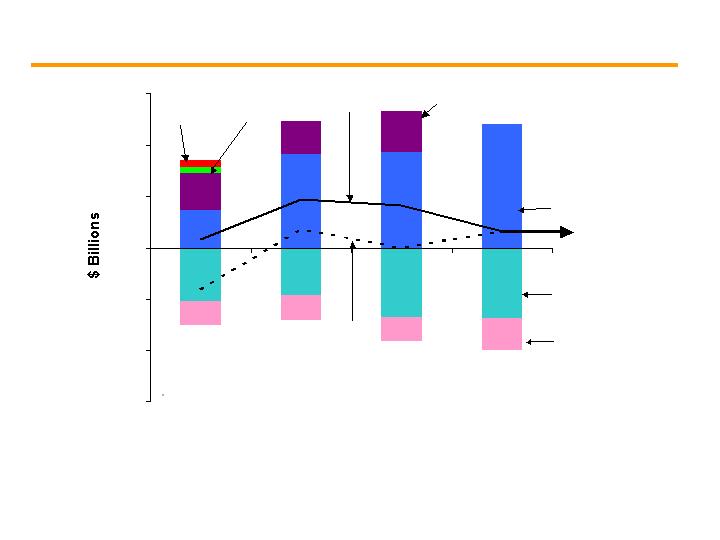

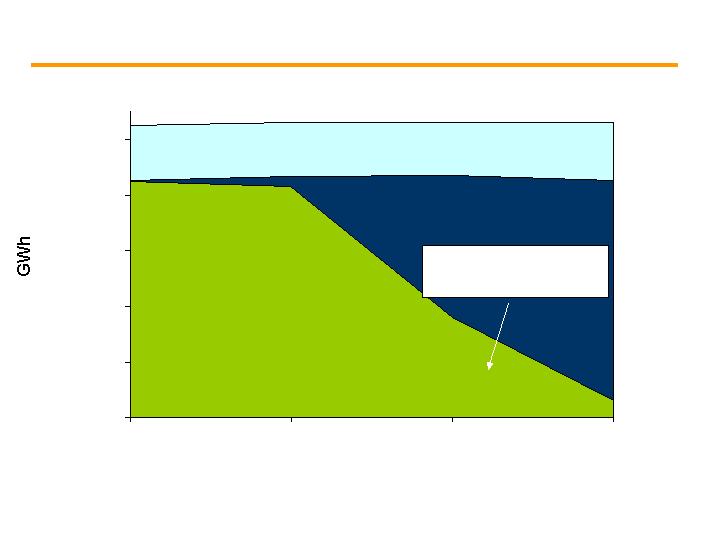

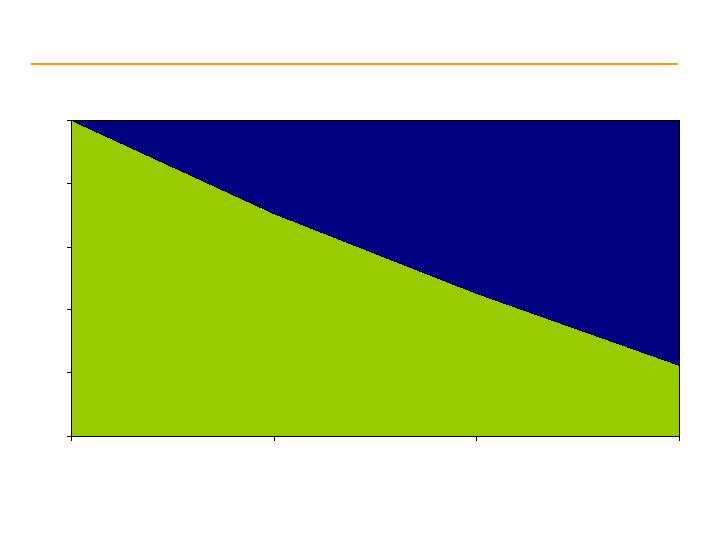

Hedging strategy adds stablility and capacity auctions increases visibility of earnings

Solid regulatory relations and appropriate regulatory incentives for EMP investments

Reshaped portfolio and continuing to evaluate capital invested internationally

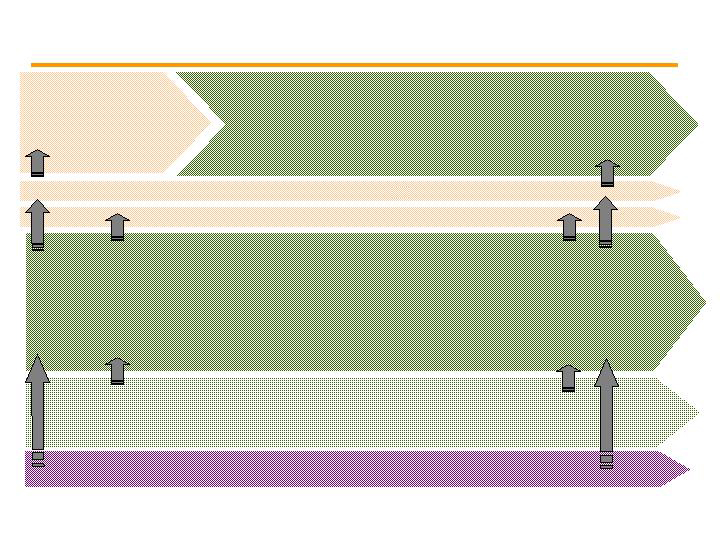

PSEG

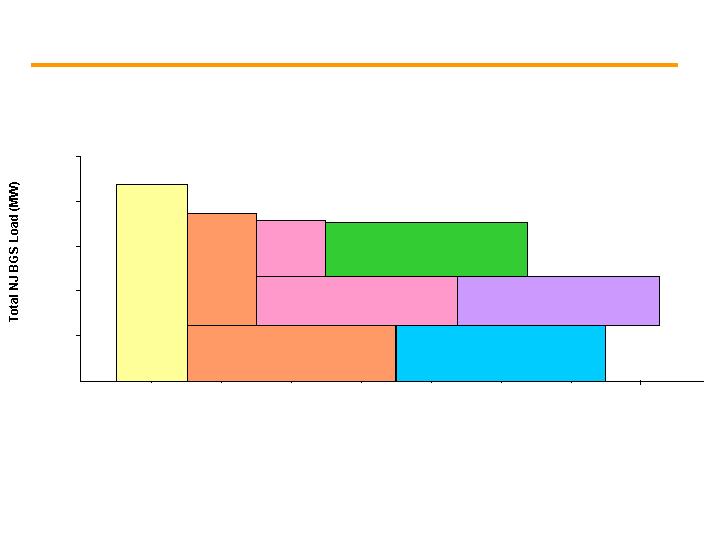

Growing markets (PJM / NY / NEPOOL)

PSE&G

Holdings

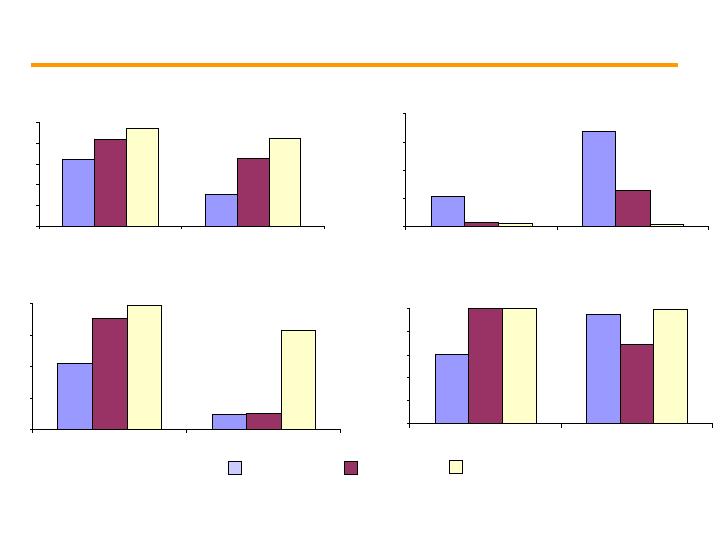

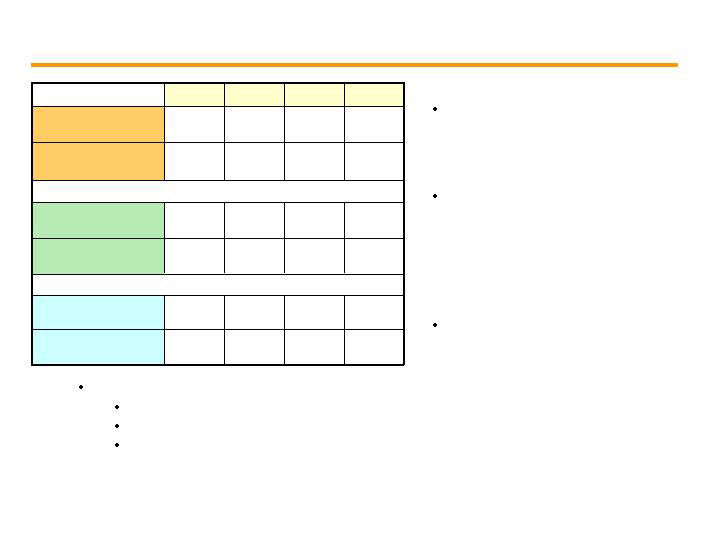

Strong Earnings from Existing Assets and Base Capital Plan

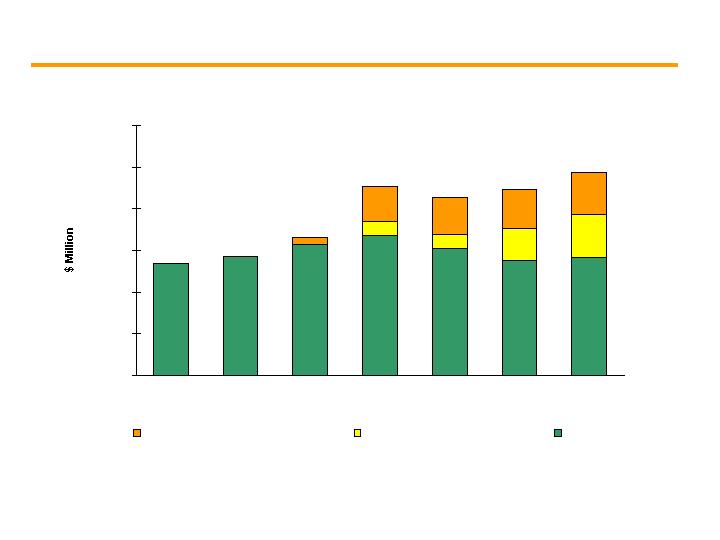

Customer growth and network investment -->

Improving returns on existing investments and Texas assets benefit from low cost -->

Power

Attractive energy markets and recontracting

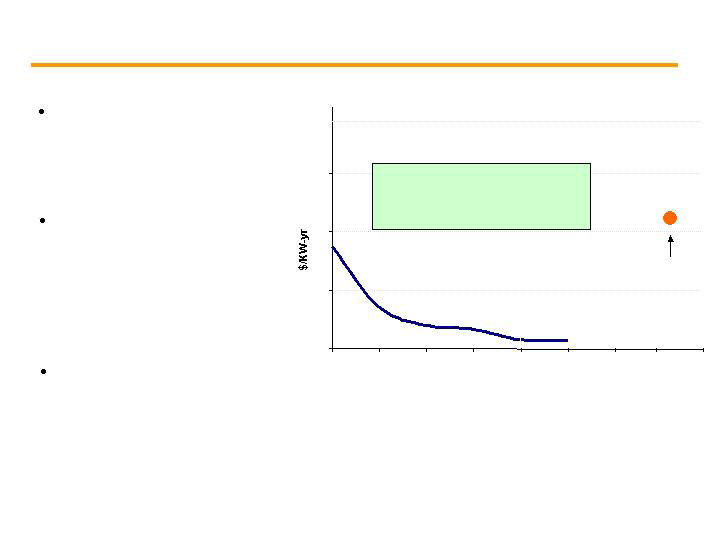

Generation value improvement (upward pressure on

capacity prices / heat rate expansion / carbon)

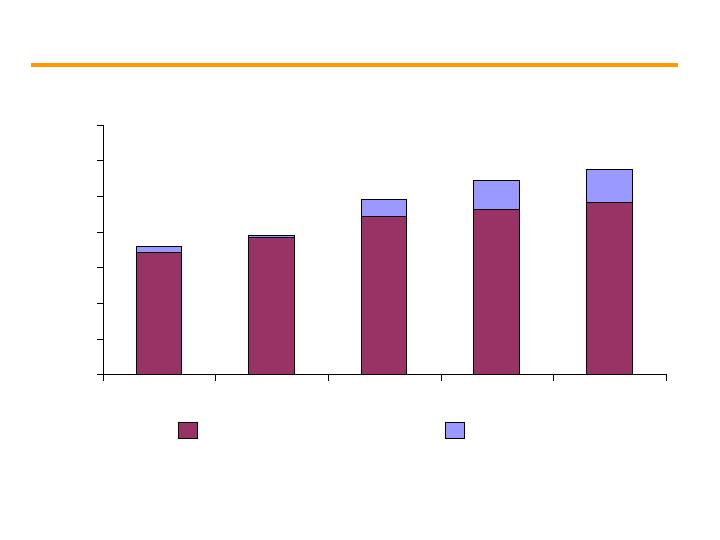

Guidance reflects strong growth

Implementing capacity market mechanisms

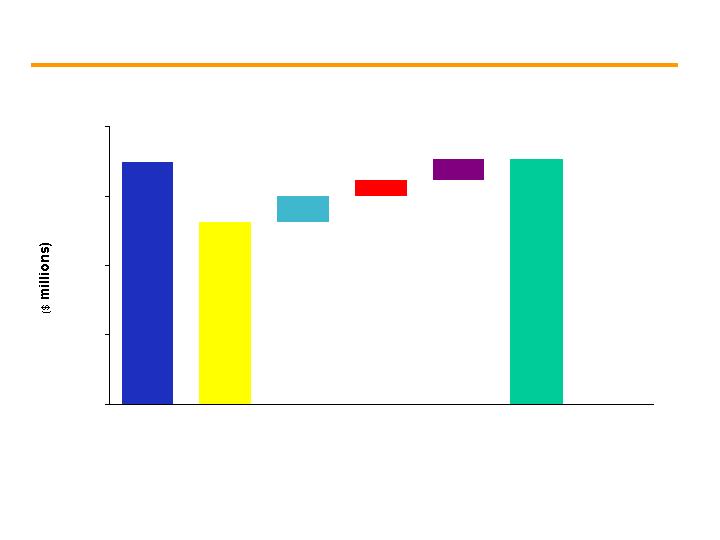

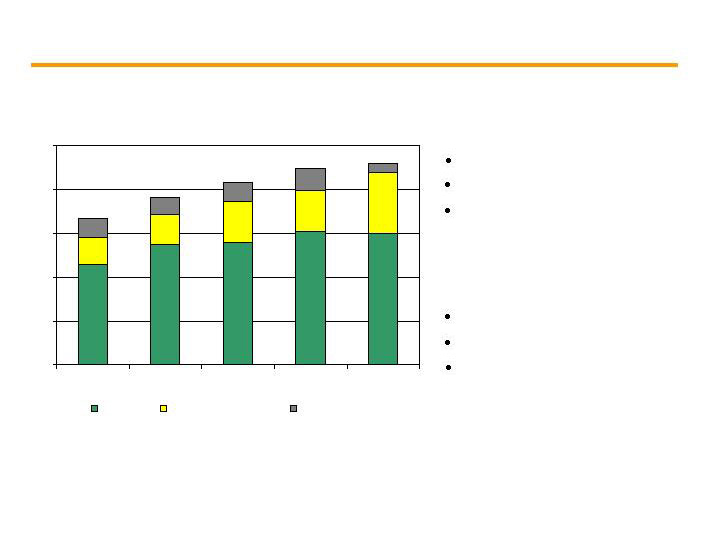

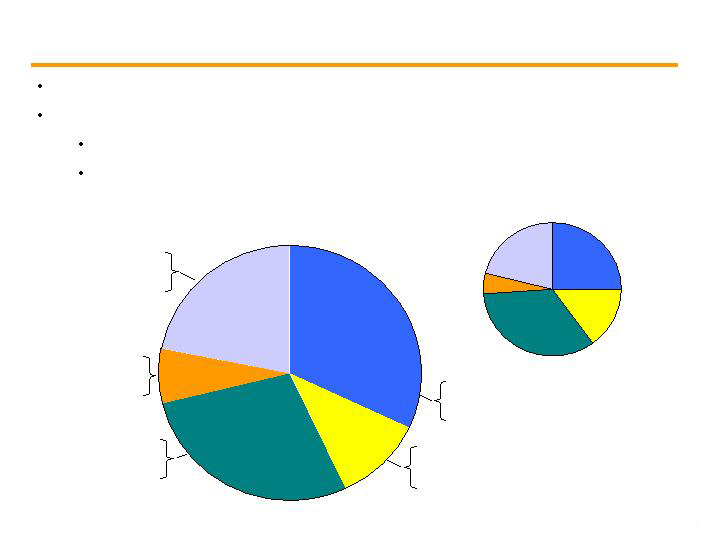

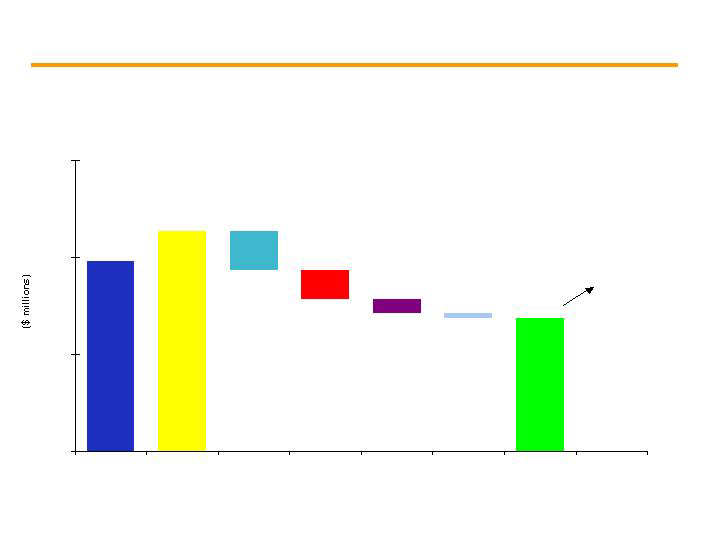

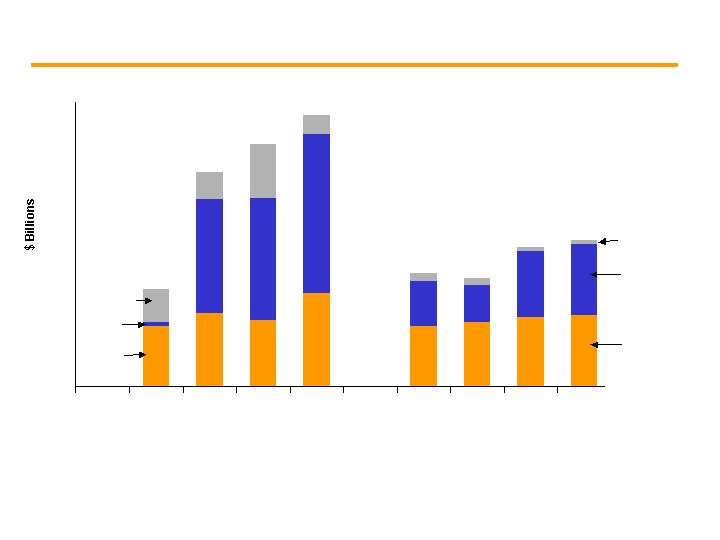

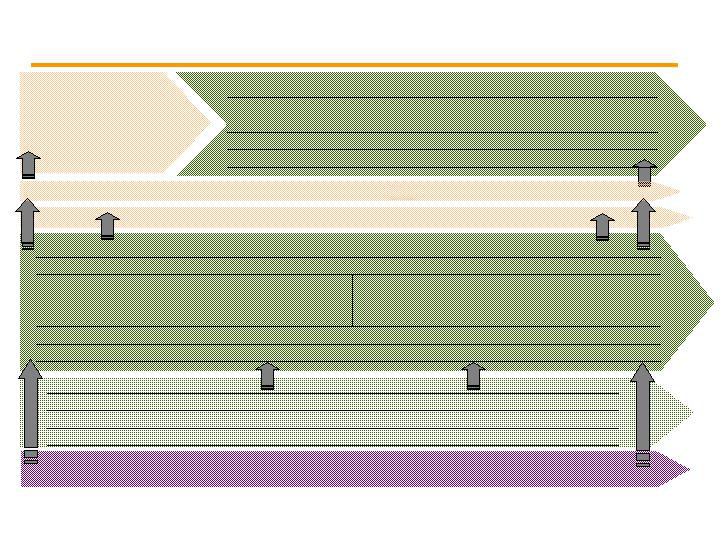

Annual Excess Cash ~ $500M

~

PSE&G

Holdings

Share Repurchases and New Investments

Power

Expansion capability at existing sites

Preliminary consideration of nuclear expansion

EMP Initiatives (new CIS, advanced metering, renewables)

Opportunity to leverage Texas position for new acquisition / build

54